Advanced Financial Accounting: Lease, Liabilities, and EPS Analysis

VerifiedAdded on 2020/05/16

|23

|5188

|62

Report

AI Summary

This report provides a comprehensive analysis of advanced financial accounting practices, specifically focusing on lease accounting, liabilities including provisions and contingent liabilities, and earnings per share (EPS). The report examines the compliance of two Australian Stock Exchange-listed companies, Acacia Coal Limited and Abilene Oil and Gas Limited, with relevant accounting standards, including AASB 117 and the upcoming IFRS 16. The analysis includes a detailed review of each company's annual reports to assess their lease disclosures, liabilities reporting, and EPS calculations. The report highlights the differences in accounting treatments, particularly regarding the transition to IFRS 16, and the impact on financial statements. It also explores the disclosure requirements for liabilities, provisions, and contingent liabilities, as well as the presentation of EPS. The report concludes by summarizing the findings and comparing the compliance of both companies with the accounting standards, providing insights into best practices and areas for improvement.

Running head: ADVANCED FINANCIAL ACCOUNTING

Advanced financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Advanced financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ADVANCED FINANCIAL ACCOUNTING

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................3

Firm’s disclosure to leasing for exploring compliance with relevant accounting standard:......3

Analyzing the annual report of Acacia coal limited relating to lease disclosure:......................4

Analyzing the annual report of Abilene Oil and gas limited relating to lease disclosure:.........5

Firm’s disclosure of liabilities including provisions and contingent liabilities for exploring

compliance with relevant accounting standard:.........................................................................8

Analyzing the annual report of Abilene Oil and Gas limited relating to liabilities disclosure:. 9

Analyzing the annual report of Acacia coal limited relating to liabilities disclosure:.............11

Firm’s disclosure of earnings per share for exploring compliance with relevant accounting

standard:...................................................................................................................................13

Analyzing the annual report of Acacia coal limited relating to earnings per share disclosure:

..................................................................................................................................................14

Analyzing the annual report of Abilene Oil and Gas limited relating to earnings per share

disclosure:................................................................................................................................16

Conclusion:..............................................................................................................................19

Reference List:.........................................................................................................................20

ADVANCED FINANCIAL ACCOUNTING

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................3

Firm’s disclosure to leasing for exploring compliance with relevant accounting standard:......3

Analyzing the annual report of Acacia coal limited relating to lease disclosure:......................4

Analyzing the annual report of Abilene Oil and gas limited relating to lease disclosure:.........5

Firm’s disclosure of liabilities including provisions and contingent liabilities for exploring

compliance with relevant accounting standard:.........................................................................8

Analyzing the annual report of Abilene Oil and Gas limited relating to liabilities disclosure:. 9

Analyzing the annual report of Acacia coal limited relating to liabilities disclosure:.............11

Firm’s disclosure of earnings per share for exploring compliance with relevant accounting

standard:...................................................................................................................................13

Analyzing the annual report of Acacia coal limited relating to earnings per share disclosure:

..................................................................................................................................................14

Analyzing the annual report of Abilene Oil and Gas limited relating to earnings per share

disclosure:................................................................................................................................16

Conclusion:..............................................................................................................................19

Reference List:.........................................................................................................................20

2

ADVANCED FINANCIAL ACCOUNTING

Introduction:

The report is prepared to explain and demonstrate the compliance of the companies

listed on Australian stock exchange concerning various particular areas. Selected company

for illustrating the compliance disclosure are companies from energy sectors that is Acacia

Coal limited and Abilene Oil and Gas limited. Explanation of disclosure is done in several

areas such as leasing, liabilities that includes contingent liabilities and provisions and earning

per shares. Report is prepared to explore the comparison of both the chosen organizations in

areas of lease, liabilities and intangible assets. Evaluation of the compliance disclosure in the

selected areas is done by conducting analysis of annual report of these companies. Acacia

coal limited is a public listed company on Australian stock exchange that is engaged in

development and exploration of coal and mine. It is based in West Perth in Australia. On

other hand, Abilene Oil and Gas limited is an oil exploration, production and development

company having interest in oil operating assets based in South Melbourne in Australia. For

the evaluation of the disclosure of accounting, standard requirement in respect of three

selected areas, which is leasing, liabilities and earnings per share is done by analyzing their

respective financial reports.

Discussion:

Firm’s disclosure to leasing for exploring compliance with relevant accounting

standard:

The accounting treatment for lease is currently treated under the standard AASB 117

where the liability pertaining to lease relating to future payments is measured at present value

and it is discounted at the rate that is implicit in the lease. Lease incorporate the payment such

as fixed payment, amount that is payable under a residual value guarantee and lease

incentives that are deducted from payments. Two types of expenses are recognized over the

ADVANCED FINANCIAL ACCOUNTING

Introduction:

The report is prepared to explain and demonstrate the compliance of the companies

listed on Australian stock exchange concerning various particular areas. Selected company

for illustrating the compliance disclosure are companies from energy sectors that is Acacia

Coal limited and Abilene Oil and Gas limited. Explanation of disclosure is done in several

areas such as leasing, liabilities that includes contingent liabilities and provisions and earning

per shares. Report is prepared to explore the comparison of both the chosen organizations in

areas of lease, liabilities and intangible assets. Evaluation of the compliance disclosure in the

selected areas is done by conducting analysis of annual report of these companies. Acacia

coal limited is a public listed company on Australian stock exchange that is engaged in

development and exploration of coal and mine. It is based in West Perth in Australia. On

other hand, Abilene Oil and Gas limited is an oil exploration, production and development

company having interest in oil operating assets based in South Melbourne in Australia. For

the evaluation of the disclosure of accounting, standard requirement in respect of three

selected areas, which is leasing, liabilities and earnings per share is done by analyzing their

respective financial reports.

Discussion:

Firm’s disclosure to leasing for exploring compliance with relevant accounting

standard:

The accounting treatment for lease is currently treated under the standard AASB 117

where the liability pertaining to lease relating to future payments is measured at present value

and it is discounted at the rate that is implicit in the lease. Lease incorporate the payment such

as fixed payment, amount that is payable under a residual value guarantee and lease

incentives that are deducted from payments. Two types of expenses are recognized over the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ADVANCED FINANCIAL ACCOUNTING

lease terms and this involves depreciation on the right to use assets and the interest on lease

liabilities. For the operating lease, recognition of lease payment by lessor should be

recognized as income on any systematic basis and on a straight-line basis. Costs of assets

shall be recognized by lessor including the depreciation that is incurred on the earning of

lease as an expense (aasb.gov.au, 2018). The determination of whether the underlying assets

should be recognized as operating lease for impairment and accounting for any impairment

loss should be done in accordance with IAS 136. Any considerable changes in carrying

amount of the net investment of operating leases should be provided with a qualitative and

quantitative explanation (Carlon et al., 2015). A maturity analysis of all the receivable

concerning lease payments should be recognized by organization. Disclosure requirements

leading to assets that are subjected to operating leases shall be done in accordance with the

other applicable standards.

Under the existing lease accounting standard, classification of lease is done to the

extent of rewards and risks that is incidental to leased assets ownership with the lessee or

lessor. Classification of lease as finance lease is done if the rewards and risks incidental to

ownership is transferred substantially (Hoggett et al., 2015). On other hand, if there is no

substantial transfer of all rewards and risks to the assets ownership, then lease is regarded as

operating lease.

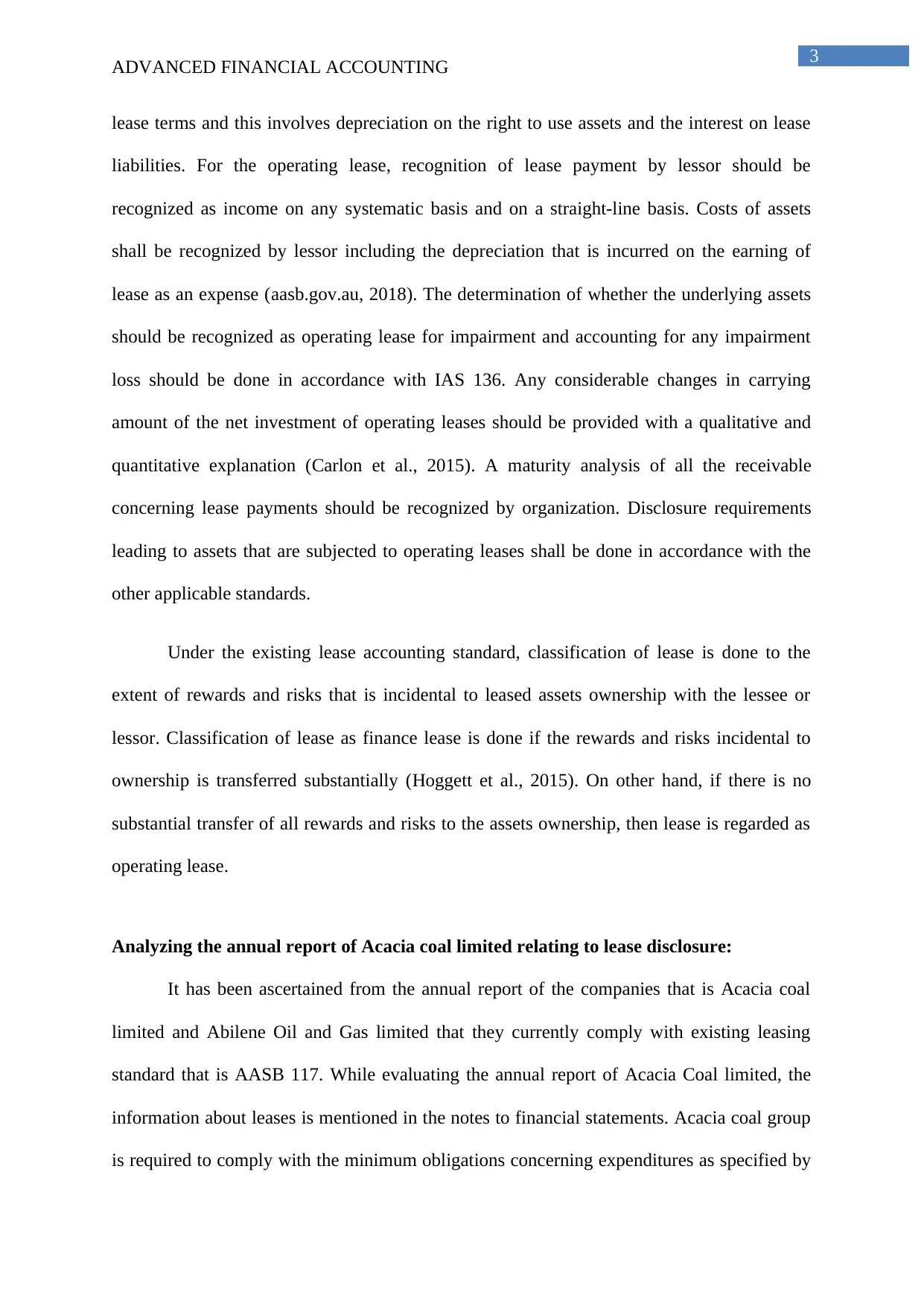

Analyzing the annual report of Acacia coal limited relating to lease disclosure:

It has been ascertained from the annual report of the companies that is Acacia coal

limited and Abilene Oil and Gas limited that they currently comply with existing leasing

standard that is AASB 117. While evaluating the annual report of Acacia Coal limited, the

information about leases is mentioned in the notes to financial statements. Acacia coal group

is required to comply with the minimum obligations concerning expenditures as specified by

ADVANCED FINANCIAL ACCOUNTING

lease terms and this involves depreciation on the right to use assets and the interest on lease

liabilities. For the operating lease, recognition of lease payment by lessor should be

recognized as income on any systematic basis and on a straight-line basis. Costs of assets

shall be recognized by lessor including the depreciation that is incurred on the earning of

lease as an expense (aasb.gov.au, 2018). The determination of whether the underlying assets

should be recognized as operating lease for impairment and accounting for any impairment

loss should be done in accordance with IAS 136. Any considerable changes in carrying

amount of the net investment of operating leases should be provided with a qualitative and

quantitative explanation (Carlon et al., 2015). A maturity analysis of all the receivable

concerning lease payments should be recognized by organization. Disclosure requirements

leading to assets that are subjected to operating leases shall be done in accordance with the

other applicable standards.

Under the existing lease accounting standard, classification of lease is done to the

extent of rewards and risks that is incidental to leased assets ownership with the lessee or

lessor. Classification of lease as finance lease is done if the rewards and risks incidental to

ownership is transferred substantially (Hoggett et al., 2015). On other hand, if there is no

substantial transfer of all rewards and risks to the assets ownership, then lease is regarded as

operating lease.

Analyzing the annual report of Acacia coal limited relating to lease disclosure:

It has been ascertained from the annual report of the companies that is Acacia coal

limited and Abilene Oil and Gas limited that they currently comply with existing leasing

standard that is AASB 117. While evaluating the annual report of Acacia Coal limited, the

information about leases is mentioned in the notes to financial statements. Acacia coal group

is required to comply with the minimum obligations concerning expenditures as specified by

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ADVANCED FINANCIAL ACCOUNTING

Queensland state government for maintaining the current rights of tenure to exploration

tenements (acaciacoal.com.au, 2018).

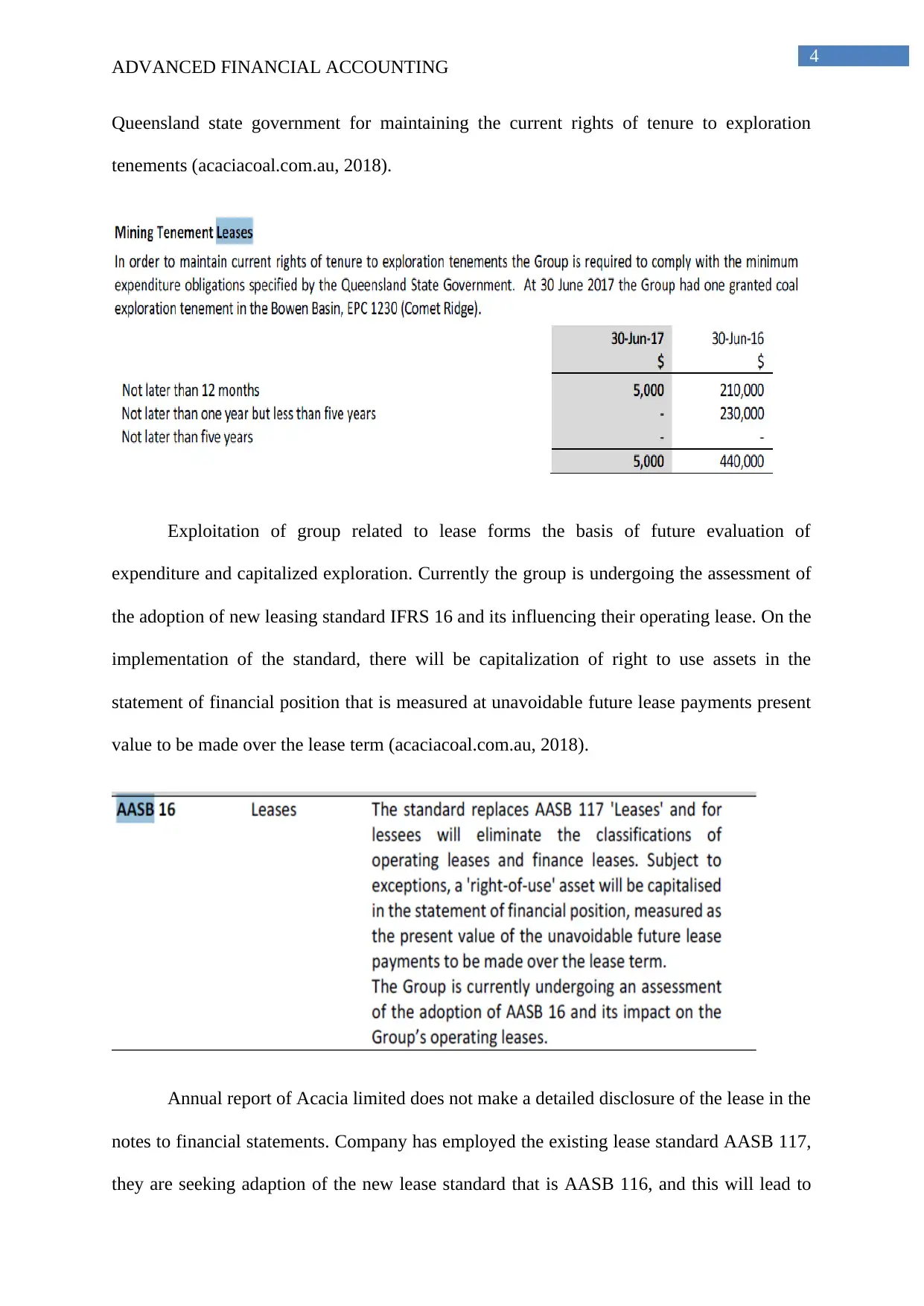

Exploitation of group related to lease forms the basis of future evaluation of

expenditure and capitalized exploration. Currently the group is undergoing the assessment of

the adoption of new leasing standard IFRS 16 and its influencing their operating lease. On the

implementation of the standard, there will be capitalization of right to use assets in the

statement of financial position that is measured at unavoidable future lease payments present

value to be made over the lease term (acaciacoal.com.au, 2018).

Annual report of Acacia limited does not make a detailed disclosure of the lease in the

notes to financial statements. Company has employed the existing lease standard AASB 117,

they are seeking adaption of the new lease standard that is AASB 116, and this will lead to

ADVANCED FINANCIAL ACCOUNTING

Queensland state government for maintaining the current rights of tenure to exploration

tenements (acaciacoal.com.au, 2018).

Exploitation of group related to lease forms the basis of future evaluation of

expenditure and capitalized exploration. Currently the group is undergoing the assessment of

the adoption of new leasing standard IFRS 16 and its influencing their operating lease. On the

implementation of the standard, there will be capitalization of right to use assets in the

statement of financial position that is measured at unavoidable future lease payments present

value to be made over the lease term (acaciacoal.com.au, 2018).

Annual report of Acacia limited does not make a detailed disclosure of the lease in the

notes to financial statements. Company has employed the existing lease standard AASB 117,

they are seeking adaption of the new lease standard that is AASB 116, and this will lead to

5

ADVANCED FINANCIAL ACCOUNTING

elimination of classifications of finance and operating lease. There will be capitalization of

right to use assets in the financial statements that are subjected to exceptions and the

measurement is done using the present value of unavoidable payment relating to future lease

over the term of lease. Adoption of new lease standard will be providing several benefits to

company relating to lease recognition (Narayanaswamy, 2017).

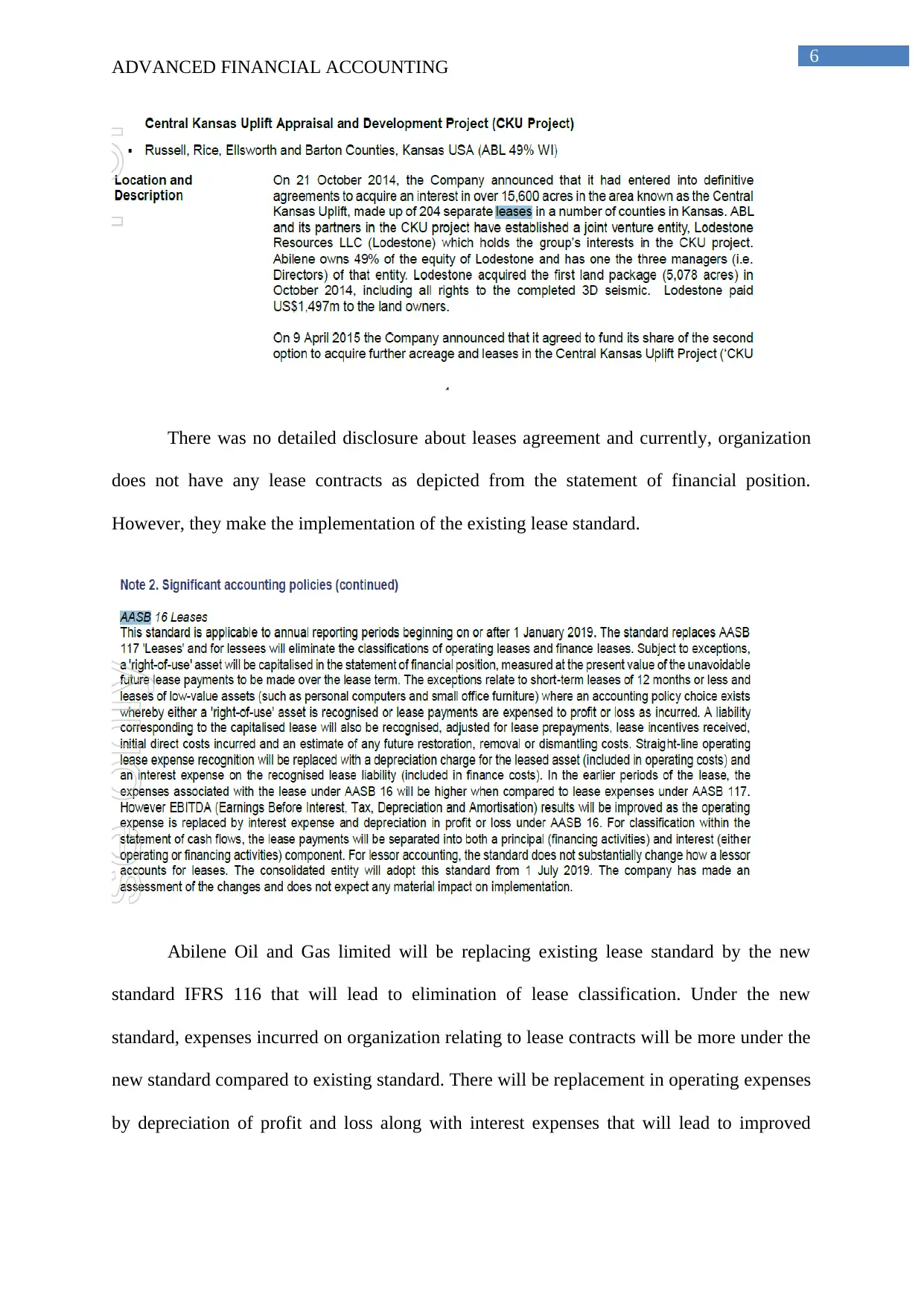

Analyzing the annual report of Abilene Oil and gas limited relating to lease disclosure:

Abilene has fifty percent net working interest in leases that covers approximately

15000 acres of Wherry Oil fields and Welch Bornholdt. Company has announced it in

financial year 2015 about its agreement to fund exercise across the final and third option of

acquiring leases in some project. On other hand, the application of new lease standard by

Abilene Oil and Gas limited, some of the expectations concerning the organization is related

to short-term lease or lease hat are less than 12 months and leases of low value assets

(abilene.com.au, 2018). There will be depreciation charge of leased assets and recognition of

leased liabilities as interest expenses. However, the expenses under the new standard will be

higher as against expenses recorded under the AASB 117. There will be separation of

components of principal and interest under the new standard. Company regarding the new

standard assesses changes and it is expected that there will not be any material impact on the

financial statements. However, from the analysis of the annual reports of both the companies,

it can be seen that there was not much information was provided regarding lease and the

obligations to lease standard. Additional information was not made in the annual reports

relating to leasing standard.

ADVANCED FINANCIAL ACCOUNTING

elimination of classifications of finance and operating lease. There will be capitalization of

right to use assets in the financial statements that are subjected to exceptions and the

measurement is done using the present value of unavoidable payment relating to future lease

over the term of lease. Adoption of new lease standard will be providing several benefits to

company relating to lease recognition (Narayanaswamy, 2017).

Analyzing the annual report of Abilene Oil and gas limited relating to lease disclosure:

Abilene has fifty percent net working interest in leases that covers approximately

15000 acres of Wherry Oil fields and Welch Bornholdt. Company has announced it in

financial year 2015 about its agreement to fund exercise across the final and third option of

acquiring leases in some project. On other hand, the application of new lease standard by

Abilene Oil and Gas limited, some of the expectations concerning the organization is related

to short-term lease or lease hat are less than 12 months and leases of low value assets

(abilene.com.au, 2018). There will be depreciation charge of leased assets and recognition of

leased liabilities as interest expenses. However, the expenses under the new standard will be

higher as against expenses recorded under the AASB 117. There will be separation of

components of principal and interest under the new standard. Company regarding the new

standard assesses changes and it is expected that there will not be any material impact on the

financial statements. However, from the analysis of the annual reports of both the companies,

it can be seen that there was not much information was provided regarding lease and the

obligations to lease standard. Additional information was not made in the annual reports

relating to leasing standard.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ADVANCED FINANCIAL ACCOUNTING

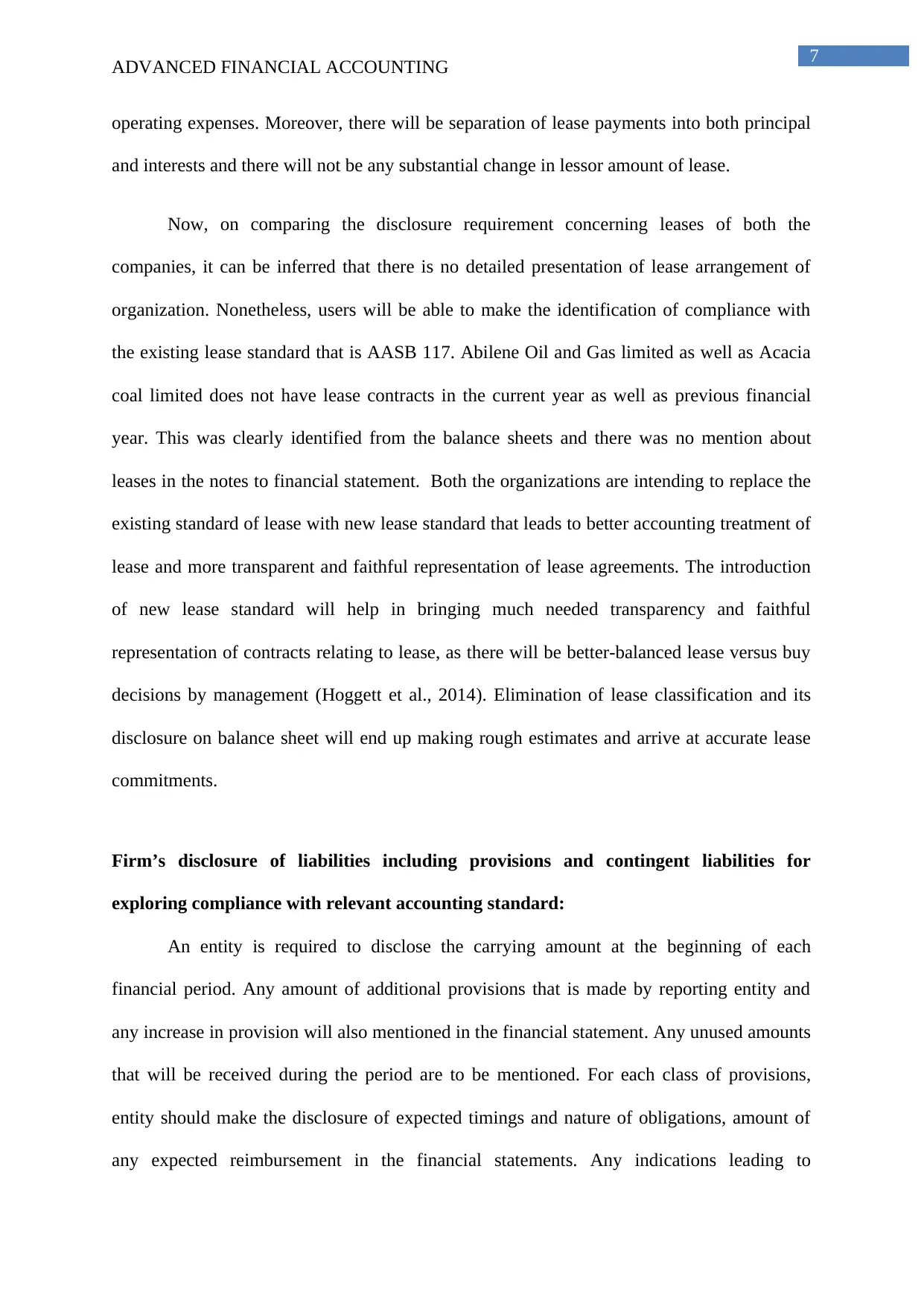

There was no detailed disclosure about leases agreement and currently, organization

does not have any lease contracts as depicted from the statement of financial position.

However, they make the implementation of the existing lease standard.

Abilene Oil and Gas limited will be replacing existing lease standard by the new

standard IFRS 116 that will lead to elimination of lease classification. Under the new

standard, expenses incurred on organization relating to lease contracts will be more under the

new standard compared to existing standard. There will be replacement in operating expenses

by depreciation of profit and loss along with interest expenses that will lead to improved

ADVANCED FINANCIAL ACCOUNTING

There was no detailed disclosure about leases agreement and currently, organization

does not have any lease contracts as depicted from the statement of financial position.

However, they make the implementation of the existing lease standard.

Abilene Oil and Gas limited will be replacing existing lease standard by the new

standard IFRS 116 that will lead to elimination of lease classification. Under the new

standard, expenses incurred on organization relating to lease contracts will be more under the

new standard compared to existing standard. There will be replacement in operating expenses

by depreciation of profit and loss along with interest expenses that will lead to improved

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ADVANCED FINANCIAL ACCOUNTING

operating expenses. Moreover, there will be separation of lease payments into both principal

and interests and there will not be any substantial change in lessor amount of lease.

Now, on comparing the disclosure requirement concerning leases of both the

companies, it can be inferred that there is no detailed presentation of lease arrangement of

organization. Nonetheless, users will be able to make the identification of compliance with

the existing lease standard that is AASB 117. Abilene Oil and Gas limited as well as Acacia

coal limited does not have lease contracts in the current year as well as previous financial

year. This was clearly identified from the balance sheets and there was no mention about

leases in the notes to financial statement. Both the organizations are intending to replace the

existing standard of lease with new lease standard that leads to better accounting treatment of

lease and more transparent and faithful representation of lease agreements. The introduction

of new lease standard will help in bringing much needed transparency and faithful

representation of contracts relating to lease, as there will be better-balanced lease versus buy

decisions by management (Hoggett et al., 2014). Elimination of lease classification and its

disclosure on balance sheet will end up making rough estimates and arrive at accurate lease

commitments.

Firm’s disclosure of liabilities including provisions and contingent liabilities for

exploring compliance with relevant accounting standard:

An entity is required to disclose the carrying amount at the beginning of each

financial period. Any amount of additional provisions that is made by reporting entity and

any increase in provision will also mentioned in the financial statement. Any unused amounts

that will be received during the period are to be mentioned. For each class of provisions,

entity should make the disclosure of expected timings and nature of obligations, amount of

any expected reimbursement in the financial statements. Any indications leading to

ADVANCED FINANCIAL ACCOUNTING

operating expenses. Moreover, there will be separation of lease payments into both principal

and interests and there will not be any substantial change in lessor amount of lease.

Now, on comparing the disclosure requirement concerning leases of both the

companies, it can be inferred that there is no detailed presentation of lease arrangement of

organization. Nonetheless, users will be able to make the identification of compliance with

the existing lease standard that is AASB 117. Abilene Oil and Gas limited as well as Acacia

coal limited does not have lease contracts in the current year as well as previous financial

year. This was clearly identified from the balance sheets and there was no mention about

leases in the notes to financial statement. Both the organizations are intending to replace the

existing standard of lease with new lease standard that leads to better accounting treatment of

lease and more transparent and faithful representation of lease agreements. The introduction

of new lease standard will help in bringing much needed transparency and faithful

representation of contracts relating to lease, as there will be better-balanced lease versus buy

decisions by management (Hoggett et al., 2014). Elimination of lease classification and its

disclosure on balance sheet will end up making rough estimates and arrive at accurate lease

commitments.

Firm’s disclosure of liabilities including provisions and contingent liabilities for

exploring compliance with relevant accounting standard:

An entity is required to disclose the carrying amount at the beginning of each

financial period. Any amount of additional provisions that is made by reporting entity and

any increase in provision will also mentioned in the financial statement. Any unused amounts

that will be received during the period are to be mentioned. For each class of provisions,

entity should make the disclosure of expected timings and nature of obligations, amount of

any expected reimbursement in the financial statements. Any indications leading to

8

ADVANCED FINANCIAL ACCOUNTING

uncertainties should also be disclosed in the report. In relation to contingent liabilities, an

entity is required to make disclosure about the description of contingent liabilities along with

the nature of descriptions. An entity should make disclosure about the link between

contingent liabilities and provisions when the contingent liability and provisions are arising

from the same set of circumstances. Recognition of contingent liabilities are done when the

entity has present obligations and when there is probability of outflow of economic benefits

for settling the obligations (Jouber et al., 2017).

For accounting for provision and contingent liabilities, it is required by entities to

comply with IAS 137. Provisions are required to be recognized by entities when there are

present obligations and there is a reliable that can be made for the obligations. Measurement

of provisions is done for the settlement of present obligations and at the best estimate of

expenditures. This incorporates time value of money, uncertainties and risk considerations

and future events in the evidence of sufficient objectives. Recognition of contingent liabilities

is prohibited by organization as per IAS 137 when the recognition criteria is not met under

present obligations and existence of other possible obligations as confirmation is required for

reporting entity present obligations leading to resources outflow.

Analyzing the annual report of Abilene Oil and Gas limited relating to liabilities

disclosure:

The financial report of Abilene Oil and Gas limited is prepared on a going concern by

contemplating realization of assets and settlement of liabilities in the ordinary course of

business. Financial report does not incorporate any adjustments relating to recoverability and

classification of liabilities that might be incurred should the consolidated entity does not

continue as going concern. Total amount of liabilities of the group is divided into current

ADVANCED FINANCIAL ACCOUNTING

uncertainties should also be disclosed in the report. In relation to contingent liabilities, an

entity is required to make disclosure about the description of contingent liabilities along with

the nature of descriptions. An entity should make disclosure about the link between

contingent liabilities and provisions when the contingent liability and provisions are arising

from the same set of circumstances. Recognition of contingent liabilities are done when the

entity has present obligations and when there is probability of outflow of economic benefits

for settling the obligations (Jouber et al., 2017).

For accounting for provision and contingent liabilities, it is required by entities to

comply with IAS 137. Provisions are required to be recognized by entities when there are

present obligations and there is a reliable that can be made for the obligations. Measurement

of provisions is done for the settlement of present obligations and at the best estimate of

expenditures. This incorporates time value of money, uncertainties and risk considerations

and future events in the evidence of sufficient objectives. Recognition of contingent liabilities

is prohibited by organization as per IAS 137 when the recognition criteria is not met under

present obligations and existence of other possible obligations as confirmation is required for

reporting entity present obligations leading to resources outflow.

Analyzing the annual report of Abilene Oil and Gas limited relating to liabilities

disclosure:

The financial report of Abilene Oil and Gas limited is prepared on a going concern by

contemplating realization of assets and settlement of liabilities in the ordinary course of

business. Financial report does not incorporate any adjustments relating to recoverability and

classification of liabilities that might be incurred should the consolidated entity does not

continue as going concern. Total amount of liabilities of the group is divided into current

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ADVANCED FINANCIAL ACCOUNTING

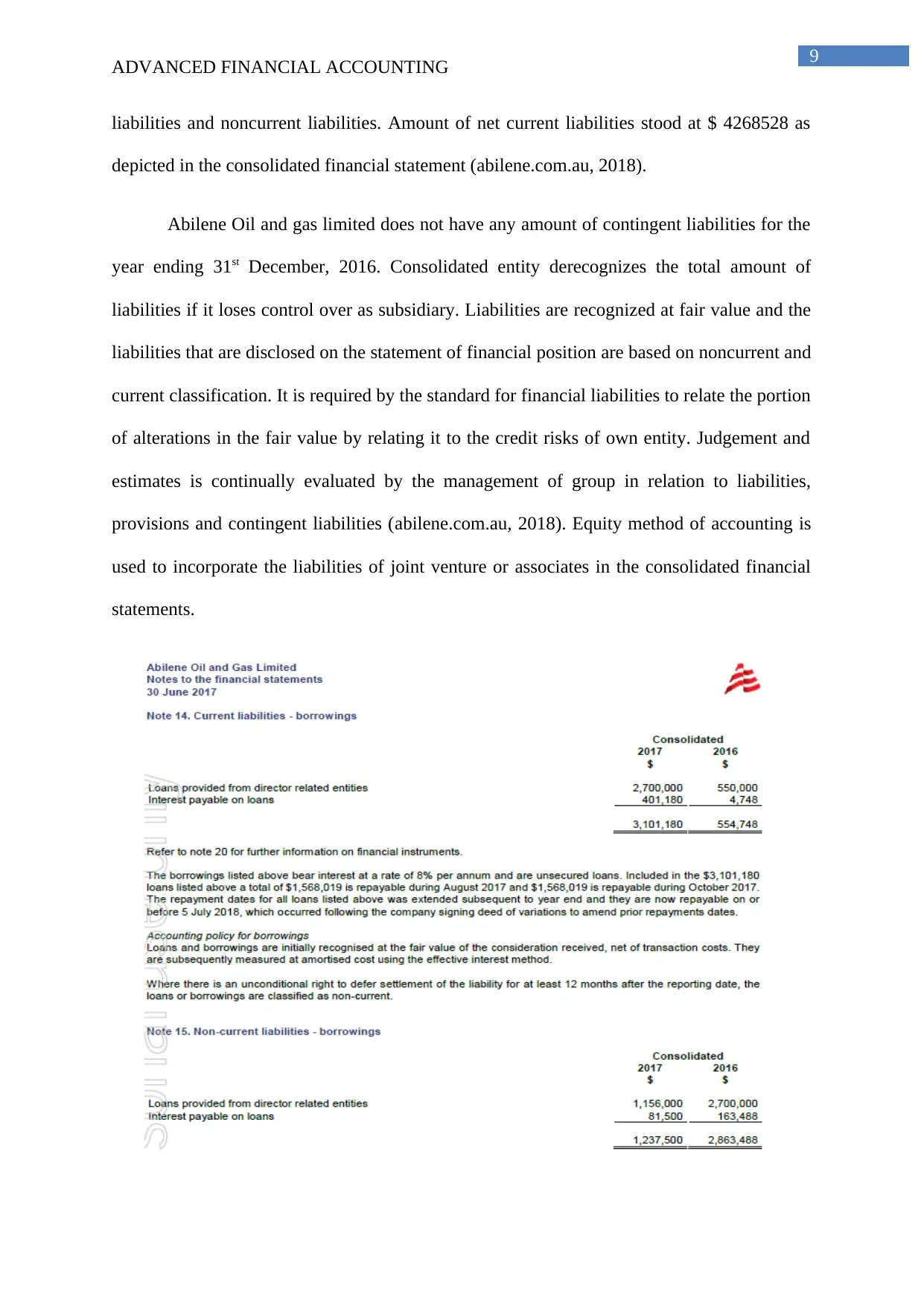

liabilities and noncurrent liabilities. Amount of net current liabilities stood at $ 4268528 as

depicted in the consolidated financial statement (abilene.com.au, 2018).

Abilene Oil and gas limited does not have any amount of contingent liabilities for the

year ending 31st December, 2016. Consolidated entity derecognizes the total amount of

liabilities if it loses control over as subsidiary. Liabilities are recognized at fair value and the

liabilities that are disclosed on the statement of financial position are based on noncurrent and

current classification. It is required by the standard for financial liabilities to relate the portion

of alterations in the fair value by relating it to the credit risks of own entity. Judgement and

estimates is continually evaluated by the management of group in relation to liabilities,

provisions and contingent liabilities (abilene.com.au, 2018). Equity method of accounting is

used to incorporate the liabilities of joint venture or associates in the consolidated financial

statements.

ADVANCED FINANCIAL ACCOUNTING

liabilities and noncurrent liabilities. Amount of net current liabilities stood at $ 4268528 as

depicted in the consolidated financial statement (abilene.com.au, 2018).

Abilene Oil and gas limited does not have any amount of contingent liabilities for the

year ending 31st December, 2016. Consolidated entity derecognizes the total amount of

liabilities if it loses control over as subsidiary. Liabilities are recognized at fair value and the

liabilities that are disclosed on the statement of financial position are based on noncurrent and

current classification. It is required by the standard for financial liabilities to relate the portion

of alterations in the fair value by relating it to the credit risks of own entity. Judgement and

estimates is continually evaluated by the management of group in relation to liabilities,

provisions and contingent liabilities (abilene.com.au, 2018). Equity method of accounting is

used to incorporate the liabilities of joint venture or associates in the consolidated financial

statements.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ADVANCED FINANCIAL ACCOUNTING

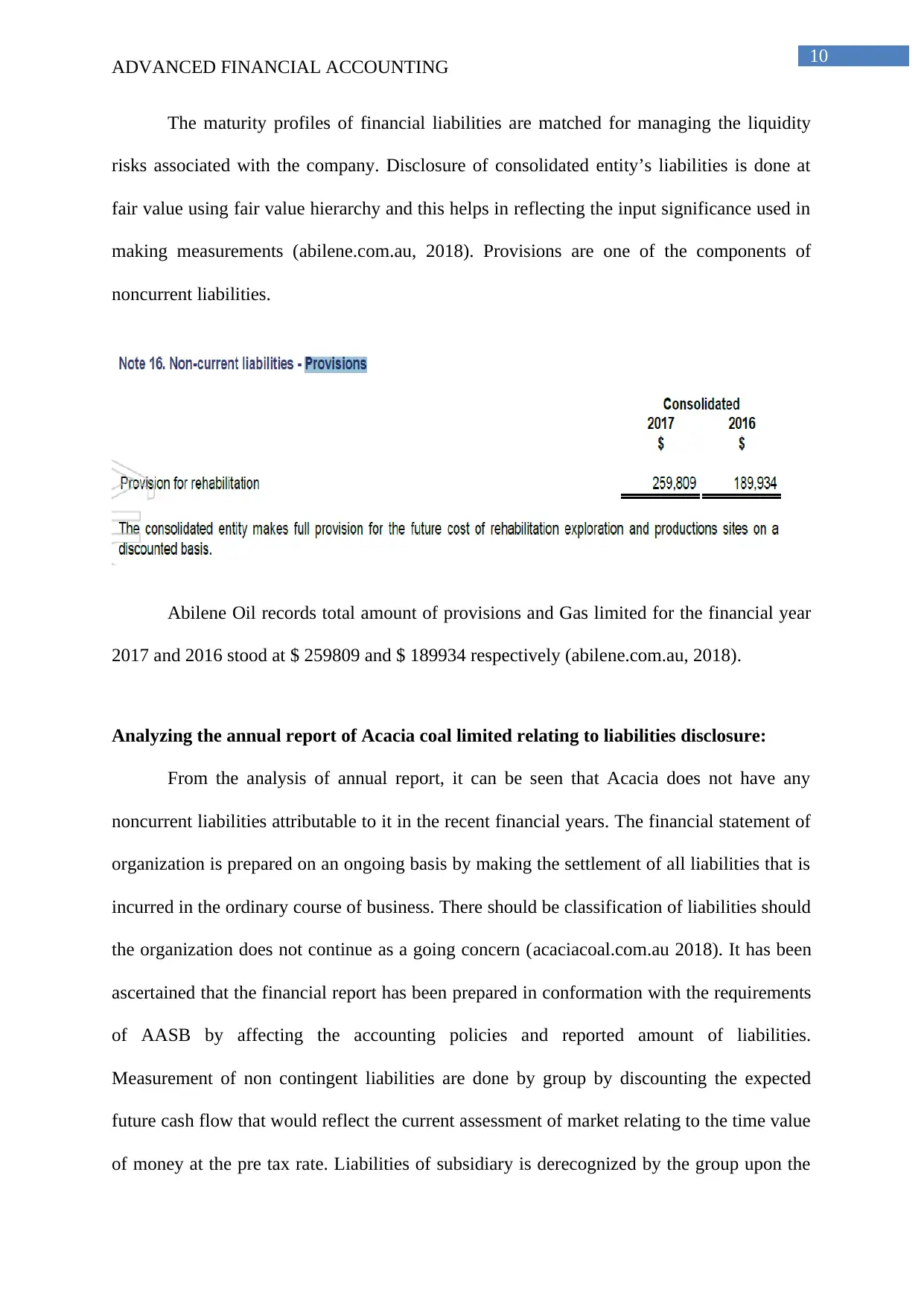

The maturity profiles of financial liabilities are matched for managing the liquidity

risks associated with the company. Disclosure of consolidated entity’s liabilities is done at

fair value using fair value hierarchy and this helps in reflecting the input significance used in

making measurements (abilene.com.au, 2018). Provisions are one of the components of

noncurrent liabilities.

Abilene Oil records total amount of provisions and Gas limited for the financial year

2017 and 2016 stood at $ 259809 and $ 189934 respectively (abilene.com.au, 2018).

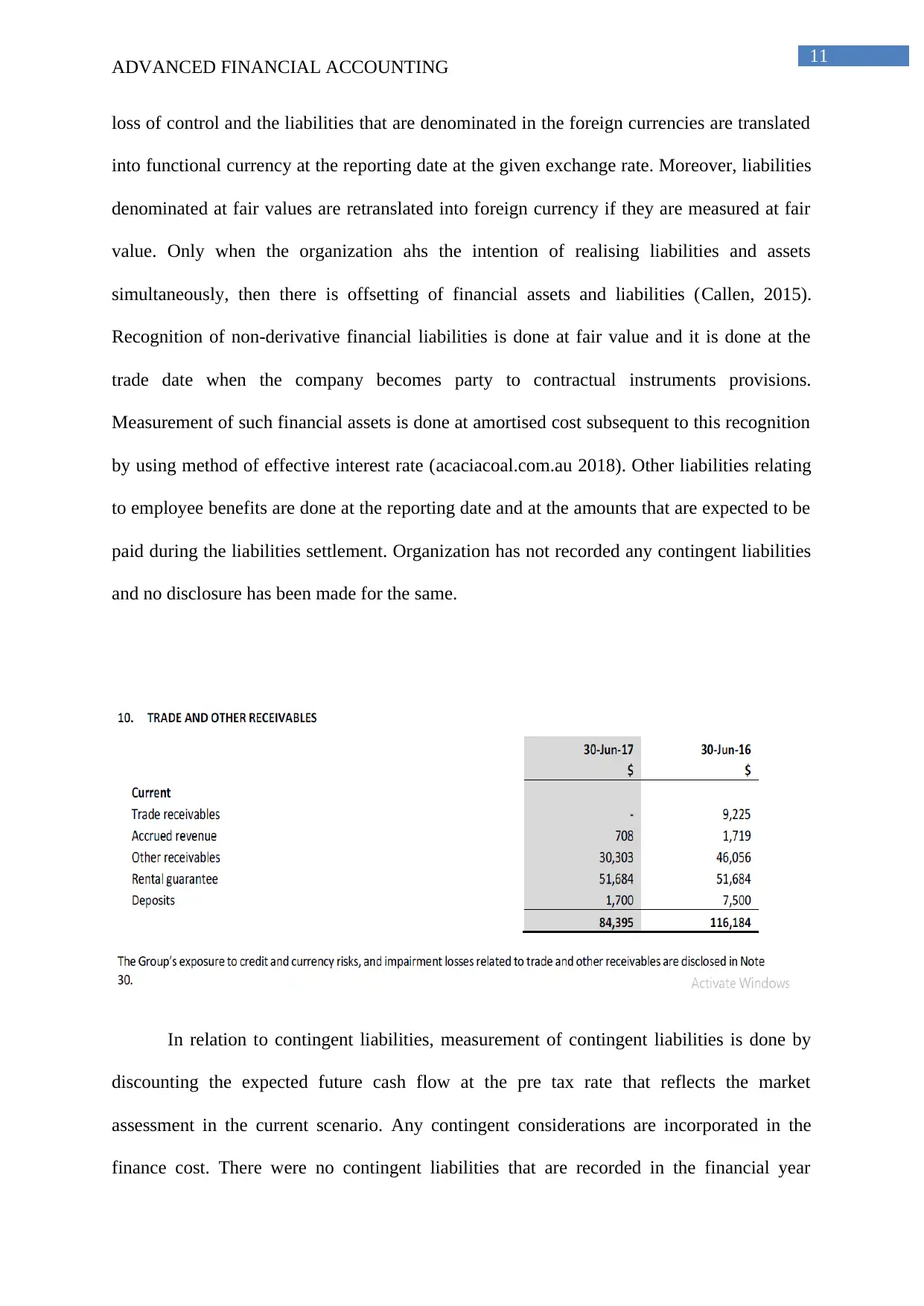

Analyzing the annual report of Acacia coal limited relating to liabilities disclosure:

From the analysis of annual report, it can be seen that Acacia does not have any

noncurrent liabilities attributable to it in the recent financial years. The financial statement of

organization is prepared on an ongoing basis by making the settlement of all liabilities that is

incurred in the ordinary course of business. There should be classification of liabilities should

the organization does not continue as a going concern (acaciacoal.com.au 2018). It has been

ascertained that the financial report has been prepared in conformation with the requirements

of AASB by affecting the accounting policies and reported amount of liabilities.

Measurement of non contingent liabilities are done by group by discounting the expected

future cash flow that would reflect the current assessment of market relating to the time value

of money at the pre tax rate. Liabilities of subsidiary is derecognized by the group upon the

ADVANCED FINANCIAL ACCOUNTING

The maturity profiles of financial liabilities are matched for managing the liquidity

risks associated with the company. Disclosure of consolidated entity’s liabilities is done at

fair value using fair value hierarchy and this helps in reflecting the input significance used in

making measurements (abilene.com.au, 2018). Provisions are one of the components of

noncurrent liabilities.

Abilene Oil records total amount of provisions and Gas limited for the financial year

2017 and 2016 stood at $ 259809 and $ 189934 respectively (abilene.com.au, 2018).

Analyzing the annual report of Acacia coal limited relating to liabilities disclosure:

From the analysis of annual report, it can be seen that Acacia does not have any

noncurrent liabilities attributable to it in the recent financial years. The financial statement of

organization is prepared on an ongoing basis by making the settlement of all liabilities that is

incurred in the ordinary course of business. There should be classification of liabilities should

the organization does not continue as a going concern (acaciacoal.com.au 2018). It has been

ascertained that the financial report has been prepared in conformation with the requirements

of AASB by affecting the accounting policies and reported amount of liabilities.

Measurement of non contingent liabilities are done by group by discounting the expected

future cash flow that would reflect the current assessment of market relating to the time value

of money at the pre tax rate. Liabilities of subsidiary is derecognized by the group upon the

11

ADVANCED FINANCIAL ACCOUNTING

loss of control and the liabilities that are denominated in the foreign currencies are translated

into functional currency at the reporting date at the given exchange rate. Moreover, liabilities

denominated at fair values are retranslated into foreign currency if they are measured at fair

value. Only when the organization ahs the intention of realising liabilities and assets

simultaneously, then there is offsetting of financial assets and liabilities (Callen, 2015).

Recognition of non-derivative financial liabilities is done at fair value and it is done at the

trade date when the company becomes party to contractual instruments provisions.

Measurement of such financial assets is done at amortised cost subsequent to this recognition

by using method of effective interest rate (acaciacoal.com.au 2018). Other liabilities relating

to employee benefits are done at the reporting date and at the amounts that are expected to be

paid during the liabilities settlement. Organization has not recorded any contingent liabilities

and no disclosure has been made for the same.

In relation to contingent liabilities, measurement of contingent liabilities is done by

discounting the expected future cash flow at the pre tax rate that reflects the market

assessment in the current scenario. Any contingent considerations are incorporated in the

finance cost. There were no contingent liabilities that are recorded in the financial year

ADVANCED FINANCIAL ACCOUNTING

loss of control and the liabilities that are denominated in the foreign currencies are translated

into functional currency at the reporting date at the given exchange rate. Moreover, liabilities

denominated at fair values are retranslated into foreign currency if they are measured at fair

value. Only when the organization ahs the intention of realising liabilities and assets

simultaneously, then there is offsetting of financial assets and liabilities (Callen, 2015).

Recognition of non-derivative financial liabilities is done at fair value and it is done at the

trade date when the company becomes party to contractual instruments provisions.

Measurement of such financial assets is done at amortised cost subsequent to this recognition

by using method of effective interest rate (acaciacoal.com.au 2018). Other liabilities relating

to employee benefits are done at the reporting date and at the amounts that are expected to be

paid during the liabilities settlement. Organization has not recorded any contingent liabilities

and no disclosure has been made for the same.

In relation to contingent liabilities, measurement of contingent liabilities is done by

discounting the expected future cash flow at the pre tax rate that reflects the market

assessment in the current scenario. Any contingent considerations are incorporated in the

finance cost. There were no contingent liabilities that are recorded in the financial year

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.