Final Accounts Preparation: Sole Traders and Partnerships - Analysis

VerifiedAdded on 2020/10/22

|18

|4469

|364

Report

AI Summary

This report delves into the intricacies of preparing final accounts for sole traders and partnerships. It begins by outlining the reasons for closing accounts and producing a trial balance, as well as the processes and limitations involved. The report then covers the methods of constructing accounts from incomplete records, reasons for imbalances and incomplete records. The core of the report focuses on practical applications, including calculating opening and closing capital and cash/bank balances. It covers sales and purchase ledger control accounts and the use of markups and margins. The report also meticulously details the components of final accounts for a sole trader, including the statement of profit and loss and the statement of financial position. The report extends to partnerships, outlining key components of partnership agreements and accounts, including profit and loss appropriation accounts, partner capital and current accounts. Finally, it addresses the calculation of closing balances on partner accounts and the preparation of the statement of financial position in compliance with the partnership agreement.

PREPARE FINAL

ACCOUNTS FOR SOLE

TRADERS AND

PARTNERSHIPS

ACCOUNTS FOR SOLE

TRADERS AND

PARTNERSHIPS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Reasons for closing off accounts and producing a trial balance .....................................1

1.2 The process and limitations of preparing a set of final accounts from a trial balance ....1

1.3 The methods of constructing accounts from incomplete records.....................................2

1.4 Reasons for imbalances resulting from incorrect double entries......................................3

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies with in

the data provided ...................................................................................................................3

TASK 2............................................................................................................................................4

2.1 Calculate opening and closing capital .............................................................................4

2.2 Calculate the opening and closing cash/bank account balance .......................................5

2.3 Sales and purchase ledger control accounts ....................................................................5

2.4 Account balances using mark ups and margins ...............................................................6

TASK 3............................................................................................................................................6

3.1 The components of a set of final accounts for a sole trader ............................................6

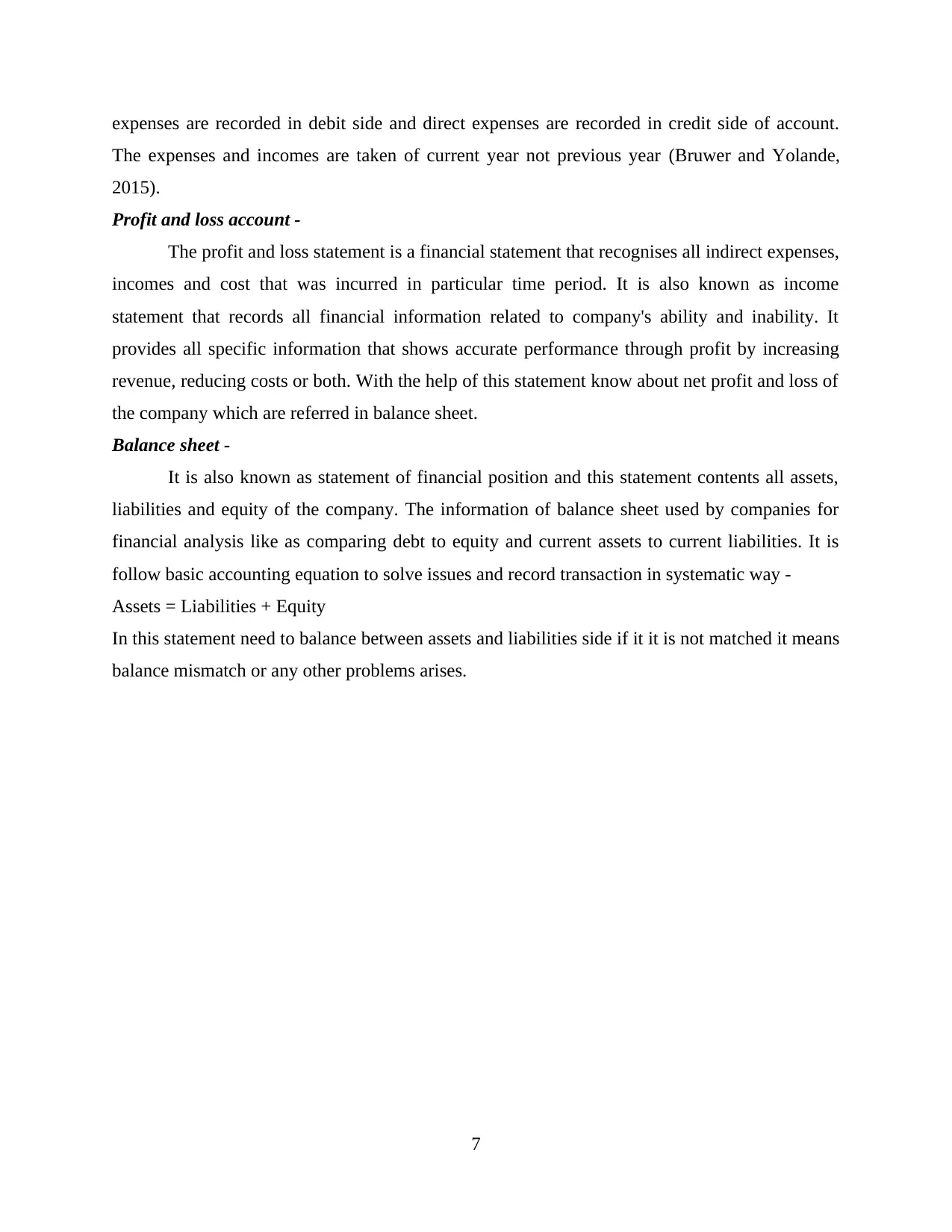

3.2 Statement of profit and loss for a sole trader....................................................................8

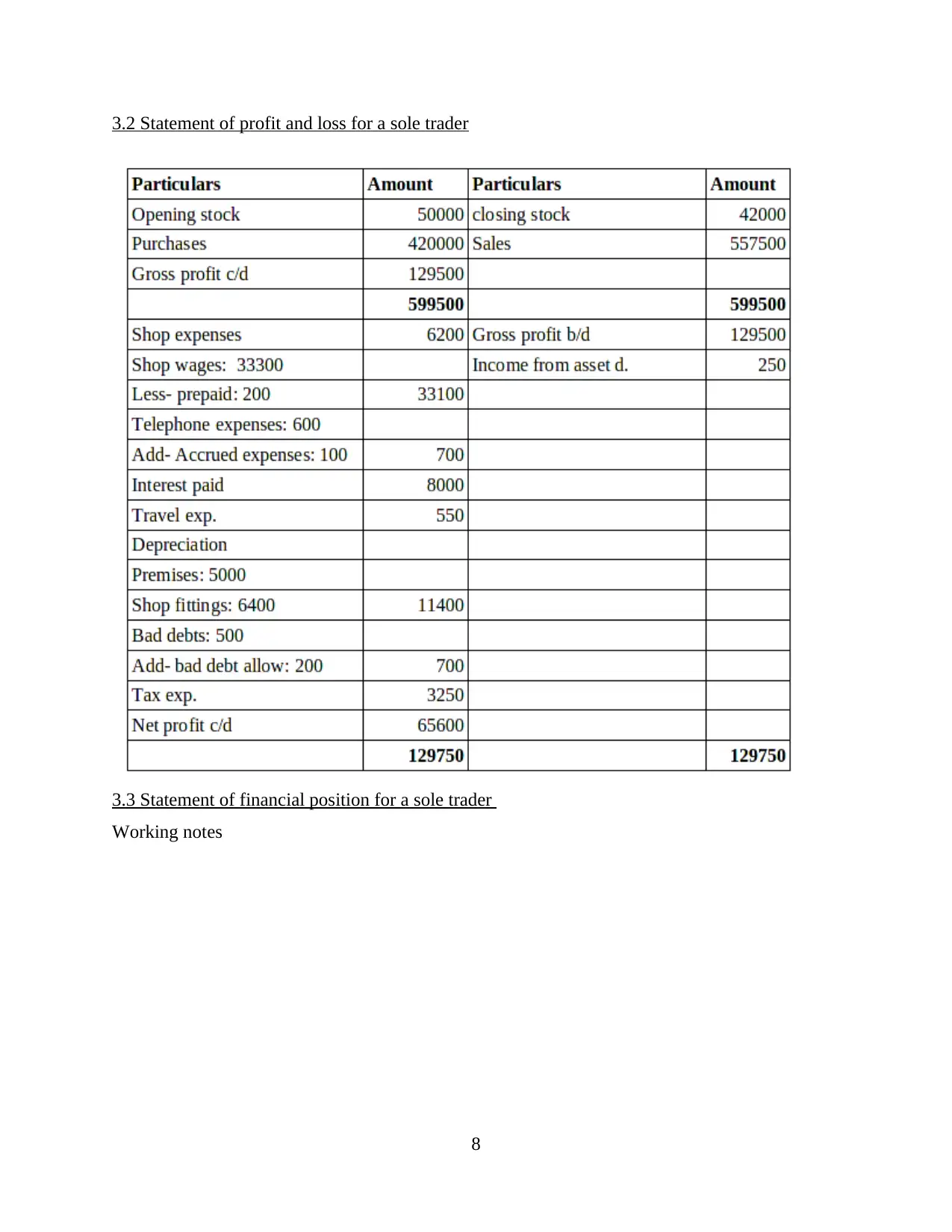

3.3 Statement of financial position for a sole trader ..............................................................8

TASK 4............................................................................................................................................9

4.1 The key components of a partnership agreement ............................................................9

4.2 Key components of partnership accounts ......................................................................10

TASK 5..........................................................................................................................................11

5.1 Statement of profit and loss appropriation account for a partnership ...........................11

5.2 Accurately determine the allocation of profit to partners after allowing for interest on

capital, interest on drawings and salary paid to partners......................................................13

5.3 Prepare the capital and current accounts of each partner...............................................13

TASK 6..........................................................................................................................................14

6.1 Calculate the closing balances on each partners' capital and current accounts, including

drawings...............................................................................................................................14

6.2 Statement of financial position, in compliance with the partnership agreement ...........15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Reasons for closing off accounts and producing a trial balance .....................................1

1.2 The process and limitations of preparing a set of final accounts from a trial balance ....1

1.3 The methods of constructing accounts from incomplete records.....................................2

1.4 Reasons for imbalances resulting from incorrect double entries......................................3

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies with in

the data provided ...................................................................................................................3

TASK 2............................................................................................................................................4

2.1 Calculate opening and closing capital .............................................................................4

2.2 Calculate the opening and closing cash/bank account balance .......................................5

2.3 Sales and purchase ledger control accounts ....................................................................5

2.4 Account balances using mark ups and margins ...............................................................6

TASK 3............................................................................................................................................6

3.1 The components of a set of final accounts for a sole trader ............................................6

3.2 Statement of profit and loss for a sole trader....................................................................8

3.3 Statement of financial position for a sole trader ..............................................................8

TASK 4............................................................................................................................................9

4.1 The key components of a partnership agreement ............................................................9

4.2 Key components of partnership accounts ......................................................................10

TASK 5..........................................................................................................................................11

5.1 Statement of profit and loss appropriation account for a partnership ...........................11

5.2 Accurately determine the allocation of profit to partners after allowing for interest on

capital, interest on drawings and salary paid to partners......................................................13

5.3 Prepare the capital and current accounts of each partner...............................................13

TASK 6..........................................................................................................................................14

6.1 Calculate the closing balances on each partners' capital and current accounts, including

drawings...............................................................................................................................14

6.2 Statement of financial position, in compliance with the partnership agreement ...........15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

REFERENCES..............................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Final accounts are the accounts, which are prepared by every organisation at the end of a

financial year. It provides actual position of an organisation and helps to manager for effective

decision making (Singhvi and BODHANWALA, 2018). Final accounts prepare by sole traders

and partnership whether net profit and loss own by owner in sole traders and in partnership it

will divide according to their proportion. It is important to prepare by business entities because it

provides all financial information to owners and related parties of business. In final account

includes trading account, profit and loss account and balance sheet. In partnership also prepare

P&L appropriation account to know profit share of each partner. This report focused on need and

process of final accounts, calculate opening and closing capital/cash/bank balance. Preparation of

sales and purchase ledger control accounts, statement of profit and loss, statement of financial

position is also discussed in this report. Along with identification of key components of a

partnership agreement and partner's capital accounts, partners' current accounts profit and loss

appropriation account for partnership to determine interest on capital, salary paid to partners and

interest on drawings also discussed in this report.

TASK 1

1.1 Reasons for closing off accounts and producing a trial balance

The reason for the closing off accounts is to ensure that each revenue and expenses

account will begin the next accounting year with a zero balance. It is important to complete the

accounting cycle for the current time period. It will help to determine of each transactions are

recorded in journal books and posting in ledger or not. After that it is important to produce a trial

balance to show all closing balance for determine every transactions (Arora, 2016). In trial

balance debit side amount match with credit side amount to shows each and every transaction are

recorded in final accounts. With the help of trial balance know about differences of each

accounts compare to previous year.

1.2 The process and limitations of preparing a set of final accounts from a trial balance

There is particular process to prepare final accounts from trial balance and it is followed

by every organisation. The final accounts are part of internal report of company that provides

actual information and performance of business. There is mention following process of

generating final accounts from trial balance -

1

Final accounts are the accounts, which are prepared by every organisation at the end of a

financial year. It provides actual position of an organisation and helps to manager for effective

decision making (Singhvi and BODHANWALA, 2018). Final accounts prepare by sole traders

and partnership whether net profit and loss own by owner in sole traders and in partnership it

will divide according to their proportion. It is important to prepare by business entities because it

provides all financial information to owners and related parties of business. In final account

includes trading account, profit and loss account and balance sheet. In partnership also prepare

P&L appropriation account to know profit share of each partner. This report focused on need and

process of final accounts, calculate opening and closing capital/cash/bank balance. Preparation of

sales and purchase ledger control accounts, statement of profit and loss, statement of financial

position is also discussed in this report. Along with identification of key components of a

partnership agreement and partner's capital accounts, partners' current accounts profit and loss

appropriation account for partnership to determine interest on capital, salary paid to partners and

interest on drawings also discussed in this report.

TASK 1

1.1 Reasons for closing off accounts and producing a trial balance

The reason for the closing off accounts is to ensure that each revenue and expenses

account will begin the next accounting year with a zero balance. It is important to complete the

accounting cycle for the current time period. It will help to determine of each transactions are

recorded in journal books and posting in ledger or not. After that it is important to produce a trial

balance to show all closing balance for determine every transactions (Arora, 2016). In trial

balance debit side amount match with credit side amount to shows each and every transaction are

recorded in final accounts. With the help of trial balance know about differences of each

accounts compare to previous year.

1.2 The process and limitations of preparing a set of final accounts from a trial balance

There is particular process to prepare final accounts from trial balance and it is followed

by every organisation. The final accounts are part of internal report of company that provides

actual information and performance of business. There is mention following process of

generating final accounts from trial balance -

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Process of producing final accounts -

There is firstly determine all items of trial balance and adjusted information.

After that all items are divided to related account according to their nature like opening

stock, wages in trading account, in P & L account all direct expenses and incomes. In

balance sheet all assets and liabilities of during the year.

From assets and liabilities less provision and depreciation to relative item.

At the end of final account calculate profit and loss of the company and estimate their

performance for future growth. There is also match total balance from their additional

information to reduce mistake (Collis, Holt and Hussey, 2017).

Limitations of trial balance -

Posting the entry in correct side but to a wrong account – When prepare final

accounts from trial balance so there is mistake to amount of rent account shows in cash

account.

Accounting principle not properly following – While preparing of trial balance many

accountants are not following all principles of accounting and mistakes happen.

Trial balance is not assessed all transaction in proper way and not able to find out errors.

1.3 The methods of constructing accounts from incomplete records

Many times all the records are not available from clients and not able to get everything,

the accounts still need to be complete. There is following three methods for preparing final

accounts from incomplete records -

The accounting equation -

When the client is unable to provide value of capital but company have all details about

the assets and liabilities so there is a technique applying accounting equation method. It is used

to work out the value of capital (Blair and Marcum, 2015). The formula is – Assets – Liabilities

= Capital

Control accounts –

It is prepared when the balances are missing and transactions are not recorded in proper

way. In control accounts including sales control account, purchase control account, bank control

account with the all detail. The account is not working to search missing information, it is shows

balancing figure as missing balance.

2

There is firstly determine all items of trial balance and adjusted information.

After that all items are divided to related account according to their nature like opening

stock, wages in trading account, in P & L account all direct expenses and incomes. In

balance sheet all assets and liabilities of during the year.

From assets and liabilities less provision and depreciation to relative item.

At the end of final account calculate profit and loss of the company and estimate their

performance for future growth. There is also match total balance from their additional

information to reduce mistake (Collis, Holt and Hussey, 2017).

Limitations of trial balance -

Posting the entry in correct side but to a wrong account – When prepare final

accounts from trial balance so there is mistake to amount of rent account shows in cash

account.

Accounting principle not properly following – While preparing of trial balance many

accountants are not following all principles of accounting and mistakes happen.

Trial balance is not assessed all transaction in proper way and not able to find out errors.

1.3 The methods of constructing accounts from incomplete records

Many times all the records are not available from clients and not able to get everything,

the accounts still need to be complete. There is following three methods for preparing final

accounts from incomplete records -

The accounting equation -

When the client is unable to provide value of capital but company have all details about

the assets and liabilities so there is a technique applying accounting equation method. It is used

to work out the value of capital (Blair and Marcum, 2015). The formula is – Assets – Liabilities

= Capital

Control accounts –

It is prepared when the balances are missing and transactions are not recorded in proper

way. In control accounts including sales control account, purchase control account, bank control

account with the all detail. The account is not working to search missing information, it is shows

balancing figure as missing balance.

2

Mark up or margin method –

When company have sales figure but they wants to amount of costs of goods sold so there

is applied mark up and margin method.

These methods are helping to work with incomplete accounts however they are not right

but for completing accounts there is using all of the correct information. With the help of

available information complete all accounts and complete accounting terms.

1.4 Reasons for imbalances resulting from incorrect double entries

The unadjusted trial balance have many errors and few errors are identified easily in the

format of trial balance. There are mentioned many reasons for imbalances, they are as follows -

Entries made twice – When the entries are made twice time and it is affected to balance

so there is need to find out transaction to resolve itself.

Entries to the wrong account – When prepare of individuals account that time record

amount in wrong head. It creates issue of imbalance (Chhabra and Pattanayak, 2014).

Reversed entries – An entry are recording wrongly debit side but recorded in credit side

as well as recording in credit side but recorded in debit side. It is shows in trial balance if the

amount is large and affected to accounts in highest way.

Unbalanced entries – When the entries are in balanced way but system are not recorded

as balanced way so that time create imbalance situation.

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies with in the

data provided

Every small business owner wants to maintain accounting records in accurate and

completing way. But sometimes records are not completed by company that can arise problems

during planning for future years. There are described many reasons that are occurred in

accounting records, they are as follows -

Unintentional failure to record

Many times in the companies incomplete records are occurred when employees forgot to

maintain records and not add in the book of accounts. In small business all departments are

handled all problems by owner. When a particular person responsible for all of the transactions

so get misplaced and hard to believe on employee.

Data loss

3

When company have sales figure but they wants to amount of costs of goods sold so there

is applied mark up and margin method.

These methods are helping to work with incomplete accounts however they are not right

but for completing accounts there is using all of the correct information. With the help of

available information complete all accounts and complete accounting terms.

1.4 Reasons for imbalances resulting from incorrect double entries

The unadjusted trial balance have many errors and few errors are identified easily in the

format of trial balance. There are mentioned many reasons for imbalances, they are as follows -

Entries made twice – When the entries are made twice time and it is affected to balance

so there is need to find out transaction to resolve itself.

Entries to the wrong account – When prepare of individuals account that time record

amount in wrong head. It creates issue of imbalance (Chhabra and Pattanayak, 2014).

Reversed entries – An entry are recording wrongly debit side but recorded in credit side

as well as recording in credit side but recorded in debit side. It is shows in trial balance if the

amount is large and affected to accounts in highest way.

Unbalanced entries – When the entries are in balanced way but system are not recorded

as balanced way so that time create imbalance situation.

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies with in the

data provided

Every small business owner wants to maintain accounting records in accurate and

completing way. But sometimes records are not completed by company that can arise problems

during planning for future years. There are described many reasons that are occurred in

accounting records, they are as follows -

Unintentional failure to record

Many times in the companies incomplete records are occurred when employees forgot to

maintain records and not add in the book of accounts. In small business all departments are

handled all problems by owner. When a particular person responsible for all of the transactions

so get misplaced and hard to believe on employee.

Data loss

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In present time mostly companies are move to paperless accounting records and

transactions are recorded in computer. It is help to prevent data loss and create frequent and

redundant backups from accounting data (Raj, Walters and Rashid, 2017).

Employee turn over

In the company employees are left and they are intentionally kept records with them. It is

a big issue that are happened in multiple companies. On the time company have not other source

to generate to information so it will create difficulty on auditing time. Many times these records

are used by competitors to achieve competitive advantage.

Intentional Manipulation

It is a big reason for incomplete records because employees are trying to fraud and steal

record of accounting. It is affected to image of company and on the time of preparation final

accounts issues are created.

TASK 2

2.1 Calculate opening and closing capital

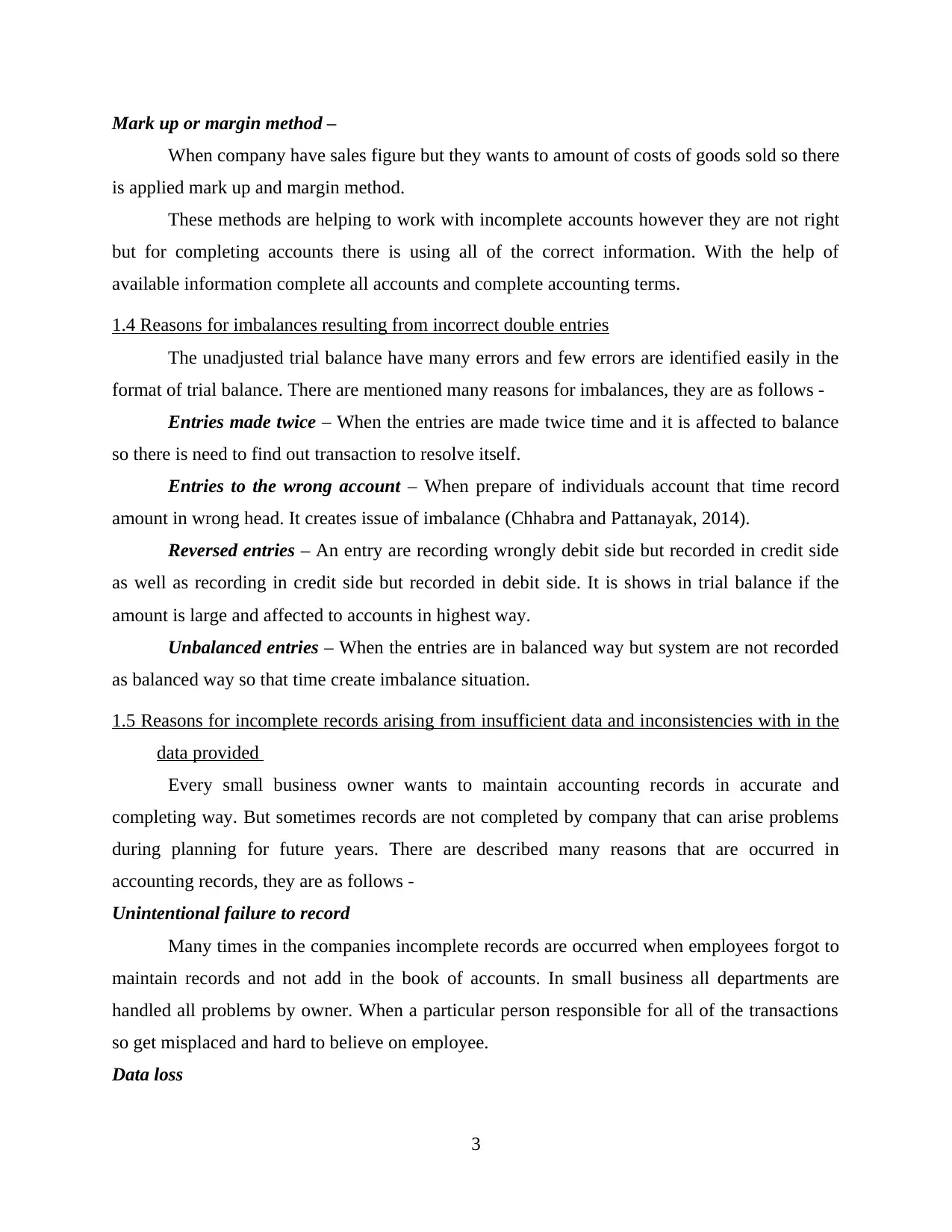

(a) Calculate closing capital of ABC Ltd for the year -

Opening capital - £1000

Net profit of the company - £2600

Drawings - £600

Capital account

Details £ Details £

To Drawings a/c 600 By Balance b/d 1000

To Closing balance 3000 By Net profit a/c 2600

3600 3600

(b) Calculate closing capital for the year -

Closing capital - £4200

Net profit - £360

Drawings - £800

Capital account

4

transactions are recorded in computer. It is help to prevent data loss and create frequent and

redundant backups from accounting data (Raj, Walters and Rashid, 2017).

Employee turn over

In the company employees are left and they are intentionally kept records with them. It is

a big issue that are happened in multiple companies. On the time company have not other source

to generate to information so it will create difficulty on auditing time. Many times these records

are used by competitors to achieve competitive advantage.

Intentional Manipulation

It is a big reason for incomplete records because employees are trying to fraud and steal

record of accounting. It is affected to image of company and on the time of preparation final

accounts issues are created.

TASK 2

2.1 Calculate opening and closing capital

(a) Calculate closing capital of ABC Ltd for the year -

Opening capital - £1000

Net profit of the company - £2600

Drawings - £600

Capital account

Details £ Details £

To Drawings a/c 600 By Balance b/d 1000

To Closing balance 3000 By Net profit a/c 2600

3600 3600

(b) Calculate closing capital for the year -

Closing capital - £4200

Net profit - £360

Drawings - £800

Capital account

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Details £ Details £

To Drawings a/c 800 By Balance b/d (b/f) 4640

To Closing balance 4200 By Net profit a/c 360

5000 5000

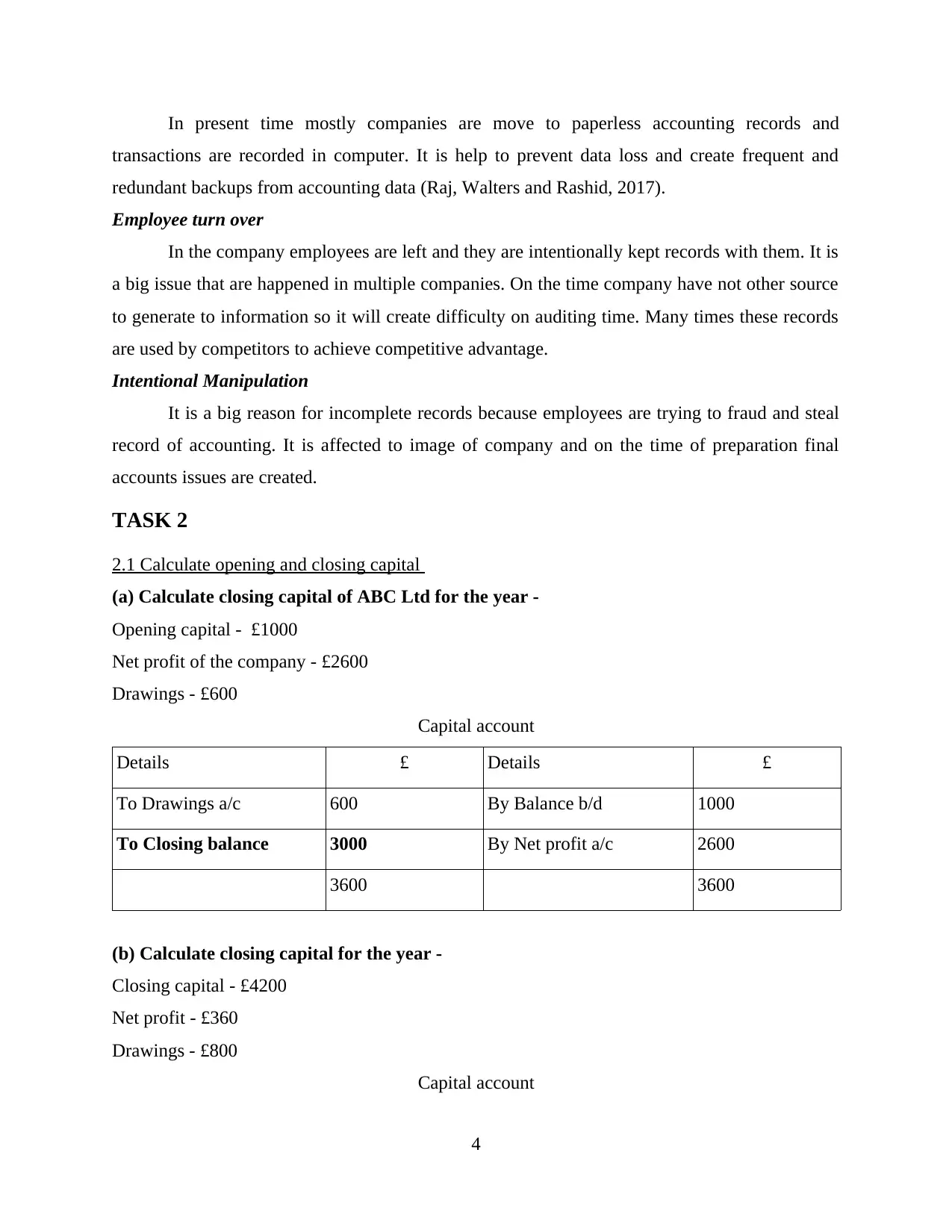

2.2 Calculate the opening and closing cash/bank account balance

Date Particular Cash Bank Date Particular Cash Bank

01/09

/19

To Op balance

b/d

10940 06/09/

19

By Rent a/c 135

02/09

/19

To M. Boom 315 07/09/

19

By Cash a/c C 50

04/09

/19

To Sales a/c 802 23/09/

19

By S. Wills 277

07/09

/19

To bank a/c C 50 29/09/

19

By Drawings a/c C 120

15/09

/19

To Sales a/c 490 30/09/

19

By Wages a/c 518

29/09

/19

To bank a/c C 120 30/09/

19

By Balance c/d 319 11298

Total 972 11745 Total 972 11745

01/10

/19

To Opening

Bal.

319 11298

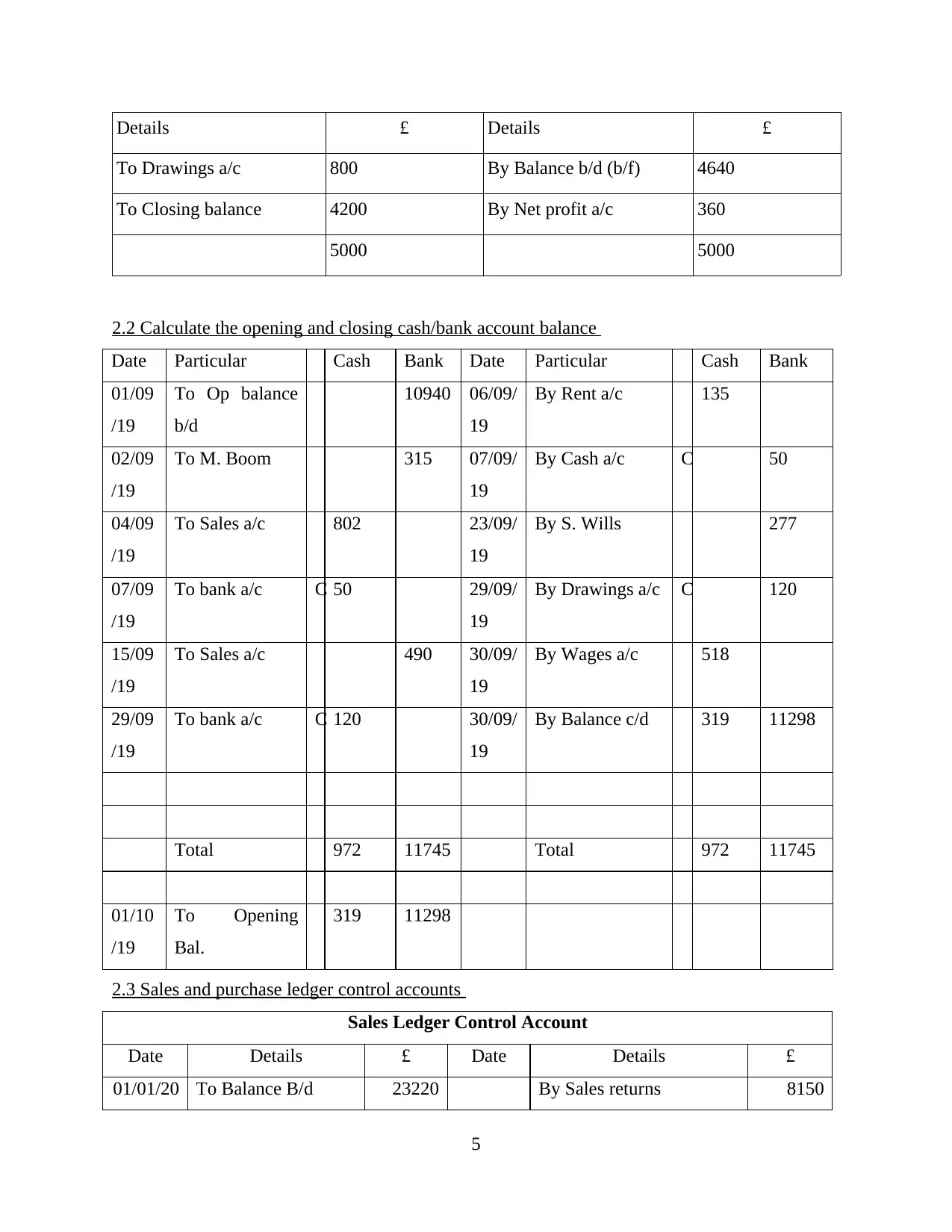

2.3 Sales and purchase ledger control accounts

Sales Ledger Control Account

Date Details £ Date Details £

01/01/20 To Balance B/d 23220 By Sales returns 8150

5

To Drawings a/c 800 By Balance b/d (b/f) 4640

To Closing balance 4200 By Net profit a/c 360

5000 5000

2.2 Calculate the opening and closing cash/bank account balance

Date Particular Cash Bank Date Particular Cash Bank

01/09

/19

To Op balance

b/d

10940 06/09/

19

By Rent a/c 135

02/09

/19

To M. Boom 315 07/09/

19

By Cash a/c C 50

04/09

/19

To Sales a/c 802 23/09/

19

By S. Wills 277

07/09

/19

To bank a/c C 50 29/09/

19

By Drawings a/c C 120

15/09

/19

To Sales a/c 490 30/09/

19

By Wages a/c 518

29/09

/19

To bank a/c C 120 30/09/

19

By Balance c/d 319 11298

Total 972 11745 Total 972 11745

01/10

/19

To Opening

Bal.

319 11298

2.3 Sales and purchase ledger control accounts

Sales Ledger Control Account

Date Details £ Date Details £

01/01/20 To Balance B/d 23220 By Sales returns 8150

5

To Credit Sales

(SDB)

162540 By Cash received from

customers

146610

By Bad Debts 4770

By Discounts allowed 3160

By Balance c/d 23070

185760 185760

Purchases Ledger Control Account

Date Details £ Date Details £

To Paid to Suppliers 109040 01/01/2

0

By Balance B/d 16400

To Purchases returns 2330 By Credit purchases 114800

To Discount

received

1310

To Balance C/d 18520

131200 131200

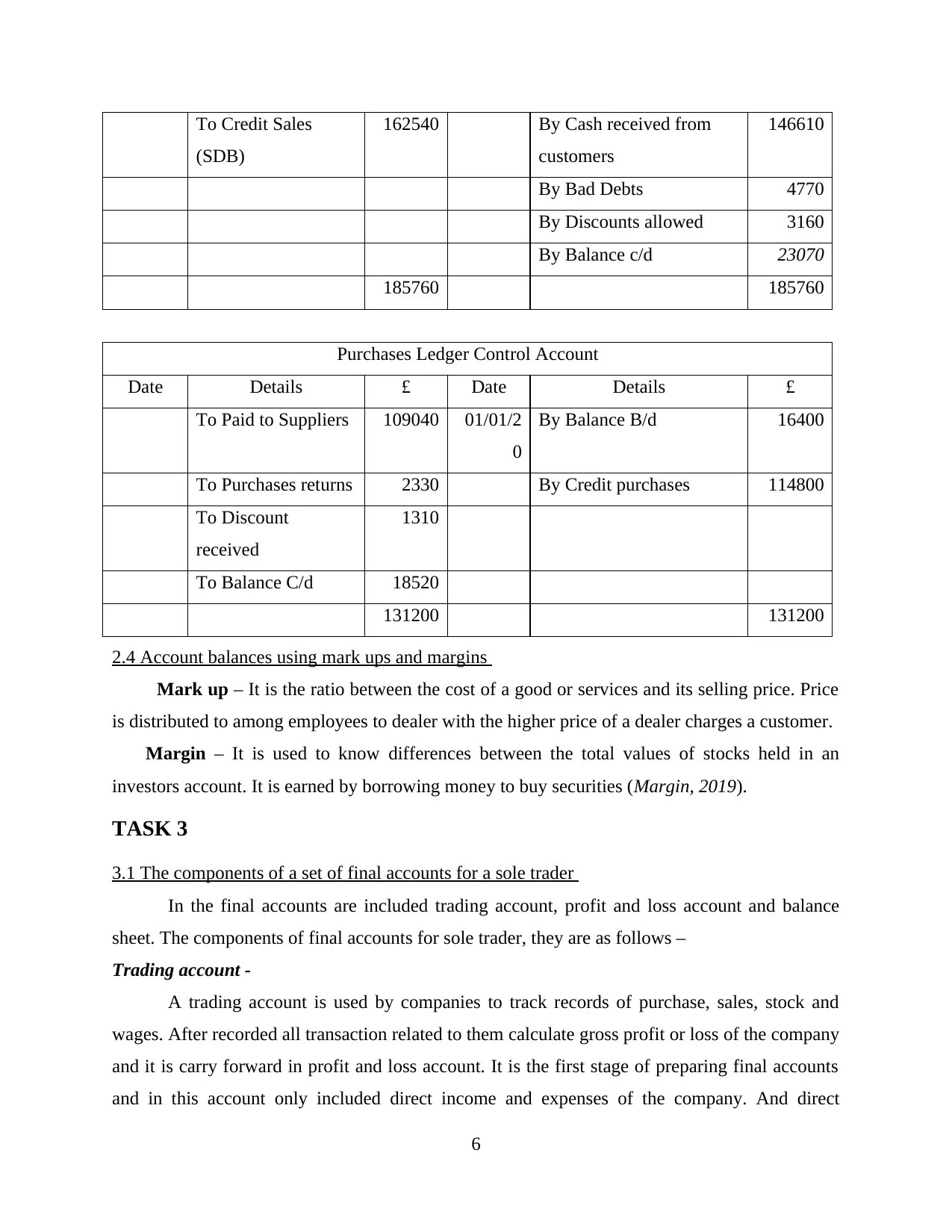

2.4 Account balances using mark ups and margins

Mark up – It is the ratio between the cost of a good or services and its selling price. Price

is distributed to among employees to dealer with the higher price of a dealer charges a customer.

Margin – It is used to know differences between the total values of stocks held in an

investors account. It is earned by borrowing money to buy securities (Margin, 2019).

TASK 3

3.1 The components of a set of final accounts for a sole trader

In the final accounts are included trading account, profit and loss account and balance

sheet. The components of final accounts for sole trader, they are as follows –

Trading account -

A trading account is used by companies to track records of purchase, sales, stock and

wages. After recorded all transaction related to them calculate gross profit or loss of the company

and it is carry forward in profit and loss account. It is the first stage of preparing final accounts

and in this account only included direct income and expenses of the company. And direct

6

(SDB)

162540 By Cash received from

customers

146610

By Bad Debts 4770

By Discounts allowed 3160

By Balance c/d 23070

185760 185760

Purchases Ledger Control Account

Date Details £ Date Details £

To Paid to Suppliers 109040 01/01/2

0

By Balance B/d 16400

To Purchases returns 2330 By Credit purchases 114800

To Discount

received

1310

To Balance C/d 18520

131200 131200

2.4 Account balances using mark ups and margins

Mark up – It is the ratio between the cost of a good or services and its selling price. Price

is distributed to among employees to dealer with the higher price of a dealer charges a customer.

Margin – It is used to know differences between the total values of stocks held in an

investors account. It is earned by borrowing money to buy securities (Margin, 2019).

TASK 3

3.1 The components of a set of final accounts for a sole trader

In the final accounts are included trading account, profit and loss account and balance

sheet. The components of final accounts for sole trader, they are as follows –

Trading account -

A trading account is used by companies to track records of purchase, sales, stock and

wages. After recorded all transaction related to them calculate gross profit or loss of the company

and it is carry forward in profit and loss account. It is the first stage of preparing final accounts

and in this account only included direct income and expenses of the company. And direct

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

expenses are recorded in debit side and direct expenses are recorded in credit side of account.

The expenses and incomes are taken of current year not previous year (Bruwer and Yolande,

2015).

Profit and loss account -

The profit and loss statement is a financial statement that recognises all indirect expenses,

incomes and cost that was incurred in particular time period. It is also known as income

statement that records all financial information related to company's ability and inability. It

provides all specific information that shows accurate performance through profit by increasing

revenue, reducing costs or both. With the help of this statement know about net profit and loss of

the company which are referred in balance sheet.

Balance sheet -

It is also known as statement of financial position and this statement contents all assets,

liabilities and equity of the company. The information of balance sheet used by companies for

financial analysis like as comparing debt to equity and current assets to current liabilities. It is

follow basic accounting equation to solve issues and record transaction in systematic way -

Assets = Liabilities + Equity

In this statement need to balance between assets and liabilities side if it it is not matched it means

balance mismatch or any other problems arises.

7

The expenses and incomes are taken of current year not previous year (Bruwer and Yolande,

2015).

Profit and loss account -

The profit and loss statement is a financial statement that recognises all indirect expenses,

incomes and cost that was incurred in particular time period. It is also known as income

statement that records all financial information related to company's ability and inability. It

provides all specific information that shows accurate performance through profit by increasing

revenue, reducing costs or both. With the help of this statement know about net profit and loss of

the company which are referred in balance sheet.

Balance sheet -

It is also known as statement of financial position and this statement contents all assets,

liabilities and equity of the company. The information of balance sheet used by companies for

financial analysis like as comparing debt to equity and current assets to current liabilities. It is

follow basic accounting equation to solve issues and record transaction in systematic way -

Assets = Liabilities + Equity

In this statement need to balance between assets and liabilities side if it it is not matched it means

balance mismatch or any other problems arises.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3.2 Statement of profit and loss for a sole trader

3.3 Statement of financial position for a sole trader

Working notes

8

3.3 Statement of financial position for a sole trader

Working notes

8

TASK 4

4.1 The key components of a partnership agreement

Partnership agreement offer legal protection to their partners after forming a business

partnership. Without agreement there is chances to arises conflicts and disputes between among

partners so it is important for partnership. The partnership agreement describes about role and

responsibilities of each partner and their profit sharing ratio. There are key components of

Partnership agreements -

Percentage of ownership -

There is mention of record how much each partner is contributing for partnership and

their contribution decided ownership. There is decided ownership according to contribution, if a

partner contribute 40% in the fir and another partners contribute 20% so there is power or

authority have those partner who contribute 40%. there is not any particular formula to decide

percentage of an ownership (Hoyle and Whitehead, 2014).

Allocation of profit and losses -

9

4.1 The key components of a partnership agreement

Partnership agreement offer legal protection to their partners after forming a business

partnership. Without agreement there is chances to arises conflicts and disputes between among

partners so it is important for partnership. The partnership agreement describes about role and

responsibilities of each partner and their profit sharing ratio. There are key components of

Partnership agreements -

Percentage of ownership -

There is mention of record how much each partner is contributing for partnership and

their contribution decided ownership. There is decided ownership according to contribution, if a

partner contribute 40% in the fir and another partners contribute 20% so there is power or

authority have those partner who contribute 40%. there is not any particular formula to decide

percentage of an ownership (Hoyle and Whitehead, 2014).

Allocation of profit and losses -

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.