Analyzing Finance and Funding in the Travel and Tourism Sector

VerifiedAdded on 2023/04/17

|13

|4407

|184

Report

AI Summary

This report provides an in-depth analysis of finance and funding within the travel and tourism sector, focusing on Merlin Entertainment as a case study. It explores the significance of finance in business, emphasizing cost management, pricing strategies, and profit analysis. The report covers various aspects such as cost volume profit (CVP) analysis, different pricing methods including value-added, skimmed, and cost-plus pricing, and the factors influencing profitability like economic and political elements. The study also highlights the importance of financial planning and decision-making tools in enhancing business efficiency and competitiveness within the travel and tourism industry. Desklib offers a platform for students to access this and other solved assignments.

FINANCE AND FUNDING

IN TRAVEL AND TOURISM

IN TRAVEL AND TOURISM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.......................................................................................................................................3

TASK 1.......................................................................................................................................................3

1.1............................................................................................................................................................3

1.2............................................................................................................................................................4

1.3............................................................................................................................................................6

TASK 2.......................................................................................................................................................6

2.1............................................................................................................................................................6

2.2............................................................................................................................................................7

TASK 3.......................................................................................................................................................8

3.1............................................................................................................................................................8

TASK 4.....................................................................................................................................................10

4.1 Enclosed in poster............................................................................................................................10

CONCLUSION.....................................................................................................................................10

REFERENCES..........................................................................................................................................12

INTRODUCTION.......................................................................................................................................3

TASK 1.......................................................................................................................................................3

1.1............................................................................................................................................................3

1.2............................................................................................................................................................4

1.3............................................................................................................................................................6

TASK 2.......................................................................................................................................................6

2.1............................................................................................................................................................6

2.2............................................................................................................................................................7

TASK 3.......................................................................................................................................................8

3.1............................................................................................................................................................8

TASK 4.....................................................................................................................................................10

4.1 Enclosed in poster............................................................................................................................10

CONCLUSION.....................................................................................................................................10

REFERENCES..........................................................................................................................................12

INTRODUCTION

Finance is life line of every business enterprise as without which the existence of business is not

possible. Funding is that feature which involves in the business in which financial resources are

utilized by an enterprise that assists the entity in cost reduction. The efficiency of the business is

higher with the existence of stockholders and financiers who will give recognition to an entity by

uplifting their existing status. Merlin entertainment is that enterprise whose significance has been

showcase with the help of this report. The following report will give emphasis on the internal

business proceedings of this enterprise as it is related to travel and tourism operations. This

project report is all about describing various needs of the current organizations in order to collect

various kinds of financial resources as per their current business requirement. This report stresses

on different forms of investment taken up by an enterprise. The major objective of this report is

to analyze various skills, tools, knowledge that has been emerged with the help of different

management decision making tools in travel and tourism industry. It also involves various

pricing methods that can be used by the business throughout the report.

TASK 1

1.1

Business is a combination of income and expenses which are incurred in daily routine business

as the owner needs to control their expenses in order to increase the amount of the sales and the

revenues (Ward and Peppard, 2016). Different expenses involved in the business enterprise such

as operating expenses includes material expenses, use of equipments, wages and salaries and

different other expenses which may be fall in the business at particular time interval. There are

different kinds of costs involved in an enterprise which needs to be maintained by preparing

budgets and using different monitoring tools and techniques (Stewart, 2014). The costs can be of

two major categories that is fixed costs and variable costs. The fixed costs is that kind of costs

which will be not be reduces as it is jointly connected with the opening of business such as rent

of the premises and utility bills.

On the other hand variable costs are that costs which may vary according to the changes in the

production level of the business. The nil production unit may doesn’t produce any variable costs

as it is increases or decreases with the changes takes place in the activity level of production of

an entity. Various costs involved in the business of Merlin Entertainment include preliminary

costs involved in arranging funds and financial resources from the external business environment

(Mulley and Walters, 2014). It also involves various costs such as expenses involved for providing

fun and leisure activities for visitors who visits different tourists destinations, ticket booking

services by opening travel centers to facilitate all its customers, booking accommodation facility

which requires costs as the owner will collaborate with different hotels in order to provide this

kind of feature to all their customers who books tickers for various destinations.

Finance is life line of every business enterprise as without which the existence of business is not

possible. Funding is that feature which involves in the business in which financial resources are

utilized by an enterprise that assists the entity in cost reduction. The efficiency of the business is

higher with the existence of stockholders and financiers who will give recognition to an entity by

uplifting their existing status. Merlin entertainment is that enterprise whose significance has been

showcase with the help of this report. The following report will give emphasis on the internal

business proceedings of this enterprise as it is related to travel and tourism operations. This

project report is all about describing various needs of the current organizations in order to collect

various kinds of financial resources as per their current business requirement. This report stresses

on different forms of investment taken up by an enterprise. The major objective of this report is

to analyze various skills, tools, knowledge that has been emerged with the help of different

management decision making tools in travel and tourism industry. It also involves various

pricing methods that can be used by the business throughout the report.

TASK 1

1.1

Business is a combination of income and expenses which are incurred in daily routine business

as the owner needs to control their expenses in order to increase the amount of the sales and the

revenues (Ward and Peppard, 2016). Different expenses involved in the business enterprise such

as operating expenses includes material expenses, use of equipments, wages and salaries and

different other expenses which may be fall in the business at particular time interval. There are

different kinds of costs involved in an enterprise which needs to be maintained by preparing

budgets and using different monitoring tools and techniques (Stewart, 2014). The costs can be of

two major categories that is fixed costs and variable costs. The fixed costs is that kind of costs

which will be not be reduces as it is jointly connected with the opening of business such as rent

of the premises and utility bills.

On the other hand variable costs are that costs which may vary according to the changes in the

production level of the business. The nil production unit may doesn’t produce any variable costs

as it is increases or decreases with the changes takes place in the activity level of production of

an entity. Various costs involved in the business of Merlin Entertainment include preliminary

costs involved in arranging funds and financial resources from the external business environment

(Mulley and Walters, 2014). It also involves various costs such as expenses involved for providing

fun and leisure activities for visitors who visits different tourists destinations, ticket booking

services by opening travel centers to facilitate all its customers, booking accommodation facility

which requires costs as the owner will collaborate with different hotels in order to provide this

kind of feature to all their customers who books tickers for various destinations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The costs should be reviewed and revised periodically in order to attract wide number of

customers as the higher prices will de-motivated various customers and hence reduces the level

of sales and the revenue (Kaplan and Atkinson, 2015). Another perspective involve in revision of

costs is that all the changes are taken into considerations in the price of tickets which includes

increasing fares of flights, increase in the cost of visa services, higher taxation burden such as

service tax, excise duty and value added tax. It helps an enterprise in determining the financial

position by identifying the actual proportion among the income and expense ratio. This ratio

assists an entity in order to increase their overall profitability by collecting income from several

kinds of sources.

This enterprise will also use various techniques that are cost volume profit analysis technique

which is concerned with an entity in order to firm relationship between cost and sales of the firm.

The importance of CVP analysis which is beneficial for an entity for operating in this fast

growing and emerged industry that is travel and tourism sector which are given as below:

It helps Merlin enterprise in assessing their costs as the burden of fixed costs on the

business will suppress the existing business conditions (WisCombe, 2016). CVP used to

forecast the future sales and specific percentage of sales and also identify that amount of

sales level at which the entity will not earn profit nor loss just top cover their basic costs

involved in the business entity.

It helps to provide different sales mix which facilities variety of customers as wide

variety of products or services. It also used to carry out analysis in which variety of

activities are conducted by Merlin entertainment plc, such as recruitment of new staff,

buying or selling of existing assets, leasing new machines in order to reduce costs to a

greater extent.

It assists management to consider all its potential expenses even in the form of small

categories to the higher range of expenses (Stewart, 2014). It includes various expenses

such as maintenance of premises, fuel costs and oiling of the machines to operate the

machines without any kind of stoppage which allows an entity to increase their overall

productivity which in turn increase the sales and revenue of the entity in order to earn

higher amount of profit.

The basic thing involved in this technique is that it gives emphasis on the division of

costs in tow major categories such as fixed and variable costs (Ward and Peppard, 2016).

This division of cost is essential for the business as the future action of an entity will be

totally based on the division criteria utilized by the business enterprise.

1.2

Integral part of every business is price element which is essential for Merlin entertainment plc

which is operating in the business which deals in different variety of services related to the travel

and tourism (Mulley and Walters, 2014). Price is that attribute of an organization which able to

attract wide number of customers by framing their prices as per the budget and income capability

of an entity. It play crucial role in the current organization as it aids in determining the initial

customers as the higher prices will de-motivated various customers and hence reduces the level

of sales and the revenue (Kaplan and Atkinson, 2015). Another perspective involve in revision of

costs is that all the changes are taken into considerations in the price of tickets which includes

increasing fares of flights, increase in the cost of visa services, higher taxation burden such as

service tax, excise duty and value added tax. It helps an enterprise in determining the financial

position by identifying the actual proportion among the income and expense ratio. This ratio

assists an entity in order to increase their overall profitability by collecting income from several

kinds of sources.

This enterprise will also use various techniques that are cost volume profit analysis technique

which is concerned with an entity in order to firm relationship between cost and sales of the firm.

The importance of CVP analysis which is beneficial for an entity for operating in this fast

growing and emerged industry that is travel and tourism sector which are given as below:

It helps Merlin enterprise in assessing their costs as the burden of fixed costs on the

business will suppress the existing business conditions (WisCombe, 2016). CVP used to

forecast the future sales and specific percentage of sales and also identify that amount of

sales level at which the entity will not earn profit nor loss just top cover their basic costs

involved in the business entity.

It helps to provide different sales mix which facilities variety of customers as wide

variety of products or services. It also used to carry out analysis in which variety of

activities are conducted by Merlin entertainment plc, such as recruitment of new staff,

buying or selling of existing assets, leasing new machines in order to reduce costs to a

greater extent.

It assists management to consider all its potential expenses even in the form of small

categories to the higher range of expenses (Stewart, 2014). It includes various expenses

such as maintenance of premises, fuel costs and oiling of the machines to operate the

machines without any kind of stoppage which allows an entity to increase their overall

productivity which in turn increase the sales and revenue of the entity in order to earn

higher amount of profit.

The basic thing involved in this technique is that it gives emphasis on the division of

costs in tow major categories such as fixed and variable costs (Ward and Peppard, 2016).

This division of cost is essential for the business as the future action of an entity will be

totally based on the division criteria utilized by the business enterprise.

1.2

Integral part of every business is price element which is essential for Merlin entertainment plc

which is operating in the business which deals in different variety of services related to the travel

and tourism (Mulley and Walters, 2014). Price is that attribute of an organization which able to

attract wide number of customers by framing their prices as per the budget and income capability

of an entity. It play crucial role in the current organization as it aids in determining the initial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

costs that is the basic costs involved in the business of an entity which can be covered by

generating higher sales. Different pricing strategies adopted by an enterprise will help an

enterprise in order to gain competitive advantage over its rivals which creates several threats and

tough business situation in order to maintain the existence of an enterprise which are given as

below:

Value added pricing- It is that pricing strategy which is commonly used by an enterprise in

order to gain higher level of customer satisfaction as their main motive is to catch the interest of

several kind of customers (Stewart, 2014). This form of pricing strategy in which states and

preferences of buyers given higher priority as they are rational action who make several

decisions regarding quality of services offered by the enterprise to various number of customers

with a clear cut approach to gain popularity among wide set of customers. This popularity among

customers will be able to generate higher amount of sales (WisCombe, 2016). Merlin

entertainment can utilize this efficient technique as selling travel related services require much

patience as the expensive services will not be purchased by the customers easily as it involves

various kinds of risks related to flights. Tourists attractions of the famous tourist destinations

such as LEGO-LAND and other theme parks based on the resort which provides refreshment

services to all the visitors is an attractive feature that can be adopted by this enterprise in order to

attract wide number of customers.

Skimmed pricing- In this particular sector that is travel and tourism where all the expensive

services will be not easily taken up by the business due to its expensiveness the initial business

owner will adopt this strategy. It is strategy which will catches interest of wide number of

peoples as there is less profit margin as the main focus of the owner is attracting different set of

customers with less cost and various benefits in form of cash backs, free and complimentary

services (Stewart, 2014). It is also regarded as discounted pricing technique in which all the

services are offered to all the customers in discounted prices to lute different kinds of clients

towards he efficient quality of the business. The enterprise will able to create loyalty among

customers and all the existing customers will do mouth publicity that reduces marketing cost for

the business for greater extent.

Cost plus pricing- It is commonly used technique in used by an organization in which all the

costs are covered in the pricing of tour packages offered by tour operators with determined

percentage of profit included in the price (Mulley and Walters, 2014). It will cover two basic kinds

of costs such as all fixed and variable costs with specific percentage of profit as their main

motive is to earn profit. The owner help responsible for uplifting their company with a clear

goals and objective is to maximize the wealth of all the shareholders for whom business held

responsible (Stewart, 2014). It is that strategy which is best suitable strategy for an enterprise

which is best suitable technique which can be used in this travel and tourism and the owner can

earn amount of profit by producing higher level of sales and the revenue.

generating higher sales. Different pricing strategies adopted by an enterprise will help an

enterprise in order to gain competitive advantage over its rivals which creates several threats and

tough business situation in order to maintain the existence of an enterprise which are given as

below:

Value added pricing- It is that pricing strategy which is commonly used by an enterprise in

order to gain higher level of customer satisfaction as their main motive is to catch the interest of

several kind of customers (Stewart, 2014). This form of pricing strategy in which states and

preferences of buyers given higher priority as they are rational action who make several

decisions regarding quality of services offered by the enterprise to various number of customers

with a clear cut approach to gain popularity among wide set of customers. This popularity among

customers will be able to generate higher amount of sales (WisCombe, 2016). Merlin

entertainment can utilize this efficient technique as selling travel related services require much

patience as the expensive services will not be purchased by the customers easily as it involves

various kinds of risks related to flights. Tourists attractions of the famous tourist destinations

such as LEGO-LAND and other theme parks based on the resort which provides refreshment

services to all the visitors is an attractive feature that can be adopted by this enterprise in order to

attract wide number of customers.

Skimmed pricing- In this particular sector that is travel and tourism where all the expensive

services will be not easily taken up by the business due to its expensiveness the initial business

owner will adopt this strategy. It is strategy which will catches interest of wide number of

peoples as there is less profit margin as the main focus of the owner is attracting different set of

customers with less cost and various benefits in form of cash backs, free and complimentary

services (Stewart, 2014). It is also regarded as discounted pricing technique in which all the

services are offered to all the customers in discounted prices to lute different kinds of clients

towards he efficient quality of the business. The enterprise will able to create loyalty among

customers and all the existing customers will do mouth publicity that reduces marketing cost for

the business for greater extent.

Cost plus pricing- It is commonly used technique in used by an organization in which all the

costs are covered in the pricing of tour packages offered by tour operators with determined

percentage of profit included in the price (Mulley and Walters, 2014). It will cover two basic kinds

of costs such as all fixed and variable costs with specific percentage of profit as their main

motive is to earn profit. The owner help responsible for uplifting their company with a clear

goals and objective is to maximize the wealth of all the shareholders for whom business held

responsible (Stewart, 2014). It is that strategy which is best suitable strategy for an enterprise

which is best suitable technique which can be used in this travel and tourism and the owner can

earn amount of profit by producing higher level of sales and the revenue.

1.3

Profit is the final outcome after meeting all kind of expenses that involves in operating of

business from the revenue generated by the owner (Inderst, 2013). It is those things which every

business will make efforts in order to earn this much of amount as their main aim is o earn higher

profit by boosting their level of sales and revenue. Higher sales doesn’t mean to be in higher

profit as the expenses also play a significant role as higher the expenses lower will be its profit

and vice-versa . It can also be said that revenue generated by an enterprise by providing their

precious services with quality oriented approach used by the enterprise. The service is important

in travel and tourism industry by offering good quality services and earn high amount of profit.

The management is concern with reducing costs in order to increase the level of profit (Hanna,

2014). It also plays crucial role play in determination of selling price of goods and services as

their main aim is to identify all the factors that affect an entity in the different situations in order

to increase the profit level by providing wide range of services to facilitate all the customers.

There are various factors which help marlin entertainment in order to determine the price of

goods and services which are given as below:

Economic factors- Inflation and recession are the main dangerous things involved in economical

factors of the economy which may boost or reduces the standard of living or financial status of

the economy (Hanna, 2014). The stability of the economy will helps an entity in inducing their

sales level which is far more important thing for an entity. The increasing business complexities

in the external business environment troubles the survival of an entity will get impossible which

creates depression and financial stress which increases the variable cost (Inderst, 2013). In this

sector people will spend less in different activities such as travel bookings, entertainment

services such as exploring theme parks such as LEGOLAND, luxurious products and many more

services as per the availability and dependability of customers as per their tastes and preferences.

Political factors- It also involves different political factors such as government and its

authorities which intervenes in the price determination as the taxation will be incorporated in the

prices which will increases the prices and by providing services at low prices the business will

required to decrease their profit as higher prices will not entertain different set of customers

quality and price are the main elements which every customer looks as primary component in the

determination of prices.

TASK 2

2.1

The major concern of management accountant is to reduce the costs as the specialized function

of managements is to reduce all their expenses to a greater extent in order to avoid all kinds of

problems that may arise in the path of business in form of challenges (WisCombe, 2016). These

challenges can be of any shape such as uncertain future expenses, heavy burden of taxation,

Profit is the final outcome after meeting all kind of expenses that involves in operating of

business from the revenue generated by the owner (Inderst, 2013). It is those things which every

business will make efforts in order to earn this much of amount as their main aim is o earn higher

profit by boosting their level of sales and revenue. Higher sales doesn’t mean to be in higher

profit as the expenses also play a significant role as higher the expenses lower will be its profit

and vice-versa . It can also be said that revenue generated by an enterprise by providing their

precious services with quality oriented approach used by the enterprise. The service is important

in travel and tourism industry by offering good quality services and earn high amount of profit.

The management is concern with reducing costs in order to increase the level of profit (Hanna,

2014). It also plays crucial role play in determination of selling price of goods and services as

their main aim is to identify all the factors that affect an entity in the different situations in order

to increase the profit level by providing wide range of services to facilitate all the customers.

There are various factors which help marlin entertainment in order to determine the price of

goods and services which are given as below:

Economic factors- Inflation and recession are the main dangerous things involved in economical

factors of the economy which may boost or reduces the standard of living or financial status of

the economy (Hanna, 2014). The stability of the economy will helps an entity in inducing their

sales level which is far more important thing for an entity. The increasing business complexities

in the external business environment troubles the survival of an entity will get impossible which

creates depression and financial stress which increases the variable cost (Inderst, 2013). In this

sector people will spend less in different activities such as travel bookings, entertainment

services such as exploring theme parks such as LEGOLAND, luxurious products and many more

services as per the availability and dependability of customers as per their tastes and preferences.

Political factors- It also involves different political factors such as government and its

authorities which intervenes in the price determination as the taxation will be incorporated in the

prices which will increases the prices and by providing services at low prices the business will

required to decrease their profit as higher prices will not entertain different set of customers

quality and price are the main elements which every customer looks as primary component in the

determination of prices.

TASK 2

2.1

The major concern of management accountant is to reduce the costs as the specialized function

of managements is to reduce all their expenses to a greater extent in order to avoid all kinds of

problems that may arise in the path of business in form of challenges (WisCombe, 2016). These

challenges can be of any shape such as uncertain future expenses, heavy burden of taxation,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

merger and acquisition costs involves in the business. Increasing cost of goods sold includes cost

of purchases, salaries and wages costs increases due to high staff turnover. Identifying a different

costs center which helps in reducing costs by analyzing their impact on a business in order to

increase the profitability of the business (Stewart, 2014). All the accounting records and financial

records are prepared to ascertain the affect the increasing costs as the future of an entity has been

determine by identifying the future impact of these kinds of costs. There are various kinds of

management accounting information which will be helpful for an enterprise which are given as

below:

Ascertainment of costs- Cost plays a significant role in an entity as the determination of costs

will help an enterprise owner in order to determine the price of products as the cost element will

be involved in the price of products (Inderst, 2013). The costs has also further divided as per their

nature, element, relevancy and controllability in order to bifurcate the total costs into various

categories which assist an entity in order to include or exclude their different costs by prioritizing

the costs.

Budgeting- After analyzing and determining the costs takes place in an enterprise another tool

which also commonly used by management in planning their current as well as future expenses

and incomes by preparing budgets. The budgets are that weapon used in the business which is

also regarded as one of the controlling tool which has utilized in the business for planning. There

various kinds of budgets prepared in an enterprise such as cash, material, operating, sales and

expenses budget (Kaplan and Atkinson, 2015). Different aspects of the business majorly

categorized in income and expenses basis in which the favorable balances generated from these

budgets will helps an entity in return to showcases their ability to deal complex business

situations.

2.2

Management takes several steps in order to move ahead in the business as their main aim is to

reduce the costs which further help an entity in order to form business decisions. The accounting

information is also helpful for an entity in decision making as one of the important decision

making tool (Inderst, 2013.). Forming business decision are also one of the vital part of the

business concern as it involves accepting or rejecting a business project on the basis of the

information which will assist an entity to gain competitive advantage over its competitors which

are given as below:

Market trends- The travel and tourism business is that business which will directly affect by the

external market changes in form of market trends and styles that may affect the business

performance (Hanna, 2014). The globalization is that approach which enhances the scope of an

entity in terms of expanding their services by increases its various services and getting brand

recognition and image.

of purchases, salaries and wages costs increases due to high staff turnover. Identifying a different

costs center which helps in reducing costs by analyzing their impact on a business in order to

increase the profitability of the business (Stewart, 2014). All the accounting records and financial

records are prepared to ascertain the affect the increasing costs as the future of an entity has been

determine by identifying the future impact of these kinds of costs. There are various kinds of

management accounting information which will be helpful for an enterprise which are given as

below:

Ascertainment of costs- Cost plays a significant role in an entity as the determination of costs

will help an enterprise owner in order to determine the price of products as the cost element will

be involved in the price of products (Inderst, 2013). The costs has also further divided as per their

nature, element, relevancy and controllability in order to bifurcate the total costs into various

categories which assist an entity in order to include or exclude their different costs by prioritizing

the costs.

Budgeting- After analyzing and determining the costs takes place in an enterprise another tool

which also commonly used by management in planning their current as well as future expenses

and incomes by preparing budgets. The budgets are that weapon used in the business which is

also regarded as one of the controlling tool which has utilized in the business for planning. There

various kinds of budgets prepared in an enterprise such as cash, material, operating, sales and

expenses budget (Kaplan and Atkinson, 2015). Different aspects of the business majorly

categorized in income and expenses basis in which the favorable balances generated from these

budgets will helps an entity in return to showcases their ability to deal complex business

situations.

2.2

Management takes several steps in order to move ahead in the business as their main aim is to

reduce the costs which further help an entity in order to form business decisions. The accounting

information is also helpful for an entity in decision making as one of the important decision

making tool (Inderst, 2013.). Forming business decision are also one of the vital part of the

business concern as it involves accepting or rejecting a business project on the basis of the

information which will assist an entity to gain competitive advantage over its competitors which

are given as below:

Market trends- The travel and tourism business is that business which will directly affect by the

external market changes in form of market trends and styles that may affect the business

performance (Hanna, 2014). The globalization is that approach which enhances the scope of an

entity in terms of expanding their services by increases its various services and getting brand

recognition and image.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Forecasting- It is also terms as one of the predictive tool that uses business analytics in form of

statistical tools applied to assess the currents facts and figures of the business in order to forecast

the future efficiency (DRURY, 2013). It can be done by preparing budgets that uses different

components of the business such as cash and other expenses to strengthen the business position

by increasing their goals by meeting desired outcomes in period.

Capital budgeting- different tools of capital budgeting is also used to assess the viability of the

project in form of investing in the proposal or rejecting the project by applying various

techniques (Figge and Hahn, 2013). It involves various techniques like payback period, net present

value, and internal rate of return and also involves average rate of return which helps

management in order to accept or reject the proposal.

TASK 3

3.1

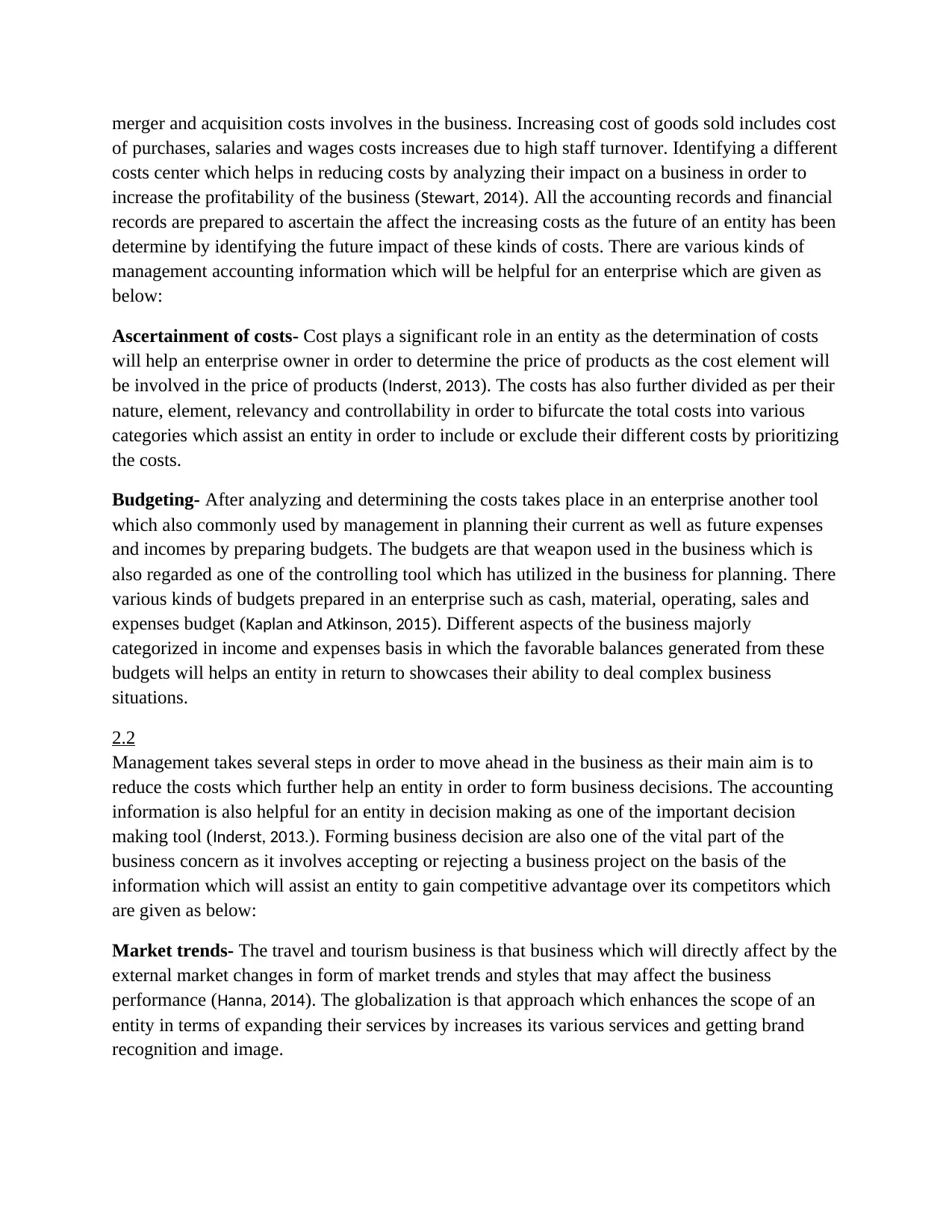

Ratio analysis is that technique which helps an enterprise in order to ascertain the financial

performance of the business as their main motive is to beat all the customers by strengthening

their financial conditions (Bhowmik and Saha, 2013). There are several ratios that reflect the

business in efficiency in two standard forms that is internal and external to assess the burden

created by other rivals exists in the business environment. The financial status of Restaurant

group plc has been evaluated and assessed by analyzing their internal business operations which

are reflected with the help of various ratios which are given as below:

Financial Ratios Formulas 2015 2014

Liquidity Ratios

Current Ratio Current Asset / Current Liabilities 0.28 0.24

Quick Ratio (Current asset – closing

inventory)/Current Liabilities

0.12 0.08

Profitability Ratios

Gross Profit Ratio (Gross Profit/ Net Sales)*100 18.51 17.93

Net Profit Ratio (Net Profit/ Net sales)*100 10.05 10.55

Operating Profit Ratio (Operating profit/ Net sales)*100 12.97 13.75

Gearing Ratios

Debt Equity Ratios Debt/ Equity 0.12 0.17

statistical tools applied to assess the currents facts and figures of the business in order to forecast

the future efficiency (DRURY, 2013). It can be done by preparing budgets that uses different

components of the business such as cash and other expenses to strengthen the business position

by increasing their goals by meeting desired outcomes in period.

Capital budgeting- different tools of capital budgeting is also used to assess the viability of the

project in form of investing in the proposal or rejecting the project by applying various

techniques (Figge and Hahn, 2013). It involves various techniques like payback period, net present

value, and internal rate of return and also involves average rate of return which helps

management in order to accept or reject the proposal.

TASK 3

3.1

Ratio analysis is that technique which helps an enterprise in order to ascertain the financial

performance of the business as their main motive is to beat all the customers by strengthening

their financial conditions (Bhowmik and Saha, 2013). There are several ratios that reflect the

business in efficiency in two standard forms that is internal and external to assess the burden

created by other rivals exists in the business environment. The financial status of Restaurant

group plc has been evaluated and assessed by analyzing their internal business operations which

are reflected with the help of various ratios which are given as below:

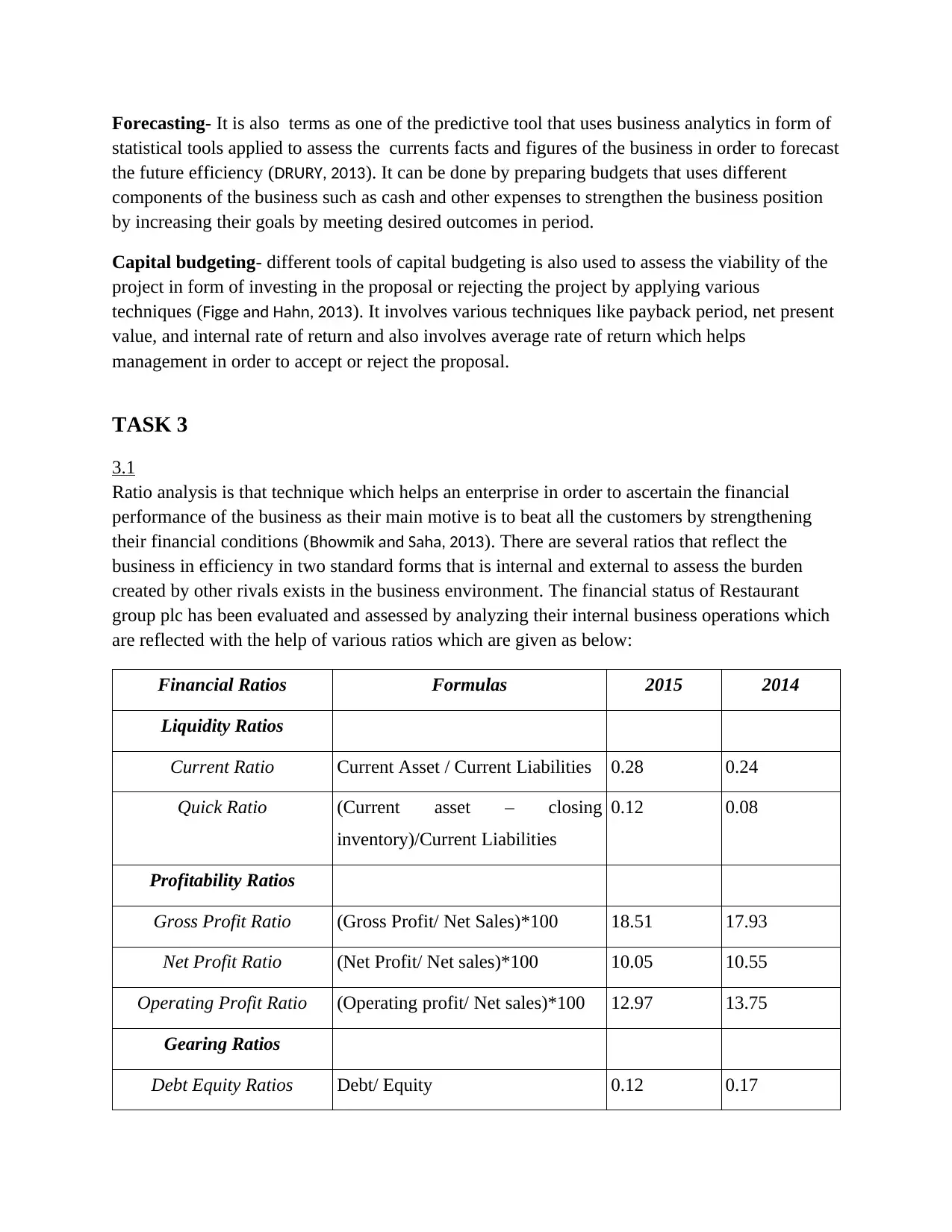

Financial Ratios Formulas 2015 2014

Liquidity Ratios

Current Ratio Current Asset / Current Liabilities 0.28 0.24

Quick Ratio (Current asset – closing

inventory)/Current Liabilities

0.12 0.08

Profitability Ratios

Gross Profit Ratio (Gross Profit/ Net Sales)*100 18.51 17.93

Net Profit Ratio (Net Profit/ Net sales)*100 10.05 10.55

Operating Profit Ratio (Operating profit/ Net sales)*100 12.97 13.75

Gearing Ratios

Debt Equity Ratios Debt/ Equity 0.12 0.17

Total asset Turnover ratio Net sales/ total assets 1.54 1.54

Inventory turnover ratio COGS/ inventory 93.71 98.22

Liquidity ratios- It is one of the category used in ratio analysis as one of the tool used I the

business to evaluate their business efficiency by assessing current assets and current liabilities by

identifying their existing proportion in the entity. It helps to calculate the available balance held

by an enterprise in order to meet all the short term obligations occur in form of current liabilities

in the business (Figge and Hahn, 2013). There are certain sub parts of this main heading are also

helped an enterprise by assessing their own weakness or strengths in relation to the specific

factors are given as below:

Current ratio- It is that ratio which is essential part of the liquidity ratio in which the

current assets are evaluated that it is sufficient to meet all the current liabilities sands also

contributes in the business by maintaining available cash balance in the organization

(Bhowmik and Saha, 2013). In the above table, the ratio has increases from 2014 to 2015

due to gather decease in the amounts of current liabilities held by an enterprise.

Quick ratio- It is that ratio which assess the efficiency of an entity of the current assets

without involving closing stock in the amount of current assets. The efficiency of an

entity has been increased from previous year but doesn’t show significant efforts made by

the business in order to increase or decrease the ratio (Ahrendsen and Katchova, 2012). In

the given case, the quick ratio of the restaurant group plc has increases its quick ratio that

shows the efficient of current asset without inclusion of closing stock.

Profitability- The main of every enterprise is to earn profit by generating more sales and the

revenue (Abbasi, 2014). There are two main ratios that helps a entity in order to ascertain there

profitability by analyzing two kind of profit before tax and one is after tax, There are common

part of this kind of ratios which are given as below:

GP ratio- It is usually found in every enterprise as the GP I that raw profit generated by

an organization after deducting cost of sales from the sales figure. It is one of the

components of profit and loss statement (DRURY, 2013). The GP ratio has increases from

previous which shows firm’s ability in generating higher level of sales and the revenue

and at the same time it also depicts that the cost of goods sold also gets reduces.

Net profit – It is regarded as complete profit which is widely used every entity in

ascertaining their profitability of a particular year as it also states in the annual reports

generated by the enterprise and circulated to different shareholders in order to convey

efficient and transparent business conditions of the entity. It is commonly used ratio as it

involves tax implications on the profit generated by an enterprise (Inderst, 2013). Tax will

be deducted from the gross profit amount generated after excluding cost of sales from the

Inventory turnover ratio COGS/ inventory 93.71 98.22

Liquidity ratios- It is one of the category used in ratio analysis as one of the tool used I the

business to evaluate their business efficiency by assessing current assets and current liabilities by

identifying their existing proportion in the entity. It helps to calculate the available balance held

by an enterprise in order to meet all the short term obligations occur in form of current liabilities

in the business (Figge and Hahn, 2013). There are certain sub parts of this main heading are also

helped an enterprise by assessing their own weakness or strengths in relation to the specific

factors are given as below:

Current ratio- It is that ratio which is essential part of the liquidity ratio in which the

current assets are evaluated that it is sufficient to meet all the current liabilities sands also

contributes in the business by maintaining available cash balance in the organization

(Bhowmik and Saha, 2013). In the above table, the ratio has increases from 2014 to 2015

due to gather decease in the amounts of current liabilities held by an enterprise.

Quick ratio- It is that ratio which assess the efficiency of an entity of the current assets

without involving closing stock in the amount of current assets. The efficiency of an

entity has been increased from previous year but doesn’t show significant efforts made by

the business in order to increase or decrease the ratio (Ahrendsen and Katchova, 2012). In

the given case, the quick ratio of the restaurant group plc has increases its quick ratio that

shows the efficient of current asset without inclusion of closing stock.

Profitability- The main of every enterprise is to earn profit by generating more sales and the

revenue (Abbasi, 2014). There are two main ratios that helps a entity in order to ascertain there

profitability by analyzing two kind of profit before tax and one is after tax, There are common

part of this kind of ratios which are given as below:

GP ratio- It is usually found in every enterprise as the GP I that raw profit generated by

an organization after deducting cost of sales from the sales figure. It is one of the

components of profit and loss statement (DRURY, 2013). The GP ratio has increases from

previous which shows firm’s ability in generating higher level of sales and the revenue

and at the same time it also depicts that the cost of goods sold also gets reduces.

Net profit – It is regarded as complete profit which is widely used every entity in

ascertaining their profitability of a particular year as it also states in the annual reports

generated by the enterprise and circulated to different shareholders in order to convey

efficient and transparent business conditions of the entity. It is commonly used ratio as it

involves tax implications on the profit generated by an enterprise (Inderst, 2013). Tax will

be deducted from the gross profit amount generated after excluding cost of sales from the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

net sales. This ratio has decreases from its earlier years as this shows heavy tax burden on

enterprise which reduces its overall net profit.

Operating profit- It is another most important element forms part of profit and loss

statement as it is that profit which is generated after deducting all kind of operating costs

from the figure of net sales. It has produced after deducting cost of sales from the sales

and further excluding selling and distribution and administration expenses from GP then

operating profit arrived (Hanna, 2014). Operating ratio has declined from previous year

which totally denotes the negligence of an enterprise in order to increase the burden on

their overall business by increasing their operating expenses in proportion to the sales

generated by an entity.

Gearing ratios- It is that ratios which help to find out the relationships between capital and asset

held by an entity which is further discussed by the business.

Debt equity ratio- this ratio helps to find out the perfect alignment among these two

components which is widely used as alone or in combination (Kroenke and Boyle, 2015).

This ratio helps to find out the proportion among debt and equity held by an entity. The

debt shows burden and on the contrary to it equity shows ability of the firm by increasing

their strength. The financial performance of an entity has declining from previous years

as the debt component in form of debentures or bank loan is higher which dominates the

firm’s ability in order to create a larger impact on their overall performance.

Assert turnover- It shows the contribution of assets in generating higher amount of the

sales and revenue (Mulley and Walters, 2014). The proportion between the net sales in

relation the total number of sales produces by an entity will have significant importance

or not has been explained with the help of this kind of ratio. The constant ratio shows

careless attitude adopted by the entity in order creates significant positive changes in the

ratios.

Inventory turnover- It is that kind o ratio which helps an entity in order to ascertain

their business efficiency by analyzing the major part of the organization that is the

inventory (WisCombe, 2016). The declining ratio shows that cost of goods sold increases

as compared to the inventory held by an enterprise creates bi significant changes in

uplifting and fostering their current and existing working conditions.

TASK 4

4.1 Enclosed in poster

CONCLUSION

It can be summarized from the above project report that financial resources and there is funding

is essential aspect of a enterprise as an enterprise’s current working conditions will be improved

by following various kinds of standards and measures. Merlin entertainment that provides their

enterprise which reduces its overall net profit.

Operating profit- It is another most important element forms part of profit and loss

statement as it is that profit which is generated after deducting all kind of operating costs

from the figure of net sales. It has produced after deducting cost of sales from the sales

and further excluding selling and distribution and administration expenses from GP then

operating profit arrived (Hanna, 2014). Operating ratio has declined from previous year

which totally denotes the negligence of an enterprise in order to increase the burden on

their overall business by increasing their operating expenses in proportion to the sales

generated by an entity.

Gearing ratios- It is that ratios which help to find out the relationships between capital and asset

held by an entity which is further discussed by the business.

Debt equity ratio- this ratio helps to find out the perfect alignment among these two

components which is widely used as alone or in combination (Kroenke and Boyle, 2015).

This ratio helps to find out the proportion among debt and equity held by an entity. The

debt shows burden and on the contrary to it equity shows ability of the firm by increasing

their strength. The financial performance of an entity has declining from previous years

as the debt component in form of debentures or bank loan is higher which dominates the

firm’s ability in order to create a larger impact on their overall performance.

Assert turnover- It shows the contribution of assets in generating higher amount of the

sales and revenue (Mulley and Walters, 2014). The proportion between the net sales in

relation the total number of sales produces by an entity will have significant importance

or not has been explained with the help of this kind of ratio. The constant ratio shows

careless attitude adopted by the entity in order creates significant positive changes in the

ratios.

Inventory turnover- It is that kind o ratio which helps an entity in order to ascertain

their business efficiency by analyzing the major part of the organization that is the

inventory (WisCombe, 2016). The declining ratio shows that cost of goods sold increases

as compared to the inventory held by an enterprise creates bi significant changes in

uplifting and fostering their current and existing working conditions.

TASK 4

4.1 Enclosed in poster

CONCLUSION

It can be summarized from the above project report that financial resources and there is funding

is essential aspect of a enterprise as an enterprise’s current working conditions will be improved

by following various kinds of standards and measures. Merlin entertainment that provides their

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

extended services which includes entertainment services and majorly includes travel and tourism

services in these sectors will bring lots of opportunities whole using wide range of sources in

order to attract different kinds of customers. The above report also stresses on the cost element in

contrast with the impact on the profit component which helps to increase the profitability of an

enterprise. This report has also focused on various aspects which an enterprise owner needs to

give emphasize in order control its costs. The major concern of management accountant is to

maintain coordination among the enterprise by maintaining discipline and peaceful working

environment. Ratio analysis has also used as one of the comparative analysis tool that helps an

enterprise in order to assess it business efficiency by judging current ability in comparison with

the previous figures in the category of different aspects of the business such as profitability,

liquidity, financial health and gearing ratios that assess all the components of the balance sheet.

services in these sectors will bring lots of opportunities whole using wide range of sources in

order to attract different kinds of customers. The above report also stresses on the cost element in

contrast with the impact on the profit component which helps to increase the profitability of an

enterprise. This report has also focused on various aspects which an enterprise owner needs to

give emphasize in order control its costs. The major concern of management accountant is to

maintain coordination among the enterprise by maintaining discipline and peaceful working

environment. Ratio analysis has also used as one of the comparative analysis tool that helps an

enterprise in order to assess it business efficiency by judging current ability in comparison with

the previous figures in the category of different aspects of the business such as profitability,

liquidity, financial health and gearing ratios that assess all the components of the balance sheet.

REFERENCES

Books and journals

Abbasi, H., 2014. Role of Management Accounting Information System in Organizations.

Journal of Business and Technovation. 2(1). pp.96-102.

Ahrendsen, B. L. and Katchova, A. L., 2012. Financial ratio analysis using ARMS data.

Agricultural Finance Review. 72(2). pp.262-272.

Bhowmik, S. K. and Saha, D., 2013. Sources of Finance. In Financial Inclusion of the

Marginalised (pp. 61-71). Springer India.

Brigham, E. F. and Ehrhardt, M. C., 2013. Financial management: Theory & practice. Cengage

Learning.

Dollery, B. E., Kortt, M. A. and Grant, B. J., 2013. Funding the Future: Financial sustainability

and infrastructure finance in Australian Local Government.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Figge, F. and Hahn, T., 2013. Value drivers of corporate eco-efficiency: Management accounting

information for the efficient use of environmental resources. Management Accounting

Research. 24(4). pp.387-400.

Galliers, R. D. and Leidner, D. E., 2014. Strategic information management: challenges and

strategies in managing information systems. Routledge.

Hanna, R. W., 2014. The adoption of performance funding in higher education: A combination

of public policy, finance and politics.

Inderst, G., 2013. Private infrastructure finance and investment in Europe.

Ismail, N. A. and King, M., 2014. Factors influencing the alignment of accounting information

systems in small and medium sized Malaysian manufacturing firms. Journal of

Information Systems and Small Business. 1(1-2). pp.1-20.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Kroenke, D. M. and Boyle, R. J., 2015. Using Mis. Prentice Hall Press.

Mulley, C. and Walters, J., 2014. Workshop 7 Report: Innovative finance for innovative public

transport. Research in Transportation Economics. 48. pp.389-392.

Norris, P. and van Es, A. A., 2016. The Lessons for Political Finance Reform.Checkbook

Elections?: Political Finance in Comparative Perspective. pp.257.

Stewart, B., 2014. Sport funding and finance. Routledge.

Ward, J. and Peppard, J., 2016. The Strategic Management of Information Systems: Building a

Digital Strategy. John Wiley & Sons.

WisCombe, C. and et.al., 2016. Finance and funding in the travel sector. Operations

Management in the Travel Industry. pp.154.

Online

Books and journals

Abbasi, H., 2014. Role of Management Accounting Information System in Organizations.

Journal of Business and Technovation. 2(1). pp.96-102.

Ahrendsen, B. L. and Katchova, A. L., 2012. Financial ratio analysis using ARMS data.

Agricultural Finance Review. 72(2). pp.262-272.

Bhowmik, S. K. and Saha, D., 2013. Sources of Finance. In Financial Inclusion of the

Marginalised (pp. 61-71). Springer India.

Brigham, E. F. and Ehrhardt, M. C., 2013. Financial management: Theory & practice. Cengage

Learning.

Dollery, B. E., Kortt, M. A. and Grant, B. J., 2013. Funding the Future: Financial sustainability

and infrastructure finance in Australian Local Government.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Figge, F. and Hahn, T., 2013. Value drivers of corporate eco-efficiency: Management accounting

information for the efficient use of environmental resources. Management Accounting

Research. 24(4). pp.387-400.

Galliers, R. D. and Leidner, D. E., 2014. Strategic information management: challenges and

strategies in managing information systems. Routledge.

Hanna, R. W., 2014. The adoption of performance funding in higher education: A combination

of public policy, finance and politics.

Inderst, G., 2013. Private infrastructure finance and investment in Europe.

Ismail, N. A. and King, M., 2014. Factors influencing the alignment of accounting information

systems in small and medium sized Malaysian manufacturing firms. Journal of

Information Systems and Small Business. 1(1-2). pp.1-20.

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Kroenke, D. M. and Boyle, R. J., 2015. Using Mis. Prentice Hall Press.

Mulley, C. and Walters, J., 2014. Workshop 7 Report: Innovative finance for innovative public

transport. Research in Transportation Economics. 48. pp.389-392.

Norris, P. and van Es, A. A., 2016. The Lessons for Political Finance Reform.Checkbook

Elections?: Political Finance in Comparative Perspective. pp.257.

Stewart, B., 2014. Sport funding and finance. Routledge.

Ward, J. and Peppard, J., 2016. The Strategic Management of Information Systems: Building a

Digital Strategy. John Wiley & Sons.

WisCombe, C. and et.al., 2016. Finance and funding in the travel sector. Operations

Management in the Travel Industry. pp.154.

Online

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.