Economic Evaluation Assignment 2: Project Proposal Analysis, 49003

VerifiedAdded on 2022/12/29

|3

|658

|66

Homework Assignment

AI Summary

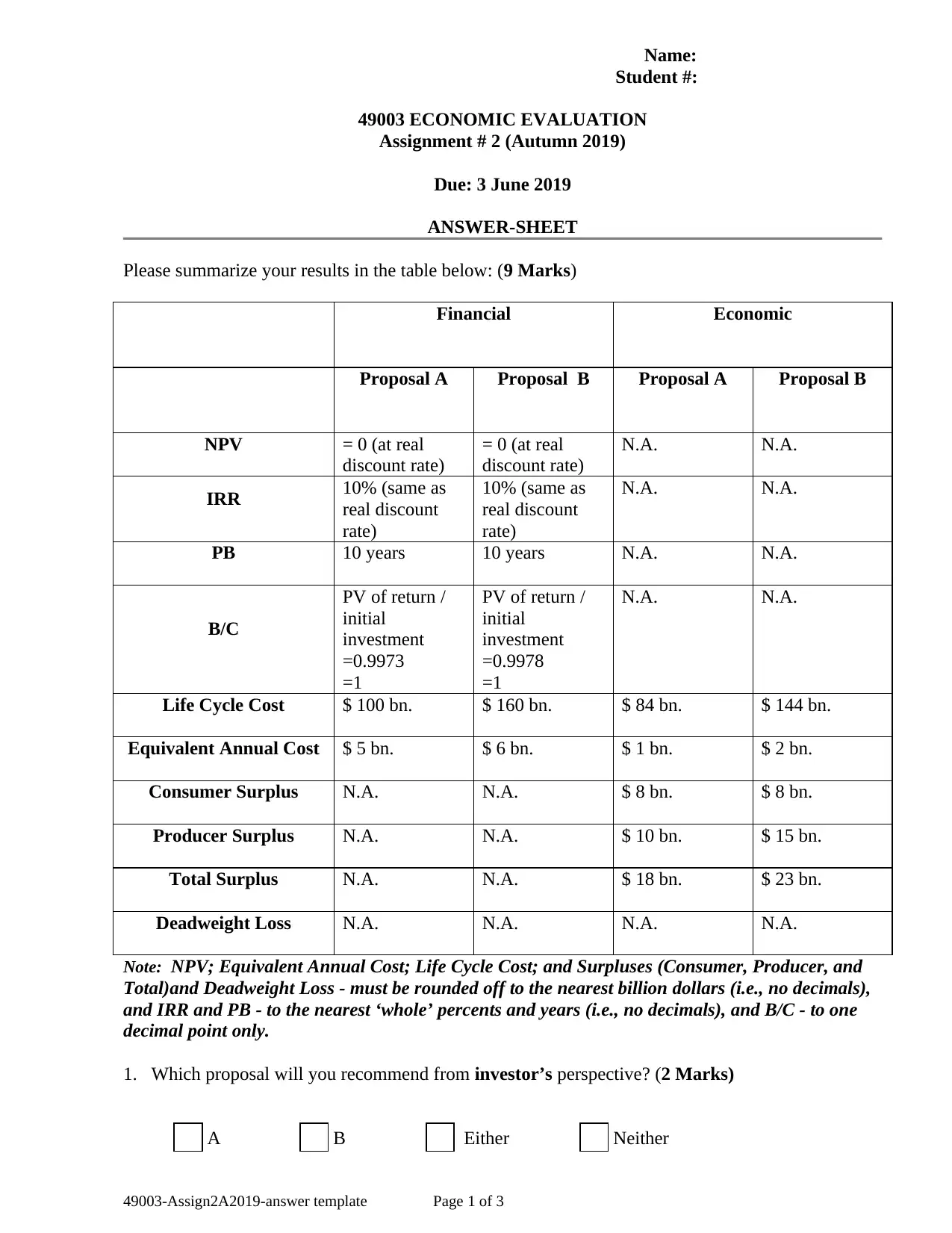

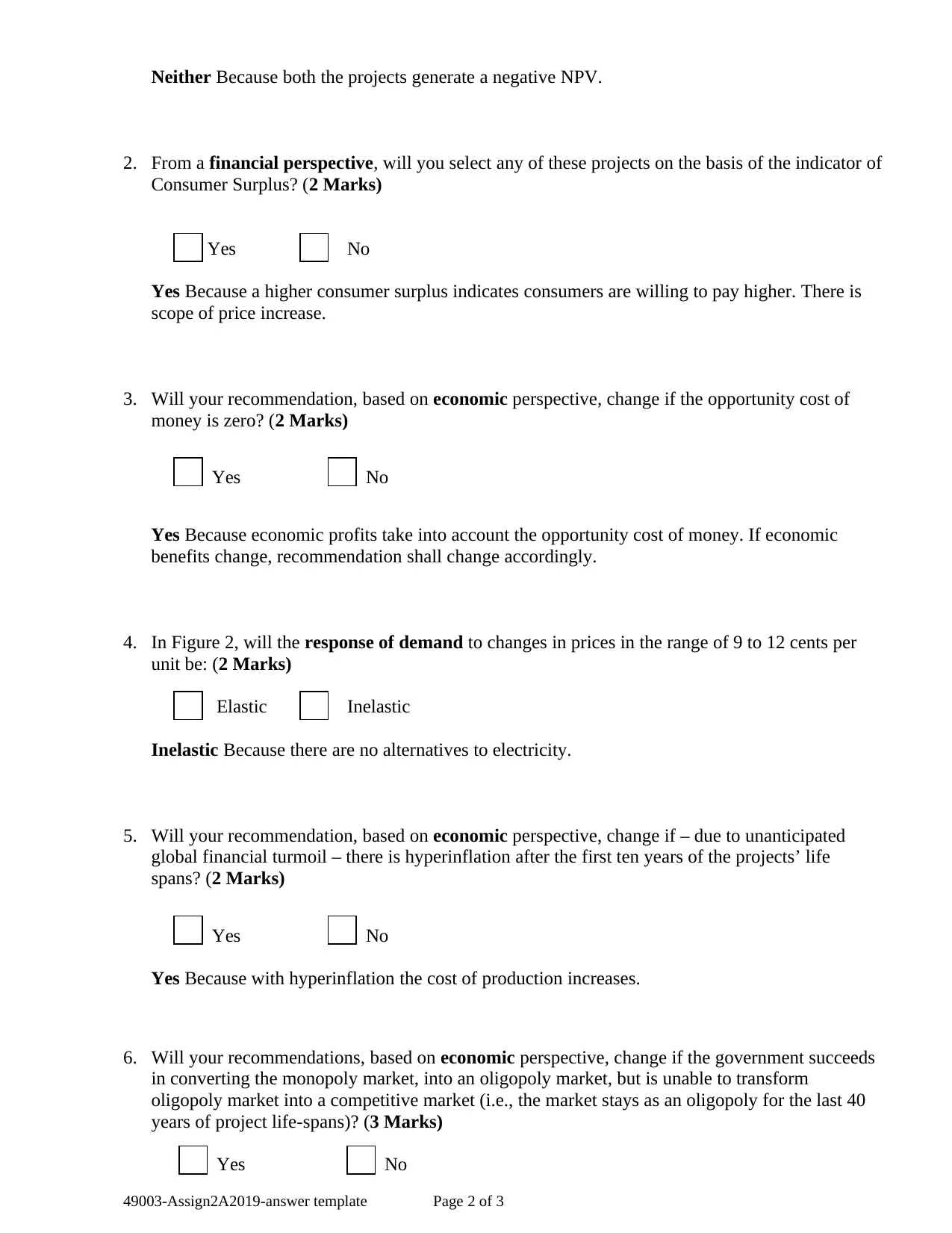

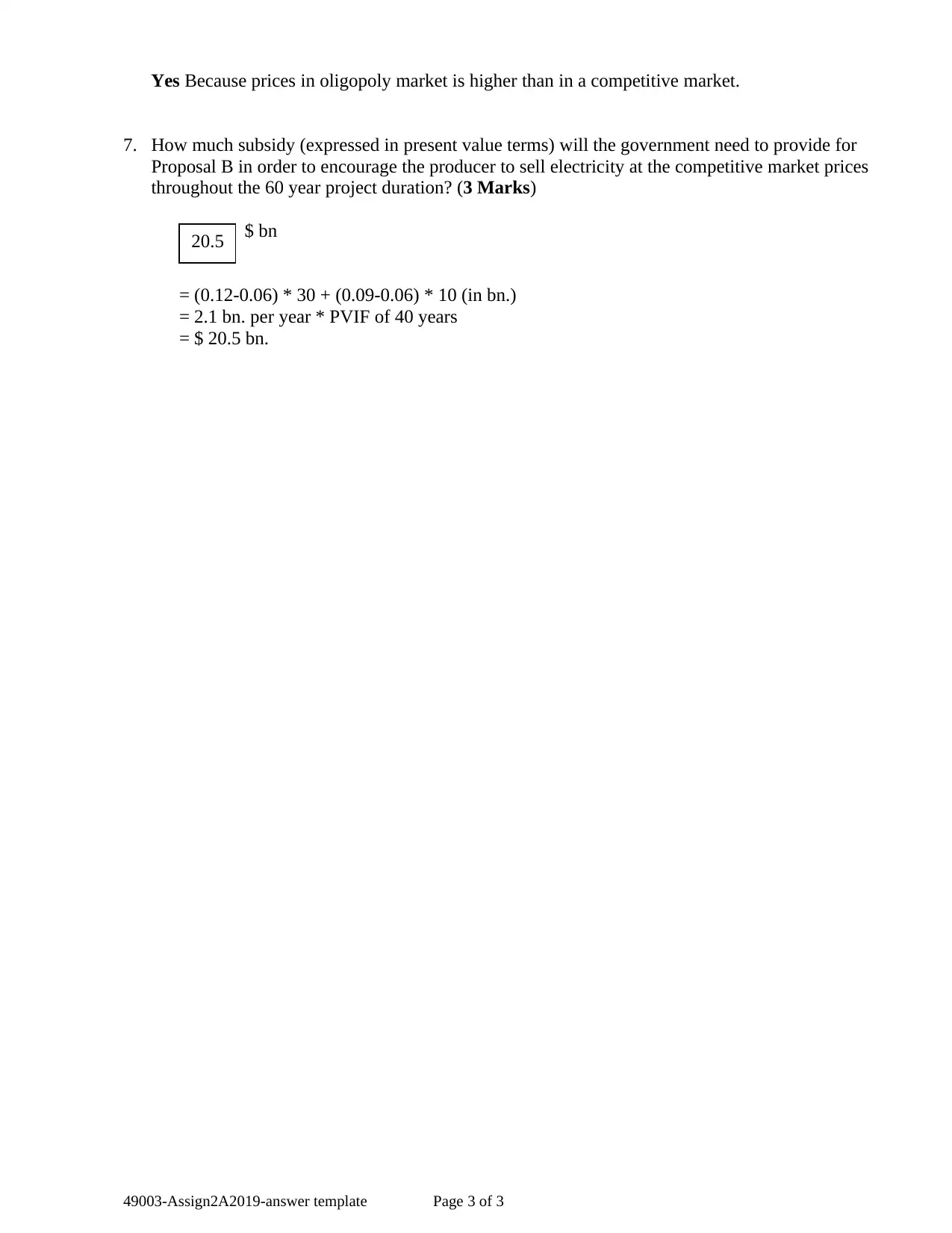

This assignment solution provides a comprehensive analysis of two project proposals (A and B) from both financial and economic perspectives. It includes calculations and evaluations of key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period (PB), and Benefit-Cost ratio (B/C). Furthermore, the solution explores economic aspects like Life Cycle Cost, Equivalent Annual Cost, Consumer Surplus, Producer Surplus, and Total Surplus, considering factors like opportunity cost, market structures (monopoly, oligopoly, and competitive markets), and the impact of hyperinflation. The assignment also delves into the concept of demand elasticity and the need for government subsidies to encourage competitive pricing. The student's answers and recommendations are provided with justifications based on the economic principles and financial indicators.

1 out of 3

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)