Environmental and Management Accounting Report on Premier Investments

VerifiedAdded on 2020/03/07

|18

|3700

|75

Report

AI Summary

This report provides a comprehensive analysis of environmental and management accounting practices, focusing on Premier Investments. It begins with an executive summary, followed by an introduction outlining the report's objectives. Part A delves into the social and environmental impacts of Premier Investments, identifies key Global Reporting Initiative (GRI) disclosures, compares environmental performance information between Premier Investments and Myers, and evaluates the benefits of GRI compliance. Part B examines the major costs associated with Smiggle and Peter Alexander, evaluates the usefulness of break-even analysis, and develops a balanced scorecard for Premier Investments. Finally, Part C presents break-even analysis for proposed business expansions. The report incorporates relevant disclosures and provides an overview of the company's sustainability efforts. It also addresses the broader implications of corporate social responsibility and the benefits of GRI guidelines for stakeholders. The report utilizes financial statements and industry insights to support its findings and recommendations.

Running head: ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 1

Environmental and Management Accounting Assignment

Student’s Name

Name of University

Environmental and Management Accounting Assignment

Student’s Name

Name of University

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 2

Executive Summary

The report is divided into three parts. Part A provides a report on environmental and

social impacts of Premier Investments, identifies and discusses key Global Reporting Initiative,

compares the quality and depth of environmental performance information provided by Premier

Investments and Myers, and evaluates the benefits of compliance to Global Reporting Initiatives.

Part B identifies the major costs associated with the operations of Smiggle and Peter Alexander,

evaluates the usefulness of break-even analysis, and develops a balanced-score-card for Premier

Investments. Part C presents break-even analysis for proposed business expansions.

Executive Summary

The report is divided into three parts. Part A provides a report on environmental and

social impacts of Premier Investments, identifies and discusses key Global Reporting Initiative,

compares the quality and depth of environmental performance information provided by Premier

Investments and Myers, and evaluates the benefits of compliance to Global Reporting Initiatives.

Part B identifies the major costs associated with the operations of Smiggle and Peter Alexander,

evaluates the usefulness of break-even analysis, and develops a balanced-score-card for Premier

Investments. Part C presents break-even analysis for proposed business expansions.

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 3

Table of Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................5

Part C...............................................................................................................................................5

References........................................................................................................................................5

Table of Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................5

Part C...............................................................................................................................................5

References........................................................................................................................................5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 4

Introduction

Premier investment is considered one of the most successful companies in Australia. Over the

years, the company has been able to grow and expand its footprint in and outside of Australia.

The company has been able to use its expertise and huge capital reserves to own and expand its

retail, consumer, and wholesale businesses (Premier Investments Ltd, 2014). The growth and

expansion of Premier Investments Ltd have had various impacts. This report will focus on the

environmental and management accounting matters regarding Premier Investments Ltd.

Part A

1. Impact of Premier Investments

Social Impacts

(i) The wage rate paid by large retailers like Premier Investment is traditionally higher

than that paid by small shops. The expansion of Premier Investments’ outlets might

lead to closure of smaller retailers but the expansions are accompanied by higher pay

levels. The overall effect of higher incomes is higher standards of livings (Shaw,

Lafontine, & Hicks, 2014).

(ii) The expansion and growth of Premier Investments have led to the social development

of countries like Bangladesh. In Bangladesh, the apparel sector contributes

approximately 80% of the country’s gross domestic product and employs more than 3

million workers most of whom are women. This has led to the empowerment of

women.

(iii) Large retailers offer consumers a wide variety of goods at lower prices which is good

for the welfare of society,

(iv) Premier Investments support numerous philanthropic activities that improve the

welfare of the communities in which they operate in.

Introduction

Premier investment is considered one of the most successful companies in Australia. Over the

years, the company has been able to grow and expand its footprint in and outside of Australia.

The company has been able to use its expertise and huge capital reserves to own and expand its

retail, consumer, and wholesale businesses (Premier Investments Ltd, 2014). The growth and

expansion of Premier Investments Ltd have had various impacts. This report will focus on the

environmental and management accounting matters regarding Premier Investments Ltd.

Part A

1. Impact of Premier Investments

Social Impacts

(i) The wage rate paid by large retailers like Premier Investment is traditionally higher

than that paid by small shops. The expansion of Premier Investments’ outlets might

lead to closure of smaller retailers but the expansions are accompanied by higher pay

levels. The overall effect of higher incomes is higher standards of livings (Shaw,

Lafontine, & Hicks, 2014).

(ii) The expansion and growth of Premier Investments have led to the social development

of countries like Bangladesh. In Bangladesh, the apparel sector contributes

approximately 80% of the country’s gross domestic product and employs more than 3

million workers most of whom are women. This has led to the empowerment of

women.

(iii) Large retailers offer consumers a wide variety of goods at lower prices which is good

for the welfare of society,

(iv) Premier Investments support numerous philanthropic activities that improve the

welfare of the communities in which they operate in.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 5

(v) The growth and expansion of outlets have helped to expand tax revenues, particularly

for small towns. These revenues fund better infrastructure, education, and healthcare;

these benefit societies.

(vi) Large retailers offer lower prices which encourage consumerism; whereby consumers

buy what they do not need and do not obtain maximum benefits from purchases

(vii) The closure of small retailers leads to unemployment which stimulates crime and

other social ills

Environmental Impacts

(i) According to Loth (2016), large retailers like Premier Investment normally offer

aggressive competition to smaller retailers. This forces the smaller outlets to close.

Normally, the nature of the business conducted by companies like Premier Investment

covers many products thus impacts large numbers of small businesses. The large

closures of these small outlets result in urban decay given that the building that these

businesses were operating from deteriorate and become dilapidated due to lack of use

and maintenance.

(ii) Most of the merchandise sold is made in developing countries with little or no

adherence to environmental issues. The industries that make the products have been

found to emit high levels of green house gases.

(iii) The companies’ advertisement and business model encourage consumerism.

Encouraging consumers to buy what they do not need. Eventually, these unwanted

goods end up in landfills and water bodies.

(iv)Premier Investment has introduced recycling and waste management programs and

initiatives aimed at reducing destruction and dilapidation of the environment.

(v) The growth and expansion of outlets have helped to expand tax revenues, particularly

for small towns. These revenues fund better infrastructure, education, and healthcare;

these benefit societies.

(vi) Large retailers offer lower prices which encourage consumerism; whereby consumers

buy what they do not need and do not obtain maximum benefits from purchases

(vii) The closure of small retailers leads to unemployment which stimulates crime and

other social ills

Environmental Impacts

(i) According to Loth (2016), large retailers like Premier Investment normally offer

aggressive competition to smaller retailers. This forces the smaller outlets to close.

Normally, the nature of the business conducted by companies like Premier Investment

covers many products thus impacts large numbers of small businesses. The large

closures of these small outlets result in urban decay given that the building that these

businesses were operating from deteriorate and become dilapidated due to lack of use

and maintenance.

(ii) Most of the merchandise sold is made in developing countries with little or no

adherence to environmental issues. The industries that make the products have been

found to emit high levels of green house gases.

(iii) The companies’ advertisement and business model encourage consumerism.

Encouraging consumers to buy what they do not need. Eventually, these unwanted

goods end up in landfills and water bodies.

(iv)Premier Investment has introduced recycling and waste management programs and

initiatives aimed at reducing destruction and dilapidation of the environment.

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 6

2. Relevant Disclosures

The GRI has two types of disclosure namely General Standard Disclosure and Specific

Standard Disclosures (Global Reporting Initiative, 2011). The general standard disclosures

include strategy and analysis, organisational profile, governance, report profile, identified

material aspects and boundaries, stakeholder engagement and ethic and integrity. The specific

standard disclosures include disclosure on management approach and indicators. The most

important disclosures to the stakeholders of Premier Investments include:

(i) Strategy Analysis: This is given mostly by way of a statement by the Chief Operating

Officer, Chairman of the board or the senior most officers in the company. The

strategic analysis is normally presented at the beginning of the financial report

indicating the strategy put in place to ensure sustainability of the organisation (KPMG,

2015). The statement highlights the short to long-term economic, environmental, and

social impacts of the company. The strategy gives the stakeholders such as suppliers,

shareholders, local communities, and the government the direction that the company is

taking and the resultant effect.

(ii) Stakeholder Engagement: This disclosure indicates the company’s stakeholders and

the methods being used to interact and engage with them. The aim of this disclosure is

to ensure that the company aligns its processes and objectives with the interests of the

stakeholder which is crucial for sustainability (Moratis & Brandt, 2017).

(iii) Governance and Ethics: This disclosure highlights the organization’s values and

principles while highlighting the mechanisms for dealing with ethical issues. The

disclosure also indicates the composition of the governance of the company and the

structures present. The study by Chan, Watson, and Woodliff (2014) established that

2. Relevant Disclosures

The GRI has two types of disclosure namely General Standard Disclosure and Specific

Standard Disclosures (Global Reporting Initiative, 2011). The general standard disclosures

include strategy and analysis, organisational profile, governance, report profile, identified

material aspects and boundaries, stakeholder engagement and ethic and integrity. The specific

standard disclosures include disclosure on management approach and indicators. The most

important disclosures to the stakeholders of Premier Investments include:

(i) Strategy Analysis: This is given mostly by way of a statement by the Chief Operating

Officer, Chairman of the board or the senior most officers in the company. The

strategic analysis is normally presented at the beginning of the financial report

indicating the strategy put in place to ensure sustainability of the organisation (KPMG,

2015). The statement highlights the short to long-term economic, environmental, and

social impacts of the company. The strategy gives the stakeholders such as suppliers,

shareholders, local communities, and the government the direction that the company is

taking and the resultant effect.

(ii) Stakeholder Engagement: This disclosure indicates the company’s stakeholders and

the methods being used to interact and engage with them. The aim of this disclosure is

to ensure that the company aligns its processes and objectives with the interests of the

stakeholder which is crucial for sustainability (Moratis & Brandt, 2017).

(iii) Governance and Ethics: This disclosure highlights the organization’s values and

principles while highlighting the mechanisms for dealing with ethical issues. The

disclosure also indicates the composition of the governance of the company and the

structures present. The study by Chan, Watson, and Woodliff (2014) established that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 7

these disclosures improve the quality of management of companies and are critical for

corporate social responsibility.

(iv) Disclosure on Management Approach: This disclosure focuses on economic, social

and environmental practices of the company. The social practices category is relevant

to the workers of the company as it highlights the rights of the employees, occupation

safety issues, training and education provisions, diversity and equal opportunity

policies, and indicate the working conditions (Allianz, 2011). For the society, this

disclosure indicates the social and product responsibility of the company.

A review of the financial statements of Premier Investments indicates that the company

makes all the above disclosures.

3. Quality and Depth of Environmental Performance Information of Premier Investment

and Myers

About Myers

Myers is the largest department store in Australia. The company has more than 60 outlets

across Australia (Myers, 2016). The company’s women wear brands Sass & Bide are the most

popular brands. On average, the company handles 130 million clients per year. Myers has more

than 12,500 employees dedicated to handling the needs and demands of the millions of

customers. The large customer base has ensured that the company has been able to grow its

profit margin. In the year 2016, the company reported sales revenue of $3,289 million (Myers,

2016). The financial statements of Myers indicate that:

(i) There is a scheme in place to manage the energy consumption with the aim being to

reduce consumption from 34-30W/m2 to 11W/m2.

these disclosures improve the quality of management of companies and are critical for

corporate social responsibility.

(iv) Disclosure on Management Approach: This disclosure focuses on economic, social

and environmental practices of the company. The social practices category is relevant

to the workers of the company as it highlights the rights of the employees, occupation

safety issues, training and education provisions, diversity and equal opportunity

policies, and indicate the working conditions (Allianz, 2011). For the society, this

disclosure indicates the social and product responsibility of the company.

A review of the financial statements of Premier Investments indicates that the company

makes all the above disclosures.

3. Quality and Depth of Environmental Performance Information of Premier Investment

and Myers

About Myers

Myers is the largest department store in Australia. The company has more than 60 outlets

across Australia (Myers, 2016). The company’s women wear brands Sass & Bide are the most

popular brands. On average, the company handles 130 million clients per year. Myers has more

than 12,500 employees dedicated to handling the needs and demands of the millions of

customers. The large customer base has ensured that the company has been able to grow its

profit margin. In the year 2016, the company reported sales revenue of $3,289 million (Myers,

2016). The financial statements of Myers indicate that:

(i) There is a scheme in place to manage the energy consumption with the aim being to

reduce consumption from 34-30W/m2 to 11W/m2.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 8

(ii) Energy rating policy: under this scheme, Myers gives appliances energy ratings so

that the consumers can buy products that are energy efficient.

(iii) Recycling of waste product and encouraging the reuse of recycled items.

(iv)Environmental Regulation: Myers indicates that they are subject to the regulations

presented in the National Greenhouse and Energy Reporting Act of 2007.URNEY

In the financial statements of Premier Investment, the environmental disclosures include:

(i) Packaging Stewardship: The aim of the program is to reduce the effect of packaging

on the environment, and increase the collection and recycling of the packaging material.

(ii) Waste and Recycling plan which indicates the companies recycling facilities and

competencies. The company has developed a reuse policy as an auxiliary to the waste

and recycling project.

(iii) Energy Efficiency: the company indicates the type of lighting systems and energy

management practises across all locations.

(iv)Compliance with regulations: The Company indicates that they are not subject to any

significant obligation and regulations with regard to the environment.

In their statements, both companies give a brief overview of the policies and projects that are

in place to protect the environment. However, the submissions do not provide sustainability

measures, self-assessment tools, and do not go far enough in providing the companies’

dependence on the environment and the impact thereof.

4. Evaluation of the widespread compliance with the GRI guidelines by Australian retail

businesses would benefit potential investors, current shareholders and other stakeholders

In the current business environment, companies are being required by various stakeholders

and shareholder not only to increase profits and grow the business but also to help address some

(ii) Energy rating policy: under this scheme, Myers gives appliances energy ratings so

that the consumers can buy products that are energy efficient.

(iii) Recycling of waste product and encouraging the reuse of recycled items.

(iv)Environmental Regulation: Myers indicates that they are subject to the regulations

presented in the National Greenhouse and Energy Reporting Act of 2007.URNEY

In the financial statements of Premier Investment, the environmental disclosures include:

(i) Packaging Stewardship: The aim of the program is to reduce the effect of packaging

on the environment, and increase the collection and recycling of the packaging material.

(ii) Waste and Recycling plan which indicates the companies recycling facilities and

competencies. The company has developed a reuse policy as an auxiliary to the waste

and recycling project.

(iii) Energy Efficiency: the company indicates the type of lighting systems and energy

management practises across all locations.

(iv)Compliance with regulations: The Company indicates that they are not subject to any

significant obligation and regulations with regard to the environment.

In their statements, both companies give a brief overview of the policies and projects that are

in place to protect the environment. However, the submissions do not provide sustainability

measures, self-assessment tools, and do not go far enough in providing the companies’

dependence on the environment and the impact thereof.

4. Evaluation of the widespread compliance with the GRI guidelines by Australian retail

businesses would benefit potential investors, current shareholders and other stakeholders

In the current business environment, companies are being required by various stakeholders

and shareholder not only to increase profits and grow the business but also to help address some

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 9

of the countries and communities concerns including economic development and environmental

protection (Noked, 2013). There are different opinions on how the businesses both in the public

and private sector should handle their responsibility. However, there is consensus that the

various stakeholders who include shareholders, customers, employees, communities, regulators,

and the government that businesses and corporate entities have a broader scope of responsibility

to each of them individually and collectively.

As a result, companies working more closely with the stakeholders in order to understand

their concerns and develop strategies to address their concerns. These strategies are what are

commonly referred to as corporate social responsibilities which encompass environmental,

communal, economic, legal and social concerns (Higgins & Stubbs, 2015). The GRI guidelines

provide the format, details, and extent of the reports. The guidelines provide an indication of the

elements and disclosures to be presented in the report. These disclosures provide certain benefits

to the stakeholders

(i) For the shareholders – the increased disclosures indicate the business models, governance

structures specifically with regard to risk profile taking and mitigation. This helps to indicate

the growth and success of the company;

(ii) Employees- the regulations address the diversity issues, labour rights, health, safety,

wages, and benefits.

(iii) Customers- These address their concern on environmental impacts and health and

safety of the products they procure

(iv)Communities – highlight the corporate social responsibility programs, investment in the

community, and social and environmental impacts

of the countries and communities concerns including economic development and environmental

protection (Noked, 2013). There are different opinions on how the businesses both in the public

and private sector should handle their responsibility. However, there is consensus that the

various stakeholders who include shareholders, customers, employees, communities, regulators,

and the government that businesses and corporate entities have a broader scope of responsibility

to each of them individually and collectively.

As a result, companies working more closely with the stakeholders in order to understand

their concerns and develop strategies to address their concerns. These strategies are what are

commonly referred to as corporate social responsibilities which encompass environmental,

communal, economic, legal and social concerns (Higgins & Stubbs, 2015). The GRI guidelines

provide the format, details, and extent of the reports. The guidelines provide an indication of the

elements and disclosures to be presented in the report. These disclosures provide certain benefits

to the stakeholders

(i) For the shareholders – the increased disclosures indicate the business models, governance

structures specifically with regard to risk profile taking and mitigation. This helps to indicate

the growth and success of the company;

(ii) Employees- the regulations address the diversity issues, labour rights, health, safety,

wages, and benefits.

(iii) Customers- These address their concern on environmental impacts and health and

safety of the products they procure

(iv)Communities – highlight the corporate social responsibility programs, investment in the

community, and social and environmental impacts

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 10

(v) Regulatory Authorities and Government – address issues surrounding public welfare and

compliance to rules and regulations.

The benefits are not limited to the stakeholders only; they also benefit companies in the

following manner:

(i) Enable the board and management to formulate policies and strategies that are well

informed;

(ii) Allows for enhanced business intelligence which reduces business risks;

(iii) The interactions with the stakeholders enhance business opportunities, increases brand

value and improves the reputation, and allows for diversity which allows for

innovation; all these help to improve sustainability and ultimately the shareholder

value.

Part B

1. Major costs associated with Smiggles and Peter Alexander. The major costs associated

with Smiggles and Peter Alexander includes Labour Costs, Inventory, Variable Overheads, Rent,

Depreciation, and Marketing costs (Premier Investment, 2016).

2. Types of Costs Associated with Smiggles and Peter Alexander

The main types of costs associated with the operations of Smiggles and Peter Alexander are

fixed costs and variable costs. The values of the fixed costs remain constant irrespective of the

level of product or volume of sales (Ross, Westerfield, & Jaffe, 2010). For example the cost of

depreciation and rent remain the same. The variable costs depend on the level of production. An

increase in the level of production will result in an increase in the variable costs while a

reduction in the level of production will result in the reduction of variable costs.

(v) Regulatory Authorities and Government – address issues surrounding public welfare and

compliance to rules and regulations.

The benefits are not limited to the stakeholders only; they also benefit companies in the

following manner:

(i) Enable the board and management to formulate policies and strategies that are well

informed;

(ii) Allows for enhanced business intelligence which reduces business risks;

(iii) The interactions with the stakeholders enhance business opportunities, increases brand

value and improves the reputation, and allows for diversity which allows for

innovation; all these help to improve sustainability and ultimately the shareholder

value.

Part B

1. Major costs associated with Smiggles and Peter Alexander. The major costs associated

with Smiggles and Peter Alexander includes Labour Costs, Inventory, Variable Overheads, Rent,

Depreciation, and Marketing costs (Premier Investment, 2016).

2. Types of Costs Associated with Smiggles and Peter Alexander

The main types of costs associated with the operations of Smiggles and Peter Alexander are

fixed costs and variable costs. The values of the fixed costs remain constant irrespective of the

level of product or volume of sales (Ross, Westerfield, & Jaffe, 2010). For example the cost of

depreciation and rent remain the same. The variable costs depend on the level of production. An

increase in the level of production will result in an increase in the variable costs while a

reduction in the level of production will result in the reduction of variable costs.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 11

3. Usefulness of break-even analysis

The break-even analysis can be a useful tool in financial planning and management decision

making because

(i) The Cost-Volume- Profit analysis associated with the break-even analysis helps the

management to determine whether to go ahead with production and indicates the level

of production;

(ii) Helps to identify the products and sales mix that yield maximum profits;

(iii) The break-even analysis helps to identify costs and indicates the rise in prices

However, there are various shortcomings of the break-even analysis. These include

(i) Most of the costs associated do not fall into the two categoris of fixed costs and

variable costs. Some costs such as delivery costs and fuel costs can be considered as

fixed or variable;

(ii) Given that Premier Investment Ltd has a wide variety of goods, the managers have to

formulate and evaluate various sales and production mixes in order to establish optimal

levels.

(iii) The break-even point is an estimation and often short-run given that the business

environment is static.

(iv)The break-even analysis does not take into consideration the cost of production.

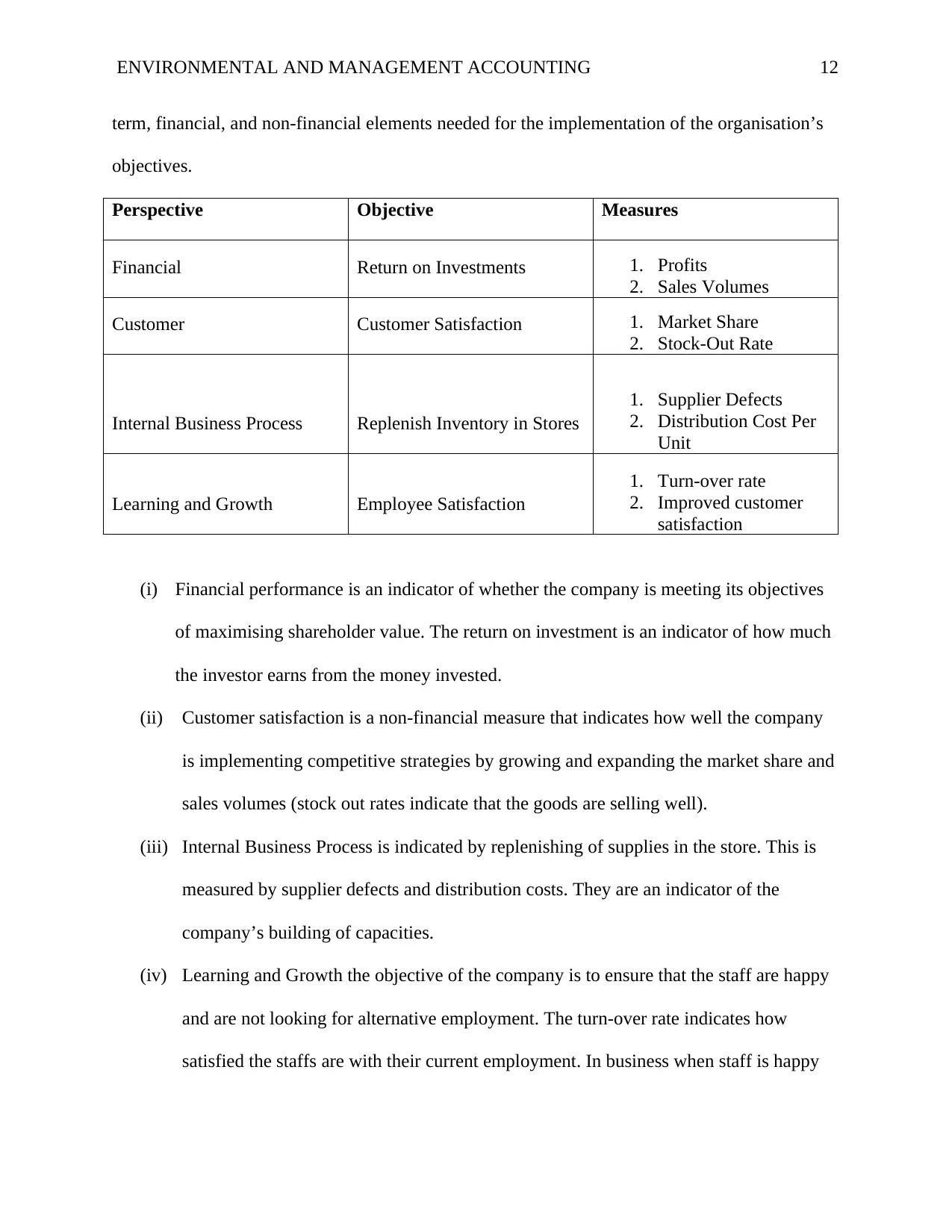

4. Balance-Score Card

The Balance-Score Card is a mechanism used by organisations to evaluate the performance

by clearly stating the objectives of the organisation, the targets, and the measures used to

evaluate performance (Atkinson, 2007). The score card takes into consideration long-term, short-

3. Usefulness of break-even analysis

The break-even analysis can be a useful tool in financial planning and management decision

making because

(i) The Cost-Volume- Profit analysis associated with the break-even analysis helps the

management to determine whether to go ahead with production and indicates the level

of production;

(ii) Helps to identify the products and sales mix that yield maximum profits;

(iii) The break-even analysis helps to identify costs and indicates the rise in prices

However, there are various shortcomings of the break-even analysis. These include

(i) Most of the costs associated do not fall into the two categoris of fixed costs and

variable costs. Some costs such as delivery costs and fuel costs can be considered as

fixed or variable;

(ii) Given that Premier Investment Ltd has a wide variety of goods, the managers have to

formulate and evaluate various sales and production mixes in order to establish optimal

levels.

(iii) The break-even point is an estimation and often short-run given that the business

environment is static.

(iv)The break-even analysis does not take into consideration the cost of production.

4. Balance-Score Card

The Balance-Score Card is a mechanism used by organisations to evaluate the performance

by clearly stating the objectives of the organisation, the targets, and the measures used to

evaluate performance (Atkinson, 2007). The score card takes into consideration long-term, short-

ENVIRONMENTAL AND MANAGEMENT ACCOUNTING 12

term, financial, and non-financial elements needed for the implementation of the organisation’s

objectives.

Perspective Objective Measures

Financial Return on Investments 1. Profits

2. Sales Volumes

Customer Customer Satisfaction 1. Market Share

2. Stock-Out Rate

Internal Business Process Replenish Inventory in Stores

1. Supplier Defects

2. Distribution Cost Per

Unit

Learning and Growth Employee Satisfaction

1. Turn-over rate

2. Improved customer

satisfaction

(i) Financial performance is an indicator of whether the company is meeting its objectives

of maximising shareholder value. The return on investment is an indicator of how much

the investor earns from the money invested.

(ii) Customer satisfaction is a non-financial measure that indicates how well the company

is implementing competitive strategies by growing and expanding the market share and

sales volumes (stock out rates indicate that the goods are selling well).

(iii) Internal Business Process is indicated by replenishing of supplies in the store. This is

measured by supplier defects and distribution costs. They are an indicator of the

company’s building of capacities.

(iv) Learning and Growth the objective of the company is to ensure that the staff are happy

and are not looking for alternative employment. The turn-over rate indicates how

satisfied the staffs are with their current employment. In business when staff is happy

term, financial, and non-financial elements needed for the implementation of the organisation’s

objectives.

Perspective Objective Measures

Financial Return on Investments 1. Profits

2. Sales Volumes

Customer Customer Satisfaction 1. Market Share

2. Stock-Out Rate

Internal Business Process Replenish Inventory in Stores

1. Supplier Defects

2. Distribution Cost Per

Unit

Learning and Growth Employee Satisfaction

1. Turn-over rate

2. Improved customer

satisfaction

(i) Financial performance is an indicator of whether the company is meeting its objectives

of maximising shareholder value. The return on investment is an indicator of how much

the investor earns from the money invested.

(ii) Customer satisfaction is a non-financial measure that indicates how well the company

is implementing competitive strategies by growing and expanding the market share and

sales volumes (stock out rates indicate that the goods are selling well).

(iii) Internal Business Process is indicated by replenishing of supplies in the store. This is

measured by supplier defects and distribution costs. They are an indicator of the

company’s building of capacities.

(iv) Learning and Growth the objective of the company is to ensure that the staff are happy

and are not looking for alternative employment. The turn-over rate indicates how

satisfied the staffs are with their current employment. In business when staff is happy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.