Financial Accounting Report: Clients' Financial Data Analysis

VerifiedAdded on 2021/02/21

|30

|4790

|26

Homework Assignment

AI Summary

This financial accounting report provides a comprehensive overview of various accounting concepts and their practical applications. It begins by defining financial accounting and its purpose, emphasizing the importance of financial information for both internal and external stakeholders. The report delves into the specifics of accounting treatments for multiple clients, including journal entries, ledger accounts, and trial balances. It covers the preparation of profit statements and balance sheets, along with the application of accounting principles like consistency and prudence. The report also explores depreciation methods, the differences between financial statements of sole proprietorships and limited companies, and the process of bank reconciliation. Furthermore, it explains the purpose of control accounts, suspense accounts, and the rectification of errors in financial records. The report provides practical examples and analyses to illustrate these concepts, offering a thorough understanding of financial accounting principles and practices.

FINANCIAL

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

A) Define financial accounting and its purpose.....................................................................4

B) External and internal stakeholders and their interest in financial information of

organisation............................................................................................................................1

CLIENT 1........................................................................................................................................2

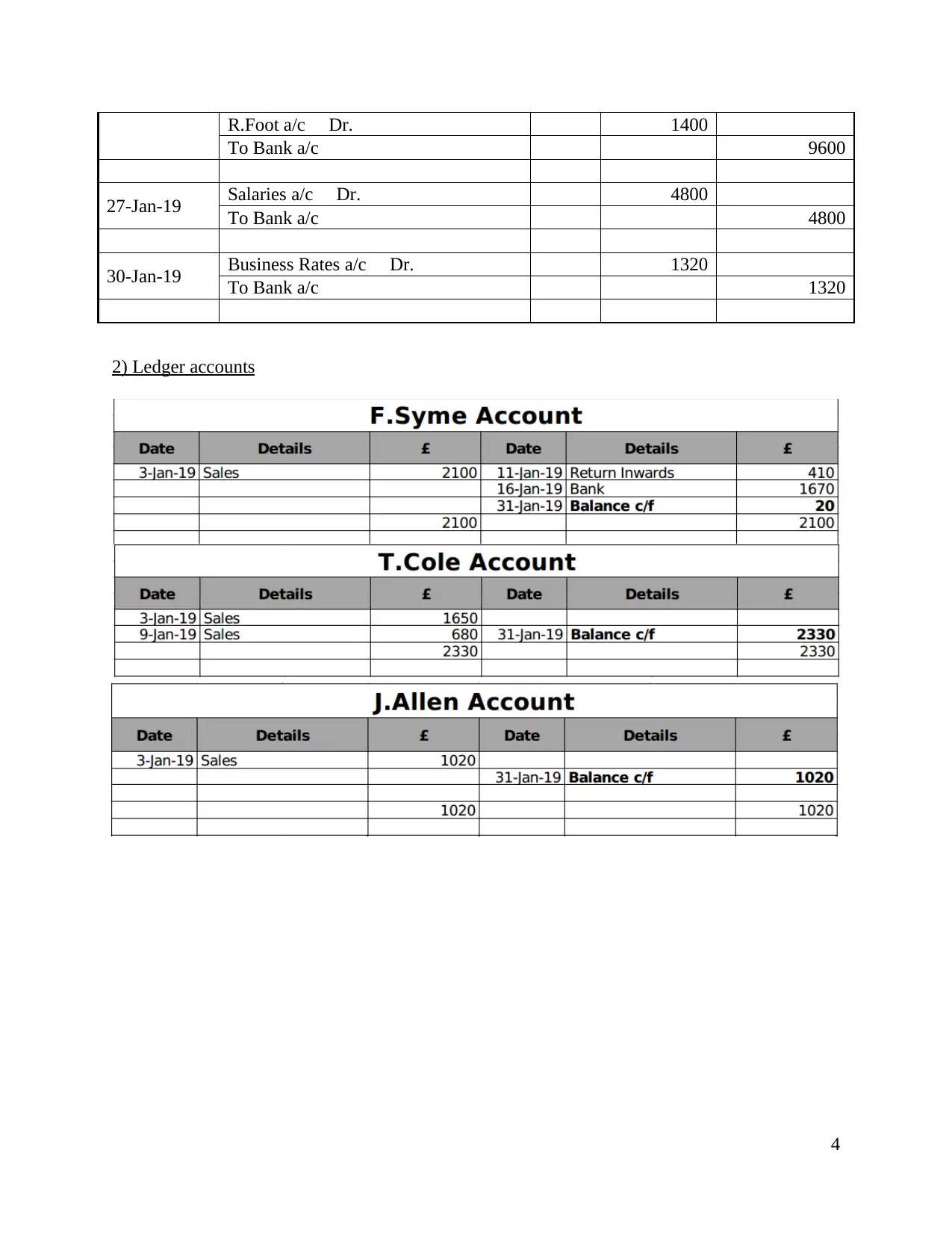

1) Journal entries....................................................................................................................2

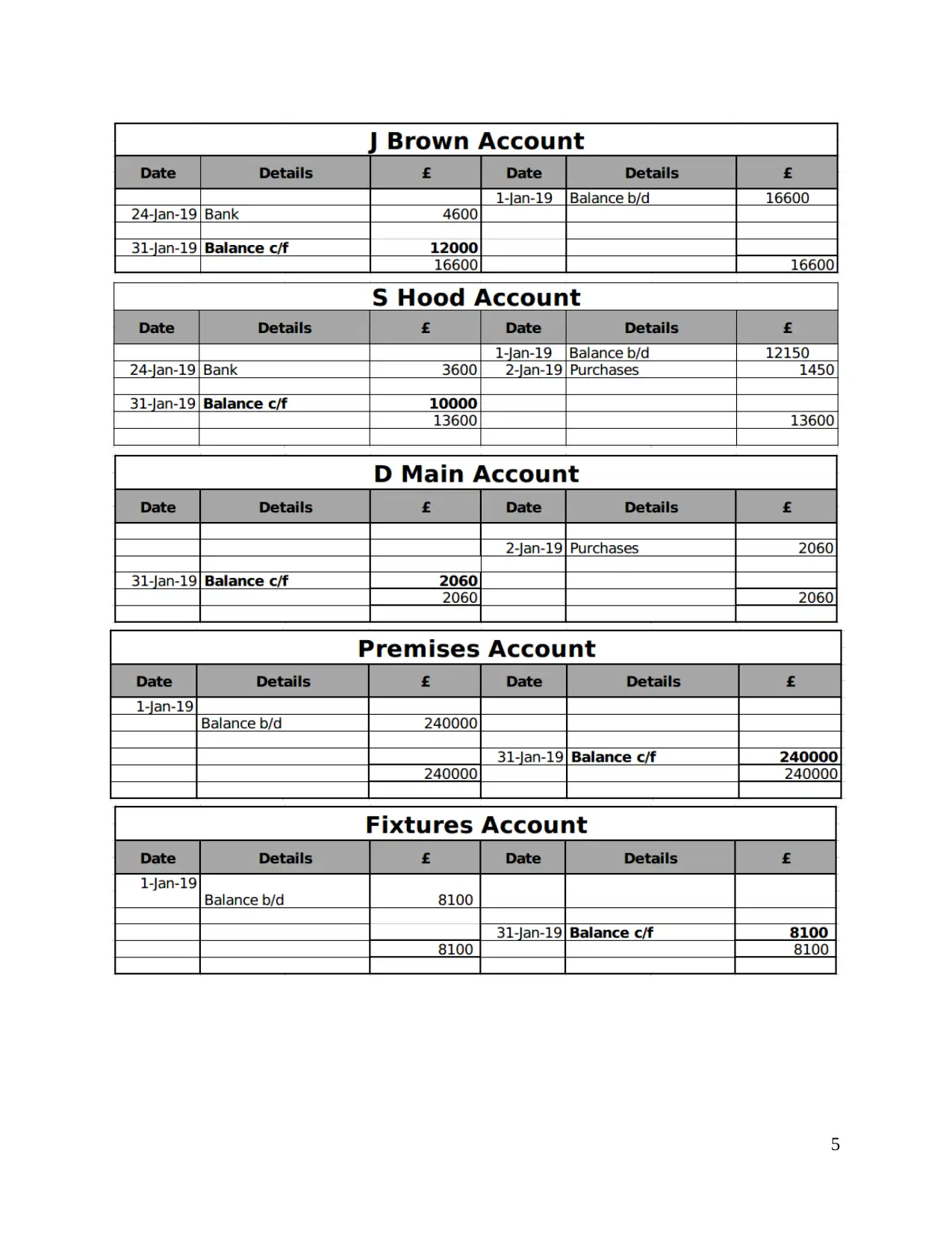

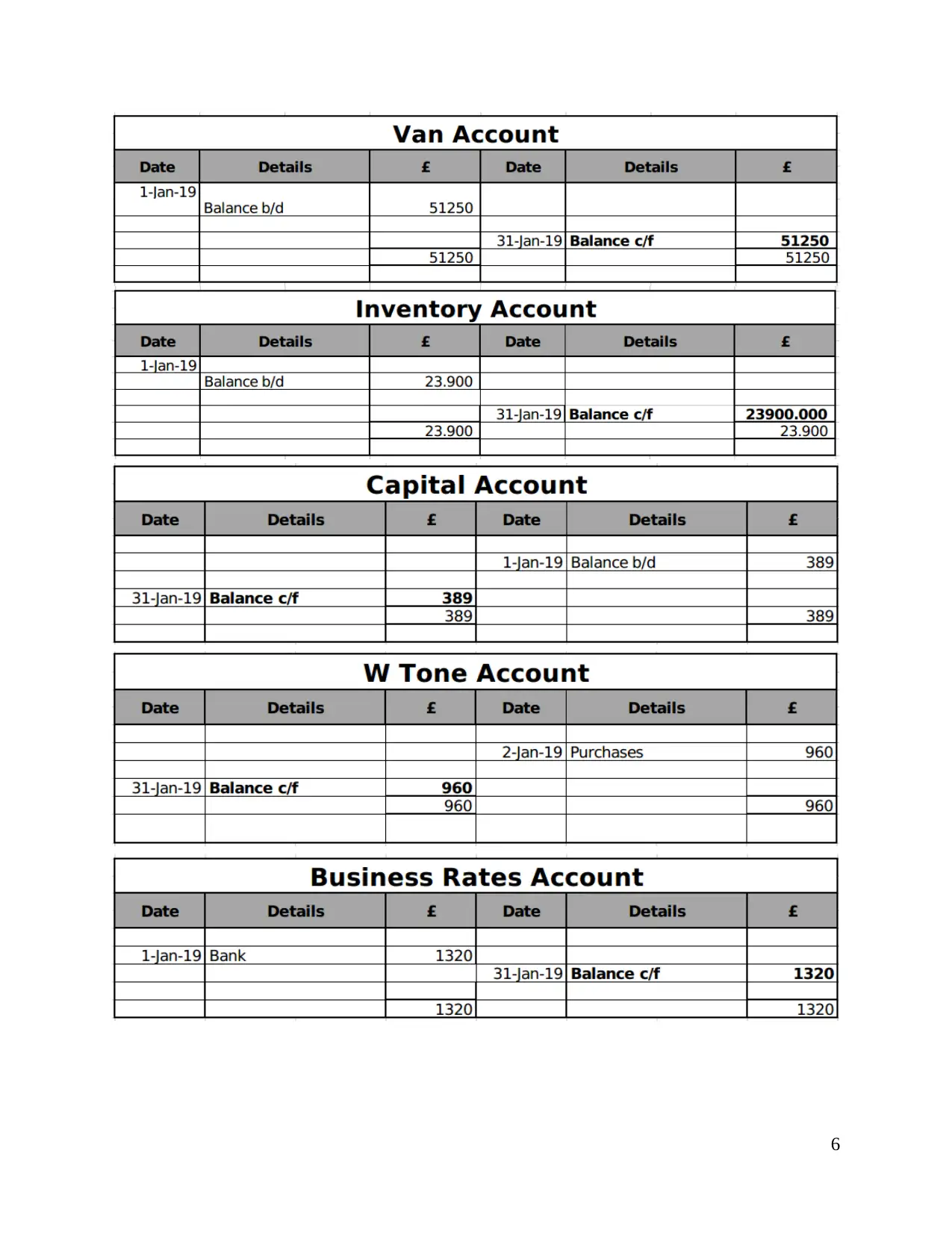

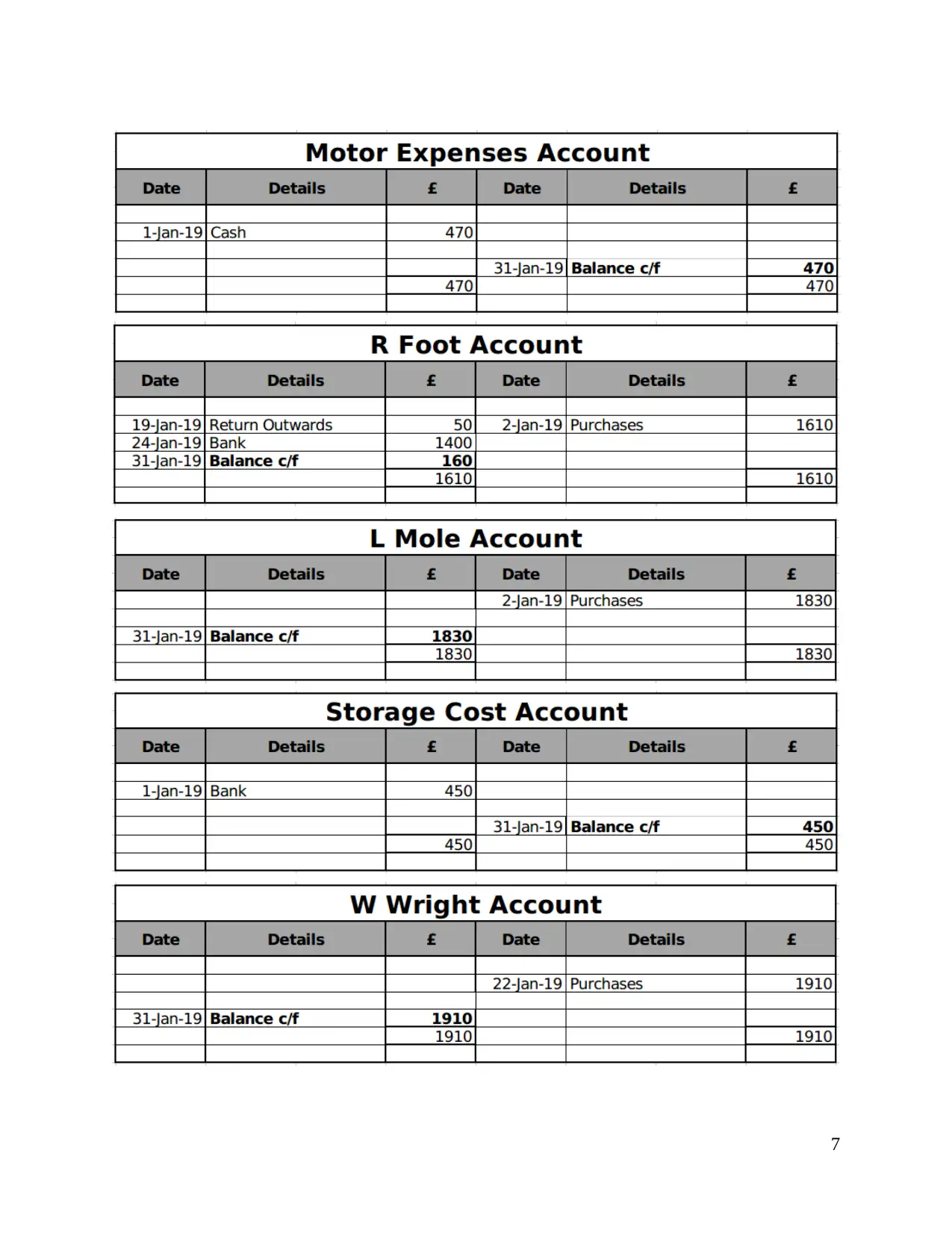

2) Ledger accounts.................................................................................................................4

3) Trial Balance....................................................................................................................12

CLIENT 2......................................................................................................................................13

A) Profit statement ..............................................................................................................13

B) Balance sheet...................................................................................................................13

C) Consistency and prudence concepts................................................................................14

Consistency...........................................................................................................................14

Prudence...............................................................................................................................15

D) Depreciation objectives and methods of calculating depreciation..................................15

E) Distinguish between final report of sole proprietorship and limited companies.............16

CLIENT 3.....................................................................................................................................17

A) Meaning and purpose of BRS.........................................................................................17

B) Reasons of difference between cash and bank statements..............................................17

C) Concept of imprest under system of petty cash...............................................................18

D) Bank Reconciliation Statement of Burcu ltd...................................................................19

CLIENT 4......................................................................................................................................20

A) Sales and purchase ledger account .................................................................................20

B) control account................................................................................................................21

CLIENT 5......................................................................................................................................21

A) Suspense account and its characteristics.........................................................................21

B) Trial balance ...................................................................................................................22

c. Rectifying errors ..............................................................................................................22

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

A) Define financial accounting and its purpose.....................................................................4

B) External and internal stakeholders and their interest in financial information of

organisation............................................................................................................................1

CLIENT 1........................................................................................................................................2

1) Journal entries....................................................................................................................2

2) Ledger accounts.................................................................................................................4

3) Trial Balance....................................................................................................................12

CLIENT 2......................................................................................................................................13

A) Profit statement ..............................................................................................................13

B) Balance sheet...................................................................................................................13

C) Consistency and prudence concepts................................................................................14

Consistency...........................................................................................................................14

Prudence...............................................................................................................................15

D) Depreciation objectives and methods of calculating depreciation..................................15

E) Distinguish between final report of sole proprietorship and limited companies.............16

CLIENT 3.....................................................................................................................................17

A) Meaning and purpose of BRS.........................................................................................17

B) Reasons of difference between cash and bank statements..............................................17

C) Concept of imprest under system of petty cash...............................................................18

D) Bank Reconciliation Statement of Burcu ltd...................................................................19

CLIENT 4......................................................................................................................................20

A) Sales and purchase ledger account .................................................................................20

B) control account................................................................................................................21

CLIENT 5......................................................................................................................................21

A) Suspense account and its characteristics.........................................................................21

B) Trial balance ...................................................................................................................22

c. Rectifying errors ..............................................................................................................22

CONCLUSION..............................................................................................................................24

REFERENCES..............................................................................................................................25

REFERENCES..............................................................................................................................25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial accounting is a branch of accounting which records the financial transactions

of the organization so that this financial information can be presented to creditors, investors and

many other people outside the organisation. In this file ,includes the data of financial activities

of clients are available for accounting treatment during the year. With the available information

financial statements & trial balance are prepared (May, 2013). Brief description over accounting

concept which include consistency , prudence . This report explains various objectives of

calculating depreciation and also methods of depreciation that an accountant can choose for

computing depreciation. Apart from that it also determines the difference or comparison between

financial statements of sole trader and limited companies. This study includes the preparation of

bank and cash statements and their purpose and the reasons of differences between cash and

bank statements. It also describes the term imprest used in the petty cash system. And in the end

this report ascertains the meaning of control account, suspense account and its characteristics.

MAIN BODY

A) Define financial accounting and its purpose.

The term financial accounting is like a branch of the accounting, in which only financial

transactions are take into consideration or recorded. In financial accounting only those

transactions should be recorded which has its financial impact on the entity. Financial accounting

serves the financial information to its users which includes various external and internal

stakeholders and then users of the financial informations get such information from the financial

statements which can be beneficial for them. However the financial statements may include

balance sheet, cash flows statements, income statements and statements of shareholders' equity

(Sharma and Panigrahi, 2013).

The financial statements of a company play an important role in the organization, they

need to prepare it for a specified period which is decided by the management. The period of

making financial statements is generally of one financial year, but in case of large companies the

financial statements can be prepared quarterly or monthly as well. So the preparation and

presentation of financial statements is required to comply with various standardized principles,

concepts, guidelines, assumptions and conventions. The various purposes of financial accounting

is stated as below:-

Financial accounting is a branch of accounting which records the financial transactions

of the organization so that this financial information can be presented to creditors, investors and

many other people outside the organisation. In this file ,includes the data of financial activities

of clients are available for accounting treatment during the year. With the available information

financial statements & trial balance are prepared (May, 2013). Brief description over accounting

concept which include consistency , prudence . This report explains various objectives of

calculating depreciation and also methods of depreciation that an accountant can choose for

computing depreciation. Apart from that it also determines the difference or comparison between

financial statements of sole trader and limited companies. This study includes the preparation of

bank and cash statements and their purpose and the reasons of differences between cash and

bank statements. It also describes the term imprest used in the petty cash system. And in the end

this report ascertains the meaning of control account, suspense account and its characteristics.

MAIN BODY

A) Define financial accounting and its purpose.

The term financial accounting is like a branch of the accounting, in which only financial

transactions are take into consideration or recorded. In financial accounting only those

transactions should be recorded which has its financial impact on the entity. Financial accounting

serves the financial information to its users which includes various external and internal

stakeholders and then users of the financial informations get such information from the financial

statements which can be beneficial for them. However the financial statements may include

balance sheet, cash flows statements, income statements and statements of shareholders' equity

(Sharma and Panigrahi, 2013).

The financial statements of a company play an important role in the organization, they

need to prepare it for a specified period which is decided by the management. The period of

making financial statements is generally of one financial year, but in case of large companies the

financial statements can be prepared quarterly or monthly as well. So the preparation and

presentation of financial statements is required to comply with various standardized principles,

concepts, guidelines, assumptions and conventions. The various purposes of financial accounting

is stated as below:-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

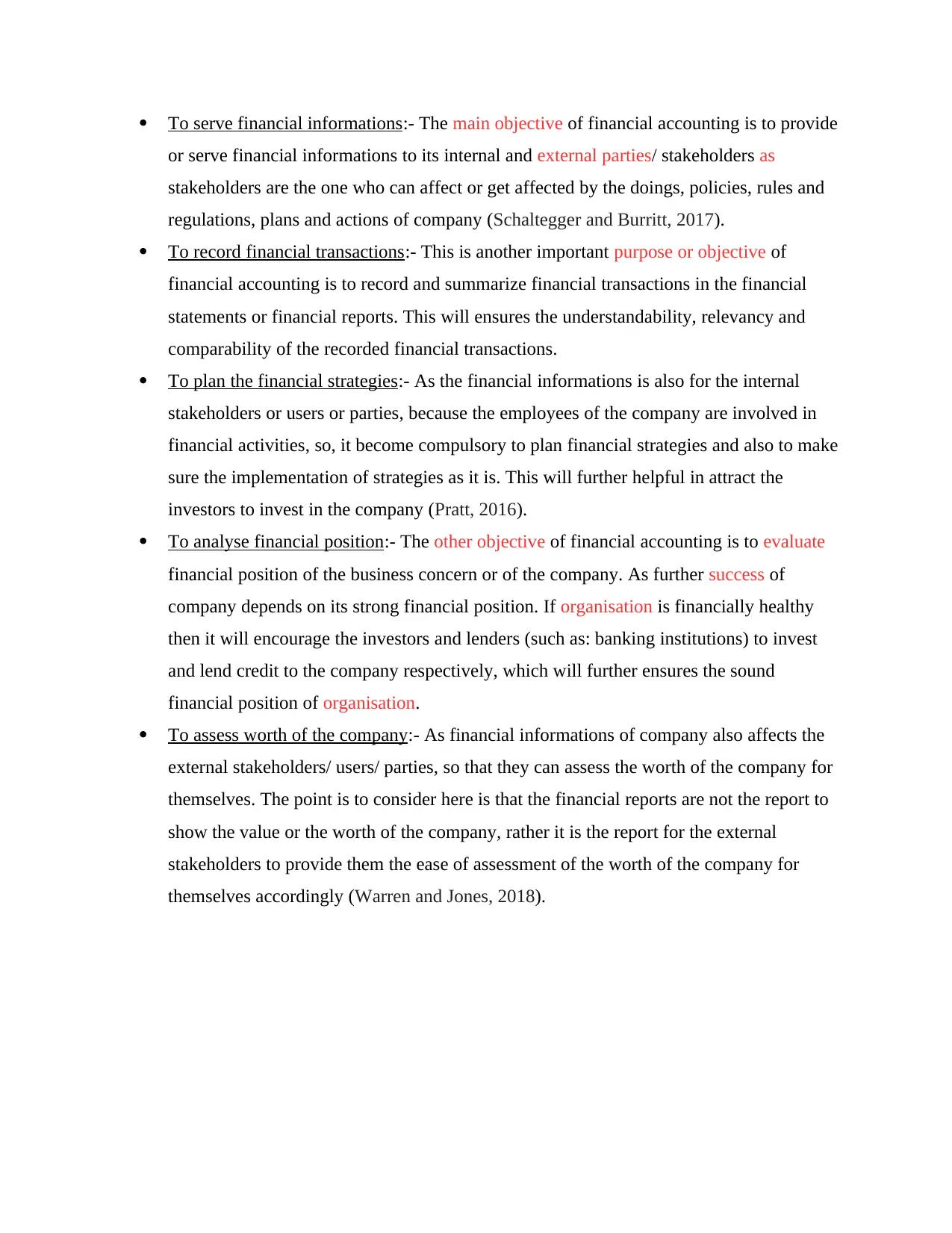

To serve financial informations:- The main objective of financial accounting is to provide

or serve financial informations to its internal and external parties/ stakeholders as

stakeholders are the one who can affect or get affected by the doings, policies, rules and

regulations, plans and actions of company (Schaltegger and Burritt, 2017).

To record financial transactions:- This is another important purpose or objective of

financial accounting is to record and summarize financial transactions in the financial

statements or financial reports. This will ensures the understandability, relevancy and

comparability of the recorded financial transactions.

To plan the financial strategies:- As the financial informations is also for the internal

stakeholders or users or parties, because the employees of the company are involved in

financial activities, so, it become compulsory to plan financial strategies and also to make

sure the implementation of strategies as it is. This will further helpful in attract the

investors to invest in the company (Pratt, 2016).

To analyse financial position:- The other objective of financial accounting is to evaluate

financial position of the business concern or of the company. As further success of

company depends on its strong financial position. If organisation is financially healthy

then it will encourage the investors and lenders (such as: banking institutions) to invest

and lend credit to the company respectively, which will further ensures the sound

financial position of organisation.

To assess worth of the company:- As financial informations of company also affects the

external stakeholders/ users/ parties, so that they can assess the worth of the company for

themselves. The point is to consider here is that the financial reports are not the report to

show the value or the worth of the company, rather it is the report for the external

stakeholders to provide them the ease of assessment of the worth of the company for

themselves accordingly (Warren and Jones, 2018).

or serve financial informations to its internal and external parties/ stakeholders as

stakeholders are the one who can affect or get affected by the doings, policies, rules and

regulations, plans and actions of company (Schaltegger and Burritt, 2017).

To record financial transactions:- This is another important purpose or objective of

financial accounting is to record and summarize financial transactions in the financial

statements or financial reports. This will ensures the understandability, relevancy and

comparability of the recorded financial transactions.

To plan the financial strategies:- As the financial informations is also for the internal

stakeholders or users or parties, because the employees of the company are involved in

financial activities, so, it become compulsory to plan financial strategies and also to make

sure the implementation of strategies as it is. This will further helpful in attract the

investors to invest in the company (Pratt, 2016).

To analyse financial position:- The other objective of financial accounting is to evaluate

financial position of the business concern or of the company. As further success of

company depends on its strong financial position. If organisation is financially healthy

then it will encourage the investors and lenders (such as: banking institutions) to invest

and lend credit to the company respectively, which will further ensures the sound

financial position of organisation.

To assess worth of the company:- As financial informations of company also affects the

external stakeholders/ users/ parties, so that they can assess the worth of the company for

themselves. The point is to consider here is that the financial reports are not the report to

show the value or the worth of the company, rather it is the report for the external

stakeholders to provide them the ease of assessment of the worth of the company for

themselves accordingly (Warren and Jones, 2018).

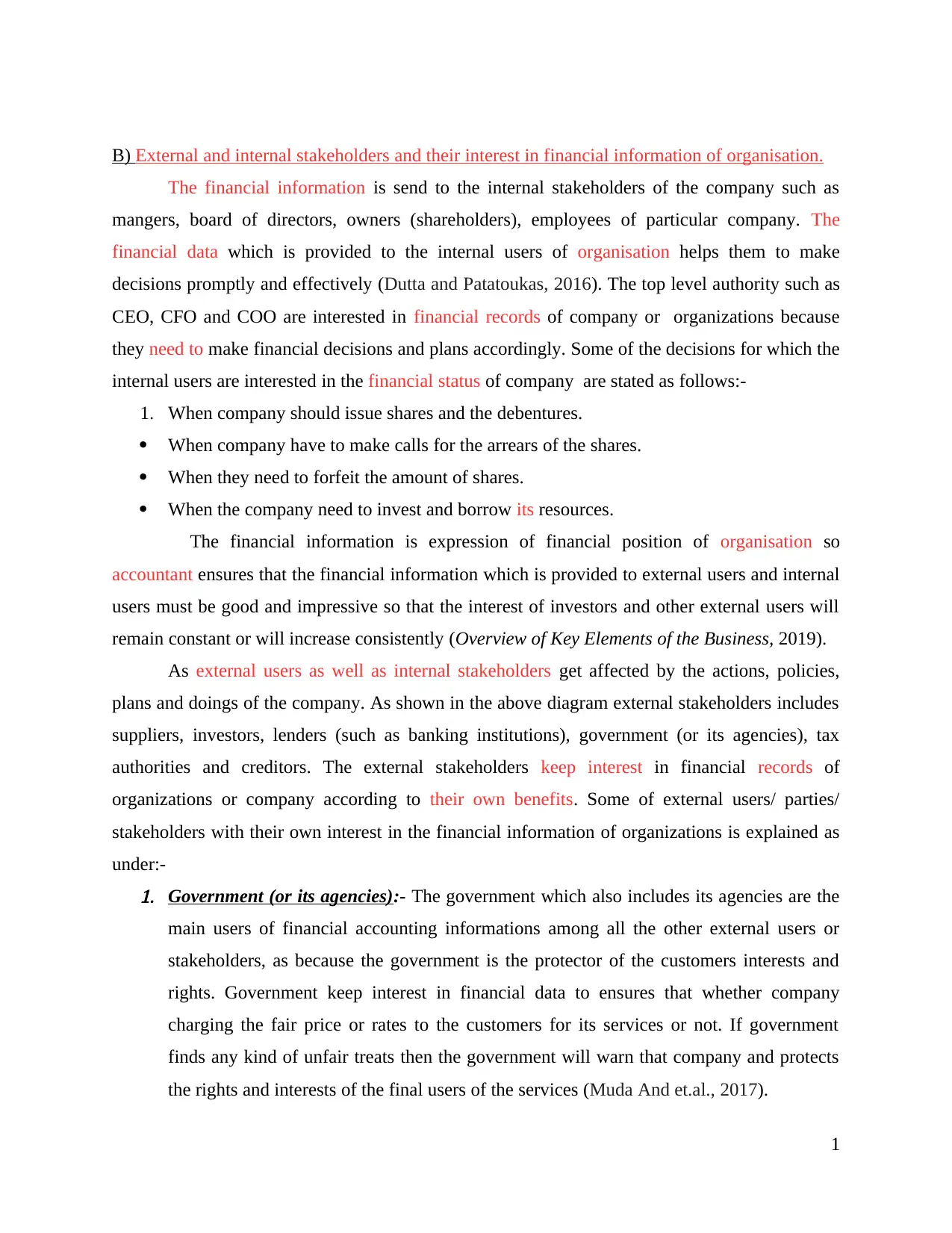

B) External and internal stakeholders and their interest in financial information of organisation.

The financial information is send to the internal stakeholders of the company such as

mangers, board of directors, owners (shareholders), employees of particular company. The

financial data which is provided to the internal users of organisation helps them to make

decisions promptly and effectively (Dutta and Patatoukas, 2016). The top level authority such as

CEO, CFO and COO are interested in financial records of company or organizations because

they need to make financial decisions and plans accordingly. Some of the decisions for which the

internal users are interested in the financial status of company are stated as follows:-

1. When company should issue shares and the debentures.

When company have to make calls for the arrears of the shares.

When they need to forfeit the amount of shares.

When the company need to invest and borrow its resources.

The financial information is expression of financial position of organisation so

accountant ensures that the financial information which is provided to external users and internal

users must be good and impressive so that the interest of investors and other external users will

remain constant or will increase consistently (Overview of Key Elements of the Business, 2019).

As external users as well as internal stakeholders get affected by the actions, policies,

plans and doings of the company. As shown in the above diagram external stakeholders includes

suppliers, investors, lenders (such as banking institutions), government (or its agencies), tax

authorities and creditors. The external stakeholders keep interest in financial records of

organizations or company according to their own benefits. Some of external users/ parties/

stakeholders with their own interest in the financial information of organizations is explained as

under:-1. Government (or its agencies):- The government which also includes its agencies are the

main users of financial accounting informations among all the other external users or

stakeholders, as because the government is the protector of the customers interests and

rights. Government keep interest in financial data to ensures that whether company

charging the fair price or rates to the customers for its services or not. If government

finds any kind of unfair treats then the government will warn that company and protects

the rights and interests of the final users of the services (Muda And et.al., 2017).

1

The financial information is send to the internal stakeholders of the company such as

mangers, board of directors, owners (shareholders), employees of particular company. The

financial data which is provided to the internal users of organisation helps them to make

decisions promptly and effectively (Dutta and Patatoukas, 2016). The top level authority such as

CEO, CFO and COO are interested in financial records of company or organizations because

they need to make financial decisions and plans accordingly. Some of the decisions for which the

internal users are interested in the financial status of company are stated as follows:-

1. When company should issue shares and the debentures.

When company have to make calls for the arrears of the shares.

When they need to forfeit the amount of shares.

When the company need to invest and borrow its resources.

The financial information is expression of financial position of organisation so

accountant ensures that the financial information which is provided to external users and internal

users must be good and impressive so that the interest of investors and other external users will

remain constant or will increase consistently (Overview of Key Elements of the Business, 2019).

As external users as well as internal stakeholders get affected by the actions, policies,

plans and doings of the company. As shown in the above diagram external stakeholders includes

suppliers, investors, lenders (such as banking institutions), government (or its agencies), tax

authorities and creditors. The external stakeholders keep interest in financial records of

organizations or company according to their own benefits. Some of external users/ parties/

stakeholders with their own interest in the financial information of organizations is explained as

under:-1. Government (or its agencies):- The government which also includes its agencies are the

main users of financial accounting informations among all the other external users or

stakeholders, as because the government is the protector of the customers interests and

rights. Government keep interest in financial data to ensures that whether company

charging the fair price or rates to the customers for its services or not. If government

finds any kind of unfair treats then the government will warn that company and protects

the rights and interests of the final users of the services (Muda And et.al., 2017).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Investors:- The main motive of the management team of the company or the accountants

is to attract the investors and make the interests of the investors to keep investing in the

organizations. Investors are attentive to know financial status of company for the heavy

return in return. If there is profit in investing in the company and the investors will gets

the good return against the investment then they will invest in that concerned company.

Investors also need the financial data to ascertain financial position of organization

whether they have to invest in that company or not, whether it will be beneficial to invest

in the concerned company or not.3. Lenders (such as banking institutions):- Lenders are also the major stakeholders of

companies as they want to know creditability of the company. Whether the company can

repay the loan amount with interest. Is the company is capable enough to pay its debts

and liabilities. Lenders lends money or finance to organisation based on financial reports

issued by the company. This is why lenders have interest in financial position of the

company through financial reports (Muda And et.al., 2017).

4. Tax authorities:- The tax authorities also focus on financial data of company because

they want to know that tax which is paid by the company is according to its financial

position or the less amount is paid by the company. Is the company is hiding any profits

or truth from the tax authorities. Is company is stealing the tax or pays the correct or right

amount of the tax.

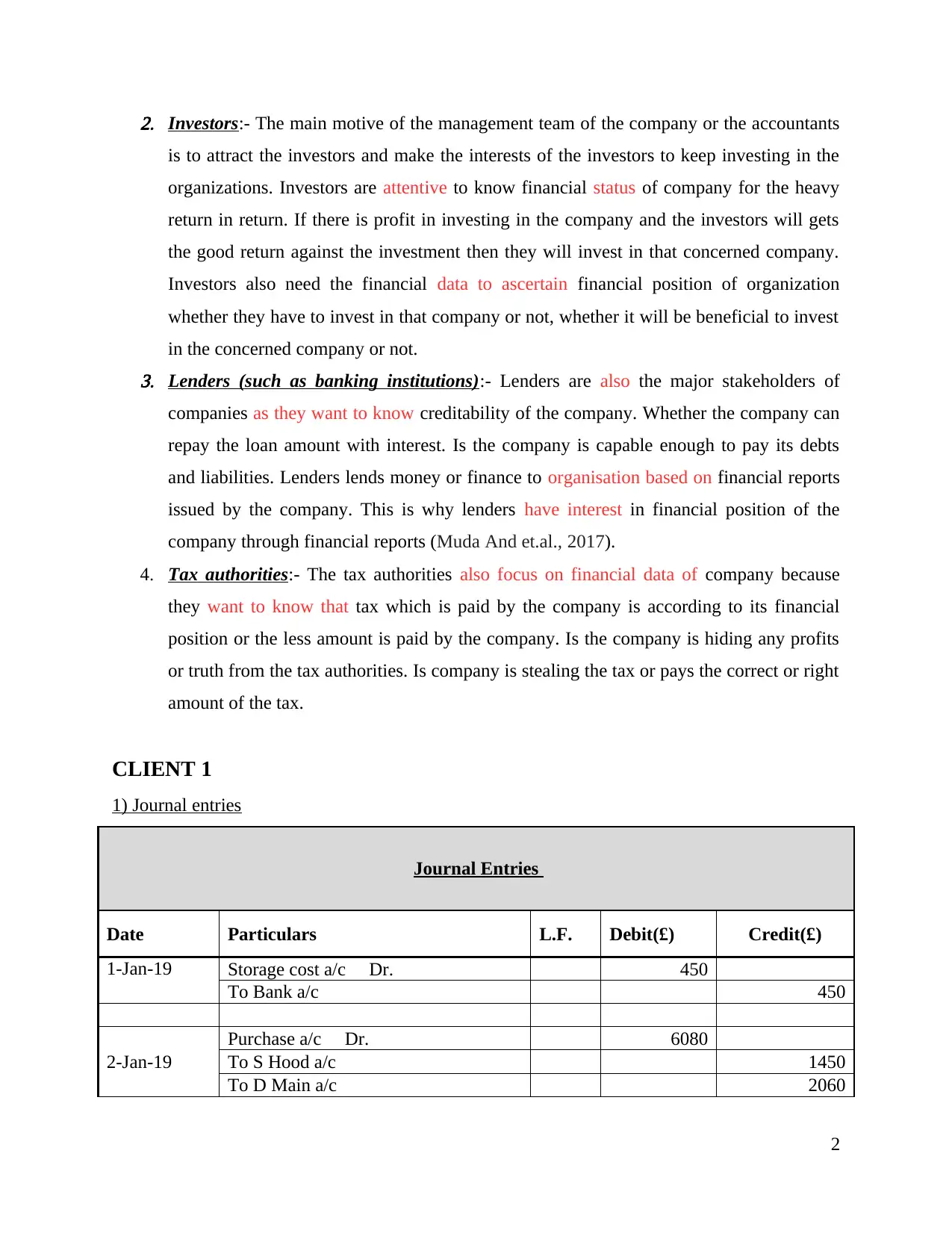

CLIENT 1

1) Journal entries

Journal Entries

Date Particulars L.F. Debit(£) Credit(£)

1-Jan-19 Storage cost a/c Dr. 450

To Bank a/c 450

2-Jan-19

Purchase a/c Dr. 6080

To S Hood a/c 1450

To D Main a/c 2060

2

is to attract the investors and make the interests of the investors to keep investing in the

organizations. Investors are attentive to know financial status of company for the heavy

return in return. If there is profit in investing in the company and the investors will gets

the good return against the investment then they will invest in that concerned company.

Investors also need the financial data to ascertain financial position of organization

whether they have to invest in that company or not, whether it will be beneficial to invest

in the concerned company or not.3. Lenders (such as banking institutions):- Lenders are also the major stakeholders of

companies as they want to know creditability of the company. Whether the company can

repay the loan amount with interest. Is the company is capable enough to pay its debts

and liabilities. Lenders lends money or finance to organisation based on financial reports

issued by the company. This is why lenders have interest in financial position of the

company through financial reports (Muda And et.al., 2017).

4. Tax authorities:- The tax authorities also focus on financial data of company because

they want to know that tax which is paid by the company is according to its financial

position or the less amount is paid by the company. Is the company is hiding any profits

or truth from the tax authorities. Is company is stealing the tax or pays the correct or right

amount of the tax.

CLIENT 1

1) Journal entries

Journal Entries

Date Particulars L.F. Debit(£) Credit(£)

1-Jan-19 Storage cost a/c Dr. 450

To Bank a/c 450

2-Jan-19

Purchase a/c Dr. 6080

To S Hood a/c 1450

To D Main a/c 2060

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

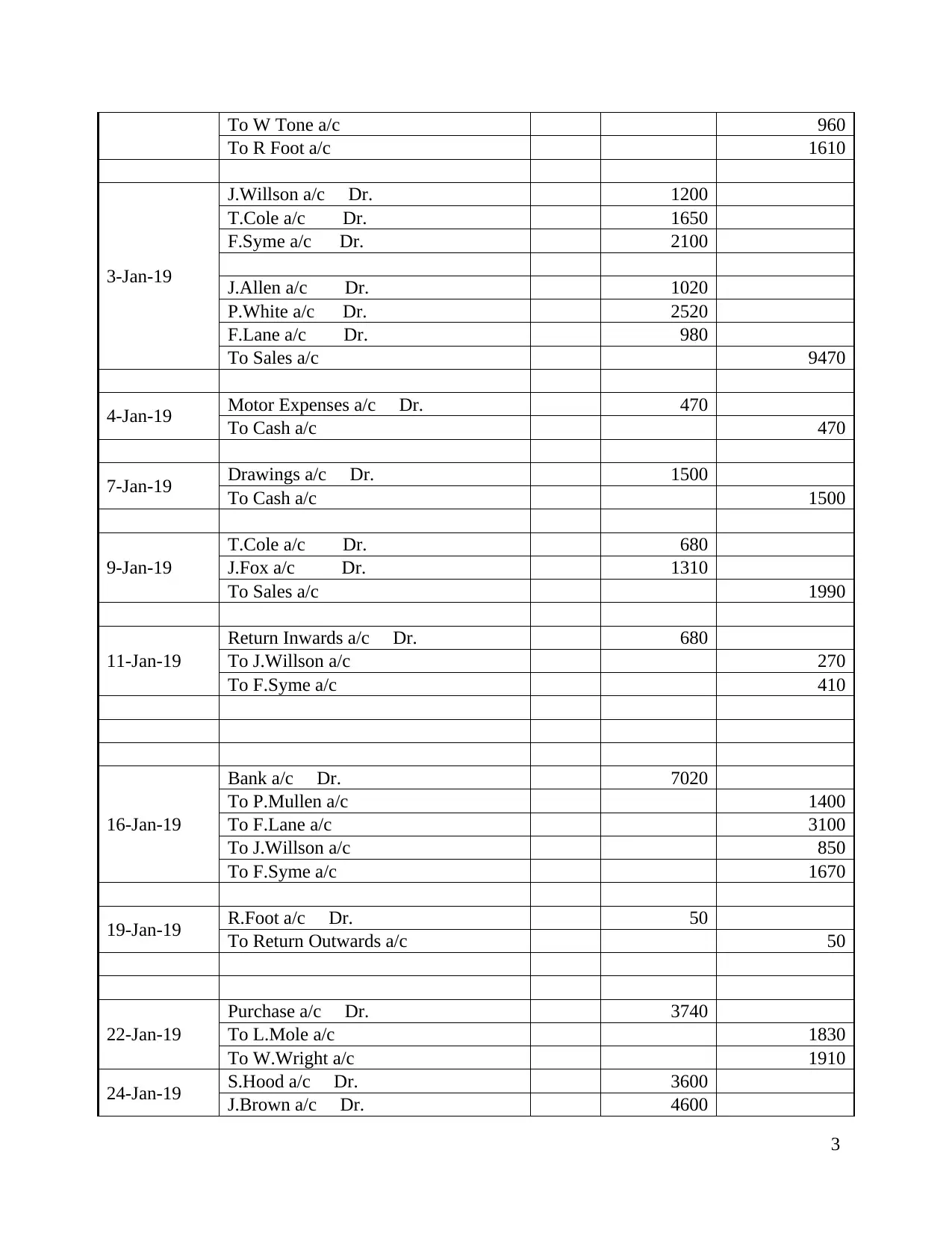

To W Tone a/c 960

To R Foot a/c 1610

3-Jan-19

J.Willson a/c Dr. 1200

T.Cole a/c Dr. 1650

F.Syme a/c Dr. 2100

J.Allen a/c Dr. 1020

P.White a/c Dr. 2520

F.Lane a/c Dr. 980

To Sales a/c 9470

4-Jan-19 Motor Expenses a/c Dr. 470

To Cash a/c 470

7-Jan-19 Drawings a/c Dr. 1500

To Cash a/c 1500

9-Jan-19

T.Cole a/c Dr. 680

J.Fox a/c Dr. 1310

To Sales a/c 1990

11-Jan-19

Return Inwards a/c Dr. 680

To J.Willson a/c 270

To F.Syme a/c 410

16-Jan-19

Bank a/c Dr. 7020

To P.Mullen a/c 1400

To F.Lane a/c 3100

To J.Willson a/c 850

To F.Syme a/c 1670

19-Jan-19 R.Foot a/c Dr. 50

To Return Outwards a/c 50

22-Jan-19

Purchase a/c Dr. 3740

To L.Mole a/c 1830

To W.Wright a/c 1910

24-Jan-19 S.Hood a/c Dr. 3600

J.Brown a/c Dr. 4600

3

To R Foot a/c 1610

3-Jan-19

J.Willson a/c Dr. 1200

T.Cole a/c Dr. 1650

F.Syme a/c Dr. 2100

J.Allen a/c Dr. 1020

P.White a/c Dr. 2520

F.Lane a/c Dr. 980

To Sales a/c 9470

4-Jan-19 Motor Expenses a/c Dr. 470

To Cash a/c 470

7-Jan-19 Drawings a/c Dr. 1500

To Cash a/c 1500

9-Jan-19

T.Cole a/c Dr. 680

J.Fox a/c Dr. 1310

To Sales a/c 1990

11-Jan-19

Return Inwards a/c Dr. 680

To J.Willson a/c 270

To F.Syme a/c 410

16-Jan-19

Bank a/c Dr. 7020

To P.Mullen a/c 1400

To F.Lane a/c 3100

To J.Willson a/c 850

To F.Syme a/c 1670

19-Jan-19 R.Foot a/c Dr. 50

To Return Outwards a/c 50

22-Jan-19

Purchase a/c Dr. 3740

To L.Mole a/c 1830

To W.Wright a/c 1910

24-Jan-19 S.Hood a/c Dr. 3600

J.Brown a/c Dr. 4600

3

R.Foot a/c Dr. 1400

To Bank a/c 9600

27-Jan-19 Salaries a/c Dr. 4800

To Bank a/c 4800

30-Jan-19 Business Rates a/c Dr. 1320

To Bank a/c 1320

2) Ledger accounts

4

To Bank a/c 9600

27-Jan-19 Salaries a/c Dr. 4800

To Bank a/c 4800

30-Jan-19 Business Rates a/c Dr. 1320

To Bank a/c 1320

2) Ledger accounts

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.