Finance for Managers: Capital Budgeting and Working Capital Analysis

VerifiedAdded on 2020/03/13

|9

|1238

|71

Homework Assignment

AI Summary

This finance assignment delves into several key areas of financial management. It begins by calculating the cost of capital, including the cost of debt, preferred stock, and common stock, providing a detailed breakdown of the formulas and figures. The assignment then explores capital budgeting techniques, specifically comparing electric-powered and gas-powered trucks using Net Present Value (NPV) and Internal Rate of Return (IRR) methods to determine the most financially viable option. It also considers qualitative factors influencing capital investment decisions, such as organizational culture, product quality, and ethical considerations. Furthermore, the assignment analyzes the importance of working capital, discussing its role in maintaining business solvency, promoting goodwill, securing loans, and facilitating efficient operations. It highlights how adequate working capital enables companies to exploit market opportunities and ensure timely returns on investment. The assignment provides calculations and explanations to support its conclusions, offering a comprehensive overview of financial management principles.

Running head: FINANCE FOR MANAGERS

Finance for Managers

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Finance for Managers

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE FOR MANAGERS

Table of Contents

Answer to Question 1:................................................................................................................2

Answer to Question 2:................................................................................................................3

Answer to Part (i):..................................................................................................................3

Answer to part (ii):.................................................................................................................5

Answer to part B:...................................................................................................................5

Answer to 3:...............................................................................................................................6

Reference list:.............................................................................................................................9

Table of Contents

Answer to Question 1:................................................................................................................2

Answer to Question 2:................................................................................................................3

Answer to Part (i):..................................................................................................................3

Answer to part (ii):.................................................................................................................5

Answer to part B:...................................................................................................................5

Answer to 3:...............................................................................................................................6

Reference list:.............................................................................................................................9

2FINANCE FOR MANAGERS

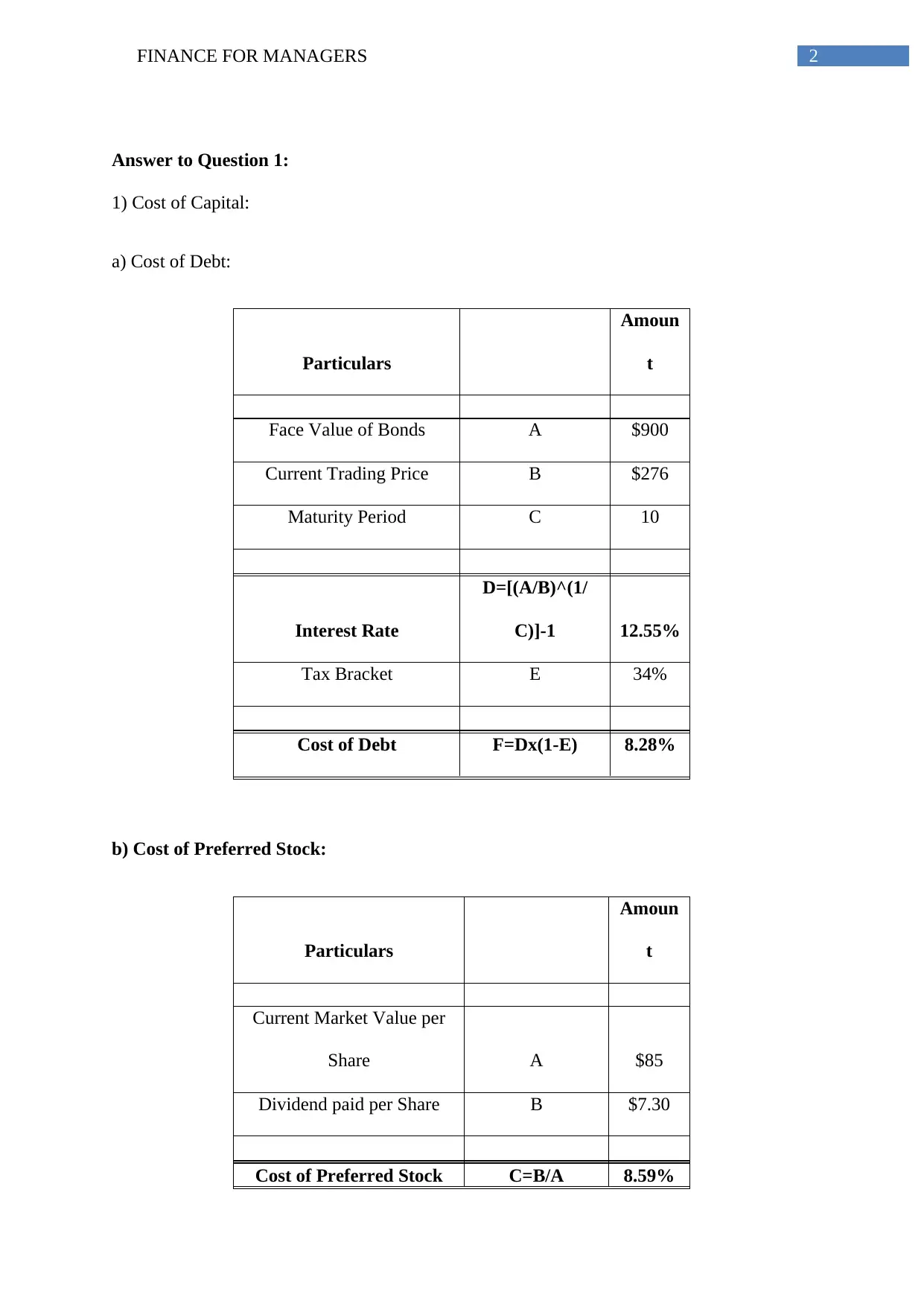

Answer to Question 1:

1) Cost of Capital:

a) Cost of Debt:

Particulars

Amoun

t

Face Value of Bonds A $900

Current Trading Price B $276

Maturity Period C 10

Interest Rate

D=[(A/B)^(1/

C)]-1 12.55%

Tax Bracket E 34%

Cost of Debt F=Dx(1-E) 8.28%

b) Cost of Preferred Stock:

Particulars

Amoun

t

Current Market Value per

Share A $85

Dividend paid per Share B $7.30

Cost of Preferred Stock C=B/A 8.59%

Answer to Question 1:

1) Cost of Capital:

a) Cost of Debt:

Particulars

Amoun

t

Face Value of Bonds A $900

Current Trading Price B $276

Maturity Period C 10

Interest Rate

D=[(A/B)^(1/

C)]-1 12.55%

Tax Bracket E 34%

Cost of Debt F=Dx(1-E) 8.28%

b) Cost of Preferred Stock:

Particulars

Amoun

t

Current Market Value per

Share A $85

Dividend paid per Share B $7.30

Cost of Preferred Stock C=B/A 8.59%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE FOR MANAGERS

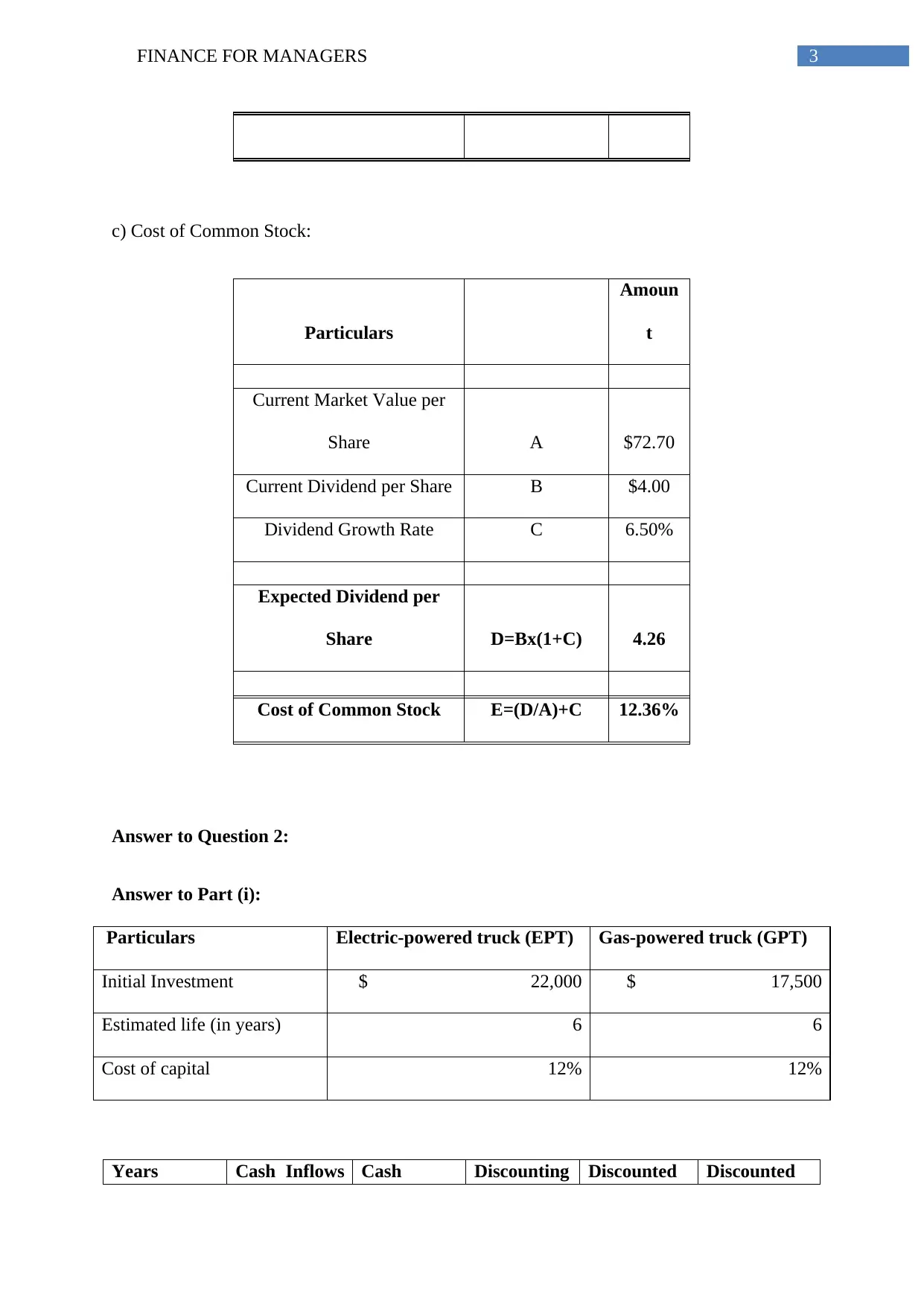

c) Cost of Common Stock:

Particulars

Amoun

t

Current Market Value per

Share A $72.70

Current Dividend per Share B $4.00

Dividend Growth Rate C 6.50%

Expected Dividend per

Share D=Bx(1+C) 4.26

Cost of Common Stock E=(D/A)+C 12.36%

Answer to Question 2:

Answer to Part (i):

Particulars Electric-powered truck (EPT) Gas-powered truck (GPT)

Initial Investment $ 22,000 $ 17,500

Estimated life (in years) 6 6

Cost of capital 12% 12%

Years Cash Inflows Cash Discounting Discounted Discounted

c) Cost of Common Stock:

Particulars

Amoun

t

Current Market Value per

Share A $72.70

Current Dividend per Share B $4.00

Dividend Growth Rate C 6.50%

Expected Dividend per

Share D=Bx(1+C) 4.26

Cost of Common Stock E=(D/A)+C 12.36%

Answer to Question 2:

Answer to Part (i):

Particulars Electric-powered truck (EPT) Gas-powered truck (GPT)

Initial Investment $ 22,000 $ 17,500

Estimated life (in years) 6 6

Cost of capital 12% 12%

Years Cash Inflows Cash Discounting Discounted Discounted

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE FOR MANAGERS

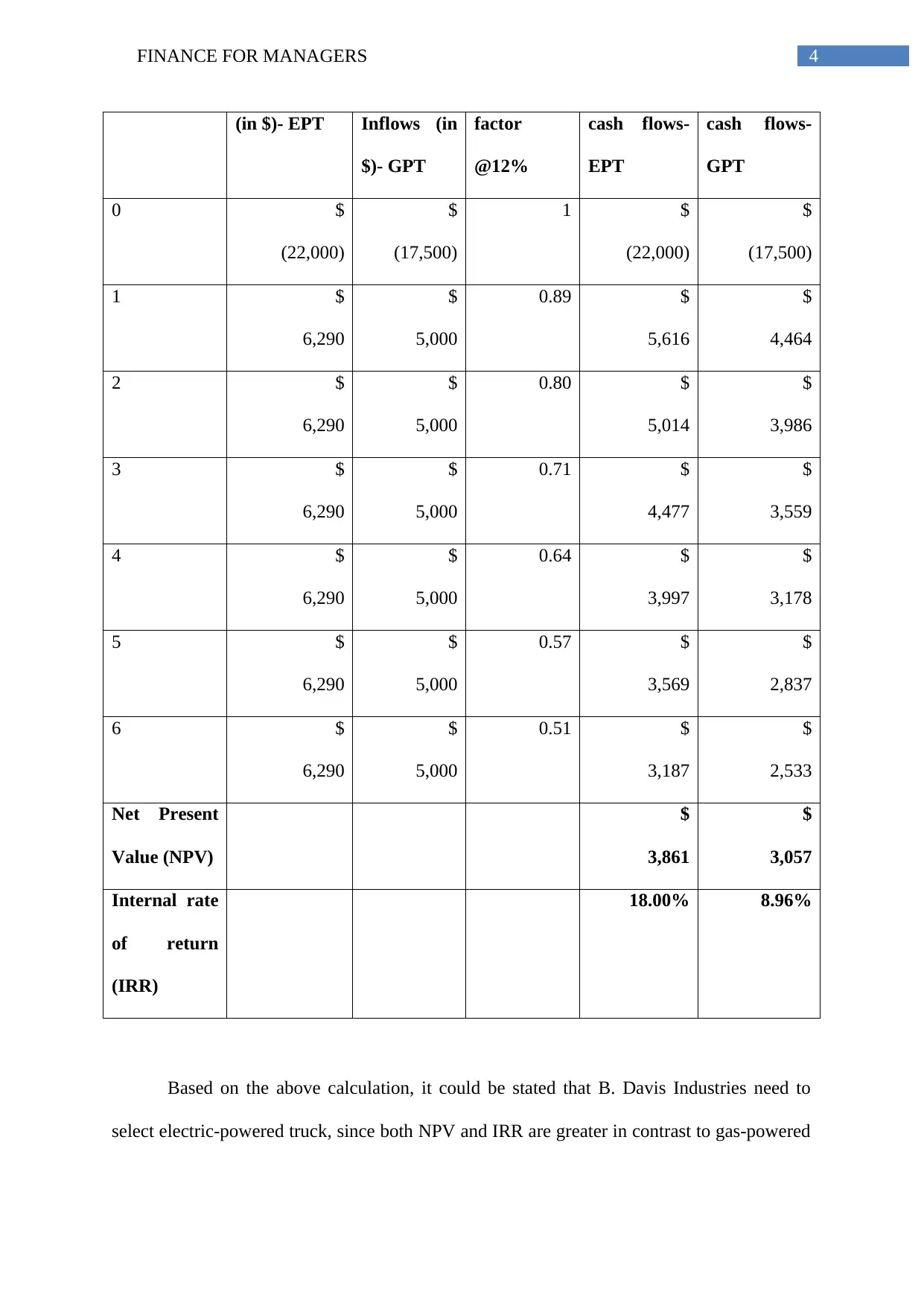

(in $)- EPT Inflows (in

$)- GPT

factor

@12%

cash flows-

EPT

cash flows-

GPT

0 $

(22,000)

$

(17,500)

1 $

(22,000)

$

(17,500)

1 $

6,290

$

5,000

0.89 $

5,616

$

4,464

2 $

6,290

$

5,000

0.80 $

5,014

$

3,986

3 $

6,290

$

5,000

0.71 $

4,477

$

3,559

4 $

6,290

$

5,000

0.64 $

3,997

$

3,178

5 $

6,290

$

5,000

0.57 $

3,569

$

2,837

6 $

6,290

$

5,000

0.51 $

3,187

$

2,533

Net Present

Value (NPV)

$

3,861

$

3,057

Internal rate

of return

(IRR)

18.00% 8.96%

Based on the above calculation, it could be stated that B. Davis Industries need to

select electric-powered truck, since both NPV and IRR are greater in contrast to gas-powered

(in $)- EPT Inflows (in

$)- GPT

factor

@12%

cash flows-

EPT

cash flows-

GPT

0 $

(22,000)

$

(17,500)

1 $

(22,000)

$

(17,500)

1 $

6,290

$

5,000

0.89 $

5,616

$

4,464

2 $

6,290

$

5,000

0.80 $

5,014

$

3,986

3 $

6,290

$

5,000

0.71 $

4,477

$

3,559

4 $

6,290

$

5,000

0.64 $

3,997

$

3,178

5 $

6,290

$

5,000

0.57 $

3,569

$

2,837

6 $

6,290

$

5,000

0.51 $

3,187

$

2,533

Net Present

Value (NPV)

$

3,861

$

3,057

Internal rate

of return

(IRR)

18.00% 8.96%

Based on the above calculation, it could be stated that B. Davis Industries need to

select electric-powered truck, since both NPV and IRR are greater in contrast to gas-powered

5FINANCE FOR MANAGERS

project. The higher NPV and IRR are always desirable for an organisation, as it helps in

maximising the overall return on investment.

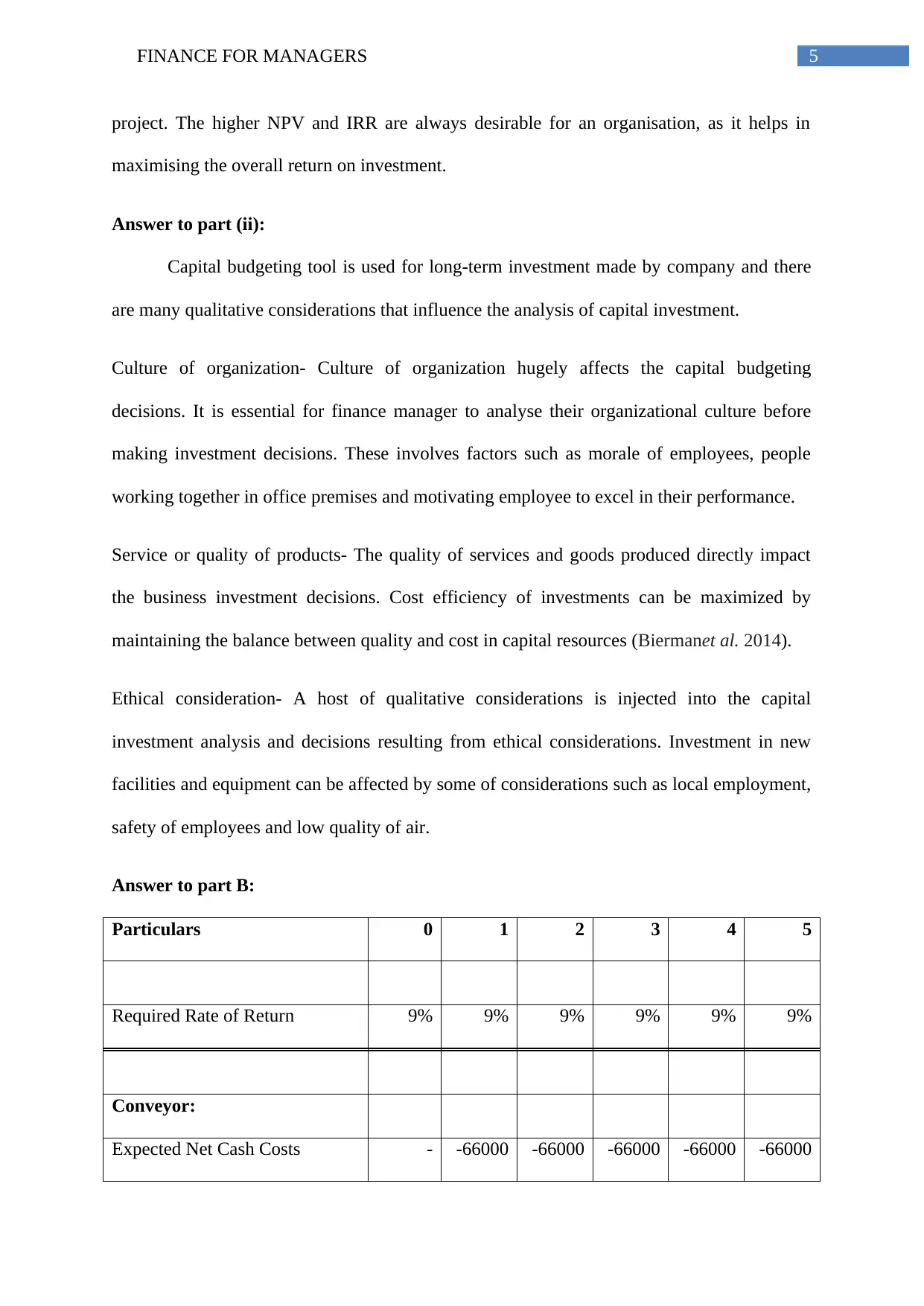

Answer to part (ii):

Capital budgeting tool is used for long-term investment made by company and there

are many qualitative considerations that influence the analysis of capital investment.

Culture of organization- Culture of organization hugely affects the capital budgeting

decisions. It is essential for finance manager to analyse their organizational culture before

making investment decisions. These involves factors such as morale of employees, people

working together in office premises and motivating employee to excel in their performance.

Service or quality of products- The quality of services and goods produced directly impact

the business investment decisions. Cost efficiency of investments can be maximized by

maintaining the balance between quality and cost in capital resources (Biermanet al. 2014).

Ethical consideration- A host of qualitative considerations is injected into the capital

investment analysis and decisions resulting from ethical considerations. Investment in new

facilities and equipment can be affected by some of considerations such as local employment,

safety of employees and low quality of air.

Answer to part B:

Particulars 0 1 2 3 4 5

Required Rate of Return 9% 9% 9% 9% 9% 9%

Conveyor:

Expected Net Cash Costs - -66000 -66000 -66000 -66000 -66000

project. The higher NPV and IRR are always desirable for an organisation, as it helps in

maximising the overall return on investment.

Answer to part (ii):

Capital budgeting tool is used for long-term investment made by company and there

are many qualitative considerations that influence the analysis of capital investment.

Culture of organization- Culture of organization hugely affects the capital budgeting

decisions. It is essential for finance manager to analyse their organizational culture before

making investment decisions. These involves factors such as morale of employees, people

working together in office premises and motivating employee to excel in their performance.

Service or quality of products- The quality of services and goods produced directly impact

the business investment decisions. Cost efficiency of investments can be maximized by

maintaining the balance between quality and cost in capital resources (Biermanet al. 2014).

Ethical consideration- A host of qualitative considerations is injected into the capital

investment analysis and decisions resulting from ethical considerations. Investment in new

facilities and equipment can be affected by some of considerations such as local employment,

safety of employees and low quality of air.

Answer to part B:

Particulars 0 1 2 3 4 5

Required Rate of Return 9% 9% 9% 9% 9% 9%

Conveyor:

Expected Net Cash Costs - -66000 -66000 -66000 -66000 -66000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

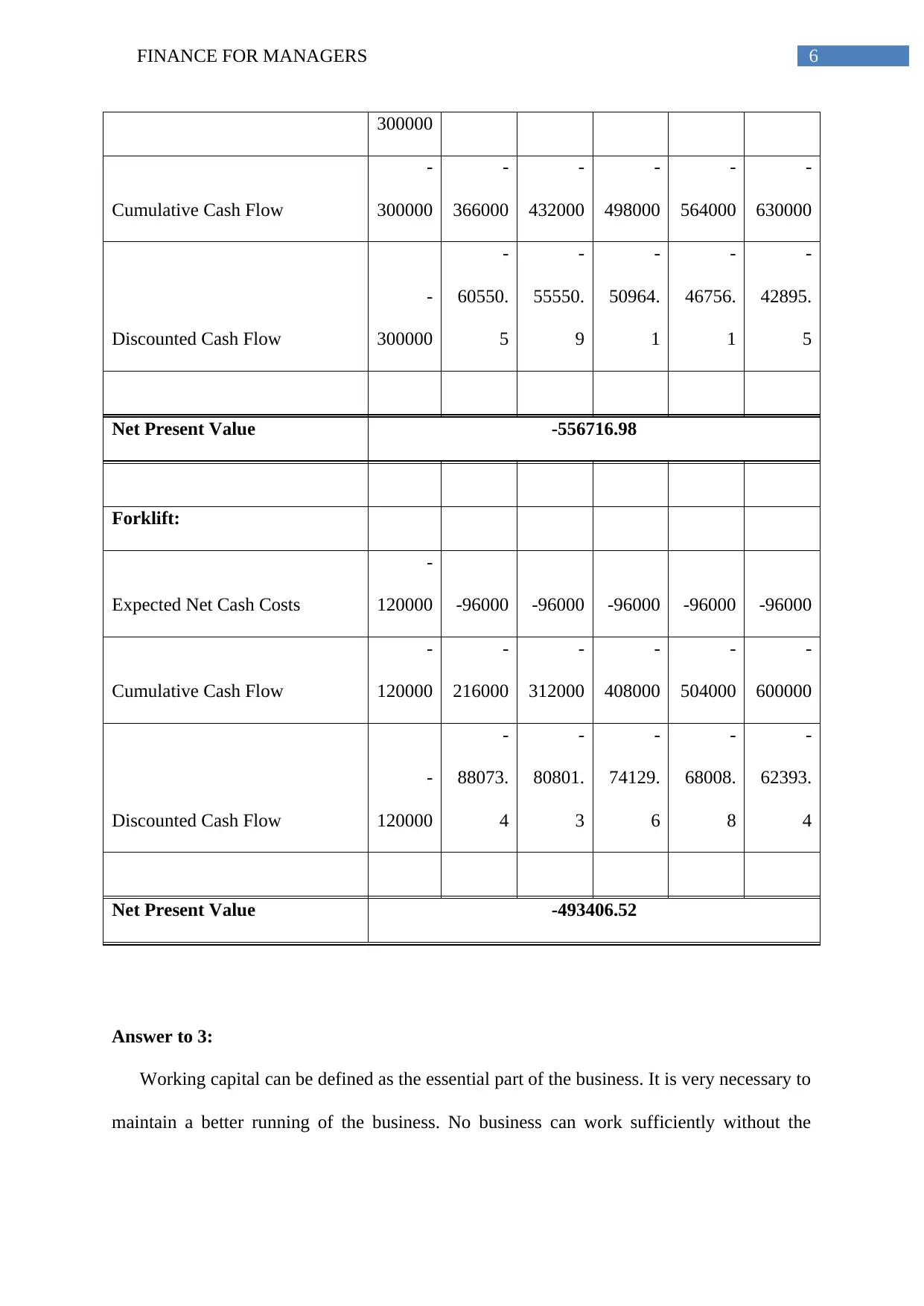

6FINANCE FOR MANAGERS

300000

Cumulative Cash Flow

-

300000

-

366000

-

432000

-

498000

-

564000

-

630000

Discounted Cash Flow

-

300000

-

60550.

5

-

55550.

9

-

50964.

1

-

46756.

1

-

42895.

5

Net Present Value -556716.98

Forklift:

Expected Net Cash Costs

-

120000 -96000 -96000 -96000 -96000 -96000

Cumulative Cash Flow

-

120000

-

216000

-

312000

-

408000

-

504000

-

600000

Discounted Cash Flow

-

120000

-

88073.

4

-

80801.

3

-

74129.

6

-

68008.

8

-

62393.

4

Net Present Value -493406.52

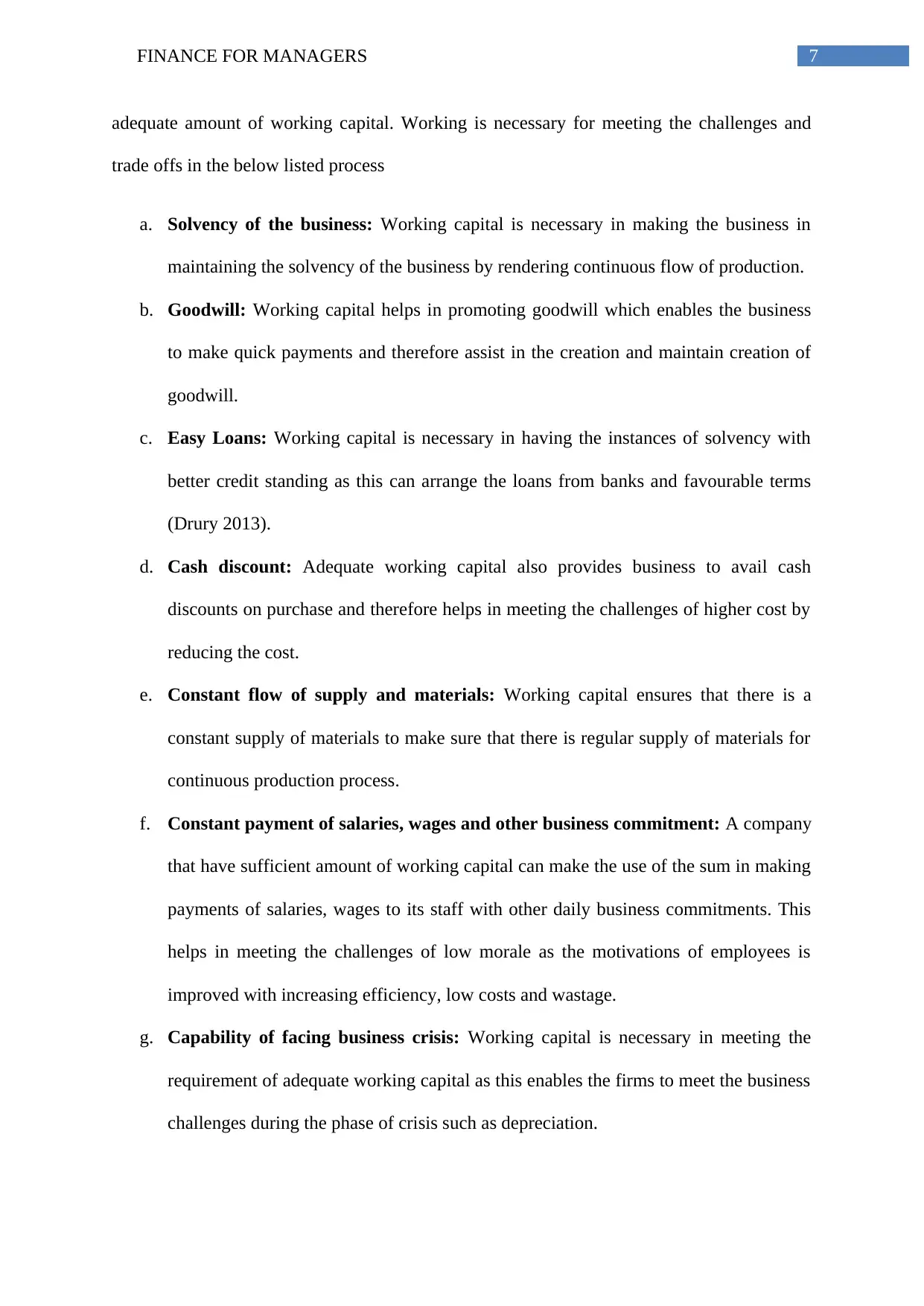

Answer to 3:

Working capital can be defined as the essential part of the business. It is very necessary to

maintain a better running of the business. No business can work sufficiently without the

300000

Cumulative Cash Flow

-

300000

-

366000

-

432000

-

498000

-

564000

-

630000

Discounted Cash Flow

-

300000

-

60550.

5

-

55550.

9

-

50964.

1

-

46756.

1

-

42895.

5

Net Present Value -556716.98

Forklift:

Expected Net Cash Costs

-

120000 -96000 -96000 -96000 -96000 -96000

Cumulative Cash Flow

-

120000

-

216000

-

312000

-

408000

-

504000

-

600000

Discounted Cash Flow

-

120000

-

88073.

4

-

80801.

3

-

74129.

6

-

68008.

8

-

62393.

4

Net Present Value -493406.52

Answer to 3:

Working capital can be defined as the essential part of the business. It is very necessary to

maintain a better running of the business. No business can work sufficiently without the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE FOR MANAGERS

adequate amount of working capital. Working is necessary for meeting the challenges and

trade offs in the below listed process

a. Solvency of the business: Working capital is necessary in making the business in

maintaining the solvency of the business by rendering continuous flow of production.

b. Goodwill: Working capital helps in promoting goodwill which enables the business

to make quick payments and therefore assist in the creation and maintain creation of

goodwill.

c. Easy Loans: Working capital is necessary in having the instances of solvency with

better credit standing as this can arrange the loans from banks and favourable terms

(Drury 2013).

d. Cash discount: Adequate working capital also provides business to avail cash

discounts on purchase and therefore helps in meeting the challenges of higher cost by

reducing the cost.

e. Constant flow of supply and materials: Working capital ensures that there is a

constant supply of materials to make sure that there is regular supply of materials for

continuous production process.

f. Constant payment of salaries, wages and other business commitment: A company

that have sufficient amount of working capital can make the use of the sum in making

payments of salaries, wages to its staff with other daily business commitments. This

helps in meeting the challenges of low morale as the motivations of employees is

improved with increasing efficiency, low costs and wastage.

g. Capability of facing business crisis: Working capital is necessary in meeting the

requirement of adequate working capital as this enables the firms to meet the business

challenges during the phase of crisis such as depreciation.

adequate amount of working capital. Working is necessary for meeting the challenges and

trade offs in the below listed process

a. Solvency of the business: Working capital is necessary in making the business in

maintaining the solvency of the business by rendering continuous flow of production.

b. Goodwill: Working capital helps in promoting goodwill which enables the business

to make quick payments and therefore assist in the creation and maintain creation of

goodwill.

c. Easy Loans: Working capital is necessary in having the instances of solvency with

better credit standing as this can arrange the loans from banks and favourable terms

(Drury 2013).

d. Cash discount: Adequate working capital also provides business to avail cash

discounts on purchase and therefore helps in meeting the challenges of higher cost by

reducing the cost.

e. Constant flow of supply and materials: Working capital ensures that there is a

constant supply of materials to make sure that there is regular supply of materials for

continuous production process.

f. Constant payment of salaries, wages and other business commitment: A company

that have sufficient amount of working capital can make the use of the sum in making

payments of salaries, wages to its staff with other daily business commitments. This

helps in meeting the challenges of low morale as the motivations of employees is

improved with increasing efficiency, low costs and wastage.

g. Capability of facing business crisis: Working capital is necessary in meeting the

requirement of adequate working capital as this enables the firms to meet the business

challenges during the phase of crisis such as depreciation.

8FINANCE FOR MANAGERS

h. Speedy and regular return on investment: Every investors needs quick and regular

return on their business (Fayard 2015). Therefore, it is necessary to have sufficient

amount of working capital as this provides the firms with the ability in discharging

quick pay and regular dividends to its investors. There might not be pressure of

ploughing back the profits that gains the confidence of the investors and creates a

favourable scenario in the market to raise extra amount of fund in future.

i. Exploitation of favourable market conditions: One of the major necessities of

working capital is that firms can exploit the favourable market conditions in the form

of purchase requirements by holding inventories in bulk for higher costs.

h. Speedy and regular return on investment: Every investors needs quick and regular

return on their business (Fayard 2015). Therefore, it is necessary to have sufficient

amount of working capital as this provides the firms with the ability in discharging

quick pay and regular dividends to its investors. There might not be pressure of

ploughing back the profits that gains the confidence of the investors and creates a

favourable scenario in the market to raise extra amount of fund in future.

i. Exploitation of favourable market conditions: One of the major necessities of

working capital is that firms can exploit the favourable market conditions in the form

of purchase requirements by holding inventories in bulk for higher costs.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.