Macroeconomics: Expenditure, Fiscal, and Monetary Policy Analysis

VerifiedAdded on 2023/01/12

|6

|1298

|93

Homework Assignment

AI Summary

This economics assignment analyzes a macroeconomic model, calculating autonomous consumption, taxation, investment, and net exports. It determines equilibrium income and illustrates the economy using the aggregate expenditure model. The assignment further explores the GDP gap using the AD-AS and AE models, calculating changes in government spending and taxation needed to close the gap. It then examines the effects of monetary policy, including interest rate adjustments and open market operations, on exchange rates and the economy using the exchange rate market model and the IS-LM model, considering the impact on unemployment. The solution provides detailed calculations and explanations of key macroeconomic concepts and models.

Consider an economy with the following data:

Consumption expenditure = $171,701.1 million

Planned investment = $119,020.5 million

Government expenditure = $48,621.7 million

Export expenditure = $840,223.9 million

Import expenditure = $720,695.8 million

Autonomous taxes = $206,700.0 million

Income tax rate = 17.5%

Marginal propensity to save = 0.42

Marginal propensity to import = 0.08

Section A

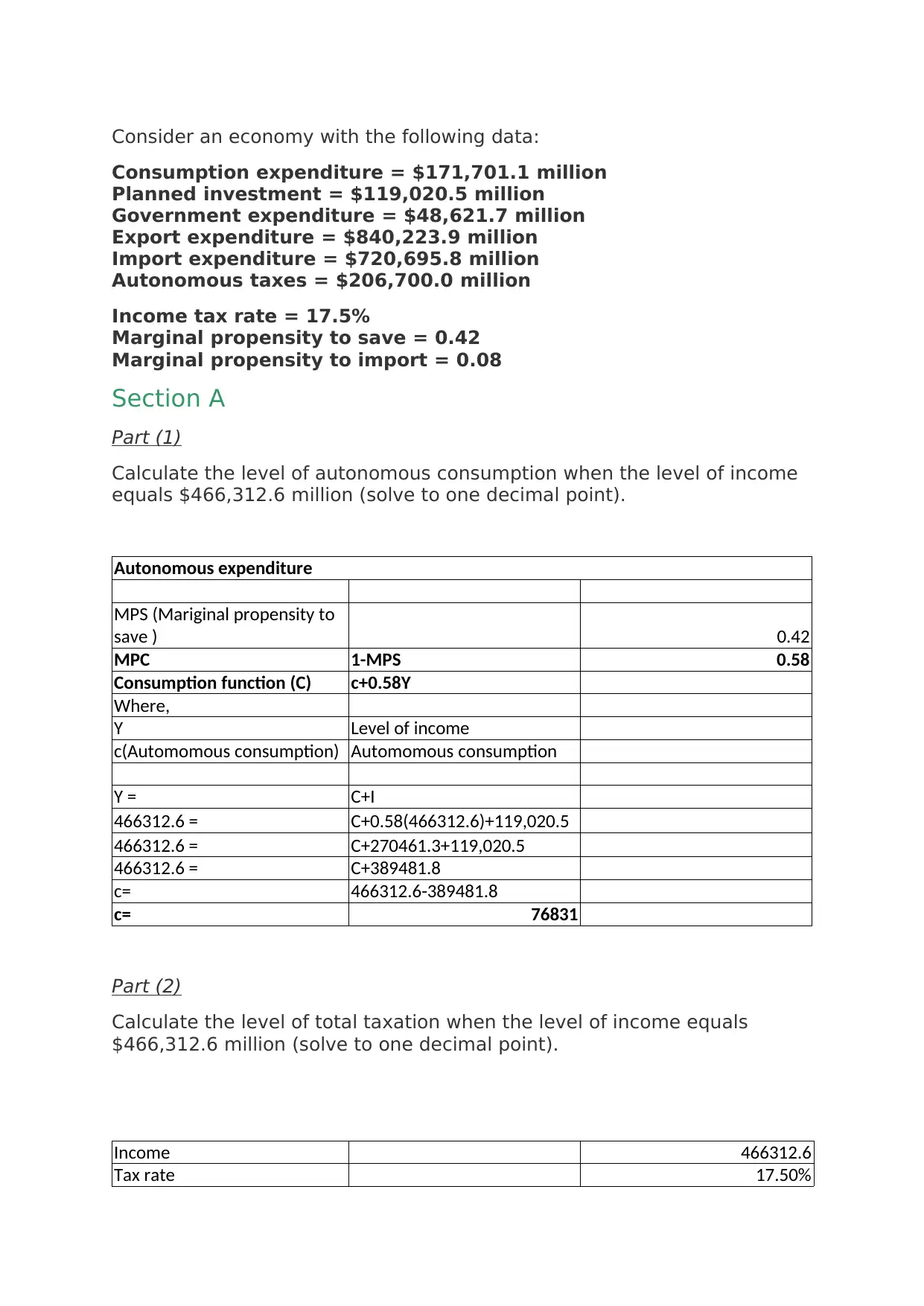

Part (1)

Calculate the level of autonomous consumption when the level of income

equals $466,312.6 million (solve to one decimal point).

Autonomous expenditure

MPS (Mariginal propensity to

save ) 0.42

MPC 1-MPS 0.58

Consumption function (C) c+0.58Y

Where,

Y Level of income

c(Automomous consumption) Automomous consumption

Y = C+I

466312.6 = C+0.58(466312.6)+119,020.5

466312.6 = C+270461.3+119,020.5

466312.6 = C+389481.8

c= 466312.6-389481.8

c= 76831

Part (2)

Calculate the level of total taxation when the level of income equals

$466,312.6 million (solve to one decimal point).

Income 466312.6

Tax rate 17.50%

Consumption expenditure = $171,701.1 million

Planned investment = $119,020.5 million

Government expenditure = $48,621.7 million

Export expenditure = $840,223.9 million

Import expenditure = $720,695.8 million

Autonomous taxes = $206,700.0 million

Income tax rate = 17.5%

Marginal propensity to save = 0.42

Marginal propensity to import = 0.08

Section A

Part (1)

Calculate the level of autonomous consumption when the level of income

equals $466,312.6 million (solve to one decimal point).

Autonomous expenditure

MPS (Mariginal propensity to

save ) 0.42

MPC 1-MPS 0.58

Consumption function (C) c+0.58Y

Where,

Y Level of income

c(Automomous consumption) Automomous consumption

Y = C+I

466312.6 = C+0.58(466312.6)+119,020.5

466312.6 = C+270461.3+119,020.5

466312.6 = C+389481.8

c= 466312.6-389481.8

c= 76831

Part (2)

Calculate the level of total taxation when the level of income equals

$466,312.6 million (solve to one decimal point).

Income 466312.6

Tax rate 17.50%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Level of taxation 466313*17.50% 81604.7

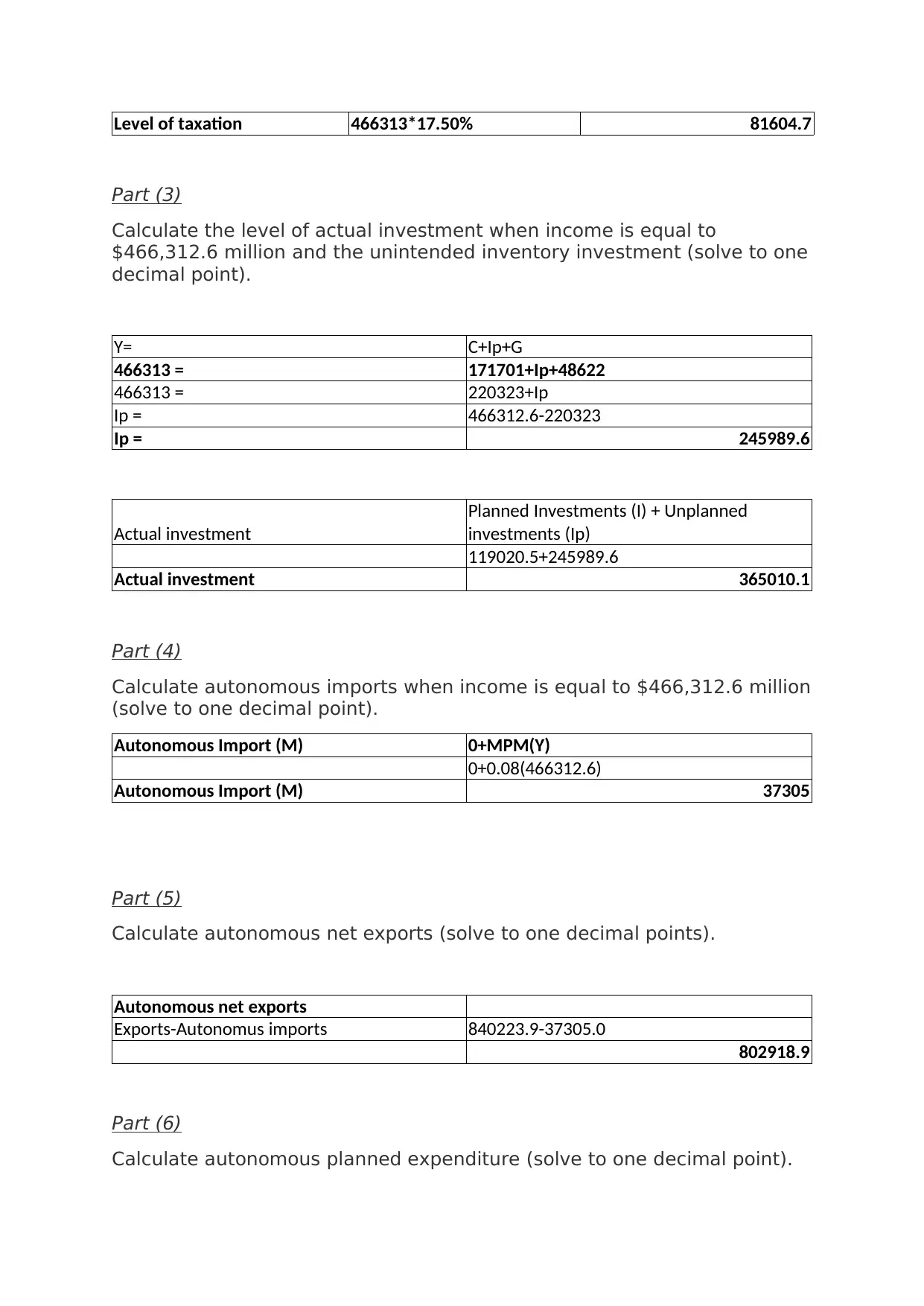

Part (3)

Calculate the level of actual investment when income is equal to

$466,312.6 million and the unintended inventory investment (solve to one

decimal point).

Y= C+Ip+G

466313 = 171701+Ip+48622

466313 = 220323+Ip

Ip = 466312.6-220323

Ip = 245989.6

Actual investment

Planned Investments (I) + Unplanned

investments (Ip)

119020.5+245989.6

Actual investment 365010.1

Part (4)

Calculate autonomous imports when income is equal to $466,312.6 million

(solve to one decimal point).

Autonomous Import (M) 0+MPM(Y)

0+0.08(466312.6)

Autonomous Import (M) 37305

Part (5)

Calculate autonomous net exports (solve to one decimal points).

Autonomous net exports

Exports-Autonomus imports 840223.9-37305.0

802918.9

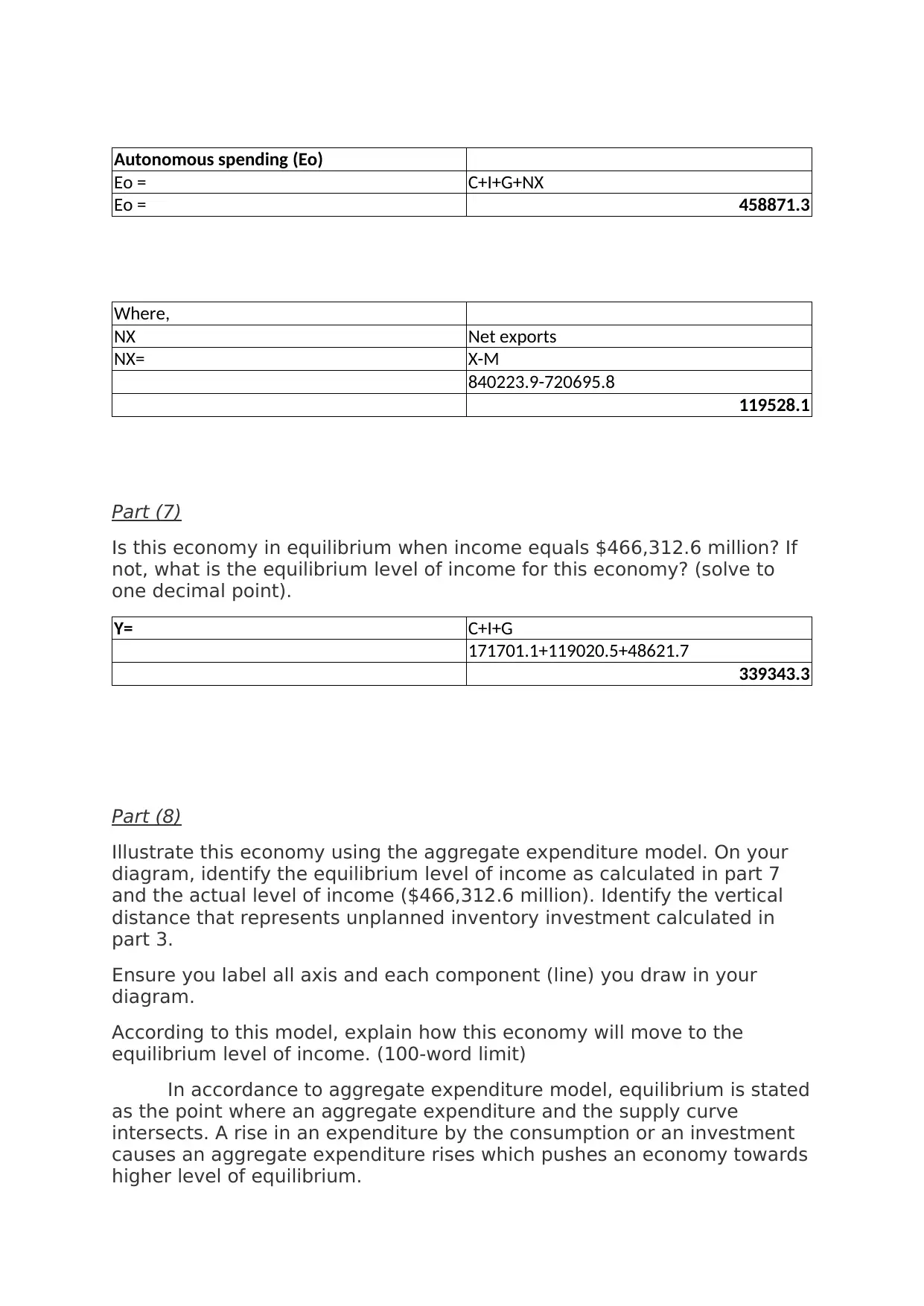

Part (6)

Calculate autonomous planned expenditure (solve to one decimal point).

Part (3)

Calculate the level of actual investment when income is equal to

$466,312.6 million and the unintended inventory investment (solve to one

decimal point).

Y= C+Ip+G

466313 = 171701+Ip+48622

466313 = 220323+Ip

Ip = 466312.6-220323

Ip = 245989.6

Actual investment

Planned Investments (I) + Unplanned

investments (Ip)

119020.5+245989.6

Actual investment 365010.1

Part (4)

Calculate autonomous imports when income is equal to $466,312.6 million

(solve to one decimal point).

Autonomous Import (M) 0+MPM(Y)

0+0.08(466312.6)

Autonomous Import (M) 37305

Part (5)

Calculate autonomous net exports (solve to one decimal points).

Autonomous net exports

Exports-Autonomus imports 840223.9-37305.0

802918.9

Part (6)

Calculate autonomous planned expenditure (solve to one decimal point).

Autonomous spending (Eo)

Eo = C+I+G+NX

Eo = 458871.3

Where,

NX Net exports

NX= X-M

840223.9-720695.8

119528.1

Part (7)

Is this economy in equilibrium when income equals $466,312.6 million? If

not, what is the equilibrium level of income for this economy? (solve to

one decimal point).

Y= C+I+G

171701.1+119020.5+48621.7

339343.3

Part (8)

Illustrate this economy using the aggregate expenditure model. On your

diagram, identify the equilibrium level of income as calculated in part 7

and the actual level of income ($466,312.6 million). Identify the vertical

distance that represents unplanned inventory investment calculated in

part 3.

Ensure you label all axis and each component (line) you draw in your

diagram.

According to this model, explain how this economy will move to the

equilibrium level of income. (100-word limit)

In accordance to aggregate expenditure model, equilibrium is stated

as the point where an aggregate expenditure and the supply curve

intersects. A rise in an expenditure by the consumption or an investment

causes an aggregate expenditure rises which pushes an economy towards

higher level of equilibrium.

Eo = C+I+G+NX

Eo = 458871.3

Where,

NX Net exports

NX= X-M

840223.9-720695.8

119528.1

Part (7)

Is this economy in equilibrium when income equals $466,312.6 million? If

not, what is the equilibrium level of income for this economy? (solve to

one decimal point).

Y= C+I+G

171701.1+119020.5+48621.7

339343.3

Part (8)

Illustrate this economy using the aggregate expenditure model. On your

diagram, identify the equilibrium level of income as calculated in part 7

and the actual level of income ($466,312.6 million). Identify the vertical

distance that represents unplanned inventory investment calculated in

part 3.

Ensure you label all axis and each component (line) you draw in your

diagram.

According to this model, explain how this economy will move to the

equilibrium level of income. (100-word limit)

In accordance to aggregate expenditure model, equilibrium is stated

as the point where an aggregate expenditure and the supply curve

intersects. A rise in an expenditure by the consumption or an investment

causes an aggregate expenditure rises which pushes an economy towards

higher level of equilibrium.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

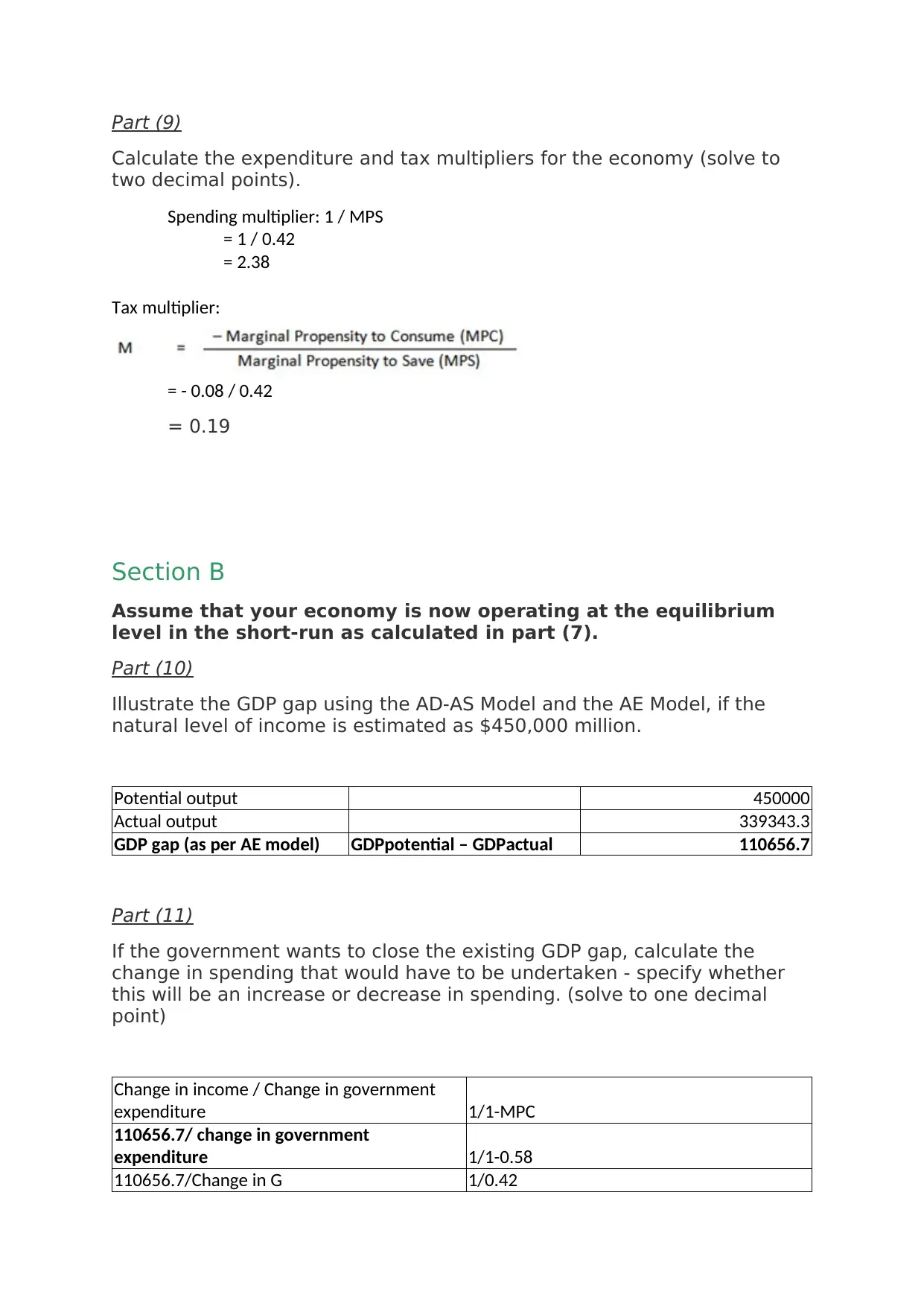

Part (9)

Calculate the expenditure and tax multipliers for the economy (solve to

two decimal points).

Spending multiplier: 1 / MPS

= 1 / 0.42

= 2.38

Tax multiplier:

= - 0.08 / 0.42

= 0.19

Section B

Assume that your economy is now operating at the equilibrium

level in the short-run as calculated in part (7).

Part (10)

Illustrate the GDP gap using the AD-AS Model and the AE Model, if the

natural level of income is estimated as $450,000 million.

Potential output 450000

Actual output 339343.3

GDP gap (as per AE model) GDPpotential – GDPactual 110656.7

Part (11)

If the government wants to close the existing GDP gap, calculate the

change in spending that would have to be undertaken - specify whether

this will be an increase or decrease in spending. (solve to one decimal

point)

Change in income / Change in government

expenditure 1/1-MPC

110656.7/ change in government

expenditure 1/1-0.58

110656.7/Change in G 1/0.42

Calculate the expenditure and tax multipliers for the economy (solve to

two decimal points).

Spending multiplier: 1 / MPS

= 1 / 0.42

= 2.38

Tax multiplier:

= - 0.08 / 0.42

= 0.19

Section B

Assume that your economy is now operating at the equilibrium

level in the short-run as calculated in part (7).

Part (10)

Illustrate the GDP gap using the AD-AS Model and the AE Model, if the

natural level of income is estimated as $450,000 million.

Potential output 450000

Actual output 339343.3

GDP gap (as per AE model) GDPpotential – GDPactual 110656.7

Part (11)

If the government wants to close the existing GDP gap, calculate the

change in spending that would have to be undertaken - specify whether

this will be an increase or decrease in spending. (solve to one decimal

point)

Change in income / Change in government

expenditure 1/1-MPC

110656.7/ change in government

expenditure 1/1-0.58

110656.7/Change in G 1/0.42

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

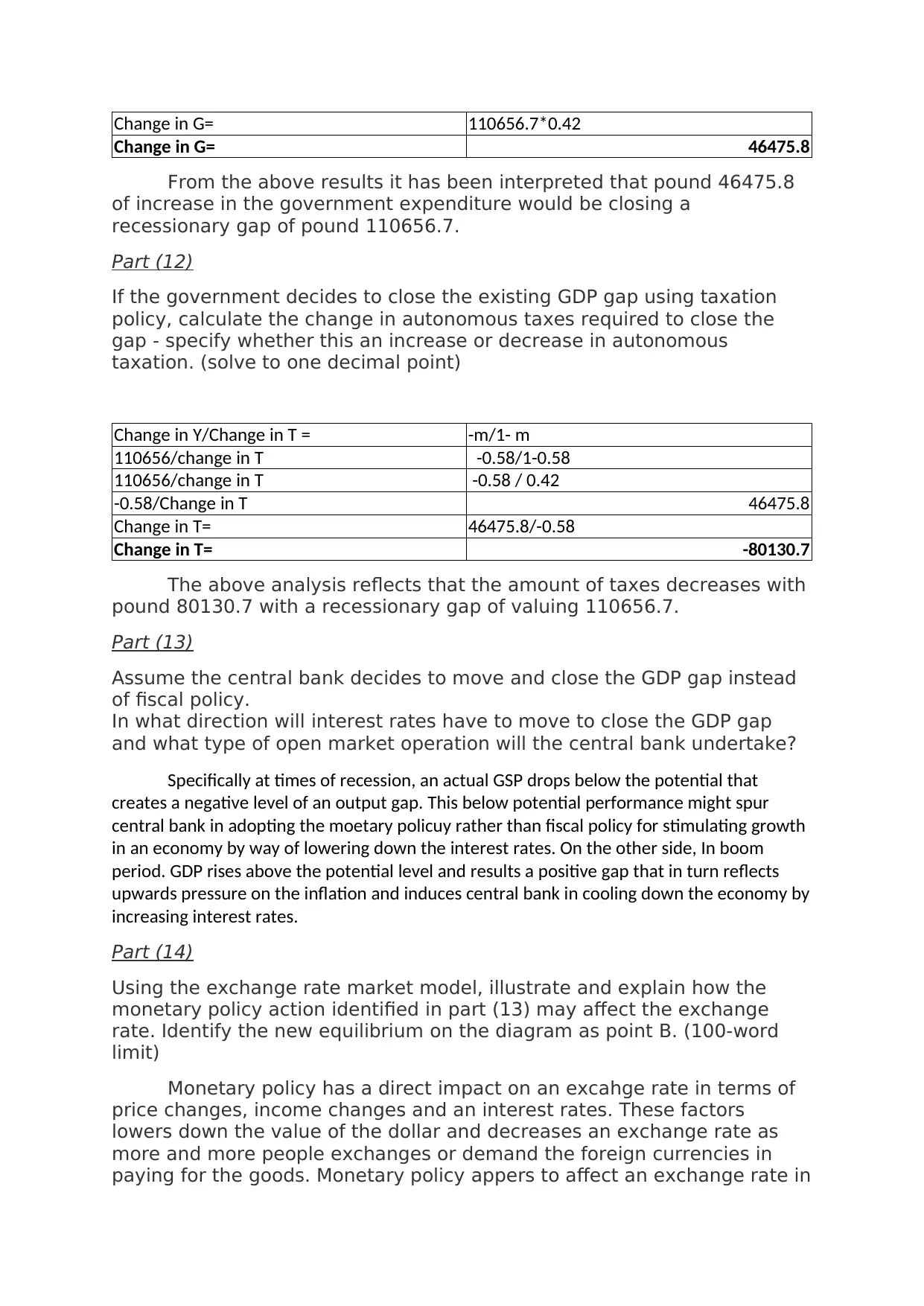

Change in G= 110656.7*0.42

Change in G= 46475.8

From the above results it has been interpreted that pound 46475.8

of increase in the government expenditure would be closing a

recessionary gap of pound 110656.7.

Part (12)

If the government decides to close the existing GDP gap using taxation

policy, calculate the change in autonomous taxes required to close the

gap - specify whether this an increase or decrease in autonomous

taxation. (solve to one decimal point)

Change in Y/Change in T = -m/1- m

110656/change in T -0.58/1-0.58

110656/change in T -0.58 / 0.42

-0.58/Change in T 46475.8

Change in T= 46475.8/-0.58

Change in T= -80130.7

The above analysis reflects that the amount of taxes decreases with

pound 80130.7 with a recessionary gap of valuing 110656.7.

Part (13)

Assume the central bank decides to move and close the GDP gap instead

of fiscal policy.

In what direction will interest rates have to move to close the GDP gap

and what type of open market operation will the central bank undertake?

Specifically at times of recession, an actual GSP drops below the potential that

creates a negative level of an output gap. This below potential performance might spur

central bank in adopting the moetary policuy rather than fiscal policy for stimulating growth

in an economy by way of lowering down the interest rates. On the other side, In boom

period. GDP rises above the potential level and results a positive gap that in turn reflects

upwards pressure on the inflation and induces central bank in cooling down the economy by

increasing interest rates.

Part (14)

Using the exchange rate market model, illustrate and explain how the

monetary policy action identified in part (13) may affect the exchange

rate. Identify the new equilibrium on the diagram as point B. (100-word

limit)

Monetary policy has a direct impact on an excahge rate in terms of

price changes, income changes and an interest rates. These factors

lowers down the value of the dollar and decreases an exchange rate as

more and more people exchanges or demand the foreign currencies in

paying for the goods. Monetary policy appers to affect an exchange rate in

Change in G= 46475.8

From the above results it has been interpreted that pound 46475.8

of increase in the government expenditure would be closing a

recessionary gap of pound 110656.7.

Part (12)

If the government decides to close the existing GDP gap using taxation

policy, calculate the change in autonomous taxes required to close the

gap - specify whether this an increase or decrease in autonomous

taxation. (solve to one decimal point)

Change in Y/Change in T = -m/1- m

110656/change in T -0.58/1-0.58

110656/change in T -0.58 / 0.42

-0.58/Change in T 46475.8

Change in T= 46475.8/-0.58

Change in T= -80130.7

The above analysis reflects that the amount of taxes decreases with

pound 80130.7 with a recessionary gap of valuing 110656.7.

Part (13)

Assume the central bank decides to move and close the GDP gap instead

of fiscal policy.

In what direction will interest rates have to move to close the GDP gap

and what type of open market operation will the central bank undertake?

Specifically at times of recession, an actual GSP drops below the potential that

creates a negative level of an output gap. This below potential performance might spur

central bank in adopting the moetary policuy rather than fiscal policy for stimulating growth

in an economy by way of lowering down the interest rates. On the other side, In boom

period. GDP rises above the potential level and results a positive gap that in turn reflects

upwards pressure on the inflation and induces central bank in cooling down the economy by

increasing interest rates.

Part (14)

Using the exchange rate market model, illustrate and explain how the

monetary policy action identified in part (13) may affect the exchange

rate. Identify the new equilibrium on the diagram as point B. (100-word

limit)

Monetary policy has a direct impact on an excahge rate in terms of

price changes, income changes and an interest rates. These factors

lowers down the value of the dollar and decreases an exchange rate as

more and more people exchanges or demand the foreign currencies in

paying for the goods. Monetary policy appers to affect an exchange rate in

such a direction in time of the turbulence. Although this policy apperas as

capable in stabilizing an excahnge rate even in times of teh tubulence,

often the central banks ends up partly in accomodating the exchange

market related pressure.

Part (15)

Using the IS-LM model, illustrate and explain how the economy and the

unemployment may be impacted as a result of the change in the

exchange rate in part (14). Identify the new equilibrium on the diagram as

point B. (100-word limit)

In accordance to this model, it has been indicated that due to the

change in an exchange rates, unemployment and overall economy is

highly affected. Increase in the currency exchange rate depicts growth in

an economy because teh disposable income of the people increases and

this in tur reduces the rate of unemployment. On the other state,

decrease or decline in currency rate, the GDP of the country gets affected

to a large extent which impacts or influences an entire economy and the

rate of unemployment would be seen as the major concern for a country.

capable in stabilizing an excahnge rate even in times of teh tubulence,

often the central banks ends up partly in accomodating the exchange

market related pressure.

Part (15)

Using the IS-LM model, illustrate and explain how the economy and the

unemployment may be impacted as a result of the change in the

exchange rate in part (14). Identify the new equilibrium on the diagram as

point B. (100-word limit)

In accordance to this model, it has been indicated that due to the

change in an exchange rates, unemployment and overall economy is

highly affected. Increase in the currency exchange rate depicts growth in

an economy because teh disposable income of the people increases and

this in tur reduces the rate of unemployment. On the other state,

decrease or decline in currency rate, the GDP of the country gets affected

to a large extent which impacts or influences an entire economy and the

rate of unemployment would be seen as the major concern for a country.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.