Financial Management in Hospitality: A Case Study of Hilton Hotels

VerifiedAdded on 2021/02/20

|19

|3969

|56

Report

AI Summary

This report provides a detailed financial analysis of Hilton Hotels & Resorts. It begins by exploring various sources of finance available to businesses, including venture capital, public share issues, bank loans, retained earnings, and business angels, with a focus on factors to consider when accessing these sources. The report then discusses sales promotion, commission, and grants as revenue streams, and it defines and provides examples of cost elements, including fixed, variable, and semi-variable costs. It further delves into methods for controlling stock and cash, and it explains the structure and purpose of a trial balance, including adjustments and budgetary control. Financial ratios are calculated to determine financial performance, and recommendations are provided for future management strategies. The report concludes with a solution to a given case study, offering a comprehensive overview of financial management within the hospitality industry.

Finance in the Hospitality

Industry

Industry

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ...............................................................................................................................3

MAIN BODY.......................................................................................................................................3

TASK 1.................................................................................................................................................3

AC1.1 Various sources of finance available for funding to different business and service

industries. ........................................................................................................................................3

The factors which should have the consideration when accessing the sources of financing...........4

AC 1.2 Discussing...........................................................................................................................4

TASK 2.................................................................................................................................................5

AC 2.1..............................................................................................................................................5

b. Explaining following with the help of example...........................................................................8

AC 2.2 Methods of Controlling Stock & Cash...............................................................................9

TASK 3...............................................................................................................................................10

AC 3.1 Trial Balance.....................................................................................................................10

AC 3.2 Trial balance.....................................................................................................................13

a. Explaining adjustments..............................................................................................................13

b. Preparation of trial balance........................................................................................................13

AC 3.3 Budgetary control..............................................................................................................14

AC 3.4 Calculation ................................................................................................14

TASK 4 – DISCLOSED IN POWERPOINT PRESENTATION.......................................................15

TASK 5...............................................................................................................................................15

AC 5.1 Categorising......................................................................................................................15

AC 5.2 Contribution per unit.........................................................................................................16

AC 5.3 Justify................................................................................................................................17

CONCLUSION..................................................................................................................................18

REFERENCES...................................................................................................................................19

INTRODUCTION ...............................................................................................................................3

MAIN BODY.......................................................................................................................................3

TASK 1.................................................................................................................................................3

AC1.1 Various sources of finance available for funding to different business and service

industries. ........................................................................................................................................3

The factors which should have the consideration when accessing the sources of financing...........4

AC 1.2 Discussing...........................................................................................................................4

TASK 2.................................................................................................................................................5

AC 2.1..............................................................................................................................................5

b. Explaining following with the help of example...........................................................................8

AC 2.2 Methods of Controlling Stock & Cash...............................................................................9

TASK 3...............................................................................................................................................10

AC 3.1 Trial Balance.....................................................................................................................10

AC 3.2 Trial balance.....................................................................................................................13

a. Explaining adjustments..............................................................................................................13

b. Preparation of trial balance........................................................................................................13

AC 3.3 Budgetary control..............................................................................................................14

AC 3.4 Calculation ................................................................................................14

TASK 4 – DISCLOSED IN POWERPOINT PRESENTATION.......................................................15

TASK 5...............................................................................................................................................15

AC 5.1 Categorising......................................................................................................................15

AC 5.2 Contribution per unit.........................................................................................................16

AC 5.3 Justify................................................................................................................................17

CONCLUSION..................................................................................................................................18

REFERENCES...................................................................................................................................19

INTRODUCTION

Finance is considered as one of the main business aspect without which no business organisation

can undertake its business operations. By managing financial activities of the company, it helps in

ensuring proper flow of cash as well as fund thereby making right allocation of financial resources

to the different business department. The present report is based on Hilton Hotels & Resorts which

is one of the global as well as multinational company with its buisness operations across the globe.

It will emphasises on different sources of funding for new and existing business firms. Also,

explanation will be made regarding to elements of cost with cash and stock controlling methods.

Furthermore, focus will be made on defining source and main structure of Trial Balance with

formation of new Trial Balance of ABC Traders after considering all the adjustments. Financial

ratios will be calculated for determining the financial performance of the business along with

recommendation related to appropriate future management strategies required. At last, it will

streamline about proper solution of the given case study.

MAIN BODY

TASK 1

AC1.1 Various sources of finance available for funding to different business and service industries.

The sources of finance have been termed as the significant facto in different business and

service organization. There is the need for the development of different sources to arise the finance

for the further growth and prosperity of business. There are various sources which are having their

availability to business that can be described such as-

Venture capital: the company should be aware of the venture capitalist who will promise

carrying out risky project. The venture capitalist are looking for the business which are

technological driven along with high level of potentiality over growth ( Balaban, Župljanin. and

Ivanović., 2016..). Venture capitalist have the taken the position of equity sources of financing as

they have the expectancy of healthy return on investment. Hotel Hilton can have look for investors

who can help in brining relevant gains and knowledge to business. More risk management is

involved turns to be benefit. On other hand funding is retentively scarce and difficult to obtain.

Public share issue: it is regarding the collection of the firm fund by issuing of share to the

public and raise the fund. Thorough this sources of raising fund the company can collect the large

amount of fund for longer period which helps in achieving vision and mission of organization. As

the type of financing don't have the risk of debt but the company has to be enlisted in the stock

exchange.

Finance is considered as one of the main business aspect without which no business organisation

can undertake its business operations. By managing financial activities of the company, it helps in

ensuring proper flow of cash as well as fund thereby making right allocation of financial resources

to the different business department. The present report is based on Hilton Hotels & Resorts which

is one of the global as well as multinational company with its buisness operations across the globe.

It will emphasises on different sources of funding for new and existing business firms. Also,

explanation will be made regarding to elements of cost with cash and stock controlling methods.

Furthermore, focus will be made on defining source and main structure of Trial Balance with

formation of new Trial Balance of ABC Traders after considering all the adjustments. Financial

ratios will be calculated for determining the financial performance of the business along with

recommendation related to appropriate future management strategies required. At last, it will

streamline about proper solution of the given case study.

MAIN BODY

TASK 1

AC1.1 Various sources of finance available for funding to different business and service industries.

The sources of finance have been termed as the significant facto in different business and

service organization. There is the need for the development of different sources to arise the finance

for the further growth and prosperity of business. There are various sources which are having their

availability to business that can be described such as-

Venture capital: the company should be aware of the venture capitalist who will promise

carrying out risky project. The venture capitalist are looking for the business which are

technological driven along with high level of potentiality over growth ( Balaban, Župljanin. and

Ivanović., 2016..). Venture capitalist have the taken the position of equity sources of financing as

they have the expectancy of healthy return on investment. Hotel Hilton can have look for investors

who can help in brining relevant gains and knowledge to business. More risk management is

involved turns to be benefit. On other hand funding is retentively scarce and difficult to obtain.

Public share issue: it is regarding the collection of the firm fund by issuing of share to the

public and raise the fund. Thorough this sources of raising fund the company can collect the large

amount of fund for longer period which helps in achieving vision and mission of organization. As

the type of financing don't have the risk of debt but the company has to be enlisted in the stock

exchange.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Bank loan: There is the collection of necessary funds from the commercial banks at low

interest rate for a particular period. Banks loan has been termed as the most preferable resources

fort a business company in a particular short period (Jerzmanowski, 2017. ). The commercial banks

used to provide the bank overdraft facility to various activities established by business. On the other

hand the there is high interest rate are charged by bank on overdraft. The company has enhanced the

overdraft facility for a particular period for the accomplishment of task.

Retain earnings: The earned surplus or the accumulated earnings can be termed as the

financing use for the company as it reduces the level of dependence in the funds derived from

external sources in order to have regulation business company can have the option of self-financing

or ' ploughing back of profits. This is powerful strategy to have control over business as it involves

a long process of decision-making.

Business angels: the company should have the identification of professional investors which

have the investment as well as their time for the growth and potentiality of business, this helps I the

quantum of angel investment (Amornkitvikai and Harvie, 2018). There is less level of risk as

compare to debt financing but the having the angel investors is loss of complete control as part of

owner.

The factors which should have the consideration when accessing the sources of financing

Debt/equity- while assessing the source of finance there will be quite level of understanding

whether the capital raise in debt of equity. This will help in having proper analysing the requirement

of business.

Control- the investor should have the proper analysis the control over the business s

expansion of the requirement of business in later end period to have proper control and evaluation.

Security- the company should have the access over the level of security in having proper

finding of finance in regular examination of business.

Legal authorities- The company should be aware about the legal requirement which the

company should have address in the market along with government.

Time: Time is the essential requirement which is to capable for worst and best happening of

the different development of business.

AC 1.2 Discussing

1. Sales Promotion – A process which assist in persuading as well as influencing the target

customer group in the market place so as to purchase a particular product or service of the

company thereby boosting the sales as well as profitability aspects of the company. With the

help of sales promotion techniques, it supports the company in formulating a base or reason

interest rate for a particular period. Banks loan has been termed as the most preferable resources

fort a business company in a particular short period (Jerzmanowski, 2017. ). The commercial banks

used to provide the bank overdraft facility to various activities established by business. On the other

hand the there is high interest rate are charged by bank on overdraft. The company has enhanced the

overdraft facility for a particular period for the accomplishment of task.

Retain earnings: The earned surplus or the accumulated earnings can be termed as the

financing use for the company as it reduces the level of dependence in the funds derived from

external sources in order to have regulation business company can have the option of self-financing

or ' ploughing back of profits. This is powerful strategy to have control over business as it involves

a long process of decision-making.

Business angels: the company should have the identification of professional investors which

have the investment as well as their time for the growth and potentiality of business, this helps I the

quantum of angel investment (Amornkitvikai and Harvie, 2018). There is less level of risk as

compare to debt financing but the having the angel investors is loss of complete control as part of

owner.

The factors which should have the consideration when accessing the sources of financing

Debt/equity- while assessing the source of finance there will be quite level of understanding

whether the capital raise in debt of equity. This will help in having proper analysing the requirement

of business.

Control- the investor should have the proper analysis the control over the business s

expansion of the requirement of business in later end period to have proper control and evaluation.

Security- the company should have the access over the level of security in having proper

finding of finance in regular examination of business.

Legal authorities- The company should be aware about the legal requirement which the

company should have address in the market along with government.

Time: Time is the essential requirement which is to capable for worst and best happening of

the different development of business.

AC 1.2 Discussing

1. Sales Promotion – A process which assist in persuading as well as influencing the target

customer group in the market place so as to purchase a particular product or service of the

company thereby boosting the sales as well as profitability aspects of the company. With the

help of sales promotion techniques, it supports the company in formulating a base or reason

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for buying such thing. Hilton Hitel by making focus on its marketing strategies and

approaches can capture the current market opportunities along with increase in customer

base. Hilton by offering discounted products, coupon, branded gifts can attracts large

number of customers towards itself (Arkan, 2016). Also, by providing schemes such as buy

more - save more, points of loyalty, pricing strategy matching promise etc. Can assist the

company in generating more and more revenue along with increase in market share.

2. Commission – A type of revenue which is taken by all the financial institutions from the

customers in relation to charges for providing account related services. Such type of charges,

commission and fees mostly includes non – sufficient nature of fund fees, over the limit

fees, late fees etc. Hilton Hotels by charging montly service charges or commission from its

customer dolding membership earns their revenue for the year. For hospitality industries, it

is very much essential to manage their revenue part with the help of strategic planning,

distribution as well as sound pricing tactics for selling its own property or inventory at the

right time to the right guest so as to increase the sales level. With the help of revenue

management, it provides company in making unique as well as creative innovation related to

the products and services which are being offered by them in the market place.

3. Grants – Is considered as one the most important type of income which is received in by

the company in form of financial aids for which nothing has to paid in return. The amount as

received in by the company in form of grants has to be spend on particular activities for

which it is received in stead of using it in for some other business purpose. However, in case

of Hilton Hotels the grant amount as received by it will be treated as income for the

company as it is provided for the business expansion as well as for increasing the sales level

along with increase in the customer and market share.

TASK 2

AC 2.1

a. Describing following elements of cost with example:

The term elements of cost is basically related with the total amount of cost which has been incurred

for producing or manufacturing a particular product of the company. Thus, these are divided into

three main types viz.

1. Material – Is related with the cost amount which has been incurred for producing a specific

product or service. Is basically of direct as well as indirect types. Example – raw material.

2. Labour – Human efforts which has become part of production function so as to convert

material into finished goods and products. Example – Labour and workers wages (Tian and

Yu, 2017).

approaches can capture the current market opportunities along with increase in customer

base. Hilton by offering discounted products, coupon, branded gifts can attracts large

number of customers towards itself (Arkan, 2016). Also, by providing schemes such as buy

more - save more, points of loyalty, pricing strategy matching promise etc. Can assist the

company in generating more and more revenue along with increase in market share.

2. Commission – A type of revenue which is taken by all the financial institutions from the

customers in relation to charges for providing account related services. Such type of charges,

commission and fees mostly includes non – sufficient nature of fund fees, over the limit

fees, late fees etc. Hilton Hotels by charging montly service charges or commission from its

customer dolding membership earns their revenue for the year. For hospitality industries, it

is very much essential to manage their revenue part with the help of strategic planning,

distribution as well as sound pricing tactics for selling its own property or inventory at the

right time to the right guest so as to increase the sales level. With the help of revenue

management, it provides company in making unique as well as creative innovation related to

the products and services which are being offered by them in the market place.

3. Grants – Is considered as one the most important type of income which is received in by

the company in form of financial aids for which nothing has to paid in return. The amount as

received in by the company in form of grants has to be spend on particular activities for

which it is received in stead of using it in for some other business purpose. However, in case

of Hilton Hotels the grant amount as received by it will be treated as income for the

company as it is provided for the business expansion as well as for increasing the sales level

along with increase in the customer and market share.

TASK 2

AC 2.1

a. Describing following elements of cost with example:

The term elements of cost is basically related with the total amount of cost which has been incurred

for producing or manufacturing a particular product of the company. Thus, these are divided into

three main types viz.

1. Material – Is related with the cost amount which has been incurred for producing a specific

product or service. Is basically of direct as well as indirect types. Example – raw material.

2. Labour – Human efforts which has become part of production function so as to convert

material into finished goods and products. Example – Labour and workers wages (Tian and

Yu, 2017).

3. Expenses – The cost of service as provided to the company along with notional amount

related to the owned assets used in production operations of the company. Example – Power,

fuel used in carrying own operational fuctions.

Graphs of Fixed , variable and Semi-variable costs

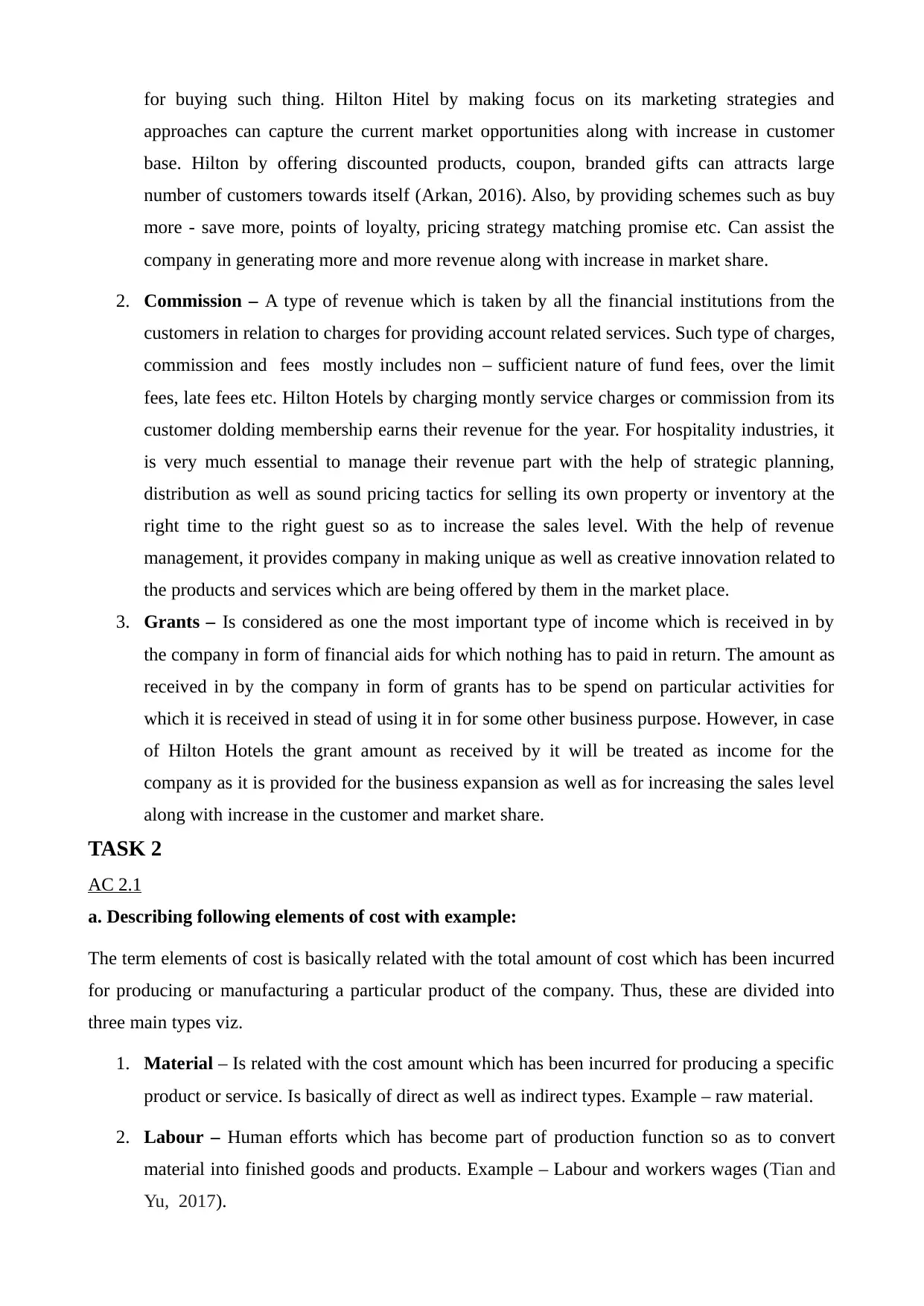

1. Fixed Cost – A type of cost amount which remains fixed and donot changes with change in

sales as well as production level.

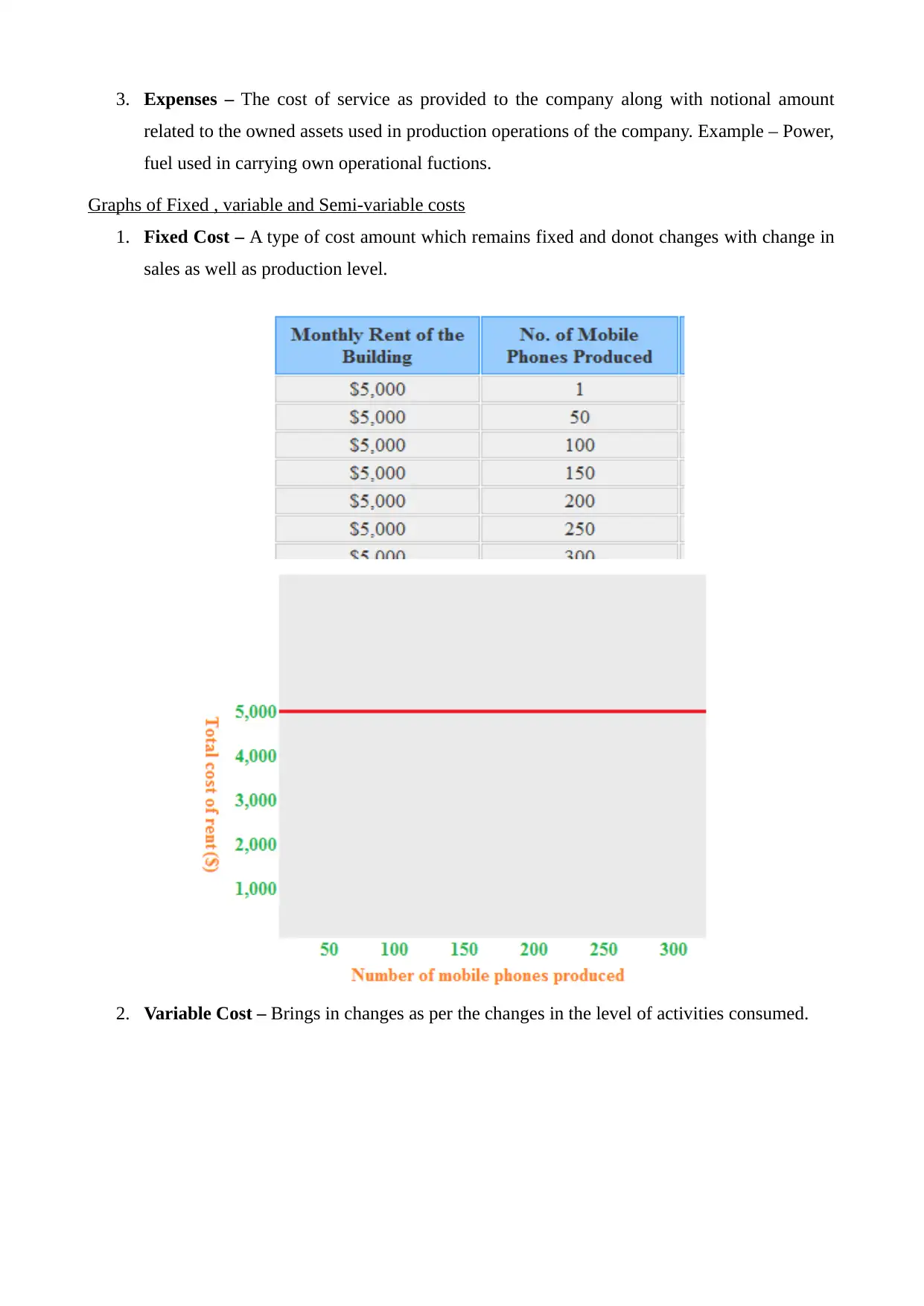

2. Variable Cost – Brings in changes as per the changes in the level of activities consumed.

related to the owned assets used in production operations of the company. Example – Power,

fuel used in carrying own operational fuctions.

Graphs of Fixed , variable and Semi-variable costs

1. Fixed Cost – A type of cost amount which remains fixed and donot changes with change in

sales as well as production level.

2. Variable Cost – Brings in changes as per the changes in the level of activities consumed.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

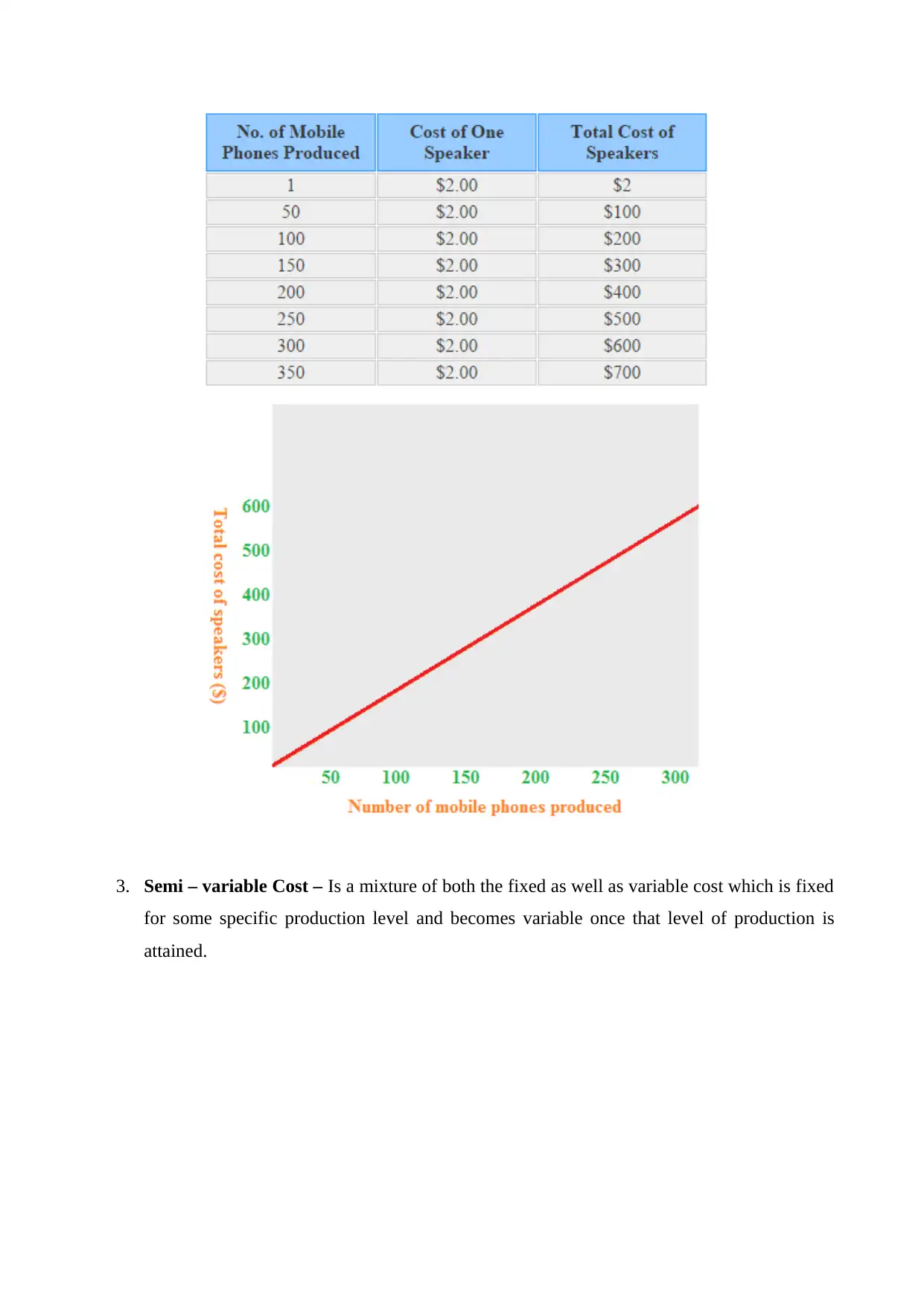

3. Semi – variable Cost – Is a mixture of both the fixed as well as variable cost which is fixed

for some specific production level and becomes variable once that level of production is

attained.

for some specific production level and becomes variable once that level of production is

attained.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

b. Explaining following with the help of example.

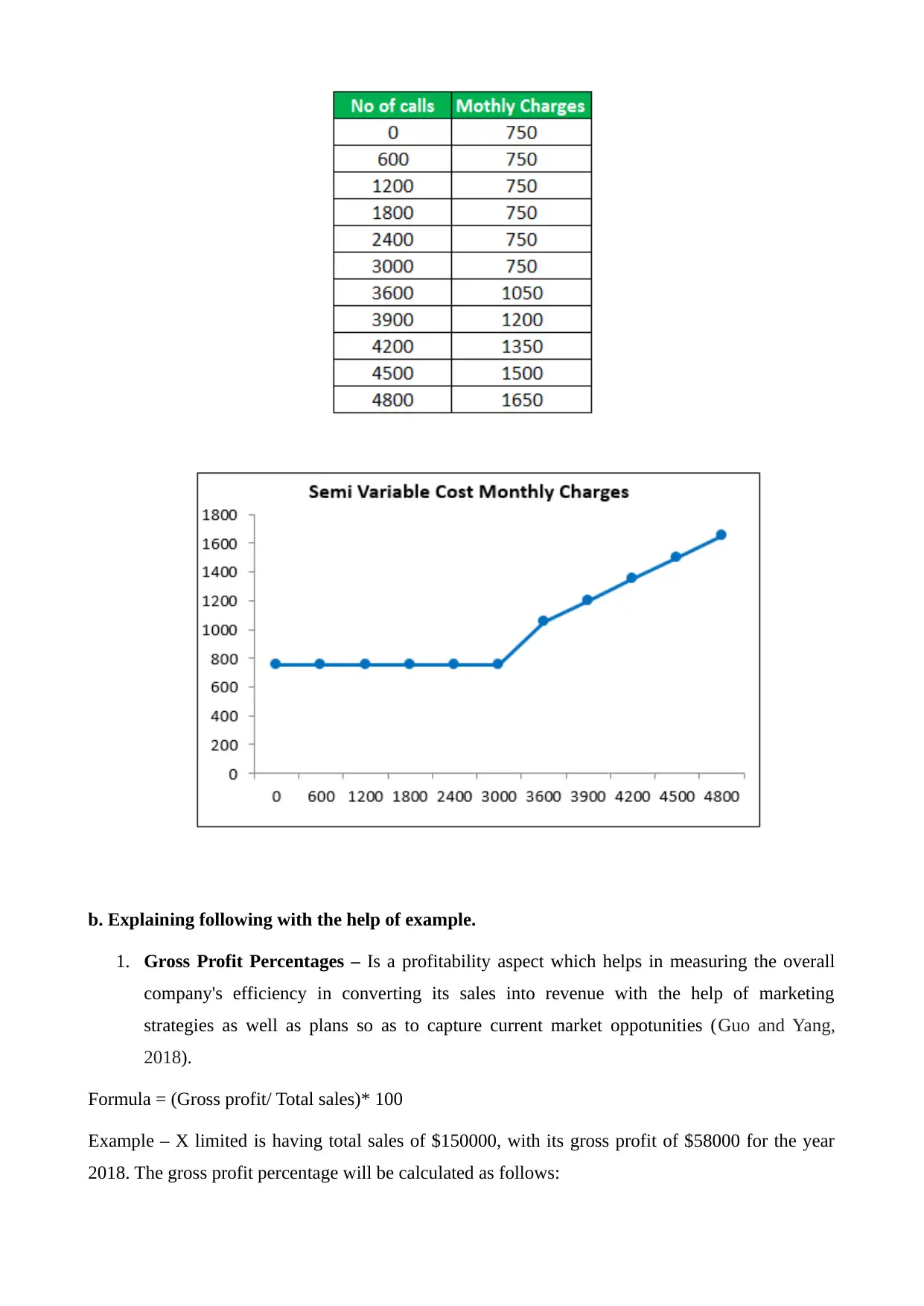

1. Gross Profit Percentages – Is a profitability aspect which helps in measuring the overall

company's efficiency in converting its sales into revenue with the help of marketing

strategies as well as plans so as to capture current market oppotunities (Guo and Yang,

2018).

Formula = (Gross profit/ Total sales)* 100

Example – X limited is having total sales of $150000, with its gross profit of $58000 for the year

2018. The gross profit percentage will be calculated as follows:

1. Gross Profit Percentages – Is a profitability aspect which helps in measuring the overall

company's efficiency in converting its sales into revenue with the help of marketing

strategies as well as plans so as to capture current market oppotunities (Guo and Yang,

2018).

Formula = (Gross profit/ Total sales)* 100

Example – X limited is having total sales of $150000, with its gross profit of $58000 for the year

2018. The gross profit percentage will be calculated as follows:

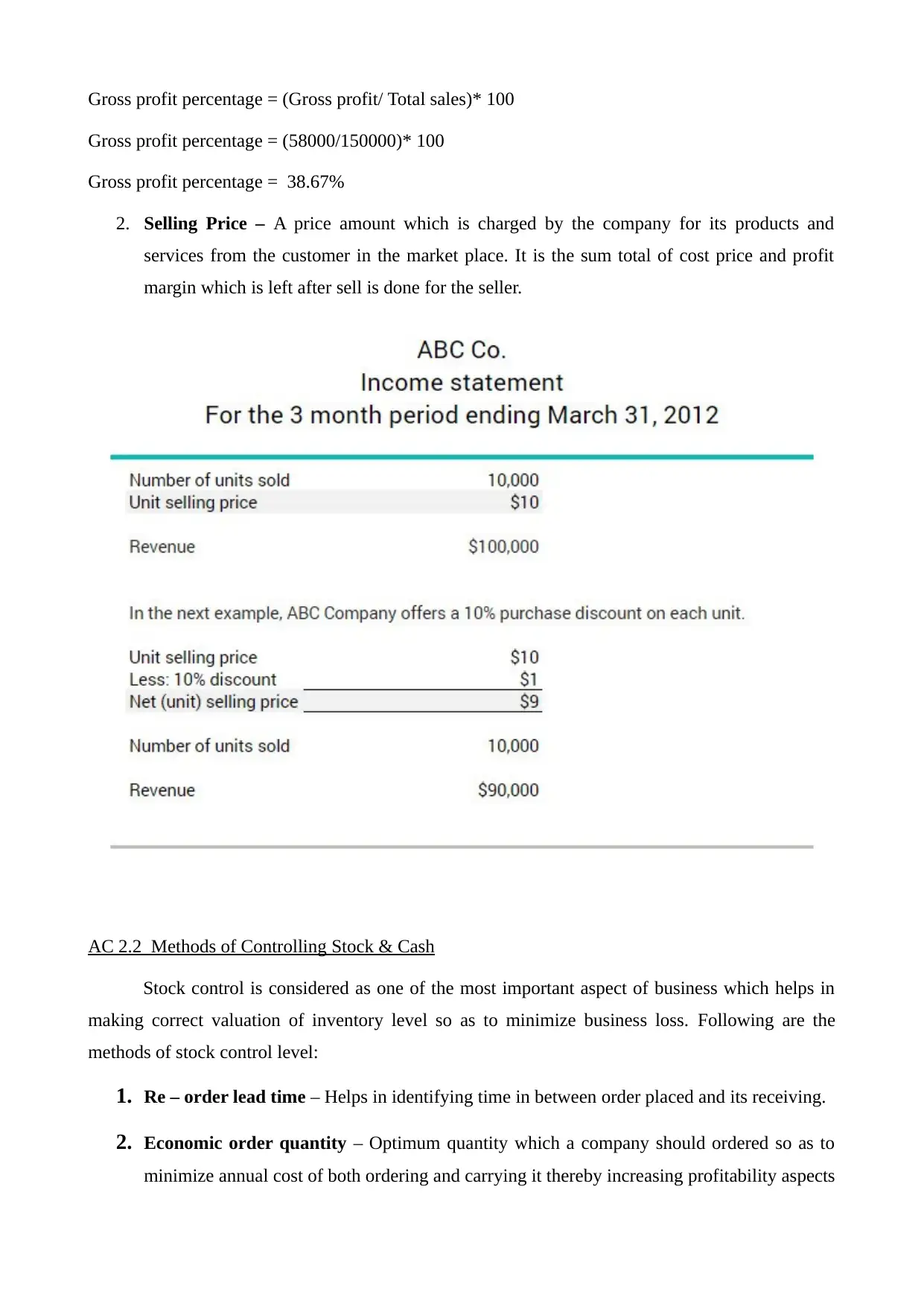

Gross profit percentage = (Gross profit/ Total sales)* 100

Gross profit percentage = (58000/150000)* 100

Gross profit percentage = 38.67%

2. Selling Price – A price amount which is charged by the company for its products and

services from the customer in the market place. It is the sum total of cost price and profit

margin which is left after sell is done for the seller.

AC 2.2 Methods of Controlling Stock & Cash

Stock control is considered as one of the most important aspect of business which helps in

making correct valuation of inventory level so as to minimize business loss. Following are the

methods of stock control level:

1. Re – order lead time – Helps in identifying time in between order placed and its receiving.

2. Economic order quantity – Optimum quantity which a company should ordered so as to

minimize annual cost of both ordering and carrying it thereby increasing profitability aspects

Gross profit percentage = (58000/150000)* 100

Gross profit percentage = 38.67%

2. Selling Price – A price amount which is charged by the company for its products and

services from the customer in the market place. It is the sum total of cost price and profit

margin which is left after sell is done for the seller.

AC 2.2 Methods of Controlling Stock & Cash

Stock control is considered as one of the most important aspect of business which helps in

making correct valuation of inventory level so as to minimize business loss. Following are the

methods of stock control level:

1. Re – order lead time – Helps in identifying time in between order placed and its receiving.

2. Economic order quantity – Optimum quantity which a company should ordered so as to

minimize annual cost of both ordering and carrying it thereby increasing profitability aspects

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of the business (Shibli and Wilson, 2018).

3. First in, frst out – It helps in selling out persihable nature stock so as to protect it from

getting deteriorate. Stock produced first is move out for selling as per strict oder.

Cash control is a process of managing as well as controlling the flow of cash in and out of

the business. It is also related with monitoring credit policies, debtor collection strategies, allocation

of cash resources etc. Following are the methods for controlling cash:

1. Documentation and records – Ensures safeguarding to the company by making proper

records and documents of the cash transactions of the business.

2. Segregation of duties – Cash related duties i.e. Maintaining of cash registers, recieving

cash, recording cash receipts transaction should be assigned to different employees for

minimizing theft or such activities.

3. Proper authorization – Handling cash related transactions should be assigned to only

limited people for maintaining its accuracy level.

TASK 3

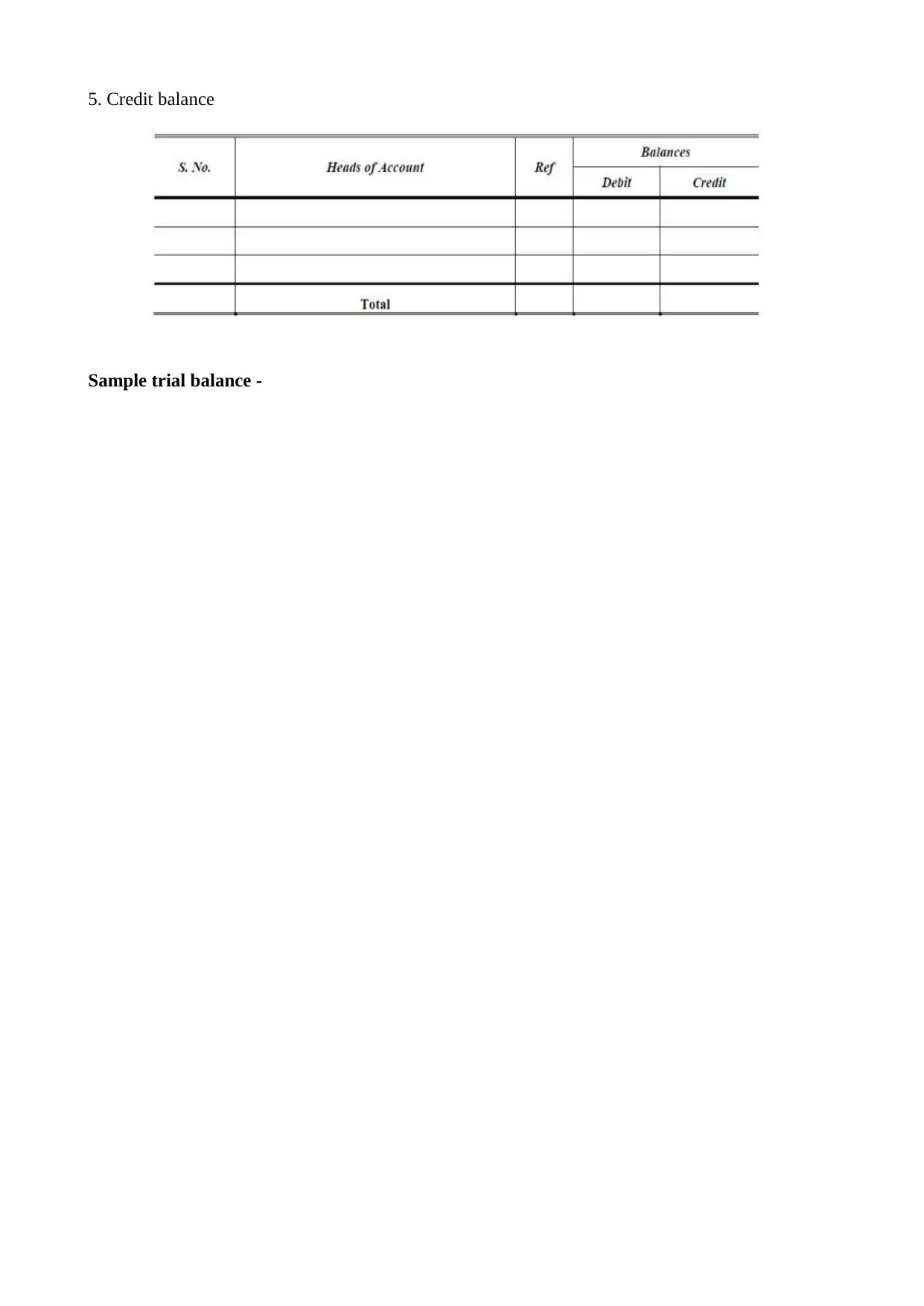

AC 3.1 Trial Balance

Definition – An accounting report depicting about list of general ledger account balances on debit

as well as credit side.

Purpose – The main aim of preparing trial balance is:

1. To check arithmetical accuracy of ledger accounts.

2. To identify mathematical errors done in double entry accounting system (Liang and et.al., 2016).

3. Provides base for preparation of financial statement.

Source and structure -

A trial balance is having a list containing two columns i.e. Debit and credit in which

balances of all the ledger accounts are disclosed.

Structure of trial balance

It contains five columns:

1. Serial number

2. Heads of accounts

3. References

4. Debit balance

3. First in, frst out – It helps in selling out persihable nature stock so as to protect it from

getting deteriorate. Stock produced first is move out for selling as per strict oder.

Cash control is a process of managing as well as controlling the flow of cash in and out of

the business. It is also related with monitoring credit policies, debtor collection strategies, allocation

of cash resources etc. Following are the methods for controlling cash:

1. Documentation and records – Ensures safeguarding to the company by making proper

records and documents of the cash transactions of the business.

2. Segregation of duties – Cash related duties i.e. Maintaining of cash registers, recieving

cash, recording cash receipts transaction should be assigned to different employees for

minimizing theft or such activities.

3. Proper authorization – Handling cash related transactions should be assigned to only

limited people for maintaining its accuracy level.

TASK 3

AC 3.1 Trial Balance

Definition – An accounting report depicting about list of general ledger account balances on debit

as well as credit side.

Purpose – The main aim of preparing trial balance is:

1. To check arithmetical accuracy of ledger accounts.

2. To identify mathematical errors done in double entry accounting system (Liang and et.al., 2016).

3. Provides base for preparation of financial statement.

Source and structure -

A trial balance is having a list containing two columns i.e. Debit and credit in which

balances of all the ledger accounts are disclosed.

Structure of trial balance

It contains five columns:

1. Serial number

2. Heads of accounts

3. References

4. Debit balance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5. Credit balance

Sample trial balance -

Sample trial balance -

Procedure – It includes:

1. All the ledger accounts are closed at accounting period end.

2. Ledger balances are posted to the trial balance.

3. Trial Balance is checked so as to identify any errors done.

1. All the ledger accounts are closed at accounting period end.

2. Ledger balances are posted to the trial balance.

3. Trial Balance is checked so as to identify any errors done.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.