Finance Report: Scylace Plc Superstore & Helibeb Takeover Analysis

VerifiedAdded on 2023/01/19

|14

|3712

|100

Report

AI Summary

This finance report, prepared for Scylace Plc, evaluates two alternative proposals for building new superstores (Option A and Option B) and a potential takeover bid for Helibeb Plc. The report begins with an executive summary, followed by an introduction, and then outlines the methodology for evaluating the superstore locations and acquisition, considering available financing options like 20-year and 50-year bonds and the issuance of shares. The evaluation and analysis section assesses the financial viability of each superstore option based on initial costs, revenue, and expenses, including depreciation. The report also analyzes the financial performance of Helibeb Plc using ratio analysis, including return on shareholders' equity, turnover of capital employed, net profit margin, and operating margin. The report concludes with recommendations on which investments Scylace Plc should prioritize based on financial returns and available resources.

Running head: FINANCE PART 2

Finance

Name of the Student:

Name of the University:

Author’s Note:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE PART 2

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Methodology................................................................................................................................3

Evaluation and Analysis..............................................................................................................5

Conclusion.......................................................................................................................................8

Recommendations............................................................................................................................9

References......................................................................................................................................11

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Methodology................................................................................................................................3

Evaluation and Analysis..............................................................................................................5

Conclusion.......................................................................................................................................8

Recommendations............................................................................................................................9

References......................................................................................................................................11

2FINANCE PART 2

Executive Summary

The aim of the assignment is to conduct a financial assessment of the two alternative proposal

available for building of a new superstore and for a takeover bid for the Helibeb Plc. The

alternative option would be considered for the purpose of the financial evaluation based on the

return generated and the initial investment done by the company. In order to make an effective

evaluation, the major set of data that has been made available are the cost of the building of New

superstores under different options along with estimated cost and annual sales of both proposed

stores. The proposal for financing the options will be analysed with the help of the available

option like the 20-Year Bond, 50-Year Bond and issuance of shares. The assignment also deals

with the evaluation and determining the takeover bid for the Helibeb Plc. and the same was done

with the help of the ratio analysis comparing the financial performance of the company over the

last two-years. The analysis for the project will be done with the help of the financial position of

the company and assessing how the company has performed on a financial basis. It is essential to

consider various business and macro-economic environment for the purpose of the analysis. The

takeover bid will be evaluated in order to make a takeover offer to a clothing retailer naming

Helibeb Plc for which the income statement, Balance sheet and significant ratios have been

provided to assist the process of this evaluation. The major areas covered by this report include

the methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance, an evaluation of the proposed new superstore

locations and prospective acquisition of the firm.

Executive Summary

The aim of the assignment is to conduct a financial assessment of the two alternative proposal

available for building of a new superstore and for a takeover bid for the Helibeb Plc. The

alternative option would be considered for the purpose of the financial evaluation based on the

return generated and the initial investment done by the company. In order to make an effective

evaluation, the major set of data that has been made available are the cost of the building of New

superstores under different options along with estimated cost and annual sales of both proposed

stores. The proposal for financing the options will be analysed with the help of the available

option like the 20-Year Bond, 50-Year Bond and issuance of shares. The assignment also deals

with the evaluation and determining the takeover bid for the Helibeb Plc. and the same was done

with the help of the ratio analysis comparing the financial performance of the company over the

last two-years. The analysis for the project will be done with the help of the financial position of

the company and assessing how the company has performed on a financial basis. It is essential to

consider various business and macro-economic environment for the purpose of the analysis. The

takeover bid will be evaluated in order to make a takeover offer to a clothing retailer naming

Helibeb Plc for which the income statement, Balance sheet and significant ratios have been

provided to assist the process of this evaluation. The major areas covered by this report include

the methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance, an evaluation of the proposed new superstore

locations and prospective acquisition of the firm.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE PART 2

Introduction

Financial viability of the project is evaluated with the help of the cash flows and the net

profitability generated by the investment project. The financial assessment for building Project A

and Project B would be taken into consideration for the purpose of the evaluation of the overall

suitable project for the investors. It is essential that the financing sources selected by the

company for financing the assets of the company be suitable so that the investor and company on

a net enjoy a higher return from the investment (Khmel & Zhao, 2016). The report is based on

the case study of Scylace Plc, which has engaged a management consultant who will be

recommending the best alternative investment proposal available with Scylace plc for which the

requisite quantitative data has been provided. The alternative investment options are the

construction of new superstores either at one or at both of the different locations or considering

the proposal for the takeover of Helibeb Playa clothing retailer. Currently as a means of raising

finance, the alternative sources of finance to be evaluated are bonds with 20 years or 50-year

redemption period or the shares to be. Further, the requisite data for the target organization, the

Helibeb Plc. as provided are the income statement, balance sheet and the relevant ratios of the

entity. The financial performance of the Helibeb Company will be taken into consideration for

the purpose of the evaluation of the financial statement of the company (Iswandari,

Amboningtyas & Yulianeu, 2018). The selection of the best alternative project for the company

will done accordingly with the tools of capital budgeting which will help in better assessment of

the available projects (Huang & Zhao, 2016).

Introduction

Financial viability of the project is evaluated with the help of the cash flows and the net

profitability generated by the investment project. The financial assessment for building Project A

and Project B would be taken into consideration for the purpose of the evaluation of the overall

suitable project for the investors. It is essential that the financing sources selected by the

company for financing the assets of the company be suitable so that the investor and company on

a net enjoy a higher return from the investment (Khmel & Zhao, 2016). The report is based on

the case study of Scylace Plc, which has engaged a management consultant who will be

recommending the best alternative investment proposal available with Scylace plc for which the

requisite quantitative data has been provided. The alternative investment options are the

construction of new superstores either at one or at both of the different locations or considering

the proposal for the takeover of Helibeb Playa clothing retailer. Currently as a means of raising

finance, the alternative sources of finance to be evaluated are bonds with 20 years or 50-year

redemption period or the shares to be. Further, the requisite data for the target organization, the

Helibeb Plc. as provided are the income statement, balance sheet and the relevant ratios of the

entity. The financial performance of the Helibeb Company will be taken into consideration for

the purpose of the evaluation of the financial statement of the company (Iswandari,

Amboningtyas & Yulianeu, 2018). The selection of the best alternative project for the company

will done accordingly with the tools of capital budgeting which will help in better assessment of

the available projects (Huang & Zhao, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE PART 2

Discussion

Methodology

The available option for the construction of the superstore will be in the case of Option A

or Option B where the company will be spending an initial amount and generating cash inflows

in the form of annual revenue done by the company. The net cash flows generated by the

company from each of the store will be taken into consideration for the evaluation of the

financial viability of the project (García-Quevedo, Segarra-Blasco & Teruel, 2018).

Option A: In the case of Option A, the case taken into consideration for the purpose of the

analysis requires an initial investment of around £40 million, which will be recovered in the form

of annual revenue generated by the company on an annual basis, which will be around £13

million on annual basis. The annual cost of sales, staff costs and other annual costs will be the

key sources of the expenses that the company will be incurring. It is to be noted that after

accounting for all the income sources and the expenses of the company the company is expected

to earn £1 million on a yearly basis. The depreciation on the investment will be done on a

straight-line basis where the life of the asset will be considered for a sum of 50-years and the

residual value of the property will be taken at £10 million (Del Giudice, Manganelli & De Paola,

2016). The net profitability in the case of Option A would be around £1 million an annual basis,

which will be earned by the company with a net investment of around £25 million euro. The

accounting rate of return for the project sums up to 4%, which will be defined as the return on

the project (Tappura et al., 2015).

Option B: In the case of Option B, it will be seen that the investment will be done initially for a

sum of £25 million. The revenue and expenses sources for the company will be accounted in the

same way as Option A. Option B where the annual sales of the company will be around £10

Discussion

Methodology

The available option for the construction of the superstore will be in the case of Option A

or Option B where the company will be spending an initial amount and generating cash inflows

in the form of annual revenue done by the company. The net cash flows generated by the

company from each of the store will be taken into consideration for the evaluation of the

financial viability of the project (García-Quevedo, Segarra-Blasco & Teruel, 2018).

Option A: In the case of Option A, the case taken into consideration for the purpose of the

analysis requires an initial investment of around £40 million, which will be recovered in the form

of annual revenue generated by the company on an annual basis, which will be around £13

million on annual basis. The annual cost of sales, staff costs and other annual costs will be the

key sources of the expenses that the company will be incurring. It is to be noted that after

accounting for all the income sources and the expenses of the company the company is expected

to earn £1 million on a yearly basis. The depreciation on the investment will be done on a

straight-line basis where the life of the asset will be considered for a sum of 50-years and the

residual value of the property will be taken at £10 million (Del Giudice, Manganelli & De Paola,

2016). The net profitability in the case of Option A would be around £1 million an annual basis,

which will be earned by the company with a net investment of around £25 million euro. The

accounting rate of return for the project sums up to 4%, which will be defined as the return on

the project (Tappura et al., 2015).

Option B: In the case of Option B, it will be seen that the investment will be done initially for a

sum of £25 million. The revenue and expenses sources for the company will be accounted in the

same way as Option A. Option B where the annual sales of the company will be around £10

5FINANCE PART 2

million for a year and the related costs for the company will be treated as a expenses for the

company. The annual depreciation for the company will be around £0.44 million and the same

would be treated as an expense for the project. The annual investment, which will be done for the

company, will be around £14 million and the annual profit from the Option B would be around

£0.66 million. The accounting rate of return from the project on the other hand would be around

£4.71 million. There were various factors including the relevant costs incurred by the company

was taken into consideration while analyzing the feasibility of the investment (Jo et al., 2015).

Financing Sources: The financing sources for the company will be calculated with the help of

the available financing sources available with the company, which will be from issuance of bond,

which be of maturity for 20 years and 50 years respectively (Goldstein, Jiang & Ng, 2017). The

yield on the bond was calculated with the help of the yield to maturity on each of the bond. The

required rate of return on the shares on the other hand side would be considered as the cost of

equity shares for the company (Pilbeam, 2018).

Financial Analysis: The financial analysis for the company was done with the help of the ratio

analysis of the company comparing the financial performance of the company over the year 2017

and 2018 and considering them while evaluating the financial performance of the company

(Robinson et al., 2015).

Evaluation and Analysis

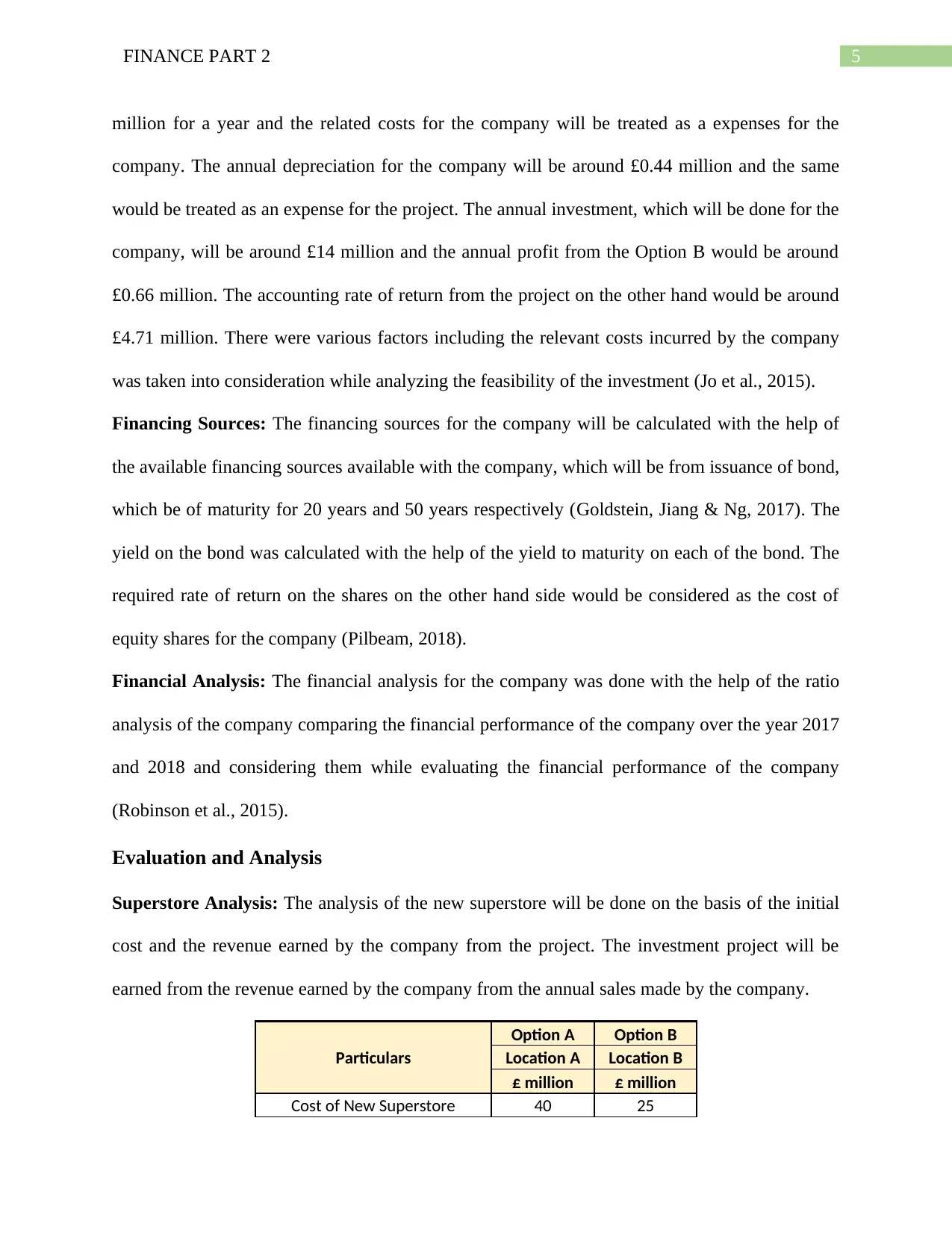

Superstore Analysis: The analysis of the new superstore will be done on the basis of the initial

cost and the revenue earned by the company from the project. The investment project will be

earned from the revenue earned by the company from the annual sales made by the company.

Particulars

Option A Option B

Location A Location B

£ million £ million

Cost of New Superstore 40 25

million for a year and the related costs for the company will be treated as a expenses for the

company. The annual depreciation for the company will be around £0.44 million and the same

would be treated as an expense for the project. The annual investment, which will be done for the

company, will be around £14 million and the annual profit from the Option B would be around

£0.66 million. The accounting rate of return from the project on the other hand would be around

£4.71 million. There were various factors including the relevant costs incurred by the company

was taken into consideration while analyzing the feasibility of the investment (Jo et al., 2015).

Financing Sources: The financing sources for the company will be calculated with the help of

the available financing sources available with the company, which will be from issuance of bond,

which be of maturity for 20 years and 50 years respectively (Goldstein, Jiang & Ng, 2017). The

yield on the bond was calculated with the help of the yield to maturity on each of the bond. The

required rate of return on the shares on the other hand side would be considered as the cost of

equity shares for the company (Pilbeam, 2018).

Financial Analysis: The financial analysis for the company was done with the help of the ratio

analysis of the company comparing the financial performance of the company over the year 2017

and 2018 and considering them while evaluating the financial performance of the company

(Robinson et al., 2015).

Evaluation and Analysis

Superstore Analysis: The analysis of the new superstore will be done on the basis of the initial

cost and the revenue earned by the company from the project. The investment project will be

earned from the revenue earned by the company from the annual sales made by the company.

Particulars

Option A Option B

Location A Location B

£ million £ million

Cost of New Superstore 40 25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE PART 2

Residual Value 10 3

Annual Sales Revenue 13 10

Annual Cost of Sales -9.1 -7

Annual Staff Costs -1.2 -1.1

Other Annual Costs -1.1 -0.8

Depreciation Charges -0.6 -0.44

Net Profit 1.00 0.66

The annual net profit earned by the company was accounted after accounting for all the

major expenses and revenue for the company. The depreciation charged on the investment will

be done on a straight-line basis and the same will be treated as an expenses for the company. The

effectiveness and the financial viability of the project would be well addressed with the help of

the financial return generated by each of the project. In both the case available taken into

consideration for the purpose of the analysis has one or the other form of initial cash inflows and

cash outflows for the project (Ng & Beruvides, 2015). Option B would be considered as the best

option for the purpose of investment because of the higher accounting return generated by the

project.

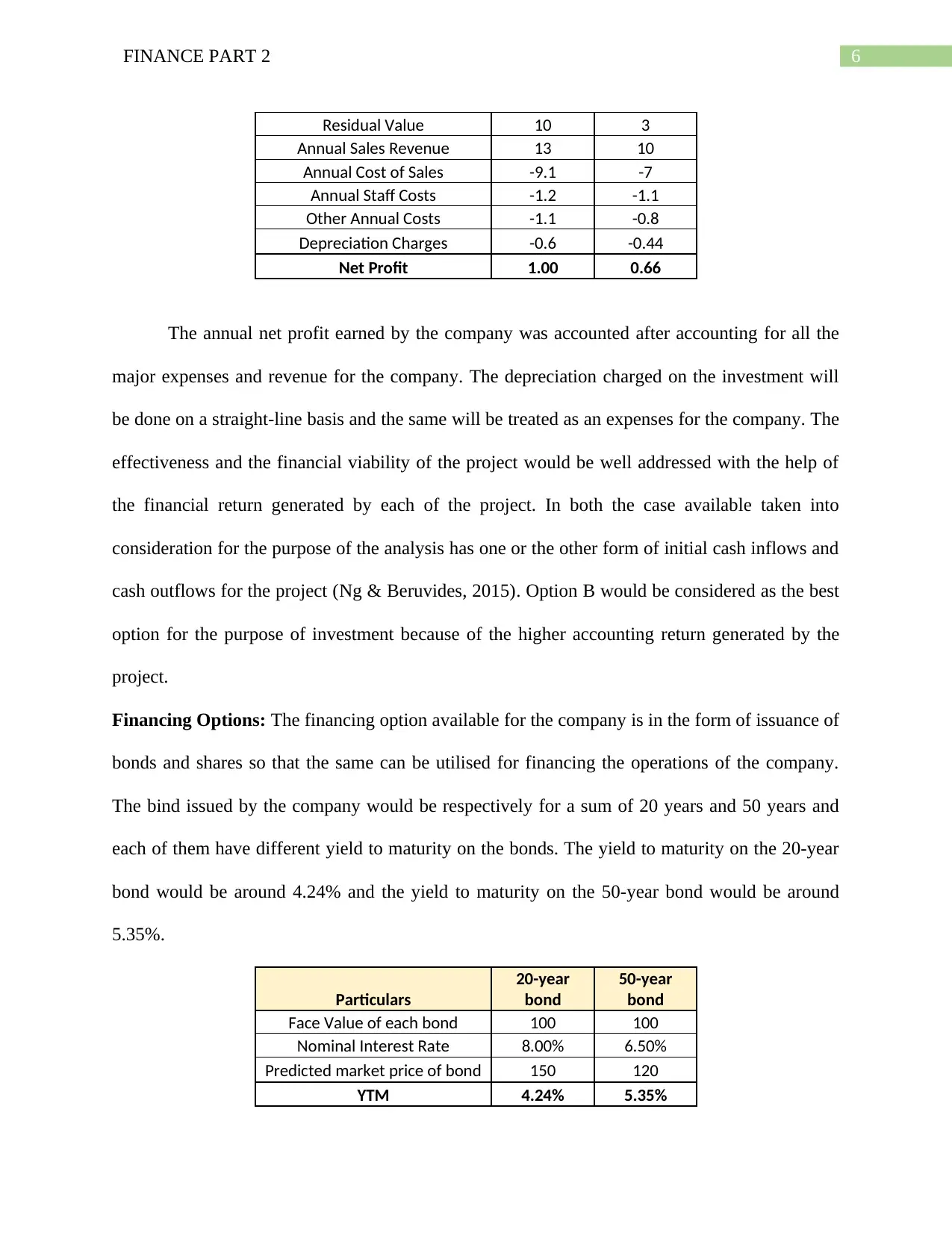

Financing Options: The financing option available for the company is in the form of issuance of

bonds and shares so that the same can be utilised for financing the operations of the company.

The bind issued by the company would be respectively for a sum of 20 years and 50 years and

each of them have different yield to maturity on the bonds. The yield to maturity on the 20-year

bond would be around 4.24% and the yield to maturity on the 50-year bond would be around

5.35%.

Particulars

20-year

bond

50-year

bond

Face Value of each bond 100 100

Nominal Interest Rate 8.00% 6.50%

Predicted market price of bond 150 120

YTM 4.24% 5.35%

Residual Value 10 3

Annual Sales Revenue 13 10

Annual Cost of Sales -9.1 -7

Annual Staff Costs -1.2 -1.1

Other Annual Costs -1.1 -0.8

Depreciation Charges -0.6 -0.44

Net Profit 1.00 0.66

The annual net profit earned by the company was accounted after accounting for all the

major expenses and revenue for the company. The depreciation charged on the investment will

be done on a straight-line basis and the same will be treated as an expenses for the company. The

effectiveness and the financial viability of the project would be well addressed with the help of

the financial return generated by each of the project. In both the case available taken into

consideration for the purpose of the analysis has one or the other form of initial cash inflows and

cash outflows for the project (Ng & Beruvides, 2015). Option B would be considered as the best

option for the purpose of investment because of the higher accounting return generated by the

project.

Financing Options: The financing option available for the company is in the form of issuance of

bonds and shares so that the same can be utilised for financing the operations of the company.

The bind issued by the company would be respectively for a sum of 20 years and 50 years and

each of them have different yield to maturity on the bonds. The yield to maturity on the 20-year

bond would be around 4.24% and the yield to maturity on the 50-year bond would be around

5.35%.

Particulars

20-year

bond

50-year

bond

Face Value of each bond 100 100

Nominal Interest Rate 8.00% 6.50%

Predicted market price of bond 150 120

YTM 4.24% 5.35%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE PART 2

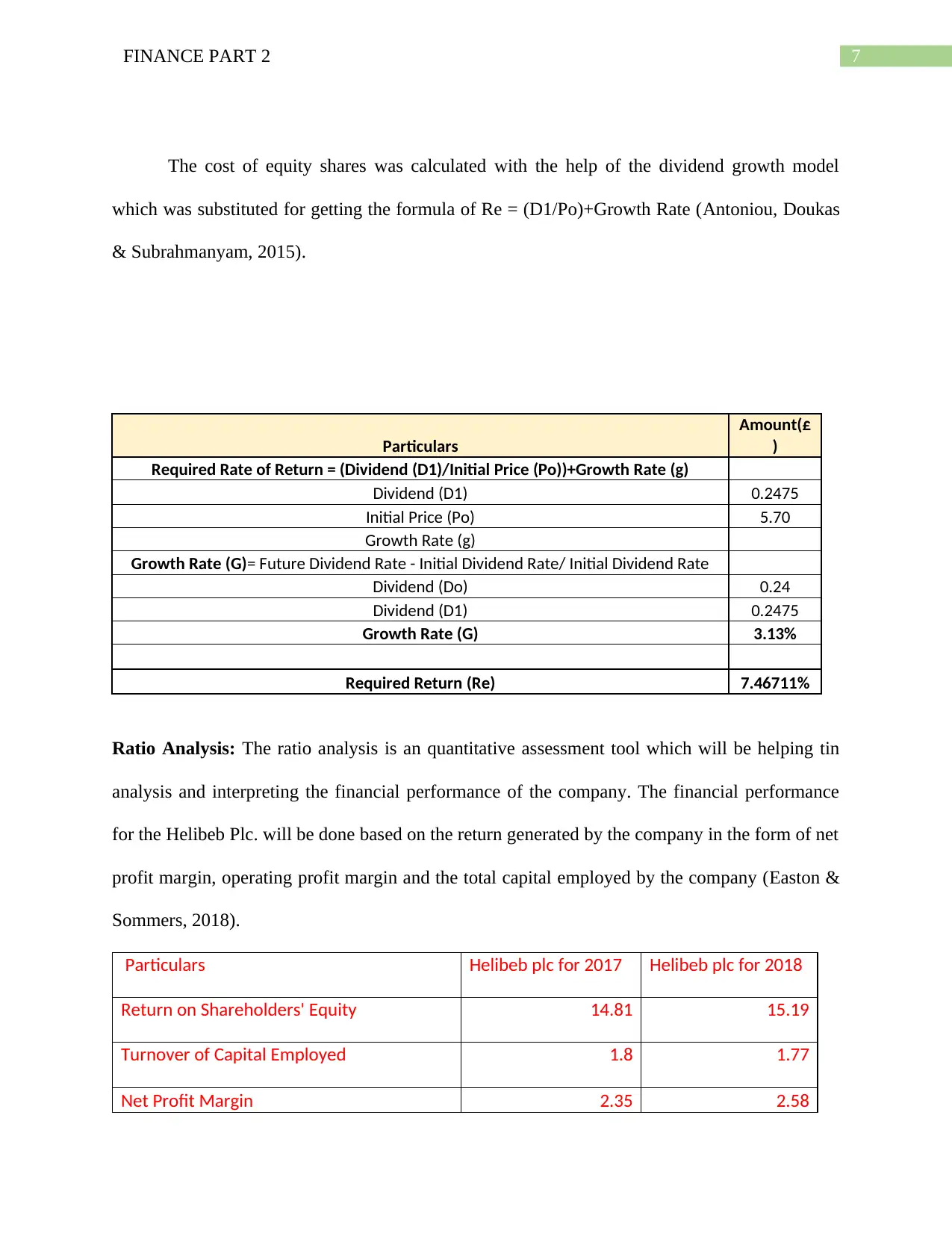

The cost of equity shares was calculated with the help of the dividend growth model

which was substituted for getting the formula of Re = (D1/Po)+Growth Rate (Antoniou, Doukas

& Subrahmanyam, 2015).

Particulars

Amount(£

)

Required Rate of Return = (Dividend (D1)/Initial Price (Po))+Growth Rate (g)

Dividend (D1) 0.2475

Initial Price (Po) 5.70

Growth Rate (g)

Growth Rate (G)= Future Dividend Rate - Initial Dividend Rate/ Initial Dividend Rate

Dividend (Do) 0.24

Dividend (D1) 0.2475

Growth Rate (G) 3.13%

Required Return (Re) 7.46711%

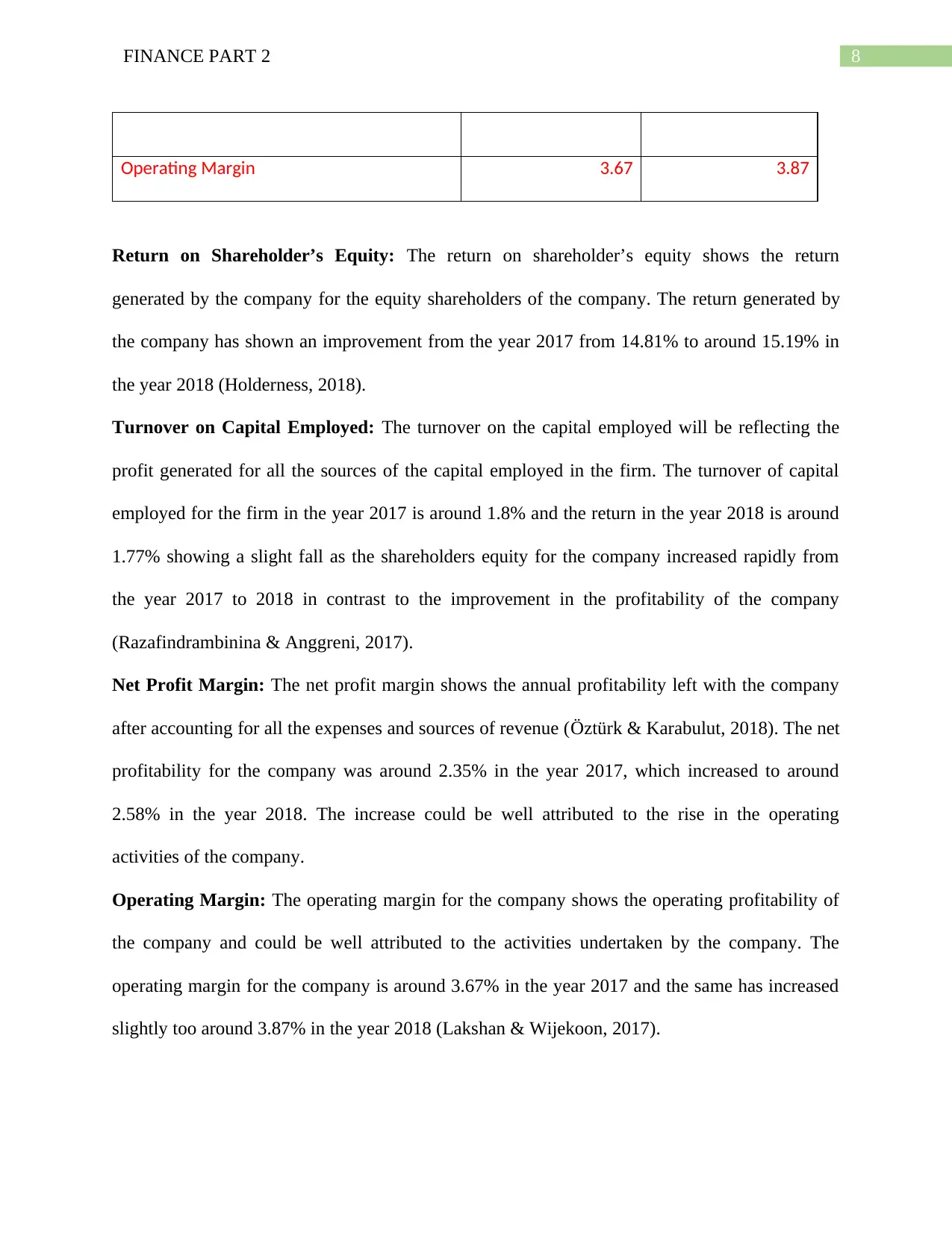

Ratio Analysis: The ratio analysis is an quantitative assessment tool which will be helping tin

analysis and interpreting the financial performance of the company. The financial performance

for the Helibeb Plc. will be done based on the return generated by the company in the form of net

profit margin, operating profit margin and the total capital employed by the company (Easton &

Sommers, 2018).

Particulars Helibeb plc for 2017 Helibeb plc for 2018

Return on Shareholders' Equity 14.81 15.19

Turnover of Capital Employed 1.8 1.77

Net Profit Margin 2.35 2.58

The cost of equity shares was calculated with the help of the dividend growth model

which was substituted for getting the formula of Re = (D1/Po)+Growth Rate (Antoniou, Doukas

& Subrahmanyam, 2015).

Particulars

Amount(£

)

Required Rate of Return = (Dividend (D1)/Initial Price (Po))+Growth Rate (g)

Dividend (D1) 0.2475

Initial Price (Po) 5.70

Growth Rate (g)

Growth Rate (G)= Future Dividend Rate - Initial Dividend Rate/ Initial Dividend Rate

Dividend (Do) 0.24

Dividend (D1) 0.2475

Growth Rate (G) 3.13%

Required Return (Re) 7.46711%

Ratio Analysis: The ratio analysis is an quantitative assessment tool which will be helping tin

analysis and interpreting the financial performance of the company. The financial performance

for the Helibeb Plc. will be done based on the return generated by the company in the form of net

profit margin, operating profit margin and the total capital employed by the company (Easton &

Sommers, 2018).

Particulars Helibeb plc for 2017 Helibeb plc for 2018

Return on Shareholders' Equity 14.81 15.19

Turnover of Capital Employed 1.8 1.77

Net Profit Margin 2.35 2.58

8FINANCE PART 2

Operating Margin 3.67 3.87

Return on Shareholder’s Equity: The return on shareholder’s equity shows the return

generated by the company for the equity shareholders of the company. The return generated by

the company has shown an improvement from the year 2017 from 14.81% to around 15.19% in

the year 2018 (Holderness, 2018).

Turnover on Capital Employed: The turnover on the capital employed will be reflecting the

profit generated for all the sources of the capital employed in the firm. The turnover of capital

employed for the firm in the year 2017 is around 1.8% and the return in the year 2018 is around

1.77% showing a slight fall as the shareholders equity for the company increased rapidly from

the year 2017 to 2018 in contrast to the improvement in the profitability of the company

(Razafindrambinina & Anggreni, 2017).

Net Profit Margin: The net profit margin shows the annual profitability left with the company

after accounting for all the expenses and sources of revenue (Öztürk & Karabulut, 2018). The net

profitability for the company was around 2.35% in the year 2017, which increased to around

2.58% in the year 2018. The increase could be well attributed to the rise in the operating

activities of the company.

Operating Margin: The operating margin for the company shows the operating profitability of

the company and could be well attributed to the activities undertaken by the company. The

operating margin for the company is around 3.67% in the year 2017 and the same has increased

slightly too around 3.87% in the year 2018 (Lakshan & Wijekoon, 2017).

Operating Margin 3.67 3.87

Return on Shareholder’s Equity: The return on shareholder’s equity shows the return

generated by the company for the equity shareholders of the company. The return generated by

the company has shown an improvement from the year 2017 from 14.81% to around 15.19% in

the year 2018 (Holderness, 2018).

Turnover on Capital Employed: The turnover on the capital employed will be reflecting the

profit generated for all the sources of the capital employed in the firm. The turnover of capital

employed for the firm in the year 2017 is around 1.8% and the return in the year 2018 is around

1.77% showing a slight fall as the shareholders equity for the company increased rapidly from

the year 2017 to 2018 in contrast to the improvement in the profitability of the company

(Razafindrambinina & Anggreni, 2017).

Net Profit Margin: The net profit margin shows the annual profitability left with the company

after accounting for all the expenses and sources of revenue (Öztürk & Karabulut, 2018). The net

profitability for the company was around 2.35% in the year 2017, which increased to around

2.58% in the year 2018. The increase could be well attributed to the rise in the operating

activities of the company.

Operating Margin: The operating margin for the company shows the operating profitability of

the company and could be well attributed to the activities undertaken by the company. The

operating margin for the company is around 3.67% in the year 2017 and the same has increased

slightly too around 3.87% in the year 2018 (Lakshan & Wijekoon, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE PART 2

On an overall basis, the profitability for the company has increased consistently for the

company the financial risk of the company has also reduced with the reduction of the debt in the

balance sheet of the company. Helibeb Plc. could be considered as the best alternative source for

acquiring the company (Durrah et al., 2016).

Conclusion

The financial evaluation and analysis was done for assessing the financial viability of the

superstore. Annual revenue from the superstore from both the stores was taken as a source of

income generation for the company. The Accounting Rate of return from the Option B would be

around 4.71% and the same was found to be more consistent in contrast to Option A. The

Financing options evaluated for the company was in the field of selecting the various available

sources of finance. The financing source for the company in the form of debt and equity both can

be considered but it is recommended that the company go ahead with 20-year bond issuance, as

the company was not having any major liabilities in the form of non-current liability for the

company. The company can consider increasing the liability so that they can get additive benefit

in the form of low cost financing for the company. The financial analysis for the Helibeb

Company was also done where it was found that the financial performance of the company in

terms of profitability and return has performed well. The stable growth of the revenue and the net

profitability of the company has been performing well and this has been the key reason where it

was seen that the company could place a takeover bid for the Helibeb Company.

On an overall basis, the profitability for the company has increased consistently for the

company the financial risk of the company has also reduced with the reduction of the debt in the

balance sheet of the company. Helibeb Plc. could be considered as the best alternative source for

acquiring the company (Durrah et al., 2016).

Conclusion

The financial evaluation and analysis was done for assessing the financial viability of the

superstore. Annual revenue from the superstore from both the stores was taken as a source of

income generation for the company. The Accounting Rate of return from the Option B would be

around 4.71% and the same was found to be more consistent in contrast to Option A. The

Financing options evaluated for the company was in the field of selecting the various available

sources of finance. The financing source for the company in the form of debt and equity both can

be considered but it is recommended that the company go ahead with 20-year bond issuance, as

the company was not having any major liabilities in the form of non-current liability for the

company. The company can consider increasing the liability so that they can get additive benefit

in the form of low cost financing for the company. The financial analysis for the Helibeb

Company was also done where it was found that the financial performance of the company in

terms of profitability and return has performed well. The stable growth of the revenue and the net

profitability of the company has been performing well and this has been the key reason where it

was seen that the company could place a takeover bid for the Helibeb Company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE PART 2

Recommendations

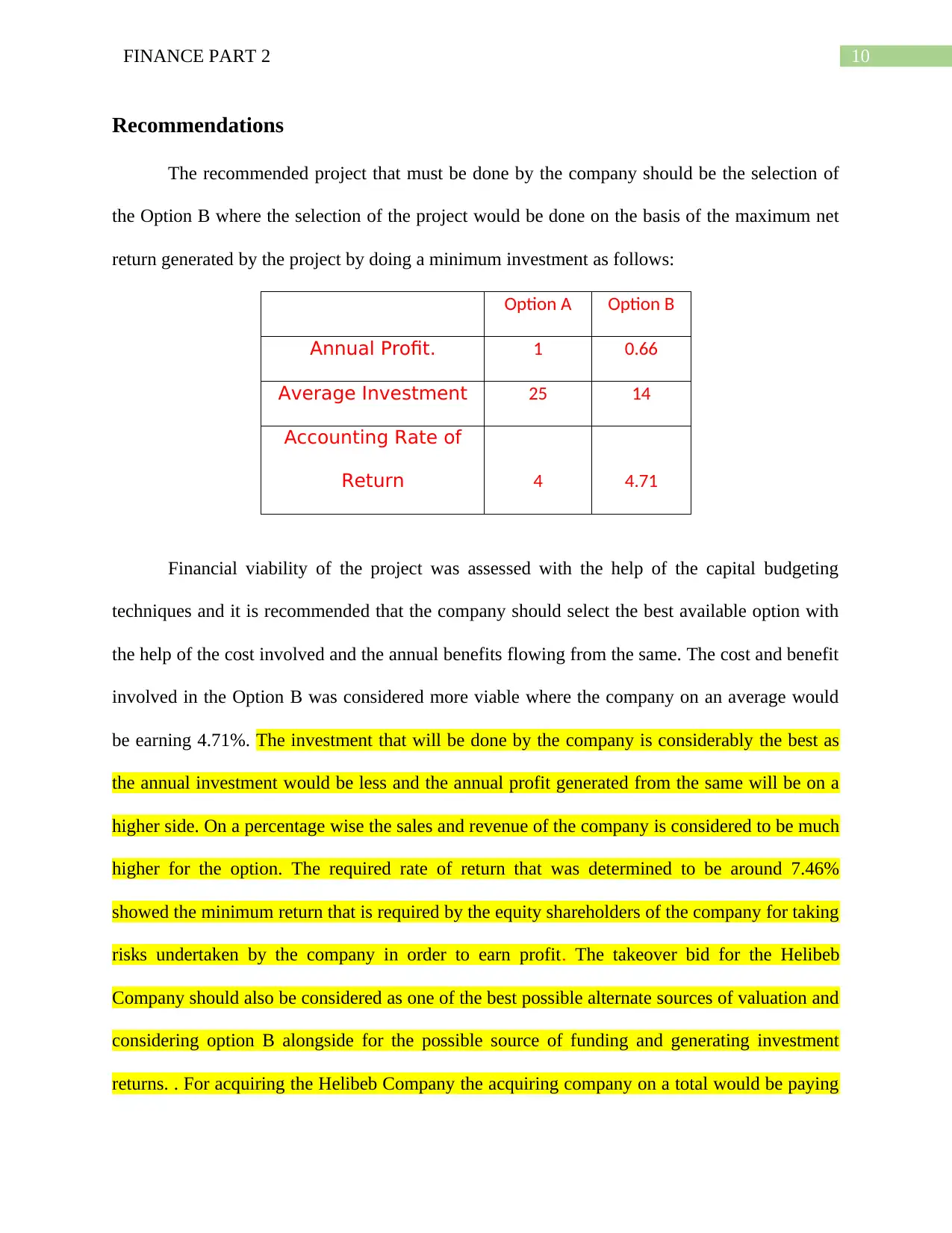

The recommended project that must be done by the company should be the selection of

the Option B where the selection of the project would be done on the basis of the maximum net

return generated by the project by doing a minimum investment as follows:

Option A Option B

Annual Profit. 1 0.66

Average Investment 25 14

Accounting Rate of

Return 4 4.71

Financial viability of the project was assessed with the help of the capital budgeting

techniques and it is recommended that the company should select the best available option with

the help of the cost involved and the annual benefits flowing from the same. The cost and benefit

involved in the Option B was considered more viable where the company on an average would

be earning 4.71%. The investment that will be done by the company is considerably the best as

the annual investment would be less and the annual profit generated from the same will be on a

higher side. On a percentage wise the sales and revenue of the company is considered to be much

higher for the option. The required rate of return that was determined to be around 7.46%

showed the minimum return that is required by the equity shareholders of the company for taking

risks undertaken by the company in order to earn profit. The takeover bid for the Helibeb

Company should also be considered as one of the best possible alternate sources of valuation and

considering option B alongside for the possible source of funding and generating investment

returns. . For acquiring the Helibeb Company the acquiring company on a total would be paying

Recommendations

The recommended project that must be done by the company should be the selection of

the Option B where the selection of the project would be done on the basis of the maximum net

return generated by the project by doing a minimum investment as follows:

Option A Option B

Annual Profit. 1 0.66

Average Investment 25 14

Accounting Rate of

Return 4 4.71

Financial viability of the project was assessed with the help of the capital budgeting

techniques and it is recommended that the company should select the best available option with

the help of the cost involved and the annual benefits flowing from the same. The cost and benefit

involved in the Option B was considered more viable where the company on an average would

be earning 4.71%. The investment that will be done by the company is considerably the best as

the annual investment would be less and the annual profit generated from the same will be on a

higher side. On a percentage wise the sales and revenue of the company is considered to be much

higher for the option. The required rate of return that was determined to be around 7.46%

showed the minimum return that is required by the equity shareholders of the company for taking

risks undertaken by the company in order to earn profit. The takeover bid for the Helibeb

Company should also be considered as one of the best possible alternate sources of valuation and

considering option B alongside for the possible source of funding and generating investment

returns. . For acquiring the Helibeb Company the acquiring company on a total would be paying

11FINANCE PART 2

a sum of £124 million and can earn 15% on the investment, which will be significantly create

wealth for the company. However, on the other hand side it is crucial to note that the financial

position of Scylace Plc shows the company is not having major liabilities on the balance sheet of

the company. The company can borrow the fund by issuing the 20-year bond and investing the

proceeds for the purpose of investment into the Superstore and acquisition of Helibeb Plc

Company. The high growth rate of the firm in terms of the profitability of the company is the key

source for the higher return on investment. Higher return on investment from both the sources of

investment along with the benefit of diversification in the business will be the key source for the

selection of the investment project and takeover bid for Helibeb Plc.

a sum of £124 million and can earn 15% on the investment, which will be significantly create

wealth for the company. However, on the other hand side it is crucial to note that the financial

position of Scylace Plc shows the company is not having major liabilities on the balance sheet of

the company. The company can borrow the fund by issuing the 20-year bond and investing the

proceeds for the purpose of investment into the Superstore and acquisition of Helibeb Plc

Company. The high growth rate of the firm in terms of the profitability of the company is the key

source for the higher return on investment. Higher return on investment from both the sources of

investment along with the benefit of diversification in the business will be the key source for the

selection of the investment project and takeover bid for Helibeb Plc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.