Evaluating Budgeting Systems & Financial Management Practices

VerifiedAdded on 2023/01/19

|10

|3388

|93

Report

AI Summary

This report delves into business finance concepts, focusing on cash flow, working capital management, and budgeting methods, using Bright Lawns Ltd and BoatWorld Plc as case examples. Part 1 explains profit, cash flow, working capital, receivables, inventory, and payables, analyzing their application within BrightLawns Ltd and recommending steps to improve cash flow. Part 2 discusses the purpose of budgeting, comparing traditional (incremental) and alternative (rolling, zero-based, activity-based) budgeting approaches. It demonstrates how these methods can plan future cost management and analyzes the suitability of each system for different parts of a business. The report concludes by summarizing key findings and recommendations for effective financial management.

Project

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1. Explanation of different terms.................................................................................................1

2. Application of concepts within the company...........................................................................3

3. Analysis and recommendation regarding the steps which should be taken to improve cash

flow through better working capital management.......................................................................3

PART 2............................................................................................................................................4

1. Purpose of preparing of budget and explanation of traditional and alternative budgeting

approaches....................................................................................................................................4

2. Demonstration of application of budgeting methods showing the way in which they might

be used to plan future cost management......................................................................................6

3. Analysing of whether traditional or alternative budgetary system is appropriate to all of the

parts of the business in its planned future form...........................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1. Explanation of different terms.................................................................................................1

2. Application of concepts within the company...........................................................................3

3. Analysis and recommendation regarding the steps which should be taken to improve cash

flow through better working capital management.......................................................................3

PART 2............................................................................................................................................4

1. Purpose of preparing of budget and explanation of traditional and alternative budgeting

approaches....................................................................................................................................4

2. Demonstration of application of budgeting methods showing the way in which they might

be used to plan future cost management......................................................................................6

3. Analysing of whether traditional or alternative budgetary system is appropriate to all of the

parts of the business in its planned future form...........................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Business finance is the set of different monetary resources which are required to be

maintained and managed properly by all the companies for the purpose of operating business in

systematic manner. If an organisation is not having sufficient funds then it may create difficulties

for it to attain all the business goals because it is not possible to carry operations without proper

funding (Bakar, Rosbi and Uzaki, 2017). This report is based upon two different organisations

which are Bright Lawns Ltd operates in London, Birmingham and Manchester and BoatWorld

Plc a leisure company that rents boats to holiday makers and operates in United Kingdom and

France. This assignment covers various topics which are explanation of profit, cash flow,

working capital, receivables, inventory and payables, application of all of them and steps to be

taken to improve cash flow. Along with this, purpose of preparing a budget, explanation of

tradition and alternative budgeting methods, their application to show the way in which they

might be used to plan future cost management and appropriateness of one of the processes are

also covered in this project.

PART 1

1. Explanation of different terms

Profit: All the incomes which are gained by an organisation by selling all its products

and service to clients is known as profit. For the purpose of calculating it cost is deducted from

the selling price of the items which are sold to customers. It is a type of financial gain which is

used by organisations to carry out business for long term.

Cash flow: The monetary resources which are flowing inward and outward of an

organisation are known as cash flow. In order to calculate it managers have to deducted all the

outflow from inflow. In other words, it can be defined as the money which is transferred in or out

of a business.

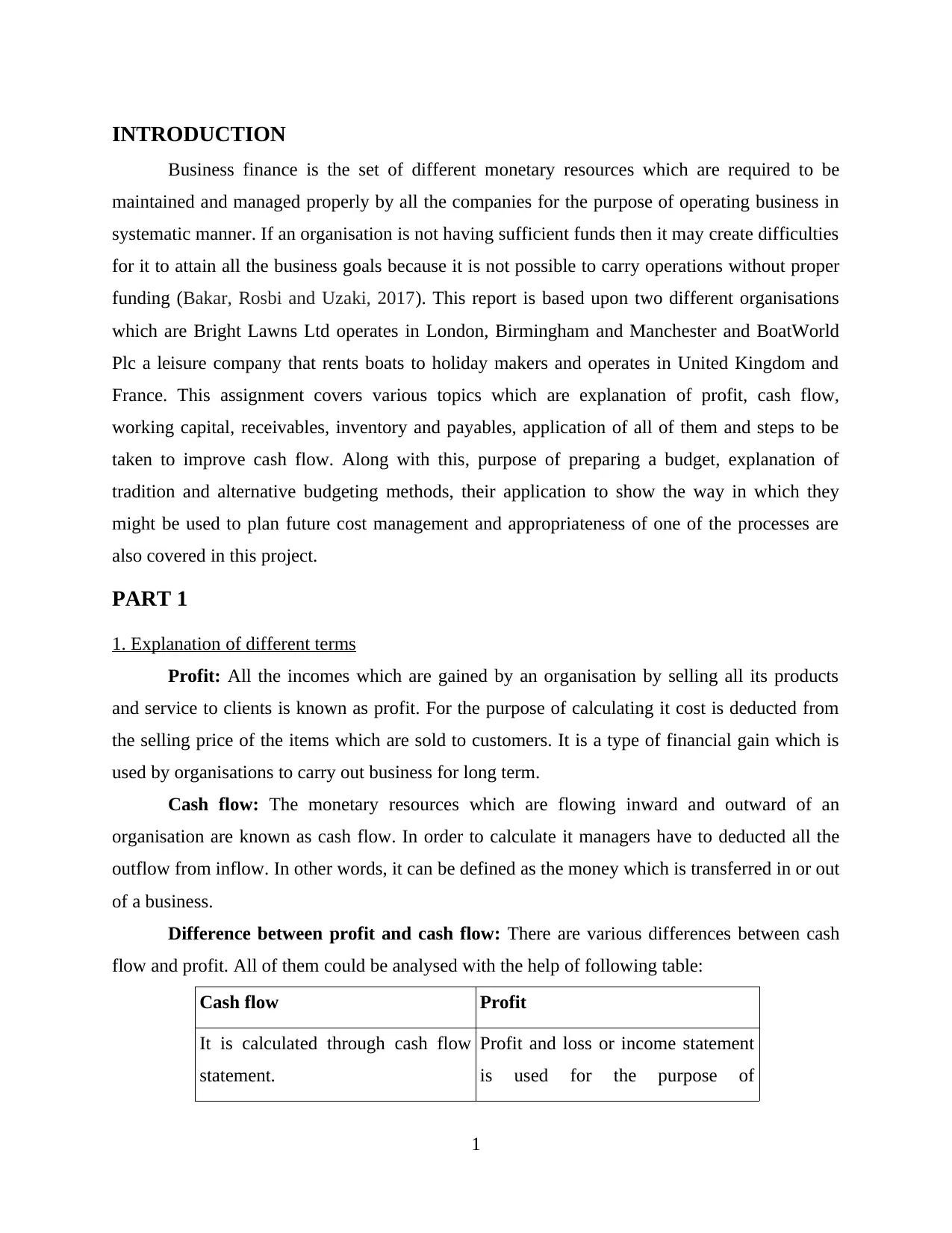

Difference between profit and cash flow: There are various differences between cash

flow and profit. All of them could be analysed with the help of following table:

Cash flow Profit

It is calculated through cash flow

statement.

Profit and loss or income statement

is used for the purpose of

1

Business finance is the set of different monetary resources which are required to be

maintained and managed properly by all the companies for the purpose of operating business in

systematic manner. If an organisation is not having sufficient funds then it may create difficulties

for it to attain all the business goals because it is not possible to carry operations without proper

funding (Bakar, Rosbi and Uzaki, 2017). This report is based upon two different organisations

which are Bright Lawns Ltd operates in London, Birmingham and Manchester and BoatWorld

Plc a leisure company that rents boats to holiday makers and operates in United Kingdom and

France. This assignment covers various topics which are explanation of profit, cash flow,

working capital, receivables, inventory and payables, application of all of them and steps to be

taken to improve cash flow. Along with this, purpose of preparing a budget, explanation of

tradition and alternative budgeting methods, their application to show the way in which they

might be used to plan future cost management and appropriateness of one of the processes are

also covered in this project.

PART 1

1. Explanation of different terms

Profit: All the incomes which are gained by an organisation by selling all its products

and service to clients is known as profit. For the purpose of calculating it cost is deducted from

the selling price of the items which are sold to customers. It is a type of financial gain which is

used by organisations to carry out business for long term.

Cash flow: The monetary resources which are flowing inward and outward of an

organisation are known as cash flow. In order to calculate it managers have to deducted all the

outflow from inflow. In other words, it can be defined as the money which is transferred in or out

of a business.

Difference between profit and cash flow: There are various differences between cash

flow and profit. All of them could be analysed with the help of following table:

Cash flow Profit

It is calculated through cash flow

statement.

Profit and loss or income statement

is used for the purpose of

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

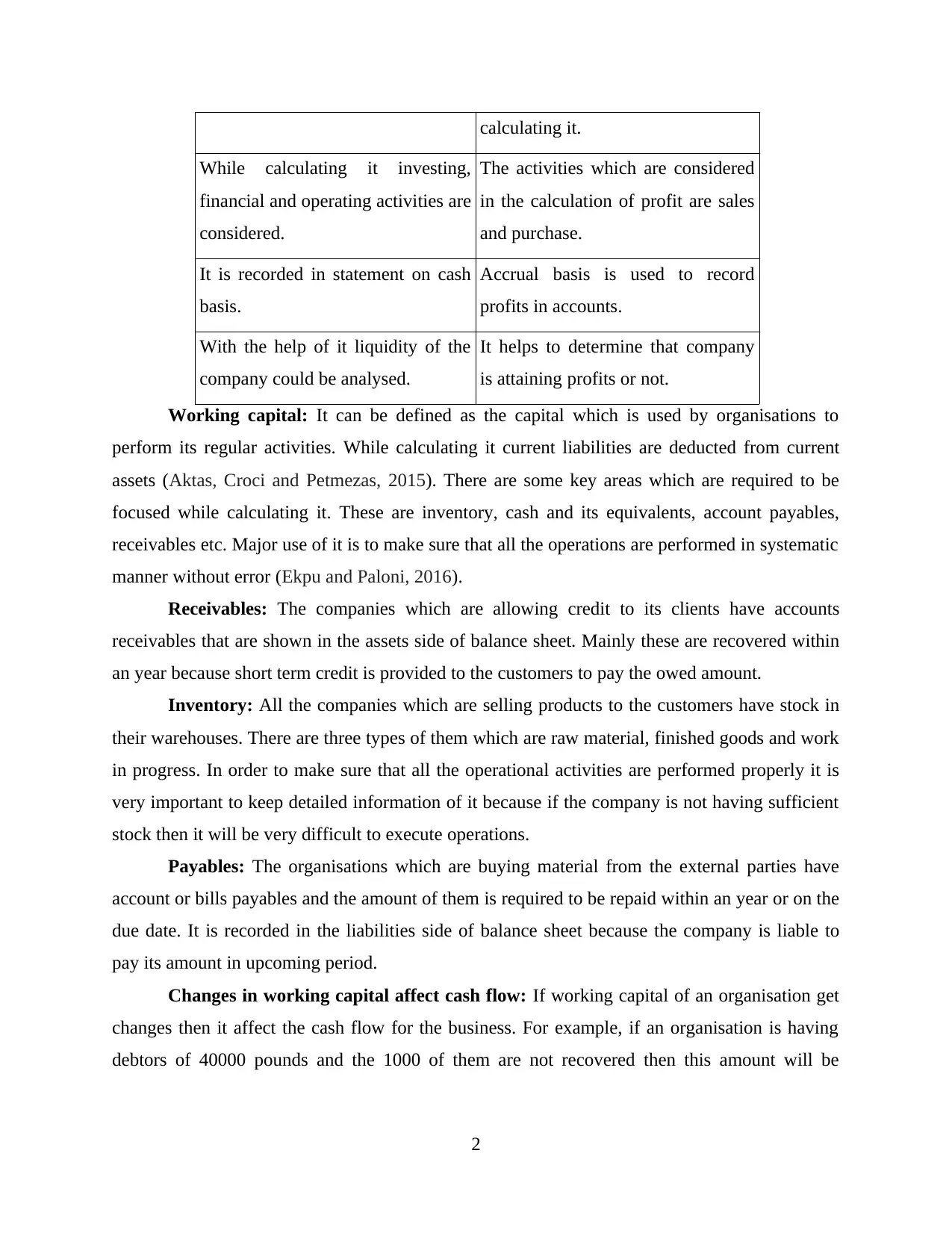

calculating it.

While calculating it investing,

financial and operating activities are

considered.

The activities which are considered

in the calculation of profit are sales

and purchase.

It is recorded in statement on cash

basis.

Accrual basis is used to record

profits in accounts.

With the help of it liquidity of the

company could be analysed.

It helps to determine that company

is attaining profits or not.

Working capital: It can be defined as the capital which is used by organisations to

perform its regular activities. While calculating it current liabilities are deducted from current

assets (Aktas, Croci and Petmezas, 2015). There are some key areas which are required to be

focused while calculating it. These are inventory, cash and its equivalents, account payables,

receivables etc. Major use of it is to make sure that all the operations are performed in systematic

manner without error (Ekpu and Paloni, 2016).

Receivables: The companies which are allowing credit to its clients have accounts

receivables that are shown in the assets side of balance sheet. Mainly these are recovered within

an year because short term credit is provided to the customers to pay the owed amount.

Inventory: All the companies which are selling products to the customers have stock in

their warehouses. There are three types of them which are raw material, finished goods and work

in progress. In order to make sure that all the operational activities are performed properly it is

very important to keep detailed information of it because if the company is not having sufficient

stock then it will be very difficult to execute operations.

Payables: The organisations which are buying material from the external parties have

account or bills payables and the amount of them is required to be repaid within an year or on the

due date. It is recorded in the liabilities side of balance sheet because the company is liable to

pay its amount in upcoming period.

Changes in working capital affect cash flow: If working capital of an organisation get

changes then it affect the cash flow for the business. For example, if an organisation is having

debtors of 40000 pounds and the 1000 of them are not recovered then this amount will be

2

While calculating it investing,

financial and operating activities are

considered.

The activities which are considered

in the calculation of profit are sales

and purchase.

It is recorded in statement on cash

basis.

Accrual basis is used to record

profits in accounts.

With the help of it liquidity of the

company could be analysed.

It helps to determine that company

is attaining profits or not.

Working capital: It can be defined as the capital which is used by organisations to

perform its regular activities. While calculating it current liabilities are deducted from current

assets (Aktas, Croci and Petmezas, 2015). There are some key areas which are required to be

focused while calculating it. These are inventory, cash and its equivalents, account payables,

receivables etc. Major use of it is to make sure that all the operations are performed in systematic

manner without error (Ekpu and Paloni, 2016).

Receivables: The companies which are allowing credit to its clients have accounts

receivables that are shown in the assets side of balance sheet. Mainly these are recovered within

an year because short term credit is provided to the customers to pay the owed amount.

Inventory: All the companies which are selling products to the customers have stock in

their warehouses. There are three types of them which are raw material, finished goods and work

in progress. In order to make sure that all the operational activities are performed properly it is

very important to keep detailed information of it because if the company is not having sufficient

stock then it will be very difficult to execute operations.

Payables: The organisations which are buying material from the external parties have

account or bills payables and the amount of them is required to be repaid within an year or on the

due date. It is recorded in the liabilities side of balance sheet because the company is liable to

pay its amount in upcoming period.

Changes in working capital affect cash flow: If working capital of an organisation get

changes then it affect the cash flow for the business. For example, if an organisation is having

debtors of 40000 pounds and the 1000 of them are not recovered then this amount will be

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

deducted from the actual balance. It will also be added in the operating activities of cash flow

and affect the cash flow of the organisation (Gallegati and Semmler, 2014).

Those organizations having excessive working capital, they should have to invest in

corporate area because this channel helps in reducing the unnecessary working capital from the

one period (Aktas, Croci and Petmezas, 2015). Company cut working capital to re-deploy the

under utilization of resources for the higher uses. These changes further impact the cash flow of

company which need to evaluate by the managers to build strategies to overcome the challenges

in the business operations.

2. Application of concepts within the company

There are various concepts which are described in the above question, all of them are

applied in BrightLawns Ltd. The analysed elements from all of them are net profit which is

showing a balance of 5 million pounds. It is profit before interest and tax. The amount of account

payables which are owed by BrightLawns Ltd are recorded at 1.5 million pounds. Outstanding

dispute is also showing an outstanding amount of 2 million pound.

In order to calculate the accurate amount of cash flow its concept is also applied by

accounting professionals of BrightLawns Ltd. The dispute of 2 million pounds have faced by the

company due to faulty workmanship of contractors which are resulted in stopped payment. Due

to this issue financial results are getting negatively influenced because it is showing higher debts

for the organisation.

3. Analysis and recommendation regarding the steps which should be taken to improve cash flow

through better working capital management

In order to improve the cash flow of BrightLawns Ltd through better working capital

management following steps could be taken by the managers:

The management can plan to meet debt obligations that will help to pay all the payables

on time and maintain working capital management and improve cash flow (Atrill,

McLaney and Harvey, 2014).

It is very important for managers to manage inventory properly and ignore tom record

such items which are not having any reliable value. With the help of it working capital

management could be performed in better way and cash flow could be improved.

By decreasing the overspending of budgets management can also improve cash flow

because it results in proper management of working capital (Haseeb, 2018).

3

and affect the cash flow of the organisation (Gallegati and Semmler, 2014).

Those organizations having excessive working capital, they should have to invest in

corporate area because this channel helps in reducing the unnecessary working capital from the

one period (Aktas, Croci and Petmezas, 2015). Company cut working capital to re-deploy the

under utilization of resources for the higher uses. These changes further impact the cash flow of

company which need to evaluate by the managers to build strategies to overcome the challenges

in the business operations.

2. Application of concepts within the company

There are various concepts which are described in the above question, all of them are

applied in BrightLawns Ltd. The analysed elements from all of them are net profit which is

showing a balance of 5 million pounds. It is profit before interest and tax. The amount of account

payables which are owed by BrightLawns Ltd are recorded at 1.5 million pounds. Outstanding

dispute is also showing an outstanding amount of 2 million pound.

In order to calculate the accurate amount of cash flow its concept is also applied by

accounting professionals of BrightLawns Ltd. The dispute of 2 million pounds have faced by the

company due to faulty workmanship of contractors which are resulted in stopped payment. Due

to this issue financial results are getting negatively influenced because it is showing higher debts

for the organisation.

3. Analysis and recommendation regarding the steps which should be taken to improve cash flow

through better working capital management

In order to improve the cash flow of BrightLawns Ltd through better working capital

management following steps could be taken by the managers:

The management can plan to meet debt obligations that will help to pay all the payables

on time and maintain working capital management and improve cash flow (Atrill,

McLaney and Harvey, 2014).

It is very important for managers to manage inventory properly and ignore tom record

such items which are not having any reliable value. With the help of it working capital

management could be performed in better way and cash flow could be improved.

By decreasing the overspending of budgets management can also improve cash flow

because it results in proper management of working capital (Haseeb, 2018).

3

PART 2

1. Purpose of preparing of budget and explanation of traditional and alternative budgeting

approaches

Budget: It can be defined as the estimation of all the expenses and incomes which could

be acquired by an organisation in future. With the help of it, management of large as well as

small business entities get aware of all the areas where funds are spent for the purpose of

carrying out operational activities. Mainly it is generated on yearly basis but some companies

create it create it on half yearly, quarterly and monthly basis for the purpose of running business

smoothly.

Purposes of budget: Various organisations generate budget for different purposes. All of

them are as follows:

It is basically prepared for the purpose of analyse financial performance of business and

formulate strategic decisions for future (Hope and Vyas, 2017). In order to determine overspending of funds budgets are prepared because with the help

of them it could be reduced.

Traditional budgeting: It is a technique of preparing a budget in which last year's data is

used for the purpose generating records of current year. It is made by altering the old reports and

making adjustments according to the existing conditions of business. The factors which are

considered for the purpose of making changes in financial plan are consumer demand, inflation

or deflation rates etc. Incremental budgeting is the approach of traditional budgeting. Description

of it is as follows:

Incremental budgeting: It can be defined as the process in which last year's budget is

considered as the base for the records of current year. In some of the cases when appropaiet

information regarding previous reports is difficult to gather then actual performance is used 9in

this method for the purpose of conducting budgeting processes. It encourages the business

entities to spend up to the budget by allocating funds to all the operations accounting to their

requirements. All its strengths and weaknesses are as follows:

Strengths: It is an easy to implement and understand method that can help to gather

accurate and trustworthy results. It ensures continuity of funding for the divisions without

any detailed analysis of requirements of them regarding funds (Khan, 2015).

4

1. Purpose of preparing of budget and explanation of traditional and alternative budgeting

approaches

Budget: It can be defined as the estimation of all the expenses and incomes which could

be acquired by an organisation in future. With the help of it, management of large as well as

small business entities get aware of all the areas where funds are spent for the purpose of

carrying out operational activities. Mainly it is generated on yearly basis but some companies

create it create it on half yearly, quarterly and monthly basis for the purpose of running business

smoothly.

Purposes of budget: Various organisations generate budget for different purposes. All of

them are as follows:

It is basically prepared for the purpose of analyse financial performance of business and

formulate strategic decisions for future (Hope and Vyas, 2017). In order to determine overspending of funds budgets are prepared because with the help

of them it could be reduced.

Traditional budgeting: It is a technique of preparing a budget in which last year's data is

used for the purpose generating records of current year. It is made by altering the old reports and

making adjustments according to the existing conditions of business. The factors which are

considered for the purpose of making changes in financial plan are consumer demand, inflation

or deflation rates etc. Incremental budgeting is the approach of traditional budgeting. Description

of it is as follows:

Incremental budgeting: It can be defined as the process in which last year's budget is

considered as the base for the records of current year. In some of the cases when appropaiet

information regarding previous reports is difficult to gather then actual performance is used 9in

this method for the purpose of conducting budgeting processes. It encourages the business

entities to spend up to the budget by allocating funds to all the operations accounting to their

requirements. All its strengths and weaknesses are as follows:

Strengths: It is an easy to implement and understand method that can help to gather

accurate and trustworthy results. It ensures continuity of funding for the divisions without

any detailed analysis of requirements of them regarding funds (Khan, 2015).

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Weaknesses: There is lack of innovation in this budgeting technique because new ideas

are not used in it to form budgets. By using this method business is executes in

conservative mode (Attrill, 2015).

Alternative budget methods: There are various budgeting techniques which could be

used by organisations and replace traditional approaches. There are various types of budgets

which are used by business entities for the purpose of keeping track record of all the financial

activities. All the types are described below:

Rolling budget: It is a type of budget which continuously gets updated with the changes

in business situations. In other words, it can be defined as a revised or new set of finance related

plans for upcoming financial year that replaces the previous one in the budgeting system. It

guides the managers to keep control over spending of funds and monitor the progress of

business. There are various strengths and weaknesses of it which are as follows:

Strengths: This budget is flexible as changes are made in it with the modifications in the

business processes. It also helps to bring responsibility and understanding between the

enterprise and staff members (Rolling Budget, 2019).

Weaknesses: The companies which are generating it required robust system and

experienced employees because the process of creating it is very critical. As constant

changes could be made in it therefore it results in confusion for staff members.

Zero based budget: It is a type of budget in which management have to justify all the

incomes and expenses for each and every accounting period. All the functions of the company

are analysed in detail in order to determine the financial needs of them so that appropriate funds

could be allocated to them. All its strengths and weaknesses could be understood with the help of

following discussion:

Strengths: With the help of zero based budget detailed information of all the incomes

and expenditures could be analysed. This budget enhances motivation level of employees

because it provides them responsibilities in the decision making process (Owen, Brennan

and Lyon, 2018).

Weaknesses: The process of generating this budget is time consuming and complex that

create difficulties for managers to conduct detailed analysis of all the transactions.

Activity based budget: In this type of budget activity based costing is used for the

purpose of conducting budgeting activities after considering all the overhead costs. Past year's

5

are not used in it to form budgets. By using this method business is executes in

conservative mode (Attrill, 2015).

Alternative budget methods: There are various budgeting techniques which could be

used by organisations and replace traditional approaches. There are various types of budgets

which are used by business entities for the purpose of keeping track record of all the financial

activities. All the types are described below:

Rolling budget: It is a type of budget which continuously gets updated with the changes

in business situations. In other words, it can be defined as a revised or new set of finance related

plans for upcoming financial year that replaces the previous one in the budgeting system. It

guides the managers to keep control over spending of funds and monitor the progress of

business. There are various strengths and weaknesses of it which are as follows:

Strengths: This budget is flexible as changes are made in it with the modifications in the

business processes. It also helps to bring responsibility and understanding between the

enterprise and staff members (Rolling Budget, 2019).

Weaknesses: The companies which are generating it required robust system and

experienced employees because the process of creating it is very critical. As constant

changes could be made in it therefore it results in confusion for staff members.

Zero based budget: It is a type of budget in which management have to justify all the

incomes and expenses for each and every accounting period. All the functions of the company

are analysed in detail in order to determine the financial needs of them so that appropriate funds

could be allocated to them. All its strengths and weaknesses could be understood with the help of

following discussion:

Strengths: With the help of zero based budget detailed information of all the incomes

and expenditures could be analysed. This budget enhances motivation level of employees

because it provides them responsibilities in the decision making process (Owen, Brennan

and Lyon, 2018).

Weaknesses: The process of generating this budget is time consuming and complex that

create difficulties for managers to conduct detailed analysis of all the transactions.

Activity based budget: In this type of budget activity based costing is used for the

purpose of conducting budgeting activities after considering all the overhead costs. Past year's

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

records are not considered for the purpose of preparing budget for existing accounting period.

All the strengths and weaknesses of it are as follows:

Strengths: With the help of this budget all the unnecessary activities could be eliminated

that helps businesses to save its costs that helps to attain competitive advantage. It guides

managers to find appropriate cost of each and every activity performed for attaining

business goals.

Weaknesses: It requires proper understanding of the activity based costing because lack

of knowledge may result in improper formulation of budget. It could be used for short

term purposes as it is not able to provide positive outcomes in long run.

2. Demonstration of application of budgeting methods showing the way in which they might be

used to plan future cost management

BoatWorld Plc is currently operating business in France and United Kingdom and now it

is planning to open new outlets in Netherlands and Germany. The organisation has always used

traditional approaches of budgeting for business processes. For example, organisation used

incremental method for the purpose of formulating budgets for business. While using it the

managers used previous year's information so that estimation for current could be formed (Shah

and Rankin, 2017).

Now the managers can use different alternative methods for budgeting that can help to

forecast the cost for the business plan of introducing business in Netherlands and Germany. First

option is rolling budget in which management can make proper adjustments with time and plan

future cost management as it could be modified with situations.

Activity based budget can also be used by the management of BoatWorld Plc for the

purpose of recording detailed information of all the activities such as marketing, advertising etc.

separately. It will help to allocate funds properly because it guides managers to estimate the costs

which may take place in future.

Zero based budget is also an alternative method which starts with a zero base and justifies

all the incomes and expenses. With the help of it the managers in BoatWorld Plc will be able to

execute their plan of business expansion in Netherlands and Germany properly. This method will

be highly advantageous for the company because it will be formed for a new period according to

the market situations of new locations. It will also facilitate the process of managing future cost

because there will be no existing cost in the budget (Turner, 2017).

6

All the strengths and weaknesses of it are as follows:

Strengths: With the help of this budget all the unnecessary activities could be eliminated

that helps businesses to save its costs that helps to attain competitive advantage. It guides

managers to find appropriate cost of each and every activity performed for attaining

business goals.

Weaknesses: It requires proper understanding of the activity based costing because lack

of knowledge may result in improper formulation of budget. It could be used for short

term purposes as it is not able to provide positive outcomes in long run.

2. Demonstration of application of budgeting methods showing the way in which they might be

used to plan future cost management

BoatWorld Plc is currently operating business in France and United Kingdom and now it

is planning to open new outlets in Netherlands and Germany. The organisation has always used

traditional approaches of budgeting for business processes. For example, organisation used

incremental method for the purpose of formulating budgets for business. While using it the

managers used previous year's information so that estimation for current could be formed (Shah

and Rankin, 2017).

Now the managers can use different alternative methods for budgeting that can help to

forecast the cost for the business plan of introducing business in Netherlands and Germany. First

option is rolling budget in which management can make proper adjustments with time and plan

future cost management as it could be modified with situations.

Activity based budget can also be used by the management of BoatWorld Plc for the

purpose of recording detailed information of all the activities such as marketing, advertising etc.

separately. It will help to allocate funds properly because it guides managers to estimate the costs

which may take place in future.

Zero based budget is also an alternative method which starts with a zero base and justifies

all the incomes and expenses. With the help of it the managers in BoatWorld Plc will be able to

execute their plan of business expansion in Netherlands and Germany properly. This method will

be highly advantageous for the company because it will be formed for a new period according to

the market situations of new locations. It will also facilitate the process of managing future cost

because there will be no existing cost in the budget (Turner, 2017).

6

3. Analysing of whether traditional or alternative budgetary system is appropriate to all of the

parts of the business in its planned future form

Alternative and traditional budgeting approaches are used by most of the companies for

different objectives. In various organisations such as BoatWorld Plc traditional approaches for

budgeting are used in which last year's information is used to create budgets. Currently, all of

them are being replaced with various alternative methods which are zero based, rolling and

activity based budgets.

As BoatWorld Plc is planning to expand its business in new locations so it has been

recommended to the managers to focus of alternative budgeting systems because all of them can

guide to manage the plan of expansion effectively. All the methods under this budgeting do not

take prior year's records that will be a great opportunity for the organisation to execute its plan

properly (Voordeckers, Le Breton-Miller and Miller, 2014).

CONCLUSION

From the above project report, it has been concluded that business finance is the term

which is used to define all the funds that are used by business entities to execute operations

properly. While planning for working capital management it is very important for accounting

professionals to focus on different elements such as profit, cash, inventory, payables, receivables

etc. In order to improve cash flows companies are required to take specific steps such as

reducing spendings, making payment in less than one year etc. There are various traditional and

alternative methods of preparing budget which could be followed by companies for running

operations. These are incremental, zero based, rolling and activity based budgets.

7

parts of the business in its planned future form

Alternative and traditional budgeting approaches are used by most of the companies for

different objectives. In various organisations such as BoatWorld Plc traditional approaches for

budgeting are used in which last year's information is used to create budgets. Currently, all of

them are being replaced with various alternative methods which are zero based, rolling and

activity based budgets.

As BoatWorld Plc is planning to expand its business in new locations so it has been

recommended to the managers to focus of alternative budgeting systems because all of them can

guide to manage the plan of expansion effectively. All the methods under this budgeting do not

take prior year's records that will be a great opportunity for the organisation to execute its plan

properly (Voordeckers, Le Breton-Miller and Miller, 2014).

CONCLUSION

From the above project report, it has been concluded that business finance is the term

which is used to define all the funds that are used by business entities to execute operations

properly. While planning for working capital management it is very important for accounting

professionals to focus on different elements such as profit, cash, inventory, payables, receivables

etc. In order to improve cash flows companies are required to take specific steps such as

reducing spendings, making payment in less than one year etc. There are various traditional and

alternative methods of preparing budget which could be followed by companies for running

operations. These are incremental, zero based, rolling and activity based budgets.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals:

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance. 30.

pp.98-113.

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance.

30.pp.98-113.

Atrill, P., McLaney, E. and Harvey, D., 2014. Accounting: An Introduction, 6/E (Vol. 6).

Pearson Higher Education AU.

Attrill, A. ed., 2015. financial management for decision makers. Oxford University Press, USA.

Bakar, N. A., Rosbi, S. and Uzaki, K., 2017. Cryptocurrency Framework Diagnostics from

Islamic Finance Perspective: A New Insight of Bitcoin System

Transaction. International Journal of Management Science and Business

Administration. 4(1). pp.19-28.

Ekpu, V. and Paloni, A., 2016. Business lending and bank profitability in the UK. Studies in

Economics and Finance. 33(2). pp.302-319.

Gallegati, M. and Semmler, W. eds., 2014. Wavelet applications in economics and finance (Vol.

20). New York: Springer.

Haseeb, M., 2018. Emerging issues in islamic banking & finance: Challenges and

Solutions. Academy of Accounting and Financial Studies Journal. 22. pp.1-5.

Hope, O. K. and Vyas, D., 2017. Private company finance and financial reporting. Accounting

and Business Research. 47(5). pp.506-537.

Khan, M. M., 2015. Sources of finance available for SME sector in Pakistan. International

Letters of Social and Humanistic Sciences, 47, pp.184-194.

Owen, R., Brennan, G. and Lyon, F., 2018. Enabling investment for the transition to a low

carbon economy: government policy to finance early stage green innovation. Current

Opinion in Environmental Sustainability. 31. pp.137-145.

Shah, A. K. and Rankin, A., 2017. Jainism and Ethical Finance: A Timeless Business Model.

Taylor & Francis.

Turner, A., 2017. Between debt and the devil: Money, credit, and fixing global finance.

Princeton University Press.

Voordeckers, W., Le Breton-Miller, I. and Miller, D., 2014. In search of the best of both worlds:

Crafting a finance paper for the family business review.

Online

Rolling Budget. 2019. [Online]. Available through:

<https://www.wallstreetmojo.com/rolling-budget/>

8

Books and Journals:

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance. 30.

pp.98-113.

Aktas, N., Croci, E. and Petmezas, D., 2015. Is working capital management value-enhancing?

Evidence from firm performance and investments. Journal of Corporate Finance.

30.pp.98-113.

Atrill, P., McLaney, E. and Harvey, D., 2014. Accounting: An Introduction, 6/E (Vol. 6).

Pearson Higher Education AU.

Attrill, A. ed., 2015. financial management for decision makers. Oxford University Press, USA.

Bakar, N. A., Rosbi, S. and Uzaki, K., 2017. Cryptocurrency Framework Diagnostics from

Islamic Finance Perspective: A New Insight of Bitcoin System

Transaction. International Journal of Management Science and Business

Administration. 4(1). pp.19-28.

Ekpu, V. and Paloni, A., 2016. Business lending and bank profitability in the UK. Studies in

Economics and Finance. 33(2). pp.302-319.

Gallegati, M. and Semmler, W. eds., 2014. Wavelet applications in economics and finance (Vol.

20). New York: Springer.

Haseeb, M., 2018. Emerging issues in islamic banking & finance: Challenges and

Solutions. Academy of Accounting and Financial Studies Journal. 22. pp.1-5.

Hope, O. K. and Vyas, D., 2017. Private company finance and financial reporting. Accounting

and Business Research. 47(5). pp.506-537.

Khan, M. M., 2015. Sources of finance available for SME sector in Pakistan. International

Letters of Social and Humanistic Sciences, 47, pp.184-194.

Owen, R., Brennan, G. and Lyon, F., 2018. Enabling investment for the transition to a low

carbon economy: government policy to finance early stage green innovation. Current

Opinion in Environmental Sustainability. 31. pp.137-145.

Shah, A. K. and Rankin, A., 2017. Jainism and Ethical Finance: A Timeless Business Model.

Taylor & Francis.

Turner, A., 2017. Between debt and the devil: Money, credit, and fixing global finance.

Princeton University Press.

Voordeckers, W., Le Breton-Miller, I. and Miller, D., 2014. In search of the best of both worlds:

Crafting a finance paper for the family business review.

Online

Rolling Budget. 2019. [Online]. Available through:

<https://www.wallstreetmojo.com/rolling-budget/>

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.