Economics Assignment: Analysis of Sugar Tax in Mexico - Course ID

VerifiedAdded on 2022/09/22

|10

|984

|14

Homework Assignment

AI Summary

This economics assignment analyzes the impact of a sugar tax implemented in Mexico. The assignment begins by calculating the own price elasticity of demand for sugar-sweetened beverages (SSBs) for both the overall economy and low-income households, based on provided consumption data. It then compares the responsiveness of these two groups to the tax, identifying which group is more affected by price changes. The analysis further explores the factors determining responsiveness to price increases, explaining the differences in elasticity estimates. The cross-price elasticity between SSBs and bottled water is calculated to assess the relationship between these goods. The assignment incorporates graphical representations of the SSB market, illustrating the effects of the tax and a social awareness campaign on market equilibrium, including price, quantity, and tax revenue. Finally, it compares the effects of the tax and the awareness campaign, both individually and in combination, on SSB consumption, concluding that a combined approach would yield the greatest reduction in consumption.

Running head: ECONOMICS

Economics

Name of the Student

Name of the University

Course ID

Economics

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Table of Contents

Question 1........................................................................................................................................2

Question a....................................................................................................................................2

Question b....................................................................................................................................2

Question c....................................................................................................................................3

Question d....................................................................................................................................4

Question e....................................................................................................................................5

Question f.....................................................................................................................................6

Question g....................................................................................................................................7

References........................................................................................................................................9

Table of Contents

Question 1........................................................................................................................................2

Question a....................................................................................................................................2

Question b....................................................................................................................................2

Question c....................................................................................................................................3

Question d....................................................................................................................................4

Question e....................................................................................................................................5

Question f.....................................................................................................................................6

Question g....................................................................................................................................7

References........................................................................................................................................9

2ECONOMICS

Question 1

Question a

Own price elasticity

i)

For the economy on average= Percemtage∈quantity demand

Percentage change∈ price

¿ −7.6

10

¿−0.76

ii)

For low income household= Percemtage∈quantity demand

Percentage change∈ price

¿ −11.6

10

¿−1.16

Question b

Own price elasticity of demand indicates responsiveness of demand of a good considering

variations in prices. Higher the price elasticity of demand, more responsive the demand is. The

price elasticity of demand for Mexican economy as a whole and low income household are -0.76

and -1.16 respectively. The estimated price elasticity of demand is larger for low income

household meaning that low income household are more responsive to price change compared to

Question 1

Question a

Own price elasticity

i)

For the economy on average= Percemtage∈quantity demand

Percentage change∈ price

¿ −7.6

10

¿−0.76

ii)

For low income household= Percemtage∈quantity demand

Percentage change∈ price

¿ −11.6

10

¿−1.16

Question b

Own price elasticity of demand indicates responsiveness of demand of a good considering

variations in prices. Higher the price elasticity of demand, more responsive the demand is. The

price elasticity of demand for Mexican economy as a whole and low income household are -0.76

and -1.16 respectively. The estimated price elasticity of demand is larger for low income

household meaning that low income household are more responsive to price change compared to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

the economy as a whole (Fine 2016). This in turn suggests low income households are likely to

respond more to the tax on SSB.

Question c

Factors explaining responsiveness to a price increase are as follows

Nature of the commodity

Responses of demand to a price change depends on whether the commodity in question is

a necessary, or luxury or comfort.

Availability of substitutes

Greater the number of available substitutes larger is the responsiveness of demand and

vice-versa.

Income level

Demand elasticity of a commodity varies according among different income groups. For

people with higher income, a relatively smaller proportion of income is spent on any product and

hence, elasticity of demand is relatively low (Kreps 2019). However, lower income people are

highly affected for any change in price and hence, have a larger elasticity of demand.

Level of price

Demand elasticity also depends on initial price level. In case of costly goods, demand is

much elastic relative to a price change. For inexpensive good however demand is relatively

inelastic.

the economy as a whole (Fine 2016). This in turn suggests low income households are likely to

respond more to the tax on SSB.

Question c

Factors explaining responsiveness to a price increase are as follows

Nature of the commodity

Responses of demand to a price change depends on whether the commodity in question is

a necessary, or luxury or comfort.

Availability of substitutes

Greater the number of available substitutes larger is the responsiveness of demand and

vice-versa.

Income level

Demand elasticity of a commodity varies according among different income groups. For

people with higher income, a relatively smaller proportion of income is spent on any product and

hence, elasticity of demand is relatively low (Kreps 2019). However, lower income people are

highly affected for any change in price and hence, have a larger elasticity of demand.

Level of price

Demand elasticity also depends on initial price level. In case of costly goods, demand is

much elastic relative to a price change. For inexpensive good however demand is relatively

inelastic.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

Share of total expenditure

Larger the share of income spent on goods more elastic is the demand and vice-versa.

Postponement of consumption

Commodities whose demand can be postponed generally have a more elastic demand.

Of the above discussed factors difference in income level in explaining difference in price

elasticity of demand explain the difference in elasticity estimate of low income household and

the economy as a whole. Since, people belonging to low income group are more sensitive to

price change computed elasticity is higher for low income household.

Question d

Cross price elasticity of demand= Percentage ∈demand of a good

Percentage change ∈ price of related good

¿ Percentage change∈demand of bottled water

Percentage change∈ price of SSB

¿ 2.1

10

¿ 0.21

The cross price elasticity stands as a measure of evaluating how demand of a good responds

given a change in the price of related good. For substitute goods, since demand responds

positively with change in price of substitute, cross price elasticity of demand is positive. For

complementary goods however, demand changes in opposite direction of price of its

complements and cross price elasticity therefore is negative (Besanko and Braeutigam 2020).

Share of total expenditure

Larger the share of income spent on goods more elastic is the demand and vice-versa.

Postponement of consumption

Commodities whose demand can be postponed generally have a more elastic demand.

Of the above discussed factors difference in income level in explaining difference in price

elasticity of demand explain the difference in elasticity estimate of low income household and

the economy as a whole. Since, people belonging to low income group are more sensitive to

price change computed elasticity is higher for low income household.

Question d

Cross price elasticity of demand= Percentage ∈demand of a good

Percentage change ∈ price of related good

¿ Percentage change∈demand of bottled water

Percentage change∈ price of SSB

¿ 2.1

10

¿ 0.21

The cross price elasticity stands as a measure of evaluating how demand of a good responds

given a change in the price of related good. For substitute goods, since demand responds

positively with change in price of substitute, cross price elasticity of demand is positive. For

complementary goods however, demand changes in opposite direction of price of its

complements and cross price elasticity therefore is negative (Besanko and Braeutigam 2020).

5ECONOMICS

The positive cross price elasticity of demand in the above case indicate SSB and bottled water

are substitutes.

Question e

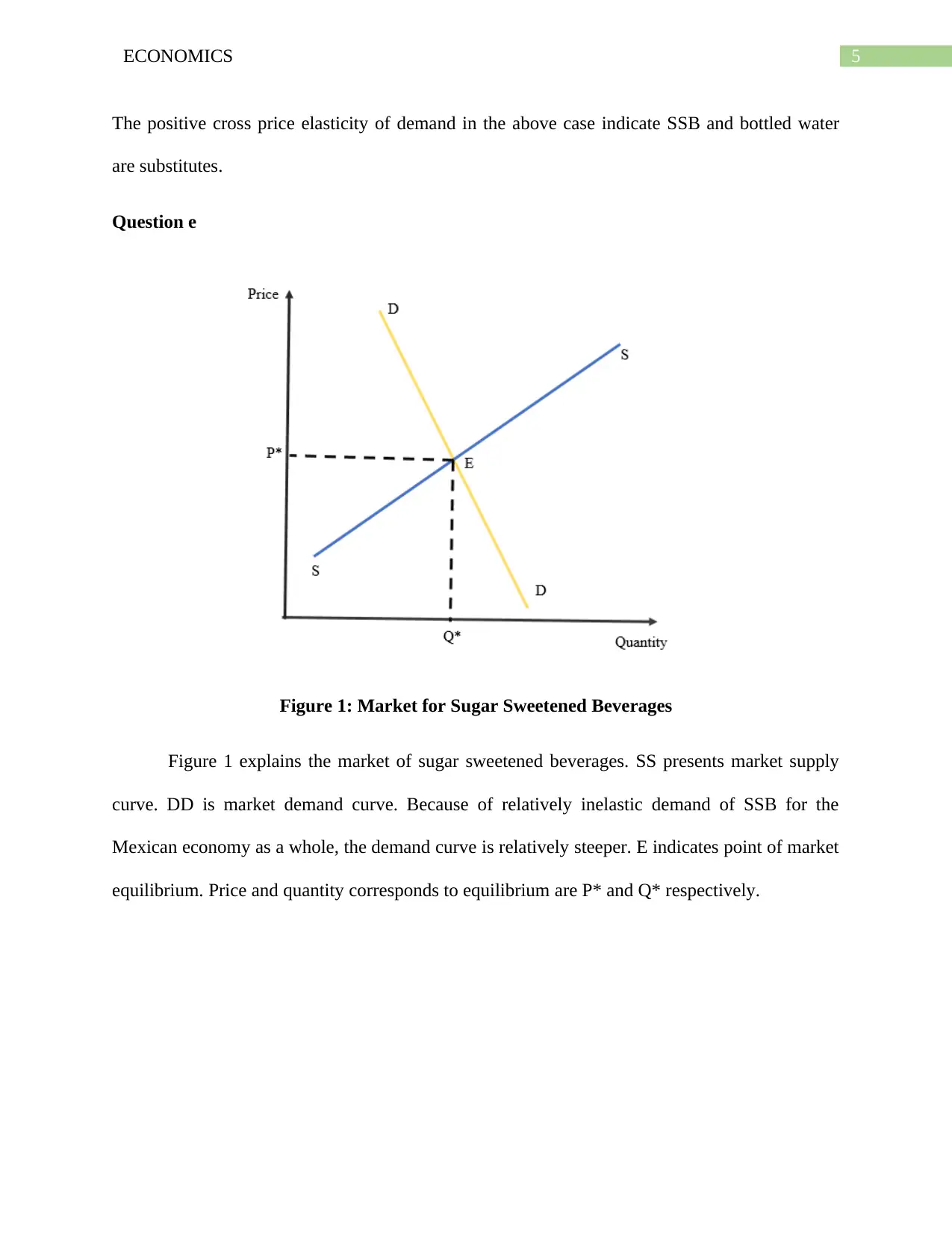

Figure 1: Market for Sugar Sweetened Beverages

Figure 1 explains the market of sugar sweetened beverages. SS presents market supply

curve. DD is market demand curve. Because of relatively inelastic demand of SSB for the

Mexican economy as a whole, the demand curve is relatively steeper. E indicates point of market

equilibrium. Price and quantity corresponds to equilibrium are P* and Q* respectively.

The positive cross price elasticity of demand in the above case indicate SSB and bottled water

are substitutes.

Question e

Figure 1: Market for Sugar Sweetened Beverages

Figure 1 explains the market of sugar sweetened beverages. SS presents market supply

curve. DD is market demand curve. Because of relatively inelastic demand of SSB for the

Mexican economy as a whole, the demand curve is relatively steeper. E indicates point of market

equilibrium. Price and quantity corresponds to equilibrium are P* and Q* respectively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

Question f

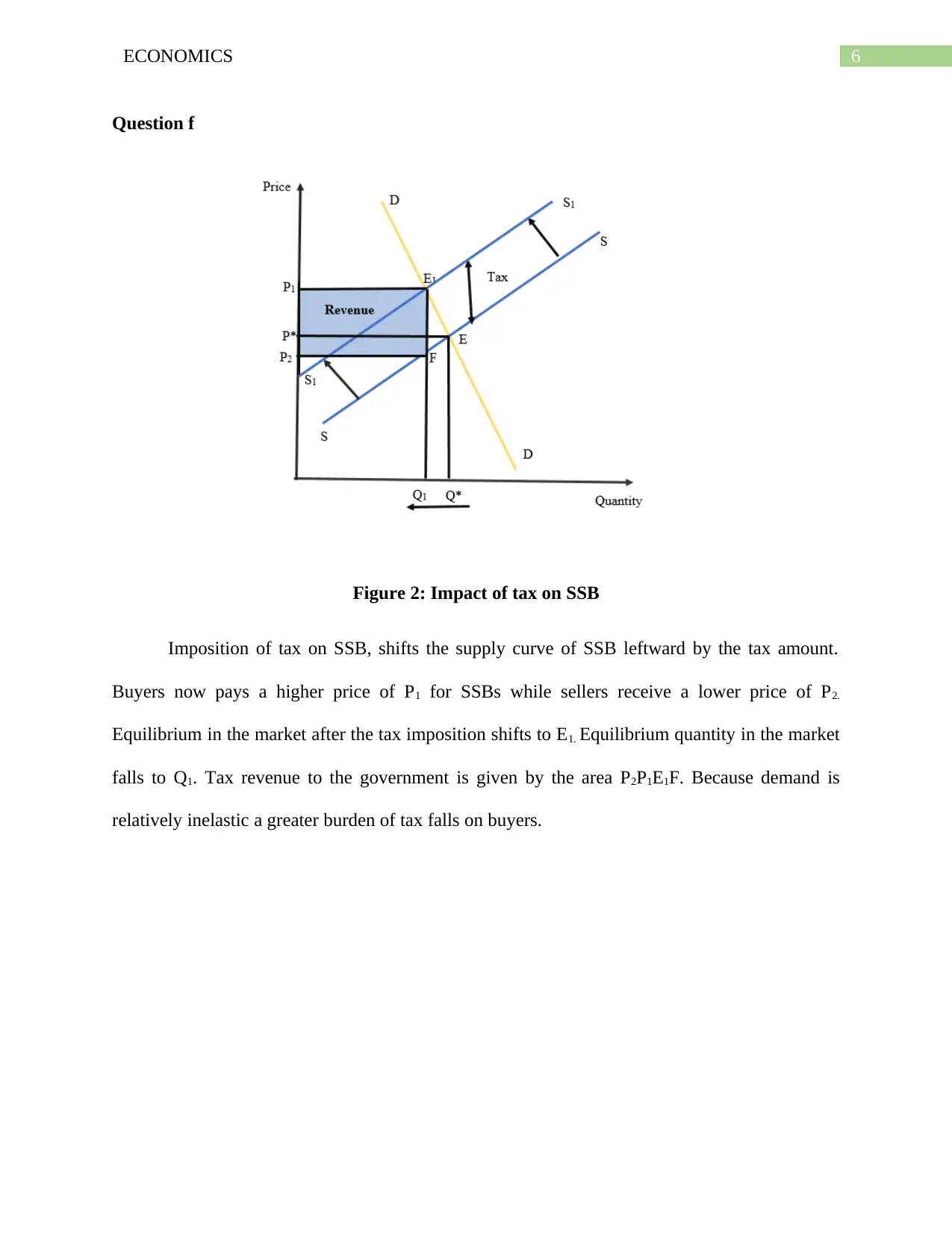

Figure 2: Impact of tax on SSB

Imposition of tax on SSB, shifts the supply curve of SSB leftward by the tax amount.

Buyers now pays a higher price of P1 for SSBs while sellers receive a lower price of P2.

Equilibrium in the market after the tax imposition shifts to E1. Equilibrium quantity in the market

falls to Q1. Tax revenue to the government is given by the area P2P1E1F. Because demand is

relatively inelastic a greater burden of tax falls on buyers.

Question f

Figure 2: Impact of tax on SSB

Imposition of tax on SSB, shifts the supply curve of SSB leftward by the tax amount.

Buyers now pays a higher price of P1 for SSBs while sellers receive a lower price of P2.

Equilibrium in the market after the tax imposition shifts to E1. Equilibrium quantity in the market

falls to Q1. Tax revenue to the government is given by the area P2P1E1F. Because demand is

relatively inelastic a greater burden of tax falls on buyers.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

Question g

i)

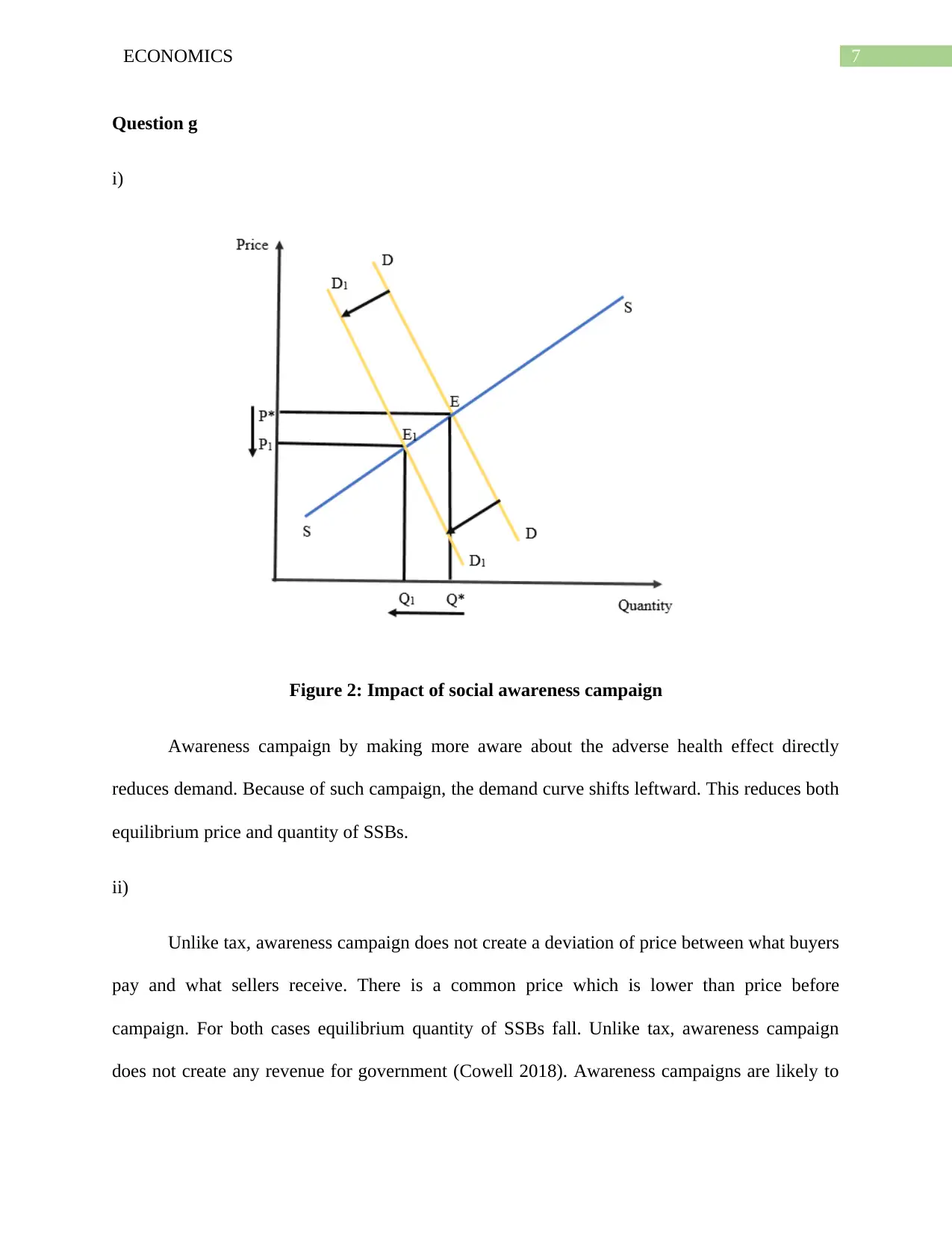

Figure 2: Impact of social awareness campaign

Awareness campaign by making more aware about the adverse health effect directly

reduces demand. Because of such campaign, the demand curve shifts leftward. This reduces both

equilibrium price and quantity of SSBs.

ii)

Unlike tax, awareness campaign does not create a deviation of price between what buyers

pay and what sellers receive. There is a common price which is lower than price before

campaign. For both cases equilibrium quantity of SSBs fall. Unlike tax, awareness campaign

does not create any revenue for government (Cowell 2018). Awareness campaigns are likely to

Question g

i)

Figure 2: Impact of social awareness campaign

Awareness campaign by making more aware about the adverse health effect directly

reduces demand. Because of such campaign, the demand curve shifts leftward. This reduces both

equilibrium price and quantity of SSBs.

ii)

Unlike tax, awareness campaign does not create a deviation of price between what buyers

pay and what sellers receive. There is a common price which is lower than price before

campaign. For both cases equilibrium quantity of SSBs fall. Unlike tax, awareness campaign

does not create any revenue for government (Cowell 2018). Awareness campaigns are likely to

8ECONOMICS

have a greater impact on the economy as whole compared to the impact on a particular group

like low income household.

iii)

If awareness campaigns are arranged along with tax, there will be larger reduction of

quantity consumed of SSB. The awareness campaign by increasing awareness among people

reduces demand (Mochrie 2015). Tax on SSBs by increasing price of SSBs reduces quantity of

SSB consumption. Therefore, combined effect of both policies will be larger on consumption on

SSB compared to individual policies.

have a greater impact on the economy as whole compared to the impact on a particular group

like low income household.

iii)

If awareness campaigns are arranged along with tax, there will be larger reduction of

quantity consumed of SSB. The awareness campaign by increasing awareness among people

reduces demand (Mochrie 2015). Tax on SSBs by increasing price of SSBs reduces quantity of

SSB consumption. Therefore, combined effect of both policies will be larger on consumption on

SSB compared to individual policies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS

References

Besanko, D. and Braeutigam, R., 2020. Microeconomics. John Wiley & Sons.

Cowell, F., 2018. Microeconomics: principles and analysis. Oxford University Press.

Fine, B., 2016. Microeconomics. University of Chicago Press Economics Books.

Kreps, D.M., 2019. Microeconomics for managers. Princeton University Press.

Mankiw, N.G., 2020. Principles of microeconomics. Cengage Learning.

Mochrie, R., 2015. Intermediate microeconomics. Macmillan International Higher Education

References

Besanko, D. and Braeutigam, R., 2020. Microeconomics. John Wiley & Sons.

Cowell, F., 2018. Microeconomics: principles and analysis. Oxford University Press.

Fine, B., 2016. Microeconomics. University of Chicago Press Economics Books.

Kreps, D.M., 2019. Microeconomics for managers. Princeton University Press.

Mankiw, N.G., 2020. Principles of microeconomics. Cengage Learning.

Mochrie, R., 2015. Intermediate microeconomics. Macmillan International Higher Education

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.