Finance Assignment: Portfolio Analysis, VaR, and Efficient Frontier

VerifiedAdded on 2023/02/01

|16

|3519

|35

Homework Assignment

AI Summary

This finance assignment analyzes a portfolio consisting of Apple Inc., Coca-Cola, and Netflix stocks. It includes calculating monthly returns, mean, variance, standard deviation, and correlation coefficients. The assignment determines portfolio weights, mean, variance, and standard deviation. It assesses portfolio return with a loss of 10% and calculates Value at Risk (VaR) at a 99% confidence level. An efficient frontier is drawn to optimize portfolio returns. The assignment further discusses the role of data analysis in the business, using a revenue data analyst's perspective at Hertz, and concludes with a case study of General Motors' change management strategies, emphasizing market analysis and adaptation.

Running head: FINANCE

Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................8

Question 3:.....................................................................................................................................10

References:....................................................................................................................................15

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................8

Question 3:.....................................................................................................................................10

References:....................................................................................................................................15

2FINANCE

Question 1:

1. Selecting the stock of three publicly traded companies from different industries, while

depicting about the selection criteria:

The stocks selected from the portfolio are Apple Inc., Coco Cola and Netflix, as all the

three companies fall in different industries. Moreover, the stock selected for investment is

considered one of the market leaders, which can allow the portfolio to adequately improve their

overall returns from investment. The main criteria for the selection were to detect stock with the

highest market cap and market value.

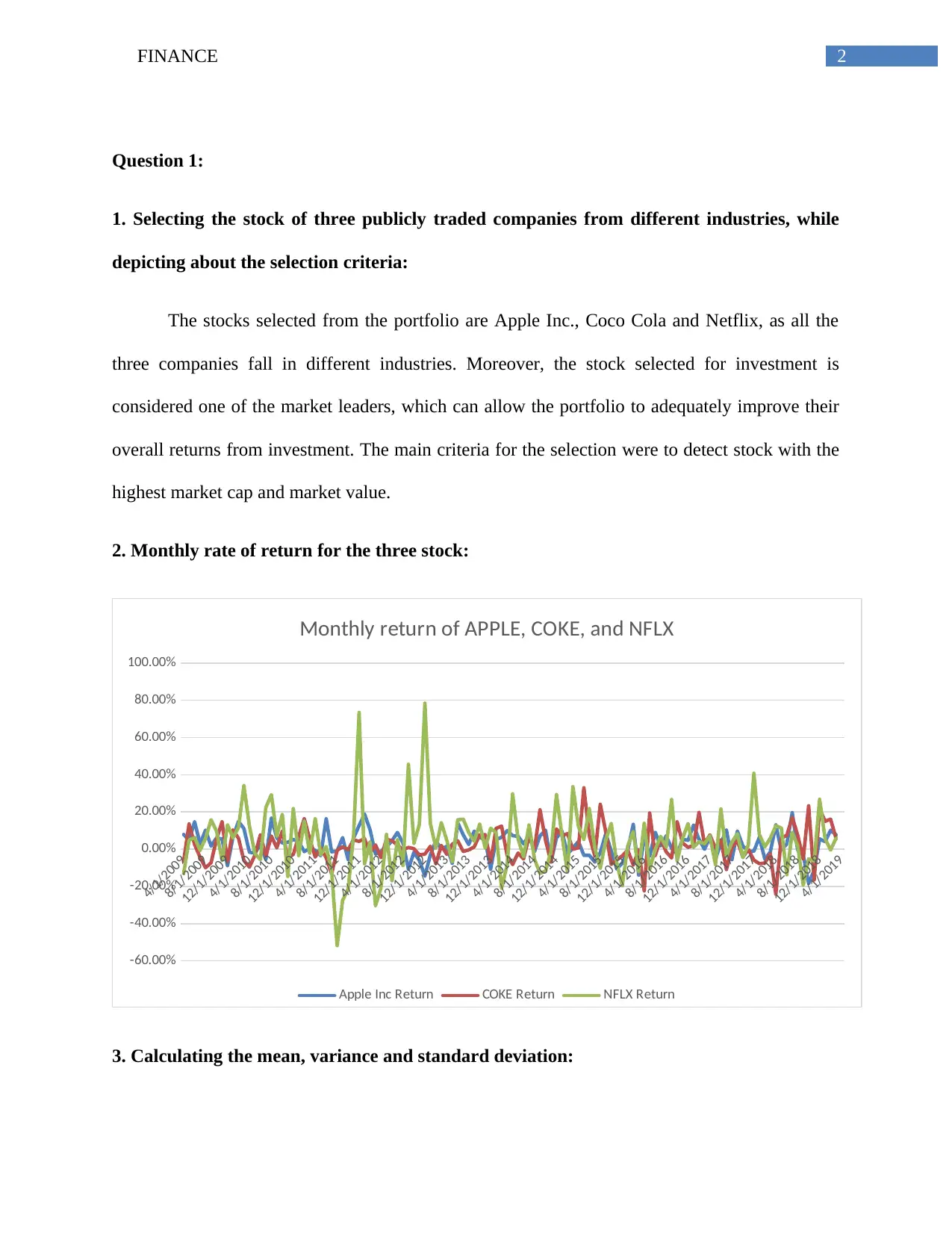

2. Monthly rate of return for the three stock:

4/1/2009

8/1/2009

12/1/2009

4/1/2010

8/1/2010

12/1/2010

4/1/2011

8/1/2011

12/1/2011

4/1/2012

8/1/2012

12/1/2012

4/1/2013

8/1/2013

12/1/2013

4/1/2014

8/1/2014

12/1/2014

4/1/2015

8/1/2015

12/1/2015

4/1/2016

8/1/2016

12/1/2016

4/1/2017

8/1/2017

12/1/2017

4/1/2018

8/1/2018

12/1/2018

4/1/2019

-60.00%

-40.00%

-20.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

Monthly return of APPLE, COKE, and NFLX

Apple Inc Return COKE Return NFLX Return

3. Calculating the mean, variance and standard deviation:

Question 1:

1. Selecting the stock of three publicly traded companies from different industries, while

depicting about the selection criteria:

The stocks selected from the portfolio are Apple Inc., Coco Cola and Netflix, as all the

three companies fall in different industries. Moreover, the stock selected for investment is

considered one of the market leaders, which can allow the portfolio to adequately improve their

overall returns from investment. The main criteria for the selection were to detect stock with the

highest market cap and market value.

2. Monthly rate of return for the three stock:

4/1/2009

8/1/2009

12/1/2009

4/1/2010

8/1/2010

12/1/2010

4/1/2011

8/1/2011

12/1/2011

4/1/2012

8/1/2012

12/1/2012

4/1/2013

8/1/2013

12/1/2013

4/1/2014

8/1/2014

12/1/2014

4/1/2015

8/1/2015

12/1/2015

4/1/2016

8/1/2016

12/1/2016

4/1/2017

8/1/2017

12/1/2017

4/1/2018

8/1/2018

12/1/2018

4/1/2019

-60.00%

-40.00%

-20.00%

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

Monthly return of APPLE, COKE, and NFLX

Apple Inc Return COKE Return NFLX Return

3. Calculating the mean, variance and standard deviation:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

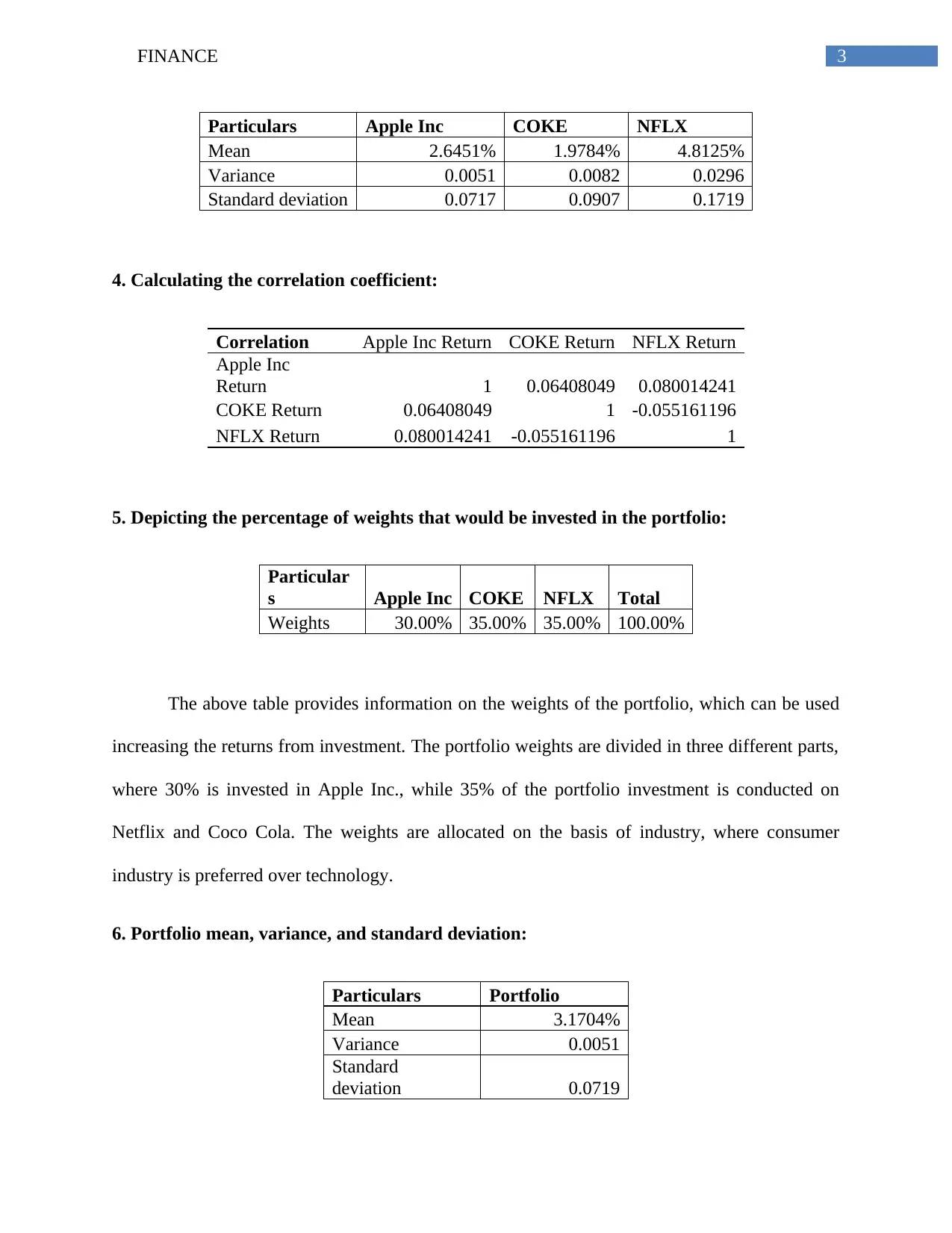

3FINANCE

Particulars Apple Inc COKE NFLX

Mean 2.6451% 1.9784% 4.8125%

Variance 0.0051 0.0082 0.0296

Standard deviation 0.0717 0.0907 0.1719

4. Calculating the correlation coefficient:

Correlation Apple Inc Return COKE Return NFLX Return

Apple Inc

Return 1 0.06408049 0.080014241

COKE Return 0.06408049 1 -0.055161196

NFLX Return 0.080014241 -0.055161196 1

5. Depicting the percentage of weights that would be invested in the portfolio:

Particular

s Apple Inc COKE NFLX Total

Weights 30.00% 35.00% 35.00% 100.00%

The above table provides information on the weights of the portfolio, which can be used

increasing the returns from investment. The portfolio weights are divided in three different parts,

where 30% is invested in Apple Inc., while 35% of the portfolio investment is conducted on

Netflix and Coco Cola. The weights are allocated on the basis of industry, where consumer

industry is preferred over technology.

6. Portfolio mean, variance, and standard deviation:

Particulars Portfolio

Mean 3.1704%

Variance 0.0051

Standard

deviation 0.0719

Particulars Apple Inc COKE NFLX

Mean 2.6451% 1.9784% 4.8125%

Variance 0.0051 0.0082 0.0296

Standard deviation 0.0717 0.0907 0.1719

4. Calculating the correlation coefficient:

Correlation Apple Inc Return COKE Return NFLX Return

Apple Inc

Return 1 0.06408049 0.080014241

COKE Return 0.06408049 1 -0.055161196

NFLX Return 0.080014241 -0.055161196 1

5. Depicting the percentage of weights that would be invested in the portfolio:

Particular

s Apple Inc COKE NFLX Total

Weights 30.00% 35.00% 35.00% 100.00%

The above table provides information on the weights of the portfolio, which can be used

increasing the returns from investment. The portfolio weights are divided in three different parts,

where 30% is invested in Apple Inc., while 35% of the portfolio investment is conducted on

Netflix and Coco Cola. The weights are allocated on the basis of industry, where consumer

industry is preferred over technology.

6. Portfolio mean, variance, and standard deviation:

Particulars Portfolio

Mean 3.1704%

Variance 0.0051

Standard

deviation 0.0719

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

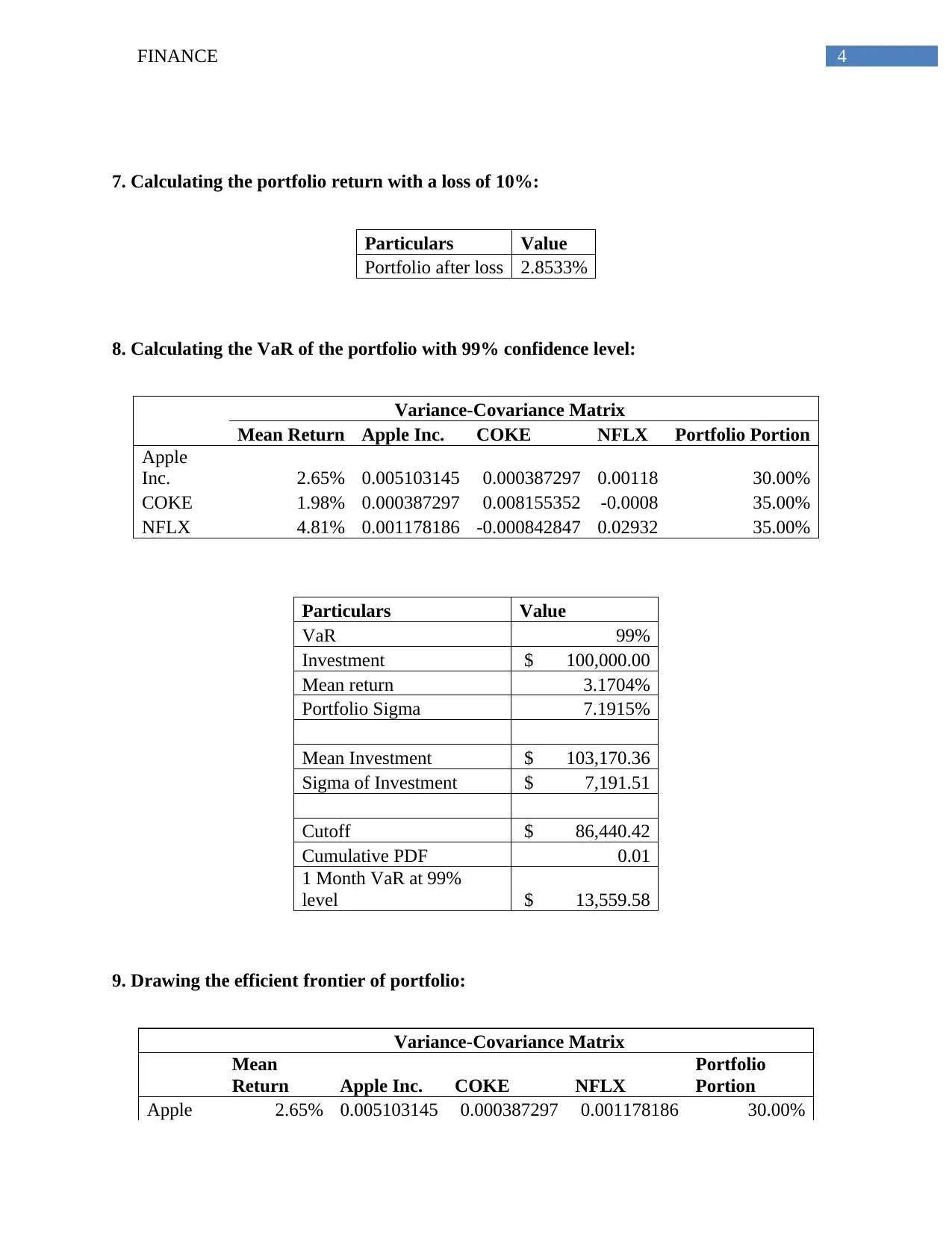

4FINANCE

7. Calculating the portfolio return with a loss of 10%:

Particulars Value

Portfolio after loss 2.8533%

8. Calculating the VaR of the portfolio with 99% confidence level:

Variance-Covariance Matrix

Mean Return Apple Inc. COKE NFLX Portfolio Portion

Apple

Inc. 2.65% 0.005103145 0.000387297 0.00118 30.00%

COKE 1.98% 0.000387297 0.008155352 -0.0008 35.00%

NFLX 4.81% 0.001178186 -0.000842847 0.02932 35.00%

Particulars Value

VaR 99%

Investment $ 100,000.00

Mean return 3.1704%

Portfolio Sigma 7.1915%

Mean Investment $ 103,170.36

Sigma of Investment $ 7,191.51

Cutoff $ 86,440.42

Cumulative PDF 0.01

1 Month VaR at 99%

level $ 13,559.58

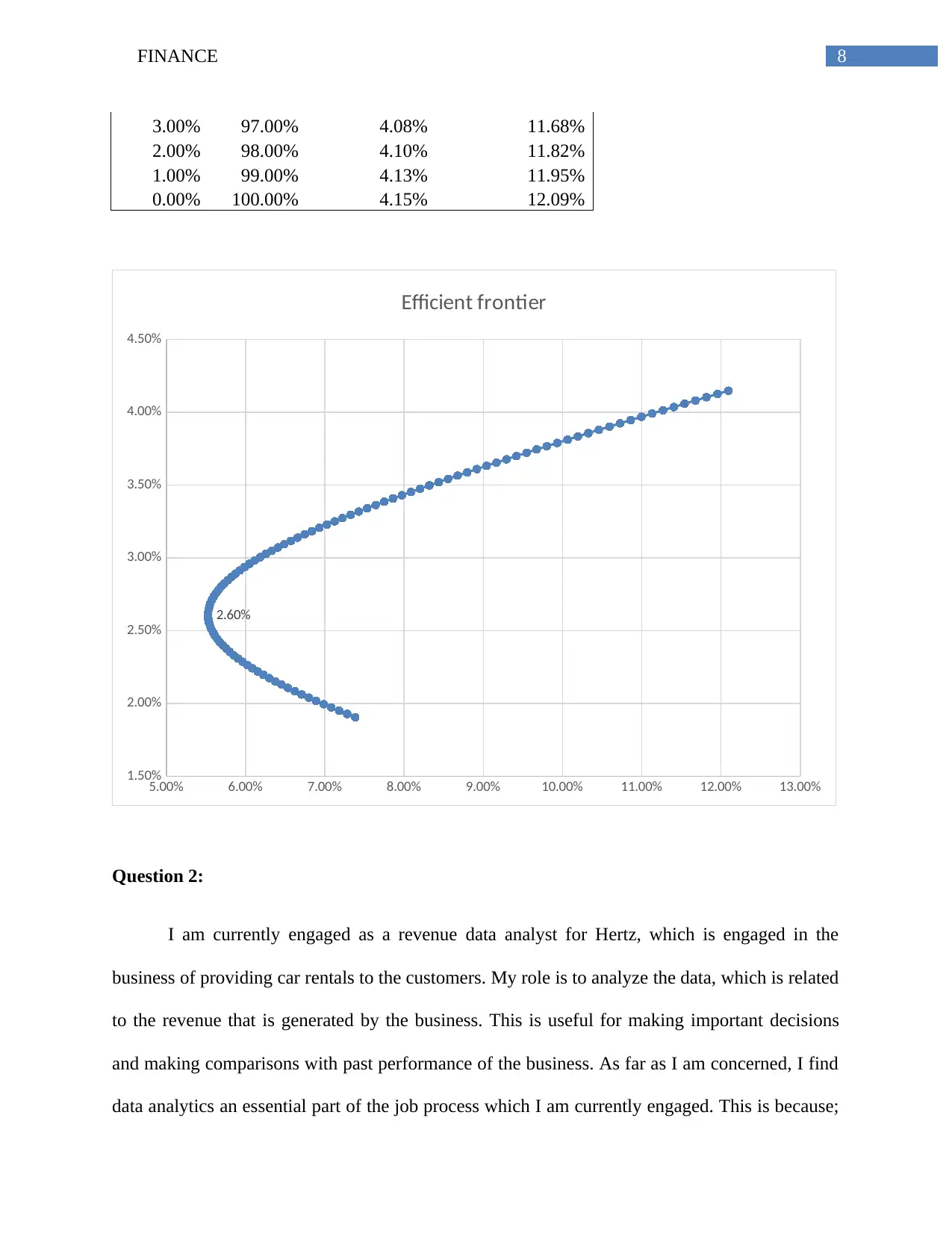

9. Drawing the efficient frontier of portfolio:

Variance-Covariance Matrix

Mean

Return Apple Inc. COKE NFLX

Portfolio

Portion

Apple 2.65% 0.005103145 0.000387297 0.001178186 30.00%

7. Calculating the portfolio return with a loss of 10%:

Particulars Value

Portfolio after loss 2.8533%

8. Calculating the VaR of the portfolio with 99% confidence level:

Variance-Covariance Matrix

Mean Return Apple Inc. COKE NFLX Portfolio Portion

Apple

Inc. 2.65% 0.005103145 0.000387297 0.00118 30.00%

COKE 1.98% 0.000387297 0.008155352 -0.0008 35.00%

NFLX 4.81% 0.001178186 -0.000842847 0.02932 35.00%

Particulars Value

VaR 99%

Investment $ 100,000.00

Mean return 3.1704%

Portfolio Sigma 7.1915%

Mean Investment $ 103,170.36

Sigma of Investment $ 7,191.51

Cutoff $ 86,440.42

Cumulative PDF 0.01

1 Month VaR at 99%

level $ 13,559.58

9. Drawing the efficient frontier of portfolio:

Variance-Covariance Matrix

Mean

Return Apple Inc. COKE NFLX

Portfolio

Portion

Apple 2.65% 0.005103145 0.000387297 0.001178186 30.00%

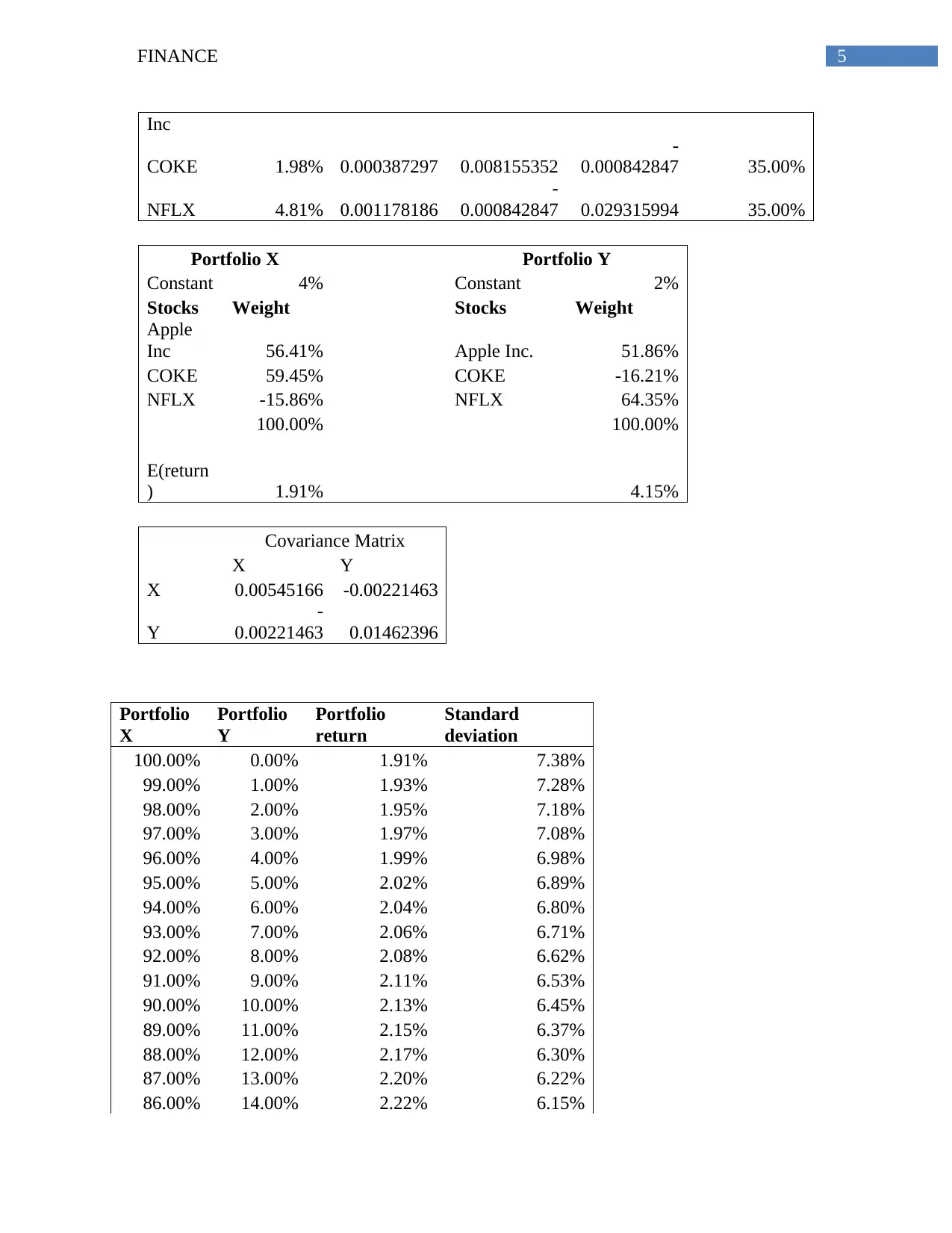

5FINANCE

Inc

COKE 1.98% 0.000387297 0.008155352

-

0.000842847 35.00%

NFLX 4.81% 0.001178186

-

0.000842847 0.029315994 35.00%

Portfolio X Portfolio Y

Constant 4% Constant 2%

Stocks Weight Stocks Weight

Apple

Inc 56.41% Apple Inc. 51.86%

COKE 59.45% COKE -16.21%

NFLX -15.86% NFLX 64.35%

100.00% 100.00%

E(return

) 1.91% 4.15%

Covariance Matrix

X Y

X 0.00545166 -0.00221463

Y

-

0.00221463 0.01462396

Portfolio

X

Portfolio

Y

Portfolio

return

Standard

deviation

100.00% 0.00% 1.91% 7.38%

99.00% 1.00% 1.93% 7.28%

98.00% 2.00% 1.95% 7.18%

97.00% 3.00% 1.97% 7.08%

96.00% 4.00% 1.99% 6.98%

95.00% 5.00% 2.02% 6.89%

94.00% 6.00% 2.04% 6.80%

93.00% 7.00% 2.06% 6.71%

92.00% 8.00% 2.08% 6.62%

91.00% 9.00% 2.11% 6.53%

90.00% 10.00% 2.13% 6.45%

89.00% 11.00% 2.15% 6.37%

88.00% 12.00% 2.17% 6.30%

87.00% 13.00% 2.20% 6.22%

86.00% 14.00% 2.22% 6.15%

Inc

COKE 1.98% 0.000387297 0.008155352

-

0.000842847 35.00%

NFLX 4.81% 0.001178186

-

0.000842847 0.029315994 35.00%

Portfolio X Portfolio Y

Constant 4% Constant 2%

Stocks Weight Stocks Weight

Apple

Inc 56.41% Apple Inc. 51.86%

COKE 59.45% COKE -16.21%

NFLX -15.86% NFLX 64.35%

100.00% 100.00%

E(return

) 1.91% 4.15%

Covariance Matrix

X Y

X 0.00545166 -0.00221463

Y

-

0.00221463 0.01462396

Portfolio

X

Portfolio

Y

Portfolio

return

Standard

deviation

100.00% 0.00% 1.91% 7.38%

99.00% 1.00% 1.93% 7.28%

98.00% 2.00% 1.95% 7.18%

97.00% 3.00% 1.97% 7.08%

96.00% 4.00% 1.99% 6.98%

95.00% 5.00% 2.02% 6.89%

94.00% 6.00% 2.04% 6.80%

93.00% 7.00% 2.06% 6.71%

92.00% 8.00% 2.08% 6.62%

91.00% 9.00% 2.11% 6.53%

90.00% 10.00% 2.13% 6.45%

89.00% 11.00% 2.15% 6.37%

88.00% 12.00% 2.17% 6.30%

87.00% 13.00% 2.20% 6.22%

86.00% 14.00% 2.22% 6.15%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE

85.00% 15.00% 2.24% 6.09%

84.00% 16.00% 2.26% 6.02%

83.00% 17.00% 2.29% 5.96%

82.00% 18.00% 2.31% 5.90%

81.00% 19.00% 2.33% 5.85%

80.00% 20.00% 2.35% 5.80%

79.00% 21.00% 2.38% 5.76%

78.00% 22.00% 2.40% 5.71%

77.00% 23.00% 2.42% 5.68%

76.00% 24.00% 2.44% 5.64%

75.00% 25.00% 2.47% 5.61%

74.00% 26.00% 2.49% 5.59%

73.00% 27.00% 2.51% 5.57%

72.00% 28.00% 2.53% 5.55%

71.00% 29.00% 2.56% 5.54%

70.00% 30.00% 2.58% 5.53%

69.00% 31.00% 2.60% 5.53%

68.00% 32.00% 2.62% 5.53%

67.00% 33.00% 2.65% 5.53%

66.00% 34.00% 2.67% 5.54%

65.00% 35.00% 2.69% 5.56%

64.00% 36.00% 2.71% 5.57%

63.00% 37.00% 2.73% 5.60%

62.00% 38.00% 2.76% 5.62%

61.00% 39.00% 2.78% 5.66%

60.00% 40.00% 2.80% 5.69%

59.00% 41.00% 2.82% 5.73%

58.00% 42.00% 2.85% 5.77%

57.00% 43.00% 2.87% 5.82%

56.00% 44.00% 2.89% 5.87%

55.00% 45.00% 2.91% 5.93%

54.00% 46.00% 2.94% 5.99%

53.00% 47.00% 2.96% 6.05%

52.00% 48.00% 2.98% 6.11%

51.00% 49.00% 3.00% 6.18%

50.00% 50.00% 3.03% 6.25%

49.00% 51.00% 3.05% 6.33%

48.00% 52.00% 3.07% 6.41%

47.00% 53.00% 3.09% 6.49%

46.00% 54.00% 3.12% 6.57%

45.00% 55.00% 3.14% 6.66%

85.00% 15.00% 2.24% 6.09%

84.00% 16.00% 2.26% 6.02%

83.00% 17.00% 2.29% 5.96%

82.00% 18.00% 2.31% 5.90%

81.00% 19.00% 2.33% 5.85%

80.00% 20.00% 2.35% 5.80%

79.00% 21.00% 2.38% 5.76%

78.00% 22.00% 2.40% 5.71%

77.00% 23.00% 2.42% 5.68%

76.00% 24.00% 2.44% 5.64%

75.00% 25.00% 2.47% 5.61%

74.00% 26.00% 2.49% 5.59%

73.00% 27.00% 2.51% 5.57%

72.00% 28.00% 2.53% 5.55%

71.00% 29.00% 2.56% 5.54%

70.00% 30.00% 2.58% 5.53%

69.00% 31.00% 2.60% 5.53%

68.00% 32.00% 2.62% 5.53%

67.00% 33.00% 2.65% 5.53%

66.00% 34.00% 2.67% 5.54%

65.00% 35.00% 2.69% 5.56%

64.00% 36.00% 2.71% 5.57%

63.00% 37.00% 2.73% 5.60%

62.00% 38.00% 2.76% 5.62%

61.00% 39.00% 2.78% 5.66%

60.00% 40.00% 2.80% 5.69%

59.00% 41.00% 2.82% 5.73%

58.00% 42.00% 2.85% 5.77%

57.00% 43.00% 2.87% 5.82%

56.00% 44.00% 2.89% 5.87%

55.00% 45.00% 2.91% 5.93%

54.00% 46.00% 2.94% 5.99%

53.00% 47.00% 2.96% 6.05%

52.00% 48.00% 2.98% 6.11%

51.00% 49.00% 3.00% 6.18%

50.00% 50.00% 3.03% 6.25%

49.00% 51.00% 3.05% 6.33%

48.00% 52.00% 3.07% 6.41%

47.00% 53.00% 3.09% 6.49%

46.00% 54.00% 3.12% 6.57%

45.00% 55.00% 3.14% 6.66%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

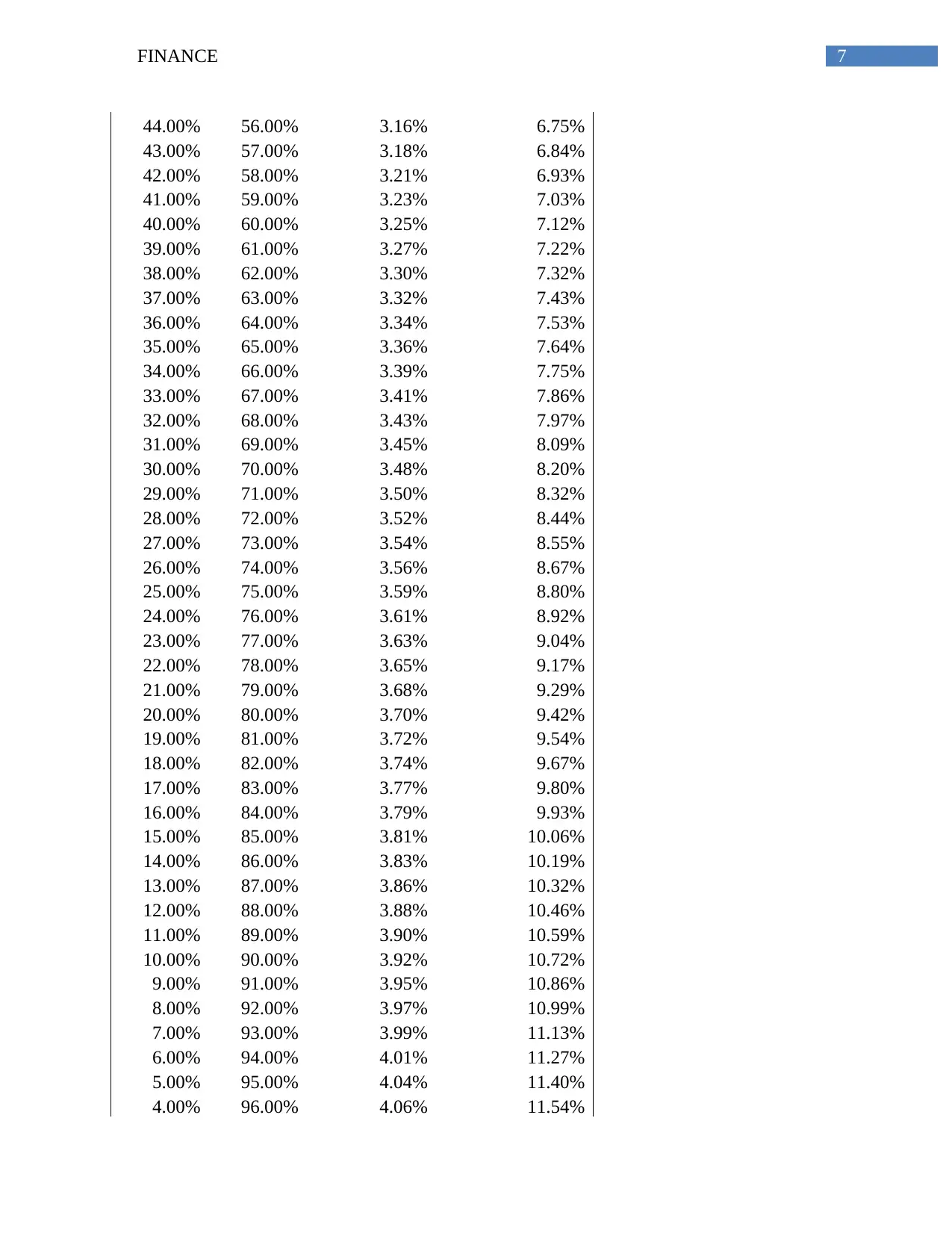

44.00% 56.00% 3.16% 6.75%

43.00% 57.00% 3.18% 6.84%

42.00% 58.00% 3.21% 6.93%

41.00% 59.00% 3.23% 7.03%

40.00% 60.00% 3.25% 7.12%

39.00% 61.00% 3.27% 7.22%

38.00% 62.00% 3.30% 7.32%

37.00% 63.00% 3.32% 7.43%

36.00% 64.00% 3.34% 7.53%

35.00% 65.00% 3.36% 7.64%

34.00% 66.00% 3.39% 7.75%

33.00% 67.00% 3.41% 7.86%

32.00% 68.00% 3.43% 7.97%

31.00% 69.00% 3.45% 8.09%

30.00% 70.00% 3.48% 8.20%

29.00% 71.00% 3.50% 8.32%

28.00% 72.00% 3.52% 8.44%

27.00% 73.00% 3.54% 8.55%

26.00% 74.00% 3.56% 8.67%

25.00% 75.00% 3.59% 8.80%

24.00% 76.00% 3.61% 8.92%

23.00% 77.00% 3.63% 9.04%

22.00% 78.00% 3.65% 9.17%

21.00% 79.00% 3.68% 9.29%

20.00% 80.00% 3.70% 9.42%

19.00% 81.00% 3.72% 9.54%

18.00% 82.00% 3.74% 9.67%

17.00% 83.00% 3.77% 9.80%

16.00% 84.00% 3.79% 9.93%

15.00% 85.00% 3.81% 10.06%

14.00% 86.00% 3.83% 10.19%

13.00% 87.00% 3.86% 10.32%

12.00% 88.00% 3.88% 10.46%

11.00% 89.00% 3.90% 10.59%

10.00% 90.00% 3.92% 10.72%

9.00% 91.00% 3.95% 10.86%

8.00% 92.00% 3.97% 10.99%

7.00% 93.00% 3.99% 11.13%

6.00% 94.00% 4.01% 11.27%

5.00% 95.00% 4.04% 11.40%

4.00% 96.00% 4.06% 11.54%

44.00% 56.00% 3.16% 6.75%

43.00% 57.00% 3.18% 6.84%

42.00% 58.00% 3.21% 6.93%

41.00% 59.00% 3.23% 7.03%

40.00% 60.00% 3.25% 7.12%

39.00% 61.00% 3.27% 7.22%

38.00% 62.00% 3.30% 7.32%

37.00% 63.00% 3.32% 7.43%

36.00% 64.00% 3.34% 7.53%

35.00% 65.00% 3.36% 7.64%

34.00% 66.00% 3.39% 7.75%

33.00% 67.00% 3.41% 7.86%

32.00% 68.00% 3.43% 7.97%

31.00% 69.00% 3.45% 8.09%

30.00% 70.00% 3.48% 8.20%

29.00% 71.00% 3.50% 8.32%

28.00% 72.00% 3.52% 8.44%

27.00% 73.00% 3.54% 8.55%

26.00% 74.00% 3.56% 8.67%

25.00% 75.00% 3.59% 8.80%

24.00% 76.00% 3.61% 8.92%

23.00% 77.00% 3.63% 9.04%

22.00% 78.00% 3.65% 9.17%

21.00% 79.00% 3.68% 9.29%

20.00% 80.00% 3.70% 9.42%

19.00% 81.00% 3.72% 9.54%

18.00% 82.00% 3.74% 9.67%

17.00% 83.00% 3.77% 9.80%

16.00% 84.00% 3.79% 9.93%

15.00% 85.00% 3.81% 10.06%

14.00% 86.00% 3.83% 10.19%

13.00% 87.00% 3.86% 10.32%

12.00% 88.00% 3.88% 10.46%

11.00% 89.00% 3.90% 10.59%

10.00% 90.00% 3.92% 10.72%

9.00% 91.00% 3.95% 10.86%

8.00% 92.00% 3.97% 10.99%

7.00% 93.00% 3.99% 11.13%

6.00% 94.00% 4.01% 11.27%

5.00% 95.00% 4.04% 11.40%

4.00% 96.00% 4.06% 11.54%

8FINANCE

3.00% 97.00% 4.08% 11.68%

2.00% 98.00% 4.10% 11.82%

1.00% 99.00% 4.13% 11.95%

0.00% 100.00% 4.15% 12.09%

5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2.60%

Efficient frontier

Question 2:

I am currently engaged as a revenue data analyst for Hertz, which is engaged in the

business of providing car rentals to the customers. My role is to analyze the data, which is related

to the revenue that is generated by the business. This is useful for making important decisions

and making comparisons with past performance of the business. As far as I am concerned, I find

data analytics an essential part of the job process which I am currently engaged. This is because;

3.00% 97.00% 4.08% 11.68%

2.00% 98.00% 4.10% 11.82%

1.00% 99.00% 4.13% 11.95%

0.00% 100.00% 4.15% 12.09%

5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2.60%

Efficient frontier

Question 2:

I am currently engaged as a revenue data analyst for Hertz, which is engaged in the

business of providing car rentals to the customers. My role is to analyze the data, which is related

to the revenue that is generated by the business. This is useful for making important decisions

and making comparisons with past performance of the business. As far as I am concerned, I find

data analytics an essential part of the job process which I am currently engaged. This is because;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE

it effectively identifies the hotspot in the population from where the business is able to derive

maximum revenue. In addition to this, the management of the company can recognize whether

the business is growing or not on the basis of the data which is available.

I have gained an interest in the subject where I first experienced the use of data and the

widespread application of the same. I am come to terms that no matter what the nature of the

business is, every business has some data and the management relies on such data for predicting

the likelihood of the business in near future. Similarly, the business which I am associated with is

engaged with is associated with car rentals. The company uses the data, which we collect for

estimating the future. I believe that they decide whether to invest more funds in the business and

expand its operations or just avoid risks and continue with the operations of the business. In

addition to this, I get to learn to operate different machine learning software for conducting data

analytics. As per present scenario, my company uses R programming language for analyzing the

data and modelling the same.

One thing that I become aware while doing my job as a revenue analyst is that data

analysis requires in-depth knowledge of statistics and important functions such as variances,

correlation, and regression analysis. Despite in-depth knowledge of statistics being important, in

practical life we need to have knowledge of different programs, which are used for the purpose

of analyzing data of a business. This post as revenue analysts has taught me a lot of about

application of programming language.

When I first started the job, I found it slightly difficult to run the programs for analyzing

the data, which was because I had more of a theoretical knowledge and limited practical

knowledge. In my studies, the data, which we used for analysis, was not so much in numbers.

it effectively identifies the hotspot in the population from where the business is able to derive

maximum revenue. In addition to this, the management of the company can recognize whether

the business is growing or not on the basis of the data which is available.

I have gained an interest in the subject where I first experienced the use of data and the

widespread application of the same. I am come to terms that no matter what the nature of the

business is, every business has some data and the management relies on such data for predicting

the likelihood of the business in near future. Similarly, the business which I am associated with is

engaged with is associated with car rentals. The company uses the data, which we collect for

estimating the future. I believe that they decide whether to invest more funds in the business and

expand its operations or just avoid risks and continue with the operations of the business. In

addition to this, I get to learn to operate different machine learning software for conducting data

analytics. As per present scenario, my company uses R programming language for analyzing the

data and modelling the same.

One thing that I become aware while doing my job as a revenue analyst is that data

analysis requires in-depth knowledge of statistics and important functions such as variances,

correlation, and regression analysis. Despite in-depth knowledge of statistics being important, in

practical life we need to have knowledge of different programs, which are used for the purpose

of analyzing data of a business. This post as revenue analysts has taught me a lot of about

application of programming language.

When I first started the job, I found it slightly difficult to run the programs for analyzing

the data, which was because I had more of a theoretical knowledge and limited practical

knowledge. In my studies, the data, which we used for analysis, was not so much in numbers.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE

However, I started to find it much more comfortable as time passes. I am now confident that I

would be able to operate R programming language easily even if I switch my job. I want to learn

more data analytics programs such as RapidMiner, Tableau and SAS. I believe that I can excel in

this area and develop further. I have realized that data which is available to the management is

the basis on which trends are identified and major business decisions are taken with a view to

achieve the goals of the business.

Question 3:

1. Managing Changes in a Business

In a business, Change Management is essential especially in times when the level of

competition in the market is very high (Hayes, 2018). The nature of the change, which is to be

brought about by the management, depends on the market position of the business and

competitive pressure in the industry. The company, which is considered for this part, is General

Motors. In the case of General Motors, which was considered to be one of the biggest vehicle

manufacturing companies in the world, faced serious competition in the market from its biggest

competitor Toyota which had successfully captured the market which resulted in steep fall in the

sales of the business and ultimately led to bankruptcy of the business (Helper & Henderson,

2014).

2. Steps taken by the Management

It was due to the efforts of the management and the Government that the company was

revived and significant changes were brought about in the management of the company. The

managers of the company played a significant role in bringing about change in the business

(Kuipers et al., 2014). The managers of the company decide the approaches, which needs to be

However, I started to find it much more comfortable as time passes. I am now confident that I

would be able to operate R programming language easily even if I switch my job. I want to learn

more data analytics programs such as RapidMiner, Tableau and SAS. I believe that I can excel in

this area and develop further. I have realized that data which is available to the management is

the basis on which trends are identified and major business decisions are taken with a view to

achieve the goals of the business.

Question 3:

1. Managing Changes in a Business

In a business, Change Management is essential especially in times when the level of

competition in the market is very high (Hayes, 2018). The nature of the change, which is to be

brought about by the management, depends on the market position of the business and

competitive pressure in the industry. The company, which is considered for this part, is General

Motors. In the case of General Motors, which was considered to be one of the biggest vehicle

manufacturing companies in the world, faced serious competition in the market from its biggest

competitor Toyota which had successfully captured the market which resulted in steep fall in the

sales of the business and ultimately led to bankruptcy of the business (Helper & Henderson,

2014).

2. Steps taken by the Management

It was due to the efforts of the management and the Government that the company was

revived and significant changes were brought about in the management of the company. The

managers of the company played a significant role in bringing about change in the business

(Kuipers et al., 2014). The managers of the company decide the approaches, which needs to be

11FINANCE

taken and identify what particular changes need to be brought about in the business. It is also to

be noted that the management also needs to take steps for the purpose of sustaining the changes

which is made by the management and ensure that the same are appropriate to the needs of the

business (Pugh, 2016). Therefore, it can be said that the management of the company has played

an important role in bringing about change management and ensuring that the business is able to

adapt to the market situation.

It is a known fact that resistance from the part of the employee often meets changes in the

business structure as they are of the opinion that the same can affect their lives. It is the role of

the management of the company to assure the employee that such changes are for the benefit of

everyone and ensure that the changes are implemented. In order to bring about changes in the

business, the management took a detailed analysis of the market. The management of the

company undertook SWOT Analysis for identifying the strength, weaknesses, opportunities and

threats of the business (Booth, 2015). This allowed the management to make the necessary

changes in the products and processes of the business so that the company can be reestablished in

the market. Some of the factors which have been recognized which needed to be changed are

cutting the costs of the business, introducing Hybrid engine system, bringing about new

innovation to the products which is offered by the business in order to combat competitive

pressure.

3. Lewin’s Change Model

In order to understand the areas, which needed change, the management applied Lewin’s

Change model (Cummings, Bridgman & Brown, 2016). This model effectively identified the

taken and identify what particular changes need to be brought about in the business. It is also to

be noted that the management also needs to take steps for the purpose of sustaining the changes

which is made by the management and ensure that the same are appropriate to the needs of the

business (Pugh, 2016). Therefore, it can be said that the management of the company has played

an important role in bringing about change management and ensuring that the business is able to

adapt to the market situation.

It is a known fact that resistance from the part of the employee often meets changes in the

business structure as they are of the opinion that the same can affect their lives. It is the role of

the management of the company to assure the employee that such changes are for the benefit of

everyone and ensure that the changes are implemented. In order to bring about changes in the

business, the management took a detailed analysis of the market. The management of the

company undertook SWOT Analysis for identifying the strength, weaknesses, opportunities and

threats of the business (Booth, 2015). This allowed the management to make the necessary

changes in the products and processes of the business so that the company can be reestablished in

the market. Some of the factors which have been recognized which needed to be changed are

cutting the costs of the business, introducing Hybrid engine system, bringing about new

innovation to the products which is offered by the business in order to combat competitive

pressure.

3. Lewin’s Change Model

In order to understand the areas, which needed change, the management applied Lewin’s

Change model (Cummings, Bridgman & Brown, 2016). This model effectively identified the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.