Finance in Hospitality: Financial Analysis and Budgetary Control

VerifiedAdded on 2019/12/03

|17

|4572

|157

Report

AI Summary

This report provides a detailed analysis of financial management within the hospitality sector, addressing various aspects such as finance sources, cost elements, and budgetary control. The report begins by exploring funding options available to Mr. Stephen, including loans and leasing, along with their associated advantages and disadvantages. It then delves into methods for enhancing income generation, focusing on sales, sponsorships, and grants. The report further examines cost elements, gross profit calculations, and selling price determination. It also covers inventory and cash control methods, including stock levels and cash budgets. A trial balance is prepared, business accounts are evaluated, and adjustments are made. The process and purpose of budgetary control are explained, including variance analysis. The report concludes with an analysis of financial statements, offering insights into appropriate future management strategies and a classification of costs, calculation of contribution and cost volume relationship, and short-term management decisions based upon profit/loss potential and break even analysis.

FINANCE IN

HOSPITALITY

1 | P a g e

HOSPITALITY

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Reviewing the finance sources available to Mr. Stephens........................................1

AC 1.2 Evaluating the contribution of the methods in generating income...........................2

TASK 2......................................................................................................................................3

AC 2.1 Element of cost, gross profit and selling prices........................................................3

AC 2.2 Evaluating the method of controlling the stock and cash.........................................3

TASK 3......................................................................................................................................4

AC 3.1 Preparation of the trial balance.................................................................................4

AC 3.2 Evaluating the business accounts, adjustment and notes..........................................5

AC 3.3 Process and purpose of budgetary control................................................................6

AC 3.4 Analysis of variances................................................................................................6

TASK 4......................................................................................................................................8

AC 4.1 Analysis of financial statements...............................................................................8

AC 4.2 Appropriate future management strategies.............................................................10

TASK 5....................................................................................................................................10

AC 5.1 Classification of cost...............................................................................................10

AC 5.2 Calculation of contribution and cost volume relationship......................................11

AC 5.3 Short term management decisions based upon profit/loss potential and break even

analysis................................................................................................................................12

CONCLUSION........................................................................................................................12

REFERENCES ........................................................................................................................13

2 | P a g e

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Reviewing the finance sources available to Mr. Stephens........................................1

AC 1.2 Evaluating the contribution of the methods in generating income...........................2

TASK 2......................................................................................................................................3

AC 2.1 Element of cost, gross profit and selling prices........................................................3

AC 2.2 Evaluating the method of controlling the stock and cash.........................................3

TASK 3......................................................................................................................................4

AC 3.1 Preparation of the trial balance.................................................................................4

AC 3.2 Evaluating the business accounts, adjustment and notes..........................................5

AC 3.3 Process and purpose of budgetary control................................................................6

AC 3.4 Analysis of variances................................................................................................6

TASK 4......................................................................................................................................8

AC 4.1 Analysis of financial statements...............................................................................8

AC 4.2 Appropriate future management strategies.............................................................10

TASK 5....................................................................................................................................10

AC 5.1 Classification of cost...............................................................................................10

AC 5.2 Calculation of contribution and cost volume relationship......................................11

AC 5.3 Short term management decisions based upon profit/loss potential and break even

analysis................................................................................................................................12

CONCLUSION........................................................................................................................12

REFERENCES ........................................................................................................................13

2 | P a g e

Index of Tables

Table 1: Trial balance ................................................................................................................4

Table 2: Ratio Analysis..............................................................................................................8

3 | P a g e

Table 1: Trial balance ................................................................................................................4

Table 2: Ratio Analysis..............................................................................................................8

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is considered as very important factor for every organization. The need for

finance sources require in both business and services industry in order to fulfil its short term,

medium term and long term funds requirements. Every organization needs to have proper

availability of funds to run their operations. Financial manager plays a vital role in managing

the finance sources to the company. He determines the funds requirement and tries to acquire

this by applying variety of finance sources. Hospitality is a type of service industry it require

funds in order to achieve its set objectives through providing better quality of services to the

consumers. This report will assists in identifying different kinds of finances sources available

to Mr. Stephen with their associated advantage and disadvantage. Moreover, the report

explains the purpose of budgetary control and its importance for the organization. Ratio

analysis is also implemented for interpreting the financial performance by analysing the

financial statements.

TASK 1

AC 1.1 reviewing the finance sources available to Mr. Stephens

The finance sources that are available to Mr. Stephen to fulfil its fund requirements

are as follows:

Loans from friends and relatives: Along with the personal savings, Mr. Stephens can

take loans from his friends and relatives to meet its finance requirements. The advantage of

this method is that it helps to acquire the funds to a great extent. It may be available without

any security also. In addition to it, these loans are available at lower interest rate compare to

the bank loan rates (Scott, 2014). However, disadvantage is that the they has to pay interest

on loans. Moreover, instalment payment is requiring on a timely basis to the creditors.

Leasing: For starting a new enterprise, Mr. Stephen can also use leasing sources

through getting rights to use the assets without purchasing it. The advantage of this method is

that it prevent the huge investment for purchase the assets. Thus, the available money can be

used for other productive purposes. The disadvantage is that the owner of the assets charge

high periodical rent for giving the using rights (Mangan, Hughes and Slack, 2010). Therefore,

high financial cost will be arising to Mr. Stephen.

Recommendation: On the basis of above advantage and disadvantage it can be

recommended that Mr. Stephen should take loans from friends or relatives to fulfil their funds

requirements.

Finance sources available to large organizations:

4 | P a g e

Finance is considered as very important factor for every organization. The need for

finance sources require in both business and services industry in order to fulfil its short term,

medium term and long term funds requirements. Every organization needs to have proper

availability of funds to run their operations. Financial manager plays a vital role in managing

the finance sources to the company. He determines the funds requirement and tries to acquire

this by applying variety of finance sources. Hospitality is a type of service industry it require

funds in order to achieve its set objectives through providing better quality of services to the

consumers. This report will assists in identifying different kinds of finances sources available

to Mr. Stephen with their associated advantage and disadvantage. Moreover, the report

explains the purpose of budgetary control and its importance for the organization. Ratio

analysis is also implemented for interpreting the financial performance by analysing the

financial statements.

TASK 1

AC 1.1 reviewing the finance sources available to Mr. Stephens

The finance sources that are available to Mr. Stephen to fulfil its fund requirements

are as follows:

Loans from friends and relatives: Along with the personal savings, Mr. Stephens can

take loans from his friends and relatives to meet its finance requirements. The advantage of

this method is that it helps to acquire the funds to a great extent. It may be available without

any security also. In addition to it, these loans are available at lower interest rate compare to

the bank loan rates (Scott, 2014). However, disadvantage is that the they has to pay interest

on loans. Moreover, instalment payment is requiring on a timely basis to the creditors.

Leasing: For starting a new enterprise, Mr. Stephen can also use leasing sources

through getting rights to use the assets without purchasing it. The advantage of this method is

that it prevent the huge investment for purchase the assets. Thus, the available money can be

used for other productive purposes. The disadvantage is that the owner of the assets charge

high periodical rent for giving the using rights (Mangan, Hughes and Slack, 2010). Therefore,

high financial cost will be arising to Mr. Stephen.

Recommendation: On the basis of above advantage and disadvantage it can be

recommended that Mr. Stephen should take loans from friends or relatives to fulfil their funds

requirements.

Finance sources available to large organizations:

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

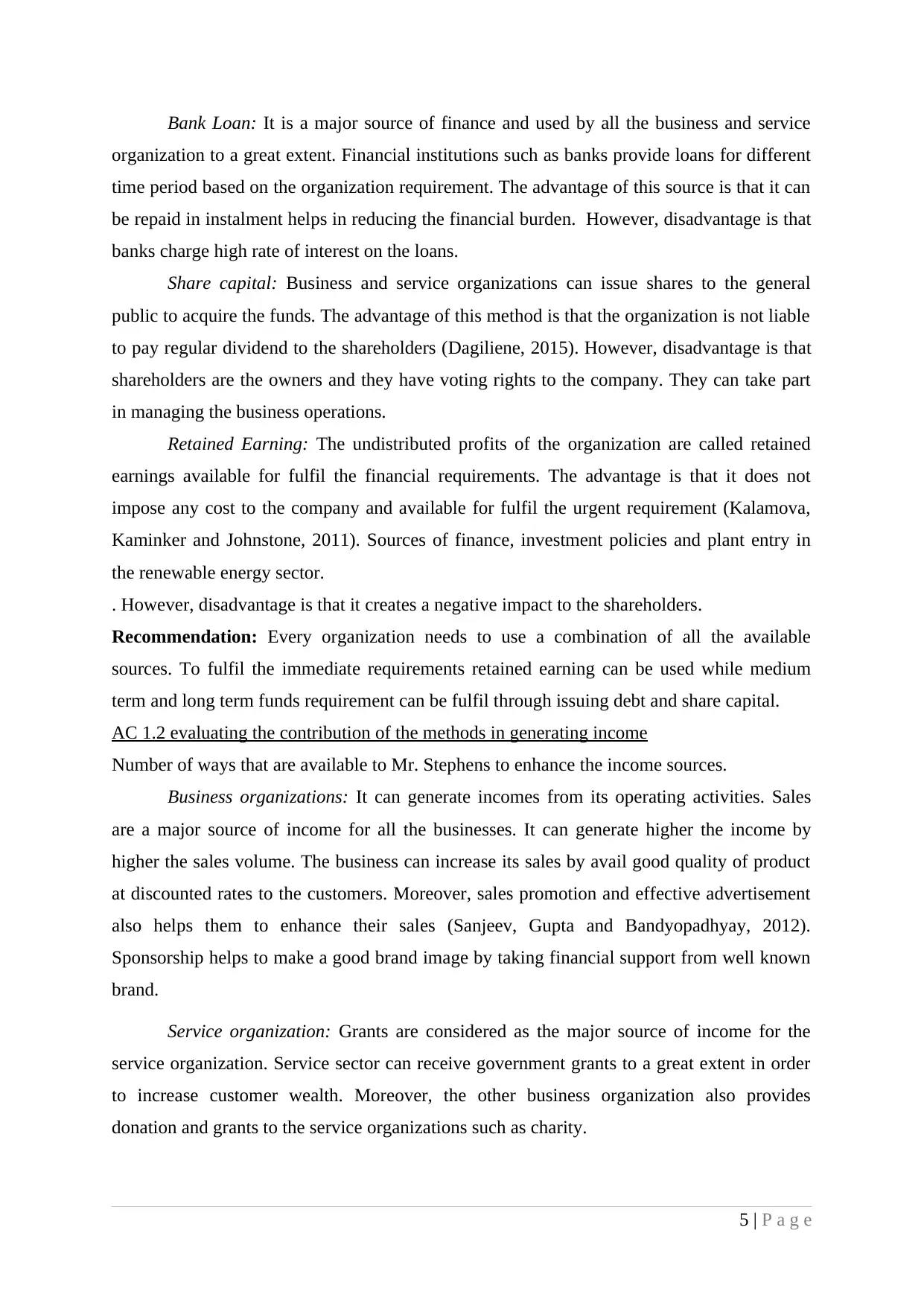

Bank Loan: It is a major source of finance and used by all the business and service

organization to a great extent. Financial institutions such as banks provide loans for different

time period based on the organization requirement. The advantage of this source is that it can

be repaid in instalment helps in reducing the financial burden. However, disadvantage is that

banks charge high rate of interest on the loans.

Share capital: Business and service organizations can issue shares to the general

public to acquire the funds. The advantage of this method is that the organization is not liable

to pay regular dividend to the shareholders (Dagiliene, 2015). However, disadvantage is that

shareholders are the owners and they have voting rights to the company. They can take part

in managing the business operations.

Retained Earning: The undistributed profits of the organization are called retained

earnings available for fulfil the financial requirements. The advantage is that it does not

impose any cost to the company and available for fulfil the urgent requirement (Kalamova,

Kaminker and Johnstone, 2011). Sources of finance, investment policies and plant entry in

the renewable energy sector.

. However, disadvantage is that it creates a negative impact to the shareholders.

Recommendation: Every organization needs to use a combination of all the available

sources. To fulfil the immediate requirements retained earning can be used while medium

term and long term funds requirement can be fulfil through issuing debt and share capital.

AC 1.2 evaluating the contribution of the methods in generating income

Number of ways that are available to Mr. Stephens to enhance the income sources.

Business organizations: It can generate incomes from its operating activities. Sales

are a major source of income for all the businesses. It can generate higher the income by

higher the sales volume. The business can increase its sales by avail good quality of product

at discounted rates to the customers. Moreover, sales promotion and effective advertisement

also helps them to enhance their sales (Sanjeev, Gupta and Bandyopadhyay, 2012).

Sponsorship helps to make a good brand image by taking financial support from well known

brand.

Service organization: Grants are considered as the major source of income for the

service organization. Service sector can receive government grants to a great extent in order

to increase customer wealth. Moreover, the other business organization also provides

donation and grants to the service organizations such as charity.

5 | P a g e

organization to a great extent. Financial institutions such as banks provide loans for different

time period based on the organization requirement. The advantage of this source is that it can

be repaid in instalment helps in reducing the financial burden. However, disadvantage is that

banks charge high rate of interest on the loans.

Share capital: Business and service organizations can issue shares to the general

public to acquire the funds. The advantage of this method is that the organization is not liable

to pay regular dividend to the shareholders (Dagiliene, 2015). However, disadvantage is that

shareholders are the owners and they have voting rights to the company. They can take part

in managing the business operations.

Retained Earning: The undistributed profits of the organization are called retained

earnings available for fulfil the financial requirements. The advantage is that it does not

impose any cost to the company and available for fulfil the urgent requirement (Kalamova,

Kaminker and Johnstone, 2011). Sources of finance, investment policies and plant entry in

the renewable energy sector.

. However, disadvantage is that it creates a negative impact to the shareholders.

Recommendation: Every organization needs to use a combination of all the available

sources. To fulfil the immediate requirements retained earning can be used while medium

term and long term funds requirement can be fulfil through issuing debt and share capital.

AC 1.2 evaluating the contribution of the methods in generating income

Number of ways that are available to Mr. Stephens to enhance the income sources.

Business organizations: It can generate incomes from its operating activities. Sales

are a major source of income for all the businesses. It can generate higher the income by

higher the sales volume. The business can increase its sales by avail good quality of product

at discounted rates to the customers. Moreover, sales promotion and effective advertisement

also helps them to enhance their sales (Sanjeev, Gupta and Bandyopadhyay, 2012).

Sponsorship helps to make a good brand image by taking financial support from well known

brand.

Service organization: Grants are considered as the major source of income for the

service organization. Service sector can receive government grants to a great extent in order

to increase customer wealth. Moreover, the other business organization also provides

donation and grants to the service organizations such as charity.

5 | P a g e

TASK 2

AC 2.1 Element of cost, gross profit and selling prices

Element of cost: There are two types of cost involved in total cost of products and

services that are direct and indirect cost. Direct cost can directly attribute to the specific cost

element also known as prime cost. It includes material, labour and direct overhead cost.

However, indirect cost cannot be attributes to a specific cost object (Datar and et. al., 2013).

It is apportioned on any other basis to the various department of the organization. Both fixed

as well as variable expenditures are prevails under the indirect cost. It includes depreciation

on the assets, manager remuneration and building rent.

Gross profit percentage: The amount of gross profit is the excess of total business

sales over the purchase and direct expenditures. The gross profit percentage is calculated by

dividing the gross profit to the total sales (Blocher and et. al., 2008). Therefore, it has two

elements sales and gross profit earned.

Selling price: Every entrepreneur decides their selling price by adding a profit margin

to the total cost. Thus, selling price has two element cost per unit and profit margin per unit.

By assuming the cost per unit amounted to 500£ and profit percentage is 10%

Selling price = Cost + Profit percentage on cost

= 500£ + 10% of 500£

=500£ + 50£ = 550£

AC 2.2 evaluating the method of controlling the stock and cash

Every organization requires controlling the stock and the cash in order to maximize its

profits. There are different ways available to the organization to control its inventory that is

described below:

Decide various stock levels: Under this method, organization can decide reorder level,

maximum and minimum order level and danger level of stock in order to control its

inventory. It helps the organization to reduce undesired quantity of purchase and helps to

decrease the cost.

Inventory Budget: Budgets can also be prepared for maintain and managing the stock

level. Moreover, it helps to ensure optimum utilization of stock so as to reduce the

deficiencies.

There are different ways available to the organization to control its cash that are described

below:

6 | P a g e

AC 2.1 Element of cost, gross profit and selling prices

Element of cost: There are two types of cost involved in total cost of products and

services that are direct and indirect cost. Direct cost can directly attribute to the specific cost

element also known as prime cost. It includes material, labour and direct overhead cost.

However, indirect cost cannot be attributes to a specific cost object (Datar and et. al., 2013).

It is apportioned on any other basis to the various department of the organization. Both fixed

as well as variable expenditures are prevails under the indirect cost. It includes depreciation

on the assets, manager remuneration and building rent.

Gross profit percentage: The amount of gross profit is the excess of total business

sales over the purchase and direct expenditures. The gross profit percentage is calculated by

dividing the gross profit to the total sales (Blocher and et. al., 2008). Therefore, it has two

elements sales and gross profit earned.

Selling price: Every entrepreneur decides their selling price by adding a profit margin

to the total cost. Thus, selling price has two element cost per unit and profit margin per unit.

By assuming the cost per unit amounted to 500£ and profit percentage is 10%

Selling price = Cost + Profit percentage on cost

= 500£ + 10% of 500£

=500£ + 50£ = 550£

AC 2.2 evaluating the method of controlling the stock and cash

Every organization requires controlling the stock and the cash in order to maximize its

profits. There are different ways available to the organization to control its inventory that is

described below:

Decide various stock levels: Under this method, organization can decide reorder level,

maximum and minimum order level and danger level of stock in order to control its

inventory. It helps the organization to reduce undesired quantity of purchase and helps to

decrease the cost.

Inventory Budget: Budgets can also be prepared for maintain and managing the stock

level. Moreover, it helps to ensure optimum utilization of stock so as to reduce the

deficiencies.

There are different ways available to the organization to control its cash that are described

below:

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash Budget: It is prepared by estimating the cash inflows and outflows for a future

period so as to know the cash surplus or deficit. It helps to reduce the cash deficit by reducing

the expenditures and increase its revenues (Baker and English, 2009). By preparing this

budget the business can manage their cash related activities more efficiently.

Cash flow management: This statement analyse the cash inflows and outflows by

business operating, investing and financing activities. Through this statement the business

can find out the areas where it needs to control their expenditures. Thus, this statement helps

to enhance the cash inflows by analysing the sources and application of funds.

TASK 3

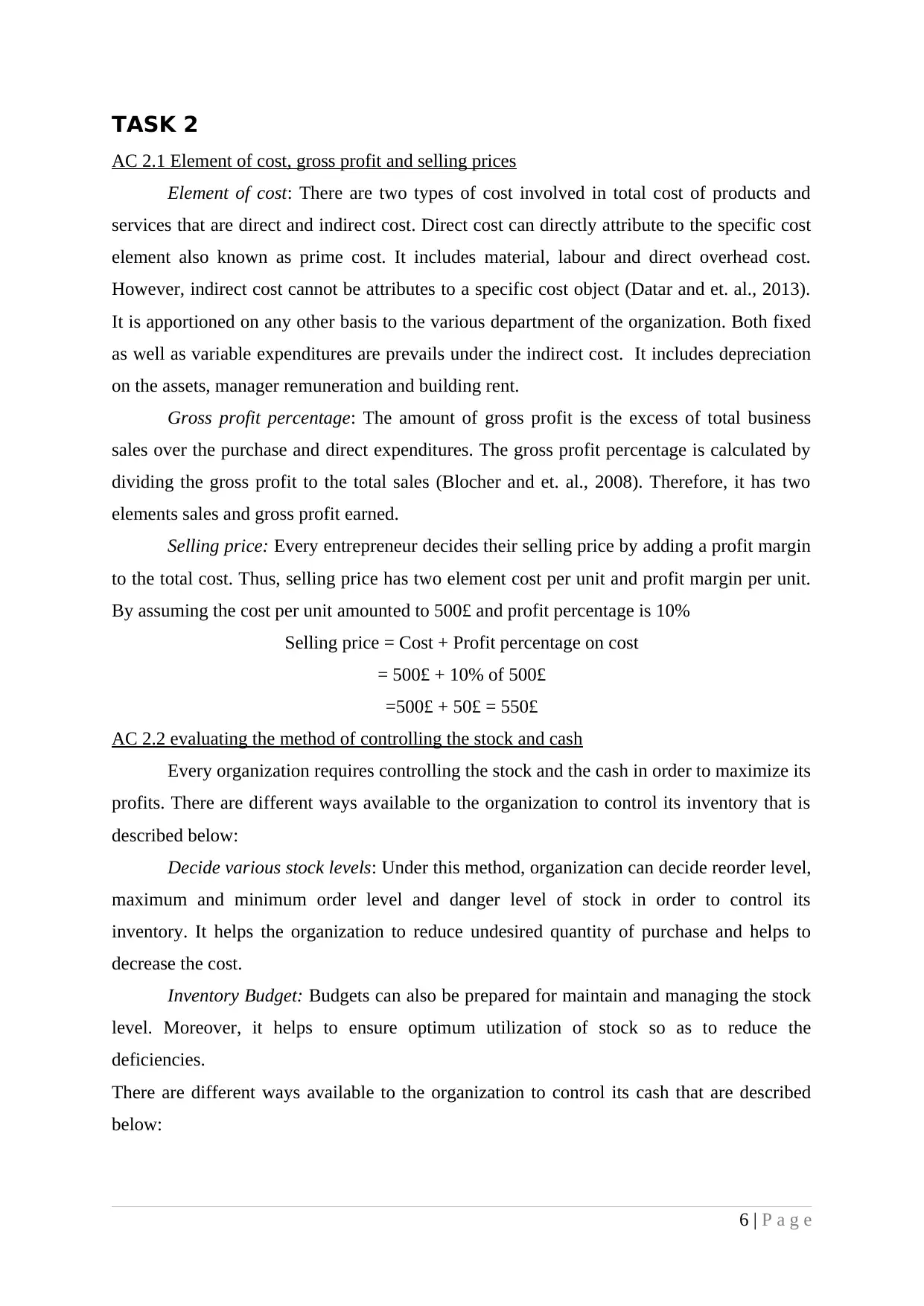

AC 3.1 Preparation of the trial balance

Trial balance: It is prepared by combining all the ledger account balances. It combines

assets and liability balances and expenditure and income balances. The purpose of preparing

the trial balance is to determine the arithmetical or mathematical accuracy (Stickney and et.

al., 2009). Moreover, it helps the business in preparing the final accounts including both

income statement and balance sheet.

Table 1: Trial balance

Particulars Debit (£) Credit (£)

Bank loan 12000

Cash 11700

Capital 13000

Rates 1880

Trade creditors 11200

Purchases 12400

Sales 14600

Sundry creditor 1620

Debtors 12000

Bank loan interest 1400

Other expenses 11020

Vehicle 2020

Total 52420 52420

7 | P a g e

period so as to know the cash surplus or deficit. It helps to reduce the cash deficit by reducing

the expenditures and increase its revenues (Baker and English, 2009). By preparing this

budget the business can manage their cash related activities more efficiently.

Cash flow management: This statement analyse the cash inflows and outflows by

business operating, investing and financing activities. Through this statement the business

can find out the areas where it needs to control their expenditures. Thus, this statement helps

to enhance the cash inflows by analysing the sources and application of funds.

TASK 3

AC 3.1 Preparation of the trial balance

Trial balance: It is prepared by combining all the ledger account balances. It combines

assets and liability balances and expenditure and income balances. The purpose of preparing

the trial balance is to determine the arithmetical or mathematical accuracy (Stickney and et.

al., 2009). Moreover, it helps the business in preparing the final accounts including both

income statement and balance sheet.

Table 1: Trial balance

Particulars Debit (£) Credit (£)

Bank loan 12000

Cash 11700

Capital 13000

Rates 1880

Trade creditors 11200

Purchases 12400

Sales 14600

Sundry creditor 1620

Debtors 12000

Bank loan interest 1400

Other expenses 11020

Vehicle 2020

Total 52420 52420

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

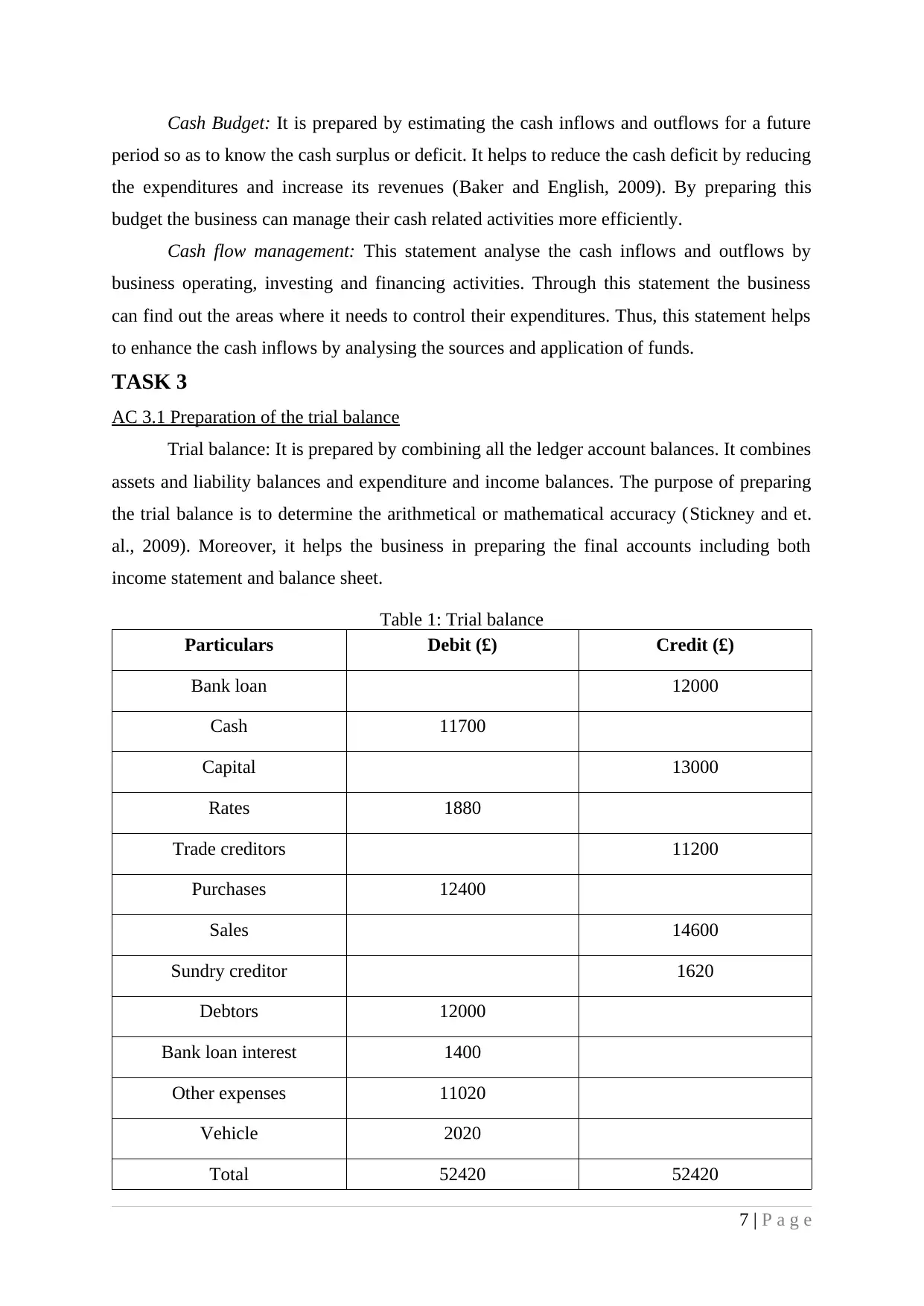

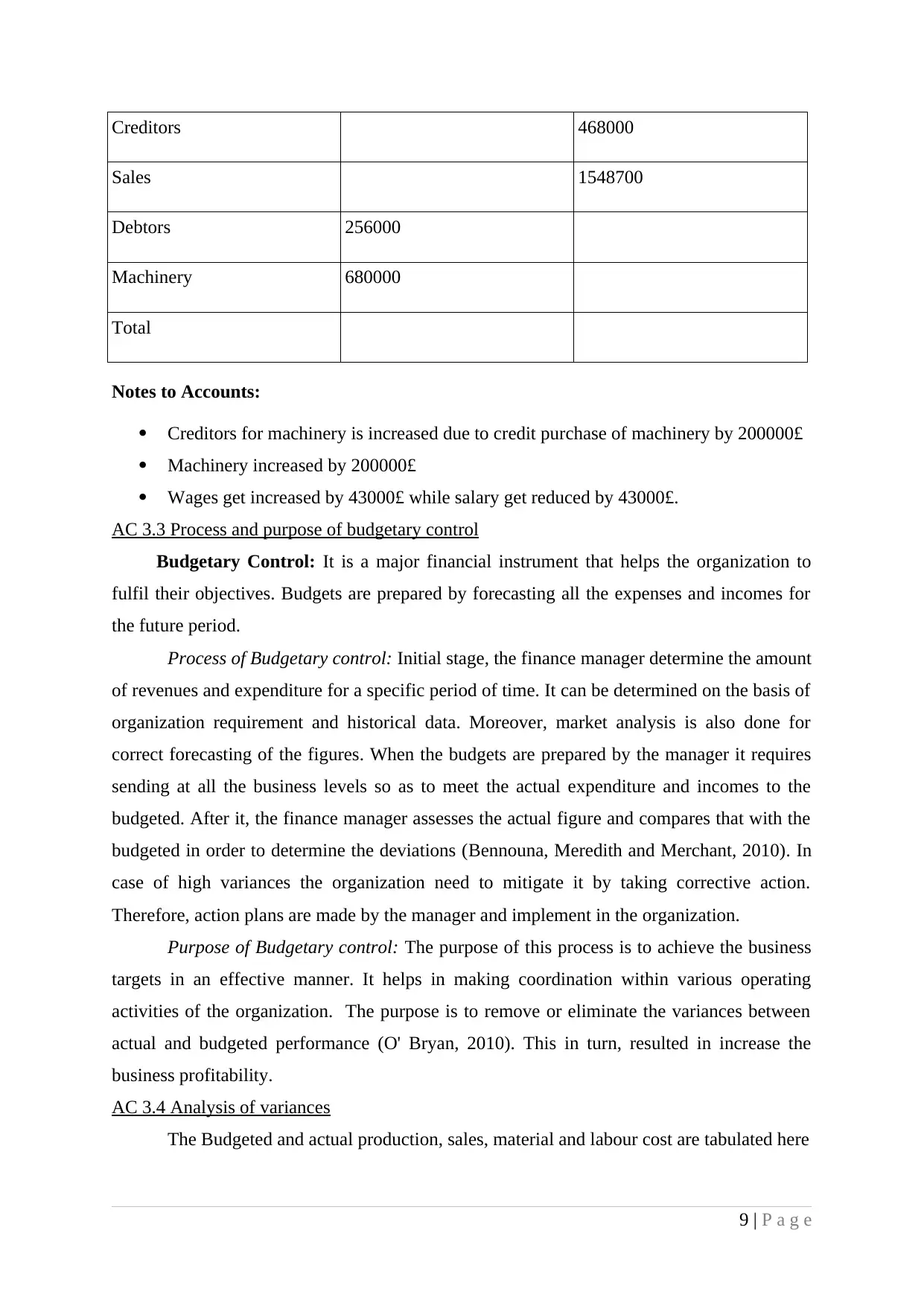

AC 3.2 Evaluating the business accounts, adjustment and notes

Date Particulars Debit (£) Credit (£)

03/03/12 Machinery a/c...............Dr.

To Ramsay machine

tools....................Cr.

200000

200000

30/12/12 Wages a/c..................Dr.

To cash...Cr.

43000

43000

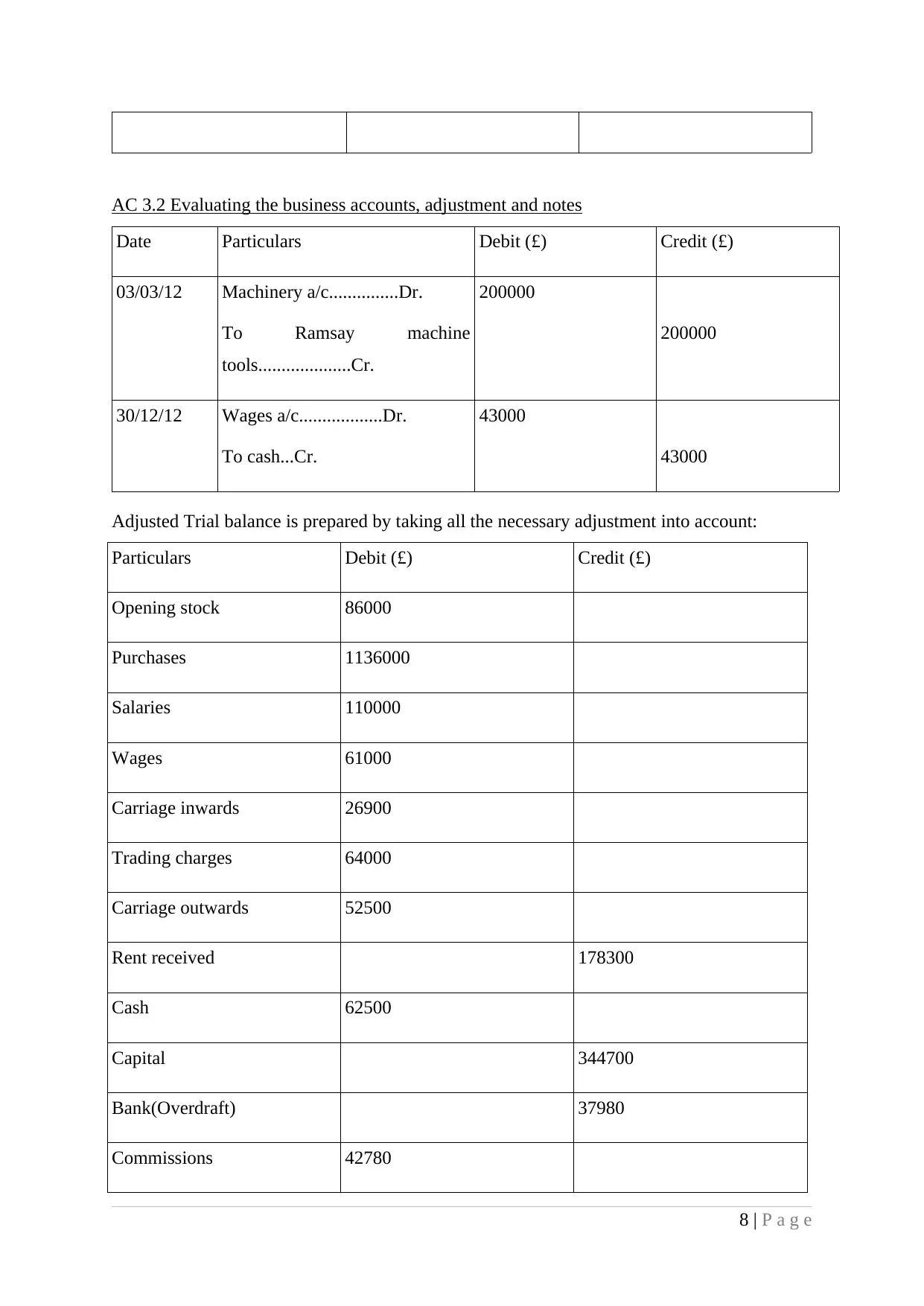

Adjusted Trial balance is prepared by taking all the necessary adjustment into account:

Particulars Debit (£) Credit (£)

Opening stock 86000

Purchases 1136000

Salaries 110000

Wages 61000

Carriage inwards 26900

Trading charges 64000

Carriage outwards 52500

Rent received 178300

Cash 62500

Capital 344700

Bank(Overdraft) 37980

Commissions 42780

8 | P a g e

Date Particulars Debit (£) Credit (£)

03/03/12 Machinery a/c...............Dr.

To Ramsay machine

tools....................Cr.

200000

200000

30/12/12 Wages a/c..................Dr.

To cash...Cr.

43000

43000

Adjusted Trial balance is prepared by taking all the necessary adjustment into account:

Particulars Debit (£) Credit (£)

Opening stock 86000

Purchases 1136000

Salaries 110000

Wages 61000

Carriage inwards 26900

Trading charges 64000

Carriage outwards 52500

Rent received 178300

Cash 62500

Capital 344700

Bank(Overdraft) 37980

Commissions 42780

8 | P a g e

Creditors 468000

Sales 1548700

Debtors 256000

Machinery 680000

Total

Notes to Accounts:

Creditors for machinery is increased due to credit purchase of machinery by 200000£

Machinery increased by 200000£

Wages get increased by 43000£ while salary get reduced by 43000£.

AC 3.3 Process and purpose of budgetary control

Budgetary Control: It is a major financial instrument that helps the organization to

fulfil their objectives. Budgets are prepared by forecasting all the expenses and incomes for

the future period.

Process of Budgetary control: Initial stage, the finance manager determine the amount

of revenues and expenditure for a specific period of time. It can be determined on the basis of

organization requirement and historical data. Moreover, market analysis is also done for

correct forecasting of the figures. When the budgets are prepared by the manager it requires

sending at all the business levels so as to meet the actual expenditure and incomes to the

budgeted. After it, the finance manager assesses the actual figure and compares that with the

budgeted in order to determine the deviations (Bennouna, Meredith and Merchant, 2010). In

case of high variances the organization need to mitigate it by taking corrective action.

Therefore, action plans are made by the manager and implement in the organization.

Purpose of Budgetary control: The purpose of this process is to achieve the business

targets in an effective manner. It helps in making coordination within various operating

activities of the organization. The purpose is to remove or eliminate the variances between

actual and budgeted performance (O' Bryan, 2010). This in turn, resulted in increase the

business profitability.

AC 3.4 Analysis of variances

The Budgeted and actual production, sales, material and labour cost are tabulated here

9 | P a g e

Sales 1548700

Debtors 256000

Machinery 680000

Total

Notes to Accounts:

Creditors for machinery is increased due to credit purchase of machinery by 200000£

Machinery increased by 200000£

Wages get increased by 43000£ while salary get reduced by 43000£.

AC 3.3 Process and purpose of budgetary control

Budgetary Control: It is a major financial instrument that helps the organization to

fulfil their objectives. Budgets are prepared by forecasting all the expenses and incomes for

the future period.

Process of Budgetary control: Initial stage, the finance manager determine the amount

of revenues and expenditure for a specific period of time. It can be determined on the basis of

organization requirement and historical data. Moreover, market analysis is also done for

correct forecasting of the figures. When the budgets are prepared by the manager it requires

sending at all the business levels so as to meet the actual expenditure and incomes to the

budgeted. After it, the finance manager assesses the actual figure and compares that with the

budgeted in order to determine the deviations (Bennouna, Meredith and Merchant, 2010). In

case of high variances the organization need to mitigate it by taking corrective action.

Therefore, action plans are made by the manager and implement in the organization.

Purpose of Budgetary control: The purpose of this process is to achieve the business

targets in an effective manner. It helps in making coordination within various operating

activities of the organization. The purpose is to remove or eliminate the variances between

actual and budgeted performance (O' Bryan, 2010). This in turn, resulted in increase the

business profitability.

AC 3.4 Analysis of variances

The Budgeted and actual production, sales, material and labour cost are tabulated here

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

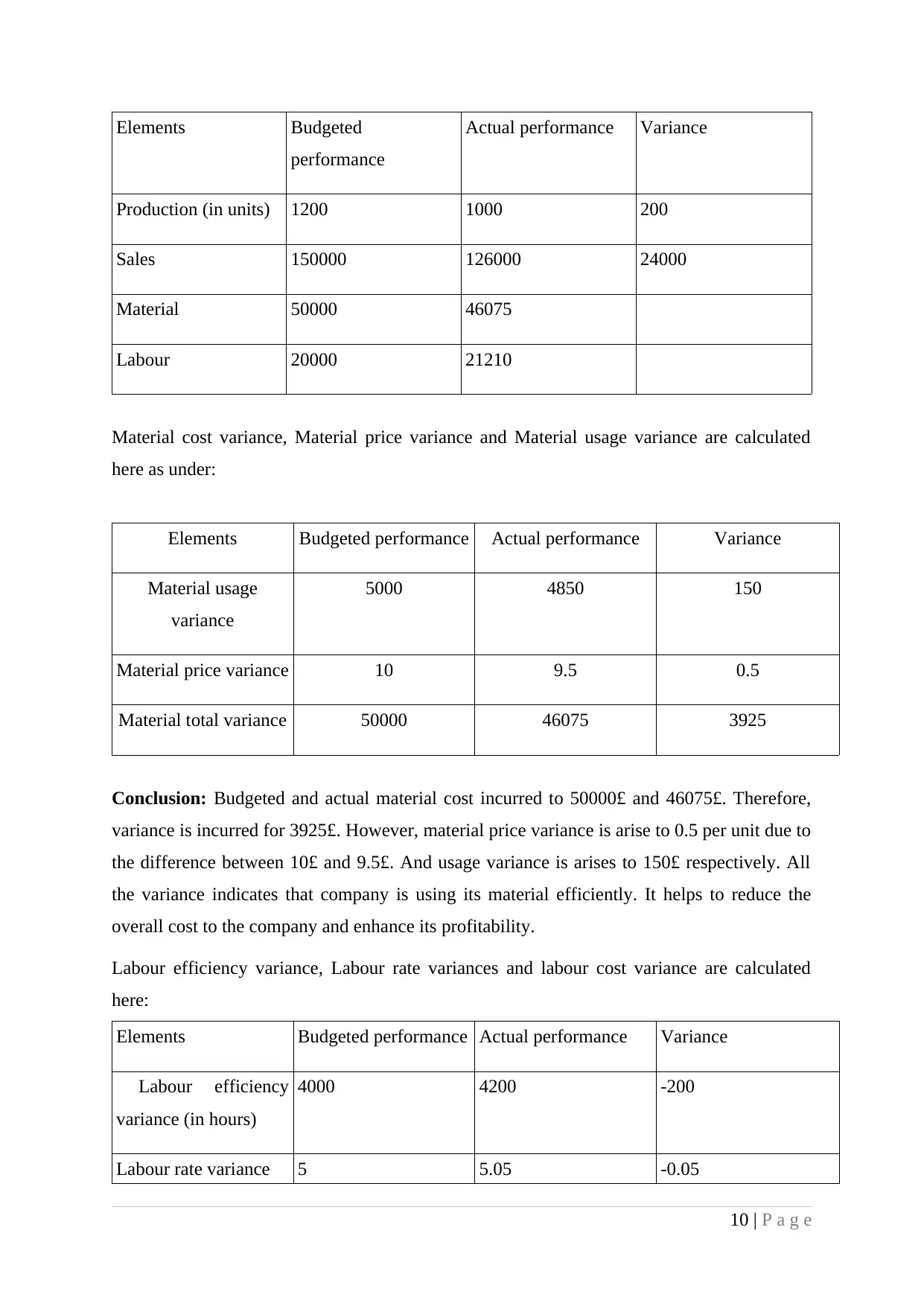

Elements Budgeted

performance

Actual performance Variance

Production (in units) 1200 1000 200

Sales 150000 126000 24000

Material 50000 46075

Labour 20000 21210

Material cost variance, Material price variance and Material usage variance are calculated

here as under:

Elements Budgeted performance Actual performance Variance

Material usage

variance

5000 4850 150

Material price variance 10 9.5 0.5

Material total variance 50000 46075 3925

Conclusion: Budgeted and actual material cost incurred to 50000£ and 46075£. Therefore,

variance is incurred for 3925£. However, material price variance is arise to 0.5 per unit due to

the difference between 10£ and 9.5£. And usage variance is arises to 150£ respectively. All

the variance indicates that company is using its material efficiently. It helps to reduce the

overall cost to the company and enhance its profitability.

Labour efficiency variance, Labour rate variances and labour cost variance are calculated

here:

Elements Budgeted performance Actual performance Variance

Labour efficiency

variance (in hours)

4000 4200 -200

Labour rate variance 5 5.05 -0.05

10 | P a g e

performance

Actual performance Variance

Production (in units) 1200 1000 200

Sales 150000 126000 24000

Material 50000 46075

Labour 20000 21210

Material cost variance, Material price variance and Material usage variance are calculated

here as under:

Elements Budgeted performance Actual performance Variance

Material usage

variance

5000 4850 150

Material price variance 10 9.5 0.5

Material total variance 50000 46075 3925

Conclusion: Budgeted and actual material cost incurred to 50000£ and 46075£. Therefore,

variance is incurred for 3925£. However, material price variance is arise to 0.5 per unit due to

the difference between 10£ and 9.5£. And usage variance is arises to 150£ respectively. All

the variance indicates that company is using its material efficiently. It helps to reduce the

overall cost to the company and enhance its profitability.

Labour efficiency variance, Labour rate variances and labour cost variance are calculated

here:

Elements Budgeted performance Actual performance Variance

Labour efficiency

variance (in hours)

4000 4200 -200

Labour rate variance 5 5.05 -0.05

10 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

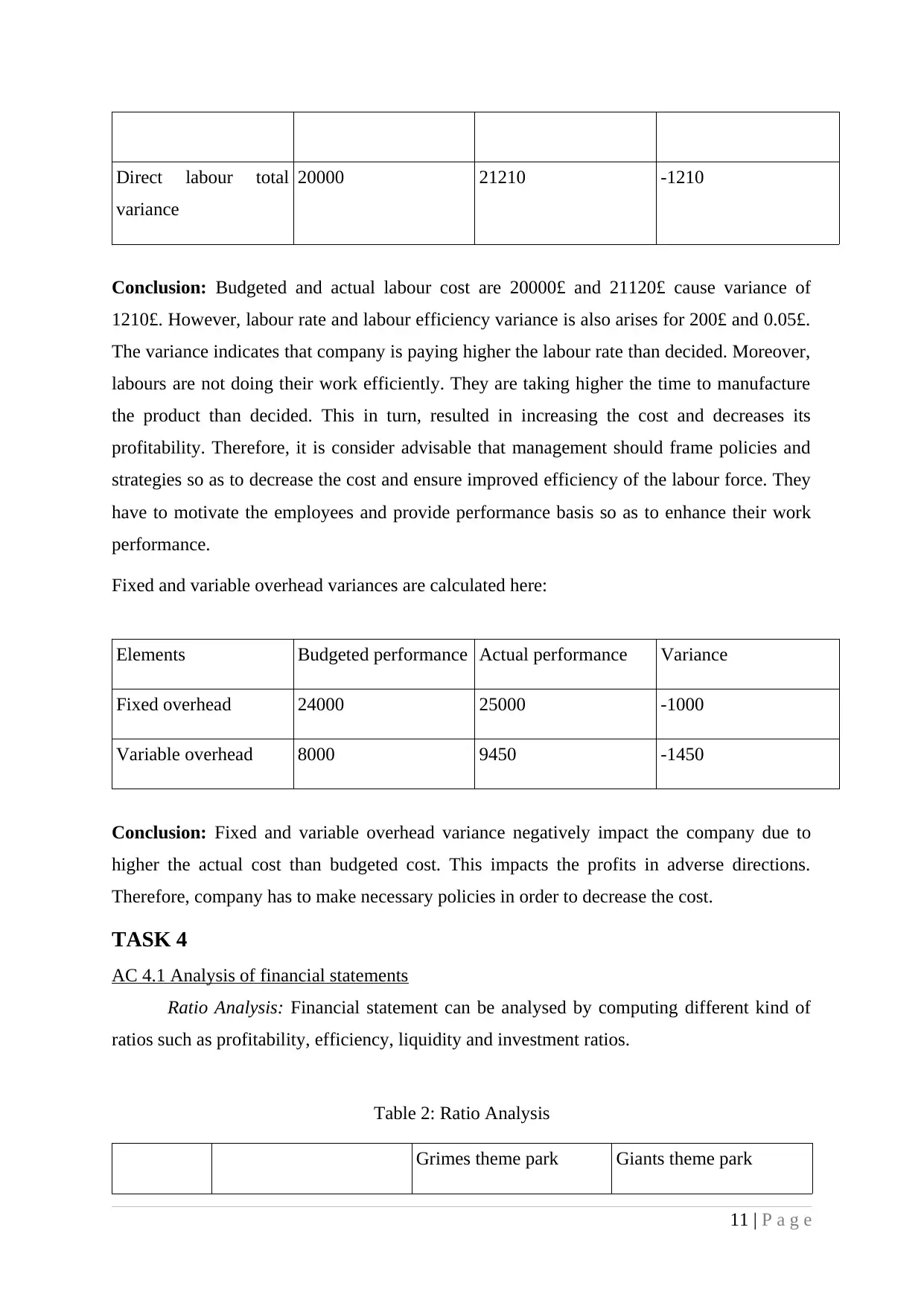

Direct labour total

variance

20000 21210 -1210

Conclusion: Budgeted and actual labour cost are 20000£ and 21120£ cause variance of

1210£. However, labour rate and labour efficiency variance is also arises for 200£ and 0.05£.

The variance indicates that company is paying higher the labour rate than decided. Moreover,

labours are not doing their work efficiently. They are taking higher the time to manufacture

the product than decided. This in turn, resulted in increasing the cost and decreases its

profitability. Therefore, it is consider advisable that management should frame policies and

strategies so as to decrease the cost and ensure improved efficiency of the labour force. They

have to motivate the employees and provide performance basis so as to enhance their work

performance.

Fixed and variable overhead variances are calculated here:

Elements Budgeted performance Actual performance Variance

Fixed overhead 24000 25000 -1000

Variable overhead 8000 9450 -1450

Conclusion: Fixed and variable overhead variance negatively impact the company due to

higher the actual cost than budgeted cost. This impacts the profits in adverse directions.

Therefore, company has to make necessary policies in order to decrease the cost.

TASK 4

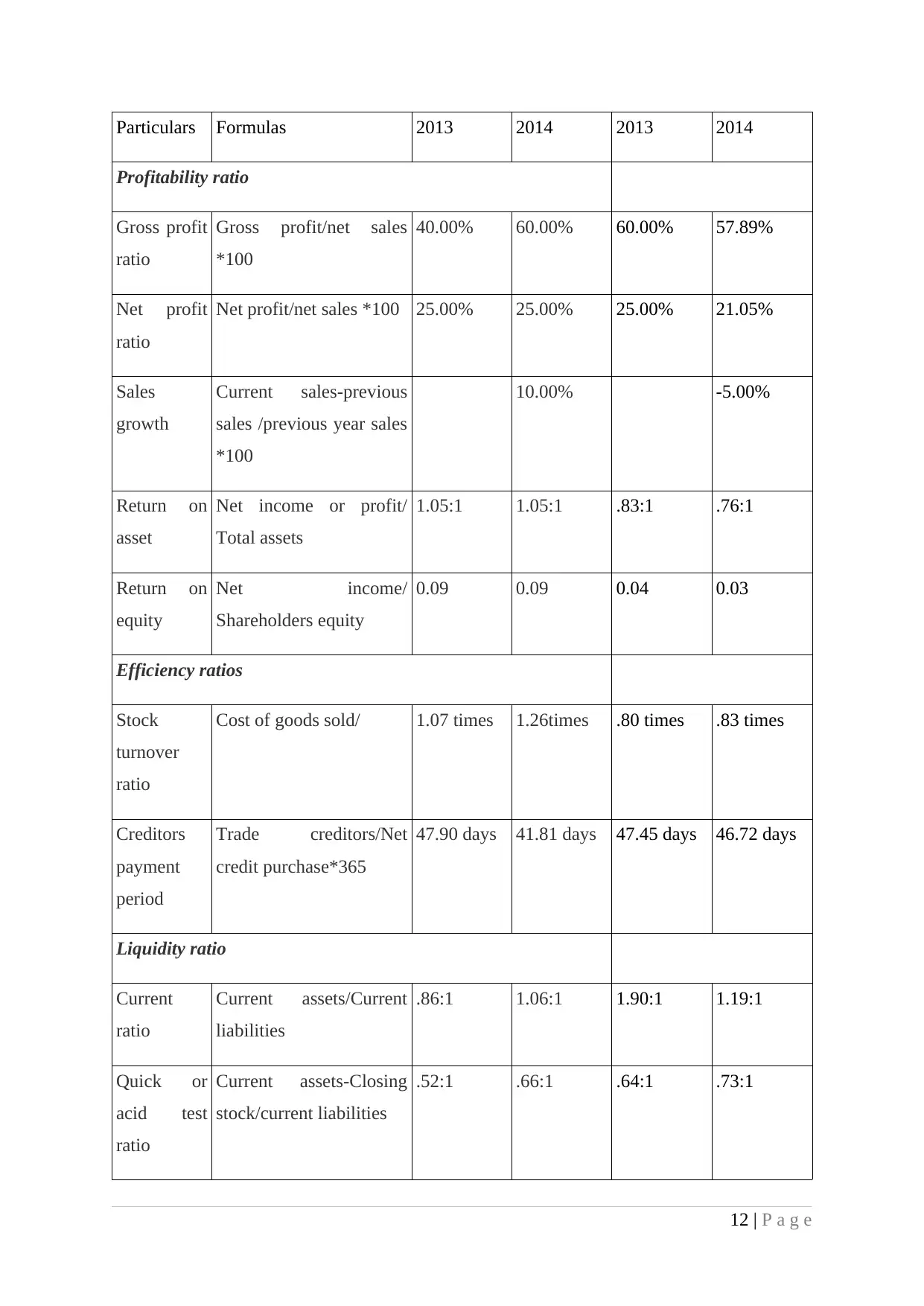

AC 4.1 Analysis of financial statements

Ratio Analysis: Financial statement can be analysed by computing different kind of

ratios such as profitability, efficiency, liquidity and investment ratios.

Table 2: Ratio Analysis

Grimes theme park Giants theme park

11 | P a g e

variance

20000 21210 -1210

Conclusion: Budgeted and actual labour cost are 20000£ and 21120£ cause variance of

1210£. However, labour rate and labour efficiency variance is also arises for 200£ and 0.05£.

The variance indicates that company is paying higher the labour rate than decided. Moreover,

labours are not doing their work efficiently. They are taking higher the time to manufacture

the product than decided. This in turn, resulted in increasing the cost and decreases its

profitability. Therefore, it is consider advisable that management should frame policies and

strategies so as to decrease the cost and ensure improved efficiency of the labour force. They

have to motivate the employees and provide performance basis so as to enhance their work

performance.

Fixed and variable overhead variances are calculated here:

Elements Budgeted performance Actual performance Variance

Fixed overhead 24000 25000 -1000

Variable overhead 8000 9450 -1450

Conclusion: Fixed and variable overhead variance negatively impact the company due to

higher the actual cost than budgeted cost. This impacts the profits in adverse directions.

Therefore, company has to make necessary policies in order to decrease the cost.

TASK 4

AC 4.1 Analysis of financial statements

Ratio Analysis: Financial statement can be analysed by computing different kind of

ratios such as profitability, efficiency, liquidity and investment ratios.

Table 2: Ratio Analysis

Grimes theme park Giants theme park

11 | P a g e

Particulars Formulas 2013 2014 2013 2014

Profitability ratio

Gross profit

ratio

Gross profit/net sales

*100

40.00% 60.00% 60.00% 57.89%

Net profit

ratio

Net profit/net sales *100 25.00% 25.00% 25.00% 21.05%

Sales

growth

Current sales-previous

sales /previous year sales

*100

10.00% -5.00%

Return on

asset

Net income or profit/

Total assets

1.05:1 1.05:1 .83:1 .76:1

Return on

equity

Net income/

Shareholders equity

0.09 0.09 0.04 0.03

Efficiency ratios

Stock

turnover

ratio

Cost of goods sold/ 1.07 times 1.26times .80 times .83 times

Creditors

payment

period

Trade creditors/Net

credit purchase*365

47.90 days 41.81 days 47.45 days 46.72 days

Liquidity ratio

Current

ratio

Current assets/Current

liabilities

.86:1 1.06:1 1.90:1 1.19:1

Quick or

acid test

ratio

Current assets-Closing

stock/current liabilities

.52:1 .66:1 .64:1 .73:1

12 | P a g e

Profitability ratio

Gross profit

ratio

Gross profit/net sales

*100

40.00% 60.00% 60.00% 57.89%

Net profit

ratio

Net profit/net sales *100 25.00% 25.00% 25.00% 21.05%

Sales

growth

Current sales-previous

sales /previous year sales

*100

10.00% -5.00%

Return on

asset

Net income or profit/

Total assets

1.05:1 1.05:1 .83:1 .76:1

Return on

equity

Net income/

Shareholders equity

0.09 0.09 0.04 0.03

Efficiency ratios

Stock

turnover

ratio

Cost of goods sold/ 1.07 times 1.26times .80 times .83 times

Creditors

payment

period

Trade creditors/Net

credit purchase*365

47.90 days 41.81 days 47.45 days 46.72 days

Liquidity ratio

Current

ratio

Current assets/Current

liabilities

.86:1 1.06:1 1.90:1 1.19:1

Quick or

acid test

ratio

Current assets-Closing

stock/current liabilities

.52:1 .66:1 .64:1 .73:1

12 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.