Financial Accounting and Analysis: A Comprehensive Assignment

VerifiedAdded on 2023/01/04

|25

|3439

|68

Homework Assignment

AI Summary

This document presents a detailed solution to an accounting assignment, encompassing two assessments. The first assessment involves various calculations, including journal entries, and the creation of ledger accounts, trial balance, and income statement. The second assessment focuses on analyzing a business's financial performance through ratio analysis. The assignment covers topics such as different types of business structures, advantages and disadvantages of accounting for profit businesses, and the potential impact of COVID-19 on income statements. The solution includes detailed journal entries, general ledger accounts, a trial balance, and an income statement, providing a comprehensive understanding of financial accounting principles and their practical application. The document also includes an analysis of the impact of COVID-19 on financial statements.

Academic

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

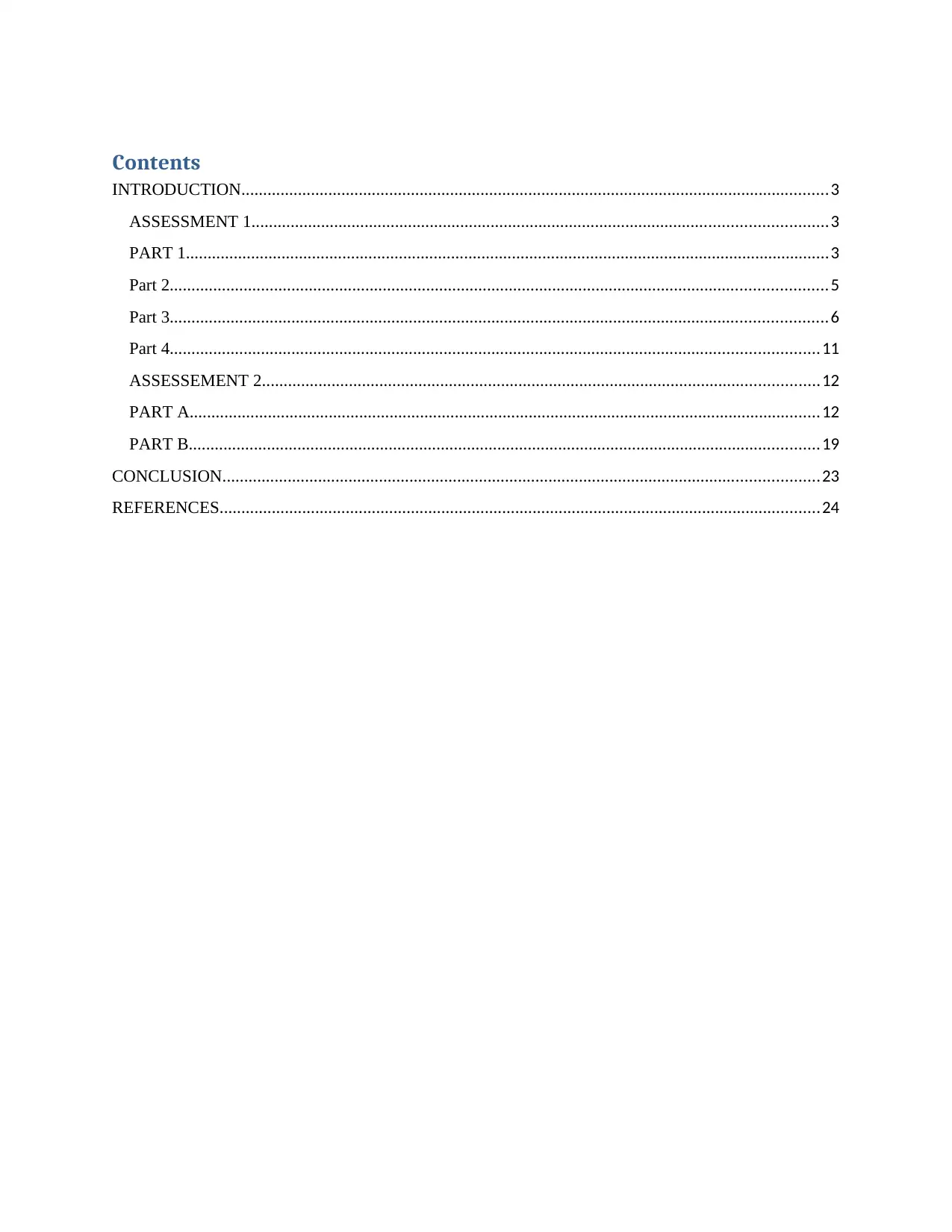

Contents

INTRODUCTION.......................................................................................................................................3

ASSESSMENT 1....................................................................................................................................3

PART 1....................................................................................................................................................3

Part 2.......................................................................................................................................................5

Part 3.......................................................................................................................................................6

Part 4.....................................................................................................................................................11

ASSESSEMENT 2................................................................................................................................12

PART A.................................................................................................................................................12

PART B.................................................................................................................................................19

CONCLUSION.........................................................................................................................................23

REFERENCES..........................................................................................................................................24

INTRODUCTION.......................................................................................................................................3

ASSESSMENT 1....................................................................................................................................3

PART 1....................................................................................................................................................3

Part 2.......................................................................................................................................................5

Part 3.......................................................................................................................................................6

Part 4.....................................................................................................................................................11

ASSESSEMENT 2................................................................................................................................12

PART A.................................................................................................................................................12

PART B.................................................................................................................................................19

CONCLUSION.........................................................................................................................................23

REFERENCES..........................................................................................................................................24

INTRODUCTION

It essential for companies to record their business transactions in a manner by which accountants

can gather utilize key information for further processing (De Kruijff and Weigand, 2017). There

are a range of activities and operations which are performed in order to prepare financial reports

but basis is only one which is to correctively recording of financial activities. The report is based

on two assessments under which distinct type of requirement is needed. In the assessment one

different kinds of calculations are performed while in second part Linda’s business’s financial

performance is analyzed through ratio analysis.

ASSESSMENT 1

PART 1

(a) Who are the decision makers referred to in the above definition and explain their need for

accounting information?

Decision-makers are people within an organization who do have the capacity to make

informed choices, such as purchases, development, or investment. Organizational,

business processes, practical, personal, scheduled, and non-programmed decisions could

be part of any context of decision. In the Tesco plc sense, the choice is made by the

individuals referred to below, which are as follows:

Management- Administrators are also invited to take steps in order to solve challenges.

Decision-making and problem-solving require ongoing processes in which situations or

concerns are analyses, solutions discussed, decisions being made and necessary measures

taken (Deshpande, Shiurkar and Devane, 2017). The method of judgment is always very

brief and the mental analysis is almost instantaneous. In certain cases, the procedure can

take months or even years. The entire decision-making process depends on the best

information available to the relevant individual at the right time. Managers take crucial

decisions related to various kinds of aspects in the sense of the above business.

It essential for companies to record their business transactions in a manner by which accountants

can gather utilize key information for further processing (De Kruijff and Weigand, 2017). There

are a range of activities and operations which are performed in order to prepare financial reports

but basis is only one which is to correctively recording of financial activities. The report is based

on two assessments under which distinct type of requirement is needed. In the assessment one

different kinds of calculations are performed while in second part Linda’s business’s financial

performance is analyzed through ratio analysis.

ASSESSMENT 1

PART 1

(a) Who are the decision makers referred to in the above definition and explain their need for

accounting information?

Decision-makers are people within an organization who do have the capacity to make

informed choices, such as purchases, development, or investment. Organizational,

business processes, practical, personal, scheduled, and non-programmed decisions could

be part of any context of decision. In the Tesco plc sense, the choice is made by the

individuals referred to below, which are as follows:

Management- Administrators are also invited to take steps in order to solve challenges.

Decision-making and problem-solving require ongoing processes in which situations or

concerns are analyses, solutions discussed, decisions being made and necessary measures

taken (Deshpande, Shiurkar and Devane, 2017). The method of judgment is always very

brief and the mental analysis is almost instantaneous. In certain cases, the procedure can

take months or even years. The entire decision-making process depends on the best

information available to the relevant individual at the right time. Managers take crucial

decisions related to various kinds of aspects in the sense of the above business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

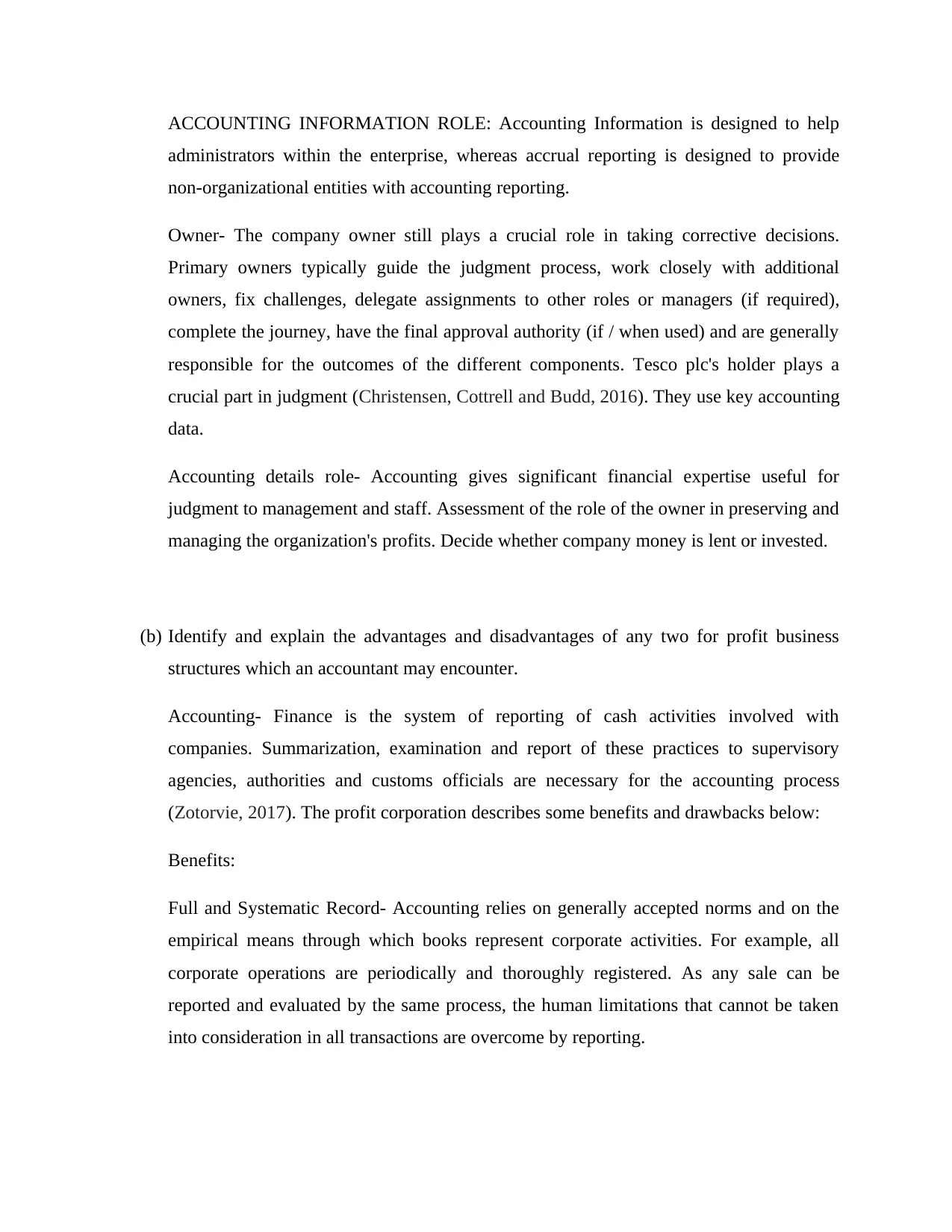

ACCOUNTING INFORMATION ROLE: Accounting Information is designed to help

administrators within the enterprise, whereas accrual reporting is designed to provide

non-organizational entities with accounting reporting.

Owner- The company owner still plays a crucial role in taking corrective decisions.

Primary owners typically guide the judgment process, work closely with additional

owners, fix challenges, delegate assignments to other roles or managers (if required),

complete the journey, have the final approval authority (if / when used) and are generally

responsible for the outcomes of the different components. Tesco plc's holder plays a

crucial part in judgment (Christensen, Cottrell and Budd, 2016). They use key accounting

data.

Accounting details role- Accounting gives significant financial expertise useful for

judgment to management and staff. Assessment of the role of the owner in preserving and

managing the organization's profits. Decide whether company money is lent or invested.

(b) Identify and explain the advantages and disadvantages of any two for profit business

structures which an accountant may encounter.

Accounting- Finance is the system of reporting of cash activities involved with

companies. Summarization, examination and report of these practices to supervisory

agencies, authorities and customs officials are necessary for the accounting process

(Zotorvie, 2017). The profit corporation describes some benefits and drawbacks below:

Benefits:

Full and Systematic Record- Accounting relies on generally accepted norms and on the

empirical means through which books represent corporate activities. For example, all

corporate operations are periodically and thoroughly registered. As any sale can be

reported and evaluated by the same process, the human limitations that cannot be taken

into consideration in all transactions are overcome by reporting.

administrators within the enterprise, whereas accrual reporting is designed to provide

non-organizational entities with accounting reporting.

Owner- The company owner still plays a crucial role in taking corrective decisions.

Primary owners typically guide the judgment process, work closely with additional

owners, fix challenges, delegate assignments to other roles or managers (if required),

complete the journey, have the final approval authority (if / when used) and are generally

responsible for the outcomes of the different components. Tesco plc's holder plays a

crucial part in judgment (Christensen, Cottrell and Budd, 2016). They use key accounting

data.

Accounting details role- Accounting gives significant financial expertise useful for

judgment to management and staff. Assessment of the role of the owner in preserving and

managing the organization's profits. Decide whether company money is lent or invested.

(b) Identify and explain the advantages and disadvantages of any two for profit business

structures which an accountant may encounter.

Accounting- Finance is the system of reporting of cash activities involved with

companies. Summarization, examination and report of these practices to supervisory

agencies, authorities and customs officials are necessary for the accounting process

(Zotorvie, 2017). The profit corporation describes some benefits and drawbacks below:

Benefits:

Full and Systematic Record- Accounting relies on generally accepted norms and on the

empirical means through which books represent corporate activities. For example, all

corporate operations are periodically and thoroughly registered. As any sale can be

reported and evaluated by the same process, the human limitations that cannot be taken

into consideration in all transactions are overcome by reporting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Helps to collect loans- Business should have sufficient capital for further expansion.

Occasionally, because of the shortage of capital, the organization could not do well

(Wagner, Datascape Inc, 2016). In such situations, by obtaining loans from other

financial institutions such as banks, more funds may be collected. These commercial

banks offer loans on the basis of the business entity's feasibility and legitimacy. The

Exchange and Profit & Expense Report and cash balances, the final analyses of financial

documents, will measure the productivity and authenticity.

Drawbacks:

Preference to Rational Decision Making- Analytical decisions can be taken with the help

of financial techniques. Often accounting firms and senior management, however, favor

prior judgment expertise and insight (Hauser, Suboti LLC, 2016). This is because taking

an intuitive decision is genuinely transparent and easy.

The decisions are made by the administration. Their execution is in the possession of the

auditor in charge of operations. For the efficient operation of the management accounting

practices, the continued contributions of management accountants and the complete

involvement of all management levels are important.

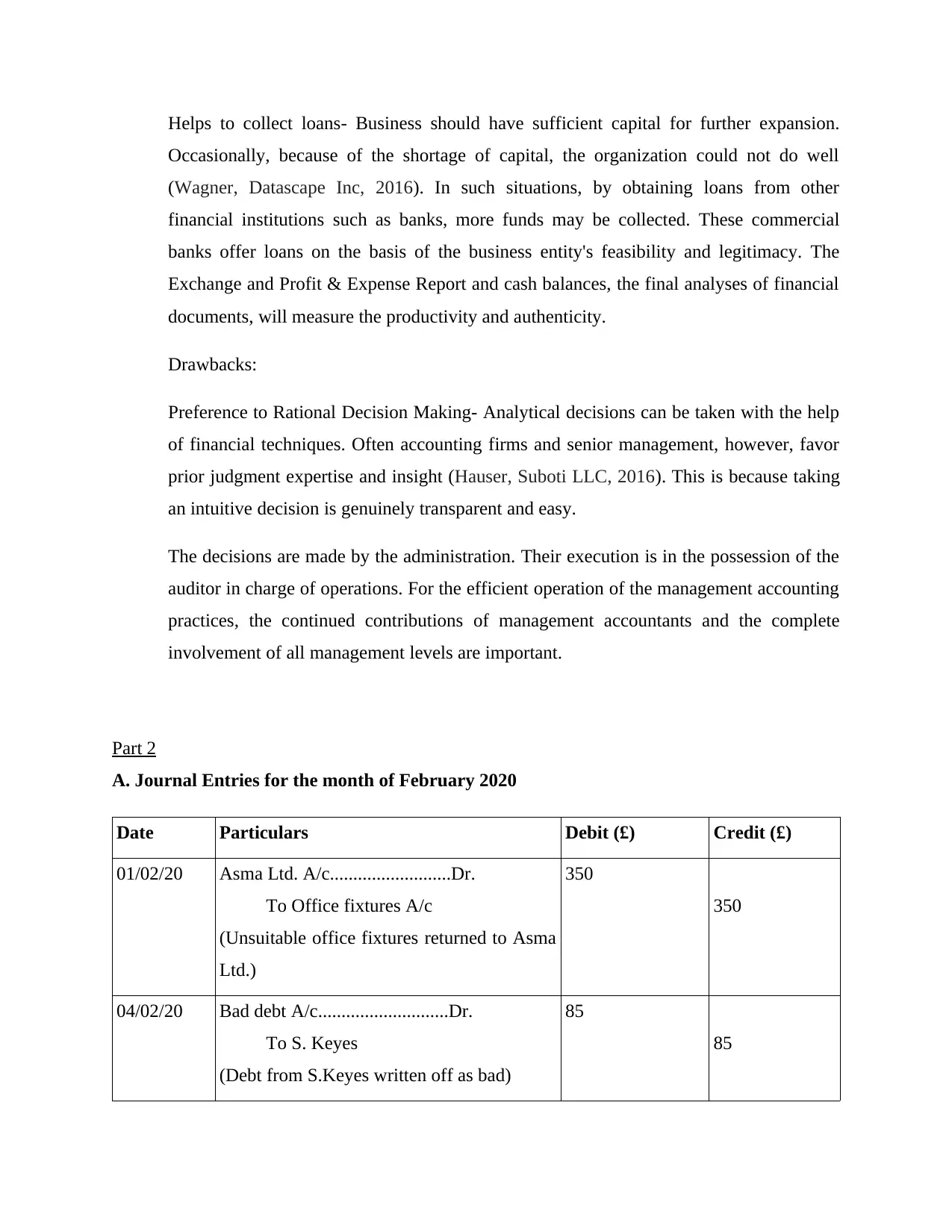

Part 2

A. Journal Entries for the month of February 2020

Date Particulars Debit (£) Credit (£)

01/02/20 Asma Ltd. A/c..........................Dr.

To Office fixtures A/c

(Unsuitable office fixtures returned to Asma

Ltd.)

350

350

04/02/20 Bad debt A/c............................Dr.

To S. Keyes

(Debt from S.Keyes written off as bad)

85

85

Occasionally, because of the shortage of capital, the organization could not do well

(Wagner, Datascape Inc, 2016). In such situations, by obtaining loans from other

financial institutions such as banks, more funds may be collected. These commercial

banks offer loans on the basis of the business entity's feasibility and legitimacy. The

Exchange and Profit & Expense Report and cash balances, the final analyses of financial

documents, will measure the productivity and authenticity.

Drawbacks:

Preference to Rational Decision Making- Analytical decisions can be taken with the help

of financial techniques. Often accounting firms and senior management, however, favor

prior judgment expertise and insight (Hauser, Suboti LLC, 2016). This is because taking

an intuitive decision is genuinely transparent and easy.

The decisions are made by the administration. Their execution is in the possession of the

auditor in charge of operations. For the efficient operation of the management accounting

practices, the continued contributions of management accountants and the complete

involvement of all management levels are important.

Part 2

A. Journal Entries for the month of February 2020

Date Particulars Debit (£) Credit (£)

01/02/20 Asma Ltd. A/c..........................Dr.

To Office fixtures A/c

(Unsuitable office fixtures returned to Asma

Ltd.)

350

350

04/02/20 Bad debt A/c............................Dr.

To S. Keyes

(Debt from S.Keyes written off as bad)

85

85

09/02/20 Machinery A/c.........................Dr.

To Bank A/c

To TS Co. A/c

(Machinery bought from TS Co. on part cash

and part credit)

2300

200

2100

13/02/20 Bank A/c...................................Dr.

Bad debt A/c.............................Dr.

To S. Hill A/c

(Only £220 received out of £270 from

bankrupt debtor S. Hill as full and final

settlement)

220

50

270

20/02/20 Drawings A/c............................Dr.

To Purchases A/c

(Goods taken for personal use by owner)

180

180

26/02/20 Drawings A/c..........................Dr.

To Insurance A/c

(Personal insurance bill debited to business

not stands corrected)

85

85

28/02/20 TS Co. A/c..............................Dr.

To Bank A/c

(Half payment of machine credit paid by

owner to TS Co)

1050

1050

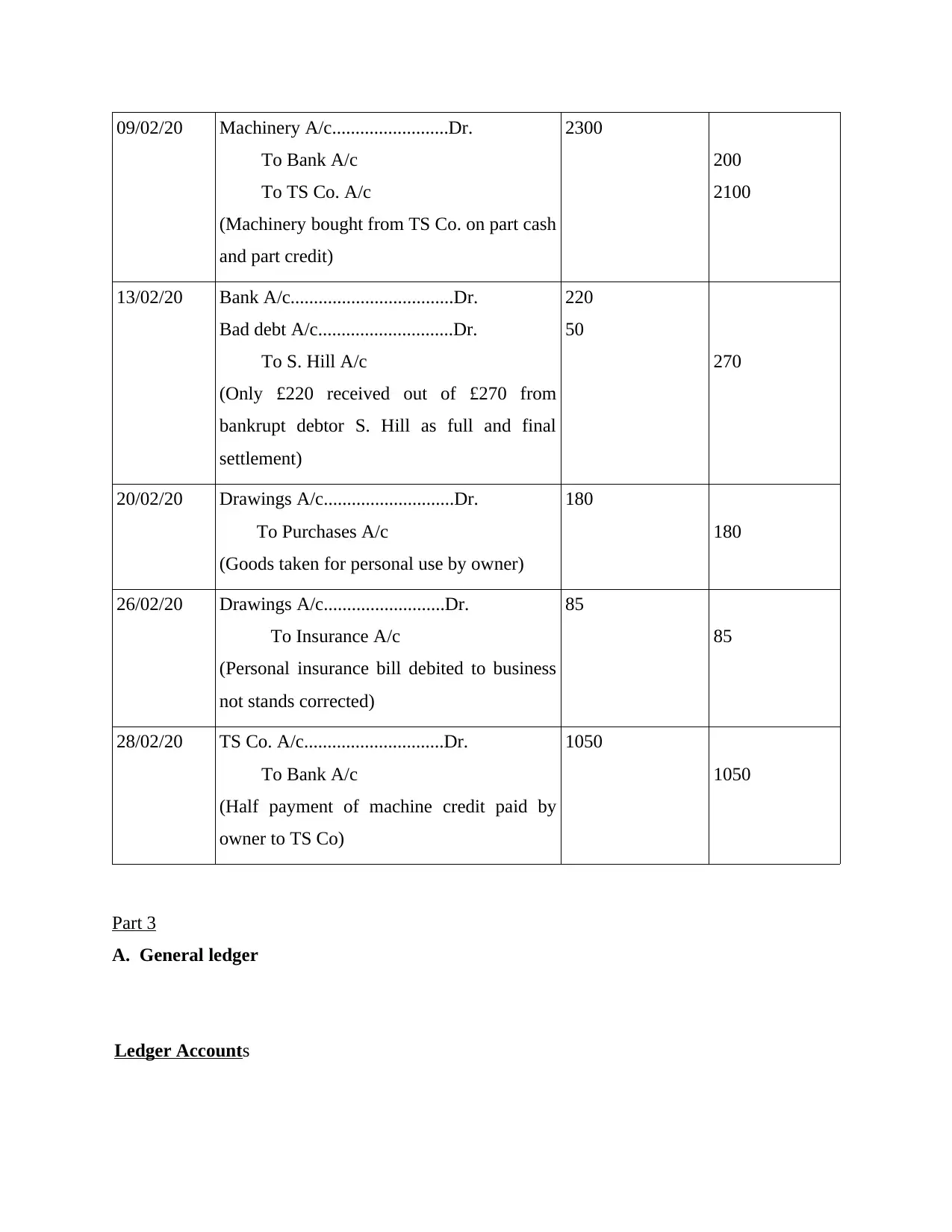

Part 3

A. General ledger

Ledger Accounts

To Bank A/c

To TS Co. A/c

(Machinery bought from TS Co. on part cash

and part credit)

2300

200

2100

13/02/20 Bank A/c...................................Dr.

Bad debt A/c.............................Dr.

To S. Hill A/c

(Only £220 received out of £270 from

bankrupt debtor S. Hill as full and final

settlement)

220

50

270

20/02/20 Drawings A/c............................Dr.

To Purchases A/c

(Goods taken for personal use by owner)

180

180

26/02/20 Drawings A/c..........................Dr.

To Insurance A/c

(Personal insurance bill debited to business

not stands corrected)

85

85

28/02/20 TS Co. A/c..............................Dr.

To Bank A/c

(Half payment of machine credit paid by

owner to TS Co)

1050

1050

Part 3

A. General ledger

Ledger Accounts

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

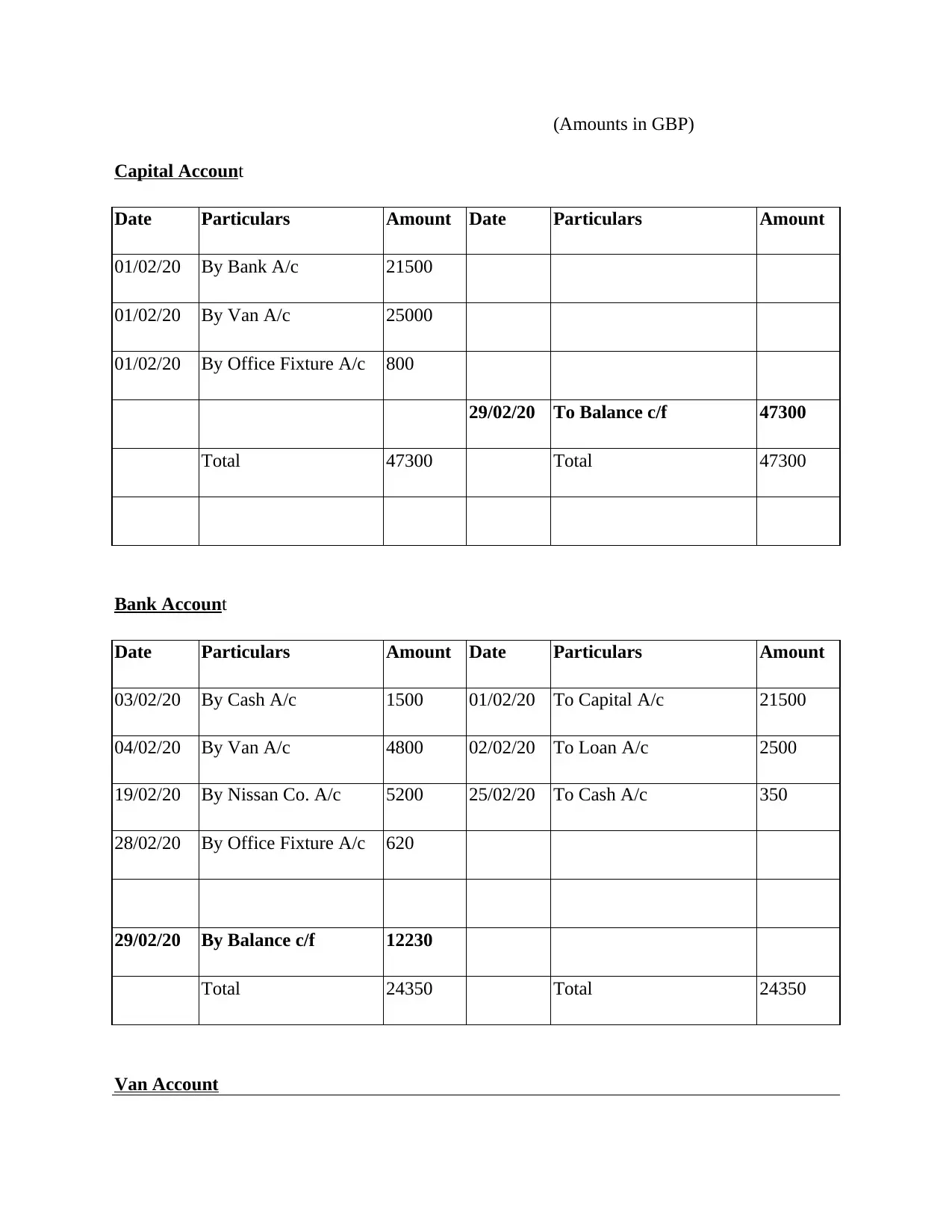

(Amounts in GBP)

Capital Account

Date Particulars Amount Date Particulars Amount

01/02/20 By Bank A/c 21500

01/02/20 By Van A/c 25000

01/02/20 By Office Fixture A/c 800

29/02/20 To Balance c/f 47300

Total 47300 Total 47300

Bank Account

Date Particulars Amount Date Particulars Amount

03/02/20 By Cash A/c 1500 01/02/20 To Capital A/c 21500

04/02/20 By Van A/c 4800 02/02/20 To Loan A/c 2500

19/02/20 By Nissan Co. A/c 5200 25/02/20 To Cash A/c 350

28/02/20 By Office Fixture A/c 620

29/02/20 By Balance c/f 12230

Total 24350 Total 24350

Van Account

Capital Account

Date Particulars Amount Date Particulars Amount

01/02/20 By Bank A/c 21500

01/02/20 By Van A/c 25000

01/02/20 By Office Fixture A/c 800

29/02/20 To Balance c/f 47300

Total 47300 Total 47300

Bank Account

Date Particulars Amount Date Particulars Amount

03/02/20 By Cash A/c 1500 01/02/20 To Capital A/c 21500

04/02/20 By Van A/c 4800 02/02/20 To Loan A/c 2500

19/02/20 By Nissan Co. A/c 5200 25/02/20 To Cash A/c 350

28/02/20 By Office Fixture A/c 620

29/02/20 By Balance c/f 12230

Total 24350 Total 24350

Van Account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

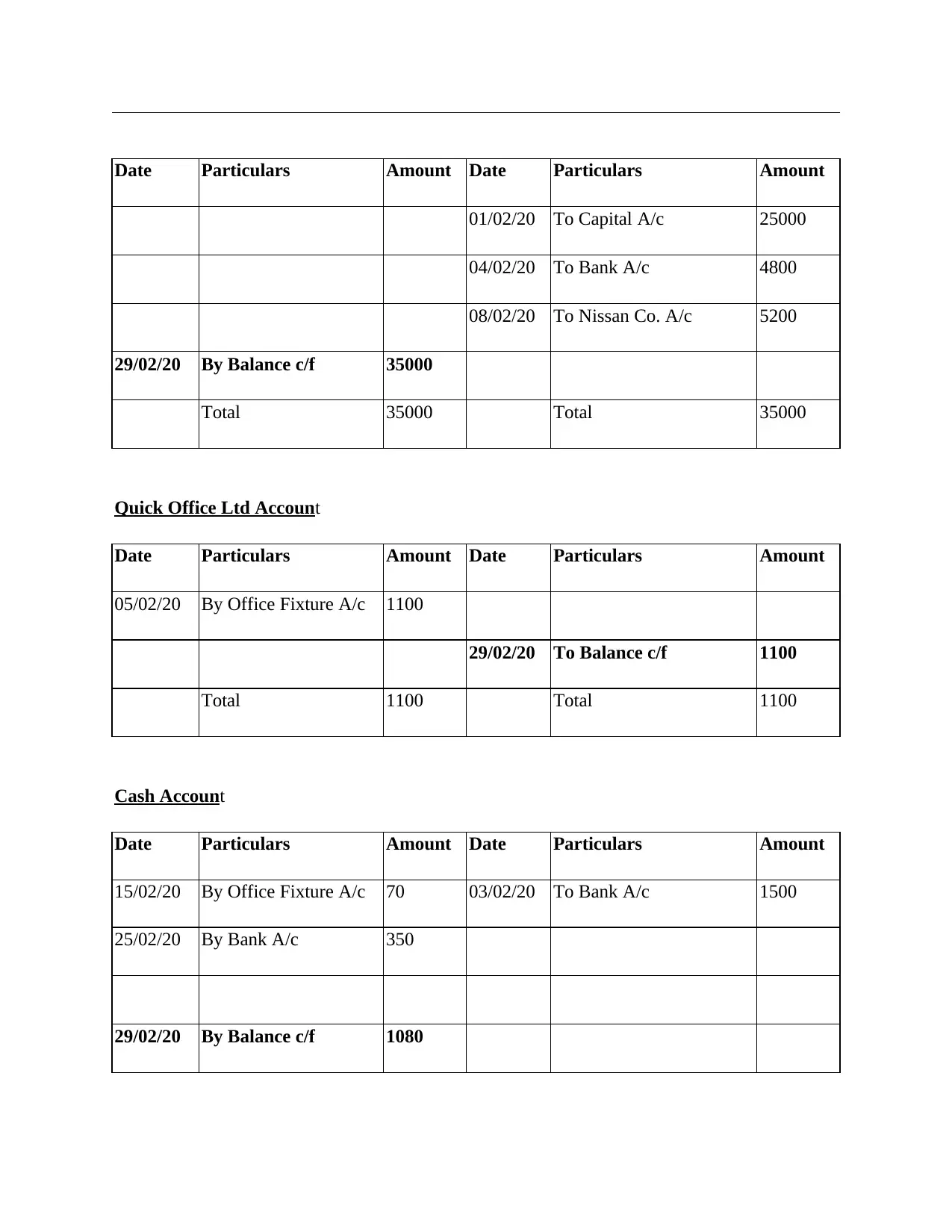

Date Particulars Amount Date Particulars Amount

01/02/20 To Capital A/c 25000

04/02/20 To Bank A/c 4800

08/02/20 To Nissan Co. A/c 5200

29/02/20 By Balance c/f 35000

Total 35000 Total 35000

Quick Office Ltd Account

Date Particulars Amount Date Particulars Amount

05/02/20 By Office Fixture A/c 1100

29/02/20 To Balance c/f 1100

Total 1100 Total 1100

Cash Account

Date Particulars Amount Date Particulars Amount

15/02/20 By Office Fixture A/c 70 03/02/20 To Bank A/c 1500

25/02/20 By Bank A/c 350

29/02/20 By Balance c/f 1080

01/02/20 To Capital A/c 25000

04/02/20 To Bank A/c 4800

08/02/20 To Nissan Co. A/c 5200

29/02/20 By Balance c/f 35000

Total 35000 Total 35000

Quick Office Ltd Account

Date Particulars Amount Date Particulars Amount

05/02/20 By Office Fixture A/c 1100

29/02/20 To Balance c/f 1100

Total 1100 Total 1100

Cash Account

Date Particulars Amount Date Particulars Amount

15/02/20 By Office Fixture A/c 70 03/02/20 To Bank A/c 1500

25/02/20 By Bank A/c 350

29/02/20 By Balance c/f 1080

Total 1500 Total 1500

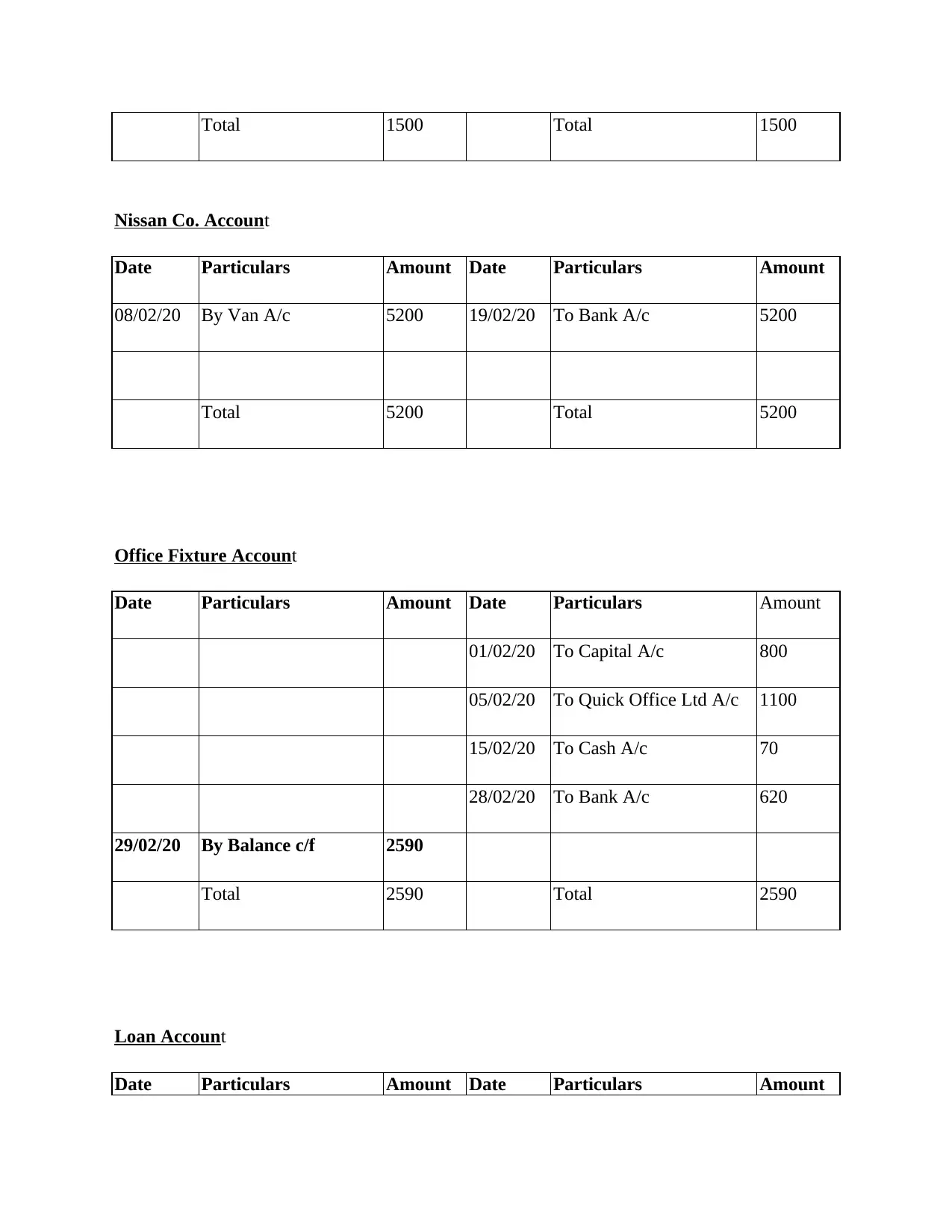

Nissan Co. Account

Date Particulars Amount Date Particulars Amount

08/02/20 By Van A/c 5200 19/02/20 To Bank A/c 5200

Total 5200 Total 5200

Office Fixture Account

Date Particulars Amount Date Particulars Amount

01/02/20 To Capital A/c 800

05/02/20 To Quick Office Ltd A/c 1100

15/02/20 To Cash A/c 70

28/02/20 To Bank A/c 620

29/02/20 By Balance c/f 2590

Total 2590 Total 2590

Loan Account

Date Particulars Amount Date Particulars Amount

Nissan Co. Account

Date Particulars Amount Date Particulars Amount

08/02/20 By Van A/c 5200 19/02/20 To Bank A/c 5200

Total 5200 Total 5200

Office Fixture Account

Date Particulars Amount Date Particulars Amount

01/02/20 To Capital A/c 800

05/02/20 To Quick Office Ltd A/c 1100

15/02/20 To Cash A/c 70

28/02/20 To Bank A/c 620

29/02/20 By Balance c/f 2590

Total 2590 Total 2590

Loan Account

Date Particulars Amount Date Particulars Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

02/02/20 By Bank A/c 2500

29/02/20 By Balance c/f 2500

Total 2500 Total 2500

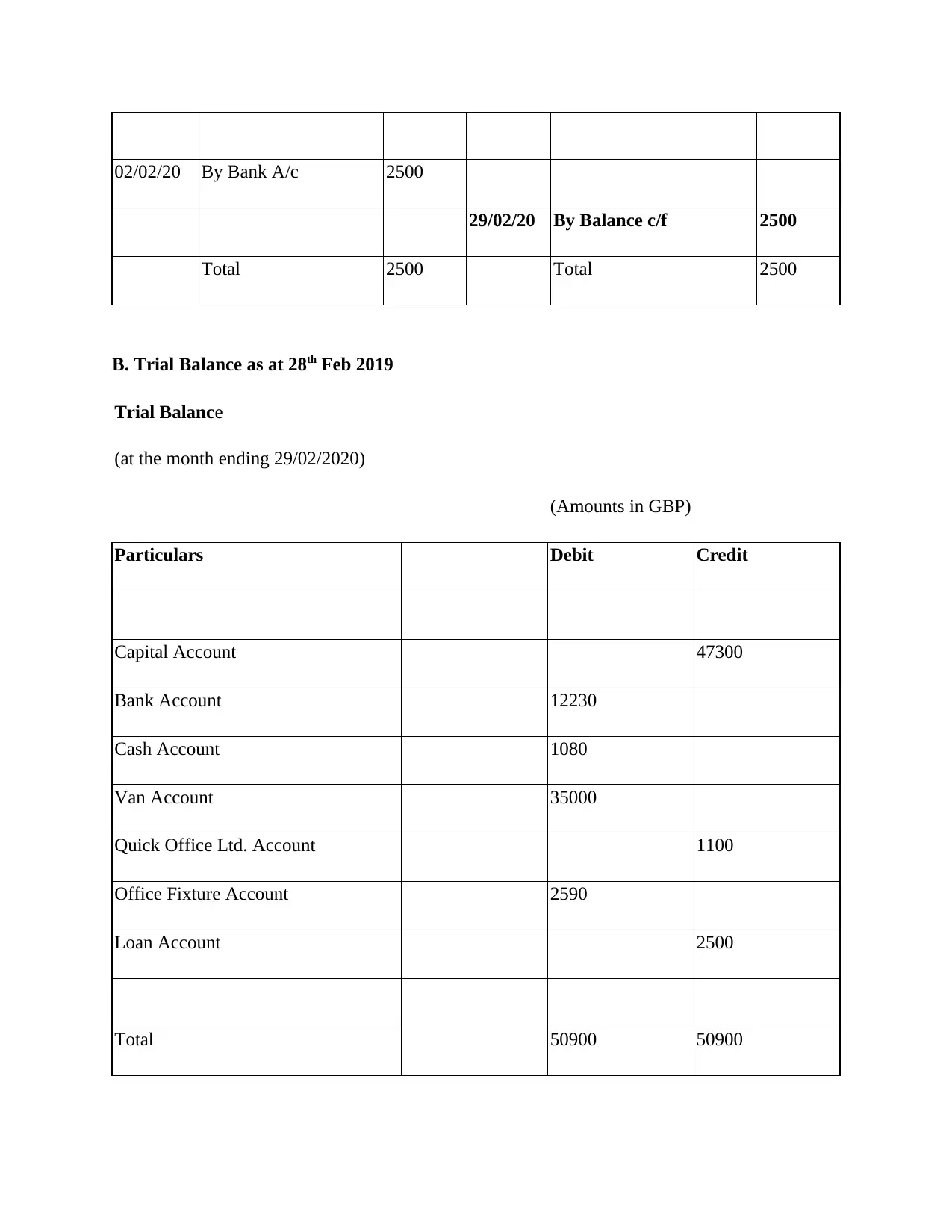

B. Trial Balance as at 28th Feb 2019

Trial Balance

(at the month ending 29/02/2020)

(Amounts in GBP)

Particulars Debit Credit

Capital Account 47300

Bank Account 12230

Cash Account 1080

Van Account 35000

Quick Office Ltd. Account 1100

Office Fixture Account 2590

Loan Account 2500

Total 50900 50900

29/02/20 By Balance c/f 2500

Total 2500 Total 2500

B. Trial Balance as at 28th Feb 2019

Trial Balance

(at the month ending 29/02/2020)

(Amounts in GBP)

Particulars Debit Credit

Capital Account 47300

Bank Account 12230

Cash Account 1080

Van Account 35000

Quick Office Ltd. Account 1100

Office Fixture Account 2590

Loan Account 2500

Total 50900 50900

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

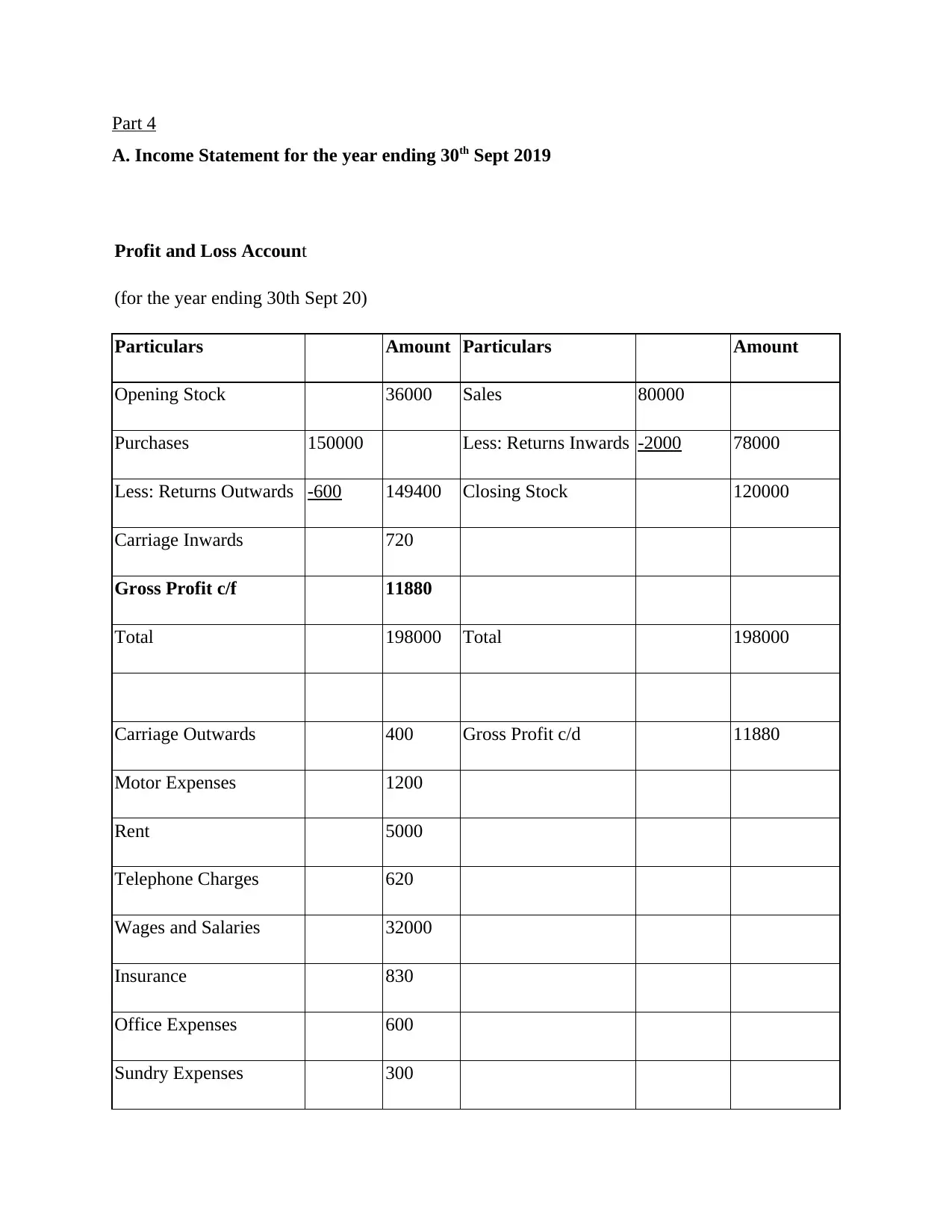

Part 4

A. Income Statement for the year ending 30th Sept 2019

Profit and Loss Account

(for the year ending 30th Sept 20)

Particulars Amount Particulars Amount

Opening Stock 36000 Sales 80000

Purchases 150000 Less: Returns Inwards -2000 78000

Less: Returns Outwards -600 149400 Closing Stock 120000

Carriage Inwards 720

Gross Profit c/f 11880

Total 198000 Total 198000

Carriage Outwards 400 Gross Profit c/d 11880

Motor Expenses 1200

Rent 5000

Telephone Charges 620

Wages and Salaries 32000

Insurance 830

Office Expenses 600

Sundry Expenses 300

A. Income Statement for the year ending 30th Sept 2019

Profit and Loss Account

(for the year ending 30th Sept 20)

Particulars Amount Particulars Amount

Opening Stock 36000 Sales 80000

Purchases 150000 Less: Returns Inwards -2000 78000

Less: Returns Outwards -600 149400 Closing Stock 120000

Carriage Inwards 720

Gross Profit c/f 11880

Total 198000 Total 198000

Carriage Outwards 400 Gross Profit c/d 11880

Motor Expenses 1200

Rent 5000

Telephone Charges 620

Wages and Salaries 32000

Insurance 830

Office Expenses 600

Sundry Expenses 300

Net profit / (loss) -29070

Total 11880 Total 11880

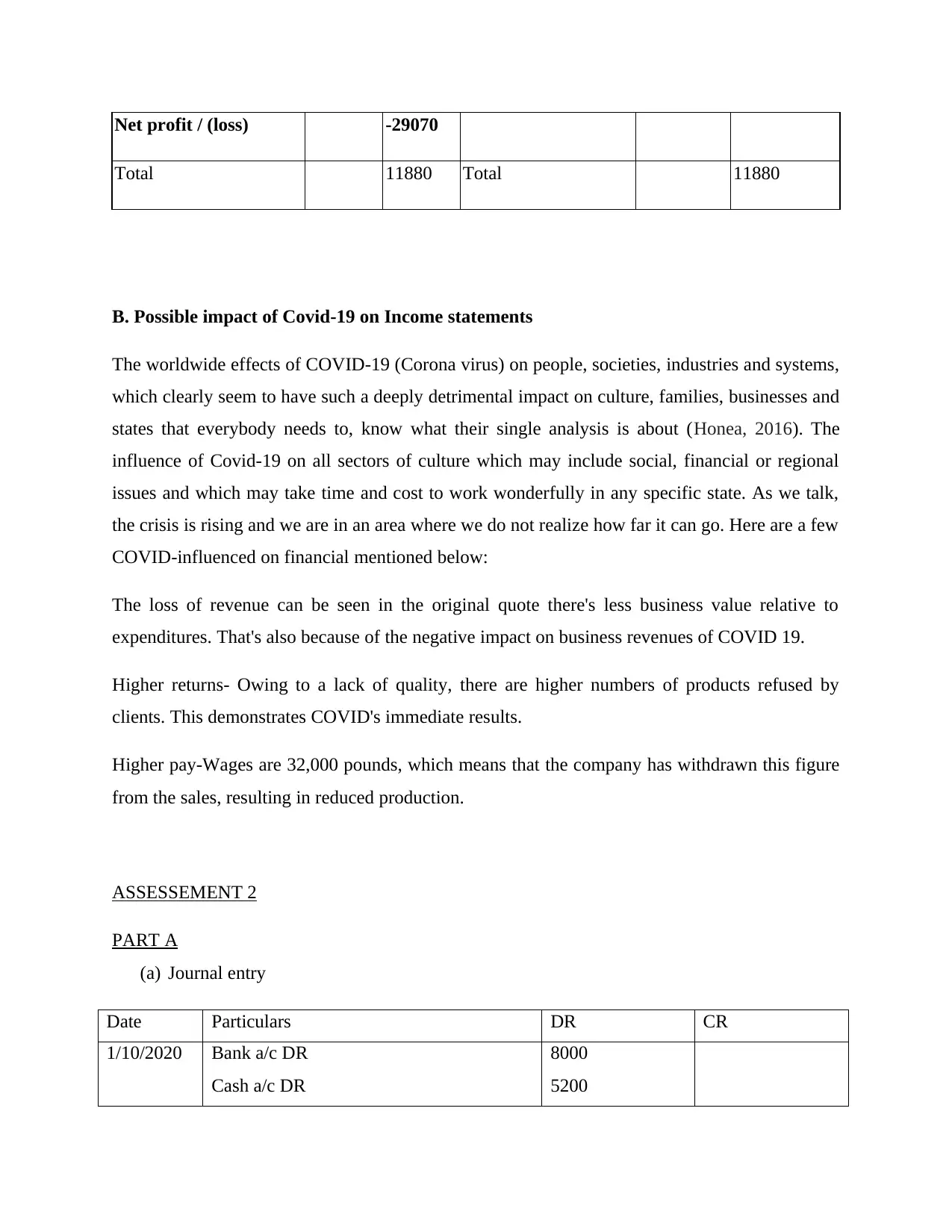

B. Possible impact of Covid-19 on Income statements

The worldwide effects of COVID-19 (Corona virus) on people, societies, industries and systems,

which clearly seem to have such a deeply detrimental impact on culture, families, businesses and

states that everybody needs to, know what their single analysis is about (Honea, 2016). The

influence of Covid-19 on all sectors of culture which may include social, financial or regional

issues and which may take time and cost to work wonderfully in any specific state. As we talk,

the crisis is rising and we are in an area where we do not realize how far it can go. Here are a few

COVID-influenced on financial mentioned below:

The loss of revenue can be seen in the original quote there's less business value relative to

expenditures. That's also because of the negative impact on business revenues of COVID 19.

Higher returns- Owing to a lack of quality, there are higher numbers of products refused by

clients. This demonstrates COVID's immediate results.

Higher pay-Wages are 32,000 pounds, which means that the company has withdrawn this figure

from the sales, resulting in reduced production.

ASSESSEMENT 2

PART A

(a) Journal entry

Date Particulars DR CR

1/10/2020 Bank a/c DR

Cash a/c DR

8000

5200

Total 11880 Total 11880

B. Possible impact of Covid-19 on Income statements

The worldwide effects of COVID-19 (Corona virus) on people, societies, industries and systems,

which clearly seem to have such a deeply detrimental impact on culture, families, businesses and

states that everybody needs to, know what their single analysis is about (Honea, 2016). The

influence of Covid-19 on all sectors of culture which may include social, financial or regional

issues and which may take time and cost to work wonderfully in any specific state. As we talk,

the crisis is rising and we are in an area where we do not realize how far it can go. Here are a few

COVID-influenced on financial mentioned below:

The loss of revenue can be seen in the original quote there's less business value relative to

expenditures. That's also because of the negative impact on business revenues of COVID 19.

Higher returns- Owing to a lack of quality, there are higher numbers of products refused by

clients. This demonstrates COVID's immediate results.

Higher pay-Wages are 32,000 pounds, which means that the company has withdrawn this figure

from the sales, resulting in reduced production.

ASSESSEMENT 2

PART A

(a) Journal entry

Date Particulars DR CR

1/10/2020 Bank a/c DR

Cash a/c DR

8000

5200

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.