Finance Brokerage Report: Detailed Analysis of Finance Topics

VerifiedAdded on 2021/01/04

|40

|12797

|19

Report

AI Summary

This report provides a detailed analysis of various aspects of finance brokerage, addressing topics such as email communication with clients, software applications for financial calculations, audit programs, and mechanisms for ensuring regulatory compliance. It covers the roles and responsibilities of finance brokers, including acting as limited agents, developing client relationships, and utilizing media and marketing tools. The report also examines concepts like loan applications, creditworthiness, loan-to-value ratios, and the difference between pre-approval and pre-qualification. Furthermore, it explores legal frameworks, risk assessment techniques, risk management processes, and strategies for business development, including diversification and relationship management. The report also delves into managing credit risk, lender-debtor interactions, and personal insolvency, along with topics like invoice discounting and complex business loan structures. Finally, it includes case studies that cover eligibility for grants, required documentation, anti-money laundering, and loan recommendations, offering a comprehensive overview of the finance brokerage landscape, all available on Desklib.

END OF CHAPTER

QUESTIONS

QUESTIONS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

CHAPTER 4....................................................................................................................................5

4.1 Email designed to overcome the reluctance of the clients.....................................................5

4.2 ................................................................................................................................................6

(a) Software applications to calculate a client's financial position..............................................6

(b) Audit Program to evidence that clients received the So Sweet credit guide..........................6

(c) Email to the mentor summarizing broker's efforts on a weekly basis....................................6

(d) Mechanism to ensure the currency of regulatory literature is distributed in a timely fashion

in accordance with organisational policy. ...................................................................................6

(e) Ensuring operational procedure is updated and reflects changes to regulation and

legislation as well as their implications.......................................................................................7

(f) Calculate the cost of implementing triple bottom line principles in an office with no eco

policies.........................................................................................................................................7

(g) Email enquiring if any staff would like to undertake the triple bottom line implementation

process as a business opportunity. ..............................................................................................7

4.3 Situation when a finance broker act as a limited agent of a credit provider..........................8

4.4.................................................................................................................................................8

(a) Developing and cultivating the relationship, in order to market and benefit the organisation

......................................................................................................................................................8

(b) Cooperating with other professionals and third parties to expand and enhance the

reputation of the organisation and to identify new and improved business practices.................8

(c) Following up with referrals to secure the new business relationship.....................................8

(d) Media , Marketing and public relations tools used for the business......................................9

(e) Identifying potential buyer’s motives and approaches related to each...................................9

4.5 Case Study.............................................................................................................................9

CHAPTER 5..................................................................................................................................14

5.1 Documentation of changes in First Home Owners Grants and Stamp Duty Concessions. .14

5.2 Concept of a 100% loan.......................................................................................................14

5.3 Concept of split and blended loans......................................................................................14

5.4 ....................................................................................................................................14_final

CHAPTER 4....................................................................................................................................5

4.1 Email designed to overcome the reluctance of the clients.....................................................5

4.2 ................................................................................................................................................6

(a) Software applications to calculate a client's financial position..............................................6

(b) Audit Program to evidence that clients received the So Sweet credit guide..........................6

(c) Email to the mentor summarizing broker's efforts on a weekly basis....................................6

(d) Mechanism to ensure the currency of regulatory literature is distributed in a timely fashion

in accordance with organisational policy. ...................................................................................6

(e) Ensuring operational procedure is updated and reflects changes to regulation and

legislation as well as their implications.......................................................................................7

(f) Calculate the cost of implementing triple bottom line principles in an office with no eco

policies.........................................................................................................................................7

(g) Email enquiring if any staff would like to undertake the triple bottom line implementation

process as a business opportunity. ..............................................................................................7

4.3 Situation when a finance broker act as a limited agent of a credit provider..........................8

4.4.................................................................................................................................................8

(a) Developing and cultivating the relationship, in order to market and benefit the organisation

......................................................................................................................................................8

(b) Cooperating with other professionals and third parties to expand and enhance the

reputation of the organisation and to identify new and improved business practices.................8

(c) Following up with referrals to secure the new business relationship.....................................8

(d) Media , Marketing and public relations tools used for the business......................................9

(e) Identifying potential buyer’s motives and approaches related to each...................................9

4.5 Case Study.............................................................................................................................9

CHAPTER 5..................................................................................................................................14

5.1 Documentation of changes in First Home Owners Grants and Stamp Duty Concessions. .14

5.2 Concept of a 100% loan.......................................................................................................14

5.3 Concept of split and blended loans......................................................................................14

5.4 ....................................................................................................................................14_final

(a)Concept of a line of credit loan ............................................................................................14

(b) Concept of Interest-only Loan..............................................................................................15

5.5 Case Study...........................................................................................................................15

CHAPTER 6..................................................................................................................................15

6.1 Stages involved in Loan Application Process......................................................................15

6.2 The 5Cs important in establishing credit-worthiness..........................................................17

6.3 Concept of Loan-to-Value Ratio (LTV)..............................................................................18

6.4 Difference between Pre-approval and Pre-Qualification.....................................................18

CHAPTER 11................................................................................................................................19

11.1 Difference between Contract Law and Common Law......................................................19

11.2 Key elements within Insurance Contracts Act, 1984........................................................20

11.3 Credit Activities defined under the National Consumer Credit Protection Act (NCCPA),

2009............................................................................................................................................20

11.4 Obligations of an ACL Licensee as well as penalties prescribed under National Credit

Act in regards to non-compliance with legislations and obligations.........................................20

11.5 Case Study:.......................................................................................................................21

CHAPTER 12................................................................................................................................22

12.1 The most common risk assessment techniques..................................................................22

12.2 External and Internal Risk Drivers....................................................................................23

12.3 The risk management process and treatment options available to manage risk................23

12.4 Distinctions between Monitoring and review processes in risk management...................24

12.5 Case Study.........................................................................................................................24

CHAPTER 13................................................................................................................................27

13.1 Diversification or Cross-Sell..............................................................................................27

13.2 The industry participants that may help to build a mortgage/finance brokers’ business...27

13.3 Ways in which a Mortgage/Finance Broker develop and nurture professional

relationships...............................................................................................................................27

13.4 Importance of maintain business relationship ...................................................................28

13.5 Case Study.........................................................................................................................29

CHAPTER 14................................................................................................................................32

(b) Concept of Interest-only Loan..............................................................................................15

5.5 Case Study...........................................................................................................................15

CHAPTER 6..................................................................................................................................15

6.1 Stages involved in Loan Application Process......................................................................15

6.2 The 5Cs important in establishing credit-worthiness..........................................................17

6.3 Concept of Loan-to-Value Ratio (LTV)..............................................................................18

6.4 Difference between Pre-approval and Pre-Qualification.....................................................18

CHAPTER 11................................................................................................................................19

11.1 Difference between Contract Law and Common Law......................................................19

11.2 Key elements within Insurance Contracts Act, 1984........................................................20

11.3 Credit Activities defined under the National Consumer Credit Protection Act (NCCPA),

2009............................................................................................................................................20

11.4 Obligations of an ACL Licensee as well as penalties prescribed under National Credit

Act in regards to non-compliance with legislations and obligations.........................................20

11.5 Case Study:.......................................................................................................................21

CHAPTER 12................................................................................................................................22

12.1 The most common risk assessment techniques..................................................................22

12.2 External and Internal Risk Drivers....................................................................................23

12.3 The risk management process and treatment options available to manage risk................23

12.4 Distinctions between Monitoring and review processes in risk management...................24

12.5 Case Study.........................................................................................................................24

CHAPTER 13................................................................................................................................27

13.1 Diversification or Cross-Sell..............................................................................................27

13.2 The industry participants that may help to build a mortgage/finance brokers’ business...27

13.3 Ways in which a Mortgage/Finance Broker develop and nurture professional

relationships...............................................................................................................................27

13.4 Importance of maintain business relationship ...................................................................28

13.5 Case Study.........................................................................................................................29

CHAPTER 14................................................................................................................................32

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

14.1 Ways to manage interaction between credit risk and business objectives in an

organization................................................................................................................................32

14.2 Lenders deals with debtors in different circumstances......................................................32

14.3 Typical circumstances that lead to personal insolvency situations...................................32

14.4 Ways in which a lender can register security for a loan ...................................................33

CHAPTER 15................................................................................................................................33

15.1 Invoice discounting............................................................................................................33

15.2 The appropriate procedures involved in the implementation process of a complex

business loan structure ..............................................................................................................34

15.3 Various entities who may wish to purchase a vehicle the appropriate finance options as

part of the implementation solution...........................................................................................34

15.4 Documentation needed in each of the steps arranging a novated lease.............................35

15.5 Case Study.........................................................................................................................35

CASE STUDY...............................................................................................................................36

1. Eligibility of clients under First Home Owners Grants or Stamp Duty Exemptions

applicable in Victoria (VIC)......................................................................................................36

2. Documents required by clients to be submitted for the application of a mortgage loan and

their need....................................................................................................................................37

3. Responsibilities as a mortgage broker under the anti-money laundering legislation............37

4. Measures to avoid committing unconscionable, misleading or deceptive conduct...............38

5. Loan recommended to the clients..........................................................................................38

6. Recommending a portability feature within the loan for clients............................................38

7. The loan-to-value ratio and its implications on the lender's decision for granting loan........38

8. Monthly payments of an interest-only loan if the interest rate is 7% per annum..................38

9. The initial monthly repayment for a variable loan if the interest rate was 7% and the loan

term was 25 years.......................................................................................................................39

10. Detailed remuneration arrangement in regards to the services provided.............................39

REFERENCES..............................................................................................................................41

organization................................................................................................................................32

14.2 Lenders deals with debtors in different circumstances......................................................32

14.3 Typical circumstances that lead to personal insolvency situations...................................32

14.4 Ways in which a lender can register security for a loan ...................................................33

CHAPTER 15................................................................................................................................33

15.1 Invoice discounting............................................................................................................33

15.2 The appropriate procedures involved in the implementation process of a complex

business loan structure ..............................................................................................................34

15.3 Various entities who may wish to purchase a vehicle the appropriate finance options as

part of the implementation solution...........................................................................................34

15.4 Documentation needed in each of the steps arranging a novated lease.............................35

15.5 Case Study.........................................................................................................................35

CASE STUDY...............................................................................................................................36

1. Eligibility of clients under First Home Owners Grants or Stamp Duty Exemptions

applicable in Victoria (VIC)......................................................................................................36

2. Documents required by clients to be submitted for the application of a mortgage loan and

their need....................................................................................................................................37

3. Responsibilities as a mortgage broker under the anti-money laundering legislation............37

4. Measures to avoid committing unconscionable, misleading or deceptive conduct...............38

5. Loan recommended to the clients..........................................................................................38

6. Recommending a portability feature within the loan for clients............................................38

7. The loan-to-value ratio and its implications on the lender's decision for granting loan........38

8. Monthly payments of an interest-only loan if the interest rate is 7% per annum..................38

9. The initial monthly repayment for a variable loan if the interest rate was 7% and the loan

term was 25 years.......................................................................................................................39

10. Detailed remuneration arrangement in regards to the services provided.............................39

REFERENCES..............................................................................................................................41

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CHAPTER 4

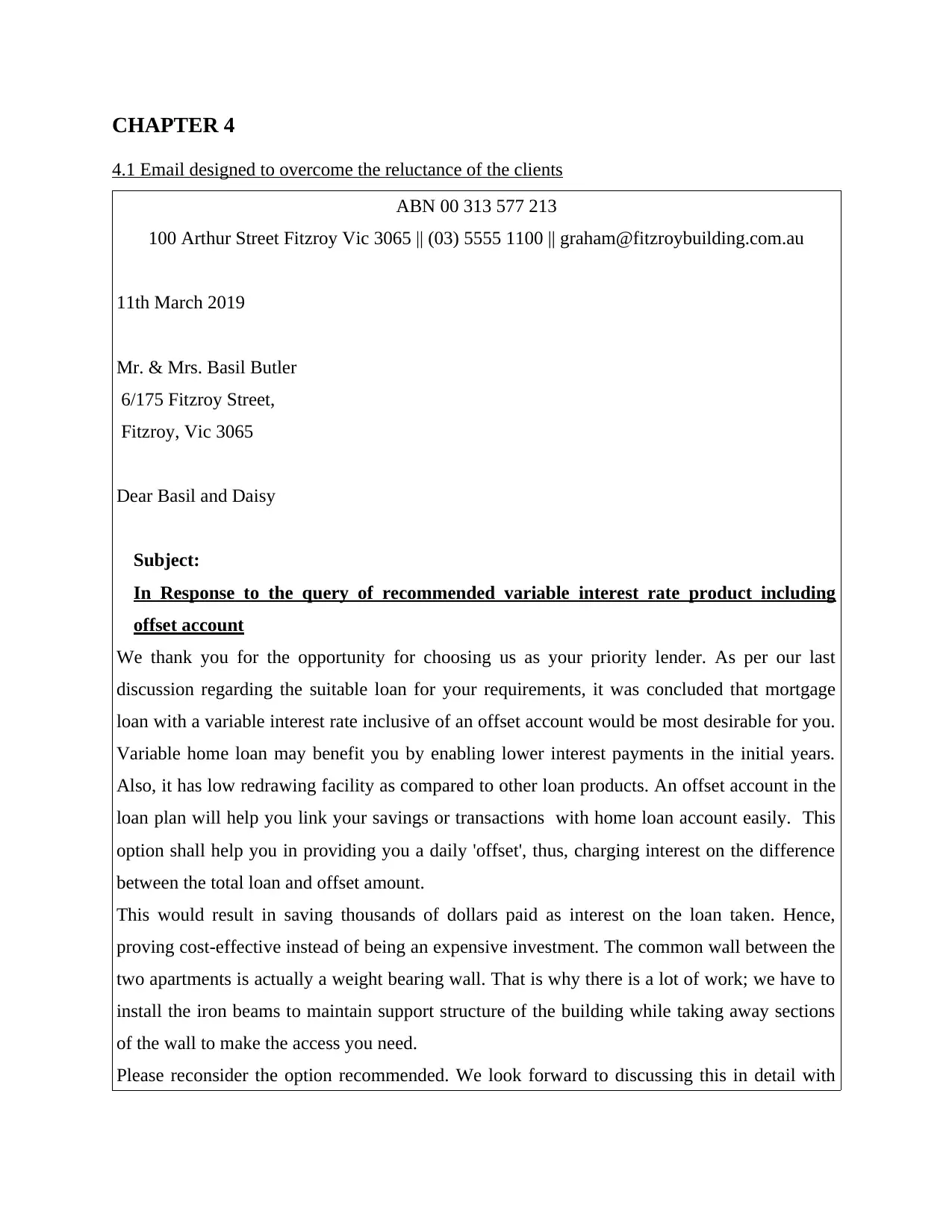

4.1 Email designed to overcome the reluctance of the clients

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March 2019

Mr. & Mrs. Basil Butler

6/175 Fitzroy Street,

Fitzroy, Vic 3065

Dear Basil and Daisy

Subject:

In Response to the query of recommended variable interest rate product including

offset account

We thank you for the opportunity for choosing us as your priority lender. As per our last

discussion regarding the suitable loan for your requirements, it was concluded that mortgage

loan with a variable interest rate inclusive of an offset account would be most desirable for you.

Variable home loan may benefit you by enabling lower interest payments in the initial years.

Also, it has low redrawing facility as compared to other loan products. An offset account in the

loan plan will help you link your savings or transactions with home loan account easily. This

option shall help you in providing you a daily 'offset', thus, charging interest on the difference

between the total loan and offset amount.

This would result in saving thousands of dollars paid as interest on the loan taken. Hence,

proving cost-effective instead of being an expensive investment. The common wall between the

two apartments is actually a weight bearing wall. That is why there is a lot of work; we have to

install the iron beams to maintain support structure of the building while taking away sections

of the wall to make the access you need.

Please reconsider the option recommended. We look forward to discussing this in detail with

4.1 Email designed to overcome the reluctance of the clients

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March 2019

Mr. & Mrs. Basil Butler

6/175 Fitzroy Street,

Fitzroy, Vic 3065

Dear Basil and Daisy

Subject:

In Response to the query of recommended variable interest rate product including

offset account

We thank you for the opportunity for choosing us as your priority lender. As per our last

discussion regarding the suitable loan for your requirements, it was concluded that mortgage

loan with a variable interest rate inclusive of an offset account would be most desirable for you.

Variable home loan may benefit you by enabling lower interest payments in the initial years.

Also, it has low redrawing facility as compared to other loan products. An offset account in the

loan plan will help you link your savings or transactions with home loan account easily. This

option shall help you in providing you a daily 'offset', thus, charging interest on the difference

between the total loan and offset amount.

This would result in saving thousands of dollars paid as interest on the loan taken. Hence,

proving cost-effective instead of being an expensive investment. The common wall between the

two apartments is actually a weight bearing wall. That is why there is a lot of work; we have to

install the iron beams to maintain support structure of the building while taking away sections

of the wall to make the access you need.

Please reconsider the option recommended. We look forward to discussing this in detail with

you.

Kind Regards,

XYZ

4.2

(a) Software applications to calculate a client's financial position

Serviceability calculator has been used to calculate the financial position of Basil

(Eldridge and Crombie, 2013).

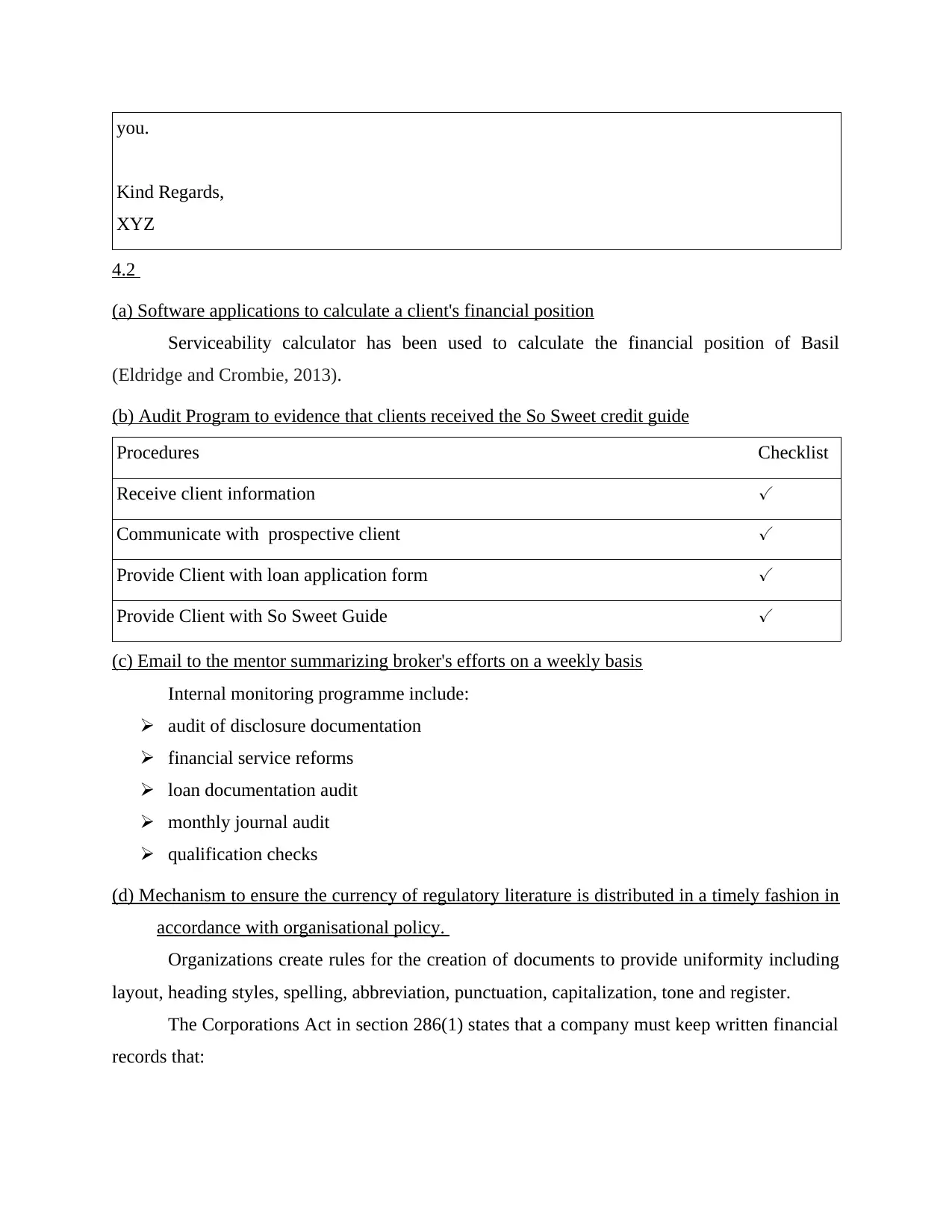

(b) Audit Program to evidence that clients received the So Sweet credit guide

Procedures Checklist

Receive client information ✓

Communicate with prospective client ✓

Provide Client with loan application form ✓

Provide Client with So Sweet Guide ✓

(c) Email to the mentor summarizing broker's efforts on a weekly basis

Internal monitoring programme include:

audit of disclosure documentation

financial service reforms

loan documentation audit

monthly journal audit

qualification checks

(d) Mechanism to ensure the currency of regulatory literature is distributed in a timely fashion in

accordance with organisational policy.

Organizations create rules for the creation of documents to provide uniformity including

layout, heading styles, spelling, abbreviation, punctuation, capitalization, tone and register.

The Corporations Act in section 286(1) states that a company must keep written financial

records that:

Kind Regards,

XYZ

4.2

(a) Software applications to calculate a client's financial position

Serviceability calculator has been used to calculate the financial position of Basil

(Eldridge and Crombie, 2013).

(b) Audit Program to evidence that clients received the So Sweet credit guide

Procedures Checklist

Receive client information ✓

Communicate with prospective client ✓

Provide Client with loan application form ✓

Provide Client with So Sweet Guide ✓

(c) Email to the mentor summarizing broker's efforts on a weekly basis

Internal monitoring programme include:

audit of disclosure documentation

financial service reforms

loan documentation audit

monthly journal audit

qualification checks

(d) Mechanism to ensure the currency of regulatory literature is distributed in a timely fashion in

accordance with organisational policy.

Organizations create rules for the creation of documents to provide uniformity including

layout, heading styles, spelling, abbreviation, punctuation, capitalization, tone and register.

The Corporations Act in section 286(1) states that a company must keep written financial

records that:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

correctly record and explain its transactions and financial position and performance,

and

would enable true and fair financial statements to be prepared and audited

Financial records are defined in section 9 of the Corporations Act as including:

invoices, receipts orders for the payment of money, bills of exchange, cheques,

promissory notes and vouchers

documents of prime entry

working papers and other documents

Implementation of these laws as organisational policies will help in the assurance of

distribution of regulatory literature in a timely fashion.

(e) Ensuring operational procedure is updated and reflects changes to regulation and legislation

as well as their implications

(f) Calculate the cost of implementing triple bottom line principles in an office with no eco

policies

Work planning in organizational frameworks is now to incorporate and support triple

bottom line principles. It therefore falls to the financial services industry (and indeed, to all

industries) to identify sustainability issues where they arise and then incorporate principles,

practices and available tools and techniques of sustainability management that are relevant to the

context of the financial services industry. This of course takes some degree of skill and planning

to implement. As there are no eco policies implemented in the office, it is difficult to calculate

the cost for such principles based on dollars. However, most of the businesses use TBL Index

that is based on taxes paid, average hours of training of an employee, water consumption and

amount of waste generated.

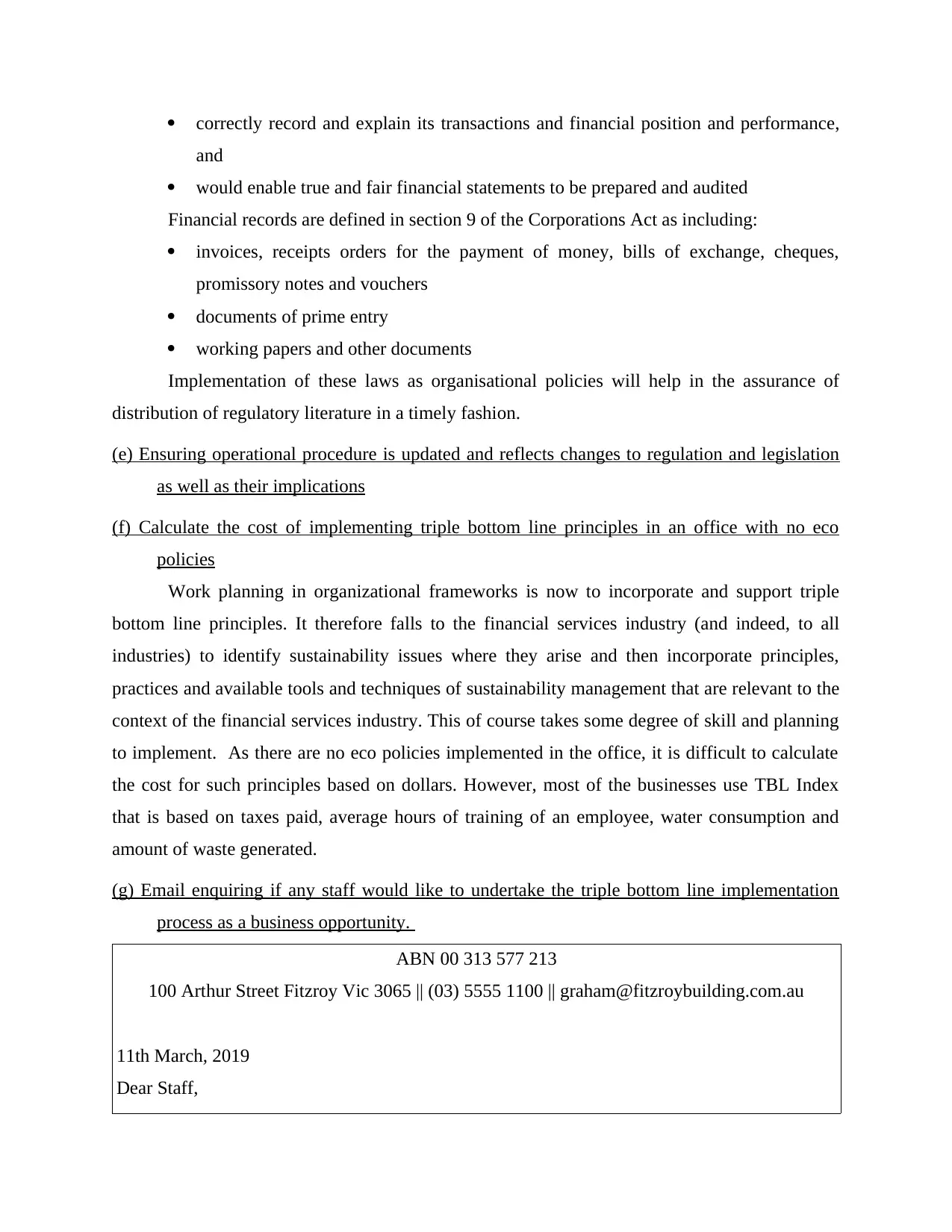

(g) Email enquiring if any staff would like to undertake the triple bottom line implementation

process as a business opportunity.

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March, 2019

Dear Staff,

and

would enable true and fair financial statements to be prepared and audited

Financial records are defined in section 9 of the Corporations Act as including:

invoices, receipts orders for the payment of money, bills of exchange, cheques,

promissory notes and vouchers

documents of prime entry

working papers and other documents

Implementation of these laws as organisational policies will help in the assurance of

distribution of regulatory literature in a timely fashion.

(e) Ensuring operational procedure is updated and reflects changes to regulation and legislation

as well as their implications

(f) Calculate the cost of implementing triple bottom line principles in an office with no eco

policies

Work planning in organizational frameworks is now to incorporate and support triple

bottom line principles. It therefore falls to the financial services industry (and indeed, to all

industries) to identify sustainability issues where they arise and then incorporate principles,

practices and available tools and techniques of sustainability management that are relevant to the

context of the financial services industry. This of course takes some degree of skill and planning

to implement. As there are no eco policies implemented in the office, it is difficult to calculate

the cost for such principles based on dollars. However, most of the businesses use TBL Index

that is based on taxes paid, average hours of training of an employee, water consumption and

amount of waste generated.

(g) Email enquiring if any staff would like to undertake the triple bottom line implementation

process as a business opportunity.

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March, 2019

Dear Staff,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Greetings for the day!

This is in regards to the triple bottom-line implementation in the firm. It has come to our

knowledge that a triple-bottom principle would help in enhancing sustainability and

profitability in the organisation. For this purpose, we would like to have some volunteers from

the staff willing to undertake this business opportunity. Please provide us with your details by

14.00 hours by March 8, 2019.

Thank you.

Kind Regards,

XYZ

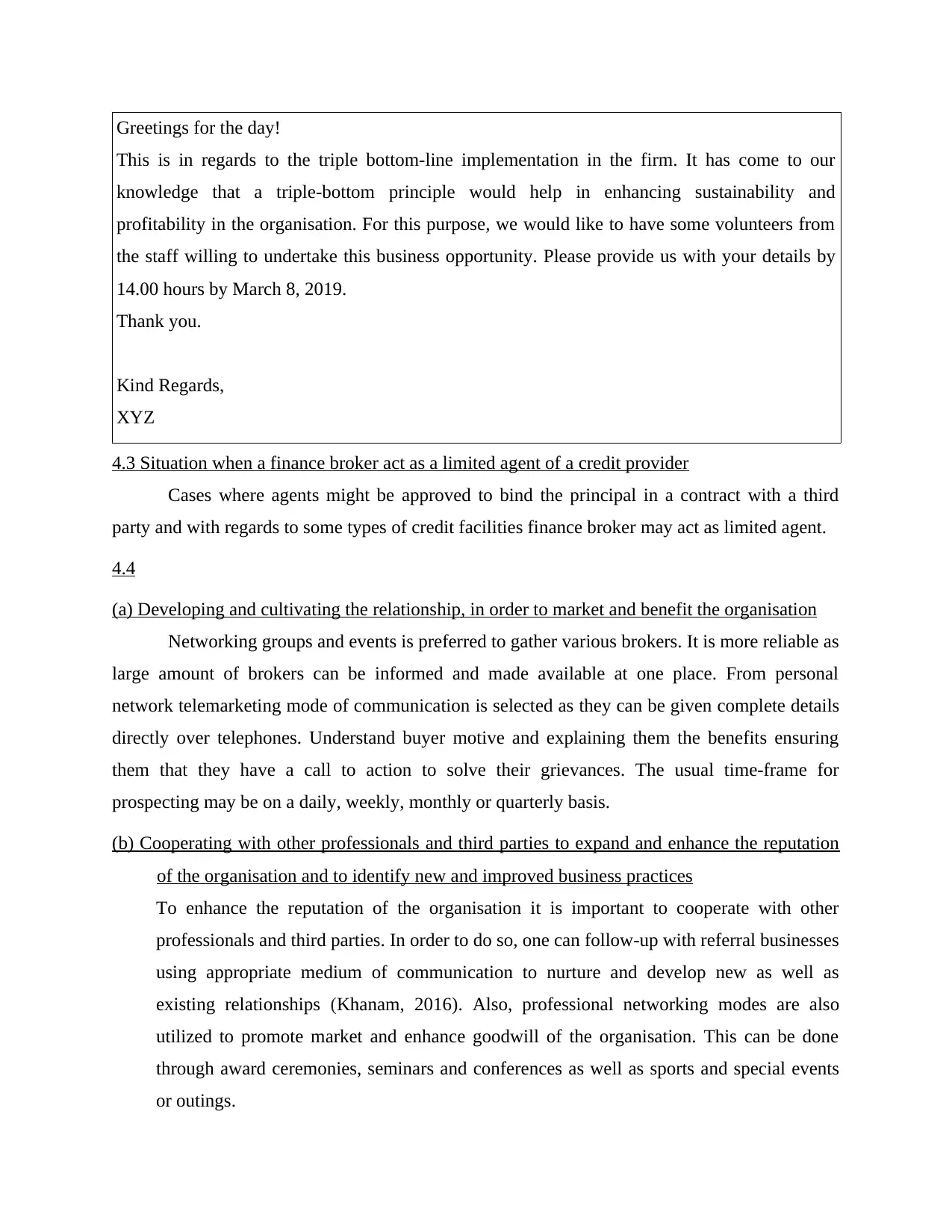

4.3 Situation when a finance broker act as a limited agent of a credit provider

Cases where agents might be approved to bind the principal in a contract with a third

party and with regards to some types of credit facilities finance broker may act as limited agent.

4.4

(a) Developing and cultivating the relationship, in order to market and benefit the organisation

Networking groups and events is preferred to gather various brokers. It is more reliable as

large amount of brokers can be informed and made available at one place. From personal

network telemarketing mode of communication is selected as they can be given complete details

directly over telephones. Understand buyer motive and explaining them the benefits ensuring

them that they have a call to action to solve their grievances. The usual time-frame for

prospecting may be on a daily, weekly, monthly or quarterly basis.

(b) Cooperating with other professionals and third parties to expand and enhance the reputation

of the organisation and to identify new and improved business practices

To enhance the reputation of the organisation it is important to cooperate with other

professionals and third parties. In order to do so, one can follow-up with referral businesses

using appropriate medium of communication to nurture and develop new as well as

existing relationships (Khanam, 2016). Also, professional networking modes are also

utilized to promote market and enhance goodwill of the organisation. This can be done

through award ceremonies, seminars and conferences as well as sports and special events

or outings.

This is in regards to the triple bottom-line implementation in the firm. It has come to our

knowledge that a triple-bottom principle would help in enhancing sustainability and

profitability in the organisation. For this purpose, we would like to have some volunteers from

the staff willing to undertake this business opportunity. Please provide us with your details by

14.00 hours by March 8, 2019.

Thank you.

Kind Regards,

XYZ

4.3 Situation when a finance broker act as a limited agent of a credit provider

Cases where agents might be approved to bind the principal in a contract with a third

party and with regards to some types of credit facilities finance broker may act as limited agent.

4.4

(a) Developing and cultivating the relationship, in order to market and benefit the organisation

Networking groups and events is preferred to gather various brokers. It is more reliable as

large amount of brokers can be informed and made available at one place. From personal

network telemarketing mode of communication is selected as they can be given complete details

directly over telephones. Understand buyer motive and explaining them the benefits ensuring

them that they have a call to action to solve their grievances. The usual time-frame for

prospecting may be on a daily, weekly, monthly or quarterly basis.

(b) Cooperating with other professionals and third parties to expand and enhance the reputation

of the organisation and to identify new and improved business practices

To enhance the reputation of the organisation it is important to cooperate with other

professionals and third parties. In order to do so, one can follow-up with referral businesses

using appropriate medium of communication to nurture and develop new as well as

existing relationships (Khanam, 2016). Also, professional networking modes are also

utilized to promote market and enhance goodwill of the organisation. This can be done

through award ceremonies, seminars and conferences as well as sports and special events

or outings.

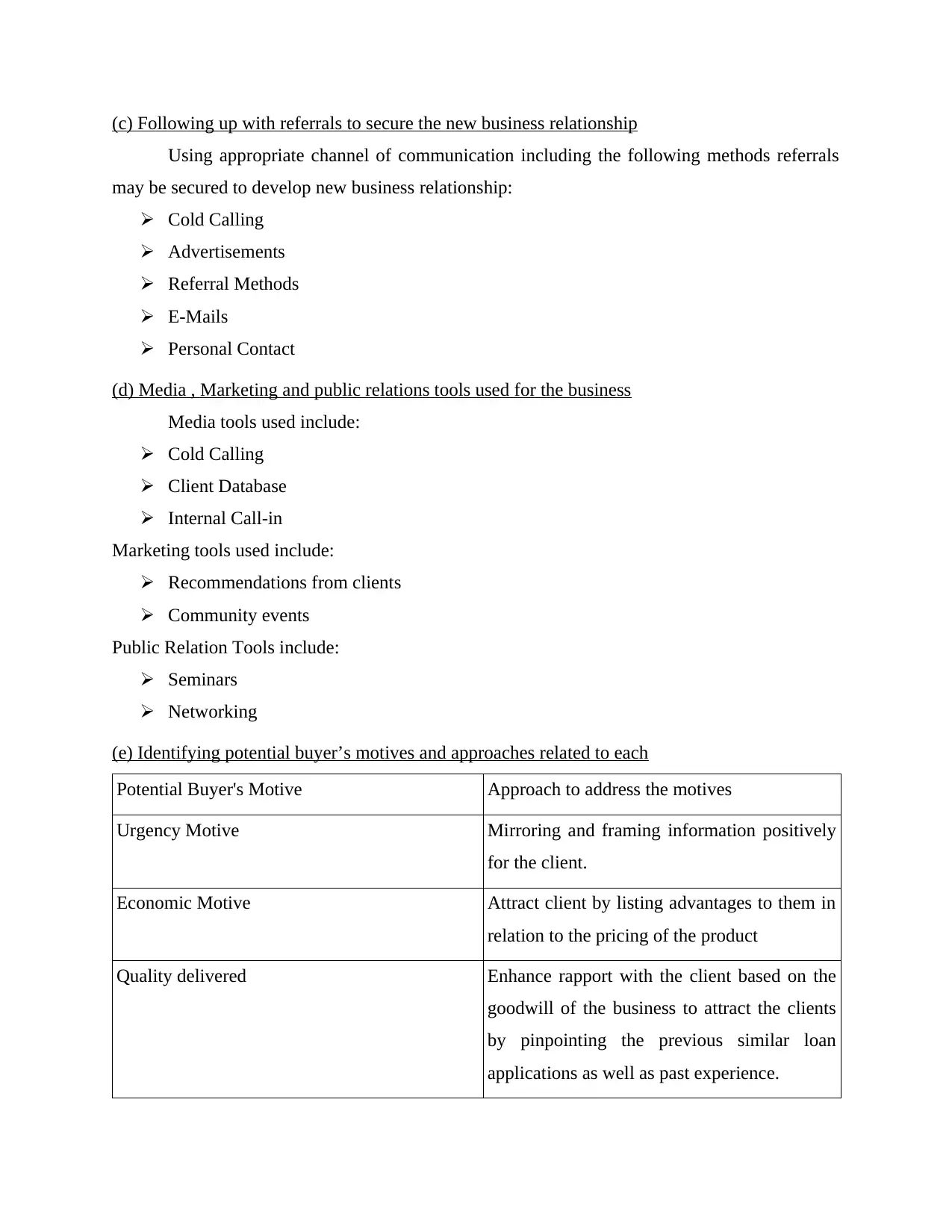

(c) Following up with referrals to secure the new business relationship

Using appropriate channel of communication including the following methods referrals

may be secured to develop new business relationship:

Cold Calling

Advertisements

Referral Methods

E-Mails

Personal Contact

(d) Media , Marketing and public relations tools used for the business

Media tools used include:

Cold Calling

Client Database

Internal Call-in

Marketing tools used include:

Recommendations from clients

Community events

Public Relation Tools include:

Seminars

Networking

(e) Identifying potential buyer’s motives and approaches related to each

Potential Buyer's Motive Approach to address the motives

Urgency Motive Mirroring and framing information positively

for the client.

Economic Motive Attract client by listing advantages to them in

relation to the pricing of the product

Quality delivered Enhance rapport with the client based on the

goodwill of the business to attract the clients

by pinpointing the previous similar loan

applications as well as past experience.

Using appropriate channel of communication including the following methods referrals

may be secured to develop new business relationship:

Cold Calling

Advertisements

Referral Methods

E-Mails

Personal Contact

(d) Media , Marketing and public relations tools used for the business

Media tools used include:

Cold Calling

Client Database

Internal Call-in

Marketing tools used include:

Recommendations from clients

Community events

Public Relation Tools include:

Seminars

Networking

(e) Identifying potential buyer’s motives and approaches related to each

Potential Buyer's Motive Approach to address the motives

Urgency Motive Mirroring and framing information positively

for the client.

Economic Motive Attract client by listing advantages to them in

relation to the pricing of the product

Quality delivered Enhance rapport with the client based on the

goodwill of the business to attract the clients

by pinpointing the previous similar loan

applications as well as past experience.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4.5 Case Study

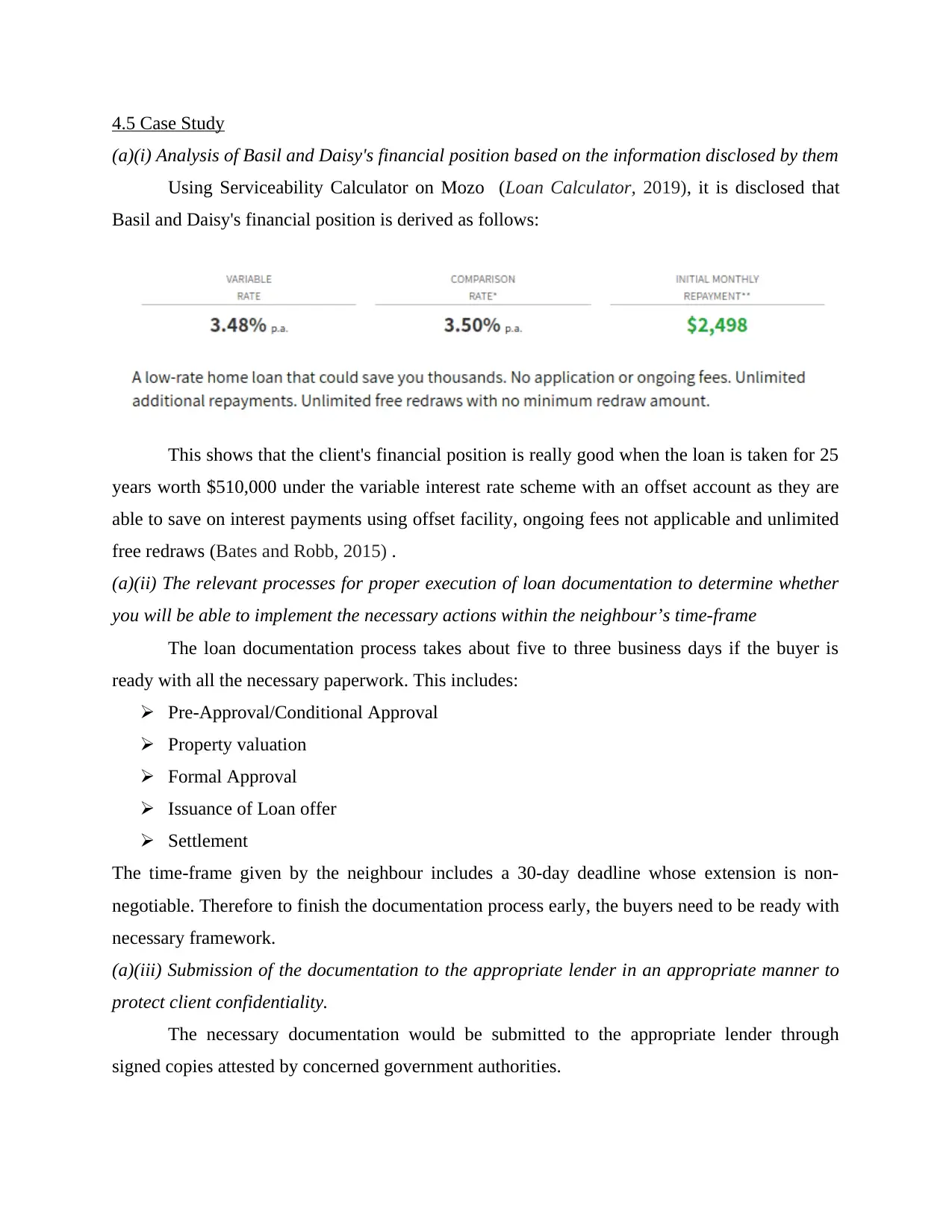

(a)(i) Analysis of Basil and Daisy's financial position based on the information disclosed by them

Using Serviceability Calculator on Mozo (Loan Calculator, 2019), it is disclosed that

Basil and Daisy's financial position is derived as follows:

This shows that the client's financial position is really good when the loan is taken for 25

years worth $510,000 under the variable interest rate scheme with an offset account as they are

able to save on interest payments using offset facility, ongoing fees not applicable and unlimited

free redraws (Bates and Robb, 2015) .

(a)(ii) The relevant processes for proper execution of loan documentation to determine whether

you will be able to implement the necessary actions within the neighbour’s time-frame

The loan documentation process takes about five to three business days if the buyer is

ready with all the necessary paperwork. This includes:

Pre-Approval/Conditional Approval

Property valuation

Formal Approval

Issuance of Loan offer

Settlement

The time-frame given by the neighbour includes a 30-day deadline whose extension is non-

negotiable. Therefore to finish the documentation process early, the buyers need to be ready with

necessary framework.

(a)(iii) Submission of the documentation to the appropriate lender in an appropriate manner to

protect client confidentiality.

The necessary documentation would be submitted to the appropriate lender through

signed copies attested by concerned government authorities.

(a)(i) Analysis of Basil and Daisy's financial position based on the information disclosed by them

Using Serviceability Calculator on Mozo (Loan Calculator, 2019), it is disclosed that

Basil and Daisy's financial position is derived as follows:

This shows that the client's financial position is really good when the loan is taken for 25

years worth $510,000 under the variable interest rate scheme with an offset account as they are

able to save on interest payments using offset facility, ongoing fees not applicable and unlimited

free redraws (Bates and Robb, 2015) .

(a)(ii) The relevant processes for proper execution of loan documentation to determine whether

you will be able to implement the necessary actions within the neighbour’s time-frame

The loan documentation process takes about five to three business days if the buyer is

ready with all the necessary paperwork. This includes:

Pre-Approval/Conditional Approval

Property valuation

Formal Approval

Issuance of Loan offer

Settlement

The time-frame given by the neighbour includes a 30-day deadline whose extension is non-

negotiable. Therefore to finish the documentation process early, the buyers need to be ready with

necessary framework.

(a)(iii) Submission of the documentation to the appropriate lender in an appropriate manner to

protect client confidentiality.

The necessary documentation would be submitted to the appropriate lender through

signed copies attested by concerned government authorities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

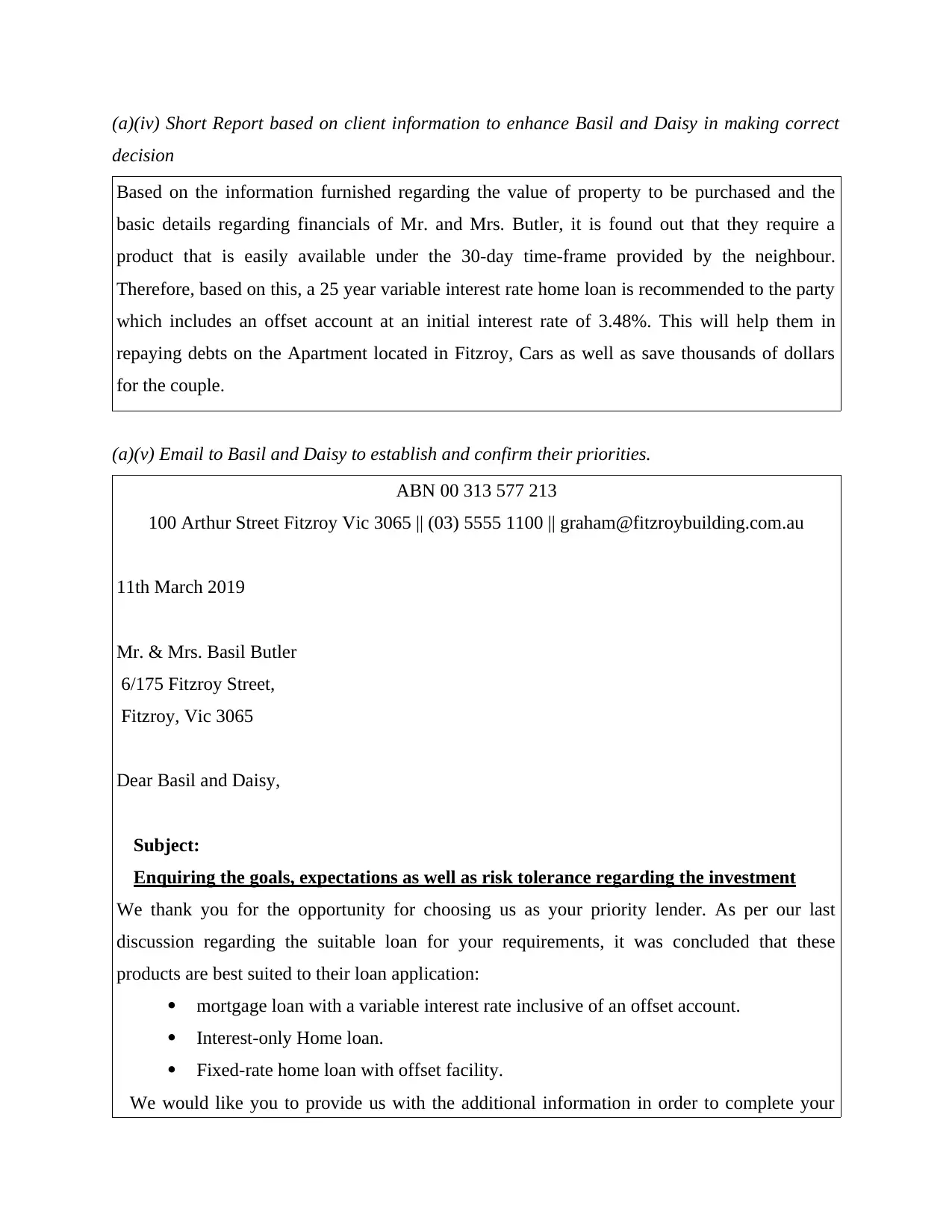

(a)(iv) Short Report based on client information to enhance Basil and Daisy in making correct

decision

Based on the information furnished regarding the value of property to be purchased and the

basic details regarding financials of Mr. and Mrs. Butler, it is found out that they require a

product that is easily available under the 30-day time-frame provided by the neighbour.

Therefore, based on this, a 25 year variable interest rate home loan is recommended to the party

which includes an offset account at an initial interest rate of 3.48%. This will help them in

repaying debts on the Apartment located in Fitzroy, Cars as well as save thousands of dollars

for the couple.

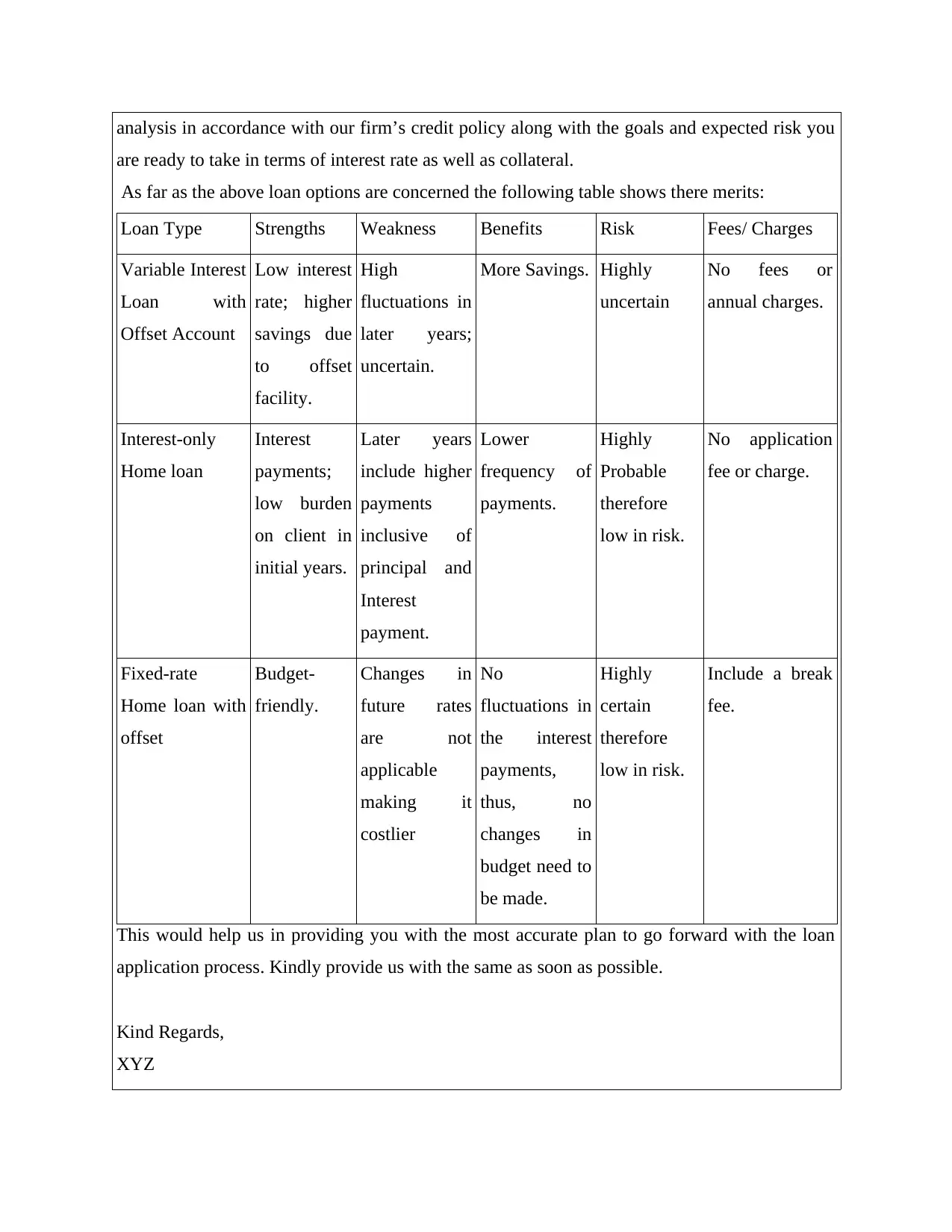

(a)(v) Email to Basil and Daisy to establish and confirm their priorities.

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March 2019

Mr. & Mrs. Basil Butler

6/175 Fitzroy Street,

Fitzroy, Vic 3065

Dear Basil and Daisy,

Subject:

Enquiring the goals, expectations as well as risk tolerance regarding the investment

We thank you for the opportunity for choosing us as your priority lender. As per our last

discussion regarding the suitable loan for your requirements, it was concluded that these

products are best suited to their loan application:

mortgage loan with a variable interest rate inclusive of an offset account.

Interest-only Home loan.

Fixed-rate home loan with offset facility.

We would like you to provide us with the additional information in order to complete your

decision

Based on the information furnished regarding the value of property to be purchased and the

basic details regarding financials of Mr. and Mrs. Butler, it is found out that they require a

product that is easily available under the 30-day time-frame provided by the neighbour.

Therefore, based on this, a 25 year variable interest rate home loan is recommended to the party

which includes an offset account at an initial interest rate of 3.48%. This will help them in

repaying debts on the Apartment located in Fitzroy, Cars as well as save thousands of dollars

for the couple.

(a)(v) Email to Basil and Daisy to establish and confirm their priorities.

ABN 00 313 577 213

100 Arthur Street Fitzroy Vic 3065 || (03) 5555 1100 || graham@fitzroybuilding.com.au

11th March 2019

Mr. & Mrs. Basil Butler

6/175 Fitzroy Street,

Fitzroy, Vic 3065

Dear Basil and Daisy,

Subject:

Enquiring the goals, expectations as well as risk tolerance regarding the investment

We thank you for the opportunity for choosing us as your priority lender. As per our last

discussion regarding the suitable loan for your requirements, it was concluded that these

products are best suited to their loan application:

mortgage loan with a variable interest rate inclusive of an offset account.

Interest-only Home loan.

Fixed-rate home loan with offset facility.

We would like you to provide us with the additional information in order to complete your

analysis in accordance with our firm’s credit policy along with the goals and expected risk you

are ready to take in terms of interest rate as well as collateral.

As far as the above loan options are concerned the following table shows there merits:

Loan Type Strengths Weakness Benefits Risk Fees/ Charges

Variable Interest

Loan with

Offset Account

Low interest

rate; higher

savings due

to offset

facility.

High

fluctuations in

later years;

uncertain.

More Savings. Highly

uncertain

No fees or

annual charges.

Interest-only

Home loan

Interest

payments;

low burden

on client in

initial years.

Later years

include higher

payments

inclusive of

principal and

Interest

payment.

Lower

frequency of

payments.

Highly

Probable

therefore

low in risk.

No application

fee or charge.

Fixed-rate

Home loan with

offset

Budget-

friendly.

Changes in

future rates

are not

applicable

making it

costlier

No

fluctuations in

the interest

payments,

thus, no

changes in

budget need to

be made.

Highly

certain

therefore

low in risk.

Include a break

fee.

This would help us in providing you with the most accurate plan to go forward with the loan

application process. Kindly provide us with the same as soon as possible.

Kind Regards,

XYZ

are ready to take in terms of interest rate as well as collateral.

As far as the above loan options are concerned the following table shows there merits:

Loan Type Strengths Weakness Benefits Risk Fees/ Charges

Variable Interest

Loan with

Offset Account

Low interest

rate; higher

savings due

to offset

facility.

High

fluctuations in

later years;

uncertain.

More Savings. Highly

uncertain

No fees or

annual charges.

Interest-only

Home loan

Interest

payments;

low burden

on client in

initial years.

Later years

include higher

payments

inclusive of

principal and

Interest

payment.

Lower

frequency of

payments.

Highly

Probable

therefore

low in risk.

No application

fee or charge.

Fixed-rate

Home loan with

offset

Budget-

friendly.

Changes in

future rates

are not

applicable

making it

costlier

No

fluctuations in

the interest

payments,

thus, no

changes in

budget need to

be made.

Highly

certain

therefore

low in risk.

Include a break

fee.

This would help us in providing you with the most accurate plan to go forward with the loan

application process. Kindly provide us with the same as soon as possible.

Kind Regards,

XYZ

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 40

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.