Management Accounting Report: Excite Entertainment's Financials

VerifiedAdded on 2023/01/13

|20

|5590

|87

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices applied to Excite Entertainment, a UK-based leisure industry company. The report begins with an introduction to management accounting (MA) and financial accounting (FA), highlighting their differences and the importance of MA systems. It explores various cost accounting systems, including direct and standard costing, and details inventory management techniques like Just-in-Time (JIT) and ABC analysis. The report then evaluates the advantages of these systems, such as accurate cost ascertainment and efficient inventory control. Different MA reports, including budget, accounts receivable, cost accounting, performance, and inventory reports, are presented with an explanation of their significance. The report also discusses the importance of accurate information in MA and how MA systems are integrated into a firm's operational processes. Furthermore, the report delves into determining income statements using marginal and absorption costing, comparing their methodologies and implications. Finally, the report discusses the application of planning tools and MA systems to address financial problems.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Content

INTRODUCTION...........................................................................................................................3

LO1..................................................................................................................................................3

P1. Explaining MA and importance of its systems .....................................................................3

M1. Evaluating advantages of MA systems ...............................................................................5

P2. Presenting different MA reports ...........................................................................................6

M2. Explaining reason for presenting the information in an accurate manner............................7

D1. Evaluating the ways in which MA systems and reporting are integrated within the

operational process of firm .........................................................................................................7

LO2..................................................................................................................................................7

P3 Determining income statements using the marginal and absorption costing ........................7

M2. Use of varied of management accounting approaches and developing suitable financial

reporting documents...................................................................................................................11

LO3................................................................................................................................................12

Planning tools in management accounting................................................................................12

LO4................................................................................................................................................14

P5. comparing ways within which application of MA deals with the financial problems and

prevents financial problems ......................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

LO1..................................................................................................................................................3

P1. Explaining MA and importance of its systems .....................................................................3

M1. Evaluating advantages of MA systems ...............................................................................5

P2. Presenting different MA reports ...........................................................................................6

M2. Explaining reason for presenting the information in an accurate manner............................7

D1. Evaluating the ways in which MA systems and reporting are integrated within the

operational process of firm .........................................................................................................7

LO2..................................................................................................................................................7

P3 Determining income statements using the marginal and absorption costing ........................7

M2. Use of varied of management accounting approaches and developing suitable financial

reporting documents...................................................................................................................11

LO3................................................................................................................................................12

Planning tools in management accounting................................................................................12

LO4................................................................................................................................................14

P5. comparing ways within which application of MA deals with the financial problems and

prevents financial problems ......................................................................................................14

CONCLUSION..............................................................................................................................16

REFERENCES................................................................................................................................1

INTRODUCTION

Management accounting is the provision of financial data which advice to the company

to use in its business. The present report is based on Excite Entertainment, a leisure based

industry in UK. Its main activity is to promote festivals and concerts at different locations. The

objective of this firm is to the organize entertainment programs within an overall UK.

Furthermore, it involves the difference between the MA and FA along with essentials of MA

systems. Different reports will also be highlighted which are prepared by the managers with

accuracy. Moreover the study highlights computation of profits by absorption and marginal

costing and application of different planning tools and MA systems in resolving financial

problems.

LO1.

P1. Explaining MA and importance of its systems

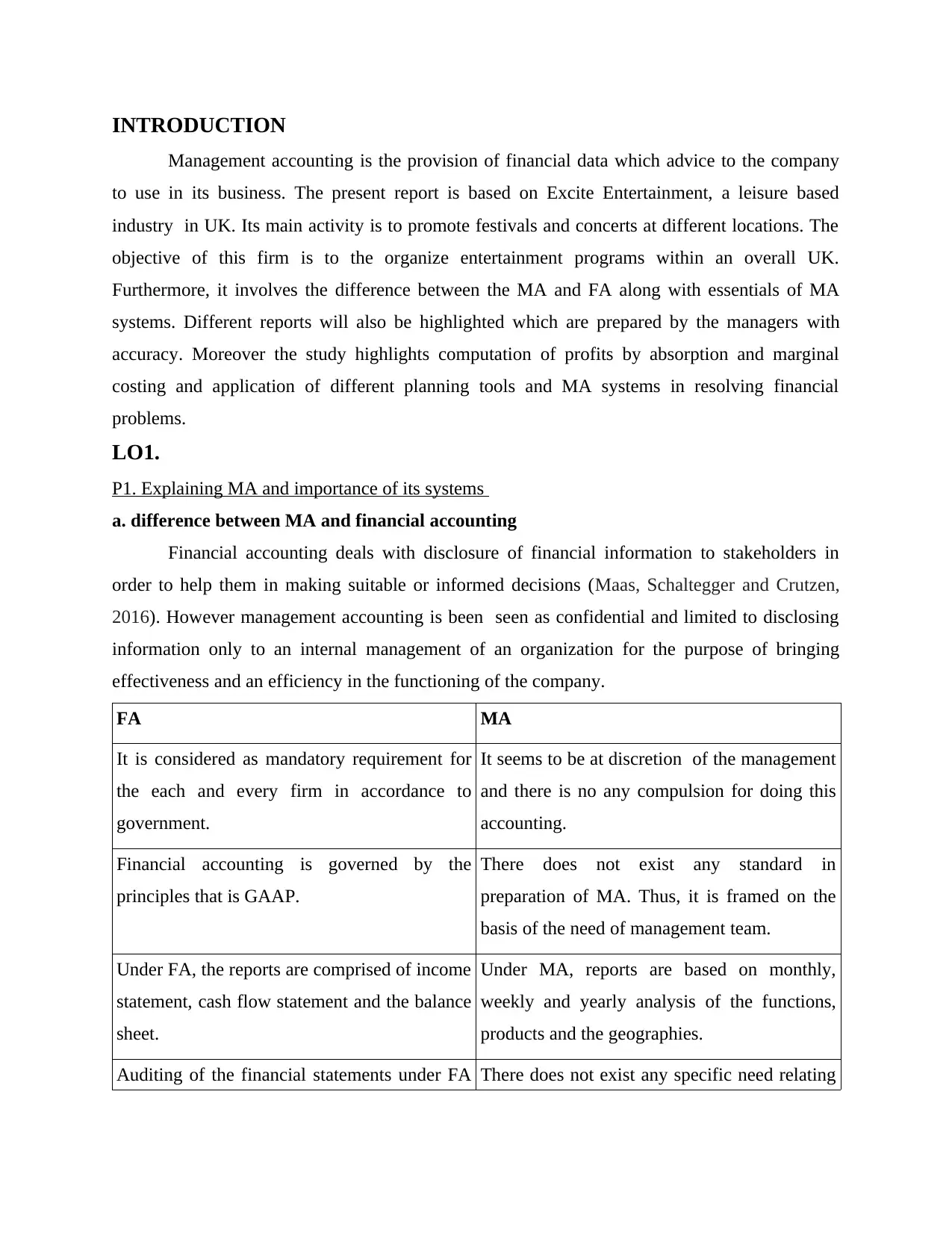

a. difference between MA and financial accounting

Financial accounting deals with disclosure of financial information to stakeholders in

order to help them in making suitable or informed decisions (Maas, Schaltegger and Crutzen,

2016). However management accounting is been seen as confidential and limited to disclosing

information only to an internal management of an organization for the purpose of bringing

effectiveness and an efficiency in the functioning of the company.

FA MA

It is considered as mandatory requirement for

the each and every firm in accordance to

government.

It seems to be at discretion of the management

and there is no any compulsion for doing this

accounting.

Financial accounting is governed by the

principles that is GAAP.

There does not exist any standard in

preparation of MA. Thus, it is framed on the

basis of the need of management team.

Under FA, the reports are comprised of income

statement, cash flow statement and the balance

sheet.

Under MA, reports are based on monthly,

weekly and yearly analysis of the functions,

products and the geographies.

Auditing of the financial statements under FA There does not exist any specific need relating

Management accounting is the provision of financial data which advice to the company

to use in its business. The present report is based on Excite Entertainment, a leisure based

industry in UK. Its main activity is to promote festivals and concerts at different locations. The

objective of this firm is to the organize entertainment programs within an overall UK.

Furthermore, it involves the difference between the MA and FA along with essentials of MA

systems. Different reports will also be highlighted which are prepared by the managers with

accuracy. Moreover the study highlights computation of profits by absorption and marginal

costing and application of different planning tools and MA systems in resolving financial

problems.

LO1.

P1. Explaining MA and importance of its systems

a. difference between MA and financial accounting

Financial accounting deals with disclosure of financial information to stakeholders in

order to help them in making suitable or informed decisions (Maas, Schaltegger and Crutzen,

2016). However management accounting is been seen as confidential and limited to disclosing

information only to an internal management of an organization for the purpose of bringing

effectiveness and an efficiency in the functioning of the company.

FA MA

It is considered as mandatory requirement for

the each and every firm in accordance to

government.

It seems to be at discretion of the management

and there is no any compulsion for doing this

accounting.

Financial accounting is governed by the

principles that is GAAP.

There does not exist any standard in

preparation of MA. Thus, it is framed on the

basis of the need of management team.

Under FA, the reports are comprised of income

statement, cash flow statement and the balance

sheet.

Under MA, reports are based on monthly,

weekly and yearly analysis of the functions,

products and the geographies.

Auditing of the financial statements under FA There does not exist any specific need relating

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

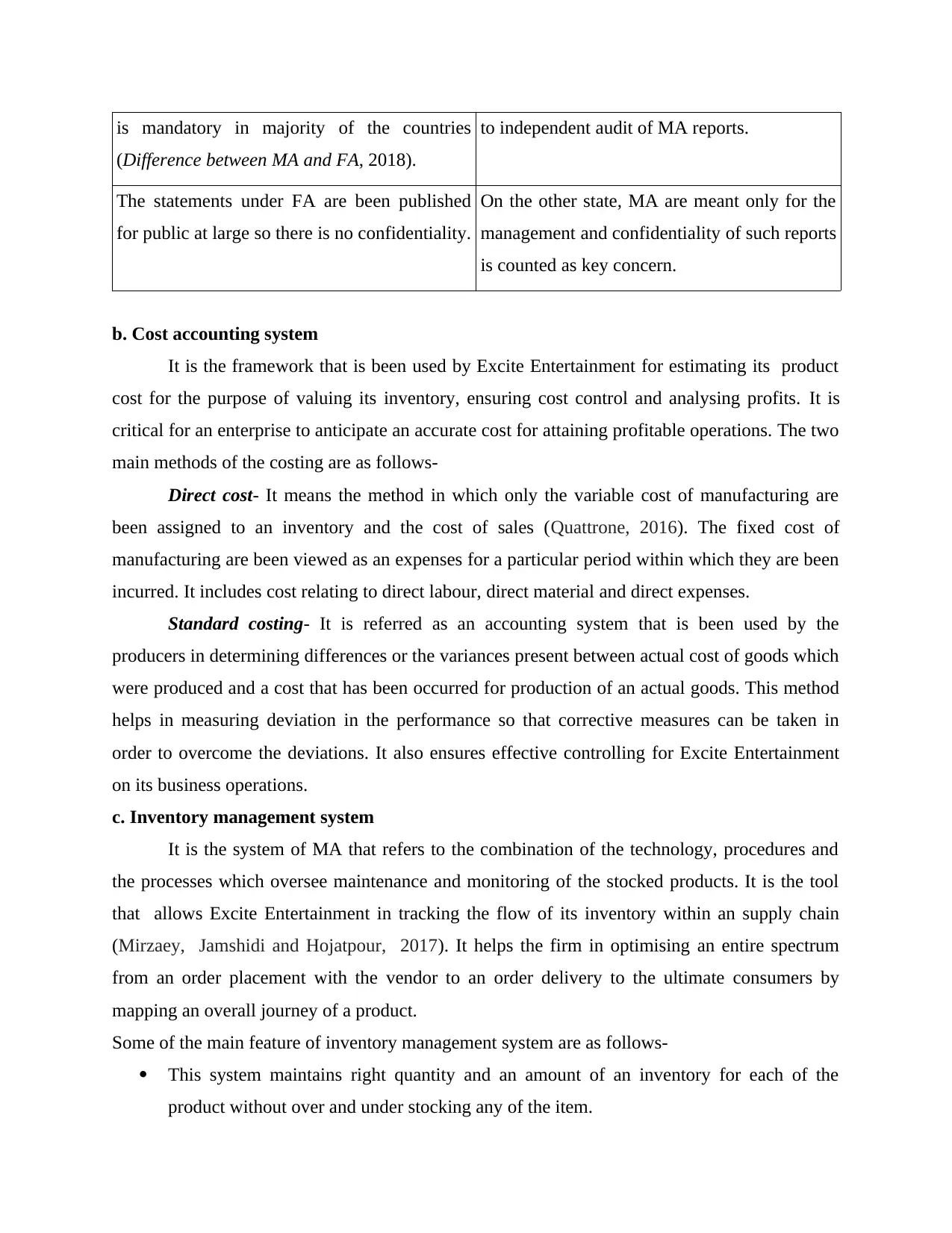

is mandatory in majority of the countries

(Difference between MA and FA, 2018).

to independent audit of MA reports.

The statements under FA are been published

for public at large so there is no confidentiality.

On the other state, MA are meant only for the

management and confidentiality of such reports

is counted as key concern.

b. Cost accounting system

It is the framework that is been used by Excite Entertainment for estimating its product

cost for the purpose of valuing its inventory, ensuring cost control and analysing profits. It is

critical for an enterprise to anticipate an accurate cost for attaining profitable operations. The two

main methods of the costing are as follows-

Direct cost- It means the method in which only the variable cost of manufacturing are

been assigned to an inventory and the cost of sales (Quattrone, 2016). The fixed cost of

manufacturing are been viewed as an expenses for a particular period within which they are been

incurred. It includes cost relating to direct labour, direct material and direct expenses.

Standard costing- It is referred as an accounting system that is been used by the

producers in determining differences or the variances present between actual cost of goods which

were produced and a cost that has been occurred for production of an actual goods. This method

helps in measuring deviation in the performance so that corrective measures can be taken in

order to overcome the deviations. It also ensures effective controlling for Excite Entertainment

on its business operations.

c. Inventory management system

It is the system of MA that refers to the combination of the technology, procedures and

the processes which oversee maintenance and monitoring of the stocked products. It is the tool

that allows Excite Entertainment in tracking the flow of its inventory within an supply chain

(Mirzaey, Jamshidi and Hojatpour, 2017). It helps the firm in optimising an entire spectrum

from an order placement with the vendor to an order delivery to the ultimate consumers by

mapping an overall journey of a product.

Some of the main feature of inventory management system are as follows-

This system maintains right quantity and an amount of an inventory for each of the

product without over and under stocking any of the item.

(Difference between MA and FA, 2018).

to independent audit of MA reports.

The statements under FA are been published

for public at large so there is no confidentiality.

On the other state, MA are meant only for the

management and confidentiality of such reports

is counted as key concern.

b. Cost accounting system

It is the framework that is been used by Excite Entertainment for estimating its product

cost for the purpose of valuing its inventory, ensuring cost control and analysing profits. It is

critical for an enterprise to anticipate an accurate cost for attaining profitable operations. The two

main methods of the costing are as follows-

Direct cost- It means the method in which only the variable cost of manufacturing are

been assigned to an inventory and the cost of sales (Quattrone, 2016). The fixed cost of

manufacturing are been viewed as an expenses for a particular period within which they are been

incurred. It includes cost relating to direct labour, direct material and direct expenses.

Standard costing- It is referred as an accounting system that is been used by the

producers in determining differences or the variances present between actual cost of goods which

were produced and a cost that has been occurred for production of an actual goods. This method

helps in measuring deviation in the performance so that corrective measures can be taken in

order to overcome the deviations. It also ensures effective controlling for Excite Entertainment

on its business operations.

c. Inventory management system

It is the system of MA that refers to the combination of the technology, procedures and

the processes which oversee maintenance and monitoring of the stocked products. It is the tool

that allows Excite Entertainment in tracking the flow of its inventory within an supply chain

(Mirzaey, Jamshidi and Hojatpour, 2017). It helps the firm in optimising an entire spectrum

from an order placement with the vendor to an order delivery to the ultimate consumers by

mapping an overall journey of a product.

Some of the main feature of inventory management system are as follows-

This system maintains right quantity and an amount of an inventory for each of the

product without over and under stocking any of the item.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It easily determines and traces the products as barcode are integrated for an instant

labelling and identification of the product.

Strategies and the process in certification, classifying and reporting under inventory

management such as Just-in-time, FIFO, ABC analysis etc.

An inventory system is said to be effective and efficient when it results better cash flows, lower

carrying cost, better supply, low dead stock etc.

Just in time- It is reflected as an inventory strategy where only the materials are ordered

and received as they are required in process of production (Panchenko, 2018). The main aim of

this technique is reducing the cost by seeking for saving money on the inventory overhead

expenses. It helps in minimizing an inventory and in increasing efficiency. It is also called as the

system of Toyota Production as the car manufacturer that is Toyota has opted for this system in

1970s.

ABC analysis- It means the method that categorises into three parts where A represented

as most valuable and the demanded product by the customers. It involves the products which

heavily contributes to overall profit without consuming too much of the resources. Category B

presents the moderate products which do not have high or low demand and lies in the middle of

the road. Lastly, Category C is seen as tiny transactions which are essential for earning profits

and the does not contributes to value of an entity (Uyar and Kuzey, 2016). This technique is used

for segmenting the customers into three major segments as per their value and specification.

d. Job costing system

It is the method which is defined as the technique of recording a cost in manufacturing

the job instead of the processes. With this system, manager could keep a track on cost of each

and every job by maintaining the data that is more relevant to business operations. It is proved to

be an efficient costing method in allocation of distinct cost of the product and in monitoring an

order expenses at the time when the products are seen as non-identical.

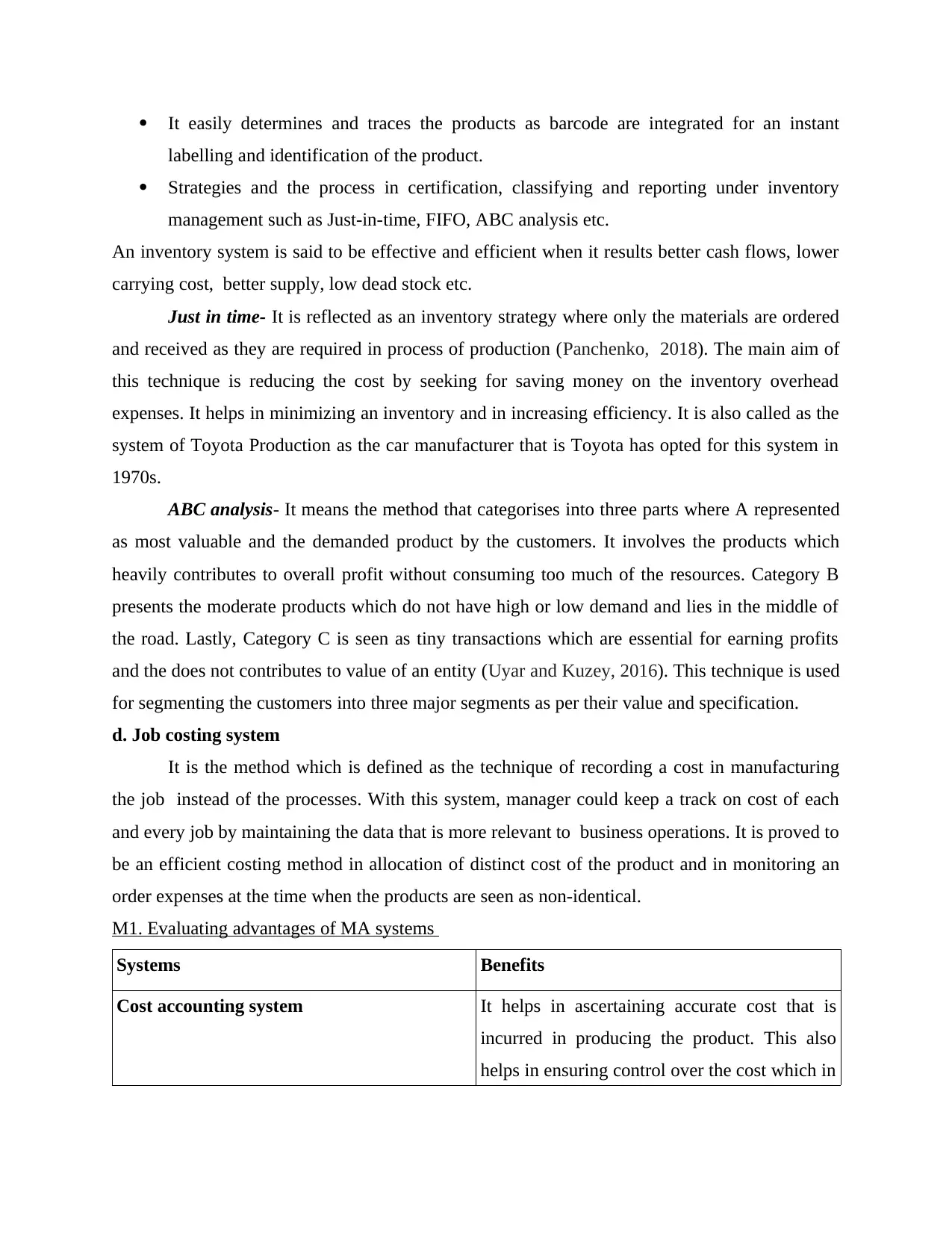

M1. Evaluating advantages of MA systems

Systems Benefits

Cost accounting system It helps in ascertaining accurate cost that is

incurred in producing the product. This also

helps in ensuring control over the cost which in

labelling and identification of the product.

Strategies and the process in certification, classifying and reporting under inventory

management such as Just-in-time, FIFO, ABC analysis etc.

An inventory system is said to be effective and efficient when it results better cash flows, lower

carrying cost, better supply, low dead stock etc.

Just in time- It is reflected as an inventory strategy where only the materials are ordered

and received as they are required in process of production (Panchenko, 2018). The main aim of

this technique is reducing the cost by seeking for saving money on the inventory overhead

expenses. It helps in minimizing an inventory and in increasing efficiency. It is also called as the

system of Toyota Production as the car manufacturer that is Toyota has opted for this system in

1970s.

ABC analysis- It means the method that categorises into three parts where A represented

as most valuable and the demanded product by the customers. It involves the products which

heavily contributes to overall profit without consuming too much of the resources. Category B

presents the moderate products which do not have high or low demand and lies in the middle of

the road. Lastly, Category C is seen as tiny transactions which are essential for earning profits

and the does not contributes to value of an entity (Uyar and Kuzey, 2016). This technique is used

for segmenting the customers into three major segments as per their value and specification.

d. Job costing system

It is the method which is defined as the technique of recording a cost in manufacturing

the job instead of the processes. With this system, manager could keep a track on cost of each

and every job by maintaining the data that is more relevant to business operations. It is proved to

be an efficient costing method in allocation of distinct cost of the product and in monitoring an

order expenses at the time when the products are seen as non-identical.

M1. Evaluating advantages of MA systems

Systems Benefits

Cost accounting system It helps in ascertaining accurate cost that is

incurred in producing the product. This also

helps in ensuring control over the cost which in

turn leads to higher profitability.

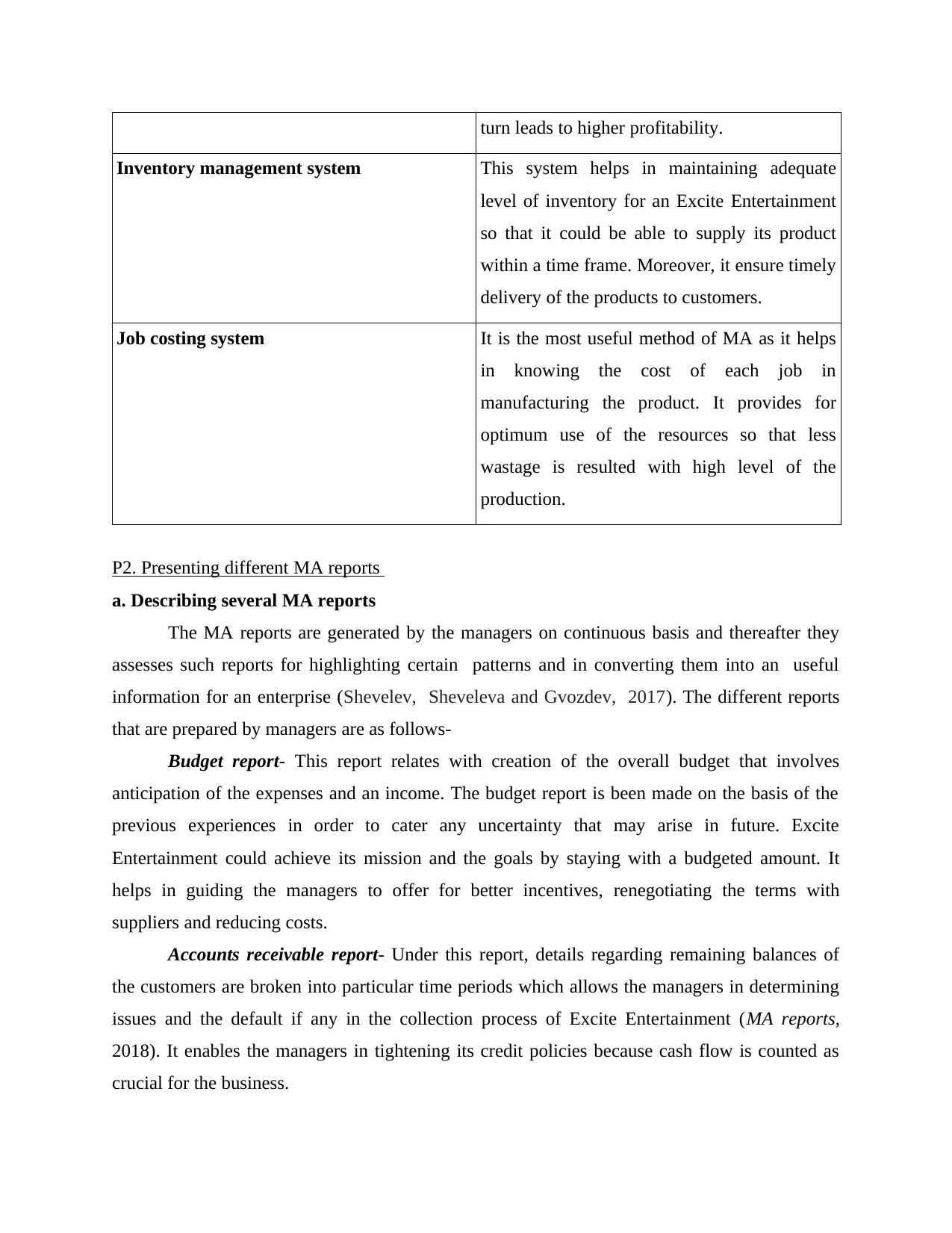

Inventory management system This system helps in maintaining adequate

level of inventory for an Excite Entertainment

so that it could be able to supply its product

within a time frame. Moreover, it ensure timely

delivery of the products to customers.

Job costing system It is the most useful method of MA as it helps

in knowing the cost of each job in

manufacturing the product. It provides for

optimum use of the resources so that less

wastage is resulted with high level of the

production.

P2. Presenting different MA reports

a. Describing several MA reports

The MA reports are generated by the managers on continuous basis and thereafter they

assesses such reports for highlighting certain patterns and in converting them into an useful

information for an enterprise (Shevelev, Sheveleva and Gvozdev, 2017). The different reports

that are prepared by managers are as follows-

Budget report- This report relates with creation of the overall budget that involves

anticipation of the expenses and an income. The budget report is been made on the basis of the

previous experiences in order to cater any uncertainty that may arise in future. Excite

Entertainment could achieve its mission and the goals by staying with a budgeted amount. It

helps in guiding the managers to offer for better incentives, renegotiating the terms with

suppliers and reducing costs.

Accounts receivable report- Under this report, details regarding remaining balances of

the customers are broken into particular time periods which allows the managers in determining

issues and the default if any in the collection process of Excite Entertainment (MA reports,

2018). It enables the managers in tightening its credit policies because cash flow is counted as

crucial for the business.

Inventory management system This system helps in maintaining adequate

level of inventory for an Excite Entertainment

so that it could be able to supply its product

within a time frame. Moreover, it ensure timely

delivery of the products to customers.

Job costing system It is the most useful method of MA as it helps

in knowing the cost of each job in

manufacturing the product. It provides for

optimum use of the resources so that less

wastage is resulted with high level of the

production.

P2. Presenting different MA reports

a. Describing several MA reports

The MA reports are generated by the managers on continuous basis and thereafter they

assesses such reports for highlighting certain patterns and in converting them into an useful

information for an enterprise (Shevelev, Sheveleva and Gvozdev, 2017). The different reports

that are prepared by managers are as follows-

Budget report- This report relates with creation of the overall budget that involves

anticipation of the expenses and an income. The budget report is been made on the basis of the

previous experiences in order to cater any uncertainty that may arise in future. Excite

Entertainment could achieve its mission and the goals by staying with a budgeted amount. It

helps in guiding the managers to offer for better incentives, renegotiating the terms with

suppliers and reducing costs.

Accounts receivable report- Under this report, details regarding remaining balances of

the customers are broken into particular time periods which allows the managers in determining

issues and the default if any in the collection process of Excite Entertainment (MA reports,

2018). It enables the managers in tightening its credit policies because cash flow is counted as

crucial for the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting reports-It presents the summary information of all the cost that includes

material cost, labour cost and overhead. It offers a capacity to the managers in realizing the cost

prices against its selling price. It provides an exact understanding relating to all the expenses that

are important for optimum use of the resources within all the departments.

Performance report- This report is created for reviewing the performance of Excite

Entertainment as well its employees. This report is used by the managers in making important

strategic decisions regarding future prospects of the business. It acts as vital for the company in

keeping an accurate measure of its strategy towards its mission.

Inventory report- It is the report that involves information of hourly cost of employment,

per unit overhead that are incurred in manufacturing. Through this report, comparison can be

drawn across the multiple lines in order to detect and emphasize on promising and the

prospective areas and also helps in rewarding employees who are performing best.

M2. Explaining reason for presenting the information in an accurate manner

It is crucial for the managers in to prepare the reports that is reliable, updated and

accurate because it helps an external users and internal users within the business in making the

decisions regarding the investment made by them in the securities of the firm and deciding for

day-to-day operational activity. It helps in managing internal control in order to improve the

departmental functioning. In case there exist an errors in the information that in turn would

hamper the final reports in terms of its accuracy and reliability.

D1. Evaluating the ways in which MA systems and reporting are integrated within the

operational process of firm

It is critical for Excite Entertainment to remain conversant with a management

accounting concept in order to make appropriate decisions for its multiple departments. Well

application of the MA concepts would translate into an efficient practices of financial accounting

for an entity. With better knowledge of the MA principles and methods, the company could be

able to equipped better budget that results in minimum wastage and attaining maximum profits.

Without the framing of the report, systems cannot be implemented in an effective manner both

reports and the systems are integrated.

material cost, labour cost and overhead. It offers a capacity to the managers in realizing the cost

prices against its selling price. It provides an exact understanding relating to all the expenses that

are important for optimum use of the resources within all the departments.

Performance report- This report is created for reviewing the performance of Excite

Entertainment as well its employees. This report is used by the managers in making important

strategic decisions regarding future prospects of the business. It acts as vital for the company in

keeping an accurate measure of its strategy towards its mission.

Inventory report- It is the report that involves information of hourly cost of employment,

per unit overhead that are incurred in manufacturing. Through this report, comparison can be

drawn across the multiple lines in order to detect and emphasize on promising and the

prospective areas and also helps in rewarding employees who are performing best.

M2. Explaining reason for presenting the information in an accurate manner

It is crucial for the managers in to prepare the reports that is reliable, updated and

accurate because it helps an external users and internal users within the business in making the

decisions regarding the investment made by them in the securities of the firm and deciding for

day-to-day operational activity. It helps in managing internal control in order to improve the

departmental functioning. In case there exist an errors in the information that in turn would

hamper the final reports in terms of its accuracy and reliability.

D1. Evaluating the ways in which MA systems and reporting are integrated within the

operational process of firm

It is critical for Excite Entertainment to remain conversant with a management

accounting concept in order to make appropriate decisions for its multiple departments. Well

application of the MA concepts would translate into an efficient practices of financial accounting

for an entity. With better knowledge of the MA principles and methods, the company could be

able to equipped better budget that results in minimum wastage and attaining maximum profits.

Without the framing of the report, systems cannot be implemented in an effective manner both

reports and the systems are integrated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LO2.

P3 Determining income statements using the marginal and absorption costing

There are different costing techniques which are used by the organisations to record their

transactions and getting the results from profits. Two of the commonly used ,management

accounting techniques are marginal costing and absorption costing.

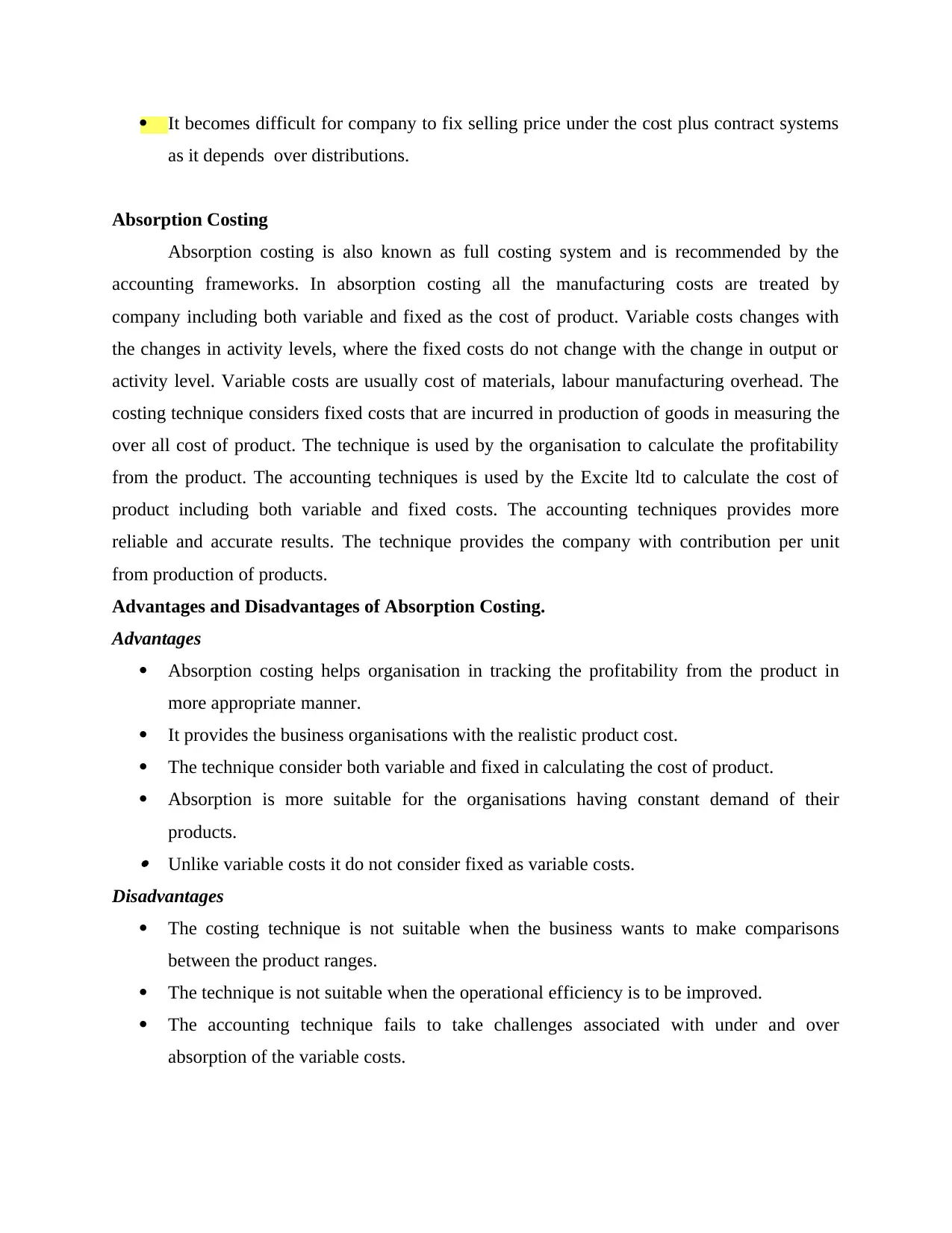

Marginal Costing

Marginal costing can be defined as principle where variable cost are charged to unit costs

and fixed costs which are attributable to relevant periods are written off against contribution for

the period. Marginal costing is concerned with ascertaining marginal costs and its effect over

profits due to change in volumes or output through differentiation between variable and fixed

costs. Costs are defined into two classes that are fixed and variables. Concept of this technique is

based over behaviour of the cost with output volumes. The approach is also known as variable

costing where only variable costs are aggregated and per unit cost is ascertained on variable

costs. Marginal costing covers only cost expenses that are variable in nature and where fixed

costs are charged as periodical costs. Excite ltd uses marginal costing for computing total costs

and net profit from manufacturing each product it is planning to manufacture.

Advantages and Disadvantages of Marginal Costing

Advantages

Marginal costing helps Excite ltd in comparing its costs with budgeted and actual and

taking the corrective steps for cost control.

This helps the business enterprise in short term planning and in defraying the break

evens.

This helps the business to calculate per unit profit of the product. Its assists the management of Excite ltd in planning the productions by disclosing change

in profit levels with the change in output.

Disadvantages

It is difficult for the enterprise to segregate cost between fixed and variable.

This technique do not account for the fixed costs associated with the production of

products.

P3 Determining income statements using the marginal and absorption costing

There are different costing techniques which are used by the organisations to record their

transactions and getting the results from profits. Two of the commonly used ,management

accounting techniques are marginal costing and absorption costing.

Marginal Costing

Marginal costing can be defined as principle where variable cost are charged to unit costs

and fixed costs which are attributable to relevant periods are written off against contribution for

the period. Marginal costing is concerned with ascertaining marginal costs and its effect over

profits due to change in volumes or output through differentiation between variable and fixed

costs. Costs are defined into two classes that are fixed and variables. Concept of this technique is

based over behaviour of the cost with output volumes. The approach is also known as variable

costing where only variable costs are aggregated and per unit cost is ascertained on variable

costs. Marginal costing covers only cost expenses that are variable in nature and where fixed

costs are charged as periodical costs. Excite ltd uses marginal costing for computing total costs

and net profit from manufacturing each product it is planning to manufacture.

Advantages and Disadvantages of Marginal Costing

Advantages

Marginal costing helps Excite ltd in comparing its costs with budgeted and actual and

taking the corrective steps for cost control.

This helps the business enterprise in short term planning and in defraying the break

evens.

This helps the business to calculate per unit profit of the product. Its assists the management of Excite ltd in planning the productions by disclosing change

in profit levels with the change in output.

Disadvantages

It is difficult for the enterprise to segregate cost between fixed and variable.

This technique do not account for the fixed costs associated with the production of

products.

It becomes difficult for company to fix selling price under the cost plus contract systems

as it depends over distributions.

Absorption Costing

Absorption costing is also known as full costing system and is recommended by the

accounting frameworks. In absorption costing all the manufacturing costs are treated by

company including both variable and fixed as the cost of product. Variable costs changes with

the changes in activity levels, where the fixed costs do not change with the change in output or

activity level. Variable costs are usually cost of materials, labour manufacturing overhead. The

costing technique considers fixed costs that are incurred in production of goods in measuring the

over all cost of product. The technique is used by the organisation to calculate the profitability

from the product. The accounting techniques is used by the Excite ltd to calculate the cost of

product including both variable and fixed costs. The accounting techniques provides more

reliable and accurate results. The technique provides the company with contribution per unit

from production of products.

Advantages and Disadvantages of Absorption Costing.

Advantages

Absorption costing helps organisation in tracking the profitability from the product in

more appropriate manner.

It provides the business organisations with the realistic product cost.

The technique consider both variable and fixed in calculating the cost of product.

Absorption is more suitable for the organisations having constant demand of their

products. Unlike variable costs it do not consider fixed as variable costs.

Disadvantages

The costing technique is not suitable when the business wants to make comparisons

between the product ranges.

The technique is not suitable when the operational efficiency is to be improved.

The accounting technique fails to take challenges associated with under and over

absorption of the variable costs.

as it depends over distributions.

Absorption Costing

Absorption costing is also known as full costing system and is recommended by the

accounting frameworks. In absorption costing all the manufacturing costs are treated by

company including both variable and fixed as the cost of product. Variable costs changes with

the changes in activity levels, where the fixed costs do not change with the change in output or

activity level. Variable costs are usually cost of materials, labour manufacturing overhead. The

costing technique considers fixed costs that are incurred in production of goods in measuring the

over all cost of product. The technique is used by the organisation to calculate the profitability

from the product. The accounting techniques is used by the Excite ltd to calculate the cost of

product including both variable and fixed costs. The accounting techniques provides more

reliable and accurate results. The technique provides the company with contribution per unit

from production of products.

Advantages and Disadvantages of Absorption Costing.

Advantages

Absorption costing helps organisation in tracking the profitability from the product in

more appropriate manner.

It provides the business organisations with the realistic product cost.

The technique consider both variable and fixed in calculating the cost of product.

Absorption is more suitable for the organisations having constant demand of their

products. Unlike variable costs it do not consider fixed as variable costs.

Disadvantages

The costing technique is not suitable when the business wants to make comparisons

between the product ranges.

The technique is not suitable when the operational efficiency is to be improved.

The accounting technique fails to take challenges associated with under and over

absorption of the variable costs.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

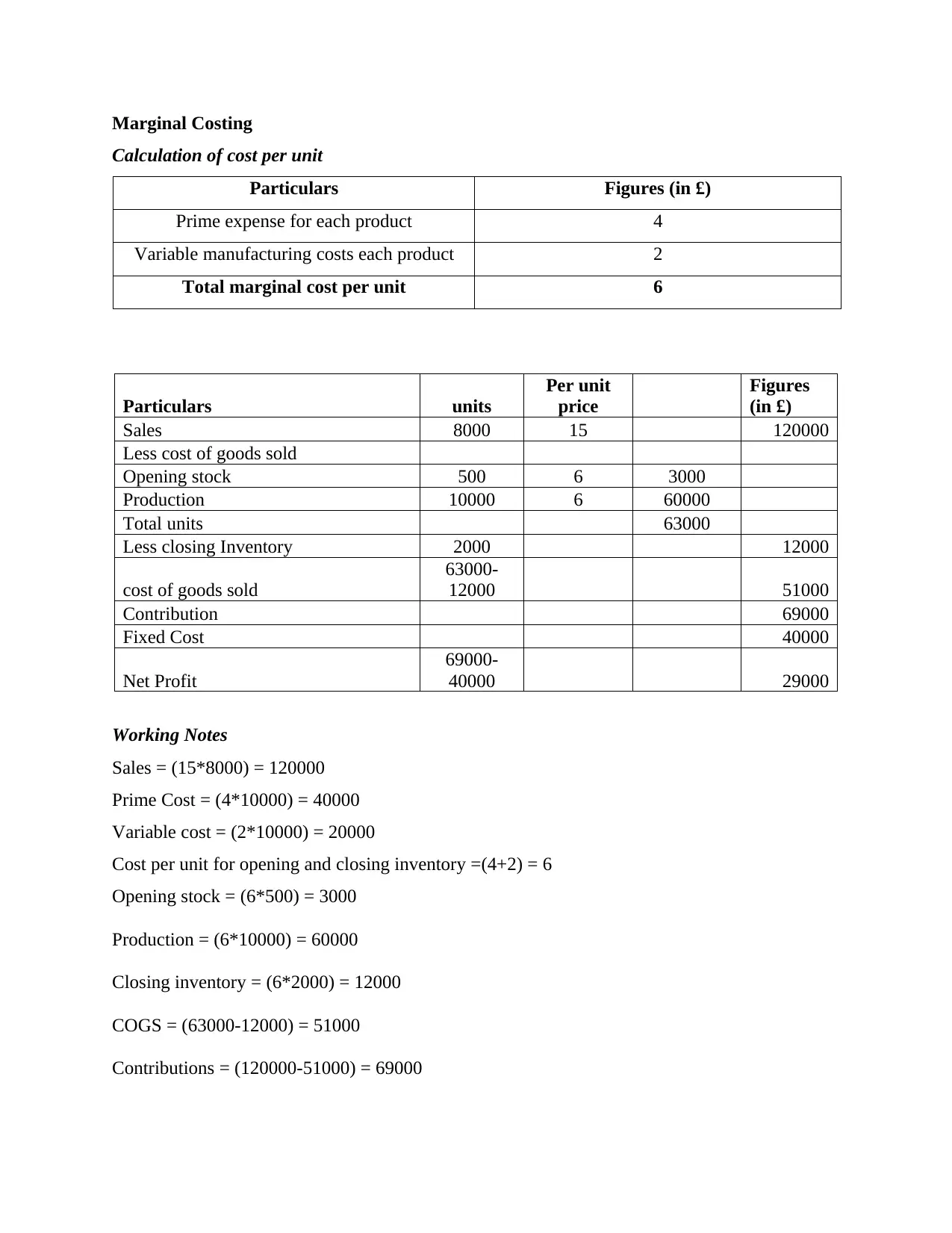

Marginal Costing

Calculation of cost per unit

Particulars Figures (in £)

Prime expense for each product 4

Variable manufacturing costs each product 2

Total marginal cost per unit 6

Particulars units

Per unit

price

Figures

(in £)

Sales 8000 15 120000

Less cost of goods sold

Opening stock 500 6 3000

Production 10000 6 60000

Total units 63000

Less closing Inventory 2000 12000

cost of goods sold

63000-

12000 51000

Contribution 69000

Fixed Cost 40000

Net Profit

69000-

40000 29000

Working Notes

Sales = (15*8000) = 120000

Prime Cost = (4*10000) = 40000

Variable cost = (2*10000) = 20000

Cost per unit for opening and closing inventory =(4+2) = 6

Opening stock = (6*500) = 3000

Production = (6*10000) = 60000

Closing inventory = (6*2000) = 12000

COGS = (63000-12000) = 51000

Contributions = (120000-51000) = 69000

Calculation of cost per unit

Particulars Figures (in £)

Prime expense for each product 4

Variable manufacturing costs each product 2

Total marginal cost per unit 6

Particulars units

Per unit

price

Figures

(in £)

Sales 8000 15 120000

Less cost of goods sold

Opening stock 500 6 3000

Production 10000 6 60000

Total units 63000

Less closing Inventory 2000 12000

cost of goods sold

63000-

12000 51000

Contribution 69000

Fixed Cost 40000

Net Profit

69000-

40000 29000

Working Notes

Sales = (15*8000) = 120000

Prime Cost = (4*10000) = 40000

Variable cost = (2*10000) = 20000

Cost per unit for opening and closing inventory =(4+2) = 6

Opening stock = (6*500) = 3000

Production = (6*10000) = 60000

Closing inventory = (6*2000) = 12000

COGS = (63000-12000) = 51000

Contributions = (120000-51000) = 69000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit = (69000-40000) = 29000

Interpretation

Profits using the technique of marginal costing is 29000. Total sales are calculated using

the selling price of 15 for 8000 units. The variables costs are calculated using the production

units 10000. The value of closing inventors is calculated without considering the fixed costs.

Net profit from the production is 29000.

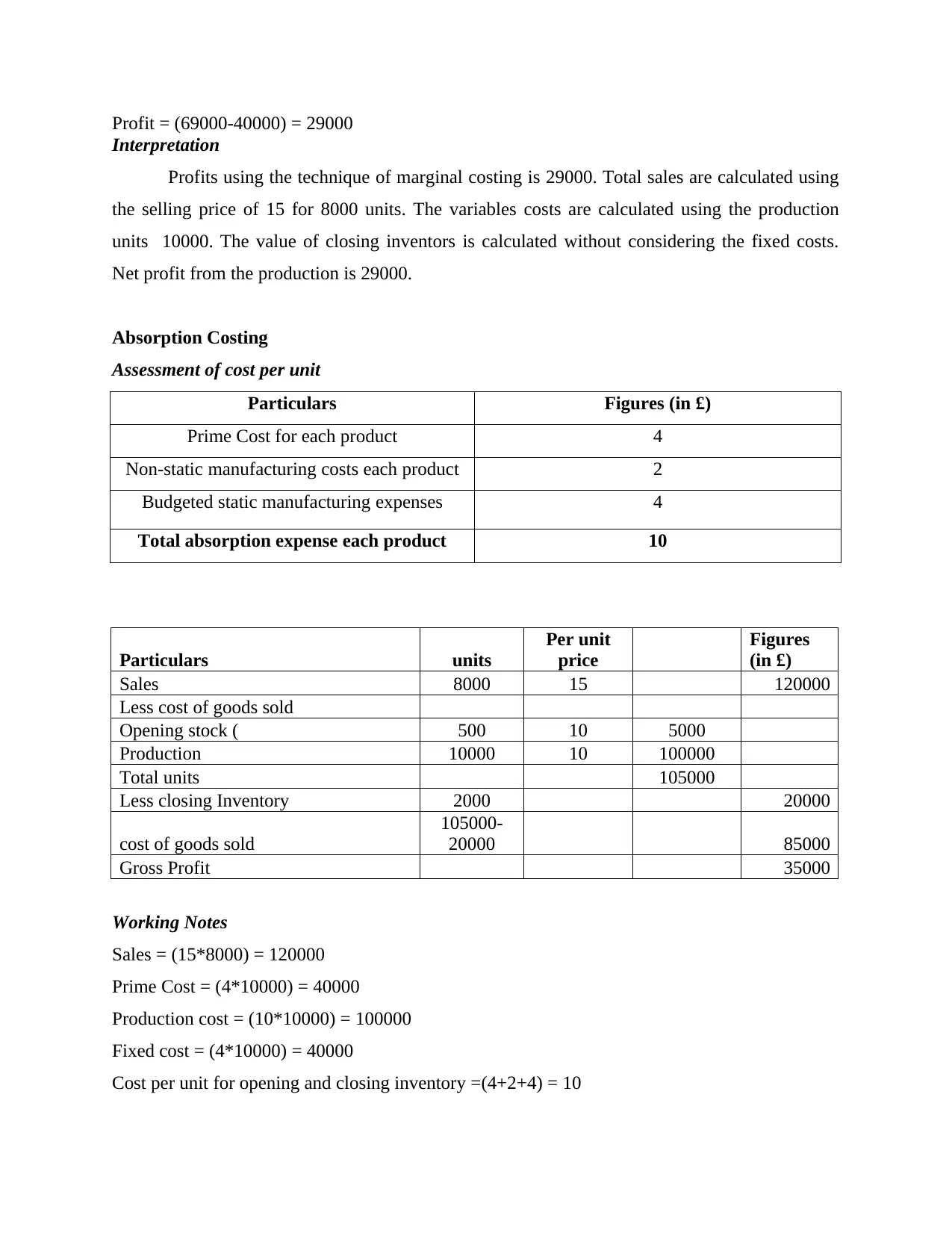

Absorption Costing

Assessment of cost per unit

Particulars Figures (in £)

Prime Cost for each product 4

Non-static manufacturing costs each product 2

Budgeted static manufacturing expenses 4

Total absorption expense each product 10

Particulars units

Per unit

price

Figures

(in £)

Sales 8000 15 120000

Less cost of goods sold

Opening stock ( 500 10 5000

Production 10000 10 100000

Total units 105000

Less closing Inventory 2000 20000

cost of goods sold

105000-

20000 85000

Gross Profit 35000

Working Notes

Sales = (15*8000) = 120000

Prime Cost = (4*10000) = 40000

Production cost = (10*10000) = 100000

Fixed cost = (4*10000) = 40000

Cost per unit for opening and closing inventory =(4+2+4) = 10

Interpretation

Profits using the technique of marginal costing is 29000. Total sales are calculated using

the selling price of 15 for 8000 units. The variables costs are calculated using the production

units 10000. The value of closing inventors is calculated without considering the fixed costs.

Net profit from the production is 29000.

Absorption Costing

Assessment of cost per unit

Particulars Figures (in £)

Prime Cost for each product 4

Non-static manufacturing costs each product 2

Budgeted static manufacturing expenses 4

Total absorption expense each product 10

Particulars units

Per unit

price

Figures

(in £)

Sales 8000 15 120000

Less cost of goods sold

Opening stock ( 500 10 5000

Production 10000 10 100000

Total units 105000

Less closing Inventory 2000 20000

cost of goods sold

105000-

20000 85000

Gross Profit 35000

Working Notes

Sales = (15*8000) = 120000

Prime Cost = (4*10000) = 40000

Production cost = (10*10000) = 100000

Fixed cost = (4*10000) = 40000

Cost per unit for opening and closing inventory =(4+2+4) = 10

Opening stock = (10*500) = 5000

Closing inventory = (10*2000) = 20000

COGS = (105000-20000) = 85000

Profit = (120000-85000) = 35000

Interpretation

Profits under the absorption costing is 35000 that is higher than the marginal profits. The

cost of goods sold have been calculated using the fixed cost in calculation of inventory. The

absorption costing is including the fixed costs for its production.

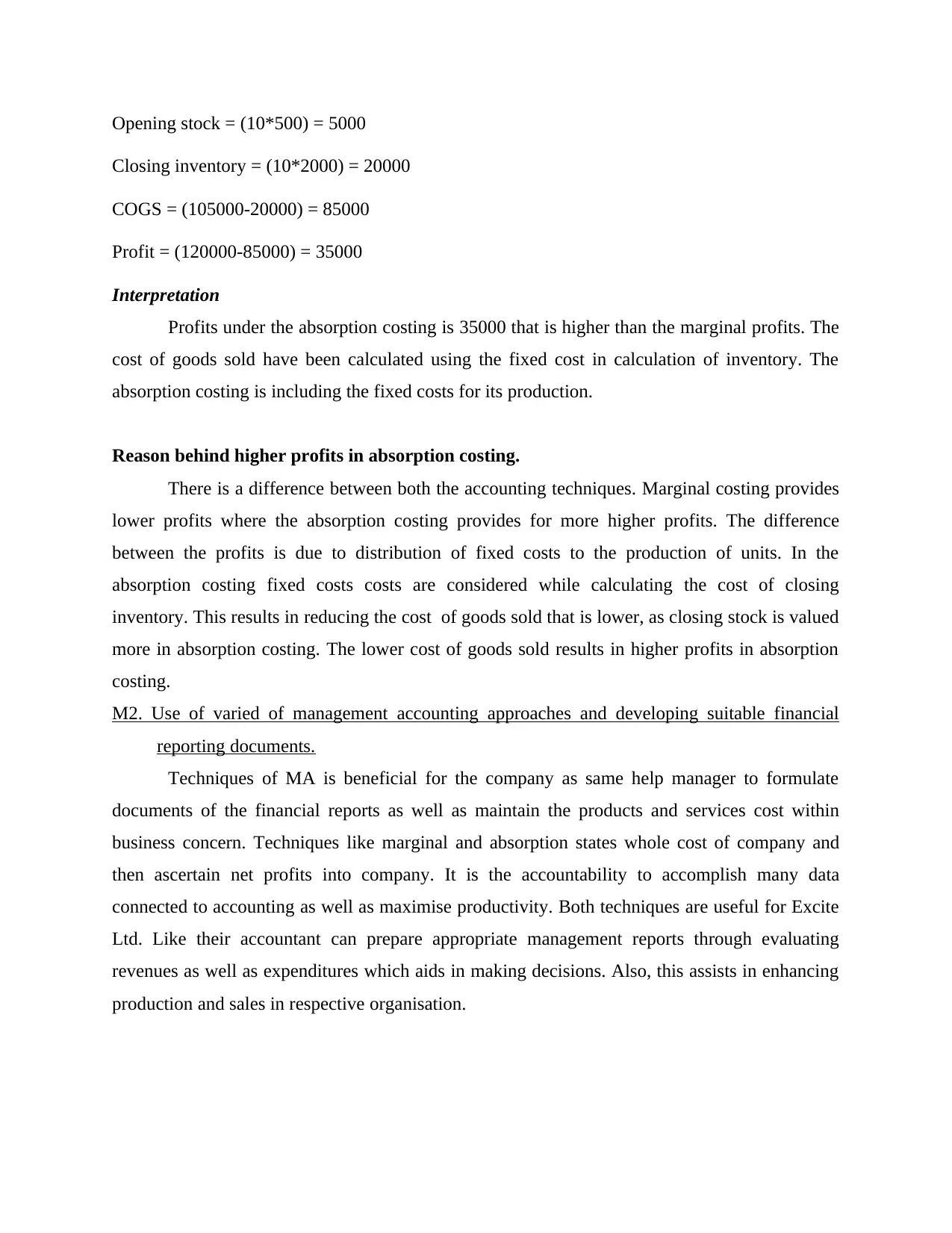

Reason behind higher profits in absorption costing.

There is a difference between both the accounting techniques. Marginal costing provides

lower profits where the absorption costing provides for more higher profits. The difference

between the profits is due to distribution of fixed costs to the production of units. In the

absorption costing fixed costs costs are considered while calculating the cost of closing

inventory. This results in reducing the cost of goods sold that is lower, as closing stock is valued

more in absorption costing. The lower cost of goods sold results in higher profits in absorption

costing.

M2. Use of varied of management accounting approaches and developing suitable financial

reporting documents.

Techniques of MA is beneficial for the company as same help manager to formulate

documents of the financial reports as well as maintain the products and services cost within

business concern. Techniques like marginal and absorption states whole cost of company and

then ascertain net profits into company. It is the accountability to accomplish many data

connected to accounting as well as maximise productivity. Both techniques are useful for Excite

Ltd. Like their accountant can prepare appropriate management reports through evaluating

revenues as well as expenditures which aids in making decisions. Also, this assists in enhancing

production and sales in respective organisation.

Closing inventory = (10*2000) = 20000

COGS = (105000-20000) = 85000

Profit = (120000-85000) = 35000

Interpretation

Profits under the absorption costing is 35000 that is higher than the marginal profits. The

cost of goods sold have been calculated using the fixed cost in calculation of inventory. The

absorption costing is including the fixed costs for its production.

Reason behind higher profits in absorption costing.

There is a difference between both the accounting techniques. Marginal costing provides

lower profits where the absorption costing provides for more higher profits. The difference

between the profits is due to distribution of fixed costs to the production of units. In the

absorption costing fixed costs costs are considered while calculating the cost of closing

inventory. This results in reducing the cost of goods sold that is lower, as closing stock is valued

more in absorption costing. The lower cost of goods sold results in higher profits in absorption

costing.

M2. Use of varied of management accounting approaches and developing suitable financial

reporting documents.

Techniques of MA is beneficial for the company as same help manager to formulate

documents of the financial reports as well as maintain the products and services cost within

business concern. Techniques like marginal and absorption states whole cost of company and

then ascertain net profits into company. It is the accountability to accomplish many data

connected to accounting as well as maximise productivity. Both techniques are useful for Excite

Ltd. Like their accountant can prepare appropriate management reports through evaluating

revenues as well as expenditures which aids in making decisions. Also, this assists in enhancing

production and sales in respective organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.