Preparing Final Accounts for Sole Traders and Partnerships Analysis

VerifiedAdded on 2020/12/29

|22

|4995

|252

Report

AI Summary

This report provides a comprehensive overview of final accounts for sole traders and partnerships. It starts by outlining the reasons for closing accounts and preparing a trial balance, explaining the processes and limitations of producing final accounts from a trial balance, and describing techniques for preparing accounts from incomplete records. The report then delves into practical applications, including computing opening and closing capital and cash/bank balances, producing sales and purchase ledger control accounts, and measuring balances using markups and margins. Detailed components of final accounts for a sole trader, including the profit or loss statement and statement of financial position, are presented. The report then discusses the components of partnership agreements and accounts, producing profit or loss appropriation accounts, determining profit allocation, and preparing current and capital accounts for partners. Finally, the report includes the computation of closing balances on capital and current accounts for partners and the production of the statement of financial position, concluding with a summary of the key takeaways and references.

PREPARE FINAL ACCOUNTS

FOR SOLE TRADERS AND

PARTNERSHIPS

FOR SOLE TRADERS AND

PARTNERSHIPS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Outlining reasons for closing off accounts and preparing trial balance................................1

1.2 Explaining process, limitations of producing final accounts from trial balance...................1

1.3 Describing techniques of preparing accounts from incomplete records...............................2

1.4 Listing out reasons for imbalances from incorrect double entries........................................3

1.5 Listing out reasons for incomplete records from insufficient data.......................................3

TASK 2............................................................................................................................................3

2.1 Computing opening and/or closing capital...........................................................................3

2.2 Computing opening and/or closing cash/bank account balance...........................................4

2.3 Producing sales and purchase ledger control accounts.........................................................4

2.4 Measuring balances by deploying mark ups and margins....................................................6

TASK 3............................................................................................................................................6

3.1 Describing components of final accounts for sole trader......................................................6

3.2 Preparation of profit or loss statement..................................................................................7

Profit or loss statement for Olivia Boulton.................................................................................7

3.3 Preparation of statement of financial position......................................................................8

Statement of financial position of Olivia Boulton......................................................................8

TASK 4............................................................................................................................................9

4.1 Describing components of partnership agreement................................................................9

4.2 Describing components of partnership accounts.................................................................10

TASK 5..........................................................................................................................................11

5.1 Producing profit or loss appropriation account...................................................................11

5.2 Determining allocation of profits for partners for producing various accounts..................12

5.3 Producing current and capital accounts for partners...........................................................13

TASK 6..........................................................................................................................................15

6.1,6.2 Computing closing balances on capital, current accounts of partners and producing

statement of financial position..................................................................................................15

CONCLUSION..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Outlining reasons for closing off accounts and preparing trial balance................................1

1.2 Explaining process, limitations of producing final accounts from trial balance...................1

1.3 Describing techniques of preparing accounts from incomplete records...............................2

1.4 Listing out reasons for imbalances from incorrect double entries........................................3

1.5 Listing out reasons for incomplete records from insufficient data.......................................3

TASK 2............................................................................................................................................3

2.1 Computing opening and/or closing capital...........................................................................3

2.2 Computing opening and/or closing cash/bank account balance...........................................4

2.3 Producing sales and purchase ledger control accounts.........................................................4

2.4 Measuring balances by deploying mark ups and margins....................................................6

TASK 3............................................................................................................................................6

3.1 Describing components of final accounts for sole trader......................................................6

3.2 Preparation of profit or loss statement..................................................................................7

Profit or loss statement for Olivia Boulton.................................................................................7

3.3 Preparation of statement of financial position......................................................................8

Statement of financial position of Olivia Boulton......................................................................8

TASK 4............................................................................................................................................9

4.1 Describing components of partnership agreement................................................................9

4.2 Describing components of partnership accounts.................................................................10

TASK 5..........................................................................................................................................11

5.1 Producing profit or loss appropriation account...................................................................11

5.2 Determining allocation of profits for partners for producing various accounts..................12

5.3 Producing current and capital accounts for partners...........................................................13

TASK 6..........................................................................................................................................15

6.1,6.2 Computing closing balances on capital, current accounts of partners and producing

statement of financial position..................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Final accounts of a business is considered as an integral part as it assist in showing the

financial position and performance of company in a specific time period. Accounting is a crucial

technique for ascertaining transactions held in business on daily basis. Present report deals with

accounts preparation of sole trader and partnership firm for the particular period. Moreover, final

accounts of trader will be prepared and of partnership business will be also be produced such as

Profit and Loss appropriation a/c, balance sheet, current and capital accounts of the partners will

be prepared. In all, overall financial analysis will be done in effective manner for business and

profits and losses incurred will be accounted for.

TASK 1

1.1 Outlining reasons for closing off accounts and preparing trial balance

The trial balance is one of the important which helps to ascertain the balance of debit and

credit in effective manner. There are various reasons which encouraged accountants to prepare

trial balance which are as follows-

Closing off accounts

Balancing each of the accounts in ledger is required soon after the completing accounting

period. Accuracy of the business position can be seen in the best manner possible (Post and

Byron, 2015). However, if balancing is not done, then ledger will not show accurate picture of

business. Surplus and deficit in accounts are arrived by balancing.

Producing trial balance

The transactions are recorded in journal, ledger accounts and then finally trial balance is

prepared which provides clarity regarding arithmetical accuracy of entries in the respective

accounts. Trial balance is the summary of entries recorded in journal and then posted into ledger.

Debit and credit is matched by preparing trial balance and errors if any can be ascertained.

Hence, accurate final accounts can be made from this information. Trail balance is the first step

towards the preparation financial statement. Trail Balances acts a a working sheet for the

preparation of financial statement. The main purpose of preparing trail balance is to locate any

errors and to be ensures that the entries in accounts are mathematically correct.

1

Final accounts of a business is considered as an integral part as it assist in showing the

financial position and performance of company in a specific time period. Accounting is a crucial

technique for ascertaining transactions held in business on daily basis. Present report deals with

accounts preparation of sole trader and partnership firm for the particular period. Moreover, final

accounts of trader will be prepared and of partnership business will be also be produced such as

Profit and Loss appropriation a/c, balance sheet, current and capital accounts of the partners will

be prepared. In all, overall financial analysis will be done in effective manner for business and

profits and losses incurred will be accounted for.

TASK 1

1.1 Outlining reasons for closing off accounts and preparing trial balance

The trial balance is one of the important which helps to ascertain the balance of debit and

credit in effective manner. There are various reasons which encouraged accountants to prepare

trial balance which are as follows-

Closing off accounts

Balancing each of the accounts in ledger is required soon after the completing accounting

period. Accuracy of the business position can be seen in the best manner possible (Post and

Byron, 2015). However, if balancing is not done, then ledger will not show accurate picture of

business. Surplus and deficit in accounts are arrived by balancing.

Producing trial balance

The transactions are recorded in journal, ledger accounts and then finally trial balance is

prepared which provides clarity regarding arithmetical accuracy of entries in the respective

accounts. Trial balance is the summary of entries recorded in journal and then posted into ledger.

Debit and credit is matched by preparing trial balance and errors if any can be ascertained.

Hence, accurate final accounts can be made from this information. Trail balance is the first step

towards the preparation financial statement. Trail Balances acts a a working sheet for the

preparation of financial statement. The main purpose of preparing trail balance is to locate any

errors and to be ensures that the entries in accounts are mathematically correct.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.2 Explaining process, limitations of producing final accounts from trial balance

Process of preparation of final accounts through trial balance

Firstly, income statement is prepared for which information such as operating

expenditures and profit generated by organisation is ascertained (Revelli and Viviani, 2015).

Soon after preparation of income statement, balance sheet is produced. The information requires

here are assets, liabilities and equity at the end of accounting period. Hence, total assets and total

liabilities and equity are matched. Thus, preparation of final accounts can be made by using

information supplied by trial balance quite effectively.

Limitations of final accounts by developing through trial balance

Limitations are outlined below-

The final accounts can be produced only where business follows double entry accounting

system so that debit and credit entries could be made.

The accuracy is being provided by preparation of trial balance. However, it fails to get

into account those entries which are made after developing it.

It depends heavily on historical costs and do not make forecast regarding the future

aspect or position of the business (Sarlin, 2015).

1.3 Describing techniques of preparing accounts from incomplete records

There are various methods which can be used while developing accounts from

incomplete records and are detailed below-

Accounting Equation

It is considered to be foundation for using double entry accounting system. Financial

position of business is based on major components such as assets and liabilities. Due to

incomplete records of accounts of company, total assets are just subtracted from liabilities owed

by business.

Control accounts

The control account is another method used for recording balances on various subsidiary

accounts and also they provide check on them. It is generally prepared by large enterprises which

have plenty of transactions on day-to-day basis. This helps to know position of business in

effective manner and as a result, it can be used for preparation of accounts on incomplete

information.

2

Process of preparation of final accounts through trial balance

Firstly, income statement is prepared for which information such as operating

expenditures and profit generated by organisation is ascertained (Revelli and Viviani, 2015).

Soon after preparation of income statement, balance sheet is produced. The information requires

here are assets, liabilities and equity at the end of accounting period. Hence, total assets and total

liabilities and equity are matched. Thus, preparation of final accounts can be made by using

information supplied by trial balance quite effectively.

Limitations of final accounts by developing through trial balance

Limitations are outlined below-

The final accounts can be produced only where business follows double entry accounting

system so that debit and credit entries could be made.

The accuracy is being provided by preparation of trial balance. However, it fails to get

into account those entries which are made after developing it.

It depends heavily on historical costs and do not make forecast regarding the future

aspect or position of the business (Sarlin, 2015).

1.3 Describing techniques of preparing accounts from incomplete records

There are various methods which can be used while developing accounts from

incomplete records and are detailed below-

Accounting Equation

It is considered to be foundation for using double entry accounting system. Financial

position of business is based on major components such as assets and liabilities. Due to

incomplete records of accounts of company, total assets are just subtracted from liabilities owed

by business.

Control accounts

The control account is another method used for recording balances on various subsidiary

accounts and also they provide check on them. It is generally prepared by large enterprises which

have plenty of transactions on day-to-day basis. This helps to know position of business in

effective manner and as a result, it can be used for preparation of accounts on incomplete

information.

2

Markup method

The markup is termed as the amount being used for increasing cost of product so as to

derive selling price in the best manner possible (Cooper, 2017). This means that firm can also

use this method for producing accounts.

1.4 Listing out reasons for imbalances from incorrect double entries

Business is required to effectively ascertain proper trial balance by making relevant

entries in the respective head. However, due to errors in trial balance, it gets affected. The main

reason of errors resulting in unbalanced trial balance is making one sided entry only in book

keeping records leading to inaccuracy up to a major extent. Transactional errors are made which

should be resolved by applying guidelines from international accounting bodies such as IFRS,

GAAP providing how accounts should be prepared in effective manner. In addition to this, by

preparing final accounts by sticking to guidelines, company can easily minimise errors and

accuracy can be made in effectual manner. Moreover, if transactional errors and any other errors

are not being rectified, then accounts prepared on such basis will lead to false results regarding

financial position of business. Thus, accuracy and transparency are main requirements of

preparation of fruitful accounts exhibiting fair view of financials.

1.5 Listing out reasons for incomplete records from insufficient data

The incomplete records of the data maintained in accounts has direct impact on accuracy

level of outcomes up to a high extent. Insufficient and inconsistencies prevailing in the database

maintained leads to affect accounts preparation and as a result, firm is unable to carry out the

accurate records (Reasons for Incomplete Records in Accounting. 2018). Another reasons arising

due to incomplete records as loss of data, manipulating data intentionally, employee turnover etc

are various reasons which affects due to insufficient data. On the other hand, manipulation done

in the database is another concern for getting inaccurate information. While, incomplete

accounting records can cause problems especially when financial statement audits are done.

Hence, it can be said that inaccuracy should be resolved so that business may be able to attain

accurate accounts and as a result, fair view of financials can be done quite effectually.

TASK 2

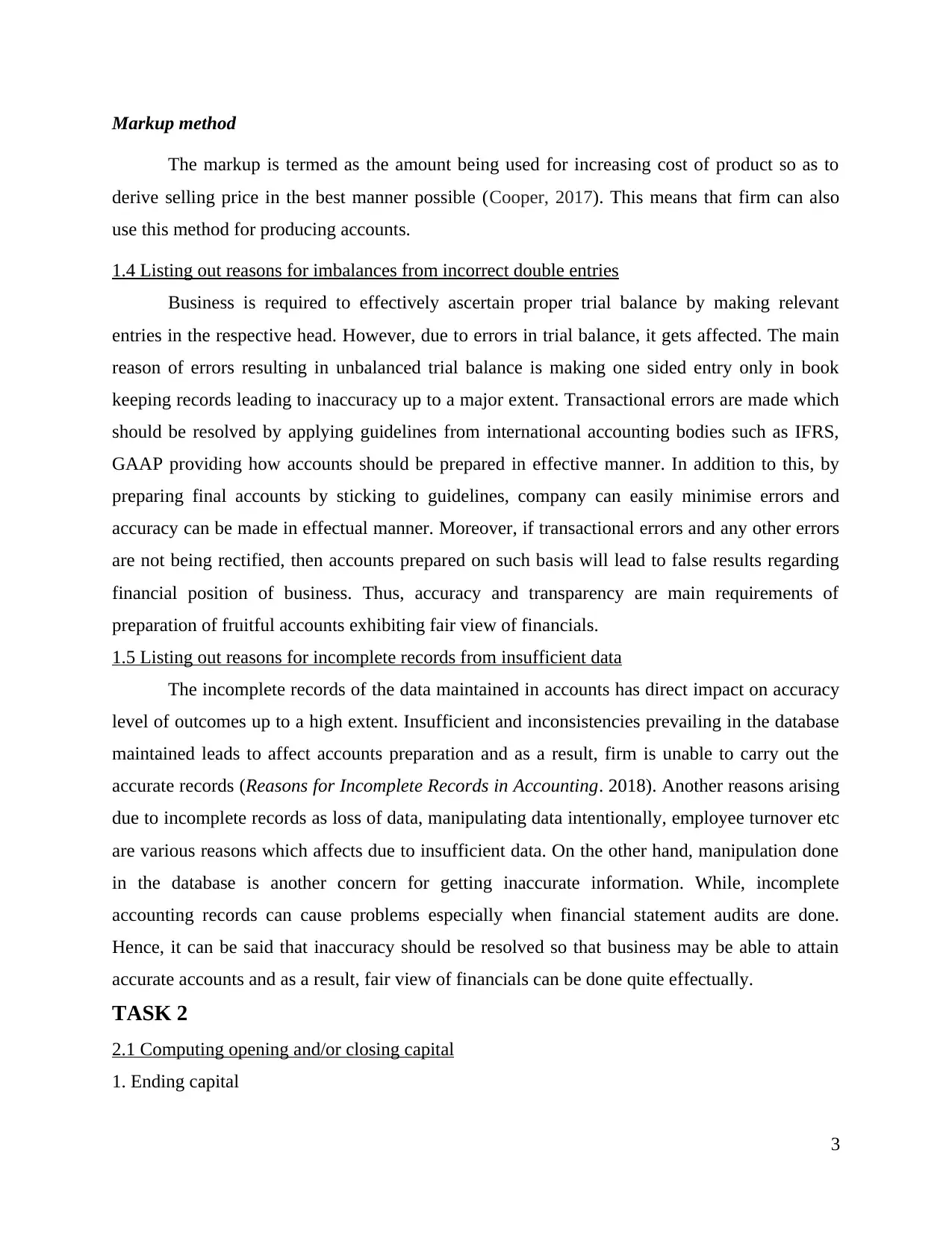

2.1 Computing opening and/or closing capital

1. Ending capital

3

The markup is termed as the amount being used for increasing cost of product so as to

derive selling price in the best manner possible (Cooper, 2017). This means that firm can also

use this method for producing accounts.

1.4 Listing out reasons for imbalances from incorrect double entries

Business is required to effectively ascertain proper trial balance by making relevant

entries in the respective head. However, due to errors in trial balance, it gets affected. The main

reason of errors resulting in unbalanced trial balance is making one sided entry only in book

keeping records leading to inaccuracy up to a major extent. Transactional errors are made which

should be resolved by applying guidelines from international accounting bodies such as IFRS,

GAAP providing how accounts should be prepared in effective manner. In addition to this, by

preparing final accounts by sticking to guidelines, company can easily minimise errors and

accuracy can be made in effectual manner. Moreover, if transactional errors and any other errors

are not being rectified, then accounts prepared on such basis will lead to false results regarding

financial position of business. Thus, accuracy and transparency are main requirements of

preparation of fruitful accounts exhibiting fair view of financials.

1.5 Listing out reasons for incomplete records from insufficient data

The incomplete records of the data maintained in accounts has direct impact on accuracy

level of outcomes up to a high extent. Insufficient and inconsistencies prevailing in the database

maintained leads to affect accounts preparation and as a result, firm is unable to carry out the

accurate records (Reasons for Incomplete Records in Accounting. 2018). Another reasons arising

due to incomplete records as loss of data, manipulating data intentionally, employee turnover etc

are various reasons which affects due to insufficient data. On the other hand, manipulation done

in the database is another concern for getting inaccurate information. While, incomplete

accounting records can cause problems especially when financial statement audits are done.

Hence, it can be said that inaccuracy should be resolved so that business may be able to attain

accurate accounts and as a result, fair view of financials can be done quite effectually.

TASK 2

2.1 Computing opening and/or closing capital

1. Ending capital

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Amount (in £)

Beginning balance 1000

Add: net profit 2600

Less: Drawings made 600

Ending capital balance 3000

2. Beginning capital

Particulars Amount (in £)

Ending balance 4200

Add: Drawings made 800

Less: Profits 360

Beginning capital balance 4640

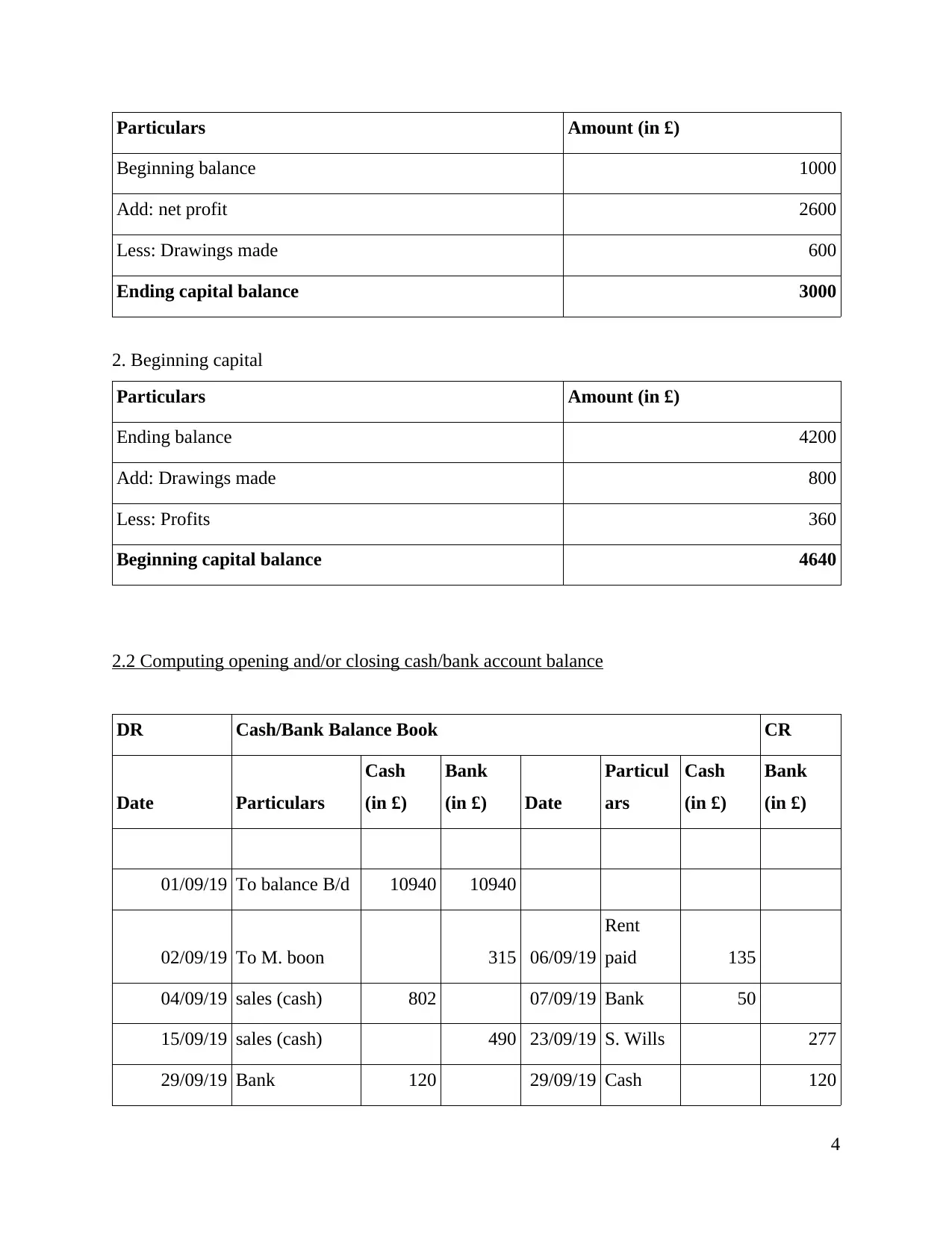

2.2 Computing opening and/or closing cash/bank account balance

DR Cash/Bank Balance Book CR

Date Particulars

Cash

(in £)

Bank

(in £) Date

Particul

ars

Cash

(in £)

Bank

(in £)

01/09/19 To balance B/d 10940 10940

02/09/19 To M. boon 315 06/09/19

Rent

paid 135

04/09/19 sales (cash) 802 07/09/19 Bank 50

15/09/19 sales (cash) 490 23/09/19 S. Wills 277

29/09/19 Bank 120 29/09/19 Cash 120

4

Beginning balance 1000

Add: net profit 2600

Less: Drawings made 600

Ending capital balance 3000

2. Beginning capital

Particulars Amount (in £)

Ending balance 4200

Add: Drawings made 800

Less: Profits 360

Beginning capital balance 4640

2.2 Computing opening and/or closing cash/bank account balance

DR Cash/Bank Balance Book CR

Date Particulars

Cash

(in £)

Bank

(in £) Date

Particul

ars

Cash

(in £)

Bank

(in £)

01/09/19 To balance B/d 10940 10940

02/09/19 To M. boon 315 06/09/19

Rent

paid 135

04/09/19 sales (cash) 802 07/09/19 Bank 50

15/09/19 sales (cash) 490 23/09/19 S. Wills 277

29/09/19 Bank 120 29/09/19 Cash 120

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

30/09/19

Wages

paid 518

Total 11862 11745 Total 11862 11745

By

Balance

b/d 11159 11348

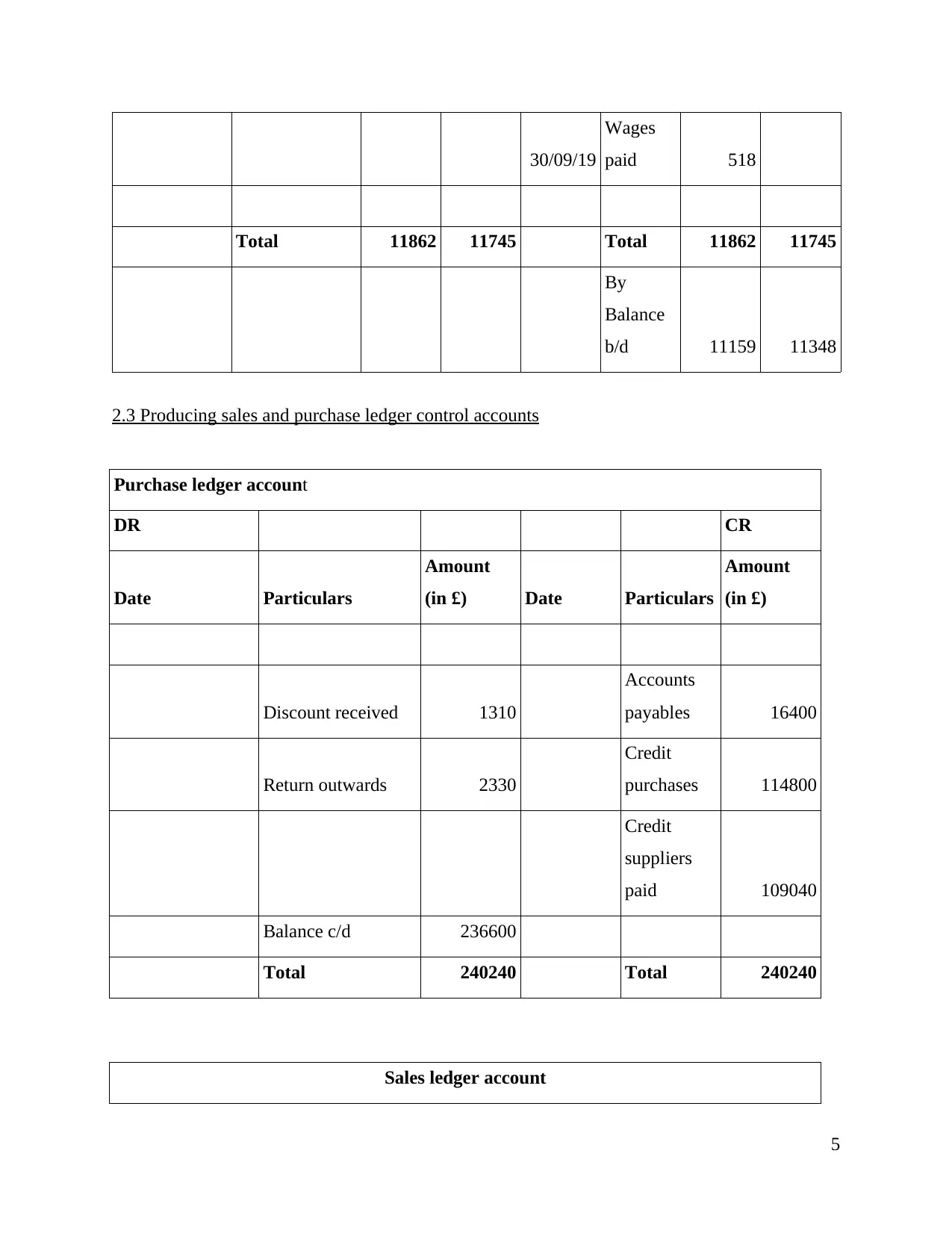

2.3 Producing sales and purchase ledger control accounts

Purchase ledger account

DR CR

Date Particulars

Amount

(in £) Date Particulars

Amount

(in £)

Discount received 1310

Accounts

payables 16400

Return outwards 2330

Credit

purchases 114800

Credit

suppliers

paid 109040

Balance c/d 236600

Total 240240 Total 240240

Sales ledger account

5

Wages

paid 518

Total 11862 11745 Total 11862 11745

By

Balance

b/d 11159 11348

2.3 Producing sales and purchase ledger control accounts

Purchase ledger account

DR CR

Date Particulars

Amount

(in £) Date Particulars

Amount

(in £)

Discount received 1310

Accounts

payables 16400

Return outwards 2330

Credit

purchases 114800

Credit

suppliers

paid 109040

Balance c/d 236600

Total 240240 Total 240240

Sales ledger account

5

DR CR

Date Particulars

Amount

(in £) Date Particulars

Amount

(in £)

Cash sales 1490

Discount

allowed 3160

Accounts

receivables 23220

Return

inwards 8150

Credit sales 162540

Written off

(Bad debts) 4770

Cash from debtors 146610

Doubtful

debts

allowed 660

Balance c/d 317120

Total 333860 Total 333860

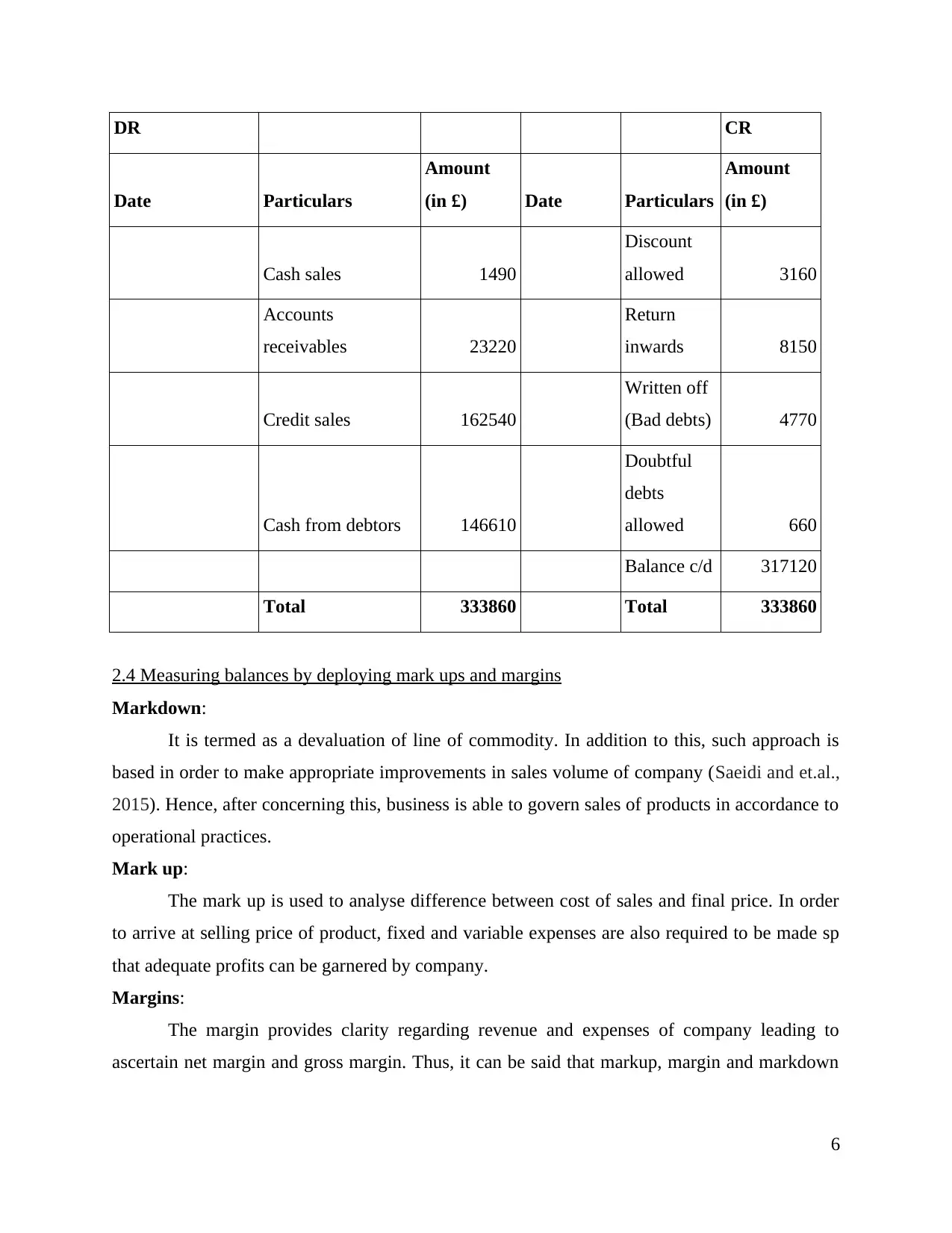

2.4 Measuring balances by deploying mark ups and margins

Markdown:

It is termed as a devaluation of line of commodity. In addition to this, such approach is

based in order to make appropriate improvements in sales volume of company (Saeidi and et.al.,

2015). Hence, after concerning this, business is able to govern sales of products in accordance to

operational practices.

Mark up:

The mark up is used to analyse difference between cost of sales and final price. In order

to arrive at selling price of product, fixed and variable expenses are also required to be made sp

that adequate profits can be garnered by company.

Margins:

The margin provides clarity regarding revenue and expenses of company leading to

ascertain net margin and gross margin. Thus, it can be said that markup, margin and markdown

6

Date Particulars

Amount

(in £) Date Particulars

Amount

(in £)

Cash sales 1490

Discount

allowed 3160

Accounts

receivables 23220

Return

inwards 8150

Credit sales 162540

Written off

(Bad debts) 4770

Cash from debtors 146610

Doubtful

debts

allowed 660

Balance c/d 317120

Total 333860 Total 333860

2.4 Measuring balances by deploying mark ups and margins

Markdown:

It is termed as a devaluation of line of commodity. In addition to this, such approach is

based in order to make appropriate improvements in sales volume of company (Saeidi and et.al.,

2015). Hence, after concerning this, business is able to govern sales of products in accordance to

operational practices.

Mark up:

The mark up is used to analyse difference between cost of sales and final price. In order

to arrive at selling price of product, fixed and variable expenses are also required to be made sp

that adequate profits can be garnered by company.

Margins:

The margin provides clarity regarding revenue and expenses of company leading to

ascertain net margin and gross margin. Thus, it can be said that markup, margin and markdown

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

are useful techniques applied by business in effective manner. Example, a markup of a product is

150 pounds which cost is 450 will be sold at 600 pounds.

TASK 3

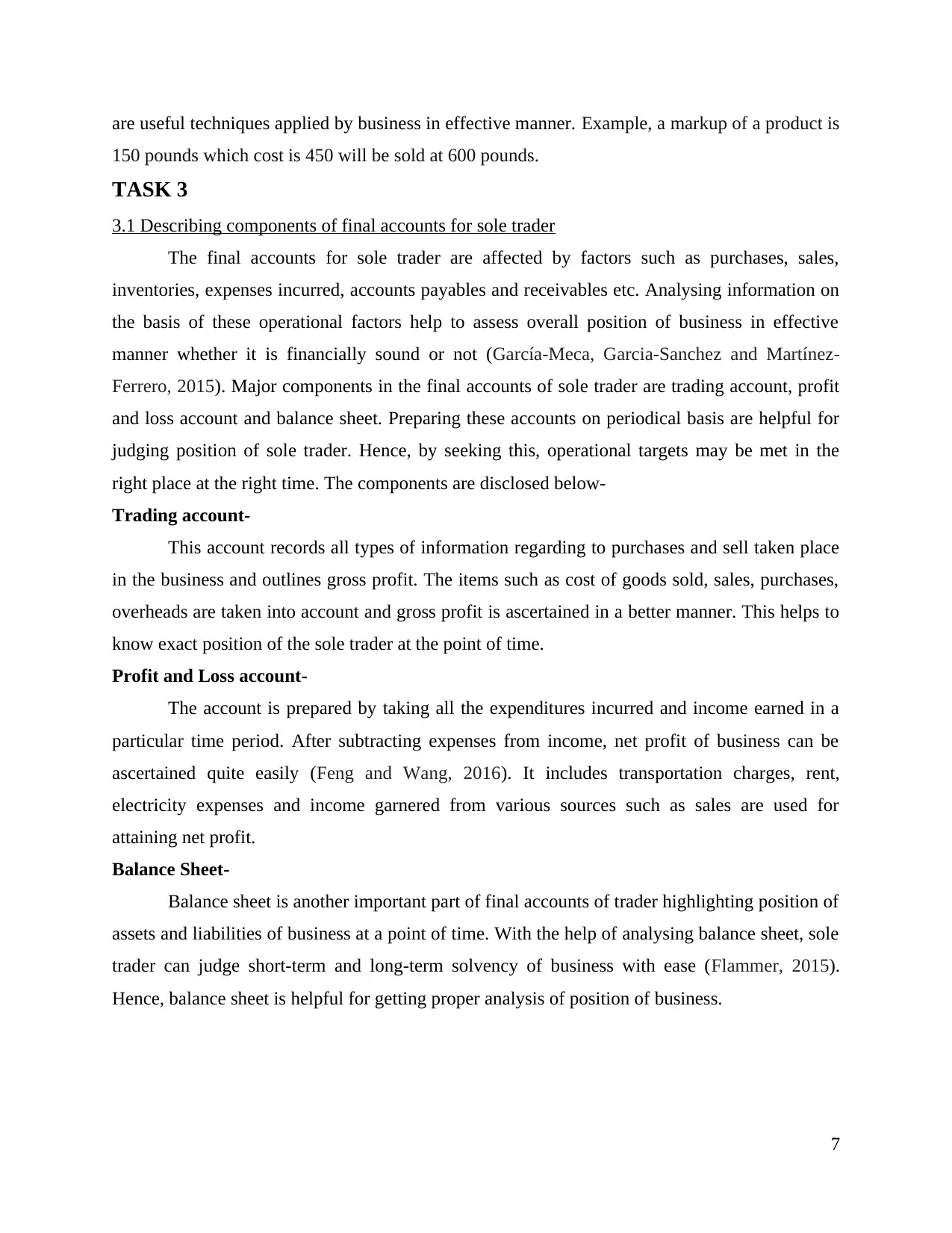

3.1 Describing components of final accounts for sole trader

The final accounts for sole trader are affected by factors such as purchases, sales,

inventories, expenses incurred, accounts payables and receivables etc. Analysing information on

the basis of these operational factors help to assess overall position of business in effective

manner whether it is financially sound or not (García-Meca, Garcia-Sanchez and Martínez-

Ferrero, 2015). Major components in the final accounts of sole trader are trading account, profit

and loss account and balance sheet. Preparing these accounts on periodical basis are helpful for

judging position of sole trader. Hence, by seeking this, operational targets may be met in the

right place at the right time. The components are disclosed below-

Trading account-

This account records all types of information regarding to purchases and sell taken place

in the business and outlines gross profit. The items such as cost of goods sold, sales, purchases,

overheads are taken into account and gross profit is ascertained in a better manner. This helps to

know exact position of the sole trader at the point of time.

Profit and Loss account-

The account is prepared by taking all the expenditures incurred and income earned in a

particular time period. After subtracting expenses from income, net profit of business can be

ascertained quite easily (Feng and Wang, 2016). It includes transportation charges, rent,

electricity expenses and income garnered from various sources such as sales are used for

attaining net profit.

Balance Sheet-

Balance sheet is another important part of final accounts of trader highlighting position of

assets and liabilities of business at a point of time. With the help of analysing balance sheet, sole

trader can judge short-term and long-term solvency of business with ease (Flammer, 2015).

Hence, balance sheet is helpful for getting proper analysis of position of business.

7

150 pounds which cost is 450 will be sold at 600 pounds.

TASK 3

3.1 Describing components of final accounts for sole trader

The final accounts for sole trader are affected by factors such as purchases, sales,

inventories, expenses incurred, accounts payables and receivables etc. Analysing information on

the basis of these operational factors help to assess overall position of business in effective

manner whether it is financially sound or not (García-Meca, Garcia-Sanchez and Martínez-

Ferrero, 2015). Major components in the final accounts of sole trader are trading account, profit

and loss account and balance sheet. Preparing these accounts on periodical basis are helpful for

judging position of sole trader. Hence, by seeking this, operational targets may be met in the

right place at the right time. The components are disclosed below-

Trading account-

This account records all types of information regarding to purchases and sell taken place

in the business and outlines gross profit. The items such as cost of goods sold, sales, purchases,

overheads are taken into account and gross profit is ascertained in a better manner. This helps to

know exact position of the sole trader at the point of time.

Profit and Loss account-

The account is prepared by taking all the expenditures incurred and income earned in a

particular time period. After subtracting expenses from income, net profit of business can be

ascertained quite easily (Feng and Wang, 2016). It includes transportation charges, rent,

electricity expenses and income garnered from various sources such as sales are used for

attaining net profit.

Balance Sheet-

Balance sheet is another important part of final accounts of trader highlighting position of

assets and liabilities of business at a point of time. With the help of analysing balance sheet, sole

trader can judge short-term and long-term solvency of business with ease (Flammer, 2015).

Hence, balance sheet is helpful for getting proper analysis of position of business.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

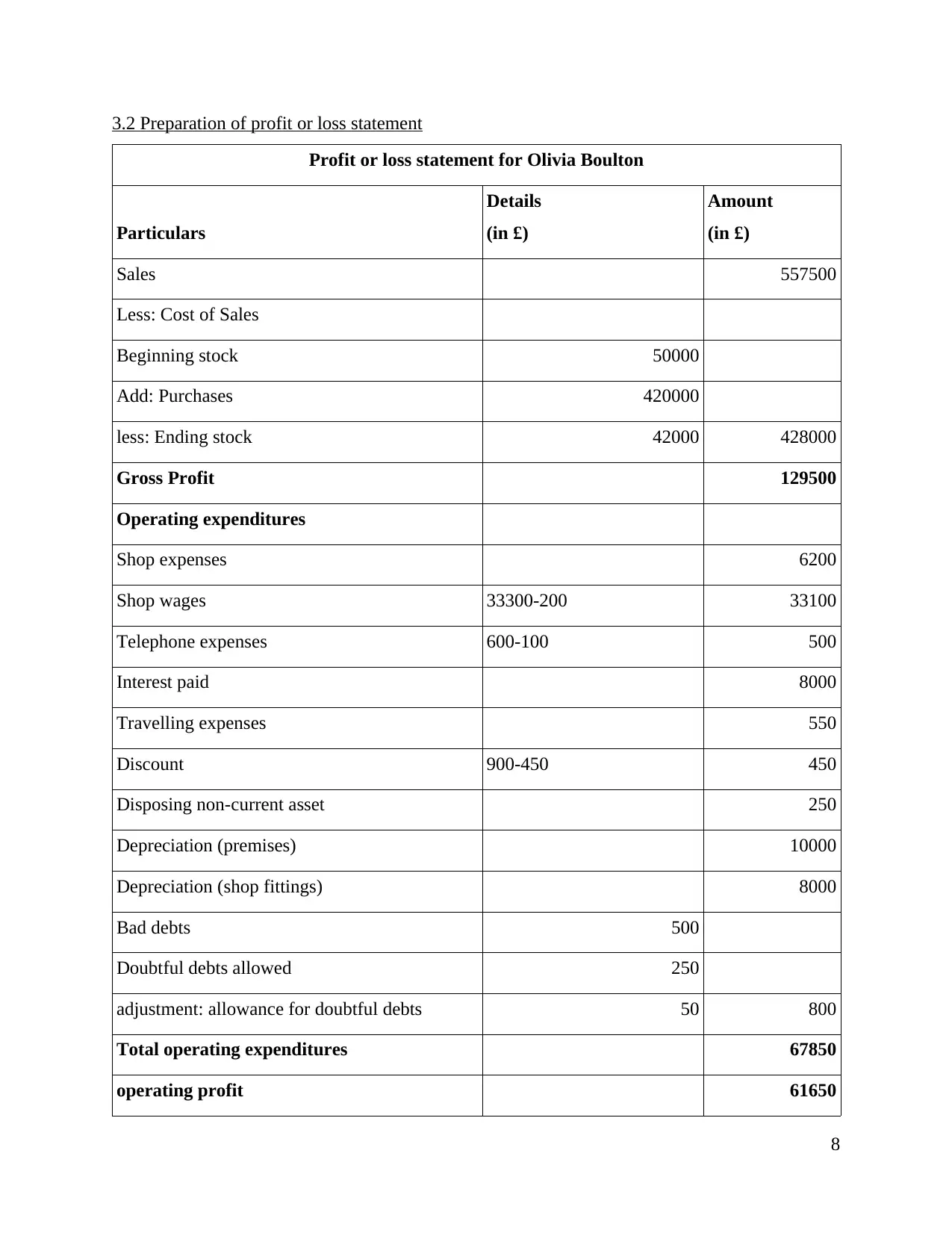

3.2 Preparation of profit or loss statement

Profit or loss statement for Olivia Boulton

Particulars

Details

(in £)

Amount

(in £)

Sales 557500

Less: Cost of Sales

Beginning stock 50000

Add: Purchases 420000

less: Ending stock 42000 428000

Gross Profit 129500

Operating expenditures

Shop expenses 6200

Shop wages 33300-200 33100

Telephone expenses 600-100 500

Interest paid 8000

Travelling expenses 550

Discount 900-450 450

Disposing non-current asset 250

Depreciation (premises) 10000

Depreciation (shop fittings) 8000

Bad debts 500

Doubtful debts allowed 250

adjustment: allowance for doubtful debts 50 800

Total operating expenditures 67850

operating profit 61650

8

Profit or loss statement for Olivia Boulton

Particulars

Details

(in £)

Amount

(in £)

Sales 557500

Less: Cost of Sales

Beginning stock 50000

Add: Purchases 420000

less: Ending stock 42000 428000

Gross Profit 129500

Operating expenditures

Shop expenses 6200

Shop wages 33300-200 33100

Telephone expenses 600-100 500

Interest paid 8000

Travelling expenses 550

Discount 900-450 450

Disposing non-current asset 250

Depreciation (premises) 10000

Depreciation (shop fittings) 8000

Bad debts 500

Doubtful debts allowed 250

adjustment: allowance for doubtful debts 50 800

Total operating expenditures 67850

operating profit 61650

8

Less: VAT 3250

Net profit 58400

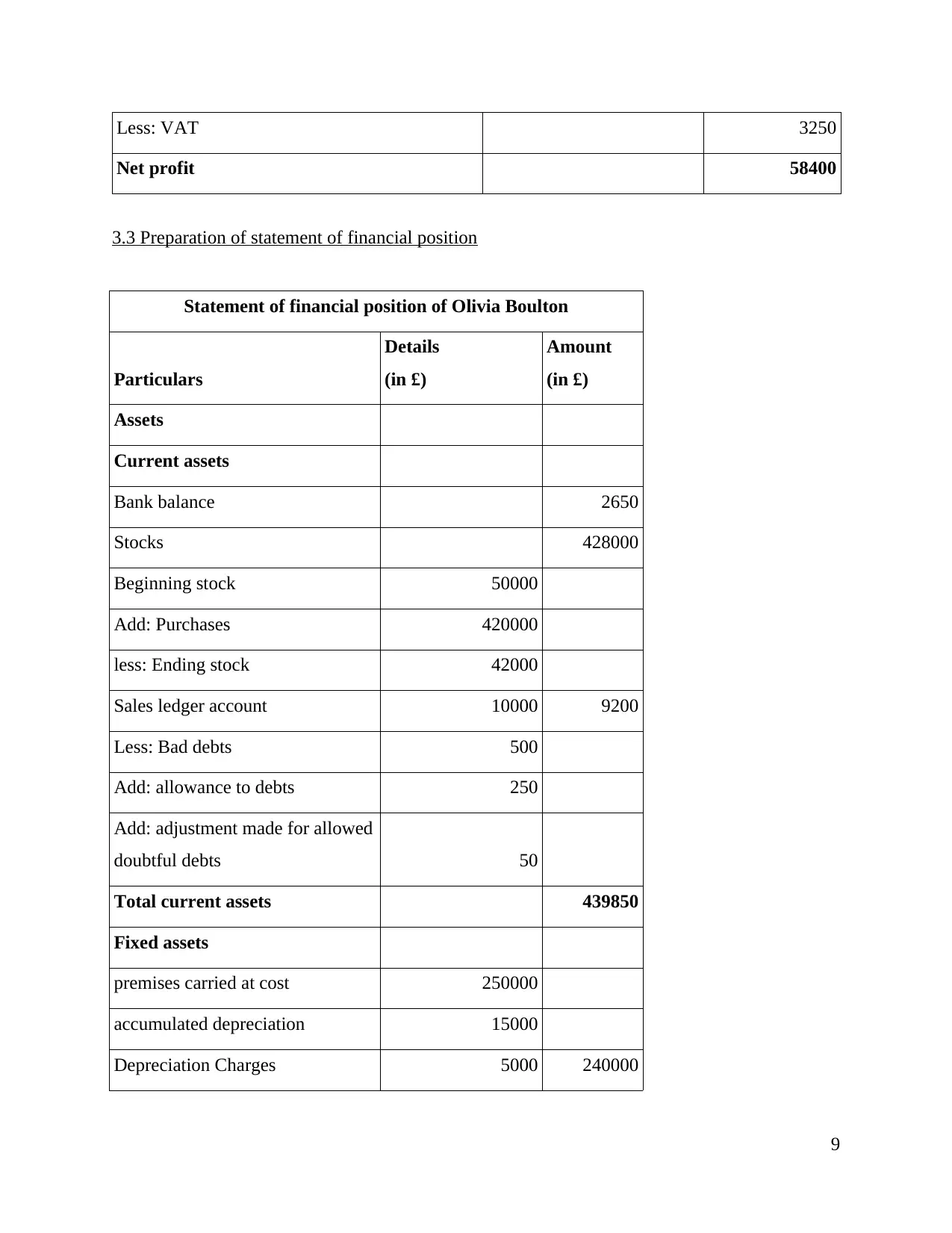

3.3 Preparation of statement of financial position

Statement of financial position of Olivia Boulton

Particulars

Details

(in £)

Amount

(in £)

Assets

Current assets

Bank balance 2650

Stocks 428000

Beginning stock 50000

Add: Purchases 420000

less: Ending stock 42000

Sales ledger account 10000 9200

Less: Bad debts 500

Add: allowance to debts 250

Add: adjustment made for allowed

doubtful debts 50

Total current assets 439850

Fixed assets

premises carried at cost 250000

accumulated depreciation 15000

Depreciation Charges 5000 240000

9

Net profit 58400

3.3 Preparation of statement of financial position

Statement of financial position of Olivia Boulton

Particulars

Details

(in £)

Amount

(in £)

Assets

Current assets

Bank balance 2650

Stocks 428000

Beginning stock 50000

Add: Purchases 420000

less: Ending stock 42000

Sales ledger account 10000 9200

Less: Bad debts 500

Add: allowance to debts 250

Add: adjustment made for allowed

doubtful debts 50

Total current assets 439850

Fixed assets

premises carried at cost 250000

accumulated depreciation 15000

Depreciation Charges 5000 240000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.