Investment and Project Analysis: A Finance Homework Assignment

VerifiedAdded on 2021/06/17

|4

|490

|123

Homework Assignment

AI Summary

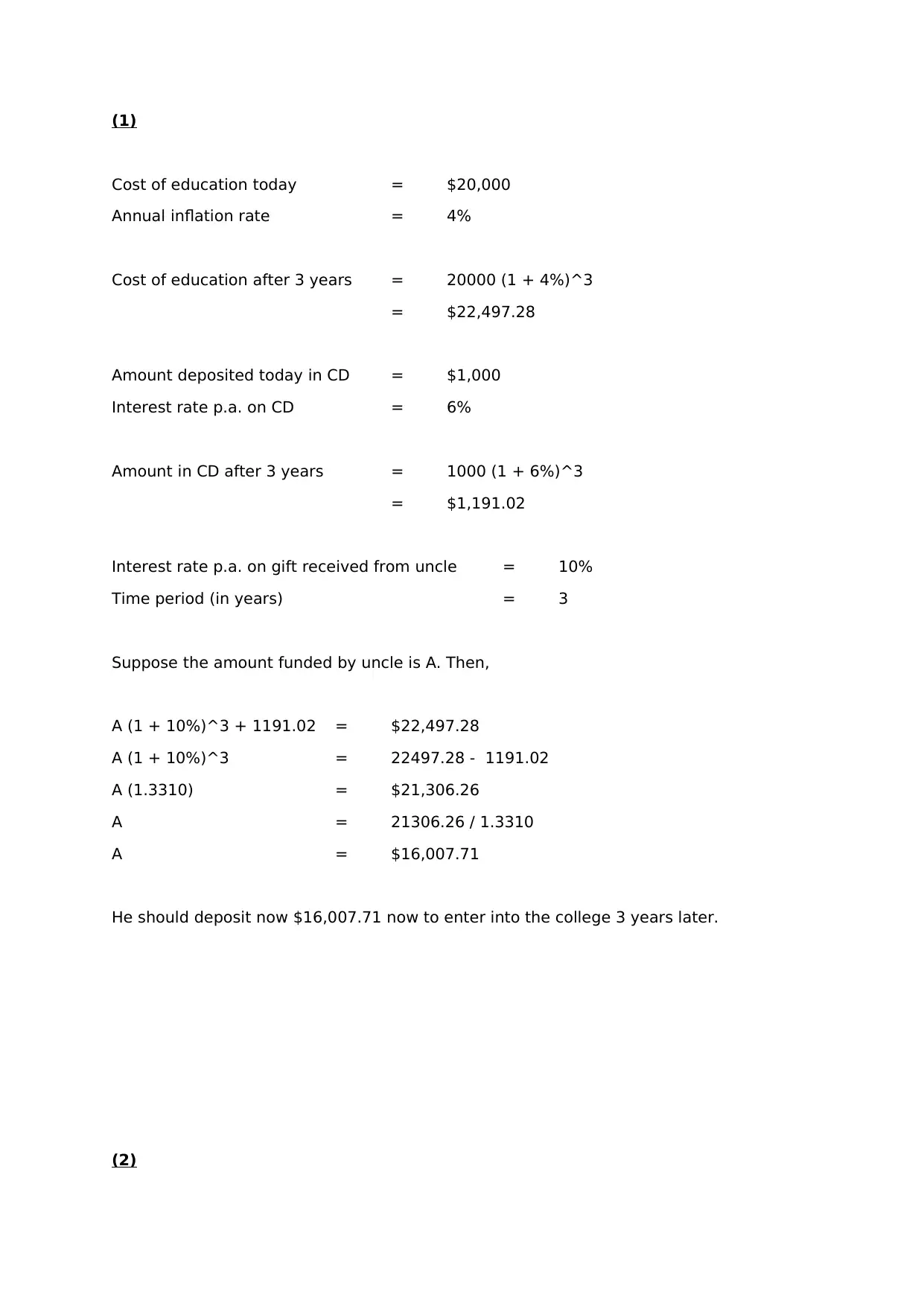

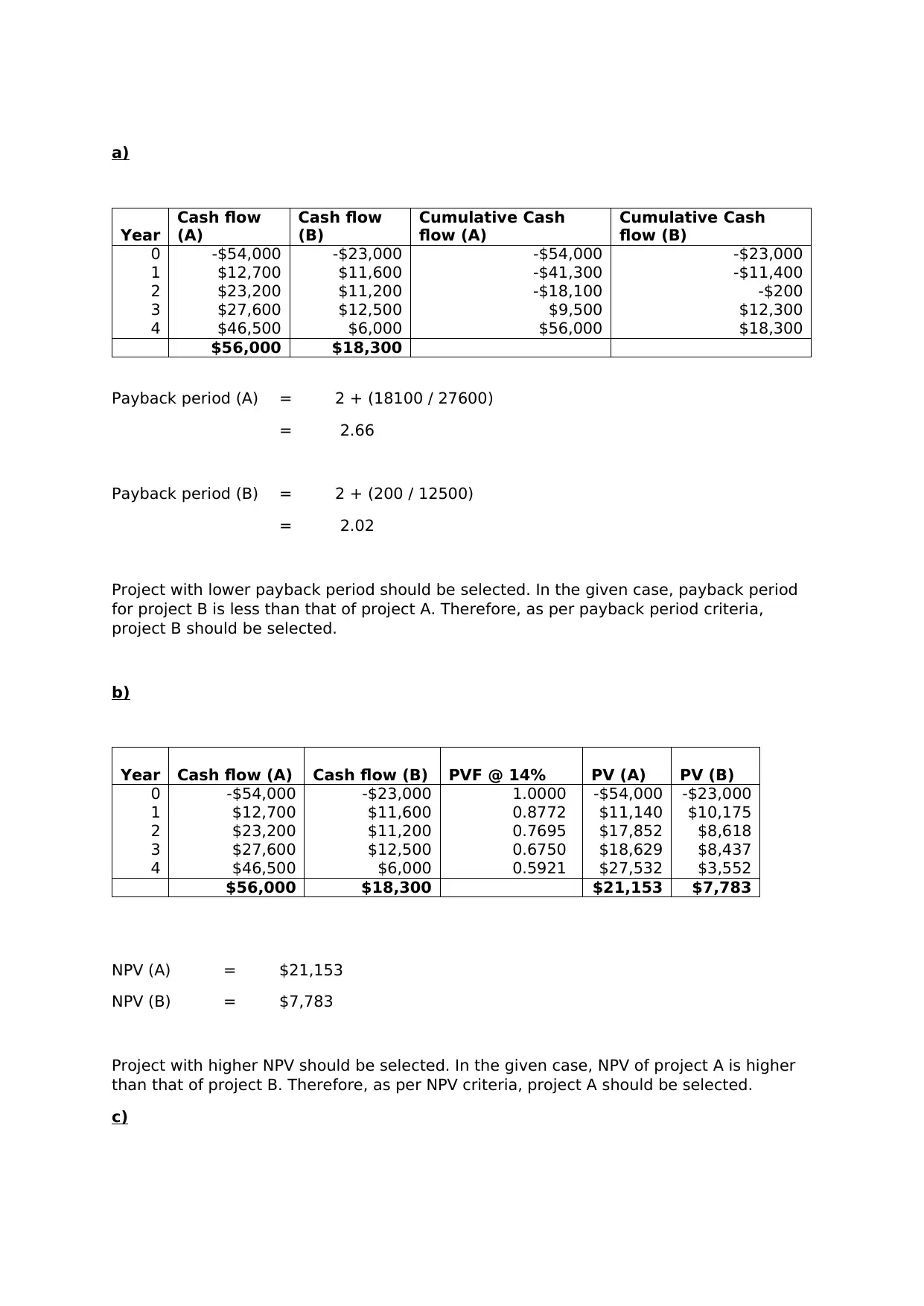

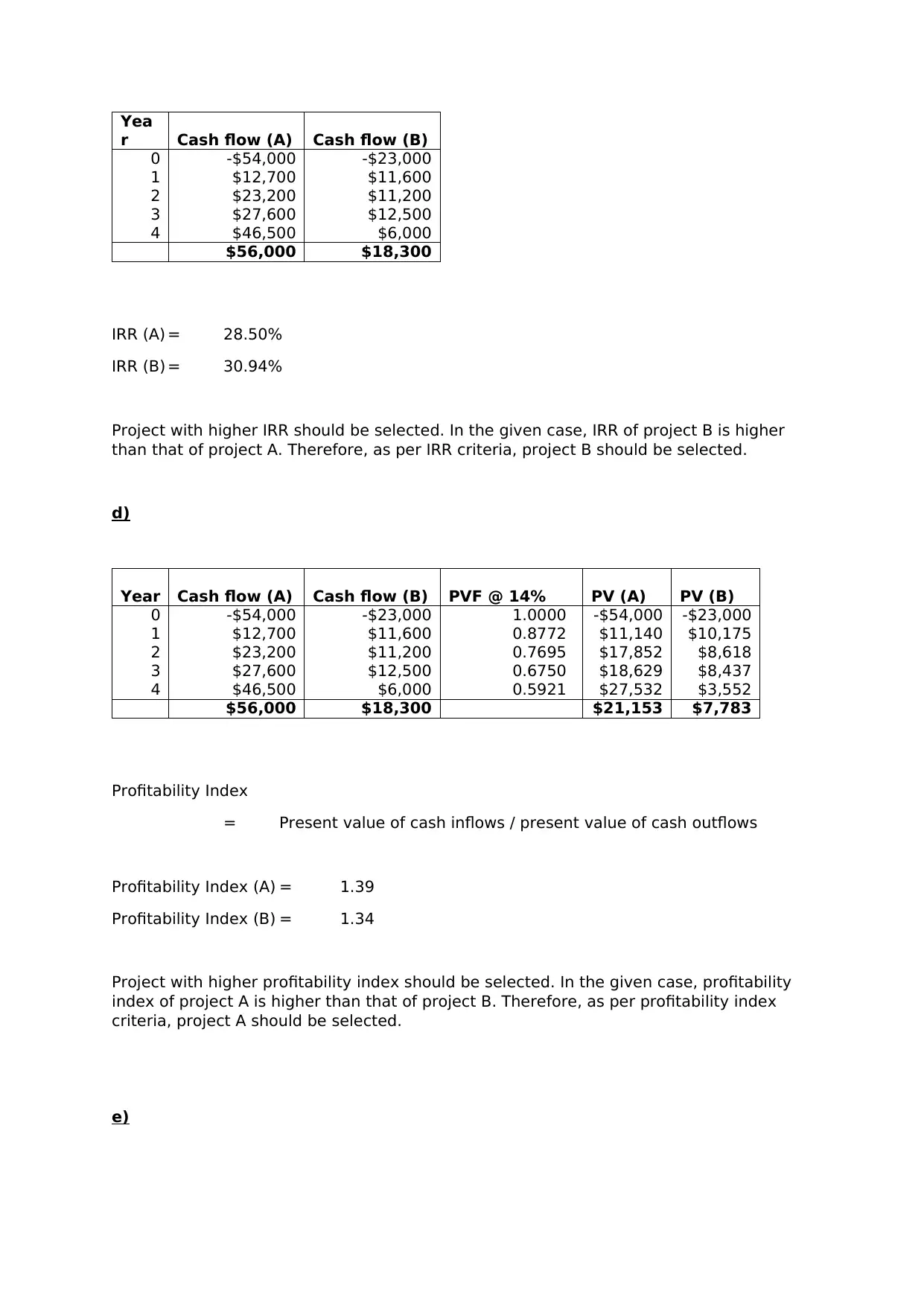

This finance homework assignment presents two primary problems. The first problem focuses on calculating the amount needed to be deposited today to cover future education costs, considering inflation, interest rates on a Certificate of Deposit (CD), and a gift from an uncle. The solution involves calculating the future cost of education, the future value of the CD, and then determining the amount the uncle needs to contribute to cover the remaining costs. The second problem assesses two investment projects (A and B) using various financial metrics. The analysis includes calculating and comparing the payback period, Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Index for both projects. The solution explains each method and provides a recommendation on which project to select based on the results, while also explaining the limitations of payback period and IRR, and justifying the preference for NPV and Profitability Index in making the final investment decision.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)