Report on Fantasy Film's Business Portfolio and Dynamic Capability

VerifiedAdded on 2022/11/17

|21

|1976

|189

Report

AI Summary

This report provides a comprehensive analysis of Fantasy Film's business portfolio and dynamic capabilities. It examines the company's various business units, including Advantage, DigiFX, Fantaspace, Anisoft, and Yoda Knows, using frameworks like the BCG matrix, GE-McKinsey matrix, and Synergy matrix to assess their market position and potential. The report offers detailed recommendations for each unit, focusing on investment strategies, technological innovation, and workforce management. Furthermore, it explores Fantasy Film's dynamic capabilities by evaluating opportunities, mobilizing resources, and implementing transformational strategies to enhance its core competencies, particularly within the digital animation sector. The report concludes with a SWOT analysis, highlighting the company's strengths and providing insights for sustainable growth and innovation.

Business Portfolio and

Dynamic Capability

Development Report

Fantasy Film

[Student Name] – [Student Number]

Dynamic Capability

Development Report

Fantasy Film

[Student Name] – [Student Number]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

Fantasy Film Business Portfolio

• Fantasy Film is significant studio among digital animal studios, which is proficient regarding digital

special effects, software of digital animation, animated feature film as well as, digital animated

advertising with respect to live action movies.

• Fantasy Film could be categorized into some business units:

Advantage :

• Through internet and television, it creates digitally animated promotion. It has several clients like

Tesla motors, Amazon, and Apple (Mitrega, and Pfajfar, 2015).

DigiFX : It generates unique effects associated with live action feature movies. Moreover, it generates

approximate $300 million of revenues.

Fantaspace :

• Digital animated feature films are developed by the company. In previous time, the team of

production received the academic award for its best animated feature movie like Slippery bob.

Anisoft :

• Through digital animation software, it has generated $150 million of revenue. In such unit,

DreamWorks has dealt to act as a subscriber for client.

Yoda knows: It generates $200 million in revenue through ‘space odyssey and gaming community.

• This report would analyze the business through different matrix like GE Mckinsey, BCG, as well as,

Synergy matrix. It would also facilitate the suggestions associated with Business Portfolio and

Dynamic Capability Development (Aversa, et. al., 2017) .

Fantasy Film Business Portfolio

• Fantasy Film is significant studio among digital animal studios, which is proficient regarding digital

special effects, software of digital animation, animated feature film as well as, digital animated

advertising with respect to live action movies.

• Fantasy Film could be categorized into some business units:

Advantage :

• Through internet and television, it creates digitally animated promotion. It has several clients like

Tesla motors, Amazon, and Apple (Mitrega, and Pfajfar, 2015).

DigiFX : It generates unique effects associated with live action feature movies. Moreover, it generates

approximate $300 million of revenues.

Fantaspace :

• Digital animated feature films are developed by the company. In previous time, the team of

production received the academic award for its best animated feature movie like Slippery bob.

Anisoft :

• Through digital animation software, it has generated $150 million of revenue. In such unit,

DreamWorks has dealt to act as a subscriber for client.

Yoda knows: It generates $200 million in revenue through ‘space odyssey and gaming community.

• This report would analyze the business through different matrix like GE Mckinsey, BCG, as well as,

Synergy matrix. It would also facilitate the suggestions associated with Business Portfolio and

Dynamic Capability Development (Aversa, et. al., 2017) .

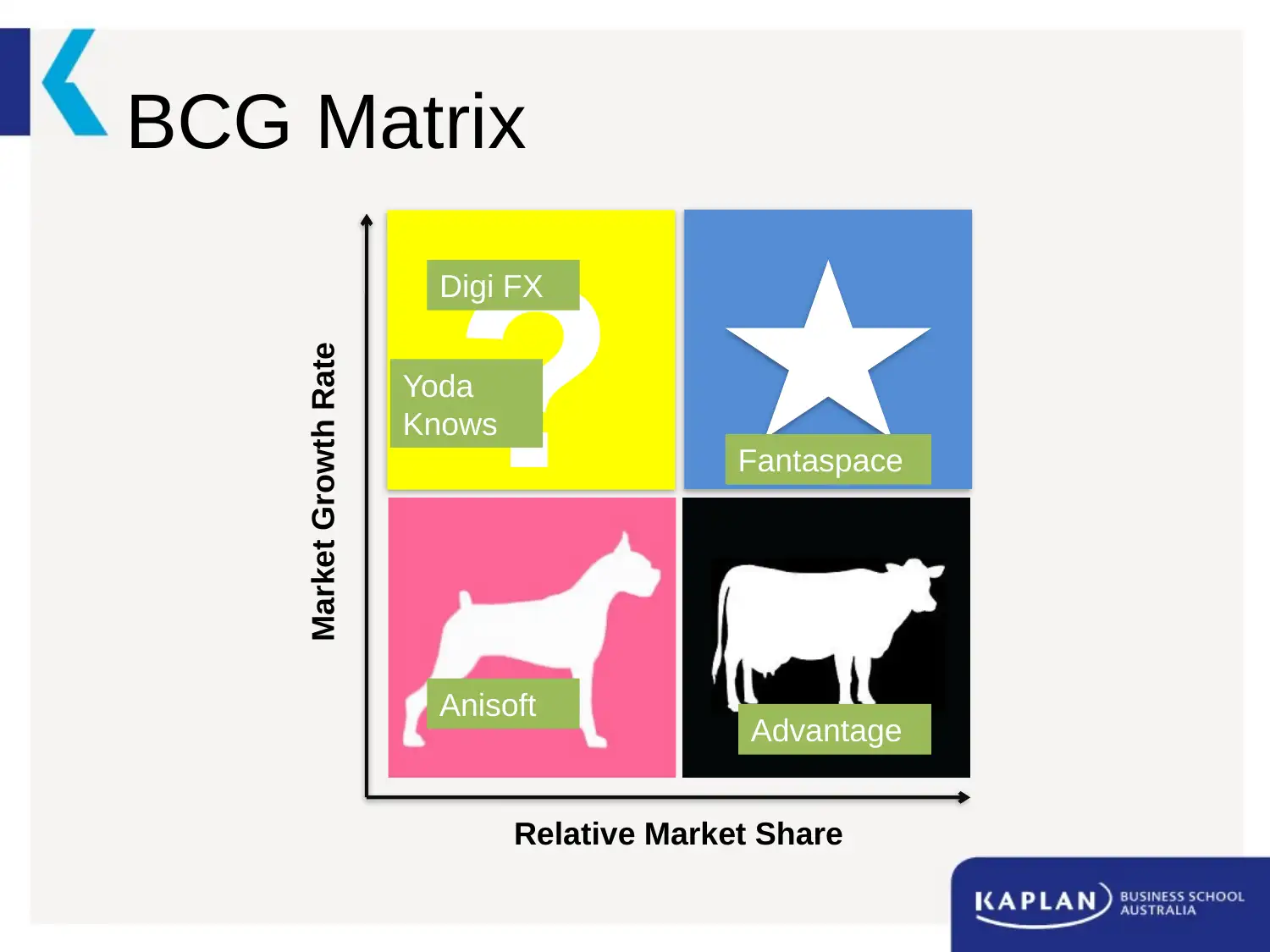

BCG Matrix

?

Relative Market Share

Market Growth Rate

Anisoft

Digi FX

Fantaspace

Advantage

Yoda

Knows

?

Relative Market Share

Market Growth Rate

Anisoft

Digi FX

Fantaspace

Advantage

Yoda

Knows

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

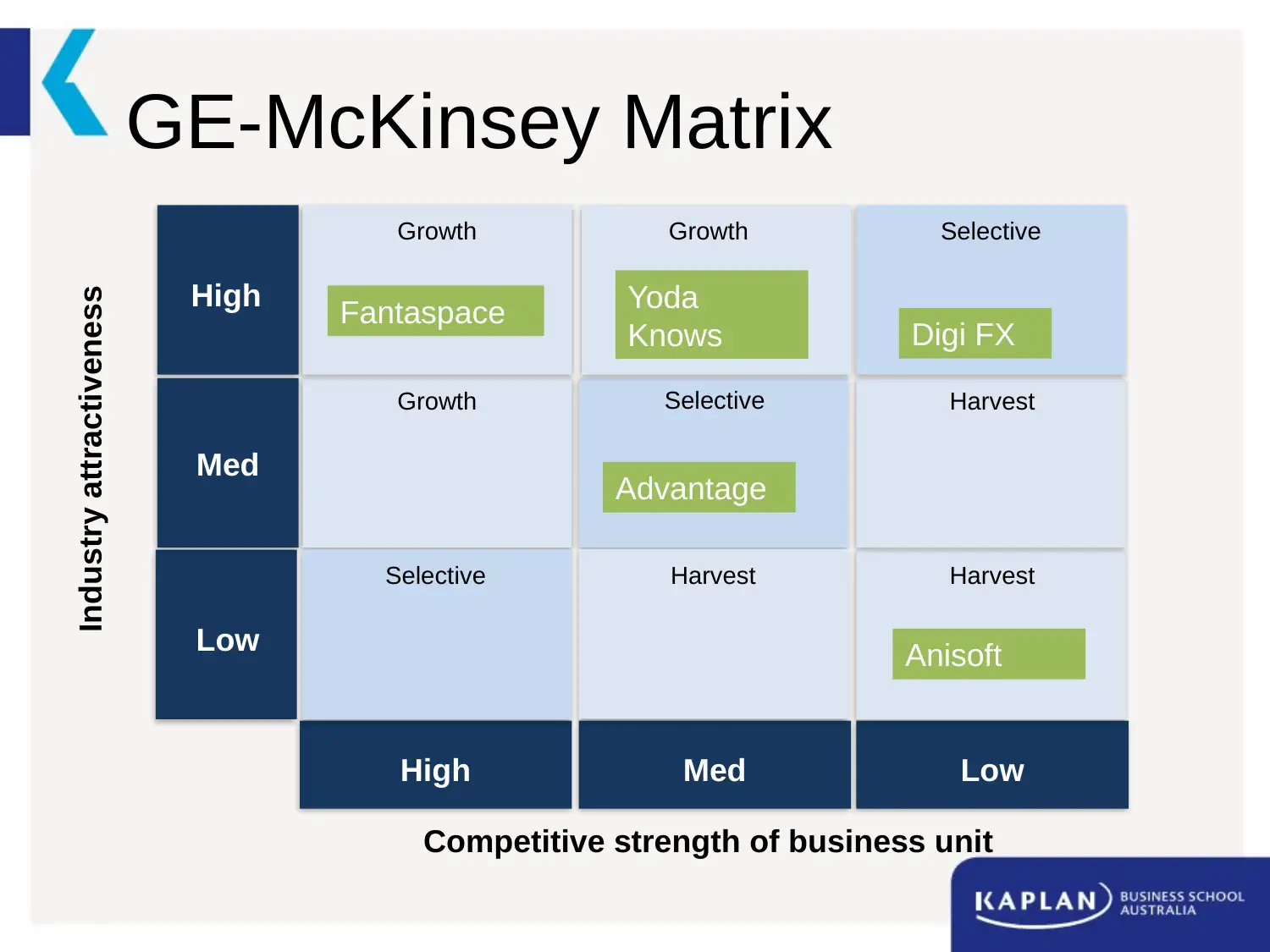

GE-McKinsey Matrix

Growth

Competitive strength of business unit

High Med Low

Industry attractiveness High

Med

Low

Growth

Harvest

Selective Harvest

HarvestSelective

SelectiveGrowth

Fantaspace

Advantage

Digi FX

Anisoft

Yoda

Knows

Growth

Competitive strength of business unit

High Med Low

Industry attractiveness High

Med

Low

Growth

Harvest

Selective Harvest

HarvestSelective

SelectiveGrowth

Fantaspace

Advantage

Digi FX

Anisoft

Yoda

Knows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

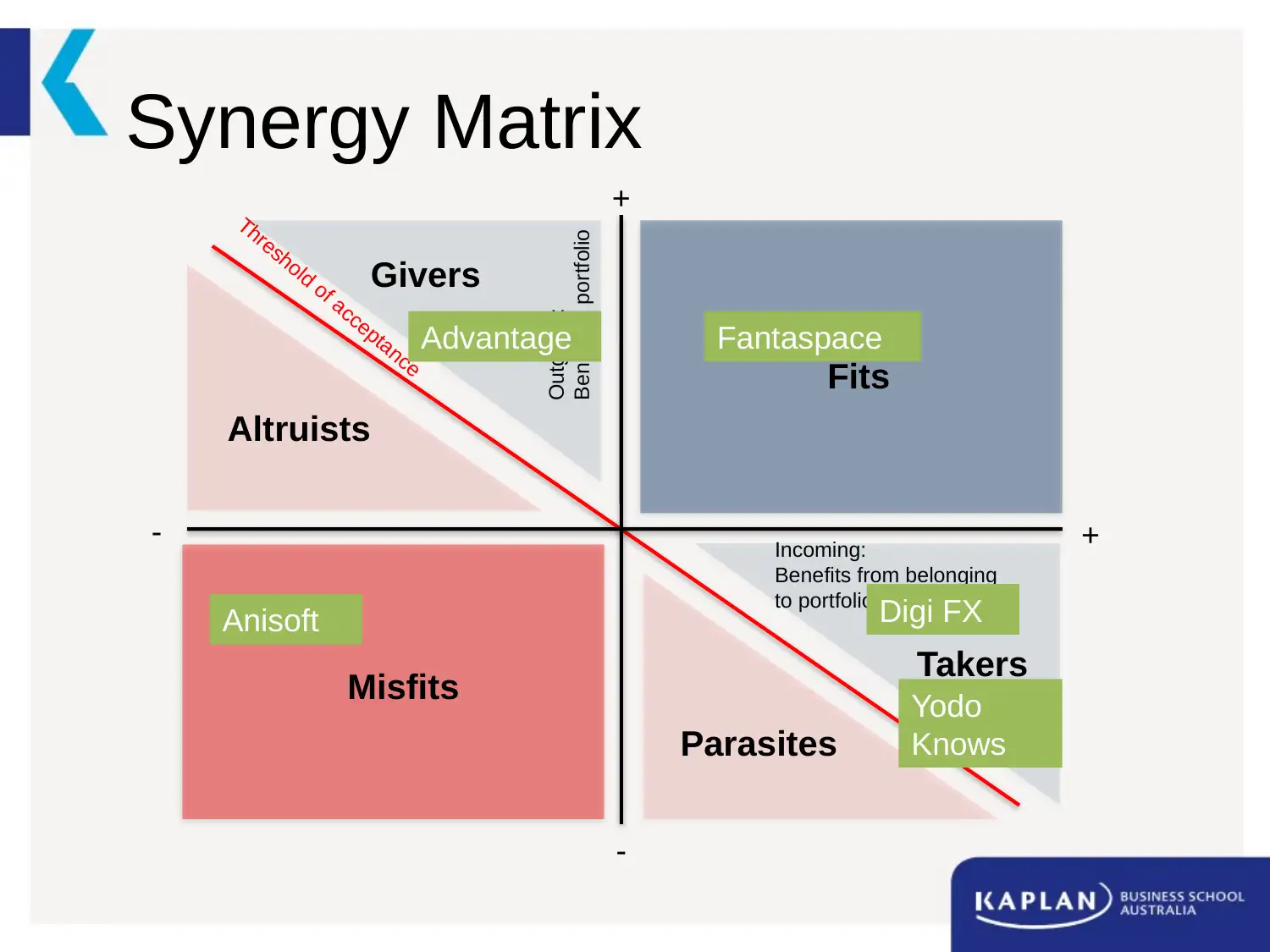

Synergy Matrix

Threshold of acceptance

Misfits

Incoming:

Benefits from belonging

to portfolio

+-

Fits

+

-

Outgoing:

Benefit to portfolio

Altruists

Givers

Parasites

Takers

Anisoft

FantaspaceAdvantage

Digi FX

Yodo

Knows

Threshold of acceptance

Misfits

Incoming:

Benefits from belonging

to portfolio

+-

Fits

+

-

Outgoing:

Benefit to portfolio

Altruists

Givers

Parasites

Takers

Anisoft

FantaspaceAdvantage

Digi FX

Yodo

Knows

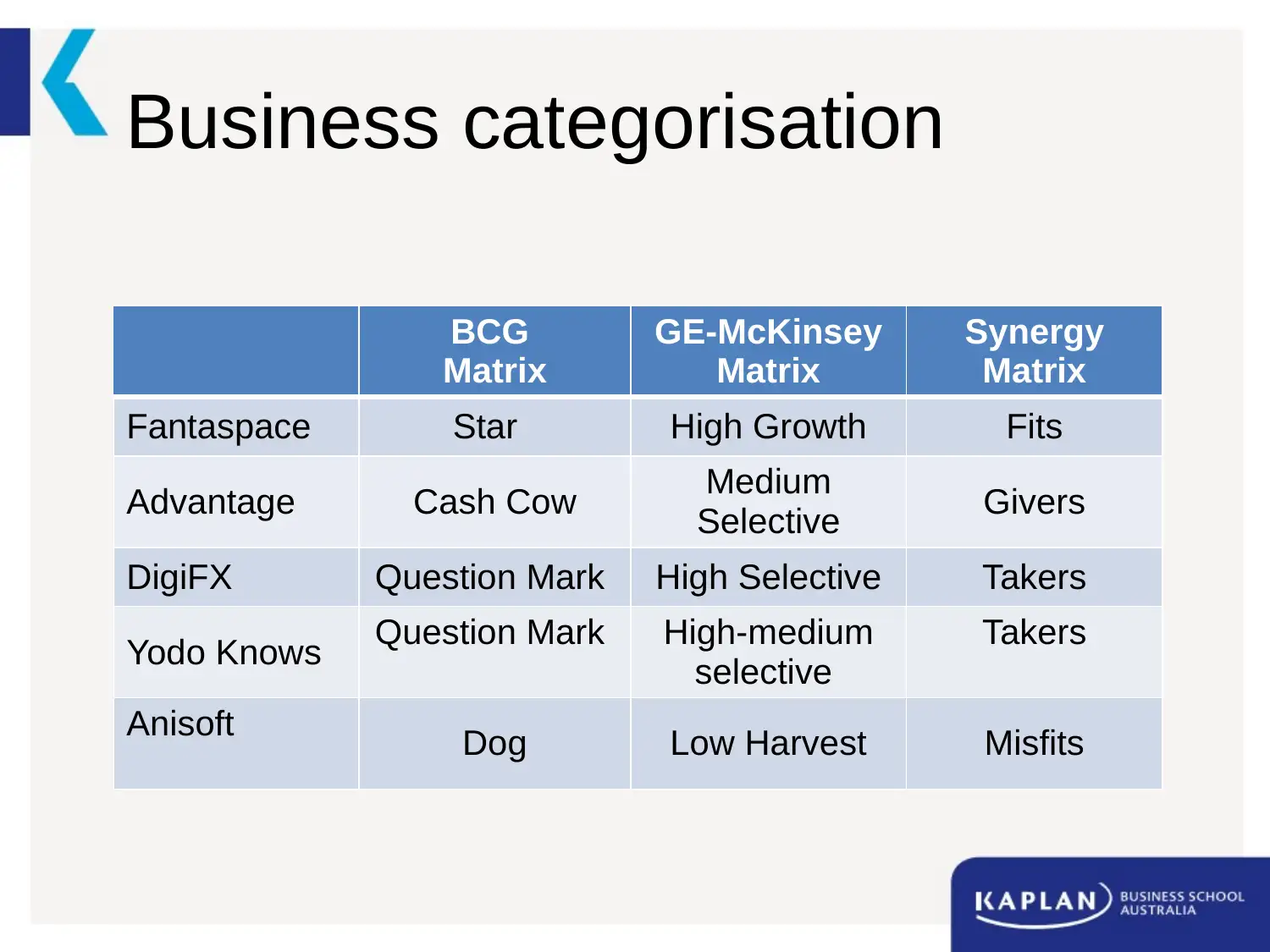

Business categorisation

BCG

Matrix

GE-McKinsey

Matrix

Synergy

Matrix

Fantaspace Star High Growth Fits

Advantage Cash Cow Medium

Selective Givers

DigiFX Question Mark High Selective Takers

Yodo Knows Question Mark High-medium

selective

Takers

Anisoft Dog Low Harvest Misfits

BCG

Matrix

GE-McKinsey

Matrix

Synergy

Matrix

Fantaspace Star High Growth Fits

Advantage Cash Cow Medium

Selective Givers

DigiFX Question Mark High Selective Takers

Yodo Knows Question Mark High-medium

selective

Takers

Anisoft Dog Low Harvest Misfits

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Fantaspace

Analysis

• Fantaspace: high feasible strength that obtains as well as offers the benefits in business.

Findings

• Market findings of animation film: higher growth rate as well as high attractiveness.

• Under BCG matrix: company is found in star category.

• Prospective to become aggressive market leader

• In GE McKinsey Matrix, higher expansion possibility for company

• It falls under Fits field in Synergy Matrix.

Recommendations

• It should be an initial choice in investment.

• It should invest into innovation technology, R&D, proficient workforces, creates

distinctiveness as well as, values to keep aggressive advantageous.

• It should create comparison among its market share as well as, growth continuously.

• Need to create solid foudation (Lehnert, Linhart, and Roeglinger, 2017).

Analysis

• Fantaspace: high feasible strength that obtains as well as offers the benefits in business.

Findings

• Market findings of animation film: higher growth rate as well as high attractiveness.

• Under BCG matrix: company is found in star category.

• Prospective to become aggressive market leader

• In GE McKinsey Matrix, higher expansion possibility for company

• It falls under Fits field in Synergy Matrix.

Recommendations

• It should be an initial choice in investment.

• It should invest into innovation technology, R&D, proficient workforces, creates

distinctiveness as well as, values to keep aggressive advantageous.

• It should create comparison among its market share as well as, growth continuously.

• Need to create solid foudation (Lehnert, Linhart, and Roeglinger, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

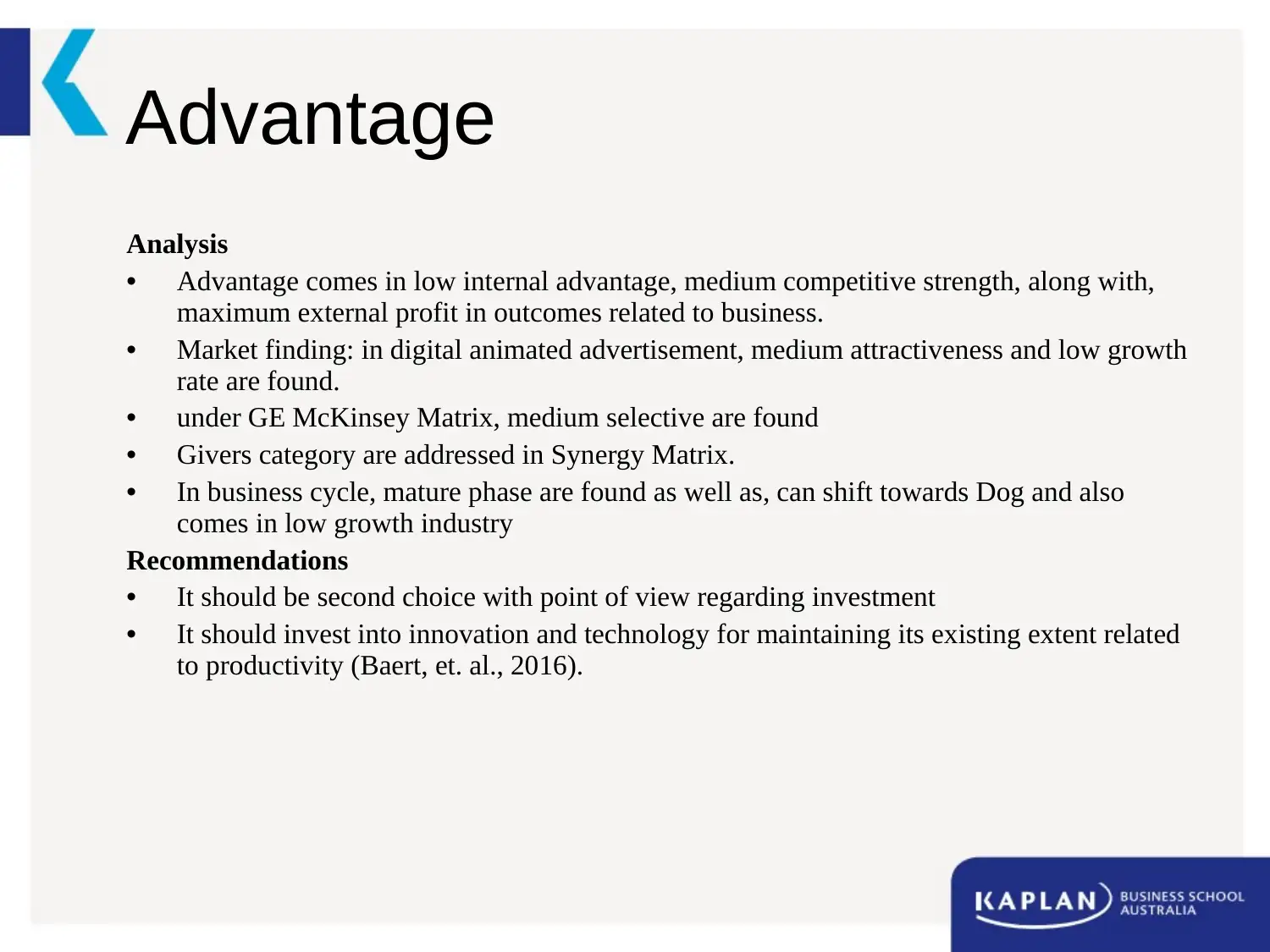

Advantage

Analysis

• Advantage comes in low internal advantage, medium competitive strength, along with,

maximum external profit in outcomes related to business.

• Market finding: in digital animated advertisement, medium attractiveness and low growth

rate are found.

• under GE McKinsey Matrix, medium selective are found

• Givers category are addressed in Synergy Matrix.

• In business cycle, mature phase are found as well as, can shift towards Dog and also

comes in low growth industry

Recommendations

• It should be second choice with point of view regarding investment

• It should invest into innovation and technology for maintaining its existing extent related

to productivity (Baert, et. al., 2016).

Analysis

• Advantage comes in low internal advantage, medium competitive strength, along with,

maximum external profit in outcomes related to business.

• Market finding: in digital animated advertisement, medium attractiveness and low growth

rate are found.

• under GE McKinsey Matrix, medium selective are found

• Givers category are addressed in Synergy Matrix.

• In business cycle, mature phase are found as well as, can shift towards Dog and also

comes in low growth industry

Recommendations

• It should be second choice with point of view regarding investment

• It should invest into innovation and technology for maintaining its existing extent related

to productivity (Baert, et. al., 2016).

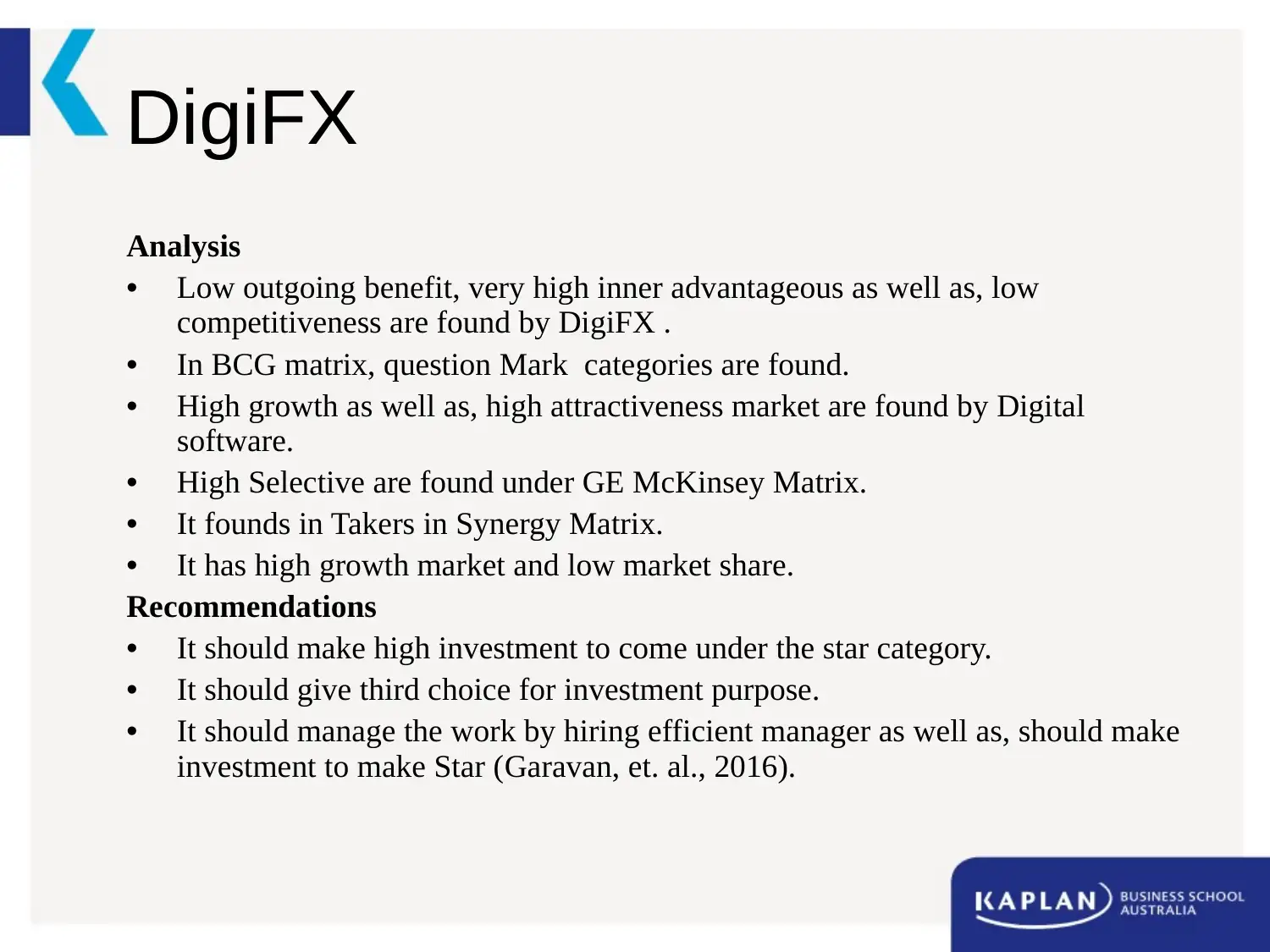

DigiFX

Analysis

• Low outgoing benefit, very high inner advantageous as well as, low

competitiveness are found by DigiFX .

• In BCG matrix, question Mark categories are found.

• High growth as well as, high attractiveness market are found by Digital

software.

• High Selective are found under GE McKinsey Matrix.

• It founds in Takers in Synergy Matrix.

• It has high growth market and low market share.

Recommendations

• It should make high investment to come under the star category.

• It should give third choice for investment purpose.

• It should manage the work by hiring efficient manager as well as, should make

investment to make Star (Garavan, et. al., 2016).

Analysis

• Low outgoing benefit, very high inner advantageous as well as, low

competitiveness are found by DigiFX .

• In BCG matrix, question Mark categories are found.

• High growth as well as, high attractiveness market are found by Digital

software.

• High Selective are found under GE McKinsey Matrix.

• It founds in Takers in Synergy Matrix.

• It has high growth market and low market share.

Recommendations

• It should make high investment to come under the star category.

• It should give third choice for investment purpose.

• It should manage the work by hiring efficient manager as well as, should make

investment to make Star (Garavan, et. al., 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Anisoft

Analysis

•Anisoft has low aggressive, low external advantageous as well as,

low incoming benefit

•In BCG matrix, Dog category are found.

•Low harvest are found as per GE McKinsey Matrix.

•Misfits situation is found in Synergy Matrix.

Recommendations

•Company can sell this business because it can ruin their

performance.

•It should focus highly on other 3 businesses.

•It should merge, transfer comprehension, hire expert in employees

with other business units (Hermano, and Martín-Cruz, 2016).

Analysis

•Anisoft has low aggressive, low external advantageous as well as,

low incoming benefit

•In BCG matrix, Dog category are found.

•Low harvest are found as per GE McKinsey Matrix.

•Misfits situation is found in Synergy Matrix.

Recommendations

•Company can sell this business because it can ruin their

performance.

•It should focus highly on other 3 businesses.

•It should merge, transfer comprehension, hire expert in employees

with other business units (Hermano, and Martín-Cruz, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Yoda Knows

Analysis

• Yoda Knows has high competitive, very low outgoing benefit, as well as,

high incoming advantageous.

• In BCG matrix, Question Mark category is found.

• In gaming, High growth as well as, high attractiveness market are found.

• High Selective are found under GE McKinsey Matrix.

• In Synergy Matrix, Takers category are found

• High growth market and high market size are addressed.

Recommendations

• It should make high investment to come under the star category.

• It should give high priority for investment purpose.

• It should manage the work by hiring efficient manager as well as, should

make investment to make Star (Garavan, et. al., 2016).

Analysis

• Yoda Knows has high competitive, very low outgoing benefit, as well as,

high incoming advantageous.

• In BCG matrix, Question Mark category is found.

• In gaming, High growth as well as, high attractiveness market are found.

• High Selective are found under GE McKinsey Matrix.

• In Synergy Matrix, Takers category are found

• High growth market and high market size are addressed.

Recommendations

• It should make high investment to come under the star category.

• It should give high priority for investment purpose.

• It should manage the work by hiring efficient manager as well as, should

make investment to make Star (Garavan, et. al., 2016).

Conclusion

Fantasy Film Business Portfolio

• Fantasy Film is expert in digital animated films, viable advertisement as well as, unique

digital effects.

• This company falls under mature phase into cycle of business according to performance

of Advantage, Fantaspace, DigiFX as well as, Yoda knows.

• The management team should be aware about the condition. Hence, they enlarge their

new business unit like DigiFX and Yoda knows for improving business performance.

Fantasy Film Business Portfolio

• Fantasy Film is expert in digital animated films, viable advertisement as well as, unique

digital effects.

• This company falls under mature phase into cycle of business according to performance

of Advantage, Fantaspace, DigiFX as well as, Yoda knows.

• The management team should be aware about the condition. Hence, they enlarge their

new business unit like DigiFX and Yoda knows for improving business performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.