Finance: Compute and Interpret Present and Future Values Analysis

VerifiedAdded on 2023/06/08

|5

|865

|222

Homework Assignment

AI Summary

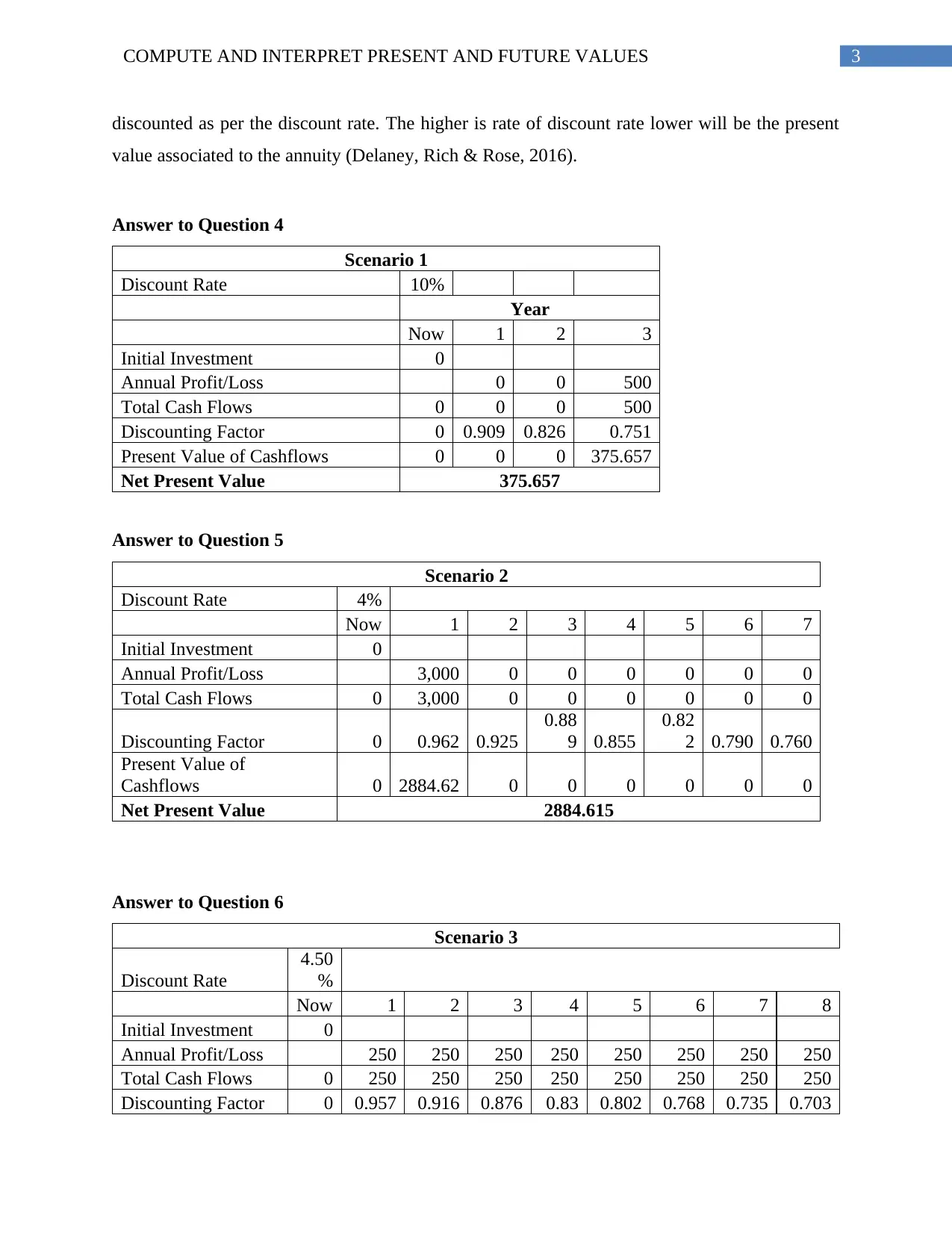

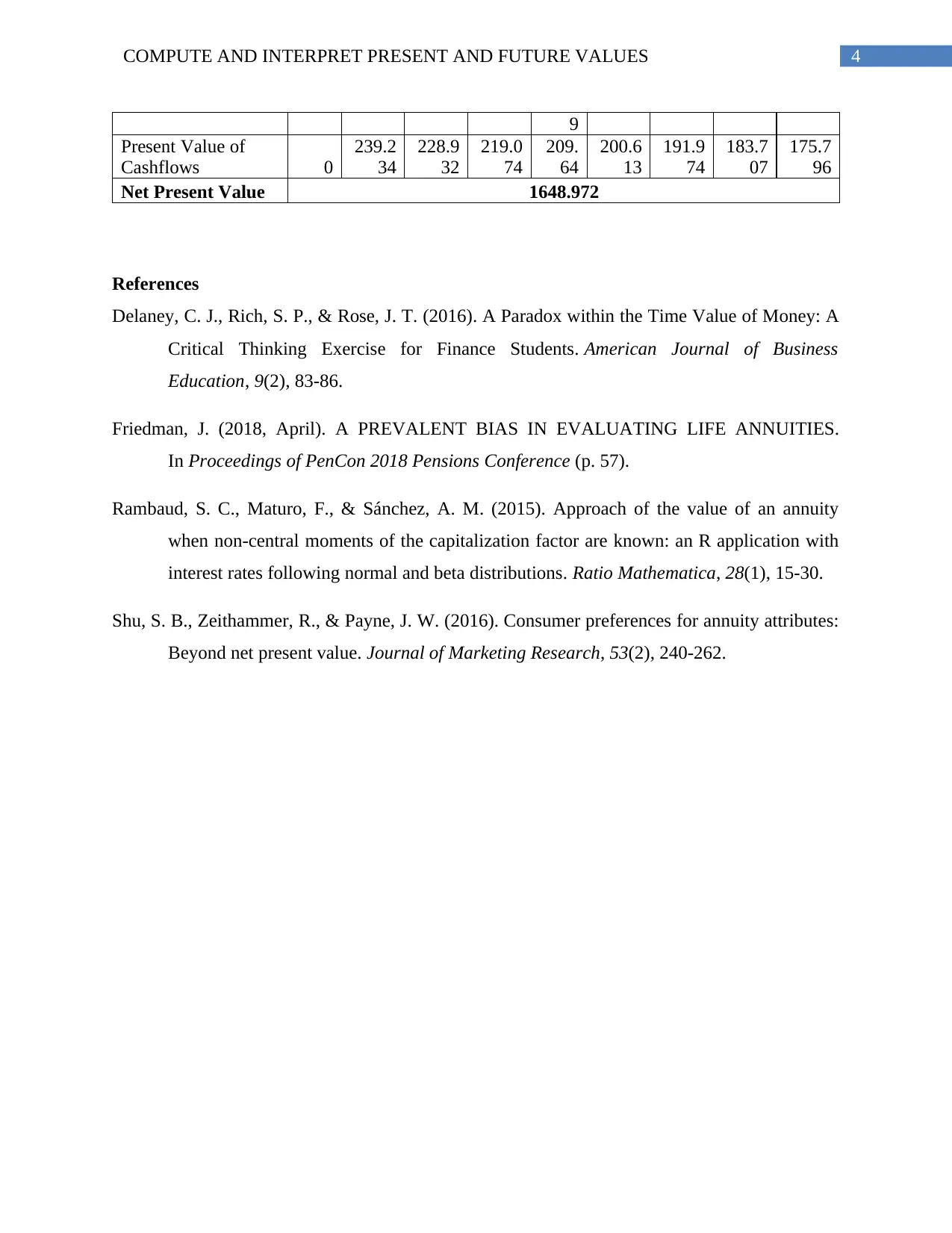

This assignment focuses on the computation and interpretation of present and future values in finance. It begins by explaining the time value of money, emphasizing that receiving money sooner is generally preferable due to potential investment opportunities. The assignment then defines an annuity as a series of payments made at the beginning of each period and provides the formula for calculating the future value of an annuity, contrasting it with the ordinary annuity formula. Furthermore, the present value of an annuity is explained as the current value of future payments, discounted by a specified rate. The assignment includes three scenarios involving calculations of net present value (NPV) with different discount rates and cash flows, demonstrating the application of these concepts in practical financial analysis. Desklib offers numerous resources for students, including solved assignments and study tools.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)