Economics for Business: Assignment Solution - Concepts and Analysis

VerifiedAdded on 2022/12/28

|23

|5441

|9

Homework Assignment

AI Summary

This economics assignment solution covers key concepts in both microeconomics and macroeconomics. The solution begins with an analysis of demand and supply, including the calculation of price elasticity of demand using the midpoint formula for petrol and air conditioners, and discusses the incidence of tax under elastic and inelastic demand conditions. It then moves on to production costs, differentiating between accounting and economic profit and provides advice for a business owner. The assignment also explores market structures, specifically focusing on a monopoly firm, discussing its demand curve characteristics, the benefits for a company, and the implications for consumers in both the short and long run. Finally, it addresses macroeconomic topics such as GDP, aggregate demand, and money supply within an economy. The assessment includes calculations, explanations, and analyses of various economic principles.

Economics for Business

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

Assessment Question Week 2 and 3 – Demand and Supply, and Elasticity....................................3

Question1....................................................................................................................................3

Assessment Question Week 4 – Production Costs..........................................................................7

Question 2...................................................................................................................................7

Assessment Question Week 5 and 6 – Market Structure.................................................................8

Question 3...................................................................................................................................8

Assessment Question Week 7 and 8 – Measuring the size of the economy..................................11

Question 4.................................................................................................................................11

Assessment Question Week 9 and 10: Inflation and unemployment, and Macro economics.......14

Question 5.................................................................................................................................14

Assessment Question Week 11......................................................................................................17

Question 6.................................................................................................................................17

Conclusion.....................................................................................................................................19

References......................................................................................................................................21

2

Introduction......................................................................................................................................3

Assessment Question Week 2 and 3 – Demand and Supply, and Elasticity....................................3

Question1....................................................................................................................................3

Assessment Question Week 4 – Production Costs..........................................................................7

Question 2...................................................................................................................................7

Assessment Question Week 5 and 6 – Market Structure.................................................................8

Question 3...................................................................................................................................8

Assessment Question Week 7 and 8 – Measuring the size of the economy..................................11

Question 4.................................................................................................................................11

Assessment Question Week 9 and 10: Inflation and unemployment, and Macro economics.......14

Question 5.................................................................................................................................14

Assessment Question Week 11......................................................................................................17

Question 6.................................................................................................................................17

Conclusion.....................................................................................................................................19

References......................................................................................................................................21

2

Introduction

Economics is a subject or branch of knowledge which is concerned with the production,

consumption and transfer of wealth. It is further bifurcated into microeconomics and

macroeconomics. Microeconomics deals with study of individual aspects like demand and

supply of individual firm while macroeconomics deals with study of economy in general and

focus on exploring concepts that aggregate individual factors like aggregate demand and

aggregate supply (Browning and Zupan, 2020). Measures like demand and supply lead to further

concepts like elasticity which determines responsiveness of demand and supply in response to

determinants like price and income. These measures impact profitability of a firm, it could be

both accounting profit and economic profit. However, accounting profit and economic profit are

supplementary concepts for accounting profit only includes explicit transactions while economic

profits take into account both explicit and implicit cost such as opportunity cost. Firms operate

under market conditions which could exhibit different types of characteristics. Based on those

characteristics, markets are divided into various categories such as perfect competition,

monopolistic, oligopoly and monopoly. Further, combined production in all the markets in a year

in an economy is known as gross domestic product or GDP (Goodstein and Polasky, 2020).

Below mentioned assessment contains questions that aims to explore various concepts

related to microeconomics and macroeconomics. There are six questions attempted below – first

of which is related to explore elasticity of demand in individual commodities using mid-point

formula, next is related to calculation of accounting profit and economic profit. Third question is

related to assess characteristics of monopoly market and in the next, concepts related to GDP are

explored with discussion over difference between real GDP and nominal GDP. In the fifth

question, determinants of aggregate demands are discussed and in the final question, concept of

money supply in the economy is explored.

Assessment Question Week 2 and 3 – Demand and Supply, and Elasticity

Question1

(I) Calculation of price elasticity of demand using mid-point formula

Midpoint method for calculating elasticity uses change in average percentage in

both quantity and price to determine price elasticity of demand

Statement for Petrol at 7-Eleven Petrol Station, Sydney

3

Economics is a subject or branch of knowledge which is concerned with the production,

consumption and transfer of wealth. It is further bifurcated into microeconomics and

macroeconomics. Microeconomics deals with study of individual aspects like demand and

supply of individual firm while macroeconomics deals with study of economy in general and

focus on exploring concepts that aggregate individual factors like aggregate demand and

aggregate supply (Browning and Zupan, 2020). Measures like demand and supply lead to further

concepts like elasticity which determines responsiveness of demand and supply in response to

determinants like price and income. These measures impact profitability of a firm, it could be

both accounting profit and economic profit. However, accounting profit and economic profit are

supplementary concepts for accounting profit only includes explicit transactions while economic

profits take into account both explicit and implicit cost such as opportunity cost. Firms operate

under market conditions which could exhibit different types of characteristics. Based on those

characteristics, markets are divided into various categories such as perfect competition,

monopolistic, oligopoly and monopoly. Further, combined production in all the markets in a year

in an economy is known as gross domestic product or GDP (Goodstein and Polasky, 2020).

Below mentioned assessment contains questions that aims to explore various concepts

related to microeconomics and macroeconomics. There are six questions attempted below – first

of which is related to explore elasticity of demand in individual commodities using mid-point

formula, next is related to calculation of accounting profit and economic profit. Third question is

related to assess characteristics of monopoly market and in the next, concepts related to GDP are

explored with discussion over difference between real GDP and nominal GDP. In the fifth

question, determinants of aggregate demands are discussed and in the final question, concept of

money supply in the economy is explored.

Assessment Question Week 2 and 3 – Demand and Supply, and Elasticity

Question1

(I) Calculation of price elasticity of demand using mid-point formula

Midpoint method for calculating elasticity uses change in average percentage in

both quantity and price to determine price elasticity of demand

Statement for Petrol at 7-Eleven Petrol Station, Sydney

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

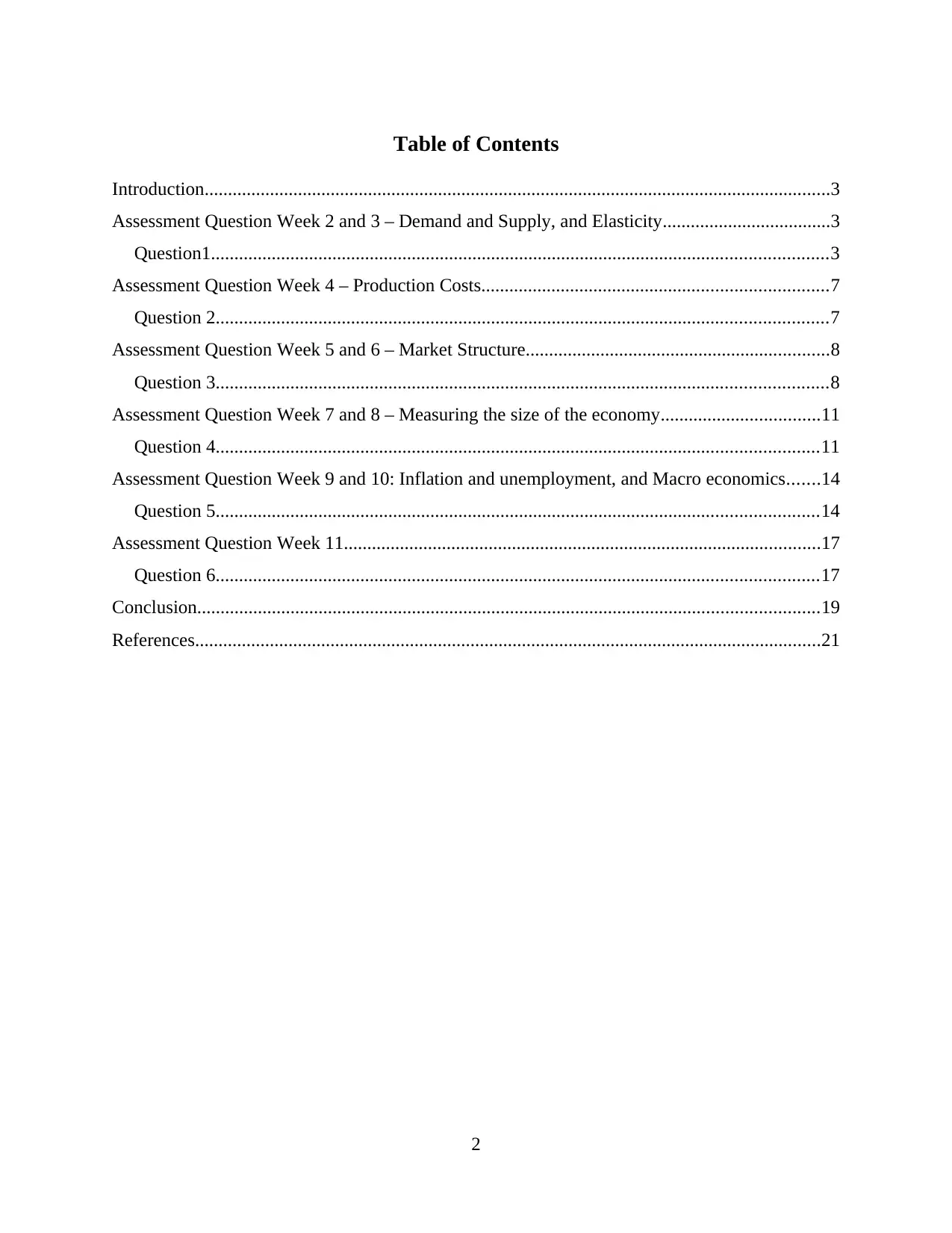

Price Demand

1.35 AUD (P1) 2500 litres (Q1)

1.45 AUD (P2) 2450 litres(Q2)

Change in quantity = Q2 – Q1 / ((Q2 + Q1) / 2) *100

= 2450 – 2500 / ((2500 + 2450) / 2) * 100

= (-50 / 2475) * 100

= (2.02 %)

Change in price = P2 – P1 / ((P2 + P1) / 2) *100

= 1.45 – 1.35 / ((1.45 + 1.35) / 2) *100

= (0.10 / 1.4) *100

= 7.14%

Price elasticity of demand = change in quantity / change in price

= (2.02%) / 7.14%

= (0.28)

Statement for Hyundai 7.5kW Inverter Split System Air Conditioners (Reverse Cycle)

Price Demand

950 AUD (P1) 2500 litres (Q1)

990 AUD (P2) 2000 litres(Q2)

Change in quantity = Q2 – Q1 / ((Q2 + Q1) / 2) *100

= 2000 – 2500 / ((2000 + 2500) / 2) * 100

= (-500 / 3250) *100

= (15.38%)

Change in price = P2 – P1 / ((P2 + P1) / 2) *100

= 990 – 950 / ((990 + 950) / 2) *100

= (40 / 970) * 100

4

1.35 AUD (P1) 2500 litres (Q1)

1.45 AUD (P2) 2450 litres(Q2)

Change in quantity = Q2 – Q1 / ((Q2 + Q1) / 2) *100

= 2450 – 2500 / ((2500 + 2450) / 2) * 100

= (-50 / 2475) * 100

= (2.02 %)

Change in price = P2 – P1 / ((P2 + P1) / 2) *100

= 1.45 – 1.35 / ((1.45 + 1.35) / 2) *100

= (0.10 / 1.4) *100

= 7.14%

Price elasticity of demand = change in quantity / change in price

= (2.02%) / 7.14%

= (0.28)

Statement for Hyundai 7.5kW Inverter Split System Air Conditioners (Reverse Cycle)

Price Demand

950 AUD (P1) 2500 litres (Q1)

990 AUD (P2) 2000 litres(Q2)

Change in quantity = Q2 – Q1 / ((Q2 + Q1) / 2) *100

= 2000 – 2500 / ((2000 + 2500) / 2) * 100

= (-500 / 3250) *100

= (15.38%)

Change in price = P2 – P1 / ((P2 + P1) / 2) *100

= 990 – 950 / ((990 + 950) / 2) *100

= (40 / 970) * 100

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= 4.12%

Price elasticity of demand = change in quantity / change in price

= (15.38 %) / 4.12 %

= (3.73)

*Negative value denotes negative relationship between price and demand, as per law of demand.

(II) Determination of elasticity of demand for each commodity

Price elasticity of demand calculates relative change in demand due to change in

price. It can be divided into five broad categories:

Value of elasticity Known as

infinity (∞) Perfectly elastic

More than one (>1) Elastic

One (1) Unitary elastic

Less than one (<1) Inelastic

Zero (0) Perfectly inelastic

From the above figures, it can be seen that price elasticity of demand of petrol is 0.28 i.e.,

less than one and therefore, can be termed as inelastic. Inelastic demand means that demand is

less responsive to change in price. On the other hand, price elasticity of demand of air

conditioners is 3.73 i.e., more than one and can therefore be termed as elastic. Elastic demand

means that demand is highly responsive to change in price (Kreps, 2019).

(III) Incidence of tax

Incidence of tax is used to understand bifurcation of tax burden between buyers and

sellers. It can be determined using price elasticity of demand and supply.

5

Price elasticity of demand = change in quantity / change in price

= (15.38 %) / 4.12 %

= (3.73)

*Negative value denotes negative relationship between price and demand, as per law of demand.

(II) Determination of elasticity of demand for each commodity

Price elasticity of demand calculates relative change in demand due to change in

price. It can be divided into five broad categories:

Value of elasticity Known as

infinity (∞) Perfectly elastic

More than one (>1) Elastic

One (1) Unitary elastic

Less than one (<1) Inelastic

Zero (0) Perfectly inelastic

From the above figures, it can be seen that price elasticity of demand of petrol is 0.28 i.e.,

less than one and therefore, can be termed as inelastic. Inelastic demand means that demand is

less responsive to change in price. On the other hand, price elasticity of demand of air

conditioners is 3.73 i.e., more than one and can therefore be termed as elastic. Elastic demand

means that demand is highly responsive to change in price (Kreps, 2019).

(III) Incidence of tax

Incidence of tax is used to understand bifurcation of tax burden between buyers and

sellers. It can be determined using price elasticity of demand and supply.

5

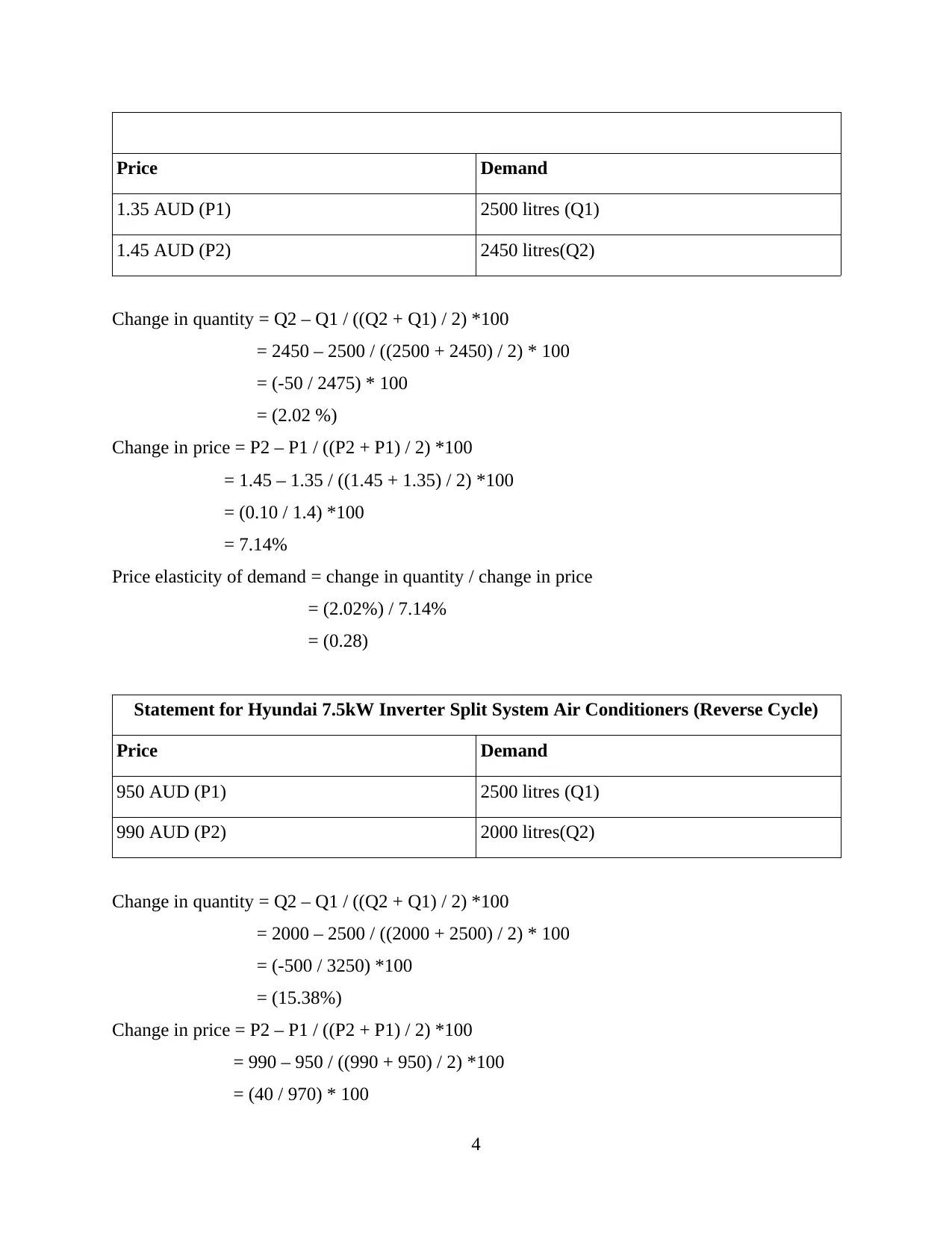

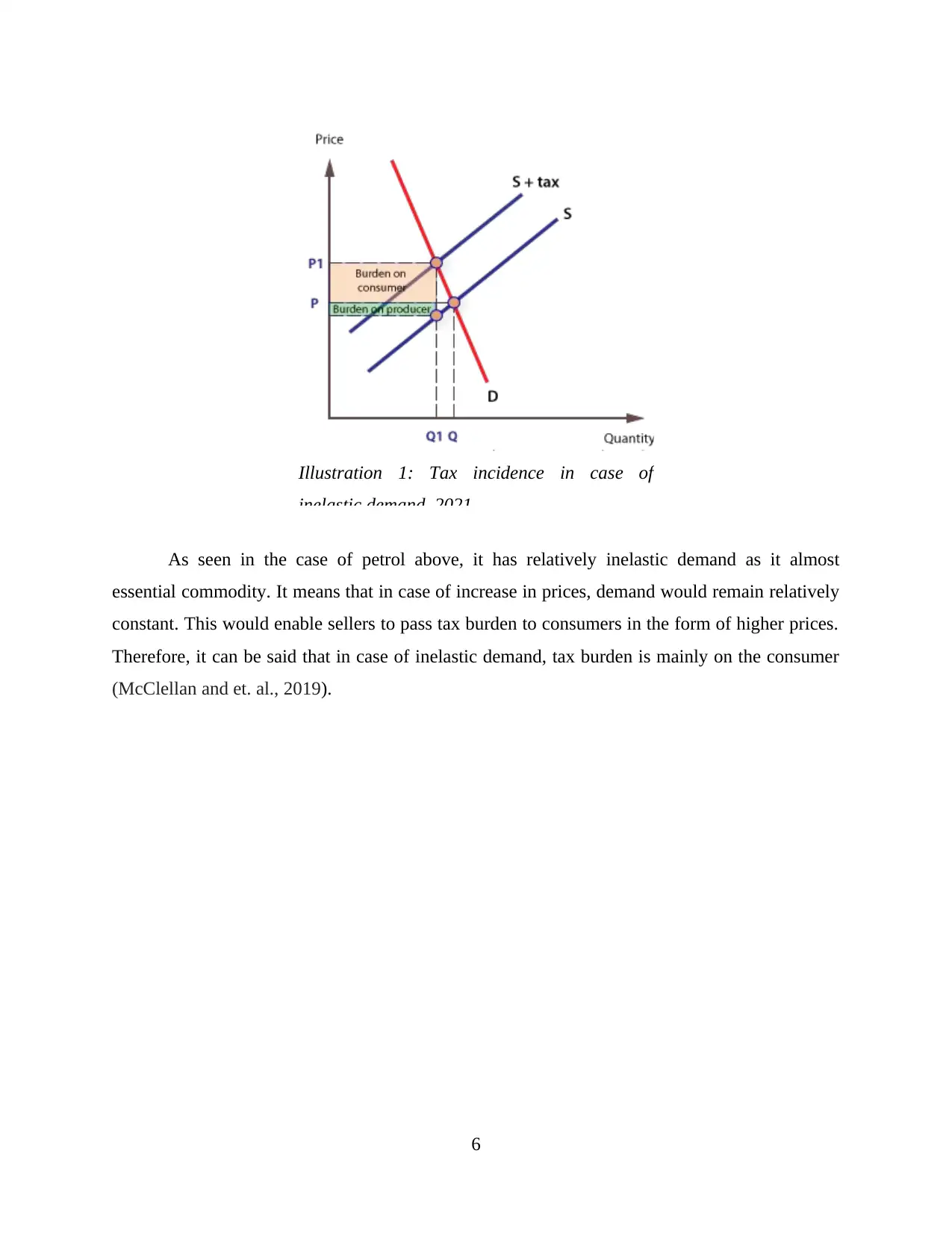

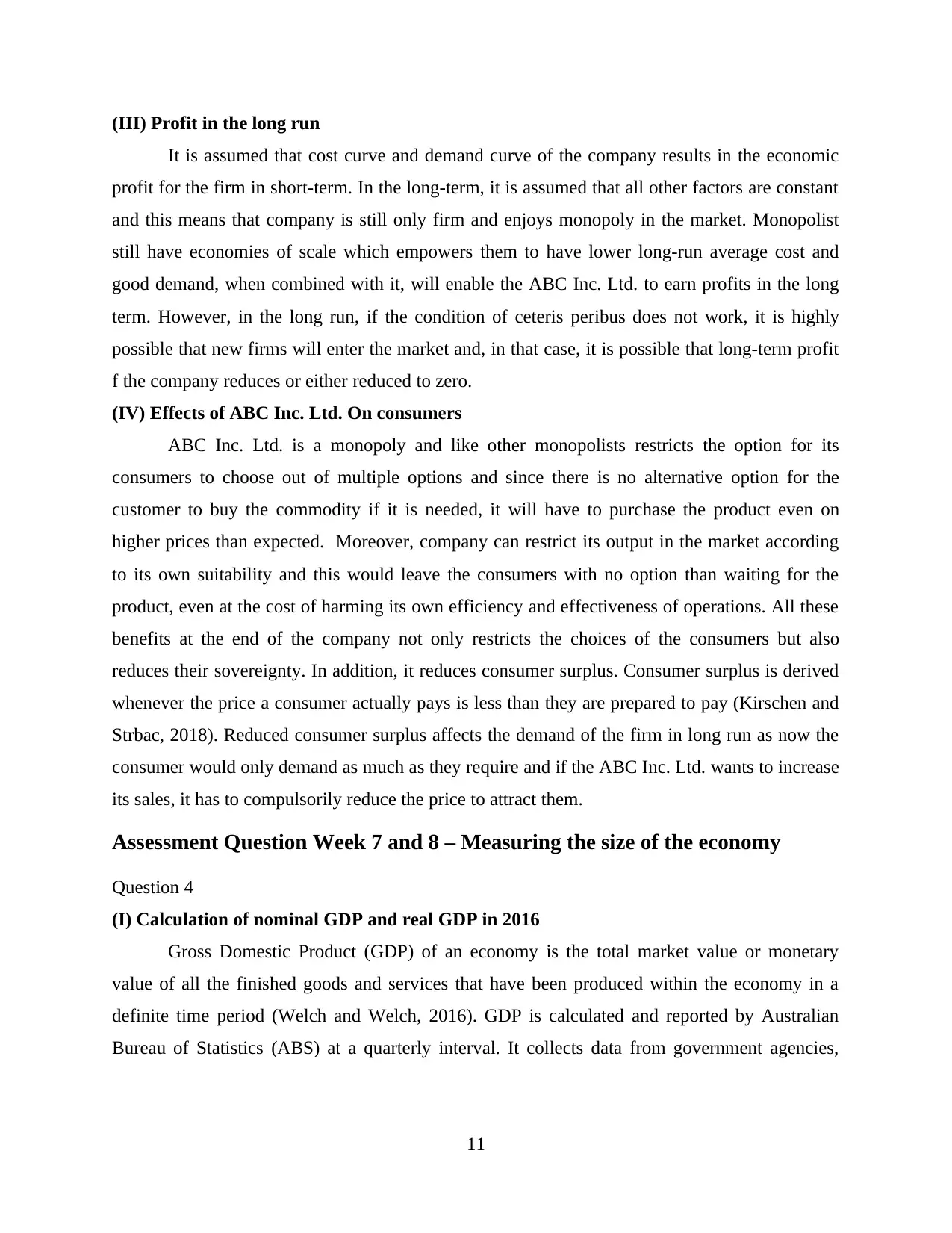

As seen in the case of petrol above, it has relatively inelastic demand as it almost

essential commodity. It means that in case of increase in prices, demand would remain relatively

constant. This would enable sellers to pass tax burden to consumers in the form of higher prices.

Therefore, it can be said that in case of inelastic demand, tax burden is mainly on the consumer

(McClellan and et. al., 2019).

6

Illustration 1: Tax incidence in case of

inelastic demand, 2021

essential commodity. It means that in case of increase in prices, demand would remain relatively

constant. This would enable sellers to pass tax burden to consumers in the form of higher prices.

Therefore, it can be said that in case of inelastic demand, tax burden is mainly on the consumer

(McClellan and et. al., 2019).

6

Illustration 1: Tax incidence in case of

inelastic demand, 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

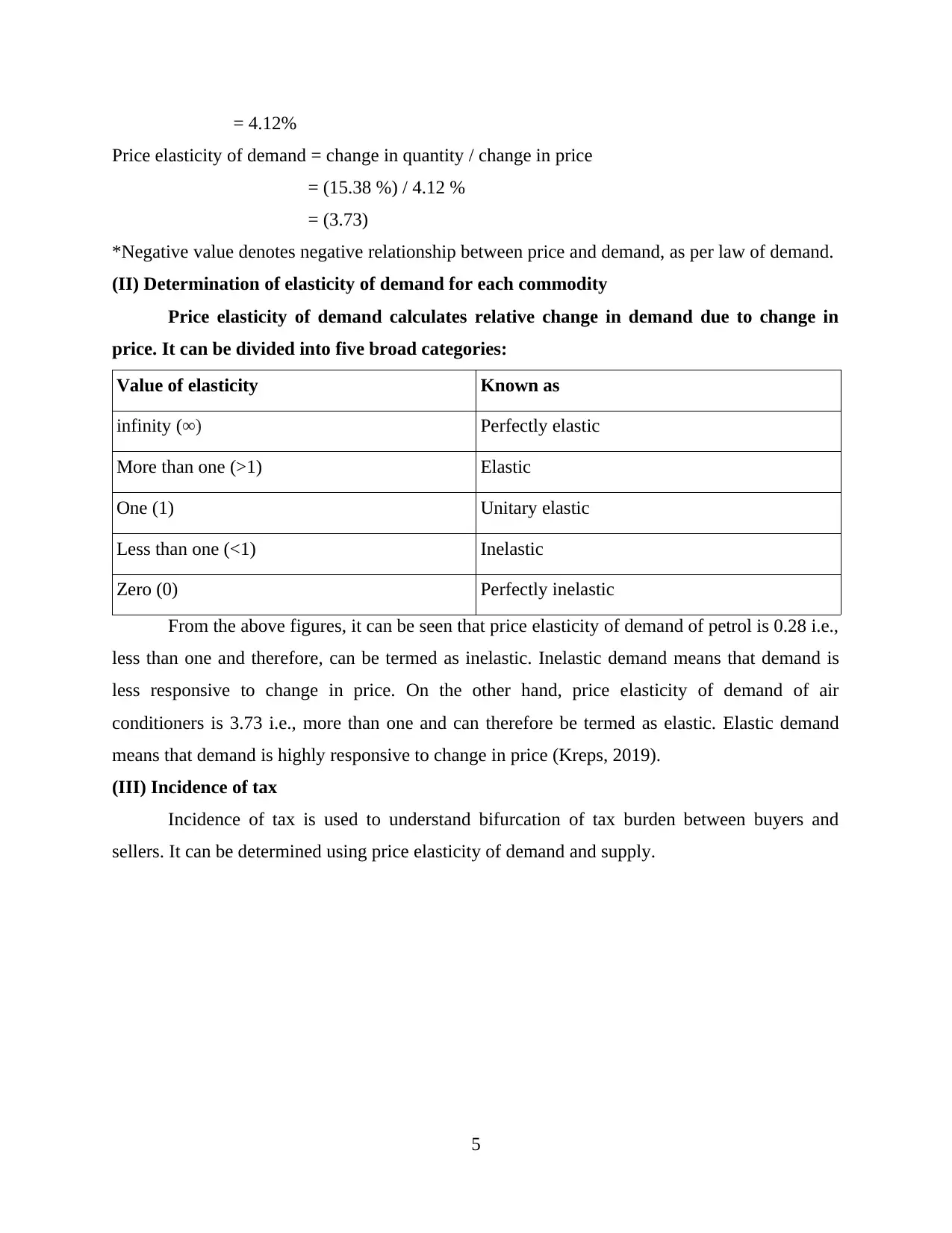

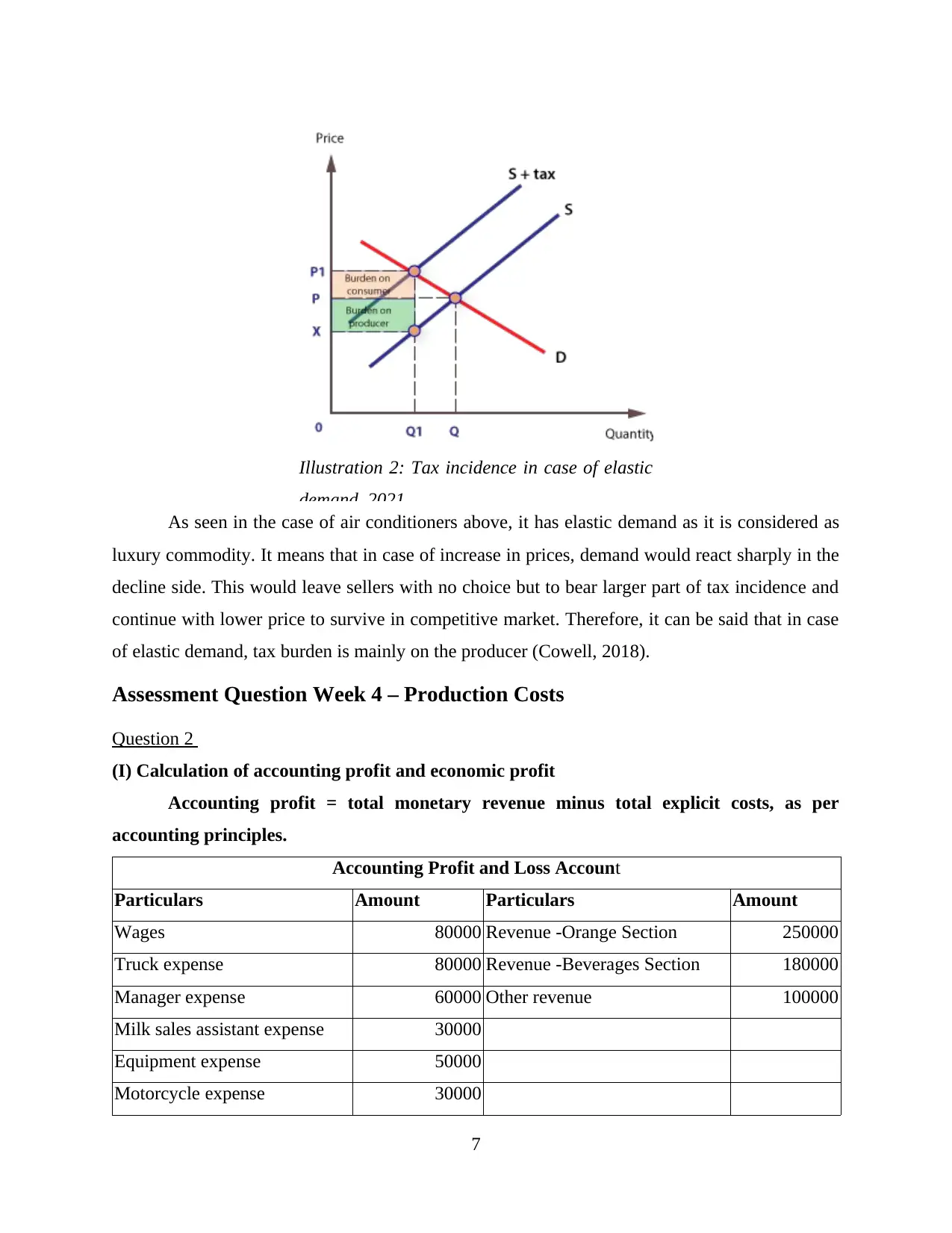

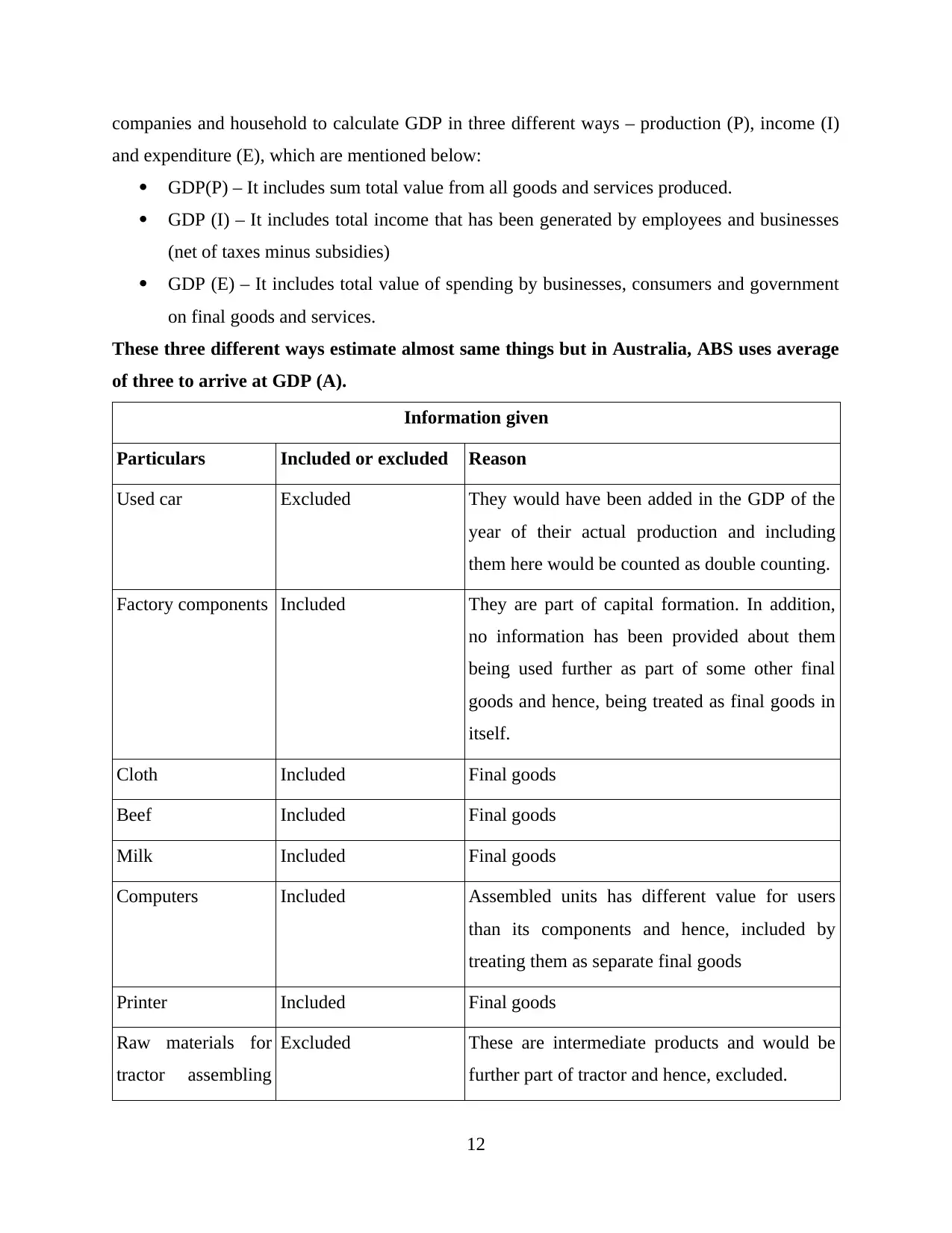

As seen in the case of air conditioners above, it has elastic demand as it is considered as

luxury commodity. It means that in case of increase in prices, demand would react sharply in the

decline side. This would leave sellers with no choice but to bear larger part of tax incidence and

continue with lower price to survive in competitive market. Therefore, it can be said that in case

of elastic demand, tax burden is mainly on the producer (Cowell, 2018).

Assessment Question Week 4 – Production Costs

Question 2

(I) Calculation of accounting profit and economic profit

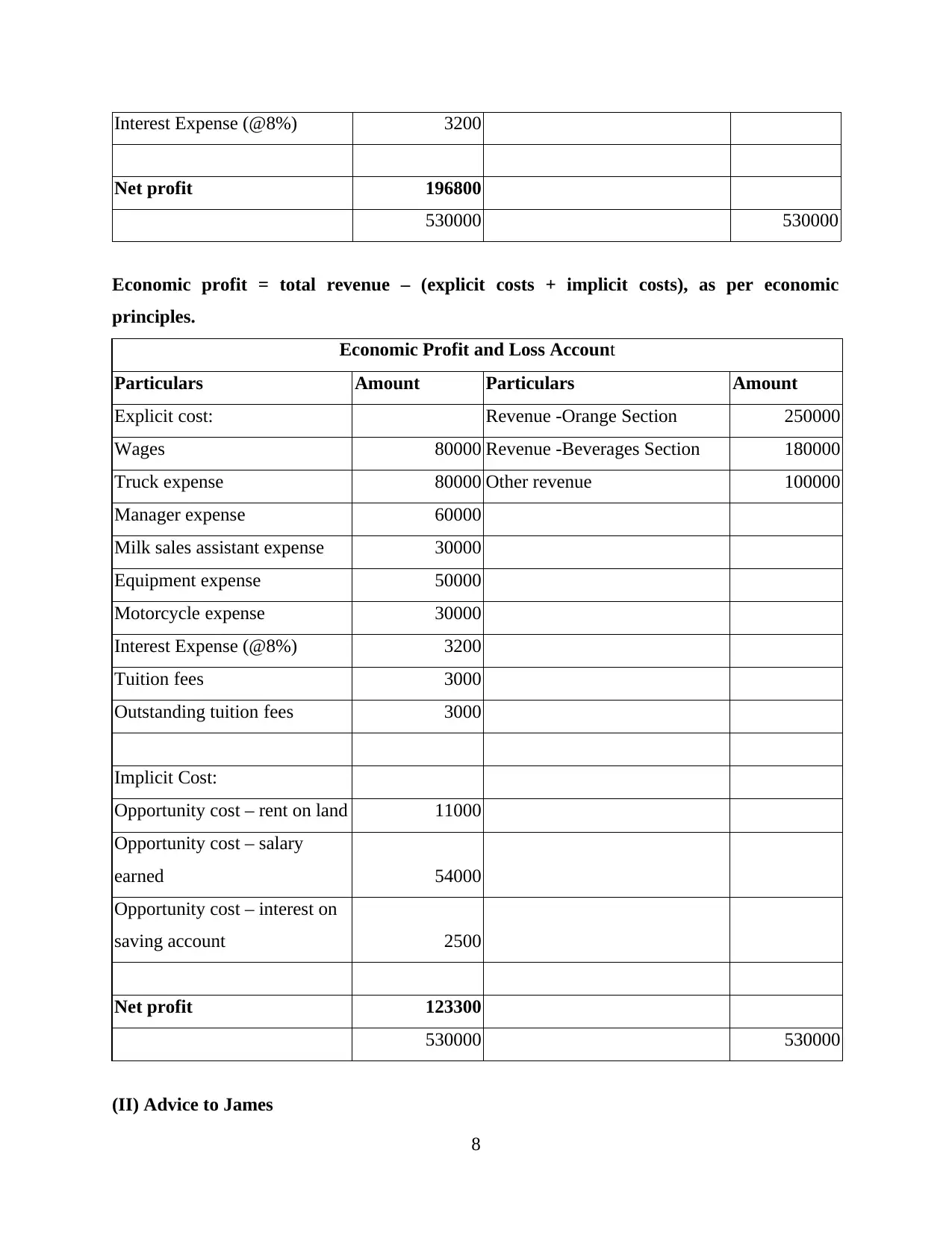

Accounting profit = total monetary revenue minus total explicit costs, as per

accounting principles.

Accounting Profit and Loss Account

Particulars Amount Particulars Amount

Wages 80000 Revenue -Orange Section 250000

Truck expense 80000 Revenue -Beverages Section 180000

Manager expense 60000 Other revenue 100000

Milk sales assistant expense 30000

Equipment expense 50000

Motorcycle expense 30000

7

Illustration 2: Tax incidence in case of elastic

demand, 2021

luxury commodity. It means that in case of increase in prices, demand would react sharply in the

decline side. This would leave sellers with no choice but to bear larger part of tax incidence and

continue with lower price to survive in competitive market. Therefore, it can be said that in case

of elastic demand, tax burden is mainly on the producer (Cowell, 2018).

Assessment Question Week 4 – Production Costs

Question 2

(I) Calculation of accounting profit and economic profit

Accounting profit = total monetary revenue minus total explicit costs, as per

accounting principles.

Accounting Profit and Loss Account

Particulars Amount Particulars Amount

Wages 80000 Revenue -Orange Section 250000

Truck expense 80000 Revenue -Beverages Section 180000

Manager expense 60000 Other revenue 100000

Milk sales assistant expense 30000

Equipment expense 50000

Motorcycle expense 30000

7

Illustration 2: Tax incidence in case of elastic

demand, 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interest Expense (@8%) 3200

Net profit 196800

530000 530000

Economic profit = total revenue – (explicit costs + implicit costs), as per economic

principles.

Economic Profit and Loss Account

Particulars Amount Particulars Amount

Explicit cost: Revenue -Orange Section 250000

Wages 80000 Revenue -Beverages Section 180000

Truck expense 80000 Other revenue 100000

Manager expense 60000

Milk sales assistant expense 30000

Equipment expense 50000

Motorcycle expense 30000

Interest Expense (@8%) 3200

Tuition fees 3000

Outstanding tuition fees 3000

Implicit Cost:

Opportunity cost – rent on land 11000

Opportunity cost – salary

earned 54000

Opportunity cost – interest on

saving account 2500

Net profit 123300

530000 530000

(II) Advice to James

8

Net profit 196800

530000 530000

Economic profit = total revenue – (explicit costs + implicit costs), as per economic

principles.

Economic Profit and Loss Account

Particulars Amount Particulars Amount

Explicit cost: Revenue -Orange Section 250000

Wages 80000 Revenue -Beverages Section 180000

Truck expense 80000 Other revenue 100000

Manager expense 60000

Milk sales assistant expense 30000

Equipment expense 50000

Motorcycle expense 30000

Interest Expense (@8%) 3200

Tuition fees 3000

Outstanding tuition fees 3000

Implicit Cost:

Opportunity cost – rent on land 11000

Opportunity cost – salary

earned 54000

Opportunity cost – interest on

saving account 2500

Net profit 123300

530000 530000

(II) Advice to James

8

Accounting profit only takes into account explicit monetary costs and incomes while

economic profit is the profit that encompasses not only explicit costs but also implicit costs and

incomes and is therefore, generally lesser than accounting profit. It accounts for a complete

picture and hence, it is a better parameter to check profitability and financial viability of the firm

(McConnell, Brue and Flynn, 2018). Economic profit can be positive, negative or zero and if

only, the economic profit is positive, should the firm continue. In the provided case, firm of

James has an economic profit of $123,300 which shows that his kiosk business is a profitable

venture. Also, the profit earned is higher than his annual salary. Therefore, it is suggested that

James should continue with kiosk business.

Assessment Question Week 5 and 6 – Market Structure

Question 3

(I) Elasticity of monopoly firm demand curve

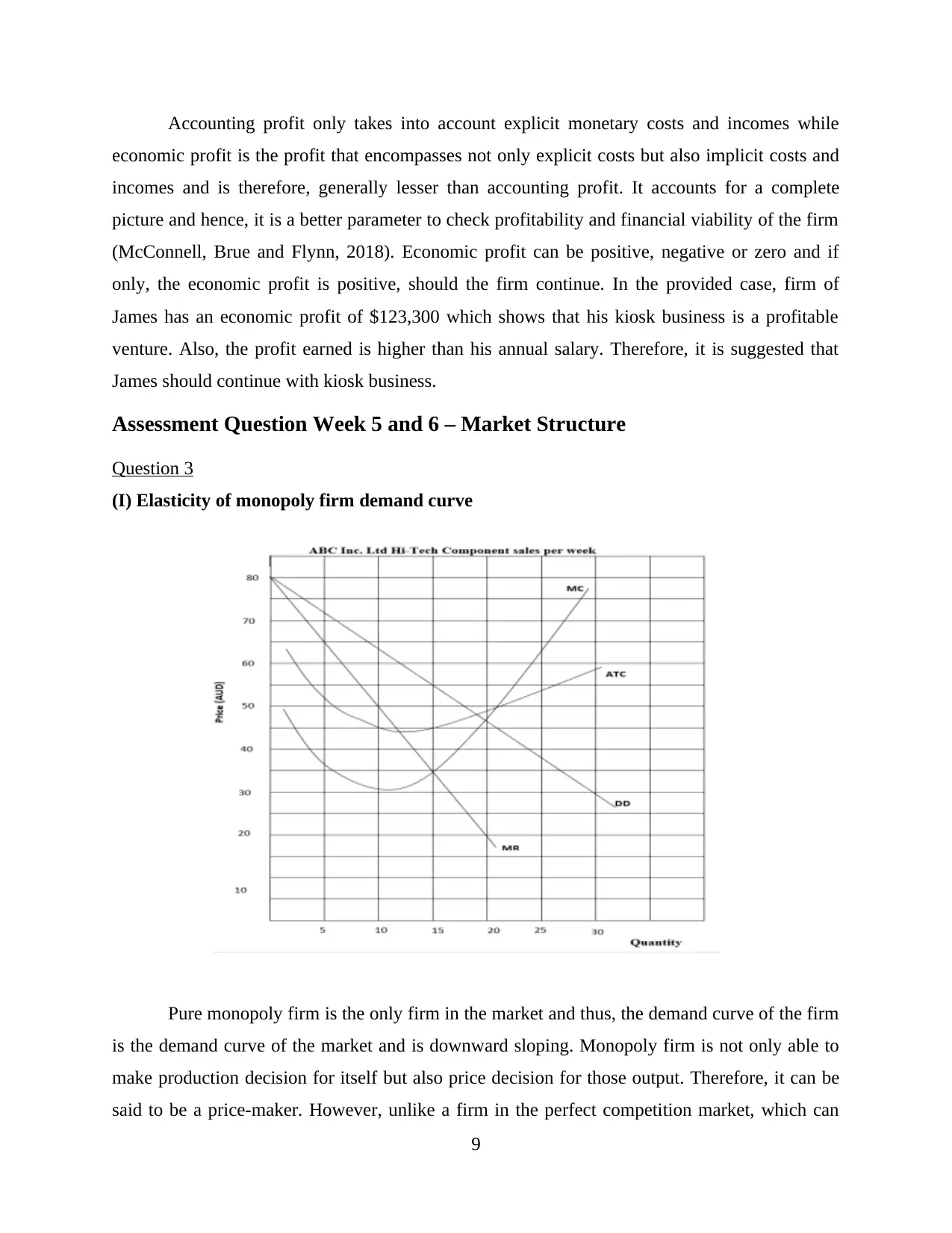

Pure monopoly firm is the only firm in the market and thus, the demand curve of the firm

is the demand curve of the market and is downward sloping. Monopoly firm is not only able to

make production decision for itself but also price decision for those output. Therefore, it can be

said to be a price-maker. However, unlike a firm in the perfect competition market, which can

9

economic profit is the profit that encompasses not only explicit costs but also implicit costs and

incomes and is therefore, generally lesser than accounting profit. It accounts for a complete

picture and hence, it is a better parameter to check profitability and financial viability of the firm

(McConnell, Brue and Flynn, 2018). Economic profit can be positive, negative or zero and if

only, the economic profit is positive, should the firm continue. In the provided case, firm of

James has an economic profit of $123,300 which shows that his kiosk business is a profitable

venture. Also, the profit earned is higher than his annual salary. Therefore, it is suggested that

James should continue with kiosk business.

Assessment Question Week 5 and 6 – Market Structure

Question 3

(I) Elasticity of monopoly firm demand curve

Pure monopoly firm is the only firm in the market and thus, the demand curve of the firm

is the demand curve of the market and is downward sloping. Monopoly firm is not only able to

make production decision for itself but also price decision for those output. Therefore, it can be

said to be a price-maker. However, unlike a firm in the perfect competition market, which can

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

sell any number of units at the market price, a monopolist can sell greater quantity, only by

cutting its price (Becker, 2017).

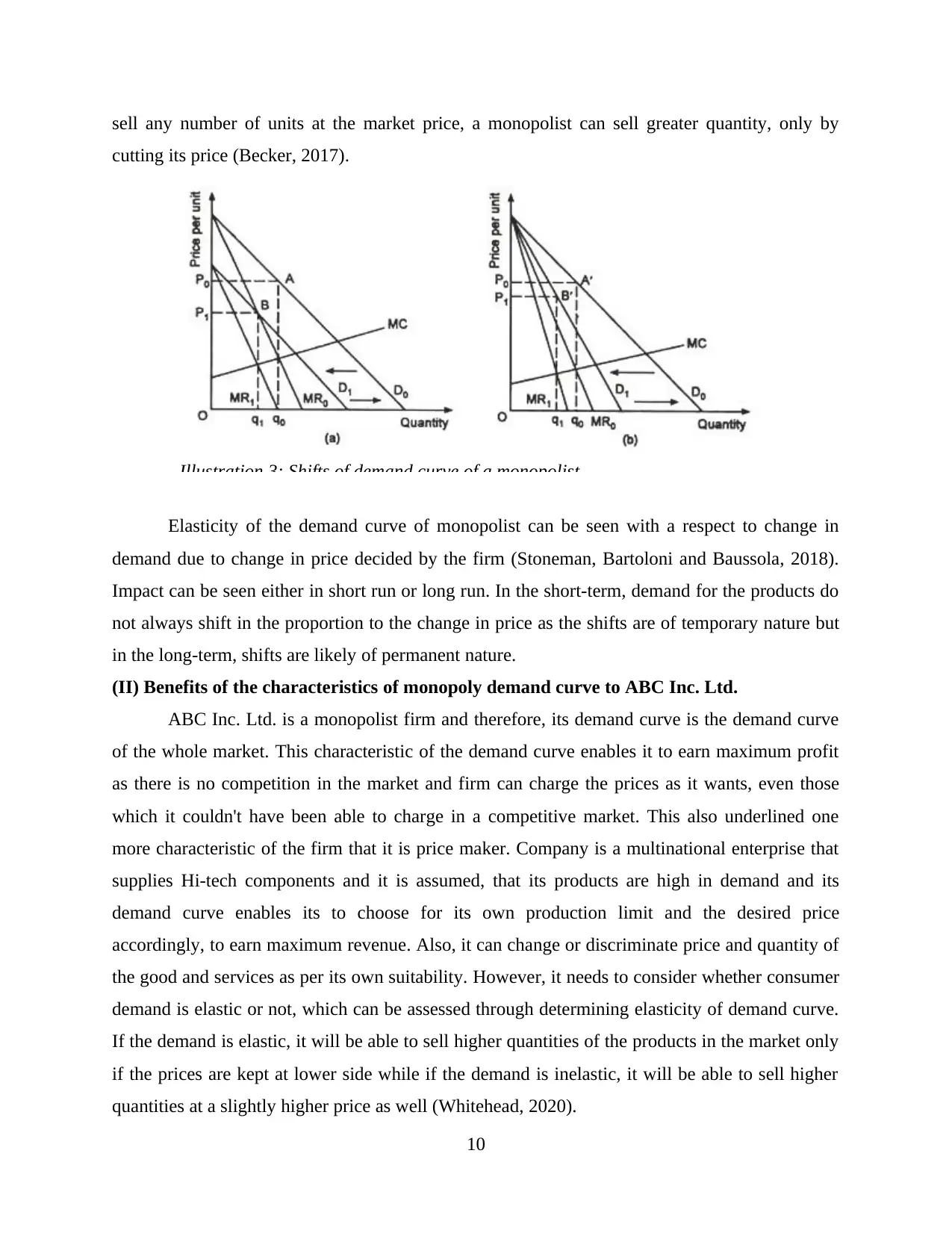

Elasticity of the demand curve of monopolist can be seen with a respect to change in

demand due to change in price decided by the firm (Stoneman, Bartoloni and Baussola, 2018).

Impact can be seen either in short run or long run. In the short-term, demand for the products do

not always shift in the proportion to the change in price as the shifts are of temporary nature but

in the long-term, shifts are likely of permanent nature.

(II) Benefits of the characteristics of monopoly demand curve to ABC Inc. Ltd.

ABC Inc. Ltd. is a monopolist firm and therefore, its demand curve is the demand curve

of the whole market. This characteristic of the demand curve enables it to earn maximum profit

as there is no competition in the market and firm can charge the prices as it wants, even those

which it couldn't have been able to charge in a competitive market. This also underlined one

more characteristic of the firm that it is price maker. Company is a multinational enterprise that

supplies Hi-tech components and it is assumed, that its products are high in demand and its

demand curve enables its to choose for its own production limit and the desired price

accordingly, to earn maximum revenue. Also, it can change or discriminate price and quantity of

the good and services as per its own suitability. However, it needs to consider whether consumer

demand is elastic or not, which can be assessed through determining elasticity of demand curve.

If the demand is elastic, it will be able to sell higher quantities of the products in the market only

if the prices are kept at lower side while if the demand is inelastic, it will be able to sell higher

quantities at a slightly higher price as well (Whitehead, 2020).

10

Illustration 3: Shifts of demand curve of a monopolist

cutting its price (Becker, 2017).

Elasticity of the demand curve of monopolist can be seen with a respect to change in

demand due to change in price decided by the firm (Stoneman, Bartoloni and Baussola, 2018).

Impact can be seen either in short run or long run. In the short-term, demand for the products do

not always shift in the proportion to the change in price as the shifts are of temporary nature but

in the long-term, shifts are likely of permanent nature.

(II) Benefits of the characteristics of monopoly demand curve to ABC Inc. Ltd.

ABC Inc. Ltd. is a monopolist firm and therefore, its demand curve is the demand curve

of the whole market. This characteristic of the demand curve enables it to earn maximum profit

as there is no competition in the market and firm can charge the prices as it wants, even those

which it couldn't have been able to charge in a competitive market. This also underlined one

more characteristic of the firm that it is price maker. Company is a multinational enterprise that

supplies Hi-tech components and it is assumed, that its products are high in demand and its

demand curve enables its to choose for its own production limit and the desired price

accordingly, to earn maximum revenue. Also, it can change or discriminate price and quantity of

the good and services as per its own suitability. However, it needs to consider whether consumer

demand is elastic or not, which can be assessed through determining elasticity of demand curve.

If the demand is elastic, it will be able to sell higher quantities of the products in the market only

if the prices are kept at lower side while if the demand is inelastic, it will be able to sell higher

quantities at a slightly higher price as well (Whitehead, 2020).

10

Illustration 3: Shifts of demand curve of a monopolist

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(III) Profit in the long run

It is assumed that cost curve and demand curve of the company results in the economic

profit for the firm in short-term. In the long-term, it is assumed that all other factors are constant

and this means that company is still only firm and enjoys monopoly in the market. Monopolist

still have economies of scale which empowers them to have lower long-run average cost and

good demand, when combined with it, will enable the ABC Inc. Ltd. to earn profits in the long

term. However, in the long run, if the condition of ceteris peribus does not work, it is highly

possible that new firms will enter the market and, in that case, it is possible that long-term profit

f the company reduces or either reduced to zero.

(IV) Effects of ABC Inc. Ltd. On consumers

ABC Inc. Ltd. is a monopoly and like other monopolists restricts the option for its

consumers to choose out of multiple options and since there is no alternative option for the

customer to buy the commodity if it is needed, it will have to purchase the product even on

higher prices than expected. Moreover, company can restrict its output in the market according

to its own suitability and this would leave the consumers with no option than waiting for the

product, even at the cost of harming its own efficiency and effectiveness of operations. All these

benefits at the end of the company not only restricts the choices of the consumers but also

reduces their sovereignty. In addition, it reduces consumer surplus. Consumer surplus is derived

whenever the price a consumer actually pays is less than they are prepared to pay (Kirschen and

Strbac, 2018). Reduced consumer surplus affects the demand of the firm in long run as now the

consumer would only demand as much as they require and if the ABC Inc. Ltd. wants to increase

its sales, it has to compulsorily reduce the price to attract them.

Assessment Question Week 7 and 8 – Measuring the size of the economy

Question 4

(I) Calculation of nominal GDP and real GDP in 2016

Gross Domestic Product (GDP) of an economy is the total market value or monetary

value of all the finished goods and services that have been produced within the economy in a

definite time period (Welch and Welch, 2016). GDP is calculated and reported by Australian

Bureau of Statistics (ABS) at a quarterly interval. It collects data from government agencies,

11

It is assumed that cost curve and demand curve of the company results in the economic

profit for the firm in short-term. In the long-term, it is assumed that all other factors are constant

and this means that company is still only firm and enjoys monopoly in the market. Monopolist

still have economies of scale which empowers them to have lower long-run average cost and

good demand, when combined with it, will enable the ABC Inc. Ltd. to earn profits in the long

term. However, in the long run, if the condition of ceteris peribus does not work, it is highly

possible that new firms will enter the market and, in that case, it is possible that long-term profit

f the company reduces or either reduced to zero.

(IV) Effects of ABC Inc. Ltd. On consumers

ABC Inc. Ltd. is a monopoly and like other monopolists restricts the option for its

consumers to choose out of multiple options and since there is no alternative option for the

customer to buy the commodity if it is needed, it will have to purchase the product even on

higher prices than expected. Moreover, company can restrict its output in the market according

to its own suitability and this would leave the consumers with no option than waiting for the

product, even at the cost of harming its own efficiency and effectiveness of operations. All these

benefits at the end of the company not only restricts the choices of the consumers but also

reduces their sovereignty. In addition, it reduces consumer surplus. Consumer surplus is derived

whenever the price a consumer actually pays is less than they are prepared to pay (Kirschen and

Strbac, 2018). Reduced consumer surplus affects the demand of the firm in long run as now the

consumer would only demand as much as they require and if the ABC Inc. Ltd. wants to increase

its sales, it has to compulsorily reduce the price to attract them.

Assessment Question Week 7 and 8 – Measuring the size of the economy

Question 4

(I) Calculation of nominal GDP and real GDP in 2016

Gross Domestic Product (GDP) of an economy is the total market value or monetary

value of all the finished goods and services that have been produced within the economy in a

definite time period (Welch and Welch, 2016). GDP is calculated and reported by Australian

Bureau of Statistics (ABS) at a quarterly interval. It collects data from government agencies,

11

companies and household to calculate GDP in three different ways – production (P), income (I)

and expenditure (E), which are mentioned below:

GDP(P) – It includes sum total value from all goods and services produced.

GDP (I) – It includes total income that has been generated by employees and businesses

(net of taxes minus subsidies)

GDP (E) – It includes total value of spending by businesses, consumers and government

on final goods and services.

These three different ways estimate almost same things but in Australia, ABS uses average

of three to arrive at GDP (A).

Information given

Particulars Included or excluded Reason

Used car Excluded They would have been added in the GDP of the

year of their actual production and including

them here would be counted as double counting.

Factory components Included They are part of capital formation. In addition,

no information has been provided about them

being used further as part of some other final

goods and hence, being treated as final goods in

itself.

Cloth Included Final goods

Beef Included Final goods

Milk Included Final goods

Computers Included Assembled units has different value for users

than its components and hence, included by

treating them as separate final goods

Printer Included Final goods

Raw materials for

tractor assembling

Excluded These are intermediate products and would be

further part of tractor and hence, excluded.

12

and expenditure (E), which are mentioned below:

GDP(P) – It includes sum total value from all goods and services produced.

GDP (I) – It includes total income that has been generated by employees and businesses

(net of taxes minus subsidies)

GDP (E) – It includes total value of spending by businesses, consumers and government

on final goods and services.

These three different ways estimate almost same things but in Australia, ABS uses average

of three to arrive at GDP (A).

Information given

Particulars Included or excluded Reason

Used car Excluded They would have been added in the GDP of the

year of their actual production and including

them here would be counted as double counting.

Factory components Included They are part of capital formation. In addition,

no information has been provided about them

being used further as part of some other final

goods and hence, being treated as final goods in

itself.

Cloth Included Final goods

Beef Included Final goods

Milk Included Final goods

Computers Included Assembled units has different value for users

than its components and hence, included by

treating them as separate final goods

Printer Included Final goods

Raw materials for

tractor assembling

Excluded These are intermediate products and would be

further part of tractor and hence, excluded.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.