Analyzing Final Accounts of Sole Traders and Partnerships: A Project

VerifiedAdded on 2020/10/23

|20

|4300

|131

Project

AI Summary

This project report delves into the intricacies of preparing final accounts for sole traders and partnerships. It begins by explaining the reasons for closing accounts and generating a trial balance, along with the processes and limitations of creating final accounts. The report then explores methods for constructing accounts from incomplete records, addressing imbalances caused by incorrect double entries and incomplete records due to insufficient data. Task 2 focuses on calculating closing and opening capital, cash/bank balances, preparing sales and purchase ledger control accounts, and using markups and margins. Task 3 describes the components of final accounts for a sole trader, including the statement of profit and loss and the statement of financial position. Task 4 covers the key components of a partnership agreement and partnership accounts. Task 5 details the preparation of a profit and loss appropriation account, profit allocation to partners, and capital and current accounts. Finally, Task 6 calculates closing balances and prepares the statement of financial position. The report concludes with a comprehensive overview of the processes and considerations involved in financial accounting for both sole traders and partnerships.

Prepare Final Accounts

of Sole Traders and

Partnership

of Sole Traders and

Partnership

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Reasons for closing off accounts and producing a trial balance...........................................1

1.2 Process and limitations of preparing a set of final accounts.................................................2

1.3 Methods of constructing accounts from incomplete records................................................2

1.4 Reasons for imbalances resulting from incorrect double entries..........................................3

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies.............4

TASK 2............................................................................................................................................4

2.1 Calculation of closing and opening capital using incomplete information...........................4

2.2 Calculation of opening and closing cash/ bank account balance..........................................5

2.3 Preparation of sales and purchase ledger control accounts...................................................6

2.4 Calculation of account balances using mark ups and margins..............................................7

TASK 3............................................................................................................................................7

3.1 Description of components of a set of final accounts for a sole trader.................................7

3.2 Formulation of statement of profit and loss..........................................................................8

3.3 Formulation of statement of financial position.....................................................................9

TASK 4..........................................................................................................................................11

4.1Description of key components of a partnership agreement................................................11

4.2 Description of key components of partnership accounts....................................................12

TASK 5..........................................................................................................................................12

5.1 Preparation of statement of profit and loss appropriation account.....................................12

5.2 Determination of allocation of profits to parters.................................................................14

5.3 Preparation of capital and current accounts for each partner..............................................14

TASK 6..........................................................................................................................................15

6.1 Calculation of closing balances on each partner's capital and current accounts.................15

6.2 Preparation of statement of financial position....................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Reasons for closing off accounts and producing a trial balance...........................................1

1.2 Process and limitations of preparing a set of final accounts.................................................2

1.3 Methods of constructing accounts from incomplete records................................................2

1.4 Reasons for imbalances resulting from incorrect double entries..........................................3

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies.............4

TASK 2............................................................................................................................................4

2.1 Calculation of closing and opening capital using incomplete information...........................4

2.2 Calculation of opening and closing cash/ bank account balance..........................................5

2.3 Preparation of sales and purchase ledger control accounts...................................................6

2.4 Calculation of account balances using mark ups and margins..............................................7

TASK 3............................................................................................................................................7

3.1 Description of components of a set of final accounts for a sole trader.................................7

3.2 Formulation of statement of profit and loss..........................................................................8

3.3 Formulation of statement of financial position.....................................................................9

TASK 4..........................................................................................................................................11

4.1Description of key components of a partnership agreement................................................11

4.2 Description of key components of partnership accounts....................................................12

TASK 5..........................................................................................................................................12

5.1 Preparation of statement of profit and loss appropriation account.....................................12

5.2 Determination of allocation of profits to parters.................................................................14

5.3 Preparation of capital and current accounts for each partner..............................................14

TASK 6..........................................................................................................................................15

6.1 Calculation of closing balances on each partner's capital and current accounts.................15

6.2 Preparation of statement of financial position....................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Final accounts are formulated by all the business entities whether it is sole trader,

corporate organisation or partnership firm as it can guide to analyse actual position and situation

of the company. It is very important for all the enterprises to follow set guidelines of regulatory

authorities of the country so that financial statements can be formulated in a set format. There are

various types of accounts that are created by firms (Whiteley, 2017). These are trading, profit

and loss, P & L appropriation, partner's capital and current account, balance sheet etc. In sole

traders all the profits are acquired by the owner and in firms these are distributed to the partners

in a predetermined ratio. In this project report various topics are discussed such as needs and

process of preparation of final accounts, formulation of accounting records with the help of

incomplete information and preparation of final accounts for sole traders. Legislative and

accounting requirements for partnership, formulation of P & L appropriation account and

statement of financial position are also covered in this assignment.

TASK 1

1.1 Reasons for closing off accounts and producing a trial balance

In all the business entities various ledger accounts such as income, expenses, sales,

purchase, assets, liabilities are closed every year and then trial balance is generated. There are

various reasons for closing off all of them are as follows:

All of them are closed because balance of temporary account is transferred to permanent

as they are generated for a specific financial period.

Another reasons behind closing off is to determine that firm is generating profits or losses

for a specific time period (Storey and et.al., 2016).

Trial balance is produced to analyse that all the transactions are recorded accurately or

not.

While formulating trial balance all the mathematical errors are detected that are made

during the preparation of ledger and journals.

Accountants may analyse the mistakes that are made by them previously in ledger

accounts with the help of this statement.

1

Final accounts are formulated by all the business entities whether it is sole trader,

corporate organisation or partnership firm as it can guide to analyse actual position and situation

of the company. It is very important for all the enterprises to follow set guidelines of regulatory

authorities of the country so that financial statements can be formulated in a set format. There are

various types of accounts that are created by firms (Whiteley, 2017). These are trading, profit

and loss, P & L appropriation, partner's capital and current account, balance sheet etc. In sole

traders all the profits are acquired by the owner and in firms these are distributed to the partners

in a predetermined ratio. In this project report various topics are discussed such as needs and

process of preparation of final accounts, formulation of accounting records with the help of

incomplete information and preparation of final accounts for sole traders. Legislative and

accounting requirements for partnership, formulation of P & L appropriation account and

statement of financial position are also covered in this assignment.

TASK 1

1.1 Reasons for closing off accounts and producing a trial balance

In all the business entities various ledger accounts such as income, expenses, sales,

purchase, assets, liabilities are closed every year and then trial balance is generated. There are

various reasons for closing off all of them are as follows:

All of them are closed because balance of temporary account is transferred to permanent

as they are generated for a specific financial period.

Another reasons behind closing off is to determine that firm is generating profits or losses

for a specific time period (Storey and et.al., 2016).

Trial balance is produced to analyse that all the transactions are recorded accurately or

not.

While formulating trial balance all the mathematical errors are detected that are made

during the preparation of ledger and journals.

Accountants may analyse the mistakes that are made by them previously in ledger

accounts with the help of this statement.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.2 Process and limitations of preparing a set of final accounts

Trial balance is a statement in which closing balance of all ledger accounts is recorded.

Process and limitation of formulating it are as follows:

Process of generating final accounts:

Firstly all the figures of trial balance and other information are analysed by the

accountants..

Then items according to their nature are recorded in trading and Profit & loss account are

recorded. If there is any adjustments related to the transactions then these are considered

to calculate adjusted amount. In case of partnership firm profits are distributed to partners

and then their current and capital account are generated.

Assess and liabilities are recorded in balance sheet and any type of provisions,

depreciation are deducted from them

At last profits or losses are calculated and transferred to the balance sheet. It is also

analysed that both the column have same balance or not. If it does not match then it

means mistakes are made during the formulation process of final accounts (Russell-Jones,

2014).

Limitations of Trial balance:

Trial balance is not able to analyse all types of errors such as a transaction in which

wrong amount is recorded in both the related accounts. It may create issues while

formulation of final accounts as accurate amount cannot be recorded in the profit or loss

account.

In trial balance only errors can be determined it is not possible to assess their reasons

from this statement it will result in inappropriate final accounts as they are generated on

the basis of information which is recorded in it.

The mistakes that are made by not following the right accounting principles. When these

are not considered then final accounts are not considered accurate (Trial balance and its

limitations, 2014).

1.3 Methods of constructing accounts from incomplete records

In business entities different types of methods are used to construct accounts from

incomplete records available to the accountants. All of them are described below:

2

Trial balance is a statement in which closing balance of all ledger accounts is recorded.

Process and limitation of formulating it are as follows:

Process of generating final accounts:

Firstly all the figures of trial balance and other information are analysed by the

accountants..

Then items according to their nature are recorded in trading and Profit & loss account are

recorded. If there is any adjustments related to the transactions then these are considered

to calculate adjusted amount. In case of partnership firm profits are distributed to partners

and then their current and capital account are generated.

Assess and liabilities are recorded in balance sheet and any type of provisions,

depreciation are deducted from them

At last profits or losses are calculated and transferred to the balance sheet. It is also

analysed that both the column have same balance or not. If it does not match then it

means mistakes are made during the formulation process of final accounts (Russell-Jones,

2014).

Limitations of Trial balance:

Trial balance is not able to analyse all types of errors such as a transaction in which

wrong amount is recorded in both the related accounts. It may create issues while

formulation of final accounts as accurate amount cannot be recorded in the profit or loss

account.

In trial balance only errors can be determined it is not possible to assess their reasons

from this statement it will result in inappropriate final accounts as they are generated on

the basis of information which is recorded in it.

The mistakes that are made by not following the right accounting principles. When these

are not considered then final accounts are not considered accurate (Trial balance and its

limitations, 2014).

1.3 Methods of constructing accounts from incomplete records

In business entities different types of methods are used to construct accounts from

incomplete records available to the accountants. All of them are described below:

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Control accounts: Such type of accounts are created in general ledger in order to analyse

detailed information of subsidiary ledger. The actual and appropriate balance of incomes,

expenses, assets and liabilities are recorded in them that can be transferred to financial

statements. These are mainly formulated to record data of account receivables and payables as

large number of transactions are recorded in them.

Markup and margin method: Accountants use this method to gather missing

information with the help of margin percentage. When amount of sales and this proportion is

available then cost of goods sold can be analysed.

The accounting equation: This method is used by the accounts when there is value of

capital is missing. All the external liabilities can be subtracted from total assets then actual

amount of capital can be analysed. For this purpose an accounting equation is followed which is:

Total assets= external liabilities+ internal liabilities (Capital and reserves)

1.4 Reasons for imbalances resulting from incorrect double entries

Incorrect double entries cause imbalances in trial balance which is because of

organisation may have not followed the appropriate accounting principles or other reasons. All

these causes are as follows:

Main reasons behind the imbalance is that amount of one transaction is recorded in single

account and not sowed in other related account. For example, rent of 5000 is paid in cash

but by mistake it is recorded in bank account. It may result in imbalance of bank account.

If a transaction is wrongly posted in other account which is not related then it will create

imbalance in two accounts. For example, furniture is purchased and its amount is posted

in land account.

When an entry is made more than one then it will also create variances in trial balance.

For example, if cash received from debtors is recorded twice in cash and debtor account

then it will result in imbalance of the statement.

All the above described reasons results in variance in the total of closing balance of trial

balance and also create issues in the preparation of final accounts (Bull, 2014).

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies

When accountants of firm does not have sufficient data to formulate trial balance and

final accounts then it results in incomplete records (Reasons for incomplete records, 2018).

There are various reasons behind this, that are described below in detail:

3

detailed information of subsidiary ledger. The actual and appropriate balance of incomes,

expenses, assets and liabilities are recorded in them that can be transferred to financial

statements. These are mainly formulated to record data of account receivables and payables as

large number of transactions are recorded in them.

Markup and margin method: Accountants use this method to gather missing

information with the help of margin percentage. When amount of sales and this proportion is

available then cost of goods sold can be analysed.

The accounting equation: This method is used by the accounts when there is value of

capital is missing. All the external liabilities can be subtracted from total assets then actual

amount of capital can be analysed. For this purpose an accounting equation is followed which is:

Total assets= external liabilities+ internal liabilities (Capital and reserves)

1.4 Reasons for imbalances resulting from incorrect double entries

Incorrect double entries cause imbalances in trial balance which is because of

organisation may have not followed the appropriate accounting principles or other reasons. All

these causes are as follows:

Main reasons behind the imbalance is that amount of one transaction is recorded in single

account and not sowed in other related account. For example, rent of 5000 is paid in cash

but by mistake it is recorded in bank account. It may result in imbalance of bank account.

If a transaction is wrongly posted in other account which is not related then it will create

imbalance in two accounts. For example, furniture is purchased and its amount is posted

in land account.

When an entry is made more than one then it will also create variances in trial balance.

For example, if cash received from debtors is recorded twice in cash and debtor account

then it will result in imbalance of the statement.

All the above described reasons results in variance in the total of closing balance of trial

balance and also create issues in the preparation of final accounts (Bull, 2014).

1.5 Reasons for incomplete records arising from insufficient data and inconsistencies

When accountants of firm does not have sufficient data to formulate trial balance and

final accounts then it results in incomplete records (Reasons for incomplete records, 2018).

There are various reasons behind this, that are described below in detail:

3

Unintentional failure to record: Organisation's final accounts become incomplete when

employees or accountants forgot to record transactions. It is done unintentionally hence it

is not possible to punish them but it creates issues for business because of incomplete

records. Another cause of this problem is that sometimes staff members forget to

implement appropriate policies and procedures.

Intentional manipulation: When accountants or other workers of the business entities

trying to make a fraud or steal form the organisation then they make intentional

manipulation in records. Sometimes such type of mistakes also made by owners in order

to pay less tax on wealth.

Data loss: This type of issue take place when the businesses does not have appropriate or

sufficient information for the formulation of final accounts. It take place due to changes

in software as companies are moving toward paperless work and using new and

innovative media to record data. This problem can be resolved by keeping backups of

accounting content on regular basis.

Employee turnover: When employees are terminated or they leave organisation

willingly they inadvertently take records with them. It create issues such as incomplete

records for business entities. It also may result in any legal action against the firm

because there is no proper information of transactions that are made by it in a specific

time period.

All the above described points defines that business enterprises may may have

incomplete records due to insufficient data and inconsistency.

TASK 2

2.1 Calculation of closing and opening capital using incomplete information

Capital account: It is one of the primary components of partnership firm in which

changes in ownership of net assets are recorded. It also depicts contribution of owners in capital

and retained earning of firm. It is a general ledger account in which amounts paid by the

investors are recorded as their contribution in the operational activities. Calculations of closing

and opening balances are as follows:

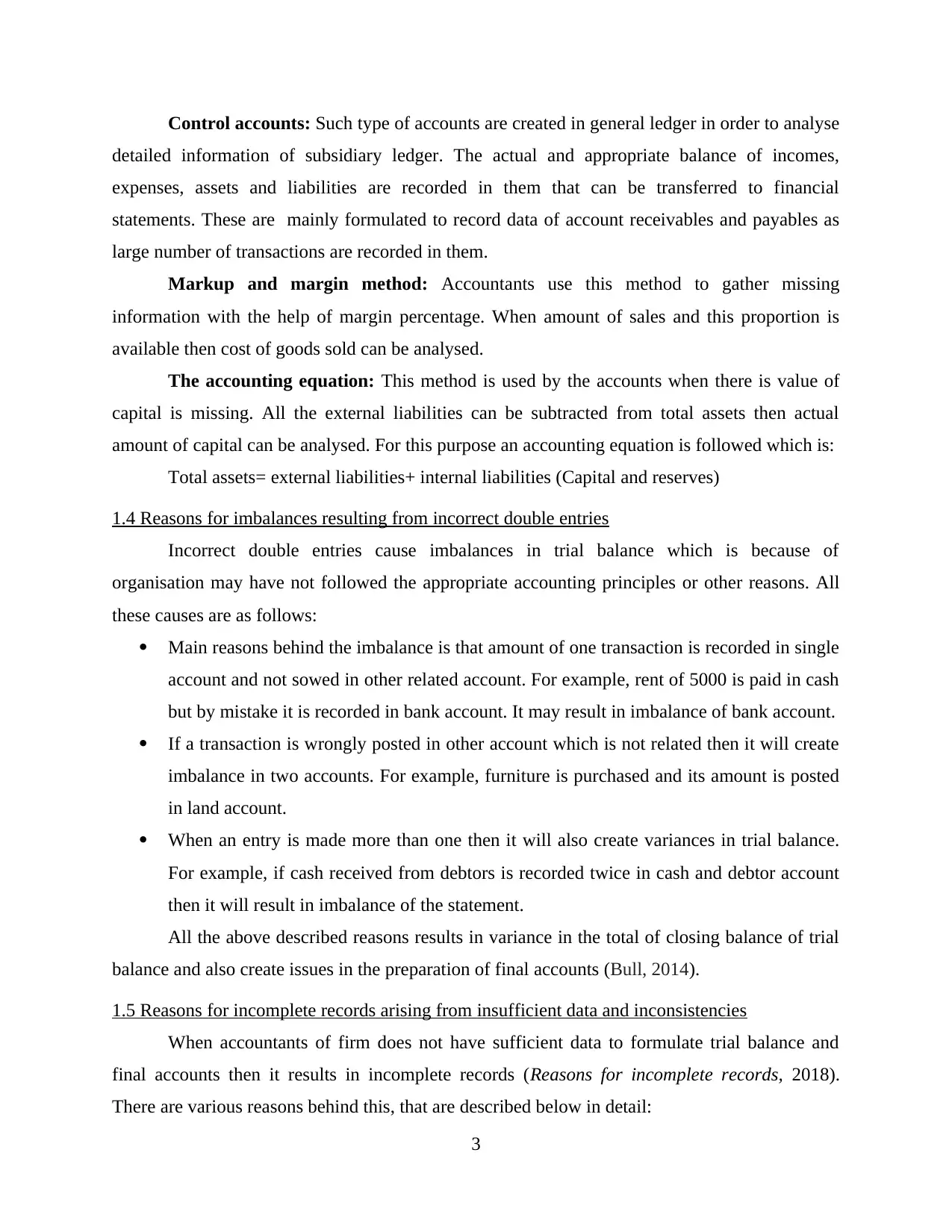

(1). Calculation of closing capital

Capital Account

4

employees or accountants forgot to record transactions. It is done unintentionally hence it

is not possible to punish them but it creates issues for business because of incomplete

records. Another cause of this problem is that sometimes staff members forget to

implement appropriate policies and procedures.

Intentional manipulation: When accountants or other workers of the business entities

trying to make a fraud or steal form the organisation then they make intentional

manipulation in records. Sometimes such type of mistakes also made by owners in order

to pay less tax on wealth.

Data loss: This type of issue take place when the businesses does not have appropriate or

sufficient information for the formulation of final accounts. It take place due to changes

in software as companies are moving toward paperless work and using new and

innovative media to record data. This problem can be resolved by keeping backups of

accounting content on regular basis.

Employee turnover: When employees are terminated or they leave organisation

willingly they inadvertently take records with them. It create issues such as incomplete

records for business entities. It also may result in any legal action against the firm

because there is no proper information of transactions that are made by it in a specific

time period.

All the above described points defines that business enterprises may may have

incomplete records due to insufficient data and inconsistency.

TASK 2

2.1 Calculation of closing and opening capital using incomplete information

Capital account: It is one of the primary components of partnership firm in which

changes in ownership of net assets are recorded. It also depicts contribution of owners in capital

and retained earning of firm. It is a general ledger account in which amounts paid by the

investors are recorded as their contribution in the operational activities. Calculations of closing

and opening balances are as follows:

(1). Calculation of closing capital

Capital Account

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Amount Particulars Amount

To drawings 600 By balance b/d 1000

To balance c/d (b.f.) 3000 By net profits 2600

3600 3600

In the above account closing balance of capital is calculated which is 3000.

(2). Calculation of opening capital

Capital Account

Particulars Amount Particulars Amount

To drawings 800 To balance b/d (b.f.) 4640

To balance c/d 4200 By net profits 360

5000 5000

From the above account opening balance of capital is calculated which is 4640.

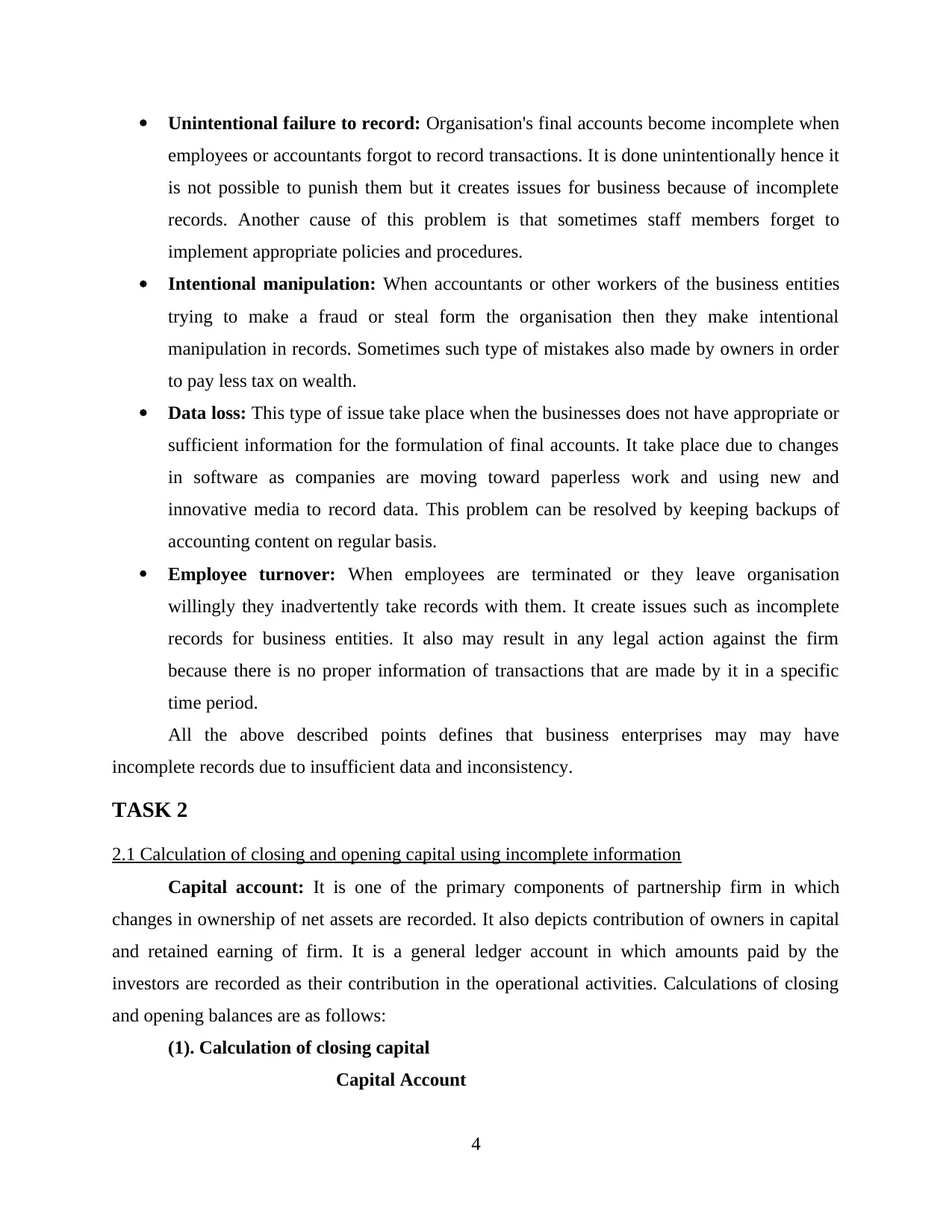

2.2 Calculation of opening and closing cash/ bank account balance

Cash book: It is a book in which cash related transactions are recorded. There are

various types of cash books are generated that are single, double, three column and petty book.

In single column only cash receipts and payments are taped. All the banks and cash related

incomes and expenses are recorded in the double column (Chappell and Dunn, 2015)

There are three separate columns that are cash, bank and discount are created in triple

column cash book. In petty books small and such transactions are recorded that are done on

regular basis.

A double column cash book is generated for the client.

Cash book

Date Particulars

Cash

(£)

Bank

(£) Date Particulars

Cash

(£)

Bank

(£)

01/Sep./19 To capital a/c 10940 06/Sep./19 By Rent a/c 135

02/Sep./19 To M. Boon a/c 315 07/Sep./19 By cash a/c 50

04/Sep./19 To sales a/c 802 23/Sep./19 By S. Wills a/c 277

5

To drawings 600 By balance b/d 1000

To balance c/d (b.f.) 3000 By net profits 2600

3600 3600

In the above account closing balance of capital is calculated which is 3000.

(2). Calculation of opening capital

Capital Account

Particulars Amount Particulars Amount

To drawings 800 To balance b/d (b.f.) 4640

To balance c/d 4200 By net profits 360

5000 5000

From the above account opening balance of capital is calculated which is 4640.

2.2 Calculation of opening and closing cash/ bank account balance

Cash book: It is a book in which cash related transactions are recorded. There are

various types of cash books are generated that are single, double, three column and petty book.

In single column only cash receipts and payments are taped. All the banks and cash related

incomes and expenses are recorded in the double column (Chappell and Dunn, 2015)

There are three separate columns that are cash, bank and discount are created in triple

column cash book. In petty books small and such transactions are recorded that are done on

regular basis.

A double column cash book is generated for the client.

Cash book

Date Particulars

Cash

(£)

Bank

(£) Date Particulars

Cash

(£)

Bank

(£)

01/Sep./19 To capital a/c 10940 06/Sep./19 By Rent a/c 135

02/Sep./19 To M. Boon a/c 315 07/Sep./19 By cash a/c 50

04/Sep./19 To sales a/c 802 23/Sep./19 By S. Wills a/c 277

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

07/Sep./19 To bank a/c 50 29/Sep./18

By Drawings

a/c 120

15/Sep./19 To sales a/c 490 30/Sep./19 By Wages a/c 518

29/Sep./19 To drawings a/c 120 30/Sep./19 By Balance c/d 319 11298

972 11745 972 11745

01/Oct./19 To balance c/d 319 11298

From the above cash book it has been analysed that closing cash and bank balances are

319 and 11298 respectively.

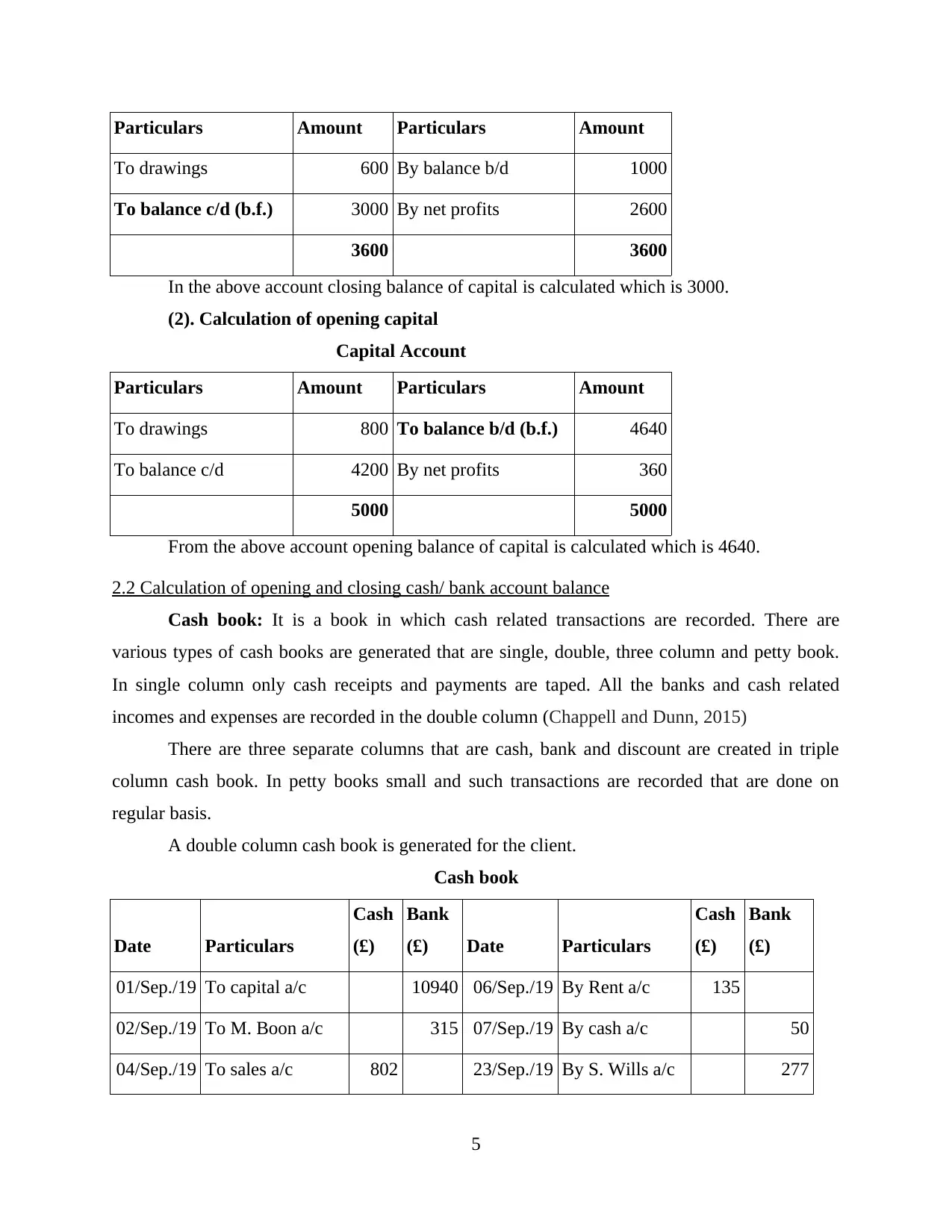

2.3 Preparation of sales and purchase ledger control accounts

Sales ledger control account: It is mainly used to monitor the amounts that are

outstanding by customers of a business entity. It is also called trade debtors control account in

which credit sales, bad debts written off, discount allowed, return inward, etc. transactions are

recorded. It is apart of balance sheet that helps to analyse the closing balance of debtors.

Sales Ledger Control Account

Date Particulars Amount Date Particulars Amount

01/01/20 Balance B/d 23220 31/Dec./20 Discount allowed 3160

31/Dec./20 Credit sales 162540 31/Dec./20 Sales return 8150

31/Dec./20 bad debt written off 4770

31/Dec./20

Received form

debtors 146610

31/Dec./20 Balance c/d (b.f.) 23070

185760 185760

From the above table it has been analysed that closing balance which is going to be

carried in balance sheet is 23070. £370 are subtracted from total receipts from debtors because

these were written off by organisation in previous year.

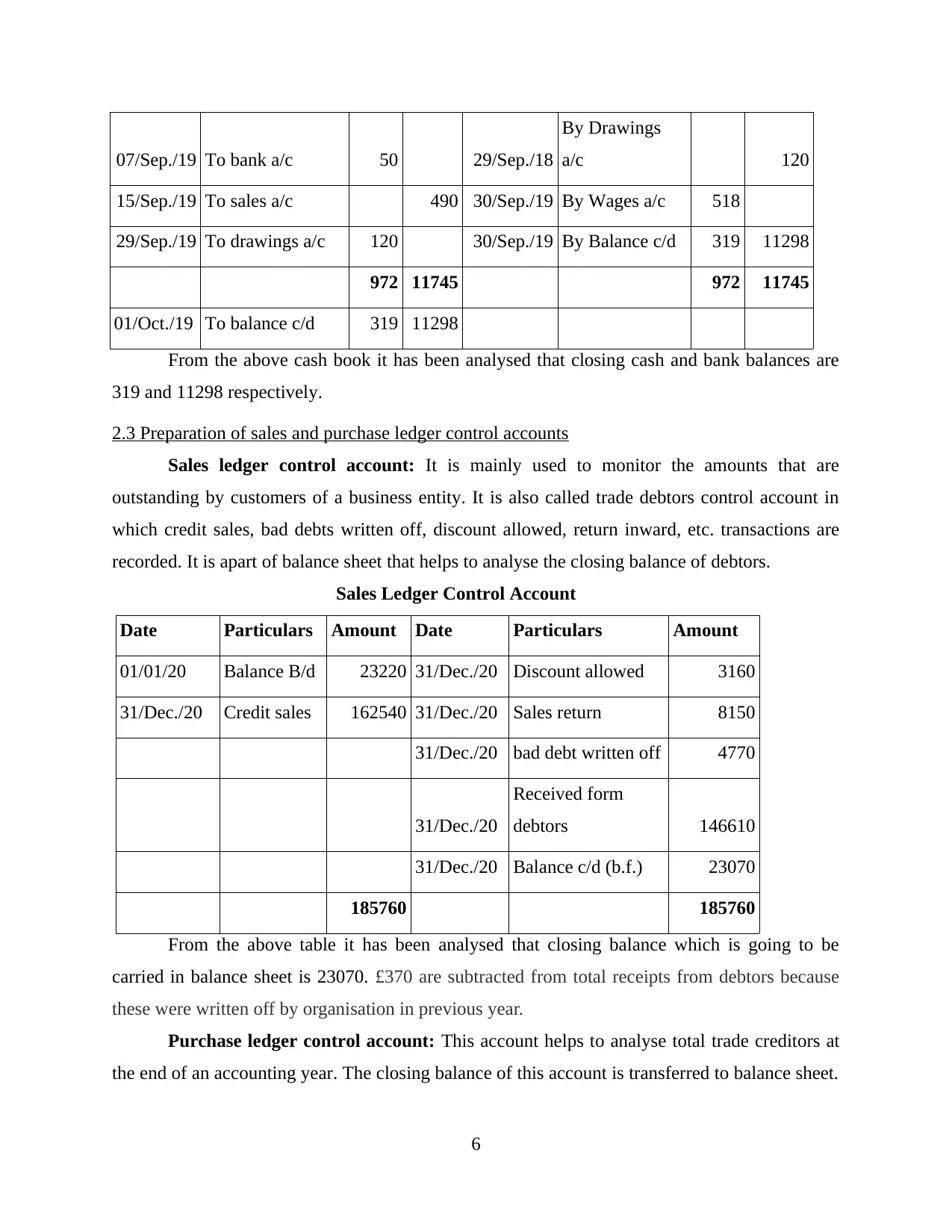

Purchase ledger control account: This account helps to analyse total trade creditors at

the end of an accounting year. The closing balance of this account is transferred to balance sheet.

6

By Drawings

a/c 120

15/Sep./19 To sales a/c 490 30/Sep./19 By Wages a/c 518

29/Sep./19 To drawings a/c 120 30/Sep./19 By Balance c/d 319 11298

972 11745 972 11745

01/Oct./19 To balance c/d 319 11298

From the above cash book it has been analysed that closing cash and bank balances are

319 and 11298 respectively.

2.3 Preparation of sales and purchase ledger control accounts

Sales ledger control account: It is mainly used to monitor the amounts that are

outstanding by customers of a business entity. It is also called trade debtors control account in

which credit sales, bad debts written off, discount allowed, return inward, etc. transactions are

recorded. It is apart of balance sheet that helps to analyse the closing balance of debtors.

Sales Ledger Control Account

Date Particulars Amount Date Particulars Amount

01/01/20 Balance B/d 23220 31/Dec./20 Discount allowed 3160

31/Dec./20 Credit sales 162540 31/Dec./20 Sales return 8150

31/Dec./20 bad debt written off 4770

31/Dec./20

Received form

debtors 146610

31/Dec./20 Balance c/d (b.f.) 23070

185760 185760

From the above table it has been analysed that closing balance which is going to be

carried in balance sheet is 23070. £370 are subtracted from total receipts from debtors because

these were written off by organisation in previous year.

Purchase ledger control account: This account helps to analyse total trade creditors at

the end of an accounting year. The closing balance of this account is transferred to balance sheet.

6

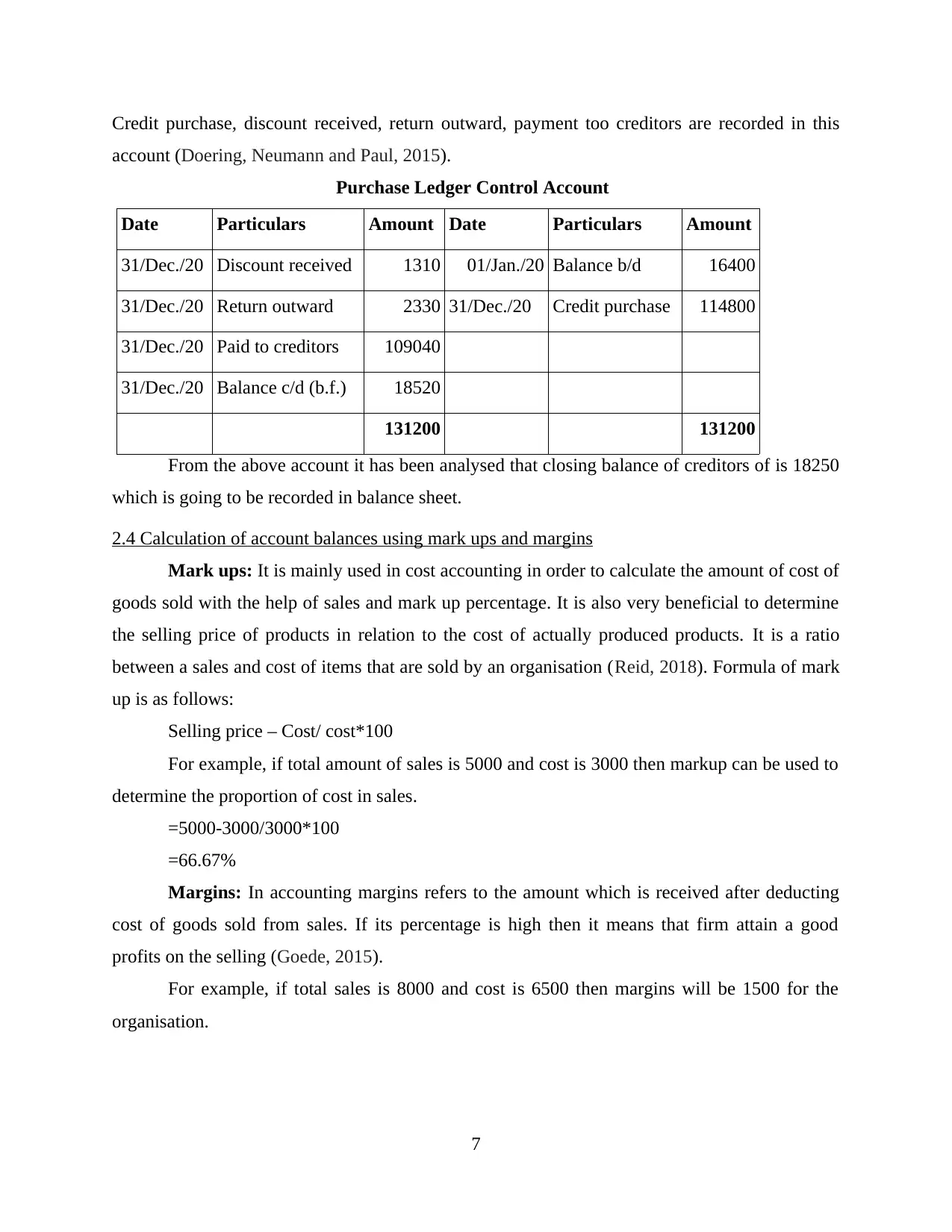

Credit purchase, discount received, return outward, payment too creditors are recorded in this

account (Doering, Neumann and Paul, 2015).

Purchase Ledger Control Account

Date Particulars Amount Date Particulars Amount

31/Dec./20 Discount received 1310 01/Jan./20 Balance b/d 16400

31/Dec./20 Return outward 2330 31/Dec./20 Credit purchase 114800

31/Dec./20 Paid to creditors 109040

31/Dec./20 Balance c/d (b.f.) 18520

131200 131200

From the above account it has been analysed that closing balance of creditors of is 18250

which is going to be recorded in balance sheet.

2.4 Calculation of account balances using mark ups and margins

Mark ups: It is mainly used in cost accounting in order to calculate the amount of cost of

goods sold with the help of sales and mark up percentage. It is also very beneficial to determine

the selling price of products in relation to the cost of actually produced products. It is a ratio

between a sales and cost of items that are sold by an organisation (Reid, 2018). Formula of mark

up is as follows:

Selling price – Cost/ cost*100

For example, if total amount of sales is 5000 and cost is 3000 then markup can be used to

determine the proportion of cost in sales.

=5000-3000/3000*100

=66.67%

Margins: In accounting margins refers to the amount which is received after deducting

cost of goods sold from sales. If its percentage is high then it means that firm attain a good

profits on the selling (Goede, 2015).

For example, if total sales is 8000 and cost is 6500 then margins will be 1500 for the

organisation.

7

account (Doering, Neumann and Paul, 2015).

Purchase Ledger Control Account

Date Particulars Amount Date Particulars Amount

31/Dec./20 Discount received 1310 01/Jan./20 Balance b/d 16400

31/Dec./20 Return outward 2330 31/Dec./20 Credit purchase 114800

31/Dec./20 Paid to creditors 109040

31/Dec./20 Balance c/d (b.f.) 18520

131200 131200

From the above account it has been analysed that closing balance of creditors of is 18250

which is going to be recorded in balance sheet.

2.4 Calculation of account balances using mark ups and margins

Mark ups: It is mainly used in cost accounting in order to calculate the amount of cost of

goods sold with the help of sales and mark up percentage. It is also very beneficial to determine

the selling price of products in relation to the cost of actually produced products. It is a ratio

between a sales and cost of items that are sold by an organisation (Reid, 2018). Formula of mark

up is as follows:

Selling price – Cost/ cost*100

For example, if total amount of sales is 5000 and cost is 3000 then markup can be used to

determine the proportion of cost in sales.

=5000-3000/3000*100

=66.67%

Margins: In accounting margins refers to the amount which is received after deducting

cost of goods sold from sales. If its percentage is high then it means that firm attain a good

profits on the selling (Goede, 2015).

For example, if total sales is 8000 and cost is 6500 then margins will be 1500 for the

organisation.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

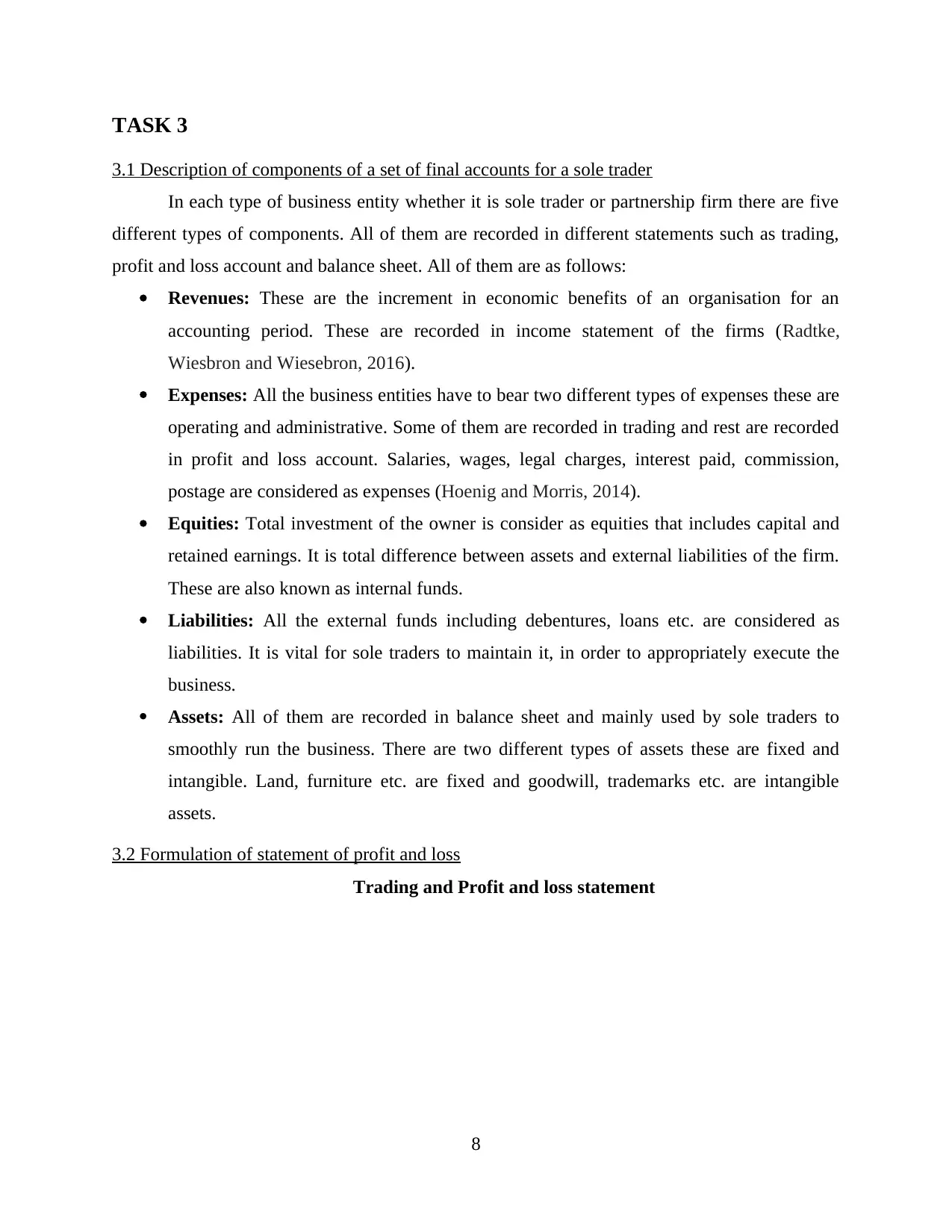

TASK 3

3.1 Description of components of a set of final accounts for a sole trader

In each type of business entity whether it is sole trader or partnership firm there are five

different types of components. All of them are recorded in different statements such as trading,

profit and loss account and balance sheet. All of them are as follows:

Revenues: These are the increment in economic benefits of an organisation for an

accounting period. These are recorded in income statement of the firms (Radtke,

Wiesbron and Wiesebron, 2016).

Expenses: All the business entities have to bear two different types of expenses these are

operating and administrative. Some of them are recorded in trading and rest are recorded

in profit and loss account. Salaries, wages, legal charges, interest paid, commission,

postage are considered as expenses (Hoenig and Morris, 2014).

Equities: Total investment of the owner is consider as equities that includes capital and

retained earnings. It is total difference between assets and external liabilities of the firm.

These are also known as internal funds.

Liabilities: All the external funds including debentures, loans etc. are considered as

liabilities. It is vital for sole traders to maintain it, in order to appropriately execute the

business.

Assets: All of them are recorded in balance sheet and mainly used by sole traders to

smoothly run the business. There are two different types of assets these are fixed and

intangible. Land, furniture etc. are fixed and goodwill, trademarks etc. are intangible

assets.

3.2 Formulation of statement of profit and loss

Trading and Profit and loss statement

8

3.1 Description of components of a set of final accounts for a sole trader

In each type of business entity whether it is sole trader or partnership firm there are five

different types of components. All of them are recorded in different statements such as trading,

profit and loss account and balance sheet. All of them are as follows:

Revenues: These are the increment in economic benefits of an organisation for an

accounting period. These are recorded in income statement of the firms (Radtke,

Wiesbron and Wiesebron, 2016).

Expenses: All the business entities have to bear two different types of expenses these are

operating and administrative. Some of them are recorded in trading and rest are recorded

in profit and loss account. Salaries, wages, legal charges, interest paid, commission,

postage are considered as expenses (Hoenig and Morris, 2014).

Equities: Total investment of the owner is consider as equities that includes capital and

retained earnings. It is total difference between assets and external liabilities of the firm.

These are also known as internal funds.

Liabilities: All the external funds including debentures, loans etc. are considered as

liabilities. It is vital for sole traders to maintain it, in order to appropriately execute the

business.

Assets: All of them are recorded in balance sheet and mainly used by sole traders to

smoothly run the business. There are two different types of assets these are fixed and

intangible. Land, furniture etc. are fixed and goodwill, trademarks etc. are intangible

assets.

3.2 Formulation of statement of profit and loss

Trading and Profit and loss statement

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

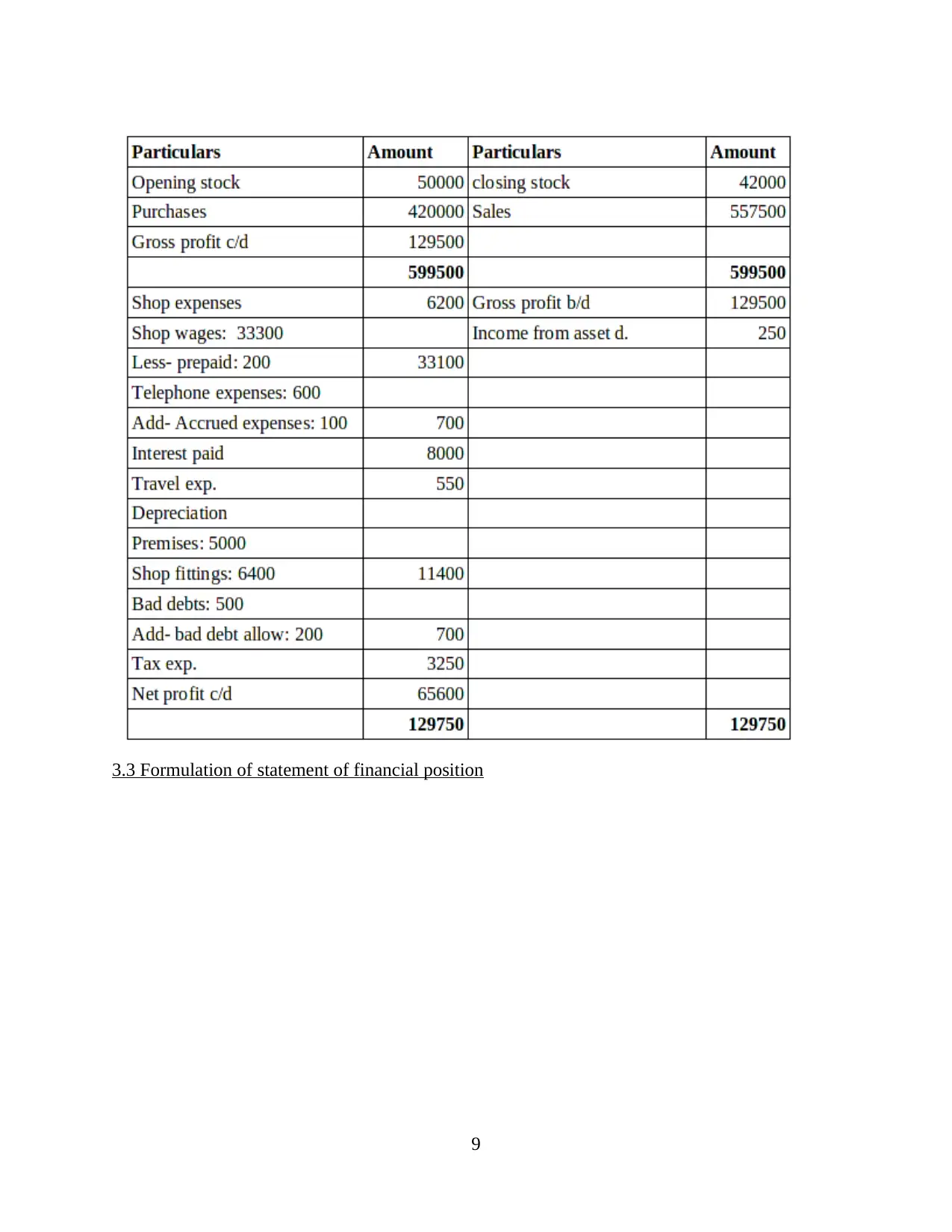

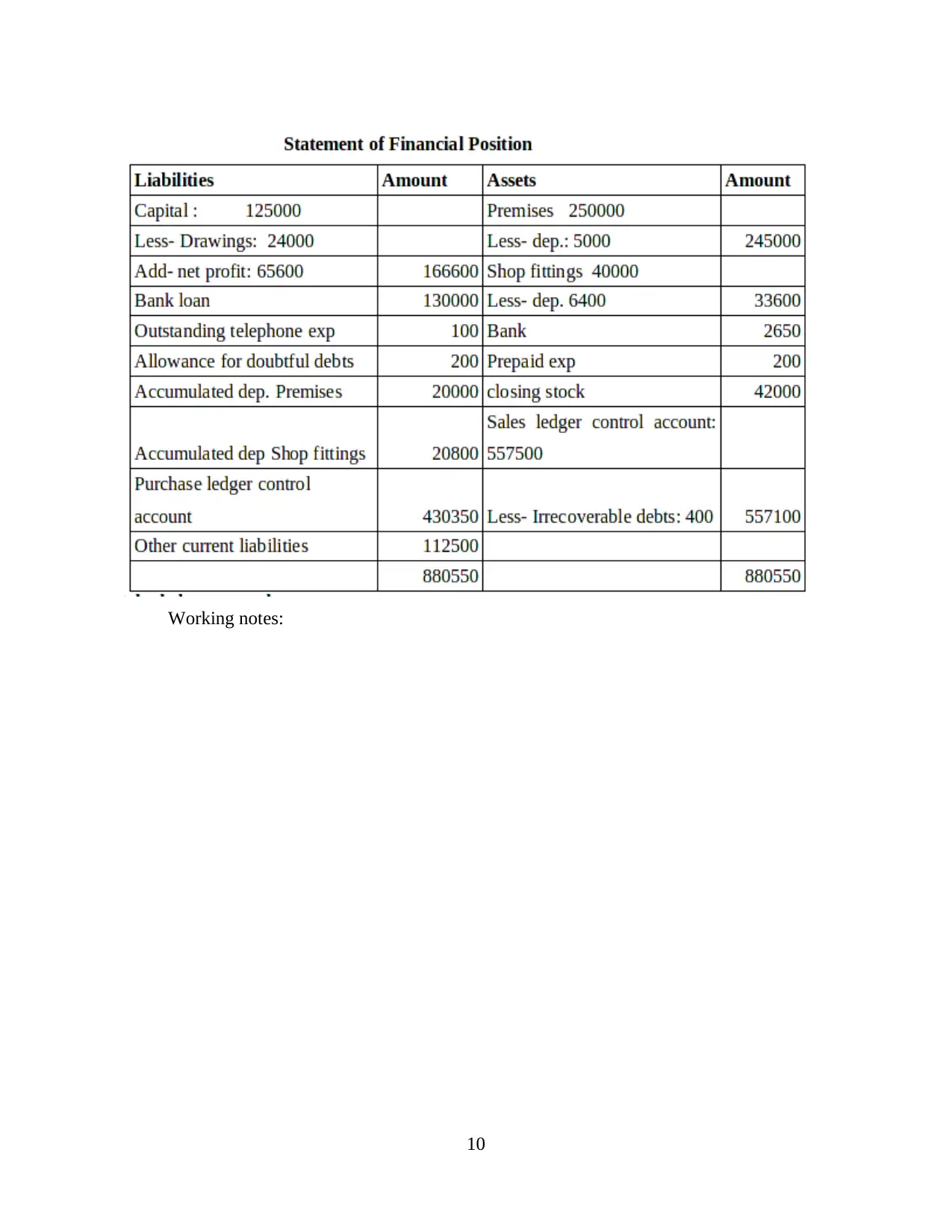

3.3 Formulation of statement of financial position

9

9

Working notes:

10

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.