Events Financial Management: Funding and Pricing Strategies

VerifiedAdded on 2021/04/17

|18

|3937

|28

Report

AI Summary

This report, focusing on Oxygen Event Services Limited, an event management organization in London, examines financial management strategies for a new product launch event. It delves into market research outcomes, alternative funding sources such as bank loans, sponsorship, and angel investors, and the primary purposes of financial management within the UK events industry, including capital structure ascertainment, capital requirement anticipation, and cash management. The report suggests flat fee pricing in combination with funding sources. The report also covers various pricing techniques like flat fee, fixed hourly rate, commission, percent of profit, and hourly rate and add-ons, and concludes with a cost-volume-profit (CVP) analysis to determine break-even points. The report provides valuable insights into the financial aspects of event management, offering a comprehensive overview of funding, pricing, and cost analysis within the context of the UK events industry. This report is provided to Desklib by a student.

Running head: EVENTS FINANCIAL MANAGEMENT

Events Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Events Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1EVENTS FINANCIAL MANAGEMENT

Executive Summary:

This report focuses on the perspective of an assistant financial manager of an event

management organisation that organises different types of events in London. Hence, Oxygen

Event Services Limited is chosen as the firm, which produces wide variety of events for a group

of clients working in different types of venues. It is assumed that the organisation would carry

out a new product launch for a popular retail firm in UK to attract the customers to buy its

product. Financial management is necessary for the conduction of such as event, since it would

help in anticipating capital requirements, ascertaining capital cost, cash management and many

others. Finally, the funding sources that are suggested to the organisation include bank loans and

sponsorship, while the flat fee pricing structure is recommended in combination with the sources

of finance.

Executive Summary:

This report focuses on the perspective of an assistant financial manager of an event

management organisation that organises different types of events in London. Hence, Oxygen

Event Services Limited is chosen as the firm, which produces wide variety of events for a group

of clients working in different types of venues. It is assumed that the organisation would carry

out a new product launch for a popular retail firm in UK to attract the customers to buy its

product. Financial management is necessary for the conduction of such as event, since it would

help in anticipating capital requirements, ascertaining capital cost, cash management and many

others. Finally, the funding sources that are suggested to the organisation include bank loans and

sponsorship, while the flat fee pricing structure is recommended in combination with the sources

of finance.

2EVENTS FINANCIAL MANAGEMENT

Table of Contents

Introduction:....................................................................................................................................3

Market research outcomes regarding the commercial feasibility of similar events:.......................3

Alternative funding sources for the event:.......................................................................................4

Primary purposes of financial management within the UK events industry:..................................6

Pricing techniques to be adopted for the event:...............................................................................8

Cost-volume-profit (CVP) analysis:................................................................................................9

Suggestion of feasible pricing and funding sources of the event:.................................................13

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

Table of Contents

Introduction:....................................................................................................................................3

Market research outcomes regarding the commercial feasibility of similar events:.......................3

Alternative funding sources for the event:.......................................................................................4

Primary purposes of financial management within the UK events industry:..................................6

Pricing techniques to be adopted for the event:...............................................................................8

Cost-volume-profit (CVP) analysis:................................................................................................9

Suggestion of feasible pricing and funding sources of the event:.................................................13

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3EVENTS FINANCIAL MANAGEMENT

Introduction:

This report focuses on the perspective of an assistant financial manager of an event

management organisation that organises different types of events in London. Hence, Oxygen

Event Services Limited is chosen as the firm, which produces wide variety of events for a group

of clients working in different types of venues. It follows a personal approach coupled with

leadership, design and creativity for assuring the effective event delivery possible (Oxygen-

events.com 2018). It is assumed that the organisation would carry out a new product launch for a

popular retail firm in UK to attract the customers to buy its product. In addition, some renowned

movie personalities would be present in the event, in which the London individuals are able to

attend the event via an entry fee.

Oxygen Event Services Limited has various venues to conduct different events. Some of

the main venues of the event firm comprise of Barton Court, Hedsor House, The Royal

Geographical Society, The Household Cavalry Museum, The Hurlingham Club and The Steel

Yard. The main services of the firm comprise of global events, awards ceremony production,

brand event management and launch of new events. Thus, the report would shed light on

launching the brand new product of the popular retail firm in UK.

Market research outcomes regarding the commercial feasibility of similar events:

Oxygen Event Services Limited has conducted few identical events in the past and it

made considerable profits from them, few of which are described as follows:

Rebranding of Restaurant Associates:

Restaurant Associates has spent six months to work on re-branding and thus, it is

necessary for them to find a space to go through the passion, which had gone into design. For

Introduction:

This report focuses on the perspective of an assistant financial manager of an event

management organisation that organises different types of events in London. Hence, Oxygen

Event Services Limited is chosen as the firm, which produces wide variety of events for a group

of clients working in different types of venues. It follows a personal approach coupled with

leadership, design and creativity for assuring the effective event delivery possible (Oxygen-

events.com 2018). It is assumed that the organisation would carry out a new product launch for a

popular retail firm in UK to attract the customers to buy its product. In addition, some renowned

movie personalities would be present in the event, in which the London individuals are able to

attend the event via an entry fee.

Oxygen Event Services Limited has various venues to conduct different events. Some of

the main venues of the event firm comprise of Barton Court, Hedsor House, The Royal

Geographical Society, The Household Cavalry Museum, The Hurlingham Club and The Steel

Yard. The main services of the firm comprise of global events, awards ceremony production,

brand event management and launch of new events. Thus, the report would shed light on

launching the brand new product of the popular retail firm in UK.

Market research outcomes regarding the commercial feasibility of similar events:

Oxygen Event Services Limited has conducted few identical events in the past and it

made considerable profits from them, few of which are described as follows:

Rebranding of Restaurant Associates:

Restaurant Associates has spent six months to work on re-branding and thus, it is

necessary for them to find a space to go through the passion, which had gone into design. For

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4EVENTS FINANCIAL MANAGEMENT

this particular event, Oxygen Event Services Limited has developed white stage flats in order to

cover the venue back wall for presentation space. The intention is to form a huge backdrop

having a central screen. The design was made for maximising the effect of power point

presentation and graphics (Atkins, Carey and Sanders 2016). The event fetched adequate number

of audience due to which it emerged out as a success for the organisation.

IAA Summer Ball:

The event was a dinner and party for 950 individuals at the Hurlingham Club. The

organisation has worked with the International Advertising Association, which is contracting

with the organisation to prepare its annual summer and Christmas events for the past seven years.

The club hired for conducting the event was turned into a circus theme along with effective

lighting design for the venue, columns, dance floor and dining area. The guests were treated

effectively and the association has praised the work of Oxygen Event Services Limited, which

made this event a huge success.

Alternative funding sources for the event:

There are several alternative sources of finance for Oxygen Event Services Limited and

they are elaborated briefly as follows:

Bank loan:

As the banks hardly make any profit by providing funding for an event, it would be hard

to obtain loans from them (Barr and McClellan 2018). Due to the popularity of Oxygen Event

Services Limited in the event industry of UK, it would be easier for the organisation to obtain

bank loan. This could be obtained in the form of an asset mortgage. However, before mortgaging

this particular event, Oxygen Event Services Limited has developed white stage flats in order to

cover the venue back wall for presentation space. The intention is to form a huge backdrop

having a central screen. The design was made for maximising the effect of power point

presentation and graphics (Atkins, Carey and Sanders 2016). The event fetched adequate number

of audience due to which it emerged out as a success for the organisation.

IAA Summer Ball:

The event was a dinner and party for 950 individuals at the Hurlingham Club. The

organisation has worked with the International Advertising Association, which is contracting

with the organisation to prepare its annual summer and Christmas events for the past seven years.

The club hired for conducting the event was turned into a circus theme along with effective

lighting design for the venue, columns, dance floor and dining area. The guests were treated

effectively and the association has praised the work of Oxygen Event Services Limited, which

made this event a huge success.

Alternative funding sources for the event:

There are several alternative sources of finance for Oxygen Event Services Limited and

they are elaborated briefly as follows:

Bank loan:

As the banks hardly make any profit by providing funding for an event, it would be hard

to obtain loans from them (Barr and McClellan 2018). Due to the popularity of Oxygen Event

Services Limited in the event industry of UK, it would be easier for the organisation to obtain

bank loan. This could be obtained in the form of an asset mortgage. However, before mortgaging

5EVENTS FINANCIAL MANAGEMENT

its asset to the bank, it would be necessary for the organisation to ensure that the event would

succeed prior to obtain the bank loan.

Sponsorship:

Once after the completion of the event, the sponsors tend to attend the venue. The motive

is to accumulate information about the number of people attended the event, duration of the

event and its agenda along with the marketing strategy of Oxygen Event Services Limited. As a

result, it would be necessary for the organization to accumulate funds for the event from people

attending the event before the approach is made towards the sponsors. Along with this, the

finalisation of sponsorship packages is necessary, which could be carried out with a clear

description of the sponsor benefits.

Angel investors:

Websites like Angelsden could be used on the part of Oxygen Event Services Limited to

develop a link with the potential investors via personal introduction or event pitch in exchange of

fee. The success rate of the website is 90% and it has nearly 13,000 angel investors (Finkler et al.

2016). The other methods through which the organisation could obtain investors are using the

current contacts or specialised investment groups. For instance, since Oxygen Event Services

Limited would arrange the event of a retail firm for launching a new product, the organisation

could advance the sports organisations for placing advertisements on the selected venue of the

event.

Advance selling of tickets:

its asset to the bank, it would be necessary for the organisation to ensure that the event would

succeed prior to obtain the bank loan.

Sponsorship:

Once after the completion of the event, the sponsors tend to attend the venue. The motive

is to accumulate information about the number of people attended the event, duration of the

event and its agenda along with the marketing strategy of Oxygen Event Services Limited. As a

result, it would be necessary for the organization to accumulate funds for the event from people

attending the event before the approach is made towards the sponsors. Along with this, the

finalisation of sponsorship packages is necessary, which could be carried out with a clear

description of the sponsor benefits.

Angel investors:

Websites like Angelsden could be used on the part of Oxygen Event Services Limited to

develop a link with the potential investors via personal introduction or event pitch in exchange of

fee. The success rate of the website is 90% and it has nearly 13,000 angel investors (Finkler et al.

2016). The other methods through which the organisation could obtain investors are using the

current contacts or specialised investment groups. For instance, since Oxygen Event Services

Limited would arrange the event of a retail firm for launching a new product, the organisation

could advance the sports organisations for placing advertisements on the selected venue of the

event.

Advance selling of tickets:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6EVENTS FINANCIAL MANAGEMENT

For selling tickets in advance, Oxygen Event Services Limited could use Eventbrite,

which is a platform of event-ticketing. As a result, the organisation could assess the viability of

the event proposal, since it could obtain working capital access (Gatzert 2015). Such processing

of payment of the platform would be crucial for Oxygen Event Services Limited to apply for

prepaid payment before the event date. Thus, the organisation could be able to accumulate some

money from advance selling of tickets, since the cash inflows would be increased for execution

of the project.

Primary purposes of financial management within the UK events industry:

Financial management has an important role to play in the UK events industry and its

main purposes within the sector are elucidated as follows:

Ascertainment of the composition of capital:

It is the responsibility of the assistant financial manager of Oxygen Event Services

Limited to ascertain the capital structure of the firm before making estimations. As laid out by

Lau (2016), in order to find out the capital structure, both long-term and short-term debt and

stockholders’ equity are necessary. This would rely on the proportion of equity that the

organisation has and excess funds to be accumulated from the external parties.

Anticipation of capital requirements:

Anticipating the capital needs is another crucial responsibility of the assistant financial

manager of Oxygen Event Services Limited. Such anticipation is relied on the estimated benefits

and costs along with the upcoming policies and programs of the organisation (Karadag 2015).

Thus, it could be stated that anticipations are to be made correctly, since they would help in

enhancing the earning capacity of the organisation.

For selling tickets in advance, Oxygen Event Services Limited could use Eventbrite,

which is a platform of event-ticketing. As a result, the organisation could assess the viability of

the event proposal, since it could obtain working capital access (Gatzert 2015). Such processing

of payment of the platform would be crucial for Oxygen Event Services Limited to apply for

prepaid payment before the event date. Thus, the organisation could be able to accumulate some

money from advance selling of tickets, since the cash inflows would be increased for execution

of the project.

Primary purposes of financial management within the UK events industry:

Financial management has an important role to play in the UK events industry and its

main purposes within the sector are elucidated as follows:

Ascertainment of the composition of capital:

It is the responsibility of the assistant financial manager of Oxygen Event Services

Limited to ascertain the capital structure of the firm before making estimations. As laid out by

Lau (2016), in order to find out the capital structure, both long-term and short-term debt and

stockholders’ equity are necessary. This would rely on the proportion of equity that the

organisation has and excess funds to be accumulated from the external parties.

Anticipation of capital requirements:

Anticipating the capital needs is another crucial responsibility of the assistant financial

manager of Oxygen Event Services Limited. Such anticipation is relied on the estimated benefits

and costs along with the upcoming policies and programs of the organisation (Karadag 2015).

Thus, it could be stated that anticipations are to be made correctly, since they would help in

enhancing the earning capacity of the organisation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7EVENTS FINANCIAL MANAGEMENT

Financial controls:

As the assistant financial manager of Oxygen Event Services Limited, planning, utilising

and procuring the funds are of utmost significance. In addition, authority needs to be provided to

the personnel for gaining control over funds. The control would be achieved by using the

techniques of financial forecasting, ratio analysis and control of cost (Martin 2016).

Fund investment:

Assistance needs to be provided to the assistant financial manager of Oxygen Event

Services Limited for finding out the distribution of funds towards profitable events. As a result,

the investment risk would be reduced, while timely returns would be provided whenever possible

(Getz 2014).

Choosing sources of funding:

Options like angel investors, loans from banks and financial institutions and public

deposits obtained in the form of bonds would be useful for the organisation for procuring funds.

The selection of factors needs to be made depending on relative merits and demerits of the

funding sources and periods (Vogel 2014).

Cash management:

The assistant financial manager has an important role to play in managing cash decisions

of the organisation. This is because cash is required for paying wages and salaries, water bill,

electricity, existing dues, creditors, inventory level and other event stuffs (Henninger, Alevizou

and Oates 2017).

Disposal of surplus:

Financial controls:

As the assistant financial manager of Oxygen Event Services Limited, planning, utilising

and procuring the funds are of utmost significance. In addition, authority needs to be provided to

the personnel for gaining control over funds. The control would be achieved by using the

techniques of financial forecasting, ratio analysis and control of cost (Martin 2016).

Fund investment:

Assistance needs to be provided to the assistant financial manager of Oxygen Event

Services Limited for finding out the distribution of funds towards profitable events. As a result,

the investment risk would be reduced, while timely returns would be provided whenever possible

(Getz 2014).

Choosing sources of funding:

Options like angel investors, loans from banks and financial institutions and public

deposits obtained in the form of bonds would be useful for the organisation for procuring funds.

The selection of factors needs to be made depending on relative merits and demerits of the

funding sources and periods (Vogel 2014).

Cash management:

The assistant financial manager has an important role to play in managing cash decisions

of the organisation. This is because cash is required for paying wages and salaries, water bill,

electricity, existing dues, creditors, inventory level and other event stuffs (Henninger, Alevizou

and Oates 2017).

Disposal of surplus:

8EVENTS FINANCIAL MANAGEMENT

In order to undertake net profit decision, it is necessary for the assistant financial

manager of the organisation to extend support to the financial manager. This assistance could be

made in two ways. The first procedure is declaring dividends constituting of the dividend rate

and other bonus benefits. Another method is retained income, in which it is necessary to find out

the volume based on innovation and diversification plans of the organisation (Hoye et al. 2015).

Pricing techniques to be adopted for the event:

In order to carry out this event, Oxygen Event Services Limited could adopt the

following pricing techniques for the event:

Flat fee:

The event requirements need to be reviewed with the client and once they are made, the

price needs to be presented. In the words of Jones and Jones (2014), this strategy is preferred

mostly due to the prior information of the payments to be made. However, it is necessary for the

firm in anticipating the time spent on the job or it might have negative consequences on the

payment type.

Fixed hourly rate:

The rate would initiate from £15 and above. The attendees paying this rate might intend

to obtain information about the total number of hours the event would continue. Such rate would

enable Oxygen Event Services Limited to obtain payment for the total event hours.

Commission:

Some event firms charge their fees in order to accumulate commissions from venues,

travel agents and hotels. This strategy is profitable; however, it would be the sole alternative

In order to undertake net profit decision, it is necessary for the assistant financial

manager of the organisation to extend support to the financial manager. This assistance could be

made in two ways. The first procedure is declaring dividends constituting of the dividend rate

and other bonus benefits. Another method is retained income, in which it is necessary to find out

the volume based on innovation and diversification plans of the organisation (Hoye et al. 2015).

Pricing techniques to be adopted for the event:

In order to carry out this event, Oxygen Event Services Limited could adopt the

following pricing techniques for the event:

Flat fee:

The event requirements need to be reviewed with the client and once they are made, the

price needs to be presented. In the words of Jones and Jones (2014), this strategy is preferred

mostly due to the prior information of the payments to be made. However, it is necessary for the

firm in anticipating the time spent on the job or it might have negative consequences on the

payment type.

Fixed hourly rate:

The rate would initiate from £15 and above. The attendees paying this rate might intend

to obtain information about the total number of hours the event would continue. Such rate would

enable Oxygen Event Services Limited to obtain payment for the total event hours.

Commission:

Some event firms charge their fees in order to accumulate commissions from venues,

travel agents and hotels. This strategy is profitable; however, it would be the sole alternative

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9EVENTS FINANCIAL MANAGEMENT

(Matthew 2017). In addition, some clients know the full advantages of this technique, which

would help in collecting payment, venue for equivalent services along with double dipping. Such

strategy would be advantageous in the context of Oxygen Event Services Limited, since the retail

firm is popular in the UK market and thus, it could pay its rates due to financial stability.

Percent of profit:

This pricing technique is reliant on the proportion of the amount to be accumulated from

the client. Thus, it is necessary for Oxygen Event Services Limited to sell all the seats or the

profit level would go down from the event. In this context, McKinney (2015) advocated that

some event companies aim to earn between 15% and 20% of the overall event cost irrespective

of the overall number of individuals.

Hourly rate:

Hourly rate could be charged along with add-ons for meeting the total expenses to be

incurred for the event. Along with this, the different project managers of the firm might

subcontract few parts that are not handled directly. In such a scenario, the client might have to

pay an additional charge ranging between 15% and 20% of the total event cost. In addition, this

technique considers printing and mailing as well (Morgan, Jackson and Laws 2015).

Cost-volume-profit (CVP) analysis:

In the words of Phillips (2016), with the help of CVP analysis, break-even point and

product volume could be ascertained. As a result, it enables the managers of an organisation in

undertaking short-term decisions. The analysis considers different assumptions, in which the

fixed cost, variable cost per unit and selling price per unit do not change. For carrying out this

analysis, there is need for different equations and such development could be made via price,

(Matthew 2017). In addition, some clients know the full advantages of this technique, which

would help in collecting payment, venue for equivalent services along with double dipping. Such

strategy would be advantageous in the context of Oxygen Event Services Limited, since the retail

firm is popular in the UK market and thus, it could pay its rates due to financial stability.

Percent of profit:

This pricing technique is reliant on the proportion of the amount to be accumulated from

the client. Thus, it is necessary for Oxygen Event Services Limited to sell all the seats or the

profit level would go down from the event. In this context, McKinney (2015) advocated that

some event companies aim to earn between 15% and 20% of the overall event cost irrespective

of the overall number of individuals.

Hourly rate:

Hourly rate could be charged along with add-ons for meeting the total expenses to be

incurred for the event. Along with this, the different project managers of the firm might

subcontract few parts that are not handled directly. In such a scenario, the client might have to

pay an additional charge ranging between 15% and 20% of the total event cost. In addition, this

technique considers printing and mailing as well (Morgan, Jackson and Laws 2015).

Cost-volume-profit (CVP) analysis:

In the words of Phillips (2016), with the help of CVP analysis, break-even point and

product volume could be ascertained. As a result, it enables the managers of an organisation in

undertaking short-term decisions. The analysis considers different assumptions, in which the

fixed cost, variable cost per unit and selling price per unit do not change. For carrying out this

analysis, there is need for different equations and such development could be made via price,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10EVENTS FINANCIAL MANAGEMENT

cost and other variables. For plotting them, the utilisation of economic graphs is made. Hence,

this is a cost accounting technique associated with the effect of changing cost and sales levels in

relation to the operating profit of the organisation.

Oxygen Event Services Limited needs to depend on CVP analysis, if costs do not change

with a specific production level. It is assumed that all tickets would be sold and there is no

presence of semi-variable cost. This denotes that the types of cost in the event would be fixed

and variable. CVP analysis uses the contribution margin, which is beneficial for managing the

product contribution margin. The margin could be termed as the output that is obtained after the

variable expenses are deducted from the total sales (Pedersen and Thibault 2014).

For making this event a success, Oxygen Event Services Limited is required to be aware

regarding the contribution margin, since the total fixed costs are required to be lower than the

contribution margin. Along with this, the use of contribution margin is to be made to arrive at the

break-even point and sales. For determining the break-even point, the following formula is used:

Break-even point = Fixed costs/ Contribution margin ratio

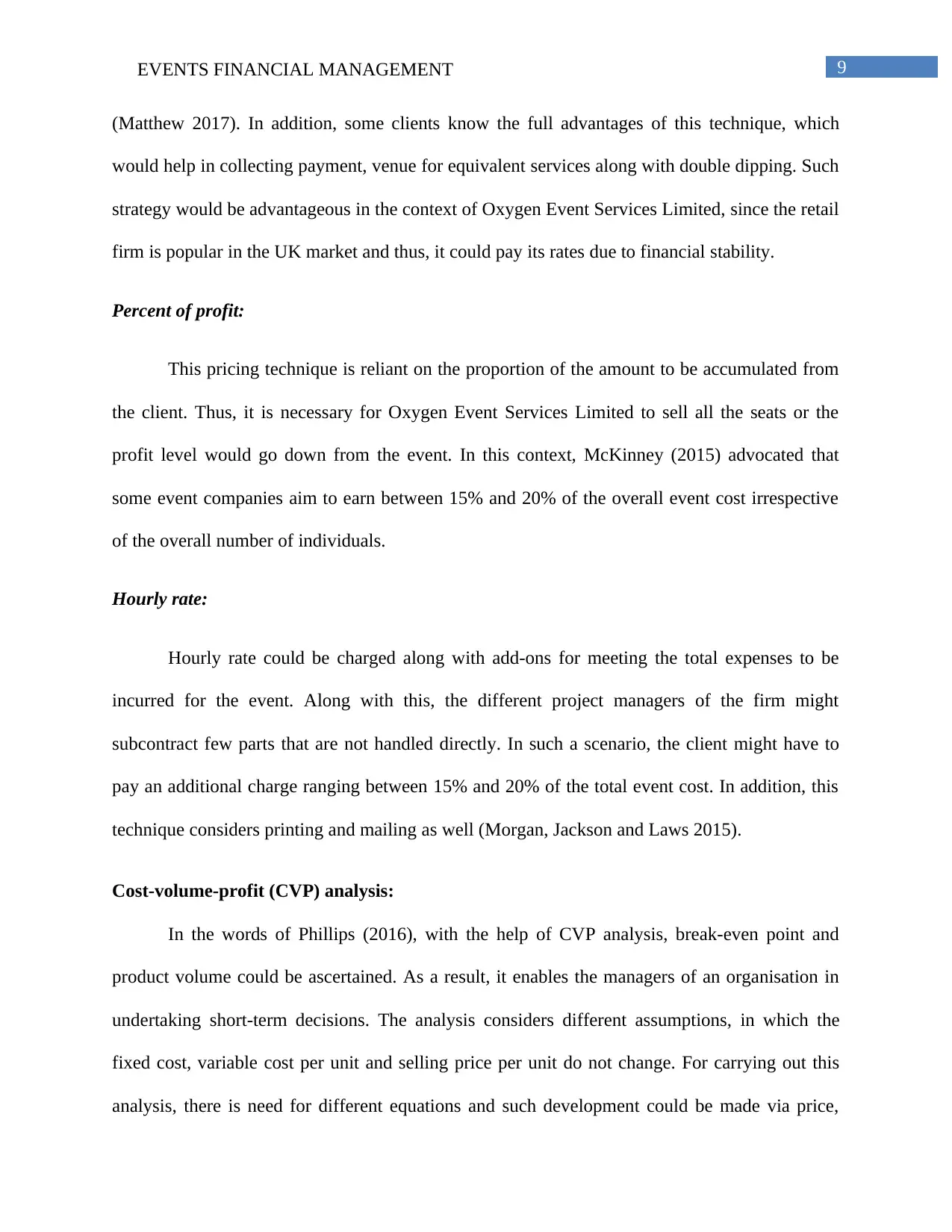

In order to arrive at the number of customers for break-even, the following assumptions

are made:

Primary Assumptions:

Particulars Units

Average revenue per customer £ 16

Average variable cost per

customer £ 4

cost and other variables. For plotting them, the utilisation of economic graphs is made. Hence,

this is a cost accounting technique associated with the effect of changing cost and sales levels in

relation to the operating profit of the organisation.

Oxygen Event Services Limited needs to depend on CVP analysis, if costs do not change

with a specific production level. It is assumed that all tickets would be sold and there is no

presence of semi-variable cost. This denotes that the types of cost in the event would be fixed

and variable. CVP analysis uses the contribution margin, which is beneficial for managing the

product contribution margin. The margin could be termed as the output that is obtained after the

variable expenses are deducted from the total sales (Pedersen and Thibault 2014).

For making this event a success, Oxygen Event Services Limited is required to be aware

regarding the contribution margin, since the total fixed costs are required to be lower than the

contribution margin. Along with this, the use of contribution margin is to be made to arrive at the

break-even point and sales. For determining the break-even point, the following formula is used:

Break-even point = Fixed costs/ Contribution margin ratio

In order to arrive at the number of customers for break-even, the following assumptions

are made:

Primary Assumptions:

Particulars Units

Average revenue per customer £ 16

Average variable cost per

customer £ 4

11EVENTS FINANCIAL MANAGEMENT

Contribution margin per customer £ 12

Incremental fixed cost £ 3,000

Number of customers 300

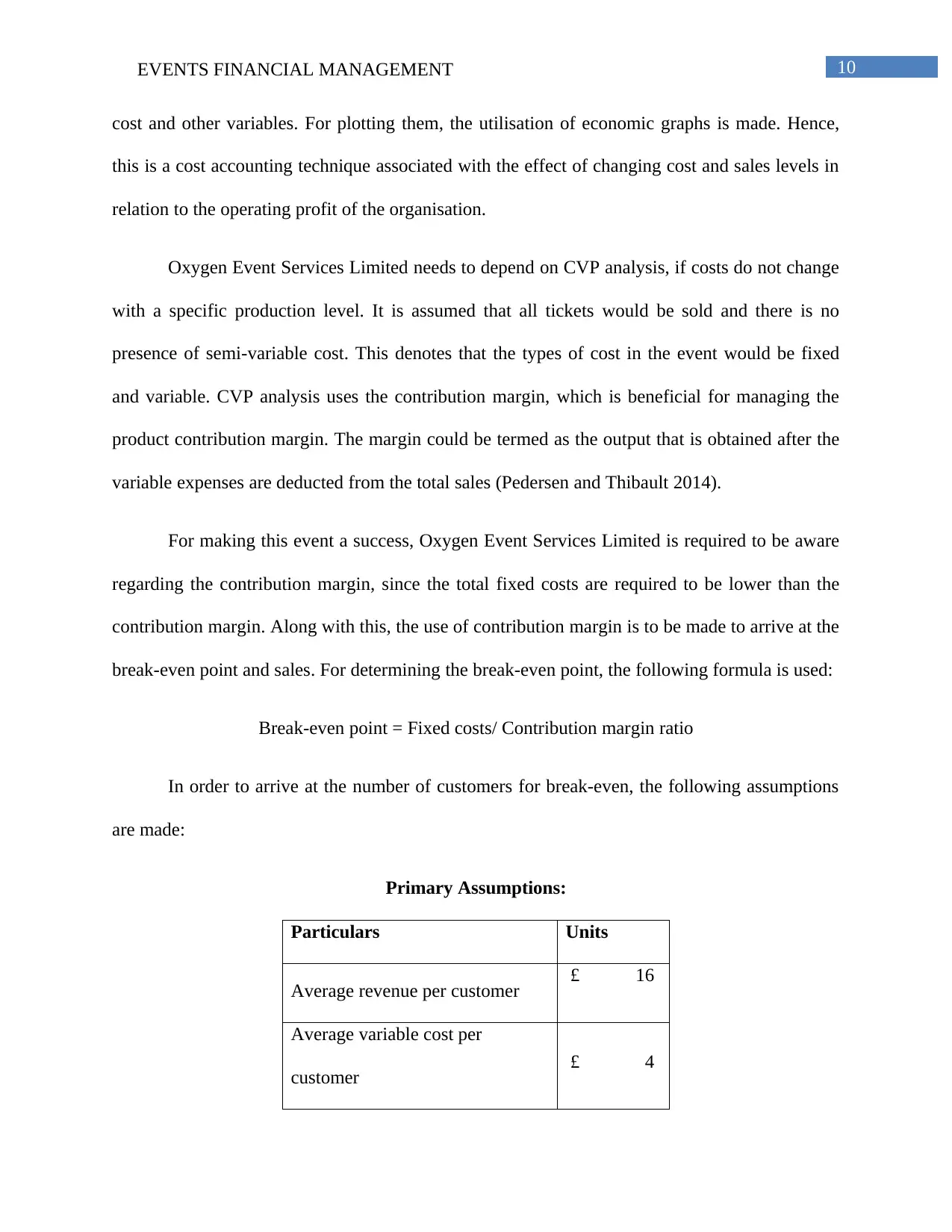

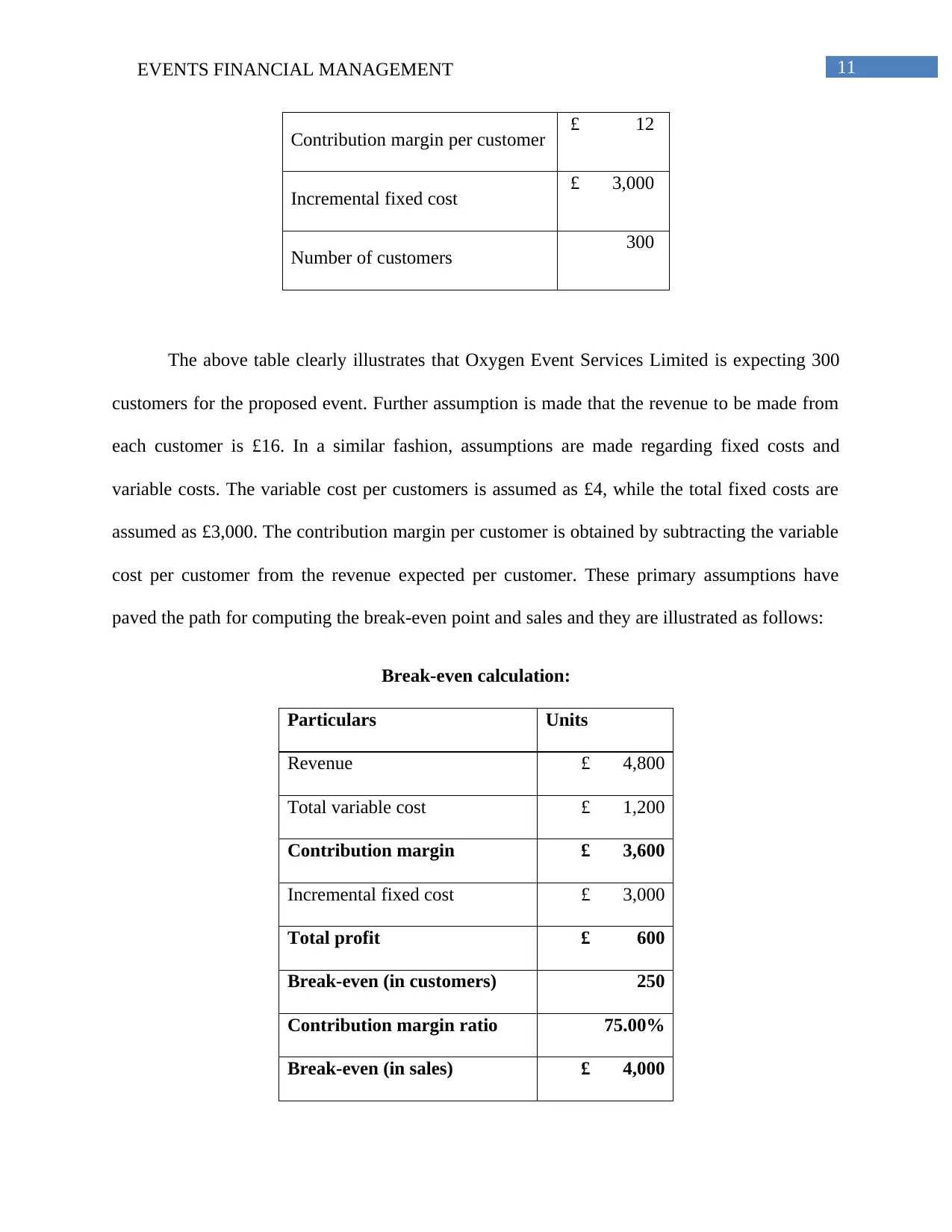

The above table clearly illustrates that Oxygen Event Services Limited is expecting 300

customers for the proposed event. Further assumption is made that the revenue to be made from

each customer is £16. In a similar fashion, assumptions are made regarding fixed costs and

variable costs. The variable cost per customers is assumed as £4, while the total fixed costs are

assumed as £3,000. The contribution margin per customer is obtained by subtracting the variable

cost per customer from the revenue expected per customer. These primary assumptions have

paved the path for computing the break-even point and sales and they are illustrated as follows:

Break-even calculation:

Particulars Units

Revenue £ 4,800

Total variable cost £ 1,200

Contribution margin £ 3,600

Incremental fixed cost £ 3,000

Total profit £ 600

Break-even (in customers) 250

Contribution margin ratio 75.00%

Break-even (in sales) £ 4,000

Contribution margin per customer £ 12

Incremental fixed cost £ 3,000

Number of customers 300

The above table clearly illustrates that Oxygen Event Services Limited is expecting 300

customers for the proposed event. Further assumption is made that the revenue to be made from

each customer is £16. In a similar fashion, assumptions are made regarding fixed costs and

variable costs. The variable cost per customers is assumed as £4, while the total fixed costs are

assumed as £3,000. The contribution margin per customer is obtained by subtracting the variable

cost per customer from the revenue expected per customer. These primary assumptions have

paved the path for computing the break-even point and sales and they are illustrated as follows:

Break-even calculation:

Particulars Units

Revenue £ 4,800

Total variable cost £ 1,200

Contribution margin £ 3,600

Incremental fixed cost £ 3,000

Total profit £ 600

Break-even (in customers) 250

Contribution margin ratio 75.00%

Break-even (in sales) £ 4,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.