Economics for Business: Analysis of UK Housing Sector (2006-2016)

VerifiedAdded on 2021/04/19

|21

|4169

|57

Report

AI Summary

This report provides an in-depth analysis of the UK housing market from 2006 to 2016. It examines the dynamics of house prices, highlighting the fluctuations observed during the period, including the impact of the 2008 financial crisis. The report explores the various factors influencing housing prices, such as economic growth, supply and demand gaps, and consumer confidence. It also analyzes the effects of government schemes and policies aimed at supporting first-time buyers and stabilizing the market. The analysis is divided into pre- and post-crisis periods, offering insights into the changing market conditions and their drivers. The report concludes with a summary of the key findings and their implications for the UK housing sector.

Running head: ECONOMICS FOR BUSINESS

Economics for Business

Name of the Student

Name of the University

Author Note

Economics for Business

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR BUSINESS

Executive Summary

The housing sector of the United Kingdom has been one of the eminent sectors

contributing robustly to the economic growth of the country and also getting facilitated by the

same. Over the years, this sector has experienced significant expansion owing to the increase in

the population of the country resulting in a higher demand. However, the price levels of the

residential assets in the United Kingdom have been subjected to considerable amount of

fluctuations, with the same being more within the time period of 2006 to 2016. However, in the

second half of the total time span the trend of the price growth has been more or less positive.

Keeping this into consideration, the report tries to analyze the different factors behind the

dynamics in the price levels of the residential assets of the country. It also tries to analyze the

different policies and schemes which have been implemented by the government of the country,

in order to facilitate the first time buyers in the residential asset market of the country and tries to

logically interpret the impacts of the schemes on the price levels and overall economic welfare of

the residents of the country.

Executive Summary

The housing sector of the United Kingdom has been one of the eminent sectors

contributing robustly to the economic growth of the country and also getting facilitated by the

same. Over the years, this sector has experienced significant expansion owing to the increase in

the population of the country resulting in a higher demand. However, the price levels of the

residential assets in the United Kingdom have been subjected to considerable amount of

fluctuations, with the same being more within the time period of 2006 to 2016. However, in the

second half of the total time span the trend of the price growth has been more or less positive.

Keeping this into consideration, the report tries to analyze the different factors behind the

dynamics in the price levels of the residential assets of the country. It also tries to analyze the

different policies and schemes which have been implemented by the government of the country,

in order to facilitate the first time buyers in the residential asset market of the country and tries to

logically interpret the impacts of the schemes on the price levels and overall economic welfare of

the residents of the country.

2ECONOMICS FOR BUSINESS

Table of Contents

Executive Summary.........................................................................................................................1

Introduction......................................................................................................................................3

Housing Sector of the United Kingdom: Overview........................................................................4

Dynamics in the price levels of residential assets in UK.................................................................5

Factors determining the price levels of housing assets in the United Kingdom..............................6

Factors affecting house prices before Financial Crisis of 2008:..................................................7

Period of Recession and Stagnation............................................................................................9

Factors affecting house prices in UK post stagnation period (2013-2016)...............................11

Impact of Government Schemes....................................................................................................14

Conclusion.....................................................................................................................................16

References......................................................................................................................................18

Table of Contents

Executive Summary.........................................................................................................................1

Introduction......................................................................................................................................3

Housing Sector of the United Kingdom: Overview........................................................................4

Dynamics in the price levels of residential assets in UK.................................................................5

Factors determining the price levels of housing assets in the United Kingdom..............................6

Factors affecting house prices before Financial Crisis of 2008:..................................................7

Period of Recession and Stagnation............................................................................................9

Factors affecting house prices in UK post stagnation period (2013-2016)...............................11

Impact of Government Schemes....................................................................................................14

Conclusion.....................................................................................................................................16

References......................................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR BUSINESS

Introduction

The United Kingdom has over the years, developed into one of the most highly

developed economies in the global scenario with considerable market orientation in the

economy. Being the sixth largest economy in the world in terms of the nominal GDP as well as

the ninth-largest in terms of the purchasing power parity, the country has shown impressive

growth trends in all the aspects of growth (Capie and Webber 2013). The United Kingdom is the

second largest economy in the European Union, with respect to the size of the economy as well

as the with respect to the industrial and commercial growth the country has experienced over the

years.

Of the different sectors in the economy of the country, the one which has experienced

immense dynamics and fluctuations over the decades is the housing sector of the country. With

the increase in the boom in the industrial sector of the country, the economic prosperity of the

population of the country increased substantially, which in turn also increased the number of

people migrating in the country over the years. This upward pressure in the population and

income generation in the country contributed considerably in building up the housing sector of

the country (Ngai and Tenreyro 2014).

However, the housing sector of the United Kingdom has experienced immense

fluctuations in the last few decades, which can be attributed to the different domestic as well as

global incidents, which in turn left lasting impression on the demand and supply situations in the

housing market of the country. The implications of these incidents have been more negative than

positive, especially post the financial crisis of 2008, which created immense negative

repercussion on the economy of the country as a whole and on the housing sector in particular

Introduction

The United Kingdom has over the years, developed into one of the most highly

developed economies in the global scenario with considerable market orientation in the

economy. Being the sixth largest economy in the world in terms of the nominal GDP as well as

the ninth-largest in terms of the purchasing power parity, the country has shown impressive

growth trends in all the aspects of growth (Capie and Webber 2013). The United Kingdom is the

second largest economy in the European Union, with respect to the size of the economy as well

as the with respect to the industrial and commercial growth the country has experienced over the

years.

Of the different sectors in the economy of the country, the one which has experienced

immense dynamics and fluctuations over the decades is the housing sector of the country. With

the increase in the boom in the industrial sector of the country, the economic prosperity of the

population of the country increased substantially, which in turn also increased the number of

people migrating in the country over the years. This upward pressure in the population and

income generation in the country contributed considerably in building up the housing sector of

the country (Ngai and Tenreyro 2014).

However, the housing sector of the United Kingdom has experienced immense

fluctuations in the last few decades, which can be attributed to the different domestic as well as

global incidents, which in turn left lasting impression on the demand and supply situations in the

housing market of the country. The implications of these incidents have been more negative than

positive, especially post the financial crisis of 2008, which created immense negative

repercussion on the economy of the country as a whole and on the housing sector in particular

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR BUSINESS

(Wilcox and Perry 2014). Keeping this into consideration, the report tries to analyze the

dynamics in the price levels of the housing sector of the country, in the time span of 2006 to

2016 and also tries to discuss the factors working behind the dynamics of the same. It also tries

to analyze the implications of the different policies and initiatives taken by the government of the

country in order to stabilize the demand supply scenario and also to maximize the overall welfare

of the residents of the country, in terms of availability and affordability in the residential

investment sector of the same.

Housing Sector of the United Kingdom: Overview

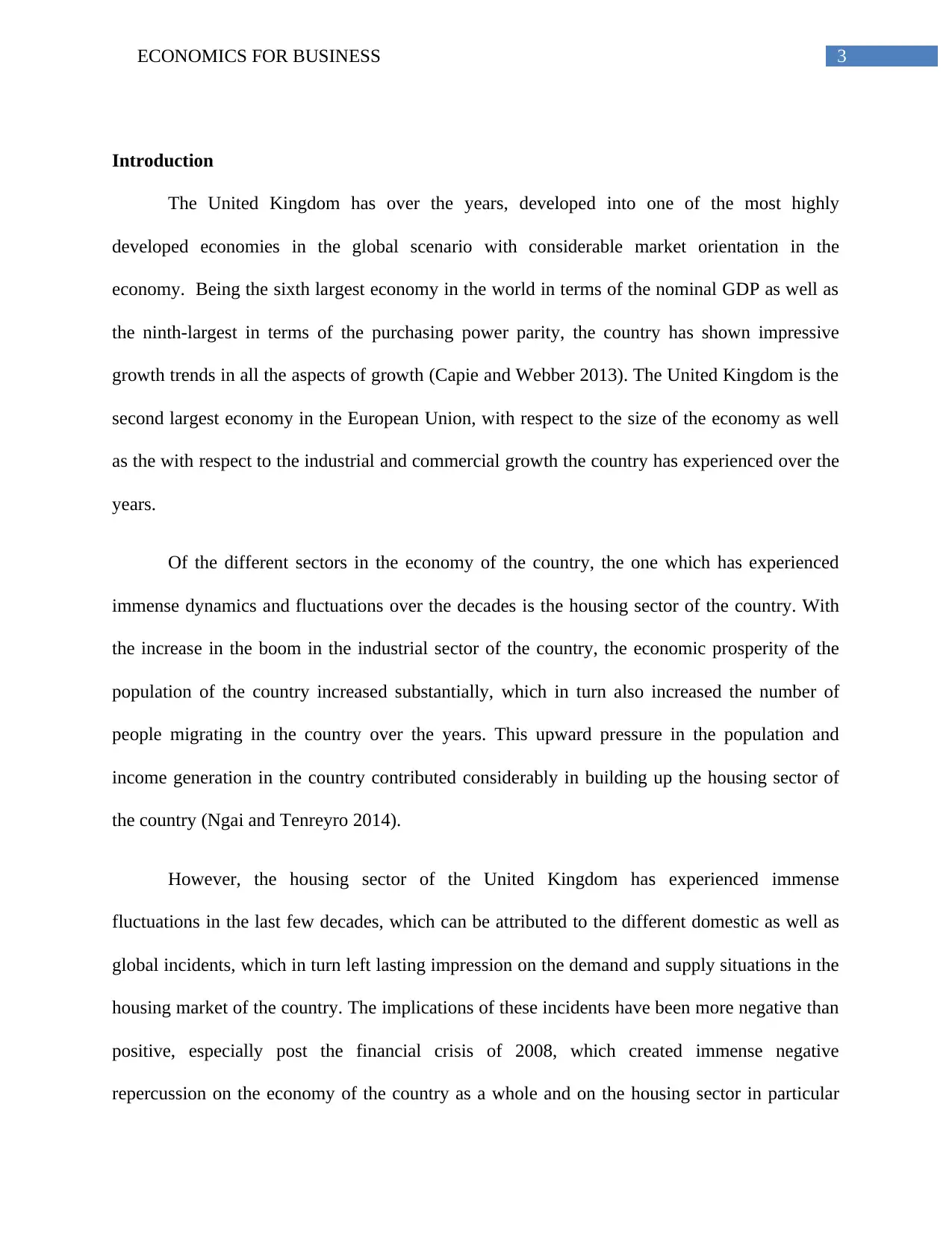

The housing industry in the United Kingdom, as discussed above, has been one of the

primary industries which has been facilitated by the economic prosperity of the country and has

also contributed in the economic growth of the country (Aron et al. 2012). This can be asserted

with the help of the following figure, which shows the sector wise contribution to the service

sector productivity growth of the United Kingdom from 2010 to 2014:

Figure 1: Contribution of different sectors in the productivity growth of the service sector

of UK (2010-2014)

(Wilcox and Perry 2014). Keeping this into consideration, the report tries to analyze the

dynamics in the price levels of the housing sector of the country, in the time span of 2006 to

2016 and also tries to discuss the factors working behind the dynamics of the same. It also tries

to analyze the implications of the different policies and initiatives taken by the government of the

country in order to stabilize the demand supply scenario and also to maximize the overall welfare

of the residents of the country, in terms of availability and affordability in the residential

investment sector of the same.

Housing Sector of the United Kingdom: Overview

The housing industry in the United Kingdom, as discussed above, has been one of the

primary industries which has been facilitated by the economic prosperity of the country and has

also contributed in the economic growth of the country (Aron et al. 2012). This can be asserted

with the help of the following figure, which shows the sector wise contribution to the service

sector productivity growth of the United Kingdom from 2010 to 2014:

Figure 1: Contribution of different sectors in the productivity growth of the service sector

of UK (2010-2014)

5ECONOMICS FOR BUSINESS

(Source: Gov.uk, 2018)

As is evident from the above figure, the real estate sector (of which the housing industry

forms the most crucial part) has contributed significantly in the productivity growth of the

economy of the country over the last few years. However, within the time period of 2006 and

2016, the housing industry has of the United Kingdom has experienced considerable fluctuations

and dynamics which have also been reflected in the dynamics of the price levels of the

residential assets of the country (Nuuter, Lill and Tupenaite 2015).

Dynamics in the price levels of residential assets in UK

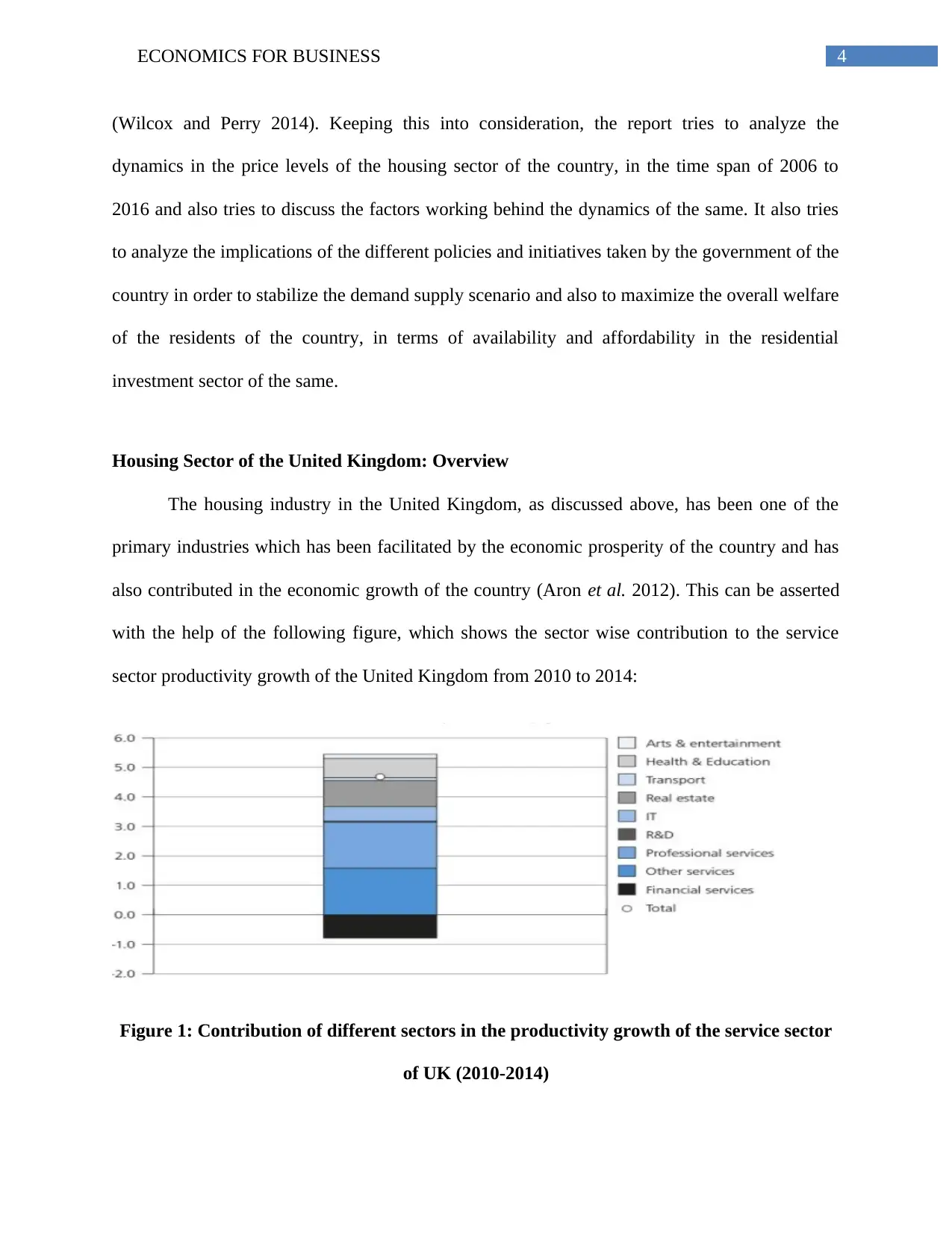

To measure the dynamics in the price levels of the housing assets of a country, the most

commonly used measure is the House Price Index (HPI). The HPI of a country or region usually

shows the changes in the prices of single family residences (taken as a unit of measurement in

the housing market) in that particular market with time. An increase in the HPI indicates towards

an increase in the values of the residences of the concerned place and vice versa (Sá 2015).

Taking this into consideration, the HPI of the residential market of the United Kingdom, from

2006 to 2016, can be observed as follows:

Figure 2: The House Price Index of United Kingdom (2006-2016)

(Source: Gov.uk, 2018)

As is evident from the above figure, the real estate sector (of which the housing industry

forms the most crucial part) has contributed significantly in the productivity growth of the

economy of the country over the last few years. However, within the time period of 2006 and

2016, the housing industry has of the United Kingdom has experienced considerable fluctuations

and dynamics which have also been reflected in the dynamics of the price levels of the

residential assets of the country (Nuuter, Lill and Tupenaite 2015).

Dynamics in the price levels of residential assets in UK

To measure the dynamics in the price levels of the housing assets of a country, the most

commonly used measure is the House Price Index (HPI). The HPI of a country or region usually

shows the changes in the prices of single family residences (taken as a unit of measurement in

the housing market) in that particular market with time. An increase in the HPI indicates towards

an increase in the values of the residences of the concerned place and vice versa (Sá 2015).

Taking this into consideration, the HPI of the residential market of the United Kingdom, from

2006 to 2016, can be observed as follows:

Figure 2: The House Price Index of United Kingdom (2006-2016)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR BUSINESS

(Source: Tradingeconomics.com, 2018)

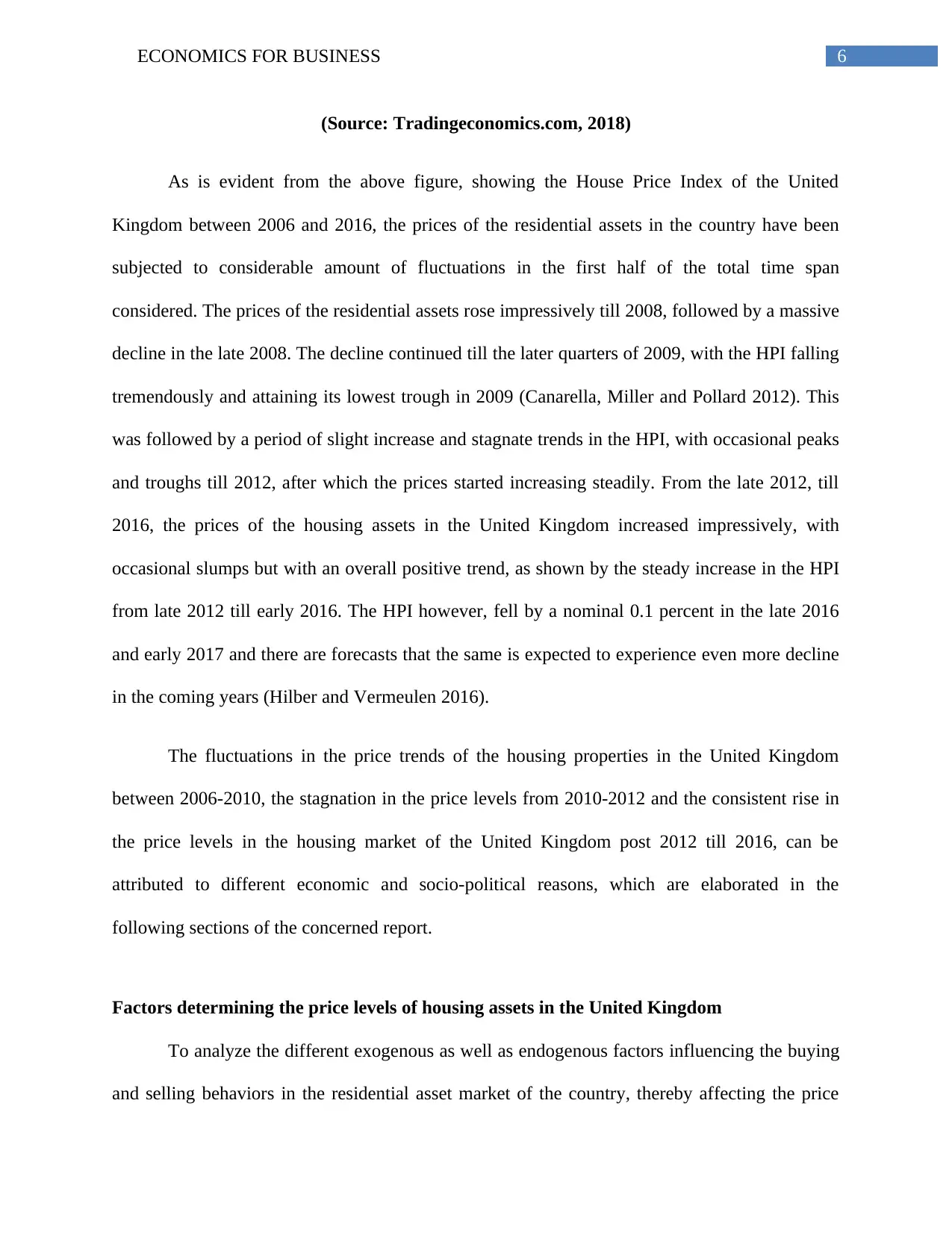

As is evident from the above figure, showing the House Price Index of the United

Kingdom between 2006 and 2016, the prices of the residential assets in the country have been

subjected to considerable amount of fluctuations in the first half of the total time span

considered. The prices of the residential assets rose impressively till 2008, followed by a massive

decline in the late 2008. The decline continued till the later quarters of 2009, with the HPI falling

tremendously and attaining its lowest trough in 2009 (Canarella, Miller and Pollard 2012). This

was followed by a period of slight increase and stagnate trends in the HPI, with occasional peaks

and troughs till 2012, after which the prices started increasing steadily. From the late 2012, till

2016, the prices of the housing assets in the United Kingdom increased impressively, with

occasional slumps but with an overall positive trend, as shown by the steady increase in the HPI

from late 2012 till early 2016. The HPI however, fell by a nominal 0.1 percent in the late 2016

and early 2017 and there are forecasts that the same is expected to experience even more decline

in the coming years (Hilber and Vermeulen 2016).

The fluctuations in the price trends of the housing properties in the United Kingdom

between 2006-2010, the stagnation in the price levels from 2010-2012 and the consistent rise in

the price levels in the housing market of the United Kingdom post 2012 till 2016, can be

attributed to different economic and socio-political reasons, which are elaborated in the

following sections of the concerned report.

Factors determining the price levels of housing assets in the United Kingdom

To analyze the different exogenous as well as endogenous factors influencing the buying

and selling behaviors in the residential asset market of the country, thereby affecting the price

(Source: Tradingeconomics.com, 2018)

As is evident from the above figure, showing the House Price Index of the United

Kingdom between 2006 and 2016, the prices of the residential assets in the country have been

subjected to considerable amount of fluctuations in the first half of the total time span

considered. The prices of the residential assets rose impressively till 2008, followed by a massive

decline in the late 2008. The decline continued till the later quarters of 2009, with the HPI falling

tremendously and attaining its lowest trough in 2009 (Canarella, Miller and Pollard 2012). This

was followed by a period of slight increase and stagnate trends in the HPI, with occasional peaks

and troughs till 2012, after which the prices started increasing steadily. From the late 2012, till

2016, the prices of the housing assets in the United Kingdom increased impressively, with

occasional slumps but with an overall positive trend, as shown by the steady increase in the HPI

from late 2012 till early 2016. The HPI however, fell by a nominal 0.1 percent in the late 2016

and early 2017 and there are forecasts that the same is expected to experience even more decline

in the coming years (Hilber and Vermeulen 2016).

The fluctuations in the price trends of the housing properties in the United Kingdom

between 2006-2010, the stagnation in the price levels from 2010-2012 and the consistent rise in

the price levels in the housing market of the United Kingdom post 2012 till 2016, can be

attributed to different economic and socio-political reasons, which are elaborated in the

following sections of the concerned report.

Factors determining the price levels of housing assets in the United Kingdom

To analyze the different exogenous as well as endogenous factors influencing the buying

and selling behaviors in the residential asset market of the country, thereby affecting the price

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR BUSINESS

levels of the concerned assets, the total time span of 2006-2016, is divided into two major parts,

one before the financial crisis of 2008 and another post the crisis of 2008, taking into

consideration the huge fluctuation which occurred in the price of the housing assets of the

country, owing to the acute recession and credit crunches at that point of time (Gallent, Mace and

Tewdwr-Jones 2017).

Factors affecting house prices before Financial Crisis of 2008:

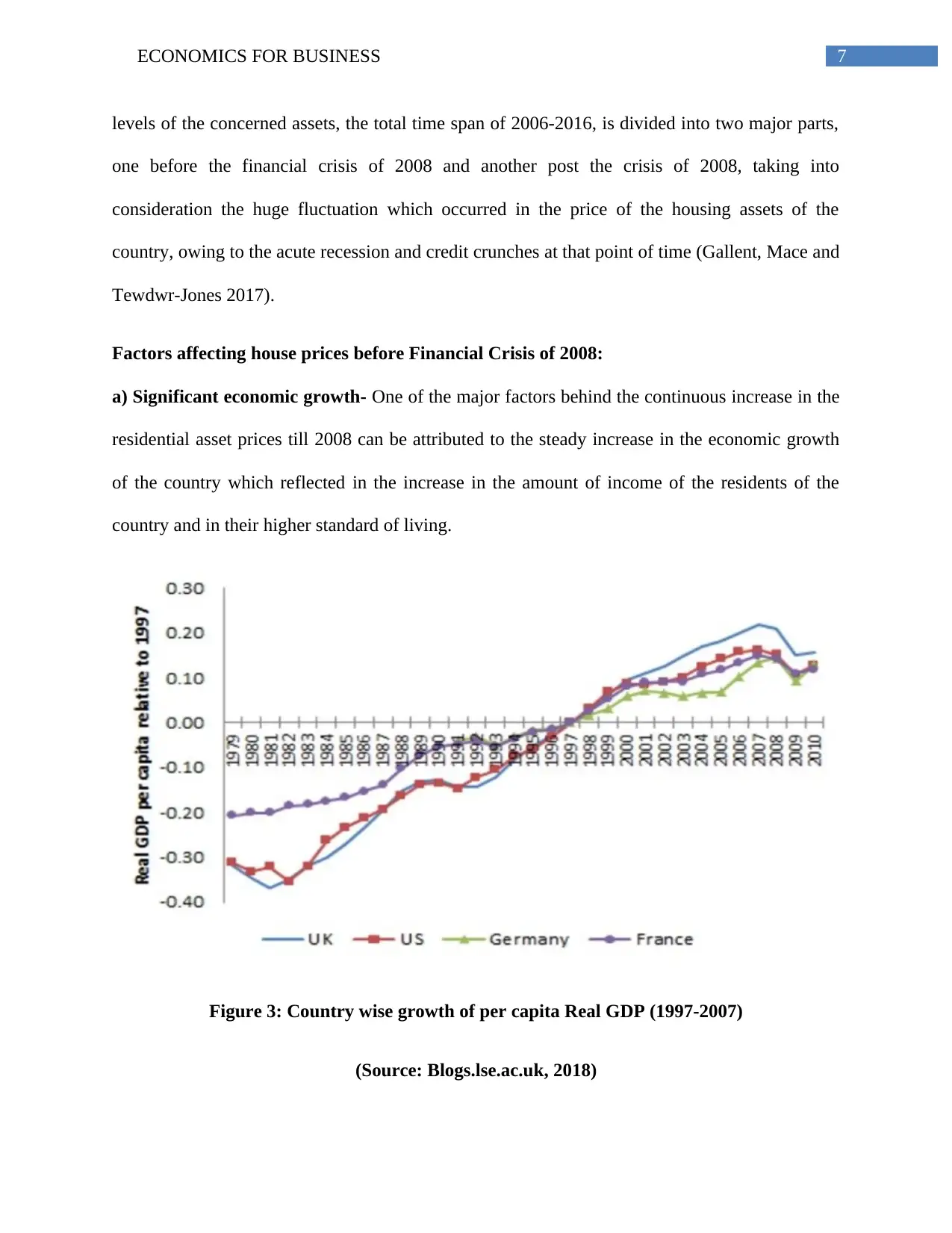

a) Significant economic growth- One of the major factors behind the continuous increase in the

residential asset prices till 2008 can be attributed to the steady increase in the economic growth

of the country which reflected in the increase in the amount of income of the residents of the

country and in their higher standard of living.

Figure 3: Country wise growth of per capita Real GDP (1997-2007)

(Source: Blogs.lse.ac.uk, 2018)

levels of the concerned assets, the total time span of 2006-2016, is divided into two major parts,

one before the financial crisis of 2008 and another post the crisis of 2008, taking into

consideration the huge fluctuation which occurred in the price of the housing assets of the

country, owing to the acute recession and credit crunches at that point of time (Gallent, Mace and

Tewdwr-Jones 2017).

Factors affecting house prices before Financial Crisis of 2008:

a) Significant economic growth- One of the major factors behind the continuous increase in the

residential asset prices till 2008 can be attributed to the steady increase in the economic growth

of the country which reflected in the increase in the amount of income of the residents of the

country and in their higher standard of living.

Figure 3: Country wise growth of per capita Real GDP (1997-2007)

(Source: Blogs.lse.ac.uk, 2018)

8ECONOMICS FOR BUSINESS

The rate of increase of the per capita Real GDP of the UK between 1997 to 2007, also

attracted people from all parts of the world to migrate to the country in search of higher

economic welfare. These factors together contributed in increasing the demand for housing

assets in the country, especially in the highly industrial metropolitan areas of the country.

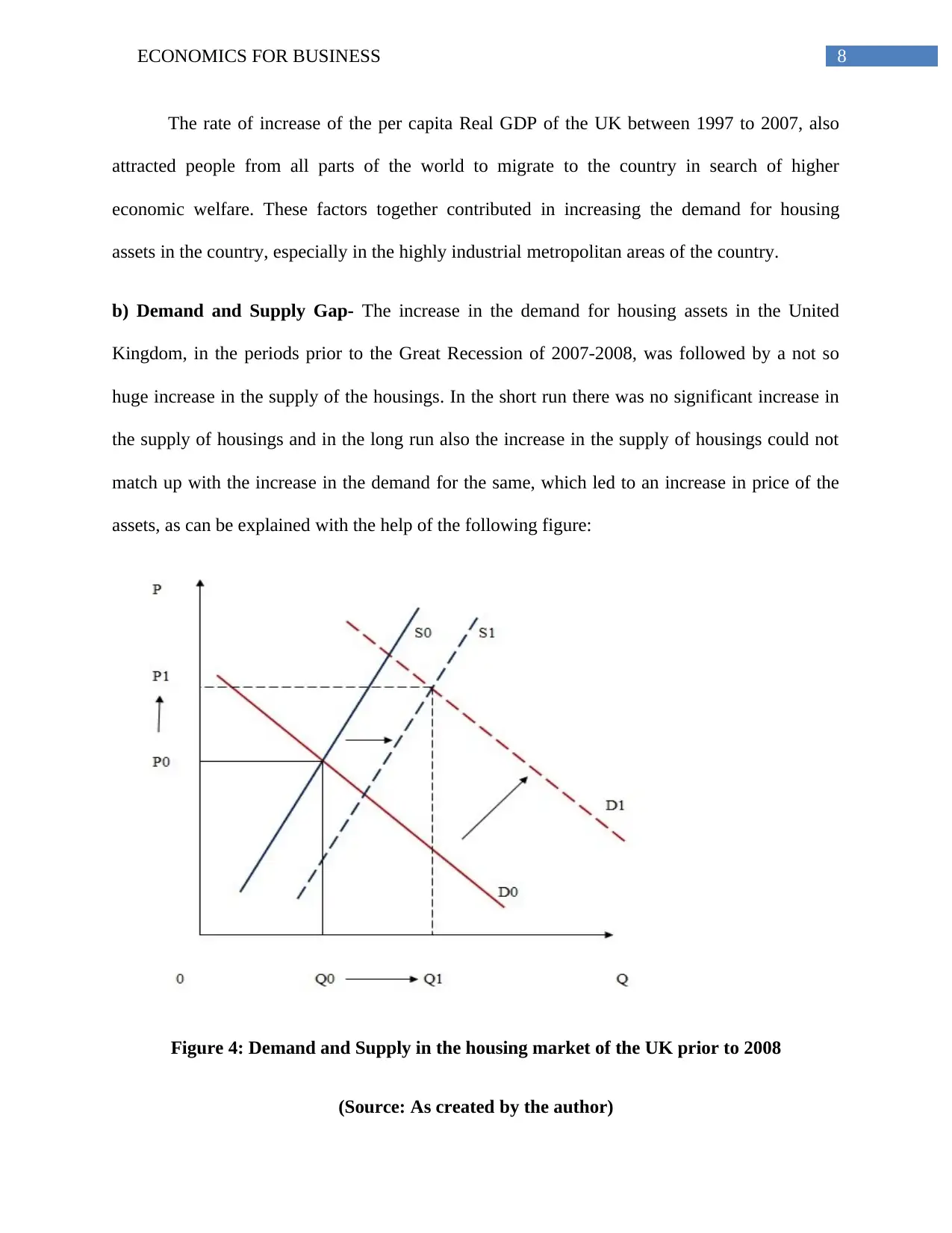

b) Demand and Supply Gap- The increase in the demand for housing assets in the United

Kingdom, in the periods prior to the Great Recession of 2007-2008, was followed by a not so

huge increase in the supply of the housings. In the short run there was no significant increase in

the supply of housings and in the long run also the increase in the supply of housings could not

match up with the increase in the demand for the same, which led to an increase in price of the

assets, as can be explained with the help of the following figure:

Figure 4: Demand and Supply in the housing market of the UK prior to 2008

(Source: As created by the author)

The rate of increase of the per capita Real GDP of the UK between 1997 to 2007, also

attracted people from all parts of the world to migrate to the country in search of higher

economic welfare. These factors together contributed in increasing the demand for housing

assets in the country, especially in the highly industrial metropolitan areas of the country.

b) Demand and Supply Gap- The increase in the demand for housing assets in the United

Kingdom, in the periods prior to the Great Recession of 2007-2008, was followed by a not so

huge increase in the supply of the housings. In the short run there was no significant increase in

the supply of housings and in the long run also the increase in the supply of housings could not

match up with the increase in the demand for the same, which led to an increase in price of the

assets, as can be explained with the help of the following figure:

Figure 4: Demand and Supply in the housing market of the UK prior to 2008

(Source: As created by the author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR BUSINESS

This less the proportional increase in the supply of housings in the country during that period led

to a steady increase in the prices of the residential assets, as can be seen from the increase in the

HPI during that time (Hodkinson, Watt and Mooney 2013).

c) Consumer’s Confidence- The increase in the housing assets values, led to the increase in the

confidence of the customers of these assets as they started perceiving housings as one of the most

fruitful form of long term investments, with the notion that the prices will never go down. This

encouraged them to take out more risky mortgages from the lending institutions to buy new

residential properties (Farmer 2012). The low rates of unemployment also had positive

contributions in increasing the confidence of the consumers, thereby creating a investment

bubble in the housing market of the country, exerting even more upward pressure on the price

levels of the residential assets.

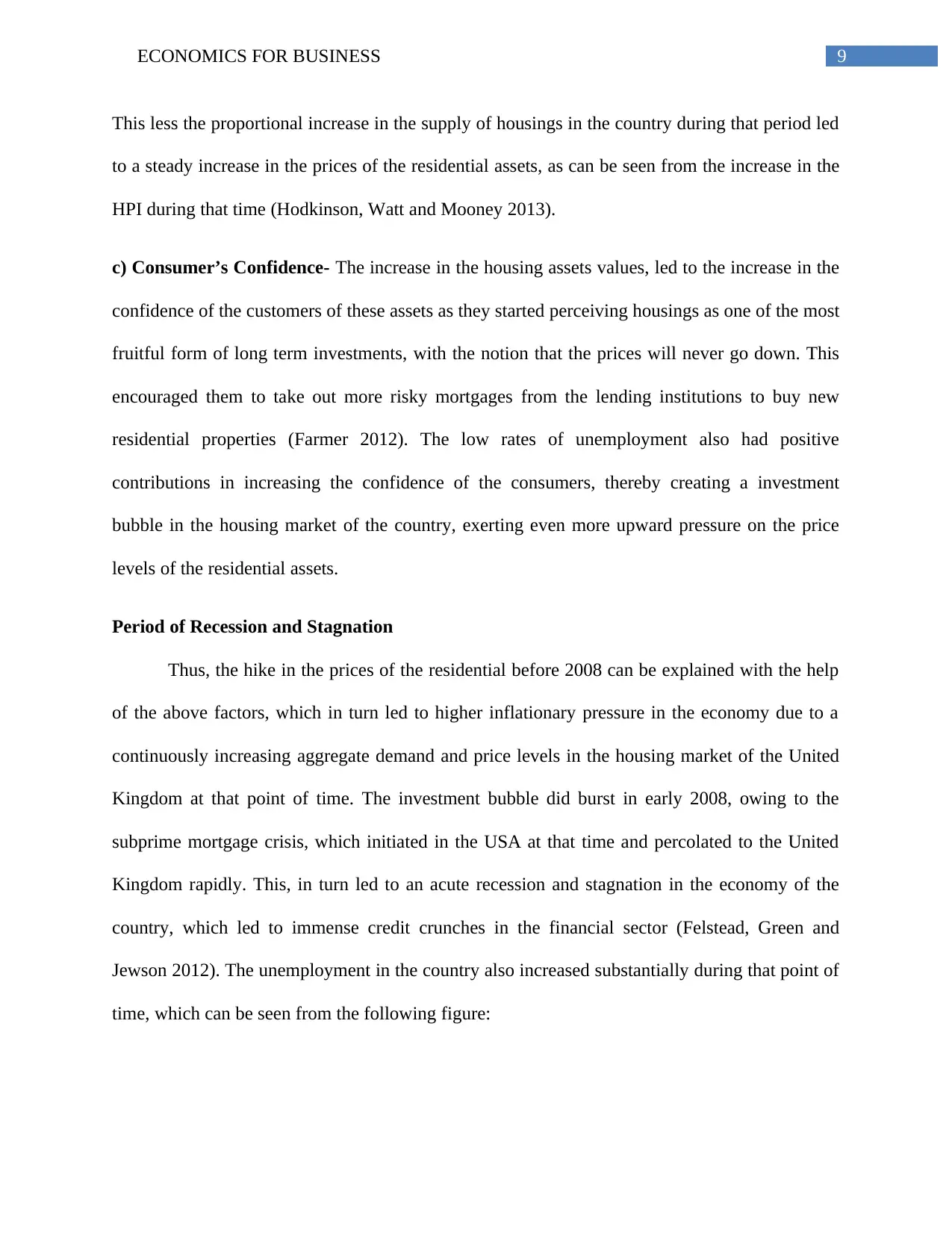

Period of Recession and Stagnation

Thus, the hike in the prices of the residential before 2008 can be explained with the help

of the above factors, which in turn led to higher inflationary pressure in the economy due to a

continuously increasing aggregate demand and price levels in the housing market of the United

Kingdom at that point of time. The investment bubble did burst in early 2008, owing to the

subprime mortgage crisis, which initiated in the USA at that time and percolated to the United

Kingdom rapidly. This, in turn led to an acute recession and stagnation in the economy of the

country, which led to immense credit crunches in the financial sector (Felstead, Green and

Jewson 2012). The unemployment in the country also increased substantially during that point of

time, which can be seen from the following figure:

This less the proportional increase in the supply of housings in the country during that period led

to a steady increase in the prices of the residential assets, as can be seen from the increase in the

HPI during that time (Hodkinson, Watt and Mooney 2013).

c) Consumer’s Confidence- The increase in the housing assets values, led to the increase in the

confidence of the customers of these assets as they started perceiving housings as one of the most

fruitful form of long term investments, with the notion that the prices will never go down. This

encouraged them to take out more risky mortgages from the lending institutions to buy new

residential properties (Farmer 2012). The low rates of unemployment also had positive

contributions in increasing the confidence of the consumers, thereby creating a investment

bubble in the housing market of the country, exerting even more upward pressure on the price

levels of the residential assets.

Period of Recession and Stagnation

Thus, the hike in the prices of the residential before 2008 can be explained with the help

of the above factors, which in turn led to higher inflationary pressure in the economy due to a

continuously increasing aggregate demand and price levels in the housing market of the United

Kingdom at that point of time. The investment bubble did burst in early 2008, owing to the

subprime mortgage crisis, which initiated in the USA at that time and percolated to the United

Kingdom rapidly. This, in turn led to an acute recession and stagnation in the economy of the

country, which led to immense credit crunches in the financial sector (Felstead, Green and

Jewson 2012). The unemployment in the country also increased substantially during that point of

time, which can be seen from the following figure:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR BUSINESS

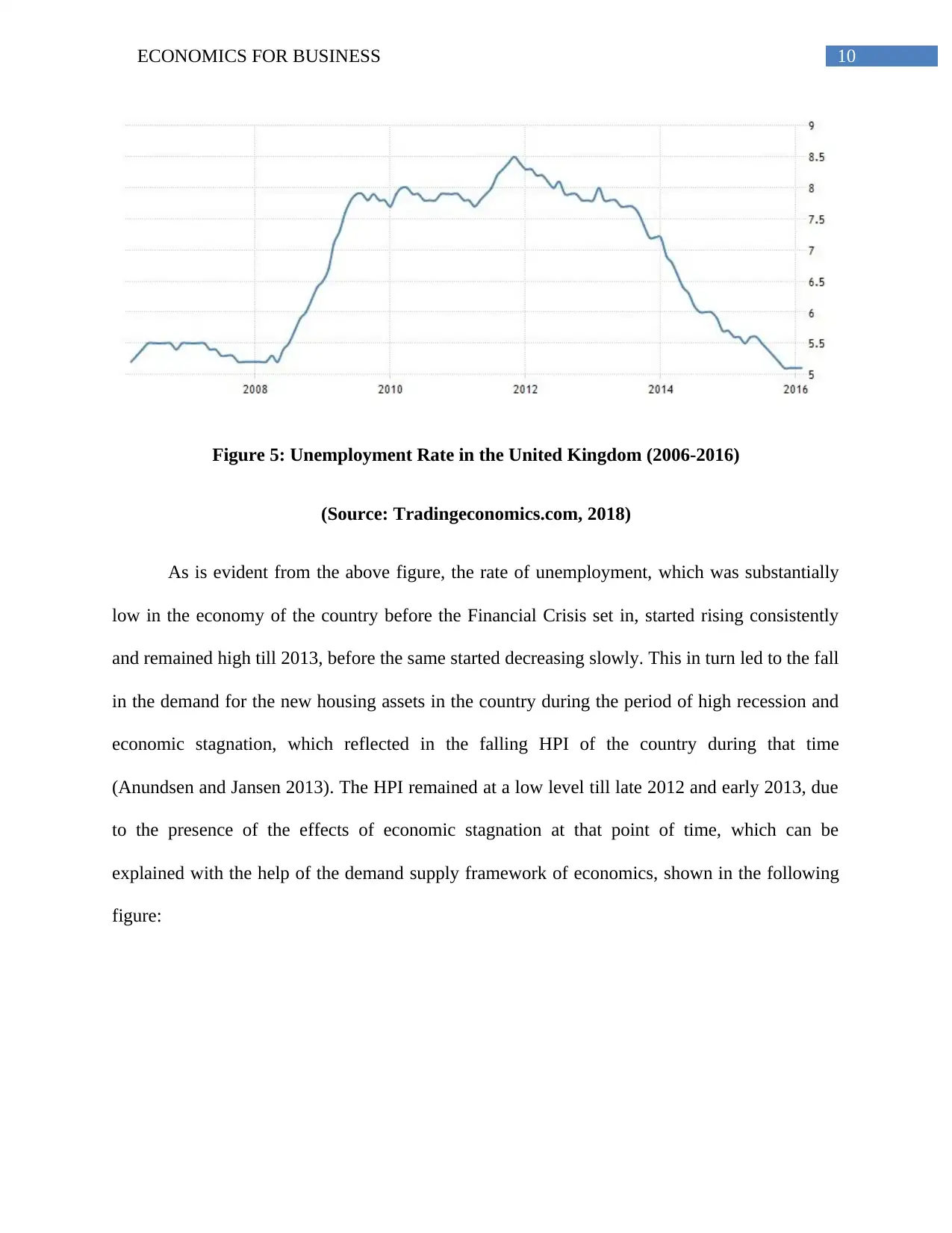

Figure 5: Unemployment Rate in the United Kingdom (2006-2016)

(Source: Tradingeconomics.com, 2018)

As is evident from the above figure, the rate of unemployment, which was substantially

low in the economy of the country before the Financial Crisis set in, started rising consistently

and remained high till 2013, before the same started decreasing slowly. This in turn led to the fall

in the demand for the new housing assets in the country during the period of high recession and

economic stagnation, which reflected in the falling HPI of the country during that time

(Anundsen and Jansen 2013). The HPI remained at a low level till late 2012 and early 2013, due

to the presence of the effects of economic stagnation at that point of time, which can be

explained with the help of the demand supply framework of economics, shown in the following

figure:

Figure 5: Unemployment Rate in the United Kingdom (2006-2016)

(Source: Tradingeconomics.com, 2018)

As is evident from the above figure, the rate of unemployment, which was substantially

low in the economy of the country before the Financial Crisis set in, started rising consistently

and remained high till 2013, before the same started decreasing slowly. This in turn led to the fall

in the demand for the new housing assets in the country during the period of high recession and

economic stagnation, which reflected in the falling HPI of the country during that time

(Anundsen and Jansen 2013). The HPI remained at a low level till late 2012 and early 2013, due

to the presence of the effects of economic stagnation at that point of time, which can be

explained with the help of the demand supply framework of economics, shown in the following

figure:

11ECONOMICS FOR BUSINESS

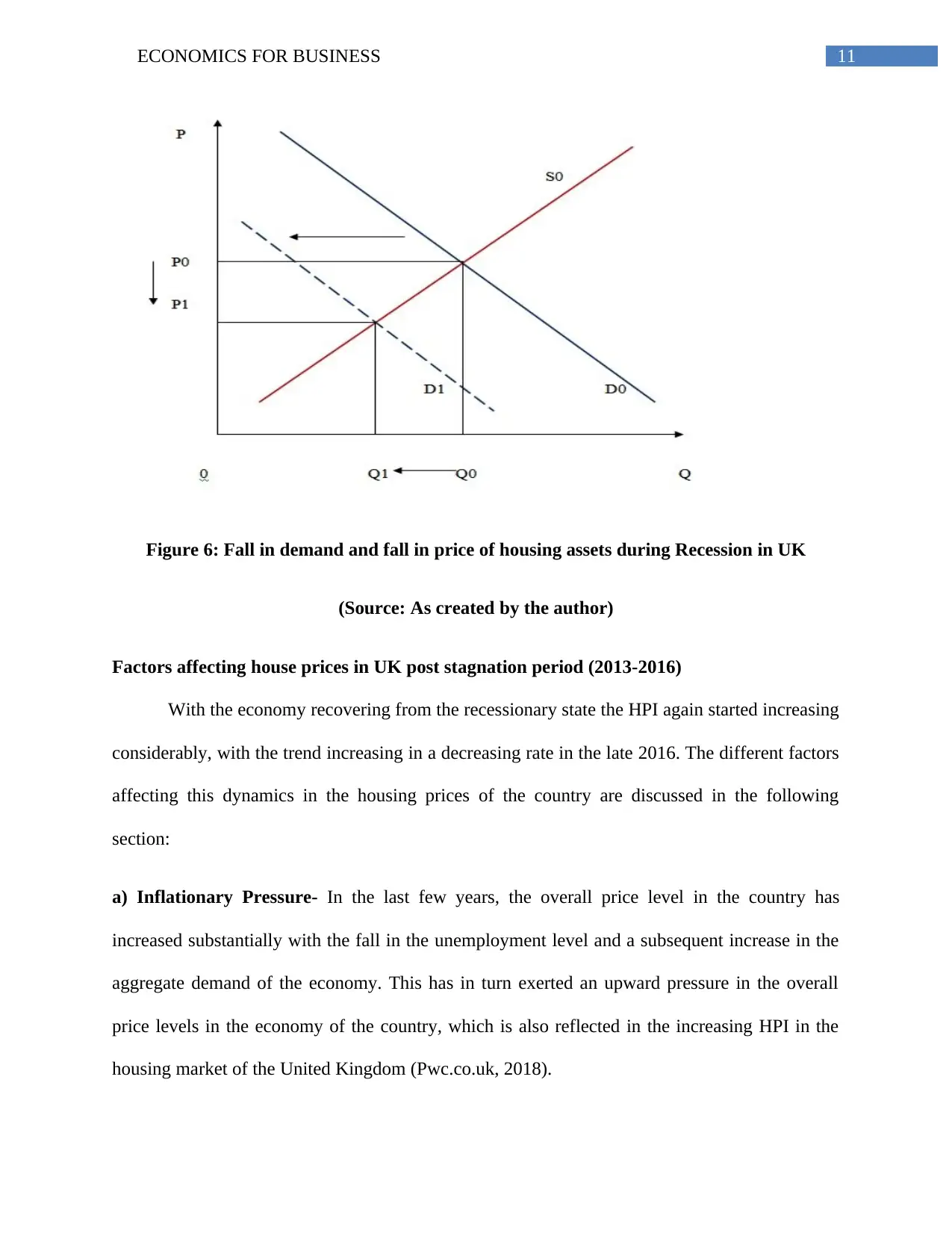

Figure 6: Fall in demand and fall in price of housing assets during Recession in UK

(Source: As created by the author)

Factors affecting house prices in UK post stagnation period (2013-2016)

With the economy recovering from the recessionary state the HPI again started increasing

considerably, with the trend increasing in a decreasing rate in the late 2016. The different factors

affecting this dynamics in the housing prices of the country are discussed in the following

section:

a) Inflationary Pressure- In the last few years, the overall price level in the country has

increased substantially with the fall in the unemployment level and a subsequent increase in the

aggregate demand of the economy. This has in turn exerted an upward pressure in the overall

price levels in the economy of the country, which is also reflected in the increasing HPI in the

housing market of the United Kingdom (Pwc.co.uk, 2018).

Figure 6: Fall in demand and fall in price of housing assets during Recession in UK

(Source: As created by the author)

Factors affecting house prices in UK post stagnation period (2013-2016)

With the economy recovering from the recessionary state the HPI again started increasing

considerably, with the trend increasing in a decreasing rate in the late 2016. The different factors

affecting this dynamics in the housing prices of the country are discussed in the following

section:

a) Inflationary Pressure- In the last few years, the overall price level in the country has

increased substantially with the fall in the unemployment level and a subsequent increase in the

aggregate demand of the economy. This has in turn exerted an upward pressure in the overall

price levels in the economy of the country, which is also reflected in the increasing HPI in the

housing market of the United Kingdom (Pwc.co.uk, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.