HA 3011 Advanced Financial Accounting: Enron & Coca-Cola Report

VerifiedAdded on 2023/06/04

|12

|1100

|138

Report

AI Summary

This report provides a detailed analysis of the financial practices of Enron and Coca-Cola. The first part of the report focuses on Enron, examining the use and misuse of mark-to-market accounting, special purpose entities (SPEs), and stock option plans. It explores how these accounting approaches and financial instruments were used, and the implications of each. The second part of the report analyzes the methodologies used by Coca-Cola to measure its financial elements, including sales, finance costs, taxation, intangible assets, property, plant, and equipment, associates and joint arrangements, inventories, trade receivables, trade payables, net debt, and equity. The report also compares the effective interest rate method with the straight-line method for measuring trade receivables, concluding that the effective interest rate method is more accurate. The study uses the IFRS conceptual framework, which prefers the use of fair value and amortisation cost to obtain the real value of a financial element.

Decision-Making

&

Problem-Solving

&

Problem-Solving

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Decision-Making & Problem-Solving

Introduction

• The paper seeks to address the key financial issues that

influence the financial investment market of Enron and

Coca Cola Corporations.

• The first part addresses accounting approaches such as

mark to market, Special purpose entities, and stock option

plan and their impact on Enron.

• The second part addresses the different methodologies used

by Coca Cola to measure their financial elements.

Introduction

• The paper seeks to address the key financial issues that

influence the financial investment market of Enron and

Coca Cola Corporations.

• The first part addresses accounting approaches such as

mark to market, Special purpose entities, and stock option

plan and their impact on Enron.

• The second part addresses the different methodologies used

by Coca Cola to measure their financial elements.

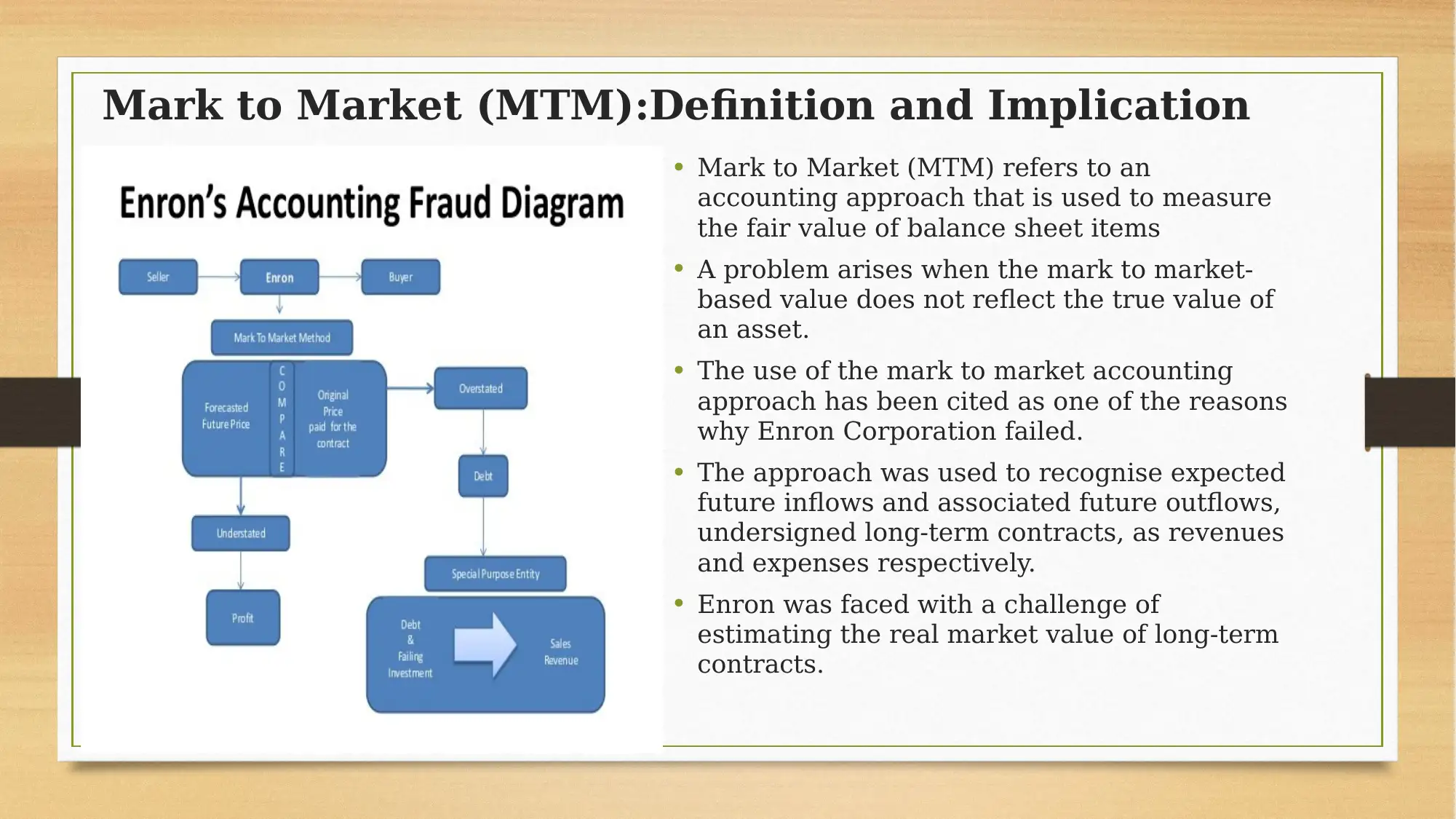

Mark to Market (MTM):Definition and Implication

• Mark to Market (MTM) refers to an

accounting approach that is used to measure

the fair value of balance sheet items

• A problem arises when the mark to market-

based value does not reflect the true value of

an asset.

• The use of the mark to market accounting

approach has been cited as one of the reasons

why Enron Corporation failed.

• The approach was used to recognise expected

future inflows and associated future outflows,

undersigned long-term contracts, as revenues

and expenses respectively.

• Enron was faced with a challenge of

estimating the real market value of long-term

contracts.

• Mark to Market (MTM) refers to an

accounting approach that is used to measure

the fair value of balance sheet items

• A problem arises when the mark to market-

based value does not reflect the true value of

an asset.

• The use of the mark to market accounting

approach has been cited as one of the reasons

why Enron Corporation failed.

• The approach was used to recognise expected

future inflows and associated future outflows,

undersigned long-term contracts, as revenues

and expenses respectively.

• Enron was faced with a challenge of

estimating the real market value of long-term

contracts.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

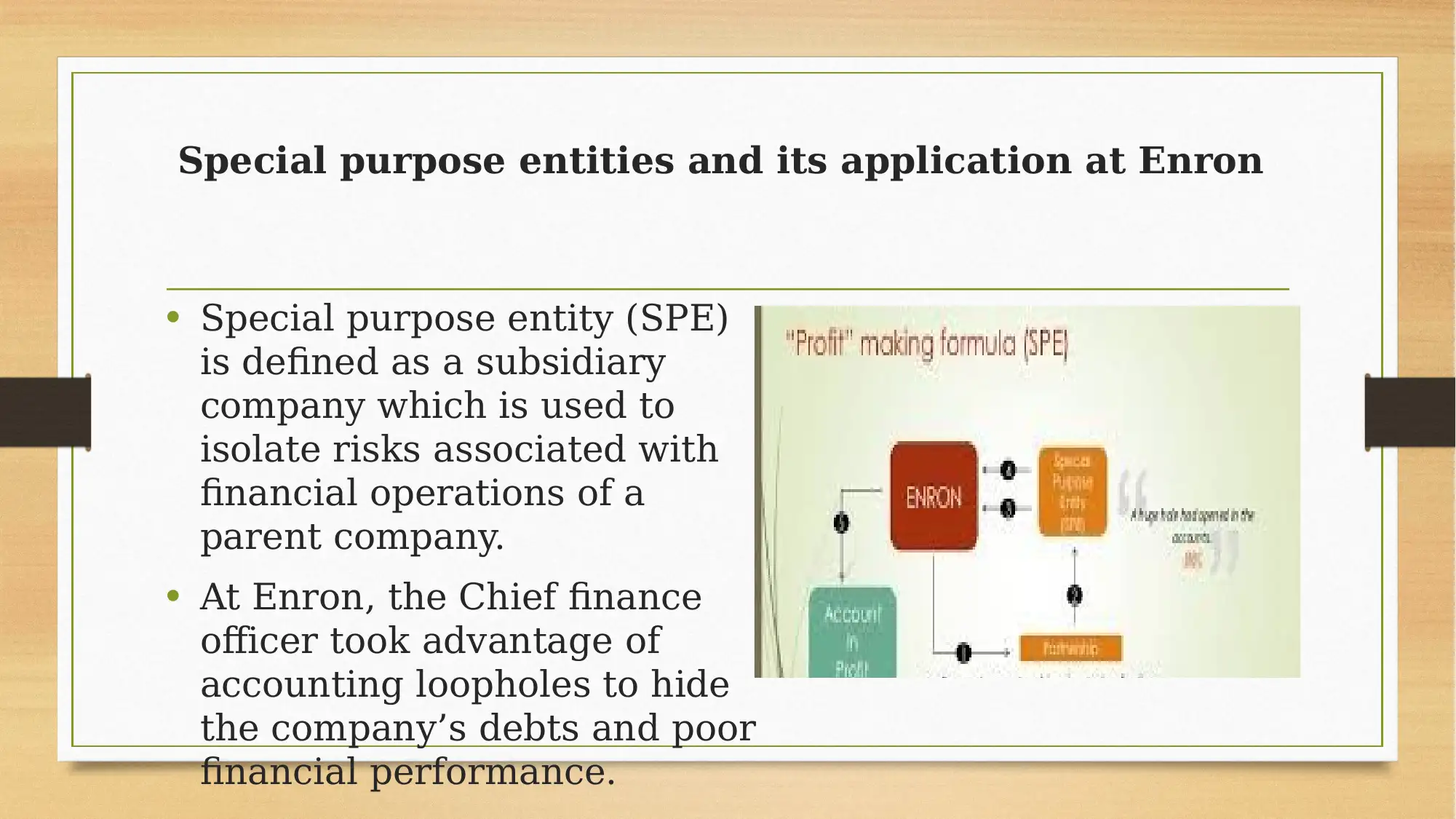

Special purpose entities and its application at Enron

• Special purpose entity (SPE)

is defined as a subsidiary

company which is used to

isolate risks associated with

financial operations of a

parent company.

• At Enron, the Chief finance

officer took advantage of

accounting loopholes to hide

the company’s debts and poor

financial performance.

• Special purpose entity (SPE)

is defined as a subsidiary

company which is used to

isolate risks associated with

financial operations of a

parent company.

• At Enron, the Chief finance

officer took advantage of

accounting loopholes to hide

the company’s debts and poor

financial performance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

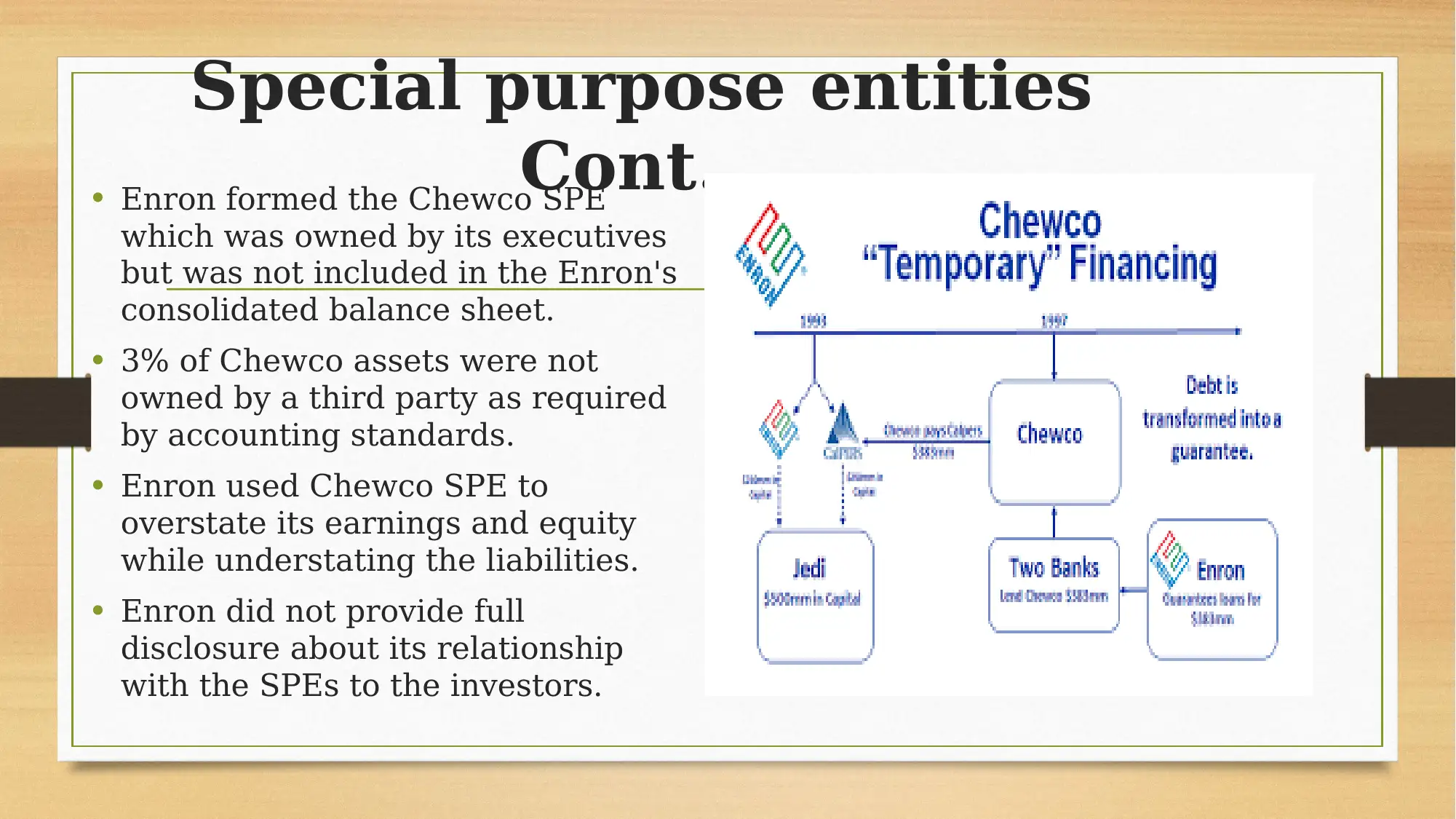

Special purpose entities

Cont…• Enron formed the Chewco SPE

which was owned by its executives

but was not included in the Enron's

consolidated balance sheet.

• 3% of Chewco assets were not

owned by a third party as required

by accounting standards.

• Enron used Chewco SPE to

overstate its earnings and equity

while understating the liabilities.

• Enron did not provide full

disclosure about its relationship

with the SPEs to the investors.

Cont…• Enron formed the Chewco SPE

which was owned by its executives

but was not included in the Enron's

consolidated balance sheet.

• 3% of Chewco assets were not

owned by a third party as required

by accounting standards.

• Enron used Chewco SPE to

overstate its earnings and equity

while understating the liabilities.

• Enron did not provide full

disclosure about its relationship

with the SPEs to the investors.

Purpose of the stock options compensation scheme

• Agency theory states that managers

should run a company in the best interest

of the shareholders.

• Failure to act in the shareholder’s interest

of the shareholders leads to an agency

problem.

• Enron stock option plan to align the

interests of shareholders and managers.

• In December 2000, Enron awarded 96

million shares to the executive managers

through the stock option plan.

• Kenneth Lay, Jeff Skilling, and remaining

directors and managers were awarded

5,285,542 shares, 824,038 shares, and

12,611,385 shares respectively.

• Agency theory states that managers

should run a company in the best interest

of the shareholders.

• Failure to act in the shareholder’s interest

of the shareholders leads to an agency

problem.

• Enron stock option plan to align the

interests of shareholders and managers.

• In December 2000, Enron awarded 96

million shares to the executive managers

through the stock option plan.

• Kenneth Lay, Jeff Skilling, and remaining

directors and managers were awarded

5,285,542 shares, 824,038 shares, and

12,611,385 shares respectively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

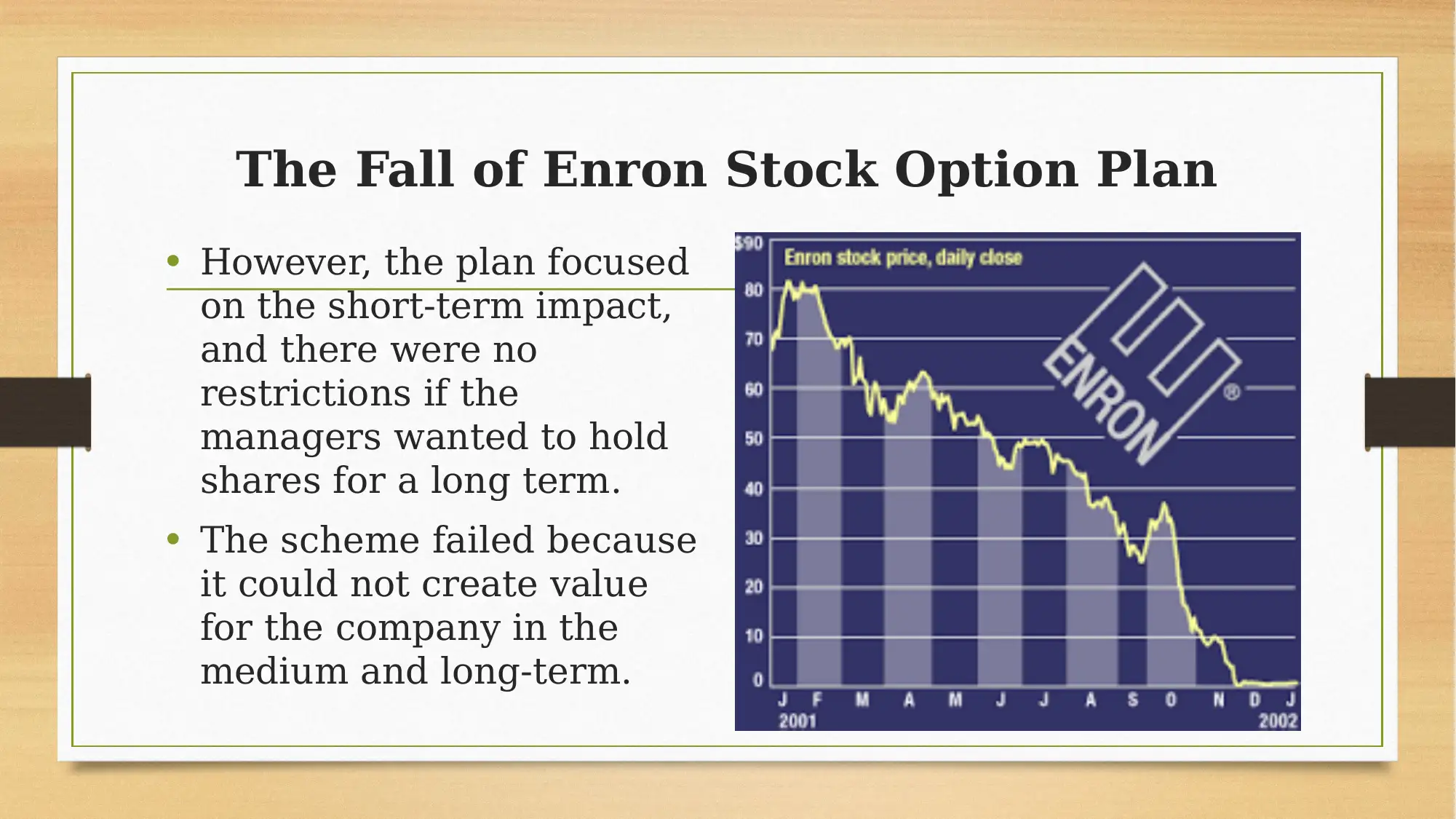

The Fall of Enron Stock Option Plan

• However, the plan focused

on the short-term impact,

and there were no

restrictions if the

managers wanted to hold

shares for a long term.

• The scheme failed because

it could not create value

for the company in the

medium and long-term.

• However, the plan focused

on the short-term impact,

and there were no

restrictions if the

managers wanted to hold

shares for a long term.

• The scheme failed because

it could not create value

for the company in the

medium and long-term.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Methodologies used by Coca Cola to measure its financial elements

• Companies use different methodologies to measure their financial elements

• Coca Cola uses the following measurement methodologies to measure financial

elements using its 2017 annual report.

Sales: Coca-Cola measures its sales at fair value after taking sales discounting,

promotion and marketing incentives and listing fees into consideration.

Finance Costs: The effective interest rate method.

Taxation: The liability method

Intangible assets:

Intangible with infinite are measured at their recoverable amount.

Intangible assets with finite are measured at amortisation over their useful

lives.

The property, Plants, and equipment: Measured at their historical cost less

impairment losses and accumulated depreciation.

• Companies use different methodologies to measure their financial elements

• Coca Cola uses the following measurement methodologies to measure financial

elements using its 2017 annual report.

Sales: Coca-Cola measures its sales at fair value after taking sales discounting,

promotion and marketing incentives and listing fees into consideration.

Finance Costs: The effective interest rate method.

Taxation: The liability method

Intangible assets:

Intangible with infinite are measured at their recoverable amount.

Intangible assets with finite are measured at amortisation over their useful

lives.

The property, Plants, and equipment: Measured at their historical cost less

impairment losses and accumulated depreciation.

Methodologies Conti…

Associates and Joint Arrangements: The equity method of

accounting.

Inventories: Uses either net realisable value or lower of cost.

Trade receivables: The effective interest rate method.

Trade Payable: Initially recognised at its fair value.

Afterward, the effective interest rate method is used.

Net debt: The amortisation cost is calculated using the

effective interest rate method.

Equity: Ordinary shares are measured at par value.

Associates and Joint Arrangements: The equity method of

accounting.

Inventories: Uses either net realisable value or lower of cost.

Trade receivables: The effective interest rate method.

Trade Payable: Initially recognised at its fair value.

Afterward, the effective interest rate method is used.

Net debt: The amortisation cost is calculated using the

effective interest rate method.

Equity: Ordinary shares are measured at par value.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Measurement method for

Coca Cola’s Trade

receivables

• FASB and IASB define decision-useful

information as the objective of financial

measurement and reporting.

• Coca-Cola uses fair value as an initial measure

of trade receivables. Subsequently, the trade

receivable are recognised at their amortised

cost

• The method is used to amortise the cost of a

trade receivable to ensure correlation between

the accumulated interest expenses at the end of

the accounting period and book value of items

at the start of the accounting period

• Coca-Cola estimates its loans at their fair value

before recognising them at their amortised cost

• Using the 2017 annual report, the effective

interest rate method achieved the decision

usefulness.

Coca Cola’s Trade

receivables

• FASB and IASB define decision-useful

information as the objective of financial

measurement and reporting.

• Coca-Cola uses fair value as an initial measure

of trade receivables. Subsequently, the trade

receivable are recognised at their amortised

cost

• The method is used to amortise the cost of a

trade receivable to ensure correlation between

the accumulated interest expenses at the end of

the accounting period and book value of items

at the start of the accounting period

• Coca-Cola estimates its loans at their fair value

before recognising them at their amortised cost

• Using the 2017 annual report, the effective

interest rate method achieved the decision

usefulness.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Critical analysis of the

effective interest rate method

• The straight-line method can also be used to

measure an amortisation cost of trade

receivables.

• Straight line method is used to charge cost and

interest on trade receivables at a constant rate.

• The effective interest rate method is preferred

compared to the straight-line method.

First, the effective interest rate method is a

more accurate measure interest rate to be

earned from a financial investment or

interest to be paid on a mortgage or loan.

Second, the effective interest rate method

emphasizes on recalculating interest rate

every month for accuracy basis to cater for

the changes in the real market.

• Therefore the effective interest rate measure is a

more accurate measure of trade receivables and

other financial instruments.

effective interest rate method

• The straight-line method can also be used to

measure an amortisation cost of trade

receivables.

• Straight line method is used to charge cost and

interest on trade receivables at a constant rate.

• The effective interest rate method is preferred

compared to the straight-line method.

First, the effective interest rate method is a

more accurate measure interest rate to be

earned from a financial investment or

interest to be paid on a mortgage or loan.

Second, the effective interest rate method

emphasizes on recalculating interest rate

every month for accuracy basis to cater for

the changes in the real market.

• Therefore the effective interest rate measure is a

more accurate measure of trade receivables and

other financial instruments.

Conclusion

• The study is based on two Corporations: Enron and Coca-Cola.

• The first part addresses the rise and fall of Enron Corporation and how the

management used several accounting approaches to deceive stakeholders

• The second addresses several measurement methodologies used by Coca-Cola

Corporation to measure its assets, liabilities, equity, income, and expenses.

• The common measurement methodologies are historical cost, current value, net

realisable value, and present value.

• The IFRS conceptual framework prefers the use of fair value and amortisation cost

to obtain the real value of a financial element.

• The study established that the effective interest rate method is preferred when it

comes to calculating amortization cost a financial instrument compared to the

straight-line method.

• The study is based on two Corporations: Enron and Coca-Cola.

• The first part addresses the rise and fall of Enron Corporation and how the

management used several accounting approaches to deceive stakeholders

• The second addresses several measurement methodologies used by Coca-Cola

Corporation to measure its assets, liabilities, equity, income, and expenses.

• The common measurement methodologies are historical cost, current value, net

realisable value, and present value.

• The IFRS conceptual framework prefers the use of fair value and amortisation cost

to obtain the real value of a financial element.

• The study established that the effective interest rate method is preferred when it

comes to calculating amortization cost a financial instrument compared to the

straight-line method.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.