Business Finance: Costing, Variance Analysis & Investment Appraisal

VerifiedAdded on 2023/06/11

|23

|5384

|394

Case Study

AI Summary

This document presents a comprehensive solution to a business finance case study, divided into two main parts. The first part focuses on cost calculation, including contribution per unit, breakeven point analysis, margin of safety, and profit calculation using marginal and absorption costing methods. It also covers the importance of standard costing and variance analysis, providing calculations and comments on material and labor variances, along with a budget preparation for controlling operations. The second part delves into investment appraisal techniques, such as payback period, net present value, and internal rate of return, offering advice on project suitability. Additionally, it includes a risk assessment of Omega Limited using accounting ratios, identifies non-finance performance indicators, and discusses the impact of pricing policy on business performance. This solved assignment is available on Desklib, a platform offering study tools and resources for students.

BUSINESS FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents:

INTRODUCTION...........................................................................................................................3

Case Study 1:...................................................................................................................................3

Part A...............................................................................................................................................3

1.Calculation of contribution per unit:...................................................................................3

2.Calculation of breakeven point in units and breakeven sales:.............................................3

3.Calculation of margin of safety:..........................................................................................4

4.Calculation of number of units sold:...................................................................................5

5.Preparation of memo suggesting the finance manager the importance of contribution:.....5

6.Calculation of profit using marginal and absorption costing and reconciliation between

them:.......................................................................................................................................6

Part B...............................................................................................................................................8

1.Importance of Standard Costing and Variance Analysis:....................................................8

2.Calculation of material and labour variance along with comment on them:.......................8

3.Preparation of budget for controlling the operations:........................................................10

CONCLUTION..............................................................................................................................11

REFERENCES..............................................................................................................................12

Case Study 2:.................................................................................................................................14

INTRODUCTION.........................................................................................................................14

Part A.............................................................................................................................................14

1.Payback period:.................................................................................................................14

2.Net present value:..............................................................................................................15

3.Internal rate of return:........................................................................................................16

4.Advice regarding suitability of the project:.......................................................................18

Part B.............................................................................................................................................18

1.Risk assessment of Omega limited using accounting ratios:.............................................18

2.Identification and explanation on non-finance performance indicators:...........................20

3.Impact of pricing policy on the performance of the business:..........................................20

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

INTRODUCTION...........................................................................................................................3

Case Study 1:...................................................................................................................................3

Part A...............................................................................................................................................3

1.Calculation of contribution per unit:...................................................................................3

2.Calculation of breakeven point in units and breakeven sales:.............................................3

3.Calculation of margin of safety:..........................................................................................4

4.Calculation of number of units sold:...................................................................................5

5.Preparation of memo suggesting the finance manager the importance of contribution:.....5

6.Calculation of profit using marginal and absorption costing and reconciliation between

them:.......................................................................................................................................6

Part B...............................................................................................................................................8

1.Importance of Standard Costing and Variance Analysis:....................................................8

2.Calculation of material and labour variance along with comment on them:.......................8

3.Preparation of budget for controlling the operations:........................................................10

CONCLUTION..............................................................................................................................11

REFERENCES..............................................................................................................................12

Case Study 2:.................................................................................................................................14

INTRODUCTION.........................................................................................................................14

Part A.............................................................................................................................................14

1.Payback period:.................................................................................................................14

2.Net present value:..............................................................................................................15

3.Internal rate of return:........................................................................................................16

4.Advice regarding suitability of the project:.......................................................................18

Part B.............................................................................................................................................18

1.Risk assessment of Omega limited using accounting ratios:.............................................18

2.Identification and explanation on non-finance performance indicators:...........................20

3.Impact of pricing policy on the performance of the business:..........................................20

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

INTRODUCTION

Business finance simply means managing the finance of the organisation in an effective

manner so the funds of the business can’t be misused. It is important for the company to hire

smart personnel in the finance department having sufficient knowledge of funds and their

treatment so that effective utilisation can be carried out. This report consists of two different case

study relating to cost calculation and investment appraisal techniques to judge the viability of the

project. (Al Dahdah, 2022).

Case Study 1:

Part A

1.Calculation of contribution per unit:

It can also be defined as profit on the sales of one unit and after subtracting all variable

expenses the amount is come is called as contribution. This detail is helpful to identify the

minimum possible price at which to sell the good.

Contribution per unit = sales per unit – variable cost per unit

= £120 – £50

= £70 per unit

Now, it can show that the sales per unit is £120 and variable expense is £50 per unit and the

contribution of the Lobelia Ltd company is £70 per unit.

2.Calculation of breakeven point in units and breakeven sales:

This is the most important concept to measure that weights the expenses of a new

company, goods and service against the unit of the selling price to identify the point at which it

will break even. Basically, it is the stage of sales where a total of fixed cost and variable cost is

equals to total sales revenue. On the other it can also say that the break- even point is a stage

where the business neither create a profit nor a loss. In simple words break- even point is an

amount of revenue that cover whole fixed and variable expenses. If company having a lower

sale, then it will show the low performance in break-even point. But if the revenue of the

company is high then break-even point, then it creates profit but after considering all expenses

(Álvarez‐Herránz, Lagos, and Balsalobre‐Lorente, 2018).

Simplification of Break- even point:

Business finance simply means managing the finance of the organisation in an effective

manner so the funds of the business can’t be misused. It is important for the company to hire

smart personnel in the finance department having sufficient knowledge of funds and their

treatment so that effective utilisation can be carried out. This report consists of two different case

study relating to cost calculation and investment appraisal techniques to judge the viability of the

project. (Al Dahdah, 2022).

Case Study 1:

Part A

1.Calculation of contribution per unit:

It can also be defined as profit on the sales of one unit and after subtracting all variable

expenses the amount is come is called as contribution. This detail is helpful to identify the

minimum possible price at which to sell the good.

Contribution per unit = sales per unit – variable cost per unit

= £120 – £50

= £70 per unit

Now, it can show that the sales per unit is £120 and variable expense is £50 per unit and the

contribution of the Lobelia Ltd company is £70 per unit.

2.Calculation of breakeven point in units and breakeven sales:

This is the most important concept to measure that weights the expenses of a new

company, goods and service against the unit of the selling price to identify the point at which it

will break even. Basically, it is the stage of sales where a total of fixed cost and variable cost is

equals to total sales revenue. On the other it can also say that the break- even point is a stage

where the business neither create a profit nor a loss. In simple words break- even point is an

amount of revenue that cover whole fixed and variable expenses. If company having a lower

sale, then it will show the low performance in break-even point. But if the revenue of the

company is high then break-even point, then it creates profit but after considering all expenses

(Álvarez‐Herránz, Lagos, and Balsalobre‐Lorente, 2018).

Simplification of Break- even point:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Break-even point is a calculation of sustenance and the lesser the quantity of break-even, the

good it is for the business.

Here is formula to calculate break-even point and Break-even sales:

Break-even point

= Fixed cost / (sales per unit – variable cost per unit)

Break-even point

= £700000 / (£120 - £50)

= £700000 / £70

= £10000 units

It clearly shows that the above formula shows the calculation of break-even point in this fixed

per unit cost is divide by the contribution per unit and the value of fixed cost is given £700000

and Contribution per unit is calculated in above point is £70.

Break- even sales in %

= Fixed cost / Contribution margin

Break- even sales

= £700000 / £2800000 *100

= 25 %

From the above calculation it clearly shows that the break-even sales is 25 % and if it calculate in

units then its show the same unit of breakeven point that is £70.

3.Calculation of margin of safety:

In this concept of margin of safety, it shows the difference between the both current sales

level and the break-even sales. It shows the stage of safety that the business appreciates before

occurring losses means decline below the break-even stage (Benton, 2022).

Clarification of Margin of safety:

It calculates the risk of the company and if margin of safety is higher than its good for the

business.

Here is formula to calculate margin of safety:

Margin of safety (MOS)

= Budgeted sales – Break-even point / budgeted sales * 100

= £40000 units - £10000 units / £40000 units *100

= £30000 units / £40000 units *100

good it is for the business.

Here is formula to calculate break-even point and Break-even sales:

Break-even point

= Fixed cost / (sales per unit – variable cost per unit)

Break-even point

= £700000 / (£120 - £50)

= £700000 / £70

= £10000 units

It clearly shows that the above formula shows the calculation of break-even point in this fixed

per unit cost is divide by the contribution per unit and the value of fixed cost is given £700000

and Contribution per unit is calculated in above point is £70.

Break- even sales in %

= Fixed cost / Contribution margin

Break- even sales

= £700000 / £2800000 *100

= 25 %

From the above calculation it clearly shows that the break-even sales is 25 % and if it calculate in

units then its show the same unit of breakeven point that is £70.

3.Calculation of margin of safety:

In this concept of margin of safety, it shows the difference between the both current sales

level and the break-even sales. It shows the stage of safety that the business appreciates before

occurring losses means decline below the break-even stage (Benton, 2022).

Clarification of Margin of safety:

It calculates the risk of the company and if margin of safety is higher than its good for the

business.

Here is formula to calculate margin of safety:

Margin of safety (MOS)

= Budgeted sales – Break-even point / budgeted sales * 100

= £40000 units - £10000 units / £40000 units *100

= £30000 units / £40000 units *100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= 75%

The above calculation show margin of safety is 75% and the budgeted sales of the company is

already given £40000 but the break-even point is calculated in above point that is £10000.

4.Calculation of number of units sold:

This concept is asked to calculate how much unit sold is needed to gain £700000 in a year

that means they want required sales unit. Here is one formula to calculate the desired profit of the

firm:

Required sales units

= fixed cost + target profit / Contribution margin per unit

= £700000 + £700000 / £70 units

= £1400000 / £70 units

= £20000 units

In the above formulation of required sales unit, it states that company need to sold £20000 units

want to earn a profit of £700000.

5.Preparation of memo suggesting the finance manager the importance of contribution:

Importance of contribution

It assists the company to know the contribution of different company lines and or

different goods and services. It also helps to know the strength and weakness of the company or

the product also. It used to measure the profit into the business after selling the goods and

services (Busch, Domeij, and Madera, 2022).

Suggestion how contribution margin helps to take business decisions:

contribution margin is a strong decision making and budgeting tools that management

accounting objective and superior utilize to take decision making procedure. Here are some uses

of contribution margin for the business decision making: Fixed minimum sale price its best

technique to target selling price it will cover both fixed and variable expenses, It permit to draw a

profit volume chart to know the position of the business that the company will be in a profitable

situation or not because of the chart it easy to understand the profit position (Clifton, 2018).

How contribution affects margin of safety

In the above formula of break-even point show that the fixed cost / contribution margin means if

contribution margin is high or less then it affects the value of break-even point and because of

The above calculation show margin of safety is 75% and the budgeted sales of the company is

already given £40000 but the break-even point is calculated in above point that is £10000.

4.Calculation of number of units sold:

This concept is asked to calculate how much unit sold is needed to gain £700000 in a year

that means they want required sales unit. Here is one formula to calculate the desired profit of the

firm:

Required sales units

= fixed cost + target profit / Contribution margin per unit

= £700000 + £700000 / £70 units

= £1400000 / £70 units

= £20000 units

In the above formulation of required sales unit, it states that company need to sold £20000 units

want to earn a profit of £700000.

5.Preparation of memo suggesting the finance manager the importance of contribution:

Importance of contribution

It assists the company to know the contribution of different company lines and or

different goods and services. It also helps to know the strength and weakness of the company or

the product also. It used to measure the profit into the business after selling the goods and

services (Busch, Domeij, and Madera, 2022).

Suggestion how contribution margin helps to take business decisions:

contribution margin is a strong decision making and budgeting tools that management

accounting objective and superior utilize to take decision making procedure. Here are some uses

of contribution margin for the business decision making: Fixed minimum sale price its best

technique to target selling price it will cover both fixed and variable expenses, It permit to draw a

profit volume chart to know the position of the business that the company will be in a profitable

situation or not because of the chart it easy to understand the profit position (Clifton, 2018).

How contribution affects margin of safety

In the above formula of break-even point show that the fixed cost / contribution margin means if

contribution margin is high or less then it affects the value of break-even point and because of

that margin of safety got affected because in the formula of MOS break-even is less into the

budgeted sales of the company (Clunan, 2022).

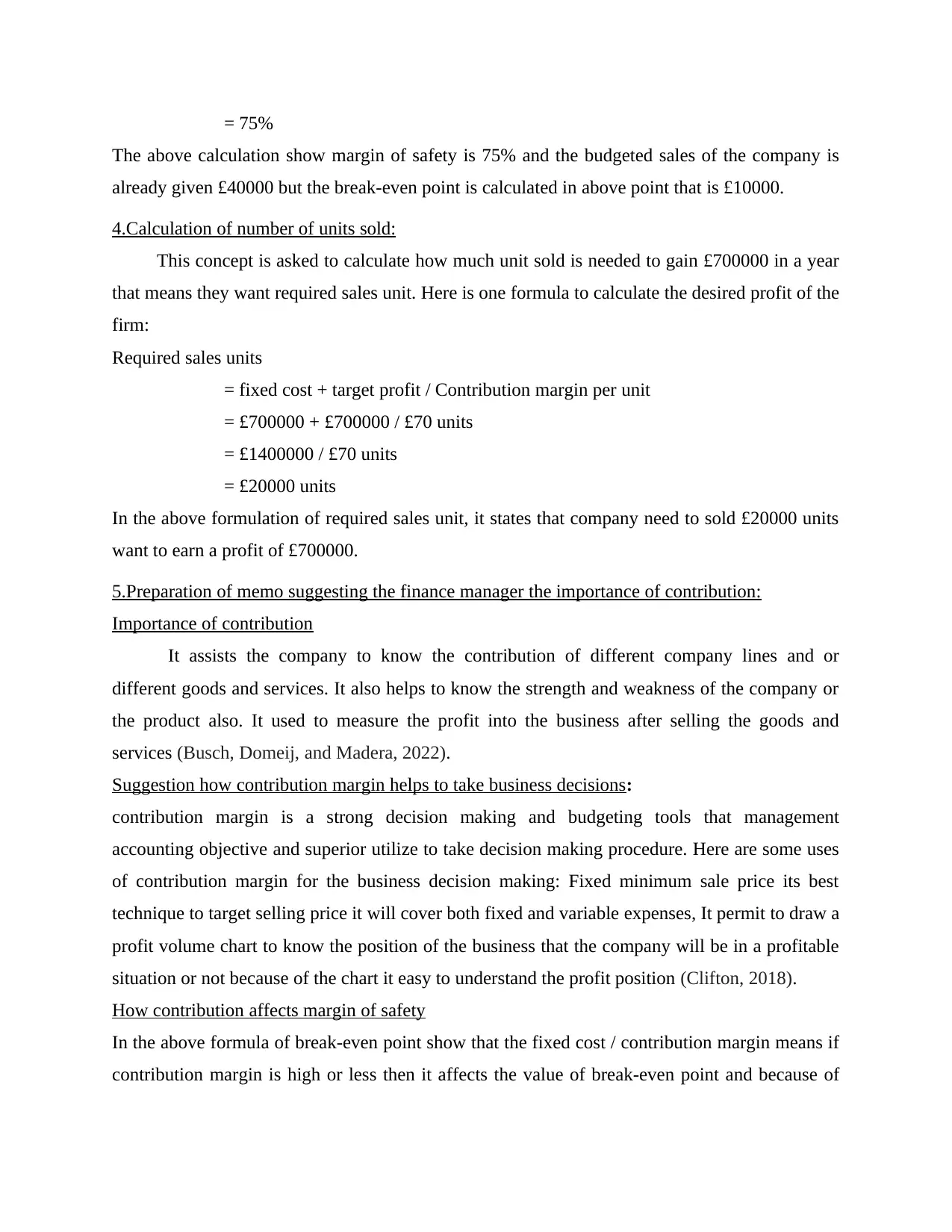

6.Calculation of profit using marginal and absorption costing and reconciliation between them:

Particulars Budgeted Profit (£) Actual Profit (£)

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Variable overhead

35000

45000

15000

33600

43200

14400

Marginal cost

Less: Closing Inventory

Add: Fixed overhead

95000

_

9000

91200

(7600)

9000

Cost of sales 104000 92600

Gross profit (sales – cost of sales)

Less: Administration, selling and distribution cost

6000

_

4200

_

Net profit 6000 4200

Working of closing stock:

The budgeted sales and production of the company is same £5000 units and it's done the

complete sale of £5000 unit so, there is no closing stock remain but the absorption rate of

the company is:

Absorption rate = marginal cost / budgeted production

= £95000 / £5000

= £19 per unit

The Actual production of the company is 4800 units and actual sale is 4400 units so, the

closing stock of the company is £400 units and the absorption rate of the business is:

Absorption rate = marginal cost / budgeted production

= 91200 / 4800

budgeted sales of the company (Clunan, 2022).

6.Calculation of profit using marginal and absorption costing and reconciliation between them:

Particulars Budgeted Profit (£) Actual Profit (£)

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Variable overhead

35000

45000

15000

33600

43200

14400

Marginal cost

Less: Closing Inventory

Add: Fixed overhead

95000

_

9000

91200

(7600)

9000

Cost of sales 104000 92600

Gross profit (sales – cost of sales)

Less: Administration, selling and distribution cost

6000

_

4200

_

Net profit 6000 4200

Working of closing stock:

The budgeted sales and production of the company is same £5000 units and it's done the

complete sale of £5000 unit so, there is no closing stock remain but the absorption rate of

the company is:

Absorption rate = marginal cost / budgeted production

= £95000 / £5000

= £19 per unit

The Actual production of the company is 4800 units and actual sale is 4400 units so, the

closing stock of the company is £400 units and the absorption rate of the business is:

Absorption rate = marginal cost / budgeted production

= 91200 / 4800

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 19 per unit

So, the actual closing inventory of the company is (400 * 19 = 7600).

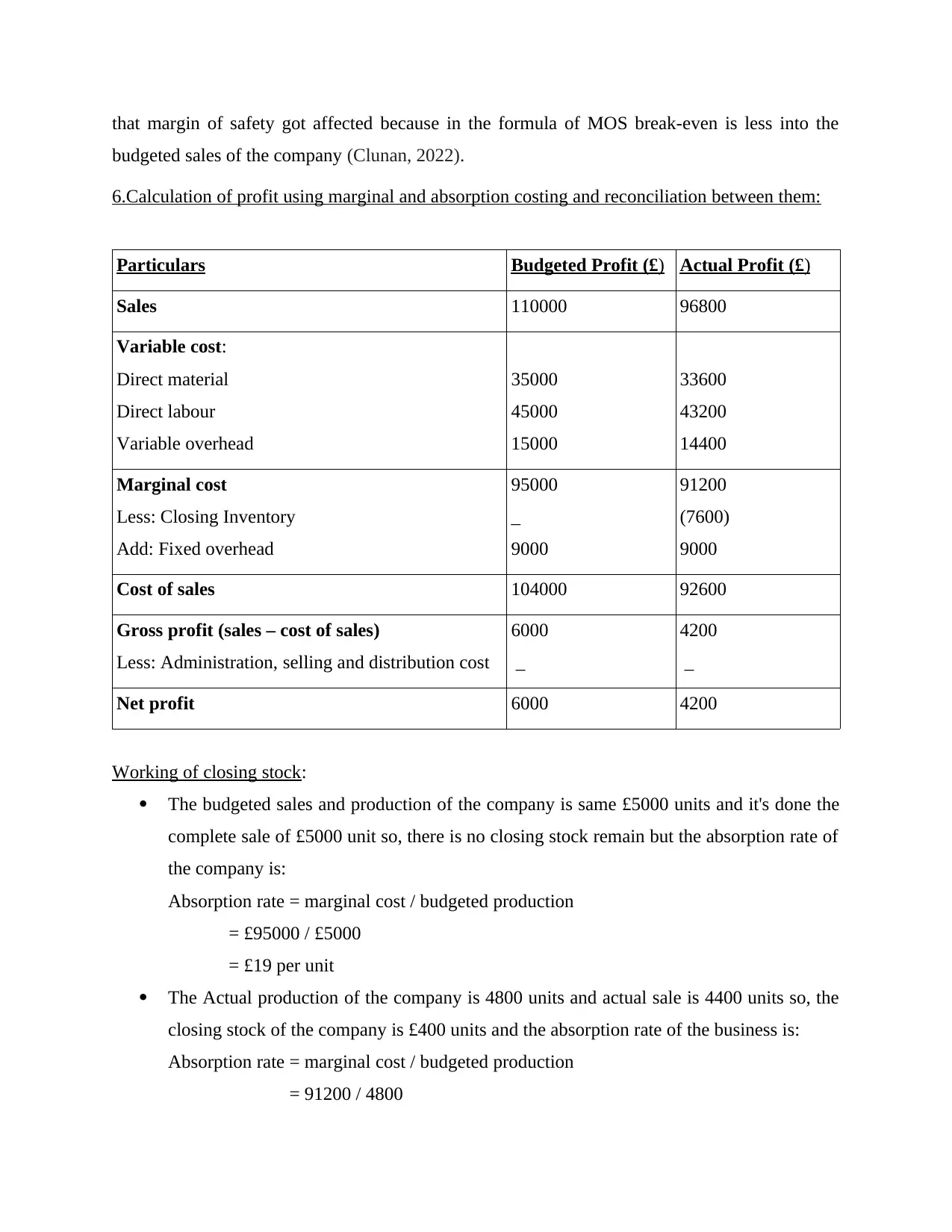

Calculation of Absorption costing

Particulars Budgeted Profit (£) Actual Profit (£)

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Total Variable overhead

35000

45000

24000

33600

43200

23400

Absorption cost

Less: Closing Inventory

104000

_

100200

(8350)

Cost of sales 104000 91850

Gross profit (sales – cost of sales)

Less: Administration, selling and distribution cost

6000

_

4950

_

Net profit 6000 4950

Working of closing stock and Total variable overhead:

The budgeted sales and production of the company is same £5000 units and it's done the

complete sale of £5000 unit so, there is no closing stock remain but the absorption rate of

the company is:

Absorption rate = Absorption cost / budgeted production

= £104000 / £5000

= £20.8per unit

The Actual production of the company is £4800 units and actual sale is £4400 units so,

the closing stock of the company is £400 units and the absorption rate of the business is:

Absorption rate = Absorption cost / budgeted production

= £100200 / £4800

= £20.875 per unit

So, the actual closing stock of the company is (£400 * £20.875 = £8350).

So, the actual closing inventory of the company is (400 * 19 = 7600).

Calculation of Absorption costing

Particulars Budgeted Profit (£) Actual Profit (£)

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Total Variable overhead

35000

45000

24000

33600

43200

23400

Absorption cost

Less: Closing Inventory

104000

_

100200

(8350)

Cost of sales 104000 91850

Gross profit (sales – cost of sales)

Less: Administration, selling and distribution cost

6000

_

4950

_

Net profit 6000 4950

Working of closing stock and Total variable overhead:

The budgeted sales and production of the company is same £5000 units and it's done the

complete sale of £5000 unit so, there is no closing stock remain but the absorption rate of

the company is:

Absorption rate = Absorption cost / budgeted production

= £104000 / £5000

= £20.8per unit

The Actual production of the company is £4800 units and actual sale is £4400 units so,

the closing stock of the company is £400 units and the absorption rate of the business is:

Absorption rate = Absorption cost / budgeted production

= £100200 / £4800

= £20.875 per unit

So, the actual closing stock of the company is (£400 * £20.875 = £8350).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The total variable overhead = Variable overhead + fixed overhead

= £14400 + £9000

= £23400

Part B

1.Importance of Standard Costing and Variance Analysis:

Standards or Standard costs are established to evaluate performance of a responsibility

centre. Apart from performance evaluation and cost control, standard costs are also used to value

inventory where actual figures are not reliably available and to determine selling prices

particularly while preparing quotations. Standard costing system is widely accepted as it serves

different needs of an organisation. The standard costing is preferred for the following reasons:

Prediction of future cost for decision making: Standard costs are set after taking all

present conditions and future possibilities into consideration. Hence, standard cost is

future cost for the purpose of cost estimation and profitability from a proposed project/

order/ activity (Gosselin, Godbout, and St-Cerny, 2020).

Provide target to be achieved: Standard costs are the target cost which should not be

crossed by the responsibility centres. Performance of a responsibility centre is

continuously monitored and measured against the set standards. Any variance from the

standard is noted and reported for appropriate action.

Used in budgeting and performance evaluation: Standard costs are used to set budgets

and based on these budgets managerial performance is evaluated. This is of two benefits,

one managers of a responsibility centre will not compromise with the quality to fulfil the

budgeted quantity and second, variances can be traced with the responsible department or

person (Hirigoyen and Basly, 2018).

Interim profit measurement and inventory valuation: Actual profit can only be known

after the closure of the accounts. But an organisation may need to prepare profitability

statement for interim periods for managerial reporting and decision making. To arrive at

profit figure, standard costs are deducted from the revenue.

2.Calculation of material and labour variance along with comment on them:

Material price variance:

= £14400 + £9000

= £23400

Part B

1.Importance of Standard Costing and Variance Analysis:

Standards or Standard costs are established to evaluate performance of a responsibility

centre. Apart from performance evaluation and cost control, standard costs are also used to value

inventory where actual figures are not reliably available and to determine selling prices

particularly while preparing quotations. Standard costing system is widely accepted as it serves

different needs of an organisation. The standard costing is preferred for the following reasons:

Prediction of future cost for decision making: Standard costs are set after taking all

present conditions and future possibilities into consideration. Hence, standard cost is

future cost for the purpose of cost estimation and profitability from a proposed project/

order/ activity (Gosselin, Godbout, and St-Cerny, 2020).

Provide target to be achieved: Standard costs are the target cost which should not be

crossed by the responsibility centres. Performance of a responsibility centre is

continuously monitored and measured against the set standards. Any variance from the

standard is noted and reported for appropriate action.

Used in budgeting and performance evaluation: Standard costs are used to set budgets

and based on these budgets managerial performance is evaluated. This is of two benefits,

one managers of a responsibility centre will not compromise with the quality to fulfil the

budgeted quantity and second, variances can be traced with the responsible department or

person (Hirigoyen and Basly, 2018).

Interim profit measurement and inventory valuation: Actual profit can only be known

after the closure of the accounts. But an organisation may need to prepare profitability

statement for interim periods for managerial reporting and decision making. To arrive at

profit figure, standard costs are deducted from the revenue.

2.Calculation of material and labour variance along with comment on them:

Material price variance:

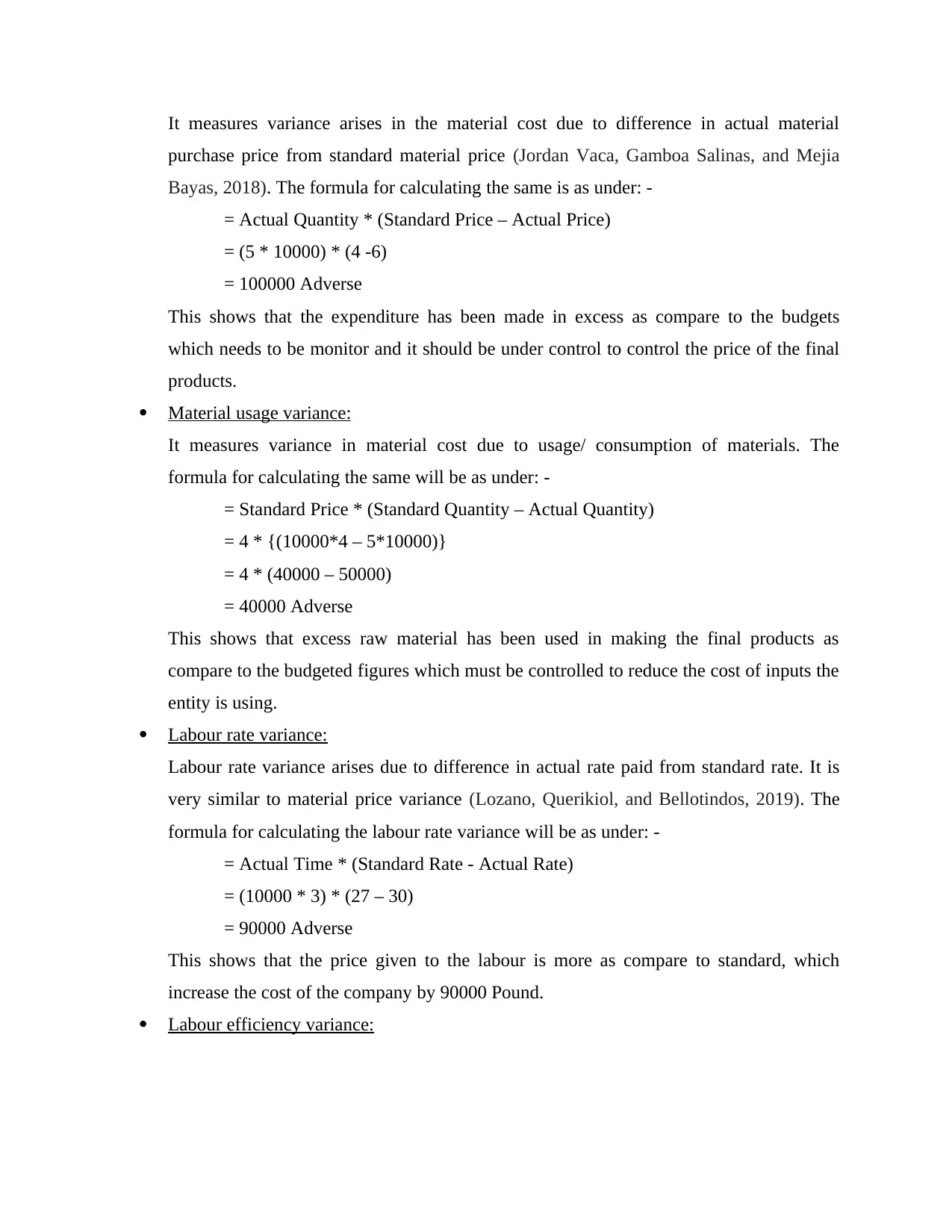

It measures variance arises in the material cost due to difference in actual material

purchase price from standard material price (Jordan Vaca, Gamboa Salinas, and Mejia

Bayas, 2018). The formula for calculating the same is as under: -

= Actual Quantity * (Standard Price – Actual Price)

= (5 * 10000) * (4 -6)

= 100000 Adverse

This shows that the expenditure has been made in excess as compare to the budgets

which needs to be monitor and it should be under control to control the price of the final

products.

Material usage variance:

It measures variance in material cost due to usage/ consumption of materials. The

formula for calculating the same will be as under: -

= Standard Price * (Standard Quantity – Actual Quantity)

= 4 * {(10000*4 – 5*10000)}

= 4 * (40000 – 50000)

= 40000 Adverse

This shows that excess raw material has been used in making the final products as

compare to the budgeted figures which must be controlled to reduce the cost of inputs the

entity is using.

Labour rate variance:

Labour rate variance arises due to difference in actual rate paid from standard rate. It is

very similar to material price variance (Lozano, Querikiol, and Bellotindos, 2019). The

formula for calculating the labour rate variance will be as under: -

= Actual Time * (Standard Rate - Actual Rate)

= (10000 * 3) * (27 – 30)

= 90000 Adverse

This shows that the price given to the labour is more as compare to standard, which

increase the cost of the company by 90000 Pound.

Labour efficiency variance:

purchase price from standard material price (Jordan Vaca, Gamboa Salinas, and Mejia

Bayas, 2018). The formula for calculating the same is as under: -

= Actual Quantity * (Standard Price – Actual Price)

= (5 * 10000) * (4 -6)

= 100000 Adverse

This shows that the expenditure has been made in excess as compare to the budgets

which needs to be monitor and it should be under control to control the price of the final

products.

Material usage variance:

It measures variance in material cost due to usage/ consumption of materials. The

formula for calculating the same will be as under: -

= Standard Price * (Standard Quantity – Actual Quantity)

= 4 * {(10000*4 – 5*10000)}

= 4 * (40000 – 50000)

= 40000 Adverse

This shows that excess raw material has been used in making the final products as

compare to the budgeted figures which must be controlled to reduce the cost of inputs the

entity is using.

Labour rate variance:

Labour rate variance arises due to difference in actual rate paid from standard rate. It is

very similar to material price variance (Lozano, Querikiol, and Bellotindos, 2019). The

formula for calculating the labour rate variance will be as under: -

= Actual Time * (Standard Rate - Actual Rate)

= (10000 * 3) * (27 – 30)

= 90000 Adverse

This shows that the price given to the labour is more as compare to standard, which

increase the cost of the company by 90000 Pound.

Labour efficiency variance:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

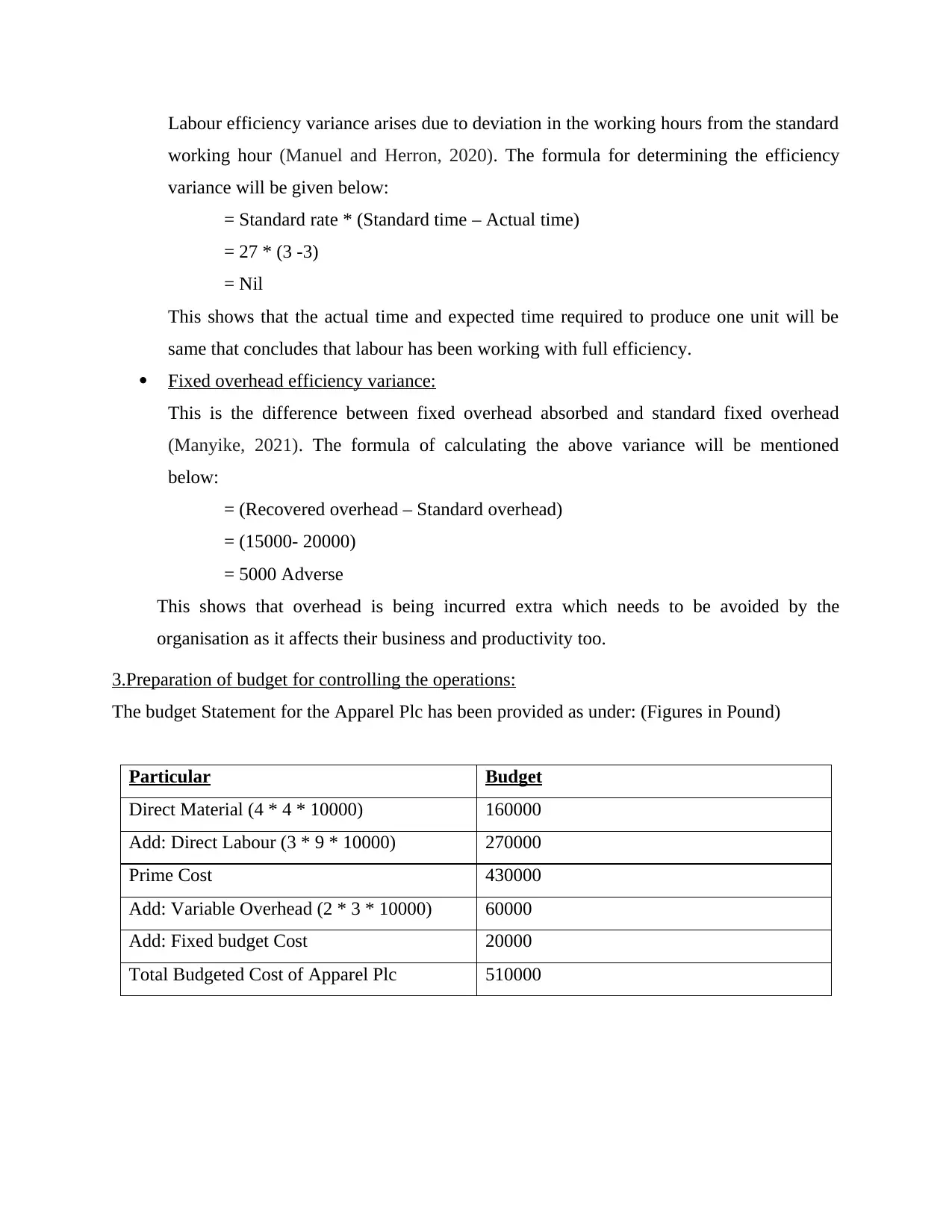

Labour efficiency variance arises due to deviation in the working hours from the standard

working hour (Manuel and Herron, 2020). The formula for determining the efficiency

variance will be given below:

= Standard rate * (Standard time – Actual time)

= 27 * (3 -3)

= Nil

This shows that the actual time and expected time required to produce one unit will be

same that concludes that labour has been working with full efficiency.

Fixed overhead efficiency variance:

This is the difference between fixed overhead absorbed and standard fixed overhead

(Manyike, 2021). The formula of calculating the above variance will be mentioned

below:

= (Recovered overhead – Standard overhead)

= (15000- 20000)

= 5000 Adverse

This shows that overhead is being incurred extra which needs to be avoided by the

organisation as it affects their business and productivity too.

3.Preparation of budget for controlling the operations:

The budget Statement for the Apparel Plc has been provided as under: (Figures in Pound)

Particular Budget

Direct Material (4 * 4 * 10000) 160000

Add: Direct Labour (3 * 9 * 10000) 270000

Prime Cost 430000

Add: Variable Overhead (2 * 3 * 10000) 60000

Add: Fixed budget Cost 20000

Total Budgeted Cost of Apparel Plc 510000

working hour (Manuel and Herron, 2020). The formula for determining the efficiency

variance will be given below:

= Standard rate * (Standard time – Actual time)

= 27 * (3 -3)

= Nil

This shows that the actual time and expected time required to produce one unit will be

same that concludes that labour has been working with full efficiency.

Fixed overhead efficiency variance:

This is the difference between fixed overhead absorbed and standard fixed overhead

(Manyike, 2021). The formula of calculating the above variance will be mentioned

below:

= (Recovered overhead – Standard overhead)

= (15000- 20000)

= 5000 Adverse

This shows that overhead is being incurred extra which needs to be avoided by the

organisation as it affects their business and productivity too.

3.Preparation of budget for controlling the operations:

The budget Statement for the Apparel Plc has been provided as under: (Figures in Pound)

Particular Budget

Direct Material (4 * 4 * 10000) 160000

Add: Direct Labour (3 * 9 * 10000) 270000

Prime Cost 430000

Add: Variable Overhead (2 * 3 * 10000) 60000

Add: Fixed budget Cost 20000

Total Budgeted Cost of Apparel Plc 510000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUTION

In the above two different case scenarios have been given which consist of different companies.

The case study 1consist of two companies that is Lobelia ltd, for which margin of safety,

contribution per unit etc has been calculated and for Apparel plc, the material and labour

variances has been calculated using the cost data to analyse the deviation and interpreting the

same.

In the above two different case scenarios have been given which consist of different companies.

The case study 1consist of two companies that is Lobelia ltd, for which margin of safety,

contribution per unit etc has been calculated and for Apparel plc, the material and labour

variances has been calculated using the cost data to analyse the deviation and interpreting the

same.

REFERENCES

Books and Journals

Al Dahdah, M., 2022. Between philanthropy and big business: the rise of mHealth in the global

health market. Development and Change. 53(2). pp.376-395.

Álvarez‐Herránz, A., Lagos, M.G. and Balsalobre‐Lorente, D., 2018 The moderating effect of

the public finances on transport infrastructures in Spain. Journal of Public Affairs,

p.e2735.

Benton, J.E., 2022. Intra-state governments in the United States: powers and authority, elections,

finances, and intergovernmental dynamics. In A Modern Guide to Local and Regional

Politics. Edward Elgar Publishing.

Busch, C., Domeij, D., and Madera, R., 2022. Skewed idiosyncratic income risk over the

business cycle: Sources and insurance. American Economic Journal:

Macroeconomics. 14(2). pp.207-42.

Clifton, J., 2018. Refinery 29 Money Diaries: Everything You've Ever Wanted To Know About

Your Finances... And Everyone Else's.

Clunan, A.L., 2022. 15. US and International Responses to Terrorist Financing. In Terrorism

financing and state responses (pp. 260-281). Stanford University Press.

Gosselin, J.S., Godbout, L., and St-Cerny, S., 2020. Finances of the Nation: The Economic

Response of Governments in Canada to COVID-19 in the First Three Months of the

Crisis. Canadian Tax Journal/Revue fiscale Canadienne. 68(3). pp.863-890.

Hirigoyen, G. and Basly, S., 2018. The 2008 financial and economic crisis and the family

business sale intention: A study of a French SMEs sample. Journal of Small Business

and Enterprise Development.

Jordan Vaca, J.E., Gamboa Salinas, J.M. and Mejia Bayas, C.V., 2018. Management skills in

managing finances for Small and Medium Business. REVISTA PUBLICANDO. 5(14).

pp.214-223.

Lozano, L., Querikiol, E.M., and Bellotindos, L.M., 2019. Techno-economic analysis of a cost-

effective power generation system for off-grid island communities: A case study of

Gilutongan Island, Cordova, Cebu, Philippines. Renewable Energy. 140. pp.905-911.

Manuel, T. and Herron, T.L., 2020. An ethical perspective of business CSR and the COVID-19

pandemic. Society and Business Review.

Books and Journals

Al Dahdah, M., 2022. Between philanthropy and big business: the rise of mHealth in the global

health market. Development and Change. 53(2). pp.376-395.

Álvarez‐Herránz, A., Lagos, M.G. and Balsalobre‐Lorente, D., 2018 The moderating effect of

the public finances on transport infrastructures in Spain. Journal of Public Affairs,

p.e2735.

Benton, J.E., 2022. Intra-state governments in the United States: powers and authority, elections,

finances, and intergovernmental dynamics. In A Modern Guide to Local and Regional

Politics. Edward Elgar Publishing.

Busch, C., Domeij, D., and Madera, R., 2022. Skewed idiosyncratic income risk over the

business cycle: Sources and insurance. American Economic Journal:

Macroeconomics. 14(2). pp.207-42.

Clifton, J., 2018. Refinery 29 Money Diaries: Everything You've Ever Wanted To Know About

Your Finances... And Everyone Else's.

Clunan, A.L., 2022. 15. US and International Responses to Terrorist Financing. In Terrorism

financing and state responses (pp. 260-281). Stanford University Press.

Gosselin, J.S., Godbout, L., and St-Cerny, S., 2020. Finances of the Nation: The Economic

Response of Governments in Canada to COVID-19 in the First Three Months of the

Crisis. Canadian Tax Journal/Revue fiscale Canadienne. 68(3). pp.863-890.

Hirigoyen, G. and Basly, S., 2018. The 2008 financial and economic crisis and the family

business sale intention: A study of a French SMEs sample. Journal of Small Business

and Enterprise Development.

Jordan Vaca, J.E., Gamboa Salinas, J.M. and Mejia Bayas, C.V., 2018. Management skills in

managing finances for Small and Medium Business. REVISTA PUBLICANDO. 5(14).

pp.214-223.

Lozano, L., Querikiol, E.M., and Bellotindos, L.M., 2019. Techno-economic analysis of a cost-

effective power generation system for off-grid island communities: A case study of

Gilutongan Island, Cordova, Cebu, Philippines. Renewable Energy. 140. pp.905-911.

Manuel, T. and Herron, T.L., 2020. An ethical perspective of business CSR and the COVID-19

pandemic. Society and Business Review.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.