Pearson BTEC Financial Accounting Assignment: Unit 10 Analysis

VerifiedAdded on 2022/02/14

|33

|9501

|49

Report

AI Summary

This assignment is a comprehensive financial accounting report covering key concepts and practical applications. It begins with an analysis of double-entry bookkeeping, including journal entries and ledger postings for a sole trader. The report then delves into the importance of trial balances, attributes of quality accounting information, and relevant regulations. Students are required to prepare a trial balance and an adjusted trial balance, incorporating adjusting entries for unbilled revenue, depreciation, insurance, and salaries. The assignment extends to preparing final accounts from the adjusted trial balance. Furthermore, the report analyzes the differences between financial reports and financial accounting, discusses different types of financial statements, and explains accounting principles like consistency, materiality, and full disclosure. Activities include preparing final accounts for a limited company. The assignment also addresses bank reconciliation, explaining its necessity and process, and includes a bank reconciliation statement. Finally, the report covers control accounts, suspense accounts, and their role in financial accounting, including the preparation of a sales ledger control account and its reconciliation with the sales ledger balance.

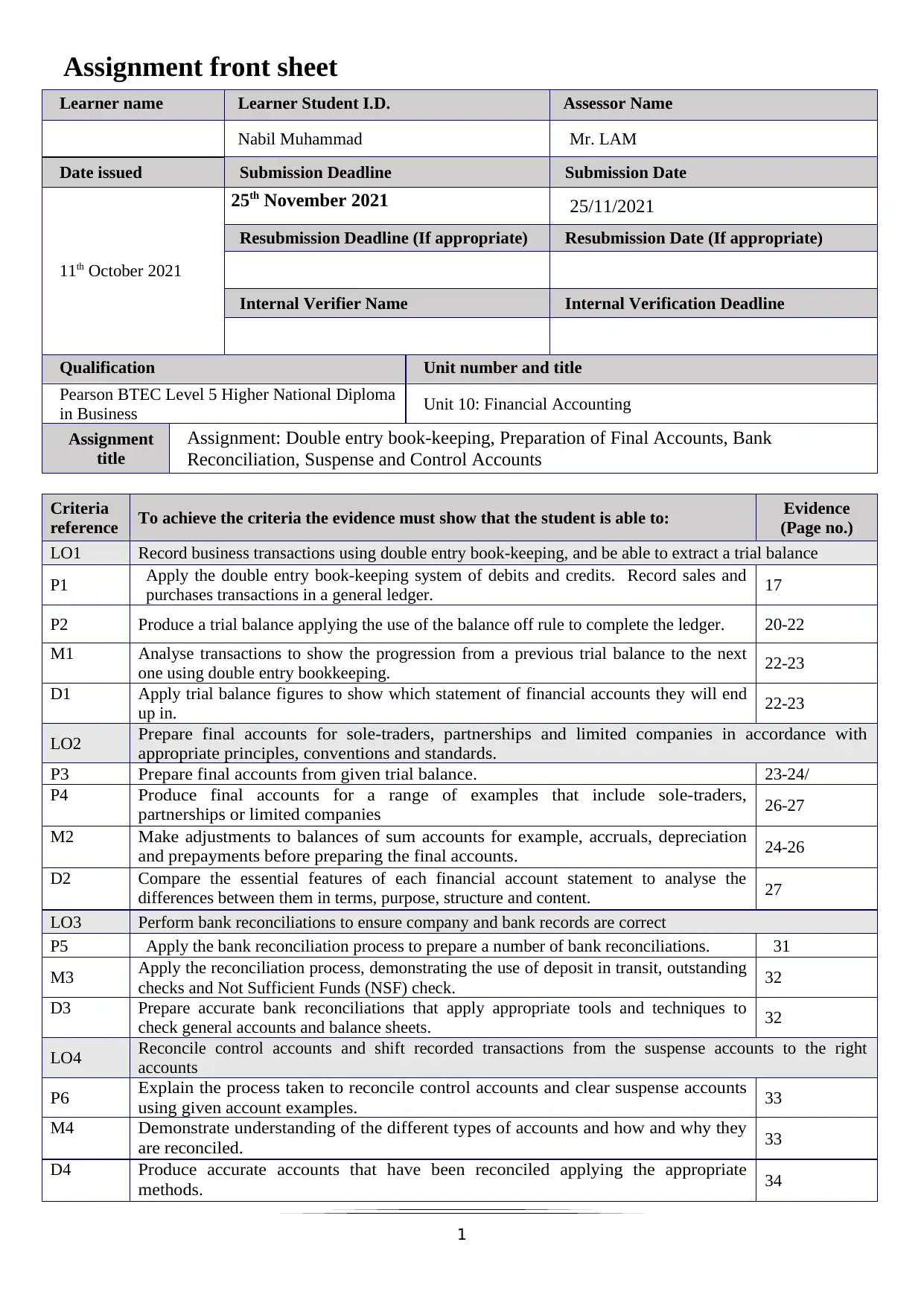

Assignment front sheet

Learner name Learner Student I.D. Assessor Name

Nabil Muhammad Mr. LAM

Date issued Submission Deadline Submission Date

11th October 2021

25th November 2021 25/11/2021

Resubmission Deadline (If appropriate) Resubmission Date (If appropriate)

Internal Verifier Name Internal Verification Deadline

Qualification Unit number and title

Pearson BTEC Level 5 Higher National Diploma

in Business Unit 10: Financial Accounting

Assignment

title

Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

Criteria

reference To achieve the criteria the evidence must show that the student is able to: Evidence

(Page no.)

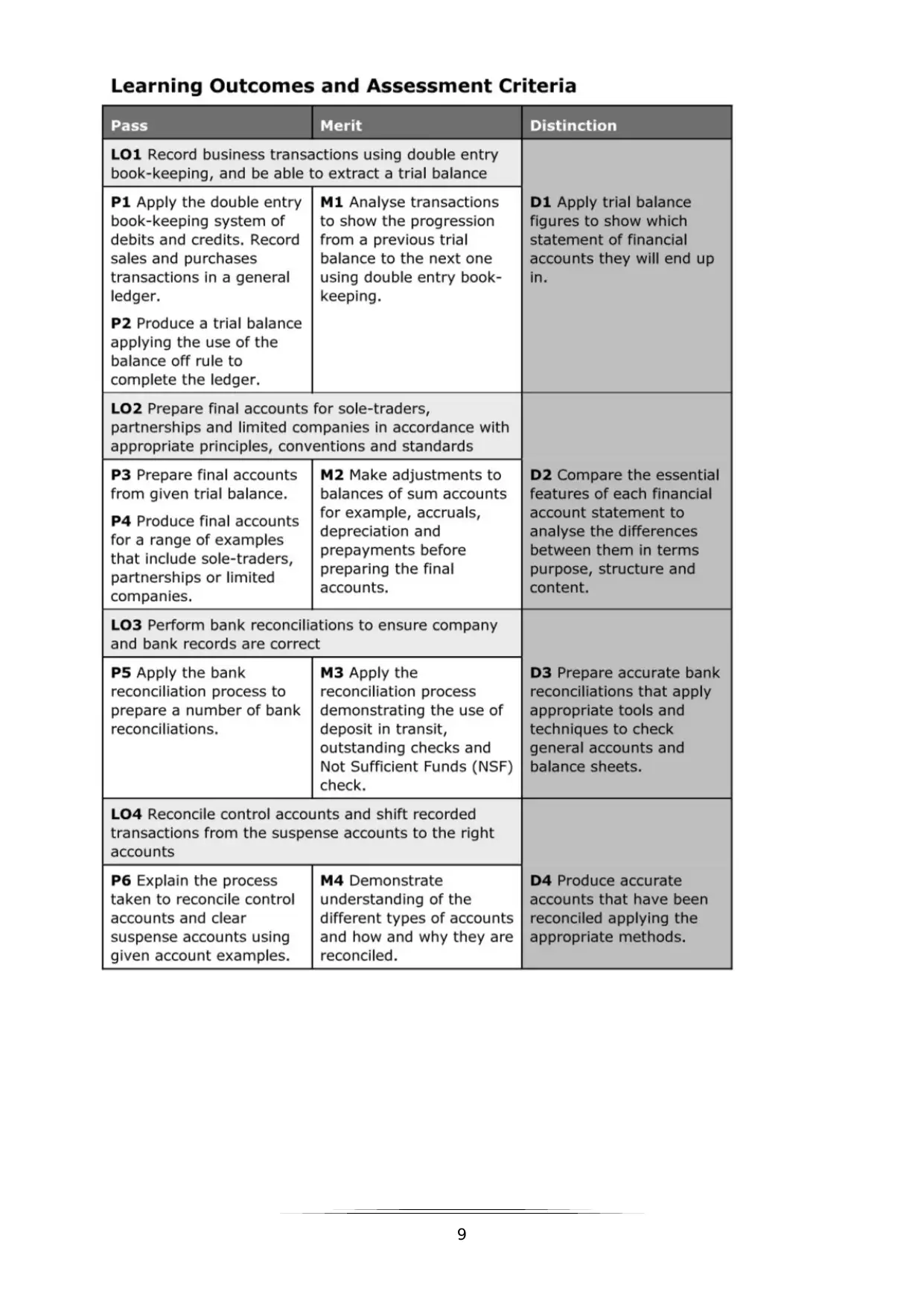

LO1 Record business transactions using double entry book-keeping, and be able to extract a trial balance

P1 Apply the double entry book-keeping system of debits and credits. Record sales and

purchases transactions in a general ledger. 17

P2 Produce a trial balance applying the use of the balance off rule to complete the ledger. 20-22

M1 Analyse transactions to show the progression from a previous trial balance to the next

one using double entry bookkeeping. 22-23

D1 Apply trial balance figures to show which statement of financial accounts they will end

up in. 22-23

LO2 Prepare final accounts for sole-traders, partnerships and limited companies in accordance with

appropriate principles, conventions and standards.

P3 Prepare final accounts from given trial balance. 23-24/

P4 Produce final accounts for a range of examples that include sole-traders,

partnerships or limited companies 26-27

M2 Make adjustments to balances of sum accounts for example, accruals, depreciation

and prepayments before preparing the final accounts. 24-26

D2 Compare the essential features of each financial account statement to analyse the

differences between them in terms, purpose, structure and content. 27

LO3 Perform bank reconciliations to ensure company and bank records are correct

P5 Apply the bank reconciliation process to prepare a number of bank reconciliations. 31

M3 Apply the reconciliation process, demonstrating the use of deposit in transit, outstanding

checks and Not Sufficient Funds (NSF) check. 32

D3 Prepare accurate bank reconciliations that apply appropriate tools and techniques to

check general accounts and balance sheets. 32

LO4 Reconcile control accounts and shift recorded transactions from the suspense accounts to the right

accounts

P6 Explain the process taken to reconcile control accounts and clear suspense accounts

using given account examples. 33

M4 Demonstrate understanding of the different types of accounts and how and why they

are reconciled. 33

D4 Produce accurate accounts that have been reconciled applying the appropriate

methods. 34

1

Learner name Learner Student I.D. Assessor Name

Nabil Muhammad Mr. LAM

Date issued Submission Deadline Submission Date

11th October 2021

25th November 2021 25/11/2021

Resubmission Deadline (If appropriate) Resubmission Date (If appropriate)

Internal Verifier Name Internal Verification Deadline

Qualification Unit number and title

Pearson BTEC Level 5 Higher National Diploma

in Business Unit 10: Financial Accounting

Assignment

title

Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

Criteria

reference To achieve the criteria the evidence must show that the student is able to: Evidence

(Page no.)

LO1 Record business transactions using double entry book-keeping, and be able to extract a trial balance

P1 Apply the double entry book-keeping system of debits and credits. Record sales and

purchases transactions in a general ledger. 17

P2 Produce a trial balance applying the use of the balance off rule to complete the ledger. 20-22

M1 Analyse transactions to show the progression from a previous trial balance to the next

one using double entry bookkeeping. 22-23

D1 Apply trial balance figures to show which statement of financial accounts they will end

up in. 22-23

LO2 Prepare final accounts for sole-traders, partnerships and limited companies in accordance with

appropriate principles, conventions and standards.

P3 Prepare final accounts from given trial balance. 23-24/

P4 Produce final accounts for a range of examples that include sole-traders,

partnerships or limited companies 26-27

M2 Make adjustments to balances of sum accounts for example, accruals, depreciation

and prepayments before preparing the final accounts. 24-26

D2 Compare the essential features of each financial account statement to analyse the

differences between them in terms, purpose, structure and content. 27

LO3 Perform bank reconciliations to ensure company and bank records are correct

P5 Apply the bank reconciliation process to prepare a number of bank reconciliations. 31

M3 Apply the reconciliation process, demonstrating the use of deposit in transit, outstanding

checks and Not Sufficient Funds (NSF) check. 32

D3 Prepare accurate bank reconciliations that apply appropriate tools and techniques to

check general accounts and balance sheets. 32

LO4 Reconcile control accounts and shift recorded transactions from the suspense accounts to the right

accounts

P6 Explain the process taken to reconcile control accounts and clear suspense accounts

using given account examples. 33

M4 Demonstrate understanding of the different types of accounts and how and why they

are reconciled. 33

D4 Produce accurate accounts that have been reconciled applying the appropriate

methods. 34

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

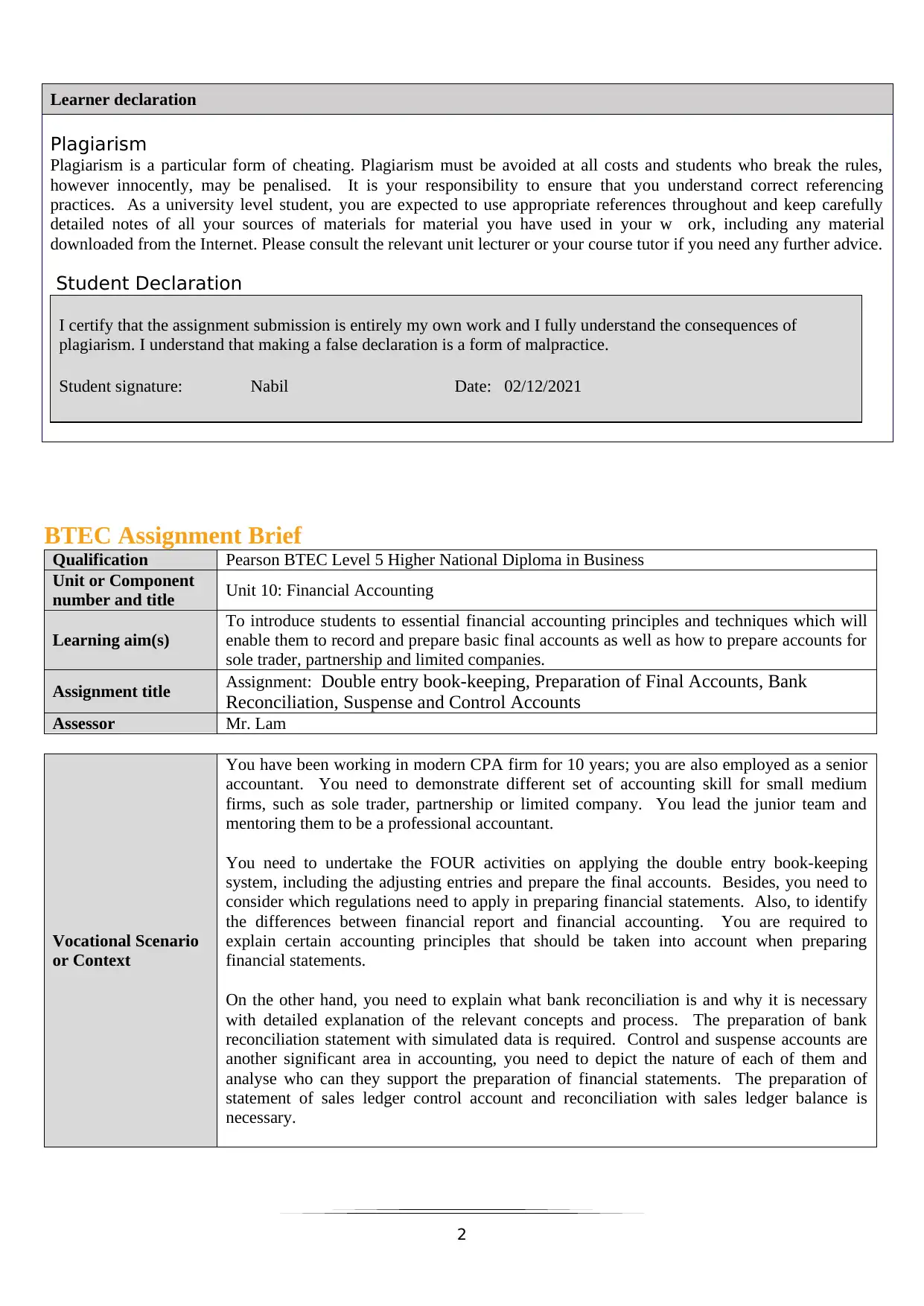

Learner declaration

Plagiarism

Plagiarism is a particular form of cheating. Plagiarism must be avoided at all costs and students who break the rules,

however innocently, may be penalised. It is your responsibility to ensure that you understand correct referencing

practices. As a university level student, you are expected to use appropriate references throughout and keep carefully

detailed notes of all your sources of materials for material you have used in your w ork, including any material

downloaded from the Internet. Please consult the relevant unit lecturer or your course tutor if you need any further advice.

Student Declaration

I certify that the assignment submission is entirely my own work and I fully understand the consequences of

plagiarism. I understand that making a false declaration is a form of malpractice.

Student signature: Nabil Date: 02/12/2021

BTEC Assignment Brief

Qualification Pearson BTEC Level 5 Higher National Diploma in Business

Unit or Component

number and title Unit 10: Financial Accounting

Learning aim(s)

To introduce students to essential financial accounting principles and techniques which will

enable them to record and prepare basic final accounts as well as how to prepare accounts for

sole trader, partnership and limited companies.

Assignment title Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

Assessor Mr. Lam

Vocational Scenario

or Context

You have been working in modern CPA firm for 10 years; you are also employed as a senior

accountant. You need to demonstrate different set of accounting skill for small medium

firms, such as sole trader, partnership or limited company. You lead the junior team and

mentoring them to be a professional accountant.

You need to undertake the FOUR activities on applying the double entry book-keeping

system, including the adjusting entries and prepare the final accounts. Besides, you need to

consider which regulations need to apply in preparing financial statements. Also, to identify

the differences between financial report and financial accounting. You are required to

explain certain accounting principles that should be taken into account when preparing

financial statements.

On the other hand, you need to explain what bank reconciliation is and why it is necessary

with detailed explanation of the relevant concepts and process. The preparation of bank

reconciliation statement with simulated data is required. Control and suspense accounts are

another significant area in accounting, you need to depict the nature of each of them and

analyse who can they support the preparation of financial statements. The preparation of

statement of sales ledger control account and reconciliation with sales ledger balance is

necessary.

2

Plagiarism

Plagiarism is a particular form of cheating. Plagiarism must be avoided at all costs and students who break the rules,

however innocently, may be penalised. It is your responsibility to ensure that you understand correct referencing

practices. As a university level student, you are expected to use appropriate references throughout and keep carefully

detailed notes of all your sources of materials for material you have used in your w ork, including any material

downloaded from the Internet. Please consult the relevant unit lecturer or your course tutor if you need any further advice.

Student Declaration

I certify that the assignment submission is entirely my own work and I fully understand the consequences of

plagiarism. I understand that making a false declaration is a form of malpractice.

Student signature: Nabil Date: 02/12/2021

BTEC Assignment Brief

Qualification Pearson BTEC Level 5 Higher National Diploma in Business

Unit or Component

number and title Unit 10: Financial Accounting

Learning aim(s)

To introduce students to essential financial accounting principles and techniques which will

enable them to record and prepare basic final accounts as well as how to prepare accounts for

sole trader, partnership and limited companies.

Assignment title Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

Assessor Mr. Lam

Vocational Scenario

or Context

You have been working in modern CPA firm for 10 years; you are also employed as a senior

accountant. You need to demonstrate different set of accounting skill for small medium

firms, such as sole trader, partnership or limited company. You lead the junior team and

mentoring them to be a professional accountant.

You need to undertake the FOUR activities on applying the double entry book-keeping

system, including the adjusting entries and prepare the final accounts. Besides, you need to

consider which regulations need to apply in preparing financial statements. Also, to identify

the differences between financial report and financial accounting. You are required to

explain certain accounting principles that should be taken into account when preparing

financial statements.

On the other hand, you need to explain what bank reconciliation is and why it is necessary

with detailed explanation of the relevant concepts and process. The preparation of bank

reconciliation statement with simulated data is required. Control and suspense accounts are

another significant area in accounting, you need to depict the nature of each of them and

analyse who can they support the preparation of financial statements. The preparation of

statement of sales ledger control account and reconciliation with sales ledger balance is

necessary.

2

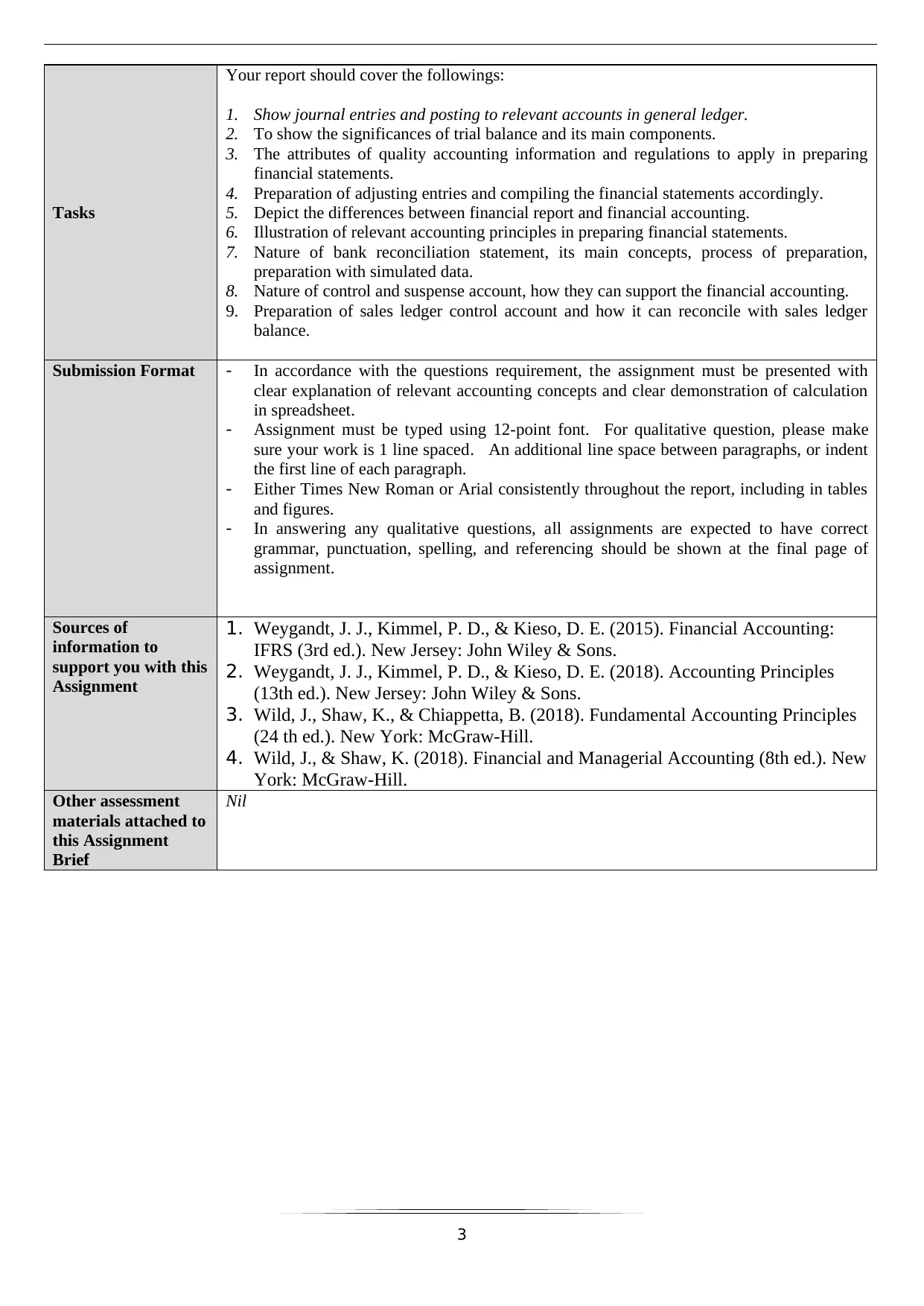

Tasks

Your report should cover the followings:

1. Show journal entries and posting to relevant accounts in general ledger.

2. To show the significances of trial balance and its main components.

3. The attributes of quality accounting information and regulations to apply in preparing

financial statements.

4. Preparation of adjusting entries and compiling the financial statements accordingly.

5. Depict the differences between financial report and financial accounting.

6. Illustration of relevant accounting principles in preparing financial statements.

7. Nature of bank reconciliation statement, its main concepts, process of preparation,

preparation with simulated data.

8. Nature of control and suspense account, how they can support the financial accounting.

9. Preparation of sales ledger control account and how it can reconcile with sales ledger

balance.

Submission Format - In accordance with the questions requirement, the assignment must be presented with

clear explanation of relevant accounting concepts and clear demonstration of calculation

in spreadsheet.

- Assignment must be typed using 12-point font. For qualitative question, please make

sure your work is 1 line spaced. An additional line space between paragraphs, or indent

the first line of each paragraph.

- Either Times New Roman or Arial consistently throughout the report, including in tables

and figures.

- In answering any qualitative questions, all assignments are expected to have correct

grammar, punctuation, spelling, and referencing should be shown at the final page of

assignment.

Sources of

information to

support you with this

Assignment

1. Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial Accounting:

IFRS (3rd ed.). New Jersey: John Wiley & Sons.

2. Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2018). Accounting Principles

(13th ed.). New Jersey: John Wiley & Sons.

3. Wild, J., Shaw, K., & Chiappetta, B. (2018). Fundamental Accounting Principles

(24 th ed.). New York: McGraw-Hill.

4. Wild, J., & Shaw, K. (2018). Financial and Managerial Accounting (8th ed.). New

York: McGraw-Hill.

Other assessment

materials attached to

this Assignment

Brief

Nil

3

Your report should cover the followings:

1. Show journal entries and posting to relevant accounts in general ledger.

2. To show the significances of trial balance and its main components.

3. The attributes of quality accounting information and regulations to apply in preparing

financial statements.

4. Preparation of adjusting entries and compiling the financial statements accordingly.

5. Depict the differences between financial report and financial accounting.

6. Illustration of relevant accounting principles in preparing financial statements.

7. Nature of bank reconciliation statement, its main concepts, process of preparation,

preparation with simulated data.

8. Nature of control and suspense account, how they can support the financial accounting.

9. Preparation of sales ledger control account and how it can reconcile with sales ledger

balance.

Submission Format - In accordance with the questions requirement, the assignment must be presented with

clear explanation of relevant accounting concepts and clear demonstration of calculation

in spreadsheet.

- Assignment must be typed using 12-point font. For qualitative question, please make

sure your work is 1 line spaced. An additional line space between paragraphs, or indent

the first line of each paragraph.

- Either Times New Roman or Arial consistently throughout the report, including in tables

and figures.

- In answering any qualitative questions, all assignments are expected to have correct

grammar, punctuation, spelling, and referencing should be shown at the final page of

assignment.

Sources of

information to

support you with this

Assignment

1. Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial Accounting:

IFRS (3rd ed.). New Jersey: John Wiley & Sons.

2. Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2018). Accounting Principles

(13th ed.). New Jersey: John Wiley & Sons.

3. Wild, J., Shaw, K., & Chiappetta, B. (2018). Fundamental Accounting Principles

(24 th ed.). New York: McGraw-Hill.

4. Wild, J., & Shaw, K. (2018). Financial and Managerial Accounting (8th ed.). New

York: McGraw-Hill.

Other assessment

materials attached to

this Assignment

Brief

Nil

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

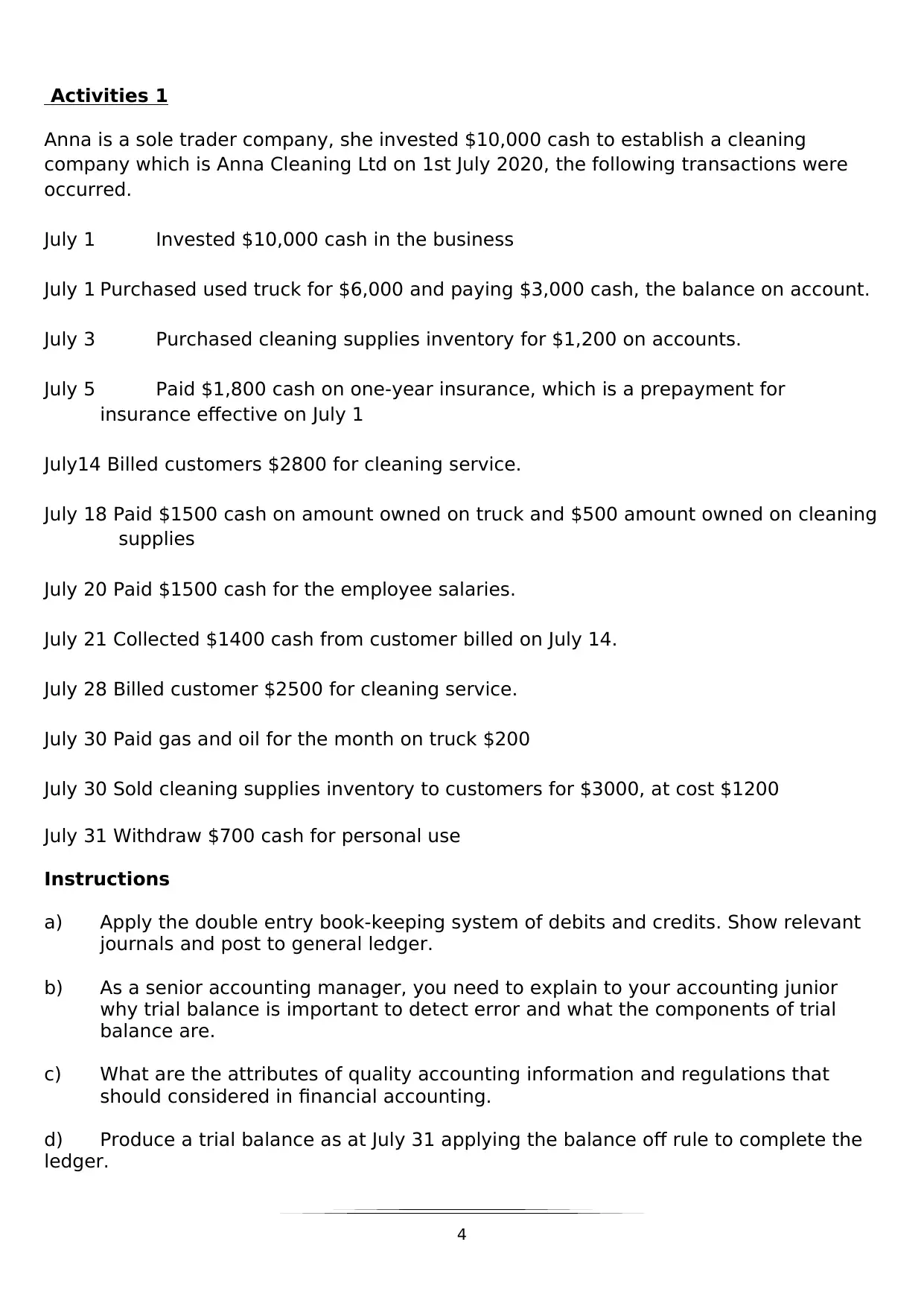

Activities 1

Anna is a sole trader company, she invested $10,000 cash to establish a cleaning

company which is Anna Cleaning Ltd on 1st July 2020, the following transactions were

occurred.

July 1 Invested $10,000 cash in the business

July 1 Purchased used truck for $6,000 and paying $3,000 cash, the balance on account.

July 3 Purchased cleaning supplies inventory for $1,200 on accounts.

July 5 Paid $1,800 cash on one-year insurance, which is a prepayment for

insurance effective on July 1

July14 Billed customers $2800 for cleaning service.

July 18 Paid $1500 cash on amount owned on truck and $500 amount owned on cleaning

supplies

July 20 Paid $1500 cash for the employee salaries.

July 21 Collected $1400 cash from customer billed on July 14.

July 28 Billed customer $2500 for cleaning service.

July 30 Paid gas and oil for the month on truck $200

July 30 Sold cleaning supplies inventory to customers for $3000, at cost $1200

July 31 Withdraw $700 cash for personal use

Instructions

a) Apply the double entry book-keeping system of debits and credits. Show relevant

journals and post to general ledger.

b) As a senior accounting manager, you need to explain to your accounting junior

why trial balance is important to detect error and what the components of trial

balance are.

c) What are the attributes of quality accounting information and regulations that

should considered in financial accounting.

d) Produce a trial balance as at July 31 applying the balance off rule to complete the

ledger.

4

Anna is a sole trader company, she invested $10,000 cash to establish a cleaning

company which is Anna Cleaning Ltd on 1st July 2020, the following transactions were

occurred.

July 1 Invested $10,000 cash in the business

July 1 Purchased used truck for $6,000 and paying $3,000 cash, the balance on account.

July 3 Purchased cleaning supplies inventory for $1,200 on accounts.

July 5 Paid $1,800 cash on one-year insurance, which is a prepayment for

insurance effective on July 1

July14 Billed customers $2800 for cleaning service.

July 18 Paid $1500 cash on amount owned on truck and $500 amount owned on cleaning

supplies

July 20 Paid $1500 cash for the employee salaries.

July 21 Collected $1400 cash from customer billed on July 14.

July 28 Billed customer $2500 for cleaning service.

July 30 Paid gas and oil for the month on truck $200

July 30 Sold cleaning supplies inventory to customers for $3000, at cost $1200

July 31 Withdraw $700 cash for personal use

Instructions

a) Apply the double entry book-keeping system of debits and credits. Show relevant

journals and post to general ledger.

b) As a senior accounting manager, you need to explain to your accounting junior

why trial balance is important to detect error and what the components of trial

balance are.

c) What are the attributes of quality accounting information and regulations that

should considered in financial accounting.

d) Produce a trial balance as at July 31 applying the balance off rule to complete the

ledger.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

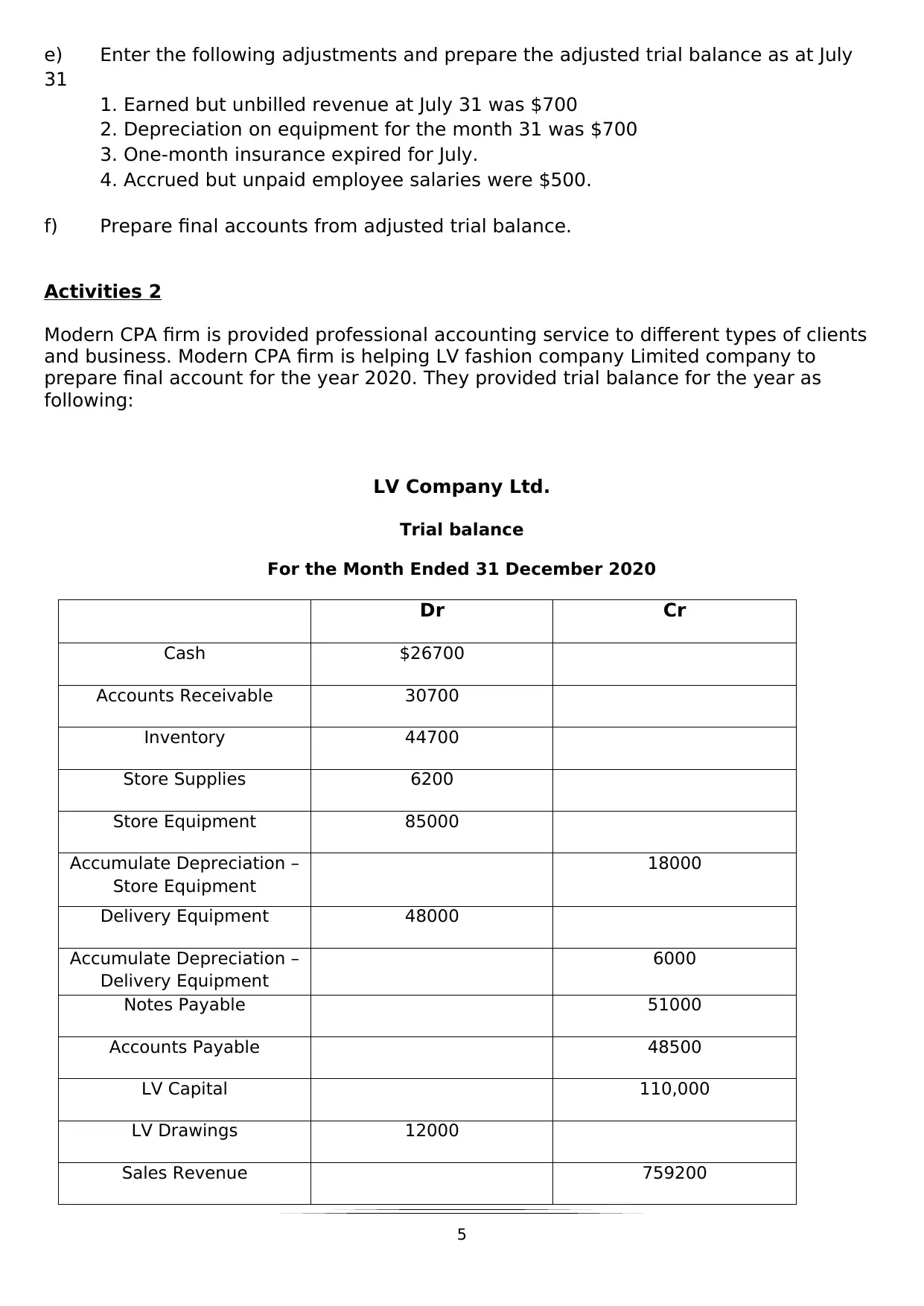

e) Enter the following adjustments and prepare the adjusted trial balance as at July

31

1. Earned but unbilled revenue at July 31 was $700

2. Depreciation on equipment for the month 31 was $700

3. One-month insurance expired for July.

4. Accrued but unpaid employee salaries were $500.

f) Prepare final accounts from adjusted trial balance.

Activities 2

Modern CPA firm is provided professional accounting service to different types of clients

and business. Modern CPA firm is helping LV fashion company Limited company to

prepare final account for the year 2020. They provided trial balance for the year as

following:

LV Company Ltd.

Trial balance

For the Month Ended 31 December 2020

Dr Cr

Cash $26700

Accounts Receivable 30700

Inventory 44700

Store Supplies 6200

Store Equipment 85000

Accumulate Depreciation –

Store Equipment

18000

Delivery Equipment 48000

Accumulate Depreciation –

Delivery Equipment

6000

Notes Payable 51000

Accounts Payable 48500

LV Capital 110,000

LV Drawings 12000

Sales Revenue 759200

5

31

1. Earned but unbilled revenue at July 31 was $700

2. Depreciation on equipment for the month 31 was $700

3. One-month insurance expired for July.

4. Accrued but unpaid employee salaries were $500.

f) Prepare final accounts from adjusted trial balance.

Activities 2

Modern CPA firm is provided professional accounting service to different types of clients

and business. Modern CPA firm is helping LV fashion company Limited company to

prepare final account for the year 2020. They provided trial balance for the year as

following:

LV Company Ltd.

Trial balance

For the Month Ended 31 December 2020

Dr Cr

Cash $26700

Accounts Receivable 30700

Inventory 44700

Store Supplies 6200

Store Equipment 85000

Accumulate Depreciation –

Store Equipment

18000

Delivery Equipment 48000

Accumulate Depreciation –

Delivery Equipment

6000

Notes Payable 51000

Accounts Payable 48500

LV Capital 110,000

LV Drawings 12000

Sales Revenue 759200

5

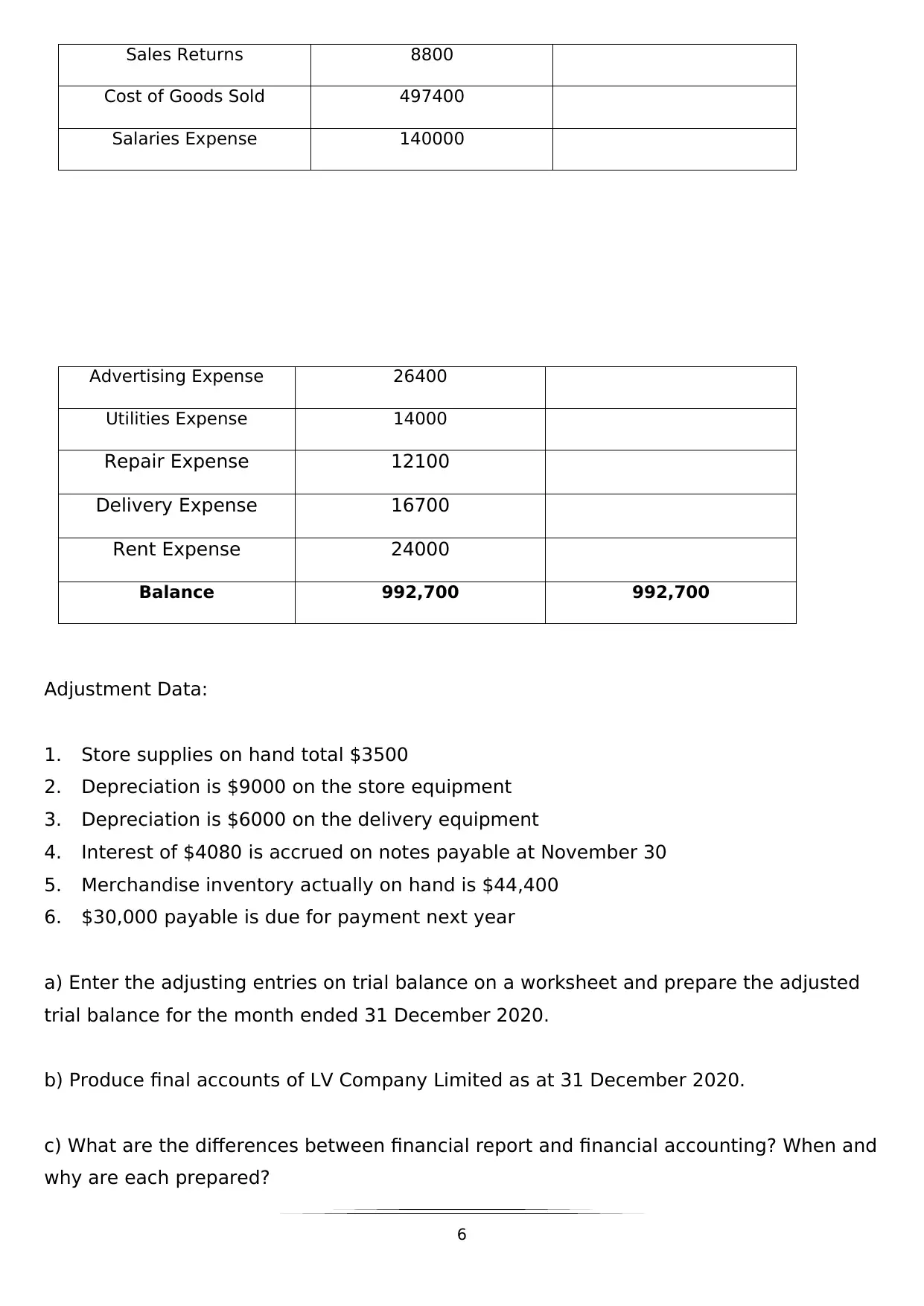

Sales Returns 8800

Cost of Goods Sold 497400

Salaries Expense 140000

Advertising Expense 26400

Utilities Expense 14000

Repair Expense 12100

Delivery Expense 16700

Rent Expense 24000

Balance 992,700 992,700

Adjustment Data:

1. Store supplies on hand total $3500

2. Depreciation is $9000 on the store equipment

3. Depreciation is $6000 on the delivery equipment

4. Interest of $4080 is accrued on notes payable at November 30

5. Merchandise inventory actually on hand is $44,400

6. $30,000 payable is due for payment next year

a) Enter the adjusting entries on trial balance on a worksheet and prepare the adjusted

trial balance for the month ended 31 December 2020.

b) Produce final accounts of LV Company Limited as at 31 December 2020.

c) What are the differences between financial report and financial accounting? When and

why are each prepared?

6

Cost of Goods Sold 497400

Salaries Expense 140000

Advertising Expense 26400

Utilities Expense 14000

Repair Expense 12100

Delivery Expense 16700

Rent Expense 24000

Balance 992,700 992,700

Adjustment Data:

1. Store supplies on hand total $3500

2. Depreciation is $9000 on the store equipment

3. Depreciation is $6000 on the delivery equipment

4. Interest of $4080 is accrued on notes payable at November 30

5. Merchandise inventory actually on hand is $44,400

6. $30,000 payable is due for payment next year

a) Enter the adjusting entries on trial balance on a worksheet and prepare the adjusted

trial balance for the month ended 31 December 2020.

b) Produce final accounts of LV Company Limited as at 31 December 2020.

c) What are the differences between financial report and financial accounting? When and

why are each prepared?

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

d) Discuss the different types of financial statement and their coverage.

e) Explain the following accounting principles

1) Consistency

2) Materiality

3) Fully disclosure

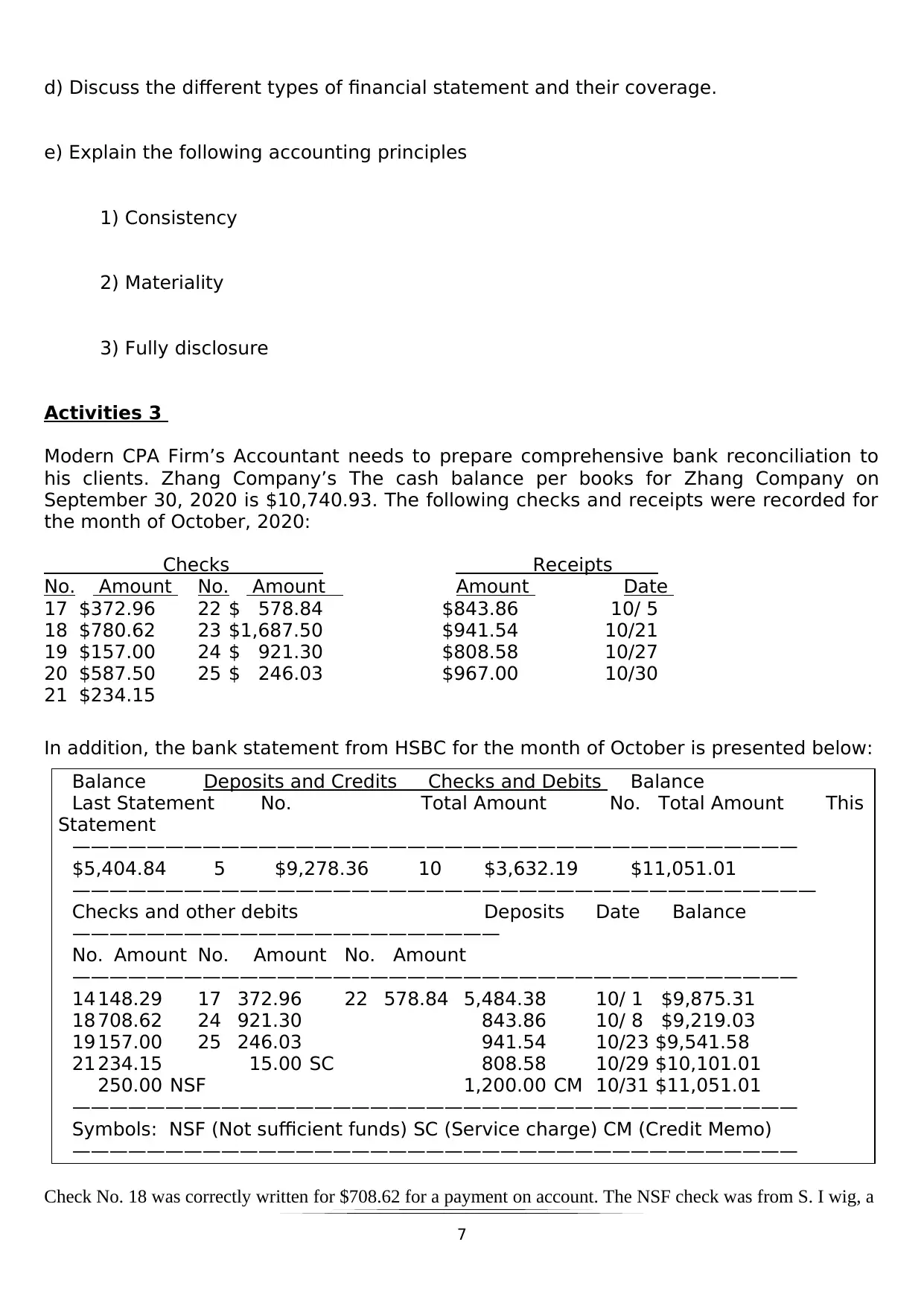

Activities 3

Modern CPA Firm’s Accountant needs to prepare comprehensive bank reconciliation to

his clients. Zhang Company’s The cash balance per books for Zhang Company on

September 30, 2020 is $10,740.93. The following checks and receipts were recorded for

the month of October, 2020:

Checks Receipts

No. Amount No. Amount Amount Date

17 $372.96 22 $ 578.84 $843.86 10/ 5

18 $780.62 23 $1,687.50 $941.54 10/21

19 $157.00 24 $ 921.30 $808.58 10/27

20 $587.50 25 $ 246.03 $967.00 10/30

21 $234.15

In addition, the bank statement from HSBC for the month of October is presented below:

Balance Deposits and Credits Checks and Debits Balance

Last Statement No. Total Amount No. Total Amount This

Statement

———————————————————————————————————————

$5,404.84 5 $9,278.36 10 $3,632.19 $11,051.01

————————————————————————————————————————

Checks and other debits Deposits Date Balance

———————————————————————

No. Amount No. Amount No. Amount

———————————————————————————————————————

14 148.29 17 372.96 22 578.84 5,484.38 10/ 1 $9,875.31

18 708.62 24 921.30 843.86 10/ 8 $9,219.03

19 157.00 25 246.03 941.54 10/23 $9,541.58

21 234.15 15.00 SC 808.58 10/29 $10,101.01

250.00 NSF 1,200.00 CM 10/31 $11,051.01

———————————————————————————————————————

Symbols: NSF (Not sufficient funds) SC (Service charge) CM (Credit Memo)

———————————————————————————————————————

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. I wig, a

7

e) Explain the following accounting principles

1) Consistency

2) Materiality

3) Fully disclosure

Activities 3

Modern CPA Firm’s Accountant needs to prepare comprehensive bank reconciliation to

his clients. Zhang Company’s The cash balance per books for Zhang Company on

September 30, 2020 is $10,740.93. The following checks and receipts were recorded for

the month of October, 2020:

Checks Receipts

No. Amount No. Amount Amount Date

17 $372.96 22 $ 578.84 $843.86 10/ 5

18 $780.62 23 $1,687.50 $941.54 10/21

19 $157.00 24 $ 921.30 $808.58 10/27

20 $587.50 25 $ 246.03 $967.00 10/30

21 $234.15

In addition, the bank statement from HSBC for the month of October is presented below:

Balance Deposits and Credits Checks and Debits Balance

Last Statement No. Total Amount No. Total Amount This

Statement

———————————————————————————————————————

$5,404.84 5 $9,278.36 10 $3,632.19 $11,051.01

————————————————————————————————————————

Checks and other debits Deposits Date Balance

———————————————————————

No. Amount No. Amount No. Amount

———————————————————————————————————————

14 148.29 17 372.96 22 578.84 5,484.38 10/ 1 $9,875.31

18 708.62 24 921.30 843.86 10/ 8 $9,219.03

19 157.00 25 246.03 941.54 10/23 $9,541.58

21 234.15 15.00 SC 808.58 10/29 $10,101.01

250.00 NSF 1,200.00 CM 10/31 $11,051.01

———————————————————————————————————————

Symbols: NSF (Not sufficient funds) SC (Service charge) CM (Credit Memo)

———————————————————————————————————————

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. I wig, a

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

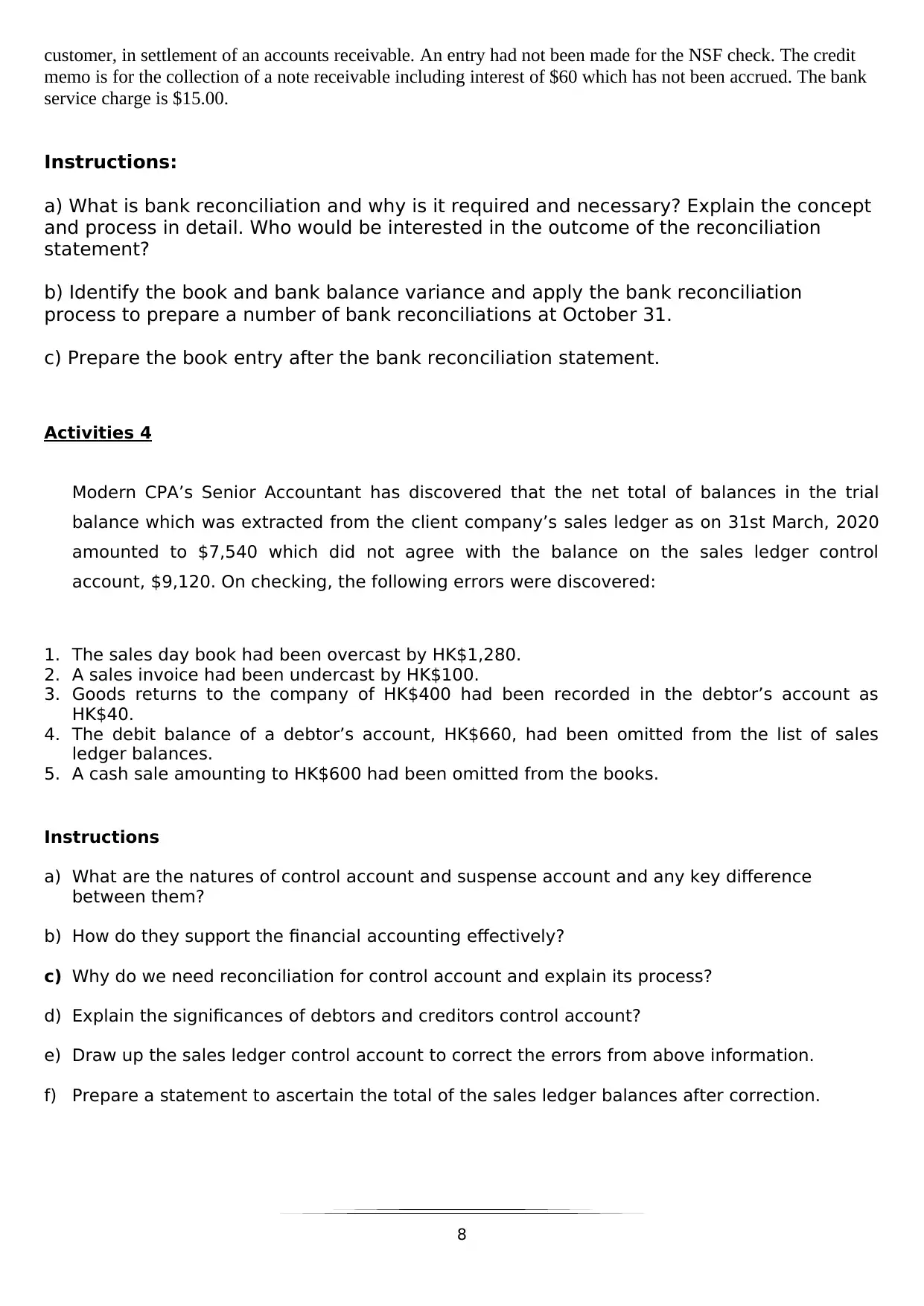

customer, in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit

memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank

service charge is $15.00.

Instructions:

a) What is bank reconciliation and why is it required and necessary? Explain the concept

and process in detail. Who would be interested in the outcome of the reconciliation

statement?

b) Identify the book and bank balance variance and apply the bank reconciliation

process to prepare a number of bank reconciliations at October 31.

c) Prepare the book entry after the bank reconciliation statement.

Activities 4

Modern CPA’s Senior Accountant has discovered that the net total of balances in the trial

balance which was extracted from the client company’s sales ledger as on 31st March, 2020

amounted to $7,540 which did not agree with the balance on the sales ledger control

account, $9,120. On checking, the following errors were discovered:

1. The sales day book had been overcast by HK$1,280.

2. A sales invoice had been undercast by HK$100.

3. Goods returns to the company of HK$400 had been recorded in the debtor’s account as

HK$40.

4. The debit balance of a debtor’s account, HK$660, had been omitted from the list of sales

ledger balances.

5. A cash sale amounting to HK$600 had been omitted from the books.

Instructions

a) What are the natures of control account and suspense account and any key difference

between them?

b) How do they support the financial accounting effectively?

c) Why do we need reconciliation for control account and explain its process?

d) Explain the significances of debtors and creditors control account?

e) Draw up the sales ledger control account to correct the errors from above information.

f) Prepare a statement to ascertain the total of the sales ledger balances after correction.

8

memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank

service charge is $15.00.

Instructions:

a) What is bank reconciliation and why is it required and necessary? Explain the concept

and process in detail. Who would be interested in the outcome of the reconciliation

statement?

b) Identify the book and bank balance variance and apply the bank reconciliation

process to prepare a number of bank reconciliations at October 31.

c) Prepare the book entry after the bank reconciliation statement.

Activities 4

Modern CPA’s Senior Accountant has discovered that the net total of balances in the trial

balance which was extracted from the client company’s sales ledger as on 31st March, 2020

amounted to $7,540 which did not agree with the balance on the sales ledger control

account, $9,120. On checking, the following errors were discovered:

1. The sales day book had been overcast by HK$1,280.

2. A sales invoice had been undercast by HK$100.

3. Goods returns to the company of HK$400 had been recorded in the debtor’s account as

HK$40.

4. The debit balance of a debtor’s account, HK$660, had been omitted from the list of sales

ledger balances.

5. A cash sale amounting to HK$600 had been omitted from the books.

Instructions

a) What are the natures of control account and suspense account and any key difference

between them?

b) How do they support the financial accounting effectively?

c) Why do we need reconciliation for control account and explain its process?

d) Explain the significances of debtors and creditors control account?

e) Draw up the sales ledger control account to correct the errors from above information.

f) Prepare a statement to ascertain the total of the sales ledger balances after correction.

8

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

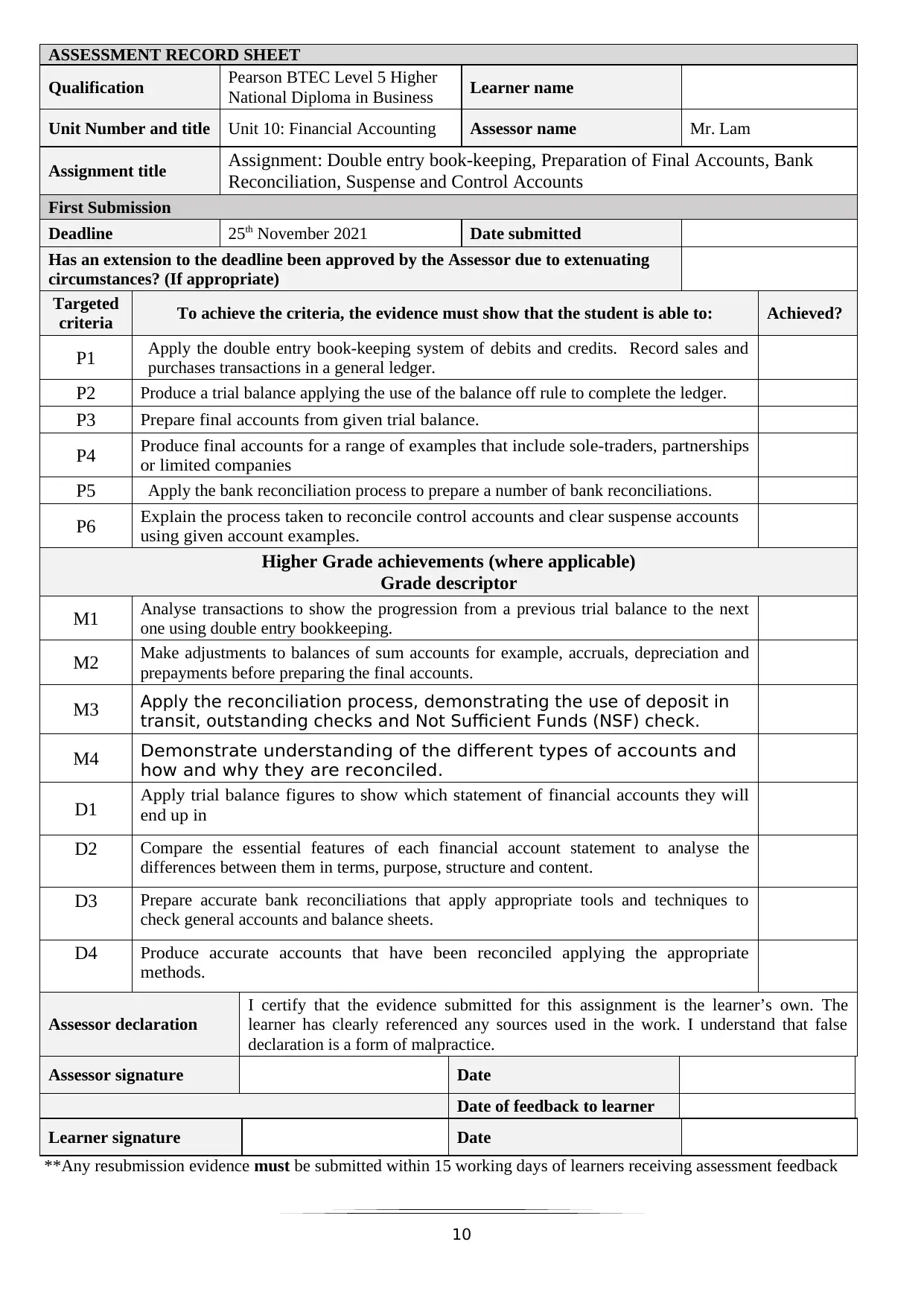

ASSESSMENT RECORD SHEET

Qualification Pearson BTEC Level 5 Higher

National Diploma in Business Learner name

Unit Number and title Unit 10: Financial Accounting Assessor name Mr. Lam

Assignment title Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

First Submission

Deadline 25th November 2021 Date submitted

Has an extension to the deadline been approved by the Assessor due to extenuating

circumstances? (If appropriate)

Targeted

criteria To achieve the criteria, the evidence must show that the student is able to: Achieved?

P1 Apply the double entry book-keeping system of debits and credits. Record sales and

purchases transactions in a general ledger.

P2 Produce a trial balance applying the use of the balance off rule to complete the ledger.

P3 Prepare final accounts from given trial balance.

P4 Produce final accounts for a range of examples that include sole-traders, partnerships

or limited companies

P5 Apply the bank reconciliation process to prepare a number of bank reconciliations.

P6 Explain the process taken to reconcile control accounts and clear suspense accounts

using given account examples.

Higher Grade achievements (where applicable)

Grade descriptor

M1 Analyse transactions to show the progression from a previous trial balance to the next

one using double entry bookkeeping.

M2 Make adjustments to balances of sum accounts for example, accruals, depreciation and

prepayments before preparing the final accounts.

M3 Apply the reconciliation process, demonstrating the use of deposit in

transit, outstanding checks and Not Sufficient Funds (NSF) check.

M4 Demonstrate understanding of the different types of accounts and

how and why they are reconciled.

D1 Apply trial balance figures to show which statement of financial accounts they will

end up in

D2 Compare the essential features of each financial account statement to analyse the

differences between them in terms, purpose, structure and content.

D3 Prepare accurate bank reconciliations that apply appropriate tools and techniques to

check general accounts and balance sheets.

D4 Produce accurate accounts that have been reconciled applying the appropriate

methods.

Assessor declaration

I certify that the evidence submitted for this assignment is the learner’s own. The

learner has clearly referenced any sources used in the work. I understand that false

declaration is a form of malpractice.

Assessor signature Date

Date of feedback to learner

Learner signature Date

**Any resubmission evidence must be submitted within 15 working days of learners receiving assessment feedback

10

Qualification Pearson BTEC Level 5 Higher

National Diploma in Business Learner name

Unit Number and title Unit 10: Financial Accounting Assessor name Mr. Lam

Assignment title Assignment: Double entry book-keeping, Preparation of Final Accounts, Bank

Reconciliation, Suspense and Control Accounts

First Submission

Deadline 25th November 2021 Date submitted

Has an extension to the deadline been approved by the Assessor due to extenuating

circumstances? (If appropriate)

Targeted

criteria To achieve the criteria, the evidence must show that the student is able to: Achieved?

P1 Apply the double entry book-keeping system of debits and credits. Record sales and

purchases transactions in a general ledger.

P2 Produce a trial balance applying the use of the balance off rule to complete the ledger.

P3 Prepare final accounts from given trial balance.

P4 Produce final accounts for a range of examples that include sole-traders, partnerships

or limited companies

P5 Apply the bank reconciliation process to prepare a number of bank reconciliations.

P6 Explain the process taken to reconcile control accounts and clear suspense accounts

using given account examples.

Higher Grade achievements (where applicable)

Grade descriptor

M1 Analyse transactions to show the progression from a previous trial balance to the next

one using double entry bookkeeping.

M2 Make adjustments to balances of sum accounts for example, accruals, depreciation and

prepayments before preparing the final accounts.

M3 Apply the reconciliation process, demonstrating the use of deposit in

transit, outstanding checks and Not Sufficient Funds (NSF) check.

M4 Demonstrate understanding of the different types of accounts and

how and why they are reconciled.

D1 Apply trial balance figures to show which statement of financial accounts they will

end up in

D2 Compare the essential features of each financial account statement to analyse the

differences between them in terms, purpose, structure and content.

D3 Prepare accurate bank reconciliations that apply appropriate tools and techniques to

check general accounts and balance sheets.

D4 Produce accurate accounts that have been reconciled applying the appropriate

methods.

Assessor declaration

I certify that the evidence submitted for this assignment is the learner’s own. The

learner has clearly referenced any sources used in the work. I understand that false

declaration is a form of malpractice.

Assessor signature Date

Date of feedback to learner

Learner signature Date

**Any resubmission evidence must be submitted within 15 working days of learners receiving assessment feedback

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

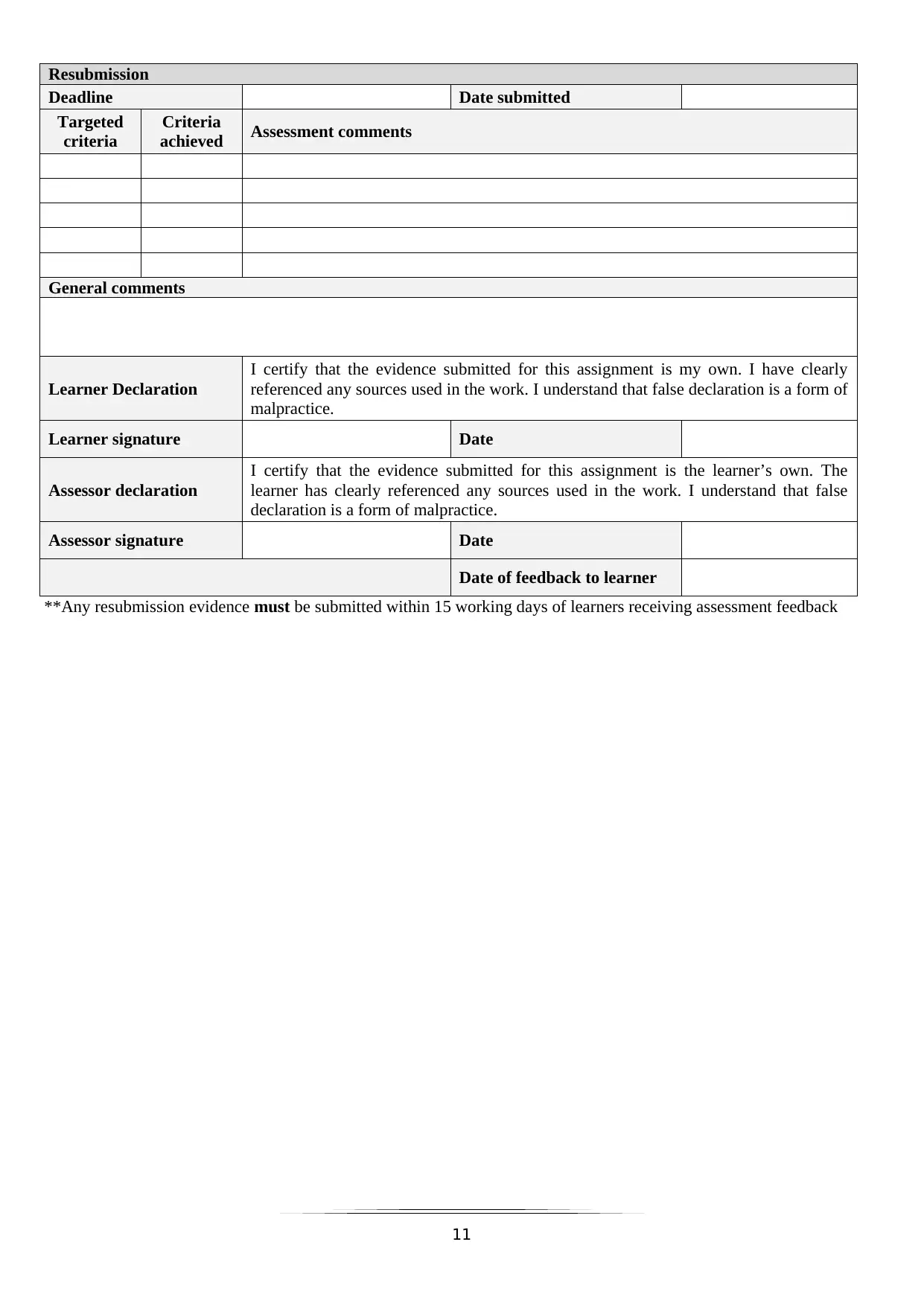

Resubmission

Deadline Date submitted

Targeted

criteria

Criteria

achieved Assessment comments

General comments

Learner Declaration

I certify that the evidence submitted for this assignment is my own. I have clearly

referenced any sources used in the work. I understand that false declaration is a form of

malpractice.

Learner signature Date

Assessor declaration

I certify that the evidence submitted for this assignment is the learner’s own. The

learner has clearly referenced any sources used in the work. I understand that false

declaration is a form of malpractice.

Assessor signature Date

Date of feedback to learner

**Any resubmission evidence must be submitted within 15 working days of learners receiving assessment feedback

11

Deadline Date submitted

Targeted

criteria

Criteria

achieved Assessment comments

General comments

Learner Declaration

I certify that the evidence submitted for this assignment is my own. I have clearly

referenced any sources used in the work. I understand that false declaration is a form of

malpractice.

Learner signature Date

Assessor declaration

I certify that the evidence submitted for this assignment is the learner’s own. The

learner has clearly referenced any sources used in the work. I understand that false

declaration is a form of malpractice.

Assessor signature Date

Date of feedback to learner

**Any resubmission evidence must be submitted within 15 working days of learners receiving assessment feedback

11

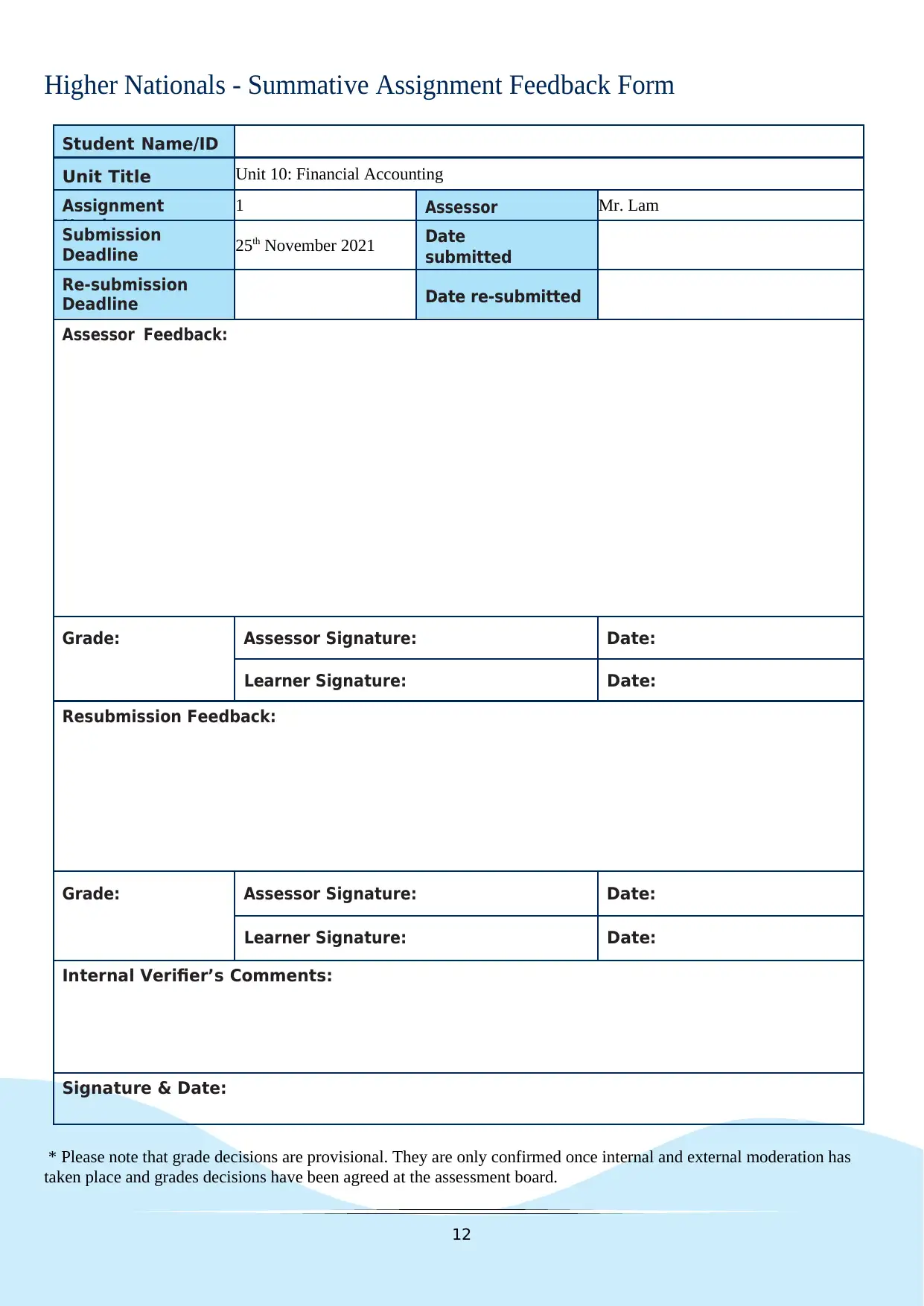

Higher Nationals - Summative Assignment Feedback Form

Student Name/ID

Unit Title Unit 10: Financial Accounting

Assignment

Number

1 Assessor Mr. Lam

Submission

Deadline 25th November 2021 Date

submitted

Re-submission

Deadline Date re-submitted

Assessor Feedback:

Grade: Assessor Signature: Date:

Learner Signature: Date:

Resubmission Feedback:

Grade: Assessor Signature: Date:

Learner Signature: Date:

Internal Verifier’s Comments:

Signature & Date:

* Please note that grade decisions are provisional. They are only confirmed once internal and external moderation has

taken place and grades decisions have been agreed at the assessment board.

12

Student Name/ID

Unit Title Unit 10: Financial Accounting

Assignment

Number

1 Assessor Mr. Lam

Submission

Deadline 25th November 2021 Date

submitted

Re-submission

Deadline Date re-submitted

Assessor Feedback:

Grade: Assessor Signature: Date:

Learner Signature: Date:

Resubmission Feedback:

Grade: Assessor Signature: Date:

Learner Signature: Date:

Internal Verifier’s Comments:

Signature & Date:

* Please note that grade decisions are provisional. They are only confirmed once internal and external moderation has

taken place and grades decisions have been agreed at the assessment board.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 33

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.