Analysing Fantasy Film's Business Portfolio & Dynamic Capabilities

VerifiedAdded on 2023/06/05

|23

|1819

|73

Report

AI Summary

This report provides a comprehensive analysis of Fantasy Film's business portfolio and dynamic capabilities. It evaluates the company's various units (Fanta space, Advantage, DigiFX, and Anisoft) using tools like the BCG matrix, GE McKinsey matrix, and synergy matrix to assess their market position and competitive strength. The report further explores Fantasy Film's dynamic capabilities, identifying opportunities and threats through SWOT analysis and offering recommendations for improvement in areas such as resource mobilization, transformation, and reconfiguration. The analysis highlights the importance of innovation, technological advancement, and strategic alliances for sustaining a competitive edge in the dynamic market. The report concludes that Fantasy Film has the potential to strengthen its weaknesses and capitalize on opportunities through strategic restructuring and knowledge sharing.

Business Portfolio and Dynamic

Capability Development Report

Fantasy Film

[Student Name] – [Student Number]

Capability Development Report

Fantasy Film

[Student Name] – [Student Number]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

• Fantasy Film Business Portfolio

• Fantasy Film is a popular and leading organisation that deals with the

production of digital advertisement facilities. The company offers

skilled services in terms of film designing, digital animated effects and

digital software for live movies.

• The head office of the organisation is situated at Sydney and the

production of facilities are provided in their Brisbane, San Francisco as

well as Los Angeles Branch. The organisation has four major units.

• Fantasy Film Business Portfolio

• Fantasy Film is a popular and leading organisation that deals with the

production of digital advertisement facilities. The company offers

skilled services in terms of film designing, digital animated effects and

digital software for live movies.

• The head office of the organisation is situated at Sydney and the

production of facilities are provided in their Brisbane, San Francisco as

well as Los Angeles Branch. The organisation has four major units.

Contd..

• Fanta space: This unit offers digital animation software’s production and generates

nearly 4.8billion of market share.

• Advantage: these unit of organisation helps in the development digital animated

advertisement for the medium of television and internet sources.

• DigiFX: The unit produces digitalised effects for live action movies and they generates

almost $1.0 billion of share.

• Focusing on the production and capabilities of these units, the report emphasises on

different tools such as BCG matrix, BE mckinsey matrix, synergy matrix. The report also

evaluates and provides effective suggestion for the development of business in this units

• Fanta space: This unit offers digital animation software’s production and generates

nearly 4.8billion of market share.

• Advantage: these unit of organisation helps in the development digital animated

advertisement for the medium of television and internet sources.

• DigiFX: The unit produces digitalised effects for live action movies and they generates

almost $1.0 billion of share.

• Focusing on the production and capabilities of these units, the report emphasises on

different tools such as BCG matrix, BE mckinsey matrix, synergy matrix. The report also

evaluates and provides effective suggestion for the development of business in this units

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

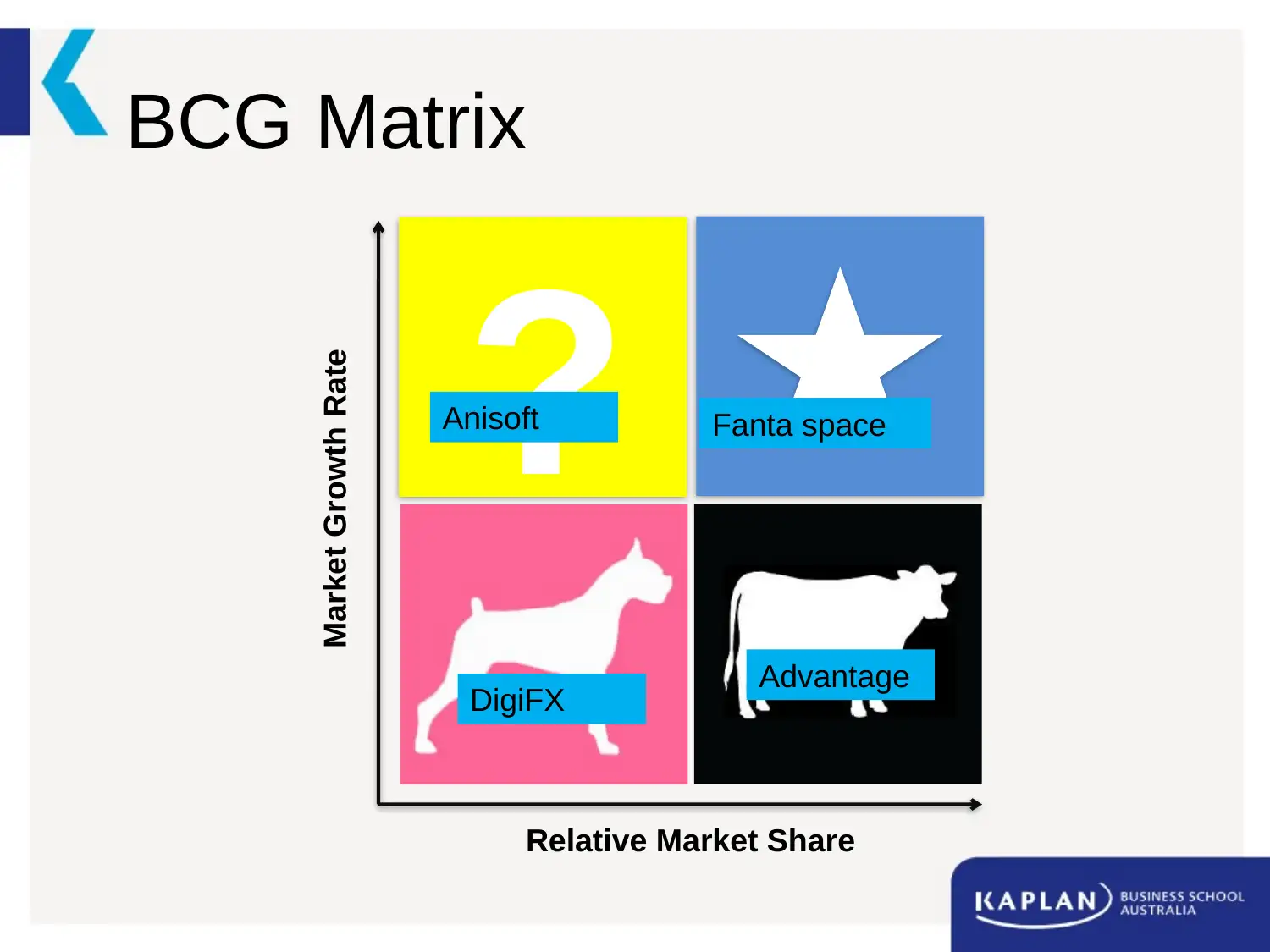

BCG Matrix

?

Relative Market Share

Market Growth Rate

Anisoft

Advantage

Fanta space

DigiFX

?

Relative Market Share

Market Growth Rate

Anisoft

Advantage

Fanta space

DigiFX

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

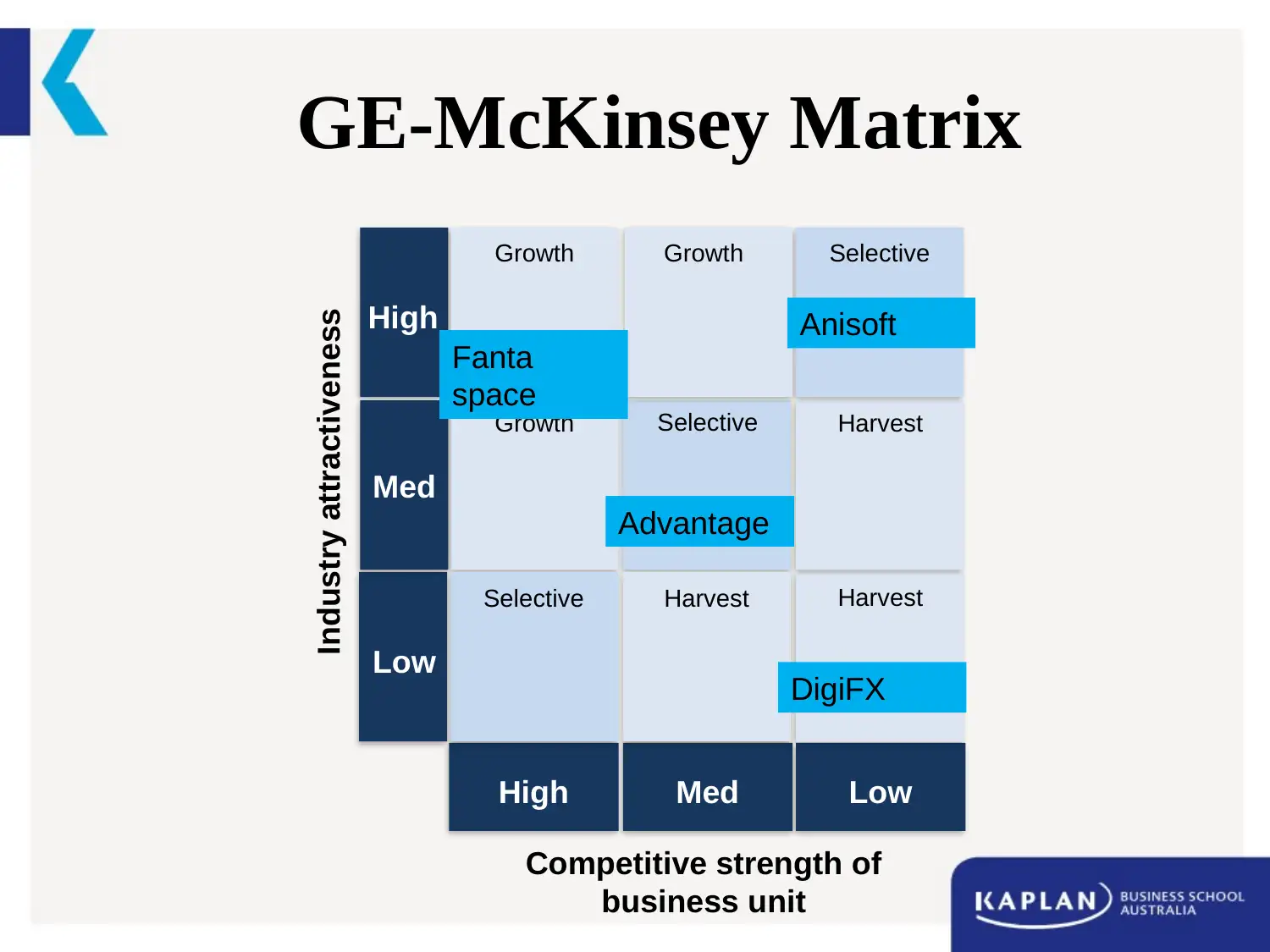

GE-McKinsey Matrix

Growth

Competitive strength of

business unit

High Med Low

Industry attractiveness High

Med

Low

Growth

Harvest

Selective Harvest

HarvestSelective

SelectiveGrowth

Anisoft

Fanta

space

Advantage

DigiFX

Growth

Competitive strength of

business unit

High Med Low

Industry attractiveness High

Med

Low

Growth

Harvest

Selective Harvest

HarvestSelective

SelectiveGrowth

Anisoft

Fanta

space

Advantage

DigiFX

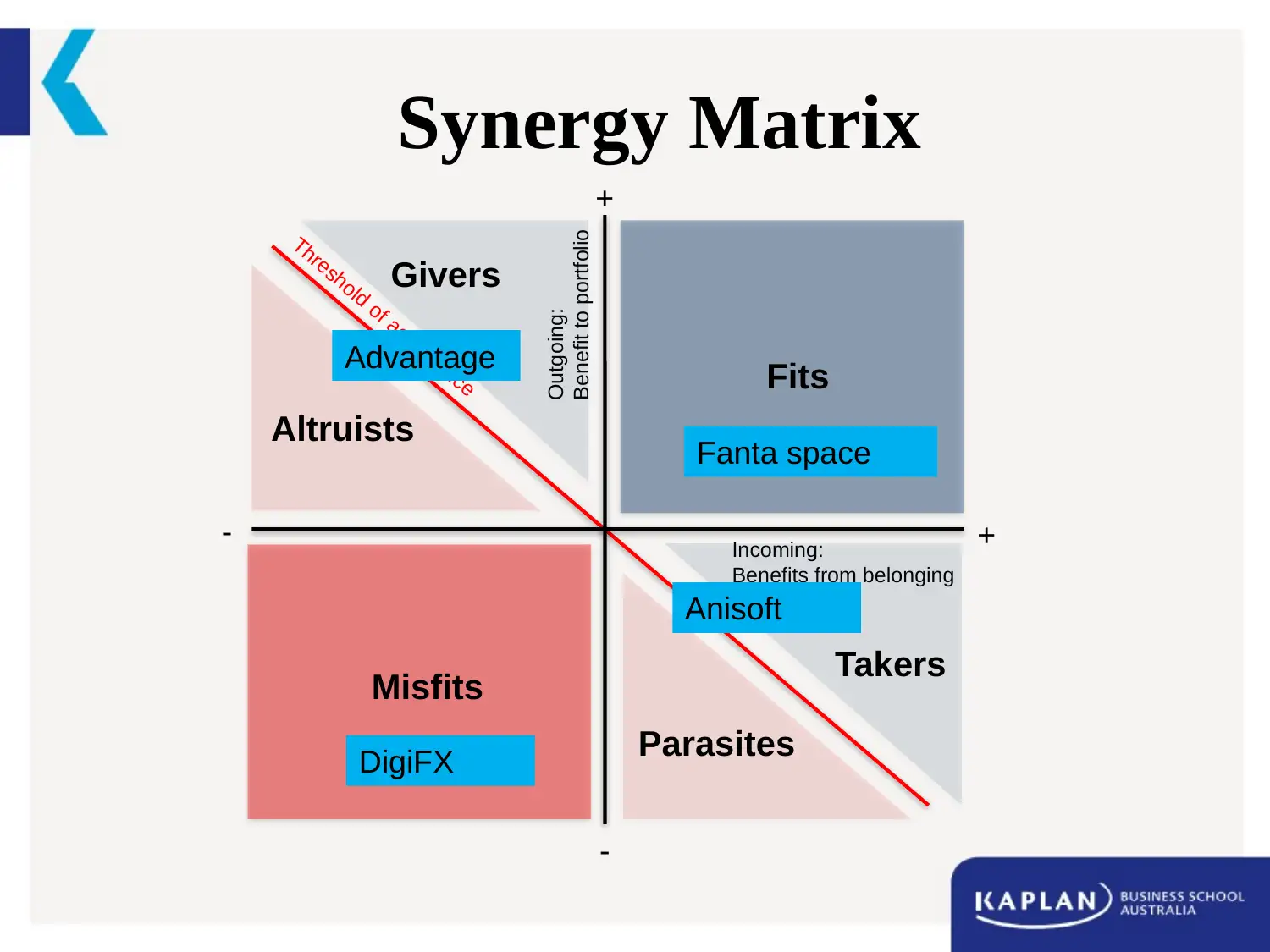

Synergy Matrix

Threshold of acceptance

Misfits

Incoming:

Benefits from belonging

to portfolio

+-

Fits

+

-

Outgoing:

Benefit to portfolio

Altruists

Givers

Parasites

Takers

Advantage

Fanta space

DigiFX

Anisoft

Threshold of acceptance

Misfits

Incoming:

Benefits from belonging

to portfolio

+-

Fits

+

-

Outgoing:

Benefit to portfolio

Altruists

Givers

Parasites

Takers

Advantage

Fanta space

DigiFX

Anisoft

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

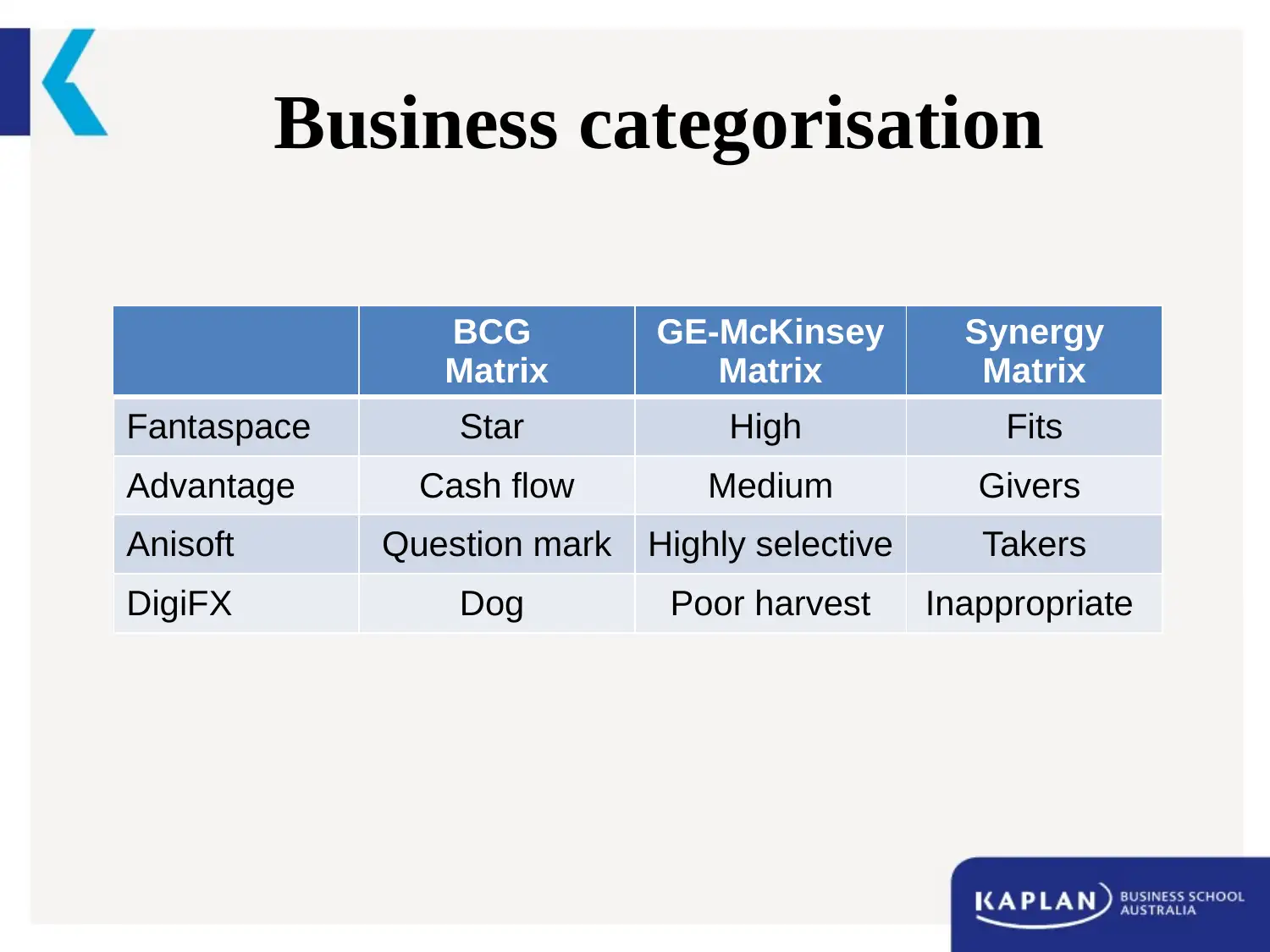

Business categorisation

BCG

Matrix

GE-McKinsey

Matrix

Synergy

Matrix

Fantaspace Star High Fits

Advantage Cash flow Medium Givers

Anisoft Question mark Highly selective Takers

DigiFX Dog Poor harvest Inappropriate

BCG

Matrix

GE-McKinsey

Matrix

Synergy

Matrix

Fantaspace Star High Fits

Advantage Cash flow Medium Givers

Anisoft Question mark Highly selective Takers

DigiFX Dog Poor harvest Inappropriate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fantaspace

• Analysis

• The business unit has an increased opportunity of competitive growth with an approaching

benefit and constraining benefits in seeking business

• The market produces approximately 4.8billion of share from the animate production of movies

• The unit is in a developing phase of business.

• Recommendations

• Observing their conduction it could be said that the unit needs to provide increased investment in

the R&D operations, development of technology and in growing skilled employees with a value

offered competitive advantage (Karimi and Walter 2015).

• Apart from these, they are required to use their academy award for the purpose of strategic

management for recognising the emerging customers as well as capabilities.

• Analysis

• The business unit has an increased opportunity of competitive growth with an approaching

benefit and constraining benefits in seeking business

• The market produces approximately 4.8billion of share from the animate production of movies

• The unit is in a developing phase of business.

• Recommendations

• Observing their conduction it could be said that the unit needs to provide increased investment in

the R&D operations, development of technology and in growing skilled employees with a value

offered competitive advantage (Karimi and Walter 2015).

• Apart from these, they are required to use their academy award for the purpose of strategic

management for recognising the emerging customers as well as capabilities.

Advantage

• Analysis

•The business unit has a moderate competitive power in the market provided with limited

approaching benefit and comparatively higher constraining benefits in their business activities

•The company produces almost 1.9 billion with near about 76% of the share market with a low

growing percentage with a moderate level of attraction

• Recommendations

•The suggestion for the unit would to invest their operation in innovating and technological

advancement activities for managing their existing level of production and to sustain its

competitive edge (Rayna and Striukova 2016).

•The unit is as well needed to build a acquisition with other companies for expanding their

value for both the firm.

• Analysis

•The business unit has a moderate competitive power in the market provided with limited

approaching benefit and comparatively higher constraining benefits in their business activities

•The company produces almost 1.9 billion with near about 76% of the share market with a low

growing percentage with a moderate level of attraction

• Recommendations

•The suggestion for the unit would to invest their operation in innovating and technological

advancement activities for managing their existing level of production and to sustain its

competitive edge (Rayna and Striukova 2016).

•The unit is as well needed to build a acquisition with other companies for expanding their

value for both the firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Anisoft

• Analysis

• The digital unit has a high growth capability with hinge attraction in the existing market

• The share margin of the company is running at 11.11% with a growth of 200 million.

• The unit is at stage of development in business with a low share in market.

• Recommendations

• The business unit is requires to collect investment for transforming in to star position with the

rapid growth of the industry.

• The company is needed to seek solution and innovative technological strategies for

developing value and to empower their competitive edge (Čiutienė and Thattakath 2014).

• Analysis

• The digital unit has a high growth capability with hinge attraction in the existing market

• The share margin of the company is running at 11.11% with a growth of 200 million.

• The unit is at stage of development in business with a low share in market.

• Recommendations

• The business unit is requires to collect investment for transforming in to star position with the

rapid growth of the industry.

• The company is needed to seek solution and innovative technological strategies for

developing value and to empower their competitive edge (Čiutienė and Thattakath 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DigiFX

• Analysis

• The business unit has poor competitive power with poor approaching as well as constraining benefits.

• The market profit of the unit is almost 11.53% with an expansion of 150 million from the 1.3 million of share

• Recommendations

• From the above analysis the company is recommended to sell their business as it could lead to downfall of the

entire business performance

• The unit is needed to focus more on the other three units for the acquisition of the knowledge and employees

skills with others

• They need to develop cross functional team for increasing the competitive power.

• Analysis

• The business unit has poor competitive power with poor approaching as well as constraining benefits.

• The market profit of the unit is almost 11.53% with an expansion of 150 million from the 1.3 million of share

• Recommendations

• From the above analysis the company is recommended to sell their business as it could lead to downfall of the

entire business performance

• The unit is needed to focus more on the other three units for the acquisition of the knowledge and employees

skills with others

• They need to develop cross functional team for increasing the competitive power.

Conclusion

• Fantasy Film Business Portfolio

• Therefore, it is evident from the study that the organisation is in a matured stage of

business growth owing high performing activities of Fanta space, Anisoft,

advantages and Digifx.

• To be specific, the management department is conscious about the growth cycle of

the company based on which they have decided to expand their business unit

through Anisoft.

• From the recommendations it is clear that they are needed to expand their capability

for establishing cross operational groups.

• Fantasy Film Business Portfolio

• Therefore, it is evident from the study that the organisation is in a matured stage of

business growth owing high performing activities of Fanta space, Anisoft,

advantages and Digifx.

• To be specific, the management department is conscious about the growth cycle of

the company based on which they have decided to expand their business unit

through Anisoft.

• From the recommendations it is clear that they are needed to expand their capability

for establishing cross operational groups.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.