Financial Analysis of the Travel and Tourism Sector: Funding

VerifiedAdded on 2020/10/22

|16

|3080

|212

Report

AI Summary

This report provides a comprehensive analysis of finance and funding within the travel and tourism sector, using Thomas Cook Airlines as a case study. It begins with an interpretation of financial accounts, including ratio analysis (current ratio, acid ratio, return on capital employed, net profit ratio) to assist in decision-making, highlighting the company's financial performance. The report then explores the application of management accounting information, such as budget reports, variance analysis, and management information systems, as decision-making tools. The second task focuses on the significance of cost and volume in the sector, analyzing cost minimization, volume impact, and various pricing methods (cost-based and value-based) used to maximize revenue. The report concludes by examining factors influencing profit in travel and tourism businesses, providing a well-rounded financial perspective of the industry.

Finance and Funding in the Travel and

Tourism Sector

Tourism Sector

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

3.1 Interpretation of financial accounts to assist decision-making.........................................1

.........................................................................................................................................................3

2.1 Different kind of management accounting information which used in tourism sector....7

2.2 Use of management accounting information as a decision making tool..........................8

TASK 2............................................................................................................................................9

1.1 Significance of cost and volume in travel and tourism sector..........................................9

1.2 Analyse of pricing methods used in travel and tourism sector.......................................10

1.3 Factors influencing profit in travel and tourism businesses...........................................11

CONCLSION ................................................................................................................................12

REFERENCES..............................................................................................................................13

.......................................................................................................................................................13

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

3.1 Interpretation of financial accounts to assist decision-making.........................................1

.........................................................................................................................................................3

2.1 Different kind of management accounting information which used in tourism sector....7

2.2 Use of management accounting information as a decision making tool..........................8

TASK 2............................................................................................................................................9

1.1 Significance of cost and volume in travel and tourism sector..........................................9

1.2 Analyse of pricing methods used in travel and tourism sector.......................................10

1.3 Factors influencing profit in travel and tourism businesses...........................................11

CONCLSION ................................................................................................................................12

REFERENCES..............................................................................................................................13

.......................................................................................................................................................13

INTRODUCTION

Financial Management is process of planning,executing and controlling financial

operations. With passage of time tourism has emerged as popular leisure activity and a major a

source of income for many nations supporting their economy by contributing in GDP,

generating employment opportunities, earning foreign exchange reserves etc. The report is based

on case study of Thomas Cook Airlines (Evans, Stonehouse and Campbell, 2012). The project

will discuss about various types of costs that is incurred by hotel along with various factors that

are essential to analyse to understand tourism sectors. Further a detailed ratio analysis of firm

will be provided along with results and interpretation. The report will also provide sources and

distribution of funds for public and private tourism development.

TASK 1

3.1 Interpretation of financial accounts to assist decision-making

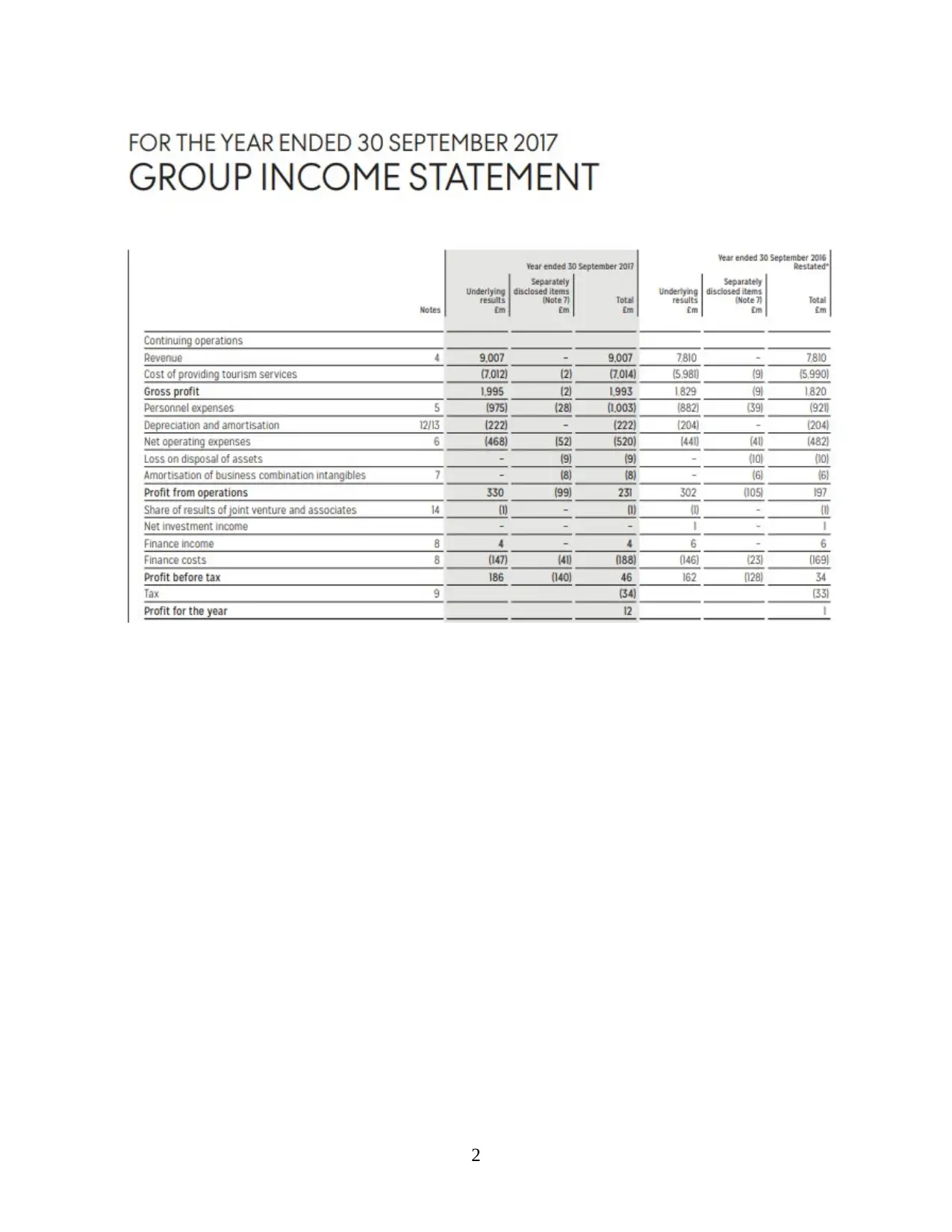

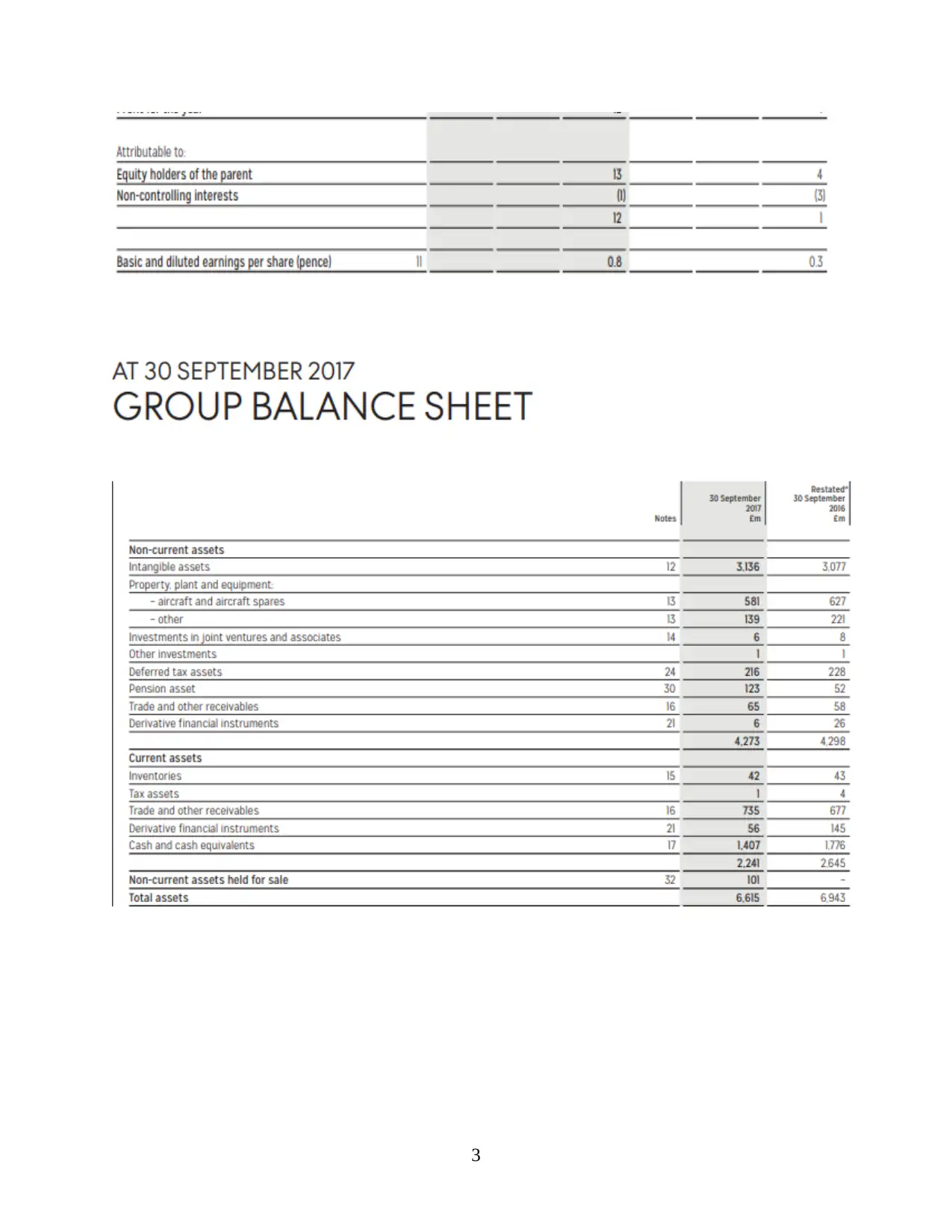

Thomas Cook is a British airline established in 2003 with its base in Manchester,

England. The firm belongs to travel and tourism sector and is a airline division of Thomas Cook

Group which is having three sister airlines. Firm is known to provide leisure destinations

worldwide. Company is having fleet around 90 aircraft and operates approx 20 sources markets

in Europe. Year by year firms revenues increased from 15.33% from 7.81bn to 9.01bn while net

income improved 225.00% from 4.00m to 13.00m. This shows good financial position of the

firm. Mentioned below is the financial statement of Thomas Cook that provides company's

income statement, cash flow statement and balance sheet for the year 2016-2017:

1

Financial Management is process of planning,executing and controlling financial

operations. With passage of time tourism has emerged as popular leisure activity and a major a

source of income for many nations supporting their economy by contributing in GDP,

generating employment opportunities, earning foreign exchange reserves etc. The report is based

on case study of Thomas Cook Airlines (Evans, Stonehouse and Campbell, 2012). The project

will discuss about various types of costs that is incurred by hotel along with various factors that

are essential to analyse to understand tourism sectors. Further a detailed ratio analysis of firm

will be provided along with results and interpretation. The report will also provide sources and

distribution of funds for public and private tourism development.

TASK 1

3.1 Interpretation of financial accounts to assist decision-making

Thomas Cook is a British airline established in 2003 with its base in Manchester,

England. The firm belongs to travel and tourism sector and is a airline division of Thomas Cook

Group which is having three sister airlines. Firm is known to provide leisure destinations

worldwide. Company is having fleet around 90 aircraft and operates approx 20 sources markets

in Europe. Year by year firms revenues increased from 15.33% from 7.81bn to 9.01bn while net

income improved 225.00% from 4.00m to 13.00m. This shows good financial position of the

firm. Mentioned below is the financial statement of Thomas Cook that provides company's

income statement, cash flow statement and balance sheet for the year 2016-2017:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

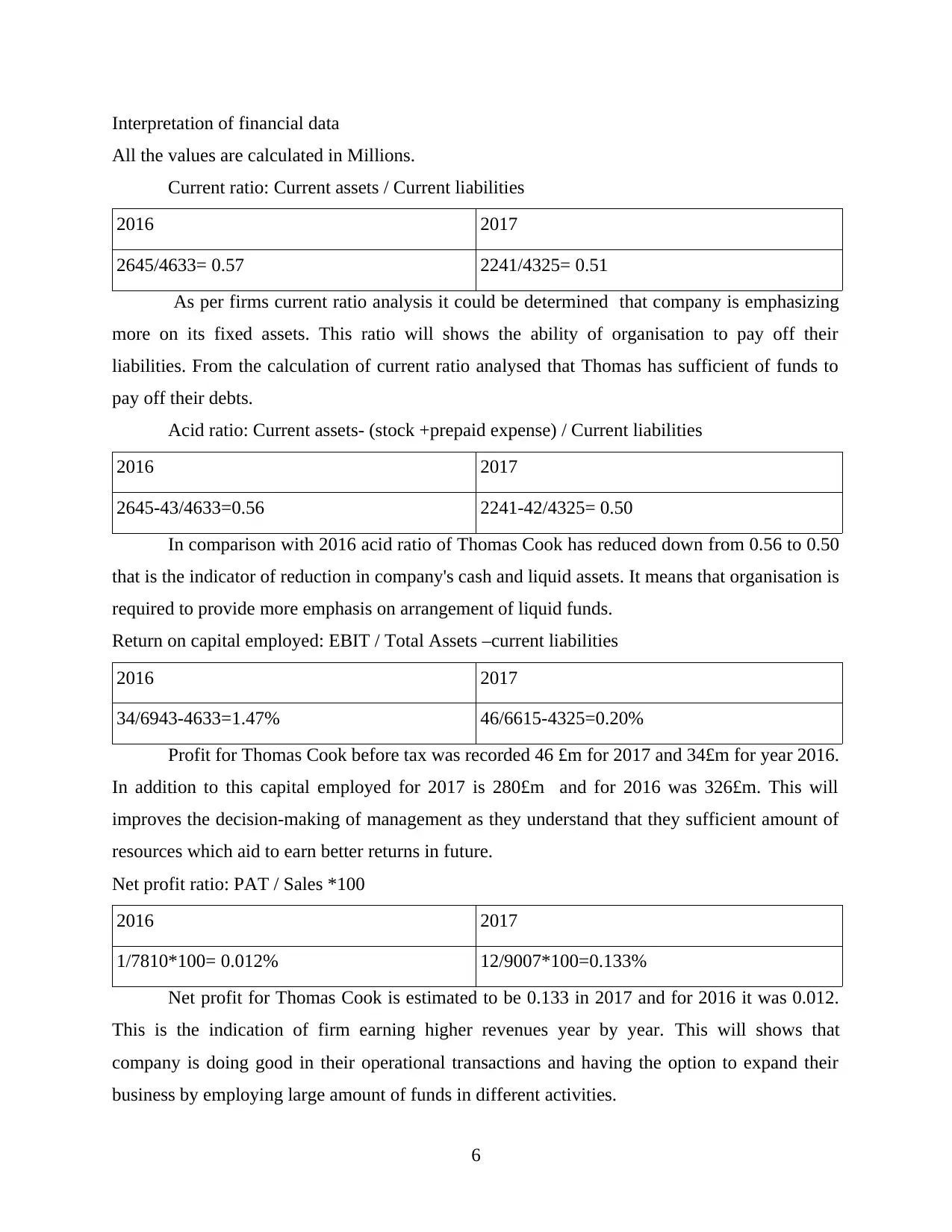

Interpretation of financial data

All the values are calculated in Millions.

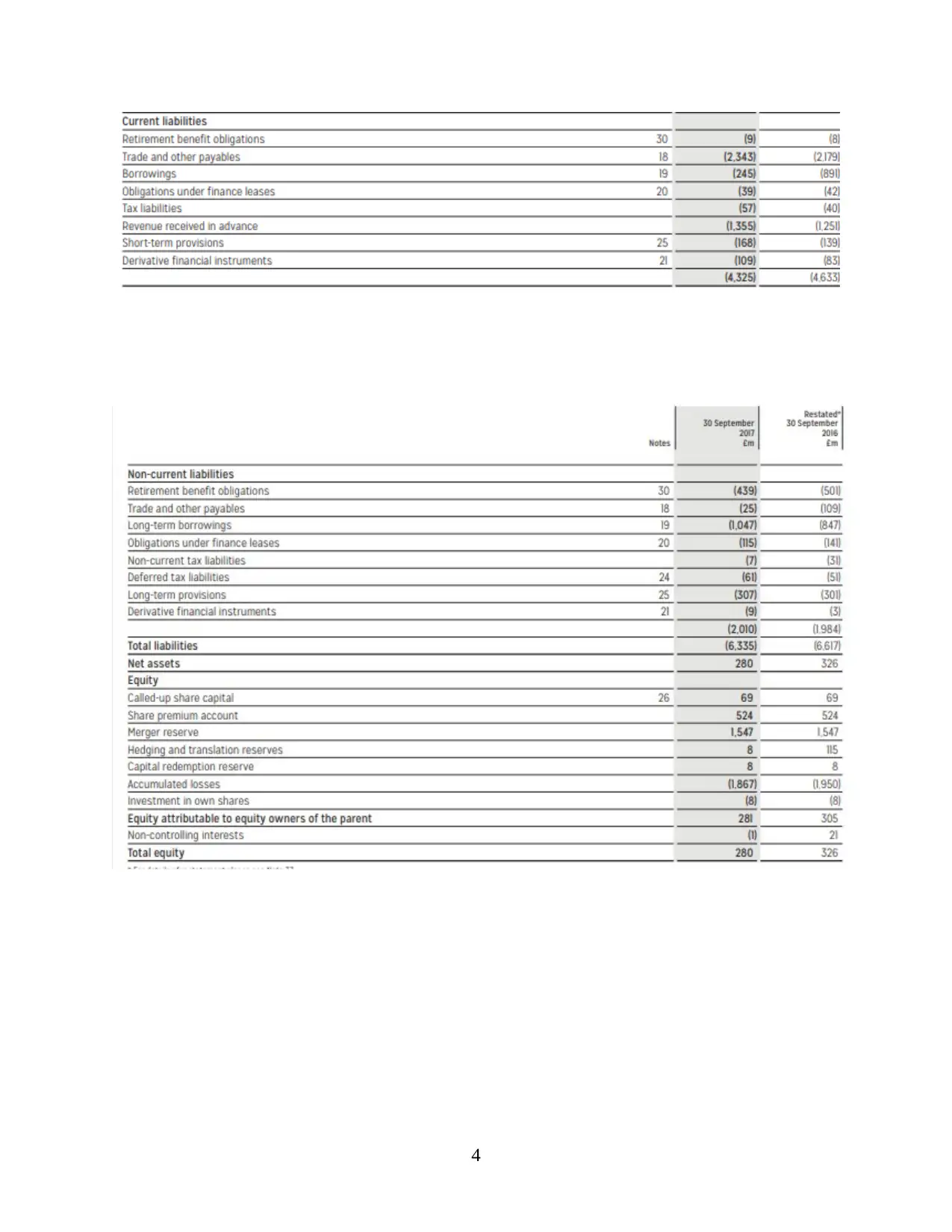

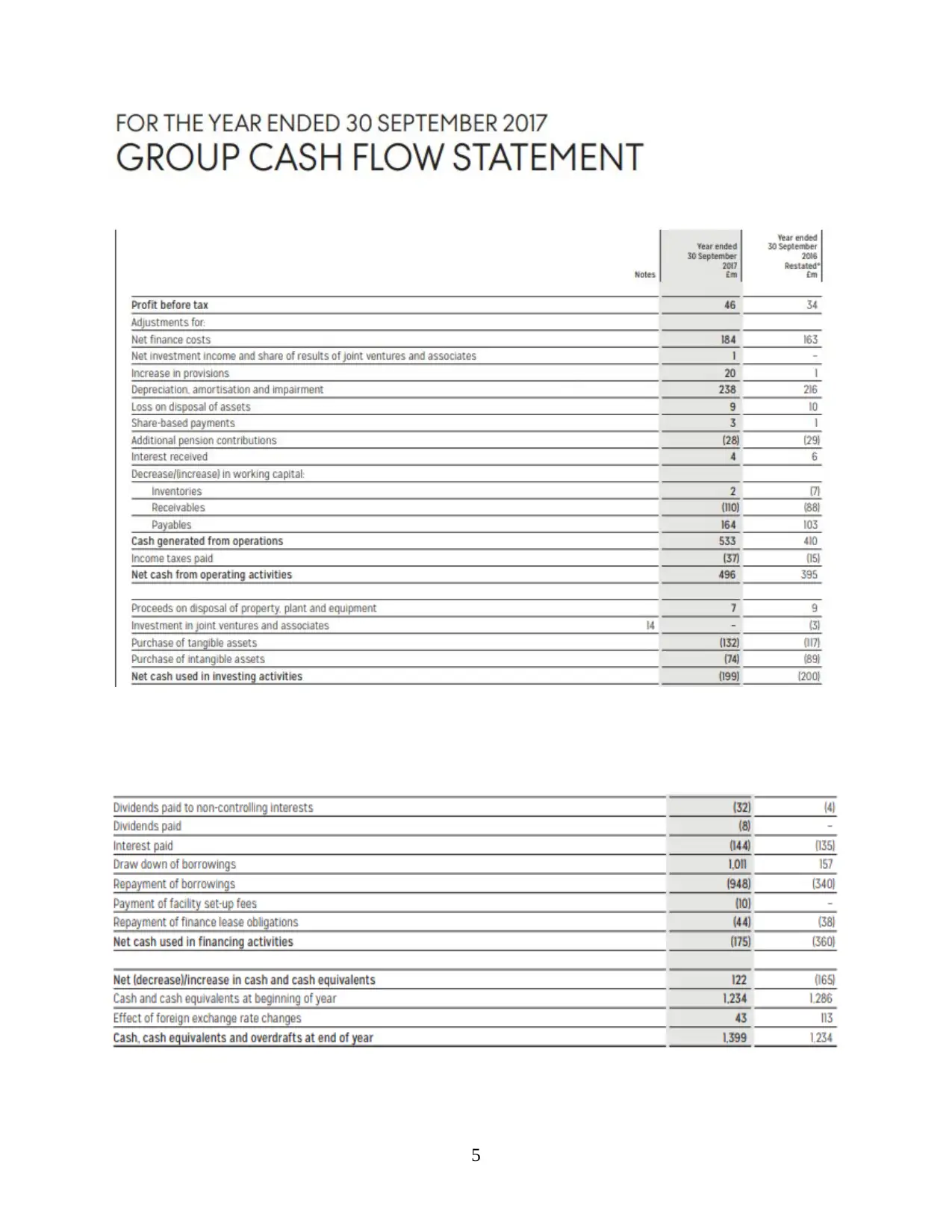

Current ratio: Current assets / Current liabilities

2016 2017

2645/4633= 0.57 2241/4325= 0.51

As per firms current ratio analysis it could be determined that company is emphasizing

more on its fixed assets. This ratio will shows the ability of organisation to pay off their

liabilities. From the calculation of current ratio analysed that Thomas has sufficient of funds to

pay off their debts.

Acid ratio: Current assets- (stock +prepaid expense) / Current liabilities

2016 2017

2645-43/4633=0.56 2241-42/4325= 0.50

In comparison with 2016 acid ratio of Thomas Cook has reduced down from 0.56 to 0.50

that is the indicator of reduction in company's cash and liquid assets. It means that organisation is

required to provide more emphasis on arrangement of liquid funds.

Return on capital employed: EBIT / Total Assets –current liabilities

2016 2017

34/6943-4633=1.47% 46/6615-4325=0.20%

Profit for Thomas Cook before tax was recorded 46 £m for 2017 and 34£m for year 2016.

In addition to this capital employed for 2017 is 280£m and for 2016 was 326£m. This will

improves the decision-making of management as they understand that they sufficient amount of

resources which aid to earn better returns in future.

Net profit ratio: PAT / Sales *100

2016 2017

1/7810*100= 0.012% 12/9007*100=0.133%

Net profit for Thomas Cook is estimated to be 0.133 in 2017 and for 2016 it was 0.012.

This is the indication of firm earning higher revenues year by year. This will shows that

company is doing good in their operational transactions and having the option to expand their

business by employing large amount of funds in different activities.

6

All the values are calculated in Millions.

Current ratio: Current assets / Current liabilities

2016 2017

2645/4633= 0.57 2241/4325= 0.51

As per firms current ratio analysis it could be determined that company is emphasizing

more on its fixed assets. This ratio will shows the ability of organisation to pay off their

liabilities. From the calculation of current ratio analysed that Thomas has sufficient of funds to

pay off their debts.

Acid ratio: Current assets- (stock +prepaid expense) / Current liabilities

2016 2017

2645-43/4633=0.56 2241-42/4325= 0.50

In comparison with 2016 acid ratio of Thomas Cook has reduced down from 0.56 to 0.50

that is the indicator of reduction in company's cash and liquid assets. It means that organisation is

required to provide more emphasis on arrangement of liquid funds.

Return on capital employed: EBIT / Total Assets –current liabilities

2016 2017

34/6943-4633=1.47% 46/6615-4325=0.20%

Profit for Thomas Cook before tax was recorded 46 £m for 2017 and 34£m for year 2016.

In addition to this capital employed for 2017 is 280£m and for 2016 was 326£m. This will

improves the decision-making of management as they understand that they sufficient amount of

resources which aid to earn better returns in future.

Net profit ratio: PAT / Sales *100

2016 2017

1/7810*100= 0.012% 12/9007*100=0.133%

Net profit for Thomas Cook is estimated to be 0.133 in 2017 and for 2016 it was 0.012.

This is the indication of firm earning higher revenues year by year. This will shows that

company is doing good in their operational transactions and having the option to expand their

business by employing large amount of funds in different activities.

6

2.1 Different kind of management accounting information which used in tourism sector

Management accounting information is concerned with internal managers and decision

makers that assists in providing relevant information and data to managers for taking sound

business decisions. This information could be in form of ratios, budget forecasts, variance

analysis, cost accounting and variance analysis. Thomas Cook make use of below mentioned

management accounting information to take authentic and accurate financial decisions:

Budget Reports: It is a financial document that comprises summary of all expenses and

incomes that are been generated by for a particular financial year. It is divided into various

sections such as general income and sales information, fixed and flexible expenditures and entire

business net worth comprising assets and liabilities. In context to Thomas Cook budget reports

ascertain expectation of top level of management from its middle and lower levels. Thomas

Cook been dealing in travel and tourism industry is subject to various market fluctuations. Thus,

it regularly prepares budgets so as to keep firms expenses within limits. Also they serve as

indicators for business targets that company strives to achieve. (Gibson, Kaplanidou and Kang,

2012).

Variance analysis: The managers of Thomas Cook make use of variance analysis to

ascertain the deviation or gaps between hotels planned and actual business behaviour. For which

company calculates variance associated with its material and labour. This enables Thomas Cook

to determine its performance as good or bad. For instance, in case variance comes out to be

negative then it becomes critical for management of Thomas Cook to take corrective actions so

that in near future that specific variance is not repeated again. It is an effective techniques to

maintain control over business by regularly examining changes in variance level on monthly

basis.

Management Information System: it is computerized database system in which

financial information of Thomas Cook are programmed and organized to produce regular

reports for its various business operation at different levels. Firm make use of this technique to

analyse its market performance by monitoring deviations revealed by MIS reports between its

actual results and planned goals (Morrison, 2013). Thus it assist top management to take

corrective measures to overcome those gaps.

7

Management accounting information is concerned with internal managers and decision

makers that assists in providing relevant information and data to managers for taking sound

business decisions. This information could be in form of ratios, budget forecasts, variance

analysis, cost accounting and variance analysis. Thomas Cook make use of below mentioned

management accounting information to take authentic and accurate financial decisions:

Budget Reports: It is a financial document that comprises summary of all expenses and

incomes that are been generated by for a particular financial year. It is divided into various

sections such as general income and sales information, fixed and flexible expenditures and entire

business net worth comprising assets and liabilities. In context to Thomas Cook budget reports

ascertain expectation of top level of management from its middle and lower levels. Thomas

Cook been dealing in travel and tourism industry is subject to various market fluctuations. Thus,

it regularly prepares budgets so as to keep firms expenses within limits. Also they serve as

indicators for business targets that company strives to achieve. (Gibson, Kaplanidou and Kang,

2012).

Variance analysis: The managers of Thomas Cook make use of variance analysis to

ascertain the deviation or gaps between hotels planned and actual business behaviour. For which

company calculates variance associated with its material and labour. This enables Thomas Cook

to determine its performance as good or bad. For instance, in case variance comes out to be

negative then it becomes critical for management of Thomas Cook to take corrective actions so

that in near future that specific variance is not repeated again. It is an effective techniques to

maintain control over business by regularly examining changes in variance level on monthly

basis.

Management Information System: it is computerized database system in which

financial information of Thomas Cook are programmed and organized to produce regular

reports for its various business operation at different levels. Firm make use of this technique to

analyse its market performance by monitoring deviations revealed by MIS reports between its

actual results and planned goals (Morrison, 2013). Thus it assist top management to take

corrective measures to overcome those gaps.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.2 Use of management accounting information as a decision making tool

Management accounting information is a technique of gathering , storing and processing

accounting and financial data and to track down various accounting activities in conjunction with

its resources (Murphy, 2013). The information revealed by management accounting system

could be utilized by both internal and external management including creditors, investors , tax

authorities etc. The data and information provided by management accounting system enables

firm to take right and accurate decisions by reviewing various analysis related to cost, activity

based costing techniques etc. Mentioned below ere certain prominent use of Management

accounting information for Thomas Cook : Controlling firms expenditures: Thomas Cook by making use of budgets keep a regular

check and control over various expenses that are been incurred by firm. Thus for

managers to estimate these expenditure it becomes essential to make predictions about

probable amount. On basis of these estimated amount various business decisions are to

made by managers. In case these estimated amount is wrongly estimated all decisions

associated with them will be wrong as well. Therefore it is essential for managers of

Thomas Cook to be cautious while formulating budgets. Enables firm to take price reducing decisions: Break even analysis technique helps in

determining the minimal sales level that is requisite for firm to attain so as to cover its

production cost. Thus, this tool helps Thomas Cook to ascertain level up till which firm

can reduce price of its products. ( Nielsen and Spenceley, 2011).

New product and service launch: The information related to various current market

trends are made available to top management with Trend analysis. This enables managers

to ascertain and determine information related to different time periods and helps

managers to spot actionable patters in current information available with firm. Thus, it

greatly influences firms capabilities to remain competitive by introducing goods and

services as per customers requirements. Thus Thomas Cook could come up with new

packages, adding ion new complementary services, premium facilities etc. to enhance its

guests experience.

8

Management accounting information is a technique of gathering , storing and processing

accounting and financial data and to track down various accounting activities in conjunction with

its resources (Murphy, 2013). The information revealed by management accounting system

could be utilized by both internal and external management including creditors, investors , tax

authorities etc. The data and information provided by management accounting system enables

firm to take right and accurate decisions by reviewing various analysis related to cost, activity

based costing techniques etc. Mentioned below ere certain prominent use of Management

accounting information for Thomas Cook : Controlling firms expenditures: Thomas Cook by making use of budgets keep a regular

check and control over various expenses that are been incurred by firm. Thus for

managers to estimate these expenditure it becomes essential to make predictions about

probable amount. On basis of these estimated amount various business decisions are to

made by managers. In case these estimated amount is wrongly estimated all decisions

associated with them will be wrong as well. Therefore it is essential for managers of

Thomas Cook to be cautious while formulating budgets. Enables firm to take price reducing decisions: Break even analysis technique helps in

determining the minimal sales level that is requisite for firm to attain so as to cover its

production cost. Thus, this tool helps Thomas Cook to ascertain level up till which firm

can reduce price of its products. ( Nielsen and Spenceley, 2011).

New product and service launch: The information related to various current market

trends are made available to top management with Trend analysis. This enables managers

to ascertain and determine information related to different time periods and helps

managers to spot actionable patters in current information available with firm. Thus, it

greatly influences firms capabilities to remain competitive by introducing goods and

services as per customers requirements. Thus Thomas Cook could come up with new

packages, adding ion new complementary services, premium facilities etc. to enhance its

guests experience.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

1.1 Significance of cost and volume in travel and tourism sector

Capital is a significant requirement for any organisation irrespective of their industry.

Cost and Volume both forms an interrelated aspects having direct relationship with each other

i.e. an increase in volume will enhance cost and vice versa. Thomas Cook being one of leading

British airline is subject to various economic situations such as recession for instance for which it

is essential for firm to required volume of funds.

Significance of Cost

Cost is money that is invested by a entrepreneur in its various business activities and one

of the major determinant that impacts firms growth and profits. For instance, in case of Thomas

Cook if company keeps its flight tickets rates too high in comparison to its business competitors

there is probability for firm to experience decrease in its sales volumes as clients will look for

affordable options (Vanhove, 2011). Thus it is essential for Thomas Cook to set right

competitive price for its airline tickets so as to provide value to its customers and to earn high

profits. Cost minimization: It is of critical significance to optimum utilize all its limitedly

available resources so as to lower down its operational costs. This will ultimately assist

Thomas Cook to keep price of its products reasonable so as to attract large number of

tourists to make bookings. Improving performance of management : There are various different types of costs that

are involved related to business operations such as direct, indirect, variable and other

costs (von, Weppen and Cochrane, 2012). Thus, carefully analysing these costs and

undertaking market research about factors effecting them will enables Thomas Cook to

take right and authentic decisions. This will lead to timely attainment of objectives within

specific time frame leading to enhancement in performance and productivity level of

hotel.

Significance of Volume

Volume : Volume could be described as the quantity of products and services that are been

offered by a company within one financial year. Achieving high volume is critical for Thomas

Cook for achieving the following:

9

1.1 Significance of cost and volume in travel and tourism sector

Capital is a significant requirement for any organisation irrespective of their industry.

Cost and Volume both forms an interrelated aspects having direct relationship with each other

i.e. an increase in volume will enhance cost and vice versa. Thomas Cook being one of leading

British airline is subject to various economic situations such as recession for instance for which it

is essential for firm to required volume of funds.

Significance of Cost

Cost is money that is invested by a entrepreneur in its various business activities and one

of the major determinant that impacts firms growth and profits. For instance, in case of Thomas

Cook if company keeps its flight tickets rates too high in comparison to its business competitors

there is probability for firm to experience decrease in its sales volumes as clients will look for

affordable options (Vanhove, 2011). Thus it is essential for Thomas Cook to set right

competitive price for its airline tickets so as to provide value to its customers and to earn high

profits. Cost minimization: It is of critical significance to optimum utilize all its limitedly

available resources so as to lower down its operational costs. This will ultimately assist

Thomas Cook to keep price of its products reasonable so as to attract large number of

tourists to make bookings. Improving performance of management : There are various different types of costs that

are involved related to business operations such as direct, indirect, variable and other

costs (von, Weppen and Cochrane, 2012). Thus, carefully analysing these costs and

undertaking market research about factors effecting them will enables Thomas Cook to

take right and authentic decisions. This will lead to timely attainment of objectives within

specific time frame leading to enhancement in performance and productivity level of

hotel.

Significance of Volume

Volume : Volume could be described as the quantity of products and services that are been

offered by a company within one financial year. Achieving high volume is critical for Thomas

Cook for achieving the following:

9

Break even point : Break even is that point or situation that indicates no profit no loss

i.e. a level of production where all expenses are equal to all revenues that are incurred.

For Thomas Cook it is significant to analysis its BEP so that company could ascertain

sales volumes that is necessary to covers hotels expenditures and to earn profits. Further

it also assist firm to know its position in market.

Economies of Scale : It refers to decrease in cost of production with an increase in

company's level of outputs. For Thomas Cook it is essential to generate economics of

scale so that it could reduce its cost of packages that it offers to customers It is critical as

with reduction in this cost the fund requirement of hotel also reduces.

1.2 Analyse of pricing methods used in travel and tourism sector

In order to ascertain right price Thomas Cook are requisite to take into consideration a

number of pricing methods to evaluate the most suitable one (Wong, Mistilis and Dwyer 2011).

It is because setting up an appropriate price for its packages forms a difficult task as in some

cases company is thought to be charging more or less in comparison to its competitors that

either lead to loss of customers or loss incurred by firm. Thus, mentioned below are certain

pricing method that could be adopted by Thomas Cook to set most appropriate price level that

can generate high revenue and sales volumes:

Cost based pricing : It forms the most simplest pricing method in which certain fixed

percentage of desired profit margin is added to product's cost to ascertain final price of product

and services. More simply it is a pricing strategy where in some percentage of total production

cost is added in cost of manufacturing for finalizing its selling price.

Value Based pricing: This pricing strategy could be beneficial for Thomas Cook to build

up a loyal customer base by providing quality services at affordable prices to them. in this

pricing strategy the focus of company is to evaluate ways to lower down its cost of production

without sacrificing on its quality aspects. For this firm is required to enhance its R&D process.

1.3 Factors influencing profit in travel and tourism businesses

Travel and tourism industry is subject to various components that greatly impacts its

profitability. Mentioned below are some most prominent factors that affects the business growth

and profit index of businesses belonging to this industry: Seasonal variations: As tourist attractions are subject to various factors such as

holidays, climatic and weather conditions etc. that are been considered by tourists while

10

i.e. a level of production where all expenses are equal to all revenues that are incurred.

For Thomas Cook it is significant to analysis its BEP so that company could ascertain

sales volumes that is necessary to covers hotels expenditures and to earn profits. Further

it also assist firm to know its position in market.

Economies of Scale : It refers to decrease in cost of production with an increase in

company's level of outputs. For Thomas Cook it is essential to generate economics of

scale so that it could reduce its cost of packages that it offers to customers It is critical as

with reduction in this cost the fund requirement of hotel also reduces.

1.2 Analyse of pricing methods used in travel and tourism sector

In order to ascertain right price Thomas Cook are requisite to take into consideration a

number of pricing methods to evaluate the most suitable one (Wong, Mistilis and Dwyer 2011).

It is because setting up an appropriate price for its packages forms a difficult task as in some

cases company is thought to be charging more or less in comparison to its competitors that

either lead to loss of customers or loss incurred by firm. Thus, mentioned below are certain

pricing method that could be adopted by Thomas Cook to set most appropriate price level that

can generate high revenue and sales volumes:

Cost based pricing : It forms the most simplest pricing method in which certain fixed

percentage of desired profit margin is added to product's cost to ascertain final price of product

and services. More simply it is a pricing strategy where in some percentage of total production

cost is added in cost of manufacturing for finalizing its selling price.

Value Based pricing: This pricing strategy could be beneficial for Thomas Cook to build

up a loyal customer base by providing quality services at affordable prices to them. in this

pricing strategy the focus of company is to evaluate ways to lower down its cost of production

without sacrificing on its quality aspects. For this firm is required to enhance its R&D process.

1.3 Factors influencing profit in travel and tourism businesses

Travel and tourism industry is subject to various components that greatly impacts its

profitability. Mentioned below are some most prominent factors that affects the business growth

and profit index of businesses belonging to this industry: Seasonal variations: As tourist attractions are subject to various factors such as

holidays, climatic and weather conditions etc. that are been considered by tourists while

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.