Enterprise Resource Management: Risk Management at Arab Bank

VerifiedAdded on 2020/05/03

|21

|5602

|112

Report

AI Summary

This report provides a comprehensive analysis of the risk management practices at Arab Bank, one of the largest financial institutions in Jordan. It begins with an executive summary, followed by an introduction and background on the bank, its aims, and its operating environment. The report identifies potential threats and opportunities, conducts a SWOT analysis, and delves into the bank's risk management practices, including credit risk, liquidity risk, market risk, compliance risk, and operational risk. It examines the existing risk management policies and suggests new policies to accommodate the bank's needs. Furthermore, the report explores risk registers, risk calculations, and mitigation actions, culminating in a conclusion. The study emphasizes the importance of monitoring risks regularly, particularly through the application of Basel guidelines, to reduce uncertainties and increase the bank's capitalization in the market.

Running head: ENTERPRISE RESOURCE MANAGEMENT

Enterprise Resource Management

Name of the student

Name of the university

Author note

Enterprise Resource Management

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ENTERPRISE RESOURCE MANAGEMENT

Executive Summary

This is a report, which will highlight the risk management practices of the

organization named Arab Bank. Arab Bank is one of the largest banks in Jordon and

focusing on managing risk in their organization. The report will portray the

objectives, potential threats, weaknesses, strengths and opportunities for the

organization. The existing risk management policies of the organization and new

policies that have to be accommodated according to the needs of the bank will be

critically analyzed to give a better understanding of the study. Thus, it can be

concluded form the study that Arab Bank will have to face various kinds of risks such

as credit risk, market risk, liquidity risk and operational. These risks will have to be

monitored on a regular basis by the application of the Basel guidelines. The

continuous monitoring of the risk factors will facilitate in reduction of the

uncertainties of the bank and will increase their capitalization in the market.

Executive Summary

This is a report, which will highlight the risk management practices of the

organization named Arab Bank. Arab Bank is one of the largest banks in Jordon and

focusing on managing risk in their organization. The report will portray the

objectives, potential threats, weaknesses, strengths and opportunities for the

organization. The existing risk management policies of the organization and new

policies that have to be accommodated according to the needs of the bank will be

critically analyzed to give a better understanding of the study. Thus, it can be

concluded form the study that Arab Bank will have to face various kinds of risks such

as credit risk, market risk, liquidity risk and operational. These risks will have to be

monitored on a regular basis by the application of the Basel guidelines. The

continuous monitoring of the risk factors will facilitate in reduction of the

uncertainties of the bank and will increase their capitalization in the market.

2ENTERPRISE RESOURCE MANAGEMENT

Table of Contents

Introduction....................................................................................................................3

Background....................................................................................................................3

Aims of organisation......................................................................................................3

Identified threats and opportunities................................................................................5

Risk management practices............................................................................................6

Risk register.................................................................................................................11

Calculation of risk and risk threshold..........................................................................14

Mitigation actions.........................................................................................................17

Conclusion....................................................................................................................17

References....................................................................................................................18

Table of Contents

Introduction....................................................................................................................3

Background....................................................................................................................3

Aims of organisation......................................................................................................3

Identified threats and opportunities................................................................................5

Risk management practices............................................................................................6

Risk register.................................................................................................................11

Calculation of risk and risk threshold..........................................................................14

Mitigation actions.........................................................................................................17

Conclusion....................................................................................................................17

References....................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ENTERPRISE RESOURCE MANAGEMENT

Introduction

This is a report, which will highlight the risk management practices of the

organization named Arab Bank. Arab Bank is one of the largest banks in Jordon and

focusing on managing risk in their organization. The report will portray the

objectives, potential threats, weaknesses, strengths and opportunities for the

organization. The existing risk management policies of the organization and new

policies that have to be accommodated according to the needs of the bank will be

critically analyzed to give a better understanding of the study.

Background

Arab Bank is one of the largest financial institutions in the Middle East and

belongs to the private sector. Arab Bank has its headquarters in Amman, which is

situated in Jordon. The organization has been catering to large number of consumers

over 600 branches, which are spread in five continents. Arab Bank is one of the major

economic contributors in Jordon as they provide banking solutions to their clients and

at the same time facilitates in development of business growth (Arabbank.jo 2017).

The organization has grabbed the majority of stakes and has highest capitalization in

the market. The bank faced some issues right after the global economic crisis, which

lead to the decrease in the credit rating of the organization. However, they have been

able to bounce back and regain their strong hold in the market.

Aims of organisation

The political instability of the Arab countries is increasing the amount of risk

in the market. The bank is aiming to incorporate strong information technology

systems, efficient governance and employment of workforce, which are highly skilled

Introduction

This is a report, which will highlight the risk management practices of the

organization named Arab Bank. Arab Bank is one of the largest banks in Jordon and

focusing on managing risk in their organization. The report will portray the

objectives, potential threats, weaknesses, strengths and opportunities for the

organization. The existing risk management policies of the organization and new

policies that have to be accommodated according to the needs of the bank will be

critically analyzed to give a better understanding of the study.

Background

Arab Bank is one of the largest financial institutions in the Middle East and

belongs to the private sector. Arab Bank has its headquarters in Amman, which is

situated in Jordon. The organization has been catering to large number of consumers

over 600 branches, which are spread in five continents. Arab Bank is one of the major

economic contributors in Jordon as they provide banking solutions to their clients and

at the same time facilitates in development of business growth (Arabbank.jo 2017).

The organization has grabbed the majority of stakes and has highest capitalization in

the market. The bank faced some issues right after the global economic crisis, which

lead to the decrease in the credit rating of the organization. However, they have been

able to bounce back and regain their strong hold in the market.

Aims of organisation

The political instability of the Arab countries is increasing the amount of risk

in the market. The bank is aiming to incorporate strong information technology

systems, efficient governance and employment of workforce, which are highly skilled

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ENTERPRISE RESOURCE MANAGEMENT

(Arabbank.jo 2017). Thus, the organization will have to prioritize the risk issues; this

will enable to include flexibility within the risk structure of the organization. Arab

Bank has its own set of values and principles that are developed based on the interest

of the stakeholders. The values are as follows:

Commitment: The organization has aimed to support economies and the

people in that region.

Trust: Arab Bank has been able to successfully protect the customer interest,

they have kept a secured network and maintains confidentiality of the client

data.

Citizenship: The organization has been involved in corporate social activities

by nurturing advancement and growth of the industry and the people. Arab

Bank has been able to contribute to the overall development of the society.

Customer Focus: The bank is focused on fulfilling the needs of the

organization.

Service Excellence: Customer experience management has been incorporated

in to the business model of the organization, which has facilitated in providing

extraordinary service by improving the experience of the customer.

Teamwork: The work culture is based on teamwork and the organization

provides encouragement in making efforts of collaboration.

Empowerment: The organization had aimed to provide effective training and

development program for the workforce. This will enable the workforce to

grow personally and professionally at the same time.

Transparency: The organization has tried to keep the communication with the

consumers as open as possible so that they can maintain the transparency of

the processes and gain their trust.

(Arabbank.jo 2017). Thus, the organization will have to prioritize the risk issues; this

will enable to include flexibility within the risk structure of the organization. Arab

Bank has its own set of values and principles that are developed based on the interest

of the stakeholders. The values are as follows:

Commitment: The organization has aimed to support economies and the

people in that region.

Trust: Arab Bank has been able to successfully protect the customer interest,

they have kept a secured network and maintains confidentiality of the client

data.

Citizenship: The organization has been involved in corporate social activities

by nurturing advancement and growth of the industry and the people. Arab

Bank has been able to contribute to the overall development of the society.

Customer Focus: The bank is focused on fulfilling the needs of the

organization.

Service Excellence: Customer experience management has been incorporated

in to the business model of the organization, which has facilitated in providing

extraordinary service by improving the experience of the customer.

Teamwork: The work culture is based on teamwork and the organization

provides encouragement in making efforts of collaboration.

Empowerment: The organization had aimed to provide effective training and

development program for the workforce. This will enable the workforce to

grow personally and professionally at the same time.

Transparency: The organization has tried to keep the communication with the

consumers as open as possible so that they can maintain the transparency of

the processes and gain their trust.

5ENTERPRISE RESOURCE MANAGEMENT

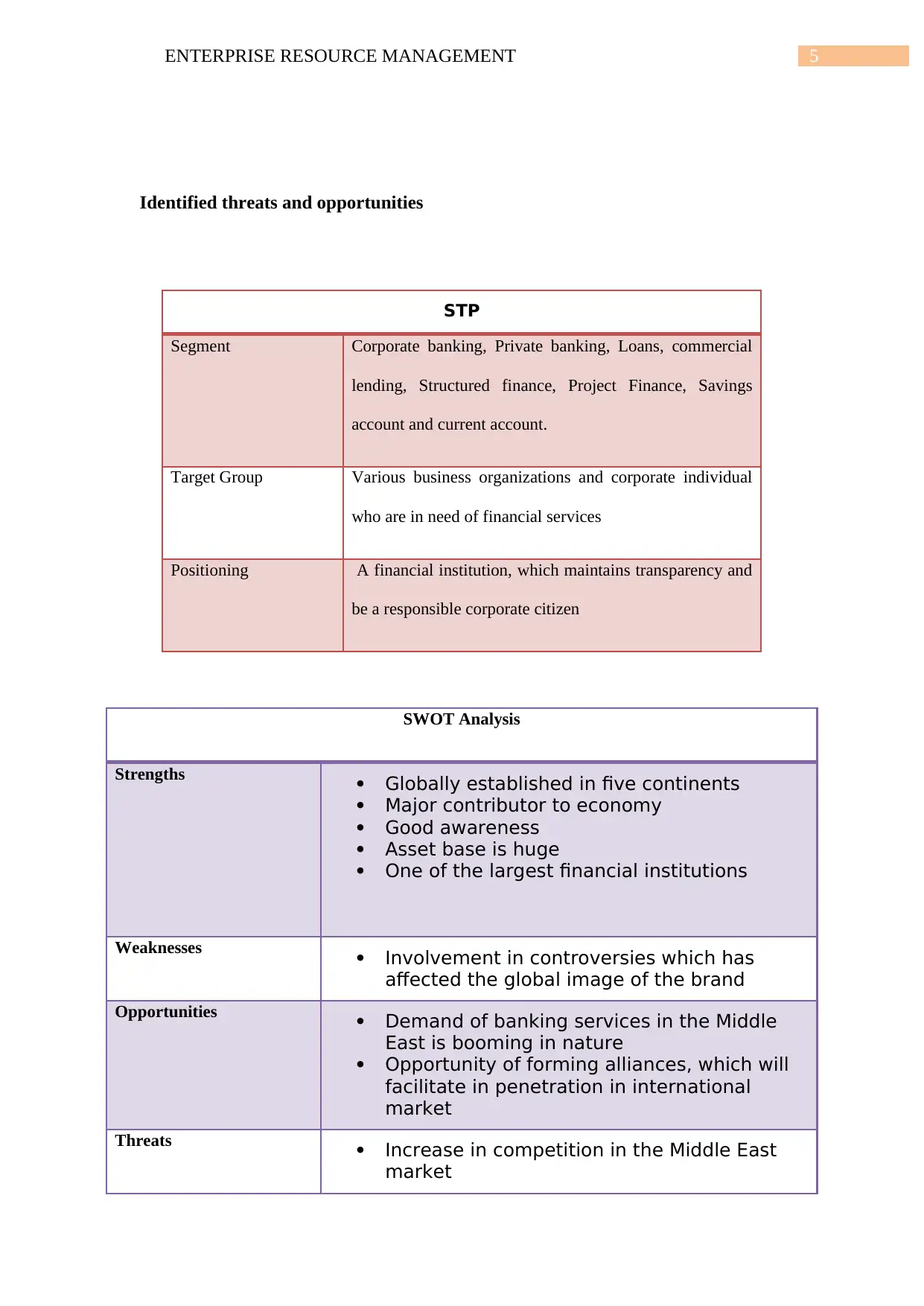

Identified threats and opportunities

STP

Segment Corporate banking, Private banking, Loans, commercial

lending, Structured finance, Project Finance, Savings

account and current account.

Target Group Various business organizations and corporate individual

who are in need of financial services

Positioning A financial institution, which maintains transparency and

be a responsible corporate citizen

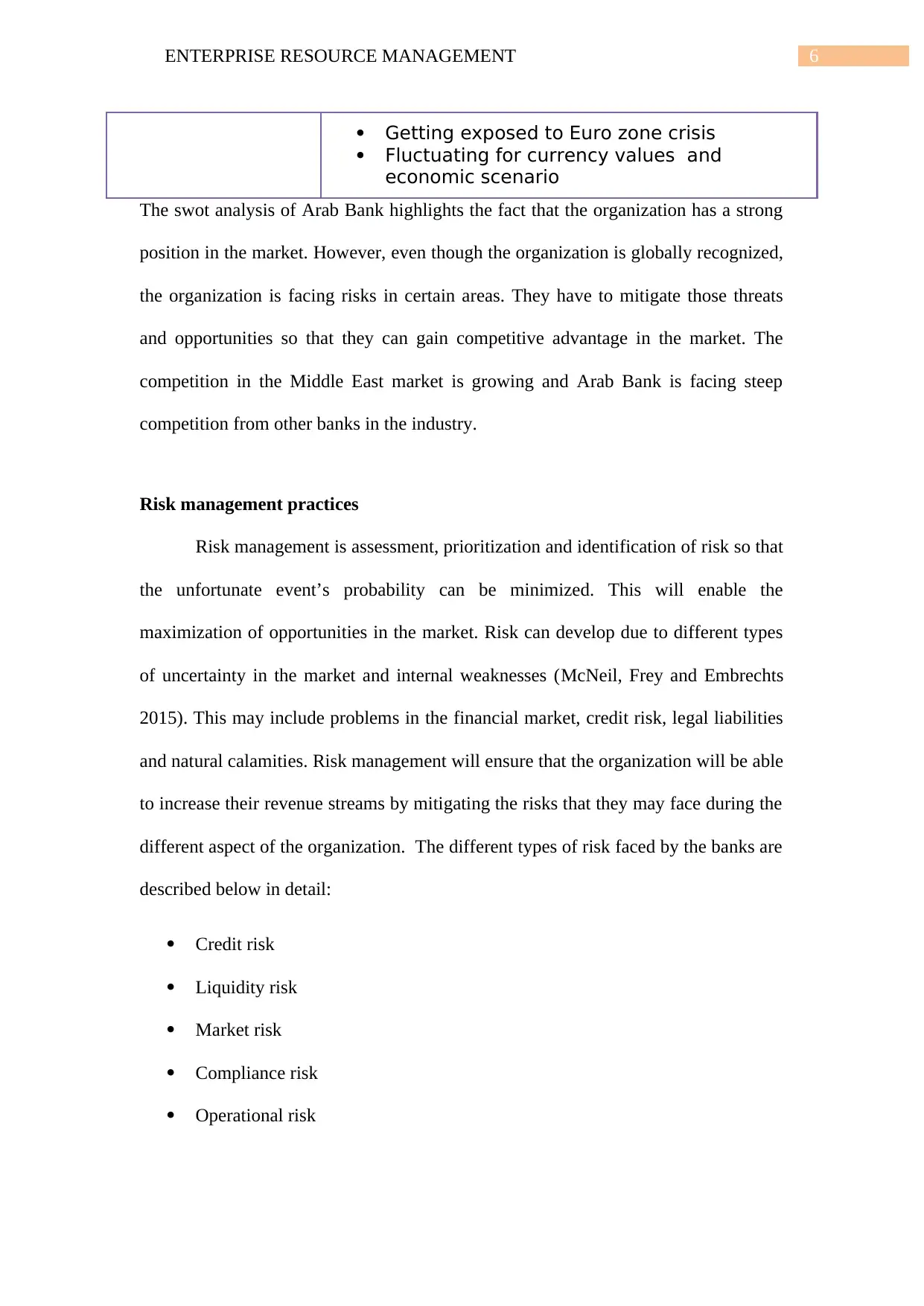

SWOT Analysis

Strengths Globally established in five continents

Major contributor to economy

Good awareness

Asset base is huge

One of the largest financial institutions

Weaknesses Involvement in controversies which has

affected the global image of the brand

Opportunities Demand of banking services in the Middle

East is booming in nature

Opportunity of forming alliances, which will

facilitate in penetration in international

market

Threats Increase in competition in the Middle East

market

Identified threats and opportunities

STP

Segment Corporate banking, Private banking, Loans, commercial

lending, Structured finance, Project Finance, Savings

account and current account.

Target Group Various business organizations and corporate individual

who are in need of financial services

Positioning A financial institution, which maintains transparency and

be a responsible corporate citizen

SWOT Analysis

Strengths Globally established in five continents

Major contributor to economy

Good awareness

Asset base is huge

One of the largest financial institutions

Weaknesses Involvement in controversies which has

affected the global image of the brand

Opportunities Demand of banking services in the Middle

East is booming in nature

Opportunity of forming alliances, which will

facilitate in penetration in international

market

Threats Increase in competition in the Middle East

market

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ENTERPRISE RESOURCE MANAGEMENT

Getting exposed to Euro zone crisis

Fluctuating for currency values and

economic scenario

The swot analysis of Arab Bank highlights the fact that the organization has a strong

position in the market. However, even though the organization is globally recognized,

the organization is facing risks in certain areas. They have to mitigate those threats

and opportunities so that they can gain competitive advantage in the market. The

competition in the Middle East market is growing and Arab Bank is facing steep

competition from other banks in the industry.

Risk management practices

Risk management is assessment, prioritization and identification of risk so that

the unfortunate event’s probability can be minimized. This will enable the

maximization of opportunities in the market. Risk can develop due to different types

of uncertainty in the market and internal weaknesses (McNeil, Frey and Embrechts

2015). This may include problems in the financial market, credit risk, legal liabilities

and natural calamities. Risk management will ensure that the organization will be able

to increase their revenue streams by mitigating the risks that they may face during the

different aspect of the organization. The different types of risk faced by the banks are

described below in detail:

Credit risk

Liquidity risk

Market risk

Compliance risk

Operational risk

Getting exposed to Euro zone crisis

Fluctuating for currency values and

economic scenario

The swot analysis of Arab Bank highlights the fact that the organization has a strong

position in the market. However, even though the organization is globally recognized,

the organization is facing risks in certain areas. They have to mitigate those threats

and opportunities so that they can gain competitive advantage in the market. The

competition in the Middle East market is growing and Arab Bank is facing steep

competition from other banks in the industry.

Risk management practices

Risk management is assessment, prioritization and identification of risk so that

the unfortunate event’s probability can be minimized. This will enable the

maximization of opportunities in the market. Risk can develop due to different types

of uncertainty in the market and internal weaknesses (McNeil, Frey and Embrechts

2015). This may include problems in the financial market, credit risk, legal liabilities

and natural calamities. Risk management will ensure that the organization will be able

to increase their revenue streams by mitigating the risks that they may face during the

different aspect of the organization. The different types of risk faced by the banks are

described below in detail:

Credit risk

Liquidity risk

Market risk

Compliance risk

Operational risk

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ENTERPRISE RESOURCE MANAGEMENT

Credit risk is the probability that a borrower will be fail in making payments on

any type of the debts. Credit risk will monitor the loss reserves and the adequacy o0f

the capital to mitigate the risk. The global economic crisis has made the banks

understood the importance of credit risk management and how it can be used to

minimize the chances of loss within a bank (DeAngelo and Stulz 2015). Thus, the

regulators want to maintain transparency in all the processes so that all banks may

have essential information regarding their customers and credit risk associated with it.

Thus, the banks will have to follow the Basel III norms so that they are able to

mitigate the risks in a better, which means that the burden of the banks have increased

significantly. The management of credit risk in an effective way will ensure

competitive advantage and overall improvement in the performance in the

organization (Ramakrishna 2015). However, in order to maintain effective credit risk

management, the bank will have to gain a complete understanding of the bank’s

overall credit risk. This can be done by evaluating the customer, level of portfolio and

individual risks. However, the banks will try to evaluate the risk profiles in an

integrated way. However, the information regarding risk portfolios are distributed

among all the units of business.

Thus, an in depth risk assessment is required for accurately identifying the capital

reserves. This will reflect the risk associated and the short-term losses in credit; thus,

this will ensure that the organization is able to increase the capital adequacy and

reduce the short credit losses by using solutions for credit risk mitigation (Matthews

2013). Simple portfolio measures can be used for mitigation of credit risk for the

banks, which are severely facing issues with the credit risk management. However, in

the long term the organization will require more sophisticated risk management

measures for managing credit risk. This will include real-time monitoring and scoring,

Credit risk is the probability that a borrower will be fail in making payments on

any type of the debts. Credit risk will monitor the loss reserves and the adequacy o0f

the capital to mitigate the risk. The global economic crisis has made the banks

understood the importance of credit risk management and how it can be used to

minimize the chances of loss within a bank (DeAngelo and Stulz 2015). Thus, the

regulators want to maintain transparency in all the processes so that all banks may

have essential information regarding their customers and credit risk associated with it.

Thus, the banks will have to follow the Basel III norms so that they are able to

mitigate the risks in a better, which means that the burden of the banks have increased

significantly. The management of credit risk in an effective way will ensure

competitive advantage and overall improvement in the performance in the

organization (Ramakrishna 2015). However, in order to maintain effective credit risk

management, the bank will have to gain a complete understanding of the bank’s

overall credit risk. This can be done by evaluating the customer, level of portfolio and

individual risks. However, the banks will try to evaluate the risk profiles in an

integrated way. However, the information regarding risk portfolios are distributed

among all the units of business.

Thus, an in depth risk assessment is required for accurately identifying the capital

reserves. This will reflect the risk associated and the short-term losses in credit; thus,

this will ensure that the organization is able to increase the capital adequacy and

reduce the short credit losses by using solutions for credit risk mitigation (Matthews

2013). Simple portfolio measures can be used for mitigation of credit risk for the

banks, which are severely facing issues with the credit risk management. However, in

the long term the organization will require more sophisticated risk management

measures for managing credit risk. This will include real-time monitoring and scoring,

8ENTERPRISE RESOURCE MANAGEMENT

management of the model in a better way to ensure that it increases the longevity of

the modelling cycle and stress testing capabilities that is robust (Abiola and Olausi

2014).

Liquidity is the ability of the bank to finance all the obligations, which are of

contractual of nature. This will include the factors such as investment, lending and

withdrawal of funds. This is a practice in which the banks are making use of the short-

term liabilities to finance the long-term assets. This gives rise to rollover and

refinancing risk; it is the prime responsibility of the banks to define clearly the

liquidity policy of the banks (Waemustafa and Sukri 2016). Thus, the banks will have

to make anticipation regarding withdrawal of funds and deposits as the contractual

maturity of the loans are shorter. Thus, the banks will have to create a cushion period

for reducing the risk by maintaining the level of liquidity in the banks. Liquidity of

the bank is important, as it will facilitate in accommodating the deposits and funding

of the loan growth.

The banks are dividing the cash flows in terms of buckets, which will facilitate in

maintaining the liquidity of the bank for all the quarters in a given fiscal year.

Liquidity risk of the bank can be divided in to factors such as asset liquidity risk and

funding liquidity risk. The losses incurred by the bank due to the transacting at the

present price in the market can be defined as asset liquidity risk (Waemustafa and

Sukri 2015). This may happen due to the fluctuation in the market and selling

products at such prices will result in loss. When the bank is unable to meet the

funding requirements then it is exposed to funding liquidity risk. This may lead to the

development of problems such as failure in meeting the capital withdrawal requests

and margin calls. Thus, the bank may be forced to liquidate the assets and the

organization may be forced to sell their assets at fire price.

management of the model in a better way to ensure that it increases the longevity of

the modelling cycle and stress testing capabilities that is robust (Abiola and Olausi

2014).

Liquidity is the ability of the bank to finance all the obligations, which are of

contractual of nature. This will include the factors such as investment, lending and

withdrawal of funds. This is a practice in which the banks are making use of the short-

term liabilities to finance the long-term assets. This gives rise to rollover and

refinancing risk; it is the prime responsibility of the banks to define clearly the

liquidity policy of the banks (Waemustafa and Sukri 2016). Thus, the banks will have

to make anticipation regarding withdrawal of funds and deposits as the contractual

maturity of the loans are shorter. Thus, the banks will have to create a cushion period

for reducing the risk by maintaining the level of liquidity in the banks. Liquidity of

the bank is important, as it will facilitate in accommodating the deposits and funding

of the loan growth.

The banks are dividing the cash flows in terms of buckets, which will facilitate in

maintaining the liquidity of the bank for all the quarters in a given fiscal year.

Liquidity risk of the bank can be divided in to factors such as asset liquidity risk and

funding liquidity risk. The losses incurred by the bank due to the transacting at the

present price in the market can be defined as asset liquidity risk (Waemustafa and

Sukri 2015). This may happen due to the fluctuation in the market and selling

products at such prices will result in loss. When the bank is unable to meet the

funding requirements then it is exposed to funding liquidity risk. This may lead to the

development of problems such as failure in meeting the capital withdrawal requests

and margin calls. Thus, the bank may be forced to liquidate the assets and the

organization may be forced to sell their assets at fire price.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ENTERPRISE RESOURCE MANAGEMENT

The risk of loss due to the factors, which will affect the overall market, is known

as market risk. Market risk cannot be diversified, as it will affect the overall industry,

which means hedging of the portfolio is the only option. This means that the risk

cannot be completely mitigated and the losses incurred can be only reduced. The main

sources of risk from the market, which will include equity price risk, interest rate risk,

commodity risk and foreign exchange risk (Leung, Banks and Saary-Littman 2016).

The changes in the interest rate due to the volatility in the market will give rise to

interest rate risk. When there is a change in the interest rate risk in the market it will

give rise to risk such as options risk, repricing risk and basis risk. The changes in the

spreads in the interest rate risk in the market will give rise to fluctuations, which can

be denoted by the basis risk (Calomiris and Carlson 2016). The changes in the spread

among the various market interest rates will give rise to basis risk. The volatility in

the prices of the security will give rise to equity price risk; in simple words decline in

the prices of security or a portfolio will give rise to this risk.

However, there are two categories one is the unsystematic risk which is the

internal risk of the organization where as the systematic risk is the overall risk in the

market which cannot be mitigated. Unsystematic risk of equity price risk can be

mitigated through diversification of the portfolio but the systematic risk cannot be

mitigated as it will affect the overall asset class (Waemustafa and Sukri 2016).

Hedging is the only option for the systematic risk that can only be reduced and cannot

be only mitigated. Foreign exchange risk is faced by the bank to the change in the

currency exchange rates. The volatility in the exchange rate among the currencies will

definitely impact the foreign direct investments of the banks. The fluctuation in the

currency exchange rates will decrease the profit margin of the organization if there is

depreciation in the value of the currency (Roy 2017). The fluctuations in the prices of

The risk of loss due to the factors, which will affect the overall market, is known

as market risk. Market risk cannot be diversified, as it will affect the overall industry,

which means hedging of the portfolio is the only option. This means that the risk

cannot be completely mitigated and the losses incurred can be only reduced. The main

sources of risk from the market, which will include equity price risk, interest rate risk,

commodity risk and foreign exchange risk (Leung, Banks and Saary-Littman 2016).

The changes in the interest rate due to the volatility in the market will give rise to

interest rate risk. When there is a change in the interest rate risk in the market it will

give rise to risk such as options risk, repricing risk and basis risk. The changes in the

spreads in the interest rate risk in the market will give rise to fluctuations, which can

be denoted by the basis risk (Calomiris and Carlson 2016). The changes in the spread

among the various market interest rates will give rise to basis risk. The volatility in

the prices of the security will give rise to equity price risk; in simple words decline in

the prices of security or a portfolio will give rise to this risk.

However, there are two categories one is the unsystematic risk which is the

internal risk of the organization where as the systematic risk is the overall risk in the

market which cannot be mitigated. Unsystematic risk of equity price risk can be

mitigated through diversification of the portfolio but the systematic risk cannot be

mitigated as it will affect the overall asset class (Waemustafa and Sukri 2016).

Hedging is the only option for the systematic risk that can only be reduced and cannot

be only mitigated. Foreign exchange risk is faced by the bank to the change in the

currency exchange rates. The volatility in the exchange rate among the currencies will

definitely impact the foreign direct investments of the banks. The fluctuation in the

currency exchange rates will decrease the profit margin of the organization if there is

depreciation in the value of the currency (Roy 2017). The fluctuations in the prices of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ENTERPRISE RESOURCE MANAGEMENT

the commodities in the market will give rise to the commodity risk. However, in this

scenario, commodity risk will not have much impact on the banks.

Compliance risk is the legal risk, which arises due to the ambiguous practices of

the clients of the banks that will affect the performance of certain bank products. This

risk may expose the financial institutions to penalties, fines, and contract voiding and

damage payments. This risk will hamper the reputation, restrict the business

opportunities, reduce the value of the franchise and decrease the potential for

expansion (Woods et al. 2017). Thus, the compliance risk is the factor, which is very

important for the long-term sustainability of the organization. Thus, the regulation of

the internal policies of the bank has to be maintained in order to identify the quality

and the quantity of the risk factors. The quantity of the risk will be evaluated based on

the seriousness of the issue and the quality of the issue will be dependent on the

quality measures applied to mitigate the issues.

Operational risk is associated with all the products, processes and activities of the

bank. Thus, the higher officials in the organization will have to incorporate strategies

for managing risk in a better way (Jaber, Ismail and Ramli 2017). Operational risk

management is used to effectively protect the organization from all sorts of

uncertainties. The organization will have to set appropriate standards for managing

risk and a strong operational risk management system is required for maintaining the

operational performance of the organization.

These are the major risk factors, which Arab bank monitors on a daily basis to

maintain their sustainability in the market. These practices will provide stability to the

bank and the organization will be able to improve the capitalization in the market.

the commodities in the market will give rise to the commodity risk. However, in this

scenario, commodity risk will not have much impact on the banks.

Compliance risk is the legal risk, which arises due to the ambiguous practices of

the clients of the banks that will affect the performance of certain bank products. This

risk may expose the financial institutions to penalties, fines, and contract voiding and

damage payments. This risk will hamper the reputation, restrict the business

opportunities, reduce the value of the franchise and decrease the potential for

expansion (Woods et al. 2017). Thus, the compliance risk is the factor, which is very

important for the long-term sustainability of the organization. Thus, the regulation of

the internal policies of the bank has to be maintained in order to identify the quality

and the quantity of the risk factors. The quantity of the risk will be evaluated based on

the seriousness of the issue and the quality of the issue will be dependent on the

quality measures applied to mitigate the issues.

Operational risk is associated with all the products, processes and activities of the

bank. Thus, the higher officials in the organization will have to incorporate strategies

for managing risk in a better way (Jaber, Ismail and Ramli 2017). Operational risk

management is used to effectively protect the organization from all sorts of

uncertainties. The organization will have to set appropriate standards for managing

risk and a strong operational risk management system is required for maintaining the

operational performance of the organization.

These are the major risk factors, which Arab bank monitors on a daily basis to

maintain their sustainability in the market. These practices will provide stability to the

bank and the organization will be able to improve the capitalization in the market.

11ENTERPRISE RESOURCE MANAGEMENT

Risk register

Risk register is one of the major factors for the management of operational

risk of the bank. It uses the upbeat management of the internal controls of the

organization through effective control of the business units and assessment of the

inherent risk. Audit function and the inspection are the internal control for managing

the operational risk of the banks (Mace et al. 2015). However, the changes in the

market trends have increased the complexity of the management of the risk of the

banks due to the invention of information technological based banking facilities.

Thus, the banks are4 forced to make use of structured and scientific approaches for

the enhancement of the internal controls of the banks. Risk register approach will help

the bank to foresee and visualize the risks that may occur in the future and thus, the

bank can take precautionary measures. However, this does not mean that the degree of

uncertainty in the market will be reduced and the bank may incur loss due to

unsystematic risk (Chen et al. 2014).

Thus, the bank will have to make use of the risk register factor for assessing

the processes, products, activities and systems. This is applicable for the new products

and the instruments that will be incorporated within the organization. Risk register

will identify the risk factors for these instruments and thus, the bank will be able to

mitigate the risk factors in an effective way.

There is no specific way of using the risk register within the banks and it has

to be developed based on the needs of the organization. Various aspects of the

operational risk of the bank will be evaluated to establish the factors that will be

included in the Risk register of the bank. Risk register is developed in a phased

manner and a timeline will have to be maintained which will continuously keep on

updating the controls and risks within the register (Black et al. 2016). The higher

Risk register

Risk register is one of the major factors for the management of operational

risk of the bank. It uses the upbeat management of the internal controls of the

organization through effective control of the business units and assessment of the

inherent risk. Audit function and the inspection are the internal control for managing

the operational risk of the banks (Mace et al. 2015). However, the changes in the

market trends have increased the complexity of the management of the risk of the

banks due to the invention of information technological based banking facilities.

Thus, the banks are4 forced to make use of structured and scientific approaches for

the enhancement of the internal controls of the banks. Risk register approach will help

the bank to foresee and visualize the risks that may occur in the future and thus, the

bank can take precautionary measures. However, this does not mean that the degree of

uncertainty in the market will be reduced and the bank may incur loss due to

unsystematic risk (Chen et al. 2014).

Thus, the bank will have to make use of the risk register factor for assessing

the processes, products, activities and systems. This is applicable for the new products

and the instruments that will be incorporated within the organization. Risk register

will identify the risk factors for these instruments and thus, the bank will be able to

mitigate the risk factors in an effective way.

There is no specific way of using the risk register within the banks and it has

to be developed based on the needs of the organization. Various aspects of the

operational risk of the bank will be evaluated to establish the factors that will be

included in the Risk register of the bank. Risk register is developed in a phased

manner and a timeline will have to be maintained which will continuously keep on

updating the controls and risks within the register (Black et al. 2016). The higher

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.