Financial Accounting Exam - Financial Statements and Analysis

VerifiedAdded on 2022/10/12

|10

|1227

|17

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial accounting exam, addressing various aspects of financial reporting and analysis. It includes detailed calculations and explanations for questions related to break-even points under different scenarios, cost of machine and rate of return, and the preparation of manufacturing accounts and balance sheets. The assignment also covers variance analysis for direct materials and direct labor, providing formulas and calculations to determine variances. Furthermore, the solution incorporates the preparation of financial statements, including a balance sheet, and references relevant academic journals and literature. The document serves as a valuable resource for students seeking to understand and solve financial accounting problems, providing a clear and concise approach to complex accounting concepts.

FINANCIAL ACCOUNTING EXAM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 4........................................................................................................................................3

Question 1........................................................................................................................................4

Question 5........................................................................................................................................5

Question 2........................................................................................................................................7

Reference List..................................................................................................................................9

2

Question 4........................................................................................................................................3

Question 1........................................................................................................................................4

Question 5........................................................................................................................................5

Question 2........................................................................................................................................7

Reference List..................................................................................................................................9

2

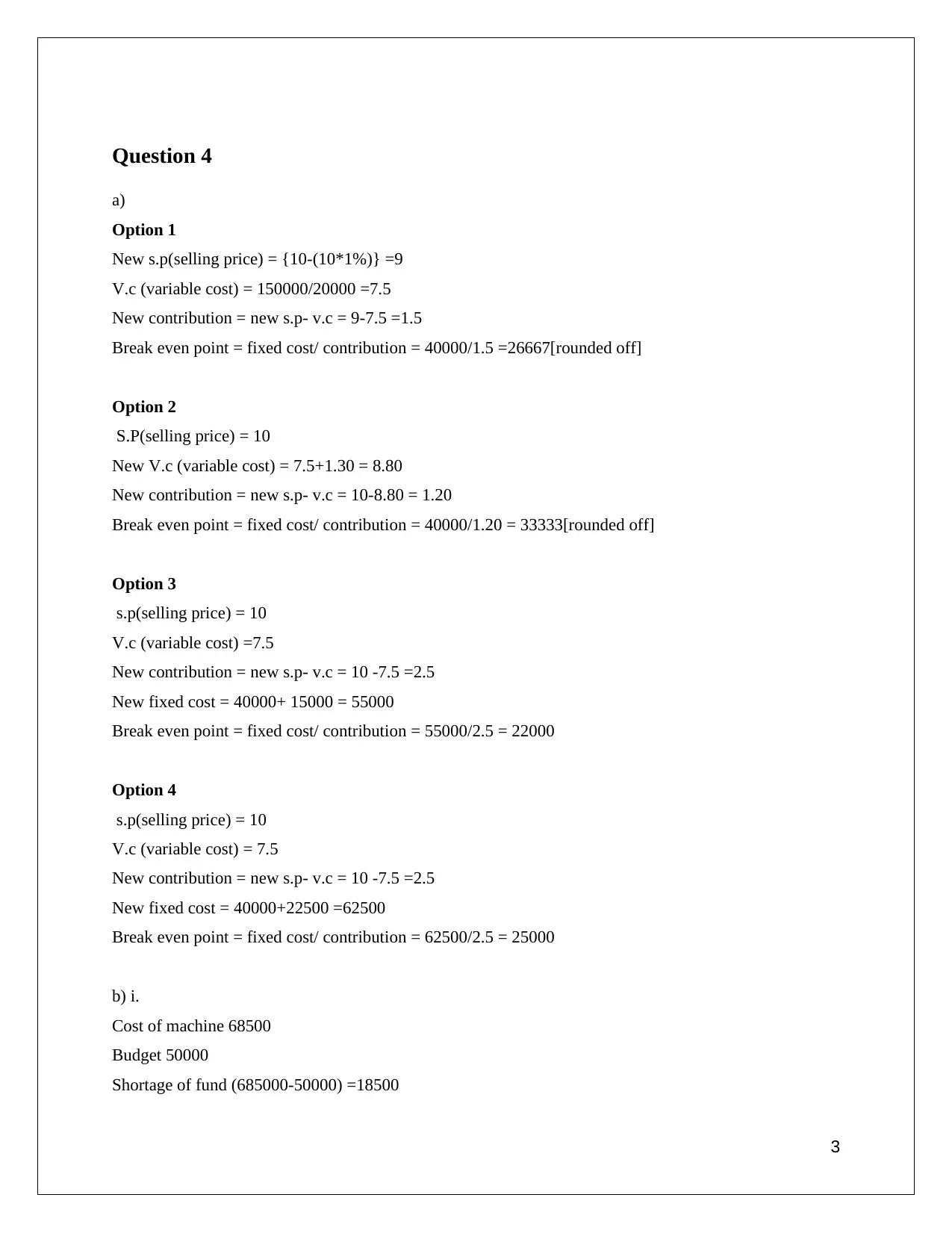

Question 4

a)

Option 1

New s.p(selling price) = {10-(10*1%)} =9

V.c (variable cost) = 150000/20000 =7.5

New contribution = new s.p- v.c = 9-7.5 =1.5

Break even point = fixed cost/ contribution = 40000/1.5 =26667[rounded off]

Option 2

S.P(selling price) = 10

New V.c (variable cost) = 7.5+1.30 = 8.80

New contribution = new s.p- v.c = 10-8.80 = 1.20

Break even point = fixed cost/ contribution = 40000/1.20 = 33333[rounded off]

Option 3

s.p(selling price) = 10

V.c (variable cost) =7.5

New contribution = new s.p- v.c = 10 -7.5 =2.5

New fixed cost = 40000+ 15000 = 55000

Break even point = fixed cost/ contribution = 55000/2.5 = 22000

Option 4

s.p(selling price) = 10

V.c (variable cost) = 7.5

New contribution = new s.p- v.c = 10 -7.5 =2.5

New fixed cost = 40000+22500 =62500

Break even point = fixed cost/ contribution = 62500/2.5 = 25000

b) i.

Cost of machine 68500

Budget 50000

Shortage of fund (685000-50000) =18500

3

a)

Option 1

New s.p(selling price) = {10-(10*1%)} =9

V.c (variable cost) = 150000/20000 =7.5

New contribution = new s.p- v.c = 9-7.5 =1.5

Break even point = fixed cost/ contribution = 40000/1.5 =26667[rounded off]

Option 2

S.P(selling price) = 10

New V.c (variable cost) = 7.5+1.30 = 8.80

New contribution = new s.p- v.c = 10-8.80 = 1.20

Break even point = fixed cost/ contribution = 40000/1.20 = 33333[rounded off]

Option 3

s.p(selling price) = 10

V.c (variable cost) =7.5

New contribution = new s.p- v.c = 10 -7.5 =2.5

New fixed cost = 40000+ 15000 = 55000

Break even point = fixed cost/ contribution = 55000/2.5 = 22000

Option 4

s.p(selling price) = 10

V.c (variable cost) = 7.5

New contribution = new s.p- v.c = 10 -7.5 =2.5

New fixed cost = 40000+22500 =62500

Break even point = fixed cost/ contribution = 62500/2.5 = 25000

b) i.

Cost of machine 68500

Budget 50000

Shortage of fund (685000-50000) =18500

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

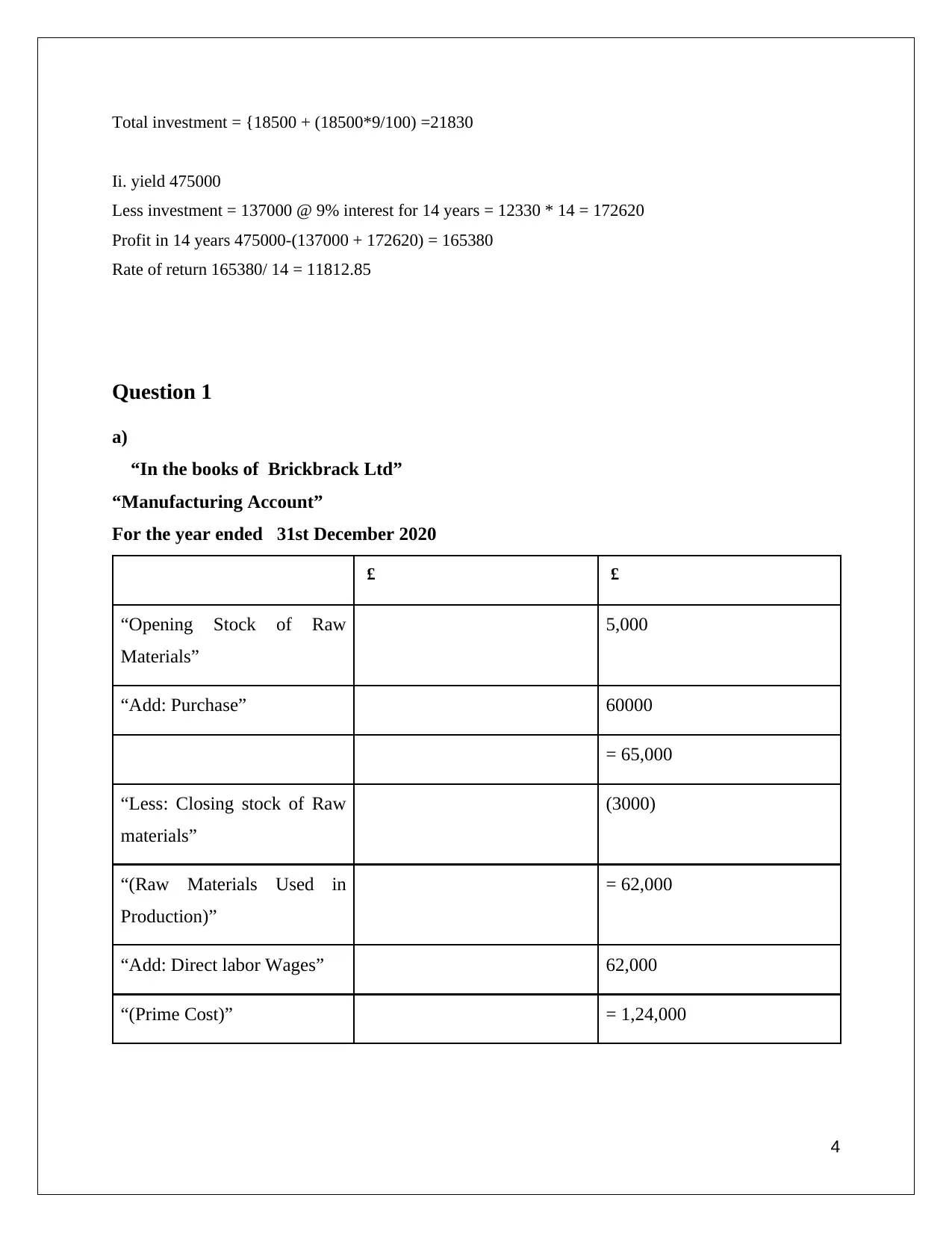

Total investment = {18500 + (18500*9/100) =21830

Ii. yield 475000

Less investment = 137000 @ 9% interest for 14 years = 12330 * 14 = 172620

Profit in 14 years 475000-(137000 + 172620) = 165380

Rate of return 165380/ 14 = 11812.85

Question 1

a)

“In the books of Brickbrack Ltd”

“Manufacturing Account”

For the year ended 31st December 2020

£ £

“Opening Stock of Raw

Materials”

5,000

“Add: Purchase” 60000

= 65,000

“Less: Closing stock of Raw

materials”

(3000)

“(Raw Materials Used in

Production)”

= 62,000

“Add: Direct labor Wages” 62,000

“(Prime Cost)” = 1,24,000

4

Ii. yield 475000

Less investment = 137000 @ 9% interest for 14 years = 12330 * 14 = 172620

Profit in 14 years 475000-(137000 + 172620) = 165380

Rate of return 165380/ 14 = 11812.85

Question 1

a)

“In the books of Brickbrack Ltd”

“Manufacturing Account”

For the year ended 31st December 2020

£ £

“Opening Stock of Raw

Materials”

5,000

“Add: Purchase” 60000

= 65,000

“Less: Closing stock of Raw

materials”

(3000)

“(Raw Materials Used in

Production)”

= 62,000

“Add: Direct labor Wages” 62,000

“(Prime Cost)” = 1,24,000

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

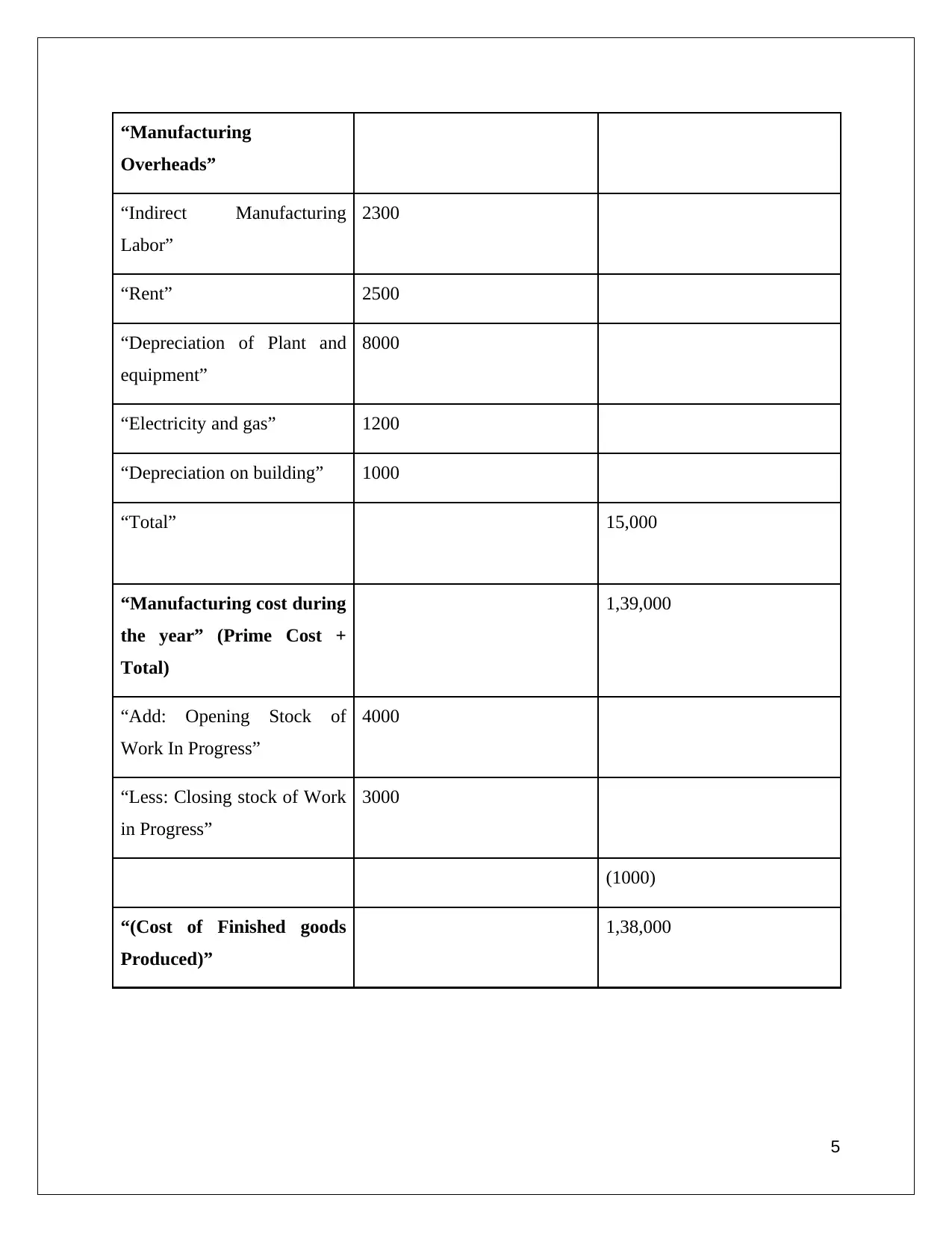

“Manufacturing

Overheads”

“Indirect Manufacturing

Labor”

2300

“Rent” 2500

“Depreciation of Plant and

equipment”

8000

“Electricity and gas” 1200

“Depreciation on building” 1000

“Total” 15,000

“Manufacturing cost during

the year” (Prime Cost +

Total)

1,39,000

“Add: Opening Stock of

Work In Progress”

4000

“Less: Closing stock of Work

in Progress”

3000

(1000)

“(Cost of Finished goods

Produced)”

1,38,000

5

Overheads”

“Indirect Manufacturing

Labor”

2300

“Rent” 2500

“Depreciation of Plant and

equipment”

8000

“Electricity and gas” 1200

“Depreciation on building” 1000

“Total” 15,000

“Manufacturing cost during

the year” (Prime Cost +

Total)

1,39,000

“Add: Opening Stock of

Work In Progress”

4000

“Less: Closing stock of Work

in Progress”

3000

(1000)

“(Cost of Finished goods

Produced)”

1,38,000

5

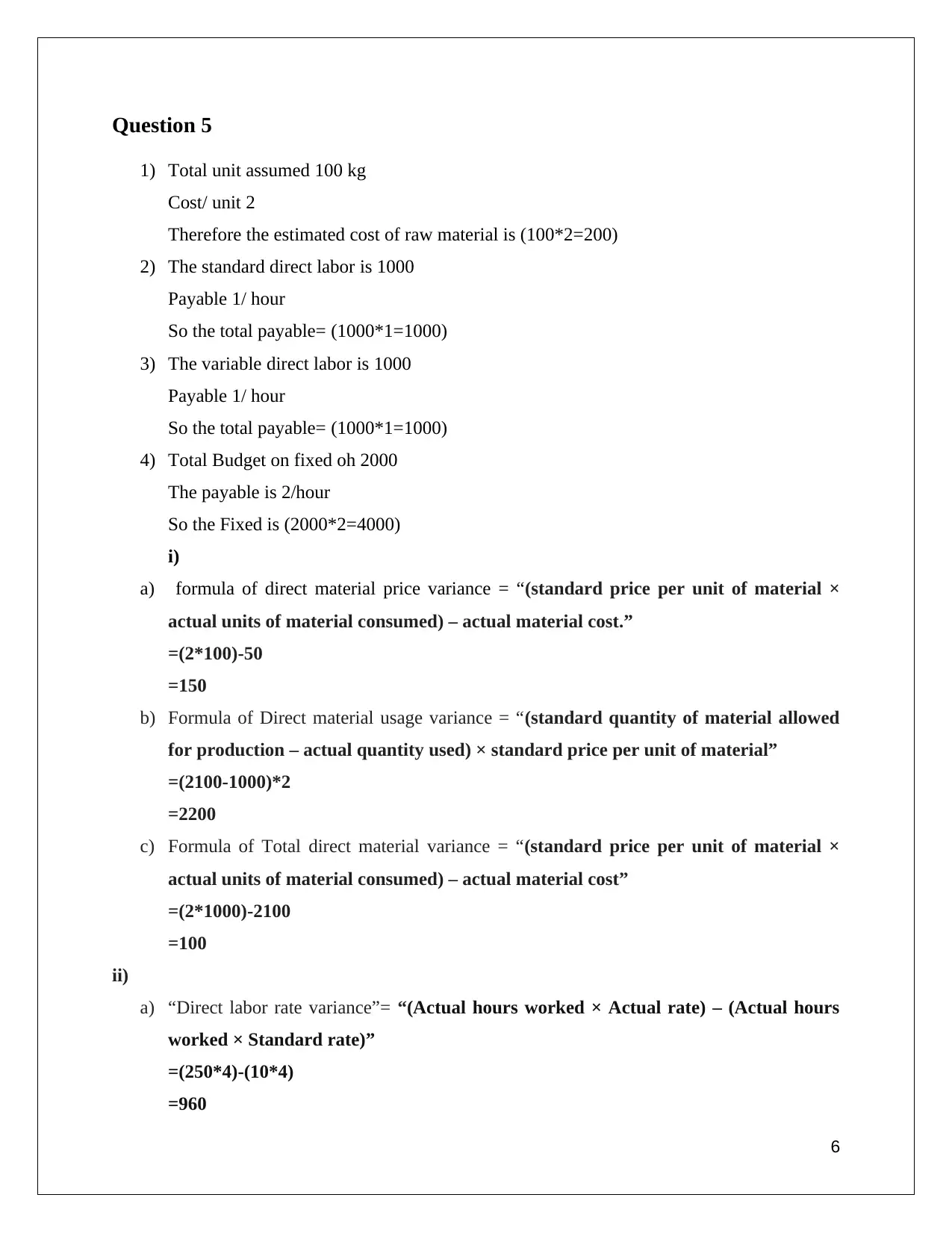

Question 5

1) Total unit assumed 100 kg

Cost/ unit 2

Therefore the estimated cost of raw material is (100*2=200)

2) The standard direct labor is 1000

Payable 1/ hour

So the total payable= (1000*1=1000)

3) The variable direct labor is 1000

Payable 1/ hour

So the total payable= (1000*1=1000)

4) Total Budget on fixed oh 2000

The payable is 2/hour

So the Fixed is (2000*2=4000)

i)

a) formula of direct material price variance = “(standard price per unit of material ×

actual units of material consumed) – actual material cost.”

=(2*100)-50

=150

b) Formula of Direct material usage variance = “(standard quantity of material allowed

for production – actual quantity used) × standard price per unit of material”

=(2100-1000)*2

=2200

c) Formula of Total direct material variance = “(standard price per unit of material ×

actual units of material consumed) – actual material cost”

=(2*1000)-2100

=100

ii)

a) “Direct labor rate variance”= “(Actual hours worked × Actual rate) – (Actual hours

worked × Standard rate)”

=(250*4)-(10*4)

=960

6

1) Total unit assumed 100 kg

Cost/ unit 2

Therefore the estimated cost of raw material is (100*2=200)

2) The standard direct labor is 1000

Payable 1/ hour

So the total payable= (1000*1=1000)

3) The variable direct labor is 1000

Payable 1/ hour

So the total payable= (1000*1=1000)

4) Total Budget on fixed oh 2000

The payable is 2/hour

So the Fixed is (2000*2=4000)

i)

a) formula of direct material price variance = “(standard price per unit of material ×

actual units of material consumed) – actual material cost.”

=(2*100)-50

=150

b) Formula of Direct material usage variance = “(standard quantity of material allowed

for production – actual quantity used) × standard price per unit of material”

=(2100-1000)*2

=2200

c) Formula of Total direct material variance = “(standard price per unit of material ×

actual units of material consumed) – actual material cost”

=(2*1000)-2100

=100

ii)

a) “Direct labor rate variance”= “(Actual hours worked × Actual rate) – (Actual hours

worked × Standard rate)”

=(250*4)-(10*4)

=960

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b) “Direct labor efficiency variance”= “(Actual hours worked × Standard rate) –

(Standard hours allowed × Standard rate)”

(250*1)-(10*1)

=240

c) “Total direct labor variance” = “Total actual direct labor cost- Total standard Direct

labor cost”

=(60-40)

=20

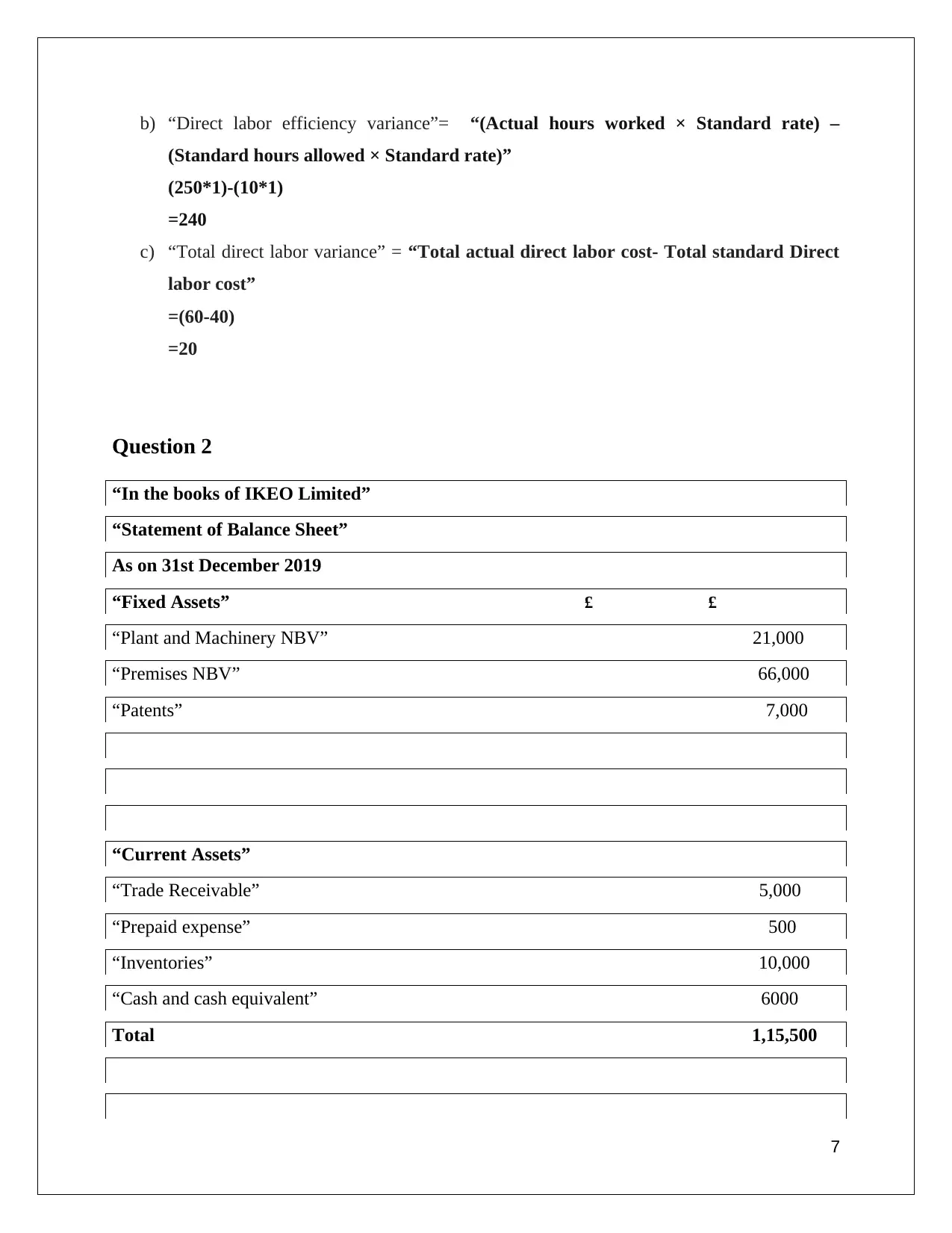

Question 2

“In the books of IKEO Limited”

“Statement of Balance Sheet”

As on 31st December 2019

“Fixed Assets” £ £

“Plant and Machinery NBV” 21,000

“Premises NBV” 66,000

“Patents” 7,000

“Current Assets”

“Trade Receivable” 5,000

“Prepaid expense” 500

“Inventories” 10,000

“Cash and cash equivalent” 6000

Total 1,15,500

7

(Standard hours allowed × Standard rate)”

(250*1)-(10*1)

=240

c) “Total direct labor variance” = “Total actual direct labor cost- Total standard Direct

labor cost”

=(60-40)

=20

Question 2

“In the books of IKEO Limited”

“Statement of Balance Sheet”

As on 31st December 2019

“Fixed Assets” £ £

“Plant and Machinery NBV” 21,000

“Premises NBV” 66,000

“Patents” 7,000

“Current Assets”

“Trade Receivable” 5,000

“Prepaid expense” 500

“Inventories” 10,000

“Cash and cash equivalent” 6000

Total 1,15,500

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

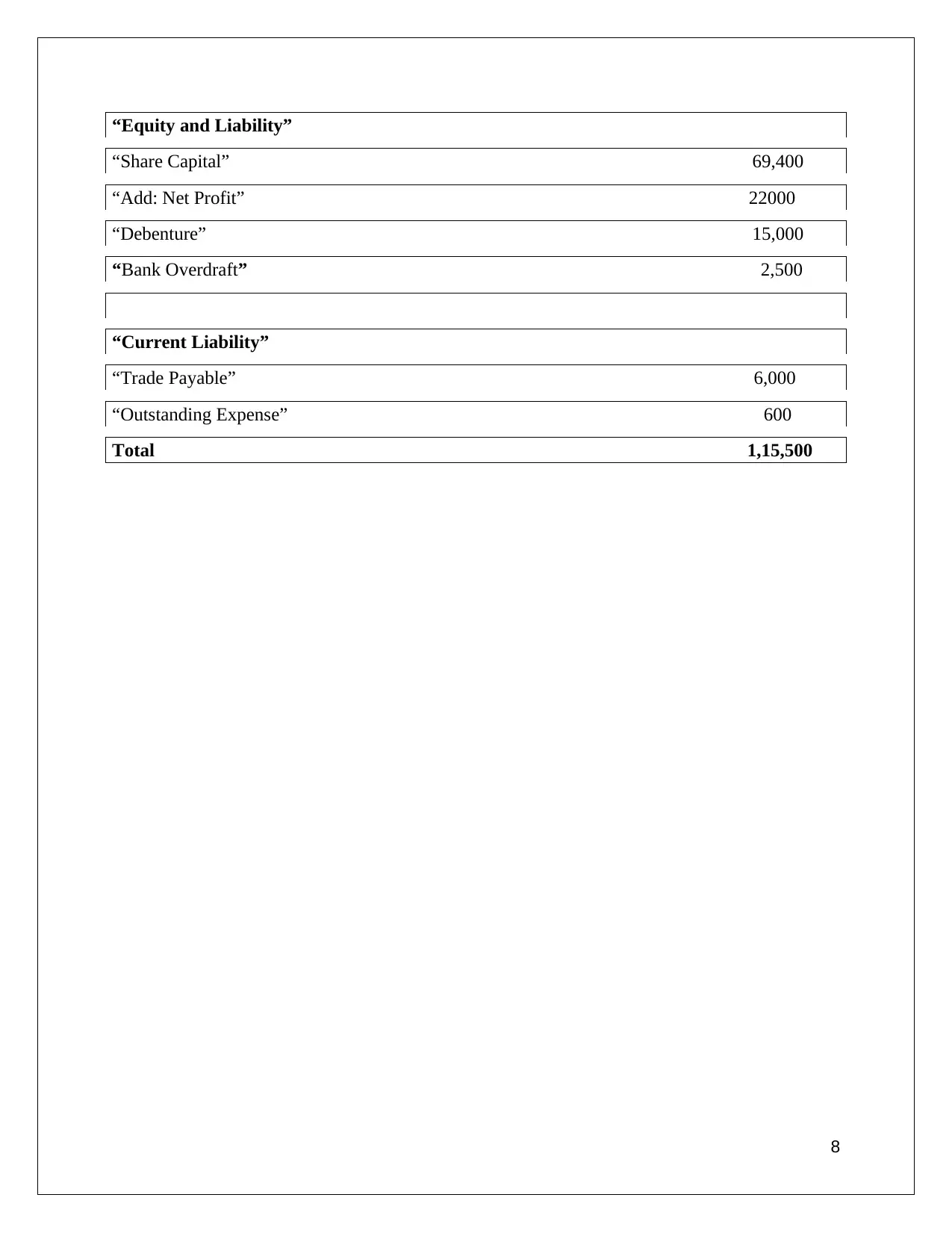

“Equity and Liability”

“Share Capital” 69,400

“Add: Net Profit” 22000

“Debenture” 15,000

“Bank Overdraft” 2,500

“Current Liability”

“Trade Payable” 6,000

“Outstanding Expense” 600

Total 1,15,500

8

“Share Capital” 69,400

“Add: Net Profit” 22000

“Debenture” 15,000

“Bank Overdraft” 2,500

“Current Liability”

“Trade Payable” 6,000

“Outstanding Expense” 600

Total 1,15,500

8

Reference List

Journals

Baxamusa, M., Datta, S. and Jha, A., 2021. Does policy uncertainty increase relational risks?

Evidence from strategic alliances. Financial Management, 50(3), pp.645-689.

Bilovodska, O., Melnyk, Y., Alenin, Y. and Arkusha, L., 2020. Implementation of marketing

and legal tools in the process of commercialization for innovative products in strategic

management and entrepreneurship. International Journal for Quality Research.

CHELULEI, B.K., 2021. Board of Management participation in implementation of strategic

plans in primary schools in Eldoret East Sub-County, UasinGishu County, Kenya (Doctoral

dissertation, University of Eldoret).

Chernov, S.I., Gaiduchenko, S.O., Dobryn, S.V. and Kipa, M.O., 2019. Defining the

objectives of enterprise strategic management depending on the level of its financial

potential.

Cradazco, W., Niebles, W., Hernández, H., Hoyos, L. and De la Ossa, S., 2019. Strategic

Management for SMEs: For the Projection to Global Markets. Modern Applied

Science, 13(1), pp.99-105.

Jaworzynska, M., 2017. Using tools of strategic management in medical facilities of Lublin

region. Engineering Management in Production and Services, 9(2).

Johanson, J.E., Johnsen, Å.,Pekkola, E. and Reid, S.A., 2019. Strategic Management in

Finnish and Norwegian Government Agencies. Administrative Sciences, 9(4), p.80.

Kucukaltan, B., Saatcioglu, O.Y., Irani, Z. and Tuna, O., 2020. Gaining strategic insights into

Logistics 4.0: expectations and impacts. Production Planning & Control, pp.1-17.

Lu, Y. and Abeysekera, I., 2021. Do investors and analysts value strategic corporate social

responsibility disclosures? Evidence from China. Journal of International Financial

Management & Accounting, 32(2), pp.147-181.

Meral, Y., 2019. Strategic Management of Finance and Role of Documentary Credit.

In Handbook of Research on Global Issues in Financial Communication and Investment

Decision Making (pp. 395-416). IGI Global.

9

Journals

Baxamusa, M., Datta, S. and Jha, A., 2021. Does policy uncertainty increase relational risks?

Evidence from strategic alliances. Financial Management, 50(3), pp.645-689.

Bilovodska, O., Melnyk, Y., Alenin, Y. and Arkusha, L., 2020. Implementation of marketing

and legal tools in the process of commercialization for innovative products in strategic

management and entrepreneurship. International Journal for Quality Research.

CHELULEI, B.K., 2021. Board of Management participation in implementation of strategic

plans in primary schools in Eldoret East Sub-County, UasinGishu County, Kenya (Doctoral

dissertation, University of Eldoret).

Chernov, S.I., Gaiduchenko, S.O., Dobryn, S.V. and Kipa, M.O., 2019. Defining the

objectives of enterprise strategic management depending on the level of its financial

potential.

Cradazco, W., Niebles, W., Hernández, H., Hoyos, L. and De la Ossa, S., 2019. Strategic

Management for SMEs: For the Projection to Global Markets. Modern Applied

Science, 13(1), pp.99-105.

Jaworzynska, M., 2017. Using tools of strategic management in medical facilities of Lublin

region. Engineering Management in Production and Services, 9(2).

Johanson, J.E., Johnsen, Å.,Pekkola, E. and Reid, S.A., 2019. Strategic Management in

Finnish and Norwegian Government Agencies. Administrative Sciences, 9(4), p.80.

Kucukaltan, B., Saatcioglu, O.Y., Irani, Z. and Tuna, O., 2020. Gaining strategic insights into

Logistics 4.0: expectations and impacts. Production Planning & Control, pp.1-17.

Lu, Y. and Abeysekera, I., 2021. Do investors and analysts value strategic corporate social

responsibility disclosures? Evidence from China. Journal of International Financial

Management & Accounting, 32(2), pp.147-181.

Meral, Y., 2019. Strategic Management of Finance and Role of Documentary Credit.

In Handbook of Research on Global Issues in Financial Communication and Investment

Decision Making (pp. 395-416). IGI Global.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.