HI5002 Finance for Business: Woolworths Ltd Analysis Report

VerifiedAdded on 2023/01/11

|15

|1098

|56

Report

AI Summary

This finance report provides a comprehensive analysis of Woolworths Ltd's financial performance. The report begins with an introduction to financing and a description of Woolworths, a major Australian supermarket chain. It then delves into the calculation and analysis of Woolworths' performance using profitability, operational, and liquidity ratios from 2017 to 2019. Further analysis includes cash management, sensitivity analysis, and an examination of systematic and unsystematic risks. The report also covers the dividend payout ratio and concludes with recommendations for financial management and a conclusion summarizing the key findings. The report also includes references to relevant financial literature.

FINANCE

FOR

BUSINESS

FOR

BUSINESS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

INTRODUCTION

DESCRIPTION OF COMPANY

CALCULATION

CASH MANAGEMENT ANALYSIS

SENSITIVITY ANALYSIS

SYSTEMATIC AND UN- SYSTEMATIC RISK

DIVIDEND PAY- OUT RATIO

RECOMMENDATION

CONCLUSION

INTRODUCTION

DESCRIPTION OF COMPANY

CALCULATION

CASH MANAGEMENT ANALYSIS

SENSITIVITY ANALYSIS

SYSTEMATIC AND UN- SYSTEMATIC RISK

DIVIDEND PAY- OUT RATIO

RECOMMENDATION

CONCLUSION

INTRODUCTION

Financing referred as the practice of facilitating the funds for

running the activities of the business smoothly, investing and

making purchases.

Financial institutions like bank are involved in business of

facilitating the capital to the consumers, investors and the

businesses in order to help them in attaining their goals or

objectives in an effective and efficient manner.

The present report is based on Woolworths Lt d, a largest

Australian super market chain, operating as a retail sector

organization in an entire Australia.

Financing referred as the practice of facilitating the funds for

running the activities of the business smoothly, investing and

making purchases.

Financial institutions like bank are involved in business of

facilitating the capital to the consumers, investors and the

businesses in order to help them in attaining their goals or

objectives in an effective and efficient manner.

The present report is based on Woolworths Lt d, a largest

Australian super market chain, operating as a retail sector

organization in an entire Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.1 Description of company

Woolworths is one of the leading and largest

supermarket chains in Australia and owned the grocery

stores.

It has been founded in the year 1924, the company

forms duopoly along with Coles of an Australian

supermarkets, that accounts for around 80% of Australian

market.

Woolworths is one of the leading and largest

supermarket chains in Australia and owned the grocery

stores.

It has been founded in the year 1924, the company

forms duopoly along with Coles of an Australian

supermarkets, that accounts for around 80% of Australian

market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.2 Calculation and analysis of performance of

company

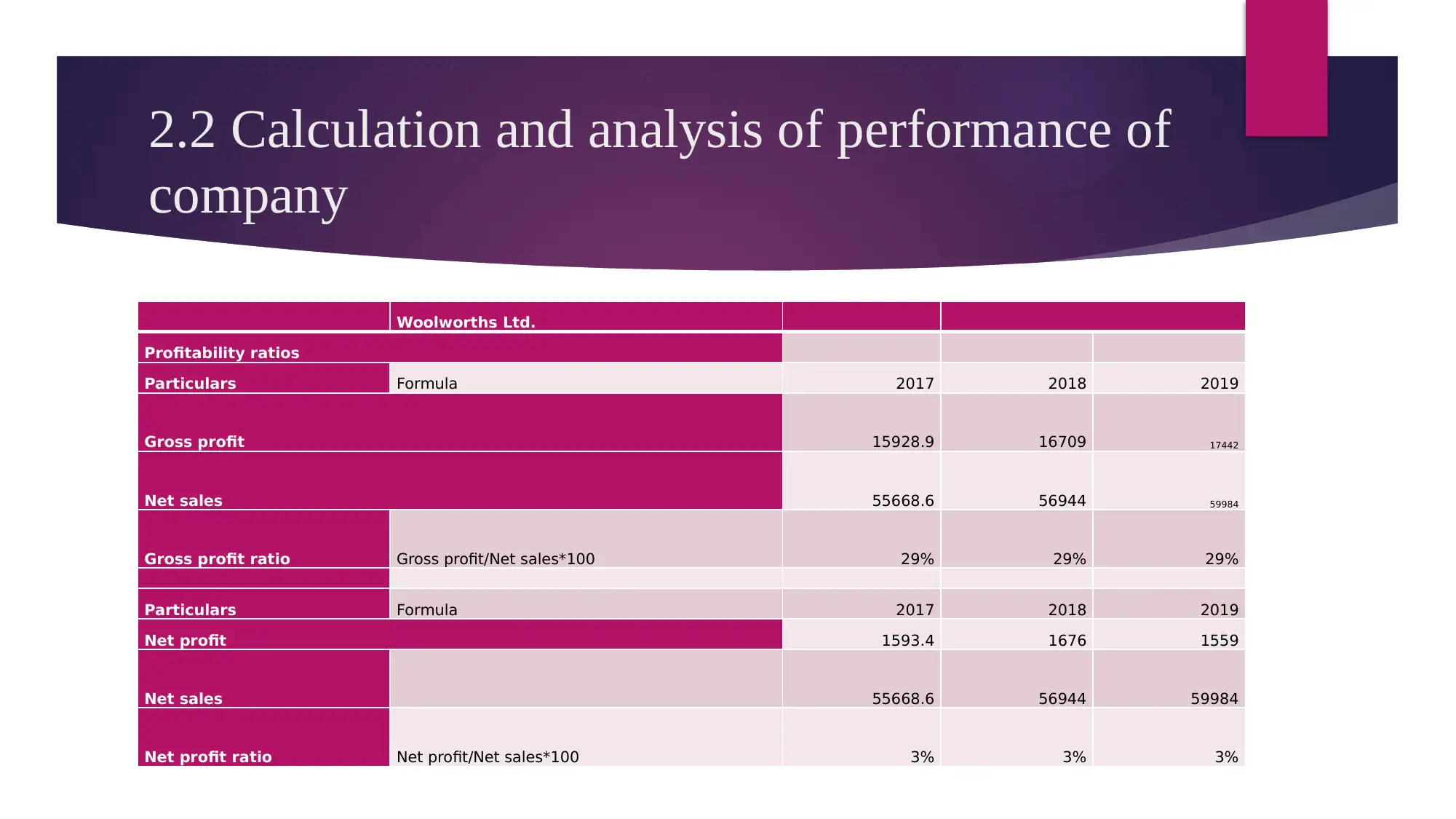

Woolworths Ltd.

Profitability ratios

Particulars Formula 2017 2018 2019

Gross profit 15928.9 16709 17442

Net sales 55668.6 56944 59984

Gross profit ratio Gross profit/Net sales*100 29% 29% 29%

Particulars Formula 2017 2018 2019

Net profit 1593.4 1676 1559

Net sales 55668.6 56944 59984

Net profit ratio Net profit/Net sales*100 3% 3% 3%

company

Woolworths Ltd.

Profitability ratios

Particulars Formula 2017 2018 2019

Gross profit 15928.9 16709 17442

Net sales 55668.6 56944 59984

Gross profit ratio Gross profit/Net sales*100 29% 29% 29%

Particulars Formula 2017 2018 2019

Net profit 1593.4 1676 1559

Net sales 55668.6 56944 59984

Net profit ratio Net profit/Net sales*100 3% 3% 3%

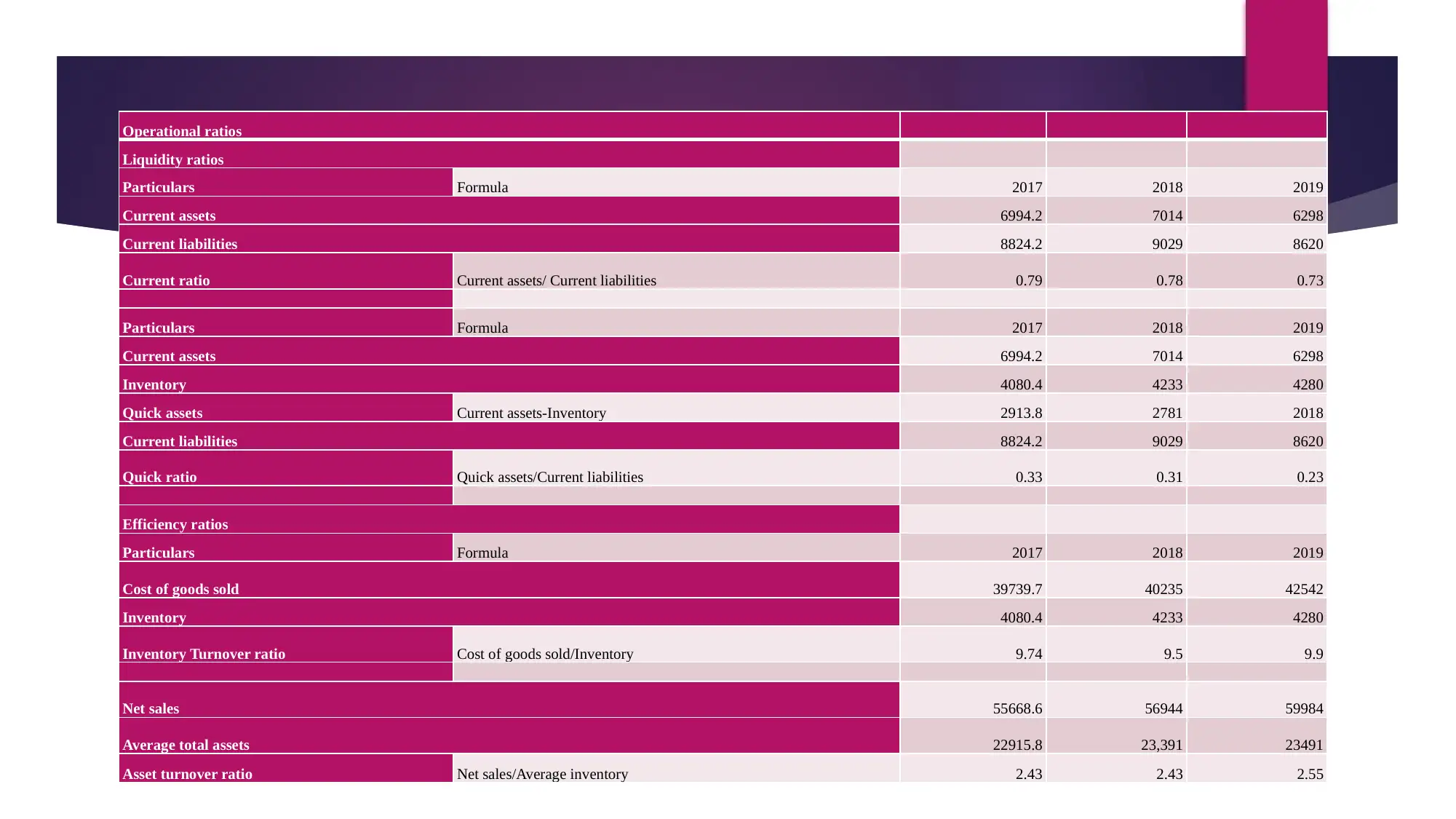

Operational ratios

Liquidity ratios

Particulars Formula 2017 2018 2019

Current assets 6994.2 7014 6298

Current liabilities 8824.2 9029 8620

Current ratio Current assets/ Current liabilities 0.79 0.78 0.73

Particulars Formula 2017 2018 2019

Current assets 6994.2 7014 6298

Inventory 4080.4 4233 4280

Quick assets Current assets-Inventory 2913.8 2781 2018

Current liabilities 8824.2 9029 8620

Quick ratio Quick assets/Current liabilities 0.33 0.31 0.23

Efficiency ratios

Particulars Formula 2017 2018 2019

Cost of goods sold 39739.7 40235 42542

Inventory 4080.4 4233 4280

Inventory Turnover ratio Cost of goods sold/Inventory 9.74 9.5 9.9

Net sales 55668.6 56944 59984

Average total assets 22915.8 23,391 23491

Asset turnover ratio Net sales/Average inventory 2.43 2.43 2.55

Liquidity ratios

Particulars Formula 2017 2018 2019

Current assets 6994.2 7014 6298

Current liabilities 8824.2 9029 8620

Current ratio Current assets/ Current liabilities 0.79 0.78 0.73

Particulars Formula 2017 2018 2019

Current assets 6994.2 7014 6298

Inventory 4080.4 4233 4280

Quick assets Current assets-Inventory 2913.8 2781 2018

Current liabilities 8824.2 9029 8620

Quick ratio Quick assets/Current liabilities 0.33 0.31 0.23

Efficiency ratios

Particulars Formula 2017 2018 2019

Cost of goods sold 39739.7 40235 42542

Inventory 4080.4 4233 4280

Inventory Turnover ratio Cost of goods sold/Inventory 9.74 9.5 9.9

Net sales 55668.6 56944 59984

Average total assets 22915.8 23,391 23491

Asset turnover ratio Net sales/Average inventory 2.43 2.43 2.55

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.3 Cash management analysis

The cash is the most important thing without which

the company cannot run or exist in the highly

competitive market.

This is majorly because of the reason that if the cash

is not proper in the business then the company will

not be able to manage the operations of the company.

Marketable securities are

Common stock

Commercial paper

The cash is the most important thing without which

the company cannot run or exist in the highly

competitive market.

This is majorly because of the reason that if the cash

is not proper in the business then the company will

not be able to manage the operations of the company.

Marketable securities are

Common stock

Commercial paper

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

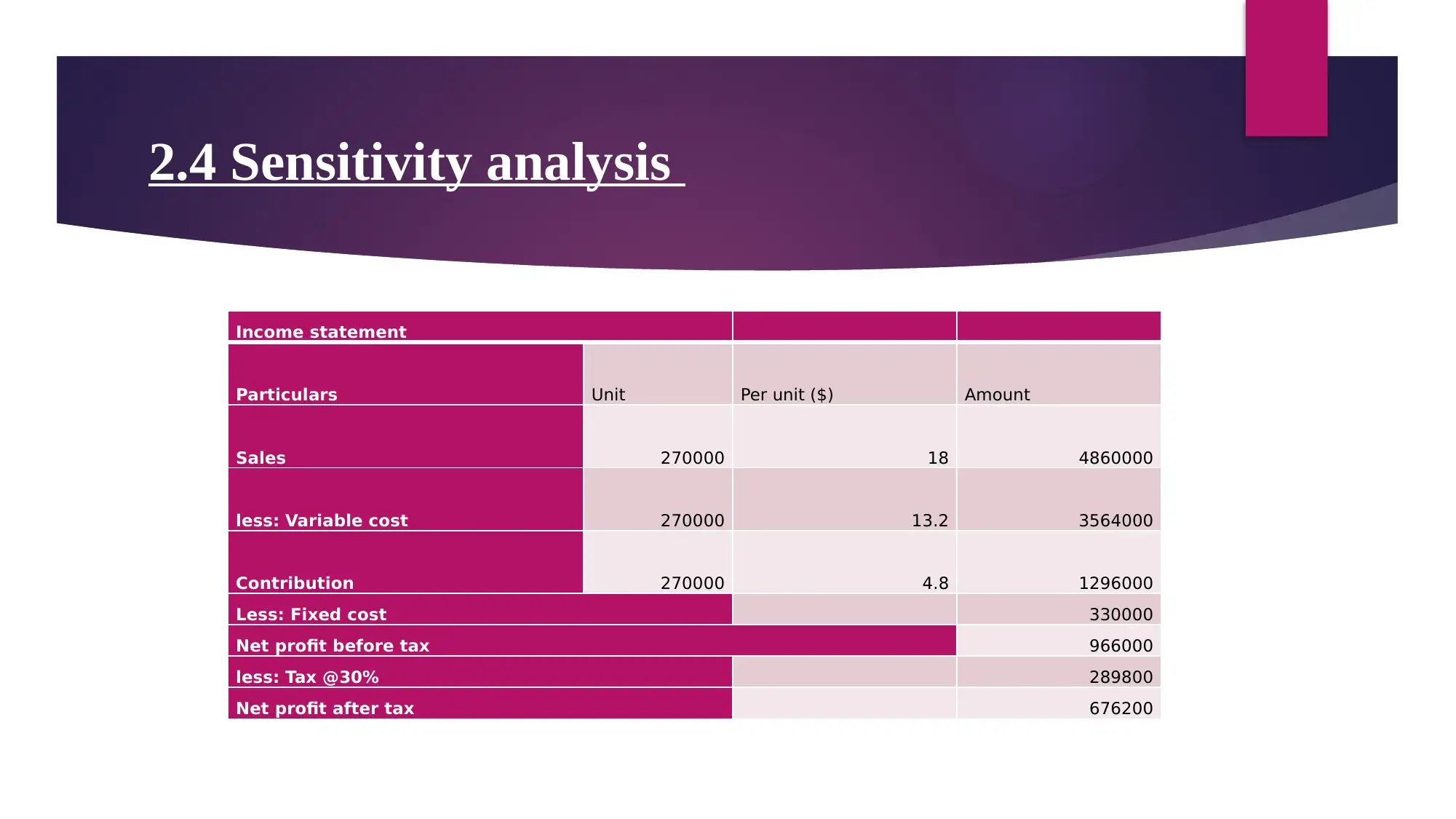

2.4 Sensitivity analysis

Income statement

Particulars Unit Per unit ($) Amount

Sales 270000 18 4860000

less: Variable cost 270000 13.2 3564000

Contribution 270000 4.8 1296000

Less: Fixed cost 330000

Net profit before tax 966000

less: Tax @30% 289800

Net profit after tax 676200

Income statement

Particulars Unit Per unit ($) Amount

Sales 270000 18 4860000

less: Variable cost 270000 13.2 3564000

Contribution 270000 4.8 1296000

Less: Fixed cost 330000

Net profit before tax 966000

less: Tax @30% 289800

Net profit after tax 676200

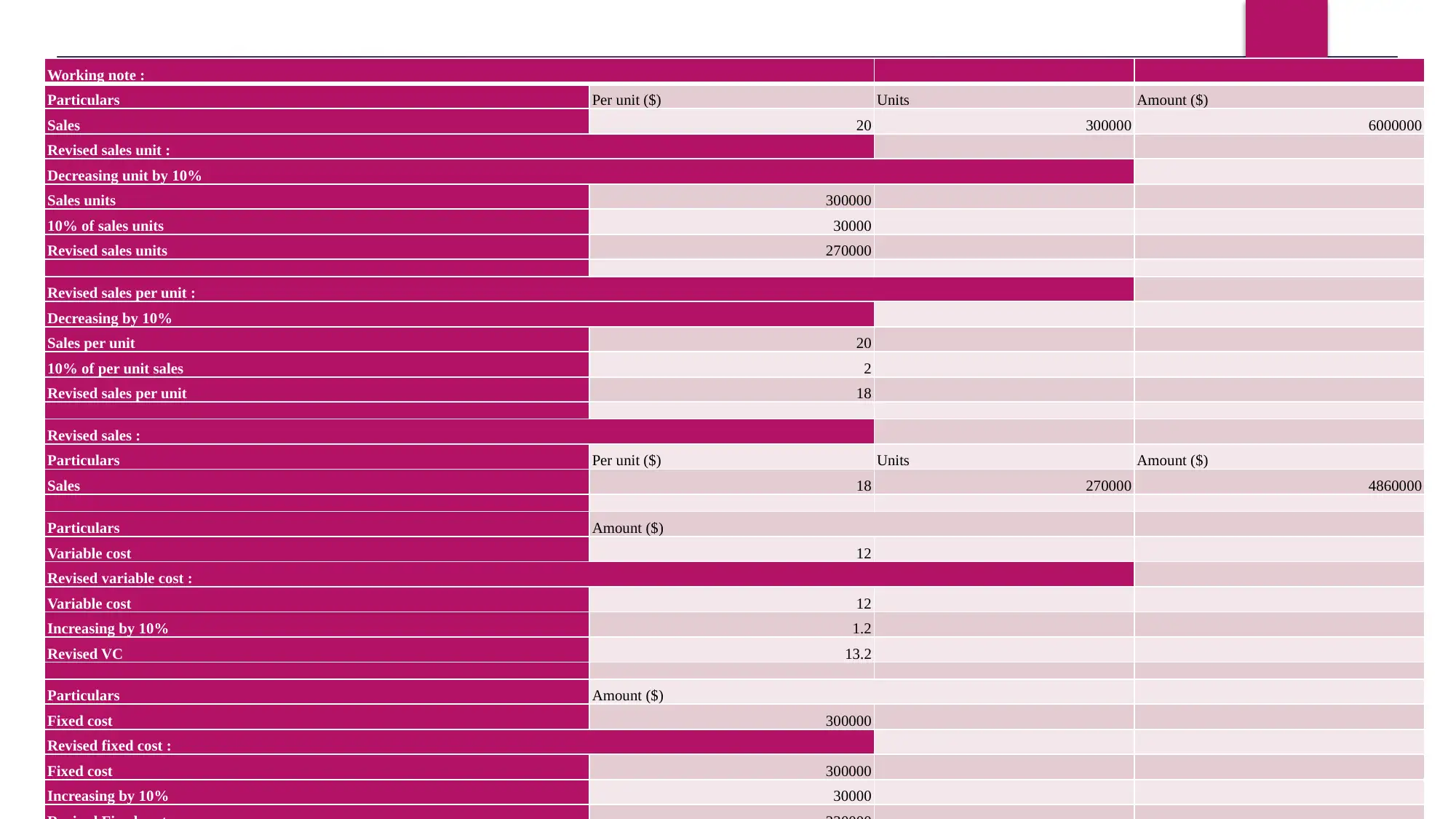

Working note :

Particulars Per unit ($) Units Amount ($)

Sales 20 300000 6000000

Revised sales unit :

Decreasing unit by 10%

Sales units 300000

10% of sales units 30000

Revised sales units 270000

Revised sales per unit :

Decreasing by 10%

Sales per unit 20

10% of per unit sales 2

Revised sales per unit 18

Revised sales :

Particulars Per unit ($) Units Amount ($)

Sales 18 270000 4860000

Particulars Amount ($)

Variable cost 12

Revised variable cost :

Variable cost 12

Increasing by 10% 1.2

Revised VC 13.2

Particulars Amount ($)

Fixed cost 300000

Revised fixed cost :

Fixed cost 300000

Increasing by 10% 30000

Particulars Per unit ($) Units Amount ($)

Sales 20 300000 6000000

Revised sales unit :

Decreasing unit by 10%

Sales units 300000

10% of sales units 30000

Revised sales units 270000

Revised sales per unit :

Decreasing by 10%

Sales per unit 20

10% of per unit sales 2

Revised sales per unit 18

Revised sales :

Particulars Per unit ($) Units Amount ($)

Sales 18 270000 4860000

Particulars Amount ($)

Variable cost 12

Revised variable cost :

Variable cost 12

Increasing by 10% 1.2

Revised VC 13.2

Particulars Amount ($)

Fixed cost 300000

Revised fixed cost :

Fixed cost 300000

Increasing by 10% 30000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.5 Systematic and un- systematic risk

The risk is the uncertain event which may occur within the future and this may impact the

performance of the company in negative manner.

Systematic risk

• Change in law

• Interest rate hike

Un- systematic risk

• Strike by employees

• Financial risk

The risk is the uncertain event which may occur within the future and this may impact the

performance of the company in negative manner.

Systematic risk

• Change in law

• Interest rate hike

Un- systematic risk

• Strike by employees

• Financial risk

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.6 Dividend pay- out ratio and policy of

dividend

The dividend pay- out ratio is the type of ratio which is helpful for the company in

calculating the total amount of the dividend which is payable to the shareholders in

relation with the net income earned by the company.

This is also referred to as the percentage of earning paid to the shareholders in form of the

dividend over their amount which is being invested.

The major reason behind the name pay- out ratio is because of the fact that this ratio

suggests the amount which is being paid out to the shareholders against the amount which

they have invested within the business.

Since past 3 years the dividend being provided by the company is very high is on

increasing trend only.

dividend

The dividend pay- out ratio is the type of ratio which is helpful for the company in

calculating the total amount of the dividend which is payable to the shareholders in

relation with the net income earned by the company.

This is also referred to as the percentage of earning paid to the shareholders in form of the

dividend over their amount which is being invested.

The major reason behind the name pay- out ratio is because of the fact that this ratio

suggests the amount which is being paid out to the shareholders against the amount which

they have invested within the business.

Since past 3 years the dividend being provided by the company is very high is on

increasing trend only.

RECOMMENDATION

From the above all discussion it is clear that management of finance is very essential for successful

running of the company.

This is majorly because of the fact that finance is the lifeline of the business. If the finance will not be

managed in successful manner, then the company might face many of the problems.

Thus, for this some of the major recommendations for the company are as follows-

Manage and control expenses

Increase marketable securities

From the above all discussion it is clear that management of finance is very essential for successful

running of the company.

This is majorly because of the fact that finance is the lifeline of the business. If the finance will not be

managed in successful manner, then the company might face many of the problems.

Thus, for this some of the major recommendations for the company are as follows-

Manage and control expenses

Increase marketable securities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.