Economics for Managers: Market Analysis and Monopoly Report

VerifiedAdded on 2022/09/17

|18

|4122

|14

Report

AI Summary

This report provides a comprehensive analysis of market structures, including perfect competition, monopoly, oligopoly, and monopolistic competition. It delves into the characteristics of each structure, such as the number of sellers, product types, entry conditions, and profit dynamics in both the short and long run. The report uses diagrams to illustrate these concepts and provides real-world examples to support the discussion. Furthermore, the report presents a detailed case study on Australia Post as a monopoly, examining its market power, pricing strategies, and output decisions. The analysis incorporates economic theory and graphical representations to evaluate the efficiency of the chosen monopoly, comparing resource allocation and market outcomes to assess its impact. The report also discusses the implications of the monopoly power on consumer surplus and social welfare and the government regulations. The report uses relevant data, tables, and diagrams to provide a thorough understanding of market structures and monopoly analysis.

Running head: Economics for Managers

Economics for Managers

Name of the Student

Name of the University

Student ID

Economics for Managers

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1Economics for Managers

Table of Contents

Answer a..........................................................................................................................................2

Answer b..........................................................................................................................................6

Answer c........................................................................................................................................10

Answer d........................................................................................................................................12

References......................................................................................................................................15

Table of Contents

Answer a..........................................................................................................................................2

Answer b..........................................................................................................................................6

Answer c........................................................................................................................................10

Answer d........................................................................................................................................12

References......................................................................................................................................15

2Economics for Managers

Answer a

In an economy there are four types of market structures and any company or firm

participating in the economy relates to any of these four market structures. The types of market

structures are perfect competition, monopoly, oligopoly and monopolistic competition (Bertoletti

& Etro, 2016). The market structures are different from each other in their characteristics. From

social welfare and consumers’ perspective perfect competition is the most suitable market

structure, whereas from the producers’ perspective monopoly is the best market structure. The

other two that is oligopoly and monopolistic competition shows market characteristics that move

around between the characteristics of monopoly and perfect competition market structure

(Kirzner, 2015). In the following paragraphs detailed discussion on the four market structures

have been made to give clear overview of all the market structures.

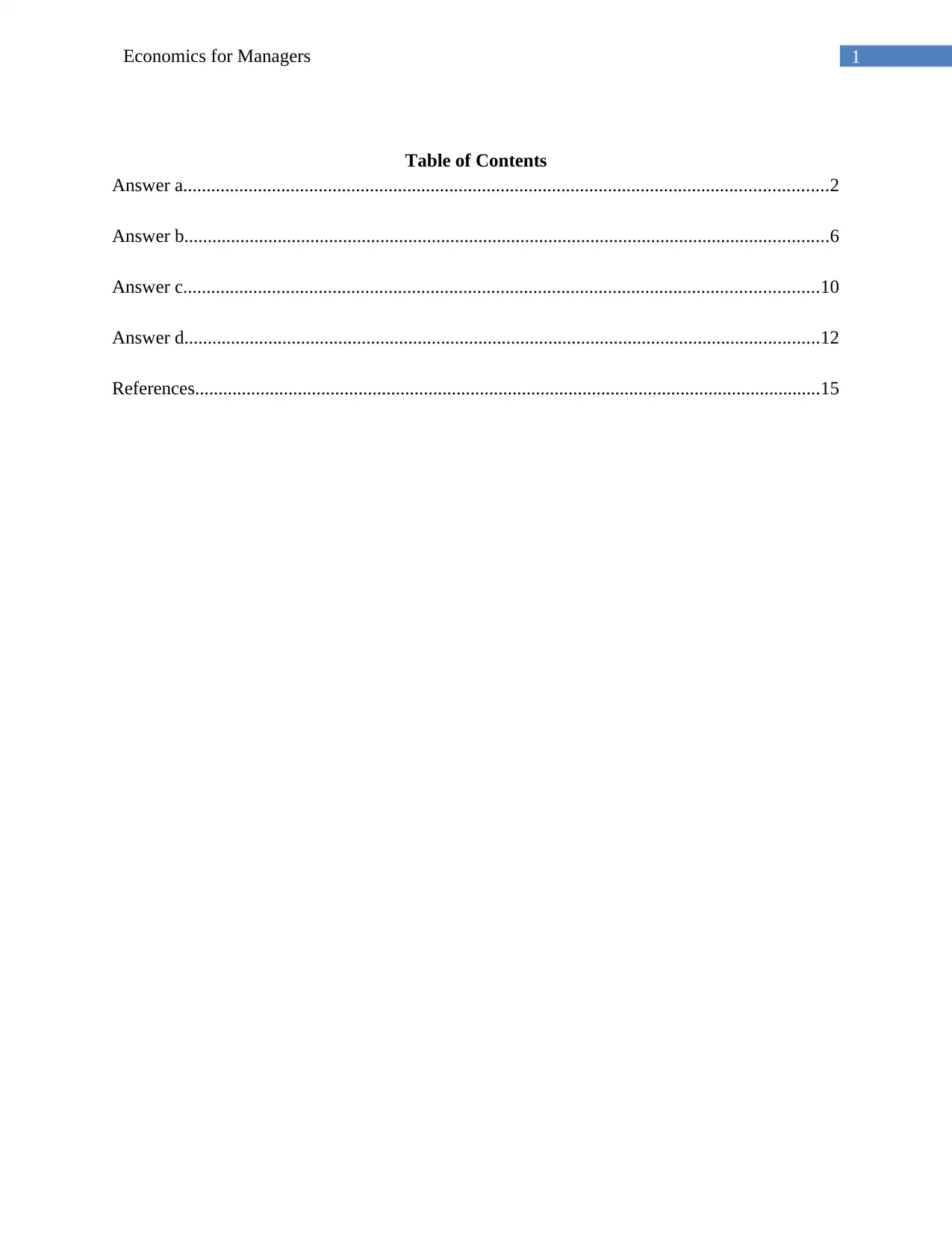

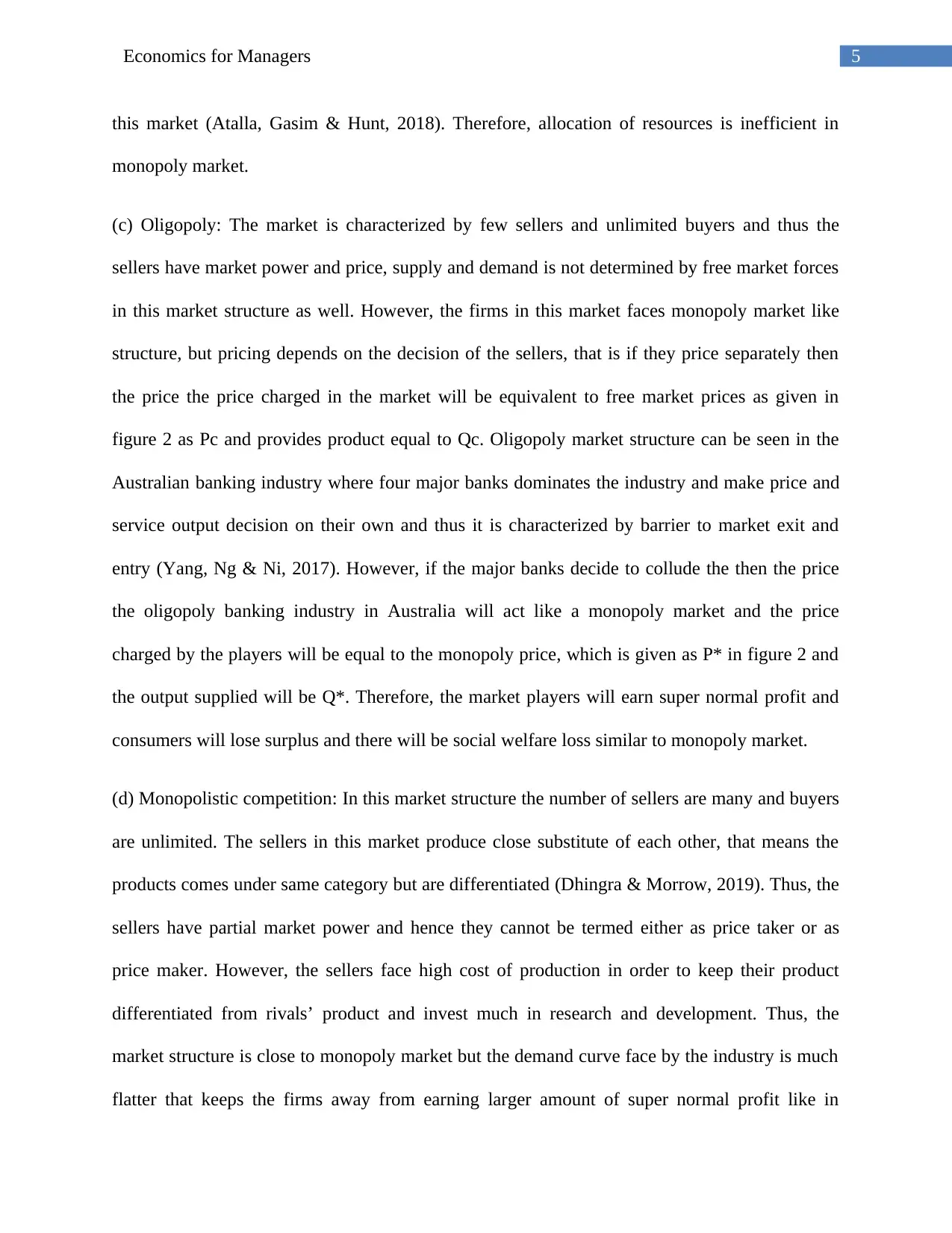

1) Perfect Competition: In perfectly competitive market structure there are unlimited numbers of

sellers and buyers. Thus, none of the buyer or seller has the power over the market and therefore

the price and supply and demand equilibrium is determined by the free market forces. The

market structure is characterized by free entry and exit, that means any firm willing to enter or

exit the market can do so without accruing any significant threat or loss. From perspective of the

market any exit or entry does not affect the price, demand and supply because the players of the

market does not depend on each other for price and output decisions. Apart from that, the

resources allocated efficiently in this market structure and therefore there is no loss in consumer

surplus, producer surplus and social welfare (Chen et al., 2016). The graphical illustration of the

market is given figure 1. The equilibrium price and quantity in the perfectly competitive market

is given in the below diagram as P* and Q* respectively. In perfectly competitive market firms

Answer a

In an economy there are four types of market structures and any company or firm

participating in the economy relates to any of these four market structures. The types of market

structures are perfect competition, monopoly, oligopoly and monopolistic competition (Bertoletti

& Etro, 2016). The market structures are different from each other in their characteristics. From

social welfare and consumers’ perspective perfect competition is the most suitable market

structure, whereas from the producers’ perspective monopoly is the best market structure. The

other two that is oligopoly and monopolistic competition shows market characteristics that move

around between the characteristics of monopoly and perfect competition market structure

(Kirzner, 2015). In the following paragraphs detailed discussion on the four market structures

have been made to give clear overview of all the market structures.

1) Perfect Competition: In perfectly competitive market structure there are unlimited numbers of

sellers and buyers. Thus, none of the buyer or seller has the power over the market and therefore

the price and supply and demand equilibrium is determined by the free market forces. The

market structure is characterized by free entry and exit, that means any firm willing to enter or

exit the market can do so without accruing any significant threat or loss. From perspective of the

market any exit or entry does not affect the price, demand and supply because the players of the

market does not depend on each other for price and output decisions. Apart from that, the

resources allocated efficiently in this market structure and therefore there is no loss in consumer

surplus, producer surplus and social welfare (Chen et al., 2016). The graphical illustration of the

market is given figure 1. The equilibrium price and quantity in the perfectly competitive market

is given in the below diagram as P* and Q* respectively. In perfectly competitive market firms

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3Economics for Managers

earn zero economic profit because free entry and exit allows new firms to enter the market

anytime (Bhattacharjee, Dana & Baron, 2015). Thus, whenever the firms in the market earn

supernormal profit new firms enter the market and increases the demand of the factors and price

firms in order capture the market lowers price and ultimately charges the price at which the firms

ear zero economic profit. An example of perfectly competitive market is fruit market as it depicts

all the characteristics discussed above.

Figure 1: Perfect Competition

Source: (Created by the Author)

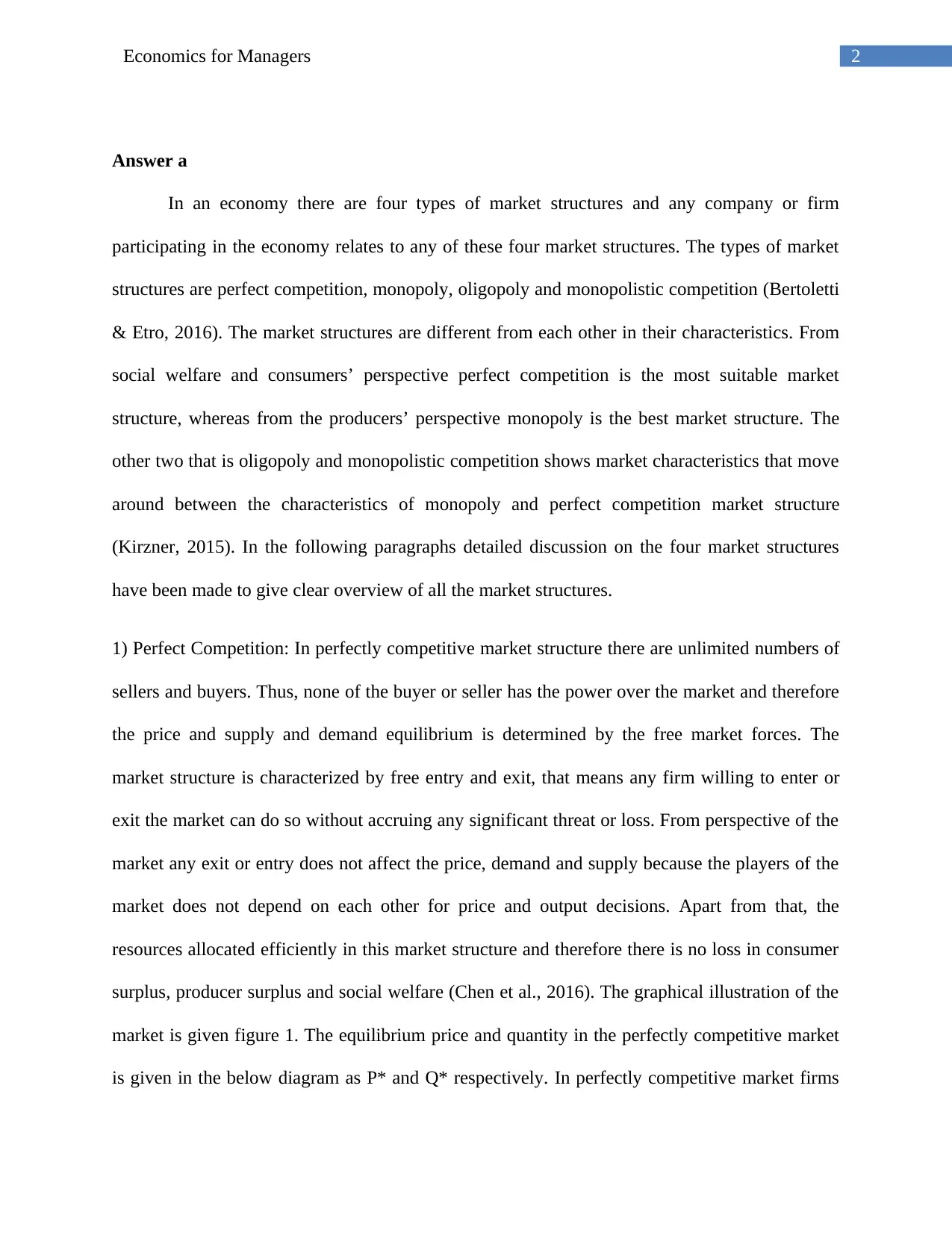

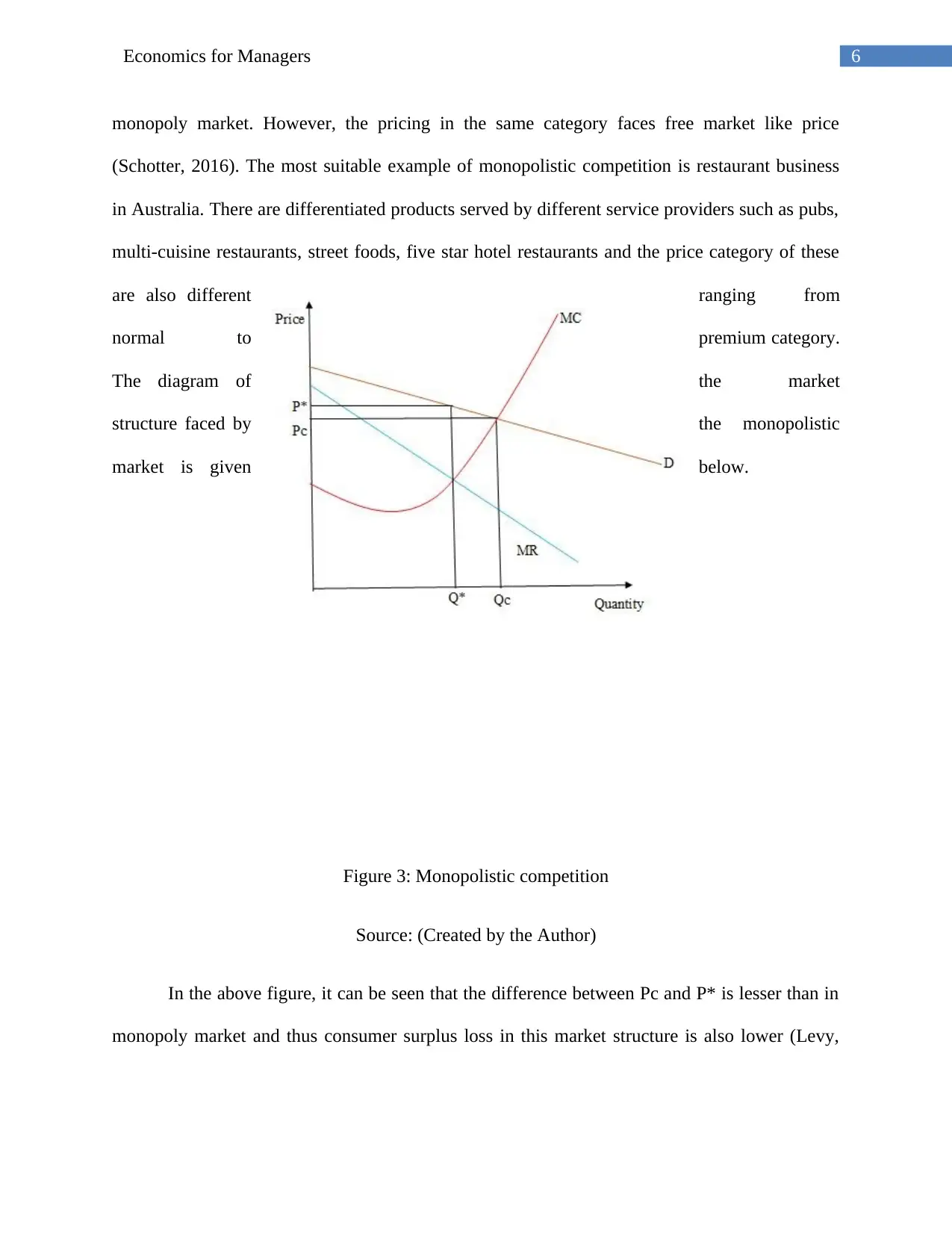

2) Monopoly: In monopoly market structure there is only one seller and unlimited buyers.

Therefore, the sellers has power over the market and can set any price to it wishes to maximize

its profit. This happens because in monopoly market seller has control over the raw material or

exclusively manufacture in its own facility and produces unique good which is not sold by any

other seller and thus giving no option to the buyers other than depending on the single seller

(Zeuthen, 2018). The huge cost of establishment and production cost and restriction by the

existing firm creates entry and exit barrier in the market. Tenaga Nasional Berhad is an

earn zero economic profit because free entry and exit allows new firms to enter the market

anytime (Bhattacharjee, Dana & Baron, 2015). Thus, whenever the firms in the market earn

supernormal profit new firms enter the market and increases the demand of the factors and price

firms in order capture the market lowers price and ultimately charges the price at which the firms

ear zero economic profit. An example of perfectly competitive market is fruit market as it depicts

all the characteristics discussed above.

Figure 1: Perfect Competition

Source: (Created by the Author)

2) Monopoly: In monopoly market structure there is only one seller and unlimited buyers.

Therefore, the sellers has power over the market and can set any price to it wishes to maximize

its profit. This happens because in monopoly market seller has control over the raw material or

exclusively manufacture in its own facility and produces unique good which is not sold by any

other seller and thus giving no option to the buyers other than depending on the single seller

(Zeuthen, 2018). The huge cost of establishment and production cost and restriction by the

existing firm creates entry and exit barrier in the market. Tenaga Nasional Berhad is an

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4Economics for Managers

electricity company Malaysia which is the only company that supplies electricity in the country.

Thus the company has the complete market power and can charge any price above the free

market price and supplies less and earn supernormal profit. The illustration of this is shown in

the diagram given

below.

Figure 2: Monopoly market structure

Source: (Created by the Author)

Consumers in a monopoly market like the electricity market in Malaysia pays the pays more than

what they receive. Hence, consumer lose their surplus they use to receive in perfectly

competitive market. Apart from that, social welfare loss occurs in the form of dead weight loss in

electricity company Malaysia which is the only company that supplies electricity in the country.

Thus the company has the complete market power and can charge any price above the free

market price and supplies less and earn supernormal profit. The illustration of this is shown in

the diagram given

below.

Figure 2: Monopoly market structure

Source: (Created by the Author)

Consumers in a monopoly market like the electricity market in Malaysia pays the pays more than

what they receive. Hence, consumer lose their surplus they use to receive in perfectly

competitive market. Apart from that, social welfare loss occurs in the form of dead weight loss in

5Economics for Managers

this market (Atalla, Gasim & Hunt, 2018). Therefore, allocation of resources is inefficient in

monopoly market.

(c) Oligopoly: The market is characterized by few sellers and unlimited buyers and thus the

sellers have market power and price, supply and demand is not determined by free market forces

in this market structure as well. However, the firms in this market faces monopoly market like

structure, but pricing depends on the decision of the sellers, that is if they price separately then

the price the price charged in the market will be equivalent to free market prices as given in

figure 2 as Pc and provides product equal to Qc. Oligopoly market structure can be seen in the

Australian banking industry where four major banks dominates the industry and make price and

service output decision on their own and thus it is characterized by barrier to market exit and

entry (Yang, Ng & Ni, 2017). However, if the major banks decide to collude the then the price

the oligopoly banking industry in Australia will act like a monopoly market and the price

charged by the players will be equal to the monopoly price, which is given as P* in figure 2 and

the output supplied will be Q*. Therefore, the market players will earn super normal profit and

consumers will lose surplus and there will be social welfare loss similar to monopoly market.

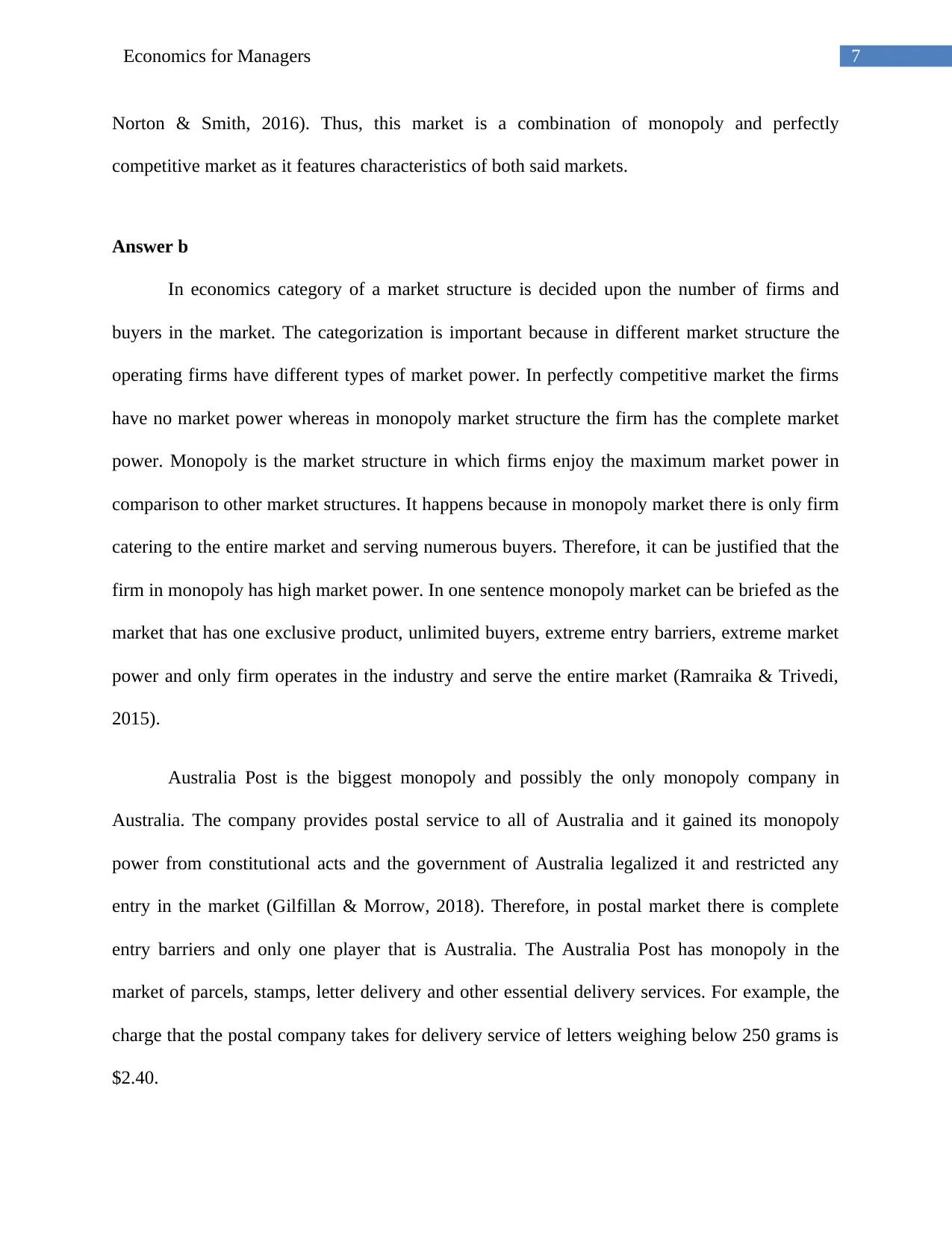

(d) Monopolistic competition: In this market structure the number of sellers are many and buyers

are unlimited. The sellers in this market produce close substitute of each other, that means the

products comes under same category but are differentiated (Dhingra & Morrow, 2019). Thus, the

sellers have partial market power and hence they cannot be termed either as price taker or as

price maker. However, the sellers face high cost of production in order to keep their product

differentiated from rivals’ product and invest much in research and development. Thus, the

market structure is close to monopoly market but the demand curve face by the industry is much

flatter that keeps the firms away from earning larger amount of super normal profit like in

this market (Atalla, Gasim & Hunt, 2018). Therefore, allocation of resources is inefficient in

monopoly market.

(c) Oligopoly: The market is characterized by few sellers and unlimited buyers and thus the

sellers have market power and price, supply and demand is not determined by free market forces

in this market structure as well. However, the firms in this market faces monopoly market like

structure, but pricing depends on the decision of the sellers, that is if they price separately then

the price the price charged in the market will be equivalent to free market prices as given in

figure 2 as Pc and provides product equal to Qc. Oligopoly market structure can be seen in the

Australian banking industry where four major banks dominates the industry and make price and

service output decision on their own and thus it is characterized by barrier to market exit and

entry (Yang, Ng & Ni, 2017). However, if the major banks decide to collude the then the price

the oligopoly banking industry in Australia will act like a monopoly market and the price

charged by the players will be equal to the monopoly price, which is given as P* in figure 2 and

the output supplied will be Q*. Therefore, the market players will earn super normal profit and

consumers will lose surplus and there will be social welfare loss similar to monopoly market.

(d) Monopolistic competition: In this market structure the number of sellers are many and buyers

are unlimited. The sellers in this market produce close substitute of each other, that means the

products comes under same category but are differentiated (Dhingra & Morrow, 2019). Thus, the

sellers have partial market power and hence they cannot be termed either as price taker or as

price maker. However, the sellers face high cost of production in order to keep their product

differentiated from rivals’ product and invest much in research and development. Thus, the

market structure is close to monopoly market but the demand curve face by the industry is much

flatter that keeps the firms away from earning larger amount of super normal profit like in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

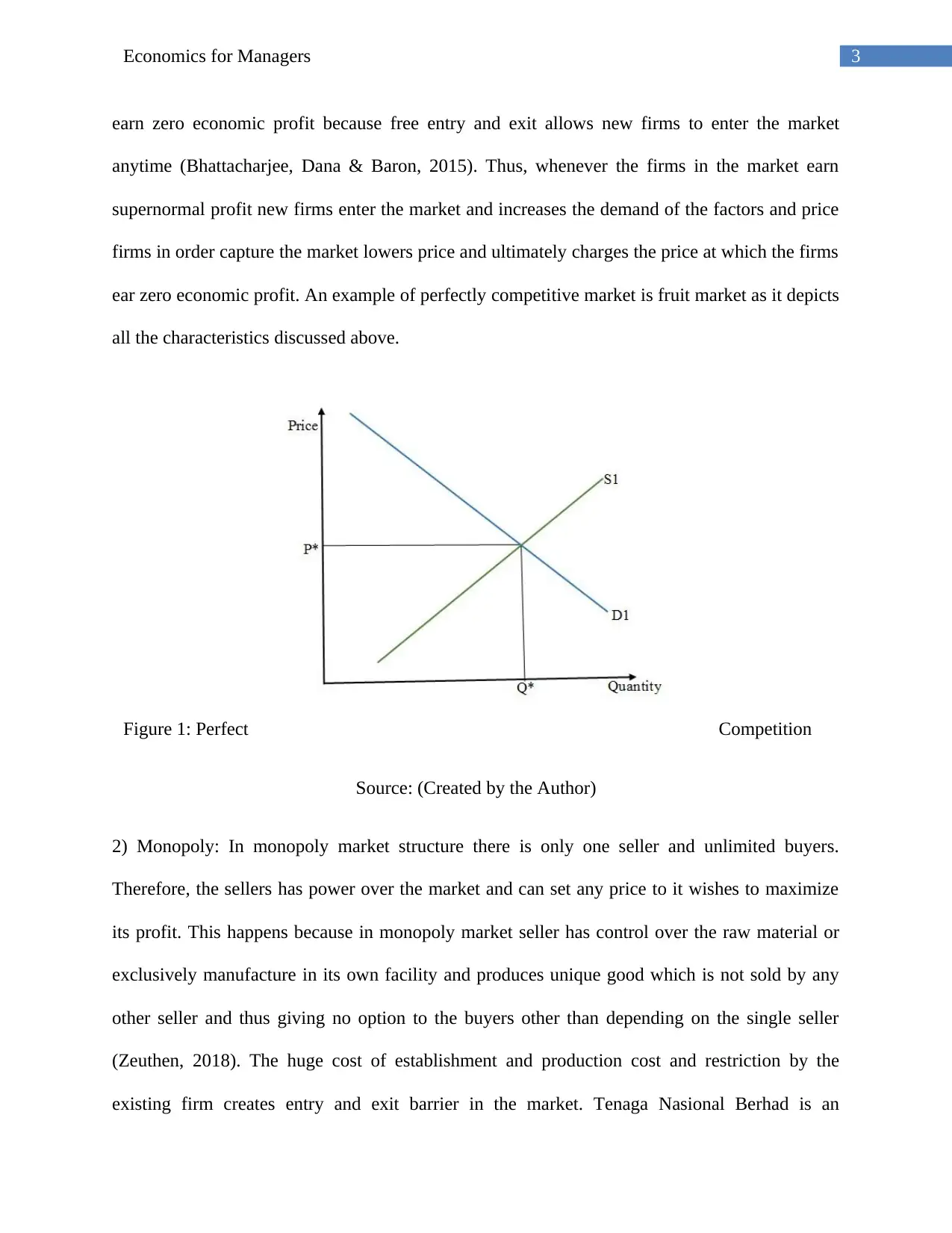

6Economics for Managers

monopoly market. However, the pricing in the same category faces free market like price

(Schotter, 2016). The most suitable example of monopolistic competition is restaurant business

in Australia. There are differentiated products served by different service providers such as pubs,

multi-cuisine restaurants, street foods, five star hotel restaurants and the price category of these

are also different ranging from

normal to premium category.

The diagram of the market

structure faced by the monopolistic

market is given below.

Figure 3: Monopolistic competition

Source: (Created by the Author)

In the above figure, it can be seen that the difference between Pc and P* is lesser than in

monopoly market and thus consumer surplus loss in this market structure is also lower (Levy,

monopoly market. However, the pricing in the same category faces free market like price

(Schotter, 2016). The most suitable example of monopolistic competition is restaurant business

in Australia. There are differentiated products served by different service providers such as pubs,

multi-cuisine restaurants, street foods, five star hotel restaurants and the price category of these

are also different ranging from

normal to premium category.

The diagram of the market

structure faced by the monopolistic

market is given below.

Figure 3: Monopolistic competition

Source: (Created by the Author)

In the above figure, it can be seen that the difference between Pc and P* is lesser than in

monopoly market and thus consumer surplus loss in this market structure is also lower (Levy,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7Economics for Managers

Norton & Smith, 2016). Thus, this market is a combination of monopoly and perfectly

competitive market as it features characteristics of both said markets.

Answer b

In economics category of a market structure is decided upon the number of firms and

buyers in the market. The categorization is important because in different market structure the

operating firms have different types of market power. In perfectly competitive market the firms

have no market power whereas in monopoly market structure the firm has the complete market

power. Monopoly is the market structure in which firms enjoy the maximum market power in

comparison to other market structures. It happens because in monopoly market there is only firm

catering to the entire market and serving numerous buyers. Therefore, it can be justified that the

firm in monopoly has high market power. In one sentence monopoly market can be briefed as the

market that has one exclusive product, unlimited buyers, extreme entry barriers, extreme market

power and only firm operates in the industry and serve the entire market (Ramraika & Trivedi,

2015).

Australia Post is the biggest monopoly and possibly the only monopoly company in

Australia. The company provides postal service to all of Australia and it gained its monopoly

power from constitutional acts and the government of Australia legalized it and restricted any

entry in the market (Gilfillan & Morrow, 2018). Therefore, in postal market there is complete

entry barriers and only one player that is Australia. The Australia Post has monopoly in the

market of parcels, stamps, letter delivery and other essential delivery services. For example, the

charge that the postal company takes for delivery service of letters weighing below 250 grams is

$2.40.

Norton & Smith, 2016). Thus, this market is a combination of monopoly and perfectly

competitive market as it features characteristics of both said markets.

Answer b

In economics category of a market structure is decided upon the number of firms and

buyers in the market. The categorization is important because in different market structure the

operating firms have different types of market power. In perfectly competitive market the firms

have no market power whereas in monopoly market structure the firm has the complete market

power. Monopoly is the market structure in which firms enjoy the maximum market power in

comparison to other market structures. It happens because in monopoly market there is only firm

catering to the entire market and serving numerous buyers. Therefore, it can be justified that the

firm in monopoly has high market power. In one sentence monopoly market can be briefed as the

market that has one exclusive product, unlimited buyers, extreme entry barriers, extreme market

power and only firm operates in the industry and serve the entire market (Ramraika & Trivedi,

2015).

Australia Post is the biggest monopoly and possibly the only monopoly company in

Australia. The company provides postal service to all of Australia and it gained its monopoly

power from constitutional acts and the government of Australia legalized it and restricted any

entry in the market (Gilfillan & Morrow, 2018). Therefore, in postal market there is complete

entry barriers and only one player that is Australia. The Australia Post has monopoly in the

market of parcels, stamps, letter delivery and other essential delivery services. For example, the

charge that the postal company takes for delivery service of letters weighing below 250 grams is

$2.40.

8Economics for Managers

Monopoly markets structure of Australia is characterized by exclusive raw materials,

existence of network externalities, high fixed cost and government regulation that restricts new

firms from entering the market (Hsu & Lin, 2016). Above stated factors are the main reasons that

maintains the monopoly power of the Australia Post. A monopoly firm has exclusive raw

material source that separate its product and makes it unique, thus it is very difficult for other

firms to replicate its product due to lack of raw material access or unavailability. Thus, Australia

Post being a monopoly player has all these advantages that enables it to control the postal market

in Australia. In monopoly market fixed costs are very high that discourages new players or firms

from making entry in the market because the existing player has economics of scale which

cannot be matched by new firms and thus entry barrier is maximum. Australia Post is widespread

in Australia and thus have effective network externality that provided large amount of loyal users

to the company. These advantages act as natural entry barrier to the market. However, apart from

these natural barriers the most effective one is the government regulation that completely

restricts entry of any new firm in the industry by law (Hawley, 2015). Therefore by the decree of

the government the Australia Post has special right to serve the industry of delivering parcels,

letters and other different types of deliverables across Australia at reasonable prices.

Furthermore, Australia Post has to abide by the government mandates of providing service for 5

times a week to 90 percent addresses of the country both in urban and rural areas.

It is already been discussed that Australia Post operates in monopoly market where entry

of new firms are restricted. Thus, the company does not face any type of competition. The

monopoly power the company has gained enables it to charge prices that it willing to charge for

its goods and services and in most of the cases it remain above free market price that results in

exploitation of the consumers and give inefficient outcome (Tauman, Weiss & Zhao, 2017). The

Monopoly markets structure of Australia is characterized by exclusive raw materials,

existence of network externalities, high fixed cost and government regulation that restricts new

firms from entering the market (Hsu & Lin, 2016). Above stated factors are the main reasons that

maintains the monopoly power of the Australia Post. A monopoly firm has exclusive raw

material source that separate its product and makes it unique, thus it is very difficult for other

firms to replicate its product due to lack of raw material access or unavailability. Thus, Australia

Post being a monopoly player has all these advantages that enables it to control the postal market

in Australia. In monopoly market fixed costs are very high that discourages new players or firms

from making entry in the market because the existing player has economics of scale which

cannot be matched by new firms and thus entry barrier is maximum. Australia Post is widespread

in Australia and thus have effective network externality that provided large amount of loyal users

to the company. These advantages act as natural entry barrier to the market. However, apart from

these natural barriers the most effective one is the government regulation that completely

restricts entry of any new firm in the industry by law (Hawley, 2015). Therefore by the decree of

the government the Australia Post has special right to serve the industry of delivering parcels,

letters and other different types of deliverables across Australia at reasonable prices.

Furthermore, Australia Post has to abide by the government mandates of providing service for 5

times a week to 90 percent addresses of the country both in urban and rural areas.

It is already been discussed that Australia Post operates in monopoly market where entry

of new firms are restricted. Thus, the company does not face any type of competition. The

monopoly power the company has gained enables it to charge prices that it willing to charge for

its goods and services and in most of the cases it remain above free market price that results in

exploitation of the consumers and give inefficient outcome (Tauman, Weiss & Zhao, 2017). The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9Economics for Managers

market stricture where price is efficient and exploitation of the consumers are the least is

popularly known as perfect competition. Therefore, it can be said that monopoly power of

Australia Post results in loss of economic surplus and exploitation of consumers.

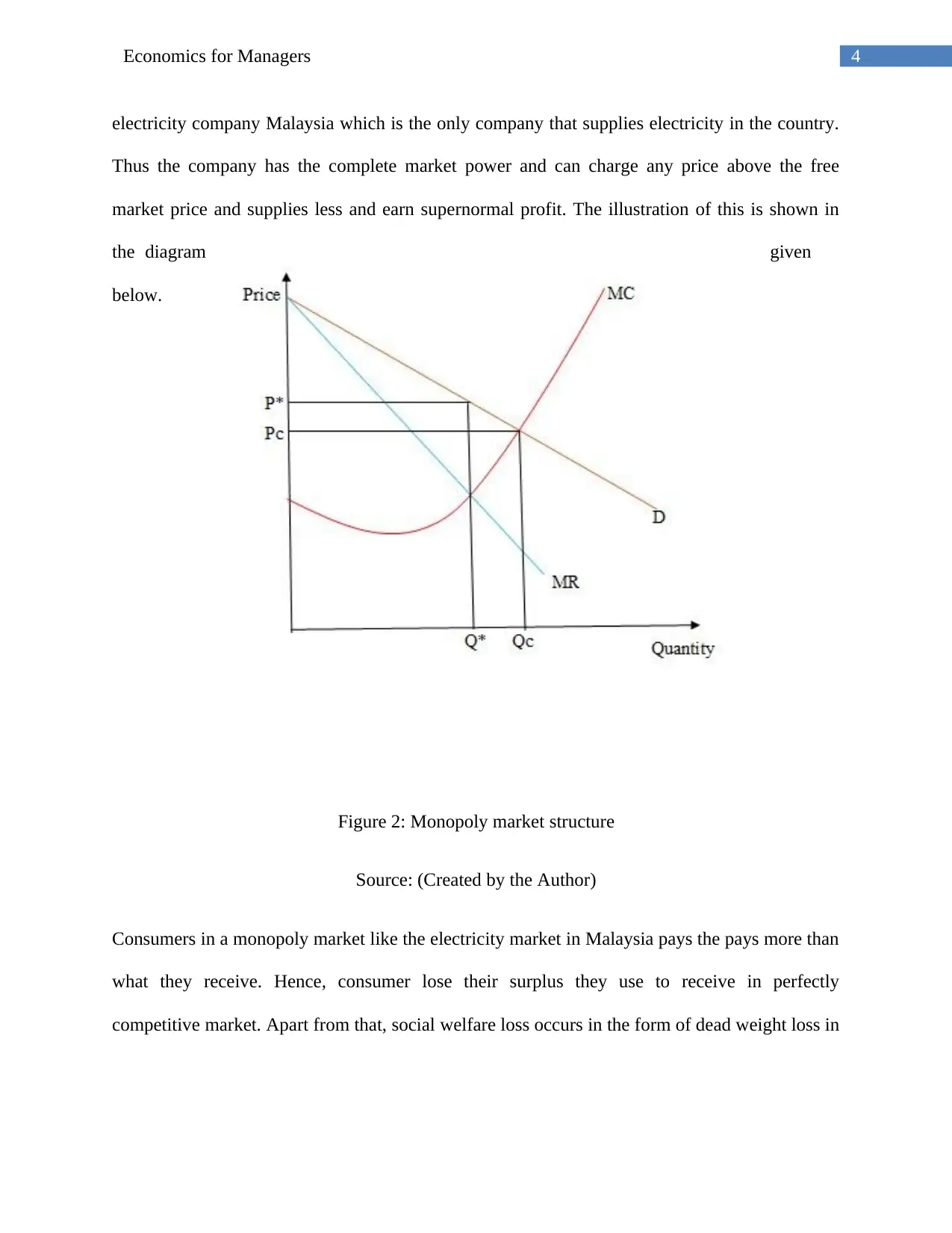

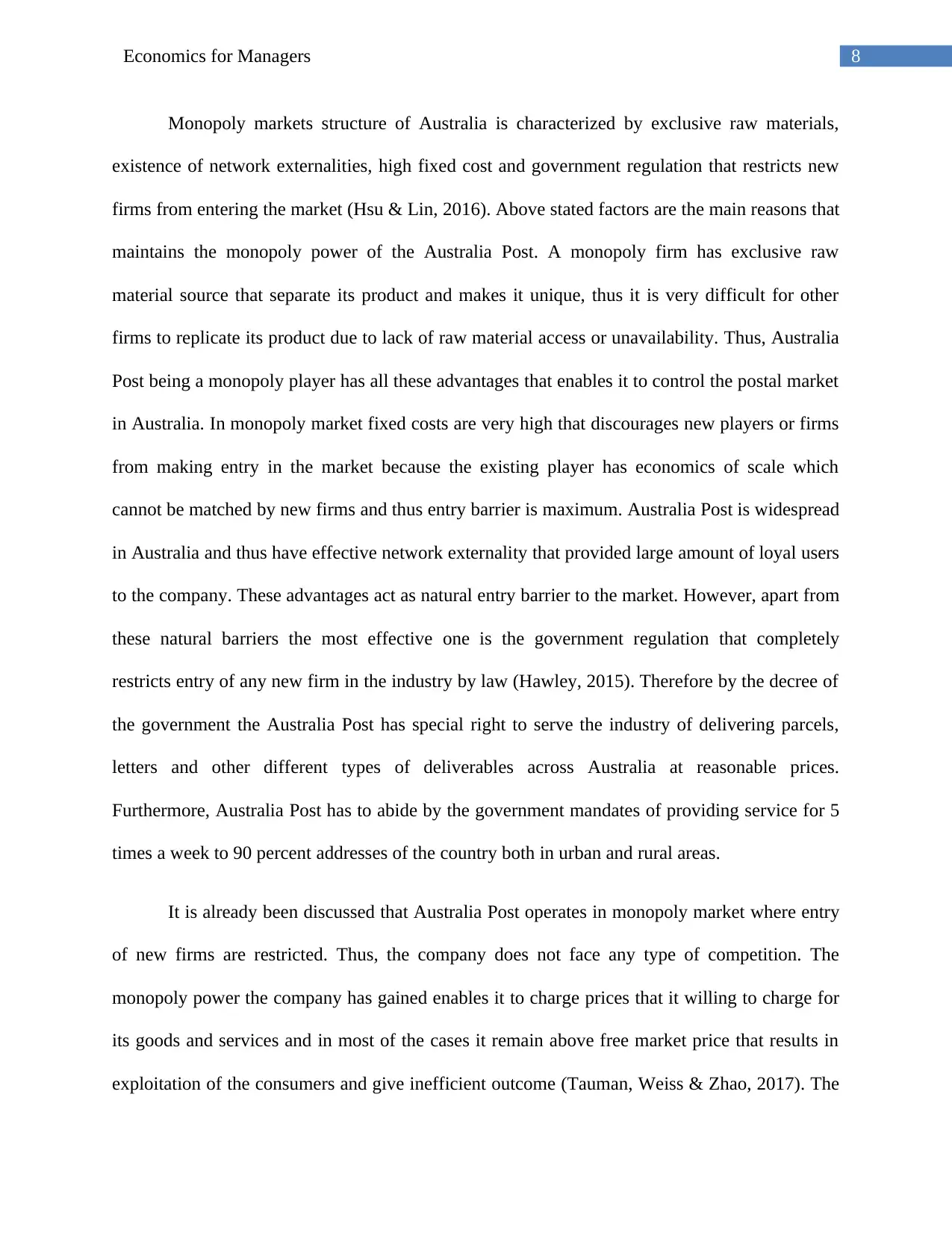

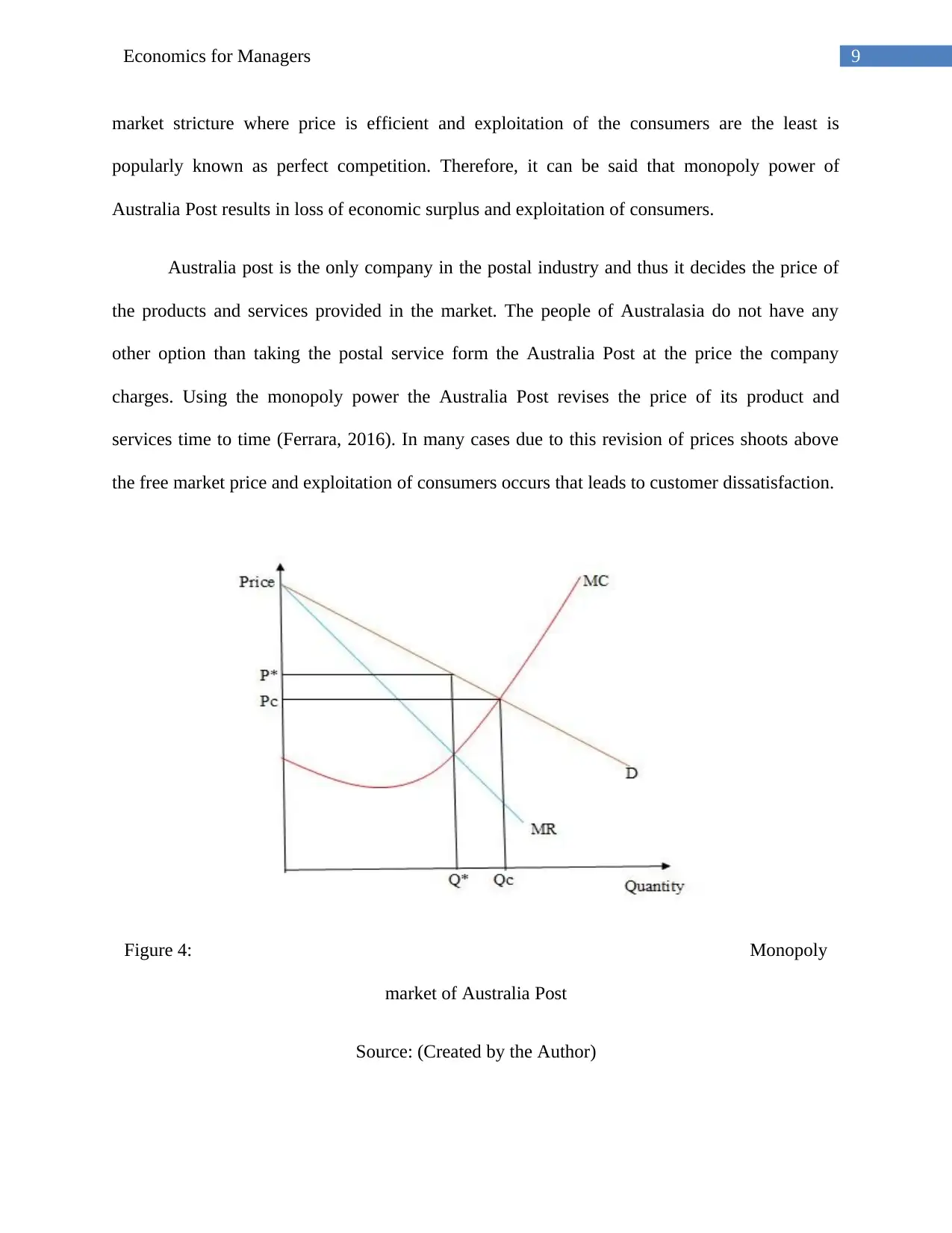

Australia post is the only company in the postal industry and thus it decides the price of

the products and services provided in the market. The people of Australasia do not have any

other option than taking the postal service form the Australia Post at the price the company

charges. Using the monopoly power the Australia Post revises the price of its product and

services time to time (Ferrara, 2016). In many cases due to this revision of prices shoots above

the free market price and exploitation of consumers occurs that leads to customer dissatisfaction.

Figure 4: Monopoly

market of Australia Post

Source: (Created by the Author)

market stricture where price is efficient and exploitation of the consumers are the least is

popularly known as perfect competition. Therefore, it can be said that monopoly power of

Australia Post results in loss of economic surplus and exploitation of consumers.

Australia post is the only company in the postal industry and thus it decides the price of

the products and services provided in the market. The people of Australasia do not have any

other option than taking the postal service form the Australia Post at the price the company

charges. Using the monopoly power the Australia Post revises the price of its product and

services time to time (Ferrara, 2016). In many cases due to this revision of prices shoots above

the free market price and exploitation of consumers occurs that leads to customer dissatisfaction.

Figure 4: Monopoly

market of Australia Post

Source: (Created by the Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10Economics for Managers

Australia Post is a regulated monopoly run by the government of Australia, thus it

charges reasonable price for its products such as $1 for a stamp event after being a monopoly

corporation. Thus, the price charged under this monopoly is equivalent to the price that would

have been charged in a perfectly competitive market and is given as Pc and the quantity of

product or service provided is Qc in figure 4 (Liu & Tyagi, 2017). However, recent product price

revision have exerted pressure on the consumers as the price exceeds the perfectly competitive

market price. The loss in consumer surplus is partly appropriated by the firm, Australia Post in

this case and partly lost as dead weight loss (Carbajal & Ely, 2016). Thus, by charging high price

the Australia Post is making supernormal profit and is the only player in the market and thus the

characteristics it shows as firm depicts that it is a monopoly firm.

Answer c

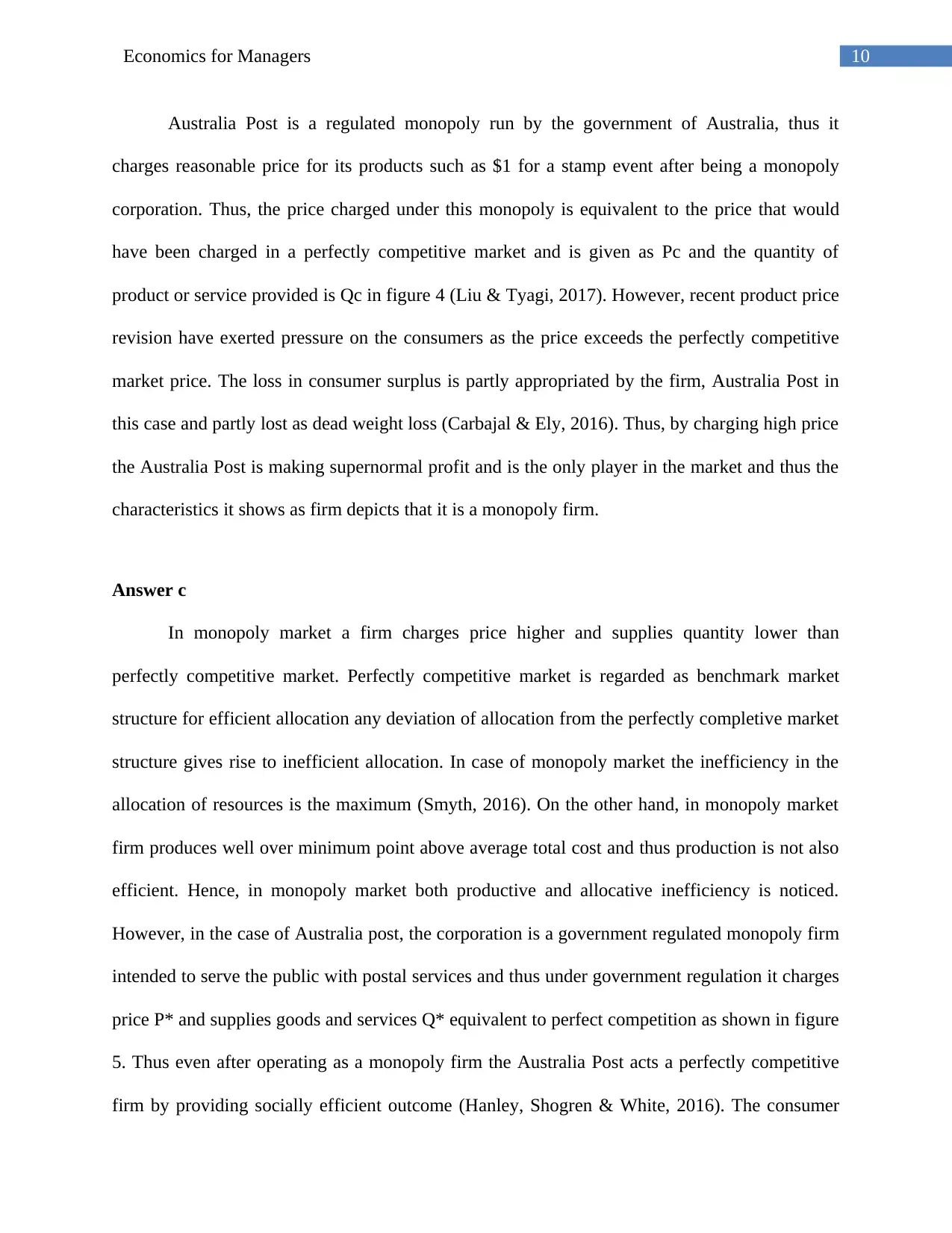

In monopoly market a firm charges price higher and supplies quantity lower than

perfectly competitive market. Perfectly competitive market is regarded as benchmark market

structure for efficient allocation any deviation of allocation from the perfectly completive market

structure gives rise to inefficient allocation. In case of monopoly market the inefficiency in the

allocation of resources is the maximum (Smyth, 2016). On the other hand, in monopoly market

firm produces well over minimum point above average total cost and thus production is not also

efficient. Hence, in monopoly market both productive and allocative inefficiency is noticed.

However, in the case of Australia post, the corporation is a government regulated monopoly firm

intended to serve the public with postal services and thus under government regulation it charges

price P* and supplies goods and services Q* equivalent to perfect competition as shown in figure

5. Thus even after operating as a monopoly firm the Australia Post acts a perfectly competitive

firm by providing socially efficient outcome (Hanley, Shogren & White, 2016). The consumer

Australia Post is a regulated monopoly run by the government of Australia, thus it

charges reasonable price for its products such as $1 for a stamp event after being a monopoly

corporation. Thus, the price charged under this monopoly is equivalent to the price that would

have been charged in a perfectly competitive market and is given as Pc and the quantity of

product or service provided is Qc in figure 4 (Liu & Tyagi, 2017). However, recent product price

revision have exerted pressure on the consumers as the price exceeds the perfectly competitive

market price. The loss in consumer surplus is partly appropriated by the firm, Australia Post in

this case and partly lost as dead weight loss (Carbajal & Ely, 2016). Thus, by charging high price

the Australia Post is making supernormal profit and is the only player in the market and thus the

characteristics it shows as firm depicts that it is a monopoly firm.

Answer c

In monopoly market a firm charges price higher and supplies quantity lower than

perfectly competitive market. Perfectly competitive market is regarded as benchmark market

structure for efficient allocation any deviation of allocation from the perfectly completive market

structure gives rise to inefficient allocation. In case of monopoly market the inefficiency in the

allocation of resources is the maximum (Smyth, 2016). On the other hand, in monopoly market

firm produces well over minimum point above average total cost and thus production is not also

efficient. Hence, in monopoly market both productive and allocative inefficiency is noticed.

However, in the case of Australia post, the corporation is a government regulated monopoly firm

intended to serve the public with postal services and thus under government regulation it charges

price P* and supplies goods and services Q* equivalent to perfect competition as shown in figure

5. Thus even after operating as a monopoly firm the Australia Post acts a perfectly competitive

firm by providing socially efficient outcome (Hanley, Shogren & White, 2016). The consumer

11Economics for Managers

surplus in an efficient market structure is received by the consumers only. Similarly, firms or

producers receive their part of surplus and apart from that there is no loss of surplus as dead

weight loss. However, regular revision of product prices by the Australia Post has raised the

prices of the product so much that it exceeds the price of the perfectly competitive market. At

increased price the Australia Post is also providing less amount of goods and services, which is

lower than the free market output. Thus, the consumers receive lower amount of goods than they

paid for. Hence, consumers loss their surplus and is appropriated by the Australia Post in this

case. The main reason of low supply in monopoly market is inefficient allocation of factors of

production that leads to low productivity per unit of factors. Thus, market supply is lower too

causing inefficient allocation in supply causing further loss in social welfare. The perfect

competition is said to be the benchmark allocative market structure and in that market price is

equal to the marginal cost (MC), marginal revenue (MR) and average revenue (AR) and the

equilibrium is given in figure below as EC, whereas in monopoly the market equilibrium is given

by EM as shown in figure 5 (Board & Skrzypacz, 2016). However, price in monopoly is equal to

AR. The equilibrium price and quantity in monopoly market of the Australian Post is given by P1

and Q1.

surplus in an efficient market structure is received by the consumers only. Similarly, firms or

producers receive their part of surplus and apart from that there is no loss of surplus as dead

weight loss. However, regular revision of product prices by the Australia Post has raised the

prices of the product so much that it exceeds the price of the perfectly competitive market. At

increased price the Australia Post is also providing less amount of goods and services, which is

lower than the free market output. Thus, the consumers receive lower amount of goods than they

paid for. Hence, consumers loss their surplus and is appropriated by the Australia Post in this

case. The main reason of low supply in monopoly market is inefficient allocation of factors of

production that leads to low productivity per unit of factors. Thus, market supply is lower too

causing inefficient allocation in supply causing further loss in social welfare. The perfect

competition is said to be the benchmark allocative market structure and in that market price is

equal to the marginal cost (MC), marginal revenue (MR) and average revenue (AR) and the

equilibrium is given in figure below as EC, whereas in monopoly the market equilibrium is given

by EM as shown in figure 5 (Board & Skrzypacz, 2016). However, price in monopoly is equal to

AR. The equilibrium price and quantity in monopoly market of the Australian Post is given by P1

and Q1.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.