Economic Foundation for Public Policy: UK Fiscal Policy Analysis

VerifiedAdded on 2021/09/19

|7

|1003

|133

Report

AI Summary

This report analyzes the economic foundation of public policy, specifically focusing on the UK's expansionary fiscal policy implemented in 2009 during the great recession. The policy aimed to stimulate economic growth and maintain inflation below 2%. The report examines the policy's components, including tax reductions, increased government expenditure, and the resulting budget deficit. It utilizes the Keynesian model to illustrate the impact on economic output, price levels, and unemployment rates. Furthermore, the report presents data on GDP growth, inflation, and unemployment in the UK during the period. It also discusses the role of monetary policy, including interest rate cuts and quantitative easing, and their limitations. The analysis concludes by emphasizing the importance of accurate economic information for effective fiscal policy and the need to consider current economic conditions when implementing such policies.

Running head: ECONOMIC FOUNDATION FOR PUBLIC POLICY

Economic Foundation for Public Policy

Name of the student

Name of the University

Author Note

Economic Foundation for Public Policy

Name of the student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC FOUNDATION FOR PUBLIC POLICY

a.

The paper considers expansionary fiscal policy taken by the UK government in 2009.

During this period, the country experienced great recession. The chief purpose of this policy

was to influence economic growth of the UK during recession. This further helped the

government to keep inflation rate below 2 percent (Degryse, Matthews and Zhao 2018). The

other important focus of this policy was to stabilise economic growth for overcoming the

boom phase of the economic cycle.

b.

Expansionary fiscal policy of the UK government considers tax reduction, increasing

expenditure of government and a budget deficit by large extend. Through adopting this

policy, the UK government intended to increase aggregate demand within the economy

during great depression. For doing this, the government increased government expenditure

and decreased value added tax (VAT). Tax reduction in turn influenced consumers to

increase demand, as they have more disposable income. However, lower tax rate increased

government borrowing in 2009. This happened because the government earned lower tax

revenue at that time. This significant amount of public borrowing influenced UK economy to

experience a stimulus within the depressed economy. However, the political condition of this

country experienced many disturbances during that period.

c.

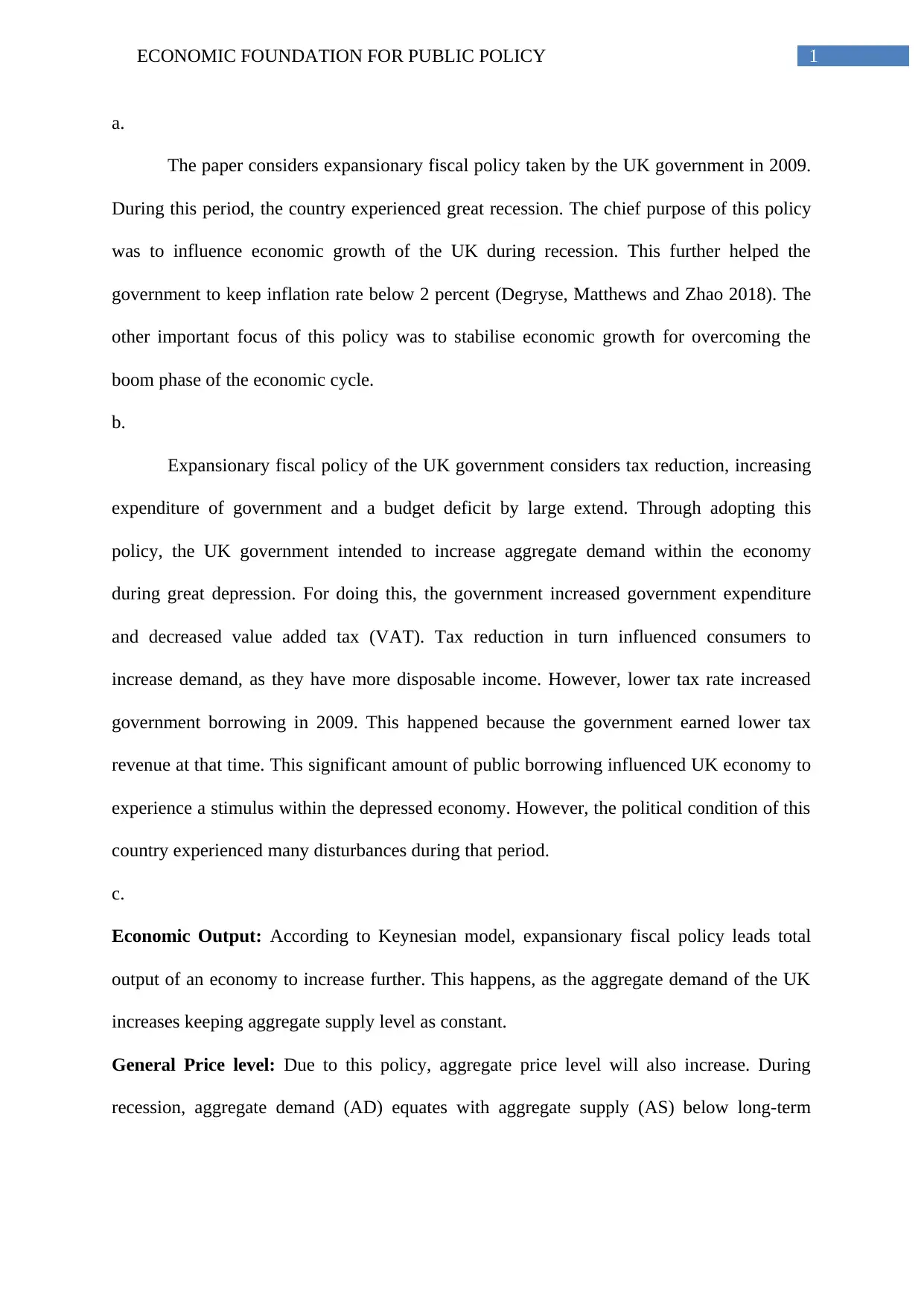

Economic Output: According to Keynesian model, expansionary fiscal policy leads total

output of an economy to increase further. This happens, as the aggregate demand of the UK

increases keeping aggregate supply level as constant.

General Price level: Due to this policy, aggregate price level will also increase. During

recession, aggregate demand (AD) equates with aggregate supply (AS) below long-term

a.

The paper considers expansionary fiscal policy taken by the UK government in 2009.

During this period, the country experienced great recession. The chief purpose of this policy

was to influence economic growth of the UK during recession. This further helped the

government to keep inflation rate below 2 percent (Degryse, Matthews and Zhao 2018). The

other important focus of this policy was to stabilise economic growth for overcoming the

boom phase of the economic cycle.

b.

Expansionary fiscal policy of the UK government considers tax reduction, increasing

expenditure of government and a budget deficit by large extend. Through adopting this

policy, the UK government intended to increase aggregate demand within the economy

during great depression. For doing this, the government increased government expenditure

and decreased value added tax (VAT). Tax reduction in turn influenced consumers to

increase demand, as they have more disposable income. However, lower tax rate increased

government borrowing in 2009. This happened because the government earned lower tax

revenue at that time. This significant amount of public borrowing influenced UK economy to

experience a stimulus within the depressed economy. However, the political condition of this

country experienced many disturbances during that period.

c.

Economic Output: According to Keynesian model, expansionary fiscal policy leads total

output of an economy to increase further. This happens, as the aggregate demand of the UK

increases keeping aggregate supply level as constant.

General Price level: Due to this policy, aggregate price level will also increase. During

recession, aggregate demand (AD) equates with aggregate supply (AS) below long-term

2ECONOMIC FOUNDATION FOR PUBLIC POLICY

aggregate supply curve. The entire situation can be described with the help of following

figure:

Figure 1: Expansionary fiscal policy

Source: (created by author)

According to above figure, real national income of the country has increased from Y1

to Y2 while aggregate price level has increased from P1 to P2.

Unemployment rates: Expansionary fiscal policy helps an economy to reduce

unemployment. Through increasing aggregate demand, the economy can create employment

opportunity.

aggregate supply curve. The entire situation can be described with the help of following

figure:

Figure 1: Expansionary fiscal policy

Source: (created by author)

According to above figure, real national income of the country has increased from Y1

to Y2 while aggregate price level has increased from P1 to P2.

Unemployment rates: Expansionary fiscal policy helps an economy to reduce

unemployment. Through increasing aggregate demand, the economy can create employment

opportunity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC FOUNDATION FOR PUBLIC POLICY

d.

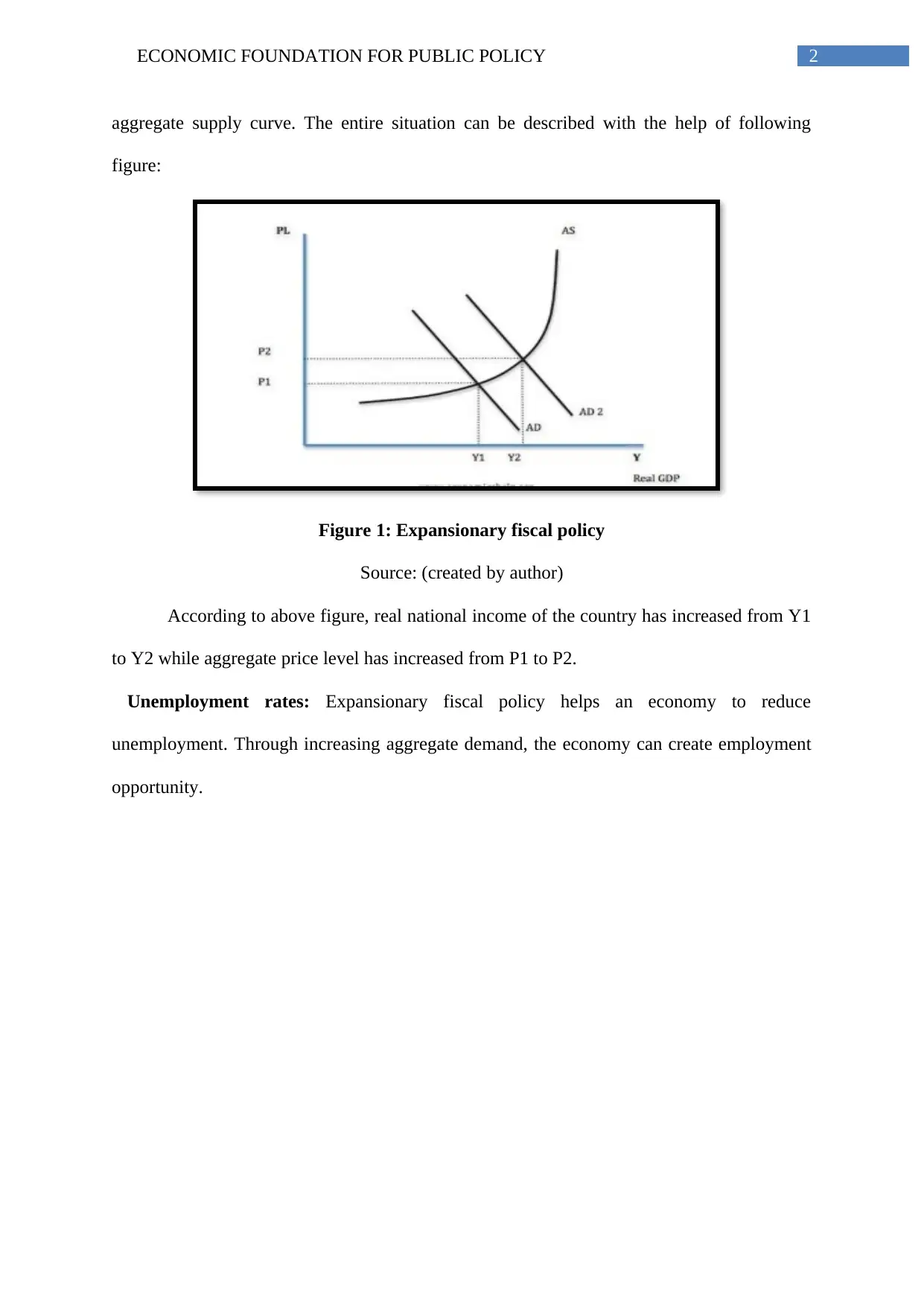

Figure 2: GDP growth rate of the United Kingdom

Source: (Tradingeconomics.com. 2018)

According to figure 2, GDP growth of the UK decreased during the period of

financial crisis. However, after taking expansionary policy, this growth rate started to

increase after 2009.

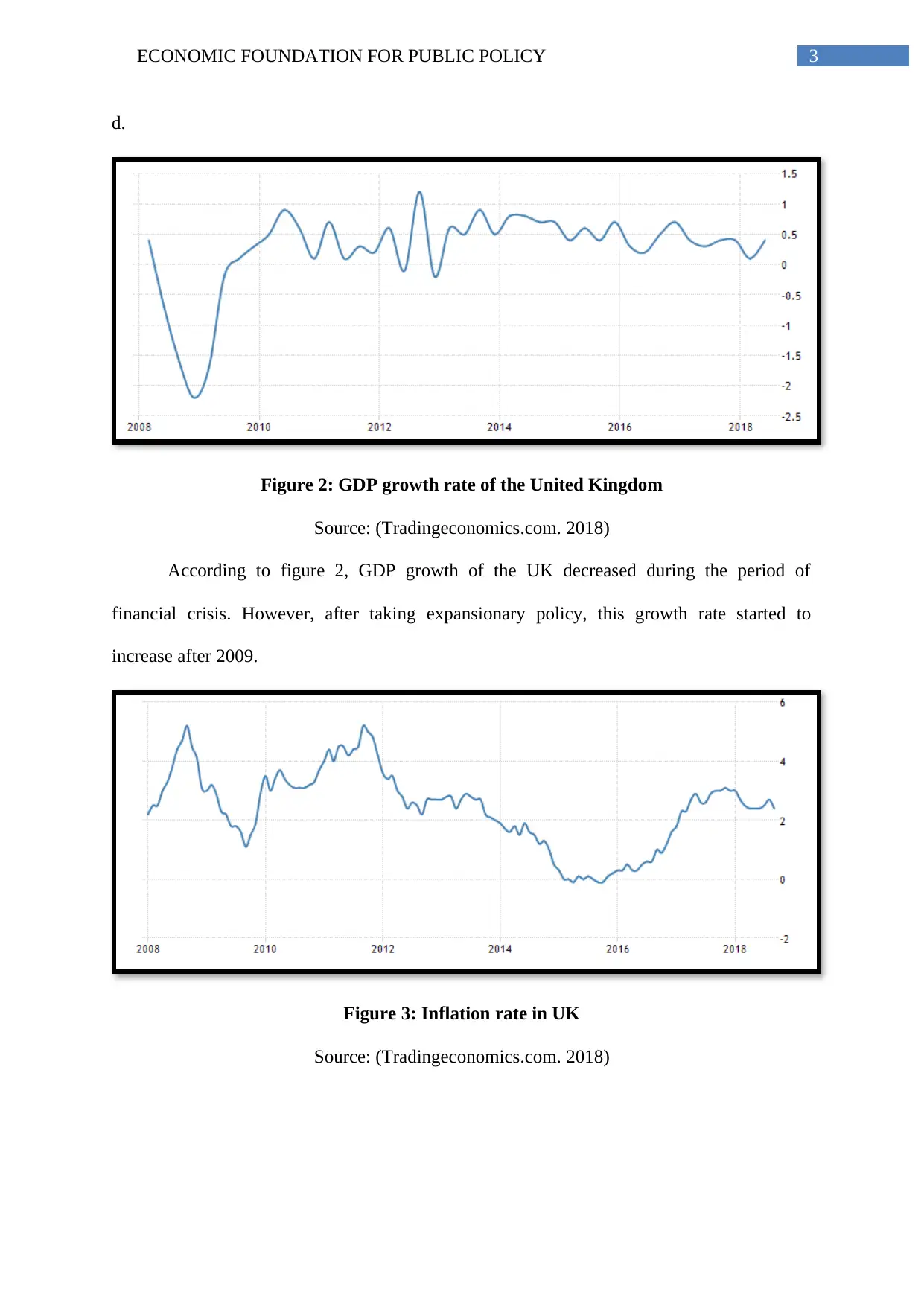

Figure 3: Inflation rate in UK

Source: (Tradingeconomics.com. 2018)

d.

Figure 2: GDP growth rate of the United Kingdom

Source: (Tradingeconomics.com. 2018)

According to figure 2, GDP growth of the UK decreased during the period of

financial crisis. However, after taking expansionary policy, this growth rate started to

increase after 2009.

Figure 3: Inflation rate in UK

Source: (Tradingeconomics.com. 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC FOUNDATION FOR PUBLIC POLICY

The above figure represents inflation rate of the UK. Inflation rate indicates change in

price level during recession. In 2009, price level decreased by significant amount. However,

after taking expansionary fiscal policy, price level increased by increasing rate.

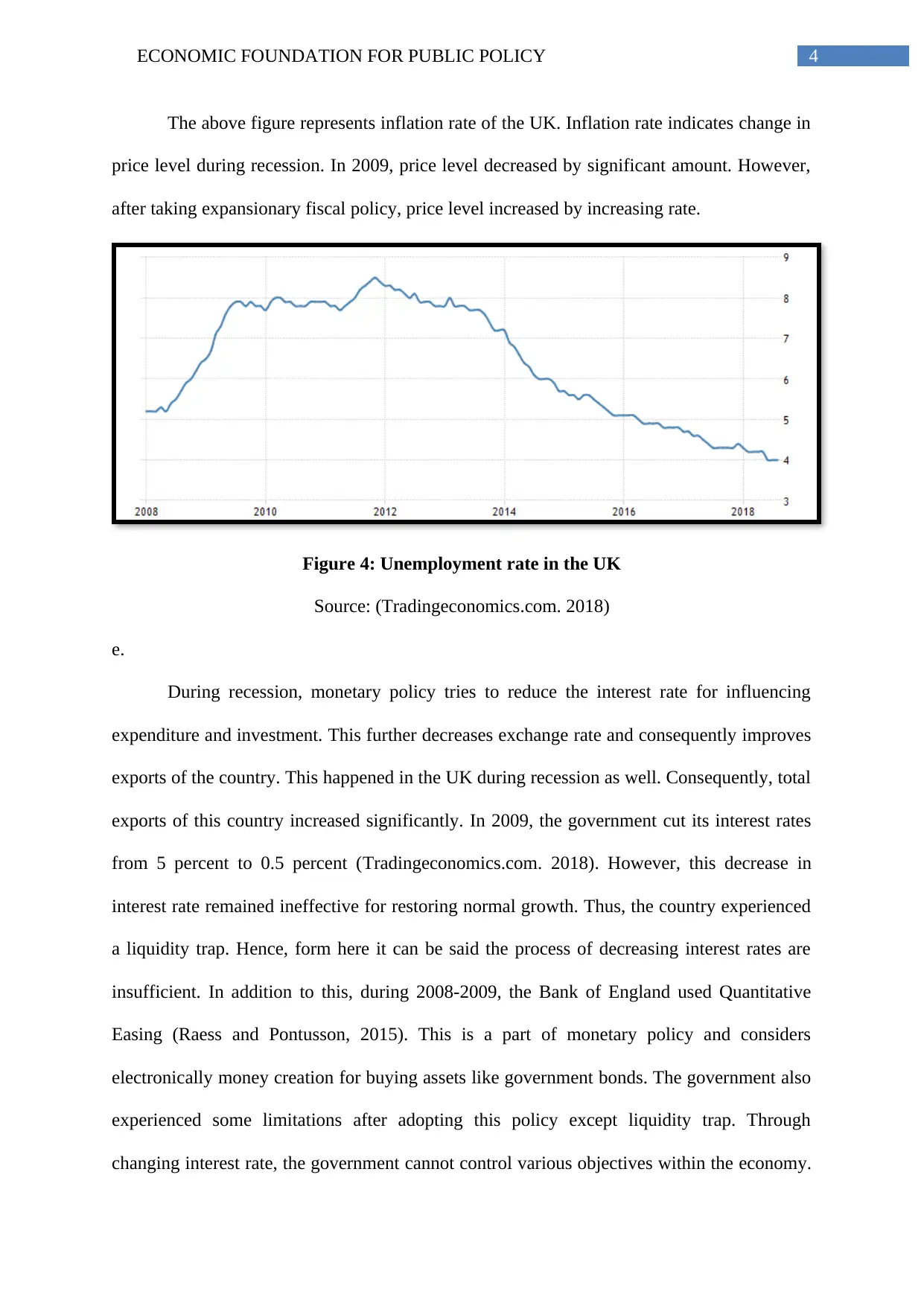

Figure 4: Unemployment rate in the UK

Source: (Tradingeconomics.com. 2018)

e.

During recession, monetary policy tries to reduce the interest rate for influencing

expenditure and investment. This further decreases exchange rate and consequently improves

exports of the country. This happened in the UK during recession as well. Consequently, total

exports of this country increased significantly. In 2009, the government cut its interest rates

from 5 percent to 0.5 percent (Tradingeconomics.com. 2018). However, this decrease in

interest rate remained ineffective for restoring normal growth. Thus, the country experienced

a liquidity trap. Hence, form here it can be said the process of decreasing interest rates are

insufficient. In addition to this, during 2008-2009, the Bank of England used Quantitative

Easing (Raess and Pontusson, 2015). This is a part of monetary policy and considers

electronically money creation for buying assets like government bonds. The government also

experienced some limitations after adopting this policy except liquidity trap. Through

changing interest rate, the government cannot control various objectives within the economy.

The above figure represents inflation rate of the UK. Inflation rate indicates change in

price level during recession. In 2009, price level decreased by significant amount. However,

after taking expansionary fiscal policy, price level increased by increasing rate.

Figure 4: Unemployment rate in the UK

Source: (Tradingeconomics.com. 2018)

e.

During recession, monetary policy tries to reduce the interest rate for influencing

expenditure and investment. This further decreases exchange rate and consequently improves

exports of the country. This happened in the UK during recession as well. Consequently, total

exports of this country increased significantly. In 2009, the government cut its interest rates

from 5 percent to 0.5 percent (Tradingeconomics.com. 2018). However, this decrease in

interest rate remained ineffective for restoring normal growth. Thus, the country experienced

a liquidity trap. Hence, form here it can be said the process of decreasing interest rates are

insufficient. In addition to this, during 2008-2009, the Bank of England used Quantitative

Easing (Raess and Pontusson, 2015). This is a part of monetary policy and considers

electronically money creation for buying assets like government bonds. The government also

experienced some limitations after adopting this policy except liquidity trap. Through

changing interest rate, the government cannot control various objectives within the economy.

5ECONOMIC FOUNDATION FOR PUBLIC POLICY

For instance, increase in oil price can cause cost-push inflation and this in turn reduces

growth of the country. Moreover, exports became comparatively less competitive.

f.

According to economic condition, the government takes fiscal policies accordingly.

However, to improve the condition, the government needs to gather exact information of the

country. To take exact and effective fiscal policy, the government needs to know accurate

information about the economy (Meinusch and Tillmann 2016). In addition to this, the

government requires to maintain borrowing costs. For this, the government can monitor the

entire scenario efficiently, as during expansionary fiscal policy bond price can be increased.

Thus, it can be beneficial for the government of the United Kingdom to adopt the policy

considering present economic condition irrespective of theoretical concept.

For instance, increase in oil price can cause cost-push inflation and this in turn reduces

growth of the country. Moreover, exports became comparatively less competitive.

f.

According to economic condition, the government takes fiscal policies accordingly.

However, to improve the condition, the government needs to gather exact information of the

country. To take exact and effective fiscal policy, the government needs to know accurate

information about the economy (Meinusch and Tillmann 2016). In addition to this, the

government requires to maintain borrowing costs. For this, the government can monitor the

entire scenario efficiently, as during expansionary fiscal policy bond price can be increased.

Thus, it can be beneficial for the government of the United Kingdom to adopt the policy

considering present economic condition irrespective of theoretical concept.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC FOUNDATION FOR PUBLIC POLICY

References:

Tradingeconomics.com. 2018. United Kingdom Unemployment Rate | 1971-2018 | Data |

Chart | Calendar. [online] Available at:

https://tradingeconomics.com/united-kingdom/unemployment-rate [Accessed 31 Oct. 2018].

Degryse, H., Matthews, K. and Zhao, T., 2018. SMEs and access to bank credit: Evidence on

the regional propagation of the financial crisis in the UK. Journal of Financial Stability, 38,

pp.53-70.

Raess, D. and Pontusson, J., 2015. The politics of fiscal policy during economic downturns,

1981–2010. European Journal of Political Research, 54(1), pp.1-22.

Meinusch, A. and Tillmann, P., 2016. The macroeconomic impact of unconventional

monetary policy shocks. Journal of Macroeconomics, 47, pp.58-67.

References:

Tradingeconomics.com. 2018. United Kingdom Unemployment Rate | 1971-2018 | Data |

Chart | Calendar. [online] Available at:

https://tradingeconomics.com/united-kingdom/unemployment-rate [Accessed 31 Oct. 2018].

Degryse, H., Matthews, K. and Zhao, T., 2018. SMEs and access to bank credit: Evidence on

the regional propagation of the financial crisis in the UK. Journal of Financial Stability, 38,

pp.53-70.

Raess, D. and Pontusson, J., 2015. The politics of fiscal policy during economic downturns,

1981–2010. European Journal of Political Research, 54(1), pp.1-22.

Meinusch, A. and Tillmann, P., 2016. The macroeconomic impact of unconventional

monetary policy shocks. Journal of Macroeconomics, 47, pp.58-67.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.