Enhanced Auditor Reporting in Australia: A Case Study on Woolworths

VerifiedAdded on 2023/06/07

|16

|3191

|101

Report

AI Summary

This report, prepared for the HI6026 Audit, Assurance, and Compliance course, examines the significance and effectiveness of enhanced auditor reporting in Australia, using Woolworths and its group of companies as a case study. The analysis includes an assessment of the auditor's report, focusing on aspects such as independence requirements, non-audit services provided, and the auditor's remuneration. The report delves into key audit matters like the carrying value of assets, inventory provisioning, accounting for rebates, and IT systems, detailing the audit procedures employed. It also discusses the role and responsibilities of the audit committee, the audit opinion, and the directors’ and management's responsibilities. Furthermore, the report covers material subsequent events and concludes that the auditor's report has performed well, providing stakeholders with a comprehensive understanding of the financial information. The report highlights how the auditor's report is transparent and free from material omissions.

Audit Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 2nd Sep 2018.

1 | P a g e

By student name

Professor

University

Date: 2nd Sep 2018.

1 | P a g e

2

Executive Summary

This purpose of this assignment is to throw light on the importance and effectiveness of

enhanced Auditor Reporting. To understand this concept better, we have answered a set of

questions, by taking Woolworths and its group of companies as an example. While analyzing the

annual report of the Company, and trying to find whether it has performed well on the

parameters of enhanced reporting, it becomes evident that the auditor’s report has managed to do

fairly well. The information provided facilitates better understanding, from the point of view of

all the stakeholders. I feel that no material information has been left out of the report.

2 | P a g e

Executive Summary

This purpose of this assignment is to throw light on the importance and effectiveness of

enhanced Auditor Reporting. To understand this concept better, we have answered a set of

questions, by taking Woolworths and its group of companies as an example. While analyzing the

annual report of the Company, and trying to find whether it has performed well on the

parameters of enhanced reporting, it becomes evident that the auditor’s report has managed to do

fairly well. The information provided facilitates better understanding, from the point of view of

all the stakeholders. I feel that no material information has been left out of the report.

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Contents

Introduction......................................................................................................................................3

Analysis...........................................................................................................................................5

Conclusion.......................................................................................................................................7

References......................................................................................................................................10

3 | P a g e

Contents

Introduction......................................................................................................................................3

Analysis...........................................................................................................................................5

Conclusion.......................................................................................................................................7

References......................................................................................................................................10

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Introduction:

The main aim of the assignment is to comment on the audit planning and all the requirements

that the auditor needs to take into consideration. The auditor needs to check the financial

statements and they should be free from all kind of misstatements. In this case the annual report

of WoolWorths company is downloaded to make throw light on important matter that are related

to the auditors in same way or the manner (Alexander, 2016). The main aim is to judge the audit

report and make that there is transparency in that.

Independence requirements

The principle of “independence” basically means that the audit is performed without being

under the undue influence of any party, including the company with which the audit engagement

takes place. The Auditor needs to exercise his own judgment and professional skills in arriving at

a conclusion (Arnott, et al., 2017). The audit opinion is formed on this conclusion and it should

be unbiased.

Analyzing the annual report of Woolworths, we come across the independence declaration given

by the partners of the auditor, Deloitte Touché Tohmatsu. Complying with the provisions of

Section 307C of the Corporations Act 2001, the Auditors expressly declare that there has been no

contravention of the Act with respect to the requirement of independence. Further, there is not

any deviation from the ethical code of professional conduct, as applicable to them.

4 | P a g e

Introduction:

The main aim of the assignment is to comment on the audit planning and all the requirements

that the auditor needs to take into consideration. The auditor needs to check the financial

statements and they should be free from all kind of misstatements. In this case the annual report

of WoolWorths company is downloaded to make throw light on important matter that are related

to the auditors in same way or the manner (Alexander, 2016). The main aim is to judge the audit

report and make that there is transparency in that.

Independence requirements

The principle of “independence” basically means that the audit is performed without being

under the undue influence of any party, including the company with which the audit engagement

takes place. The Auditor needs to exercise his own judgment and professional skills in arriving at

a conclusion (Arnott, et al., 2017). The audit opinion is formed on this conclusion and it should

be unbiased.

Analyzing the annual report of Woolworths, we come across the independence declaration given

by the partners of the auditor, Deloitte Touché Tohmatsu. Complying with the provisions of

Section 307C of the Corporations Act 2001, the Auditors expressly declare that there has been no

contravention of the Act with respect to the requirement of independence. Further, there is not

any deviation from the ethical code of professional conduct, as applicable to them.

4 | P a g e

5

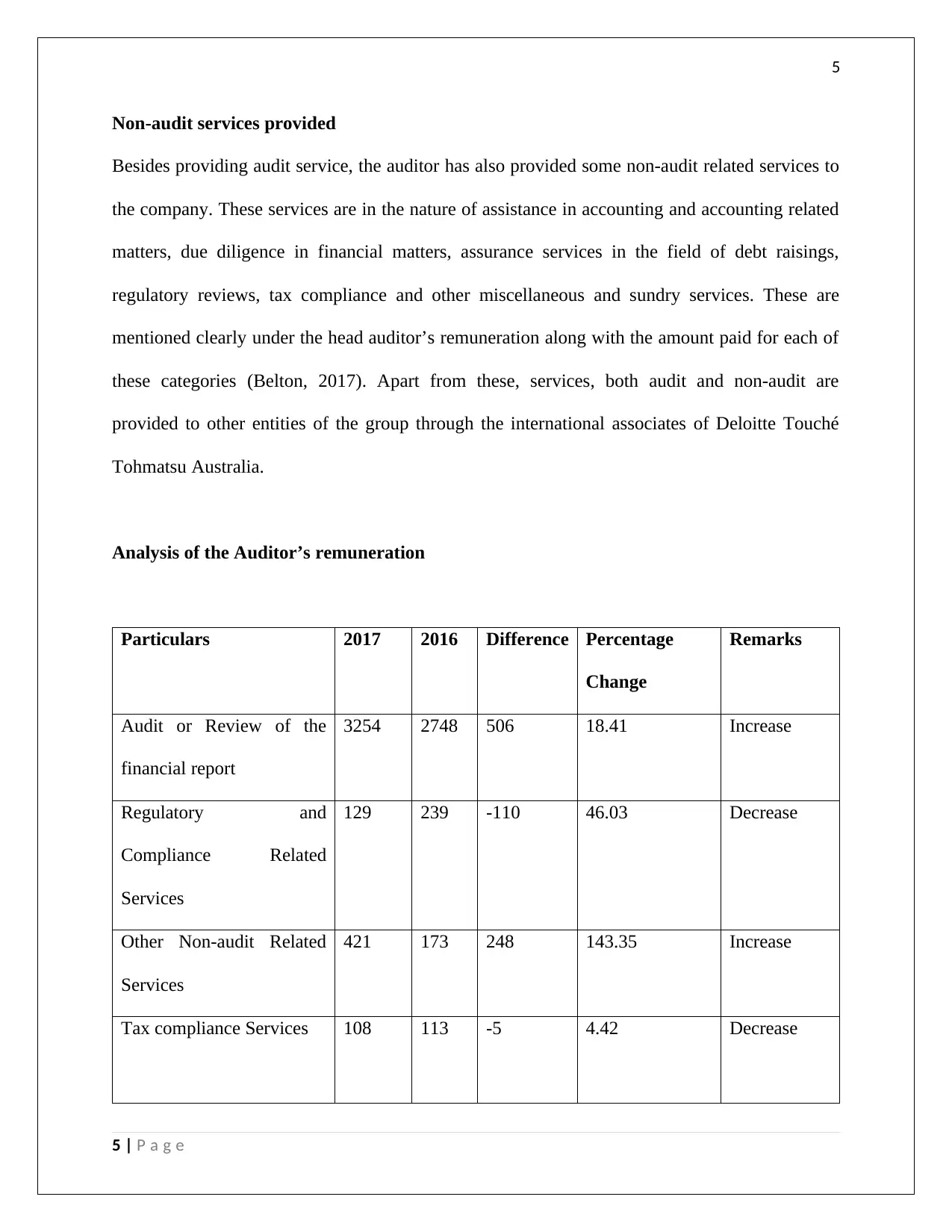

Non-audit services provided

Besides providing audit service, the auditor has also provided some non-audit related services to

the company. These services are in the nature of assistance in accounting and accounting related

matters, due diligence in financial matters, assurance services in the field of debt raisings,

regulatory reviews, tax compliance and other miscellaneous and sundry services. These are

mentioned clearly under the head auditor’s remuneration along with the amount paid for each of

these categories (Belton, 2017). Apart from these, services, both audit and non-audit are

provided to other entities of the group through the international associates of Deloitte Touché

Tohmatsu Australia.

Analysis of the Auditor’s remuneration

Particulars 2017 2016 Difference Percentage

Change

Remarks

Audit or Review of the

financial report

3254 2748 506 18.41 Increase

Regulatory and

Compliance Related

Services

129 239 -110 46.03 Decrease

Other Non-audit Related

Services

421 173 248 143.35 Increase

Tax compliance Services 108 113 -5 4.42 Decrease

5 | P a g e

Non-audit services provided

Besides providing audit service, the auditor has also provided some non-audit related services to

the company. These services are in the nature of assistance in accounting and accounting related

matters, due diligence in financial matters, assurance services in the field of debt raisings,

regulatory reviews, tax compliance and other miscellaneous and sundry services. These are

mentioned clearly under the head auditor’s remuneration along with the amount paid for each of

these categories (Belton, 2017). Apart from these, services, both audit and non-audit are

provided to other entities of the group through the international associates of Deloitte Touché

Tohmatsu Australia.

Analysis of the Auditor’s remuneration

Particulars 2017 2016 Difference Percentage

Change

Remarks

Audit or Review of the

financial report

3254 2748 506 18.41 Increase

Regulatory and

Compliance Related

Services

129 239 -110 46.03 Decrease

Other Non-audit Related

Services

421 173 248 143.35 Increase

Tax compliance Services 108 113 -5 4.42 Decrease

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

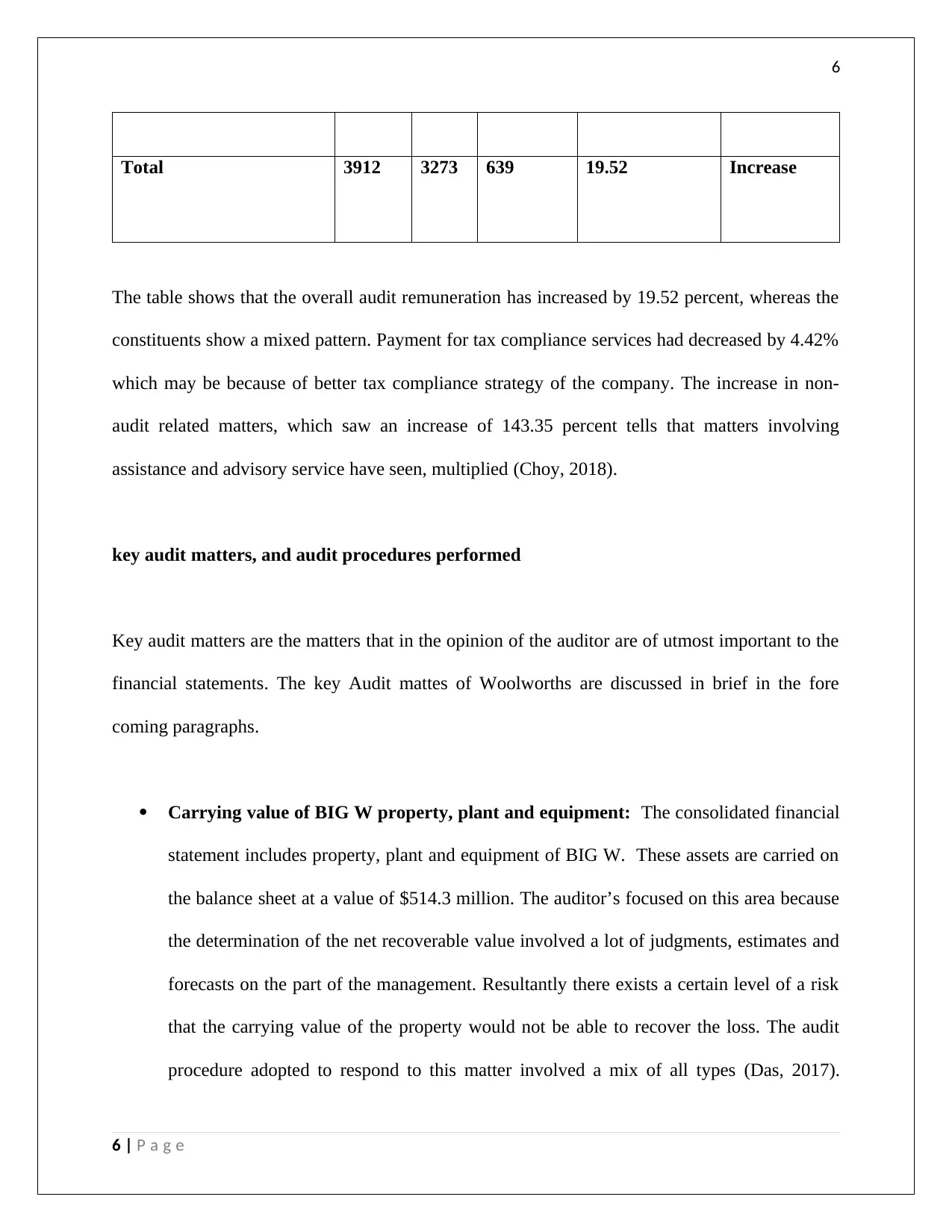

6

Total 3912 3273 639 19.52 Increase

The table shows that the overall audit remuneration has increased by 19.52 percent, whereas the

constituents show a mixed pattern. Payment for tax compliance services had decreased by 4.42%

which may be because of better tax compliance strategy of the company. The increase in non-

audit related matters, which saw an increase of 143.35 percent tells that matters involving

assistance and advisory service have seen, multiplied (Choy, 2018).

key audit matters, and audit procedures performed

Key audit matters are the matters that in the opinion of the auditor are of utmost important to the

financial statements. The key Audit mattes of Woolworths are discussed in brief in the fore

coming paragraphs.

Carrying value of BIG W property, plant and equipment: The consolidated financial

statement includes property, plant and equipment of BIG W. These assets are carried on

the balance sheet at a value of $514.3 million. The auditor’s focused on this area because

the determination of the net recoverable value involved a lot of judgments, estimates and

forecasts on the part of the management. Resultantly there exists a certain level of a risk

that the carrying value of the property would not be able to recover the loss. The audit

procedure adopted to respond to this matter involved a mix of all types (Das, 2017).

6 | P a g e

Total 3912 3273 639 19.52 Increase

The table shows that the overall audit remuneration has increased by 19.52 percent, whereas the

constituents show a mixed pattern. Payment for tax compliance services had decreased by 4.42%

which may be because of better tax compliance strategy of the company. The increase in non-

audit related matters, which saw an increase of 143.35 percent tells that matters involving

assistance and advisory service have seen, multiplied (Choy, 2018).

key audit matters, and audit procedures performed

Key audit matters are the matters that in the opinion of the auditor are of utmost important to the

financial statements. The key Audit mattes of Woolworths are discussed in brief in the fore

coming paragraphs.

Carrying value of BIG W property, plant and equipment: The consolidated financial

statement includes property, plant and equipment of BIG W. These assets are carried on

the balance sheet at a value of $514.3 million. The auditor’s focused on this area because

the determination of the net recoverable value involved a lot of judgments, estimates and

forecasts on the part of the management. Resultantly there exists a certain level of a risk

that the carrying value of the property would not be able to recover the loss. The audit

procedure adopted to respond to this matter involved a mix of all types (Das, 2017).

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Understanding the methodologies involved test of details, whereas evaluating the

Group’s assumption and estimates was analytical in nature. Similarly, verifying the

mathematical accuracy of the cash flow models was a test of balances. Test of controls

was also carried out to understand the assessment of carrying values of the said assets.

Inventory provisioning: the group under consideration follows a policy of carrying

inventory at an amount that is lower of the cost or net realizable value. As disclosed in

the financial statements, the group had inventories amounting to $4,080.4 million. Since

there are a lot of factors like historical trends obsolesce, sales assumptions, the auditor

put emphasis on assessing the fairness of the same (Erik & Jan, 2017). The audit

procedure adopted in this case is primarily test of controls. However, testing the value on

a sample is test of balances. Analytical procedures were adopted to review the historical

accuracy of making provisions.

Accounting for rebates: Owing to the size of its business, the Group receives

considerable amount of incentives, discounts and rebates from its suppliers. The usual

practice of recording these items is to reduce the value of inventory or to lower the cost

of sales. The task of gauging the timing of Recognition of these items is highly intricate.

It requires a thorough understanding of the contracts and agreements between the two

parties and also an accurate source of data. It is because of these reasons that the

accounting of rebates forms a key audit matter (Farmer, 2018).

IT Systems: The IT systems through the Group are multifaceted and there are varying

levels of integration between them. The assessment of the information technology system

therefore forms a vital component of the audit. If we look closely, all the other Ares of

audit are somehow dependent on the IT system (Goldmann, 2016). The audit procedure

7 | P a g e

Understanding the methodologies involved test of details, whereas evaluating the

Group’s assumption and estimates was analytical in nature. Similarly, verifying the

mathematical accuracy of the cash flow models was a test of balances. Test of controls

was also carried out to understand the assessment of carrying values of the said assets.

Inventory provisioning: the group under consideration follows a policy of carrying

inventory at an amount that is lower of the cost or net realizable value. As disclosed in

the financial statements, the group had inventories amounting to $4,080.4 million. Since

there are a lot of factors like historical trends obsolesce, sales assumptions, the auditor

put emphasis on assessing the fairness of the same (Erik & Jan, 2017). The audit

procedure adopted in this case is primarily test of controls. However, testing the value on

a sample is test of balances. Analytical procedures were adopted to review the historical

accuracy of making provisions.

Accounting for rebates: Owing to the size of its business, the Group receives

considerable amount of incentives, discounts and rebates from its suppliers. The usual

practice of recording these items is to reduce the value of inventory or to lower the cost

of sales. The task of gauging the timing of Recognition of these items is highly intricate.

It requires a thorough understanding of the contracts and agreements between the two

parties and also an accurate source of data. It is because of these reasons that the

accounting of rebates forms a key audit matter (Farmer, 2018).

IT Systems: The IT systems through the Group are multifaceted and there are varying

levels of integration between them. The assessment of the information technology system

therefore forms a vital component of the audit. If we look closely, all the other Ares of

audit are somehow dependent on the IT system (Goldmann, 2016). The audit procedure

7 | P a g e

8

involved discussion with the management, at appropriate levels, an understanding the key

financial processes so that the dependence of the process of financial reporting on the IT

system can be established. Testing the design of the Key IT tools was a substantive test of

detail as well as a test of controls.

Audit Committee

Yes, the group does have an audit committee comprising of five members, including the

chairman, Michael Ullmer. All the members of the committee are non-executive directors,

namely, Gordon Cairns, Jillian Broadbent, Siobhan McKenna and Scott Perkins.

The company has a charter for the audit committee which aims to streamline the behavior, roles

and responsibilities, and duties of the members by setting out the actions or behavior that is

expected of them. The main point of the charter is summarized under the following categories.

Objectives: The role of the committee is to assist and advise the Board about the

governance framework that is applicable on the company. The role also includes

recommendation with respect to risk management and internal control systems. Other

areas of assistance include compliance, accounting policies and practices, internal and

external audit functions, and the reporting of financial information (Grenier, 2017).

Authority: Proper Authority is given to the committee to act within the framework

provided by this charter. They are also authorized to have access to the senior

management and the records of the company, without any restrictions being imposed on

them. The Committee is also allowed to have a meeting with the auditors, both external

and internal. This meeting need not be in the presence of a member from the

8 | P a g e

involved discussion with the management, at appropriate levels, an understanding the key

financial processes so that the dependence of the process of financial reporting on the IT

system can be established. Testing the design of the Key IT tools was a substantive test of

detail as well as a test of controls.

Audit Committee

Yes, the group does have an audit committee comprising of five members, including the

chairman, Michael Ullmer. All the members of the committee are non-executive directors,

namely, Gordon Cairns, Jillian Broadbent, Siobhan McKenna and Scott Perkins.

The company has a charter for the audit committee which aims to streamline the behavior, roles

and responsibilities, and duties of the members by setting out the actions or behavior that is

expected of them. The main point of the charter is summarized under the following categories.

Objectives: The role of the committee is to assist and advise the Board about the

governance framework that is applicable on the company. The role also includes

recommendation with respect to risk management and internal control systems. Other

areas of assistance include compliance, accounting policies and practices, internal and

external audit functions, and the reporting of financial information (Grenier, 2017).

Authority: Proper Authority is given to the committee to act within the framework

provided by this charter. They are also authorized to have access to the senior

management and the records of the company, without any restrictions being imposed on

them. The Committee is also allowed to have a meeting with the auditors, both external

and internal. This meeting need not be in the presence of a member from the

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

management. It can also seek professional help from experts and external parties, as and

when required.

Composition: The committee is to be formed by a minimum of three directors.

Independent directors should form the majority of the members. The members should

have the ability to read, understand and analyze the financial statements. They should

possess some expertise from the business world. The Chairman shall be an independent

director, who will be appointed by the Board from the Committee’s members.

Appointments and reappointments to the Committee will be determined by the Board

(Jefferson, 2017). The committee shall not have any executive director.

Responsibilities:

The committee should Evaluate and supervise the crucial corporate policies, including the

Company’s Delegations of Authority.

It should periodically appraise the Company’s corporate governance framework and give

inputs to further strengthen it.

The committee should also recommend to the Board the names of the external auditors

for their selection, appointment and reappointment. It should also have a discussion with

the external auditor regarding the scope of the audit, the audit fees that the auditor wishes

to demand.

The committee shall also serve as a link to synchronize the internal as the external audit

programmers.

It shall also assess the quality and effectiveness of the audit. The committee shall, review

the performance of the auditor on a yearly basis (Kim, et al., 2017).

It shall discuss and resolve the concerns ascending out of the audit report.

9 | P a g e

management. It can also seek professional help from experts and external parties, as and

when required.

Composition: The committee is to be formed by a minimum of three directors.

Independent directors should form the majority of the members. The members should

have the ability to read, understand and analyze the financial statements. They should

possess some expertise from the business world. The Chairman shall be an independent

director, who will be appointed by the Board from the Committee’s members.

Appointments and reappointments to the Committee will be determined by the Board

(Jefferson, 2017). The committee shall not have any executive director.

Responsibilities:

The committee should Evaluate and supervise the crucial corporate policies, including the

Company’s Delegations of Authority.

It should periodically appraise the Company’s corporate governance framework and give

inputs to further strengthen it.

The committee should also recommend to the Board the names of the external auditors

for their selection, appointment and reappointment. It should also have a discussion with

the external auditor regarding the scope of the audit, the audit fees that the auditor wishes

to demand.

The committee shall also serve as a link to synchronize the internal as the external audit

programmers.

It shall also assess the quality and effectiveness of the audit. The committee shall, review

the performance of the auditor on a yearly basis (Kim, et al., 2017).

It shall discuss and resolve the concerns ascending out of the audit report.

9 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

It shall also review the capability of the policies to anticipate and perceive risks.

Other areas of responsibilities are transactions with the related parties, continuous

discloser and internal audit (Charter Audit, Risk Management and Compliance

Committee, 2015).

Audit Opinion

According to the audit opinion, the financial statements and prepared and presented in a way that

represents a true and fair view of the affairs of the group. The financial report also obeys with the

Australian Accounting Standards and the Corporations Regulations 2001.

Directors’ and Management’s responsibilities

Directors’ and Management’s responsibilities

It is the responsibility of the management of the company to make sure that the books of the

company are prepared in such a manner that it gives a true and fair view and it is free from any

kind of misstatements. To prepare this report by adhering to the

Australian Accounting Standards and the Corporations Act 2001 is also the responsibility of the

directors. The directors need to make sure that proper internal controls of the company are in

place and the management is able to take care of that.

It is important that auditor should access the going concern ability of the firm. (Sithole, et al.,

2017).

Auditor’s Responsibilities

10 | P a g e

It shall also review the capability of the policies to anticipate and perceive risks.

Other areas of responsibilities are transactions with the related parties, continuous

discloser and internal audit (Charter Audit, Risk Management and Compliance

Committee, 2015).

Audit Opinion

According to the audit opinion, the financial statements and prepared and presented in a way that

represents a true and fair view of the affairs of the group. The financial report also obeys with the

Australian Accounting Standards and the Corporations Regulations 2001.

Directors’ and Management’s responsibilities

Directors’ and Management’s responsibilities

It is the responsibility of the management of the company to make sure that the books of the

company are prepared in such a manner that it gives a true and fair view and it is free from any

kind of misstatements. To prepare this report by adhering to the

Australian Accounting Standards and the Corporations Act 2001 is also the responsibility of the

directors. The directors need to make sure that proper internal controls of the company are in

place and the management is able to take care of that.

It is important that auditor should access the going concern ability of the firm. (Sithole, et al.,

2017).

Auditor’s Responsibilities

10 | P a g e

11

The responsibility of the auditor is restricted to expressing an opinion on the financial reports,

after obtaining reasonable assurance that the reports reflect a true and fair view. The auditor’s

objectives is to obtain conclusive evidence that the financial report is not containing any

falsification of information. It is to be understood here that reasonable assurance is not a

guarantee; it is only an opinion which has been given after exercising professional skepticism

and judgment (Trieu, 2017).

Material subsequent events

The following events took place subsequent to year end in relation to the exit of the company

from Home Improvement Events.

The Company entered into a Share Sale Agreement (SSA) with Home Consortium

whereby it agreed t to sell its 66.7% share of Hydrox. The SSA included various freehold

trading sites, leasehold sites, and Woolworth was responsile for these master sites.

Further, Lowe’s shares in Hydrox were traded to a Trust on 4 August 2017; Home

Consortium was the beneficiary to this trust. The shares were sold for a consideration

$250.8 million, as agreed by the two parties. The JVA has been subsequently terminated.

Huge Capital losses after the balance sheet date were a consequence of the decision to sell

Hydrox. After the transaction with the Home Consortium becomes complete, it is estimated that

the capital losses would amount to $1.8 billion. It is believed that there will be adequate capital

gains available in the near future, against which these capital losses would eventually be

adjusted. Therefore the group has not recognized any deferred tax asset in its books (Annual

Report 2017, 2017).

11 | P a g e

The responsibility of the auditor is restricted to expressing an opinion on the financial reports,

after obtaining reasonable assurance that the reports reflect a true and fair view. The auditor’s

objectives is to obtain conclusive evidence that the financial report is not containing any

falsification of information. It is to be understood here that reasonable assurance is not a

guarantee; it is only an opinion which has been given after exercising professional skepticism

and judgment (Trieu, 2017).

Material subsequent events

The following events took place subsequent to year end in relation to the exit of the company

from Home Improvement Events.

The Company entered into a Share Sale Agreement (SSA) with Home Consortium

whereby it agreed t to sell its 66.7% share of Hydrox. The SSA included various freehold

trading sites, leasehold sites, and Woolworth was responsile for these master sites.

Further, Lowe’s shares in Hydrox were traded to a Trust on 4 August 2017; Home

Consortium was the beneficiary to this trust. The shares were sold for a consideration

$250.8 million, as agreed by the two parties. The JVA has been subsequently terminated.

Huge Capital losses after the balance sheet date were a consequence of the decision to sell

Hydrox. After the transaction with the Home Consortium becomes complete, it is estimated that

the capital losses would amount to $1.8 billion. It is believed that there will be adequate capital

gains available in the near future, against which these capital losses would eventually be

adjusted. Therefore the group has not recognized any deferred tax asset in its books (Annual

Report 2017, 2017).

11 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.