ACC515 Finance Report: Investment Analysis and Firm Valuation

VerifiedAdded on 2022/09/26

|19

|1546

|15

Report

AI Summary

This report provides a comprehensive analysis of various finance-related topics, including investment decisions, risk assessment, capital budgeting, and firm valuation. It evaluates different investment options, such as loan options from ABC Bank, and assesses the risks associated with them. The report also delves into the Australian dividend imputation system and its impact on shareholders. Furthermore, it includes calculations of standard deviation and beta to measure market volatility and stock risk. The analysis extends to capital budgeting decisions, comparing upgrade proposals based on NPV, payback period, and profitability index. Finally, the report determines the appropriate cost of debt and evaluates the impact of WACC on the value of the firm using discounted cash flow models. Desklib offers a platform to access similar solved assignments and past papers for students.

Running head: FINANCE

FINANCE

Name of the Student

Name of the University

Author Note

FINANCE

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCE

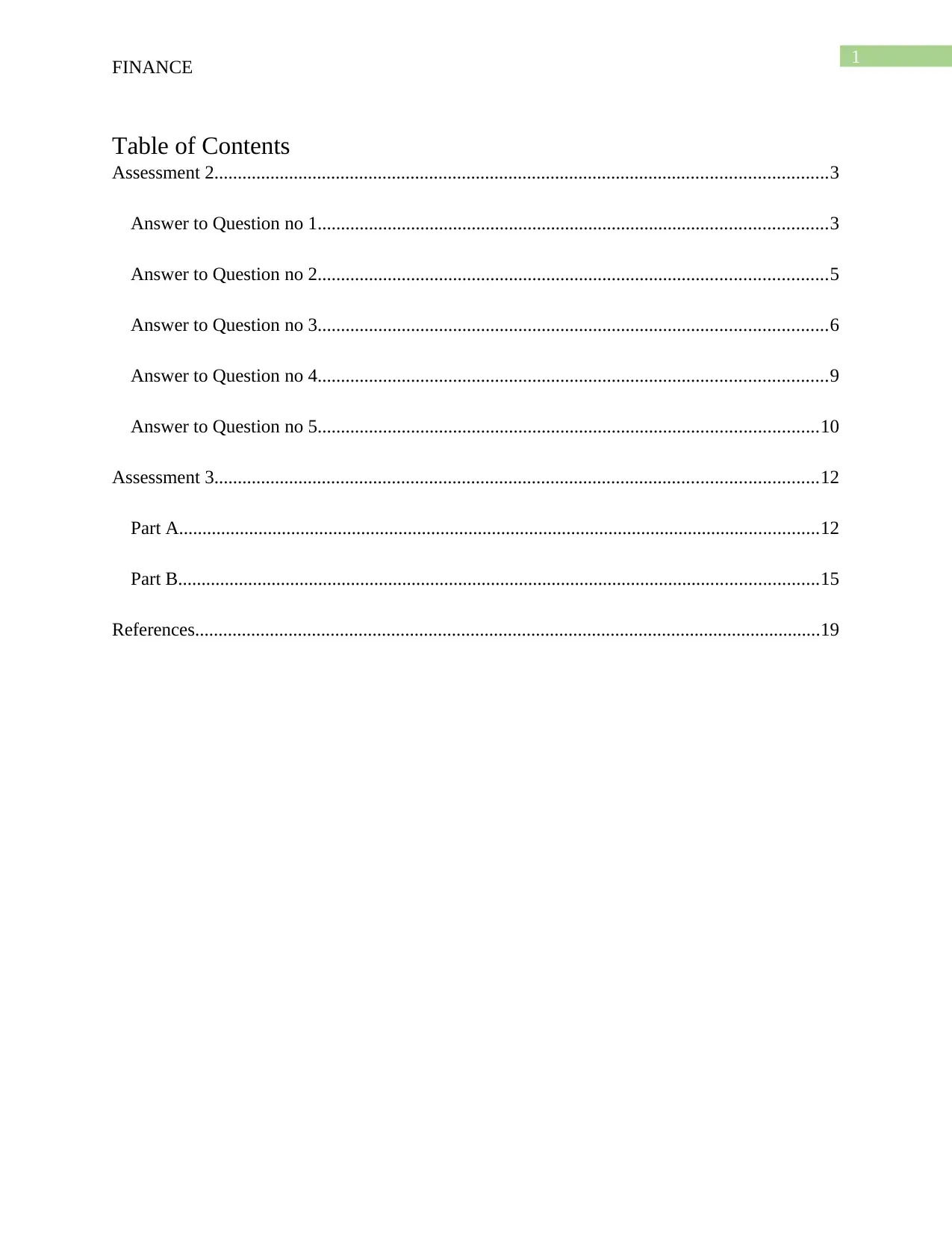

Table of Contents

Assessment 2...................................................................................................................................3

Answer to Question no 1.............................................................................................................3

Answer to Question no 2.............................................................................................................5

Answer to Question no 3.............................................................................................................6

Answer to Question no 4.............................................................................................................9

Answer to Question no 5...........................................................................................................10

Assessment 3.................................................................................................................................12

Part A.........................................................................................................................................12

Part B.........................................................................................................................................15

References......................................................................................................................................19

FINANCE

Table of Contents

Assessment 2...................................................................................................................................3

Answer to Question no 1.............................................................................................................3

Answer to Question no 2.............................................................................................................5

Answer to Question no 3.............................................................................................................6

Answer to Question no 4.............................................................................................................9

Answer to Question no 5...........................................................................................................10

Assessment 3.................................................................................................................................12

Part A.........................................................................................................................................12

Part B.........................................................................................................................................15

References......................................................................................................................................19

2

FINANCE

Assessment 2

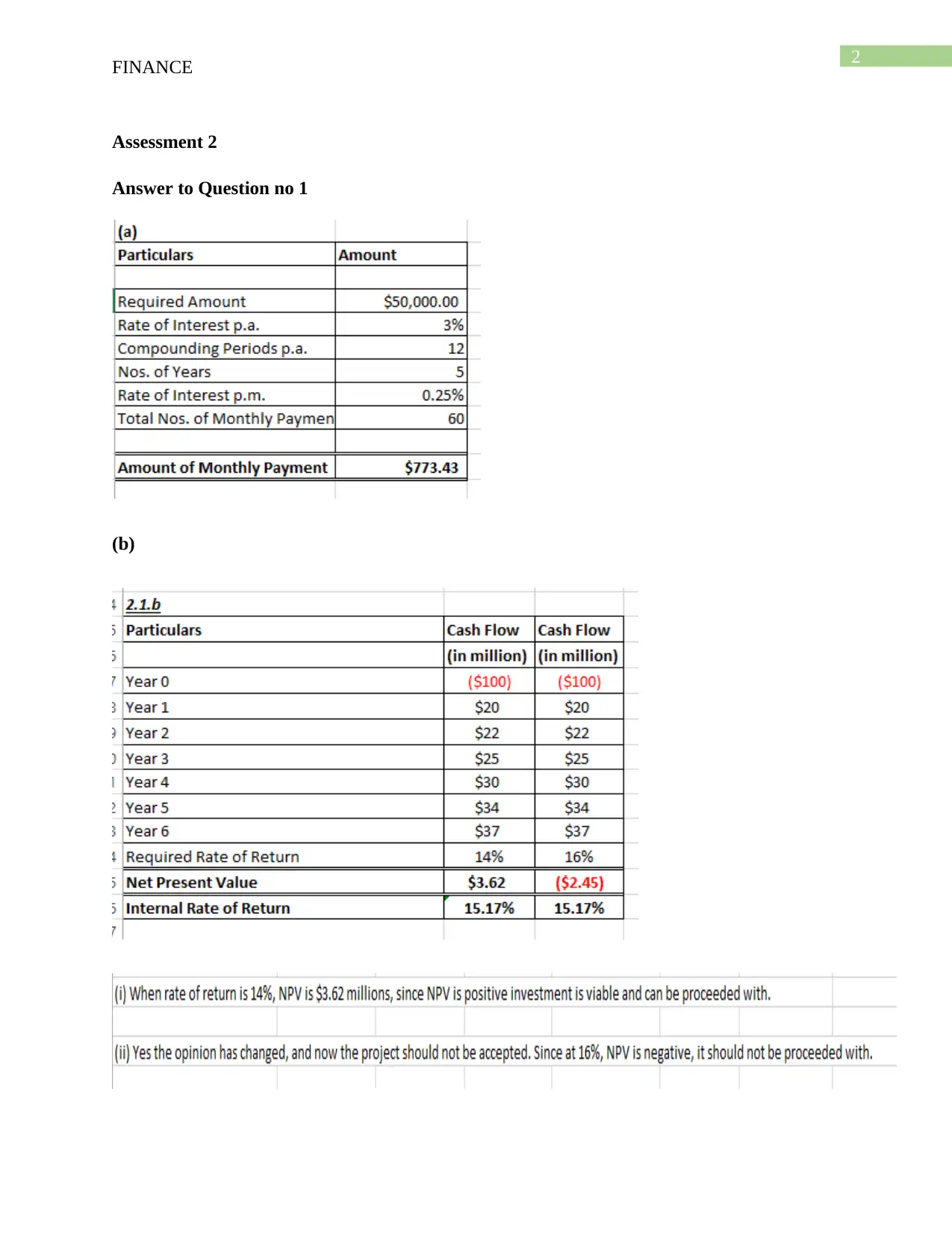

Answer to Question no 1

(b)

FINANCE

Assessment 2

Answer to Question no 1

(b)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCE

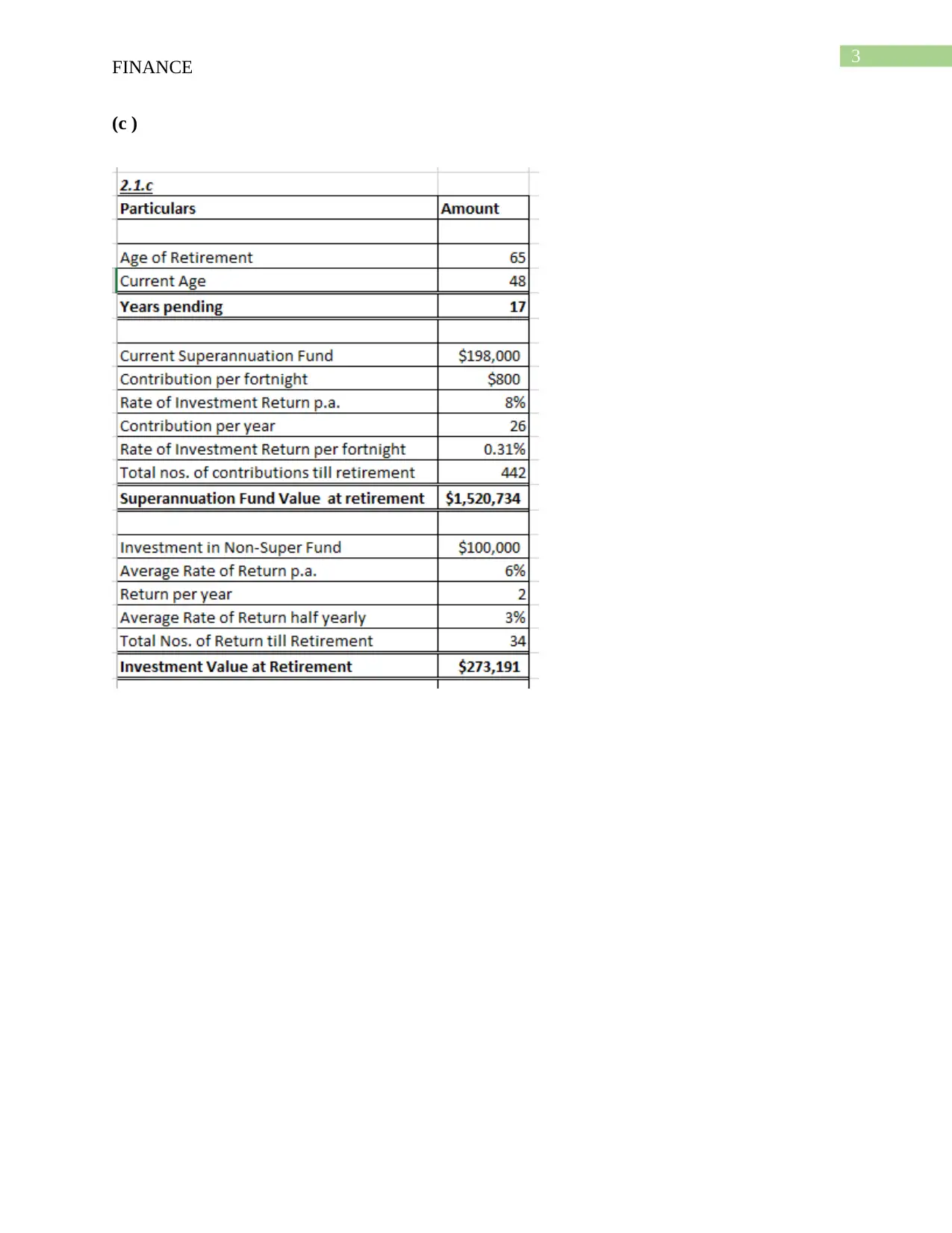

(c )

FINANCE

(c )

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

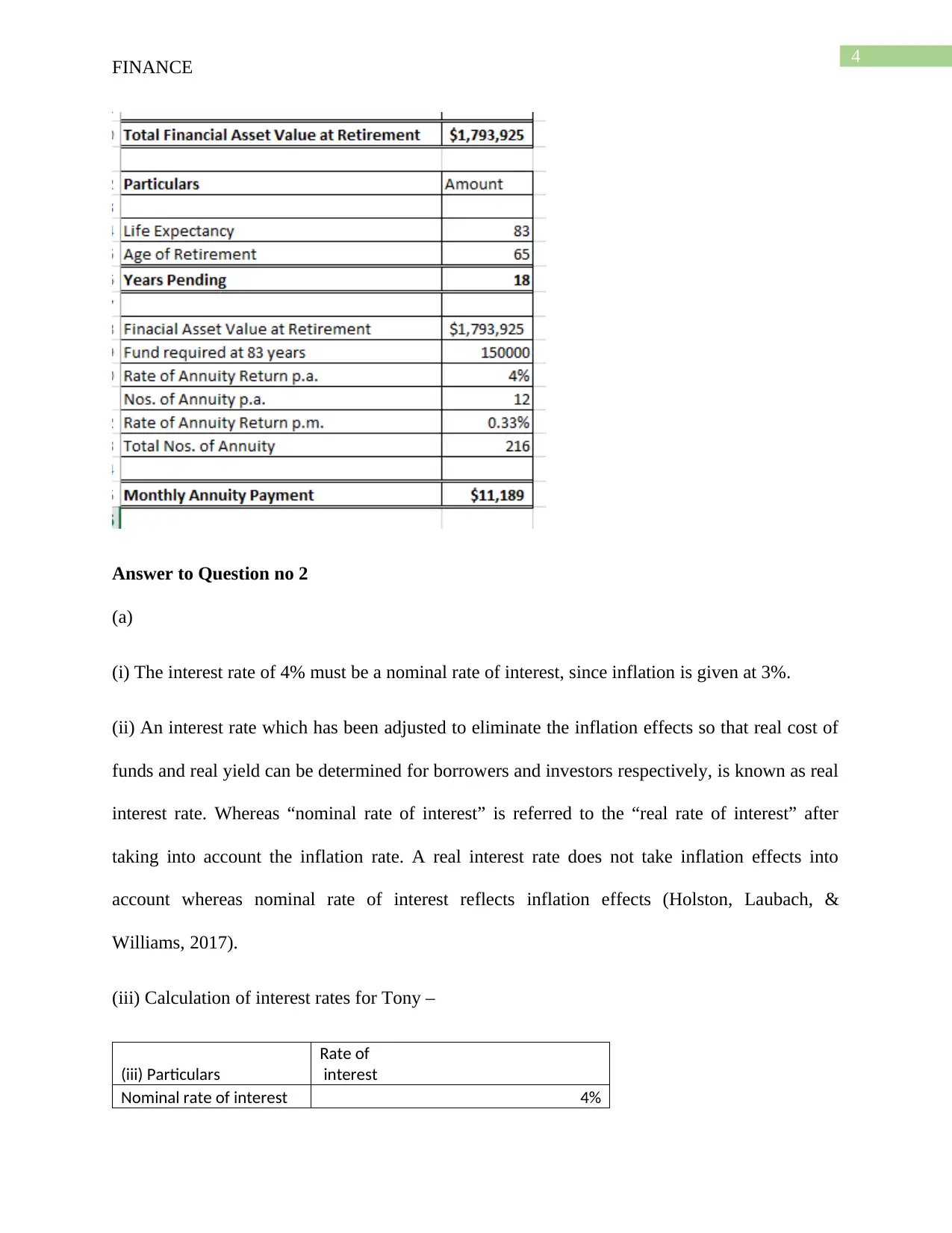

FINANCE

Answer to Question no 2

(a)

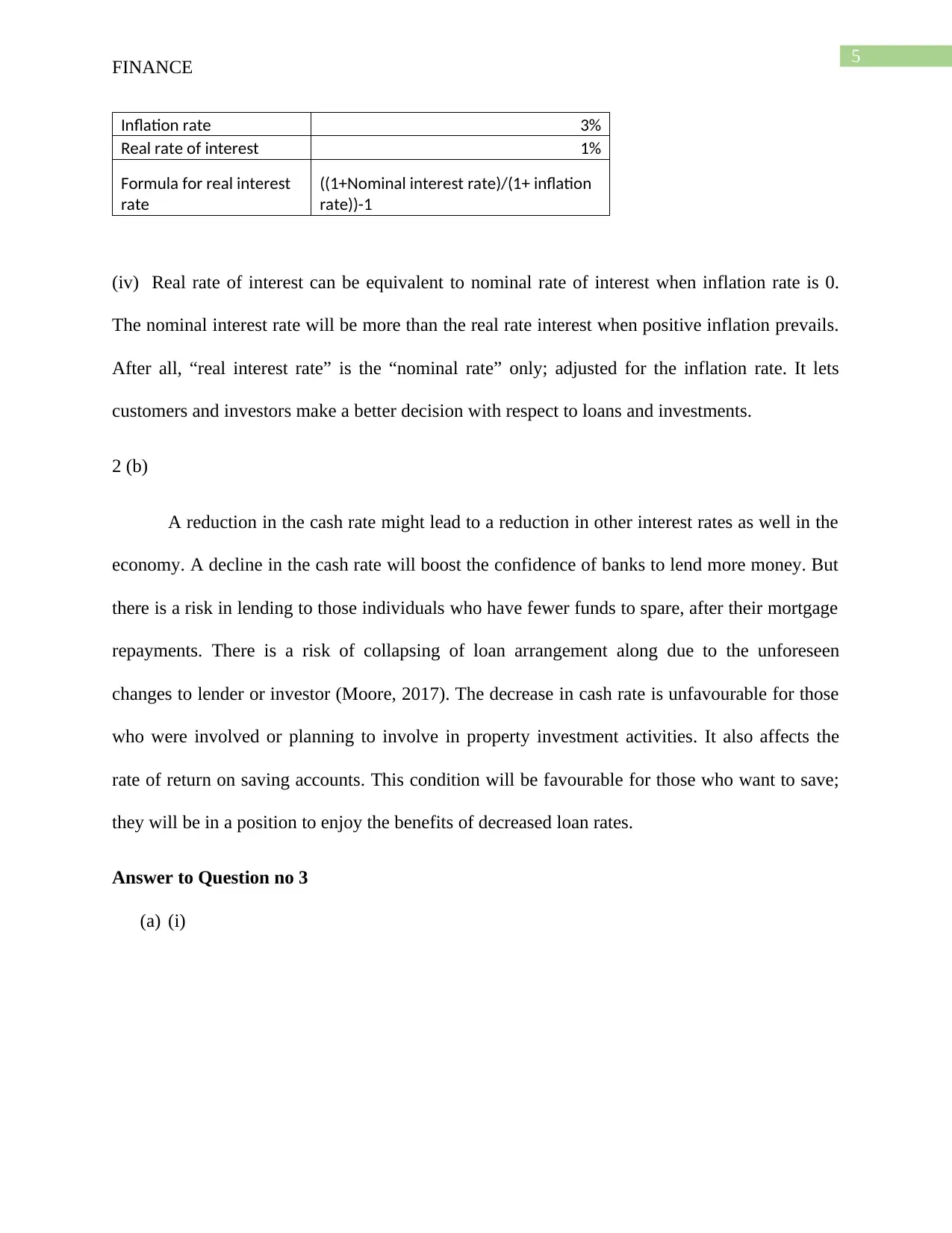

(i) The interest rate of 4% must be a nominal rate of interest, since inflation is given at 3%.

(ii) An interest rate which has been adjusted to eliminate the inflation effects so that real cost of

funds and real yield can be determined for borrowers and investors respectively, is known as real

interest rate. Whereas “nominal rate of interest” is referred to the “real rate of interest” after

taking into account the inflation rate. A real interest rate does not take inflation effects into

account whereas nominal rate of interest reflects inflation effects (Holston, Laubach, &

Williams, 2017).

(iii) Calculation of interest rates for Tony –

(iii) Particulars

Rate of

interest

Nominal rate of interest 4%

FINANCE

Answer to Question no 2

(a)

(i) The interest rate of 4% must be a nominal rate of interest, since inflation is given at 3%.

(ii) An interest rate which has been adjusted to eliminate the inflation effects so that real cost of

funds and real yield can be determined for borrowers and investors respectively, is known as real

interest rate. Whereas “nominal rate of interest” is referred to the “real rate of interest” after

taking into account the inflation rate. A real interest rate does not take inflation effects into

account whereas nominal rate of interest reflects inflation effects (Holston, Laubach, &

Williams, 2017).

(iii) Calculation of interest rates for Tony –

(iii) Particulars

Rate of

interest

Nominal rate of interest 4%

5

FINANCE

Inflation rate 3%

Real rate of interest 1%

Formula for real interest

rate

((1+Nominal interest rate)/(1+ inflation

rate))-1

(iv) Real rate of interest can be equivalent to nominal rate of interest when inflation rate is 0.

The nominal interest rate will be more than the real rate interest when positive inflation prevails.

After all, “real interest rate” is the “nominal rate” only; adjusted for the inflation rate. It lets

customers and investors make a better decision with respect to loans and investments.

2 (b)

A reduction in the cash rate might lead to a reduction in other interest rates as well in the

economy. A decline in the cash rate will boost the confidence of banks to lend more money. But

there is a risk in lending to those individuals who have fewer funds to spare, after their mortgage

repayments. There is a risk of collapsing of loan arrangement along due to the unforeseen

changes to lender or investor (Moore, 2017). The decrease in cash rate is unfavourable for those

who were involved or planning to involve in property investment activities. It also affects the

rate of return on saving accounts. This condition will be favourable for those who want to save;

they will be in a position to enjoy the benefits of decreased loan rates.

Answer to Question no 3

(a) (i)

FINANCE

Inflation rate 3%

Real rate of interest 1%

Formula for real interest

rate

((1+Nominal interest rate)/(1+ inflation

rate))-1

(iv) Real rate of interest can be equivalent to nominal rate of interest when inflation rate is 0.

The nominal interest rate will be more than the real rate interest when positive inflation prevails.

After all, “real interest rate” is the “nominal rate” only; adjusted for the inflation rate. It lets

customers and investors make a better decision with respect to loans and investments.

2 (b)

A reduction in the cash rate might lead to a reduction in other interest rates as well in the

economy. A decline in the cash rate will boost the confidence of banks to lend more money. But

there is a risk in lending to those individuals who have fewer funds to spare, after their mortgage

repayments. There is a risk of collapsing of loan arrangement along due to the unforeseen

changes to lender or investor (Moore, 2017). The decrease in cash rate is unfavourable for those

who were involved or planning to involve in property investment activities. It also affects the

rate of return on saving accounts. This condition will be favourable for those who want to save;

they will be in a position to enjoy the benefits of decreased loan rates.

Answer to Question no 3

(a) (i)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCE

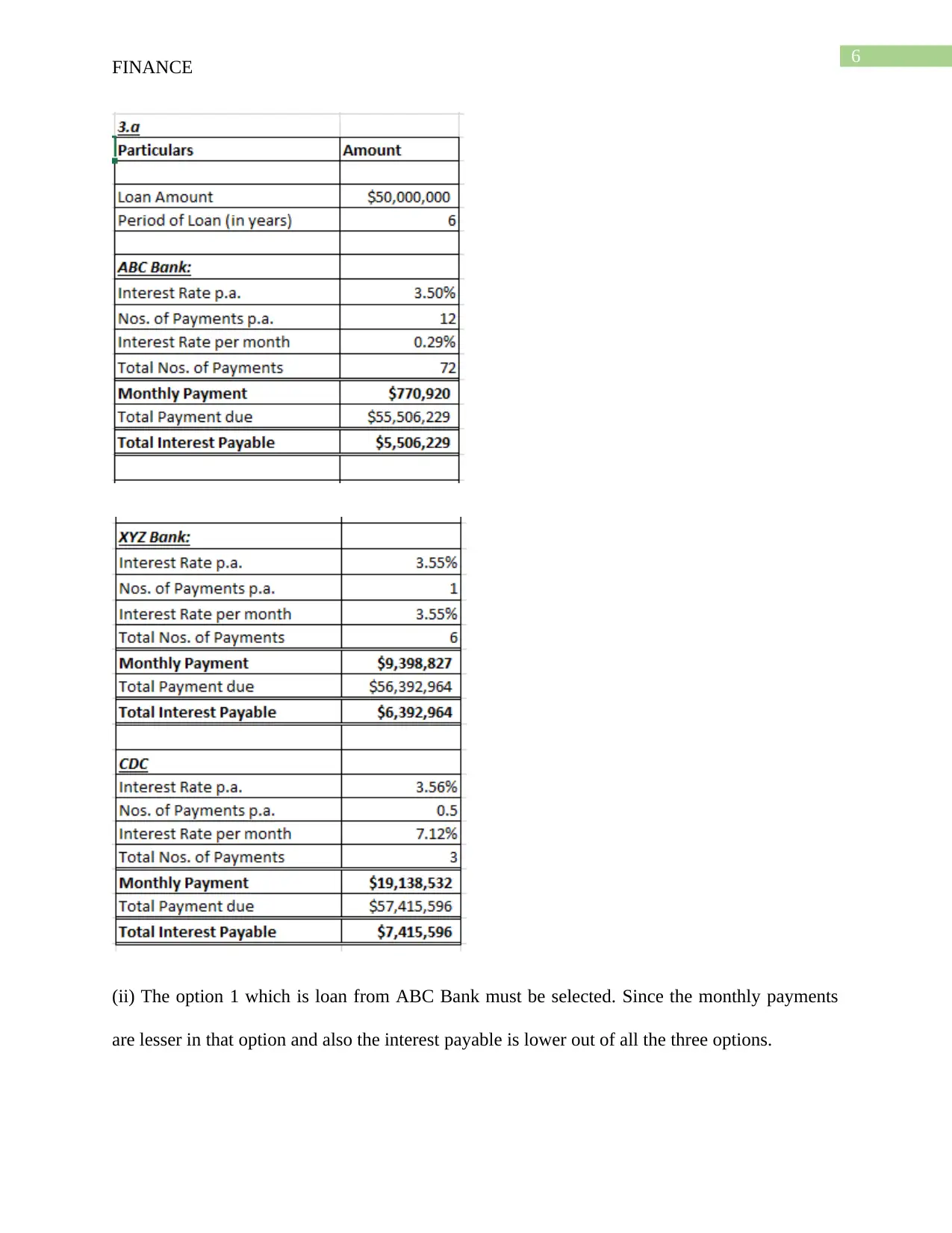

(ii) The option 1 which is loan from ABC Bank must be selected. Since the monthly payments

are lesser in that option and also the interest payable is lower out of all the three options.

FINANCE

(ii) The option 1 which is loan from ABC Bank must be selected. Since the monthly payments

are lesser in that option and also the interest payable is lower out of all the three options.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCE

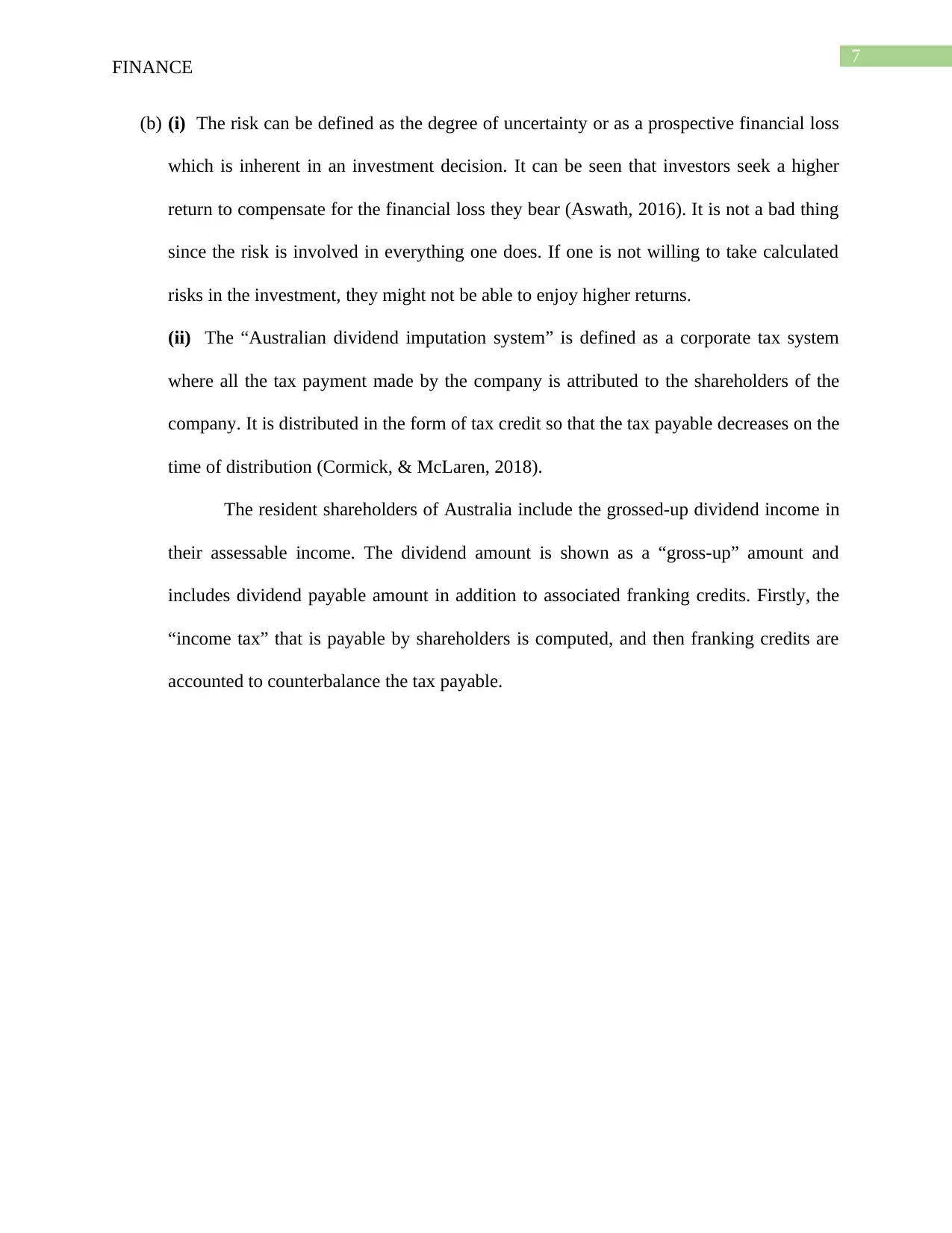

(b) (i) The risk can be defined as the degree of uncertainty or as a prospective financial loss

which is inherent in an investment decision. It can be seen that investors seek a higher

return to compensate for the financial loss they bear (Aswath, 2016). It is not a bad thing

since the risk is involved in everything one does. If one is not willing to take calculated

risks in the investment, they might not be able to enjoy higher returns.

(ii) The “Australian dividend imputation system” is defined as a corporate tax system

where all the tax payment made by the company is attributed to the shareholders of the

company. It is distributed in the form of tax credit so that the tax payable decreases on the

time of distribution (Cormick, & McLaren, 2018).

The resident shareholders of Australia include the grossed-up dividend income in

their assessable income. The dividend amount is shown as a “gross-up” amount and

includes dividend payable amount in addition to associated franking credits. Firstly, the

“income tax” that is payable by shareholders is computed, and then franking credits are

accounted to counterbalance the tax payable.

FINANCE

(b) (i) The risk can be defined as the degree of uncertainty or as a prospective financial loss

which is inherent in an investment decision. It can be seen that investors seek a higher

return to compensate for the financial loss they bear (Aswath, 2016). It is not a bad thing

since the risk is involved in everything one does. If one is not willing to take calculated

risks in the investment, they might not be able to enjoy higher returns.

(ii) The “Australian dividend imputation system” is defined as a corporate tax system

where all the tax payment made by the company is attributed to the shareholders of the

company. It is distributed in the form of tax credit so that the tax payable decreases on the

time of distribution (Cormick, & McLaren, 2018).

The resident shareholders of Australia include the grossed-up dividend income in

their assessable income. The dividend amount is shown as a “gross-up” amount and

includes dividend payable amount in addition to associated franking credits. Firstly, the

“income tax” that is payable by shareholders is computed, and then franking credits are

accounted to counterbalance the tax payable.

8

FINANCE

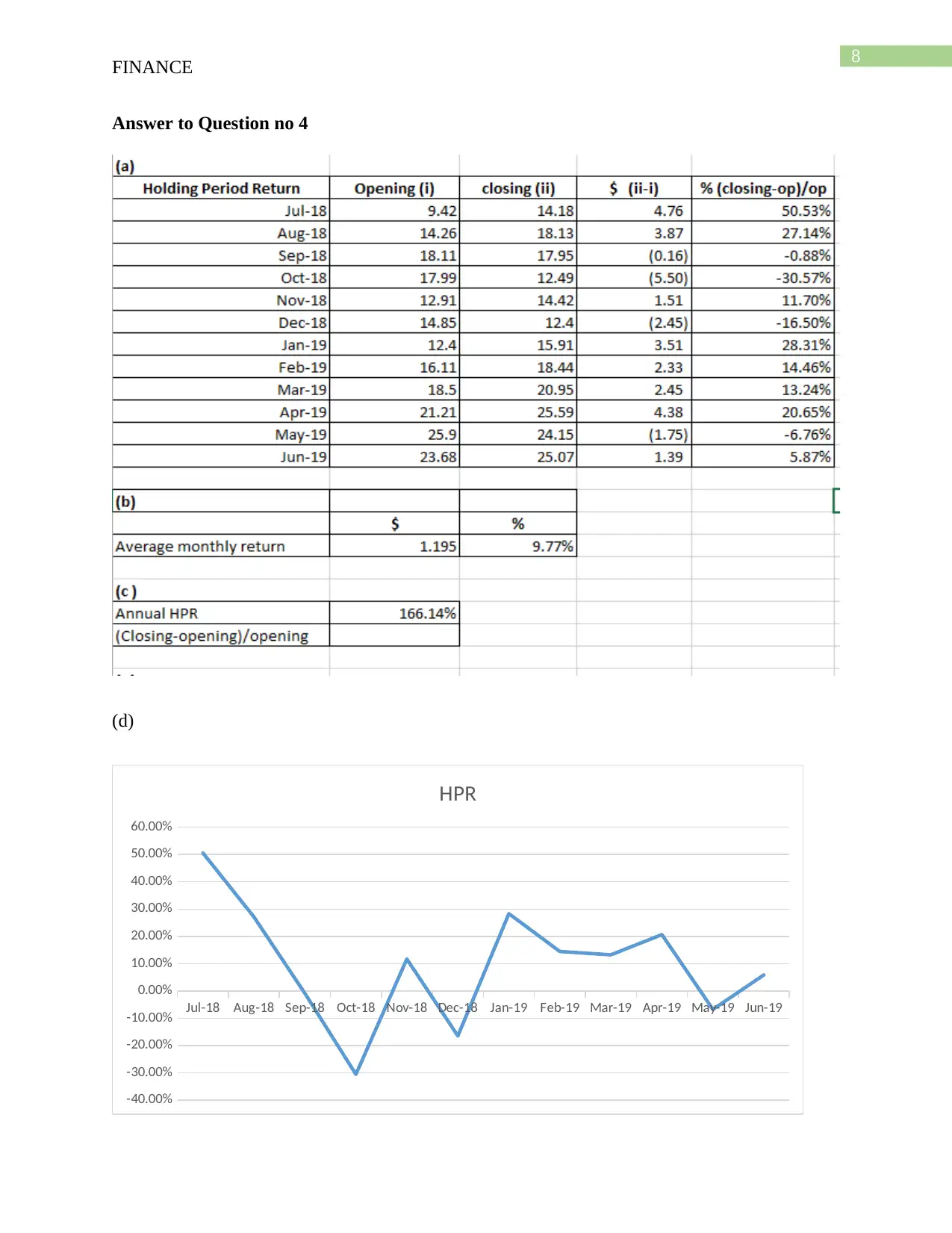

Answer to Question no 4

(d)

Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

HPR

FINANCE

Answer to Question no 4

(d)

Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

HPR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

FINANCE

(e ) Standard Deviation of speedy = 21.71%

(f) Standard Deviation of 10.4 of market is the measurement of the volatility of the market. It

measures how extensively prices are disseminated from the average price. Speedy's standard

deviation is 21.71 % which is way higher than the market's standard deviation. The high standard

deviation of the stock reflects that prices move wildly, and this entire investment can be risky. It

assists in risk-measurement and to determine whether the investment will meet its expectation of

return in a given period of time or not. It can be concluded that when compared with the market,

the stock is highly volatile.

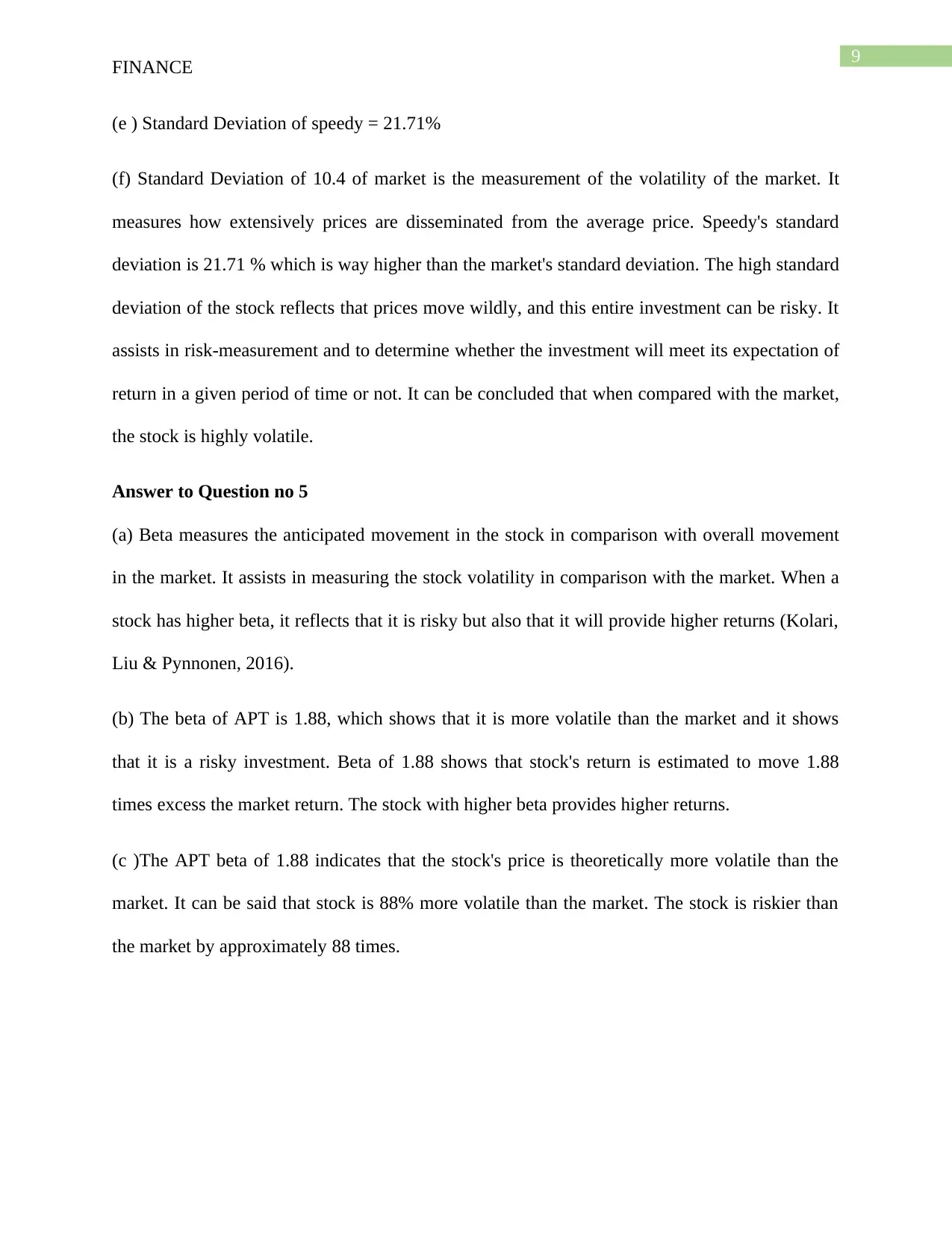

Answer to Question no 5

(a) Beta measures the anticipated movement in the stock in comparison with overall movement

in the market. It assists in measuring the stock volatility in comparison with the market. When a

stock has higher beta, it reflects that it is risky but also that it will provide higher returns (Kolari,

Liu & Pynnonen, 2016).

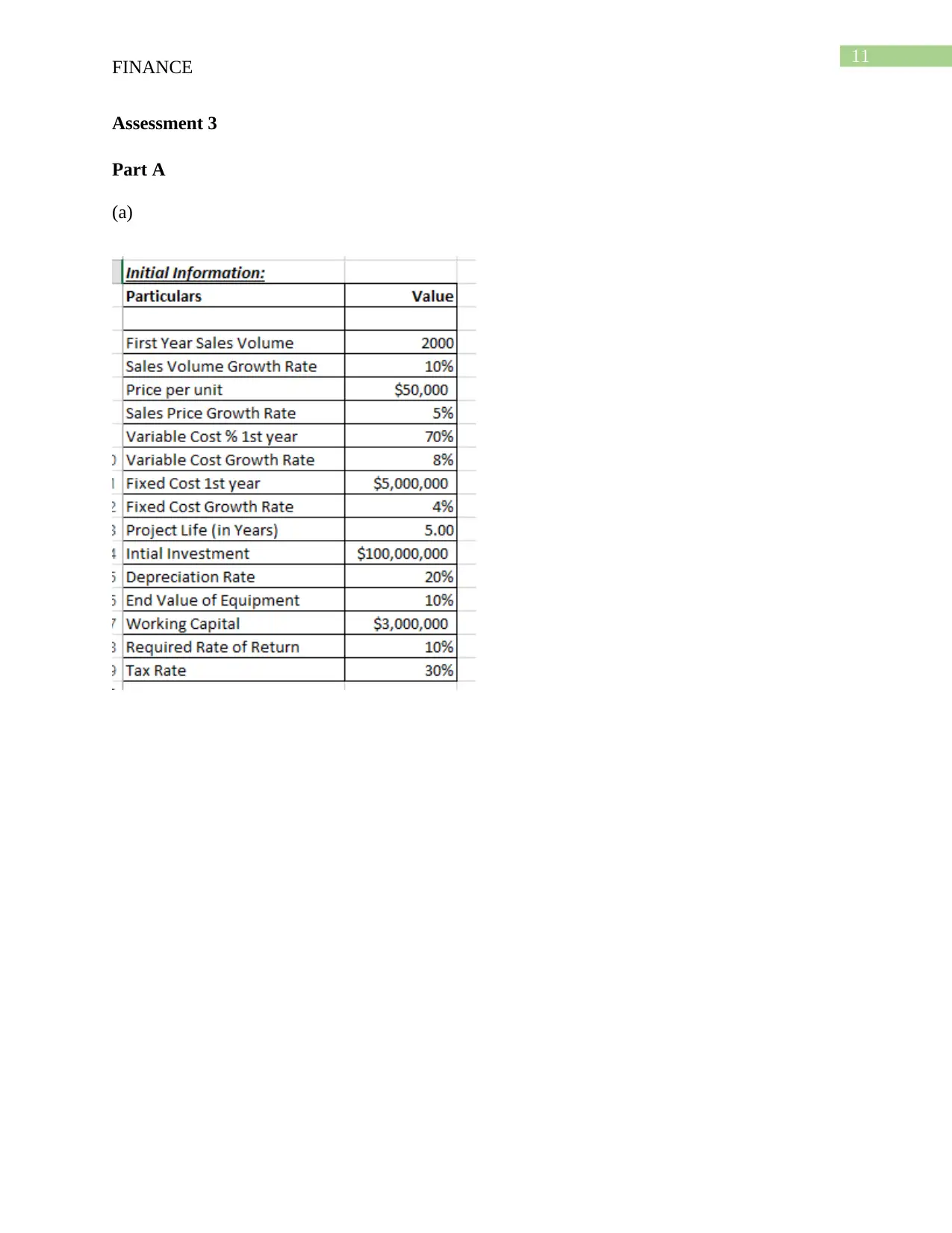

(b) The beta of APT is 1.88, which shows that it is more volatile than the market and it shows

that it is a risky investment. Beta of 1.88 shows that stock's return is estimated to move 1.88

times excess the market return. The stock with higher beta provides higher returns.

(c )The APT beta of 1.88 indicates that the stock's price is theoretically more volatile than the

market. It can be said that stock is 88% more volatile than the market. The stock is riskier than

the market by approximately 88 times.

FINANCE

(e ) Standard Deviation of speedy = 21.71%

(f) Standard Deviation of 10.4 of market is the measurement of the volatility of the market. It

measures how extensively prices are disseminated from the average price. Speedy's standard

deviation is 21.71 % which is way higher than the market's standard deviation. The high standard

deviation of the stock reflects that prices move wildly, and this entire investment can be risky. It

assists in risk-measurement and to determine whether the investment will meet its expectation of

return in a given period of time or not. It can be concluded that when compared with the market,

the stock is highly volatile.

Answer to Question no 5

(a) Beta measures the anticipated movement in the stock in comparison with overall movement

in the market. It assists in measuring the stock volatility in comparison with the market. When a

stock has higher beta, it reflects that it is risky but also that it will provide higher returns (Kolari,

Liu & Pynnonen, 2016).

(b) The beta of APT is 1.88, which shows that it is more volatile than the market and it shows

that it is a risky investment. Beta of 1.88 shows that stock's return is estimated to move 1.88

times excess the market return. The stock with higher beta provides higher returns.

(c )The APT beta of 1.88 indicates that the stock's price is theoretically more volatile than the

market. It can be said that stock is 88% more volatile than the market. The stock is riskier than

the market by approximately 88 times.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

FINANCE

(e )

(i)

(ii)

FINANCE

(e )

(i)

(ii)

11

FINANCE

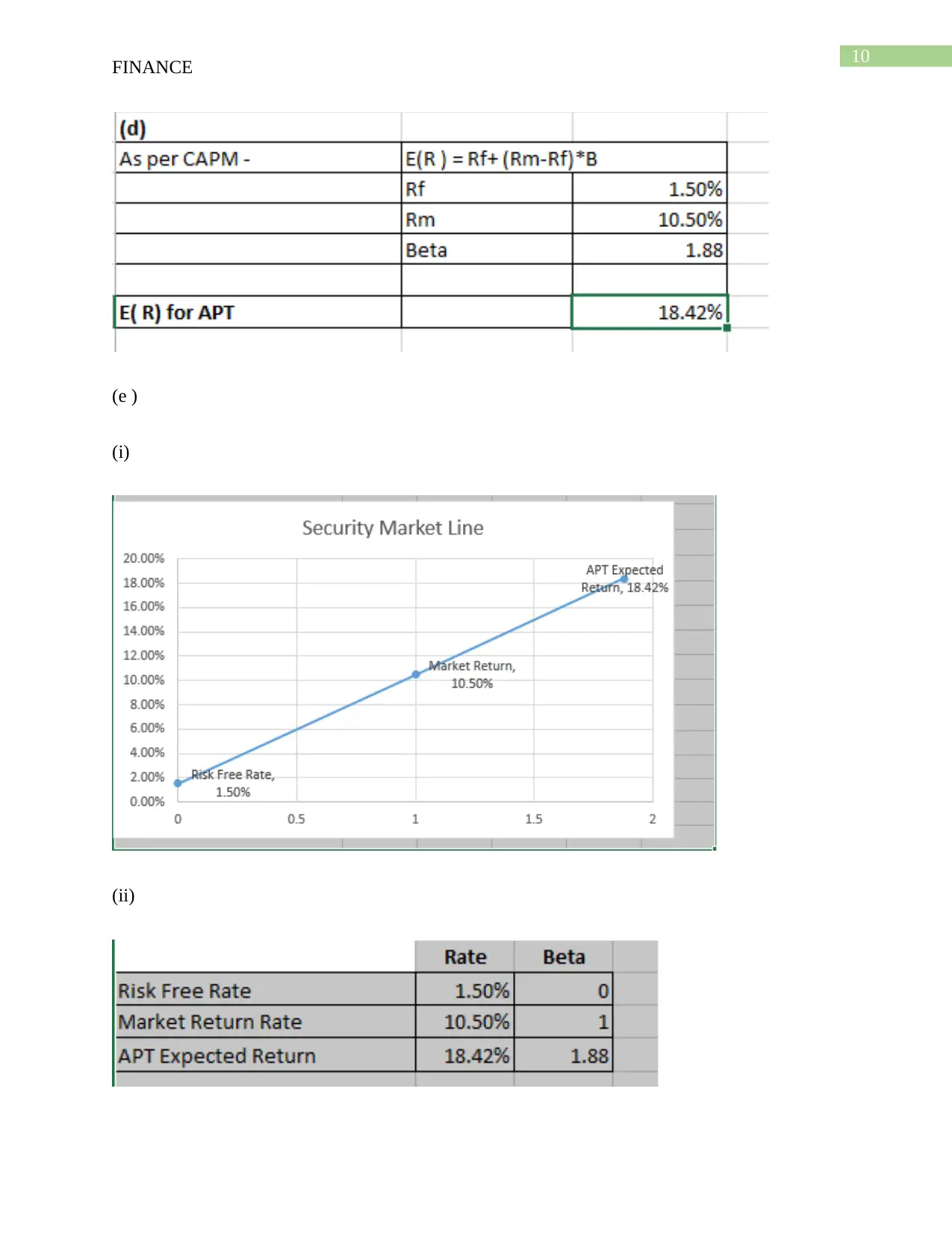

Assessment 3

Part A

(a)

FINANCE

Assessment 3

Part A

(a)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.