Book Keeping in Accounting Assignment - Finance Module

VerifiedAdded on 2021/10/27

|16

|2165

|66

Homework Assignment

AI Summary

This document presents a comprehensive solution to a book keeping assignment, addressing various aspects of accounting practices. The assignment covers topics such as maintaining client relationships, distinguishing roles of accountants and bookkeepers, and the importance of engagement letters. It delves into the requirements for small businesses, including GST registration, PAYG withholding, and Fringe Benefits Tax. The solution explores different accounting systems, petty cash management, and accounts receivable flow charts. It also examines team dynamics, reporting, and employee motivation. Furthermore, the assignment provides insights into professional service improvements, the roles of accountants and bookkeepers, and the requirements for BAS agent registration. The document includes references to relevant accounting standards and legislation.

Running head: BOOK KEEPING IN ACCOUNTING

Book Keeping in Accounting

Name of the Student:

Name of the University:

Authors Note:

Book Keeping in Accounting

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

BOOK KEEPING IN ACCOUNTING

Contents

Task 1:.............................................................................................................................................2

Part a:...........................................................................................................................................2

Part b:...........................................................................................................................................2

Par c:............................................................................................................................................4

Part d:...........................................................................................................................................4

Part e:...........................................................................................................................................5

Part f:...........................................................................................................................................6

Answer 2:.........................................................................................................................................6

Part b:...........................................................................................................................................7

Part c:...........................................................................................................................................8

Answer 3:.........................................................................................................................................9

Part a:...........................................................................................................................................9

Part b:...........................................................................................................................................9

Part c:.........................................................................................................................................10

Answer 4:.......................................................................................................................................11

Part a:.........................................................................................................................................11

Part b:.........................................................................................................................................11

Part c:.........................................................................................................................................11

Part d:.........................................................................................................................................11

BOOK KEEPING IN ACCOUNTING

Contents

Task 1:.............................................................................................................................................2

Part a:...........................................................................................................................................2

Part b:...........................................................................................................................................2

Par c:............................................................................................................................................4

Part d:...........................................................................................................................................4

Part e:...........................................................................................................................................5

Part f:...........................................................................................................................................6

Answer 2:.........................................................................................................................................6

Part b:...........................................................................................................................................7

Part c:...........................................................................................................................................8

Answer 3:.........................................................................................................................................9

Part a:...........................................................................................................................................9

Part b:...........................................................................................................................................9

Part c:.........................................................................................................................................10

Answer 4:.......................................................................................................................................11

Part a:.........................................................................................................................................11

Part b:.........................................................................................................................................11

Part c:.........................................................................................................................................11

Part d:.........................................................................................................................................11

2

BOOK KEEPING IN ACCOUNTING

Part e:.........................................................................................................................................12

Answer 5:.......................................................................................................................................12

Part a:.........................................................................................................................................12

Part b:.........................................................................................................................................13

Part c:.........................................................................................................................................13

Part d:.........................................................................................................................................13

References:....................................................................................................................................15

BOOK KEEPING IN ACCOUNTING

Part e:.........................................................................................................................................12

Answer 5:.......................................................................................................................................12

Part a:.........................................................................................................................................12

Part b:.........................................................................................................................................13

Part c:.........................................................................................................................................13

Part d:.........................................................................................................................................13

References:....................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

BOOK KEEPING IN ACCOUNTING

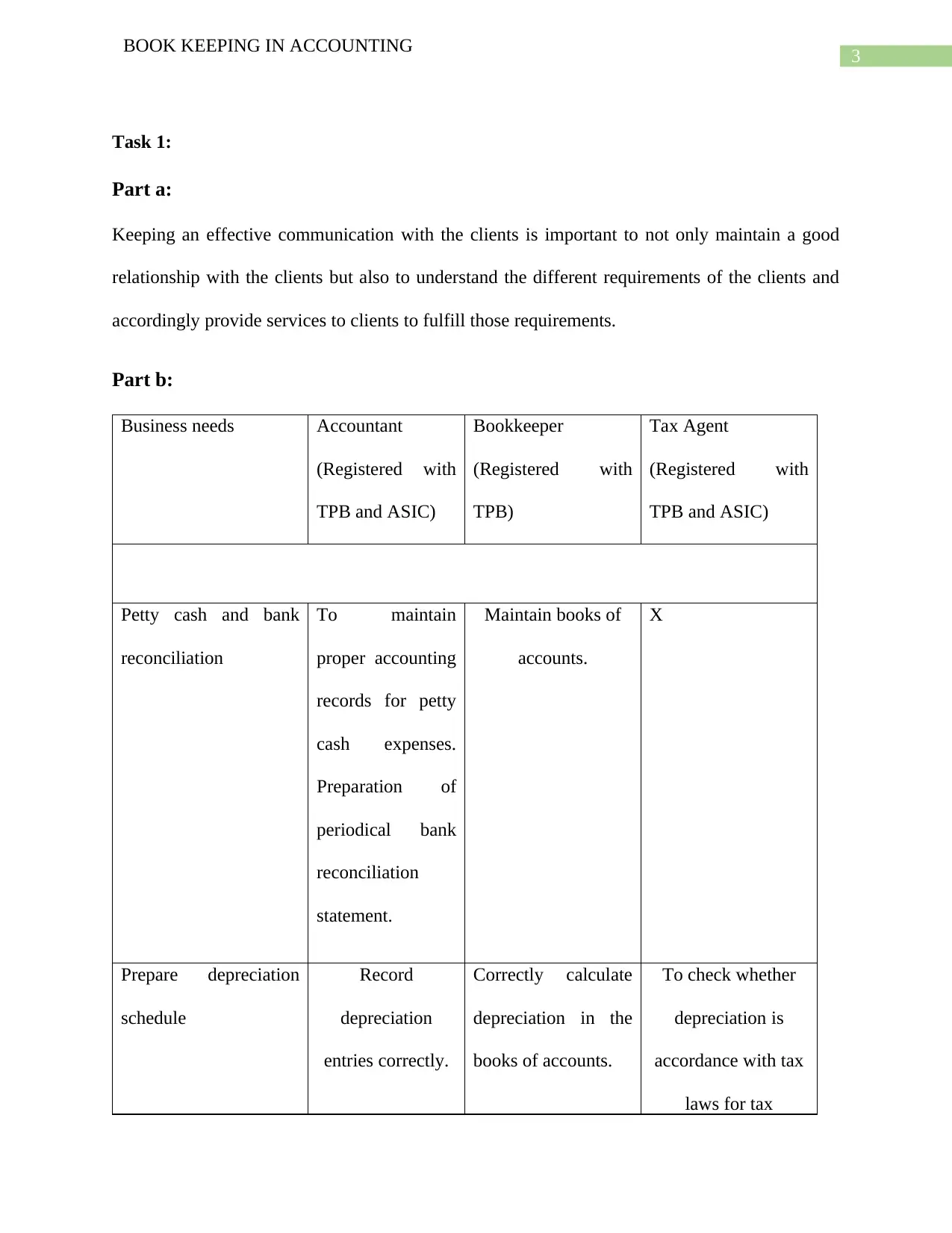

Task 1:

Part a:

Keeping an effective communication with the clients is important to not only maintain a good

relationship with the clients but also to understand the different requirements of the clients and

accordingly provide services to clients to fulfill those requirements.

Part b:

Business needs Accountant

(Registered with

TPB and ASIC)

Bookkeeper

(Registered with

TPB)

Tax Agent

(Registered with

TPB and ASIC)

Petty cash and bank

reconciliation

To maintain

proper accounting

records for petty

cash expenses.

Preparation of

periodical bank

reconciliation

statement.

Maintain books of

accounts.

X

Prepare depreciation

schedule

Record

depreciation

entries correctly.

Correctly calculate

depreciation in the

books of accounts.

To check whether

depreciation is

accordance with tax

laws for tax

BOOK KEEPING IN ACCOUNTING

Task 1:

Part a:

Keeping an effective communication with the clients is important to not only maintain a good

relationship with the clients but also to understand the different requirements of the clients and

accordingly provide services to clients to fulfill those requirements.

Part b:

Business needs Accountant

(Registered with

TPB and ASIC)

Bookkeeper

(Registered with

TPB)

Tax Agent

(Registered with

TPB and ASIC)

Petty cash and bank

reconciliation

To maintain

proper accounting

records for petty

cash expenses.

Preparation of

periodical bank

reconciliation

statement.

Maintain books of

accounts.

X

Prepare depreciation

schedule

Record

depreciation

entries correctly.

Correctly calculate

depreciation in the

books of accounts.

To check whether

depreciation is

accordance with tax

laws for tax

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

BOOK KEEPING IN ACCOUNTING

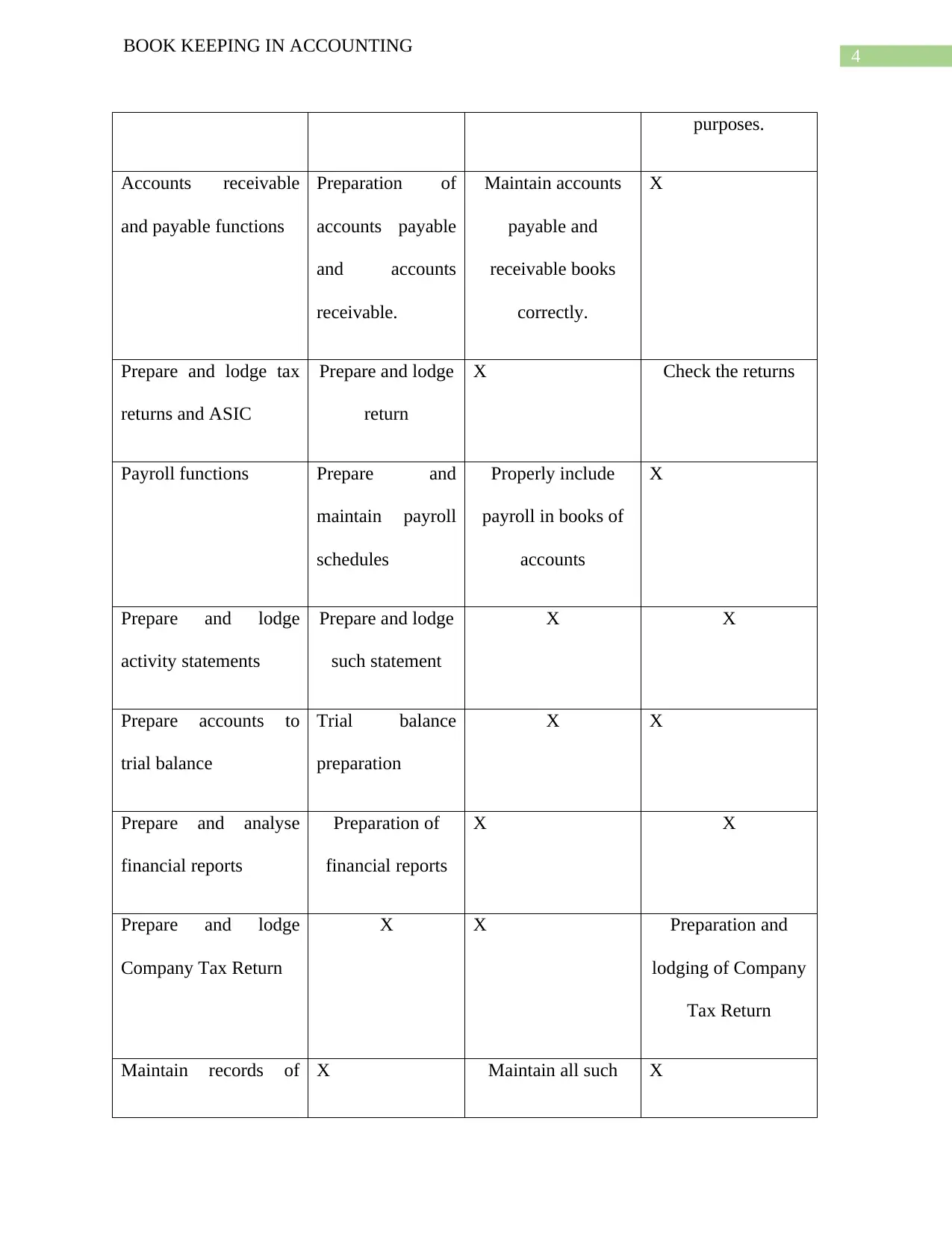

purposes.

Accounts receivable

and payable functions

Preparation of

accounts payable

and accounts

receivable.

Maintain accounts

payable and

receivable books

correctly.

X

Prepare and lodge tax

returns and ASIC

Prepare and lodge

return

X Check the returns

Payroll functions Prepare and

maintain payroll

schedules

Properly include

payroll in books of

accounts

X

Prepare and lodge

activity statements

Prepare and lodge

such statement

X X

Prepare accounts to

trial balance

Trial balance

preparation

X X

Prepare and analyse

financial reports

Preparation of

financial reports

X X

Prepare and lodge

Company Tax Return

X X Preparation and

lodging of Company

Tax Return

Maintain records of X Maintain all such X

BOOK KEEPING IN ACCOUNTING

purposes.

Accounts receivable

and payable functions

Preparation of

accounts payable

and accounts

receivable.

Maintain accounts

payable and

receivable books

correctly.

X

Prepare and lodge tax

returns and ASIC

Prepare and lodge

return

X Check the returns

Payroll functions Prepare and

maintain payroll

schedules

Properly include

payroll in books of

accounts

X

Prepare and lodge

activity statements

Prepare and lodge

such statement

X X

Prepare accounts to

trial balance

Trial balance

preparation

X X

Prepare and analyse

financial reports

Preparation of

financial reports

X X

Prepare and lodge

Company Tax Return

X X Preparation and

lodging of Company

Tax Return

Maintain records of X Maintain all such X

5

BOOK KEEPING IN ACCOUNTING

transactions transactions in books

of accounts.

Par c:

(i) Auditors and qualified Certified Accountants of Australia.

(ii) Superannuation and investment experts.

(iii) Information & Technology professionals.

(iv) Financial advisers.

Part d:

Letter of Engagement

To,

Mr David Brown,

51 Burke Street,

Melbourne, Vic-3000

Australia.

Ref: Engagement letter:

Respected sir,

This letter will help you understand the scope of our work in relation to your business. Our

responsibility is to prepare the books of accounts for your business based on the information

provided by you and your staffs. Thus, we shall not verify the true and fair nature of the

BOOK KEEPING IN ACCOUNTING

transactions transactions in books

of accounts.

Par c:

(i) Auditors and qualified Certified Accountants of Australia.

(ii) Superannuation and investment experts.

(iii) Information & Technology professionals.

(iv) Financial advisers.

Part d:

Letter of Engagement

To,

Mr David Brown,

51 Burke Street,

Melbourne, Vic-3000

Australia.

Ref: Engagement letter:

Respected sir,

This letter will help you understand the scope of our work in relation to your business. Our

responsibility is to prepare the books of accounts for your business based on the information

provided by you and your staffs. Thus, we shall not verify the true and fair nature of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

BOOK KEEPING IN ACCOUNTING

information. It is not an audit engagement rather an engagement to maintain the books of

accounts to record financial transactions of your business in the books of accounts. The books of

accounts shall be prepared in accordance with the applicable accounting standards to the nature

of business carried out by you. Up-to-date accounting records shall be maintained and provided

to your staffs as and when required to enable them to take important business decisions. The

information collected about your business shall not be disclosed by us to anyone without your

permission and as required under the laws (Guthrie and Parker, 2016). In case of any

contravention with the terms and conditions of the engagement then the engagement shall be

liable to be cancelled based on your final assessment and decision on the issue.

Please carefully read the above letter and acknowledge the engagement letter. In case of any

confusion with any points of the letter please do not hesitate to contact.

Regards,

(Name of the student)

Part e:

1. Have the necessary information required by the client has been made available to the client as and

when needed?

2. Do the client have up-to-date accounting information to assess and evaluate the financial position

of the business at any point of time?

3. Is the books of accounts have been prepared correctly as per the accounting standards in the

country?

Part f:

1. Integrity.

BOOK KEEPING IN ACCOUNTING

information. It is not an audit engagement rather an engagement to maintain the books of

accounts to record financial transactions of your business in the books of accounts. The books of

accounts shall be prepared in accordance with the applicable accounting standards to the nature

of business carried out by you. Up-to-date accounting records shall be maintained and provided

to your staffs as and when required to enable them to take important business decisions. The

information collected about your business shall not be disclosed by us to anyone without your

permission and as required under the laws (Guthrie and Parker, 2016). In case of any

contravention with the terms and conditions of the engagement then the engagement shall be

liable to be cancelled based on your final assessment and decision on the issue.

Please carefully read the above letter and acknowledge the engagement letter. In case of any

confusion with any points of the letter please do not hesitate to contact.

Regards,

(Name of the student)

Part e:

1. Have the necessary information required by the client has been made available to the client as and

when needed?

2. Do the client have up-to-date accounting information to assess and evaluate the financial position

of the business at any point of time?

3. Is the books of accounts have been prepared correctly as per the accounting standards in the

country?

Part f:

1. Integrity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

BOOK KEEPING IN ACCOUNTING

2. Honesty.

3. Reliable.

4. Confidentiality.

5. Privacy.

Answer 2:

(i) The small business must keep records of its financial transactions in an appropriate manner to

correctly portray the true and fair picture of the small business as on a particular date. The

books of accounts must be maintained in accordance with applicable accounting standards in

the country. Small businesses required to maintain books of accounts and prepare profit and

loss account and balance sheet as at the end of each accounting year (Carnegie, 2014).

(ii) GST registration is mandatory for small business with GST turnover threshold limit of

$75000 per annum. For GST all input and output documents shall be maintained properly.

GST on sales shall be paid after deducting input GST paid by the business. GST returns shall

be filed as per the Income Tax Assessment Act 1997.

(iii) PAYG withholding is the liability of the employer to withholding certain amount of gross

salaries and wages to be paid to the employees. PAYG Withheld must be deposited to the

credit of central Government on or before due date as per the guidelines issued by the

Australian Taxation Office (ATO).

(iv) Fringe Benefits Tax is the tax payable by the Employer for certain kind of non-monetary

benefits provided to the employees. Employer in order to motivate the employee often incurs

additional expenditure by providing non-monetary benefits such as car facility, house, loan

without or at concessional rate of interest etc. FBT is calculated on the grossed up value of

such benefits as per the taxation law in the country (Sangster, 2015).

(v) Payroll tax is the tax payable by the employees for the profession he or she is in.

BOOK KEEPING IN ACCOUNTING

2. Honesty.

3. Reliable.

4. Confidentiality.

5. Privacy.

Answer 2:

(i) The small business must keep records of its financial transactions in an appropriate manner to

correctly portray the true and fair picture of the small business as on a particular date. The

books of accounts must be maintained in accordance with applicable accounting standards in

the country. Small businesses required to maintain books of accounts and prepare profit and

loss account and balance sheet as at the end of each accounting year (Carnegie, 2014).

(ii) GST registration is mandatory for small business with GST turnover threshold limit of

$75000 per annum. For GST all input and output documents shall be maintained properly.

GST on sales shall be paid after deducting input GST paid by the business. GST returns shall

be filed as per the Income Tax Assessment Act 1997.

(iii) PAYG withholding is the liability of the employer to withholding certain amount of gross

salaries and wages to be paid to the employees. PAYG Withheld must be deposited to the

credit of central Government on or before due date as per the guidelines issued by the

Australian Taxation Office (ATO).

(iv) Fringe Benefits Tax is the tax payable by the Employer for certain kind of non-monetary

benefits provided to the employees. Employer in order to motivate the employee often incurs

additional expenditure by providing non-monetary benefits such as car facility, house, loan

without or at concessional rate of interest etc. FBT is calculated on the grossed up value of

such benefits as per the taxation law in the country (Sangster, 2015).

(v) Payroll tax is the tax payable by the employees for the profession he or she is in.

8

BOOK KEEPING IN ACCOUNTING

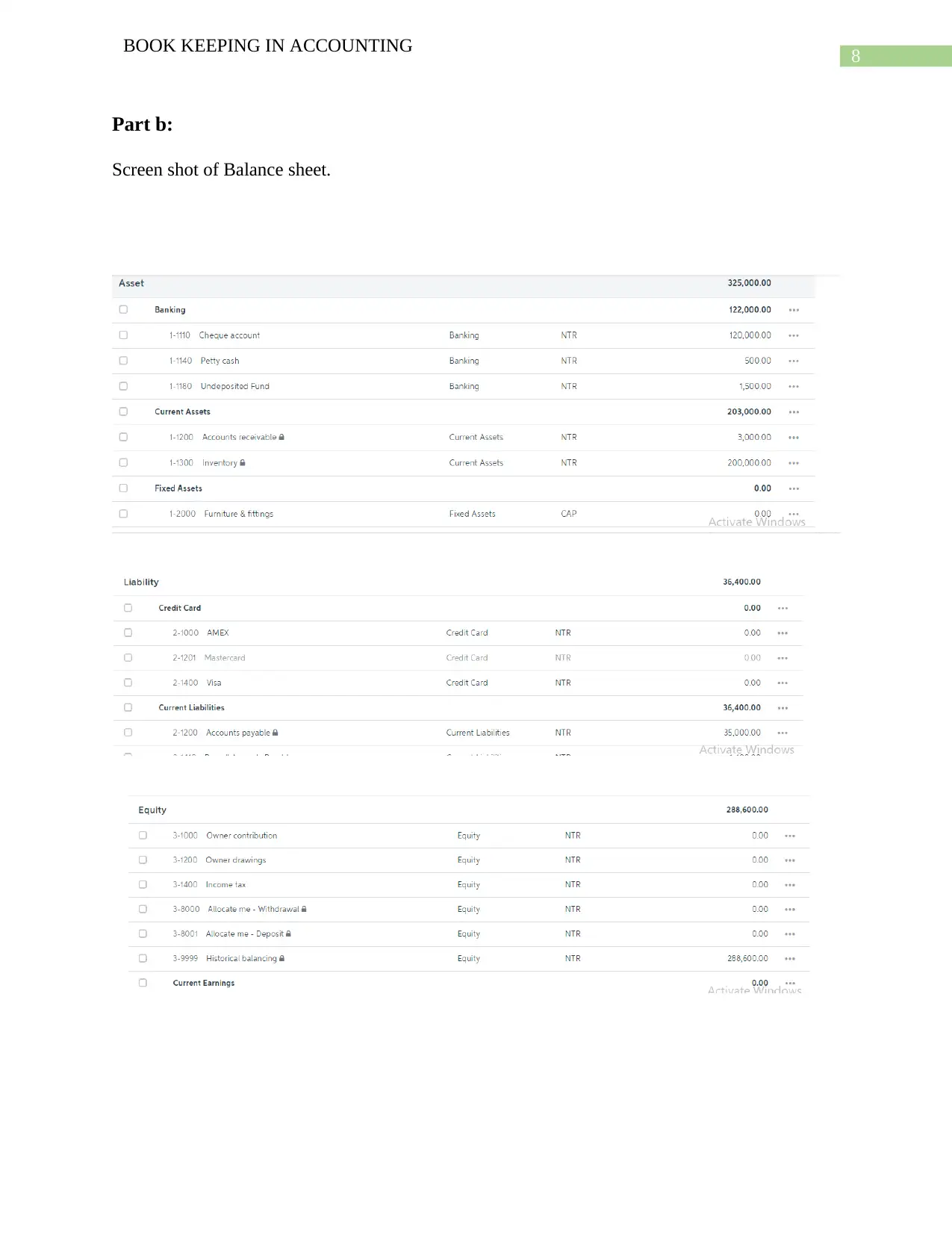

Part b:

Screen shot of Balance sheet.

BOOK KEEPING IN ACCOUNTING

Part b:

Screen shot of Balance sheet.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

BOOK KEEPING IN ACCOUNTING

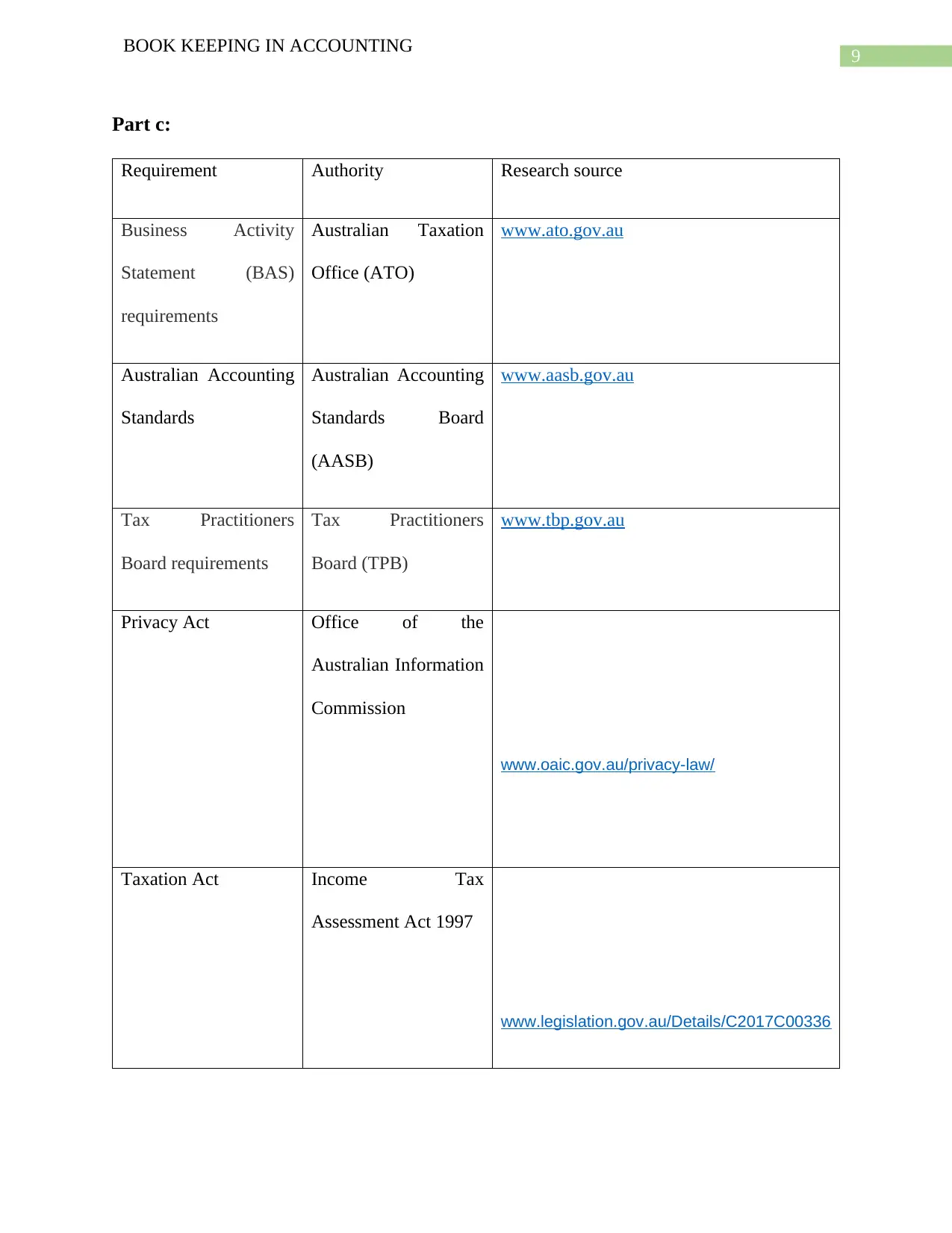

Part c:

Requirement Authority Research source

Business Activity

Statement (BAS)

requirements

Australian Taxation

Office (ATO)

www.ato.gov.au

Australian Accounting

Standards

Australian Accounting

Standards Board

(AASB)

www.aasb.gov.au

Tax Practitioners

Board requirements

Tax Practitioners

Board (TPB)

www.tbp.gov.au

Privacy Act Office of the

Australian Information

Commission

www.oaic.gov.au/privacy-law/

Taxation Act Income Tax

Assessment Act 1997

www.legislation.gov.au/Details/C2017C00336

BOOK KEEPING IN ACCOUNTING

Part c:

Requirement Authority Research source

Business Activity

Statement (BAS)

requirements

Australian Taxation

Office (ATO)

www.ato.gov.au

Australian Accounting

Standards

Australian Accounting

Standards Board

(AASB)

www.aasb.gov.au

Tax Practitioners

Board requirements

Tax Practitioners

Board (TPB)

www.tbp.gov.au

Privacy Act Office of the

Australian Information

Commission

www.oaic.gov.au/privacy-law/

Taxation Act Income Tax

Assessment Act 1997

www.legislation.gov.au/Details/C2017C00336

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

BOOK KEEPING IN ACCOUNTING

Trade Practices Act Federal Register of

Legislation

www.legislation.gov.au/Details/C2010C00426

Answer 3:

Part a:

I. Accounting system.

II. Information system.

III. Management system.

IV. Data processing system.

Part b:

Development of petty cash system policy:

The cash disbursed for petty cash expenses by the cashier shall be recorded as receipt in petty

cash system. The different petty cash expenses incurred from such amount shall be recorded as

payments in the petty cash system. The balance in petty cash system after petty cash

expenditures if negative then the amount shall be reimbursed by the cashier. In case the amount

is positive then the amounts shall be transferred to the cashier (Chenhall and Moers, 2015).

BOOK KEEPING IN ACCOUNTING

Trade Practices Act Federal Register of

Legislation

www.legislation.gov.au/Details/C2010C00426

Answer 3:

Part a:

I. Accounting system.

II. Information system.

III. Management system.

IV. Data processing system.

Part b:

Development of petty cash system policy:

The cash disbursed for petty cash expenses by the cashier shall be recorded as receipt in petty

cash system. The different petty cash expenses incurred from such amount shall be recorded as

payments in the petty cash system. The balance in petty cash system after petty cash

expenditures if negative then the amount shall be reimbursed by the cashier. In case the amount

is positive then the amounts shall be transferred to the cashier (Chenhall and Moers, 2015).

11

BOOK KEEPING IN ACCOUNTING

The petty cash claim of employees shall be met by signing petty cash vouchers by the

concerned employees. The petty cash expenses shall not be met above a certain limit for the

employees.

Checking the petty cash claim document properly to evaluate whether the cash expenses

is properly supported by necessary documents to justify such petty cash expenses. All the

supporting documents must be attached with petty cash vouchers. The vouchers shall have

proper authorization to ensure that only eligible expenses are paid from petty cash (Andersson

et. al. 2016).

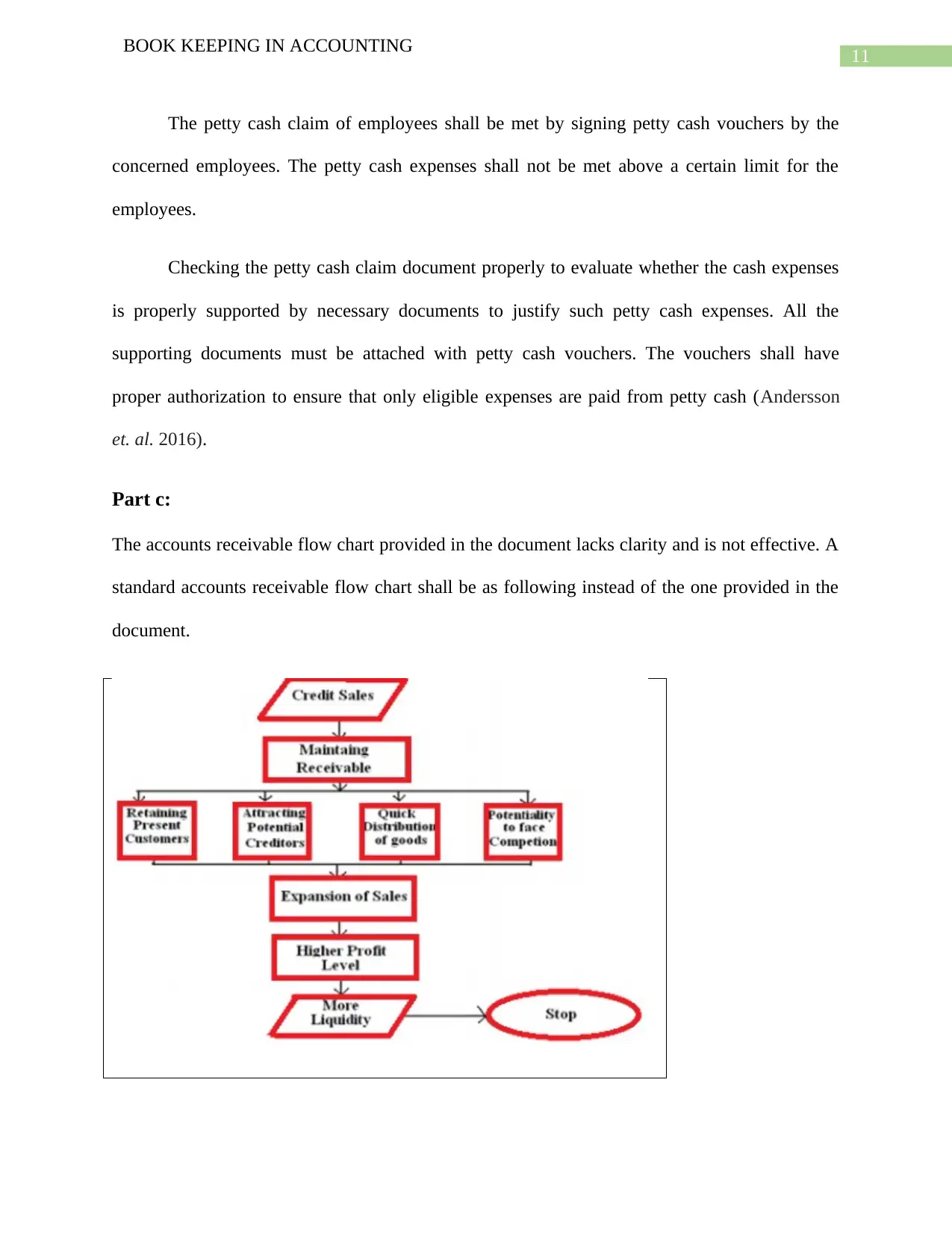

Part c:

The accounts receivable flow chart provided in the document lacks clarity and is not effective. A

standard accounts receivable flow chart shall be as following instead of the one provided in the

document.

BOOK KEEPING IN ACCOUNTING

The petty cash claim of employees shall be met by signing petty cash vouchers by the

concerned employees. The petty cash expenses shall not be met above a certain limit for the

employees.

Checking the petty cash claim document properly to evaluate whether the cash expenses

is properly supported by necessary documents to justify such petty cash expenses. All the

supporting documents must be attached with petty cash vouchers. The vouchers shall have

proper authorization to ensure that only eligible expenses are paid from petty cash (Andersson

et. al. 2016).

Part c:

The accounts receivable flow chart provided in the document lacks clarity and is not effective. A

standard accounts receivable flow chart shall be as following instead of the one provided in the

document.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.