Economics for Business: Evaluating Carbon Tax and Trade War Effects

VerifiedAdded on 2022/09/08

|20

|5744

|12

Report

AI Summary

This economics report examines two key aspects of the Australian economy: the government's ability to reduce carbon emissions through taxation and the impact of the US/China trade war on macroeconomic conditions. The report delves into the economic principles behind carbon taxes, analyzing their effectiveness, potential benefits, and challenges, supported by media reports. It explores how carbon pricing mechanisms can incentivize reduced carbon emissions and examines the Australian government's past attempts at implementing such policies, including the Clean Energy Act of 2011. The second part of the report analyzes the trade war between the US and China, assessing its effects on Australia's aggregate demand and supply, and the overall health of the Australian economy. It uses economic theory to explain the mechanisms through which trade disputes impact macroeconomic indicators and discusses the need for government intervention to mitigate negative consequences. The report incorporates relevant media reports to illustrate real-world examples and support the analysis, providing a comprehensive understanding of these critical economic issues.

Running head: ECONOMICS FOR BUSINESS

Economics for business

Name of the Student

Name of the University

Author Note

Economics for business

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR BUSINESS

Table of Contents

Answer to question 1:.................................................................................................................2

Evaluating the ability of government to lower carbon emission by implementing tax:............2

Answer to question 2:.................................................................................................................7

Explaining the impact of US/China trade war on macroeconomics condition of Australia:.....7

References list:.........................................................................................................................15

Table of Contents

Answer to question 1:.................................................................................................................2

Evaluating the ability of government to lower carbon emission by implementing tax:............2

Answer to question 2:.................................................................................................................7

Explaining the impact of US/China trade war on macroeconomics condition of Australia:.....7

References list:.........................................................................................................................15

ECONOMICS FOR BUSINESS

Answer to question 1:

Evaluating the ability of government to lower carbon emission by implementing tax:

Climatic goals of any can be met by reducing the emission of carbon by way of

imposing price on carbon. The target of climatic change is being met by Australia with the

objective of supporting the effective response internationally and improving the environment.

It has been argued by economist that the emission of carbon can be reduced in an

economically efficient way with the help of a well-designed carbon tax. Depending upon the

usage of generate of revenue by way of carbon tax, there can be significant variation in the

economic effects of tax. Reduction of carbon emission can be done by the adoption of the

cost effective regulatory approach by way of carbon pricing using the instrument of carbon

tax (aph.gov.au, 2020).

For instance, the economy of any country is positively impacted when the revenues

generated from the carbon tax is used for the reduction of a more distorted type of tax. It is

identified from the estimates that in the countries around the world, 44% of revenue

generated from carbon tax were used to lower the other taxes. Implementation of carbon tax

is argument in terms of the benefits derived such as raising revenue, encouraging alternatives,

improving environment and generation of socially efficient outcomes. In the early 2018,

implementation of subnational and national carbon system were scheduled to be implemented

all around the world. The implementation of carbon tax makes producers and consumers to

take account of the social costs of pollution that is the main source of emission of carbon and

thereby greenhouse gases (Geroe, 2019).

The concept of carbon tax to reduce the carbon emission can be understood from the

economical point of view. Government intends to address the negative externalities which is

the social cost of any activities using tax which is a policy based on market approach. For the

Answer to question 1:

Evaluating the ability of government to lower carbon emission by implementing tax:

Climatic goals of any can be met by reducing the emission of carbon by way of

imposing price on carbon. The target of climatic change is being met by Australia with the

objective of supporting the effective response internationally and improving the environment.

It has been argued by economist that the emission of carbon can be reduced in an

economically efficient way with the help of a well-designed carbon tax. Depending upon the

usage of generate of revenue by way of carbon tax, there can be significant variation in the

economic effects of tax. Reduction of carbon emission can be done by the adoption of the

cost effective regulatory approach by way of carbon pricing using the instrument of carbon

tax (aph.gov.au, 2020).

For instance, the economy of any country is positively impacted when the revenues

generated from the carbon tax is used for the reduction of a more distorted type of tax. It is

identified from the estimates that in the countries around the world, 44% of revenue

generated from carbon tax were used to lower the other taxes. Implementation of carbon tax

is argument in terms of the benefits derived such as raising revenue, encouraging alternatives,

improving environment and generation of socially efficient outcomes. In the early 2018,

implementation of subnational and national carbon system were scheduled to be implemented

all around the world. The implementation of carbon tax makes producers and consumers to

take account of the social costs of pollution that is the main source of emission of carbon and

thereby greenhouse gases (Geroe, 2019).

The concept of carbon tax to reduce the carbon emission can be understood from the

economical point of view. Government intends to address the negative externalities which is

the social cost of any activities using tax which is a policy based on market approach. For the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR BUSINESS

producer or the business, social cost is less that the private cost and this private cost would

increase with the imposition of tax on the producers. So the polluters emitting carbon are

incentivize to emit less carbon because it their private cost is increasing by the tax

implementation. This externality is expected to be counterbalanced by the tax

implementation, however, determining the appropriate tax level is a bit difficult for the

government. These external costs on the environment is internalized by the carbon tax which

is added to the products’ price. It is the consumer and producer who have to bear the total

costs which includes the external environment costs as well. Consumers and producer both

are deincentivized from using or producing the goods that are carbon intensive and this would

in turn results in lower emission of carbon (Mazengarb and Mazengarb, 2019).

A carbon tax or carbon pricing scheme is introduced by Australian government

through the clean energy Act, 2011. This initiative was intended to develop the clean energy

technologies that would help in controlling the emission as well as supporting the economic

growth. Nevertheless, the step taken by the government was successful in its effort to reduce

the emission of carbon and at the same time, it faced challenges in terms of opposition from

public. This is so because the development of such technology resulted in increase in price of

energy for both industry and household. An effort on part of Australian government to

increase the carbon taxes were shelved due to the rise in price of energy which the angry

voters backlashed. A cap and trade program was rolled out by the labor government of

Australia in year 2012 where the carbon was taxed at $ 23 per tonne and the program was

repealed eventually. In the current scenario, there is a lenient carbon pricing in place where

the large industrial polluters can buy carbon credits as a way of compensation if they exceed

pollution baseline (Zhang & Wang, 2017).

The whole idea of carbon tax is spreading widely but it has also received various

backlash by industrials and political that such tax raises the energy bills. A new report from

producer or the business, social cost is less that the private cost and this private cost would

increase with the imposition of tax on the producers. So the polluters emitting carbon are

incentivize to emit less carbon because it their private cost is increasing by the tax

implementation. This externality is expected to be counterbalanced by the tax

implementation, however, determining the appropriate tax level is a bit difficult for the

government. These external costs on the environment is internalized by the carbon tax which

is added to the products’ price. It is the consumer and producer who have to bear the total

costs which includes the external environment costs as well. Consumers and producer both

are deincentivized from using or producing the goods that are carbon intensive and this would

in turn results in lower emission of carbon (Mazengarb and Mazengarb, 2019).

A carbon tax or carbon pricing scheme is introduced by Australian government

through the clean energy Act, 2011. This initiative was intended to develop the clean energy

technologies that would help in controlling the emission as well as supporting the economic

growth. Nevertheless, the step taken by the government was successful in its effort to reduce

the emission of carbon and at the same time, it faced challenges in terms of opposition from

public. This is so because the development of such technology resulted in increase in price of

energy for both industry and household. An effort on part of Australian government to

increase the carbon taxes were shelved due to the rise in price of energy which the angry

voters backlashed. A cap and trade program was rolled out by the labor government of

Australia in year 2012 where the carbon was taxed at $ 23 per tonne and the program was

repealed eventually. In the current scenario, there is a lenient carbon pricing in place where

the large industrial polluters can buy carbon credits as a way of compensation if they exceed

pollution baseline (Zhang & Wang, 2017).

The whole idea of carbon tax is spreading widely but it has also received various

backlash by industrials and political that such tax raises the energy bills. A new report from

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR BUSINESS

IMF (International monetary fund), views that the powerful method to reduce air pollution

and combat global warming is to increase the carbon price by way of taxation.

In one of the media reports on bbc.com titled” Australia plans to impose carbon tax on

worst polluters”, the plan of government t to impose carbon tax on worst of the polluters has

been revealed. It was reported in year 2011 where the plans of government to impose carbon

tax was unveiled. It was mentioned by the prime minister of the country that from 2012, there

would be tax on the emission of carbon dioxide per tonne at A$ 23. Some five hundred

companies were covered under the biggest economic reform of the country and it was also

said that there would be the introduction of market based scheme in year 2015. This

imposition of tax would drive the consumer price of household by 1%. It was argues by the

critics that economic competitiveness would be damaged by this levy. Under this plan, the

government decided to include all such companies producing carbon dioxide by at least

25000 (bbc.com, 2019). However, the plan would exclude coal mines, steel makers and

electricity generators. Furthermore, the plan also included the imposition of tax on the biggest

polluters until 2015 who are required to pay fixed price per tonne of emission of carbon.

Then there would be the introduction of trading scheme based on market and then a floor

price would be set by the government. For the first there years, there would be an upper limit

for avoiding the excessive fluctuations in price. This move of government faced opposition

from political parties and energy industry and it was hoped by the government to win them

over by increasing public expenditure from the money collected from tax

(documents.worldbank.org, 2020).

In the new media report published by guardian.com titled” Australia kills off carbon

tax” discusses about repealing of carbon tax by Australian government and this left with no

policy in place to lower the carbon emission and meet the 5% emission target. The tax at the

current level in year 2014 was scheduled to shift to a floating and lower international price in

IMF (International monetary fund), views that the powerful method to reduce air pollution

and combat global warming is to increase the carbon price by way of taxation.

In one of the media reports on bbc.com titled” Australia plans to impose carbon tax on

worst polluters”, the plan of government t to impose carbon tax on worst of the polluters has

been revealed. It was reported in year 2011 where the plans of government to impose carbon

tax was unveiled. It was mentioned by the prime minister of the country that from 2012, there

would be tax on the emission of carbon dioxide per tonne at A$ 23. Some five hundred

companies were covered under the biggest economic reform of the country and it was also

said that there would be the introduction of market based scheme in year 2015. This

imposition of tax would drive the consumer price of household by 1%. It was argues by the

critics that economic competitiveness would be damaged by this levy. Under this plan, the

government decided to include all such companies producing carbon dioxide by at least

25000 (bbc.com, 2019). However, the plan would exclude coal mines, steel makers and

electricity generators. Furthermore, the plan also included the imposition of tax on the biggest

polluters until 2015 who are required to pay fixed price per tonne of emission of carbon.

Then there would be the introduction of trading scheme based on market and then a floor

price would be set by the government. For the first there years, there would be an upper limit

for avoiding the excessive fluctuations in price. This move of government faced opposition

from political parties and energy industry and it was hoped by the government to win them

over by increasing public expenditure from the money collected from tax

(documents.worldbank.org, 2020).

In the new media report published by guardian.com titled” Australia kills off carbon

tax” discusses about repealing of carbon tax by Australian government and this left with no

policy in place to lower the carbon emission and meet the 5% emission target. The tax at the

current level in year 2014 was scheduled to shift to a floating and lower international price in

ECONOMICS FOR BUSINESS

twelve months. Under the new budget, it was decided that tax would no longer be paid by big

manufacturers and electricity generators. It was argued by the government that although the

scheme was not effective, but there has been reduction in the overall emission. The carbon

emission have gain been climbing since the carbon tax are repealed. Year 2019 witnessed an

increase in carbon emission of 0.6% (theguardian.com, 2019).

In the media news published by abc.net.au that discussed about the adoption of carbon

tax that would address climatic change and would make the household better off. In a study

entitled” a climatic dividend for Australians offering practical solution to the problem of

energy affordability and climatic change. This approach marked addressing the climatic

change issue using the market based approach through the carbon tax. The approach is based

on the dividend plan relating to carbon which the climate leadership council based in

Washington formulated it. Under this plan, taxation of carbon emission would be done at $

50 per tonnes with the ordinary Australians benefitting from the proceeds in the form of

carbon dividends. Such dividend would be in the form of a payment that is tax free of about $

1300 per adult. This increase in price would be accounted by making the average household

better off by $ 585 a year. The household would even better off if they reduce their

consumption of energy by way of tax imposition (abc.net.au, 2018).

Carbon tax is considered to be the most efficient and powerful strategy to mitigate

carbon emission as the household and firms are offered with the lowest cost ways to shift

towards a cleaner alternatives and reduce the use of energy. Implementation of tax by the

government in Australia did make a notable difference as there was a decline in the overall

national emission which in the twenty four years record marked the largest fall. Under the

Paris target, it is committed by Australia that there would be a reduction in carbon emission

by 2030 by more than a quarter. Nevertheless, due to the abundance of the fossil fuels,

implementation of carbon tax system has been the hardest in the country. In this regard, it

twelve months. Under the new budget, it was decided that tax would no longer be paid by big

manufacturers and electricity generators. It was argued by the government that although the

scheme was not effective, but there has been reduction in the overall emission. The carbon

emission have gain been climbing since the carbon tax are repealed. Year 2019 witnessed an

increase in carbon emission of 0.6% (theguardian.com, 2019).

In the media news published by abc.net.au that discussed about the adoption of carbon

tax that would address climatic change and would make the household better off. In a study

entitled” a climatic dividend for Australians offering practical solution to the problem of

energy affordability and climatic change. This approach marked addressing the climatic

change issue using the market based approach through the carbon tax. The approach is based

on the dividend plan relating to carbon which the climate leadership council based in

Washington formulated it. Under this plan, taxation of carbon emission would be done at $

50 per tonnes with the ordinary Australians benefitting from the proceeds in the form of

carbon dividends. Such dividend would be in the form of a payment that is tax free of about $

1300 per adult. This increase in price would be accounted by making the average household

better off by $ 585 a year. The household would even better off if they reduce their

consumption of energy by way of tax imposition (abc.net.au, 2018).

Carbon tax is considered to be the most efficient and powerful strategy to mitigate

carbon emission as the household and firms are offered with the lowest cost ways to shift

towards a cleaner alternatives and reduce the use of energy. Implementation of tax by the

government in Australia did make a notable difference as there was a decline in the overall

national emission which in the twenty four years record marked the largest fall. Under the

Paris target, it is committed by Australia that there would be a reduction in carbon emission

by 2030 by more than a quarter. Nevertheless, due to the abundance of the fossil fuels,

implementation of carbon tax system has been the hardest in the country. In this regard, it

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR BUSINESS

was said by the international monetary fund that the Australia would not be able to meet its

target even by the adoption of the most expensive carbon price (Moore, 2017).

The proposal of Australian carbon dividend plan was supported by majority under

which the biggest carbon emitters would be taxed and the revenue regenerated from it would

be redistributed to the taxpayers of Australia. The dividend plan is the economic policy on a

market based approach that adopted a company emitter tax to lower the carbon emission that

would be progressively redistributed to the households of Australia. Under the proposed

dividend plan, carbon dioxide would be taxed at $ 50 metric per ton at the source such as

port, well or mine. Every Australian of voting age would be returned with the revenue

generated from such dividend plan at an estimated value of $ 1300 per year each. Australians

have extremely supported the carbon dividend as such scheme would assist the country in

addressing the most pressing and greatest challenge of climatic change

(businessinsider.com.au, 2019).

It has been found that the reason why the government has chosen to direct the

revenues generated from the carbon tax to the business that is sector specific is due to the

nature of electricity sector of Australia which is carbon intensive. Concentration of carbon

cost is in the sectors that is electricity intensive such as mining and aluminum as electricity is

largely used by such industry. The carbon tax is described as the measure of reducing the

emission of carbon in the economy and thereby mitigating the anthropogenic change in

climatic conditions. In addition to the carbon tax, various other measures were also

introduced by the government as it was not expected that carbon tax would be sufficient to

achieve the technology development goals and reduction in the carbon emission (Wesseh &

Lin, 2018).

was said by the international monetary fund that the Australia would not be able to meet its

target even by the adoption of the most expensive carbon price (Moore, 2017).

The proposal of Australian carbon dividend plan was supported by majority under

which the biggest carbon emitters would be taxed and the revenue regenerated from it would

be redistributed to the taxpayers of Australia. The dividend plan is the economic policy on a

market based approach that adopted a company emitter tax to lower the carbon emission that

would be progressively redistributed to the households of Australia. Under the proposed

dividend plan, carbon dioxide would be taxed at $ 50 metric per ton at the source such as

port, well or mine. Every Australian of voting age would be returned with the revenue

generated from such dividend plan at an estimated value of $ 1300 per year each. Australians

have extremely supported the carbon dividend as such scheme would assist the country in

addressing the most pressing and greatest challenge of climatic change

(businessinsider.com.au, 2019).

It has been found that the reason why the government has chosen to direct the

revenues generated from the carbon tax to the business that is sector specific is due to the

nature of electricity sector of Australia which is carbon intensive. Concentration of carbon

cost is in the sectors that is electricity intensive such as mining and aluminum as electricity is

largely used by such industry. The carbon tax is described as the measure of reducing the

emission of carbon in the economy and thereby mitigating the anthropogenic change in

climatic conditions. In addition to the carbon tax, various other measures were also

introduced by the government as it was not expected that carbon tax would be sufficient to

achieve the technology development goals and reduction in the carbon emission (Wesseh &

Lin, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR BUSINESS

The implementation of carbon tax with the subsequent approach in the clean energy

Act, 2011 that evolved into a trade and cap system and linked to the trading system of Europe

was never a good idea. The politicians arguing over the nonexistence of carbon price in the

climatic policy is said to be dishonest. This is so because there is carbon price attached to all

the climatic policy and the price is explicit in carbon tax and there is an implied carbon price

associated with the subsidies for batteries and targets of renewable energy that either the tax

payers, consumers or the firms would pay (Speck, 2017). Since the implied carbon prices are

hidden, they tend to be higher compared to explicit carbon price.

The political challenges in enacting the tax on the economic that is carbon intensive is

reflected by Australia’s proposal where the taxation has been implemented across the broader

comprehensive reform of multiyear tax system. Business of Australia is not entitled to receive

any deduction in the tax rate which is funded by the adoption of carbon tax and the entire tax

program is expected to be revenue negative significantly. The main focus of the government

has been on the largest emitters of carbon and taxing them. While carbon tax can be

considered as the effective regulatory approach to combat carbon emission, designing of

carbon tax has some central issues. This include taxation rate and the adjustment made to the

tax rate over time, taxation base to be applied to the emission of carbon, trade treatment of

the goods that are energy intensive and the place of tax imposition (Aph.gov.au, 2020).

Answer to question 2:

Explaining the impact of US/China trade war on macroeconomics condition of

Australia:

The deep rivalry between China and US has resulted in the trade friction as the latter

is striving to maintain its position as the largest economy of the world. The globe has been

The implementation of carbon tax with the subsequent approach in the clean energy

Act, 2011 that evolved into a trade and cap system and linked to the trading system of Europe

was never a good idea. The politicians arguing over the nonexistence of carbon price in the

climatic policy is said to be dishonest. This is so because there is carbon price attached to all

the climatic policy and the price is explicit in carbon tax and there is an implied carbon price

associated with the subsidies for batteries and targets of renewable energy that either the tax

payers, consumers or the firms would pay (Speck, 2017). Since the implied carbon prices are

hidden, they tend to be higher compared to explicit carbon price.

The political challenges in enacting the tax on the economic that is carbon intensive is

reflected by Australia’s proposal where the taxation has been implemented across the broader

comprehensive reform of multiyear tax system. Business of Australia is not entitled to receive

any deduction in the tax rate which is funded by the adoption of carbon tax and the entire tax

program is expected to be revenue negative significantly. The main focus of the government

has been on the largest emitters of carbon and taxing them. While carbon tax can be

considered as the effective regulatory approach to combat carbon emission, designing of

carbon tax has some central issues. This include taxation rate and the adjustment made to the

tax rate over time, taxation base to be applied to the emission of carbon, trade treatment of

the goods that are energy intensive and the place of tax imposition (Aph.gov.au, 2020).

Answer to question 2:

Explaining the impact of US/China trade war on macroeconomics condition of

Australia:

The deep rivalry between China and US has resulted in the trade friction as the latter

is striving to maintain its position as the largest economy of the world. The globe has been

ECONOMICS FOR BUSINESS

affected profoundly by the US-China trade war as evident from the performance of the

currency market and stocks. Traffic imposition by US and its retaliation by China has

resulted in the trade war posing greatest challenge. Other parts of the world such as Australia

would be undoubtedly impacted by the ongoing war between these two countries as Australia

is their trading partner. For evaluating the impact of the trade war on the macroeconomic

conditions of Australia, it is noteworthy to briefly discuss about the background of trade

dispute. Retaliation of China in March, 2018 with several tariffs on agricultural exports of

US. It was in July 2018-August 2018, tariffs imposed by US on Chinese goods was retaliated

by China on the export of agricultural goods and some other commodities (Kim, 2019). In

addition to this, in September 2018, China again retaliated various tariffs on exports of US

goods such as chemical, agricultural goods and machinery as against US retaliation for the

Chinese goods such as fabrics, intermediate goods, electronics and chemical. In year 2019, an

increase in tariff percentage to 25% by US was retaliated by an increase in tariff averaging

7.5%. In May, 2019, Trump threatened to increase the tariff on the imports from China with

new news from the later about retaliation. These tariffs has resulted an increase in the tariffs

on import of China by around 10% of the total import of US. However, a further increase in

the tariff would cause a significant impact on China as it implies that the 20% of the total US

import would be impacted (Geroe, 2019).

The impact crated on the Australia due to the trade war between China and US has to

be analysed on cases. The largest trading partner of Australia is China and in year 2018, the

country was accountable for a two way trade of 25.2%. China is the primary importer of iron

ore which is majorly exported by Australia. There was a fall in import of iron ore in year

2019 to 75.18 million tones and this marked the lowest quantity of import since year 2016.

China is simultaneously paying premium to Australia for the high quality of coal and iron ore

products and restricting its supply from its domestic sources that us less environmental. On

affected profoundly by the US-China trade war as evident from the performance of the

currency market and stocks. Traffic imposition by US and its retaliation by China has

resulted in the trade war posing greatest challenge. Other parts of the world such as Australia

would be undoubtedly impacted by the ongoing war between these two countries as Australia

is their trading partner. For evaluating the impact of the trade war on the macroeconomic

conditions of Australia, it is noteworthy to briefly discuss about the background of trade

dispute. Retaliation of China in March, 2018 with several tariffs on agricultural exports of

US. It was in July 2018-August 2018, tariffs imposed by US on Chinese goods was retaliated

by China on the export of agricultural goods and some other commodities (Kim, 2019). In

addition to this, in September 2018, China again retaliated various tariffs on exports of US

goods such as chemical, agricultural goods and machinery as against US retaliation for the

Chinese goods such as fabrics, intermediate goods, electronics and chemical. In year 2019, an

increase in tariff percentage to 25% by US was retaliated by an increase in tariff averaging

7.5%. In May, 2019, Trump threatened to increase the tariff on the imports from China with

new news from the later about retaliation. These tariffs has resulted an increase in the tariffs

on import of China by around 10% of the total import of US. However, a further increase in

the tariff would cause a significant impact on China as it implies that the 20% of the total US

import would be impacted (Geroe, 2019).

The impact crated on the Australia due to the trade war between China and US has to

be analysed on cases. The largest trading partner of Australia is China and in year 2018, the

country was accountable for a two way trade of 25.2%. China is the primary importer of iron

ore which is majorly exported by Australia. There was a fall in import of iron ore in year

2019 to 75.18 million tones and this marked the lowest quantity of import since year 2016.

China is simultaneously paying premium to Australia for the high quality of coal and iron ore

products and restricting its supply from its domestic sources that us less environmental. On

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR BUSINESS

other hand, the third largest two way trade partner of Australia is US and year 2018 marked

the two way trade of 8.7%. However, compared to China, the trade relation of Australia with

US is small, but the protectionist stance of US is likely to impact the trade of Australia

(news.com.au, 2019).

In this paper, the impact of trade war on Australia can be understood by analysing the four

scenarios. Firstly, the analysis of the impact of the resources and mining sector of Australia

due to increasing and ongoing impact of US aluminium and steel tariffs is done. In the second

scenario, the impact on agricultural exports of Australia has been evaluated due to the

countermeasures of China with respect to section 301 tariff of US. Thirdly, change in

preference of students of China seeking education opportunities outside US is increasing the

demand in Australia. Lastly, investment restrictions on US companies has resulted diverting

the foreign direct investment of China into the technology and manufacturing business of

Australia (McKnight & Hobbs, 2017).

The current neutral position of Australia in respect of the tension between US and

China is advantageous for the sectors such as tourism and education as this would increase

inflow to the Australian economy. The number one destination of Australia for export of the

resources to China and the reduced demand for steel products in US from China is expected

to adversely impact the export of such products from Australia and the impact of US tariff

has insulated China largely. The exploration value chain and downstream explorations of the

Australian miners would be impacted from the trade war causing reducing in the growth in

the middle income (Li et al., 2018).

The farmers of Australia are concerned due to brewing trade war as the dairy export

from Australia was impacted heavily by the sanction of Russia on the dairy exports of US.

The agribusiness of Australia has gained further traction in China due to the pricing

other hand, the third largest two way trade partner of Australia is US and year 2018 marked

the two way trade of 8.7%. However, compared to China, the trade relation of Australia with

US is small, but the protectionist stance of US is likely to impact the trade of Australia

(news.com.au, 2019).

In this paper, the impact of trade war on Australia can be understood by analysing the four

scenarios. Firstly, the analysis of the impact of the resources and mining sector of Australia

due to increasing and ongoing impact of US aluminium and steel tariffs is done. In the second

scenario, the impact on agricultural exports of Australia has been evaluated due to the

countermeasures of China with respect to section 301 tariff of US. Thirdly, change in

preference of students of China seeking education opportunities outside US is increasing the

demand in Australia. Lastly, investment restrictions on US companies has resulted diverting

the foreign direct investment of China into the technology and manufacturing business of

Australia (McKnight & Hobbs, 2017).

The current neutral position of Australia in respect of the tension between US and

China is advantageous for the sectors such as tourism and education as this would increase

inflow to the Australian economy. The number one destination of Australia for export of the

resources to China and the reduced demand for steel products in US from China is expected

to adversely impact the export of such products from Australia and the impact of US tariff

has insulated China largely. The exploration value chain and downstream explorations of the

Australian miners would be impacted from the trade war causing reducing in the growth in

the middle income (Li et al., 2018).

The farmers of Australia are concerned due to brewing trade war as the dairy export

from Australia was impacted heavily by the sanction of Russia on the dairy exports of US.

The agribusiness of Australia has gained further traction in China due to the pricing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR BUSINESS

advantage created by increase in tariffs by China on US. Trade war created supply gap in

China by the producers in US has been filed by the Australia which is more competitive in

terms of wheat market (Mahadevan & Nugroho, 2019). In addition to this, retaliation of

China against soybeans and wines in US would cause an increase in the demand of grains and

wines in Australia. Wine producers of Australia would reap the benefits of any decline in

sales of wine in China from US. However, the Australians farmers would be hurt by any kind

of deal between US and China that results in selling new volumes of the production in China.

Moreover, wool industry of Australia would be hurt due to decline in the international trade

(Beeson, 2019).

Chinese tourism have handsomely benefitted Australia and the growth of economy if

Australia could be heavily impacted due to fall in the number of tourists from China. In year

2017, the percentage of international student enrolment from china in Australia was nearly

30%. Significant investment have been made by Australia in China for driving and

diversifying growth. The preferences of Chinese student has shifted from US to Australia by

8.5% and this resulted in an increase in the export of education to China from Australia. As

the other exports are crowded out by an increase in the education exports, the overall gain is

modest for Australia. Nevertheless, trade war imposes some risks to the service sector of

Australia and therefore, the country is advised to view the trade skirmishes as both challenges

and opportunities (Farrer, 2018).

The confidence of investors in Australia could be significantly dent by the continuous

trade war and the diminished investor confidence has resulted in a five percent fall in the

investment. On other hand, Australian business could be benefited resulting from influx of

China capital as the investment of Chinese firms in US has been restricted by the US

administration. In order to replicate an increased activity in the manufacturing sector of

advantage created by increase in tariffs by China on US. Trade war created supply gap in

China by the producers in US has been filed by the Australia which is more competitive in

terms of wheat market (Mahadevan & Nugroho, 2019). In addition to this, retaliation of

China against soybeans and wines in US would cause an increase in the demand of grains and

wines in Australia. Wine producers of Australia would reap the benefits of any decline in

sales of wine in China from US. However, the Australians farmers would be hurt by any kind

of deal between US and China that results in selling new volumes of the production in China.

Moreover, wool industry of Australia would be hurt due to decline in the international trade

(Beeson, 2019).

Chinese tourism have handsomely benefitted Australia and the growth of economy if

Australia could be heavily impacted due to fall in the number of tourists from China. In year

2017, the percentage of international student enrolment from china in Australia was nearly

30%. Significant investment have been made by Australia in China for driving and

diversifying growth. The preferences of Chinese student has shifted from US to Australia by

8.5% and this resulted in an increase in the export of education to China from Australia. As

the other exports are crowded out by an increase in the education exports, the overall gain is

modest for Australia. Nevertheless, trade war imposes some risks to the service sector of

Australia and therefore, the country is advised to view the trade skirmishes as both challenges

and opportunities (Farrer, 2018).

The confidence of investors in Australia could be significantly dent by the continuous

trade war and the diminished investor confidence has resulted in a five percent fall in the

investment. On other hand, Australian business could be benefited resulting from influx of

China capital as the investment of Chinese firms in US has been restricted by the US

administration. In order to replicate an increased activity in the manufacturing sector of

ECONOMICS FOR BUSINESS

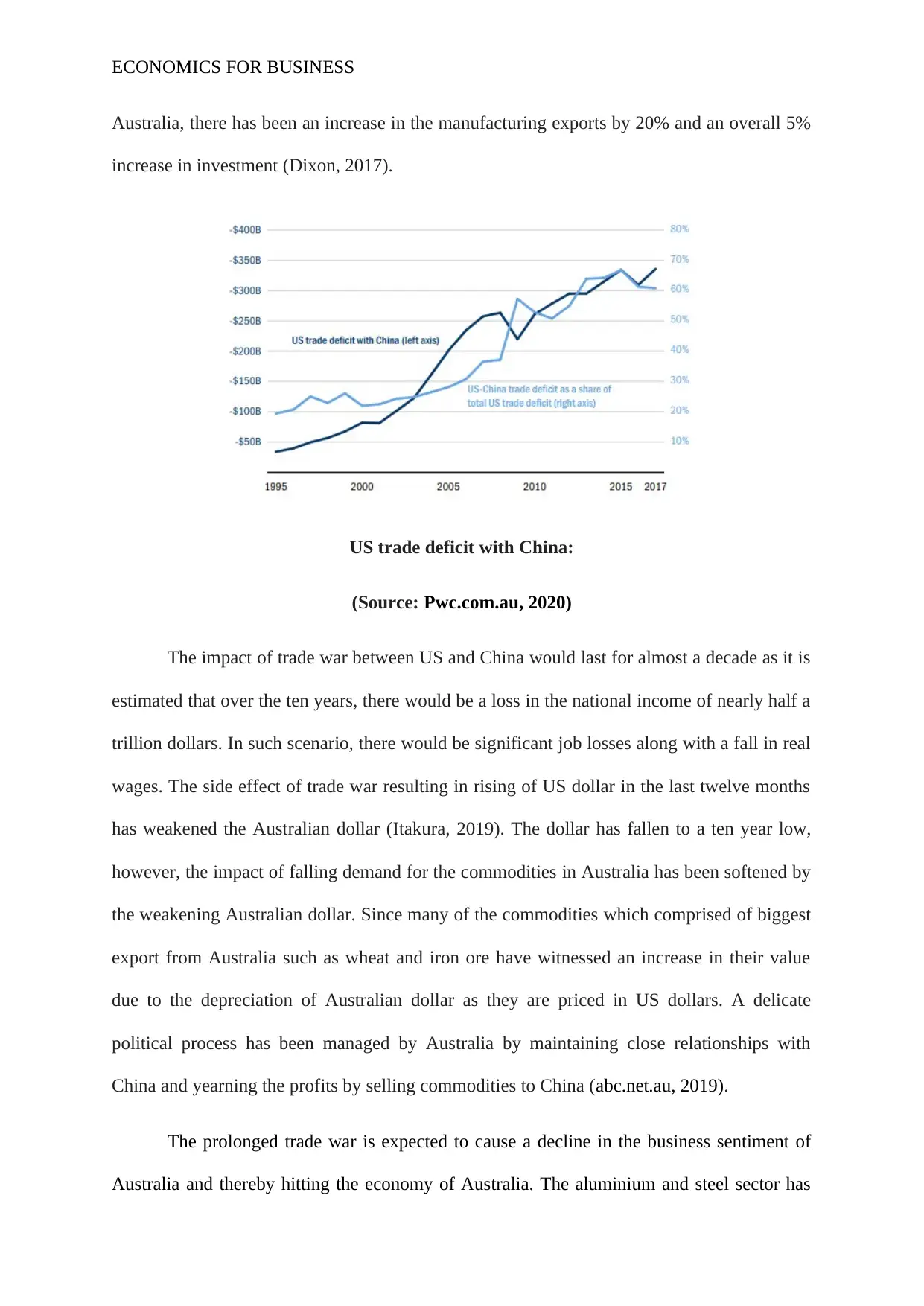

Australia, there has been an increase in the manufacturing exports by 20% and an overall 5%

increase in investment (Dixon, 2017).

US trade deficit with China:

(Source: Pwc.com.au, 2020)

The impact of trade war between US and China would last for almost a decade as it is

estimated that over the ten years, there would be a loss in the national income of nearly half a

trillion dollars. In such scenario, there would be significant job losses along with a fall in real

wages. The side effect of trade war resulting in rising of US dollar in the last twelve months

has weakened the Australian dollar (Itakura, 2019). The dollar has fallen to a ten year low,

however, the impact of falling demand for the commodities in Australia has been softened by

the weakening Australian dollar. Since many of the commodities which comprised of biggest

export from Australia such as wheat and iron ore have witnessed an increase in their value

due to the depreciation of Australian dollar as they are priced in US dollars. A delicate

political process has been managed by Australia by maintaining close relationships with

China and yearning the profits by selling commodities to China (abc.net.au, 2019).

The prolonged trade war is expected to cause a decline in the business sentiment of

Australia and thereby hitting the economy of Australia. The aluminium and steel sector has

Australia, there has been an increase in the manufacturing exports by 20% and an overall 5%

increase in investment (Dixon, 2017).

US trade deficit with China:

(Source: Pwc.com.au, 2020)

The impact of trade war between US and China would last for almost a decade as it is

estimated that over the ten years, there would be a loss in the national income of nearly half a

trillion dollars. In such scenario, there would be significant job losses along with a fall in real

wages. The side effect of trade war resulting in rising of US dollar in the last twelve months

has weakened the Australian dollar (Itakura, 2019). The dollar has fallen to a ten year low,

however, the impact of falling demand for the commodities in Australia has been softened by

the weakening Australian dollar. Since many of the commodities which comprised of biggest

export from Australia such as wheat and iron ore have witnessed an increase in their value

due to the depreciation of Australian dollar as they are priced in US dollars. A delicate

political process has been managed by Australia by maintaining close relationships with

China and yearning the profits by selling commodities to China (abc.net.au, 2019).

The prolonged trade war is expected to cause a decline in the business sentiment of

Australia and thereby hitting the economy of Australia. The aluminium and steel sector has

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.