Evaluating the Effect of FDI on Economic Growth in Australia: A Report

VerifiedAdded on 2023/06/06

|18

|4105

|125

Report

AI Summary

This research report investigates the relationship between Foreign Direct Investment (FDI) and economic growth in Australia, focusing on the period from 2007 to 2017. The study aims to determine how the inflow of FDI impacts Australia's economic prosperity. The report begins with an executive summary, table of contents, and introduction outlining the research question and objectives. A thorough literature review explores both the positive and negative impacts of FDI on economic growth, including the neo-classical growth model and the effects of technology transfer, capital accumulation, and market access. The methodology section details the data collection from the Australian Bureau of Statistics and the World Bank, followed by a quantitative analysis using descriptive statistics, bivariate correlation, and regression analysis. The findings reveal the average economic growth rate and FDI growth rate, alongside statistical analyses. The discussion interprets the results in relation to the hypothesis, and the report concludes by addressing the research aim, limitations, and offering recommendations based on the findings.

Running head: EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH

OF AUSTRALIA

Effect of Foreign Direct Investment on Economic Growth of Australia

Name of the Student

Name of the University

Author note

Course ID

OF AUSTRALIA

Effect of Foreign Direct Investment on Economic Growth of Australia

Name of the Student

Name of the University

Author note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

Executive Summary

In the research paper, evaluation has been made regarding the interconnectedness between

economic growth and foreign direct investment in Australia. The particular research question is

how inflow of foreign direct investment in Australia affects economic growth of Australia.

Research scholars have conducted extensive research in evaluating relationship of FDI to that of

economic growth of a nation. The consensus from past literature tend to conclude in favor of a

positive bearing of foreign investment on economic prosperity through gains in efficiency and

productivity. The evidences from empirical literature however are not free from ambiguity. The

influence of FDI differs across countries and even varies depending on period under

consideration.

Data on foreign direct investment and economic growth of Australia has been collected from

official websites. The considered period of time under study extends from 2007 to 2017. The

secondary data are then analyzed applying quantitative method of research.

AUSTRALIA

Executive Summary

In the research paper, evaluation has been made regarding the interconnectedness between

economic growth and foreign direct investment in Australia. The particular research question is

how inflow of foreign direct investment in Australia affects economic growth of Australia.

Research scholars have conducted extensive research in evaluating relationship of FDI to that of

economic growth of a nation. The consensus from past literature tend to conclude in favor of a

positive bearing of foreign investment on economic prosperity through gains in efficiency and

productivity. The evidences from empirical literature however are not free from ambiguity. The

influence of FDI differs across countries and even varies depending on period under

consideration.

Data on foreign direct investment and economic growth of Australia has been collected from

official websites. The considered period of time under study extends from 2007 to 2017. The

secondary data are then analyzed applying quantitative method of research.

2EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

Table of Content

1.Introduction...................................................................................................................................3

1.1 Problem Statement............................................................................................................3

1.1 Research aim and research question.................................................................................4

2. Literature review..........................................................................................................................4

2.1 Positive influence of FDI on economic growth.....................................................................4

2.2 Adverse effect of FDI on economic prosperity.....................................................................6

2.3 Hypothesis.............................................................................................................................7

3. Methodology................................................................................................................................7

3.1 Data collection.......................................................................................................................7

3.2 Data Analysis.........................................................................................................................8

4. Finding and Analysis...................................................................................................................8

4.1 Descriptive Statistics.............................................................................................................8

4.2 Bivariate Correlation...........................................................................................................10

4.3 Regression Analysis.............................................................................................................10

5. Discussion..................................................................................................................................11

5.1 Hypothesis: Foreign direct investment has a significant relation with economic growth...11

6. Conclusion.................................................................................................................................12

6.1 Addressing research aim and research question..................................................................12

6.2 Limitation............................................................................................................................13

6.3 Recommendation.................................................................................................................13

7. Reference List............................................................................................................................14

AUSTRALIA

Table of Content

1.Introduction...................................................................................................................................3

1.1 Problem Statement............................................................................................................3

1.1 Research aim and research question.................................................................................4

2. Literature review..........................................................................................................................4

2.1 Positive influence of FDI on economic growth.....................................................................4

2.2 Adverse effect of FDI on economic prosperity.....................................................................6

2.3 Hypothesis.............................................................................................................................7

3. Methodology................................................................................................................................7

3.1 Data collection.......................................................................................................................7

3.2 Data Analysis.........................................................................................................................8

4. Finding and Analysis...................................................................................................................8

4.1 Descriptive Statistics.............................................................................................................8

4.2 Bivariate Correlation...........................................................................................................10

4.3 Regression Analysis.............................................................................................................10

5. Discussion..................................................................................................................................11

5.1 Hypothesis: Foreign direct investment has a significant relation with economic growth...11

6. Conclusion.................................................................................................................................12

6.1 Addressing research aim and research question..................................................................12

6.2 Limitation............................................................................................................................13

6.3 Recommendation.................................................................................................................13

7. Reference List............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

1.Introduction

` The present research paper is developed to scrutinize the bearing of foreign direct

investment on economic growth of Australia. The paper is divided in two sections. Research

background, research aim and relevant research question and theoretical and empirical literature

are discussed in the first section. Based on the research background and past literature, the final

part of the paper is developed with discussion of applied research methodology, analysis of

collected data and the final conclusion.

1.1 Problem Statement

The FDI infers an investment that is made to acquire a place in operation of a business

enterprise in place other than own investors residency. FDI can take either the form of greenfield

investment or the form of merger and acquisition. Investment is considered as foreign direct

investment if the foreign investor acquires at least 10 percent ownership share. Ownership below

that is considered as foreign portfolio investment. Cross border movement of capital is one of

the greatest contribution of globalization (Iamsiraroj & Ulubaşoglu, 2015). Attracting foreign

investment has now become one of major component of growth strategy for several developed

and developing nations.

Foreign direct investment benefits the economy of Australiain different ways. The stock

of FDI in 2015 was increased by 7.2 percent. Foreign investment in different new projects create

opportunities for new employment contributing to expansion of new jobs and economic growth.

The increased competition with foreign investors drive productivity growth in the nation

(dfat.gov.au, 2018). The access to foreign technology causes a proliferation in productivity of

AUSTRALIA

1.Introduction

` The present research paper is developed to scrutinize the bearing of foreign direct

investment on economic growth of Australia. The paper is divided in two sections. Research

background, research aim and relevant research question and theoretical and empirical literature

are discussed in the first section. Based on the research background and past literature, the final

part of the paper is developed with discussion of applied research methodology, analysis of

collected data and the final conclusion.

1.1 Problem Statement

The FDI infers an investment that is made to acquire a place in operation of a business

enterprise in place other than own investors residency. FDI can take either the form of greenfield

investment or the form of merger and acquisition. Investment is considered as foreign direct

investment if the foreign investor acquires at least 10 percent ownership share. Ownership below

that is considered as foreign portfolio investment. Cross border movement of capital is one of

the greatest contribution of globalization (Iamsiraroj & Ulubaşoglu, 2015). Attracting foreign

investment has now become one of major component of growth strategy for several developed

and developing nations.

Foreign direct investment benefits the economy of Australiain different ways. The stock

of FDI in 2015 was increased by 7.2 percent. Foreign investment in different new projects create

opportunities for new employment contributing to expansion of new jobs and economic growth.

The increased competition with foreign investors drive productivity growth in the nation

(dfat.gov.au, 2018). The access to foreign technology causes a proliferation in productivity of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

Australia. Considering the long standing bearing of FDI on economy of Australia, the paper

examines impact of FDI flow on economic growth of Australia.

1.1 Research aim and research question

Aim of the research paper is to find out the role of foreign direct investment (FDI) in

influencing economic growth of Australia. The particular research question that the current

research is addressing is given as

How inflow of foreign direct investment influence Australia’s economic growth?

2. Literature review

Foreign direct investment is regarded as one major source of capita in nations lacking

capital for undertaking development projects that are capital intensive. Investment from foreign

nations has implication for both developed and emerging economies. FDI contributes to capital

accumulation in the receiving countries through introduction of new technologies and factor

inputs (Dike, 2018). Several studies have been conducted to evaluate impact of foreign direct

investment on economic prosperity of the targeted country. Some studies draw conclusion in

favor of positive influence of foreign capital in a nation. While findings of some researchers’

point towards an adverse influence of foreign direct investment on growth of targeted nation.

The consequence of foreign direct investment found to be ambiguous (Sbia, Shahbaz & Hamdi,

2014). This section discusses past literatures conducting researches on aspect.

2.1 Positive influence of FDI on economic growth

In the neo classical growth model, economic growth in the long run can contributed only

from technological progress that resulted from exogenous forces and enhances growth in labor

AUSTRALIA

Australia. Considering the long standing bearing of FDI on economy of Australia, the paper

examines impact of FDI flow on economic growth of Australia.

1.1 Research aim and research question

Aim of the research paper is to find out the role of foreign direct investment (FDI) in

influencing economic growth of Australia. The particular research question that the current

research is addressing is given as

How inflow of foreign direct investment influence Australia’s economic growth?

2. Literature review

Foreign direct investment is regarded as one major source of capita in nations lacking

capital for undertaking development projects that are capital intensive. Investment from foreign

nations has implication for both developed and emerging economies. FDI contributes to capital

accumulation in the receiving countries through introduction of new technologies and factor

inputs (Dike, 2018). Several studies have been conducted to evaluate impact of foreign direct

investment on economic prosperity of the targeted country. Some studies draw conclusion in

favor of positive influence of foreign capital in a nation. While findings of some researchers’

point towards an adverse influence of foreign direct investment on growth of targeted nation.

The consequence of foreign direct investment found to be ambiguous (Sbia, Shahbaz & Hamdi,

2014). This section discusses past literatures conducting researches on aspect.

2.1 Positive influence of FDI on economic growth

In the neo classical growth model, economic growth in the long run can contributed only

from technological progress that resulted from exogenous forces and enhances growth in labor

5EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

productivity. Foreign direct investment in such model can only contribute to economic growth if

it can bring technological progress (Iamsiraroj, 2016). The addition to capita stock through

foreign investment leads to the sustained long terms economic growth. The newer technology,

improvement in human capital through indirect channel, development of infrastructure and

institution all have a spillover effect on economic growth. The positive external effect is also

realized in forms of improvement in managerial skills, organizational knowledge and training

program of laborers (Paramati, Ummalla & Apergis, 2016). FDI also benefits the host nation

through gaining access into the world market.

One study attempted to find impact of FDI flow across different sectors of an economy.

The study concluded that foreign direct investment initiated in the primary sector constitute an

adverse effect on growth (Almfraji & Almsafir, 2014) However, such investment in the

manufacturing sector has a positive impact in manufacturing sector. Countries that have a stable

financial system and a stable political environment are able to exploit foreign direct investment

in a more efficient manner and hence attain a higher economic growth (Omri & Kahouli, 2014).

Developing countries are able to attract more foreign invest by their faster economic

growth and favorable investment policies. It can be observed that larger foreign direct investment

is attached to an economy having a higher economic growth rate (Penrose, 2017). On the other

hand, foreign investment also has an instrumental influence on economic growth of a nation.

Theoretical and empirical literatures thus suggest linkage between economic growth and FDI is

bi-directional (Azam & Ahmed, 2015). The positive association between economic growth and

FDI implies that host nation reaps considerable economic benefit from the foreign fund in form

of enhanced productivity.

AUSTRALIA

productivity. Foreign direct investment in such model can only contribute to economic growth if

it can bring technological progress (Iamsiraroj, 2016). The addition to capita stock through

foreign investment leads to the sustained long terms economic growth. The newer technology,

improvement in human capital through indirect channel, development of infrastructure and

institution all have a spillover effect on economic growth. The positive external effect is also

realized in forms of improvement in managerial skills, organizational knowledge and training

program of laborers (Paramati, Ummalla & Apergis, 2016). FDI also benefits the host nation

through gaining access into the world market.

One study attempted to find impact of FDI flow across different sectors of an economy.

The study concluded that foreign direct investment initiated in the primary sector constitute an

adverse effect on growth (Almfraji & Almsafir, 2014) However, such investment in the

manufacturing sector has a positive impact in manufacturing sector. Countries that have a stable

financial system and a stable political environment are able to exploit foreign direct investment

in a more efficient manner and hence attain a higher economic growth (Omri & Kahouli, 2014).

Developing countries are able to attract more foreign invest by their faster economic

growth and favorable investment policies. It can be observed that larger foreign direct investment

is attached to an economy having a higher economic growth rate (Penrose, 2017). On the other

hand, foreign investment also has an instrumental influence on economic growth of a nation.

Theoretical and empirical literatures thus suggest linkage between economic growth and FDI is

bi-directional (Azam & Ahmed, 2015). The positive association between economic growth and

FDI implies that host nation reaps considerable economic benefit from the foreign fund in form

of enhanced productivity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

A study analyzed benefits and costs associated with foreign direct investment. In this

paper the theory of marginal productivity was used to find impact of FDI across different sectors

of the receiving country (Curwin & Mahutga, 2014). The paper actually did an analysis based on

the income distribution assuming framework of perfect competition. The study concluded that

capital intensive sector of the host nation suffers from a loss because of a decline in marginal

productivity. This is because of excess addition to capital stock due to foreign investment. Labor

intensive sector on the other enjoy a higher wage following an increase in marginal productivity

of labor (Stanisic, 2015).

2.2 Adverse effect of FDI on economic prosperity

In the growth model developed on the basis of foreign direct investment also estimated

negative coefficient for foreign investment. Researches try to how foreign direct investment

costs economic growth (Seker, Ertugrul & Cetin, 2015) One channel explaining an adverse

implication of FDI on economic prosperity is the distortion in the domestic economic activity

due to interruption by foreign investors. Policies in the domestic economy are often designed that

offer foreign investors a preferential treatment (Fan et al., 2016). This leaves domestic producer

at a disadvantageous position distorting economic activity. In situation where foreign firms

continue to receive several benefits from government of host nations then the distortionary effect

might have large negative impact on economic growth (Wang et al., 2016).

FDI enters in a nation to reduce the trade barriers. There are some investments that might

not contribute to an increase in productive efficiency. These investments only create profit

opportunities for foreign firms by distorting incentive to domestic producers (Gui-Diby, 2014).

Some studies conclude that simple infusion of new technology and human capital resulted from

foreign direct investment in a distortion ridden nation neither take the host economy to higher

AUSTRALIA

A study analyzed benefits and costs associated with foreign direct investment. In this

paper the theory of marginal productivity was used to find impact of FDI across different sectors

of the receiving country (Curwin & Mahutga, 2014). The paper actually did an analysis based on

the income distribution assuming framework of perfect competition. The study concluded that

capital intensive sector of the host nation suffers from a loss because of a decline in marginal

productivity. This is because of excess addition to capital stock due to foreign investment. Labor

intensive sector on the other enjoy a higher wage following an increase in marginal productivity

of labor (Stanisic, 2015).

2.2 Adverse effect of FDI on economic prosperity

In the growth model developed on the basis of foreign direct investment also estimated

negative coefficient for foreign investment. Researches try to how foreign direct investment

costs economic growth (Seker, Ertugrul & Cetin, 2015) One channel explaining an adverse

implication of FDI on economic prosperity is the distortion in the domestic economic activity

due to interruption by foreign investors. Policies in the domestic economy are often designed that

offer foreign investors a preferential treatment (Fan et al., 2016). This leaves domestic producer

at a disadvantageous position distorting economic activity. In situation where foreign firms

continue to receive several benefits from government of host nations then the distortionary effect

might have large negative impact on economic growth (Wang et al., 2016).

FDI enters in a nation to reduce the trade barriers. There are some investments that might

not contribute to an increase in productive efficiency. These investments only create profit

opportunities for foreign firms by distorting incentive to domestic producers (Gui-Diby, 2014).

Some studies conclude that simple infusion of new technology and human capital resulted from

foreign direct investment in a distortion ridden nation neither take the host economy to higher

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

plane nor it causes any change in production function of the economy. Instead it leads to

redistribution of income in favor of newly entered foreign firms (Shahbaz et al., 2015). In some

Arab countries, it is found that there is no economic justification of foreign direct investment in

such nations as it creates nothing but economic distortion (Omri et al., 2015).

2.3 Hypothesis

Based on the insights from previous literatures and research question of the current

research the following relevant hypothesis has been developed.

Null Hypothesis (H0): No statistically significant relation exists between foreign direct

investment and economic growth of Australia

Alternative Hypothesis (H1): There exists a statistically significant relation between foreign

direct investment and economic growth of Australia

3. Methodology

3.1 Data collection

In order to conduct research on the linkage between GDP growth and growth in FDI,

secondary data has been collected on economic growth and FDI flow. The Australian Bureau of

Statistics publishes quarterly data on economic growth. Credential data on economic growth has

been collected from official website of Australian Bureau of Statistics (abs.gov.au, 2018). To

quantitative data on FDI has been collected from the world bank report (worldbank.org, 2018).

The data has been collected for past eleven years (2007 – 2017).

AUSTRALIA

plane nor it causes any change in production function of the economy. Instead it leads to

redistribution of income in favor of newly entered foreign firms (Shahbaz et al., 2015). In some

Arab countries, it is found that there is no economic justification of foreign direct investment in

such nations as it creates nothing but economic distortion (Omri et al., 2015).

2.3 Hypothesis

Based on the insights from previous literatures and research question of the current

research the following relevant hypothesis has been developed.

Null Hypothesis (H0): No statistically significant relation exists between foreign direct

investment and economic growth of Australia

Alternative Hypothesis (H1): There exists a statistically significant relation between foreign

direct investment and economic growth of Australia

3. Methodology

3.1 Data collection

In order to conduct research on the linkage between GDP growth and growth in FDI,

secondary data has been collected on economic growth and FDI flow. The Australian Bureau of

Statistics publishes quarterly data on economic growth. Credential data on economic growth has

been collected from official website of Australian Bureau of Statistics (abs.gov.au, 2018). To

quantitative data on FDI has been collected from the world bank report (worldbank.org, 2018).

The data has been collected for past eleven years (2007 – 2017).

8EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

3.2 Data Analysis

The research analysis is based on the quantitative time series data as collected from

official website of Australian Bureau of Statistics and World Bank. The analysis of collected

secondary data on economic growth and foreign direct investment is involve application of

quantitative method. The quantitative researching method uses numerical, mathematical and

statistical analysis of collected data series (Brannen, 2017) This is a relevant measure for

establishing relation between two variables. Three statistical tool used to make a complete

analysis of the data set are descriptive statistics, bivariate correlation and regression. The

descriptive statics offer an overall trend of the two data series. The bivariate correlation is used

to determine the association between economic growth and FDI growth (Bryman & Bell, 2015).

Finally, the proposed hypothesis has been tested by conducting a regression analysis taking

economic growth as dependent and growth in FDI flow as an independent variable.

4. Finding and Analysis

4.1 Descriptive Statistics

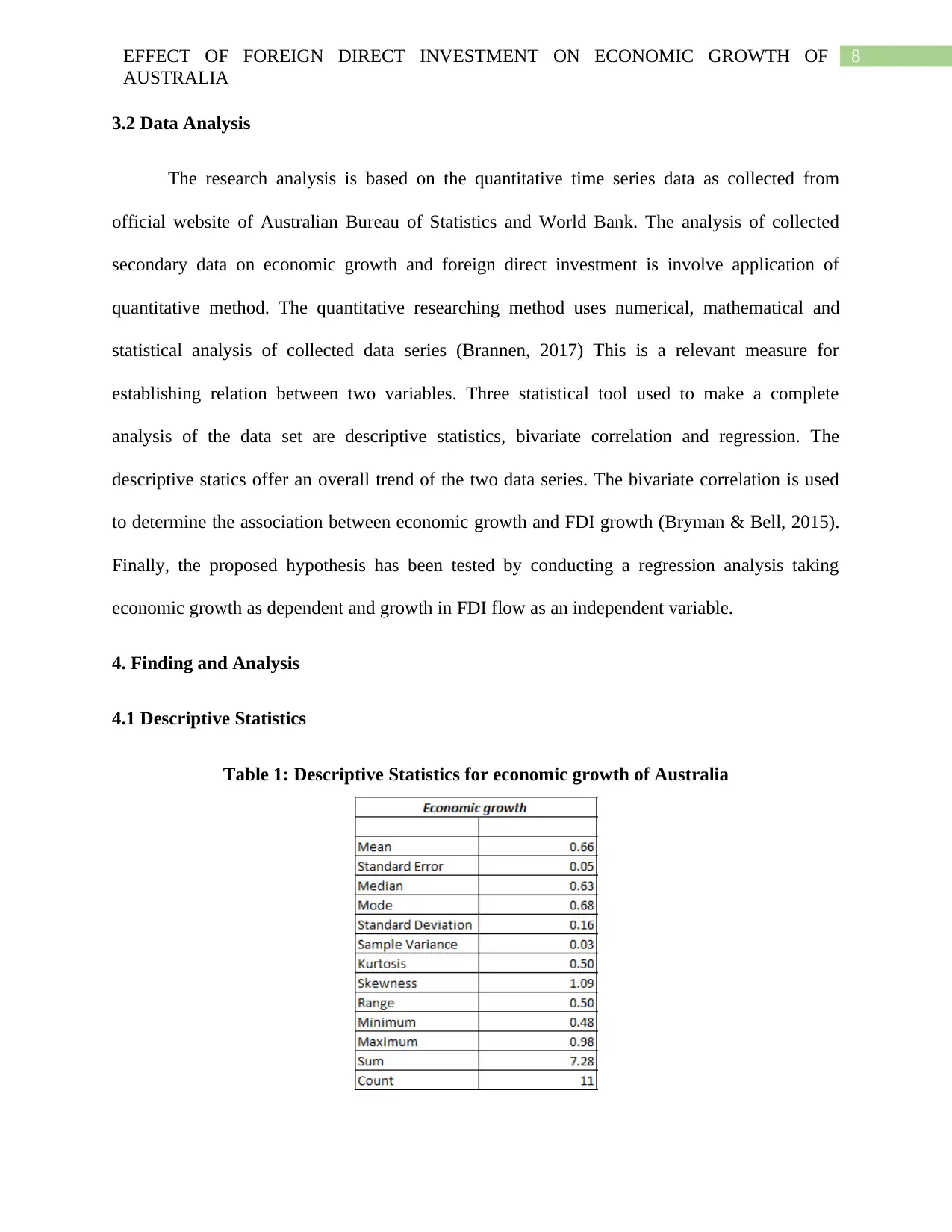

Table 1: Descriptive Statistics for economic growth of Australia

AUSTRALIA

3.2 Data Analysis

The research analysis is based on the quantitative time series data as collected from

official website of Australian Bureau of Statistics and World Bank. The analysis of collected

secondary data on economic growth and foreign direct investment is involve application of

quantitative method. The quantitative researching method uses numerical, mathematical and

statistical analysis of collected data series (Brannen, 2017) This is a relevant measure for

establishing relation between two variables. Three statistical tool used to make a complete

analysis of the data set are descriptive statistics, bivariate correlation and regression. The

descriptive statics offer an overall trend of the two data series. The bivariate correlation is used

to determine the association between economic growth and FDI growth (Bryman & Bell, 2015).

Finally, the proposed hypothesis has been tested by conducting a regression analysis taking

economic growth as dependent and growth in FDI flow as an independent variable.

4. Finding and Analysis

4.1 Descriptive Statistics

Table 1: Descriptive Statistics for economic growth of Australia

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

In Australia, estimated average economic growth rate for the chosen sample years is 0.66

percent. That is on an average Gross Domestic Product of Australia grew at a rate of 0.66

percent. Economic stability of Australia can be determined by observing the estimated standard

deviation. Standard deviation of the economic growth series is 0.16 (abs.gov.au, 2018). Because

of the fact that standard deviation is relatively smaller than the average estimate of growth,

economic growth can be said to stable over time. For the selected years, highest economic

growth has been recorded in the year 2007, the economic growth during this year was 0.98

percent. The recorded lowest GDP growth has been accounted in the year 2008 with rate of

economic growth being 0.48.

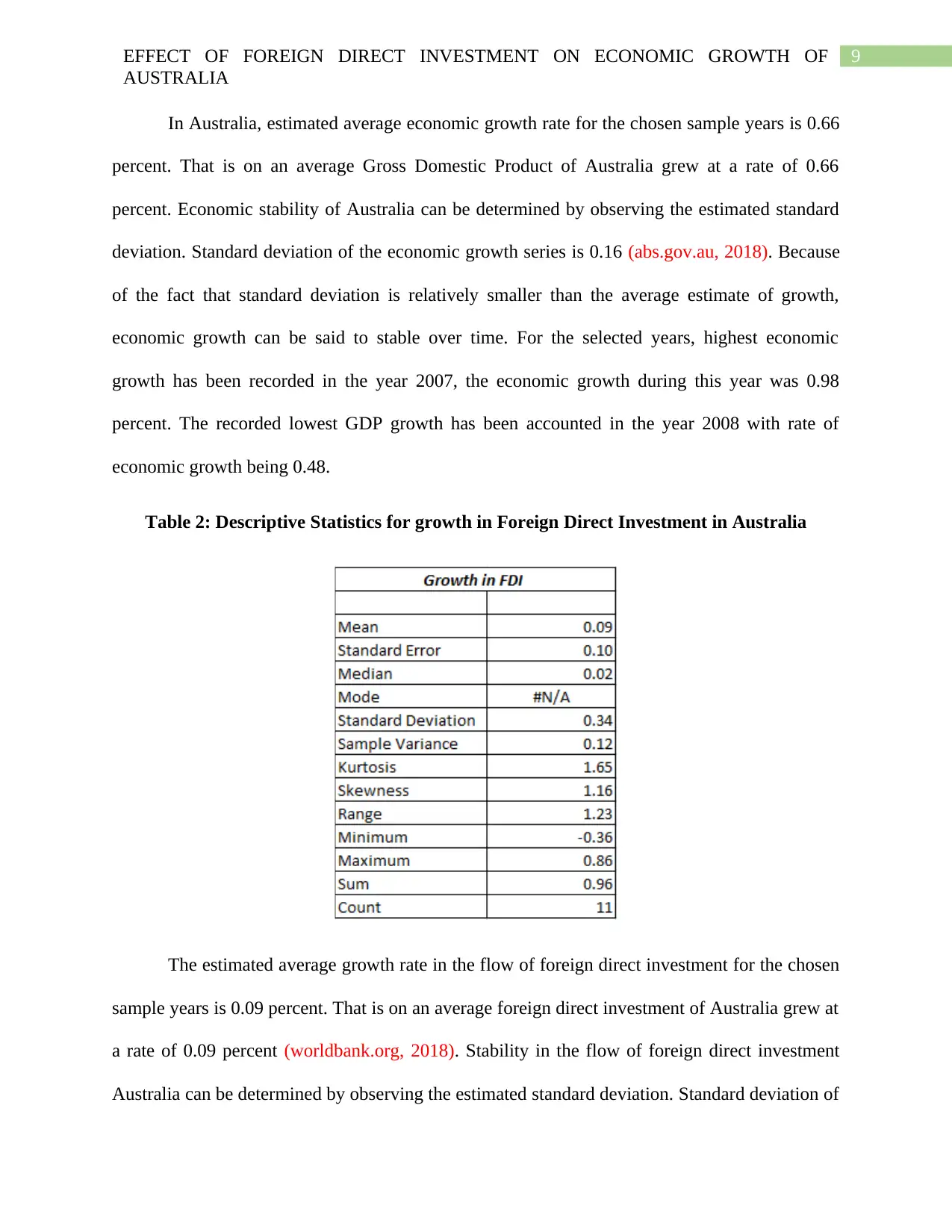

Table 2: Descriptive Statistics for growth in Foreign Direct Investment in Australia

The estimated average growth rate in the flow of foreign direct investment for the chosen

sample years is 0.09 percent. That is on an average foreign direct investment of Australia grew at

a rate of 0.09 percent (worldbank.org, 2018). Stability in the flow of foreign direct investment

Australia can be determined by observing the estimated standard deviation. Standard deviation of

AUSTRALIA

In Australia, estimated average economic growth rate for the chosen sample years is 0.66

percent. That is on an average Gross Domestic Product of Australia grew at a rate of 0.66

percent. Economic stability of Australia can be determined by observing the estimated standard

deviation. Standard deviation of the economic growth series is 0.16 (abs.gov.au, 2018). Because

of the fact that standard deviation is relatively smaller than the average estimate of growth,

economic growth can be said to stable over time. For the selected years, highest economic

growth has been recorded in the year 2007, the economic growth during this year was 0.98

percent. The recorded lowest GDP growth has been accounted in the year 2008 with rate of

economic growth being 0.48.

Table 2: Descriptive Statistics for growth in Foreign Direct Investment in Australia

The estimated average growth rate in the flow of foreign direct investment for the chosen

sample years is 0.09 percent. That is on an average foreign direct investment of Australia grew at

a rate of 0.09 percent (worldbank.org, 2018). Stability in the flow of foreign direct investment

Australia can be determined by observing the estimated standard deviation. Standard deviation of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

the FDI growth series is 0.34. Because of the fact that standard deviation is larger than the

average estimate of FDI growth rate, flow of FDI is considered to be volatile in the sample range

of years. For the selected years, highest FDI growth has been recorded in the year 2011, the rate

of change in FDI during this year was 0.86 percent. The recorded lowest FDI growth has been

accounted in the year 2009 with rate of change in foreign direct investment being 0.4.

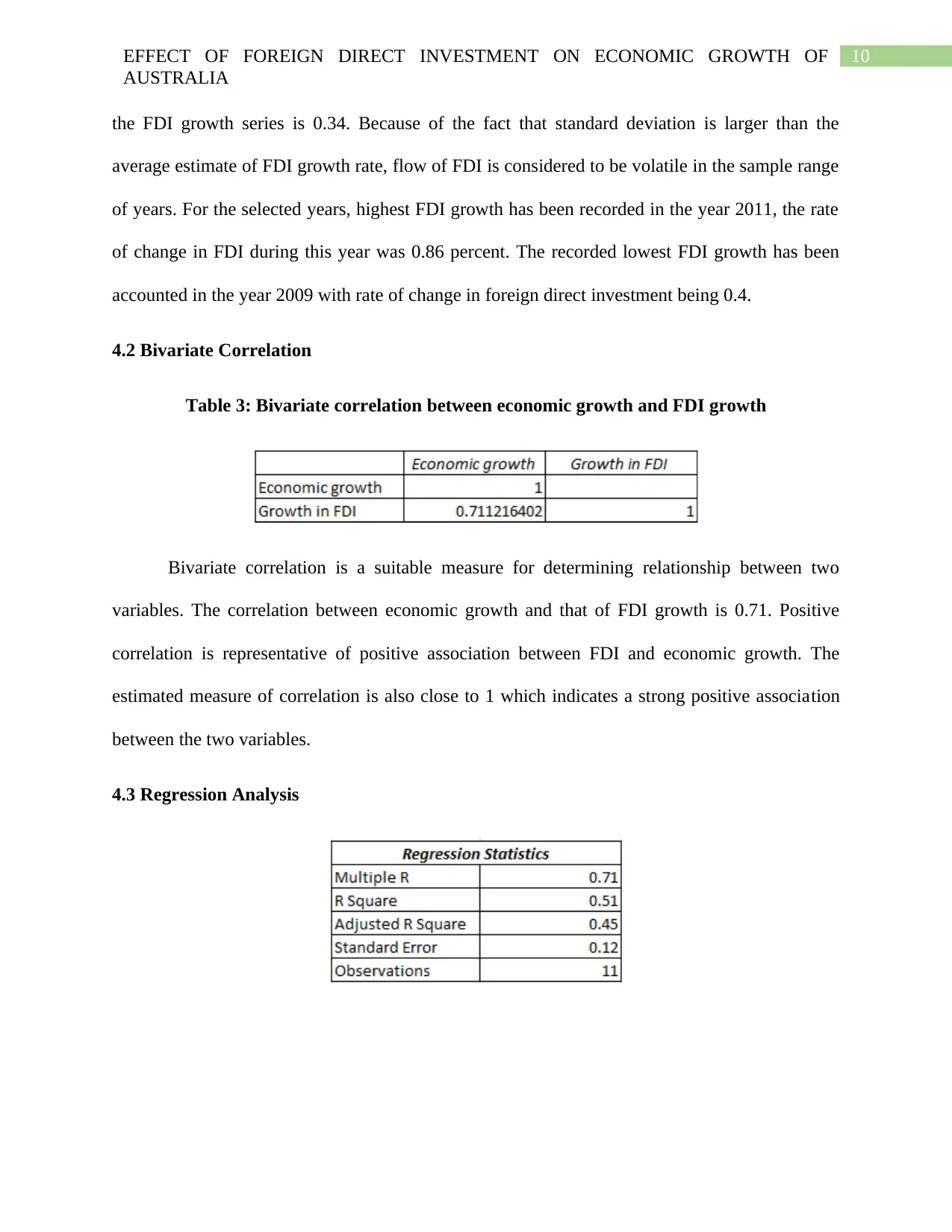

4.2 Bivariate Correlation

Table 3: Bivariate correlation between economic growth and FDI growth

Bivariate correlation is a suitable measure for determining relationship between two

variables. The correlation between economic growth and that of FDI growth is 0.71. Positive

correlation is representative of positive association between FDI and economic growth. The

estimated measure of correlation is also close to 1 which indicates a strong positive association

between the two variables.

4.3 Regression Analysis

AUSTRALIA

the FDI growth series is 0.34. Because of the fact that standard deviation is larger than the

average estimate of FDI growth rate, flow of FDI is considered to be volatile in the sample range

of years. For the selected years, highest FDI growth has been recorded in the year 2011, the rate

of change in FDI during this year was 0.86 percent. The recorded lowest FDI growth has been

accounted in the year 2009 with rate of change in foreign direct investment being 0.4.

4.2 Bivariate Correlation

Table 3: Bivariate correlation between economic growth and FDI growth

Bivariate correlation is a suitable measure for determining relationship between two

variables. The correlation between economic growth and that of FDI growth is 0.71. Positive

correlation is representative of positive association between FDI and economic growth. The

estimated measure of correlation is also close to 1 which indicates a strong positive association

between the two variables.

4.3 Regression Analysis

11EFFECT OF FOREIGN DIRECT INVESTMENT ON ECONOMIC GROWTH OF

AUSTRALIA

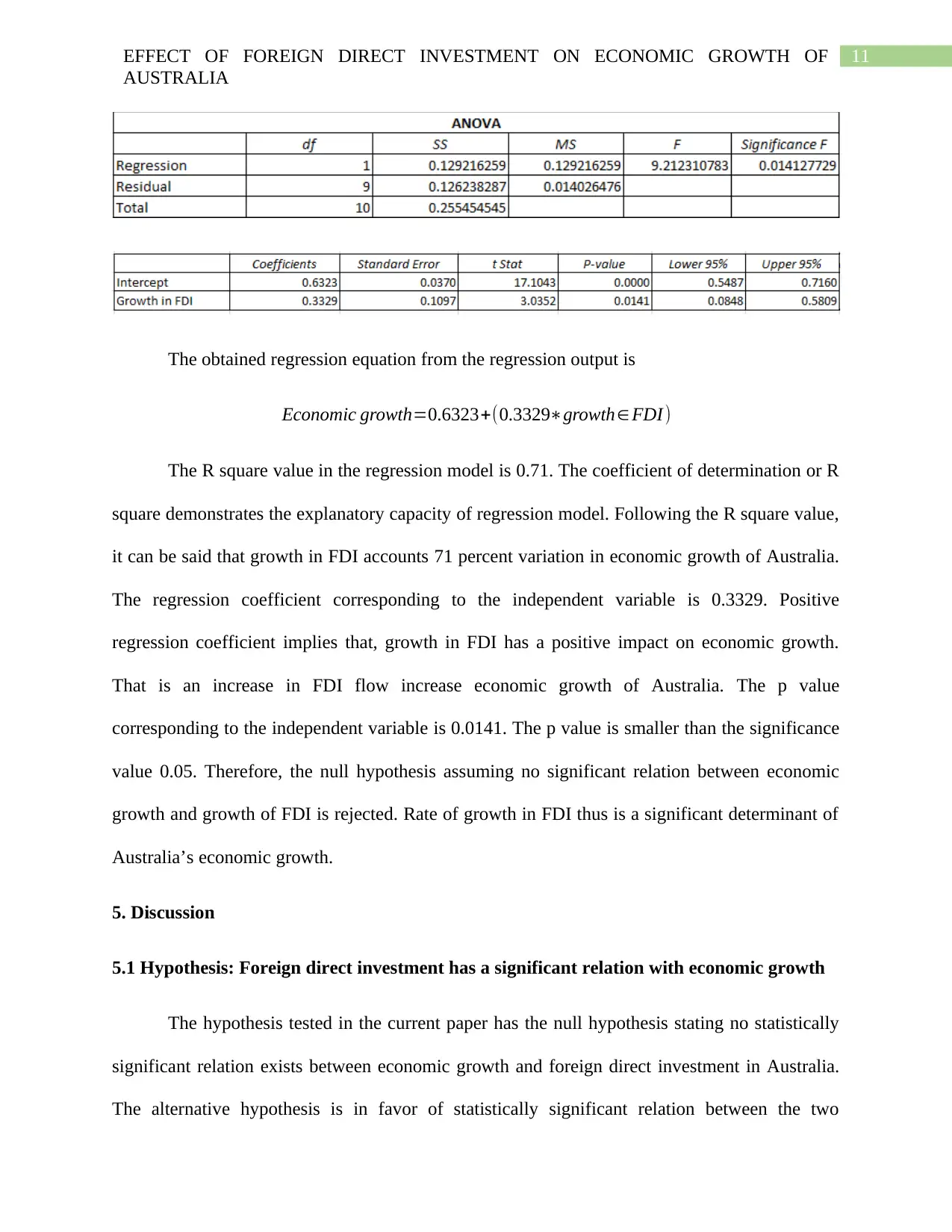

The obtained regression equation from the regression output is

Economic growth=0.6323+(0.3329∗growth∈FDI )

The R square value in the regression model is 0.71. The coefficient of determination or R

square demonstrates the explanatory capacity of regression model. Following the R square value,

it can be said that growth in FDI accounts 71 percent variation in economic growth of Australia.

The regression coefficient corresponding to the independent variable is 0.3329. Positive

regression coefficient implies that, growth in FDI has a positive impact on economic growth.

That is an increase in FDI flow increase economic growth of Australia. The p value

corresponding to the independent variable is 0.0141. The p value is smaller than the significance

value 0.05. Therefore, the null hypothesis assuming no significant relation between economic

growth and growth of FDI is rejected. Rate of growth in FDI thus is a significant determinant of

Australia’s economic growth.

5. Discussion

5.1 Hypothesis: Foreign direct investment has a significant relation with economic growth

The hypothesis tested in the current paper has the null hypothesis stating no statistically

significant relation exists between economic growth and foreign direct investment in Australia.

The alternative hypothesis is in favor of statistically significant relation between the two

AUSTRALIA

The obtained regression equation from the regression output is

Economic growth=0.6323+(0.3329∗growth∈FDI )

The R square value in the regression model is 0.71. The coefficient of determination or R

square demonstrates the explanatory capacity of regression model. Following the R square value,

it can be said that growth in FDI accounts 71 percent variation in economic growth of Australia.

The regression coefficient corresponding to the independent variable is 0.3329. Positive

regression coefficient implies that, growth in FDI has a positive impact on economic growth.

That is an increase in FDI flow increase economic growth of Australia. The p value

corresponding to the independent variable is 0.0141. The p value is smaller than the significance

value 0.05. Therefore, the null hypothesis assuming no significant relation between economic

growth and growth of FDI is rejected. Rate of growth in FDI thus is a significant determinant of

Australia’s economic growth.

5. Discussion

5.1 Hypothesis: Foreign direct investment has a significant relation with economic growth

The hypothesis tested in the current paper has the null hypothesis stating no statistically

significant relation exists between economic growth and foreign direct investment in Australia.

The alternative hypothesis is in favor of statistically significant relation between the two

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.