FIN303 Financial Management TMA: Investment and Finance Analysis

VerifiedAdded on 2023/01/19

|8

|1530

|24

Homework Assignment

AI Summary

This document presents a comprehensive solution to a FIN303 Financial Management Tutor-Marked Assignment. The assignment covers a range of financial topics, including investment analysis, portfolio management, bond valuation, and the cost of equity. The solution begins with an analysis of investment products, calculating future values under different recession scenarios and comparing investment options like Product Ace and Product Bee. It then delves into bond valuation, calculating YTM and pricing bonds, along with recommendations to reduce coupon rates. The assignment continues with portfolio analysis, computing expected returns, standard deviations, and assessing portfolio risk. The solution also includes calculations for NPV, IRR, and MIRR, and concludes with a discussion of the preferred project based on the capital budgeting criteria. The document provides detailed computations, explanations, and recommendations, offering a thorough understanding of financial management principles and their practical application.

FINANCIAL MANAGEMENT

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

a) Product Ace provides an annual return of 5% p.a. If there is no recession during the five

years, the annual returns from 6th year onwards would be 7% p.a. for a period of ten years.

Hence, amount expected at the end of 15 years = 8000*1.055*1.0710 = $20,085.11

b) Product Ace provides an annual return of 5% p.a. If there is no recession during the five

years, the annual returns from 6th year onwards would be 3% p.a. for a period of ten years.

Hence, amount expected at the end of 15 years = 8000*1.055*1.0310 = $13,721.73

c) The relevant formula for the future value of annuity due is stated below.

Here, P = $ 800, r=5 percent, n = 10

Therefore, FV of annuity = (1.05)*800*[(1.0510-1)/0.05] = $10,545.63

The above amount would keep on increasing for the next 10 years at 5 percent per annum.

Hence, amount at the end of 20 years = $10,545.63 * 1.0510 = $17,209.97

d) Deposit rate = 2 percent per annum compounded daily

Effective interest rate = (1 + (2/36500))365 -1 = 2.02% p.a.

Lending rate =6% per annum compounded monthly

a) Product Ace provides an annual return of 5% p.a. If there is no recession during the five

years, the annual returns from 6th year onwards would be 7% p.a. for a period of ten years.

Hence, amount expected at the end of 15 years = 8000*1.055*1.0710 = $20,085.11

b) Product Ace provides an annual return of 5% p.a. If there is no recession during the five

years, the annual returns from 6th year onwards would be 3% p.a. for a period of ten years.

Hence, amount expected at the end of 15 years = 8000*1.055*1.0310 = $13,721.73

c) The relevant formula for the future value of annuity due is stated below.

Here, P = $ 800, r=5 percent, n = 10

Therefore, FV of annuity = (1.05)*800*[(1.0510-1)/0.05] = $10,545.63

The above amount would keep on increasing for the next 10 years at 5 percent per annum.

Hence, amount at the end of 20 years = $10,545.63 * 1.0510 = $17,209.97

d) Deposit rate = 2 percent per annum compounded daily

Effective interest rate = (1 + (2/36500))365 -1 = 2.02% p.a.

Lending rate =6% per annum compounded monthly

Effective interest rate = (1+ (6/1200))12-1 = 6.17% p.a.

e) In order to compute the payoff from the two investment options, it is imperative to compare

the expected values at the end of 15 years.

It is known that is a 70% chance of recession and 30% chances of recession not happening.

Hence, expected value from Product Ace = 20085.11*0.3 + 13721.73*0.7 = $15,630.74

This needs to compared with the maturity value of Project Bee after 15 years

Expected value from Product Bee after 15 years = $10,545.63 * 1.055 = $13,484.46

By comparing the expected values from the above two investment options after 15 years, it is

apparent that Product Ace presents a superior investment option.

Relevant assumptions include the following.

1) The rate of returns in the two investment options remain constant and do not alter.

2) It is possible to end project Bee after 15 years.

Question 2

a) With regards to payment of coupon , the following computation is relevant.

Face value = $ 1000

Coupon rate = 6% paid semi annually

Hence, coupon paid per bond after six months = (0.06/2)*1000 = $30

Total coupon payment every six months on the total issue = 30*50,000 =$ 1,500,000

The YTM three years ago should have been the discount rate for which the future cash flows

from the bond would lead to be price of the bond.

e) In order to compute the payoff from the two investment options, it is imperative to compare

the expected values at the end of 15 years.

It is known that is a 70% chance of recession and 30% chances of recession not happening.

Hence, expected value from Product Ace = 20085.11*0.3 + 13721.73*0.7 = $15,630.74

This needs to compared with the maturity value of Project Bee after 15 years

Expected value from Product Bee after 15 years = $10,545.63 * 1.055 = $13,484.46

By comparing the expected values from the above two investment options after 15 years, it is

apparent that Product Ace presents a superior investment option.

Relevant assumptions include the following.

1) The rate of returns in the two investment options remain constant and do not alter.

2) It is possible to end project Bee after 15 years.

Question 2

a) With regards to payment of coupon , the following computation is relevant.

Face value = $ 1000

Coupon rate = 6% paid semi annually

Hence, coupon paid per bond after six months = (0.06/2)*1000 = $30

Total coupon payment every six months on the total issue = 30*50,000 =$ 1,500,000

The YTM three years ago should have been the discount rate for which the future cash flows

from the bond would lead to be price of the bond.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

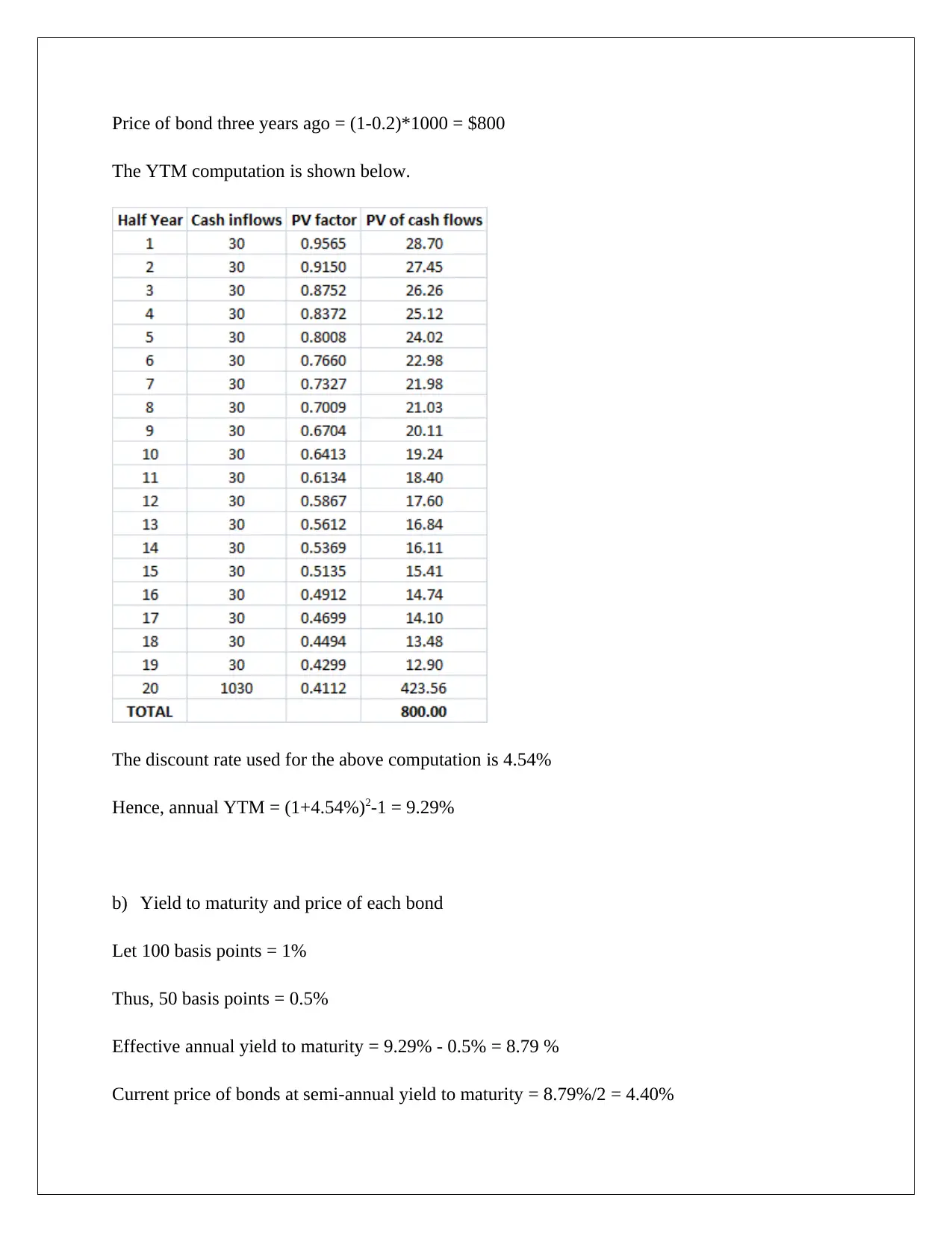

Price of bond three years ago = (1-0.2)*1000 = $800

The YTM computation is shown below.

The discount rate used for the above computation is 4.54%

Hence, annual YTM = (1+4.54%)2-1 = 9.29%

b) Yield to maturity and price of each bond

Let 100 basis points = 1%

Thus, 50 basis points = 0.5%

Effective annual yield to maturity = 9.29% - 0.5% = 8.79 %

Current price of bonds at semi-annual yield to maturity = 8.79%/2 = 4.40%

The YTM computation is shown below.

The discount rate used for the above computation is 4.54%

Hence, annual YTM = (1+4.54%)2-1 = 9.29%

b) Yield to maturity and price of each bond

Let 100 basis points = 1%

Thus, 50 basis points = 0.5%

Effective annual yield to maturity = 9.29% - 0.5% = 8.79 %

Current price of bonds at semi-annual yield to maturity = 8.79%/2 = 4.40%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Remaining semi-annual coupon period = (10-3 years) * 2 = 14 periods

Price of the bond issue = {(1500000 * (1 – (1 + 0.044)-14 / 0.044) + (50000000 /(1+0.044)14 )} =

42,797,304

c) Recommendation in order to reduce the coupon rate of the impending bond issuance

Setting up low coupon rate

Enhance bond price so as the current coupon amount would result in lower yield.

Fixing of lower coupon amounts by the new companies is common because coupon rate

is mainly dependent on the prevailing interest rates which means the new companies can

easily meet the periodic interest expenses

d) Blue Horizon Ltd’s cost of equity can be computed using the following formula.

Cost of equity = (Next dividend / Current market price) + growth rate

K(e) ={15.50*(1+0.03))/280}+0.03 = 8.70%

e) The YTM computed in part (b) came out as 8.79% which is higher than the cost of equity in

part (d). This is clearly abnormal as higher risk is carried by equity owing to which higher

returns would be expected by the investors on the equity and not the bonds. One potential

explanation of this anomaly is that the bonds have been issued at steep discount which was

not required. Owing to this steep discount in the price, the YTM have been derived as higher.

Question 3

(a) The computation of expected returns for individual stocks is shown below.

Expected return = Sum (Expected return * Probability%)

Stock RST = (0%*25%) + (6%*40%) + (15%*35%) = 7.65%

Price of the bond issue = {(1500000 * (1 – (1 + 0.044)-14 / 0.044) + (50000000 /(1+0.044)14 )} =

42,797,304

c) Recommendation in order to reduce the coupon rate of the impending bond issuance

Setting up low coupon rate

Enhance bond price so as the current coupon amount would result in lower yield.

Fixing of lower coupon amounts by the new companies is common because coupon rate

is mainly dependent on the prevailing interest rates which means the new companies can

easily meet the periodic interest expenses

d) Blue Horizon Ltd’s cost of equity can be computed using the following formula.

Cost of equity = (Next dividend / Current market price) + growth rate

K(e) ={15.50*(1+0.03))/280}+0.03 = 8.70%

e) The YTM computed in part (b) came out as 8.79% which is higher than the cost of equity in

part (d). This is clearly abnormal as higher risk is carried by equity owing to which higher

returns would be expected by the investors on the equity and not the bonds. One potential

explanation of this anomaly is that the bonds have been issued at steep discount which was

not required. Owing to this steep discount in the price, the YTM have been derived as higher.

Question 3

(a) The computation of expected returns for individual stocks is shown below.

Expected return = Sum (Expected return * Probability%)

Stock RST = (0%*25%) + (6%*40%) + (15%*35%) = 7.65%

Stock VVR = (20%*25%) + (12%*40%) +(-4%*35%) = 8.40%

Stock BAB = (40%*25%) + (15%*40%) +(-26%*35%) = 6.90%

The computation of the requisite standard deviation of individual stocks is computed below.

Stock RST = SQRT (25%*(0-0.765)^2) + (40%*(6-7.65)^2) + (35%* (15-7.65)^2) = 5.88%

Stock VVR = SQRT (25%*(20-8.40)^2) + (40%*(12-8.40)^2) + (35%* (-4-8.4)^2) = 9.62%

Stock BAB = SQRT (25%*(40-6.90)^2) + (40%*(15-6.90)^2) + (35%* (-4-6.904)^2) = 16.99 %

(b) The requisite computations are shown below.

Expected return of portfolio = (40%*7.65%) + (30%*8.40%) + (30%*6.90) = 7.65%

Expected standard deviation = (40%*5.88%) + (30%*9.62%) + (30%*16.99) = 10.34%

(c) On the basis of the above computations, it can be inferred that Ravi is using a prudent asset

allocation resources. This is because, a diversified portfolio is being formed which is

expected to reduce the portfolio risk which is indicated by standard deviation. Even though

there is some reduction in returns but the asset allocation strategy with regards to the

portfolio formation would lead to higher returns per unit risk in comparison to individual

stocks.

(d) Expected market risk premium

Expected return = Risk free return + Beta (market return – risk free return)

Expected return of portfolio = 7.65%

Risk free return = 3%

Assuming beta = 1

Let the market return is x and hence,

Stock BAB = (40%*25%) + (15%*40%) +(-26%*35%) = 6.90%

The computation of the requisite standard deviation of individual stocks is computed below.

Stock RST = SQRT (25%*(0-0.765)^2) + (40%*(6-7.65)^2) + (35%* (15-7.65)^2) = 5.88%

Stock VVR = SQRT (25%*(20-8.40)^2) + (40%*(12-8.40)^2) + (35%* (-4-8.4)^2) = 9.62%

Stock BAB = SQRT (25%*(40-6.90)^2) + (40%*(15-6.90)^2) + (35%* (-4-6.904)^2) = 16.99 %

(b) The requisite computations are shown below.

Expected return of portfolio = (40%*7.65%) + (30%*8.40%) + (30%*6.90) = 7.65%

Expected standard deviation = (40%*5.88%) + (30%*9.62%) + (30%*16.99) = 10.34%

(c) On the basis of the above computations, it can be inferred that Ravi is using a prudent asset

allocation resources. This is because, a diversified portfolio is being formed which is

expected to reduce the portfolio risk which is indicated by standard deviation. Even though

there is some reduction in returns but the asset allocation strategy with regards to the

portfolio formation would lead to higher returns per unit risk in comparison to individual

stocks.

(d) Expected market risk premium

Expected return = Risk free return + Beta (market return – risk free return)

Expected return of portfolio = 7.65%

Risk free return = 3%

Assuming beta = 1

Let the market return is x and hence,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7.65 = 3 + {1 * (X – 3)}

X=7.65 %

(e) VVR is riskier because its beta and standard deviation is higher than RST. Beta is a measure

of the systematic risk while standard deviation is a measure of the overall risk associated

with stock.

Question 4

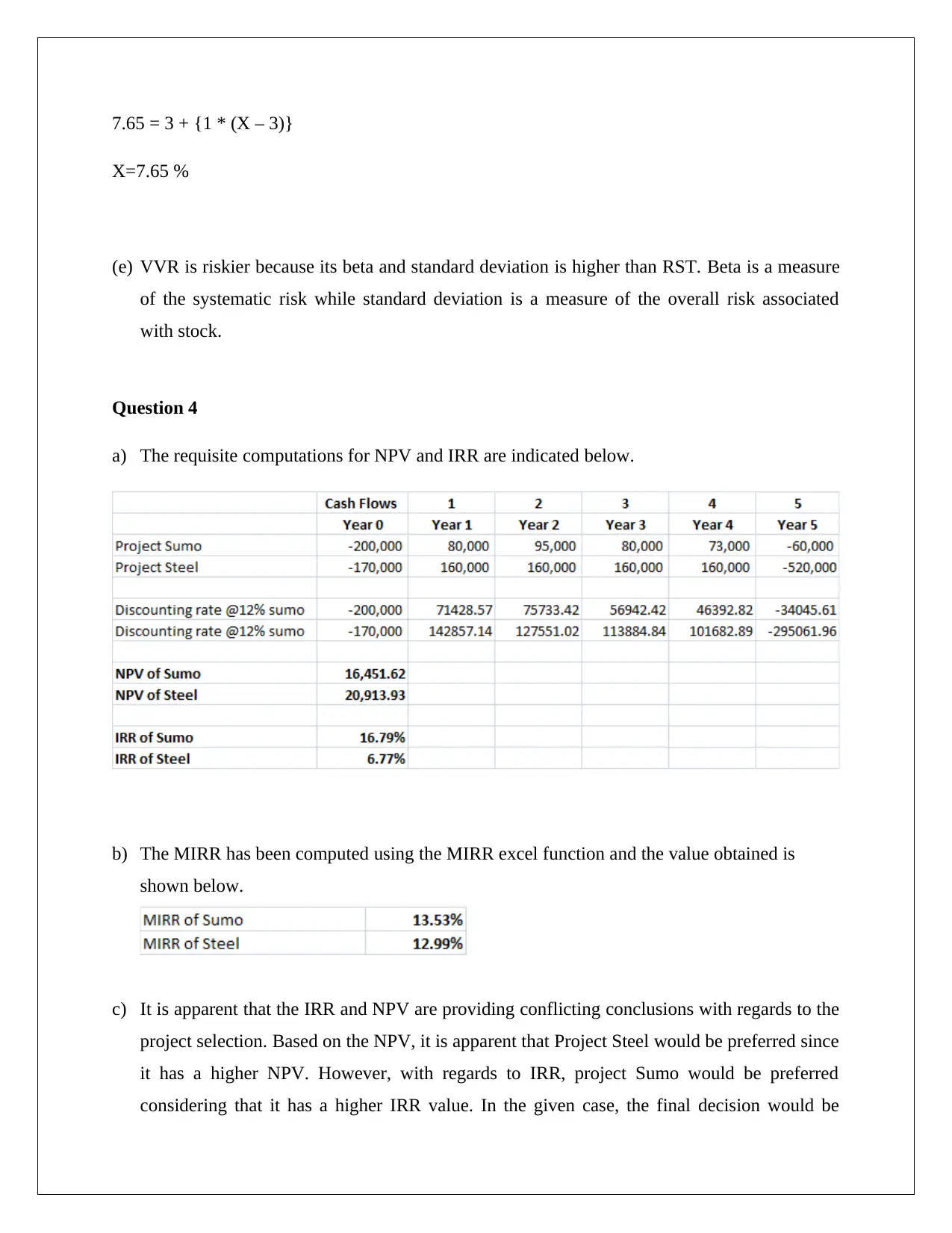

a) The requisite computations for NPV and IRR are indicated below.

b) The MIRR has been computed using the MIRR excel function and the value obtained is

shown below.

c) It is apparent that the IRR and NPV are providing conflicting conclusions with regards to the

project selection. Based on the NPV, it is apparent that Project Steel would be preferred since

it has a higher NPV. However, with regards to IRR, project Sumo would be preferred

considering that it has a higher IRR value. In the given case, the final decision would be

X=7.65 %

(e) VVR is riskier because its beta and standard deviation is higher than RST. Beta is a measure

of the systematic risk while standard deviation is a measure of the overall risk associated

with stock.

Question 4

a) The requisite computations for NPV and IRR are indicated below.

b) The MIRR has been computed using the MIRR excel function and the value obtained is

shown below.

c) It is apparent that the IRR and NPV are providing conflicting conclusions with regards to the

project selection. Based on the NPV, it is apparent that Project Steel would be preferred since

it has a higher NPV. However, with regards to IRR, project Sumo would be preferred

considering that it has a higher IRR value. In the given case, the final decision would be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

driven by NPV since there is a conflict between the two capital budgeting criteria. The

preferred project would be project Steel.

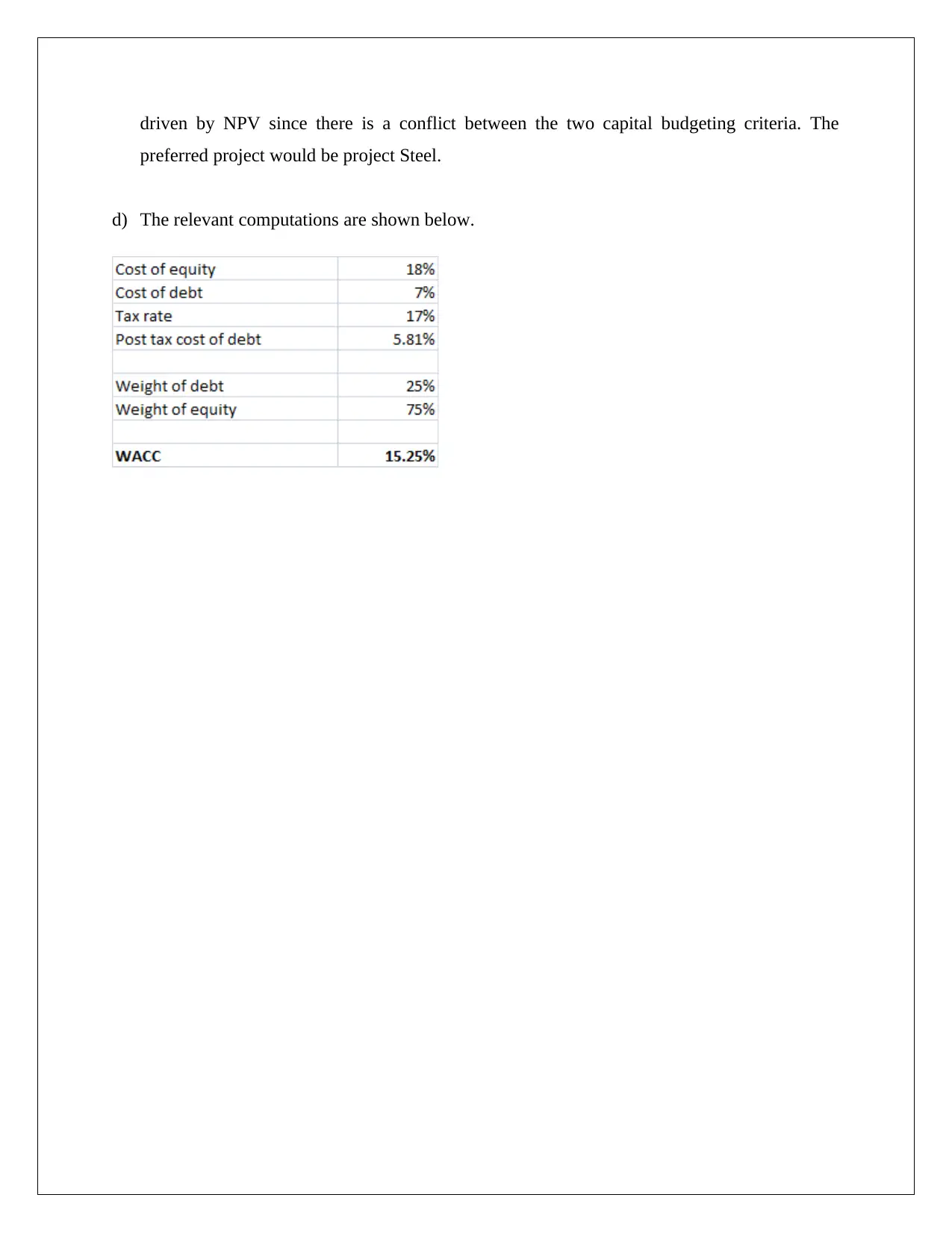

d) The relevant computations are shown below.

preferred project would be project Steel.

d) The relevant computations are shown below.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.