FIN301: Management Accounting Report for Ensoft Technologies

VerifiedAdded on 2020/07/23

|16

|4441

|32

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices within Ensoft Technologies, a software company. It explores various types of management accounting, including inventory management, job costing, profit optimization, and cost accounting systems. The report delves into different accounting methods like inventory, accounts receivable, accounts payable, performance, and budget reporting. It further examines the use of marginal and absorption costing, highlighting their differences and applications. The report also assesses the advantages and disadvantages of planning tools for budgetary control and how organizations like Ensoft are adapting management accounting to address financial challenges. The report concludes with an overview of the key findings and recommendations for improved financial decision-making within the company. This report is a valuable resource for students seeking to understand financial reporting and cost analysis.

NEW ORDER 1X

MANAGEMENT

ACCOUNTING

MANAGEMENT

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Various kind of management accounting and its requirement...............................................3

P2 Different Method that help in accounting report...................................................................4

TASK 2 ...........................................................................................................................................6

P3 Use of marginal and absorption cost......................................................................................6

TASK 3..........................................................................................................................................10

P4 Advantages and Disadvantages of various planning tools for budgetary control................10

TASK 4 .........................................................................................................................................11

P5 How organisation are adopting management accounting system to respond with financial

problem.....................................................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Various kind of management accounting and its requirement...............................................3

P2 Different Method that help in accounting report...................................................................4

TASK 2 ...........................................................................................................................................6

P3 Use of marginal and absorption cost......................................................................................6

TASK 3..........................................................................................................................................10

P4 Advantages and Disadvantages of various planning tools for budgetary control................10

TASK 4 .........................................................................................................................................11

P5 How organisation are adopting management accounting system to respond with financial

problem.....................................................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

From: Management Accountant

To: General Manager

Subject: Report will help in making better decision in organisation related to finance part

according to market scenario.

To: General Manager

Subject: Report will help in making better decision in organisation related to finance part

according to market scenario.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In today's world scenario, finance is something which is an essential part of organisation

and help in making a proper decision which does also records different thing like financial and

non financial thing and this is something that aid to have a investment criteria in effective way

(Albelda, 2011). Even technology and innovation with creativity make firm to call up for

effectiveness in their accounting system, although it is also required to maintain their records in

great way and in at one place as well. The report is based on Ensoft technologies which is a

software company and thus try to keep world connected. Assignment will include different thing

like it will use different method of accounting and comparison in between two company which

solve the problem of firm in better manner. Moreover it will also include appropriate technique

which help in producing a income statement of company.

TASK 1

P1 Various kind of management accounting and its requirement.

Management accounting is such which help in collecting information related to raw

material, sales data etc. and such this is being converted and transformed data and it can be used

in organisation for their purposes. This also help in gathering information related to operational

cost and compares with budget expense with the actual criteria. Therefore management

accounting is that which help top executives of company to make proper decision and strategy or

organisation. Different kind of management accounting are as:

Inventory management system: In organisation like ENSOFT has various policies and

procedure which help them to have an control on various thing and although this is continuous

process and also direct to take effective decision related to investment of money. Normally, a

initial form of issues they face like over stock and under stock too (Arroyo, 2012). Moreover,

there are various software which help in solving such problem and some of those are as

(Tracking software, bar code reader and EOQ) these are some methods which provide solution to

over stock and under stock issues in effective way and make company to perform in better

manner as well. Hence, this is that which help to have proper accounting and produces policy

which reduce the consequences of those in company.

Job costing system: In organisation, it is there that in company there are many jobs

which help to earn higher profit and thus also increases various cost in organisation too.

In today's world scenario, finance is something which is an essential part of organisation

and help in making a proper decision which does also records different thing like financial and

non financial thing and this is something that aid to have a investment criteria in effective way

(Albelda, 2011). Even technology and innovation with creativity make firm to call up for

effectiveness in their accounting system, although it is also required to maintain their records in

great way and in at one place as well. The report is based on Ensoft technologies which is a

software company and thus try to keep world connected. Assignment will include different thing

like it will use different method of accounting and comparison in between two company which

solve the problem of firm in better manner. Moreover it will also include appropriate technique

which help in producing a income statement of company.

TASK 1

P1 Various kind of management accounting and its requirement.

Management accounting is such which help in collecting information related to raw

material, sales data etc. and such this is being converted and transformed data and it can be used

in organisation for their purposes. This also help in gathering information related to operational

cost and compares with budget expense with the actual criteria. Therefore management

accounting is that which help top executives of company to make proper decision and strategy or

organisation. Different kind of management accounting are as:

Inventory management system: In organisation like ENSOFT has various policies and

procedure which help them to have an control on various thing and although this is continuous

process and also direct to take effective decision related to investment of money. Normally, a

initial form of issues they face like over stock and under stock too (Arroyo, 2012). Moreover,

there are various software which help in solving such problem and some of those are as

(Tracking software, bar code reader and EOQ) these are some methods which provide solution to

over stock and under stock issues in effective way and make company to perform in better

manner as well. Hence, this is that which help to have proper accounting and produces policy

which reduce the consequences of those in company.

Job costing system: In organisation, it is there that in company there are many jobs

which help to earn higher profit and thus also increases various cost in organisation too.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Moreover, for such the firm has to determine the jobs which increase cost and making them to

loose different thing and identifying and working hard over such can help them to attain their

goals and objective. Normally, entity work hard to satisfy their customer with their product and

services but in such case the ENSOFT does provide proper services to customers and make them

existing consumer for long.

Profit Optimization system: Price of services should be kept at reasonable as because

this is such factor which attract and make millions of people to buy their services and if the

prices are made up high then generally people use to ignore the company and their services too

(Becker, Messner and Schäffer, 2010). Price optimization does help to make firm to earn higher

profits and such system is that which does help in financial accounting of company.

Cost accounting system: This is something which help in calculating cost which is

related to in performing every function of firm whether it is profitability, inventory and control

etc. which can be seen in great manner. Moreover, it also help in reduction expenses and this

help in taking right and accurate actions in organisation and although it is being used to minimise

wastage of resources in proper manner. It also reduce the labour and material cost too which is

part of minimising the expenses.

Therefore, these different type of management accounting help organisation to manage

their working in right direction and make firm to earn higher profits in effective way. These

accounting system are required in every enterprise not only in ENSOFT as because finance is

that which is a part of each and every entity.

P2 Different Method that help in accounting report.

Account reporting is that which also need to organisation like ENSOFT technologies Ltd.

Moreover report is that which help in effective decision of firm and also make strategy in entity

which lead to have a earning of higher productivity and profit both at a same time (Bennett,

Schaltegger and Zvezdov, 2013). It also make enterprise to complete their working on time and

in proper manner too. Normally the method for accounting is be like:

Inventory reporting: Inventory reporting in organisation help to have a control and

information about the warehouses and product with services are available or not. This is

something which help in minimising the chance of under and over stock in organisation in great

manner and thus it is required to have improvement in inventory control.

loose different thing and identifying and working hard over such can help them to attain their

goals and objective. Normally, entity work hard to satisfy their customer with their product and

services but in such case the ENSOFT does provide proper services to customers and make them

existing consumer for long.

Profit Optimization system: Price of services should be kept at reasonable as because

this is such factor which attract and make millions of people to buy their services and if the

prices are made up high then generally people use to ignore the company and their services too

(Becker, Messner and Schäffer, 2010). Price optimization does help to make firm to earn higher

profits and such system is that which does help in financial accounting of company.

Cost accounting system: This is something which help in calculating cost which is

related to in performing every function of firm whether it is profitability, inventory and control

etc. which can be seen in great manner. Moreover, it also help in reduction expenses and this

help in taking right and accurate actions in organisation and although it is being used to minimise

wastage of resources in proper manner. It also reduce the labour and material cost too which is

part of minimising the expenses.

Therefore, these different type of management accounting help organisation to manage

their working in right direction and make firm to earn higher profits in effective way. These

accounting system are required in every enterprise not only in ENSOFT as because finance is

that which is a part of each and every entity.

P2 Different Method that help in accounting report.

Account reporting is that which also need to organisation like ENSOFT technologies Ltd.

Moreover report is that which help in effective decision of firm and also make strategy in entity

which lead to have a earning of higher productivity and profit both at a same time (Bennett,

Schaltegger and Zvezdov, 2013). It also make enterprise to complete their working on time and

in proper manner too. Normally the method for accounting is be like:

Inventory reporting: Inventory reporting in organisation help to have a control and

information about the warehouses and product with services are available or not. This is

something which help in minimising the chance of under and over stock in organisation in great

manner and thus it is required to have improvement in inventory control.

Application: Therefore, Inventory reporting system is quite required scenario in organisation a

this can help ENSOFT technologies to have information about the availability of product and

services and to satisfy their customer with timely available of items and services.

Account receivable Reporting: This kind of reporting in company is such which help to

collect information as from whom the amount has to be received and how much, such system

provide every information as when the money was taken and when to receive every data is being

there on that system, this is something which help to ignore the consequences in organisation

related to money (Bodie, 2013).

Application: It is required to have this reporting method as this help company to receive

information related to there creditor and it can be save data on basis of weekly, monthly,

quarterly as well. Although better policy and procedure in organisation should have a better

working scenario.

Account payable reporting: It is being considered as opposite of account receivable

reporting and thus it include the information related to whom the money has to be paid and this is

something which help in effective relation and it is quite in between the firm (Parker, 2012).

Application: The company ENSOFT is such firm in which information related to supplier has to

be kept and thus if payment is made on time then the goodwill of company can be there in

market and this is something which also make to have a healthy relation in most important ways.

Performance reporting: It is such which is not only used by large companies even this

is also used by small company like ENSOFT technology Ltd. This reporting is such which help

to identify the performance and productivity of employees and thus it is required to make

corrective action in organisation, goal and objective is such which has to be attained. Although it

is required to help business to determine the pitfalls and consequences as well.

Application: Performance reporting is that which should be there in organisation as thus it help

them to have an effective working by motivating employees and also making them to improve

the performances as well.

Budget Reporting: This is very much useful concept in organisation as because with this

a company can come to know that which department is taking maximum fund and money.

Budget is such which help in dividing the fund and money in proper manner (Boyns and

Edwards, 2013). It is required to use money in right context as this help in reducing the expenses

in organisation.

this can help ENSOFT technologies to have information about the availability of product and

services and to satisfy their customer with timely available of items and services.

Account receivable Reporting: This kind of reporting in company is such which help to

collect information as from whom the amount has to be received and how much, such system

provide every information as when the money was taken and when to receive every data is being

there on that system, this is something which help to ignore the consequences in organisation

related to money (Bodie, 2013).

Application: It is required to have this reporting method as this help company to receive

information related to there creditor and it can be save data on basis of weekly, monthly,

quarterly as well. Although better policy and procedure in organisation should have a better

working scenario.

Account payable reporting: It is being considered as opposite of account receivable

reporting and thus it include the information related to whom the money has to be paid and this is

something which help in effective relation and it is quite in between the firm (Parker, 2012).

Application: The company ENSOFT is such firm in which information related to supplier has to

be kept and thus if payment is made on time then the goodwill of company can be there in

market and this is something which also make to have a healthy relation in most important ways.

Performance reporting: It is such which is not only used by large companies even this

is also used by small company like ENSOFT technology Ltd. This reporting is such which help

to identify the performance and productivity of employees and thus it is required to make

corrective action in organisation, goal and objective is such which has to be attained. Although it

is required to help business to determine the pitfalls and consequences as well.

Application: Performance reporting is that which should be there in organisation as thus it help

them to have an effective working by motivating employees and also making them to improve

the performances as well.

Budget Reporting: This is very much useful concept in organisation as because with this

a company can come to know that which department is taking maximum fund and money.

Budget is such which help in dividing the fund and money in proper manner (Boyns and

Edwards, 2013). It is required to use money in right context as this help in reducing the expenses

in organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Application: ENSOFT technology Ltd is company who is working at small level and thus in such

situation too it is required to divide the funds available with them so that they can make a better

income statement in the end of their accounting session. Moreover, this also help in making a

effective decision too.

TASK 2

P3 Use of marginal and absorption cost.

Cost:- It is that which generally occur when a amount of investment is made in

manufacturing or producing product and services in effective manner. Cost is a kind of expense

which made by firms to raise their profit in proper way.

Absorption Cost: Absorption Costing is method which also include expenses with al

cost related with manufacturing product and services and it is something that generally accept

accounting principle (GAAP). Moreover, it also include the direct cost which is somewhere

associated with producing a services with wages for workers. Although cost is such which

include the direct costing in producing at cost base (DRURY, 2013). Hence, in this all the fixed

and variable cost to have cost centres, where such also account to absorption cost rates.

Moreover, thus method which check that every incurred costs are also being recovered with

selling price of product and service.

Marginal Cost: Marginal cost is such which is a additional cost in manufacturing of any

one more unit in effective way of product and services. This is something which is being derived

from the cost of production and thus fixed cost does not changes with output, although no

additional cost is required to have fixed cost which is being incurred and thus it is be like

producing another unit of goods and services while once the production scenario is being started

too (Harris and Durden, 2012). Moreover, purpose is something which also analyse the marginal

economies of scale which determine the different thing in organisation which also have

economies of scale.

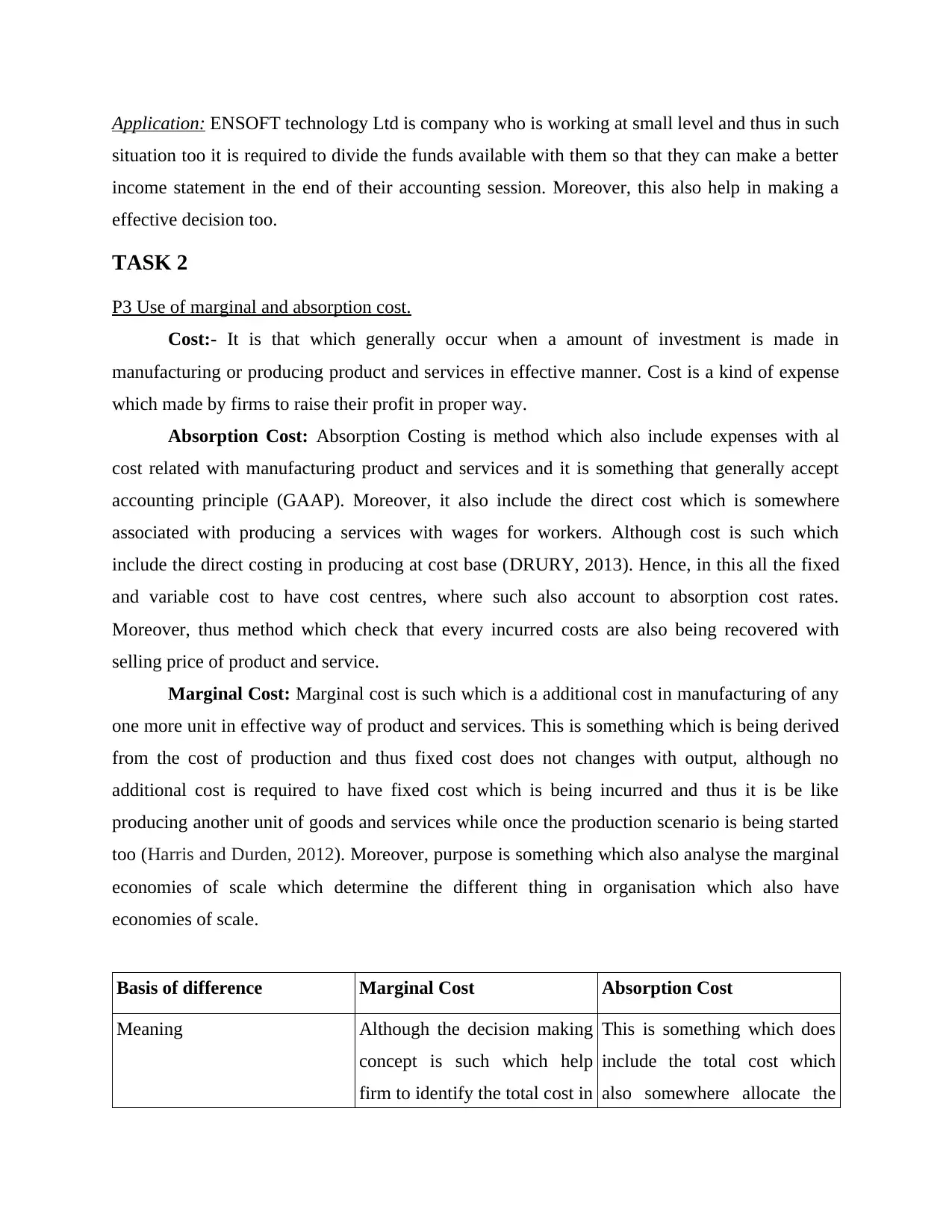

Basis of difference Marginal Cost Absorption Cost

Meaning Although the decision making

concept is such which help

firm to identify the total cost in

This is something which does

include the total cost which

also somewhere allocate the

situation too it is required to divide the funds available with them so that they can make a better

income statement in the end of their accounting session. Moreover, this also help in making a

effective decision too.

TASK 2

P3 Use of marginal and absorption cost.

Cost:- It is that which generally occur when a amount of investment is made in

manufacturing or producing product and services in effective manner. Cost is a kind of expense

which made by firms to raise their profit in proper way.

Absorption Cost: Absorption Costing is method which also include expenses with al

cost related with manufacturing product and services and it is something that generally accept

accounting principle (GAAP). Moreover, it also include the direct cost which is somewhere

associated with producing a services with wages for workers. Although cost is such which

include the direct costing in producing at cost base (DRURY, 2013). Hence, in this all the fixed

and variable cost to have cost centres, where such also account to absorption cost rates.

Moreover, thus method which check that every incurred costs are also being recovered with

selling price of product and service.

Marginal Cost: Marginal cost is such which is a additional cost in manufacturing of any

one more unit in effective way of product and services. This is something which is being derived

from the cost of production and thus fixed cost does not changes with output, although no

additional cost is required to have fixed cost which is being incurred and thus it is be like

producing another unit of goods and services while once the production scenario is being started

too (Harris and Durden, 2012). Moreover, purpose is something which also analyse the marginal

economies of scale which determine the different thing in organisation which also have

economies of scale.

Basis of difference Marginal Cost Absorption Cost

Meaning Although the decision making

concept is such which help

firm to identify the total cost in

This is something which does

include the total cost which

also somewhere allocate the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

manufacturing the product and

service as this is known as

marginal cost.

cost centres and it is also used

to determine the total cost of

production, although it is

known as absorption cost of

companies as well.

Overheads Marginal costing is that which

does include the fixed and

variable cost.

Distribution selling and

administration is such which is

being included in this only too.

Highlights In this the contribution is that

which was done on the basis of

per unit too.

In this, the net profit is that

which is being used on the

basis of per unit too.

Profitability It is related with measurement

to have a profit volume ratio in

concept too.

Moreover, different thing like

fixed cost is also include and it

also gets affected with this

everything can be done.

Cost Data This is something which is

being presented with the

contribution and made on with

every product as well.

Although, it is being used to

have a conventional thing in

perfect as well too.

Cost reduction Variable is that cost in which

product is something and it is

being considered with fixed

cost and to known with period

cost too.

Moreover, this cost is that

which totally different from

marginal and variable cost

with considered as product

cost.

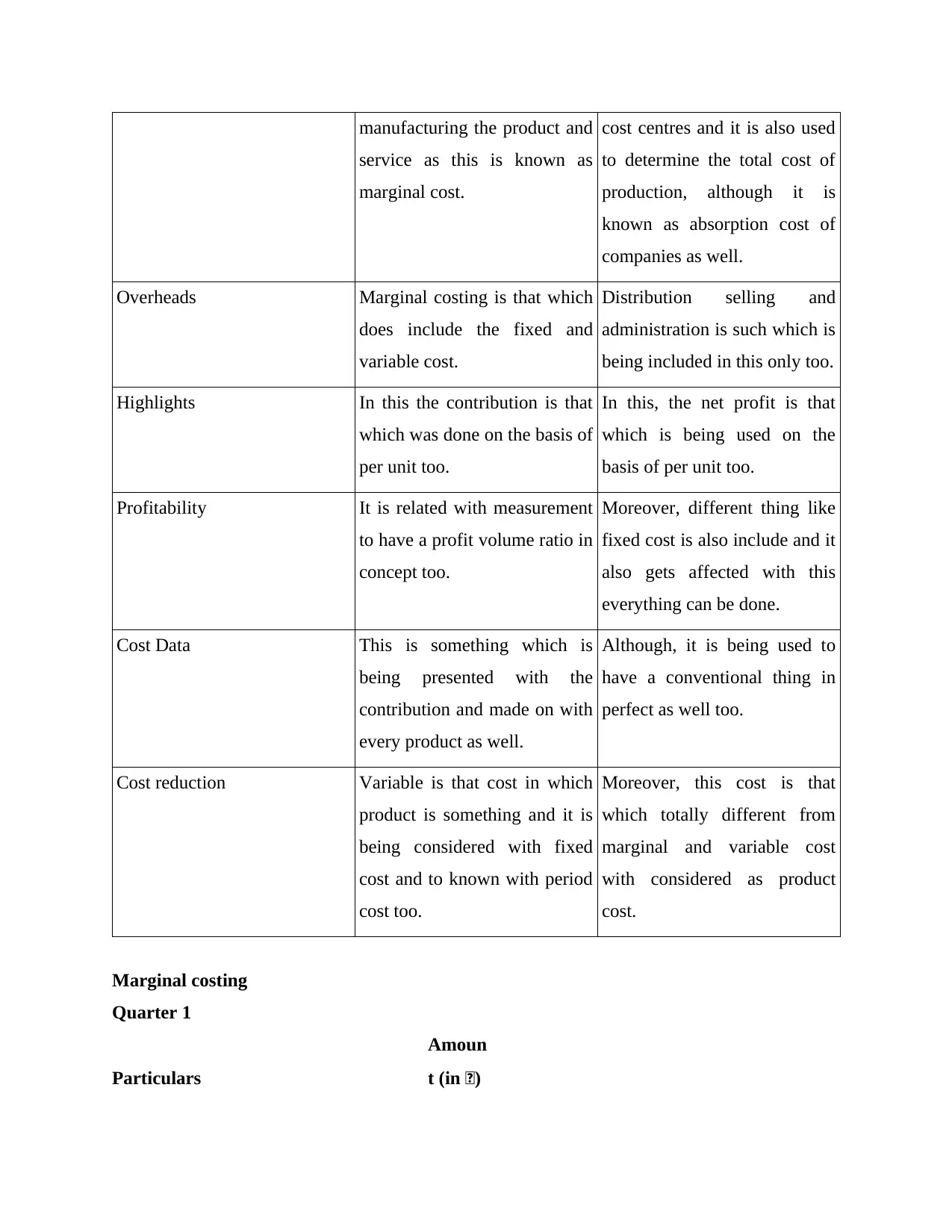

Marginal costing

Quarter 1

Particulars

Amoun

t (in £)

service as this is known as

marginal cost.

cost centres and it is also used

to determine the total cost of

production, although it is

known as absorption cost of

companies as well.

Overheads Marginal costing is that which

does include the fixed and

variable cost.

Distribution selling and

administration is such which is

being included in this only too.

Highlights In this the contribution is that

which was done on the basis of

per unit too.

In this, the net profit is that

which is being used on the

basis of per unit too.

Profitability It is related with measurement

to have a profit volume ratio in

concept too.

Moreover, different thing like

fixed cost is also include and it

also gets affected with this

everything can be done.

Cost Data This is something which is

being presented with the

contribution and made on with

every product as well.

Although, it is being used to

have a conventional thing in

perfect as well too.

Cost reduction Variable is that cost in which

product is something and it is

being considered with fixed

cost and to known with period

cost too.

Moreover, this cost is that

which totally different from

marginal and variable cost

with considered as product

cost.

Marginal costing

Quarter 1

Particulars

Amoun

t (in £)

Sales 66000

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Less: Closing stock

(12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 1900

Quarter- 2

Particulars

Amoun

t (in £)

Sales 74000

Less: Cost of sales

Opening inventory

(12000*0.65) 7800

production cost (66000*0.65) 42900

Less: Closing stock

(4000*0.65) 2600

48100

Contribution 25900

Less:

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Less: Closing stock

(12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 1900

Quarter- 2

Particulars

Amoun

t (in £)

Sales 74000

Less: Cost of sales

Opening inventory

(12000*0.65) 7800

production cost (66000*0.65) 42900

Less: Closing stock

(4000*0.65) 2600

48100

Contribution 25900

Less:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit 4700

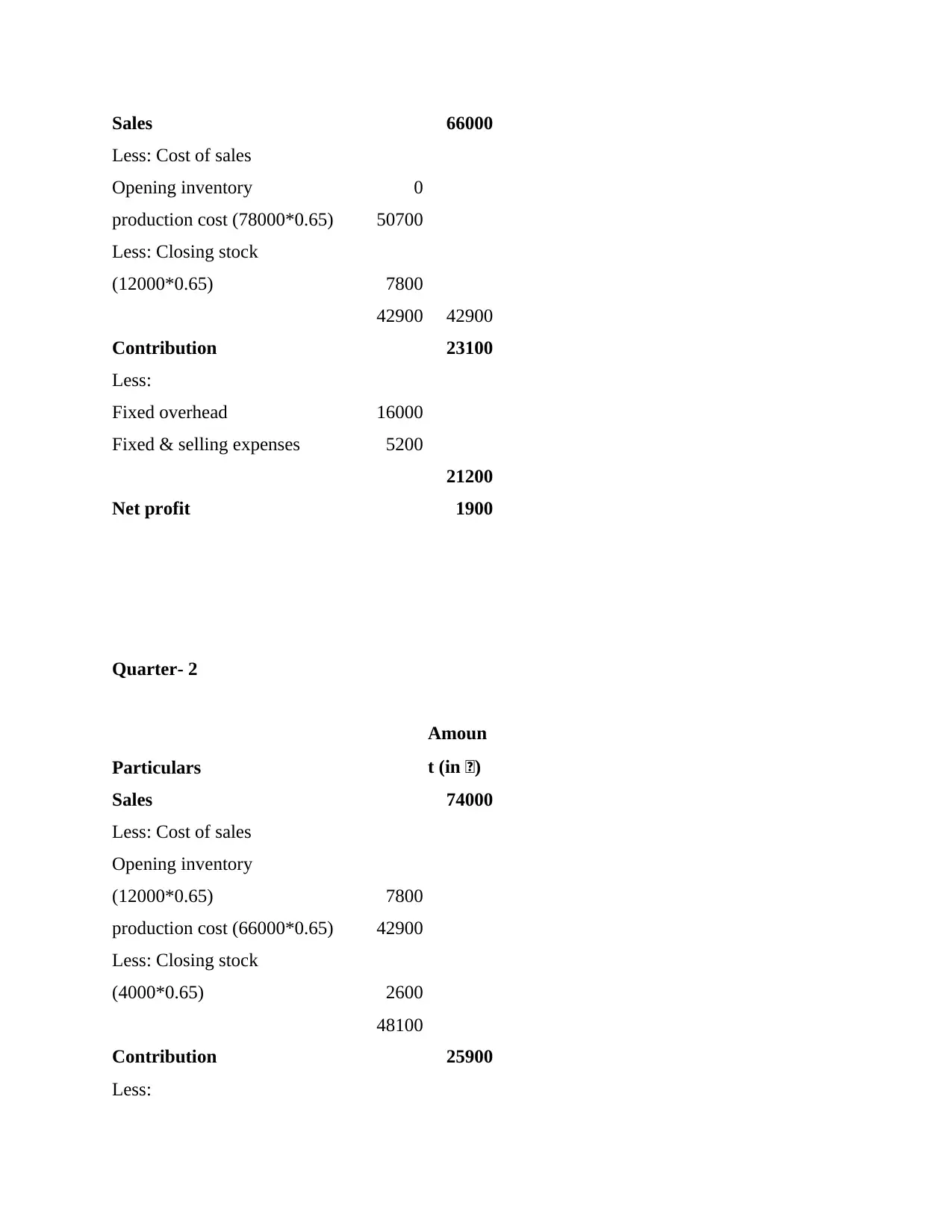

Working note Q1 Q2

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

Absorption costing for Quarter 1:

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

production cost (78000*0.65) 50700 0

Semi-variable (78000*0.20) 15600

Total Variable cost 66300

Less: Closing stock 10200

56100

Gross profit 9900

Less: -400

9500

Selling and distribution as fixed 5200

Net Profit 4300

Fixed & selling expenses 5200

21200

Net profit 4700

Working note Q1 Q2

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

Absorption costing for Quarter 1:

Particulars

Amount (in

£)

Sales 66000

Less: Cost of sales

production cost (78000*0.65) 50700 0

Semi-variable (78000*0.20) 15600

Total Variable cost 66300

Less: Closing stock 10200

56100

Gross profit 9900

Less: -400

9500

Selling and distribution as fixed 5200

Net Profit 4300

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

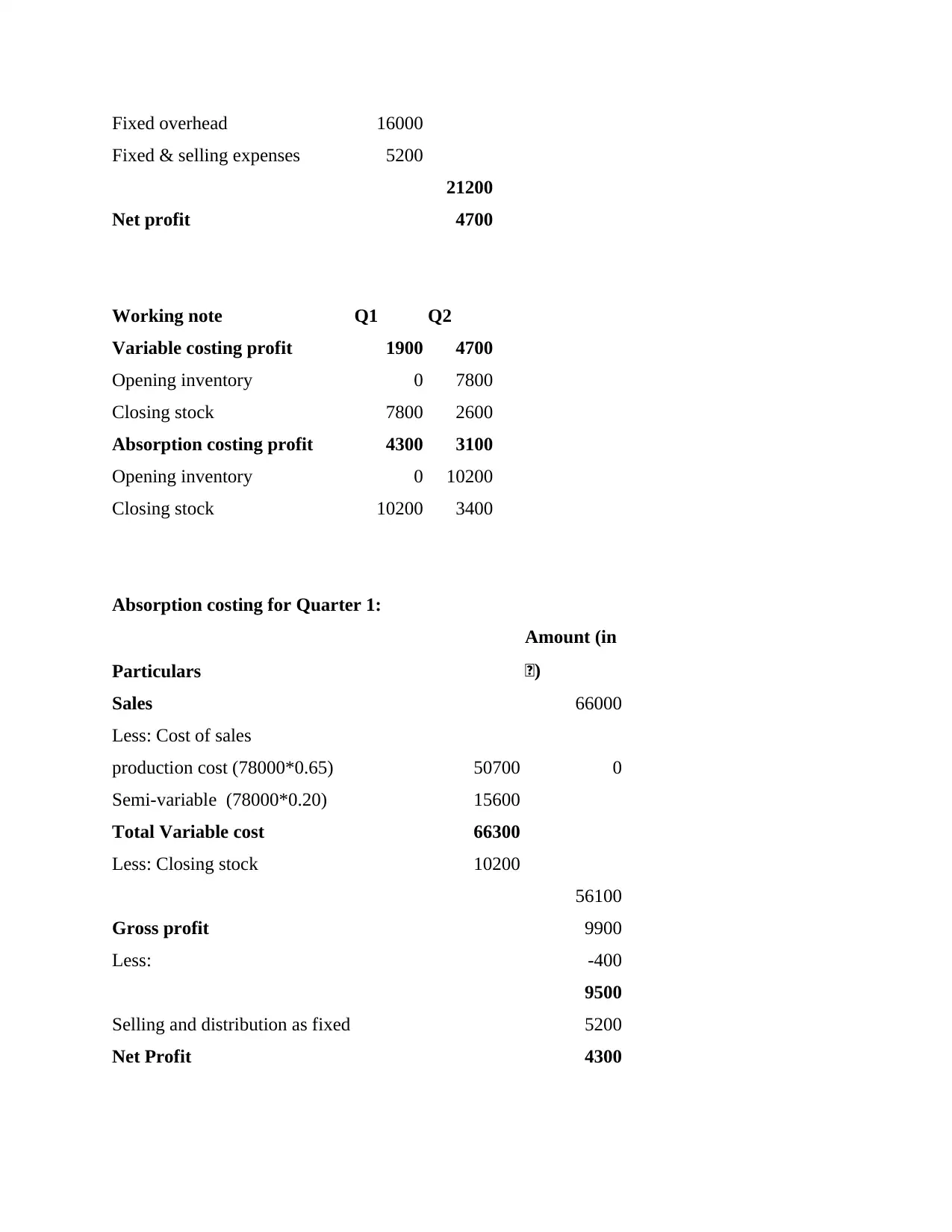

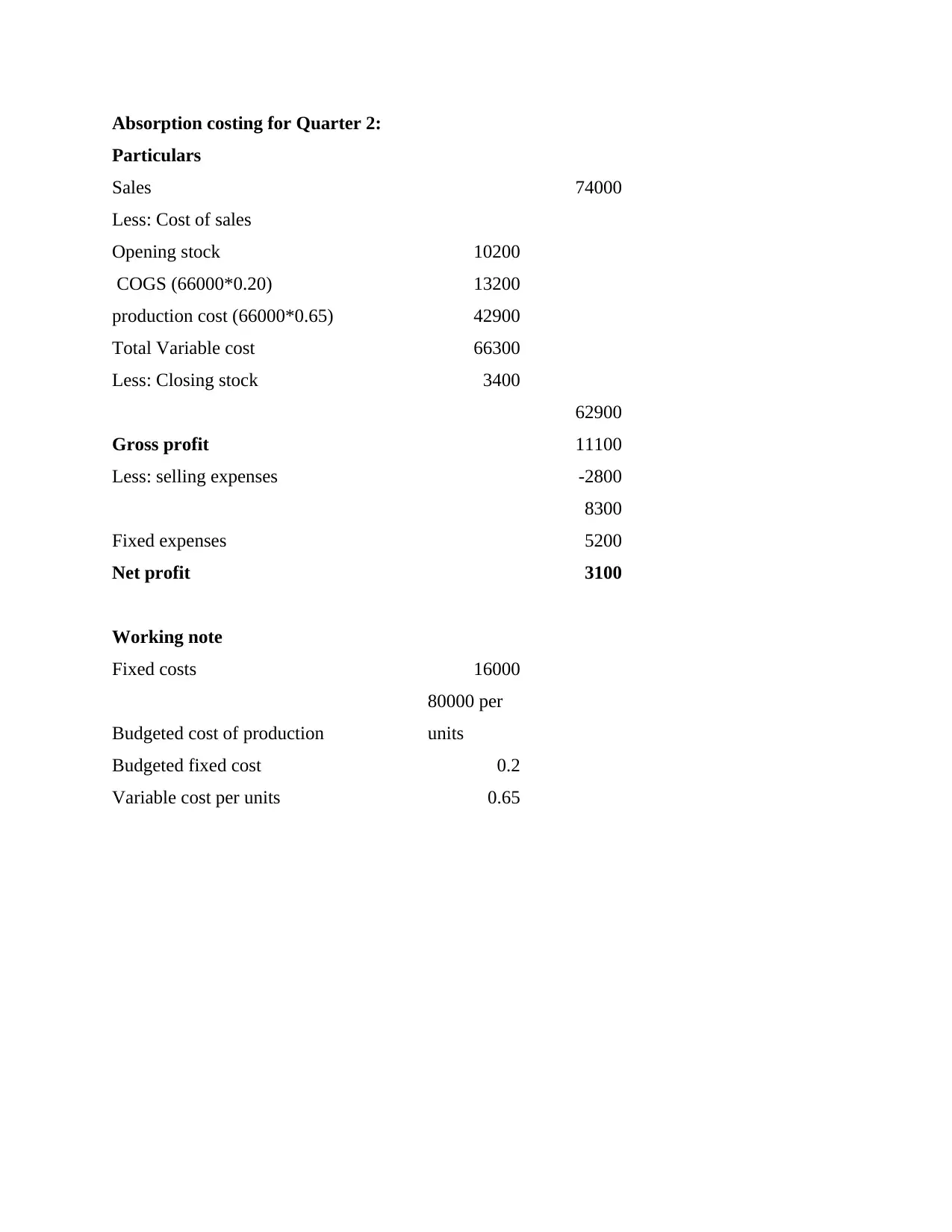

Absorption costing for Quarter 2:

Particulars

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*0.20) 13200

production cost (66000*0.65) 42900

Total Variable cost 66300

Less: Closing stock 3400

62900

Gross profit 11100

Less: selling expenses -2800

8300

Fixed expenses 5200

Net profit 3100

Working note

Fixed costs 16000

Budgeted cost of production

80000 per

units

Budgeted fixed cost 0.2

Variable cost per units 0.65

Particulars

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*0.20) 13200

production cost (66000*0.65) 42900

Total Variable cost 66300

Less: Closing stock 3400

62900

Gross profit 11100

Less: selling expenses -2800

8300

Fixed expenses 5200

Net profit 3100

Working note

Fixed costs 16000

Budgeted cost of production

80000 per

units

Budgeted fixed cost 0.2

Variable cost per units 0.65

TASK 3

P4 Advantages and Disadvantages of various planning tools for budgetary control.

Budget: Budget should be in a better document and thus which does consider the various

accurate fact and figure of research. This is such which is considered as a broad scenario for the

operational department and thus it is being included in capital investment (Herzig and et. al.

2012). For instance, planned sales and income is something which is engaged in producing and

product and service with cost and expense etc. which is almost involved in producing goods and

services in great manner.

Budget Control: Even this method is such which is very much useful for the

management as this is responsible for carrying out the various things in organisation and some of

those are as (planning, cooperation and having assessment as well), although such criteria is

being linked with various thing and some of those are as:

Recommendation for managers: Moreover, it was required to have essential head with

having information and thus it is necessary with appropriate manner and either to have

particular data which is making them to handle the cost.

Implement the effective suggestion: Feedback is like that help company to save

themselves from the losses which will occur in near future and it will make them to take

corrective action as well (Otley and Emmanuel, 2013). Planning tools:- It is required to identify the target of entity and thus future direction can

be there which can help in earning attained goals and objective as well.

◦ Forecasting tool:- Based on practical assumption and it is required to have

encouragement by management skills with learning and to have effective decision

making.

▪ Advantages: Moreover, it is something which require to have identification of

goals, although which is being determining actual amount of cost with sales and

this is something according to time period too.

▪ Disadvantages: Absence of different thing is there which should have different

expense with using used to incurred and also has to have accurate time period. If

expenses is something more then total cost then it can be said that it will affect the

company goals.

P4 Advantages and Disadvantages of various planning tools for budgetary control.

Budget: Budget should be in a better document and thus which does consider the various

accurate fact and figure of research. This is such which is considered as a broad scenario for the

operational department and thus it is being included in capital investment (Herzig and et. al.

2012). For instance, planned sales and income is something which is engaged in producing and

product and service with cost and expense etc. which is almost involved in producing goods and

services in great manner.

Budget Control: Even this method is such which is very much useful for the

management as this is responsible for carrying out the various things in organisation and some of

those are as (planning, cooperation and having assessment as well), although such criteria is

being linked with various thing and some of those are as:

Recommendation for managers: Moreover, it was required to have essential head with

having information and thus it is necessary with appropriate manner and either to have

particular data which is making them to handle the cost.

Implement the effective suggestion: Feedback is like that help company to save

themselves from the losses which will occur in near future and it will make them to take

corrective action as well (Otley and Emmanuel, 2013). Planning tools:- It is required to identify the target of entity and thus future direction can

be there which can help in earning attained goals and objective as well.

◦ Forecasting tool:- Based on practical assumption and it is required to have

encouragement by management skills with learning and to have effective decision

making.

▪ Advantages: Moreover, it is something which require to have identification of

goals, although which is being determining actual amount of cost with sales and

this is something according to time period too.

▪ Disadvantages: Absence of different thing is there which should have different

expense with using used to incurred and also has to have accurate time period. If

expenses is something more then total cost then it can be said that it will affect the

company goals.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.