Economics for Business: Australian Economy Analysis Report

VerifiedAdded on 2021/05/30

|13

|1585

|60

Report

AI Summary

This report provides an analysis of the Australian economy, focusing on key macroeconomic indicators and their interrelationships. It begins by examining the Phillips curve, exploring the inverse relationship between inflation and unemployment, and uses data from 1961-2016 to illustrate this relationship. The report then analyzes the impact of various factors on aggregate demand, including tariffs on chickpea exports, increased demand for Australian wine from China, federal government spending on infrastructure projects, and fluctuations in oil prices. Additionally, the report assesses how immigration intake affects aggregate supply, real GDP, and price levels. The analysis is supported by relevant figures and references to economic literature.

Running Head: EONOMICS FOR BUSINESS

Eonomics for Business

Name of the Student

Name of the University

Course ID

Eonomics for Business

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1EONOMICS FOR BUSINESS

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer a......................................................................................................................................4

Answer b......................................................................................................................................5

Answer c......................................................................................................................................6

Answer d......................................................................................................................................7

Answer e......................................................................................................................................9

List of references...........................................................................................................................11

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer a......................................................................................................................................4

Answer b......................................................................................................................................5

Answer c......................................................................................................................................6

Answer d......................................................................................................................................7

Answer e......................................................................................................................................9

List of references...........................................................................................................................11

2EONOMICS FOR BUSINESS

Answer 1

In determining overall performance of an economy, focus needs to be given on

movement of price level and performance of labor market. The commonly used indicator for

measuring performance of the labor market in unemployment. The rate of unemployment in an

economy presents the number of unemployed person as a percentage of total labor force.

Inflation on the other hand measures the gradual upward movement of price level (Chan, Koop

& Potter, 2016). Rate of inflation is generally measured from percentage change in cost of living

index between two consecutive years. Inflation and unemployment though belongs to different

area of macroeconomic aspect; an association is often observed between these two. Rate of

unemployment influences the price level through influencing wage growth. An inverse

relationship is found to exists between condition of price level and that of the performance of

labor market. The relationship was first discovered by A.W.Phillips based on macroeconomic

data of UK economy (Daly & Hobijn, 2014). Phillips proposed a hypothesis that inflation goes

up with a decline in the rate of unemployment. The price level moves in reverse direction in

times of rising unemployment. The proposed association between unemployment and inflation is

verified using inflation and unemployment data of Australia from 1961-2016.

Answer 1

In determining overall performance of an economy, focus needs to be given on

movement of price level and performance of labor market. The commonly used indicator for

measuring performance of the labor market in unemployment. The rate of unemployment in an

economy presents the number of unemployed person as a percentage of total labor force.

Inflation on the other hand measures the gradual upward movement of price level (Chan, Koop

& Potter, 2016). Rate of inflation is generally measured from percentage change in cost of living

index between two consecutive years. Inflation and unemployment though belongs to different

area of macroeconomic aspect; an association is often observed between these two. Rate of

unemployment influences the price level through influencing wage growth. An inverse

relationship is found to exists between condition of price level and that of the performance of

labor market. The relationship was first discovered by A.W.Phillips based on macroeconomic

data of UK economy (Daly & Hobijn, 2014). Phillips proposed a hypothesis that inflation goes

up with a decline in the rate of unemployment. The price level moves in reverse direction in

times of rising unemployment. The proposed association between unemployment and inflation is

verified using inflation and unemployment data of Australia from 1961-2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3EONOMICS FOR BUSINESS

4 4.5 5 5.5 6 6.5 7

1

1.5

2

2.5

3

3.5

4

4.5

5

f(x) = − 0.15400701871836 x + 3.51940971372956

R² = 0.0138640768243962

Inflation and Unemployment

Unemployment

Inflation

Figure 1: Association between inflation and unemployment

(Source: abs.gov.au/, 2018)

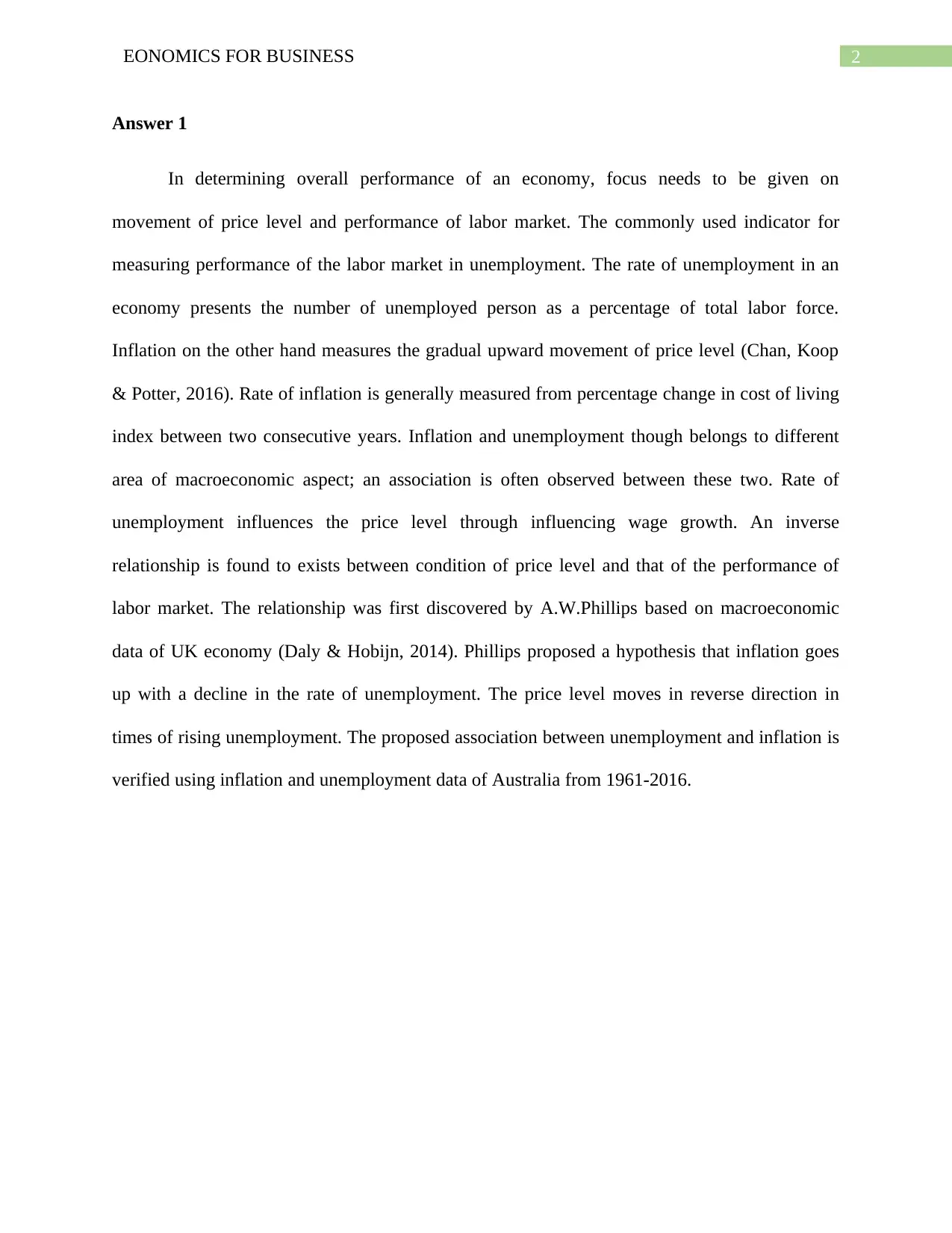

In order to observe whether there exists any association between inflation and unemployment in

context of Australian economy, a scatter plot between the variables is construction. A trend line

is set to observe the overall relationship for the chosen time period. The trend line has a general

downward slope. The downward sloping trend line represents an inverse relation between

inflation and unemployment. From the estimated trend equation, the elasticity of inflation with

respect to unemployment is obtained as -0.154. From the unemployment coefficient it can be

interpreted that every unit decreases in unemployment is associated with an increase in inflation

by 0.15 percentage point.

The reason behind inverse relation between rate of inflation and that of unemployment

can be explained with the theory of wage growth. Low rate of unemployment indicates a high

demand for labor. In the presence of high labor demand wages are generally high. The higher

wage cost reflected in high prices of commodities (Coibion, Gorodnichenko & Kamdar, 2017). A

4 4.5 5 5.5 6 6.5 7

1

1.5

2

2.5

3

3.5

4

4.5

5

f(x) = − 0.15400701871836 x + 3.51940971372956

R² = 0.0138640768243962

Inflation and Unemployment

Unemployment

Inflation

Figure 1: Association between inflation and unemployment

(Source: abs.gov.au/, 2018)

In order to observe whether there exists any association between inflation and unemployment in

context of Australian economy, a scatter plot between the variables is construction. A trend line

is set to observe the overall relationship for the chosen time period. The trend line has a general

downward slope. The downward sloping trend line represents an inverse relation between

inflation and unemployment. From the estimated trend equation, the elasticity of inflation with

respect to unemployment is obtained as -0.154. From the unemployment coefficient it can be

interpreted that every unit decreases in unemployment is associated with an increase in inflation

by 0.15 percentage point.

The reason behind inverse relation between rate of inflation and that of unemployment

can be explained with the theory of wage growth. Low rate of unemployment indicates a high

demand for labor. In the presence of high labor demand wages are generally high. The higher

wage cost reflected in high prices of commodities (Coibion, Gorodnichenko & Kamdar, 2017). A

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4EONOMICS FOR BUSINESS

low labor demand on the other hand is associated with a high unemployment rate. With lack of

demand, wages in the labor market fall. Workers are ready to accept low wages during this time.

This lowers the cost of production and hence a lower price of commodities.

The trade-off between inflation and unemployment though hold in the short run but

relation can break down in the long run. In the long run the economy reaches to the level of

unemployment called natural rate of unemployment and therefore, Phillips relation does not

hold. Trade-off between inflation and unemployment has implication for policy framework

(Malikane, 2014). Policies to reduce unemployment can result in a high inflation. In Australia,

RBA uses active monetary policy tool to keep inflation at a low level along with a low rate of

unemployment.

Answer 2

Answer a

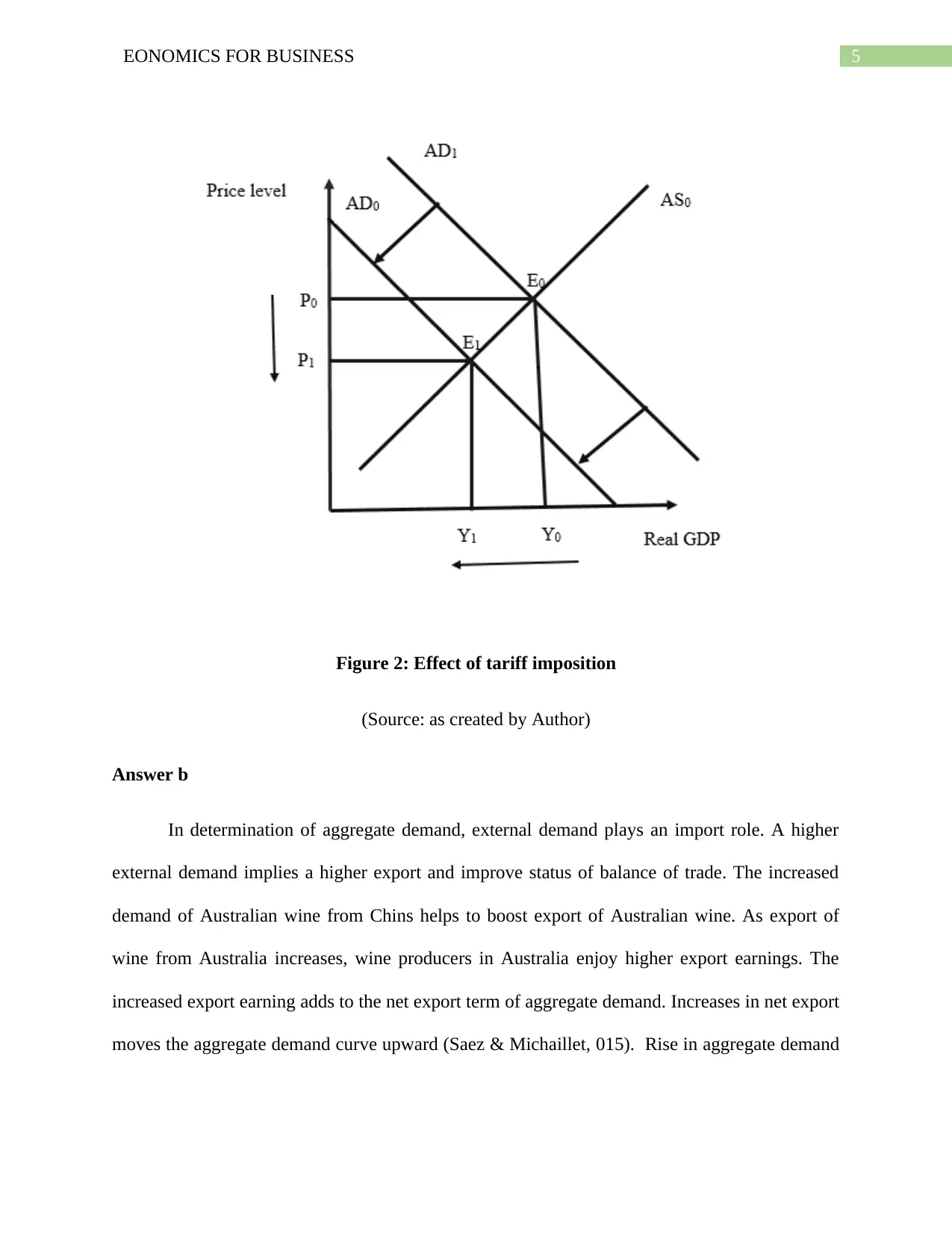

Tariff is a form of tax on import and hence, have an adverse effect on import demand.

When India places a 30% tariff on chickpea export from Australia then price of exported

chickpea from Australia experienced a price gain in Indian market. The tariff encouraged

domestic producer of India to produce more chickpea and discourage Indian consumers to

consume imported chickpea from Australia. The decrease is export volume of Australian

Chickpea hurt the export revenue worsening trade balance or net export (Riccetti, Russo &

Gallegati, 2017). The net export fall, there is downward pressure on aggregate demand. As AD

shifts downward, real GDP and price level both mark a downward movement.

low labor demand on the other hand is associated with a high unemployment rate. With lack of

demand, wages in the labor market fall. Workers are ready to accept low wages during this time.

This lowers the cost of production and hence a lower price of commodities.

The trade-off between inflation and unemployment though hold in the short run but

relation can break down in the long run. In the long run the economy reaches to the level of

unemployment called natural rate of unemployment and therefore, Phillips relation does not

hold. Trade-off between inflation and unemployment has implication for policy framework

(Malikane, 2014). Policies to reduce unemployment can result in a high inflation. In Australia,

RBA uses active monetary policy tool to keep inflation at a low level along with a low rate of

unemployment.

Answer 2

Answer a

Tariff is a form of tax on import and hence, have an adverse effect on import demand.

When India places a 30% tariff on chickpea export from Australia then price of exported

chickpea from Australia experienced a price gain in Indian market. The tariff encouraged

domestic producer of India to produce more chickpea and discourage Indian consumers to

consume imported chickpea from Australia. The decrease is export volume of Australian

Chickpea hurt the export revenue worsening trade balance or net export (Riccetti, Russo &

Gallegati, 2017). The net export fall, there is downward pressure on aggregate demand. As AD

shifts downward, real GDP and price level both mark a downward movement.

5EONOMICS FOR BUSINESS

Figure 2: Effect of tariff imposition

(Source: as created by Author)

Answer b

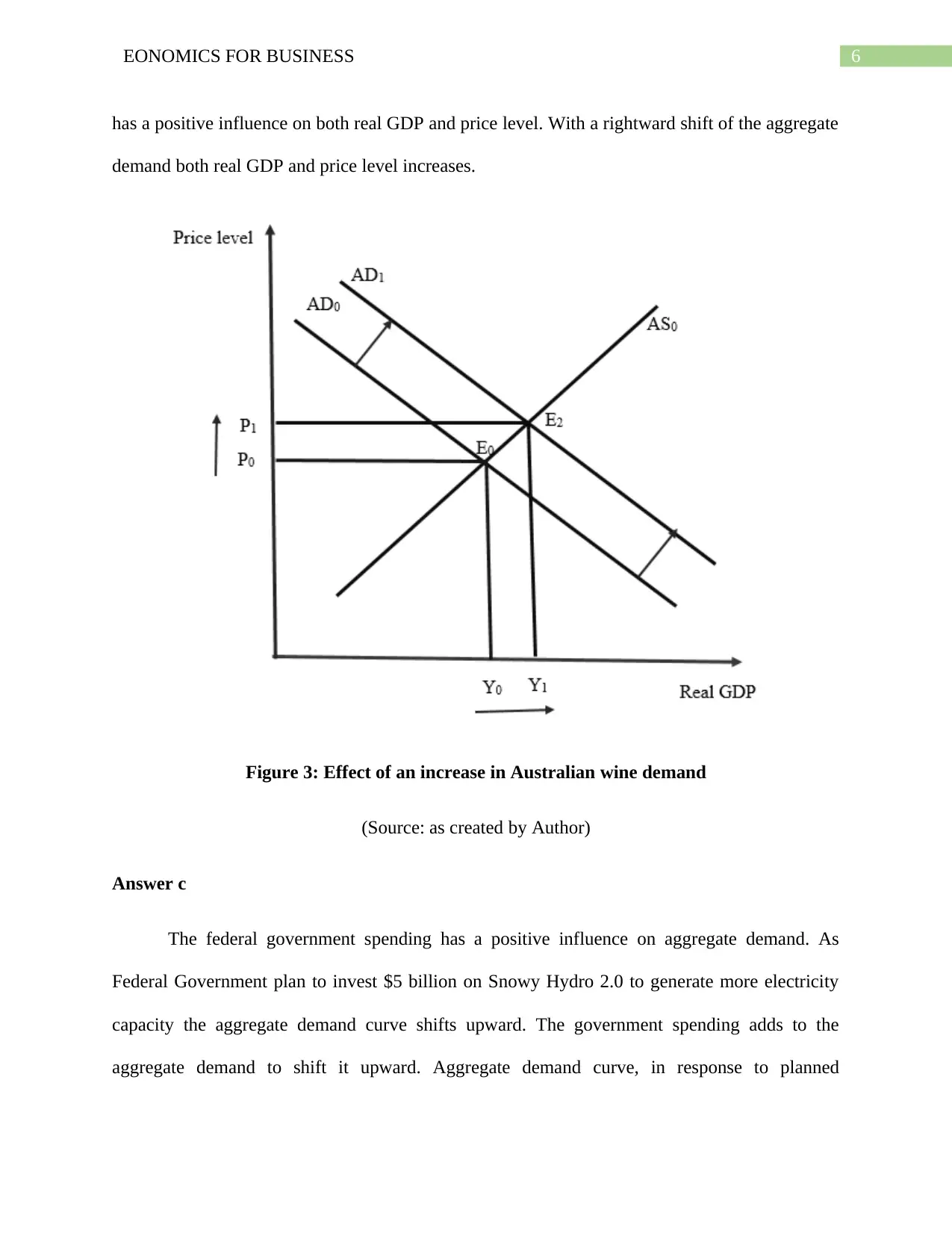

In determination of aggregate demand, external demand plays an import role. A higher

external demand implies a higher export and improve status of balance of trade. The increased

demand of Australian wine from Chins helps to boost export of Australian wine. As export of

wine from Australia increases, wine producers in Australia enjoy higher export earnings. The

increased export earning adds to the net export term of aggregate demand. Increases in net export

moves the aggregate demand curve upward (Saez & Michaillet, 015). Rise in aggregate demand

Figure 2: Effect of tariff imposition

(Source: as created by Author)

Answer b

In determination of aggregate demand, external demand plays an import role. A higher

external demand implies a higher export and improve status of balance of trade. The increased

demand of Australian wine from Chins helps to boost export of Australian wine. As export of

wine from Australia increases, wine producers in Australia enjoy higher export earnings. The

increased export earning adds to the net export term of aggregate demand. Increases in net export

moves the aggregate demand curve upward (Saez & Michaillet, 015). Rise in aggregate demand

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6EONOMICS FOR BUSINESS

has a positive influence on both real GDP and price level. With a rightward shift of the aggregate

demand both real GDP and price level increases.

Figure 3: Effect of an increase in Australian wine demand

(Source: as created by Author)

Answer c

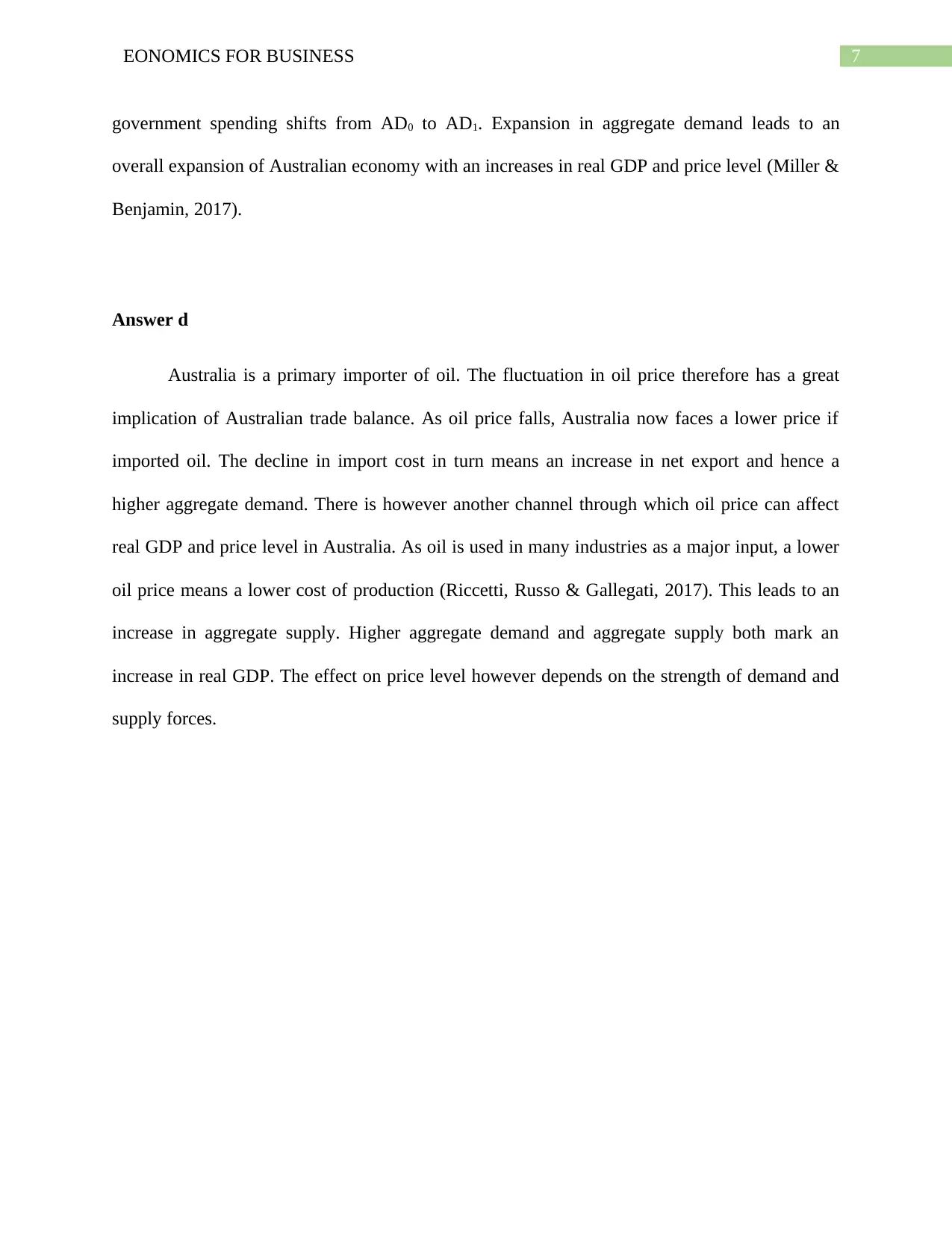

The federal government spending has a positive influence on aggregate demand. As

Federal Government plan to invest $5 billion on Snowy Hydro 2.0 to generate more electricity

capacity the aggregate demand curve shifts upward. The government spending adds to the

aggregate demand to shift it upward. Aggregate demand curve, in response to planned

has a positive influence on both real GDP and price level. With a rightward shift of the aggregate

demand both real GDP and price level increases.

Figure 3: Effect of an increase in Australian wine demand

(Source: as created by Author)

Answer c

The federal government spending has a positive influence on aggregate demand. As

Federal Government plan to invest $5 billion on Snowy Hydro 2.0 to generate more electricity

capacity the aggregate demand curve shifts upward. The government spending adds to the

aggregate demand to shift it upward. Aggregate demand curve, in response to planned

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7EONOMICS FOR BUSINESS

government spending shifts from AD0 to AD1. Expansion in aggregate demand leads to an

overall expansion of Australian economy with an increases in real GDP and price level (Miller &

Benjamin, 2017).

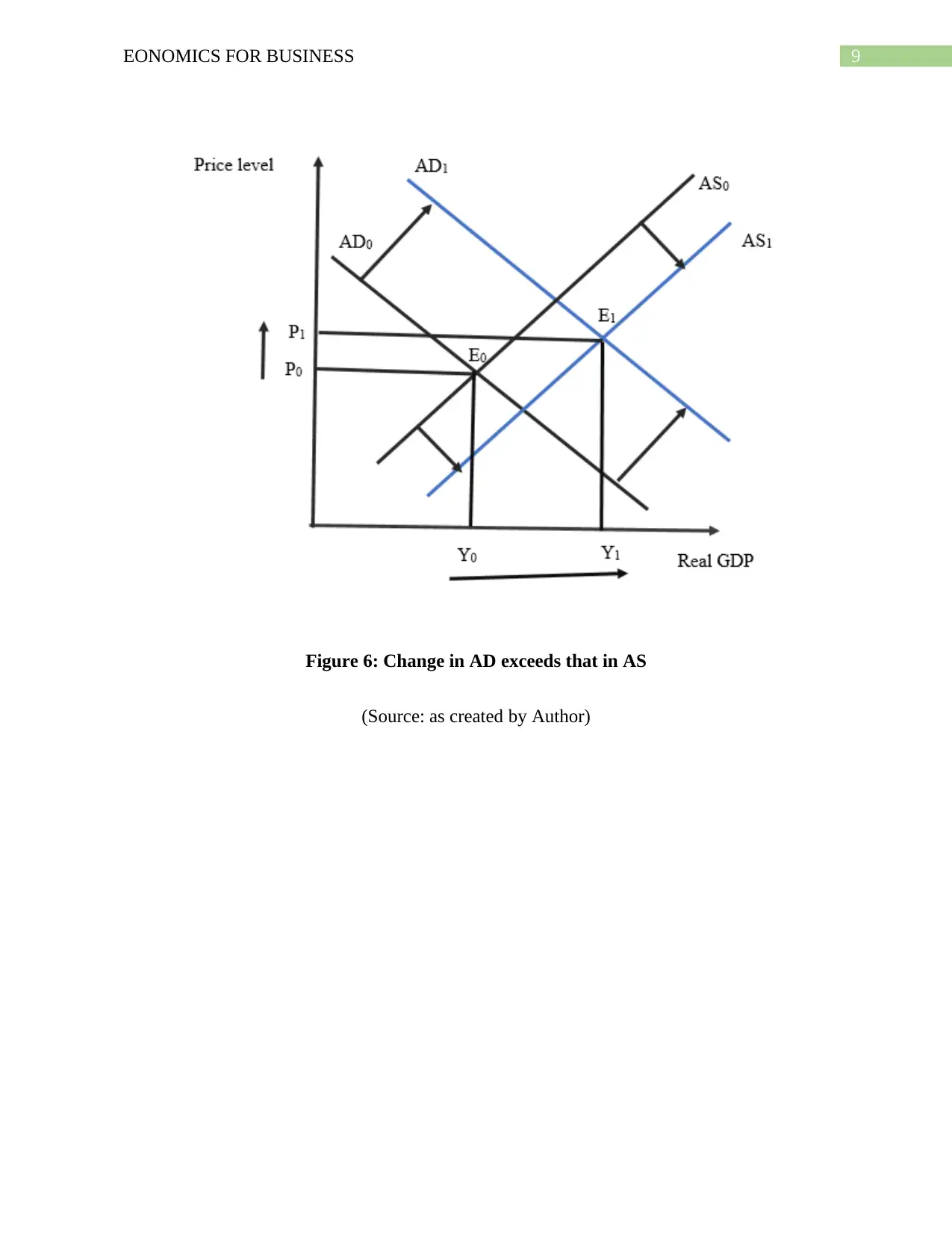

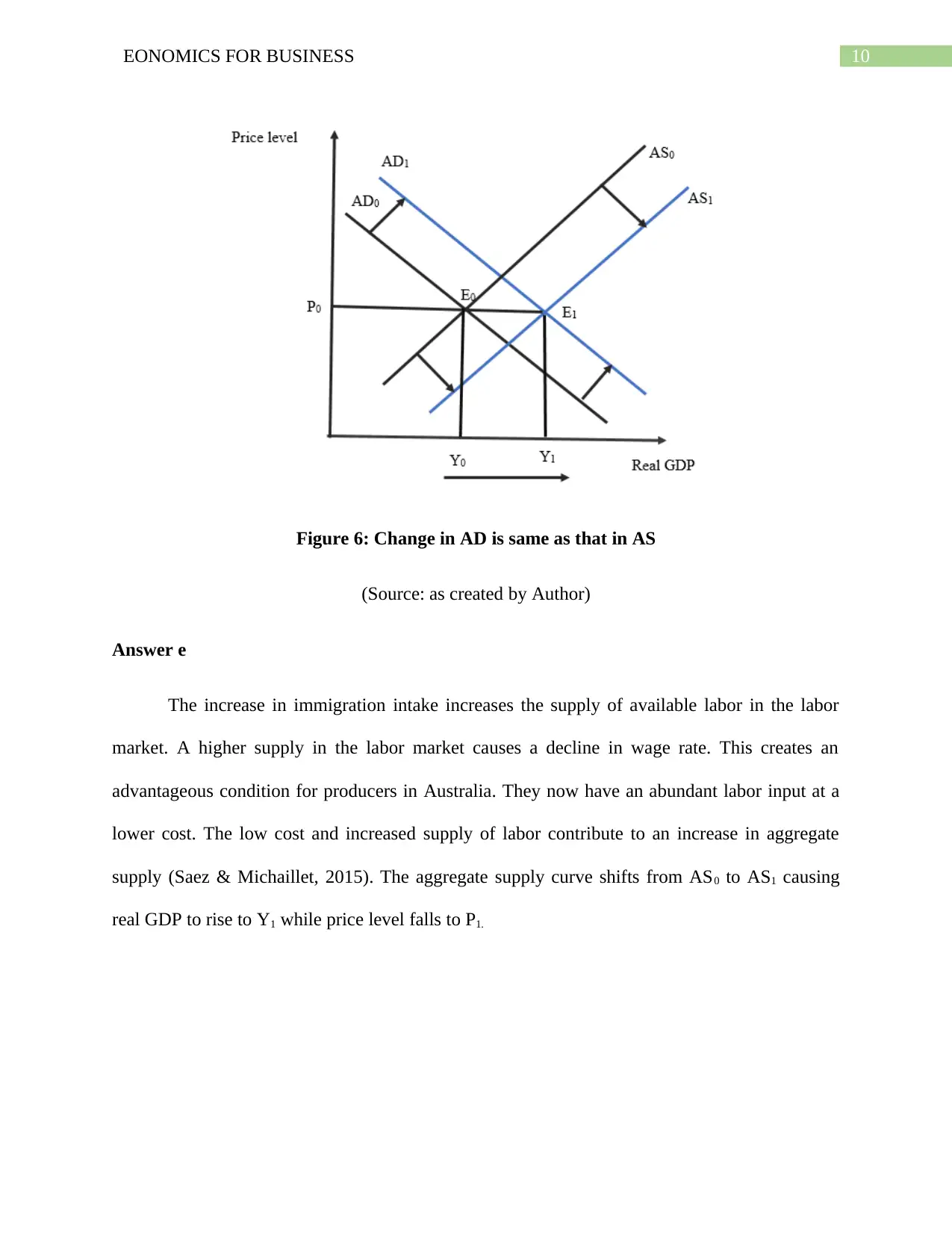

Answer d

Australia is a primary importer of oil. The fluctuation in oil price therefore has a great

implication of Australian trade balance. As oil price falls, Australia now faces a lower price if

imported oil. The decline in import cost in turn means an increase in net export and hence a

higher aggregate demand. There is however another channel through which oil price can affect

real GDP and price level in Australia. As oil is used in many industries as a major input, a lower

oil price means a lower cost of production (Riccetti, Russo & Gallegati, 2017). This leads to an

increase in aggregate supply. Higher aggregate demand and aggregate supply both mark an

increase in real GDP. The effect on price level however depends on the strength of demand and

supply forces.

government spending shifts from AD0 to AD1. Expansion in aggregate demand leads to an

overall expansion of Australian economy with an increases in real GDP and price level (Miller &

Benjamin, 2017).

Answer d

Australia is a primary importer of oil. The fluctuation in oil price therefore has a great

implication of Australian trade balance. As oil price falls, Australia now faces a lower price if

imported oil. The decline in import cost in turn means an increase in net export and hence a

higher aggregate demand. There is however another channel through which oil price can affect

real GDP and price level in Australia. As oil is used in many industries as a major input, a lower

oil price means a lower cost of production (Riccetti, Russo & Gallegati, 2017). This leads to an

increase in aggregate supply. Higher aggregate demand and aggregate supply both mark an

increase in real GDP. The effect on price level however depends on the strength of demand and

supply forces.

8EONOMICS FOR BUSINESS

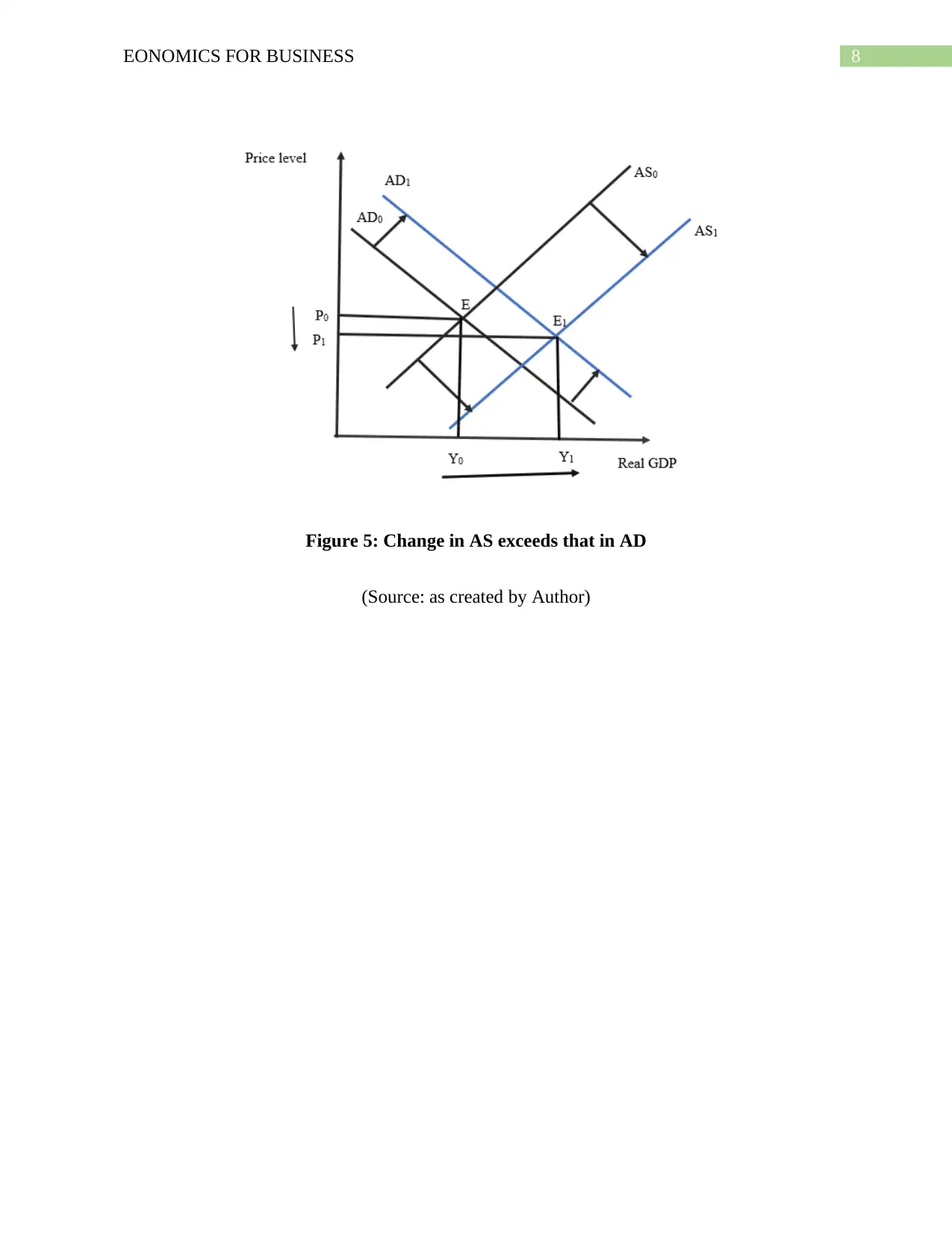

Figure 5: Change in AS exceeds that in AD

(Source: as created by Author)

Figure 5: Change in AS exceeds that in AD

(Source: as created by Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9EONOMICS FOR BUSINESS

Figure 6: Change in AD exceeds that in AS

(Source: as created by Author)

Figure 6: Change in AD exceeds that in AS

(Source: as created by Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10EONOMICS FOR BUSINESS

Figure 6: Change in AD is same as that in AS

(Source: as created by Author)

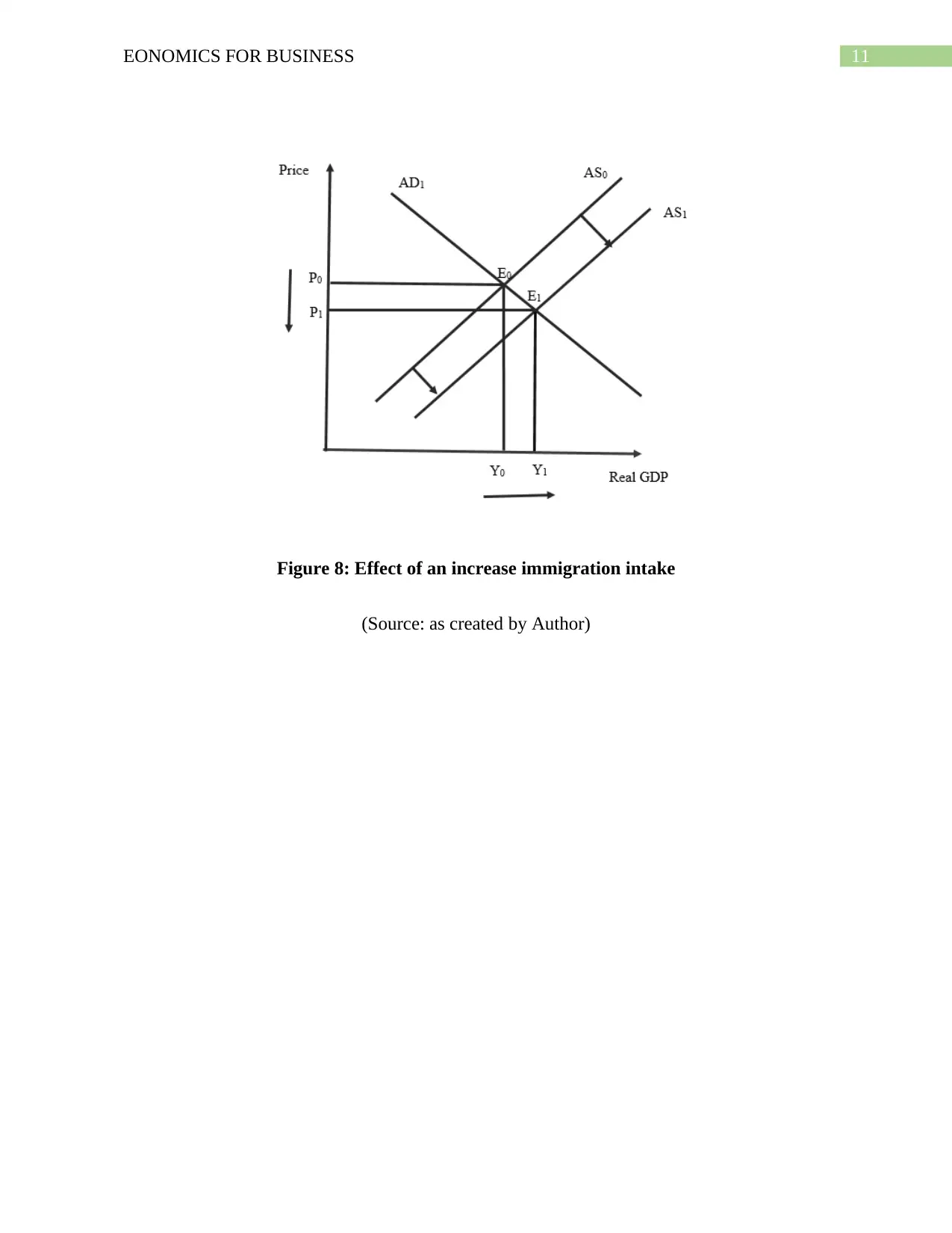

Answer e

The increase in immigration intake increases the supply of available labor in the labor

market. A higher supply in the labor market causes a decline in wage rate. This creates an

advantageous condition for producers in Australia. They now have an abundant labor input at a

lower cost. The low cost and increased supply of labor contribute to an increase in aggregate

supply (Saez & Michaillet, 2015). The aggregate supply curve shifts from AS0 to AS1 causing

real GDP to rise to Y1 while price level falls to P1.

Figure 6: Change in AD is same as that in AS

(Source: as created by Author)

Answer e

The increase in immigration intake increases the supply of available labor in the labor

market. A higher supply in the labor market causes a decline in wage rate. This creates an

advantageous condition for producers in Australia. They now have an abundant labor input at a

lower cost. The low cost and increased supply of labor contribute to an increase in aggregate

supply (Saez & Michaillet, 2015). The aggregate supply curve shifts from AS0 to AS1 causing

real GDP to rise to Y1 while price level falls to P1.

11EONOMICS FOR BUSINESS

Figure 8: Effect of an increase immigration intake

(Source: as created by Author)

Figure 8: Effect of an increase immigration intake

(Source: as created by Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.