Business Finance: Loan Amortization, Investment Decisions, & Ratios

VerifiedAdded on 2023/06/15

|19

|2617

|155

Homework Assignment

AI Summary

This business finance assignment solution covers a range of topics including loan amortization schedules, investment appraisal techniques such as Net Present Value (NPV) and Internal Rate of Return (IRR), and financial ratio analysis. The loan analysis section calculates monthly payments, interest and principal components, and the impact of refinancing. The investment appraisal section evaluates projects using payback period, NPV, and IRR, considering different discount rates. The financial ratio analysis section defines and explains the significance of various ratios, including liquidity, solvency, and profitability ratios. The assignment also includes systematic and unsystematic risk, and portfolio rate of return calculation. Desklib offers a wealth of similar solved assignments and study resources for students.

Running Head: Business Finance

Business Finance

Business Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 1

Table of Contents

Question 1.............................................................................................................................................3

Part 1.................................................................................................................................................3

Part 2.................................................................................................................................................3

Part 3.................................................................................................................................................3

Part 4.................................................................................................................................................3

Part 5.................................................................................................................................................3

Part 6.................................................................................................................................................4

Part 7.................................................................................................................................................4

Part 8.................................................................................................................................................4

Part 9.................................................................................................................................................4

Question 2.............................................................................................................................................5

Part a..................................................................................................................................................5

Part b.................................................................................................................................................5

Part c..................................................................................................................................................5

Question 3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5.............................................................................................................................................7

Part a..................................................................................................................................................7

Part b.................................................................................................................................................8

Part c..................................................................................................................................................8

Part d.................................................................................................................................................8

Question 6...........................................................................................................................................10

Part a................................................................................................................................................10

Part b...............................................................................................................................................10

Part c................................................................................................................................................11

Question 7...........................................................................................................................................12

Question 8...........................................................................................................................................13

Part a................................................................................................................................................13

Part b...............................................................................................................................................13

Part c................................................................................................................................................13

Part d...............................................................................................................................................14

Part e................................................................................................................................................15

Part f................................................................................................................................................15

Table of Contents

Question 1.............................................................................................................................................3

Part 1.................................................................................................................................................3

Part 2.................................................................................................................................................3

Part 3.................................................................................................................................................3

Part 4.................................................................................................................................................3

Part 5.................................................................................................................................................3

Part 6.................................................................................................................................................4

Part 7.................................................................................................................................................4

Part 8.................................................................................................................................................4

Part 9.................................................................................................................................................4

Question 2.............................................................................................................................................5

Part a..................................................................................................................................................5

Part b.................................................................................................................................................5

Part c..................................................................................................................................................5

Question 3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5.............................................................................................................................................7

Part a..................................................................................................................................................7

Part b.................................................................................................................................................8

Part c..................................................................................................................................................8

Part d.................................................................................................................................................8

Question 6...........................................................................................................................................10

Part a................................................................................................................................................10

Part b...............................................................................................................................................10

Part c................................................................................................................................................11

Question 7...........................................................................................................................................12

Question 8...........................................................................................................................................13

Part a................................................................................................................................................13

Part b...............................................................................................................................................13

Part c................................................................................................................................................13

Part d...............................................................................................................................................14

Part e................................................................................................................................................15

Part f................................................................................................................................................15

Business Finance 2

Question 9...........................................................................................................................................16

Question 10.........................................................................................................................................17

Part a................................................................................................................................................17

Part b...............................................................................................................................................17

Part c................................................................................................................................................17

Part d...............................................................................................................................................17

Part e................................................................................................................................................17

References:..........................................................................................................................................18

Question 9...........................................................................................................................................16

Question 10.........................................................................................................................................17

Part a................................................................................................................................................17

Part b...............................................................................................................................................17

Part c................................................................................................................................................17

Part d...............................................................................................................................................17

Part e................................................................................................................................................17

References:..........................................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance 3

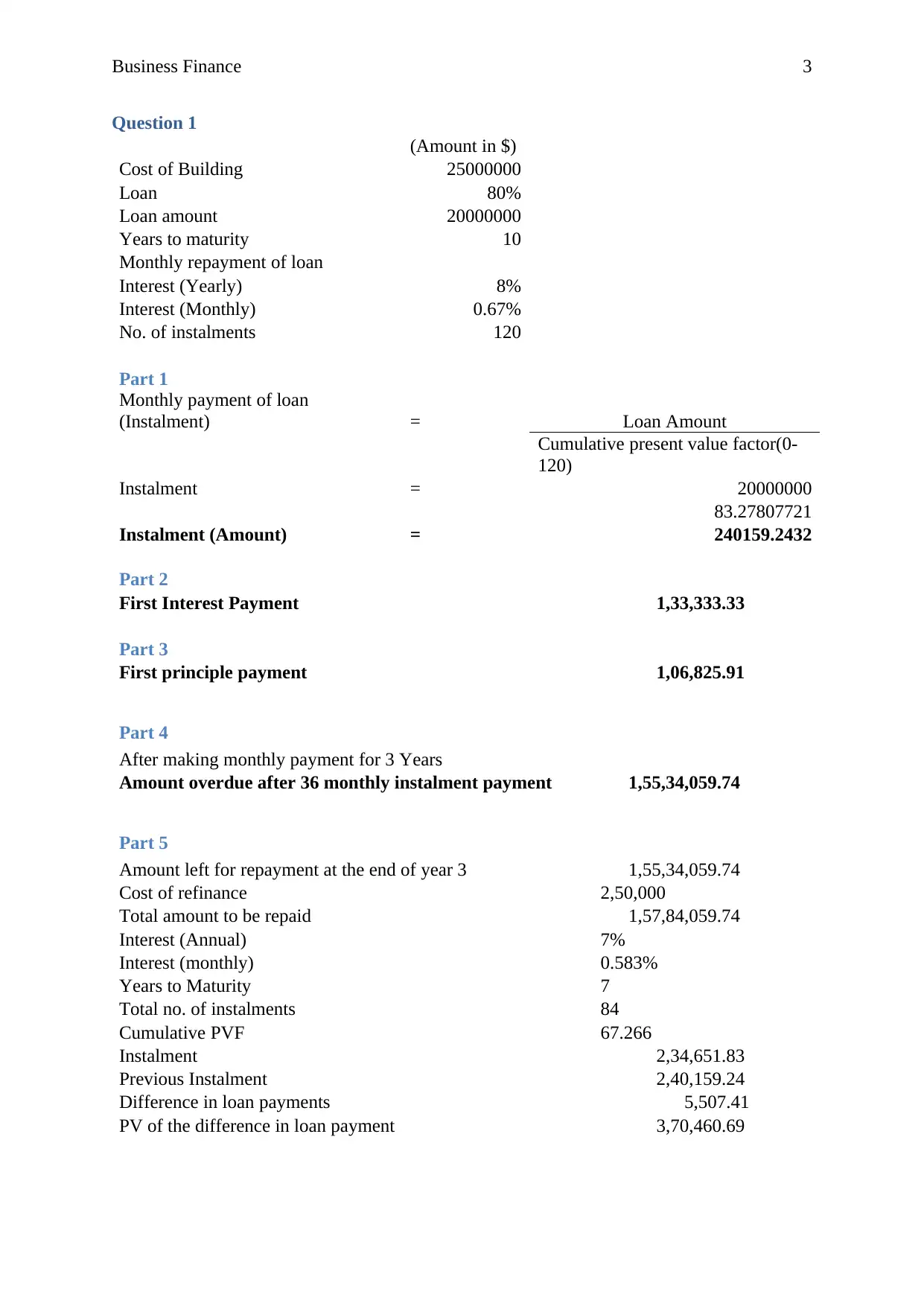

Question 1

(Amount in $)

Cost of Building 25000000

Loan 80%

Loan amount 20000000

Years to maturity 10

Monthly repayment of loan

Interest (Yearly) 8%

Interest (Monthly) 0.67%

No. of instalments 120

Part 1

Monthly payment of loan

(Instalment) = Loan Amount

Cumulative present value factor(0-

120)

Instalment = 20000000

83.27807721

Instalment (Amount) = 240159.2432

Part 2

First Interest Payment 1,33,333.33

Part 3

First principle payment 1,06,825.91

Part 4

After making monthly payment for 3 Years

Amount overdue after 36 monthly instalment payment 1,55,34,059.74

Part 5

Amount left for repayment at the end of year 3 1,55,34,059.74

Cost of refinance 2,50,000

Total amount to be repaid 1,57,84,059.74

Interest (Annual) 7%

Interest (monthly) 0.583%

Years to Maturity 7

Total no. of instalments 84

Cumulative PVF 67.266

Instalment 2,34,651.83

Previous Instalment 2,40,159.24

Difference in loan payments 5,507.41

PV of the difference in loan payment 3,70,460.69

Question 1

(Amount in $)

Cost of Building 25000000

Loan 80%

Loan amount 20000000

Years to maturity 10

Monthly repayment of loan

Interest (Yearly) 8%

Interest (Monthly) 0.67%

No. of instalments 120

Part 1

Monthly payment of loan

(Instalment) = Loan Amount

Cumulative present value factor(0-

120)

Instalment = 20000000

83.27807721

Instalment (Amount) = 240159.2432

Part 2

First Interest Payment 1,33,333.33

Part 3

First principle payment 1,06,825.91

Part 4

After making monthly payment for 3 Years

Amount overdue after 36 monthly instalment payment 1,55,34,059.74

Part 5

Amount left for repayment at the end of year 3 1,55,34,059.74

Cost of refinance 2,50,000

Total amount to be repaid 1,57,84,059.74

Interest (Annual) 7%

Interest (monthly) 0.583%

Years to Maturity 7

Total no. of instalments 84

Cumulative PVF 67.266

Instalment 2,34,651.83

Previous Instalment 2,40,159.24

Difference in loan payments 5,507.41

PV of the difference in loan payment 3,70,460.69

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 4

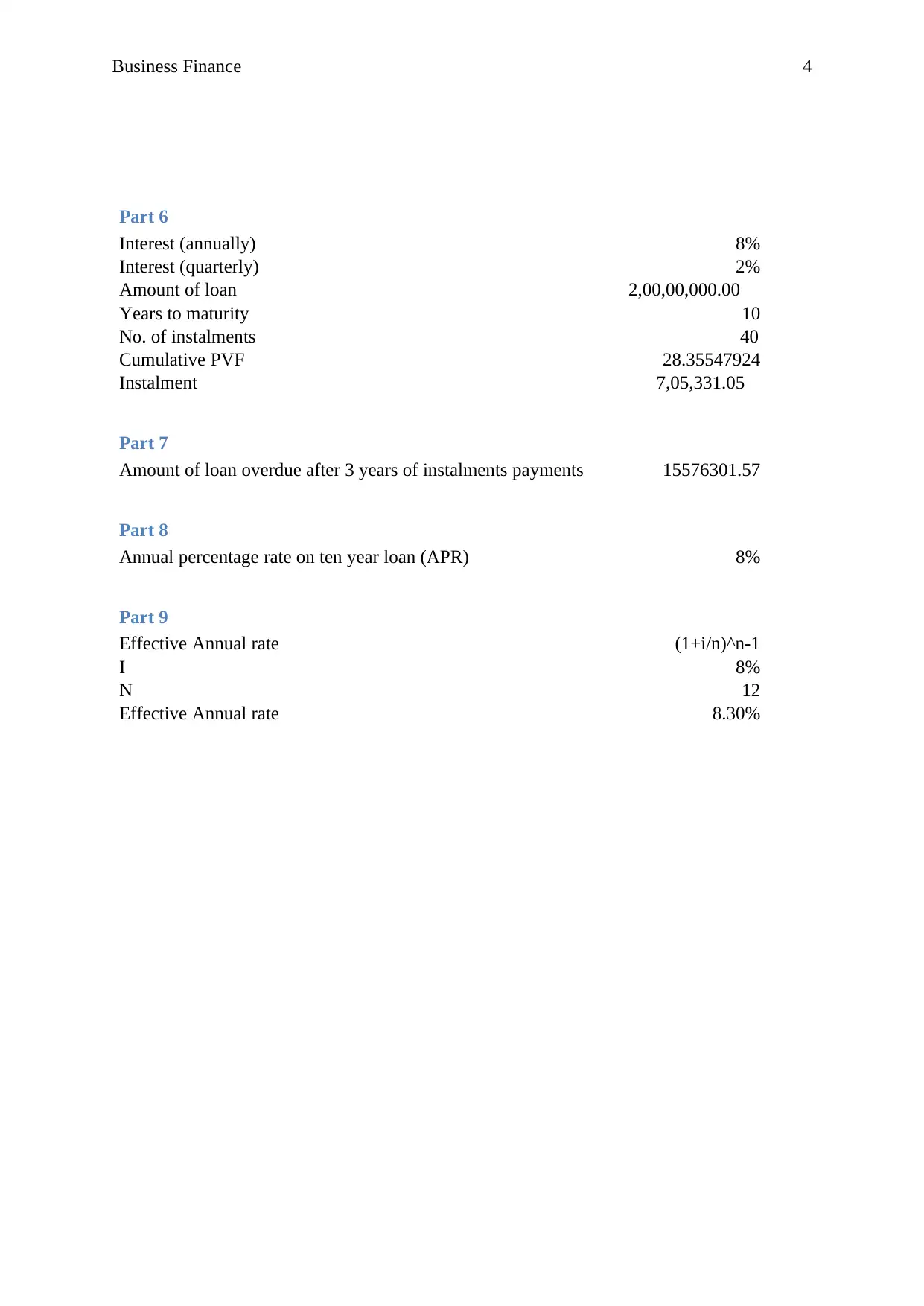

Part 6

Interest (annually) 8%

Interest (quarterly) 2%

Amount of loan 2,00,00,000.00

Years to maturity 10

No. of instalments 40

Cumulative PVF 28.35547924

Instalment 7,05,331.05

Part 7

Amount of loan overdue after 3 years of instalments payments 15576301.57

Part 8

Annual percentage rate on ten year loan (APR) 8%

Part 9

Effective Annual rate (1+i/n)^n-1

I 8%

N 12

Effective Annual rate 8.30%

Part 6

Interest (annually) 8%

Interest (quarterly) 2%

Amount of loan 2,00,00,000.00

Years to maturity 10

No. of instalments 40

Cumulative PVF 28.35547924

Instalment 7,05,331.05

Part 7

Amount of loan overdue after 3 years of instalments payments 15576301.57

Part 8

Annual percentage rate on ten year loan (APR) 8%

Part 9

Effective Annual rate (1+i/n)^n-1

I 8%

N 12

Effective Annual rate 8.30%

Business Finance 5

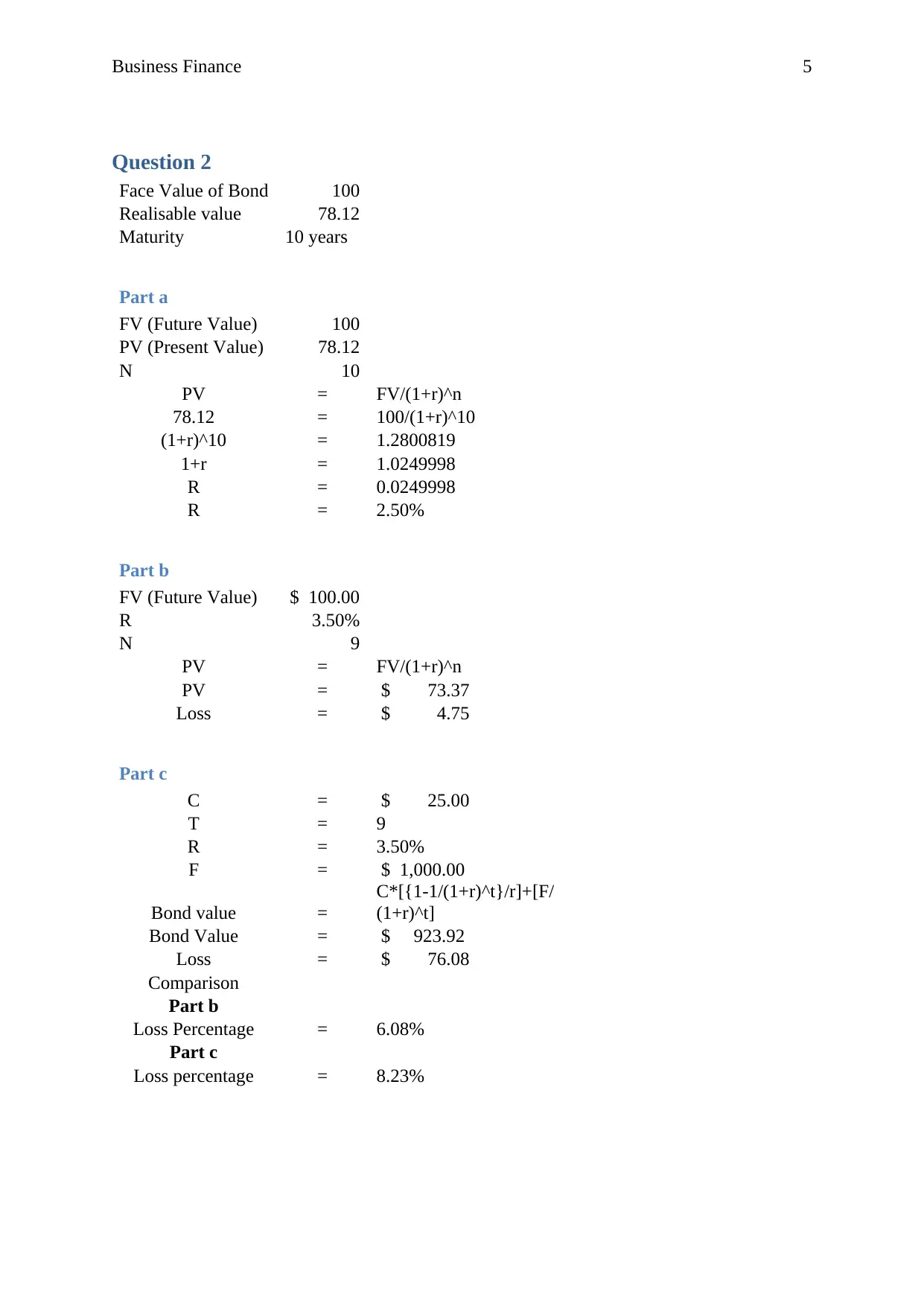

Question 2

Face Value of Bond 100

Realisable value 78.12

Maturity 10 years

Part a

FV (Future Value) 100

PV (Present Value) 78.12

N 10

PV = FV/(1+r)^n

78.12 = 100/(1+r)^10

(1+r)^10 = 1.2800819

1+r = 1.0249998

R = 0.0249998

R = 2.50%

Part b

FV (Future Value) $ 100.00

R 3.50%

N 9

PV = FV/(1+r)^n

PV = $ 73.37

Loss = $ 4.75

Part c

C = $ 25.00

T = 9

R = 3.50%

F = $ 1,000.00

Bond value =

C*[{1-1/(1+r)^t}/r]+[F/

(1+r)^t]

Bond Value = $ 923.92

Loss = $ 76.08

Comparison

Part b

Loss Percentage = 6.08%

Part c

Loss percentage = 8.23%

Question 2

Face Value of Bond 100

Realisable value 78.12

Maturity 10 years

Part a

FV (Future Value) 100

PV (Present Value) 78.12

N 10

PV = FV/(1+r)^n

78.12 = 100/(1+r)^10

(1+r)^10 = 1.2800819

1+r = 1.0249998

R = 0.0249998

R = 2.50%

Part b

FV (Future Value) $ 100.00

R 3.50%

N 9

PV = FV/(1+r)^n

PV = $ 73.37

Loss = $ 4.75

Part c

C = $ 25.00

T = 9

R = 3.50%

F = $ 1,000.00

Bond value =

C*[{1-1/(1+r)^t}/r]+[F/

(1+r)^t]

Bond Value = $ 923.92

Loss = $ 76.08

Comparison

Part b

Loss Percentage = 6.08%

Part c

Loss percentage = 8.23%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance 6

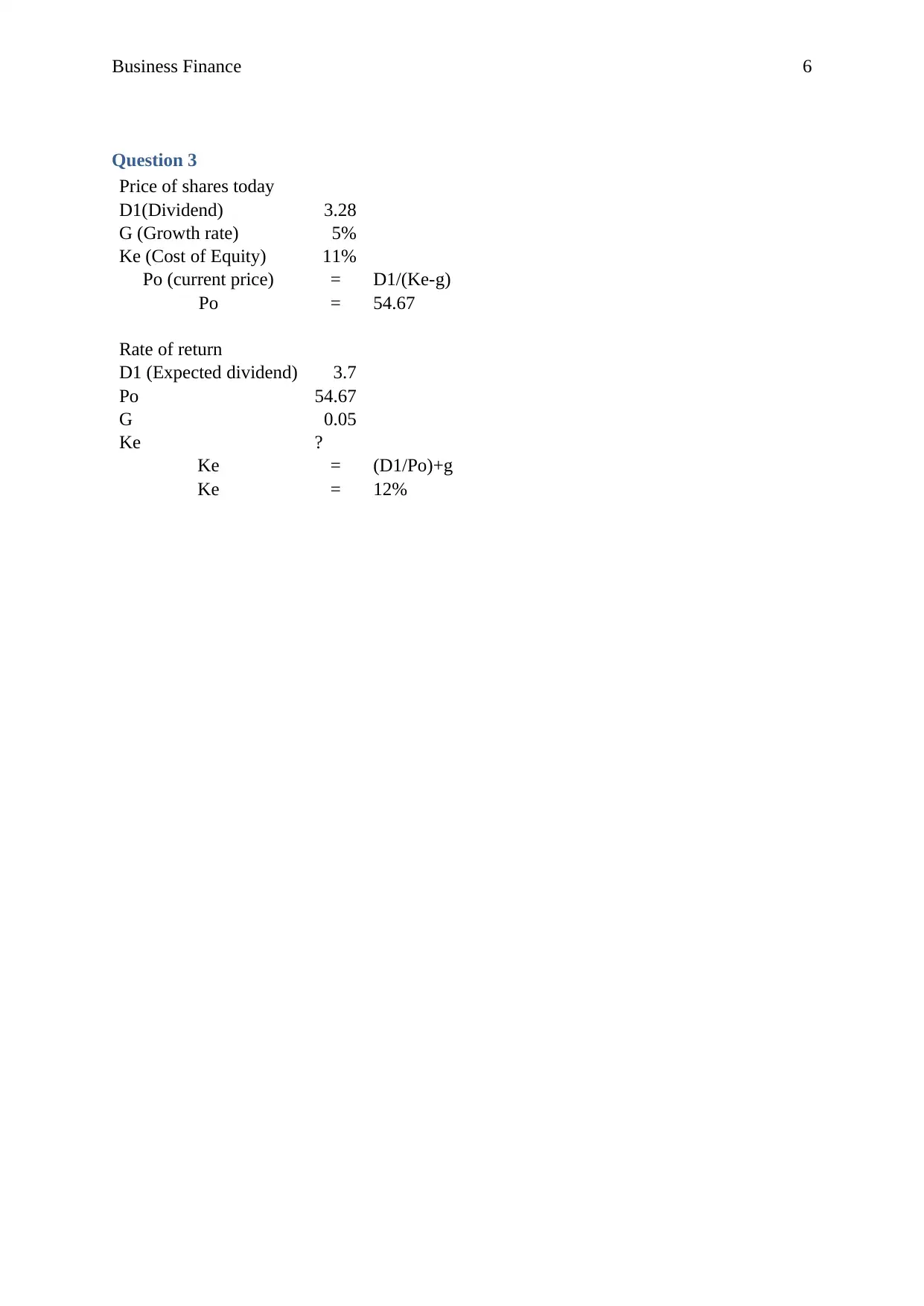

Question 3

Price of shares today

D1(Dividend) 3.28

G (Growth rate) 5%

Ke (Cost of Equity) 11%

Po (current price) = D1/(Ke-g)

Po = 54.67

Rate of return

D1 (Expected dividend) 3.7

Po 54.67

G 0.05

Ke ?

Ke = (D1/Po)+g

Ke = 12%

Question 3

Price of shares today

D1(Dividend) 3.28

G (Growth rate) 5%

Ke (Cost of Equity) 11%

Po (current price) = D1/(Ke-g)

Po = 54.67

Rate of return

D1 (Expected dividend) 3.7

Po 54.67

G 0.05

Ke ?

Ke = (D1/Po)+g

Ke = 12%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 7

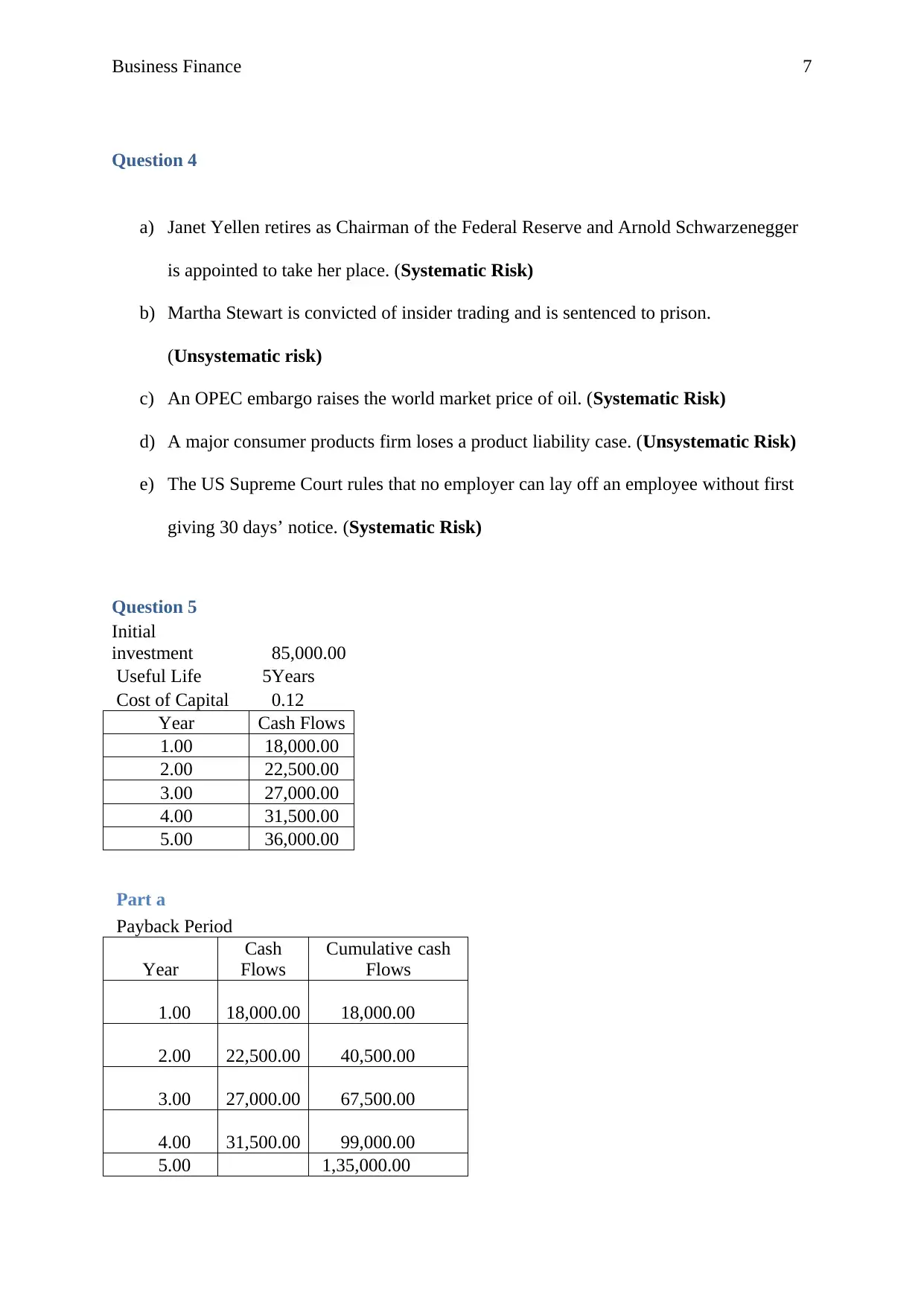

Question 4

a) Janet Yellen retires as Chairman of the Federal Reserve and Arnold Schwarzenegger

is appointed to take her place. (Systematic Risk)

b) Martha Stewart is convicted of insider trading and is sentenced to prison.

(Unsystematic risk)

c) An OPEC embargo raises the world market price of oil. (Systematic Risk)

d) A major consumer products firm loses a product liability case. (Unsystematic Risk)

e) The US Supreme Court rules that no employer can lay off an employee without first

giving 30 days’ notice. (Systematic Risk)

Question 5

Initial

investment 85,000.00

Useful Life 5Years

Cost of Capital 0.12

Year Cash Flows

1.00 18,000.00

2.00 22,500.00

3.00 27,000.00

4.00 31,500.00

5.00 36,000.00

Part a

Payback Period

Year

Cash

Flows

Cumulative cash

Flows

1.00 18,000.00 18,000.00

2.00 22,500.00 40,500.00

3.00 27,000.00 67,500.00

4.00 31,500.00 99,000.00

5.00 1,35,000.00

Question 4

a) Janet Yellen retires as Chairman of the Federal Reserve and Arnold Schwarzenegger

is appointed to take her place. (Systematic Risk)

b) Martha Stewart is convicted of insider trading and is sentenced to prison.

(Unsystematic risk)

c) An OPEC embargo raises the world market price of oil. (Systematic Risk)

d) A major consumer products firm loses a product liability case. (Unsystematic Risk)

e) The US Supreme Court rules that no employer can lay off an employee without first

giving 30 days’ notice. (Systematic Risk)

Question 5

Initial

investment 85,000.00

Useful Life 5Years

Cost of Capital 0.12

Year Cash Flows

1.00 18,000.00

2.00 22,500.00

3.00 27,000.00

4.00 31,500.00

5.00 36,000.00

Part a

Payback Period

Year

Cash

Flows

Cumulative cash

Flows

1.00 18,000.00 18,000.00

2.00 22,500.00 40,500.00

3.00 27,000.00 67,500.00

4.00 31,500.00 99,000.00

5.00 1,35,000.00

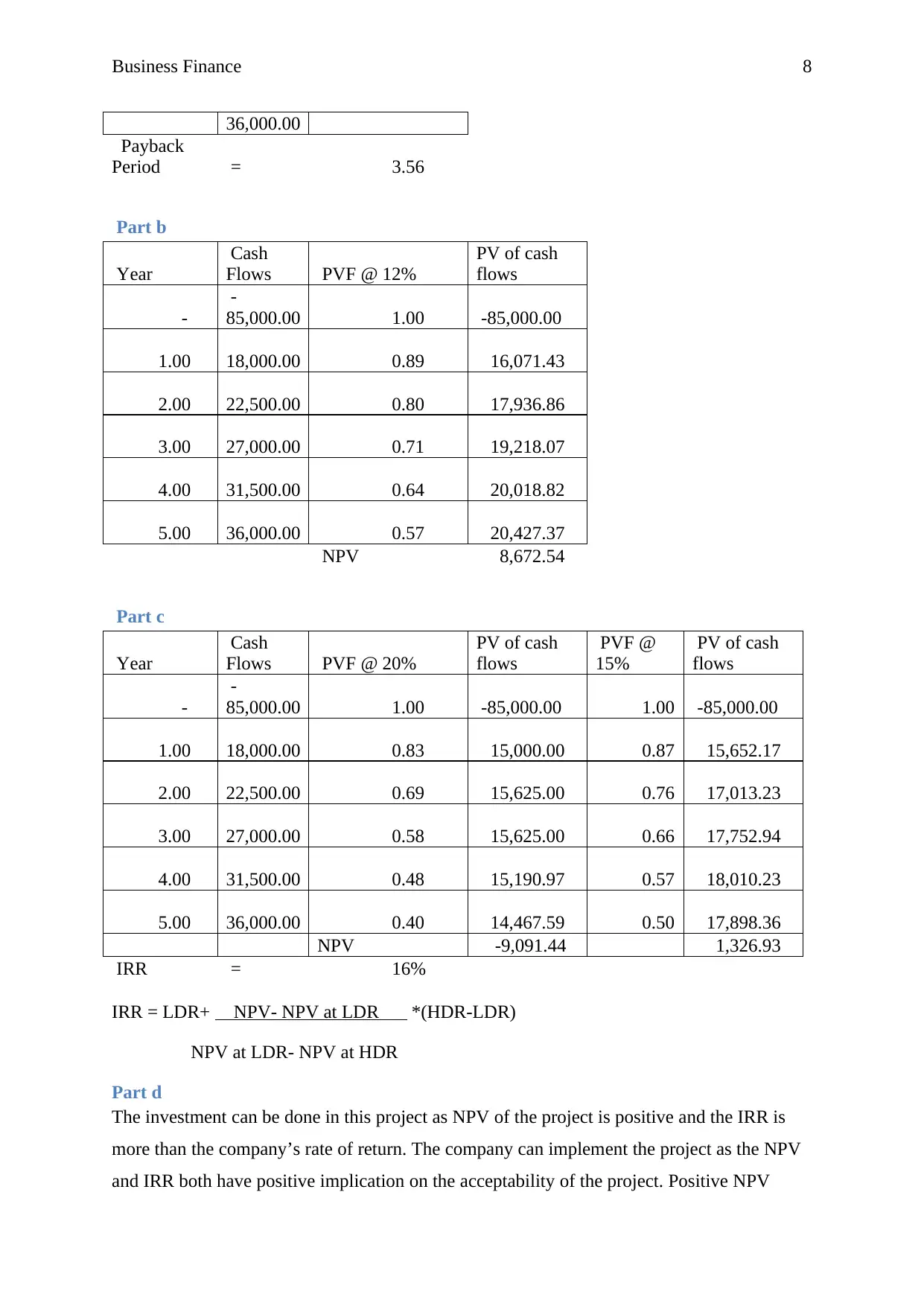

Business Finance 8

36,000.00

Payback

Period = 3.56

Part b

Year

Cash

Flows PVF @ 12%

PV of cash

flows

-

-

85,000.00 1.00 -85,000.00

1.00 18,000.00 0.89 16,071.43

2.00 22,500.00 0.80 17,936.86

3.00 27,000.00 0.71 19,218.07

4.00 31,500.00 0.64 20,018.82

5.00 36,000.00 0.57 20,427.37

NPV 8,672.54

Part c

Year

Cash

Flows PVF @ 20%

PV of cash

flows

PVF @

15%

PV of cash

flows

-

-

85,000.00 1.00 -85,000.00 1.00 -85,000.00

1.00 18,000.00 0.83 15,000.00 0.87 15,652.17

2.00 22,500.00 0.69 15,625.00 0.76 17,013.23

3.00 27,000.00 0.58 15,625.00 0.66 17,752.94

4.00 31,500.00 0.48 15,190.97 0.57 18,010.23

5.00 36,000.00 0.40 14,467.59 0.50 17,898.36

NPV -9,091.44 1,326.93

IRR = 16%

IRR = LDR+ NPV- NPV at LDR *(HDR-LDR)

NPV at LDR- NPV at HDR

Part d

The investment can be done in this project as NPV of the project is positive and the IRR is

more than the company’s rate of return. The company can implement the project as the NPV

and IRR both have positive implication on the acceptability of the project. Positive NPV

36,000.00

Payback

Period = 3.56

Part b

Year

Cash

Flows PVF @ 12%

PV of cash

flows

-

-

85,000.00 1.00 -85,000.00

1.00 18,000.00 0.89 16,071.43

2.00 22,500.00 0.80 17,936.86

3.00 27,000.00 0.71 19,218.07

4.00 31,500.00 0.64 20,018.82

5.00 36,000.00 0.57 20,427.37

NPV 8,672.54

Part c

Year

Cash

Flows PVF @ 20%

PV of cash

flows

PVF @

15%

PV of cash

flows

-

-

85,000.00 1.00 -85,000.00 1.00 -85,000.00

1.00 18,000.00 0.83 15,000.00 0.87 15,652.17

2.00 22,500.00 0.69 15,625.00 0.76 17,013.23

3.00 27,000.00 0.58 15,625.00 0.66 17,752.94

4.00 31,500.00 0.48 15,190.97 0.57 18,010.23

5.00 36,000.00 0.40 14,467.59 0.50 17,898.36

NPV -9,091.44 1,326.93

IRR = 16%

IRR = LDR+ NPV- NPV at LDR *(HDR-LDR)

NPV at LDR- NPV at HDR

Part d

The investment can be done in this project as NPV of the project is positive and the IRR is

more than the company’s rate of return. The company can implement the project as the NPV

and IRR both have positive implication on the acceptability of the project. Positive NPV

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance 9

shows that companies’ profits will increase gradually with the acceptance of the project

(Petty, Titman, Keown, Martin, Martin & Burrow, 2015).

* Payback Period= Base Year+ Cumulative cash flows of previous year

Cash Flows of Base Year

shows that companies’ profits will increase gradually with the acceptance of the project

(Petty, Titman, Keown, Martin, Martin & Burrow, 2015).

* Payback Period= Base Year+ Cumulative cash flows of previous year

Cash Flows of Base Year

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 10

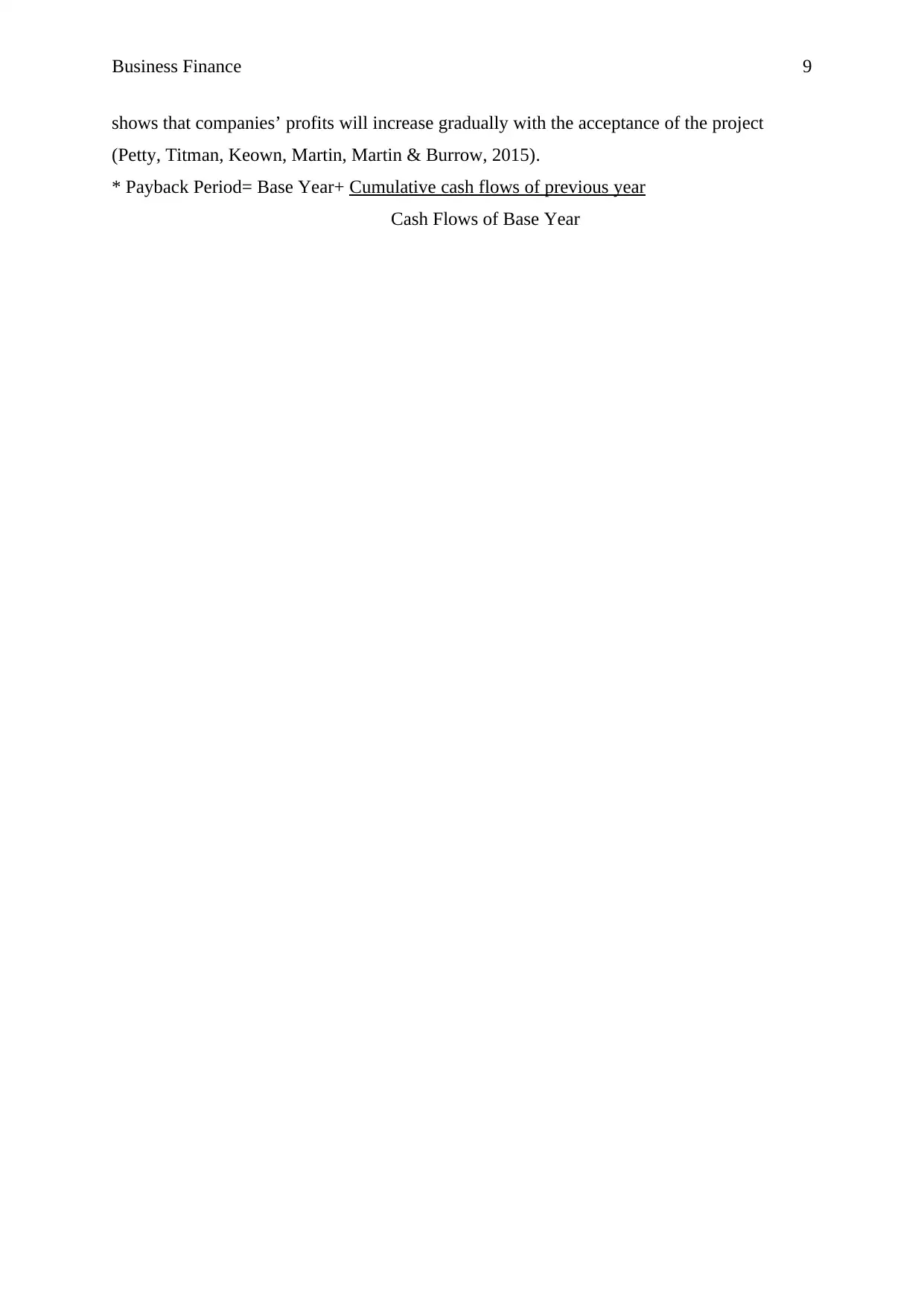

Question 6

Discount

rate 15%

Part a

Year

Renovate

(X)

Replace

(Y) PVF @ 15%

PV of cash flows

of X

PV of cash

flows of Y

0

-

90,00,000.

00

-

10,00,000.0

0 1

-

90,00,000.00

-

10,00,000.00

1

35,00,000.

00 6,00,000.00

0.86956521

7 30,43,478.26 5,21,739.13

2

30,00,000.

00 5,00,000.00

0.75614366

7 22,68,431.00 3,78,071.83

3

30,00,000.

00 4,00,000.00

0.65751623

2 19,72,548.70 2,63,006.49

4

28,00,000.

00 3,00,000.00

0.57175324

6 16,00,909.09 1,71,525.97

5

25,00,000.

00 2,00,000.00

0.49717673

5 12,42,941.84 99,435.35

NPV 11,28,308.89 4,33,778.78

Ranking

Renovate I

Replace II

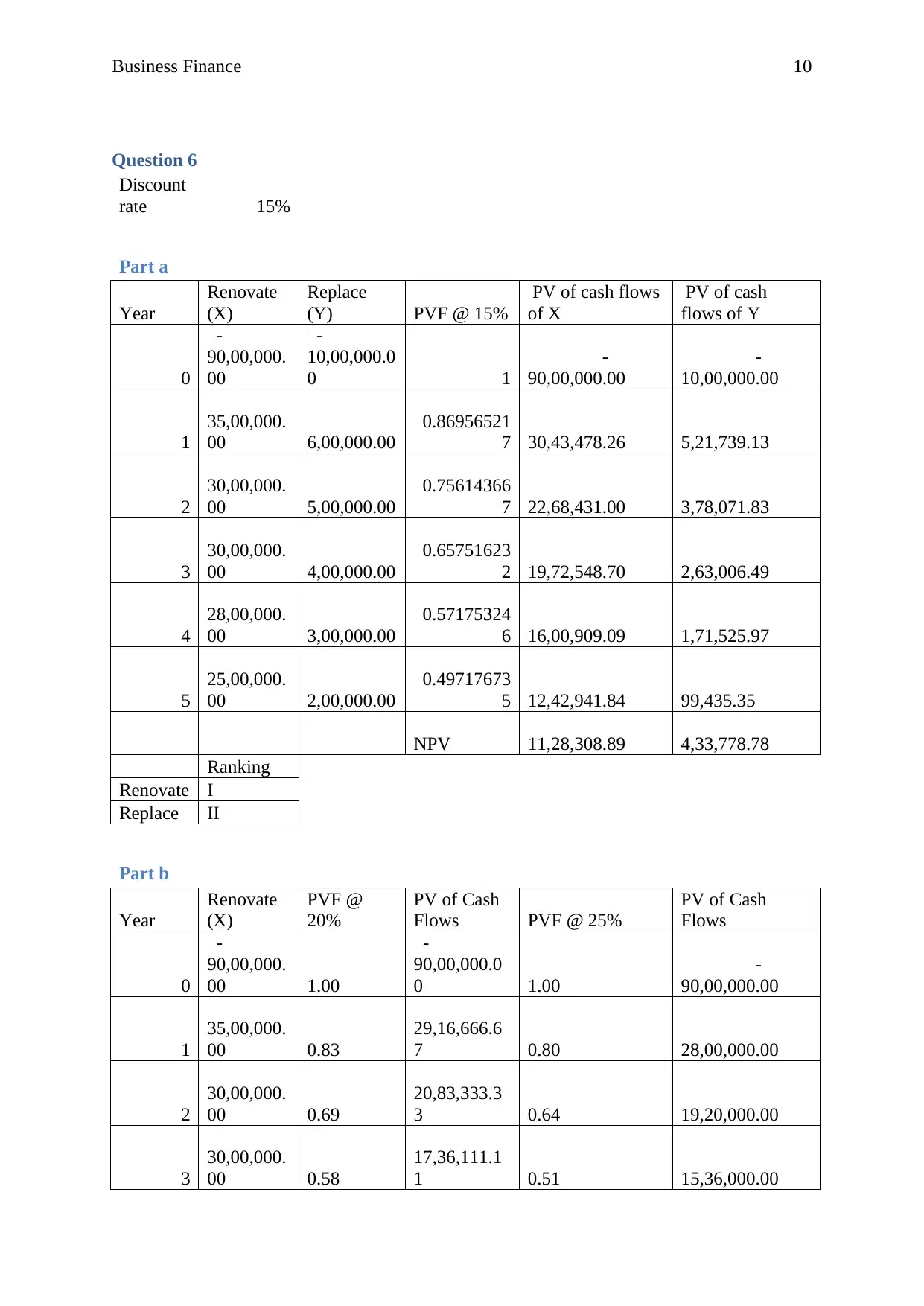

Part b

Year

Renovate

(X)

PVF @

20%

PV of Cash

Flows PVF @ 25%

PV of Cash

Flows

0

-

90,00,000.

00 1.00

-

90,00,000.0

0 1.00

-

90,00,000.00

1

35,00,000.

00 0.83

29,16,666.6

7 0.80 28,00,000.00

2

30,00,000.

00 0.69

20,83,333.3

3 0.64 19,20,000.00

3

30,00,000.

00 0.58

17,36,111.1

1 0.51 15,36,000.00

Question 6

Discount

rate 15%

Part a

Year

Renovate

(X)

Replace

(Y) PVF @ 15%

PV of cash flows

of X

PV of cash

flows of Y

0

-

90,00,000.

00

-

10,00,000.0

0 1

-

90,00,000.00

-

10,00,000.00

1

35,00,000.

00 6,00,000.00

0.86956521

7 30,43,478.26 5,21,739.13

2

30,00,000.

00 5,00,000.00

0.75614366

7 22,68,431.00 3,78,071.83

3

30,00,000.

00 4,00,000.00

0.65751623

2 19,72,548.70 2,63,006.49

4

28,00,000.

00 3,00,000.00

0.57175324

6 16,00,909.09 1,71,525.97

5

25,00,000.

00 2,00,000.00

0.49717673

5 12,42,941.84 99,435.35

NPV 11,28,308.89 4,33,778.78

Ranking

Renovate I

Replace II

Part b

Year

Renovate

(X)

PVF @

20%

PV of Cash

Flows PVF @ 25%

PV of Cash

Flows

0

-

90,00,000.

00 1.00

-

90,00,000.0

0 1.00

-

90,00,000.00

1

35,00,000.

00 0.83

29,16,666.6

7 0.80 28,00,000.00

2

30,00,000.

00 0.69

20,83,333.3

3 0.64 19,20,000.00

3

30,00,000.

00 0.58

17,36,111.1

1 0.51 15,36,000.00

Business Finance 11

4

28,00,000.

00 0.48

13,50,308.6

4 0.41 11,46,880.00

5

25,00,000.

00 0.40

10,04,693.9

3 0.33 8,19,200.00

NPV 91,113.68 NPV

-

7,77,920.00

IRR 20.49%

Year

Replace

(Y)

PVF @

30%

PV of Cash

Flows PVF @ 40%

PV of Cash

Flows

0

-

10,00,000.

00 1.00

-

10,00,000.0

0 1.00

-

10,00,000.00

1

6,00,000.0

0 0.77 4,61,538.46 0.71 4,28,571.43

2

5,00,000.0

0 0.59 2,95,857.99 0.51 2,55,102.04

3

4,00,000.0

0 0.46 1,82,066.45 0.36 1,45,772.59

4

3,00,000.0

0 0.35 1,05,038.34 0.26 78,092.46

5

2,00,000.0

0 0.27 53,865.81 0.19 37,186.89

NPV 98,367.06 NPV

-

55,274.59

IRR 36%

Ranking

Renovate II

Replace I

IRR = LDR+ NPV- NPV at LDR *(HDR-LDR)

NPV at LDR- NPV at HDR

Part c

These rankings give mixed signals as NPV is the difference between initial investment and

present value of cash inflows and IRR is the rate at which PV of cash outflows (Initial

Investment is equal to Present value of cash inflows (Titman, Keown, & Martin, 2017)..

4

28,00,000.

00 0.48

13,50,308.6

4 0.41 11,46,880.00

5

25,00,000.

00 0.40

10,04,693.9

3 0.33 8,19,200.00

NPV 91,113.68 NPV

-

7,77,920.00

IRR 20.49%

Year

Replace

(Y)

PVF @

30%

PV of Cash

Flows PVF @ 40%

PV of Cash

Flows

0

-

10,00,000.

00 1.00

-

10,00,000.0

0 1.00

-

10,00,000.00

1

6,00,000.0

0 0.77 4,61,538.46 0.71 4,28,571.43

2

5,00,000.0

0 0.59 2,95,857.99 0.51 2,55,102.04

3

4,00,000.0

0 0.46 1,82,066.45 0.36 1,45,772.59

4

3,00,000.0

0 0.35 1,05,038.34 0.26 78,092.46

5

2,00,000.0

0 0.27 53,865.81 0.19 37,186.89

NPV 98,367.06 NPV

-

55,274.59

IRR 36%

Ranking

Renovate II

Replace I

IRR = LDR+ NPV- NPV at LDR *(HDR-LDR)

NPV at LDR- NPV at HDR

Part c

These rankings give mixed signals as NPV is the difference between initial investment and

present value of cash inflows and IRR is the rate at which PV of cash outflows (Initial

Investment is equal to Present value of cash inflows (Titman, Keown, & Martin, 2017)..

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.