HI-5002 Finance for Business: CIMIC Group Financial Analysis Report

VerifiedAdded on 2024/06/03

|18

|3445

|433

Report

AI Summary

This report provides a comprehensive financial analysis of CIMIC Group Limited, a major player in infrastructure, mining, and services. It begins with a company overview, detailing its core activities, markets, and historical context. The report then examines the company's ownership and governance structure, identifying key shareholders and board members. Fundamental financial ratios are calculated for the past two years, including short-term and long-term solvency, asset utilization, profitability, and market value ratios. A graph illustrates the movements in the monthly share price over the last two years, plotted against the All Ordinaries Index, followed by a discussion of significant announcements that may have influenced the share price. The weighted average cost of capital (WACC) and debt ratio are calculated, and the company's dividend policy is analyzed. Finally, the report concludes with a letter of recommendation to a client, providing an explanation of why CIMIC Group should be included in their investment portfolio. Desklib is your go-to for similar solved assignments and study tools.

HI – 5002 Finance for business

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction:....................................................................................................................................3

1. Prepare a brief description of the company, outlining the core activities, the market(s) in

which it operates within and any factors in the companies’ history which you consider help

present a “picture” of your company...........................................................................................4

2. Specify ownership-governance structure of the company.......................................................5

3. Calculate the following Fundamental Ratios for your selected company for the past 2 years.

......................................................................................................................................................7

4. Prepare a graph / chart for movements in the monthly share price over the last two years for

the company that you are investigating. Plot them against movements in the All Ordinaries

Index.............................................................................................................................................9

5. Significant announcements which may have influenced the share price of your company...11

6. Financial data of the company...............................................................................................12

7. Weighted average cost of capital...........................................................................................13

8. The debt ratio of the company...............................................................................................14

9. Discuss what dividend policy of the management of the company appears to be

implemented. Explain any reason related to that particular dividend policy.............................15

10. Based on your analysis above, write a letter of recommendation to your client, providing

an explanation of why you would like to include this company in his/her investment portfolio.

....................................................................................................................................................16

Conclusion:....................................................................................................................................17

References:....................................................................................................................................18

2

Introduction:....................................................................................................................................3

1. Prepare a brief description of the company, outlining the core activities, the market(s) in

which it operates within and any factors in the companies’ history which you consider help

present a “picture” of your company...........................................................................................4

2. Specify ownership-governance structure of the company.......................................................5

3. Calculate the following Fundamental Ratios for your selected company for the past 2 years.

......................................................................................................................................................7

4. Prepare a graph / chart for movements in the monthly share price over the last two years for

the company that you are investigating. Plot them against movements in the All Ordinaries

Index.............................................................................................................................................9

5. Significant announcements which may have influenced the share price of your company...11

6. Financial data of the company...............................................................................................12

7. Weighted average cost of capital...........................................................................................13

8. The debt ratio of the company...............................................................................................14

9. Discuss what dividend policy of the management of the company appears to be

implemented. Explain any reason related to that particular dividend policy.............................15

10. Based on your analysis above, write a letter of recommendation to your client, providing

an explanation of why you would like to include this company in his/her investment portfolio.

....................................................................................................................................................16

Conclusion:....................................................................................................................................17

References:....................................................................................................................................18

2

Introduction:

The report related to finance for business has been prepared to enhance the knowledge related to

financial concepts and fundamentals related to an enterprise. The report will include a

description about the company relating to its business operationsandhistory. The company will

be evaluated for the purpose of identifying the financial ratios and ownership structure of the

company. The corporate governance will thus be evaluated for the purpose of getting information

aboutcorporategovernance. The report will then present a graph related to share price structure of

company and the recent announcements and factors leading to fluctuations in share prices will be

discussed accordingly. Further the report will include the description about various cost of

capital associated with thecompany and these costs will beanalyzed for the purpose of making

investment decision. The dividend policy of thecompany will be explained for the purpose of

making informed decision and the letter of recommendation will be made to the investors for

taking investment decision.

3

The report related to finance for business has been prepared to enhance the knowledge related to

financial concepts and fundamentals related to an enterprise. The report will include a

description about the company relating to its business operationsandhistory. The company will

be evaluated for the purpose of identifying the financial ratios and ownership structure of the

company. The corporate governance will thus be evaluated for the purpose of getting information

aboutcorporategovernance. The report will then present a graph related to share price structure of

company and the recent announcements and factors leading to fluctuations in share prices will be

discussed accordingly. Further the report will include the description about various cost of

capital associated with thecompany and these costs will beanalyzed for the purpose of making

investment decision. The dividend policy of thecompany will be explained for the purpose of

making informed decision and the letter of recommendation will be made to the investors for

taking investment decision.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. Prepare a brief description of the company, outlining the core activities, the market(s) in

which it operates within and any factors in the companies’ history which you consider help

present a “picture” of your company.

CIMIC Group Limited can be recognized as one of the largest infrastructure, mining, services

and public private partnership group which are engaged in the business of construction and

mineral and mining processing operations. The company is also engaged in maintenance services

which are also related with providing engineering services to the customers. The company has its

operations since 1899 and has been listed on the Australian Stock Exchange in 1962. The

corporate head office of thecompanyis situated at Sydney, Australia. The group has been

providing corporate governancestructures, leadership and financial strength to all of its operating

companies which are associated with it. The operations of thecompany are undermined by

integrity, accountability and innovation within the company. The principle adopted by the

company and the management helps in sharing languages and provide identity to CIMIC while

guiding the necessary actions for the company. The operations of the company are focused at

providing safety to its customers at all levels. Te solid foundation of thecompany with the robust

pipeline and the expertise possessed by all itspersonnel in delivering the complex construction

activities in mining and mineral extraction has provided the prospects for strong future which

will enhance the financial position of company (CIMIC Group Limited, 2017).

4

which it operates within and any factors in the companies’ history which you consider help

present a “picture” of your company.

CIMIC Group Limited can be recognized as one of the largest infrastructure, mining, services

and public private partnership group which are engaged in the business of construction and

mineral and mining processing operations. The company is also engaged in maintenance services

which are also related with providing engineering services to the customers. The company has its

operations since 1899 and has been listed on the Australian Stock Exchange in 1962. The

corporate head office of thecompanyis situated at Sydney, Australia. The group has been

providing corporate governancestructures, leadership and financial strength to all of its operating

companies which are associated with it. The operations of thecompany are undermined by

integrity, accountability and innovation within the company. The principle adopted by the

company and the management helps in sharing languages and provide identity to CIMIC while

guiding the necessary actions for the company. The operations of the company are focused at

providing safety to its customers at all levels. Te solid foundation of thecompany with the robust

pipeline and the expertise possessed by all itspersonnel in delivering the complex construction

activities in mining and mineral extraction has provided the prospects for strong future which

will enhance the financial position of company (CIMIC Group Limited, 2017).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

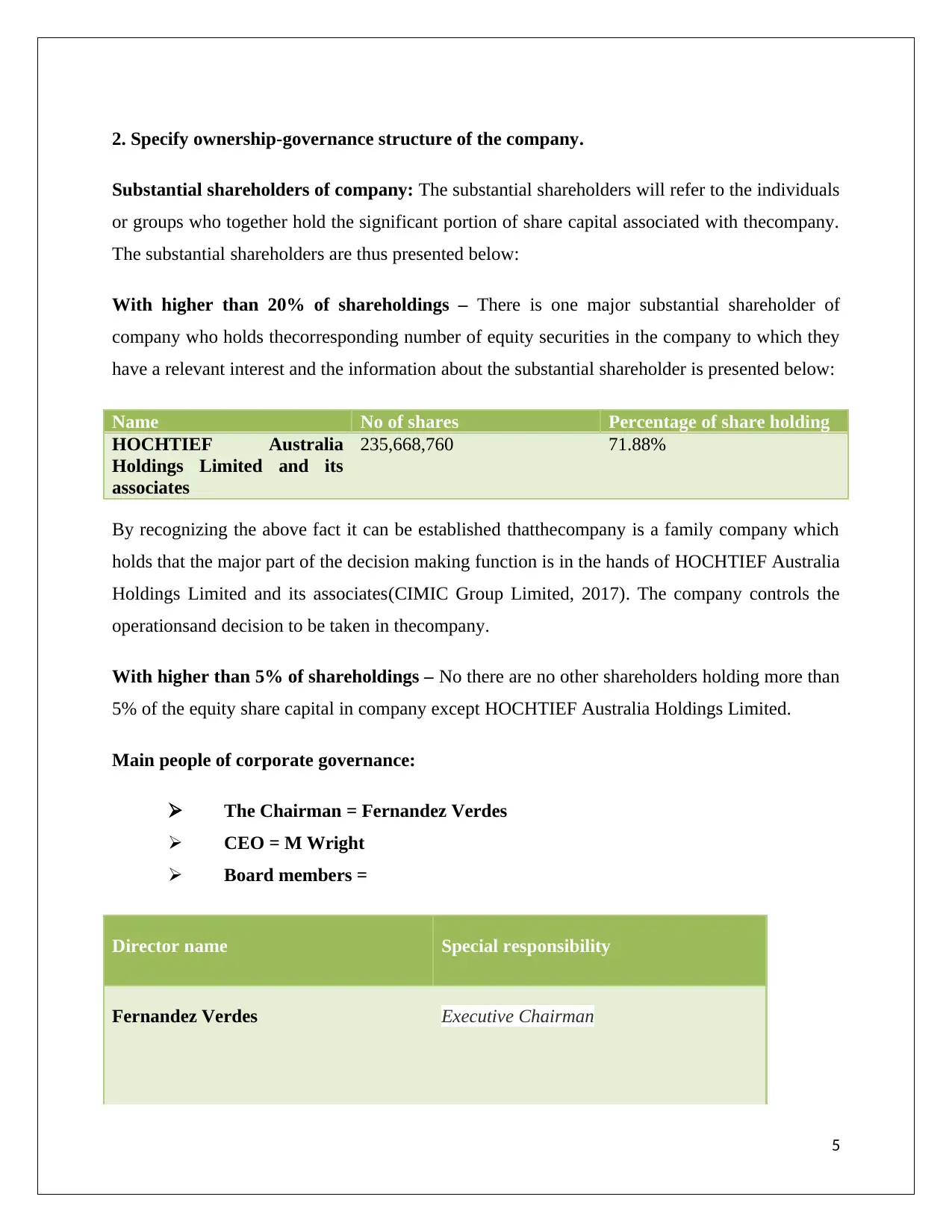

2. Specify ownership-governance structure of the company.

Substantial shareholders of company: The substantial shareholders will refer to the individuals

or groups who together hold the significant portion of share capital associated with thecompany.

The substantial shareholders are thus presented below:

With higher than 20% of shareholdings – There is one major substantial shareholder of

company who holds thecorresponding number of equity securities in the company to which they

have a relevant interest and the information about the substantial shareholder is presented below:

Name No of shares Percentage of share holding

HOCHTIEF Australia

Holdings Limited and its

associates

235,668,760 71.88%

By recognizing the above fact it can be established thatthecompany is a family company which

holds that the major part of the decision making function is in the hands of HOCHTIEF Australia

Holdings Limited and its associates(CIMIC Group Limited, 2017). The company controls the

operationsand decision to be taken in thecompany.

With higher than 5% of shareholdings – No there are no other shareholders holding more than

5% of the equity share capital in company except HOCHTIEF Australia Holdings Limited.

Main people of corporate governance:

The Chairman = Fernandez Verdes

CEO = M Wright

Board members =

Director name Special responsibility

Fernandez Verdes Executive Chairman

5

Substantial shareholders of company: The substantial shareholders will refer to the individuals

or groups who together hold the significant portion of share capital associated with thecompany.

The substantial shareholders are thus presented below:

With higher than 20% of shareholdings – There is one major substantial shareholder of

company who holds thecorresponding number of equity securities in the company to which they

have a relevant interest and the information about the substantial shareholder is presented below:

Name No of shares Percentage of share holding

HOCHTIEF Australia

Holdings Limited and its

associates

235,668,760 71.88%

By recognizing the above fact it can be established thatthecompany is a family company which

holds that the major part of the decision making function is in the hands of HOCHTIEF Australia

Holdings Limited and its associates(CIMIC Group Limited, 2017). The company controls the

operationsand decision to be taken in thecompany.

With higher than 5% of shareholdings – No there are no other shareholders holding more than

5% of the equity share capital in company except HOCHTIEF Australia Holdings Limited.

Main people of corporate governance:

The Chairman = Fernandez Verdes

CEO = M Wright

Board members =

Director name Special responsibility

Fernandez Verdes Executive Chairman

5

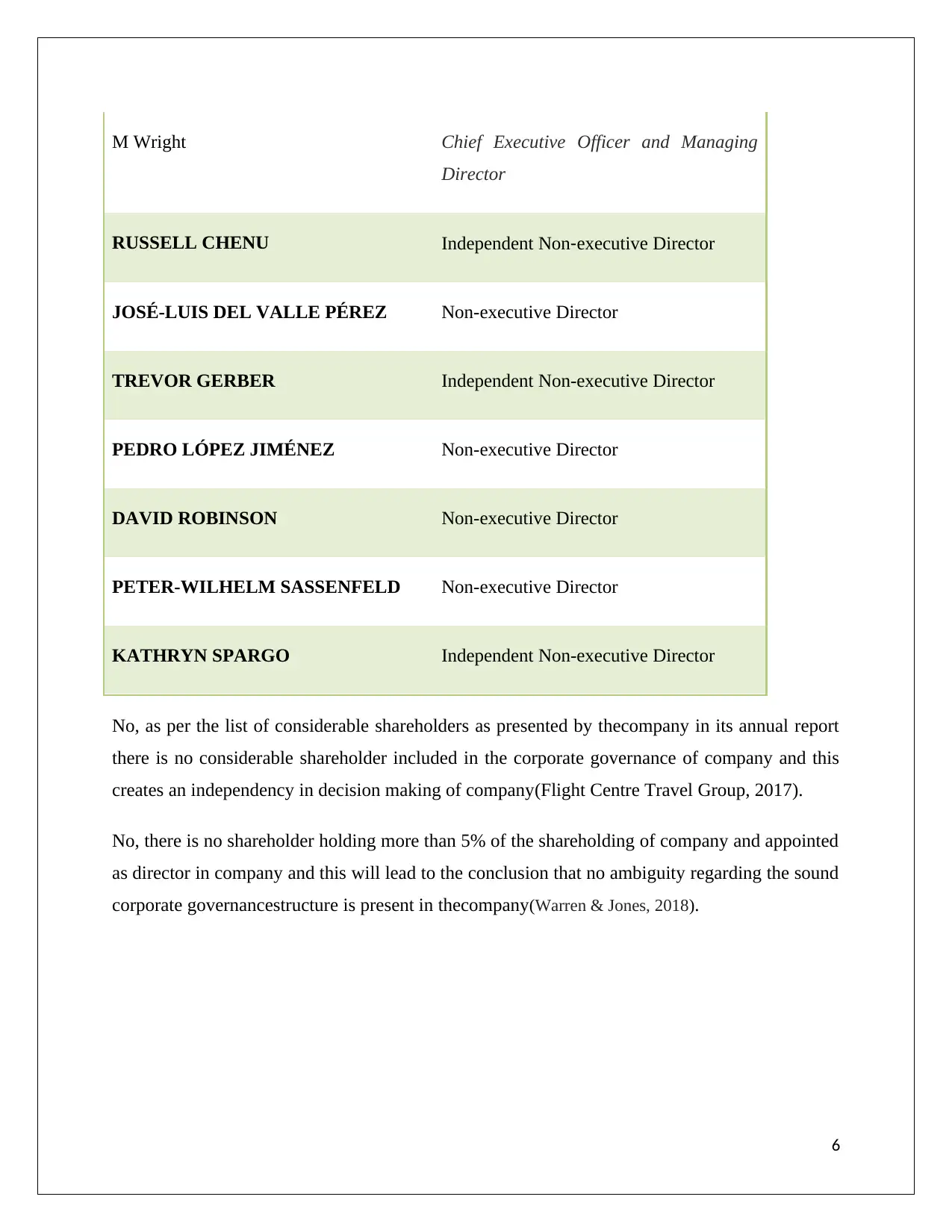

M Wright Chief Executive Officer and Managing

Director

RUSSELL CHENU Independent Non‐executive Director

JOSÉ-LUIS DEL VALLE PÉREZ Non-executive Director

TREVOR GERBER Independent Non-executive Director

PEDRO LÓPEZ JIMÉNEZ Non-executive Director

DAVID ROBINSON Non-executive Director

PETER-WILHELM SASSENFELD Non-executive Director

KATHRYN SPARGO Independent Non-executive Director

No, as per the list of considerable shareholders as presented by thecompany in its annual report

there is no considerable shareholder included in the corporate governance of company and this

creates an independency in decision making of company(Flight Centre Travel Group, 2017).

No, there is no shareholder holding more than 5% of the shareholding of company and appointed

as director in company and this will lead to the conclusion that no ambiguity regarding the sound

corporate governancestructure is present in thecompany(Warren & Jones, 2018).

6

Director

RUSSELL CHENU Independent Non‐executive Director

JOSÉ-LUIS DEL VALLE PÉREZ Non-executive Director

TREVOR GERBER Independent Non-executive Director

PEDRO LÓPEZ JIMÉNEZ Non-executive Director

DAVID ROBINSON Non-executive Director

PETER-WILHELM SASSENFELD Non-executive Director

KATHRYN SPARGO Independent Non-executive Director

No, as per the list of considerable shareholders as presented by thecompany in its annual report

there is no considerable shareholder included in the corporate governance of company and this

creates an independency in decision making of company(Flight Centre Travel Group, 2017).

No, there is no shareholder holding more than 5% of the shareholding of company and appointed

as director in company and this will lead to the conclusion that no ambiguity regarding the sound

corporate governancestructure is present in thecompany(Warren & Jones, 2018).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. Calculate the following Fundamental Ratios for your selected company for the past 2

years.

Short term solvency ratios:

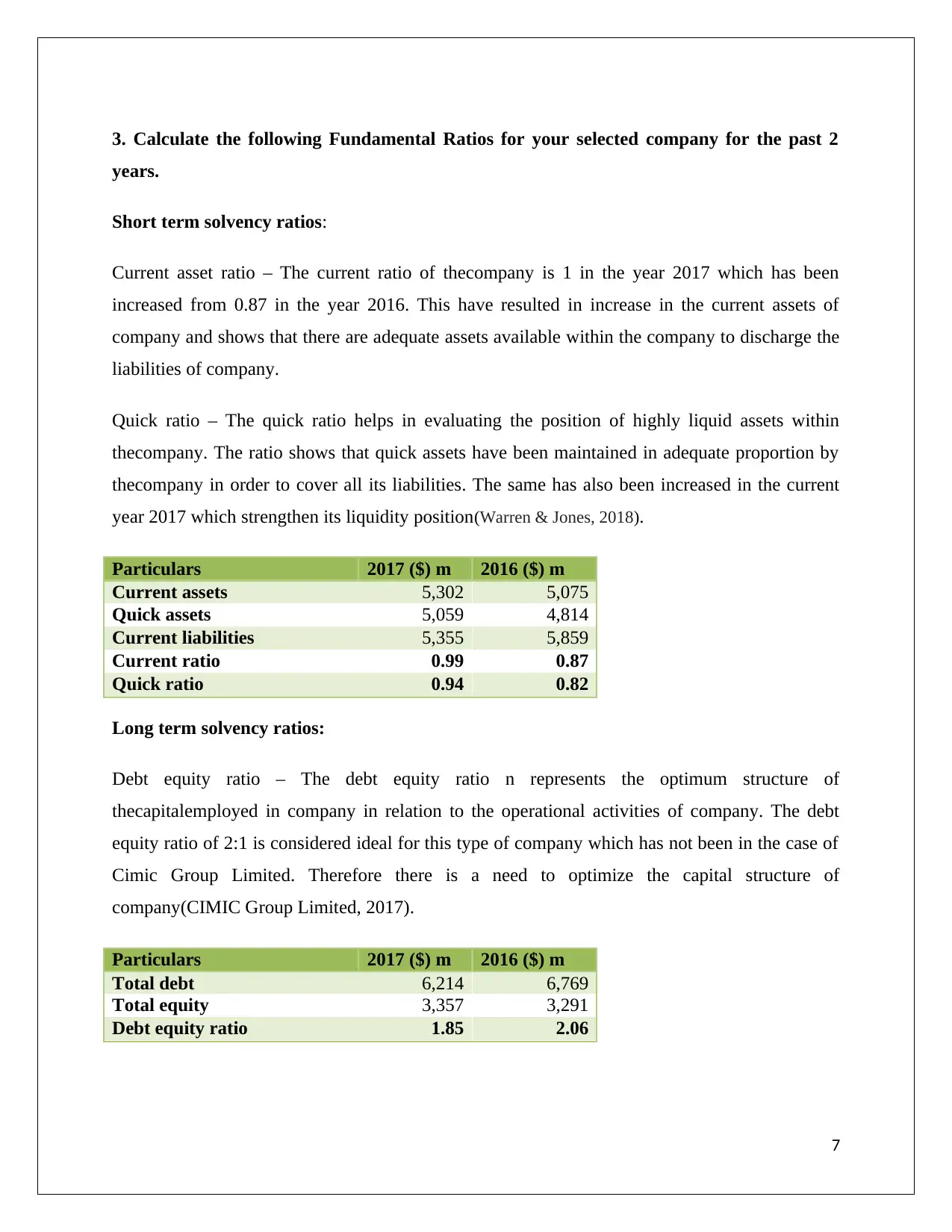

Current asset ratio – The current ratio of thecompany is 1 in the year 2017 which has been

increased from 0.87 in the year 2016. This have resulted in increase in the current assets of

company and shows that there are adequate assets available within the company to discharge the

liabilities of company.

Quick ratio – The quick ratio helps in evaluating the position of highly liquid assets within

thecompany. The ratio shows that quick assets have been maintained in adequate proportion by

thecompany in order to cover all its liabilities. The same has also been increased in the current

year 2017 which strengthen its liquidity position(Warren & Jones, 2018).

Particulars 2017 ($) m 2016 ($) m

Current assets 5,302 5,075

Quick assets 5,059 4,814

Current liabilities 5,355 5,859

Current ratio 0.99 0.87

Quick ratio 0.94 0.82

Long term solvency ratios:

Debt equity ratio – The debt equity ratio n represents the optimum structure of

thecapitalemployed in company in relation to the operational activities of company. The debt

equity ratio of 2:1 is considered ideal for this type of company which has not been in the case of

Cimic Group Limited. Therefore there is a need to optimize the capital structure of

company(CIMIC Group Limited, 2017).

Particulars 2017 ($) m 2016 ($) m

Total debt 6,214 6,769

Total equity 3,357 3,291

Debt equity ratio 1.85 2.06

7

years.

Short term solvency ratios:

Current asset ratio – The current ratio of thecompany is 1 in the year 2017 which has been

increased from 0.87 in the year 2016. This have resulted in increase in the current assets of

company and shows that there are adequate assets available within the company to discharge the

liabilities of company.

Quick ratio – The quick ratio helps in evaluating the position of highly liquid assets within

thecompany. The ratio shows that quick assets have been maintained in adequate proportion by

thecompany in order to cover all its liabilities. The same has also been increased in the current

year 2017 which strengthen its liquidity position(Warren & Jones, 2018).

Particulars 2017 ($) m 2016 ($) m

Current assets 5,302 5,075

Quick assets 5,059 4,814

Current liabilities 5,355 5,859

Current ratio 0.99 0.87

Quick ratio 0.94 0.82

Long term solvency ratios:

Debt equity ratio – The debt equity ratio n represents the optimum structure of

thecapitalemployed in company in relation to the operational activities of company. The debt

equity ratio of 2:1 is considered ideal for this type of company which has not been in the case of

Cimic Group Limited. Therefore there is a need to optimize the capital structure of

company(CIMIC Group Limited, 2017).

Particulars 2017 ($) m 2016 ($) m

Total debt 6,214 6,769

Total equity 3,357 3,291

Debt equity ratio 1.85 2.06

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

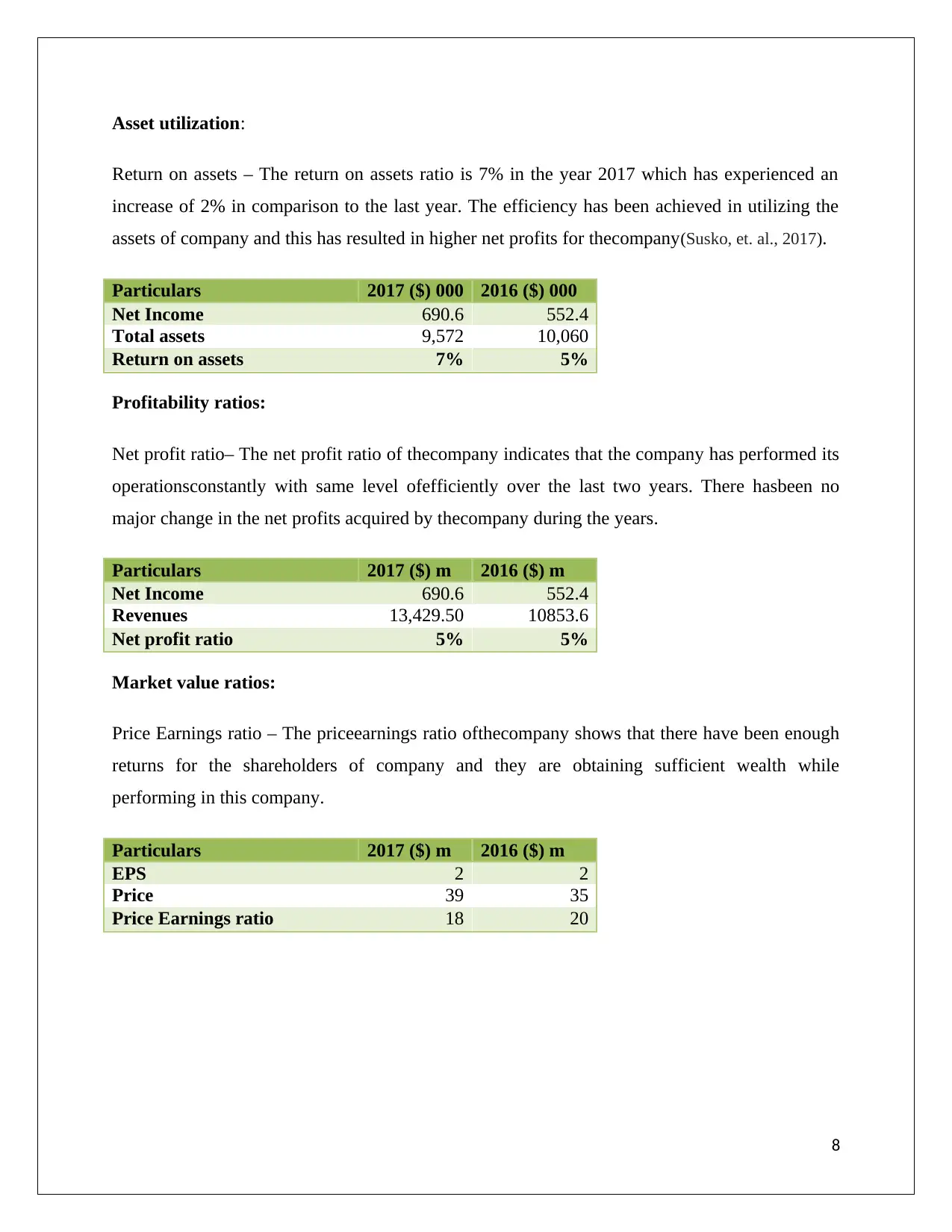

Asset utilization:

Return on assets – The return on assets ratio is 7% in the year 2017 which has experienced an

increase of 2% in comparison to the last year. The efficiency has been achieved in utilizing the

assets of company and this has resulted in higher net profits for thecompany(Susko, et. al., 2017).

Particulars 2017 ($) 000 2016 ($) 000

Net Income 690.6 552.4

Total assets 9,572 10,060

Return on assets 7% 5%

Profitability ratios:

Net profit ratio– The net profit ratio of thecompany indicates that the company has performed its

operationsconstantly with same level ofefficiently over the last two years. There hasbeen no

major change in the net profits acquired by thecompany during the years.

Particulars 2017 ($) m 2016 ($) m

Net Income 690.6 552.4

Revenues 13,429.50 10853.6

Net profit ratio 5% 5%

Market value ratios:

Price Earnings ratio – The priceearnings ratio ofthecompany shows that there have been enough

returns for the shareholders of company and they are obtaining sufficient wealth while

performing in this company.

Particulars 2017 ($) m 2016 ($) m

EPS 2 2

Price 39 35

Price Earnings ratio 18 20

8

Return on assets – The return on assets ratio is 7% in the year 2017 which has experienced an

increase of 2% in comparison to the last year. The efficiency has been achieved in utilizing the

assets of company and this has resulted in higher net profits for thecompany(Susko, et. al., 2017).

Particulars 2017 ($) 000 2016 ($) 000

Net Income 690.6 552.4

Total assets 9,572 10,060

Return on assets 7% 5%

Profitability ratios:

Net profit ratio– The net profit ratio of thecompany indicates that the company has performed its

operationsconstantly with same level ofefficiently over the last two years. There hasbeen no

major change in the net profits acquired by thecompany during the years.

Particulars 2017 ($) m 2016 ($) m

Net Income 690.6 552.4

Revenues 13,429.50 10853.6

Net profit ratio 5% 5%

Market value ratios:

Price Earnings ratio – The priceearnings ratio ofthecompany shows that there have been enough

returns for the shareholders of company and they are obtaining sufficient wealth while

performing in this company.

Particulars 2017 ($) m 2016 ($) m

EPS 2 2

Price 39 35

Price Earnings ratio 18 20

8

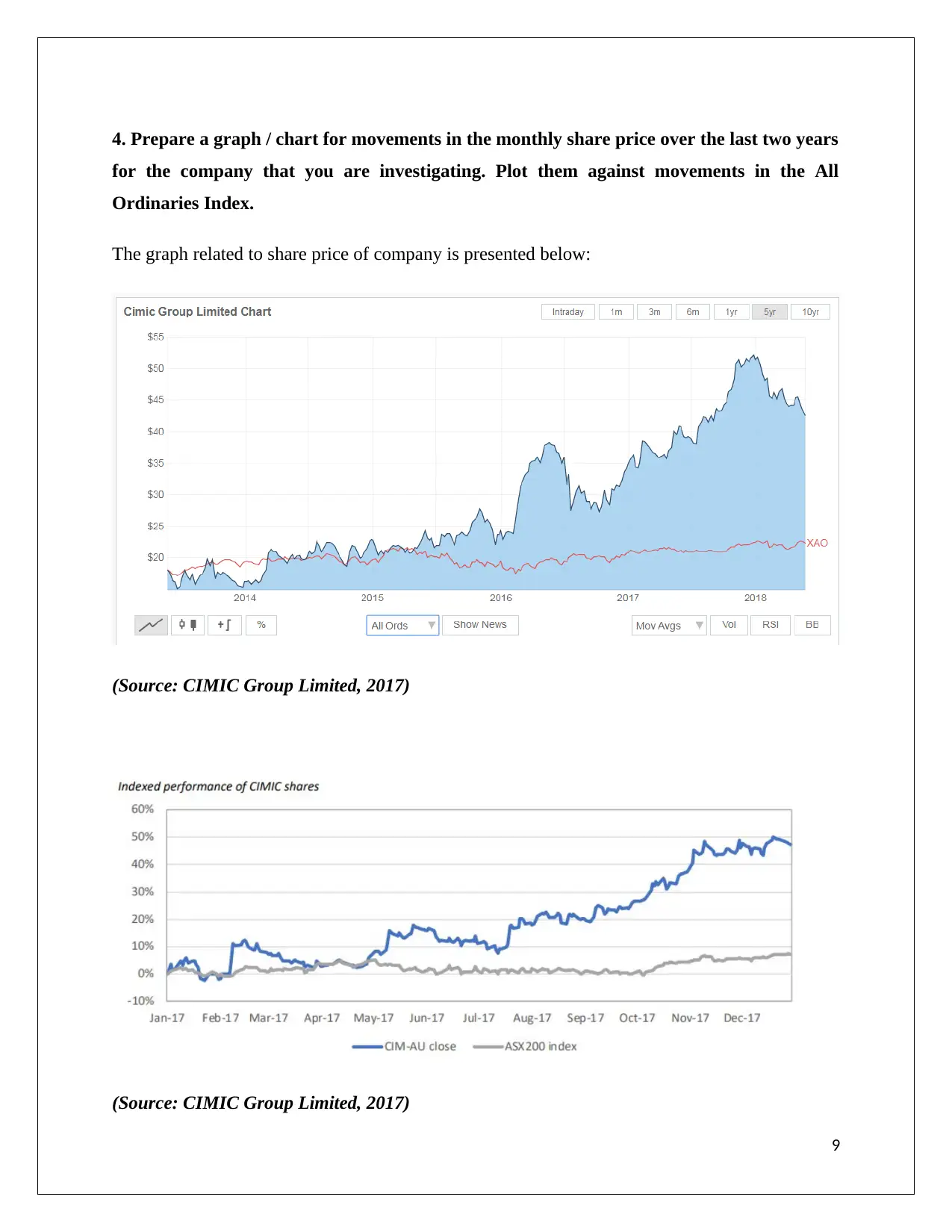

4. Prepare a graph / chart for movements in the monthly share price over the last two years

for the company that you are investigating. Plot them against movements in the All

Ordinaries Index.

The graph related to share price of company is presented below:

(Source: CIMIC Group Limited, 2017)

(Source: CIMIC Group Limited, 2017)

9

for the company that you are investigating. Plot them against movements in the All

Ordinaries Index.

The graph related to share price of company is presented below:

(Source: CIMIC Group Limited, 2017)

(Source: CIMIC Group Limited, 2017)

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

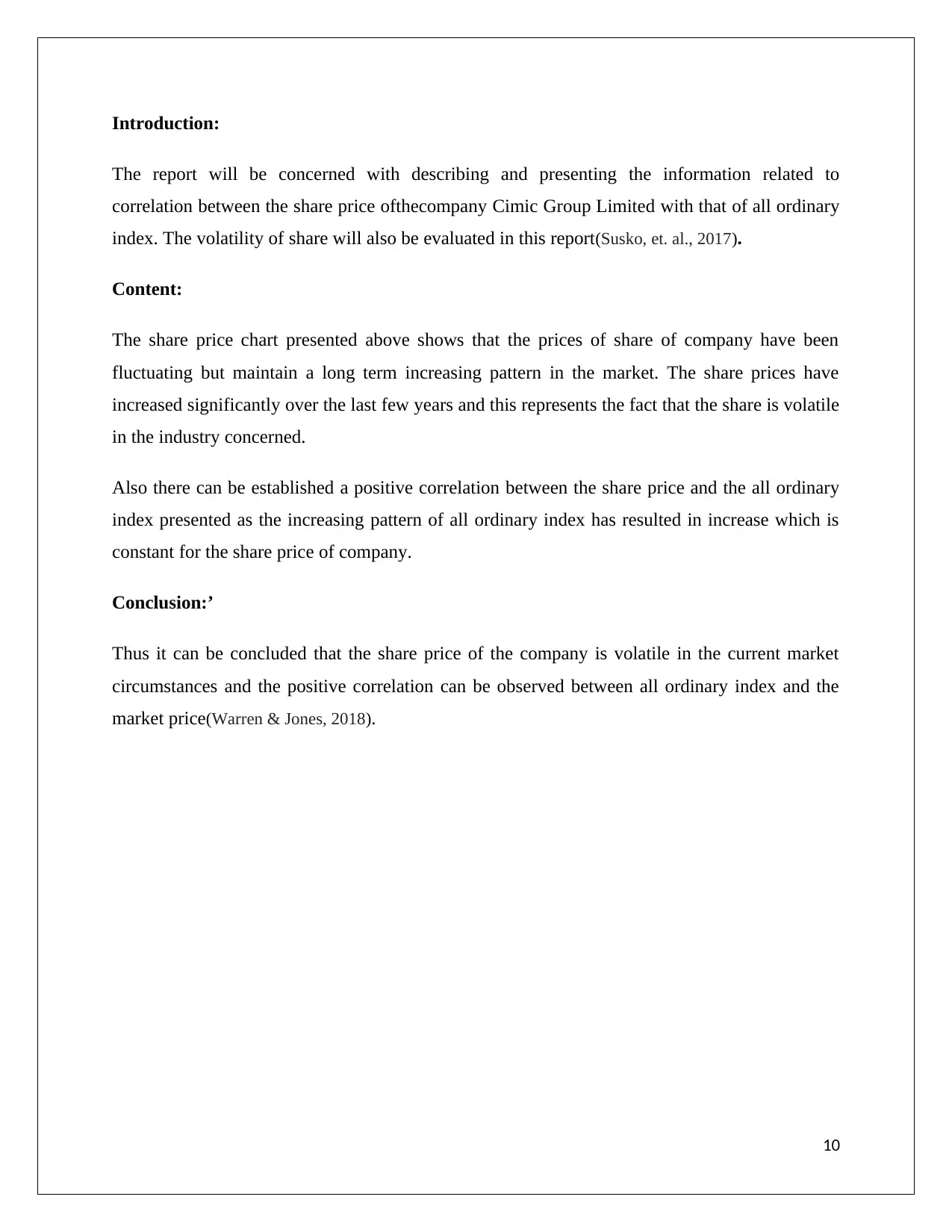

Introduction:

The report will be concerned with describing and presenting the information related to

correlation between the share price ofthecompany Cimic Group Limited with that of all ordinary

index. The volatility of share will also be evaluated in this report(Susko, et. al., 2017).

Content:

The share price chart presented above shows that the prices of share of company have been

fluctuating but maintain a long term increasing pattern in the market. The share prices have

increased significantly over the last few years and this represents the fact that the share is volatile

in the industry concerned.

Also there can be established a positive correlation between the share price and the all ordinary

index presented as the increasing pattern of all ordinary index has resulted in increase which is

constant for the share price of company.

Conclusion:’

Thus it can be concluded that the share price of the company is volatile in the current market

circumstances and the positive correlation can be observed between all ordinary index and the

market price(Warren & Jones, 2018).

10

The report will be concerned with describing and presenting the information related to

correlation between the share price ofthecompany Cimic Group Limited with that of all ordinary

index. The volatility of share will also be evaluated in this report(Susko, et. al., 2017).

Content:

The share price chart presented above shows that the prices of share of company have been

fluctuating but maintain a long term increasing pattern in the market. The share prices have

increased significantly over the last few years and this represents the fact that the share is volatile

in the industry concerned.

Also there can be established a positive correlation between the share price and the all ordinary

index presented as the increasing pattern of all ordinary index has resulted in increase which is

constant for the share price of company.

Conclusion:’

Thus it can be concluded that the share price of the company is volatile in the current market

circumstances and the positive correlation can be observed between all ordinary index and the

market price(Warren & Jones, 2018).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5. Significant announcements which may have influenced the share price of your company

CIMIC’S CPB CONTRACTORS PREFERRED FOR METRO TUNNEL RAIL

SYSTEMS (18 July, 2017) = There was a press release in which it was mentioned that the CPB

contractors have been selected by the government of Victoria for delivering the Metro Tunnel

Project Rail system Alliance which hasresulted in positive attitude of investors towards the

company. The contractors getting thecontract will result in higher profitability for thecompany.

CIMIC GROUP REPORTS CONTINUED MOMENTUM IN HY17 REVENUE (UP 28%

YOY) AND NPAT (UP 22% YOY) (18 July 2017) –Thecompanyhas reported a solid

performance in its operational activities and during the six months period ended 30 June 2017.

There were significant increase in the net profit after taxes reported by the enterprise, cash flows

concerning with the company and this resulted in strong financial position of company together

with the sound level of working capital in hand. The same resulted in increase in the share prices

of company as the efficient and effective results obtained increases the confidence of

shareholders to invest in company(CIMIC Group Limited, 2017).

CIMIC INVESTMENT HLG CONTRACTING AWARDED A$224M DUBAI PROJECT

(10 July, 2017) – It was amounted that Middle East‐based HLG Contracting, in which the

concerned group has an investment of 45% was awarded with revenue of AED619 million for

the construction of various projects. The achievement of such a source of revenue has resulted in

increase in share price of company.

CIMIC DIVESTS SHAREHOLDING IN MACMAHON (6 July, 2017) –Thecompany

announces the selling of 23.64% of its holding in McMahon Holdings Limited which was

concerned with ASX. The divestment in this type of investment has resulted in decrease in share

price of company.

11

CIMIC’S CPB CONTRACTORS PREFERRED FOR METRO TUNNEL RAIL

SYSTEMS (18 July, 2017) = There was a press release in which it was mentioned that the CPB

contractors have been selected by the government of Victoria for delivering the Metro Tunnel

Project Rail system Alliance which hasresulted in positive attitude of investors towards the

company. The contractors getting thecontract will result in higher profitability for thecompany.

CIMIC GROUP REPORTS CONTINUED MOMENTUM IN HY17 REVENUE (UP 28%

YOY) AND NPAT (UP 22% YOY) (18 July 2017) –Thecompanyhas reported a solid

performance in its operational activities and during the six months period ended 30 June 2017.

There were significant increase in the net profit after taxes reported by the enterprise, cash flows

concerning with the company and this resulted in strong financial position of company together

with the sound level of working capital in hand. The same resulted in increase in the share prices

of company as the efficient and effective results obtained increases the confidence of

shareholders to invest in company(CIMIC Group Limited, 2017).

CIMIC INVESTMENT HLG CONTRACTING AWARDED A$224M DUBAI PROJECT

(10 July, 2017) – It was amounted that Middle East‐based HLG Contracting, in which the

concerned group has an investment of 45% was awarded with revenue of AED619 million for

the construction of various projects. The achievement of such a source of revenue has resulted in

increase in share price of company.

CIMIC DIVESTS SHAREHOLDING IN MACMAHON (6 July, 2017) –Thecompany

announces the selling of 23.64% of its holding in McMahon Holdings Limited which was

concerned with ASX. The divestment in this type of investment has resulted in decrease in share

price of company.

11

6. Financial data of the company

The beta of the company is 1.08 in respect of market and other factors.

The beta calculated for thecompany helps in evaluating and identifying the relationship between

various market factors and thefluctuation in the share price of company. This will help the

investor in assessing the effect of market conditions on the share price of

company(Nesticò&Pipolo, 2015).

Required rate of return = Rf + B (Rm – Rf)

= .04 + 1.08 (.06)

= .04 + .0648

= .1048

No this is not a conservative investment for the shareholder as there are high risks involved with

this type of investment.

12

The beta of the company is 1.08 in respect of market and other factors.

The beta calculated for thecompany helps in evaluating and identifying the relationship between

various market factors and thefluctuation in the share price of company. This will help the

investor in assessing the effect of market conditions on the share price of

company(Nesticò&Pipolo, 2015).

Required rate of return = Rf + B (Rm – Rf)

= .04 + 1.08 (.06)

= .04 + .0648

= .1048

No this is not a conservative investment for the shareholder as there are high risks involved with

this type of investment.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.