Financial Management Report: Timebased Events Limited Event Planning

VerifiedAdded on 2021/04/21

|18

|3959

|43

Report

AI Summary

This report analyzes the financial management practices of Timebased Events Limited, an event management firm in London, UK. The report focuses on an event planned for Amazon's product launch, exploring market research, alternative funding sources such as angel investors, bank loans, advance ticket sales, and sponsorship. It also delves into the main purposes of financial management within the events industry, including capital requirements, capital composition, financing sources, fund investment, surplus disposal, cash management, and financial controls. The report critically evaluates relevant pricing strategies like fixed hourly rates, flat fees, profit percentage, commission, and hourly expenses. Furthermore, it includes a critical evaluation of cost-volume-profit (CVP) analysis to determine the break-even point and recommends appropriate funding sources and pricing strategies for the event's financial success.

Running head: EVENTS FINANCIAL MANAGEMENT

Events Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Events Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1EVENTS FINANCIAL MANAGEMENT

Executive Summary:

In this report, the assistant financial manager of a profit-making event management firm

organises various events for different types of occasions in London, UK. Thus, Timebased

Events Limited is chosen as the event management organisation, which collaborates with the

visionary brands of elevating ideas. The organisation needs to follow the flat fee pricing strategy,

as Amazon would be able to seek appropriate knowledge of the patients. Finally, in order to raise

funds for the event, Timebased Events Limited could seek bank loan and sponsorship for making

the stated project a success along with assuring its overall commercial viability.

Executive Summary:

In this report, the assistant financial manager of a profit-making event management firm

organises various events for different types of occasions in London, UK. Thus, Timebased

Events Limited is chosen as the event management organisation, which collaborates with the

visionary brands of elevating ideas. The organisation needs to follow the flat fee pricing strategy,

as Amazon would be able to seek appropriate knowledge of the patients. Finally, in order to raise

funds for the event, Timebased Events Limited could seek bank loan and sponsorship for making

the stated project a success along with assuring its overall commercial viability.

2EVENTS FINANCIAL MANAGEMENT

Table of Contents

1. Introduction:...............................................................................................................................3

2. Market research results about the commercial viability of similar events:.................................3

3. Alternative sources of finance to fund the event:........................................................................4

4. Main purposes of financial management within the events industry:.........................................6

5. Relevant pricing strategies for pricing the products/services of the event:................................8

6. Critical evaluation of cost-volume-profit (CVP) analysis to calculate the number of customers

to break-even:................................................................................................................................10

7. Recommendation of appropriate sources of finance and pricing strategies of the event:.........14

8. Conclusion:................................................................................................................................14

References:....................................................................................................................................16

Table of Contents

1. Introduction:...............................................................................................................................3

2. Market research results about the commercial viability of similar events:.................................3

3. Alternative sources of finance to fund the event:........................................................................4

4. Main purposes of financial management within the events industry:.........................................6

5. Relevant pricing strategies for pricing the products/services of the event:................................8

6. Critical evaluation of cost-volume-profit (CVP) analysis to calculate the number of customers

to break-even:................................................................................................................................10

7. Recommendation of appropriate sources of finance and pricing strategies of the event:.........14

8. Conclusion:................................................................................................................................14

References:....................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3EVENTS FINANCIAL MANAGEMENT

1. Introduction:

In this report, the assistant financial manager of a profit-making event management firm

organises various events for different types of occasions in London, UK. Thus, Timebased

Events Limited is chosen as the event management organisation, which collaborates with the

visionary brands of elevating ideas. It is considered as one of the leaders in event production and

corporate event planning in London and other global places (Timebased.co.uk 2018). The

organisation has numerous clients, out of which Amazon is selected for this report. It is assumed

that Amazon is planning to launch 30 new products for which it would conduct an event to draw

the attention of the potential customers. This event would host few renowned movie and sports

personalities where it would be possible for the common individuals residing in London to attend

the event through payment of entry fee.

Timebased Events Limited has different venues for carrying out various events. The

major venues that the organisation has in London include “Conde Nast College of Fashion and

Design”, “Design Museum” and “Royal Opera House”. The major services of the organisation

constitute of launching events, brand event management, international events and awards

ceremony production. Hence, the current report would concentrate on brand event management

of the new products of Amazon to be launched.

2. Market research results about the commercial viability of similar events:

Timebased Events Limited has arranged some similar events in the past and it has gained

adequate amount of profit from such events, some of which are illustrated as follows:

Vogue Festival 2015:

1. Introduction:

In this report, the assistant financial manager of a profit-making event management firm

organises various events for different types of occasions in London, UK. Thus, Timebased

Events Limited is chosen as the event management organisation, which collaborates with the

visionary brands of elevating ideas. It is considered as one of the leaders in event production and

corporate event planning in London and other global places (Timebased.co.uk 2018). The

organisation has numerous clients, out of which Amazon is selected for this report. It is assumed

that Amazon is planning to launch 30 new products for which it would conduct an event to draw

the attention of the potential customers. This event would host few renowned movie and sports

personalities where it would be possible for the common individuals residing in London to attend

the event through payment of entry fee.

Timebased Events Limited has different venues for carrying out various events. The

major venues that the organisation has in London include “Conde Nast College of Fashion and

Design”, “Design Museum” and “Royal Opera House”. The major services of the organisation

constitute of launching events, brand event management, international events and awards

ceremony production. Hence, the current report would concentrate on brand event management

of the new products of Amazon to be launched.

2. Market research results about the commercial viability of similar events:

Timebased Events Limited has arranged some similar events in the past and it has gained

adequate amount of profit from such events, some of which are illustrated as follows:

Vogue Festival 2015:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4EVENTS FINANCIAL MANAGEMENT

Vogue is a global fashion brand, which intended to drive its inspirational fashion festival

for capturing imaginations along with transporting the festival goers into a new world of fashion.

For conducting such public event, Timebased Events Limited had relocated the festival to two

new venues, which were “Royal College of Art” and “The Royal Geographical Society”. These

two venues have been designed in such a manner that they fit to carry out the global fashion elite

(Draper, Young Thomas and Fenich 2018). The editor of Vogue has appreciated the work of the

organisation after completion of the event regarding design and looks concept. This implies the

commercial viability of the project.

H&M swimwear launch:

For arranging the new swimwear launch of H&M, the organisation has arranged

Shoreditch House for hosting the event, since David Beckham was the chief guest of H&M for

the event (Fragkogianni 2018). In the poolside, branded campaign displays were designed with

the help of a striking feature of rain curtain. In addition, Timebased Events Limited had

developed a stylish showroom for displaying products along with the private lounges for global

press and list of celebrity guests. It has received huge appreciation from H&M for conducting the

event in a successful fashion, which signifies that the event is commercially feasible.

3. Alternative sources of finance to fund the event:

The alternative funding sources that Timebased Events Limited could have for financing

the event comprise of the following:

Angel investors:

Timebased Events Limited could access websites such as Angelsden in order to connect

the potential investors with the help of personal introduction or pitching events for a fee. The

Vogue is a global fashion brand, which intended to drive its inspirational fashion festival

for capturing imaginations along with transporting the festival goers into a new world of fashion.

For conducting such public event, Timebased Events Limited had relocated the festival to two

new venues, which were “Royal College of Art” and “The Royal Geographical Society”. These

two venues have been designed in such a manner that they fit to carry out the global fashion elite

(Draper, Young Thomas and Fenich 2018). The editor of Vogue has appreciated the work of the

organisation after completion of the event regarding design and looks concept. This implies the

commercial viability of the project.

H&M swimwear launch:

For arranging the new swimwear launch of H&M, the organisation has arranged

Shoreditch House for hosting the event, since David Beckham was the chief guest of H&M for

the event (Fragkogianni 2018). In the poolside, branded campaign displays were designed with

the help of a striking feature of rain curtain. In addition, Timebased Events Limited had

developed a stylish showroom for displaying products along with the private lounges for global

press and list of celebrity guests. It has received huge appreciation from H&M for conducting the

event in a successful fashion, which signifies that the event is commercially feasible.

3. Alternative sources of finance to fund the event:

The alternative funding sources that Timebased Events Limited could have for financing

the event comprise of the following:

Angel investors:

Timebased Events Limited could access websites such as Angelsden in order to connect

the potential investors with the help of personal introduction or pitching events for a fee. The

5EVENTS FINANCIAL MANAGEMENT

website contains 13,000 angel investors having 90% success rate (Barr and McClellan 2018).

The other ways of finding investors include approaching the existing contacts or specialist

investment groups. For example, as Timebased Events Limited is planning the launch of new

products in Amazon, it could approach the sports firms to place advertisements on the chosen

event venue.

Bank loan:

The bank loans are not provided easily in the current era, since the banks are unlikely to

make profit for financing an event. However, since Timebased Events Limited has global records

of achievement, it is possible for it to seek the bank loan option. Conversely, it could seek bank

loan, if it mortgages a business asset. Before mortgaging, it is necessary for an organisation to be

aware of the event success before taking into account bank loan as an option (Bekaert and

Hodrick 2017).

Advance ticket sales:

Event-ticketing platform such as Eventbrite could be used before selling advance tickets

of the planned date of the event. This would help in evaluating the popularity of the event

proposal, since working capital base could be increased (Brooks 2015). Hence, the processing of

payment in the context of Eventbrite would help Timebased Events Limited in applying for

advance payment before the date of the event. This processing enables the organisation to gather

a part of advance ticket sales, as the same would be supplied with important cash flows to kick-

start the project.

Sponsorship:

website contains 13,000 angel investors having 90% success rate (Barr and McClellan 2018).

The other ways of finding investors include approaching the existing contacts or specialist

investment groups. For example, as Timebased Events Limited is planning the launch of new

products in Amazon, it could approach the sports firms to place advertisements on the chosen

event venue.

Bank loan:

The bank loans are not provided easily in the current era, since the banks are unlikely to

make profit for financing an event. However, since Timebased Events Limited has global records

of achievement, it is possible for it to seek the bank loan option. Conversely, it could seek bank

loan, if it mortgages a business asset. Before mortgaging, it is necessary for an organisation to be

aware of the event success before taking into account bank loan as an option (Bekaert and

Hodrick 2017).

Advance ticket sales:

Event-ticketing platform such as Eventbrite could be used before selling advance tickets

of the planned date of the event. This would help in evaluating the popularity of the event

proposal, since working capital base could be increased (Brooks 2015). Hence, the processing of

payment in the context of Eventbrite would help Timebased Events Limited in applying for

advance payment before the date of the event. This processing enables the organisation to gather

a part of advance ticket sales, as the same would be supplied with important cash flows to kick-

start the project.

Sponsorship:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6EVENTS FINANCIAL MANAGEMENT

After the event is completed, the sponsors often tend to arrive. Their motive is to obtain

information about the expected audiences to attend the event, venue and event timing, event

agenda along with the marketing plan of Timebased Events Limited. Thus, it would be essential

for the firm to obtain core finance or individuals participating in the event before they tend to

approach the sponsors. Moreover, sponsorship packages need to be finalised by providing a clear

explanation of the benefits about the advantages to be provided to the sponsors.

4. Main purposes of financial management within the events industry:

There are certain main purposes of financial management within the events industry of

UK, which are described briefly as follows:

Estimation of capital requirements:

The assistant financial manager of Timebased Events Limited is required to project the

capital requirements of the firm. This would depend on the projected costs and profits coupled

with the future programs and policies of the firm (Eldenburg, Krishnan and Krishnan 2017).

Hence, the assistant financial manager of the firm needs to carry out projections effectively for

increasing the overall earning ability.

Determination of capital composition:

As soon as the projections are made, the assistant financial manager of the firm is

required to determine its capital structure. In this context, Finkler et al. (2016) remarked that

both short-term and long-term valuations of debt and equity are needed. This would depend on

the portion of equity capital a firm holds and additional funds that would be obtained from the

outside parties.

After the event is completed, the sponsors often tend to arrive. Their motive is to obtain

information about the expected audiences to attend the event, venue and event timing, event

agenda along with the marketing plan of Timebased Events Limited. Thus, it would be essential

for the firm to obtain core finance or individuals participating in the event before they tend to

approach the sponsors. Moreover, sponsorship packages need to be finalised by providing a clear

explanation of the benefits about the advantages to be provided to the sponsors.

4. Main purposes of financial management within the events industry:

There are certain main purposes of financial management within the events industry of

UK, which are described briefly as follows:

Estimation of capital requirements:

The assistant financial manager of Timebased Events Limited is required to project the

capital requirements of the firm. This would depend on the projected costs and profits coupled

with the future programs and policies of the firm (Eldenburg, Krishnan and Krishnan 2017).

Hence, the assistant financial manager of the firm needs to carry out projections effectively for

increasing the overall earning ability.

Determination of capital composition:

As soon as the projections are made, the assistant financial manager of the firm is

required to determine its capital structure. In this context, Finkler et al. (2016) remarked that

both short-term and long-term valuations of debt and equity are needed. This would depend on

the portion of equity capital a firm holds and additional funds that would be obtained from the

outside parties.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7EVENTS FINANCIAL MANAGEMENT

Selection of financing sources:

In order to procure funds, a firm has a number of alternatives such as angel investors and

loans to be sought from the banks and other financial institutions coupled with the public

deposits to be accumulated as bonds (Fox and Madura 2017). Each factor needs to be chosen

based on relative advantages and limitations of each funding source and period.

Fund investment:

The assistant financial manager needs to assist the financial manager of Timebased

Events Limited to determine the fund distribution into profitable events. This would enable in

minimising the overall investment risk and timely returns where possible (Gatzert 2015).

Surplus disposal:

The assistant financial manager of Timebased Events Limited could help the finance

manager of the organisation to aid in making net income decision. This procedure could be

conducted in two ways:

One procedure is the declaration of dividends, which comprises of the rate of dividend

and other advantages like bonus.

Another procedure is retained earnings where the volume is required to be ascertained

depending on diversification and innovation plans of the firm (Matthew 2017).

Cash management:

It is the duty of the assistant financial manager of Timebased Events Limited to undertake

cash management decisions. Cash is essential for various purposes like salary and wage

payment, electricity and water bill payment, clearing short-term obligations, creditor payments,

Selection of financing sources:

In order to procure funds, a firm has a number of alternatives such as angel investors and

loans to be sought from the banks and other financial institutions coupled with the public

deposits to be accumulated as bonds (Fox and Madura 2017). Each factor needs to be chosen

based on relative advantages and limitations of each funding source and period.

Fund investment:

The assistant financial manager needs to assist the financial manager of Timebased

Events Limited to determine the fund distribution into profitable events. This would enable in

minimising the overall investment risk and timely returns where possible (Gatzert 2015).

Surplus disposal:

The assistant financial manager of Timebased Events Limited could help the finance

manager of the organisation to aid in making net income decision. This procedure could be

conducted in two ways:

One procedure is the declaration of dividends, which comprises of the rate of dividend

and other advantages like bonus.

Another procedure is retained earnings where the volume is required to be ascertained

depending on diversification and innovation plans of the firm (Matthew 2017).

Cash management:

It is the duty of the assistant financial manager of Timebased Events Limited to undertake

cash management decisions. Cash is essential for various purposes like salary and wage

payment, electricity and water bill payment, clearing short-term obligations, creditor payments,

8EVENTS FINANCIAL MANAGEMENT

maintaining sufficient inventory and purchase of stuffs related to the events (Getz and Page

2016).

Financial controls:

It is necessary for the assistant financial manager of Timebased Events Limited for

planning, using and procuring the funds. Moreover, the personnel would require exercising

controlling over funds. This could be fulfilled with the help of various techniques by taking into

consideration ratio analysis, financial forecasting and cost control (Hoye et al. 2015).

5. Relevant pricing strategies for pricing the products/services of the event:

For conducting this particular event, the relevant pricing strategies that Timebased Events

Limited could use comprise of the following:

Fixed hourly rate:

This rate would start from £15 and more. Majority of the attendees paying hourly rate

would want to obtain information regarding the overall number of hours planning is expected to

make. With the help of fixed hourly rate, the firm would receive payment for the overall event

hours; however, the coordination hours above time.

Flat fee:

Timebased Events Limited is needed to review the requirements with Amazon and after

the review is done, the price could be presented. As laid out by Jackson, Morgan and Laws

(2018), majority of the clients prefer this strategy, since they obtain prior information regarding

the payments. However, the organisation is required to be appropriate at estimating time devoted

on the job or it would have negative effect on this type of payment.

maintaining sufficient inventory and purchase of stuffs related to the events (Getz and Page

2016).

Financial controls:

It is necessary for the assistant financial manager of Timebased Events Limited for

planning, using and procuring the funds. Moreover, the personnel would require exercising

controlling over funds. This could be fulfilled with the help of various techniques by taking into

consideration ratio analysis, financial forecasting and cost control (Hoye et al. 2015).

5. Relevant pricing strategies for pricing the products/services of the event:

For conducting this particular event, the relevant pricing strategies that Timebased Events

Limited could use comprise of the following:

Fixed hourly rate:

This rate would start from £15 and more. Majority of the attendees paying hourly rate

would want to obtain information regarding the overall number of hours planning is expected to

make. With the help of fixed hourly rate, the firm would receive payment for the overall event

hours; however, the coordination hours above time.

Flat fee:

Timebased Events Limited is needed to review the requirements with Amazon and after

the review is done, the price could be presented. As laid out by Jackson, Morgan and Laws

(2018), majority of the clients prefer this strategy, since they obtain prior information regarding

the payments. However, the organisation is required to be appropriate at estimating time devoted

on the job or it would have negative effect on this type of payment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9EVENTS FINANCIAL MANAGEMENT

Profit percentage:

This pricing strategy depends on part of the amount collected on the part of Amazon.

Hence, Timebased Events Limited is required to ensure the fill-up of seats or it might make

pennies on a pound. In this regard, Jaimangal-Jones, Fry and Haven-Tang (2018) cited that few

event firms work for a percentage varying between 15% and 20% of the total cost of the event

regardless of the number of individuals brought in.

Commission:

Few event organisations base their fees for obtaining commissions from travel agents,

venues and hotels. Such pricing strategy might be profitable; however, it would be the only

option (Jones 2014). Moreover, few clients are aware of these benefits and they might envision

double dipping, obtaining payment and venue for similar services. This strategy could be highly

beneficial for Timebased Events Limited, as it is working with Amazon, which could

accommodate its rates because of financial stability in the UK market.

Hourly expenses:

Another strategy that Timebased Events Limited could use is to charge hourly expense

with add-ons in order to cover expenditures (Lim 2017). In addition to this, the various project

managers of the organisation would subcontract portions, which are not managed directly. Under

such situation, the client would be provided with a bill of additional 15% -20% over the overall

service cost. This strategy could take into account stuffs such as mailing and printing (Raj,

Walters and Rashid 2017).

Profit percentage:

This pricing strategy depends on part of the amount collected on the part of Amazon.

Hence, Timebased Events Limited is required to ensure the fill-up of seats or it might make

pennies on a pound. In this regard, Jaimangal-Jones, Fry and Haven-Tang (2018) cited that few

event firms work for a percentage varying between 15% and 20% of the total cost of the event

regardless of the number of individuals brought in.

Commission:

Few event organisations base their fees for obtaining commissions from travel agents,

venues and hotels. Such pricing strategy might be profitable; however, it would be the only

option (Jones 2014). Moreover, few clients are aware of these benefits and they might envision

double dipping, obtaining payment and venue for similar services. This strategy could be highly

beneficial for Timebased Events Limited, as it is working with Amazon, which could

accommodate its rates because of financial stability in the UK market.

Hourly expenses:

Another strategy that Timebased Events Limited could use is to charge hourly expense

with add-ons in order to cover expenditures (Lim 2017). In addition to this, the various project

managers of the organisation would subcontract portions, which are not managed directly. Under

such situation, the client would be provided with a bill of additional 15% -20% over the overall

service cost. This strategy could take into account stuffs such as mailing and printing (Raj,

Walters and Rashid 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10EVENTS FINANCIAL MANAGEMENT

6. Critical evaluation of cost-volume-profit (CVP) analysis to calculate the number of

customers to break-even:

According to Masterman (2014), CVP analysis is reliant on determining the break-even

point of the cost and volume of product. This analysis is extremely useful for the managers of a

firm to make short-term decisions. Since it takes into account different assumptions to enhance

relevance, it considers that fixed costs, selling price and variable cost per unit do not vary. In

order to conduct this evaluation, various equations are required and these could be developed

with the help of cost, price and other variables. In order to plot them, the economic graphs are

utilised. Hence, it is a process of cost accounting related to the impact of varying levels of costs

and sales in terms of operating income of the organisation.

Timebased Events Limited could rely on CVP analysis, if the costs do not vary within a

particular level of production. Assumptions are made that all the printed tickets would be sold

and there would be absence of semi-variable cost, which means that the costs would be either

variable or fixed. With the help of CVP analysis, the use of contribution margin is made in order

to handle the product contribution margin, which is the output sought after deducting variable

costs from overall sales (Pedersen and Thibault 2014).

In order to ensure the success of the event, Timebased Events Limited needs to be aware

about the contribution margin, as it needs to be greater than the overall fixed costs. Moreover,

the contribution margin could be used for ascertaining the break-even point and break-even sales.

This could be obtained by dividing the overall fixed costs by the ratio of contribution margin

(McKinney 2015).

6. Critical evaluation of cost-volume-profit (CVP) analysis to calculate the number of

customers to break-even:

According to Masterman (2014), CVP analysis is reliant on determining the break-even

point of the cost and volume of product. This analysis is extremely useful for the managers of a

firm to make short-term decisions. Since it takes into account different assumptions to enhance

relevance, it considers that fixed costs, selling price and variable cost per unit do not vary. In

order to conduct this evaluation, various equations are required and these could be developed

with the help of cost, price and other variables. In order to plot them, the economic graphs are

utilised. Hence, it is a process of cost accounting related to the impact of varying levels of costs

and sales in terms of operating income of the organisation.

Timebased Events Limited could rely on CVP analysis, if the costs do not vary within a

particular level of production. Assumptions are made that all the printed tickets would be sold

and there would be absence of semi-variable cost, which means that the costs would be either

variable or fixed. With the help of CVP analysis, the use of contribution margin is made in order

to handle the product contribution margin, which is the output sought after deducting variable

costs from overall sales (Pedersen and Thibault 2014).

In order to ensure the success of the event, Timebased Events Limited needs to be aware

about the contribution margin, as it needs to be greater than the overall fixed costs. Moreover,

the contribution margin could be used for ascertaining the break-even point and break-even sales.

This could be obtained by dividing the overall fixed costs by the ratio of contribution margin

(McKinney 2015).

11EVENTS FINANCIAL MANAGEMENT

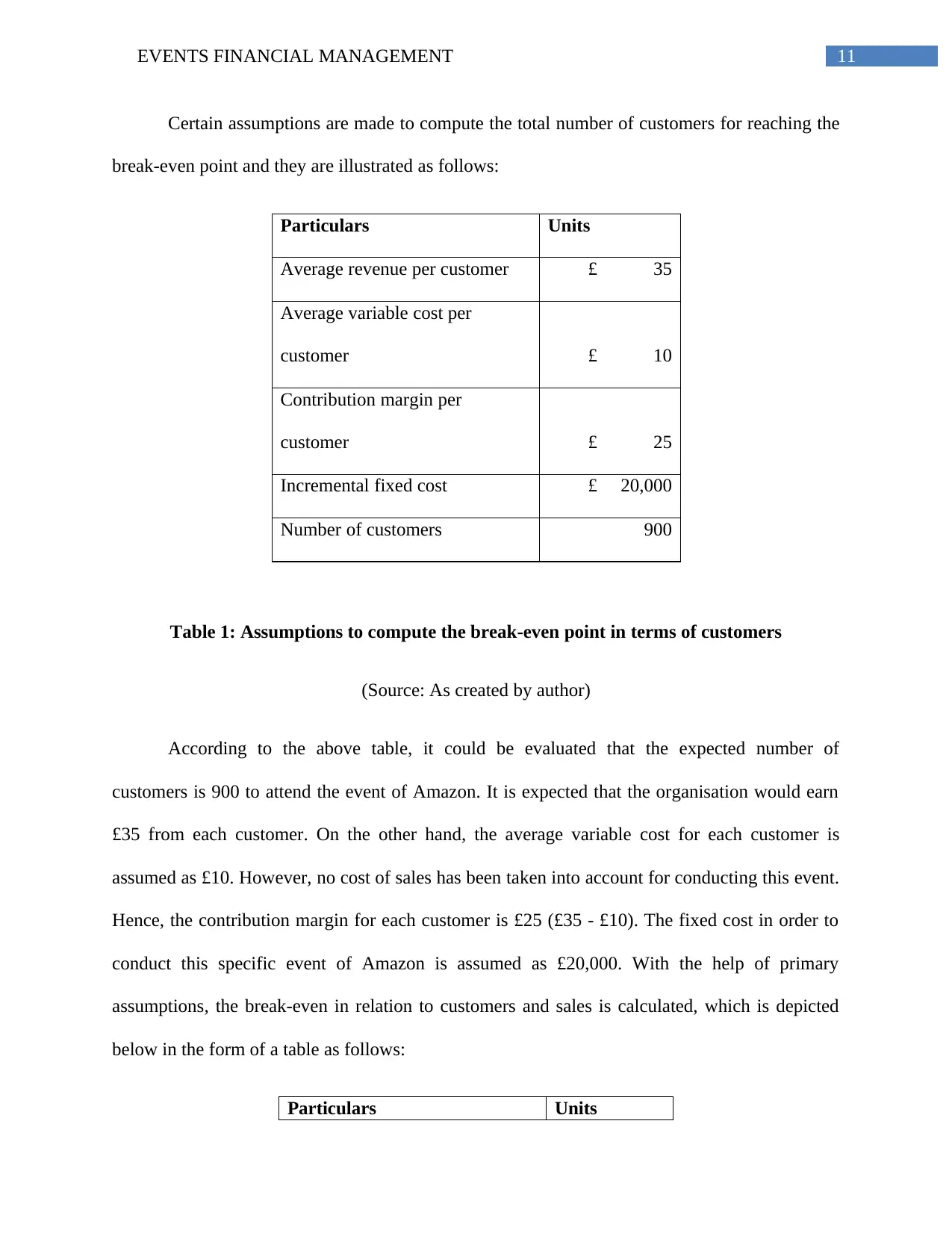

Certain assumptions are made to compute the total number of customers for reaching the

break-even point and they are illustrated as follows:

Particulars Units

Average revenue per customer £ 35

Average variable cost per

customer £ 10

Contribution margin per

customer £ 25

Incremental fixed cost £ 20,000

Number of customers 900

Table 1: Assumptions to compute the break-even point in terms of customers

(Source: As created by author)

According to the above table, it could be evaluated that the expected number of

customers is 900 to attend the event of Amazon. It is expected that the organisation would earn

£35 from each customer. On the other hand, the average variable cost for each customer is

assumed as £10. However, no cost of sales has been taken into account for conducting this event.

Hence, the contribution margin for each customer is £25 (£35 - £10). The fixed cost in order to

conduct this specific event of Amazon is assumed as £20,000. With the help of primary

assumptions, the break-even in relation to customers and sales is calculated, which is depicted

below in the form of a table as follows:

Particulars Units

Certain assumptions are made to compute the total number of customers for reaching the

break-even point and they are illustrated as follows:

Particulars Units

Average revenue per customer £ 35

Average variable cost per

customer £ 10

Contribution margin per

customer £ 25

Incremental fixed cost £ 20,000

Number of customers 900

Table 1: Assumptions to compute the break-even point in terms of customers

(Source: As created by author)

According to the above table, it could be evaluated that the expected number of

customers is 900 to attend the event of Amazon. It is expected that the organisation would earn

£35 from each customer. On the other hand, the average variable cost for each customer is

assumed as £10. However, no cost of sales has been taken into account for conducting this event.

Hence, the contribution margin for each customer is £25 (£35 - £10). The fixed cost in order to

conduct this specific event of Amazon is assumed as £20,000. With the help of primary

assumptions, the break-even in relation to customers and sales is calculated, which is depicted

below in the form of a table as follows:

Particulars Units

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.