Finance Case Study Solutions

VerifiedAdded on 2019/09/22

|8

|1082

|296

Case Study

AI Summary

This case study analyzes two companies: HDC and Blaine Kitchenware. For HDC, the analysis focuses on the profitability of a real estate investment using Net Present Value (NPV) calculations. It explores the differences in valuation between leasing and owning the property, considering factors like interest costs, opportunity costs, and depreciation. The Blaine Kitchenware case study examines the company's capital structure, payout policy, and a proposed share repurchase. It evaluates the appropriateness of the current capital structure, the impact of the repurchase on earnings per share (EPS), interest coverage, and family ownership. The analysis considers the advantages and disadvantages of the share repurchase from both majority and minority shareholder perspectives, referencing relevant financial theories like Walter's model and the concept of trading on equity. The document includes detailed calculations and references supporting the analysis.

FINANCE

FINANCE

Case Study

FINANCE

Case Study

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

Contents

Introduction2

HDC Case Study........................................................................................................................3

Blaine Kitchenware Case Study................................................................................................ 5

References................................................................................................................................. 7

1

Contents

Introduction2

HDC Case Study........................................................................................................................3

Blaine Kitchenware Case Study................................................................................................ 5

References................................................................................................................................. 7

1

FINANCE

Introduction

To run a business smoothly, one should have knowledge of Finance and its various

components. It will help not only to run the business but also to expand it. Present cases i.e.

HDC case study and Blaine kitchenware case study is based on the same.

In HDC case study, we analyse whether investing in certain project is profitable or not by

calculating NPV

In Blaine Kitchenware case study, we studied the capital structure and the payout policy of

the company. Along with this we also studied buy back of shares concept.

2

Introduction

To run a business smoothly, one should have knowledge of Finance and its various

components. It will help not only to run the business but also to expand it. Present cases i.e.

HDC case study and Blaine kitchenware case study is based on the same.

In HDC case study, we analyse whether investing in certain project is profitable or not by

calculating NPV

In Blaine Kitchenware case study, we studied the capital structure and the payout policy of

the company. Along with this we also studied buy back of shares concept.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

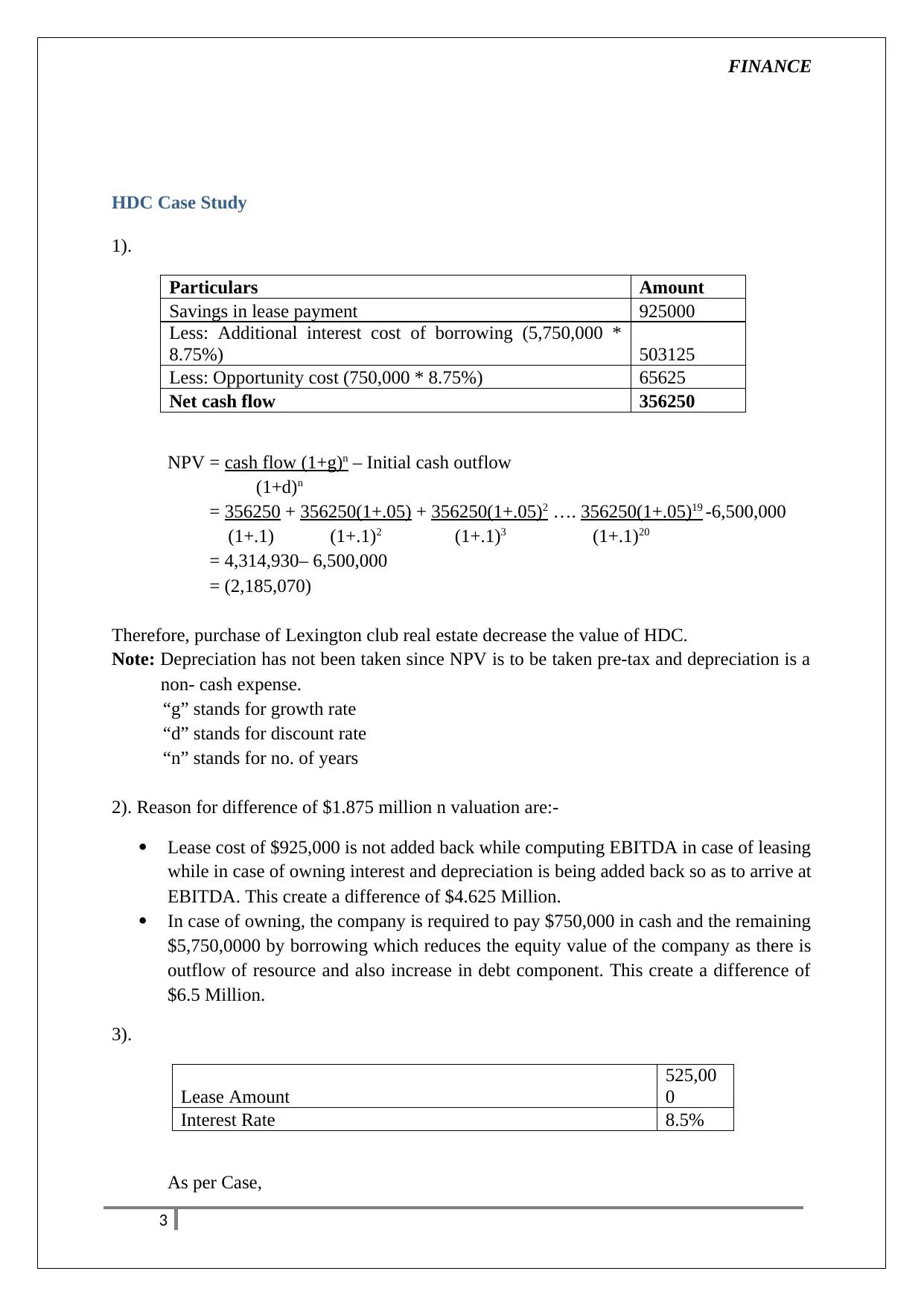

HDC Case Study

1).

Particulars Amount

Savings in lease payment 925000

Less: Additional interest cost of borrowing (5,750,000 *

8.75%) 503125

Less: Opportunity cost (750,000 * 8.75%) 65625

Net cash flow 356250

NPV = cash flow (1+g)n – Initial cash outflow

(1+d)n

= 356250 + 356250(1+.05) + 356250(1+.05)2 …. 356250(1+.05)19 -6,500,000

(1+.1) (1+.1)2 (1+.1)3 (1+.1)20

= 4,314,930– 6,500,000

= (2,185,070)

Therefore, purchase of Lexington club real estate decrease the value of HDC.

Note: Depreciation has not been taken since NPV is to be taken pre-tax and depreciation is a

non- cash expense.

“g” stands for growth rate

“d” stands for discount rate

“n” stands for no. of years

2). Reason for difference of $1.875 million n valuation are:-

Lease cost of $925,000 is not added back while computing EBITDA in case of leasing

while in case of owning interest and depreciation is being added back so as to arrive at

EBITDA. This create a difference of $4.625 Million.

In case of owning, the company is required to pay $750,000 in cash and the remaining

$5,750,0000 by borrowing which reduces the equity value of the company as there is

outflow of resource and also increase in debt component. This create a difference of

$6.5 Million.

3).

Lease Amount

525,00

0

Interest Rate 8.5%

As per Case,

3

HDC Case Study

1).

Particulars Amount

Savings in lease payment 925000

Less: Additional interest cost of borrowing (5,750,000 *

8.75%) 503125

Less: Opportunity cost (750,000 * 8.75%) 65625

Net cash flow 356250

NPV = cash flow (1+g)n – Initial cash outflow

(1+d)n

= 356250 + 356250(1+.05) + 356250(1+.05)2 …. 356250(1+.05)19 -6,500,000

(1+.1) (1+.1)2 (1+.1)3 (1+.1)20

= 4,314,930– 6,500,000

= (2,185,070)

Therefore, purchase of Lexington club real estate decrease the value of HDC.

Note: Depreciation has not been taken since NPV is to be taken pre-tax and depreciation is a

non- cash expense.

“g” stands for growth rate

“d” stands for discount rate

“n” stands for no. of years

2). Reason for difference of $1.875 million n valuation are:-

Lease cost of $925,000 is not added back while computing EBITDA in case of leasing

while in case of owning interest and depreciation is being added back so as to arrive at

EBITDA. This create a difference of $4.625 Million.

In case of owning, the company is required to pay $750,000 in cash and the remaining

$5,750,0000 by borrowing which reduces the equity value of the company as there is

outflow of resource and also increase in debt component. This create a difference of

$6.5 Million.

3).

Lease Amount

525,00

0

Interest Rate 8.5%

As per Case,

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

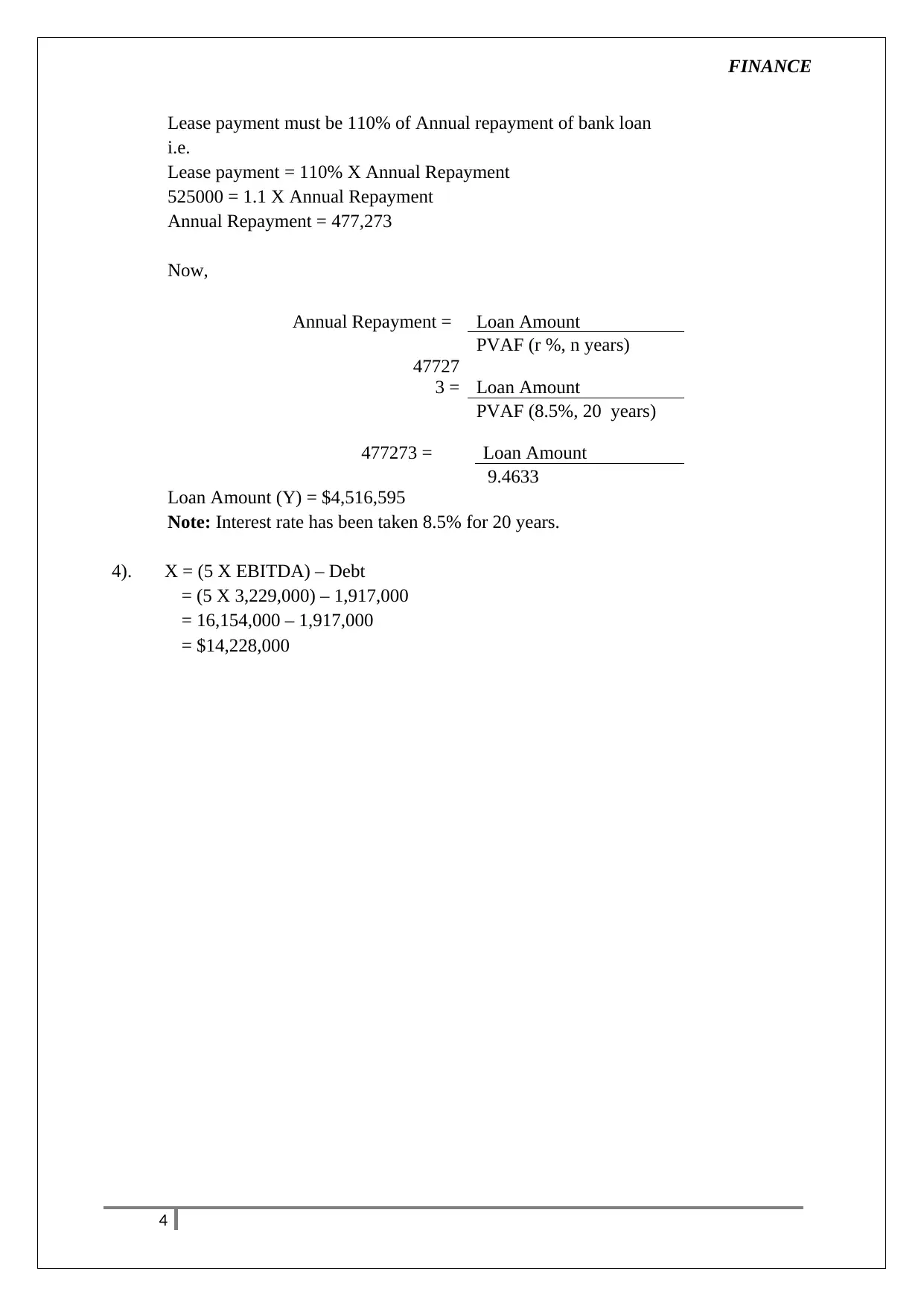

Lease payment must be 110% of Annual repayment of bank loan

i.e.

Lease payment = 110% X Annual Repayment

525000 = 1.1 X Annual Repayment

Annual Repayment = 477,273

Now,

Annual Repayment = Loan Amount

PVAF (r %, n years)

47727

3 = Loan Amount

PVAF (8.5%, 20 years)

477273 = Loan Amount

9.4633

Loan Amount (Y) = $4,516,595

Note: Interest rate has been taken 8.5% for 20 years.

4). X = (5 X EBITDA) – Debt

= (5 X 3,229,000) – 1,917,000

= 16,154,000 – 1,917,000

= $14,228,000

4

Lease payment must be 110% of Annual repayment of bank loan

i.e.

Lease payment = 110% X Annual Repayment

525000 = 1.1 X Annual Repayment

Annual Repayment = 477,273

Now,

Annual Repayment = Loan Amount

PVAF (r %, n years)

47727

3 = Loan Amount

PVAF (8.5%, 20 years)

477273 = Loan Amount

9.4633

Loan Amount (Y) = $4,516,595

Note: Interest rate has been taken 8.5% for 20 years.

4). X = (5 X EBITDA) – Debt

= (5 X 3,229,000) – 1,917,000

= 16,154,000 – 1,917,000

= $14,228,000

4

FINANCE

Blaine Kitchenware Case Study

1). No, Blaine’s current capital structure is not appropriate because the company’s capital

structure consist of only equity & they are not taking benefit of trading on equity. Trading on

equity means where company uses debt component in its capital structure so as to increase

their value as interest paid on debt is charge against profit which gives tax benefit on the

same.

Payout ratio is also not appropriate as company’s ROE is only 11% while Industry’s ROE

is 26%. So as per Walter’s model, optimum payout ratio should be 100% in order to increase

the value of shares.

Debt 0

Equity 488,363,000

Debt equity ratio

= Debt

Equity

= 0

488,363,0

00

= 0

2). Primary advantages of large share repurchase:

For repurchase, they are required to borrow which gives them benefit of trading on

equity which ultimately results in increase in value of shares.

Increase in EPS as no. of share reduces.

Primary disadvantages of large share repurchase:

If company repurchase the share then for acquisition they are required to borrow fund

which ultimately increase their risk as borrowing should be made upto certain limits.

It may leads to outflow of resources to outsiders as they are required to pay interest on

borrowed fund.

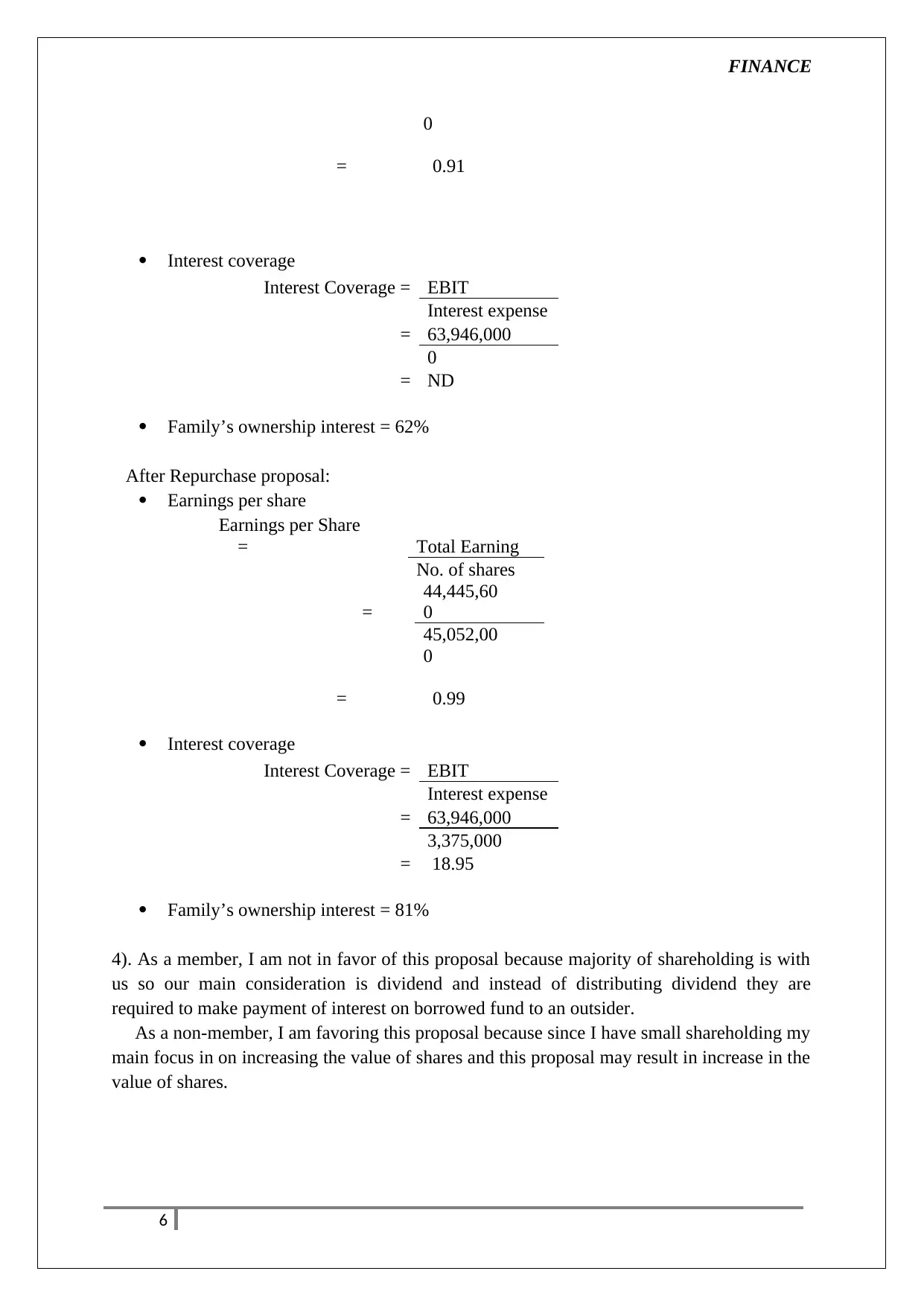

3). Before Repurchase proposal:

Earnings per share

Earnings per Share

= Total Earning

No. of shares

=

53,630,00

0

59,052,00

5

Blaine Kitchenware Case Study

1). No, Blaine’s current capital structure is not appropriate because the company’s capital

structure consist of only equity & they are not taking benefit of trading on equity. Trading on

equity means where company uses debt component in its capital structure so as to increase

their value as interest paid on debt is charge against profit which gives tax benefit on the

same.

Payout ratio is also not appropriate as company’s ROE is only 11% while Industry’s ROE

is 26%. So as per Walter’s model, optimum payout ratio should be 100% in order to increase

the value of shares.

Debt 0

Equity 488,363,000

Debt equity ratio

= Debt

Equity

= 0

488,363,0

00

= 0

2). Primary advantages of large share repurchase:

For repurchase, they are required to borrow which gives them benefit of trading on

equity which ultimately results in increase in value of shares.

Increase in EPS as no. of share reduces.

Primary disadvantages of large share repurchase:

If company repurchase the share then for acquisition they are required to borrow fund

which ultimately increase their risk as borrowing should be made upto certain limits.

It may leads to outflow of resources to outsiders as they are required to pay interest on

borrowed fund.

3). Before Repurchase proposal:

Earnings per share

Earnings per Share

= Total Earning

No. of shares

=

53,630,00

0

59,052,00

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE

0

= 0.91

Interest coverage

Interest Coverage = EBIT

Interest expense

= 63,946,000

0

= ND

Family’s ownership interest = 62%

After Repurchase proposal:

Earnings per share

Earnings per Share

= Total Earning

No. of shares

=

44,445,60

0

45,052,00

0

= 0.99

Interest coverage

Interest Coverage = EBIT

Interest expense

= 63,946,000

3,375,000

= 18.95

Family’s ownership interest = 81%

4). As a member, I am not in favor of this proposal because majority of shareholding is with

us so our main consideration is dividend and instead of distributing dividend they are

required to make payment of interest on borrowed fund to an outsider.

As a non-member, I am favoring this proposal because since I have small shareholding my

main focus in on increasing the value of shares and this proposal may result in increase in the

value of shares.

6

0

= 0.91

Interest coverage

Interest Coverage = EBIT

Interest expense

= 63,946,000

0

= ND

Family’s ownership interest = 62%

After Repurchase proposal:

Earnings per share

Earnings per Share

= Total Earning

No. of shares

=

44,445,60

0

45,052,00

0

= 0.99

Interest coverage

Interest Coverage = EBIT

Interest expense

= 63,946,000

3,375,000

= 18.95

Family’s ownership interest = 81%

4). As a member, I am not in favor of this proposal because majority of shareholding is with

us so our main consideration is dividend and instead of distributing dividend they are

required to make payment of interest on borrowed fund to an outsider.

As a non-member, I am favoring this proposal because since I have small shareholding my

main focus in on increasing the value of shares and this proposal may result in increase in the

value of shares.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE

References

1). myaccountingcourse.com (n.d) Debt to Equity Ratio, [online], Available at:

http://www.myaccountingcourse.com/financial-ratios/debt-to-equity-ratio [21st August, 2016]

2). efinancemanagement.com (n.d) Walter’s Theory on Dividend Policy, [Online], Available

at: https://www.efinancemanagement.com/dividend-decisions/walters-theory-on-dividend-

policy [21st August, 2016]

3). Smriti Chand (n.d) Trading on Equity, [Online], Available at:

(http://www.yourarticlelibrary.com/financial-management/trading-on-equity-meaning-

effects-with-examples-financial-management/29381/) [21st August, 2016]

4). investopedia.com (n.d) Net present value – NPV, [Online], Available at:

(http://www.investopedia.com/terms/n/npv.asp) [21st August, 2016]

5). investopedia.com (n.d) Share Repurchase, [Online], Available at:

(http://www.investopedia.com/terms/s/sharerepurchase.asp) [21st August, 2016]

7

References

1). myaccountingcourse.com (n.d) Debt to Equity Ratio, [online], Available at:

http://www.myaccountingcourse.com/financial-ratios/debt-to-equity-ratio [21st August, 2016]

2). efinancemanagement.com (n.d) Walter’s Theory on Dividend Policy, [Online], Available

at: https://www.efinancemanagement.com/dividend-decisions/walters-theory-on-dividend-

policy [21st August, 2016]

3). Smriti Chand (n.d) Trading on Equity, [Online], Available at:

(http://www.yourarticlelibrary.com/financial-management/trading-on-equity-meaning-

effects-with-examples-financial-management/29381/) [21st August, 2016]

4). investopedia.com (n.d) Net present value – NPV, [Online], Available at:

(http://www.investopedia.com/terms/n/npv.asp) [21st August, 2016]

5). investopedia.com (n.d) Share Repurchase, [Online], Available at:

(http://www.investopedia.com/terms/s/sharerepurchase.asp) [21st August, 2016]

7

1 out of 8

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.