Final Accounts: Sole Traders & Partnerships Report - Semester 1

VerifiedAdded on 2021/01/02

|17

|4534

|124

Report

AI Summary

This report provides a detailed analysis of final accounts for sole traders and partnerships. It covers the reasons for preparing final accounts, the process and limitations of preparing them, and methods for constructing accounts from incomplete records. The report explains the causes of imbalances resulting from incorrect entries and incomplete records. It delves into the calculation of opening and closing capital, cash/bank accounts, and the preparation of sales and purchase ledger control accounts, along with the concepts of markups and margins. The report outlines the components of final accounts, including the statement of profit and loss and the statement of financial position. It also explores the key components of partnership agreements and accounts, the preparation of the profit and loss appropriation account, and the allocation of profits to partners, including capital and current accounts. Finally, the report covers the calculation of closing balances for each partner's capital and current accounts and the presentation of the statement of financial position.

Final Accounts

For

Sole Traders

And

Partnerships

For

Sole Traders

And

Partnerships

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Reasons for closing off and producing trial balance.............................................................4

1.2 Process and limitation of preparing final accounts:..............................................................5

1.3 Methods of constructing accounts from incomplete records................................................5

1.4 Reasons for imbalance resulting from incorrect entries........................................................6

1.5 Reasons for incomplete records arising from insufficient data.............................................6

TASK 2............................................................................................................................................7

2.1 Calculation of opening and closing capital...........................................................................7

2.2 Calculation of opening and closing cash/ bank account.......................................................7

2.3 Preparation of sales and purchase ledger control account....................................................8

2.4 Mark ups and margins...........................................................................................................9

TASK 3............................................................................................................................................9

3.1 Components of a set of final accounts..................................................................................9

3.2 Statement of profit and loss.................................................................................................10

3.3 Statement of financial position............................................................................................10

TASK 4..........................................................................................................................................12

4.1 Key components of partnership agreement.........................................................................12

4.2 Key components of partnership accounts...........................................................................12

TASK 5..........................................................................................................................................13

5.1Preparation of Profit and Loss Appropriation Account:......................................................13

5.2 Allocation of profits to the partners....................................................................................14

5.3 Capital and current account for each partner......................................................................14

TASK 6..........................................................................................................................................15

6.1 Calculation of closing balance of each partner's capital and current account.....................15

6.2 Statement of financial position............................................................................................15

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

1.1 Reasons for closing off and producing trial balance.............................................................4

1.2 Process and limitation of preparing final accounts:..............................................................5

1.3 Methods of constructing accounts from incomplete records................................................5

1.4 Reasons for imbalance resulting from incorrect entries........................................................6

1.5 Reasons for incomplete records arising from insufficient data.............................................6

TASK 2............................................................................................................................................7

2.1 Calculation of opening and closing capital...........................................................................7

2.2 Calculation of opening and closing cash/ bank account.......................................................7

2.3 Preparation of sales and purchase ledger control account....................................................8

2.4 Mark ups and margins...........................................................................................................9

TASK 3............................................................................................................................................9

3.1 Components of a set of final accounts..................................................................................9

3.2 Statement of profit and loss.................................................................................................10

3.3 Statement of financial position............................................................................................10

TASK 4..........................................................................................................................................12

4.1 Key components of partnership agreement.........................................................................12

4.2 Key components of partnership accounts...........................................................................12

TASK 5..........................................................................................................................................13

5.1Preparation of Profit and Loss Appropriation Account:......................................................13

5.2 Allocation of profits to the partners....................................................................................14

5.3 Capital and current account for each partner......................................................................14

TASK 6..........................................................................................................................................15

6.1 Calculation of closing balance of each partner's capital and current account.....................15

6.2 Statement of financial position............................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

REFERENCES..............................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The final account is part of accounting process. Final account exhibits final result of the

company for a particular period. Final account refers to financial statement, that includes Profit

and loss account or revenue statement and balance sheet. Profit and loss account explains

profitability level achieved during a particular financial year and balance sheet shows a statement

of various assets, liabilities, and shareholder's fund as on a particular date, generally end of

financial year. Final account are used by owners as a basis of taking decisions in order to

enhance the performance of business. Whether entity is partnership firm or sole trader, final

accounts has same importance although some additional accounts are required in case of

partnership firm (Bain and Band, 2016). In case of final accounts of sole trader, the whole profit

is attributable to owner of sole trading firm, but in partnership firm profits are distributed among

partner according to the agreement of partnership. Calculation of capital distribution in

partnership firm is done through partner's capital and current account which differentiates the

final account of sole trader and partnership firm. This report exhibits requirement and process of

preparation of final accounts while considering different aspects of accounting data, legislative

and accounting requirements in the context of sole trader and partnership firm. Final accounts of

sole trader and partnership firm including Statement profit or loss appropriation account have

also been prepared in this report.

TASK 1

1.1 Reasons for closing off and producing trial balance

Compliance of accrual basis system of accounting is the main reason for closing off of

accounts at the year. Accrual basis requires accounting period to be closed to prevent changes

after closing of books. Under accrual system of accounting, accounts prepared by segregating

data in certain periods normally accounting period or financial period, and information or

financial data related to such period is considered and adjustments or closing entries are done to

finalise the accounts (Barrow, Barrow and Brown, 2012).

Trial balance is prepared in an entity to check mathematical accuracy while considering

double entry system of accounting. Debit side and credit side of trail balance contains closing

balance of all ledger prepared in entity as the case may be. In case total of debit column equal to

The final account is part of accounting process. Final account exhibits final result of the

company for a particular period. Final account refers to financial statement, that includes Profit

and loss account or revenue statement and balance sheet. Profit and loss account explains

profitability level achieved during a particular financial year and balance sheet shows a statement

of various assets, liabilities, and shareholder's fund as on a particular date, generally end of

financial year. Final account are used by owners as a basis of taking decisions in order to

enhance the performance of business. Whether entity is partnership firm or sole trader, final

accounts has same importance although some additional accounts are required in case of

partnership firm (Bain and Band, 2016). In case of final accounts of sole trader, the whole profit

is attributable to owner of sole trading firm, but in partnership firm profits are distributed among

partner according to the agreement of partnership. Calculation of capital distribution in

partnership firm is done through partner's capital and current account which differentiates the

final account of sole trader and partnership firm. This report exhibits requirement and process of

preparation of final accounts while considering different aspects of accounting data, legislative

and accounting requirements in the context of sole trader and partnership firm. Final accounts of

sole trader and partnership firm including Statement profit or loss appropriation account have

also been prepared in this report.

TASK 1

1.1 Reasons for closing off and producing trial balance

Compliance of accrual basis system of accounting is the main reason for closing off of

accounts at the year. Accrual basis requires accounting period to be closed to prevent changes

after closing of books. Under accrual system of accounting, accounts prepared by segregating

data in certain periods normally accounting period or financial period, and information or

financial data related to such period is considered and adjustments or closing entries are done to

finalise the accounts (Barrow, Barrow and Brown, 2012).

Trial balance is prepared in an entity to check mathematical accuracy while considering

double entry system of accounting. Debit side and credit side of trail balance contains closing

balance of all ledger prepared in entity as the case may be. In case total of debit column equal to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the total of credit column than trial balance is considered to be balanced and free from any

mathematical errors. But such Mathematical accuracy does not assure error free accounting

system because in case if account classified improperly or there is complete omission of any

accounting entry that it can not be detected by trial balance.

1.2 Process and limitation of preparing final accounts:

Accounting information or data in unstructured form is basis of preparation of annual

accounts. Accounting entries are passed in journal by accountant through such unstructured or

row data, and ledger are prepared using these journal entries. To check mathematical accuracy

trial balance are prepared using closing balance of different ledgers. At last profit and loss

account and balance sheet are prepared. At a glance this whole process is : recording, classifying,

summarizing, posting, evaluating and analysing (Bennett, Schaltegger and Zvezdov, 2013).

Limitations: Following are the major limitations of preparing final accounts, as follows:

Ignorance of qualitative aspect: Final accounts some ignores qualitative aspects of

accounts which some times creates misinterpretation of data. It is not possible to shows

qualitative aspects of data or information through final accounts.

Based upon convention and practices: Final accounts are furnished according to the

practices followed by individual firms. Different structure of entity such as partnership

firms or proprietorship, may follow or adopts different practices such as method of

charging depreciation may be different.

Window dressing: Some time final accounts are used to show false performance to

mislead others. Quantitative data used in final accounts are used by owners to manipulate

others about actual performance of company.

1.3 Methods of constructing accounts from incomplete records

There are various methods that are used to formulate accounts with the help of

incomplete record. These methods are :

The accounting equation: In this method a simple equation is used to prepare final

accounts. By using this simple equation capital, current liabilities or current assets can be

calculated. This equation is Assets = Capital + liabilities (Chambers, 2014).

Control accounts: This method is used when no balances on accounts given. Under this

method control account are completed, such as the inventory control account, with information

mathematical errors. But such Mathematical accuracy does not assure error free accounting

system because in case if account classified improperly or there is complete omission of any

accounting entry that it can not be detected by trial balance.

1.2 Process and limitation of preparing final accounts:

Accounting information or data in unstructured form is basis of preparation of annual

accounts. Accounting entries are passed in journal by accountant through such unstructured or

row data, and ledger are prepared using these journal entries. To check mathematical accuracy

trial balance are prepared using closing balance of different ledgers. At last profit and loss

account and balance sheet are prepared. At a glance this whole process is : recording, classifying,

summarizing, posting, evaluating and analysing (Bennett, Schaltegger and Zvezdov, 2013).

Limitations: Following are the major limitations of preparing final accounts, as follows:

Ignorance of qualitative aspect: Final accounts some ignores qualitative aspects of

accounts which some times creates misinterpretation of data. It is not possible to shows

qualitative aspects of data or information through final accounts.

Based upon convention and practices: Final accounts are furnished according to the

practices followed by individual firms. Different structure of entity such as partnership

firms or proprietorship, may follow or adopts different practices such as method of

charging depreciation may be different.

Window dressing: Some time final accounts are used to show false performance to

mislead others. Quantitative data used in final accounts are used by owners to manipulate

others about actual performance of company.

1.3 Methods of constructing accounts from incomplete records

There are various methods that are used to formulate accounts with the help of

incomplete record. These methods are :

The accounting equation: In this method a simple equation is used to prepare final

accounts. By using this simple equation capital, current liabilities or current assets can be

calculated. This equation is Assets = Capital + liabilities (Chambers, 2014).

Control accounts: This method is used when no balances on accounts given. Under this

method control account are completed, such as the inventory control account, with information

or details provided. At last by using such additional information such control account are

balanced.

Markup or margin method: Under this methods markup or margin in percentage forms

are given in order to find out the necessary balances or figures. In case if amount of sales and

percentage of margin is given then by using sales and margin, cost of sales can be calculated.

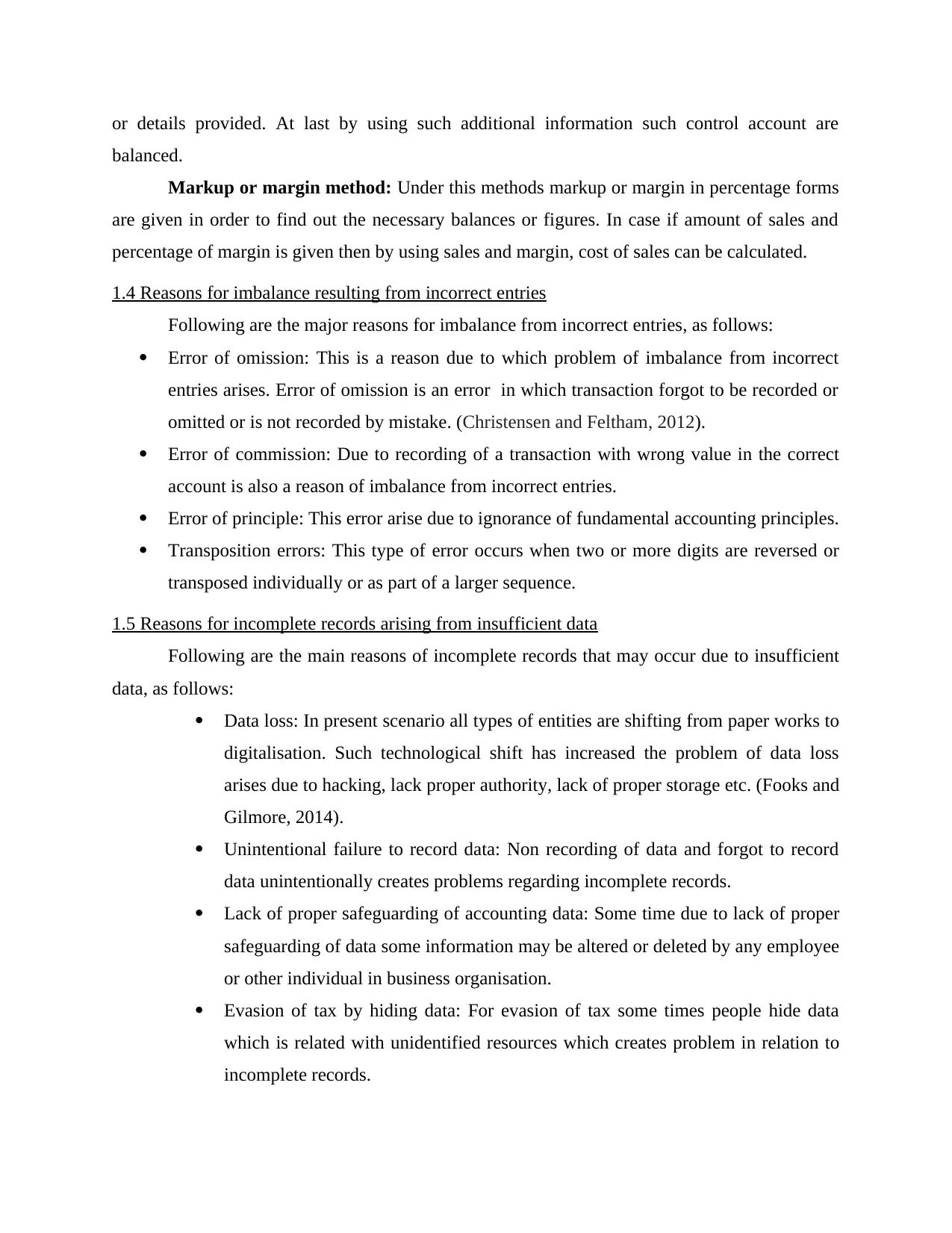

1.4 Reasons for imbalance resulting from incorrect entries

Following are the major reasons for imbalance from incorrect entries, as follows:

Error of omission: This is a reason due to which problem of imbalance from incorrect

entries arises. Error of omission is an error in which transaction forgot to be recorded or

omitted or is not recorded by mistake. (Christensen and Feltham, 2012).

Error of commission: Due to recording of a transaction with wrong value in the correct

account is also a reason of imbalance from incorrect entries.

Error of principle: This error arise due to ignorance of fundamental accounting principles.

Transposition errors: This type of error occurs when two or more digits are reversed or

transposed individually or as part of a larger sequence.

1.5 Reasons for incomplete records arising from insufficient data

Following are the main reasons of incomplete records that may occur due to insufficient

data, as follows:

Data loss: In present scenario all types of entities are shifting from paper works to

digitalisation. Such technological shift has increased the problem of data loss

arises due to hacking, lack proper authority, lack of proper storage etc. (Fooks and

Gilmore, 2014).

Unintentional failure to record data: Non recording of data and forgot to record

data unintentionally creates problems regarding incomplete records.

Lack of proper safeguarding of accounting data: Some time due to lack of proper

safeguarding of data some information may be altered or deleted by any employee

or other individual in business organisation.

Evasion of tax by hiding data: For evasion of tax some times people hide data

which is related with unidentified resources which creates problem in relation to

incomplete records.

balanced.

Markup or margin method: Under this methods markup or margin in percentage forms

are given in order to find out the necessary balances or figures. In case if amount of sales and

percentage of margin is given then by using sales and margin, cost of sales can be calculated.

1.4 Reasons for imbalance resulting from incorrect entries

Following are the major reasons for imbalance from incorrect entries, as follows:

Error of omission: This is a reason due to which problem of imbalance from incorrect

entries arises. Error of omission is an error in which transaction forgot to be recorded or

omitted or is not recorded by mistake. (Christensen and Feltham, 2012).

Error of commission: Due to recording of a transaction with wrong value in the correct

account is also a reason of imbalance from incorrect entries.

Error of principle: This error arise due to ignorance of fundamental accounting principles.

Transposition errors: This type of error occurs when two or more digits are reversed or

transposed individually or as part of a larger sequence.

1.5 Reasons for incomplete records arising from insufficient data

Following are the main reasons of incomplete records that may occur due to insufficient

data, as follows:

Data loss: In present scenario all types of entities are shifting from paper works to

digitalisation. Such technological shift has increased the problem of data loss

arises due to hacking, lack proper authority, lack of proper storage etc. (Fooks and

Gilmore, 2014).

Unintentional failure to record data: Non recording of data and forgot to record

data unintentionally creates problems regarding incomplete records.

Lack of proper safeguarding of accounting data: Some time due to lack of proper

safeguarding of data some information may be altered or deleted by any employee

or other individual in business organisation.

Evasion of tax by hiding data: For evasion of tax some times people hide data

which is related with unidentified resources which creates problem in relation to

incomplete records.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 2

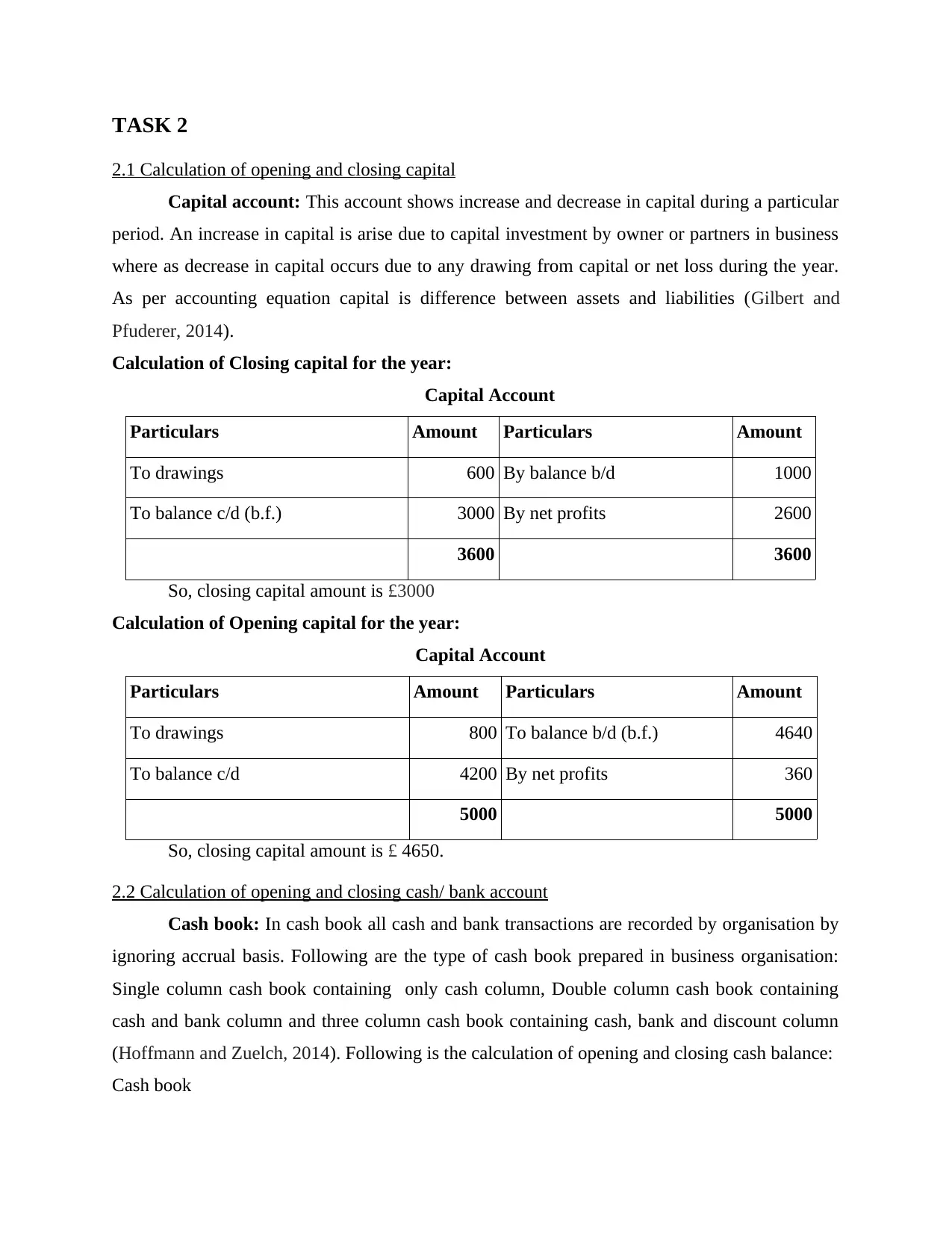

2.1 Calculation of opening and closing capital

Capital account: This account shows increase and decrease in capital during a particular

period. An increase in capital is arise due to capital investment by owner or partners in business

where as decrease in capital occurs due to any drawing from capital or net loss during the year.

As per accounting equation capital is difference between assets and liabilities (Gilbert and

Pfuderer, 2014).

Calculation of Closing capital for the year:

Capital Account

Particulars Amount Particulars Amount

To drawings 600 By balance b/d 1000

To balance c/d (b.f.) 3000 By net profits 2600

3600 3600

So, closing capital amount is £3000

Calculation of Opening capital for the year:

Capital Account

Particulars Amount Particulars Amount

To drawings 800 To balance b/d (b.f.) 4640

To balance c/d 4200 By net profits 360

5000 5000

So, closing capital amount is £ 4650.

2.2 Calculation of opening and closing cash/ bank account

Cash book: In cash book all cash and bank transactions are recorded by organisation by

ignoring accrual basis. Following are the type of cash book prepared in business organisation:

Single column cash book containing only cash column, Double column cash book containing

cash and bank column and three column cash book containing cash, bank and discount column

(Hoffmann and Zuelch, 2014). Following is the calculation of opening and closing cash balance:

Cash book

2.1 Calculation of opening and closing capital

Capital account: This account shows increase and decrease in capital during a particular

period. An increase in capital is arise due to capital investment by owner or partners in business

where as decrease in capital occurs due to any drawing from capital or net loss during the year.

As per accounting equation capital is difference between assets and liabilities (Gilbert and

Pfuderer, 2014).

Calculation of Closing capital for the year:

Capital Account

Particulars Amount Particulars Amount

To drawings 600 By balance b/d 1000

To balance c/d (b.f.) 3000 By net profits 2600

3600 3600

So, closing capital amount is £3000

Calculation of Opening capital for the year:

Capital Account

Particulars Amount Particulars Amount

To drawings 800 To balance b/d (b.f.) 4640

To balance c/d 4200 By net profits 360

5000 5000

So, closing capital amount is £ 4650.

2.2 Calculation of opening and closing cash/ bank account

Cash book: In cash book all cash and bank transactions are recorded by organisation by

ignoring accrual basis. Following are the type of cash book prepared in business organisation:

Single column cash book containing only cash column, Double column cash book containing

cash and bank column and three column cash book containing cash, bank and discount column

(Hoffmann and Zuelch, 2014). Following is the calculation of opening and closing cash balance:

Cash book

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

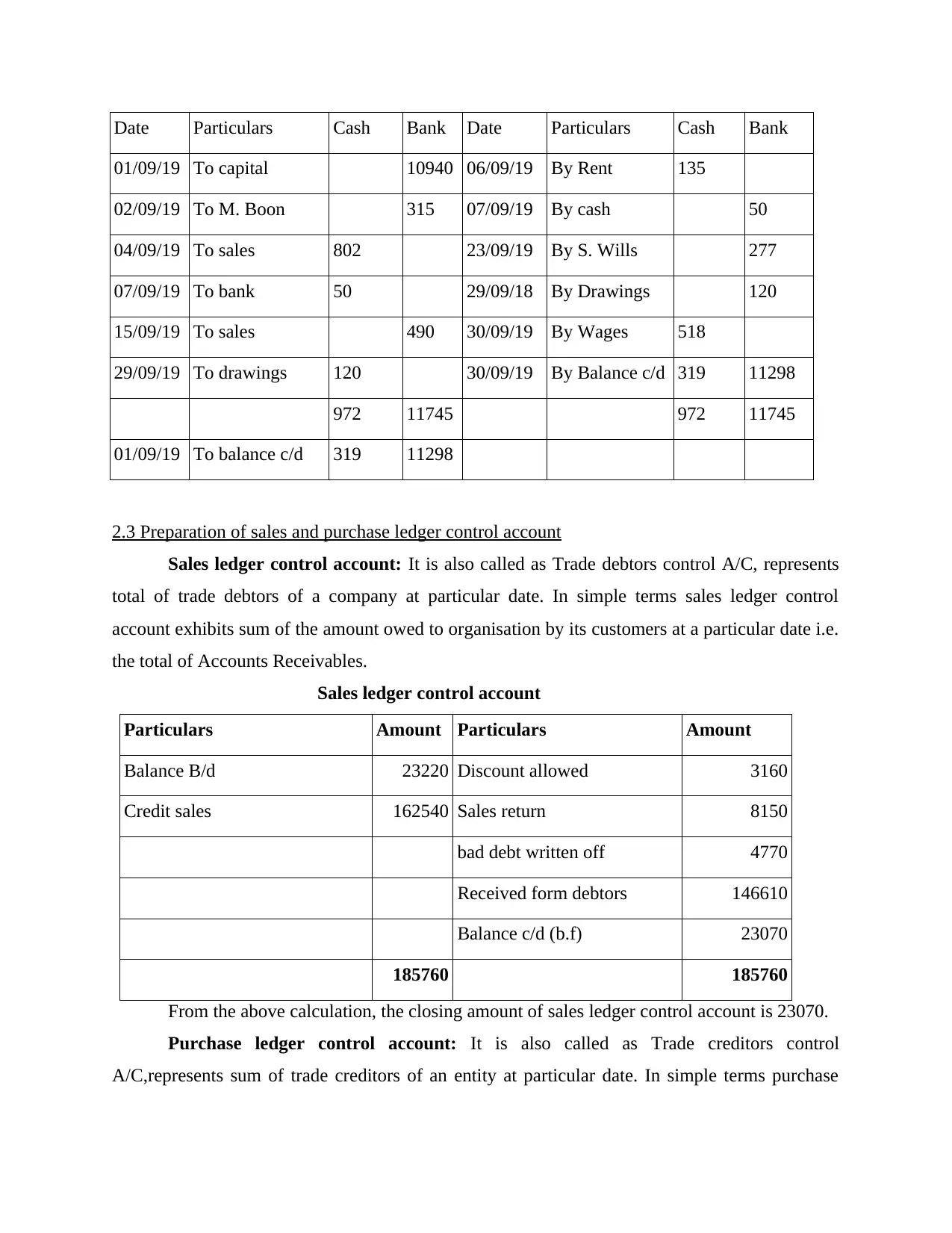

Date Particulars Cash Bank Date Particulars Cash Bank

01/09/19 To capital 10940 06/09/19 By Rent 135

02/09/19 To M. Boon 315 07/09/19 By cash 50

04/09/19 To sales 802 23/09/19 By S. Wills 277

07/09/19 To bank 50 29/09/18 By Drawings 120

15/09/19 To sales 490 30/09/19 By Wages 518

29/09/19 To drawings 120 30/09/19 By Balance c/d 319 11298

972 11745 972 11745

01/09/19 To balance c/d 319 11298

2.3 Preparation of sales and purchase ledger control account

Sales ledger control account: It is also called as Trade debtors control A/C, represents

total of trade debtors of a company at particular date. In simple terms sales ledger control

account exhibits sum of the amount owed to organisation by its customers at a particular date i.e.

the total of Accounts Receivables.

Sales ledger control account

Particulars Amount Particulars Amount

Balance B/d 23220 Discount allowed 3160

Credit sales 162540 Sales return 8150

bad debt written off 4770

Received form debtors 146610

Balance c/d (b.f) 23070

185760 185760

From the above calculation, the closing amount of sales ledger control account is 23070.

Purchase ledger control account: It is also called as Trade creditors control

A/C,represents sum of trade creditors of an entity at particular date. In simple terms purchase

01/09/19 To capital 10940 06/09/19 By Rent 135

02/09/19 To M. Boon 315 07/09/19 By cash 50

04/09/19 To sales 802 23/09/19 By S. Wills 277

07/09/19 To bank 50 29/09/18 By Drawings 120

15/09/19 To sales 490 30/09/19 By Wages 518

29/09/19 To drawings 120 30/09/19 By Balance c/d 319 11298

972 11745 972 11745

01/09/19 To balance c/d 319 11298

2.3 Preparation of sales and purchase ledger control account

Sales ledger control account: It is also called as Trade debtors control A/C, represents

total of trade debtors of a company at particular date. In simple terms sales ledger control

account exhibits sum of the amount owed to organisation by its customers at a particular date i.e.

the total of Accounts Receivables.

Sales ledger control account

Particulars Amount Particulars Amount

Balance B/d 23220 Discount allowed 3160

Credit sales 162540 Sales return 8150

bad debt written off 4770

Received form debtors 146610

Balance c/d (b.f) 23070

185760 185760

From the above calculation, the closing amount of sales ledger control account is 23070.

Purchase ledger control account: It is also called as Trade creditors control

A/C,represents sum of trade creditors of an entity at particular date. In simple terms purchase

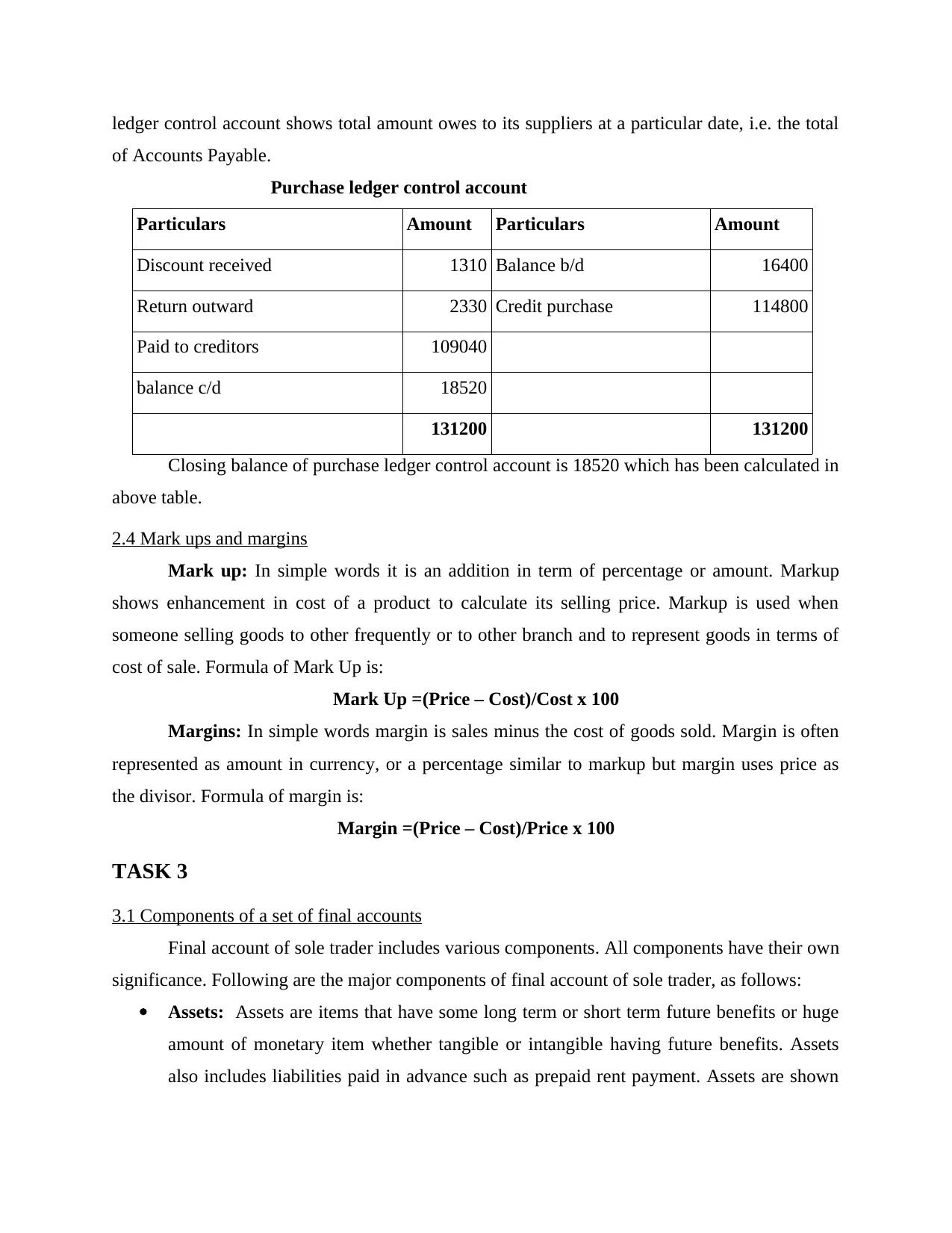

ledger control account shows total amount owes to its suppliers at a particular date, i.e. the total

of Accounts Payable.

Purchase ledger control account

Particulars Amount Particulars Amount

Discount received 1310 Balance b/d 16400

Return outward 2330 Credit purchase 114800

Paid to creditors 109040

balance c/d 18520

131200 131200

Closing balance of purchase ledger control account is 18520 which has been calculated in

above table.

2.4 Mark ups and margins

Mark up: In simple words it is an addition in term of percentage or amount. Markup

shows enhancement in cost of a product to calculate its selling price. Markup is used when

someone selling goods to other frequently or to other branch and to represent goods in terms of

cost of sale. Formula of Mark Up is:

Mark Up =(Price – Cost)/Cost x 100

Margins: In simple words margin is sales minus the cost of goods sold. Margin is often

represented as amount in currency, or a percentage similar to markup but margin uses price as

the divisor. Formula of margin is:

Margin =(Price – Cost)/Price x 100

TASK 3

3.1 Components of a set of final accounts

Final account of sole trader includes various components. All components have their own

significance. Following are the major components of final account of sole trader, as follows:

Assets: Assets are items that have some long term or short term future benefits or huge

amount of monetary item whether tangible or intangible having future benefits. Assets

also includes liabilities paid in advance such as prepaid rent payment. Assets are shown

of Accounts Payable.

Purchase ledger control account

Particulars Amount Particulars Amount

Discount received 1310 Balance b/d 16400

Return outward 2330 Credit purchase 114800

Paid to creditors 109040

balance c/d 18520

131200 131200

Closing balance of purchase ledger control account is 18520 which has been calculated in

above table.

2.4 Mark ups and margins

Mark up: In simple words it is an addition in term of percentage or amount. Markup

shows enhancement in cost of a product to calculate its selling price. Markup is used when

someone selling goods to other frequently or to other branch and to represent goods in terms of

cost of sale. Formula of Mark Up is:

Mark Up =(Price – Cost)/Cost x 100

Margins: In simple words margin is sales minus the cost of goods sold. Margin is often

represented as amount in currency, or a percentage similar to markup but margin uses price as

the divisor. Formula of margin is:

Margin =(Price – Cost)/Price x 100

TASK 3

3.1 Components of a set of final accounts

Final account of sole trader includes various components. All components have their own

significance. Following are the major components of final account of sole trader, as follows:

Assets: Assets are items that have some long term or short term future benefits or huge

amount of monetary item whether tangible or intangible having future benefits. Assets

also includes liabilities paid in advance such as prepaid rent payment. Assets are shown

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in right of balance sheet. Assets includes land, building, machinery, cash, inventories,

goodwill, trade receivables etc.

Liabilities: Liabilities are mainly divided in two parts internal liabilities and external

liabilities, however for presentation in balance sheet liabilities are classified as current

liabilities and non current liabilities. Liabilities are recorded in left side of balance sheet.

Liabilities includes loans, advances, interest payable, creditors, account payables etc.

Revenues: Revenue refers to gross earning of entity. Revenue includes all source of

income however revenues are considered as sales. These are shown in the profit and loss

account of the organisation.

Equities: Equity in case of sole traders refers to money invested by owners in own

business. Its is also considered as liabilities part but shown separately. Equity also called

as capital which is difference between assets and liabilities.

Expenses: Expenses are majorly divided in two headings operating and non operating.

Every entity incurs different expenses related to business, expenses that are directly

associated with day to day operations are treated as operating expenses whereas all other

expenses are treated as non operating expenses.

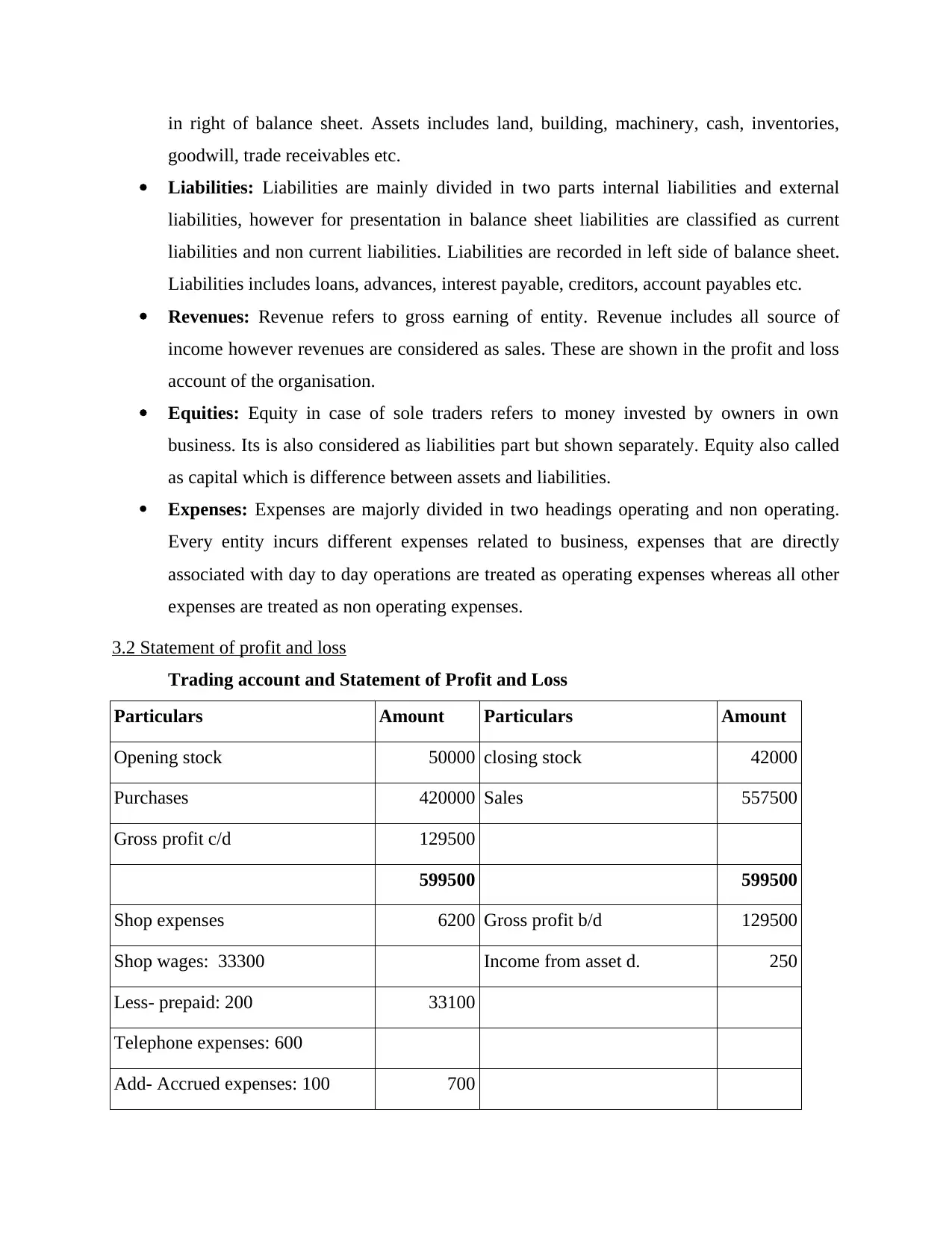

3.2 Statement of profit and loss

Trading account and Statement of Profit and Loss

Particulars Amount Particulars Amount

Opening stock 50000 closing stock 42000

Purchases 420000 Sales 557500

Gross profit c/d 129500

599500 599500

Shop expenses 6200 Gross profit b/d 129500

Shop wages: 33300 Income from asset d. 250

Less- prepaid: 200 33100

Telephone expenses: 600

Add- Accrued expenses: 100 700

goodwill, trade receivables etc.

Liabilities: Liabilities are mainly divided in two parts internal liabilities and external

liabilities, however for presentation in balance sheet liabilities are classified as current

liabilities and non current liabilities. Liabilities are recorded in left side of balance sheet.

Liabilities includes loans, advances, interest payable, creditors, account payables etc.

Revenues: Revenue refers to gross earning of entity. Revenue includes all source of

income however revenues are considered as sales. These are shown in the profit and loss

account of the organisation.

Equities: Equity in case of sole traders refers to money invested by owners in own

business. Its is also considered as liabilities part but shown separately. Equity also called

as capital which is difference between assets and liabilities.

Expenses: Expenses are majorly divided in two headings operating and non operating.

Every entity incurs different expenses related to business, expenses that are directly

associated with day to day operations are treated as operating expenses whereas all other

expenses are treated as non operating expenses.

3.2 Statement of profit and loss

Trading account and Statement of Profit and Loss

Particulars Amount Particulars Amount

Opening stock 50000 closing stock 42000

Purchases 420000 Sales 557500

Gross profit c/d 129500

599500 599500

Shop expenses 6200 Gross profit b/d 129500

Shop wages: 33300 Income from asset d. 250

Less- prepaid: 200 33100

Telephone expenses: 600

Add- Accrued expenses: 100 700

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interest paid 8000

Travel exp. 550

Depreciation

Premises: 5000

Shop fittings: 6400 11400

Bad debts: 500

Add- bad debt allow: 200 700

Tax exp. 3250

Net profit c/d 65600

129750 129750

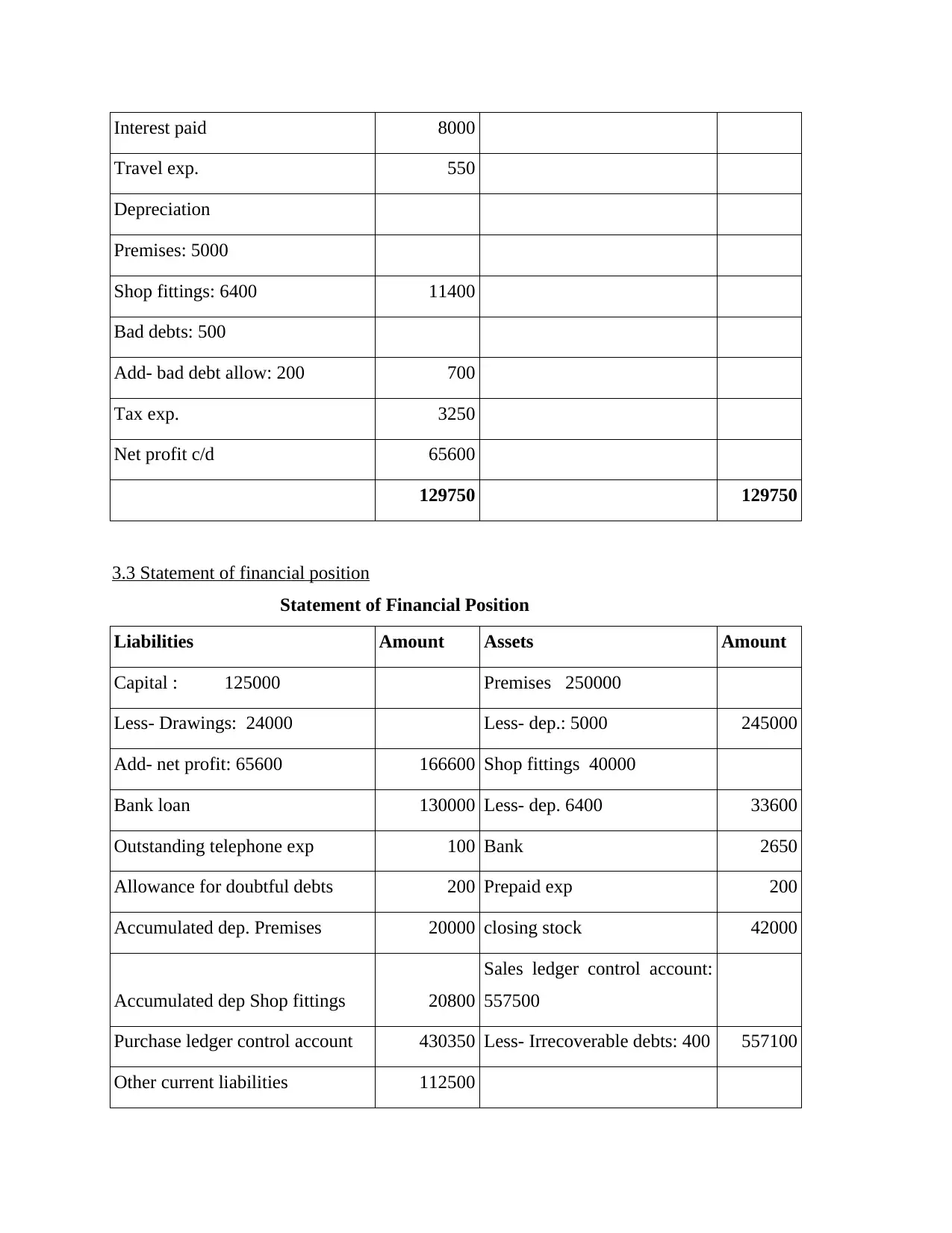

3.3 Statement of financial position

Statement of Financial Position

Liabilities Amount Assets Amount

Capital : 125000 Premises 250000

Less- Drawings: 24000 Less- dep.: 5000 245000

Add- net profit: 65600 166600 Shop fittings 40000

Bank loan 130000 Less- dep. 6400 33600

Outstanding telephone exp 100 Bank 2650

Allowance for doubtful debts 200 Prepaid exp 200

Accumulated dep. Premises 20000 closing stock 42000

Accumulated dep Shop fittings 20800

Sales ledger control account:

557500

Purchase ledger control account 430350 Less- Irrecoverable debts: 400 557100

Other current liabilities 112500

Travel exp. 550

Depreciation

Premises: 5000

Shop fittings: 6400 11400

Bad debts: 500

Add- bad debt allow: 200 700

Tax exp. 3250

Net profit c/d 65600

129750 129750

3.3 Statement of financial position

Statement of Financial Position

Liabilities Amount Assets Amount

Capital : 125000 Premises 250000

Less- Drawings: 24000 Less- dep.: 5000 245000

Add- net profit: 65600 166600 Shop fittings 40000

Bank loan 130000 Less- dep. 6400 33600

Outstanding telephone exp 100 Bank 2650

Allowance for doubtful debts 200 Prepaid exp 200

Accumulated dep. Premises 20000 closing stock 42000

Accumulated dep Shop fittings 20800

Sales ledger control account:

557500

Purchase ledger control account 430350 Less- Irrecoverable debts: 400 557100

Other current liabilities 112500

880550 880550

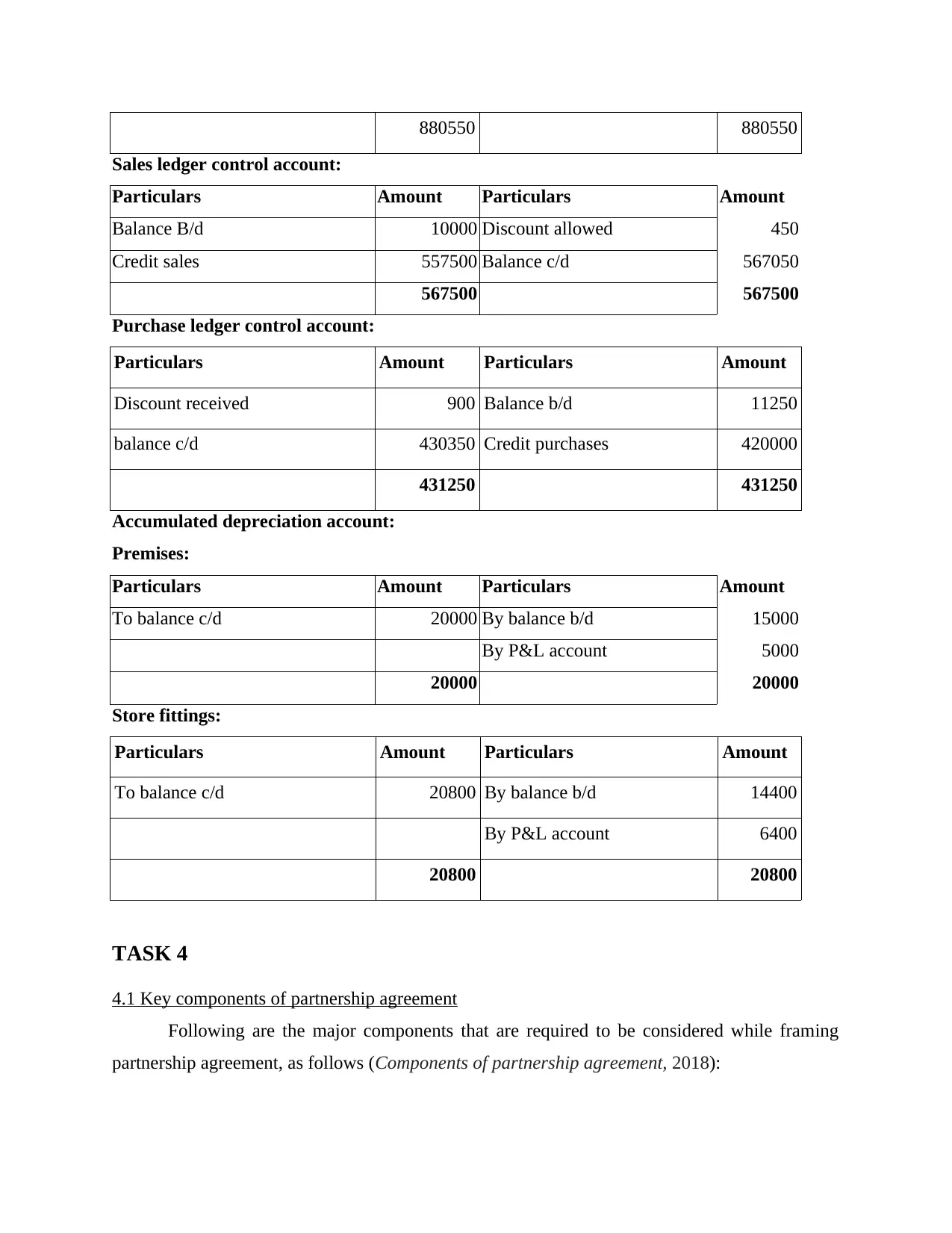

Sales ledger control account:

Particulars Amount Particulars Amount

Balance B/d 10000 Discount allowed 450

Credit sales 557500 Balance c/d 567050

567500 567500

Purchase ledger control account:

Particulars Amount Particulars Amount

Discount received 900 Balance b/d 11250

balance c/d 430350 Credit purchases 420000

431250 431250

Accumulated depreciation account:

Premises:

Particulars Amount Particulars Amount

To balance c/d 20000 By balance b/d 15000

By P&L account 5000

20000 20000

Store fittings:

Particulars Amount Particulars Amount

To balance c/d 20800 By balance b/d 14400

By P&L account 6400

20800 20800

TASK 4

4.1 Key components of partnership agreement

Following are the major components that are required to be considered while framing

partnership agreement, as follows (Components of partnership agreement, 2018):

Sales ledger control account:

Particulars Amount Particulars Amount

Balance B/d 10000 Discount allowed 450

Credit sales 557500 Balance c/d 567050

567500 567500

Purchase ledger control account:

Particulars Amount Particulars Amount

Discount received 900 Balance b/d 11250

balance c/d 430350 Credit purchases 420000

431250 431250

Accumulated depreciation account:

Premises:

Particulars Amount Particulars Amount

To balance c/d 20000 By balance b/d 15000

By P&L account 5000

20000 20000

Store fittings:

Particulars Amount Particulars Amount

To balance c/d 20800 By balance b/d 14400

By P&L account 6400

20800 20800

TASK 4

4.1 Key components of partnership agreement

Following are the major components that are required to be considered while framing

partnership agreement, as follows (Components of partnership agreement, 2018):

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.