Finance 12 Assignment: Future Value, Investments and Annuities

VerifiedAdded on 2020/04/01

|14

|1515

|117

Homework Assignment

AI Summary

This finance assignment delves into various aspects of financial calculations and investment strategies. The solution begins with future value calculations, exploring different compounding frequencies, including annual, monthly, and continuous compounding. It then addresses annuity calculations, determining the required annual deposits to reach a financial goal, both as an ordinary annuity and as a lump sum. The assignment further analyzes term deposits, comparing the returns of different interest rates and compounding periods, along with after-tax interest calculations. Finally, it examines retirement planning, calculating the required annual percentage rate and time needed to accumulate a specific amount, considering different deposit scenarios and compounding methods. The assignment uses formulas and calculations to provide a comprehensive understanding of financial concepts. The references are also mentioned at the end of the assignment.

Running head: FINANCE 1

Finance

Name:

Institution:

Date:

Finance

Name:

Institution:

Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 2

Question 1

Future value calculations if the payments are made at the end of the year with annual

compounding

FV = P * {(1+R)^N) - 1) / R}

FV= 1000(1+10%) ^5)- 1/ 0.1

FV= $ 1000(1.1^ 5)-1/0.1

= $ 1000( 1.6105-1 )/ 0.1

= $ 1000 ( 0.6105) / 0.1

= $ 610.5 /0.1

= $ 6105

(b) Future value calculation if investment is done each

FV= P * ( 1+R) ^ N) -1 / R

1st Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

Question 1

Future value calculations if the payments are made at the end of the year with annual

compounding

FV = P * {(1+R)^N) - 1) / R}

FV= 1000(1+10%) ^5)- 1/ 0.1

FV= $ 1000(1.1^ 5)-1/0.1

= $ 1000( 1.6105-1 )/ 0.1

= $ 1000 ( 0.6105) / 0.1

= $ 610.5 /0.1

= $ 6105

(b) Future value calculation if investment is done each

FV= P * ( 1+R) ^ N) -1 / R

1st Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

FINANCE 3

= $1000

2nd year FV = $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

3RD Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

4TH Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

5th Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

After 5 years compound=( P +1000*5)

= $1000

2nd year FV = $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

3RD Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

4TH Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

5th Year FV= $1000 (1 + 10%) ^1) -1/ R

= $1000 (0.1) /0.1

= $1000

After 5 years compound=( P +1000*5)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 4

=$ 6000

(c) Monthly compounding for an investment

Monthly Compounding: FV = $1,000 x (1 + (15% / 60)) ^ (12 x 5) =

FV= 1000(1+(10%/ 60)^ (12*5 )

FV= $ 1000(1 + (0.001667) ^60

= $ 1000(1.001667) ^60

= $ 1000 (1.105)

= $ 1,105.07

(d)Explain what is meant by continuous compounding.(2 marks)

This means an instance mathematically where the principle amount is constantly and

continuously earning interest and the interest being earned is also earning its own interest

continuously. It can also be defined as the limit mathematically that the compound interest

can and will earn or a process of time value for money accumulation in an instantaneous and

continuous basis (Grangaard, 2004).

=$ 6000

(c) Monthly compounding for an investment

Monthly Compounding: FV = $1,000 x (1 + (15% / 60)) ^ (12 x 5) =

FV= 1000(1+(10%/ 60)^ (12*5 )

FV= $ 1000(1 + (0.001667) ^60

= $ 1000(1.001667) ^60

= $ 1000 (1.105)

= $ 1,105.07

(d)Explain what is meant by continuous compounding.(2 marks)

This means an instance mathematically where the principle amount is constantly and

continuously earning interest and the interest being earned is also earning its own interest

continuously. It can also be defined as the limit mathematically that the compound interest

can and will earn or a process of time value for money accumulation in an instantaneous and

continuous basis (Grangaard, 2004).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 5

(e) Continuous compounding

Future Value (FV) = PV x (1 + (i / n)) ^ (n x t)

Compounding annually: FV = $1,000 x (1 + (10% / 1)) ^ (1 x 5) = $

= $ 1000 (1.6105)

= $ 1610.5

Question 2

You would like to have $100,000 in 10 years from now to fund the education expenses of a

family member. You wish to deposit money into a bank account to achieve this goal. The

money will earn interest at 3% per annum compounded annually (Shapiro & Streiff, 2004).

(a)

How much must you deposit annually as an ordinary annuity to achieve your goal?

FV= $ 100000

(e) Continuous compounding

Future Value (FV) = PV x (1 + (i / n)) ^ (n x t)

Compounding annually: FV = $1,000 x (1 + (10% / 1)) ^ (1 x 5) = $

= $ 1000 (1.6105)

= $ 1610.5

Question 2

You would like to have $100,000 in 10 years from now to fund the education expenses of a

family member. You wish to deposit money into a bank account to achieve this goal. The

money will earn interest at 3% per annum compounded annually (Shapiro & Streiff, 2004).

(a)

How much must you deposit annually as an ordinary annuity to achieve your goal?

FV= $ 100000

FINANCE 6

N = 10 years

R= 3%

P= Principal

100000= P(1+3%) ^10)- 1/ 0.03

100000= 11.46 P

P = 100000/11.46

=$ 8,723.1

(b)Instead of making annual deposits, how much would you need to deposit as a lump sum

today to reach your goal?

100000= P(1+3%) ^1)- 1/ 0.03

100000= 1 P

P = 100,000

N = 10 years

R= 3%

P= Principal

100000= P(1+3%) ^10)- 1/ 0.03

100000= 11.46 P

P = 100000/11.46

=$ 8,723.1

(b)Instead of making annual deposits, how much would you need to deposit as a lump sum

today to reach your goal?

100000= P(1+3%) ^1)- 1/ 0.03

100000= 1 P

P = 100,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 7

(c)Suppose that at the beginning of the first year, you deposit $10,000 in the bank towards

your goal of $100,000 at the end of 10 years (Donald, 2016). In addition to this deposit, how

much must you deposit each year as an ordinary annuity to obtain your goal?

FV = P * {(1+R) ^N) - 1) / R}

FV= $100000

P=

FV= $ 100000

N = 10 years

R= 3%

P= Principal

100000= P(1+3%) ^10)- 1/ 0.03

100000= 11.46 P

P = 100000/11.46

=$ 8,723.1

Question 3

(c)Suppose that at the beginning of the first year, you deposit $10,000 in the bank towards

your goal of $100,000 at the end of 10 years (Donald, 2016). In addition to this deposit, how

much must you deposit each year as an ordinary annuity to obtain your goal?

FV = P * {(1+R) ^N) - 1) / R}

FV= $100000

P=

FV= $ 100000

N = 10 years

R= 3%

P= Principal

100000= P(1+3%) ^10)- 1/ 0.03

100000= 11.46 P

P = 100000/11.46

=$ 8,723.1

Question 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 8

(Total marks for this question = 12 marks)

An investor wishes to invest $10,000 in a term deposit with a bank for a term of 2 years. The

bank is offering term an interest rate of 3% p.a with annual compounding, or an interest rate

of 2.95% p.a with bi annual compounding, or an interest rate of 2.9% p.a with quarterly

compounding.

(a) Which term deposit is the best investment? (3 marks)

A=P(1+i)^n

A=Future value

P=Principal

i=r/ppy

n=t*ppy

ppy=periods per year

investment 1: @3% annual compounding

A=$10000(1+0.003/1)^2

P=$10000

I=3%/1

Ppy=1

n=2

=$10000(1.006009)=$10060.09

Interest =$60.09

(Total marks for this question = 12 marks)

An investor wishes to invest $10,000 in a term deposit with a bank for a term of 2 years. The

bank is offering term an interest rate of 3% p.a with annual compounding, or an interest rate

of 2.95% p.a with bi annual compounding, or an interest rate of 2.9% p.a with quarterly

compounding.

(a) Which term deposit is the best investment? (3 marks)

A=P(1+i)^n

A=Future value

P=Principal

i=r/ppy

n=t*ppy

ppy=periods per year

investment 1: @3% annual compounding

A=$10000(1+0.003/1)^2

P=$10000

I=3%/1

Ppy=1

n=2

=$10000(1.006009)=$10060.09

Interest =$60.09

FINANCE 9

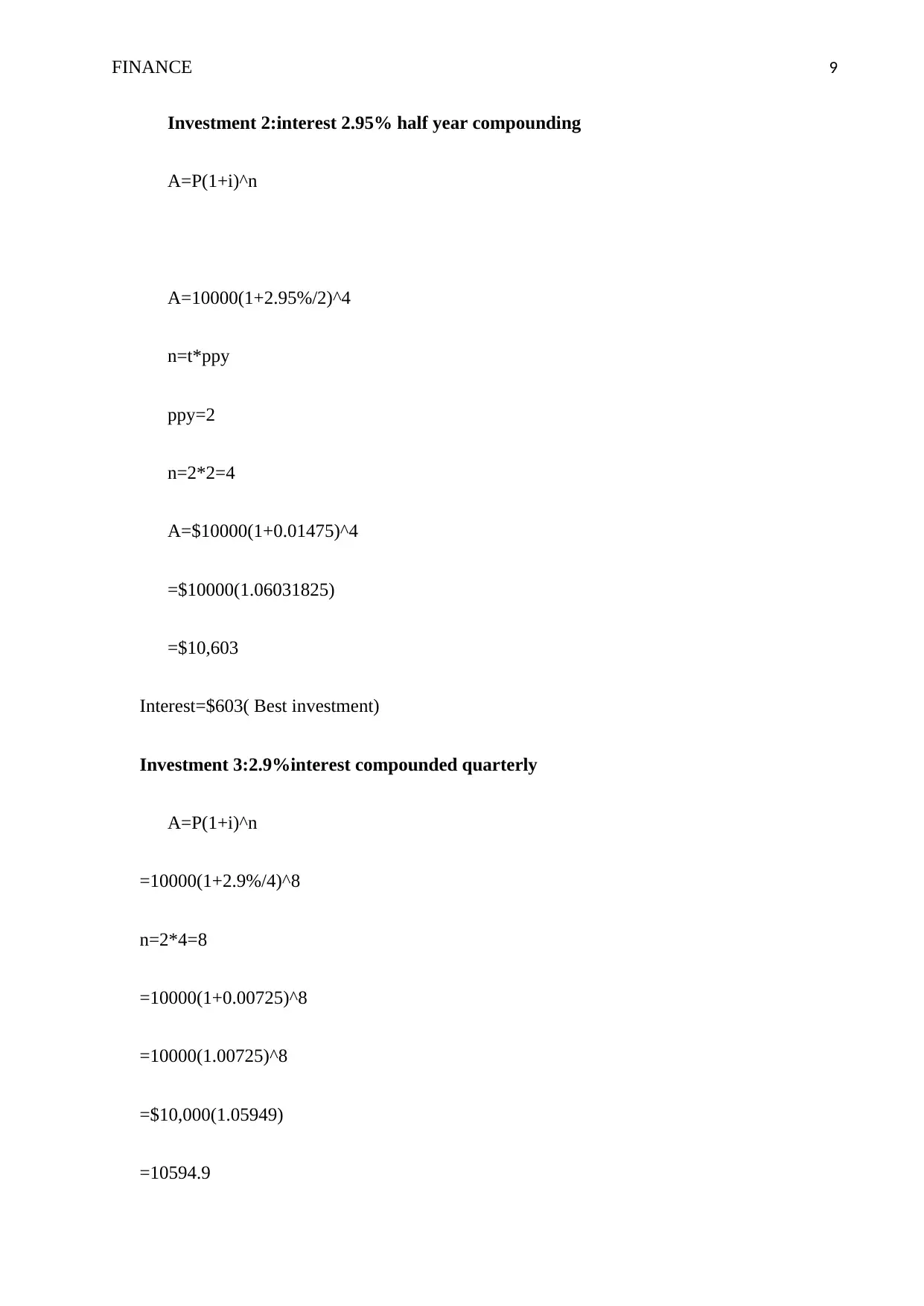

Investment 2:interest 2.95% half year compounding

A=P(1+i)^n

A=10000(1+2.95%/2)^4

n=t*ppy

ppy=2

n=2*2=4

A=$10000(1+0.01475)^4

=$10000(1.06031825)

=$10,603

Interest=$603( Best investment)

Investment 3:2.9%interest compounded quarterly

A=P(1+i)^n

=10000(1+2.9%/4)^8

n=2*4=8

=10000(1+0.00725)^8

=10000(1.00725)^8

=$10,000(1.05949)

=10594.9

Investment 2:interest 2.95% half year compounding

A=P(1+i)^n

A=10000(1+2.95%/2)^4

n=t*ppy

ppy=2

n=2*2=4

A=$10000(1+0.01475)^4

=$10000(1.06031825)

=$10,603

Interest=$603( Best investment)

Investment 3:2.9%interest compounded quarterly

A=P(1+i)^n

=10000(1+2.9%/4)^8

n=2*4=8

=10000(1+0.00725)^8

=10000(1.00725)^8

=$10,000(1.05949)

=10594.9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 10

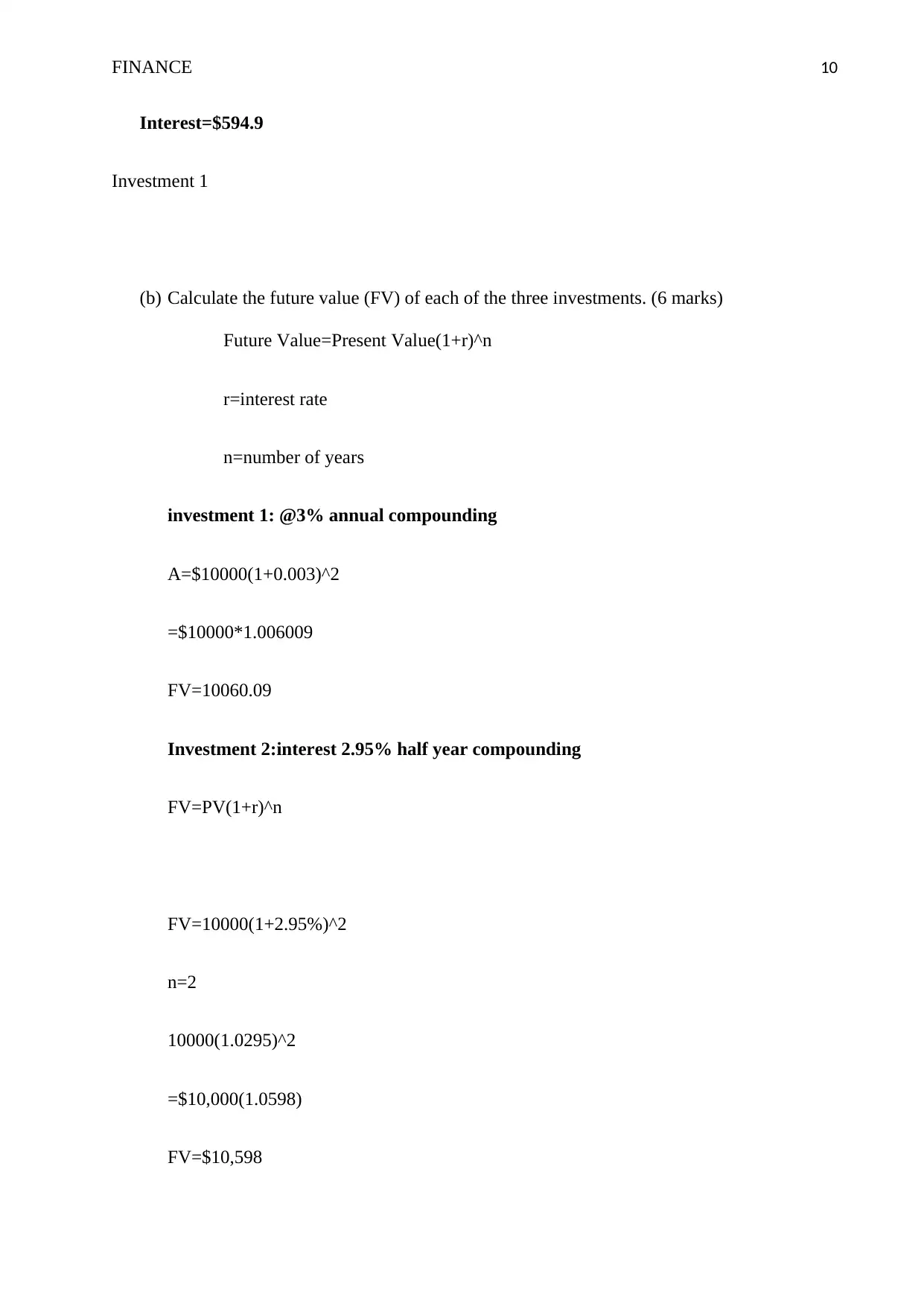

Interest=$594.9

Investment 1

(b) Calculate the future value (FV) of each of the three investments. (6 marks)

Future Value=Present Value(1+r)^n

r=interest rate

n=number of years

investment 1: @3% annual compounding

A=$10000(1+0.003)^2

=$10000*1.006009

FV=10060.09

Investment 2:interest 2.95% half year compounding

FV=PV(1+r)^n

FV=10000(1+2.95%)^2

n=2

10000(1.0295)^2

=$10,000(1.0598)

FV=$10,598

Interest=$594.9

Investment 1

(b) Calculate the future value (FV) of each of the three investments. (6 marks)

Future Value=Present Value(1+r)^n

r=interest rate

n=number of years

investment 1: @3% annual compounding

A=$10000(1+0.003)^2

=$10000*1.006009

FV=10060.09

Investment 2:interest 2.95% half year compounding

FV=PV(1+r)^n

FV=10000(1+2.95%)^2

n=2

10000(1.0295)^2

=$10,000(1.0598)

FV=$10,598

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 11

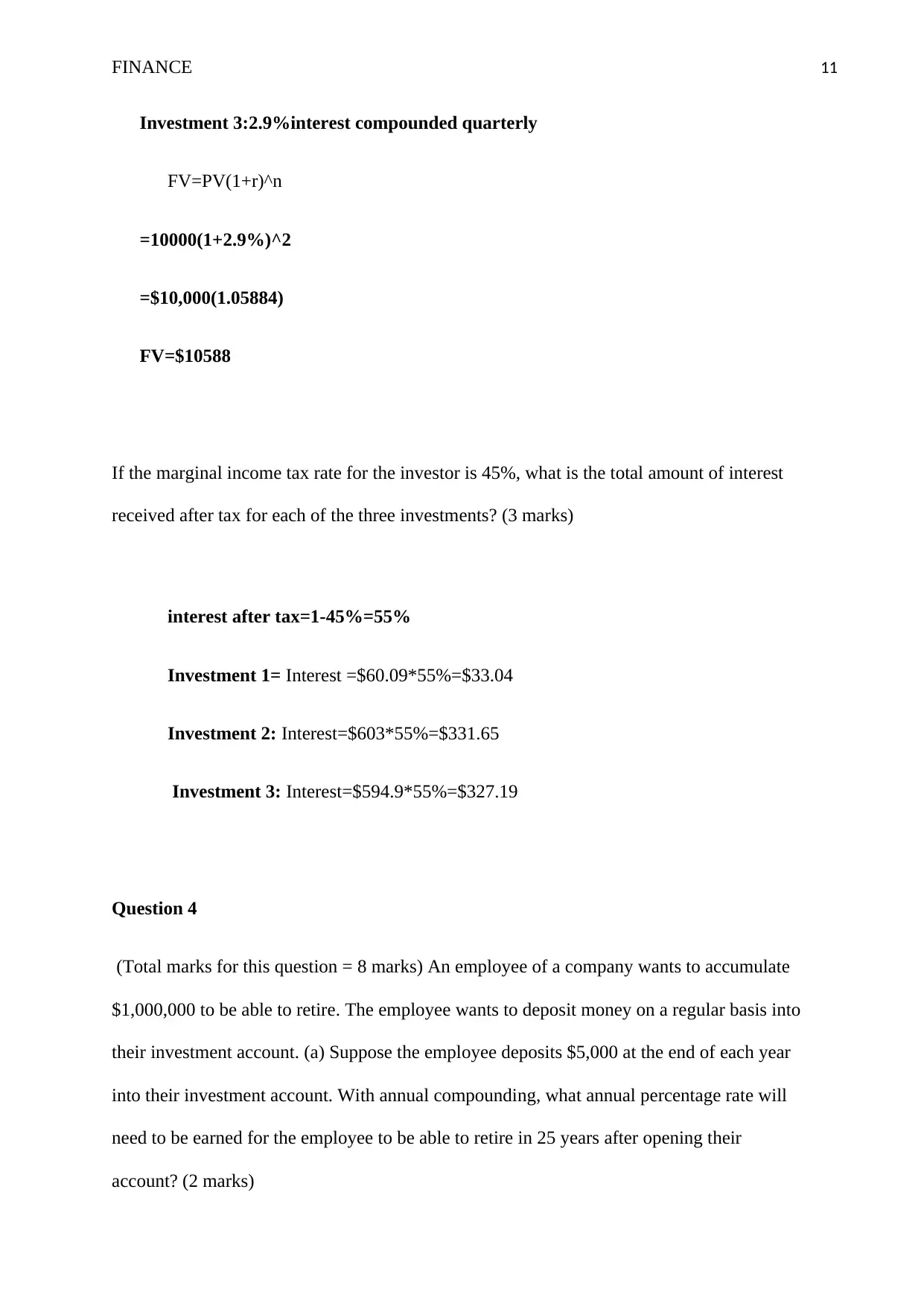

Investment 3:2.9%interest compounded quarterly

FV=PV(1+r)^n

=10000(1+2.9%)^2

=$10,000(1.05884)

FV=$10588

If the marginal income tax rate for the investor is 45%, what is the total amount of interest

received after tax for each of the three investments? (3 marks)

interest after tax=1-45%=55%

Investment 1= Interest =$60.09*55%=$33.04

Investment 2: Interest=$603*55%=$331.65

Investment 3: Interest=$594.9*55%=$327.19

Question 4

(Total marks for this question = 8 marks) An employee of a company wants to accumulate

$1,000,000 to be able to retire. The employee wants to deposit money on a regular basis into

their investment account. (a) Suppose the employee deposits $5,000 at the end of each year

into their investment account. With annual compounding, what annual percentage rate will

need to be earned for the employee to be able to retire in 25 years after opening their

account? (2 marks)

Investment 3:2.9%interest compounded quarterly

FV=PV(1+r)^n

=10000(1+2.9%)^2

=$10,000(1.05884)

FV=$10588

If the marginal income tax rate for the investor is 45%, what is the total amount of interest

received after tax for each of the three investments? (3 marks)

interest after tax=1-45%=55%

Investment 1= Interest =$60.09*55%=$33.04

Investment 2: Interest=$603*55%=$331.65

Investment 3: Interest=$594.9*55%=$327.19

Question 4

(Total marks for this question = 8 marks) An employee of a company wants to accumulate

$1,000,000 to be able to retire. The employee wants to deposit money on a regular basis into

their investment account. (a) Suppose the employee deposits $5,000 at the end of each year

into their investment account. With annual compounding, what annual percentage rate will

need to be earned for the employee to be able to retire in 25 years after opening their

account? (2 marks)

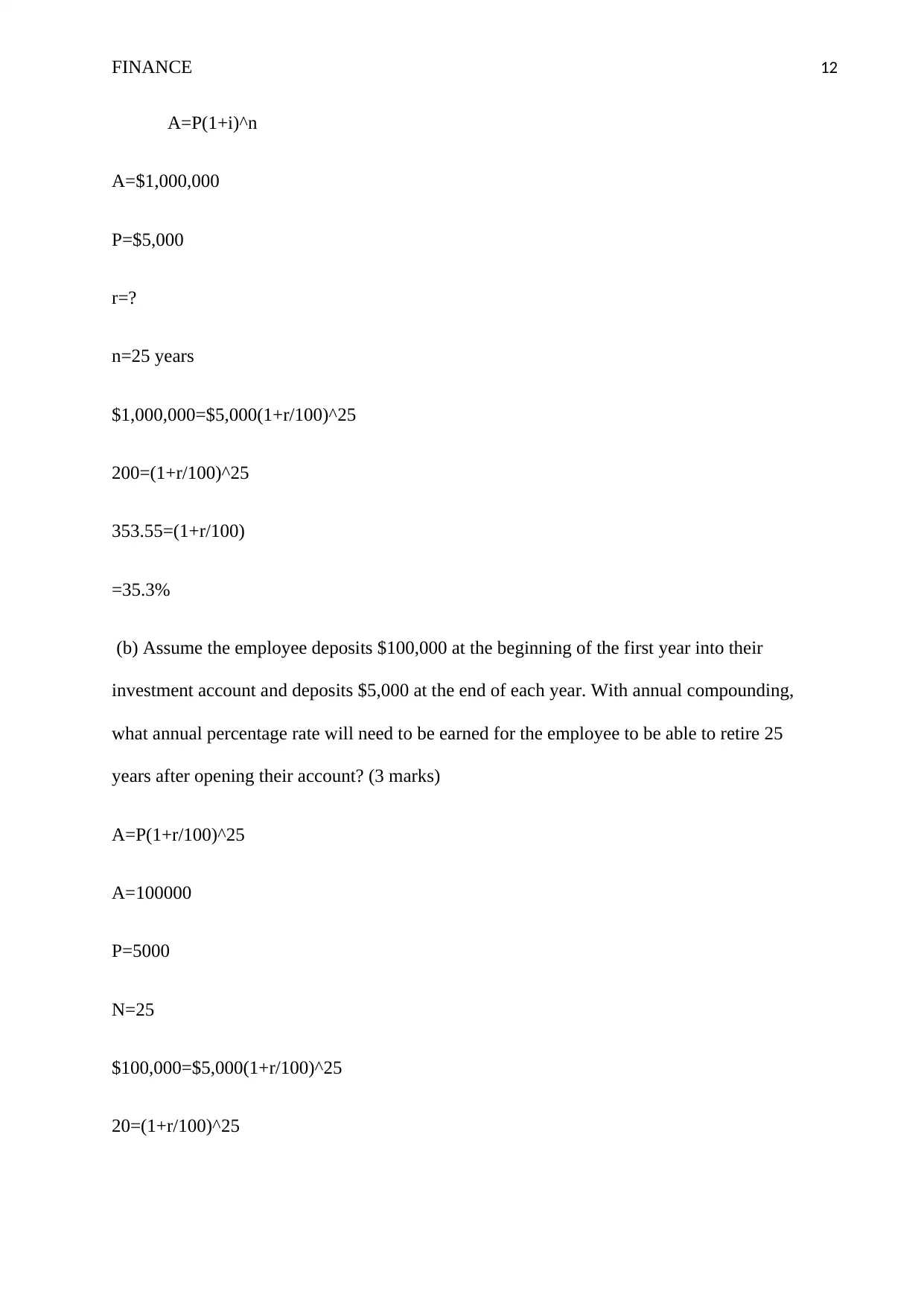

FINANCE 12

A=P(1+i)^n

A=$1,000,000

P=$5,000

r=?

n=25 years

$1,000,000=$5,000(1+r/100)^25

200=(1+r/100)^25

353.55=(1+r/100)

=35.3%

(b) Assume the employee deposits $100,000 at the beginning of the first year into their

investment account and deposits $5,000 at the end of each year. With annual compounding,

what annual percentage rate will need to be earned for the employee to be able to retire 25

years after opening their account? (3 marks)

A=P(1+r/100)^25

A=100000

P=5000

N=25

$100,000=$5,000(1+r/100)^25

20=(1+r/100)^25

A=P(1+i)^n

A=$1,000,000

P=$5,000

r=?

n=25 years

$1,000,000=$5,000(1+r/100)^25

200=(1+r/100)^25

353.55=(1+r/100)

=35.3%

(b) Assume the employee deposits $100,000 at the beginning of the first year into their

investment account and deposits $5,000 at the end of each year. With annual compounding,

what annual percentage rate will need to be earned for the employee to be able to retire 25

years after opening their account? (3 marks)

A=P(1+r/100)^25

A=100000

P=5000

N=25

$100,000=$5,000(1+r/100)^25

20=(1+r/100)^25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.