Finance for Managers Report

VerifiedAdded on 2020/02/05

|22

|7874

|190

Report

AI Summary

This report on 'Finance for Managers' covers essential topics such as the importance of financial records, techniques for recording financial information, the evaluation of financial statements for stakeholders, and methods of project appraisal. It discusses the differences between management and financial accounting, the budgetary control process, and various methods of obtaining finance for business projects. The report concludes with a comprehensive analysis of the significance of effective financial management in organizations.

FINANCE FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Explains the purpose and requirements for keeping financial records.............................3

1.2 & 1.3 Analyses the techniques for recording financial information and analyses the legal

and organisation requirements of financial reporting.............................................................4

1.4 Evaluates the usefulness of financial statements to stakeholders.....................................5

TASK 2............................................................................................................................................7

2.1 Components of working capital .......................................................................................7

2.2 how business organisations can effectively manage working capital..............................8

TASK 3............................................................................................................................................9

3.1 Difference between management and financial accounting.............................................9

3.2 Explains the budgetary control process..........................................................................10

3.3 Calculate and interpret variances from budget...............................................................11

3.4 Evaluate the use of different costing methods for pricing purposes..............................13

TASK 4..........................................................................................................................................14

4.1 Demonstrate the main methods of project appraisal......................................................14

4.2 Evaluate methods of project appraisal............................................................................15

4.3 Explain how finance might be obtained for a business project .....................................16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INDEX OF TABLES

Table 1: Variance analysis and reconciliation statement...............................................................11

Table 2: Performance of firm.........................................................................................................11

Table 3: Calculation of payback period.........................................................................................14

Table 4: Calculation of ARR.........................................................................................................14

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Explains the purpose and requirements for keeping financial records.............................3

1.2 & 1.3 Analyses the techniques for recording financial information and analyses the legal

and organisation requirements of financial reporting.............................................................4

1.4 Evaluates the usefulness of financial statements to stakeholders.....................................5

TASK 2............................................................................................................................................7

2.1 Components of working capital .......................................................................................7

2.2 how business organisations can effectively manage working capital..............................8

TASK 3............................................................................................................................................9

3.1 Difference between management and financial accounting.............................................9

3.2 Explains the budgetary control process..........................................................................10

3.3 Calculate and interpret variances from budget...............................................................11

3.4 Evaluate the use of different costing methods for pricing purposes..............................13

TASK 4..........................................................................................................................................14

4.1 Demonstrate the main methods of project appraisal......................................................14

4.2 Evaluate methods of project appraisal............................................................................15

4.3 Explain how finance might be obtained for a business project .....................................16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INDEX OF TABLES

Table 1: Variance analysis and reconciliation statement...............................................................11

Table 2: Performance of firm.........................................................................................................11

Table 3: Calculation of payback period.........................................................................................14

Table 4: Calculation of ARR.........................................................................................................14

INTRODUCTION

Financial and management accounting both are different branches of accounts. Both of

them have importance for the firms. In this report difference between both is explained in detail

on the basis of specific parameters. In middle part of the report, variance analysis is done and

performance of the firm is measured. In order to cross check variance calculation reconciliation

statement is prepared. At end of the report, project evaluation is done by using some specific

methods and viability of project is measured.

TASK 1

1.1 Explains the purpose and requirements for keeping financial records

Financial records are like a mirror and reflects the financial position of the firm and its

profitability. It is very important to keep financial records because they help managers in

identifying the point where organization is standing currently. The main purpose of preparing

financial statement is to access the strong and weak points of the firm and to make sure that

corruption is not going on in the organization (Zimmerman and Yahya-Zadeh, 2011). Financial

records help managers in identifying that from which source fund is coming in the firm and place

where it is incurred. Thus, main purpose of preparing financial record is to make sure that

everything is done in write manner in the firm. The other main purpose of preparing the financial

records is to identify and evaluate strong as well as weak points of the firm. Hence, it can be said

that preparation of financial records gives a multidimensional benefit to the firm. There are

requirements to keep financial records because as per rules it is necessary for every business

concern to maintain records. It is also necessary for the managers to conduct audit of the

company accounts by appoint specific person who is qualified to audit firm accounts. Thus, it

can be said that there are requirements to keep financial records (Kaplan and Atkinson, 2015).

Every business concern must makes sure that it is keeping proper record of company books of

accounts and all transactions are recorded at accurate value. Further, there are various techniques

and methods which are used in order to keep record of financial informations. The techniques or

tolls of financial recording are such as bookkeeping, posting and documentation, financial

transactions recording system, days books, ledger accounts, EPOS (Electronic point of sale) etc.

Apart from these come manual tools are also used such as cash register etc. in order to keep

record of financial transactions.

Financial and management accounting both are different branches of accounts. Both of

them have importance for the firms. In this report difference between both is explained in detail

on the basis of specific parameters. In middle part of the report, variance analysis is done and

performance of the firm is measured. In order to cross check variance calculation reconciliation

statement is prepared. At end of the report, project evaluation is done by using some specific

methods and viability of project is measured.

TASK 1

1.1 Explains the purpose and requirements for keeping financial records

Financial records are like a mirror and reflects the financial position of the firm and its

profitability. It is very important to keep financial records because they help managers in

identifying the point where organization is standing currently. The main purpose of preparing

financial statement is to access the strong and weak points of the firm and to make sure that

corruption is not going on in the organization (Zimmerman and Yahya-Zadeh, 2011). Financial

records help managers in identifying that from which source fund is coming in the firm and place

where it is incurred. Thus, main purpose of preparing financial record is to make sure that

everything is done in write manner in the firm. The other main purpose of preparing the financial

records is to identify and evaluate strong as well as weak points of the firm. Hence, it can be said

that preparation of financial records gives a multidimensional benefit to the firm. There are

requirements to keep financial records because as per rules it is necessary for every business

concern to maintain records. It is also necessary for the managers to conduct audit of the

company accounts by appoint specific person who is qualified to audit firm accounts. Thus, it

can be said that there are requirements to keep financial records (Kaplan and Atkinson, 2015).

Every business concern must makes sure that it is keeping proper record of company books of

accounts and all transactions are recorded at accurate value. Further, there are various techniques

and methods which are used in order to keep record of financial informations. The techniques or

tolls of financial recording are such as bookkeeping, posting and documentation, financial

transactions recording system, days books, ledger accounts, EPOS (Electronic point of sale) etc.

Apart from these come manual tools are also used such as cash register etc. in order to keep

record of financial transactions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial records are required for tax preparation and filing and, if needed for any audits.

The financial records are useful for providing managers the management information such as

information about costs, and forecasts of future costs and revenues. Financial records required

for those who requires such information for decision making and record keeping purpose. It

helps to manipulate in the financial records in order to reduce company's tax obligations. It helps

to plan for tax payments (Frieden, 2016). It helps to identify the strengths and weaknesses of the

business. Financial records will help to the company to make plan to meet financial

commitments such paying creditors or employees. Its another important purpose is with help of

financial records company makes easier to distribute profits to shareholders as dividends or for

partnerships where both profits and losses have to be shared. Financial statements are gives

information to company that it need to run the business and help it grows as well as it helps

manage changes and improvements in the organisation.

1.2 & 1.3 Analyses the techniques for recording financial information and analyses the legal and

organisation requirements of financial reporting

There are many methods in accounting that are adopted to keep record of the financial

information. Some method that are used to record financial information are given below. Journal- It is one of the most important method which is adopted to record financial

information. Per day transactions are recorded in Journal and same is transferred to the

ledger account to form separate account for each individual. It is the book of account in

which all transactions that are related to the firm are recorded. In journal entries are done

and there debit as well credit sides are recorded in the books of account (DRURY, 2013).

It is prepared by each and every type of firm irrespective of its size. Ledger- It is also one of the most important account that is prepared by the firm. In this

account all entries of the journal are recorded. A separate account is prepared under

which all similar transactions are recorded. This statement gives an overview of the

specific account collectively and on individual basis. Firms normally use ledger account

to prepare their credit related strategy. By using ledger accounts entities to whom debt

must not be given for future time period is determined by the mangers. Thus, it is one of

the most important technique of keeping record of financial information.

Cash book- In this book all cash related transactions are entered and it provides

information about the expenses that are made by the firm in specific duration (Gow,

The financial records are useful for providing managers the management information such as

information about costs, and forecasts of future costs and revenues. Financial records required

for those who requires such information for decision making and record keeping purpose. It

helps to manipulate in the financial records in order to reduce company's tax obligations. It helps

to plan for tax payments (Frieden, 2016). It helps to identify the strengths and weaknesses of the

business. Financial records will help to the company to make plan to meet financial

commitments such paying creditors or employees. Its another important purpose is with help of

financial records company makes easier to distribute profits to shareholders as dividends or for

partnerships where both profits and losses have to be shared. Financial statements are gives

information to company that it need to run the business and help it grows as well as it helps

manage changes and improvements in the organisation.

1.2 & 1.3 Analyses the techniques for recording financial information and analyses the legal and

organisation requirements of financial reporting

There are many methods in accounting that are adopted to keep record of the financial

information. Some method that are used to record financial information are given below. Journal- It is one of the most important method which is adopted to record financial

information. Per day transactions are recorded in Journal and same is transferred to the

ledger account to form separate account for each individual. It is the book of account in

which all transactions that are related to the firm are recorded. In journal entries are done

and there debit as well credit sides are recorded in the books of account (DRURY, 2013).

It is prepared by each and every type of firm irrespective of its size. Ledger- It is also one of the most important account that is prepared by the firm. In this

account all entries of the journal are recorded. A separate account is prepared under

which all similar transactions are recorded. This statement gives an overview of the

specific account collectively and on individual basis. Firms normally use ledger account

to prepare their credit related strategy. By using ledger accounts entities to whom debt

must not be given for future time period is determined by the mangers. Thus, it is one of

the most important technique of keeping record of financial information.

Cash book- In this book all cash related transactions are entered and it provides

information about the expenses that are made by the firm in specific duration (Gow,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Ormazabal and Taylor, 2010). Hence, it can be said that along with journal and ledger it

is one of the most important method of recording transactions.

Balance Sheet- A balance sheet is a financial statement of assets and liabilities and

capital of business. It is one of the best technique to record financial information. By this

the company can know that how many assets and liabilities it has within the organisation.

By using balance sheet firm liquidity and investment related performance is measured.

Ratios like current and PE ratio are usually computed by using balance sheet of the

business firm. Here the company keeps all the records of the current and fixed assets and

liabilities. It gives the clear picture of business at the quarterly, half yearly and yearly

basis.

Income Statement- A income statement is also one of the most technique to record the

financial information about the business (Angel, 2016). It measures the company's

financial performance over a specific accounting period. It is important for the business

because it shows the profitability of business during the time interval specified in its

heading. Mentioned statement reflects the proportion of the sales revenue that is covered

by the cost. On the basis of income statement cost control strategy is prepared by the

business firm. It gives the information about all the expenses and revenue generated by

the business.

There are legal requirements of financial reporting and under this every firm have to

follow provisions of IFRS or International financial reporting standards. As per provisions of

IFRS all accounts are prepared and there notes are recorded in the company books of accounts.

In an organisation there are rules about different types of reports that will be prepared in relation

to firm accounts. These rules are strictly followed while in activities that are related to financial

reporting.

1.4 Evaluates the usefulness of financial statements to stakeholders

Financial statements have great importance for the stakeholders. This is because

stakeholders are those entities that give close cooperation to the firm in running business

operations. Hence, they are always interested in knowing that in which direction firm is going in

current time period. Some of the most important stakeholders of the firm are given below. Shareholders- These are those who makes an investment in the company and buy

shareholding in same (Kieso, Weygandt and Warfield, 2010). In this way they become

is one of the most important method of recording transactions.

Balance Sheet- A balance sheet is a financial statement of assets and liabilities and

capital of business. It is one of the best technique to record financial information. By this

the company can know that how many assets and liabilities it has within the organisation.

By using balance sheet firm liquidity and investment related performance is measured.

Ratios like current and PE ratio are usually computed by using balance sheet of the

business firm. Here the company keeps all the records of the current and fixed assets and

liabilities. It gives the clear picture of business at the quarterly, half yearly and yearly

basis.

Income Statement- A income statement is also one of the most technique to record the

financial information about the business (Angel, 2016). It measures the company's

financial performance over a specific accounting period. It is important for the business

because it shows the profitability of business during the time interval specified in its

heading. Mentioned statement reflects the proportion of the sales revenue that is covered

by the cost. On the basis of income statement cost control strategy is prepared by the

business firm. It gives the information about all the expenses and revenue generated by

the business.

There are legal requirements of financial reporting and under this every firm have to

follow provisions of IFRS or International financial reporting standards. As per provisions of

IFRS all accounts are prepared and there notes are recorded in the company books of accounts.

In an organisation there are rules about different types of reports that will be prepared in relation

to firm accounts. These rules are strictly followed while in activities that are related to financial

reporting.

1.4 Evaluates the usefulness of financial statements to stakeholders

Financial statements have great importance for the stakeholders. This is because

stakeholders are those entities that give close cooperation to the firm in running business

operations. Hence, they are always interested in knowing that in which direction firm is going in

current time period. Some of the most important stakeholders of the firm are given below. Shareholders- These are those who makes an investment in the company and buy

shareholding in same (Kieso, Weygandt and Warfield, 2010). In this way they become

real owner in the company. They makes an investment in the firm and due to this reason

always like to ensure that investment made by them is fully secure. Thus, they needed

company financial statements and on the basis of evaluation of same they identify the

financial condition of the firm. By using ratio analysis method shareholders evaluate firm

from different sides and take their investment related decisions. Investors compute price

earnings ratio in order to identify whether company shares are overvalued or

undervalued. On the basis of results of PE ratio investors take purchase related decisions

in respect to shares. If firm condition is not good then shareholders sale firm shares in

the market and exit from same. Creditors- These are also one of the main stakeholders of the firm because they make

available debt to the firm to meet its working capital and long term finance needs. In

business firms often takes debt from the suppliers and other business friends (Hail, Leuz

and Wysocki, 2010). Some times already specific entity gives debt to the firm and when

second party again approach same for getting a loan creditor carry out analysis of firm

financial position. In this regard, creditor needed copy of firm financial statements. By

using ratio analysis method creditors evaluate firm from different sides and take there

debt allotment related to decision in proper manner. Managers- These are the one of the most important stakeholder of the firm because they

take its tactical and strategic decisions. Managers needed firm financial statements

because strategies are prepared to solve specific problem or to capitalize opportunities.

Managers evaluated income statement and identify the expenses that increased at fast

pace in specific time period. On this basis cost control related strategy is formulated by

the managers for the business firm. It is financial statement which reflects the area where

firm performance is weak and needs strong action to convert same in to strength (Larcker

and Rusticus, 2010). Thus, managers always first of all evaluate financial statements and

on the basis of same decide the direction in which they need to make business decisions. Government- The government is also one of the most important stakeholders of the

business entity. The government used the financial statements of the company to evaluate

the performance of the company towards the legal formalities. The government in whose

jurisdiction the company is located will request financial statements in order to determine

whether the business paid the appropriate amount of taxes (Best, 2016). The government

always like to ensure that investment made by them is fully secure. Thus, they needed

company financial statements and on the basis of evaluation of same they identify the

financial condition of the firm. By using ratio analysis method shareholders evaluate firm

from different sides and take their investment related decisions. Investors compute price

earnings ratio in order to identify whether company shares are overvalued or

undervalued. On the basis of results of PE ratio investors take purchase related decisions

in respect to shares. If firm condition is not good then shareholders sale firm shares in

the market and exit from same. Creditors- These are also one of the main stakeholders of the firm because they make

available debt to the firm to meet its working capital and long term finance needs. In

business firms often takes debt from the suppliers and other business friends (Hail, Leuz

and Wysocki, 2010). Some times already specific entity gives debt to the firm and when

second party again approach same for getting a loan creditor carry out analysis of firm

financial position. In this regard, creditor needed copy of firm financial statements. By

using ratio analysis method creditors evaluate firm from different sides and take there

debt allotment related to decision in proper manner. Managers- These are the one of the most important stakeholder of the firm because they

take its tactical and strategic decisions. Managers needed firm financial statements

because strategies are prepared to solve specific problem or to capitalize opportunities.

Managers evaluated income statement and identify the expenses that increased at fast

pace in specific time period. On this basis cost control related strategy is formulated by

the managers for the business firm. It is financial statement which reflects the area where

firm performance is weak and needs strong action to convert same in to strength (Larcker

and Rusticus, 2010). Thus, managers always first of all evaluate financial statements and

on the basis of same decide the direction in which they need to make business decisions. Government- The government is also one of the most important stakeholders of the

business entity. The government used the financial statements of the company to evaluate

the performance of the company towards the legal formalities. The government in whose

jurisdiction the company is located will request financial statements in order to determine

whether the business paid the appropriate amount of taxes (Best, 2016). The government

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

entities or tax authorities need financial statements to ascertain the propriety and accuracy

of taxes and other duties declared and paid by the company. Hence, this are the important

stakeholders who analysis the legal and taxation duties performed by the business.

Employees- The employees are one of the most important stakeholders by which

company exist and run in the market. The financial statements are useful for the

employees in order to take decision of join the company for job or not (Capie and Wood,

2016). The employees' analysis on the basis of financial informations that it is how

perform in the industry and doing growth or at the stable condition in the market. If the

company is growing always and profitable than can give the better salary and allowance

to employees, so in this way financial statements are helpful for the employees.

These are the different stakeholders of the business which use the financial

statements to take decision about the investment into the particular company. The financial

statements ate in above ways useful for all the stakeholders of the business entity.

TASK 2

2.1 Components of working capital

Following are the components of working capital for the Alpha analytic. Cash- Cash is the one of most important component of working capital of the firm. This

is because cash that remain in hand and in bank is used to meet working capital needs of

the firm (Chaney, Faccio and Parsley, 2011). It is very important to prepare cash

management related business strategy at the workplace. In this regard cash outflow can

be delayed by decentralizing payment making system. Hence, it can be said that cash is

the one of the important component of the working capital as it is used to meet day to day

finance need. Inventory- It is also known as stock of produced goods which is sold in the market by the

organization. In order to meet working capital needs firm try to sale more and more

goods in the market so that as much as amount can be raised to meet working capital

needs of the firm. Firm must try to purchase less quantity of goods in its business. This is

because when goods remain unsold inventory is not used and due to this reason stock

storage cost increased in business.

of taxes and other duties declared and paid by the company. Hence, this are the important

stakeholders who analysis the legal and taxation duties performed by the business.

Employees- The employees are one of the most important stakeholders by which

company exist and run in the market. The financial statements are useful for the

employees in order to take decision of join the company for job or not (Capie and Wood,

2016). The employees' analysis on the basis of financial informations that it is how

perform in the industry and doing growth or at the stable condition in the market. If the

company is growing always and profitable than can give the better salary and allowance

to employees, so in this way financial statements are helpful for the employees.

These are the different stakeholders of the business which use the financial

statements to take decision about the investment into the particular company. The financial

statements ate in above ways useful for all the stakeholders of the business entity.

TASK 2

2.1 Components of working capital

Following are the components of working capital for the Alpha analytic. Cash- Cash is the one of most important component of working capital of the firm. This

is because cash that remain in hand and in bank is used to meet working capital needs of

the firm (Chaney, Faccio and Parsley, 2011). It is very important to prepare cash

management related business strategy at the workplace. In this regard cash outflow can

be delayed by decentralizing payment making system. Hence, it can be said that cash is

the one of the important component of the working capital as it is used to meet day to day

finance need. Inventory- It is also known as stock of produced goods which is sold in the market by the

organization. In order to meet working capital needs firm try to sale more and more

goods in the market so that as much as amount can be raised to meet working capital

needs of the firm. Firm must try to purchase less quantity of goods in its business. This is

because when goods remain unsold inventory is not used and due to this reason stock

storage cost increased in business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Account payable or receivable- These are the one of the most important tools that are

used by the firm when there is scarcity of funds and same is needed for funding of

operations (Laux and Leuz, 2010). When firm have excessive funds then it use same to

make payment of account payable.

2.2 how business organisations can effectively manage working capital

There is great importance of the working capital management for the business because

by using same even there is small amount of fund in the business it can be used in effective

manner to run day to day operations of business. By using working capital management method

firm can reduce cash outflow or can delay same. On other hand, by using same cash inflow can

be increase. There are many techniques of working capital management and all of them must be

used by the firm to manage its cash balance (Mulford and Comiskey, 2011). This will helping it

in ensuring that it is having sufficient amount of balance in its business. Some of the methods

that can be used to manage working capital are given below.

Firm must centralize its payment making system which means that all payments must be

made from single place. On other hand, it must be made sure that payment receipt system

is decentralized. If this will happen then Alpha analytic will be able to receive payment

from debtors at fast pace.

Firm must make all payment by cheque because when firm give same to any business

firm it takes some time to cash same. Hence, balance remain in firm bank account for

some time period.

Firm can take overdraft facility to meet its working capital needs. It must make sure that

it is making payment on time (Edwards, 2013). This is because if same will not be done

then firm will loose its credibility among the business firm.

The companies can manage working capital in effective manner after making proper

financial plan with helps of budgeting process.

Budget gives financial informations for next accounting year where assets and liabilities

are also recorded, which helps to manage working capital of the company peoperly.

A working capital management will help the firm to survive through a crisis or ramp up

production in case of an unexpectedly large order.

Working capital management helps to operation the organization smoothly without any

financial problem for making the payment of short term liabilities. Purchase of raw

used by the firm when there is scarcity of funds and same is needed for funding of

operations (Laux and Leuz, 2010). When firm have excessive funds then it use same to

make payment of account payable.

2.2 how business organisations can effectively manage working capital

There is great importance of the working capital management for the business because

by using same even there is small amount of fund in the business it can be used in effective

manner to run day to day operations of business. By using working capital management method

firm can reduce cash outflow or can delay same. On other hand, by using same cash inflow can

be increase. There are many techniques of working capital management and all of them must be

used by the firm to manage its cash balance (Mulford and Comiskey, 2011). This will helping it

in ensuring that it is having sufficient amount of balance in its business. Some of the methods

that can be used to manage working capital are given below.

Firm must centralize its payment making system which means that all payments must be

made from single place. On other hand, it must be made sure that payment receipt system

is decentralized. If this will happen then Alpha analytic will be able to receive payment

from debtors at fast pace.

Firm must make all payment by cheque because when firm give same to any business

firm it takes some time to cash same. Hence, balance remain in firm bank account for

some time period.

Firm can take overdraft facility to meet its working capital needs. It must make sure that

it is making payment on time (Edwards, 2013). This is because if same will not be done

then firm will loose its credibility among the business firm.

The companies can manage working capital in effective manner after making proper

financial plan with helps of budgeting process.

Budget gives financial informations for next accounting year where assets and liabilities

are also recorded, which helps to manage working capital of the company peoperly.

A working capital management will help the firm to survive through a crisis or ramp up

production in case of an unexpectedly large order.

Working capital management helps to operation the organization smoothly without any

financial problem for making the payment of short term liabilities. Purchase of raw

materials and payment of salary, wages and overhead can be made without any delay.

Proper working capital helps in maintaining solvency of the business by providing

uninterrupted flow of production.

The sufficient working capital enables a business concern to make prompt payments and

hence in creating and maintaining goodwill (Betz, 2016). Goodwill is enhanced because

all current liabilities and operating expenses are paid on time.

Working capital is really a life blood of any business firm which maintains the firm in

well condition. Any day to day financial requirement can be met without any shortage of

fund.

Moreover, with help of cash management the respective business entity is able to manage

working capital and profitability of the firm as well which lead to achieve goals and

objectives effectively.

With the information management is able to prepare and formulate effective business

strategies by which profit level enhance and working capital will be manage as well.

Adequate working capital management enables a firm to face business crisis in

emergencies such as depression.

TASK 3

3.1 Difference between management and financial accounting

There are number of differences between management and financial accounting and same is

described below. Maintenance of record- The main difference between management and financial

accounting is that in case of former technique all information related to the production

cost are recorded (Davis and Caldeira, 2010). Means that in management accounting

finance cost and miscellaneous expenses are not recorded. Whereas, in case of financial

accounting information that is derived from management accounting and other

accounting records is used to prepare financial statements like income statement and

balance sheet. It can be said that in both type of accounting record keeping of different

things is done by the business firms. Uses- In terms of use also management and financial accounting are different from each

other. Management accounting is used by the firm to identify value of cost of production

Proper working capital helps in maintaining solvency of the business by providing

uninterrupted flow of production.

The sufficient working capital enables a business concern to make prompt payments and

hence in creating and maintaining goodwill (Betz, 2016). Goodwill is enhanced because

all current liabilities and operating expenses are paid on time.

Working capital is really a life blood of any business firm which maintains the firm in

well condition. Any day to day financial requirement can be met without any shortage of

fund.

Moreover, with help of cash management the respective business entity is able to manage

working capital and profitability of the firm as well which lead to achieve goals and

objectives effectively.

With the information management is able to prepare and formulate effective business

strategies by which profit level enhance and working capital will be manage as well.

Adequate working capital management enables a firm to face business crisis in

emergencies such as depression.

TASK 3

3.1 Difference between management and financial accounting

There are number of differences between management and financial accounting and same is

described below. Maintenance of record- The main difference between management and financial

accounting is that in case of former technique all information related to the production

cost are recorded (Davis and Caldeira, 2010). Means that in management accounting

finance cost and miscellaneous expenses are not recorded. Whereas, in case of financial

accounting information that is derived from management accounting and other

accounting records is used to prepare financial statements like income statement and

balance sheet. It can be said that in both type of accounting record keeping of different

things is done by the business firms. Uses- In terms of use also management and financial accounting are different from each

other. Management accounting is used by the firm to identify value of cost of production

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Bebbington, Unerman and O'Dwyer, 2014). Apart from this its methods are used to

identify whether all expenses are made within determined limit. It can be said that

management accounting is a tool which help in measuring the effectiveness of the

management. There is different use of the financial accounting and it is the tool which

indicate the financial condition and profitability of the firm. By using the financial

accounting techniques profitability of the firm is measured and its strong as well as weak

points are also identified by the business firm. Hence, it can be said that there are

different uses of the financial and management accounting.

Users- There are internal users of the company information that is pertained to the

management accounting (Flamholtz, 2012). Contrary to this, in case of financial

accounting there are both internal and external users. It can be said that there is wide use

of financial accounting then management accounting.

3.2 Explains the budgetary control process

Budgetary control process is the one of the most important technique of management

accounting which is used by the most of the firms. Budget control process of the firm is given

below. Forecast- It is one of the most important step of the budget and under this first of all

forecast of future time period is made and accordingly values of components of the

budget is determined (Denison, 2010). In order to make forecast of figures business

environment is analysed and advanced techniques like simulation is used by the firms. By

using simulation method on the basis of estimation of probability of happening of

likelihood of event is estimated and prediction is made about the increase or decrease that

can be observed in the cash flows of business firm for budgeted time period. In this very

first step company predict that what objective has to achieve from the budget. On the

basis of forecast budget statement is prepared. Determining values of the budget- After preparation of forecast and considering lots of

factors values are determined for the budget. These values acts as standards against which

performance of the firm is compared in order to identify the level of performance given

by same in its business. Here the company is determining with help of forecast that how

many values will be of the budget which preparing.

identify whether all expenses are made within determined limit. It can be said that

management accounting is a tool which help in measuring the effectiveness of the

management. There is different use of the financial accounting and it is the tool which

indicate the financial condition and profitability of the firm. By using the financial

accounting techniques profitability of the firm is measured and its strong as well as weak

points are also identified by the business firm. Hence, it can be said that there are

different uses of the financial and management accounting.

Users- There are internal users of the company information that is pertained to the

management accounting (Flamholtz, 2012). Contrary to this, in case of financial

accounting there are both internal and external users. It can be said that there is wide use

of financial accounting then management accounting.

3.2 Explains the budgetary control process

Budgetary control process is the one of the most important technique of management

accounting which is used by the most of the firms. Budget control process of the firm is given

below. Forecast- It is one of the most important step of the budget and under this first of all

forecast of future time period is made and accordingly values of components of the

budget is determined (Denison, 2010). In order to make forecast of figures business

environment is analysed and advanced techniques like simulation is used by the firms. By

using simulation method on the basis of estimation of probability of happening of

likelihood of event is estimated and prediction is made about the increase or decrease that

can be observed in the cash flows of business firm for budgeted time period. In this very

first step company predict that what objective has to achieve from the budget. On the

basis of forecast budget statement is prepared. Determining values of the budget- After preparation of forecast and considering lots of

factors values are determined for the budget. These values acts as standards against which

performance of the firm is compared in order to identify the level of performance given

by same in its business. Here the company is determining with help of forecast that how

many values will be of the budget which preparing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recoding of actual figures- After passage of the specific time period facts and figures

related to the budget components are recorded in the statement (Garrison and et.al.,

2010). Same is used in further stages to access performance of the firm. The company is

in the third step of budgetary control process recode the actual figures with the

determining and forecasting values of the budget in the business. By this the managers

able to know actual performance of the business in the industry and compare from past

performance as well. Comparison of actual with budgeted figures- It is one of the most important step and

under this actual figures are compared with the budgeted figure. On this basis it is

identified whether firm give excellent or poor performance in its business. In this step the

company is compare the actual budget with the budgeted figure and analysis that is it

profitable for the company or not. With the help of this step company take the decision to

implement budget in business or not. Process of comparison among the actual outputs

and expected data, known as a variance analysis. With this the manager can derive

performance of the firm and able to take corrective actions for upcoming financial years. Recommendation from middle level managers- In case of negative variance middle level

managers are asked to give recommendations to the top management regarding poor

performance. These recommendations are given after considering number of factors. In

this step the middle level managers recommend about the budget that whether it should

implement or not. If the budget is negative than should not implement and if it is in

favourable situation than company will adopt the budget in the business.

Corrective actions- Top managers receive recommendations and wherever require make

changes in same to draft corrective actions (Lennox, Francis and Wang, 2011). These are

implemented at ground level of the firm to control occurrence of negative variance. This

is the last and final step of the budgetary control process, in this company take the

decision to implement or not on the basis of above steps. Here the manager analyse and

evaluate overall process that whether it is implementing and giving output in proper

manner or not, if not then take corrective actions.

These are the above steps by which the budget can be prepare and control in the

business in an effective manner. It gives the proper decision to take the corrective action about

the budgeted project.

related to the budget components are recorded in the statement (Garrison and et.al.,

2010). Same is used in further stages to access performance of the firm. The company is

in the third step of budgetary control process recode the actual figures with the

determining and forecasting values of the budget in the business. By this the managers

able to know actual performance of the business in the industry and compare from past

performance as well. Comparison of actual with budgeted figures- It is one of the most important step and

under this actual figures are compared with the budgeted figure. On this basis it is

identified whether firm give excellent or poor performance in its business. In this step the

company is compare the actual budget with the budgeted figure and analysis that is it

profitable for the company or not. With the help of this step company take the decision to

implement budget in business or not. Process of comparison among the actual outputs

and expected data, known as a variance analysis. With this the manager can derive

performance of the firm and able to take corrective actions for upcoming financial years. Recommendation from middle level managers- In case of negative variance middle level

managers are asked to give recommendations to the top management regarding poor

performance. These recommendations are given after considering number of factors. In

this step the middle level managers recommend about the budget that whether it should

implement or not. If the budget is negative than should not implement and if it is in

favourable situation than company will adopt the budget in the business.

Corrective actions- Top managers receive recommendations and wherever require make

changes in same to draft corrective actions (Lennox, Francis and Wang, 2011). These are

implemented at ground level of the firm to control occurrence of negative variance. This

is the last and final step of the budgetary control process, in this company take the

decision to implement or not on the basis of above steps. Here the manager analyse and

evaluate overall process that whether it is implementing and giving output in proper

manner or not, if not then take corrective actions.

These are the above steps by which the budget can be prepare and control in the

business in an effective manner. It gives the proper decision to take the corrective action about

the budgeted project.

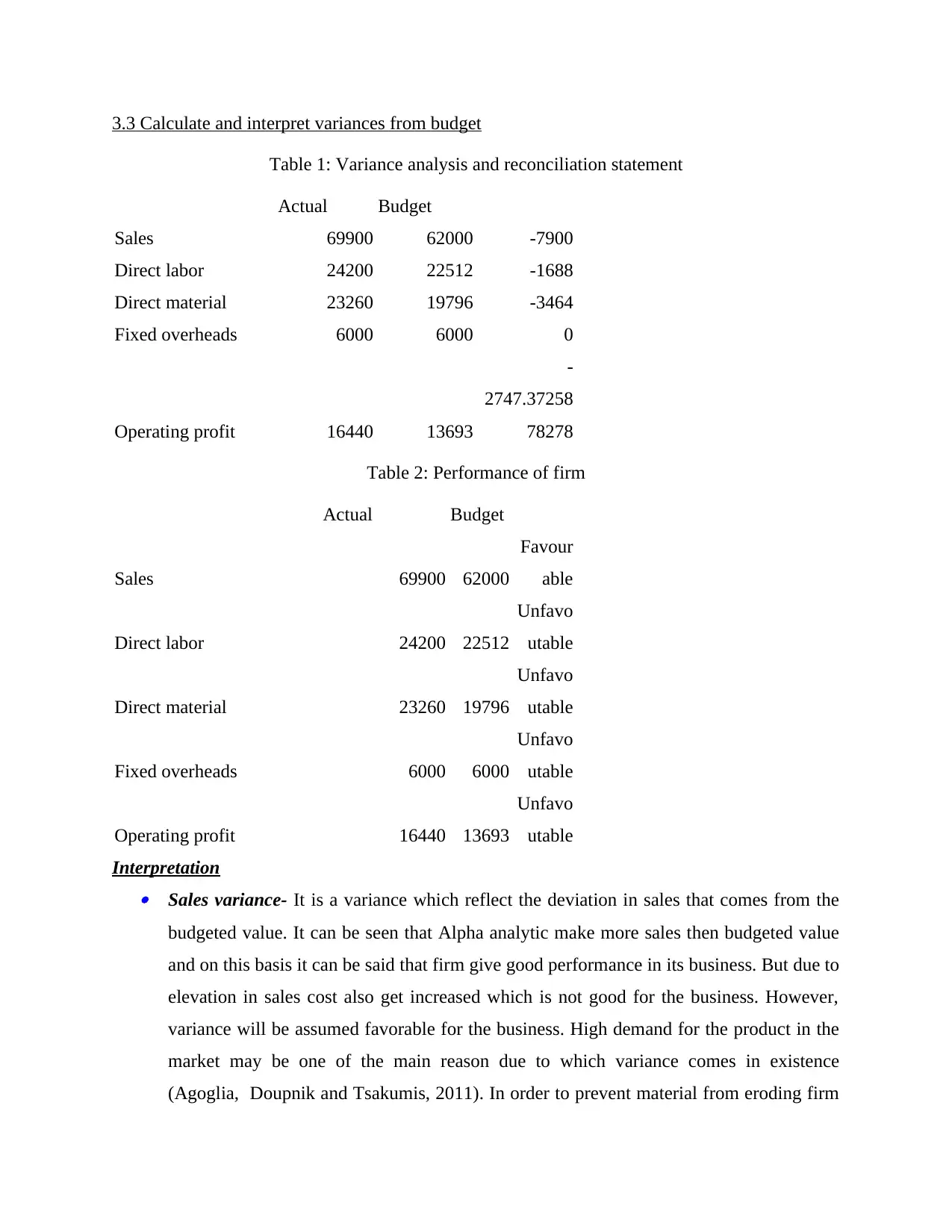

3.3 Calculate and interpret variances from budget

Table 1: Variance analysis and reconciliation statement

Actual Budget

Sales 69900 62000 -7900

Direct labor 24200 22512 -1688

Direct material 23260 19796 -3464

Fixed overheads 6000 6000 0

Operating profit 16440 13693

-

2747.37258

78278

Table 2: Performance of firm

Actual Budget

Sales 69900 62000

Favour

able

Direct labor 24200 22512

Unfavo

utable

Direct material 23260 19796

Unfavo

utable

Fixed overheads 6000 6000

Unfavo

utable

Operating profit 16440 13693

Unfavo

utable

Interpretation Sales variance- It is a variance which reflect the deviation in sales that comes from the

budgeted value. It can be seen that Alpha analytic make more sales then budgeted value

and on this basis it can be said that firm give good performance in its business. But due to

elevation in sales cost also get increased which is not good for the business. However,

variance will be assumed favorable for the business. High demand for the product in the

market may be one of the main reason due to which variance comes in existence

(Agoglia, Doupnik and Tsakumis, 2011). In order to prevent material from eroding firm

Table 1: Variance analysis and reconciliation statement

Actual Budget

Sales 69900 62000 -7900

Direct labor 24200 22512 -1688

Direct material 23260 19796 -3464

Fixed overheads 6000 6000 0

Operating profit 16440 13693

-

2747.37258

78278

Table 2: Performance of firm

Actual Budget

Sales 69900 62000

Favour

able

Direct labor 24200 22512

Unfavo

utable

Direct material 23260 19796

Unfavo

utable

Fixed overheads 6000 6000

Unfavo

utable

Operating profit 16440 13693

Unfavo

utable

Interpretation Sales variance- It is a variance which reflect the deviation in sales that comes from the

budgeted value. It can be seen that Alpha analytic make more sales then budgeted value

and on this basis it can be said that firm give good performance in its business. But due to

elevation in sales cost also get increased which is not good for the business. However,

variance will be assumed favorable for the business. High demand for the product in the

market may be one of the main reason due to which variance comes in existence

(Agoglia, Doupnik and Tsakumis, 2011). In order to prevent material from eroding firm

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.